Technical Observation:

Even after last week's weekly bullish pin bar. Gbp is yet to spike upwards as I expected. Gbp is still bullish and only a buy position can be advised. At the moment, if you're not short from 1.3071, you could wait for a breakout above the short term 4 hour resistance line 1.3292 then buy Gbp with a take profit at 1.3576. On the upper side, the key lines to look for include 1.3492, 1.3335 and 1.3576. If these lines are breached, then a rise towards the weekly resistance line 1.4478 is expected.

Technical Levels

Resistance levels

R1: 1.3285

R2: 1.3323

R3: 1.3405

Pivot

1.3242

Support Levels

1.3242

Support Levels

S1: 1.3078

S2: 1.316

S3: 1.3203

Trade Signal

Look for a long position with the first take profit at 1.3292 and the next at 1.3576

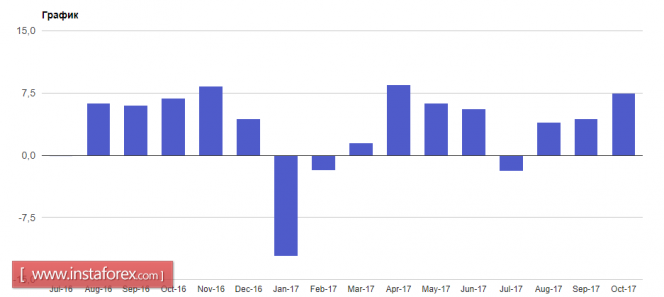

Economists had expected that borrowings would amount to £7.5 billion. In case the GBPUSD pair drops to catch hold of the resistance at 1.3260, pressure on the British pound would only increase in the near future, which will lead to the renewal of 1.3180 and 1.3140. Data on the balance of foreign trade will positively affect the overall GDP of Switzerland for the 3rd quarter of this year.

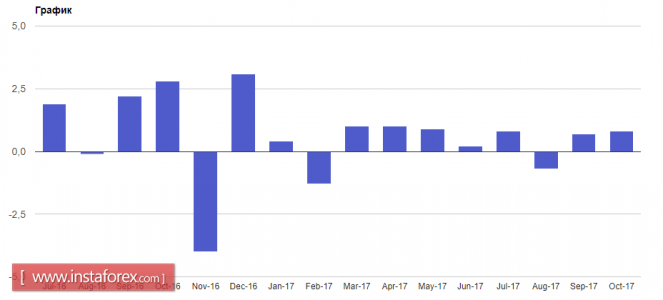

As noted in the report, the surplus increased due to the weakening of the Swiss franc in October this year, which had a positive impact on the foreign trade balance. Therefore, the positive balance of foreign trade in October 2017 amounted to 2.4 billion francs, while exports grew by 2.3% compared to the same period in 2016. The Australian dollar rose against the US dollar following a speech by the Governor of the Reserve Bank of Australia.

Let me remind you that the morning minutes of the RBA, which were prepared after the last meeting, had a negative impact on the Australian dollar. Philip Lowe said that at the moment there is no special reason to raise interest rates in the near future, and it will be more appropriate to keep rates low for quite a long time. The growth of the Australian dollar could also occur due to the fact that some major players were afraid of hints from the RBA's governor about the possibility of further lowering of rates.

However, Lowe said that in case of further improvement in the economic situation, the increase in rates is more likely than its decrease. According to the head of the RBA, in the economy of Australia there are unused capacities, while restrained growth of wages continues to subdue inflation. As for the technical picture of the AUDUSD pair, after going beyond the large support level of 0.7630, the pressure on the Australian dollar increased, which led to the renewal of new large levels of 0.7530 with the formation of the forecast for the exit at 0.7500, where a significant profit taking on short positions will occur.

In general, the technical picture did not undergo any changes in comparison with the morning forecast on Monday. In order to develop the situation in favor of buyers of risky assets, it is necessary for the EURUSD pair to reach the intermediate level of 1.1772, which will allow a return towards the test at 1.1805 with an expectation of updating 1.1860 by the middle of the week. Given that the pressure is maintained further, the retest at 1.1730 can easily lead to the growth of short positions in the single European currency as well as its collapse towards areas of 1.1680 and 1.1640. The Australian dollar quietly reacted to the publication of the minutes from the last RBA meeting. The minutes indicated that the RBA's position on monetary policy corresponds to the growth of the GDP and the target inflation rate. Furthermore, RBA experts expect a gradual increase in the level of inflation.

However, the growth of the Australian dollar might be postponed at this moment. The International Monetary Fund also announced that it expects interest rates in Australia to remain low for a long period of time, which in general, coincides with expectations of the Central Bank of Australia. Let me remind you that the RBA kept the rate at a record low level of 1.5% since August 2016, and it is expected that its increase will not begin until 2019.

No comments:

Post a Comment