Forex analysis review |

- The European currency was an outsider

- EUR/USD. What will the minutes of the Fed reveal?

- Trading recommendations for the GBPUSD currency pair - placement of trading orders (February 20)

- GBP/USD. February 20th. Results of the day. Jean-Claude Juncker and Theresa May's meeting might be a formality

- EUR/USD. February 20th. Results of the day. The minutes of the Fed meeting will unlikely give new information to the market

- Euro and Swedish Krona are in serious trouble

- GBP / USD plan for the American session on February 20. Yesterday's enthusiasm for Brexit talks is gradually diminishing

- EUR / USD plan for the US session on February 20. A good report on the German economy did not help the euro to continue to

- Technical analysis of GBP/USD for February 20, 2019

- Technical analysis of NZD/USD for February 20, 2019

- Bitcoin analysis for February 20, 2019

- Intraday technical levels and trading recommendations for EUR/USD for February 20, 2019

- Review of the foreign exchange market on 02/20/2019

- Dollar continues to rise against yen on pending Fed protocols

- February 20, 2019 : GBP/USD Bullish opportunity around the backside of the broken movement channel.

- USD/JPY analysis for February 20, 2019

- Analysis of Gold for February 20, 2019

- Wave analysis of EUR / USD for February 20. Is Eurocurrency ready for continued growth?

- Trading recommendations for the EURUSD currency pair - placement of trading orders (February 19)

- What to expect from the Fed protocols: the Fed will not raise rates and stop the balance reduction

- Wave analysis of GBP / USD for February 20. An unexpected increase in the pound may be replaced by a new fall.

- Simplified wave analysis. Overview of GBP / JPY for February 20

- GBP / USD. February 20th. The trading system. "Regression Channels". New legal conditions can lead Brexit deadlock

- EUR / USD. February 20th. The trading system. "Regression Channels". The only event of the day - the Fed protocol

- Technical analysis for EUR/USD for February 20, 2019

| The European currency was an outsider Posted: 20 Feb 2019 05:44 PM PST According to analysts of one of the largest banks, Barclays, the euro has strongly surrendered its positions and lost its appeal to market participants. Experts recommend selling the European currency and buying the greenback, despite the current easing of the Fed's rhetoric. On Tuesday, February 19, trading on the European stock exchanges took place in the "red" zone, which did not add optimism to investors. The situation was also not the most favorable one for the key pair of EUR/USD. Experts recorded a decrease of 0.3%. Despite the fact that the leadership of the US Federal Reserve System (FRS) has taken a cautious stance, Barclays currency strategists are confident that in the near future this will not prevent the US dollar from strengthening against the euro. They believe that the weakness of the European currency will be a catalyst for such a movement. Barclays believes that the euro lost all those drivers that provided the upward momentum of the EUR/USD pair in 2016-2018. One of the reasons for the deterioration of the situation was the growing political and economic risks in the eurozone. Barclays analysts point out recent weak growth in the eurozone countries, as well as a decline in investment in financial assets. According to experts of the bank, the fall of the euro against the US dollar is just a matter of time, or rather the next weeks or even days. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. What will the minutes of the Fed reveal? Posted: 20 Feb 2019 04:43 PM PST The minutes of the January Federal Reserve meeting will be published tonight - the so-called "minutes". The results of the regulator's first meeting this year were disappointing for the US dollar. The Fed finally confirmed its policy of slowing down the tightening of monetary policy. In the text of the accompanying statement, as well as during the speech of the Fed chairman, the word "patience" was often mentioned, therefore the market does not expect any "hawkish" notes from the minutes. A certain intrigue of today's release remains. The market will first of all evaluate - how monolithic the decision to slow down the rate of rate increase looks. If the number of "doves" will significantly exceed the "hawkish" wing, then the dollar will again be under additional pressure. Yesterday's comments by Loretta Mester (which, by the way, has no voting rights this year) have weakened the greenback throughout the market. This suggests that dollar bulls are still sensitive to the soft statements of members of the Federal Reserve, even though the other central banks of the leading countries of the world have also taken a "defense position". The monetary policy outlook of the Fed is gradually coming to the forefront against the background of the expected breakthrough in the US-China trade negotiations. If Beijing and Washington find a common denominator this week and make a deal before March 1 (or announce it by extending the deadline for additional approvals), the dollar will lose a significant trump card for its growth. Under these circumstances, the Fed may either increase pressure on the greenback, or become a "saving straw", especially against the background of softening the rhetoric of the ECB and other central banks. It is worth noting that the Fed's report, which will be published today, might provide unexpected support for the US currency. The fact is that the market expects too soft rhetoric from the members of the regulator. If the minutes demonstrates some disagreement within the Committee, the market reaction may disappoint EUR/USD bulls. In my opinion, the dollar can collapse throughout the market only if the regulator hints at a possible pause until the end of this year. And although this option is unlikely, it cannot be ruled out, given the recent speeches of Fed members. This is not just about Loretta Mester, who was mentioned above. Today, her position was repeated by one of the most influential members of the regulator - the head of the Federal Reserve Bank of New York, John Williams. Moreover, he stated that he did not see the need to raise the rates - only if circumstances of a "shocking" nature emerge. In his opinion, the rate has already reached its neutral level - at least the lower limit of this range. This rhetoric is very consonant with the position of Fed Chairman Jerome Powell, who at the end of last year designated the neutral level range of 2.5% -3.5%, while declaring that the monetary tightening cycle was gradually coming to an end. This year, the US regulator can more clearly articulate its idea: the rate has reached a neutral level, then the Fed will act according to circumstances, responding to incoming data. Although these findings have long been floating in the air, their "fixation" will provoke strong volatility in the market, and this volatility will not be in favor of the dollar. By the way, Williams in today's speech added that the Fed will continue to reduce the volume of the bond portfolio on the balance sheet - according to his estimates, the reduction process may end when the balance drops to one trillion dollars. In general, the dynamics of today's trading confirms the fears of investors: the euro/dollar pair froze in a flat, especially against the background of a half-empty economic calendar. Here it is worth recalling that, in addition to the publication of the Fed minutes, the results of the meeting between the British prime minister and the head of the European Commission will be announced. If, despite all the circumstances, they will be able to move the situation from a dead point, the single currency will receive a strong enough support, which will undoubtedly affect the dynamics of the EUR/USD pair. Thus, the events of today's evening can either lead the pair to the borders of the 14th figure (with an attempt to test), or return to the area of the 12th figure). Fundamental factors are too unpredictable, so it is almost impossible to talk about the probability of the implementation of a particular scenario. From a technical point of view, it is important for EUR/USD bulls to stay above 1,1305 (Tenkan-sen line) in order for it to not lose the potential for growth and approach the next resistance level of 1,1390 (the lower limit of the Kumo cloud on the daily chart). Bears of the pair, in turn, need to consolidate below 1.1270 – in this case, the Ichimoku indicator will form a bearish "Parade of lines" signal, and the price itself will be between the middle and lower lines of the Bollinger Bands indicator on the same timeframe. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading recommendations for the GBPUSD currency pair - placement of trading orders (February 20) Posted: 20 Feb 2019 04:41 PM PST For the last trading day, the currency pair Pound / Dollar showed a high volatility of 176 points. As a result, it fulfilled the previously set forecast as an upward trend. From the point of view of technical analysis, we have a pulsed upward move, overcoming the way of a number of levels at 1.2920, as well as a psychological value of 1.3000. On the other hand, Informational and news background had statistics in itself from the UK on the labor market, where, in principle, we did not see anything. The unemployment rate remained the same, which was 4.0%, , as well as the level of wages excluding bonuses which was 3.4%. So what influenced such a rapid growth? We begin by saying that growth wa expected in terms of market. The impetus may have been the statement of the head of the European Commission, Jean-Claude Juncker: : "Any decision to ask for more time lies with the UK. If such a request is made, no one in Europe will be against it. If you ask how long you can postpone the exit, I have no time frame, "Juncker stated. Today, two news are in the spotlight. The first, of course, is the publication of the FOMC protocol, where market participants are waiting for hints about whether the Fed will stop reducing its balance sheet. Then, we have another meeting between Theresa May and Jean-Claude Juncker in Brussels, where the British Prime Minister will again urge the head of the European Commission to make concessions, but I think the next round will again end in nothing. 20:30 Moscow time - Theresa May and Jean-Claude Juncker meeting in Brussels 22:00 MSK - Publication of FOMC protocols Further development Analyzing the current trading chart, we see that the quote managed to reach the value of 1.3076. After which, we saw a logical stagnation with the start of the rollback. It is likely to assume that at this stage, the pullback may continue. There is still overheating after the impulse, but the bullish potential has not yet been exhausted, and further growth is still possible if the FOMC protocol disrupts market participants. Based on the available data, it is possible to expand a number of variations. Let's consider them: - Positions to buy - the previously set forecasts in the previous review coincided by all 200%. The quotation managed to go even further than planned. We do not have positions now; a possible next run can be in two scenarios: : First, after the breakdown of the current local maximum, 1.3076; The second - after a rollback to 1.3000, where in the case of a slowdown and a refinement from the level of 1.3000, attractive long positions may appear. - Positions to sell: We consider selling in the case of price fixing lower than 1.3035, with a prospect of 1.3000 (the first point). Indicator Analysis Analyzing a different sector of time frames ( TF), we see that there is a variable downward interest against the background of a slowdown and an expected pullback in the short term. While the intraday and the medium term focus on the upstream. Weekly volatility / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, with the calculation for the Month / Quarter / Year. (February 20 was based on the time of publication of the article) The current time volatility is 31 points. Today, there is a wide informational and news background, and thus, volatility is provided to us. Key levels Zones of resistance: 1.3000 ** (1.3000 / 1.3050); 1.3200 * 1.3300; 1.3440 **; 1.3580 *; 1.3700 Support areas: 1.3000 ** (1.3000 / 1.3050); 1.2920 *; 1.2770 (1.2720 / 1.2770) **; 1.2620; 1.2500 *; 1.2350 **. * Periodic level ** Range Level The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 Feb 2019 04:20 PM PST 4-hour timeframe The amplitude of the last 5 days (high-low): 77p - 117p - 113p - 50p - 177p. Average amplitude for the last 5 days: 107p (91p). The British pound sterling showed a rather strong upward movement yesterday, based on the information that the European Union is not opposed to postponing the UK exit date. Today, there will be a meeting between Theresa May and Jean-Claude Juncker, during which new information on key differences between the parties to the divorce process, the North Irish border and its legal status, might be provided for the markets. European leaders have repeatedly pointed out that they are not ready for new negotiations with London and cannot offer anything more than an agreement already agreed upon. However, Theresa May just has no choice but to try again and again to negotiate with the EU, convincing them to make new concessions. The situation, on the one hand, is in a stalemate, on the other - very simple. One of the parties must give way, taking into account the fact that since last year, there has been no final agreement regarding the border between Ireland and Northern Ireland. As long as there is no such concession, there will be no progress in the negotiations. The date of Brexit will likely be moved, and therefore the whole process may take another year. Therefore, despite the strengthening of the British currency in recent days, this currency does not have a strong growth potential. From a technical point of view, if the pair manages to overcome the second resistance level of 1.3058, the upward movement will continue with the target of 1.3137, which is obtained, given the average instrument volatility over the past five days. Trading recommendations: The GBP/USD currency pair might start to adjust as the MACD indicator moved down. Therefore, it is recommended to open new long positions, or after a reversal of the MACD indicator upwards or in case the level of 1,3058 has been overcome. Sell positions can be considered again with targets of 1.2872 and 1.2786, if the bears manage to seize the initiative on the instrument and consolidate below the critical Kijun-sen line. In addition to the technical picture, fundamental data and the timing of their release should also be taken into account. Explanation of illustration: Ichimoku Indicator: Tenkan-sen-red line. Kijun-sen – blue line. Senkou span a – light brown dotted line. Senkou span B – light purple dotted line. Chikou span – green line. Bollinger Bands Indicator: 3 yellow lines. MACD: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 Feb 2019 03:42 PM PST 4-hour timeframe The amplitude of the last 5 days (high-low): 82p - 82p - 72p - 45p - 82p. Average amplitude for the last 5 days: 73p (69p). On Wednesday, February 20, the EUR/USD currency pair continues inactive trading. There was a certain surge in volatility the previous day, which ended with the passage of 82 points during the day, but today market activity has decreased again. Obviously due to the complete absence of any macroeconomic reports in the European Union and the United States. Thus, the euro continues to crawl up with difficulty. The minutes of the last Federal Reserve meeting will be released tonight. We believe that no important information can be gathered from this protocol. If the Fed would have thought about stopping a reduction in its own balance sheet, this would have been known already. Smoke without fire and sewed in the bag can not be hidden. Therefore, we believe that there will be no market reaction to the evening publication of the minutes. However, it should still be recognized that there is always a 5% chance of a surprise. Therefore, it is not worth ignoring such a fundamental event. If the information that the Fed is going to stop moving assets from its own accounts to the open market is correct, this can create pressure on the US currency, as it will be the second sign of a slowdown in the US economy and the Fed's willingness to stop monetary policy tightening. From a technical point of view, the "golden cross" is weak, and the resistance level of 1.1345 has not been overcome. Therefore, longs can only be considered in small lots. Overcoming the Ichimoku cloud will strengthen the buy signal. Trading recommendations: The EUR/USD tested the level of 1,1345. If this target is overcome, the upward movement will continue with a target of 1.1398 and this target can be traded. A reversal of the MACD downwards indicator will indicate the beginning of a downward correction. Sell orders will become relevant not earlier than the reverse consolidation of the price below the critical line, but even in this case, the potential for the pair to fall below 1.1250 is very small. In addition to the technical picture, fundamental data and the timing of their release should also be taken into account. Explanation of illustration: Ichimoku Indicator: Tenkan-sen-red line. Kijun-sen – blue line. Senkou span a – light brown dotted line. Senkou span B – light purple dotted line. Chikou span – green line. Bollinger Bands Indicator: 3 yellow lines. MACD: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Euro and Swedish Krona are in serious trouble Posted: 20 Feb 2019 07:02 AM PST

The Swedish Krona cannot recover after a recent fall. Recall - after the weak inflation data and plans of the local Central Bank forced investors to sell the currency. The euro, in turn, was hit by low volumes of industrial orders in Italy. Krona rose last week after the Central Bank of Sweden, despite growing caution, said it would stick to its rate increase plan in the second half of 2019. However, the next piece of data on the reduction of inflation in January sent the currency down by more than 1 percent, to a two-year low against the dollar. The forecast of the crown every day becomes more and more alarming. For the EUR / SEK pair, the range from 10.75 to 11.00 should not be excluded later, in 2019. The euro, which has already fallen due to the fact that investors have shifted the focus from progress in US-Chinese trade negotiations to the weakness of the European economy, fell even more after data showed that industrial orders in Italy lost 5.3 percent in December. The euro, despite a vigorous Monday, is going through a difficult week. It is necessary to wait for the forecasts of the EU Commission, although there will be already well-known information for all - the lost momentum of the economy and weak inflationary pressure. The euro is likely to fall below $ 1.13, but not below $ 1.12. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 Feb 2019 04:31 AM PST To open long positions on the GBP / USD pair, you need: Pound returned to the area of support, which I paid attention to in my morning forecast, but there was no serious demand for it. Hence, it led to a revision of the future strategy for purchases. At the moment, it is best to return to long positions after the new minimum in the area of 1.2987 is updated and the main task of the bulls will be a breakthrough and consolidation above the resistance of 1.3038. In case that happens, you can count on a larger growth and an update of the weekly high near 1.3097, where I recommend taking profits. The bears managed to consolidate below the morning support of 1.3035, and now, it is the resistance. The main objective for short positions in the afternoon is located in the area of 1.2987, where I recommend taking profits. An unsuccessful attempt to consolidate and return to the resistance of 1.3038 will also be a signal to sell the pound before the publication of the Fed's protocols. When the growth scenario reaches above 1.3038, it is best to rely on short positions to rebound from a high of 1.3097. We should not forget that much will depend on the results of Theresa May's negotiations with the EU representatives, which began today. More in the video forecast for February 20 Indicator signals: Moving averages Trade is conducted above 30- and 50-moving averages, which indicates the likely continued growth of the pound in the short term. Bollinger bands In the case of today's growth of the pound in the second half of the day, the upper limit of the Bollinger Bands indicator around 1.3090 may limit the upward potential. Description of indicators MA (moving average) 50 days - yellow MA (moving average) 30 days - green MACD: fast EMA 12, slow EMA 26, SMA 9 Bollinger Bands 20 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 Feb 2019 04:31 AM PST To open long positions on EUR / USD pair, you need: Euro buyers attempted to continue growth today against the backdrop of a good report on producer prices in Germany. However, they failed to gain a foothold above the resistance of 1.1355. In the afternoon, all attention will be focused on the Fed's protocols but the bulls still need to break down and consolidate above the resistance of 1.1355, which will lead to a larger upward correction already in the area of maximum 1.1394 and 1.1432, where I recommend taking profits. In the case of EUR / USD decline, long positions can be opened on the condition that a false breakdown is formed in the support area of 1.1319, where the moving average is concentrated or to rebound from the 1.1279 minimum, where the lower limit of the upward price channel is seen. To open short positions on EUR / USD pair, you need: Euro sellers formed a false breakdown today, which I drew attention in the morning forecast, in a condition that long trading will be below 1.1355 resistance. Then, we can count on a further decline of EUR/USD pair to the support area of 1.1319, where I recommend taking profits. In case of consolidation below this level, the pressure on EUR/USD pair may increase significantly, which will return the pair to the region of the lower border of the ascending channel and will lead to an update of the 1.1279 minimum. Under the scenario of a further upward correction after the publication of the Fed's minutes and a breakthrough of 1.1355, the euro can be sold for a rebound from the maximum of 1.1394. More in the video forecast for February 20 Indicator signals: Moving averages Trading remains above the 30- and 50-medium moving, indicating a bullish market advantage. Bollinger bands In the case of an upward correction, growth will be limited by the upper limit of the Bollinger Bands indicator in the area of 1.1355 and a breakthrough of this level will be a good signal to buy. Description of indicators MA (moving average) 50 days - yellow MA (moving average) 30 days - green MACD: fast EMA 12, slow EMA 26, SMA 9 Bollinger Bands 20 The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of GBP/USD for February 20, 2019 Posted: 20 Feb 2019 03:45 AM PST The GBP/USD pair continues to move downwards from the areas of 1.3210 and 1.2913 in the long term. Last week, the pair dropped from the level of 1.3210 to 1.2913 which coincides with a ratio of 61.8% Fibonacci on the H4 chart. Today, resistance is seen at the levels of 1.3130 and 1.3210. So, we expect the price to set below the strong resistance at the levels of 1.3130 and 1.3210; because the price is in a bearish channel now. Amid the previous events, the price is still moving between the levels of 1.3010 and 1.2734. Overall, we still prefer a bearish scenario as long as the price is below the level of 1.3010. Furthermore, if the GBP/USD pair is able to break out the bottom at 1.2913, the market will decline further to 1.2734 (daily support 1). Hence, the price will fall into a bearish trend in order to go further towards the strong support at 1.2734 to test it again. The level of 1.2704 will form a double bottom. On the other hand, if the price closes above the strong resistance of 1.3210, the best location for a stop loss order is seen above 1.3250. The material has been provided by InstaForex Company - www.instaforex.com |

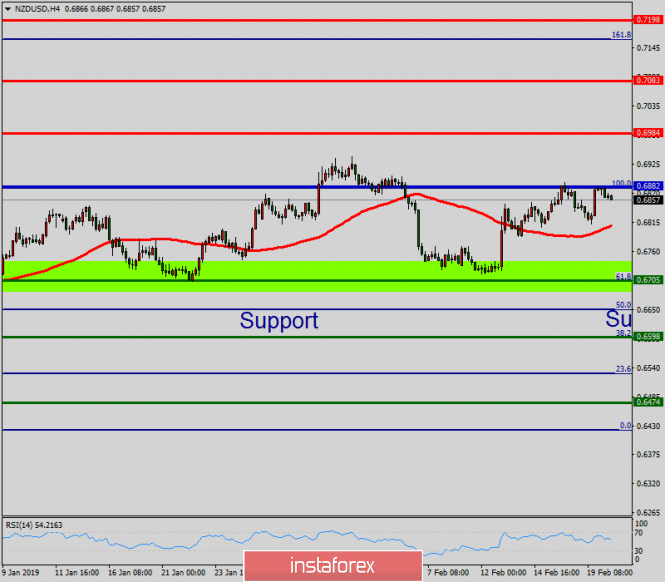

| Technical analysis of NZD/USD for February 20, 2019 Posted: 20 Feb 2019 03:33 AM PST Pivot point: 0.6882. The NZD/USD pair breached resistance which had turned into strong support at the level of 0.6705 this week. The level of 0.6705 coincides with a golden ratio, which is expected to act as major support today. The RSI is considered to be overbought, because it is above 70. The RSI is still signaling that the trend is upward as it is still strong above the moving average (100). Besides, note that the pivot point is seen at the point of 0.6882. This suggests that the pair will probably go up in the coming hours. Accordingly, the market is likely to show signs of a bullish trend. In other words, buy orders are recommended to be placed above 0.6800 with the first target at the level of 0.6882. From this point, the pair is likely to begin an ascending movement to the point of 0.6882 and further to the level of 0.6984. The level of 0.6984 will act as strong resistance. However, if there is a breakout at the support level of 0.6705, this scenario may become invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin analysis for February 20, 2019 Posted: 20 Feb 2019 03:24 AM PST

BTC has been trading sideways at the price of $4.013. The momentum is still bullish and there are no signs of a reversal yet. We found a potential end of the downward correction (running flat abc), which is a sign that buyers may resume the uptrend. Intrarday resistance is set at $4.031 and intraday support at $3.900. Trading recommendation: We are still neutral on BTC but you can buy aggressively from $4.000 with protective stop at $3.900. Profit targets are set at $4.195 and $4.360. The material has been provided by InstaForex Company - www.instaforex.com |

| Intraday technical levels and trading recommendations for EUR/USD for February 20, 2019 Posted: 20 Feb 2019 03:17 AM PST

Since June 2018, the EUR/USD pair has been moving sideways with slight bearish tendency within the depicted bearish Channel (In RED). On November 13, the EUR/USD pair demonstrated recent bullish recovery around 1.1220-1.1250 where the current bullish movement above the depicted short-term bullish channel (In BLUE) was initiated. Bullish fixation above 1.1430 was needed to enhance further bullish movement towards 1.1520. However, the market has been demonstrating obvious bearish rejection around 1.1430 few times so far. The EUR/USD pair has lost its bullish momentum since January 31 when a bearish engulfing candlestick was demonstrated around 1.1514 where another descending high was established then. On February 5, a bearish daily candlestick closure below 1.1420 terminated the recent bullish recovery. This allowed the current bearish movement to occur towards 1.1300 where the lower limit of the depicted DAILY channel failed to demonstrate immediate bullish support. However, this week, the EUR/USD pair has demonstrated some bullish recovery around the depicted price zone (1.1300-1.1270) which brought the pair again inside its movement channel. Hence, a bullish target around 1.1430 will probably be visited as long as the pair maintain its bullish persistence above 1.1300. On the other hand, a bearish flag pattern may become confirmed if bearish persistence below 1.1250 is achieved on the daily-chart basis. Pattern target is projected towards 1.1000. Trade Recommendations: A counter-trend BUY entry was already suggested near the price level (1.1285). Stop Loss to be located below 1.1225 while T/P level to be located around 1.1350 and 1.1420. The material has been provided by InstaForex Company - www.instaforex.com |

| Review of the foreign exchange market on 02/20/2019 Posted: 20 Feb 2019 03:13 AM PST Yesterday, the dollar quite actively lost its position, although if we rely on macroeconomic statistics, there are simply no reasons for this. Thus, the unemployment rate and the growth rate of the average wage in the UK remained unchanged. Yet, a decrease is expected in the unemployment rate, as well as the acceleration of the growth of average wages. Also, data on the construction industry in Europe showed a slowdown in its growth from 1.1% to 0.7%, while an acceleration of 2.1% was predicted. Thus, given that no data has been published in the United States, the weakening of the dollar looks rather strange. Nevertheless, yesterday rumors began to spread that at the minimum before the signing of a new trade agreement between the United States and China, the Federal Reserve System would try to avoid direct statements regarding the possibility of easing monetary policy. Considering that the text of the minutes of the Federal Commission on Open Market Operations is being published today, bidders began to play against the dollar. If indeed there would be no indication of reducing the rate of decline in the balance of the Federal Reserve System, they will actively buy the cheapened dollar. Such rumors themselves are completely substantiated since the US Central Bank must consider the position of the Bank of China, which under the conditions of commercial uncertainty and tendency of the Federal Reserve in mitigating the monetary policy towards softening. Indeed, there is a high probability that any hints of the possibility of mitigating the monetary policy of the Federal Reserve System, which will lead to a stronger dollar, will be excluded from the text of the protocol. Another interesting point is the meeting between Theresa May and Jean-Claude Juncker. It also became a reason for the weakening of the dollar because any hint of progress in terms of reaching agreements on the part of the divorce agreement has a positive effect on the expectations of market participants. However, relying on the results of previous meetings, as well as on the fact that the parties have not advanced a single step on this issue over the past two years, it is worth expecting that this meeting will bring some disappointments. On another end, dismay on the British side since this situation itself only promises some advantages for Europe. It turns out that the fully programmed result of this meeting will also be an occasion to weaken the pound and followed by the single European currency. EUR: Most likely, the single European currency will drop to 1.1300. GBP: The pound will be reduced to 1.2950. |

| Dollar continues to rise against yen on pending Fed protocols Posted: 20 Feb 2019 03:13 AM PST The dollar does not intend to make any sudden movements before the publication of the minutes of the Fed meeting. Although, it managed to strengthen against the yen amid a stronger risk appetite for investors, which limits the demand for the Japanese currency. In general, considering that the Japanese currency is a safe haven, it surrendered as Japanese stocks climbed to new two-month highs. Currently, the yen has gone into deep defense. This plays into the hands of the dollar in this pair. Recall that on Tuesday, the dollar rose against the yen following the statement of the head of Japan's Central bank saying that the Central Bank "is ready to increase incentives if a sharp increase in the yen will damage the economy." If you look at it, the Bank of Japan doesn't have many options even if it really decides to act. But the global trend, starting with the United States, Europe, and Australia, is moving towards a softer policy. As for the dollar, the attempts of market participants to predict its value in terms of the dovish Fed policy keep the currency on defense. The yield on 10-year US Treasury bonds plummeted to an 11-day low before the publication of the minutes of the Fed meeting. The dollar quotes grew steadily last week but the demand for the liquid dollar has recently faded amid optimism that a new round of talks between China and the United States will help resolve their trade dispute. It is worth noting that the yuan rose following the report of Bloomberg that the US insists on a promise from China that it will not devalue the yuan in a trade transaction. |

| February 20, 2019 : GBP/USD Bullish opportunity around the backside of the broken movement channel. Posted: 20 Feb 2019 03:07 AM PST

On December 12, the previously-dominating bearish momentum came to an end when the GBP/USD pair visited the price levels of 1.2500 where the backside of the broken daily uptrend was located. Since then, the current bullish swing has been taking place until January 28 when the GBP/USD pair was almost approaching the supply level of 1.3240 where the recent bearish pullback was initiated. Shortly after, the GBP/USD pair lost its bullish persistence above 1.3155. Hence, the short-term scenario turned bearish towards 1.2920 (38.2% Fibonacci) then 1.2820-1.2800 where (50% Fibonacci level) is roughly located. Last week, lack of bullish demand was demonstrated around 1.2920 until Friday when significant bullish recovery was demonstrated around 1.2800-1.2820 (Fibonacci 50% level) resulting in a Bullish Engulfing daily candlestick. This initiated the current bullish breakout above the depicted H4 bearish channel. Hence, remaining bullish target is projected towards 1.3200 and 1.3240. On the other hand, the GBP/USD currently has a significant demand zone located around (1.2960-1.2925) to be watched for BUY entries. Bullish persistence above 1.2960 (newly-established demand zone) remains mandatory so that the current bullish movement can pursue towards the mentioned bullish targets. Any bearish breakdown below which invalidates the whole bullish scenario for the short-term. Trade Recommendations : Any bearish pullback towards the depicted H4 demand zone (1.2960-1.2925) should be watched for a valid BUY entry. S/L to be located below 1.2890. T/P levels to be located around 1.3040, 1.3155 and 1.3235. The material has been provided by InstaForex Company - www.instaforex.com |

| USD/JPY analysis for February 20, 2019 Posted: 20 Feb 2019 02:55 AM PST USD/JPY is trading at 110.75 and inside of the corrective structure (bearish flag), which is a sign that buying looks risky. Since there is impulsive downward movement in the background, we expect downward continuation in the next period.

USD/JPY did a successful breakout of the rising upward trendline in the background, which is a sign of weakness. We found a hidden bearish divergence on the Stochastic oscillator, which is another sign of weakness. Key short-term resistance is set at 111.13 while the key support short-term support is set at 11.28. Trading recommendation: We sold aggressively USD/JPY (small position) from 110.77 and we placed protective stop at 111.15. We plan to add another position if we see a breakout of the bearish flag (110.47). Downward targets are set at 110.28 and 109.60. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of Gold for February 20, 2019 Posted: 20 Feb 2019 02:38 AM PST As expected gold is trading towards our minimum target at $1.360.00. This is an important long-term resistance area and the bulls are sure to find resistance there and that is why the level of $1.360.00 looks good for profit taking.

Rising white line – running support Blue line – key long-term resistance Gold is making higher highs and higher lows in the daily time - frame. Price has bounced from the running upward trendline (support). Resistance is important around $1.360. Key short-term support is set at $1.324.00. Trading recommendation: We are still bullish on Gold from $1.328.00 but we moved our stop loss on breakeven. Profit target is set at the price of $1.360.00. The material has been provided by InstaForex Company - www.instaforex.com |

| Wave analysis of EUR / USD for February 20. Is Eurocurrency ready for continued growth? Posted: 20 Feb 2019 01:19 AM PST Wave counting analysis: On Tuesday, February 19, trading ended for EUR / USD by another 30 bp increase. Thus, the pair continues to build the estimated wave 4 of the downward trend section, which assumes the form of a triangle, or the three-wave structure downward is completed. The instrument proceeds to construct an upward trend segment at least a three-wave trend. One way or another, now the tool has hit the 23.6% Fibonacci level, and the euro's future prospects are directly related to the willingness or unwillingness to make a breakthrough at this level. Sales targets: 1.1228 - 0.0% Fibonacci 1.1215 - 0.0% Fibonacci Shopping goals: 1.1356 - 23.6% Fibonacci 1.1408 - 61.8% Fibonacci General conclusions and trading recommendations: The pair completed the construction of the descending wave 3. Thus, now I recommend buying with targets located near the estimated mark of 1.1356, which corresponds to 23.6% of Fibonacci, and above, about 1.1408. According to Fibonacci, a successful attempt to break through the level of 23.6% will indicate the readiness of the euro to continue building the upward wave. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading recommendations for the EURUSD currency pair - placement of trading orders (February 19) Posted: 20 Feb 2019 12:48 AM PST The Euro / Dollar currency pair for the last trading day showed low volatility of 44 points. As a result, the pair remains to be at a range level. From the point of view of technical analysis, we can see that after an intensive move, the quotation rolled back again to the range of the range level 1.1280 / 1.1300. However, this time, we saw a clear attempt by the bulls to change the already stable market interest. No statistics was shown in the news background. This is also due to the previous day off in the United States, which led to a decrease in trading volumes. From the information background, I can single out only a small splash from the shores of the old world regarding the Brexit agreement. Members of the British Cabinet threatened the head of government, Teresa May, with a succession of resignations if she did not rule out the possibility of Brexit without a deal with the EU.

Further development Analyzing the current trading chart, we see an amplitude oscillation within the range level of 1.1280 / 1.1300, where the quote is trying to find a foothold, but still it remained at the same limits. It is likely to assume the preservation of the current amplitude oscillation with an extension to the framework of 1.1280 / 1.1340. Traders, in turn, monitor these boundaries for breakdown. And of course, special attention is paid to the upper boundary.

Based on the available data, it is possible to expand a number of variations, let's consider them: - We consider buying positions in case of price fixing higher than 1.1340, with the prospect of a move to 1.1400-1.1440. - Positions for sale, as already mentioned in the previous review, were conducted according to the principle of small positions that developed within the range of 1.1280 / 1.1340, that is, testing the value of 1.1340 which brings us back to 1.1300. This happened in principle. Indicator Analysis Analyzing the different timeframe (TF) sector , we can see that in the short and intraday perspective, there is an upward interest against the background of the recent jump. The medium-term outlook keeps the initial downward interest against the general background of the market. Weekly volatility / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation , with the calculation for the Month / Quarter / Year. (February 19 was based on the time of publication of the article) The current time volatility is 31 points. It is likely to assume that if the stagnation drags on, the volatility will remain low. But if the quotation still manages to break out above 1.1340, then we can talk about the process of working out the range level and thus, it will result to an increasing volatility. Key levels Zones of resistance: 1.1340 *; 1.1440; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1.2100 Support areas: 1.1300 **; 1.1214 **; 1.1120; 1.1000 * Periodic level ** Range Level The material has been provided by InstaForex Company - www.instaforex.com |

| What to expect from the Fed protocols: the Fed will not raise rates and stop the balance reduction Posted: 20 Feb 2019 12:40 AM PST While traders and economists are preparing to begin studying the minutes of the January meeting of the Federal Reserve System, the speeches of the Fed representatives will help determine the course of the committee's future policy at the beginning of this year. Yesterday, Cleveland Fed President Loretta Mester said that if the economy met expectations, the rates may have to be slightly raised. However, at the moment, the Fed's policy is not far behind the development of the situation in the economy, and is not much ahead of it, which gives time to gather additional information before making further adjustments to the policy. Mester is confident that at the upcoming meetings, the Fed will make final adjustments to the plans for completing the reduction of the balance sheet, which is also likely to outline prospects for interest rates. If the committee declares about the suspension of the balance reduction, it is likely that monetary tightening will be suspended. Loretta Mester considers the delay in the reduction of the balance of the Fed by the end of the year acceptable. At the end of the presentation, the representative of the Fed noted that currently, the US economy is facing counter-currents and obstacles, but the growth is likely to continue, which will allow us to expect good results for the end of 2019 As for the fundamental statistics, which was published yesterday in the afternoon, attention was attracted only by the report on the indicator of the sentiment of housing builders in the United States in February of this year, which rose again. According to the National Association of Home Builders NAHB, the housing market index in February rose to 62 points against 58 points in January. Economists had expected the index to be 59 points in February. The rise in sentiment is directly related to the recent decline in mortgage rates after the Fed's suspension of the policy of raising interest rates, as well as to the good state of the labor market, which affects the mood of the builders. Last week, the average rate for a 30-year fixed-rate mortgage loan was 4.37% against a recent high of 4.94%. As for the technical picture of the EURUSD pair, further growth will directly depend on the Federal Reserve protocols, which will be published today. If traders find nothing interesting in them, and the prospects for further increases in US interest rates remain unclear, the pressure on the US dollar may increase, which will support risky assets in the short term. This may lead to a breakthrough of resistance 1.1355 and a further increase in EURUSD in the area of highs 1.1400 and 1.1440. In the case of a downward correction, and as we can see on the chart, before each new wave of euro growth there is a sharp depreciation, large levels of support are viewed in the 1.1315 and 1.1280 ranges. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 Feb 2019 12:15 AM PST Wave counting analysis: On February 19, the GBP / USD pair gained about 140 bp. After that, it went beyond the maximum of the previous wave, which required making adjustments to the current wave marking. Nevertheless, the downward trend, taking its beginning on January 25, still looks like a 5-wave completed structure. Therefore, the current tool enhancement can be identified as a corrective wave set. If this assumption is correct, then the tool can resume its decline from the current position or from the level of 76.4% on the small Fibonacci grid, as part of building a new impulse wave with targets located below the 28th figure. Thus, an unsuccessful attempt to break through the level of 76.4% will indicate that the pair is ready to decline. Shopping goals: 1.3109 - 76.4% Fibonacci Sales targets: 1.2734 - 61.8% Fibonacci 1.2619 - 76.4% Fibonacci General conclusions and trading recommendations: The wave pattern still assumes the construction of a downward wave. Thus, now, I recommend selling the instrument with targets located near the estimated levels of 1.2826 and 1.2734, which equates to 50.0% and 61.8% Fibonacci. One can wait for the unsuccessful attempt to break through the level of 76.4% for opening sales. As the news background caused demand for the pound and on the wave of these emotions, the market may continue to buy a pound. The material has been provided by InstaForex Company - www.instaforex.com |

| Simplified wave analysis. Overview of GBP / JPY for February 20 Posted: 20 Feb 2019 12:14 AM PST Large TF: The largest scale of the terminal gives a picture of an ascending wave model, in which the first 2 parts (A + B) have now been completed. The likely potential for the upcoming growth rate reaches 10 price figures. Small TF: The rising wave of January 3 develops as an impulse. Intermediate correction left behind. From February 15, the price went up again. A rollback will follow from the current price levels, after which the general price increase will continue. Forecast and recommendations: On the cross-country chart, the preparation is completed before the price breakthrough upwards. The time of the coming flat lull is recommended to use to search for entry points in the long position. Resistance zones: - 147.60 / 148.10 Support areas: - 143.50 / 143.00 Explanatory notes for the figures: The simplified wave analysis uses waves consisting of 3 parts (A – B – C). On each of the considered scales of the graph, the last, incomplete wave is analyzed. Zones show calculated areas with the highest probability of reversal. The arrows indicate the wave marking by the method used by the author. The solid background shows the formed structure, the dotted - the expected movement. Note: The wave algorithm does not take into account the duration of tool movements over time. To conduct a trade transaction, you need confirmation signals from the trading systems you use! The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 Feb 2019 12:02 AM PST 4-hour timeframe Technical details: The senior linear regression channel: direction - up The junior linear regression channel: direction - down. Moving average (20; smoothed) - sideways. CCI: 162.1134 The currency pair GBP / USD on Wednesday, February 20, amid the information that the European Union is not at all opposed to postponing the UK exit date from the EU, has shown significant strengthening. We have already seen a similar picture more than once in the past year when the pound sterling enjoyed consolidating on various kinds of rumors, unverified information and market expectations about the positive outcome of Brexit. It seems that in 2019, the pound will also seek support in precisely such factors. It also appeared that the Attorney General of England and Wales, Geoffrey Cox, has developed new legal proposals on the conditions of the Brexit, which must satisfy both parties. Probably, this information also supported the pound. Although in fact, it does not guarantee that the procedure for discussing the terms of Brexit will really break the deadlock. Nevertheless, this information is like a breath of fresh air for investors. However, we still believe that there are no compelling fundamental reasons for the growth of the pound and in general, there are no reasons for joy. Firstly, it is not known what kind of conditions will be offered to the British Parliament and the EU, which has refused to conduct new negotiations. Secondly, today there will be a meeting between Theresa May and Jean Claude Juncker, following which there will definitely be new information on Brexit. In general, we continue to monitor the situation. Nearest support levels: S1 - 1.3031 S2 - 1.3000 S3 - 1.2970 Nearest resistance levels: R1 - 1.3062 R2 - 1.3092 R3 - 1.3123 Trading recommendations: The pair GBP / USD continues its upward movement. Thus, it is recommended to trade for a raise with targets at 1.3092 and 1.3123 until the Heikin Ashi indicator turns down. Short positions will again become relevant after the price is fixed back below the moving average line. The targets, in this case, will be the levels of 1.2848 and 1.2817. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanations for illustrations: The senior linear regression channel is the blue lines of the unidirectional movement. The junior linear channel is the purple lines of the unidirectional movement. CCI is the blue line in the indicator regression window. The moving average (20; smoothed) is the blue line on the price chart. Murray levels - multi-colored horizontal stripes. Heikin Ashi is an indicator that colors bars in blue or purple. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 Feb 2019 12:02 AM PST 4-hour timeframe Technical details: The senior linear regression channel: direction - sideways. The junior linear regression channel: direction - down. Moving average (20; smoothed) - up. CCI: 127.3110 The EUR / USD currency pair with great difficulty fixed above the moving average line and completed the Murray level of "2/8" - 1.1353. From a fundamental point of view, the growth potential of the European currency is at that exhausted. However, taking into account the fact that the pair failed from three attempts to overcome the important and strong support area of 1.1250 - 1.1290, we can assume that the strengthening of the euro can continue based on technical factors. Thus, for further upward movement, the pair will need to overcome the level of 1.1353. To date, February 20, not a single significant publication has been planned again. Only in the States will the report of the last Fed meeting be published late in the evening. However, as is almost always the case, this report does not contain fundamentally new information, therefore, the reaction to it in most cases is absent. However, this report is not recommended to be overlooked. At the same time, there is another important question to which the market would like to receive an answer. Will the Fed complete the reduction program? Earlier, it was repeatedly discussed that the Fed is completing the course on a systematic increase in the key rate, and therefore the question arises about the balance of the Fed. If any signals are received about the completion of this program or a reduction in its pace, this will be a negative point for the US dollar. Nearest support levels: S1 - 1.1292 S2 - 1.1230 S3 - 1.1169 Nearest resistance levels: R1 - 1.1353 R2 - 1.1414 R3 - 1.1475 Trading recommendations: The EUR / USD currency pair broke the moving and completed the level of 1.1353. Thus, in the case of overcoming the first target, long positions with a target of 1.1414 will be relevant. It is recommended to return to sell orders no earlier than price fixing below the moving average line. In this case, the tendency for the instrument to change is downward, and the target will be 1.1230. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanations for illustrations: The senior linear regression channel is the blue lines of the unidirectional movement. The younger linear regression channel is the purple lines of the unidirectional movement. CCI - blue line in the indicator window. The moving average (20; smoothed) is the blue line on the price chart. Murray levels - multi-colored horizontal stripes. Heikin Ashi is an indicator that colors bars in blue or purple. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis for EUR/USD for February 20, 2019 Posted: 19 Feb 2019 11:34 PM PST EUR/USD as expected has bounced towards our minimum target of the 38% Fibonacci retracement level around 1.1340. This is important short-term resistance area and if bulls manage to reclaim and stay above 1.1350, we should be heading towards 1.14-1.1420 soon.

Green line - support trend line Red line - resistance trend line Blue rectangle -short-term target (achieved) Black rectangle - next bounce target EUR/USD has started making higher highs and higher lows in the 4 hour time frame. Price has bounced as expected and reached our first target. Resistance is important around 1.1350 and if bulls are strong enough we could see a move higher towards 1.14. The next Fibonacci resistance level is at the 61.8% retracement at 1.1407. Support is at yesterday's lows at 1.1275. Bulls do not want to see this level broken. If support fails to hold we could see a move towards 1,12 or lower. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment