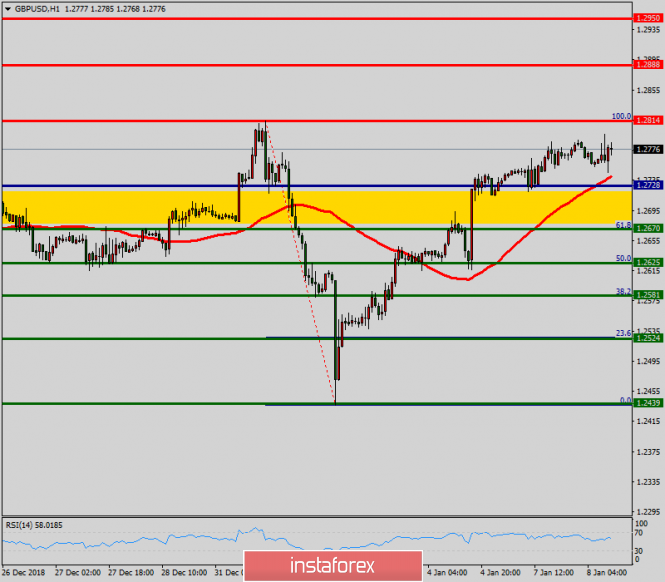

Technical analysis of GBP/USD for January 08, 2019

2019-01-08

Overview:

The GBP/USD pair continues to move upwards from the level of 1.2728. Yesterday, the pair rose from the level of 1.2728 to a top around 1.2780. Today, the first resistance level is seen at 1.2814 followed by 1.2888, while daily support 1 is seen at 1.2728. According to the previous events, the GBP/USD pair is still moving between the levels of 1.2728 and 1.2888; so we expect a range of 160 pips.

Furthermore, if the trend is able to break out through the first resistance level at 1.2814, we should see the pair climbing towards the double top (1.2888) to test it.

Therefore, buy above the level of 1.2728 with the first target at 1.2814 in order to test the daily resistance 1 and further to 1.2888. Also, it might be noted that the level of 1.2888 is a good place to take profit because it will form a major resistance today. On the other hand, in case a reversal takes place and the GBP/USD pair breaks through the support level of 1.2728, a further decline to 1.2670 can occur which would indicate a bearish market.

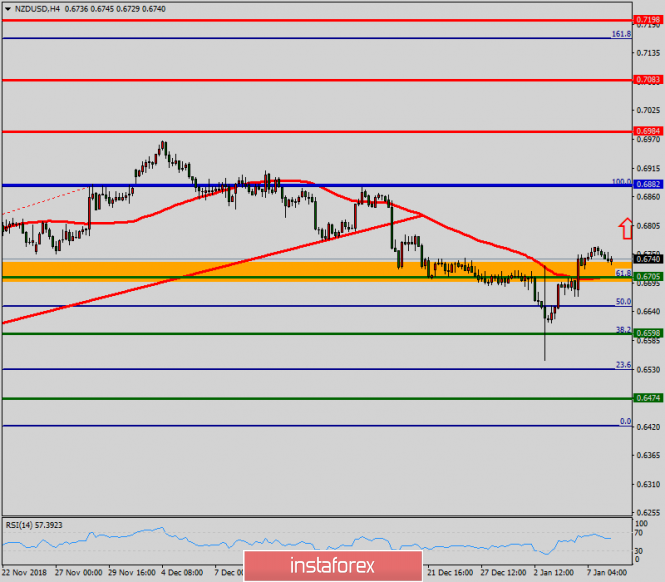

Technical analysis of NZD/USD for January 08, 2019

2019-01-08

Overview:

Pivot: 0.6882.

The NZD/USD pair breached resistance which had turned into strong support at the level of 0.6705 this week. The level of 0.6705 coincides with a golden ratio (61.8% of Fibonacci), which is expected to act as major support today. The RSI is considered to be overbought, because it is above 70. The RSI is still signaling that the trend is upward as it is still strong above the moving average (100). Besides, note that the pivot point is seen at the point of 0.6882. This suggests that the pair will probably go up in the coming hours. Accordingly, the market is likely to show signs of a bullish trend. In other words, buy orders are recommended to be placed above 0.6800 with the first target at the level of 0.6882. From this point, the pair is likely to begin an ascending movement to the point of 0.6882 and further to the level of 0.6984. The level of 0.6984 will act as strong resistance. On the other hand, if there is a breakout at the support level of 0.6705, this scenario may become invalidated.

Analysis of Gold for January 08, 2019

2019-01-08

Recently, Gold has been trading downwards as I expected. The price tested the level of $1,281.00. According to the H1 time – frame, I have found that price breached the rising wedge pattern and upward channel in the background, which is a sign that sellers are in control. My advice is to watch for selling opportunities. The downward targets are set at the price of $1,276.45 and at the price of $1,264.38.

GBP/USD analysis for January 08, 2019

2019-01-08

Recently, the GBP/USD pair has been trading sideways at the price of 1.2750. According to the M15 time – frame, I have found that GBP/USD is in a compression mode, which is a sign that there is a potential change from bullish to bearish. I have also found a hidden bearish divergence on the the MACD oscillator and a breakout of the upward trendline, which is another sign of weakness. Watch for selling opportunities. The downward targets are set at the price of 1.2714 and at the price of 1.2618.

Author's today's articles:

Mourad El Keddani

Was born in Oujda, Morocco. Currently lives in Belgium. In 2003 obtained B.S. in Experimental Sciences. In 2007 obtained a graduate diploma at Institut Marocain Specialise en Informatique Applique (IMSIA), specialty – Software Engineering Analyst. In 2007–2009 worked as teacher of computer services and trainer in a professional school specializing in computer technologies and accounting. In 2005 started Forex trading. Authored articles and analytical reviews on Forex market on Forex websites and forums. Since 2008 performs Forex market research, and develops and implements his own trading strategies of Forex analysis (especially in Forex Research & Analysis, Currency Forecast, and Recommendations and Analysis) that lies in: Numerical analysis: Probabilities, equations and techniques of applying Fibonacci levels. Classical analysis: Breakout strategy and trend indicators. Uses obtained skills to manage traders' accounts since 2009. In April 2009 was certified Financial Technician by the International Federation of Technical Analysts. Winner of several social work awards: Education Literacy and Non-Formal Education (in Literacy and Adult Education in The National Initiative for Human Development). Languages: Arabic, English, French and Dutch. Interests: Algorithm, Graphics, Social work, Psychology and Philosophy.

Petar Jacimovic

Petar was born on July 08, 1989 in Serbia. Graduated from Economy University and after has worked as a currency analyst for large private investors. Petar has been involved in the world of finance since 2007. In this trading he specializes in Volume Price Action (volume background, multi Fibonacci zones, trend channels, supply and demand). He also writes the market analytical reviews for Forex forums and websites. Moreover Petar is forex teacher and has wide experience in tutoring and conducting webinars. Interests : finance, travelling, sports, music "The key to success is hard work"

Subscription's options management Theme's:

Fundamental analysis, Fractal analysis, Wave analysis, Technical analysis, Stock Markets

Author's :

Alexandros Yfantis, Arief Makmur, Dean Leo, Michael Becker, Mohamed Samy, Mourad El Keddani, Petar Jacimovic, Rocky Yaman, Sebastian Seliga, Torben Melsted

Sincerely,

Analysts Service

If you have any questions, you can make a phone call using one of the

InstaForex Toll free numbers right now:

|

|

InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department. InstaForex Group is an international brand providing online trading services to the clients all over the world. InstaForex Group members include regulated companies in Europe, Russia and British Virgin Islands. This letter may contain personal information for access to your InstaForex trading account, so for the purpose of safety it is recommended to delete this data from the history. If you have received this letter by mistake, please contact InstaForex Customer Relations Department.

|

No comments:

Post a Comment