Forex analysis review |

- XAU/USD approaching key resistance, potential reversal!

- CAD/JPY bounced off its key support where we expect to see a further rise!

- XAG/USD approaching resistance, big drop upcoming!

- EUR / USD h4. Options for the development of the movement from April 26, 2019 Analysis of APLs & ZUP

- GBP / USD h4. Options for the development of the movement from April 26, 2019 Analysis of APLs & ZUP

- Mario Draghi's departure from the ECB will cause the euro rally - UBS

- Bets on the euro's growth is out of style

- Gold wages war on two fronts

- GBP/USD. 25th of April. Results of the day. The British pound sterling continues to fall

- EUR/USD. 25th of April. Results of the day. The euro continues to lose ground against the dollar, even without a foundation

- EUR/USD: Guindos' resounding statement and the anticipation of Friday's data

- April 25, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- April 25, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- Bitcoin analysis for April 25, 2019

- EURUSD: Orders for durable goods in the US have grown, which is a good signal for the US economy

- GBP/USD: plan for the American session on April 25. Pound sellers remain in the market

- EUR/USD: plan for the American session on April 25. Buyers of the euro work out the divergence

- EUR./USD analysis for April 25, 2019

- Gold analysis for April 25, 2019

- The Technical Analysis for BCH/USD during US Market Opening on Thursday April 25, 2019.

- The winning rally of the dollar continues and it seems that the greenback is not getting weak

- Simplified wave analysis and forecast for EUR/USD, GBP/USD, AUD/USD pairs on April 25

- Four factors affecting the rise in the price of gold

- BITCOIN to retrace to $5,250 again? April 25, 2019

- Fundamental Analysis of EUR/USD for April 25, 2019

| XAU/USD approaching key resistance, potential reversal! Posted: 25 Apr 2019 07:21 PM PDT Price is facing bearish pressure from our first resistance where we can expect a drop below this level to our first support level. Stochastic is approaching resistance as well. Entry : 1282.78 Why it's good : horizontal pullback resistance, 38.2% fibonacci retracement, 61.8% Fibonacci extension Stop Loss : 1288.97 Why it's good : horizontal pullback resistance, 50% fibonacci retracement Take Profit : 1266.66 Why it's good : horizontal swing low support, 61.8% fibonacci extension

|

| CAD/JPY bounced off its key support where we expect to see a further rise! Posted: 25 Apr 2019 07:19 PM PDT Price bounced off its support 82.67 where we expect it to rise further to its resistance at 83.49. Stochastic has bounced off near its support as well. A bullish divergence with price has been identified, which adds to our bullish bias. Entry : 82.18 Why it's good : horizontal overlap support, l61.8% fibonacci retracement, 61.8% fibonacci extension Stop Loss : 82.18 Why it's good : 78.6% Fibonacci retracement Take Profit : 83.49 Why it's good : horizontal pullback resistance, 50% fibonacci retracement

|

| XAG/USD approaching resistance, big drop upcoming! Posted: 25 Apr 2019 07:17 PM PDT Price is approaching our first resistance where we are expecting a drop below this level. Entry : 15.09 Why it's good : horizontal swing high resistance, 61.8% fibonacci retracement, 100% fibonacci extension Stop Loss : 15.20 Why it's good : 76.4% fibonacci retracement Take Profit : 14.78 Why it's good : horizontal overlap support, 61.8% fibonacci retracement

|

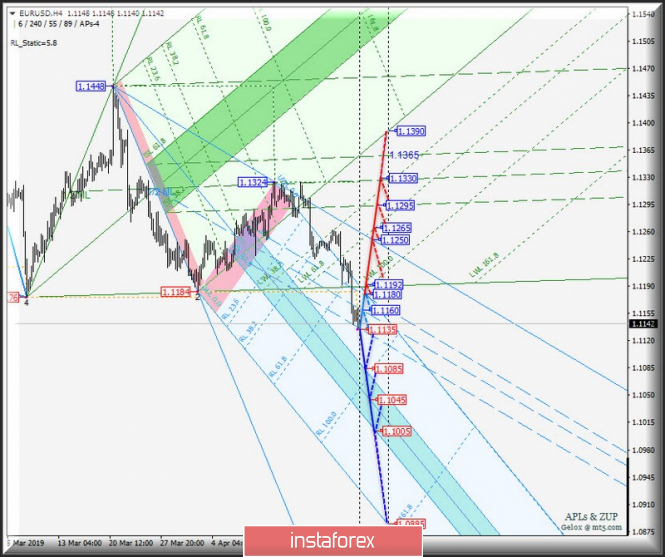

| Posted: 25 Apr 2019 07:06 PM PDT Minute ( h4 ) Euro vs US Dollar Index Previous Review from 04/19/2019 19:58 UTC + 3. ____________________ movement of the single European currency by EUR / USD c April 26, 2019 is due to perfecting the boundaries channel of the the Median Line 1/2 ( 1.1135 <-> 1.1160 <-> 1.1180 ) Fork Operational scale Minuette . The layout of the movement options inside the 1 / 2ML Minute channel is presented in an animated graphic. ____________________ Development perspective of the downward movement (sell) Breakdown For the development Prospects of the upward movement (buy) The Details are shown in animated graphics. ____________________ The review was compiled and is not a guide to action (placing orders "sell" or "buy").

Materials for the study of analysis ZUP & APL `s. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 Apr 2019 06:30 PM PDT Minute (h4) Great Britain pound vs US dollar Previous Review from 04/19/2019 19:44 UTC + 3. ____________________ Since April 26, 2019, the development of Her Majesty's currency movement , i.e. GBP / USD currency pair, will continue within the equilibrium zone ( 1.2920 <-> 1.2835 <-> 1.2745 ) of the forked operating scale Minute. The marking of movement options within the zone of the equilibrium of the Minute pitchfork is shown in the animated graphic. ____________________ The development perspective of the downward movement (sell) If the level of support 1.2745 (the lower bound ISL61.8 balance scale forks operational zone Minute) will determine the further development of the movement of GBP / USD which is already in equilibrium zone (1.2745 <-> 1.2695 <-> 1.2655), and if the fork operational scale minute, and ISL61.8 (1.2655) is broken, then the downward movement of the financial instrument continues to the end of the line FSL Minute - level of support 1.2500. Details look on animated graphics. ____________________ The development perspective of the upward movement (buy) The breakdown of the resistance level of 1.2920 (upper limit of ISL38.2 forks operating scale Minute) will make it possible to reach the borders of the 1/2 Median Line channel (1.2935 <-> 1.2955 <-> 1.2975) of the operational scale Minute, in the case of breakdown of the upper limit (1.2975) of this channel, the upward movement of GBP / USD can be continued to the targets -> the final Schiff Line Minute ( 1.3025 ) <-> control line UTL Minute ( 1.3045 ) with the prospect of achieving local maximum 1.3132 by a currency instrument. Details are shown in animated graphics. ____________________ The review was compiled without regard to the news background. The opening of trading sessions of the main financial centers and is not a guide to action (placing orders "sell" or "buy"). Materials for the study of analysis ZUP & APL `s. The material has been provided by InstaForex Company - www.instaforex.com |

| Mario Draghi's departure from the ECB will cause the euro rally - UBS Posted: 25 Apr 2019 04:50 PM PDT UBS Global Wealth Management experts believe that whoever replaces Mario Draghi as the ECB president will cause a rise in the euro. Moreover, if some candidates are appointed to this position, a rally of the single European currency may follow. "Any replacement of the current chairman of the ECB, whose eight-year term of office expires in October, is likely to be regarded as hawkish," analysts say. "Under M. Draghi, the regulator lowered interest rates to negative values, launched an inconsistent quantitative easing program to fight deflation, and kept the promise to do "everything that is needed" to save the euro," they added. Since M. Draghi took office in November 2011, the single European currency has lost about 18% in weight. "Anyone who replaces M. Draghi will probably find it difficult at first to convince the market that it is as strong and devoted as its predecessor. We think that market participants, in case of doubt, would prefer to buy rather than sell the euro, "said UBS representatives. Whoever becomes the successor to the current head of the ECB, his candidacy will be determined depending on how the leading posts in the EU are distributed after the elections to the European Parliament, which will be held in late May. UBS believes that the representatives of Germany and France - Jens Weidmann and Francois Villeroy de Galhau - have a good chance of being appointed as the ECB president. Possible candidates also include Finnish representatives Erkki Liikanen and Olli Rehn. "The growth of the euro is likely to be more sustainable if J. Weidmann or O. Rehn is chosen, since they are more conservative than other candidates who can cause a rally of the single European currency only at the initial stage. Although the ECB decision making is usually based on consensus, the personality and character of the president matter, and we should not underestimate the influence that M. Draghi had on the euro during his term of office," the experts said. The material has been provided by InstaForex Company - www.instaforex.com |

| Bets on the euro's growth is out of style Posted: 25 Apr 2019 04:50 PM PDT The US dollar confidently passes multi-months highs. Thus, it challenges analysts who predicted the US currency's fall this year due to a change in the Fed's rhetoric on interest rates. The euro suffers from the absence of signs of a recovery in the eurozone economy, while it was predicted that it would take off. Bets on strengthening the single currency become irrelevant, and traders are urgently changing their positions. What's happening? Why did market participants suddenly fall in love with the dollar? The fact is that now the US economy looks like a separate prosperous island in comparison with other countries of the world, which continue to publish disappointing reports. The contrast with the eurozone is most noticeable. Therefore, the EUR/USD pair's fall is caused not so much by the dollar's strength, as by the weakness of the euro, the rate of which goes lower with each output of macroeconomic data. Yesterday's portion of data pulled down the main forex pair to its lowest since the beginning of the year. The fate of the euro will depend on two factors. First of all, from the path that the world economy will take. If it turns out that China will stand on its feet and help German exports and GDP, then we can consider buying the euro. It is worth considering that the new trade conflict can lead to zero recovery of China, and then a test of the euro at the level of $1.05 is not excluded. The next so-called key to the door of the EUR/USD's future may well be US inflation. Despite the fact that the dollar is now confidently going up in relation to its main competitors, currency analysts stubbornly continue to doubt its long-term strength. Strategists still do not believe in the "American" rally, considering that the explosive growth that is currently taking place is associated with "the weakness of other currencies." "The dollar looks good, but, according to our estimates, it will not be able to implement a confident bullish scenario," wrote currency analysts for Europe at the Toronto-Dominion Bank in London. The Canadian dollar's plummet to its lowest since January 2019 in relation to the greenback occurred not because of the latter's strength, but in connection with the Bank of Canada meeting. The USDCAD pair's high of the day was 1.3519. The markets were focused on the adjusted estimates of economic growth and inflation, as well as the regulator's position regarding future rate changes. The regulator lowered the forecast of GDP growth for this year from 1.7% to 1.2%, and also decided to abandon the policy focus on tightening policy, opening the way for the possibility of lowering rates. Such a statement was an additional signal that the USDCAD may claim to move above 1.40 in the long term. As for the pound, it continues to slowly walk around two-month lows in the absence of news on Brexit. The economic picture in the UK is not as sad as in the eurozone, so the pound's deep failures on this background can not wait. On the eve, Theresa May reported that negotiations with the Labour Party were important, but at some point the differences are significant. As you know, the risk of a hard Brexit is eliminated, so the undervalued pound now looks attractive for purchases. |

| Posted: 25 Apr 2019 04:43 PM PDT The correction of world stock indices allowed gold bulls to take a breather. In April, the precious metal went into deaf defense against the background of new S&P 500 records and the rise of the USD index to the area of 23-month highs. Stocks of the largest specialized stock exchange SPDR Gold Shares fell to 747.9 tons, the lowest mark since October, and in general, the ETF index returned to the marks from which it began the year. The growth of global risk appetite and a strong dollar is a disastrous combination for gold. However, its fans do not intend to sprinkle ashes on the precious metal's head just yet. On the side of the bulls, XAU/USD is played by low real rates of the global debt market and high demand for physical assets from central banks and Asia. Thus, in March, Russia added 600 thousand ounces to its reserves, Turkey - 546 thousand, China - 360 thousand, Kazakhstan - 161 thousand. Regulators diversify assets, getting rid of US dollars due to Donald Trump's policy of protectionism and the threat of new sanctions . At the same time, exports of precious metals from Switzerland to China in March exceeded 1 million ounces, which is the highest value since November. In my opinion, there is no reason to flatter yourself about the latest statistics: the experience of 2013 suggests that when gold flows from West to East (from ETF to Asia), the bears dominate the derivatives market. If the release of US GDP data for the first quarter proves that the US economy is still strong, the S&P 500 and other stock indices have good chances to continue the rally. Strong dollar positions depend on the weakness of other currencies. The disappointing statistics on Australian inflation and the German business climate pulled down the aussie and the euro, while the sharp decline in the Bank of Canada's GDP forecast of the Maple Leaf country for 2019 hit the bulls positions hard. The USD index rushed to 23-month highs, and as long as investors do not see an improvement in the health status of the leading economies of the world, we cannot talk about its serious correction. In this regard, XAU/USD quotes in the short term risk a return of the downward trend. Gold and Dow Jones Dynamics In the mid-term investment horizon, the situation may seriously change. If the eurozone and China do not justify the hopes placed on them, the US dollar will continue to strengthen due to the high demand for safe-haven currencies in the face of worsening global risk appetite, but the likelihood of a correction of the S&P 500 will increase. On the contrary, good news from Asia and the eurozone will lead to a rollback of the USD index, but the US stock market is likely to retain its momentum. Both scenarios are fraught with consolidation of the precious metal. It is possible that at the turn of April and May, it will grope the boundaries of the future trading range. Technically, after reaching a target of 161.8% for the AB=CD subsidiary pattern, a slight increase in gold quotes appears logical. "Bulls" are trying to cling to the level of $1275 per ounce (38.2% of the long-term uptrend). If it works out - there will be a chance to return the precious metal in the range of $1282-1310, if it does not - the initiative will return to the "bears". The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. 25th of April. Results of the day. The British pound sterling continues to fall Posted: 25 Apr 2019 04:26 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 74p - 29p - 23p - 91p - 76p. Average amplitude for the last 5 days: 59p (51p). On Thursday, April 25, the British pound sterling completed the support level of S2 - 1.2888, but is unlikely to stop there. Most likely, the British currency is waiting for a small correction tomorrow, after which the downtrend will resume. In the past few months, we have been tirelessly writing that there is no fundamental reason for the British currency's growth. For a while, the pound was growing solely on expectations that the European Union, the British Parliament and Theresa May would be able to negotiate a "deal" on Brexit, but now that these hopes have collapsed, the pound is not holding anything anymore. In the next 6 months, we believe that in general, the pound will continue to fall. Of course, not without corrections and periods of growth. Even if it's from the United States, it is now quite difficult to expect positive information for the pound. The Fed does not plan to reduce rates in the near future. The country's economy, despite long conversations about a possible recession, continues to feel stable. Macroeconomic reports can not be called a failure as a whole, but Britain continues to lose large sums of money due to Brexit, as a result of which economic indicators are falling, which creates an even greater pressure on the pound. Not a single important report was received from Britain this week, nor will there be one tomorrow. Even on Brexit, there is no new information, except rumors about a possible new vote of no confidence in Theresa May. On the 24-hour chart, the pair broke through the Ichimoku cloud, which reinforces the current "dead cross" and again contributes to the downward movement of the pair. Trading recommendations: zThe GBP/USD continues to move downwards. Thus, sell orders with targets of 1.2888 and 1.2828 remain relevant. It is recommended to hold them until the MACD indicator turns upward, which will indicate a correctional turn. Long positions with small lots are recommended to be considered not earlier than overcoming the Kijun-sen line with a goal of the Senkou Span B line. However, bulls may need fundamental support, which still does not exist.and not a single important report has been received this week, nor will there be one for tomorrow. In addition to the technical picture, one should also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chikou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 Apr 2019 04:13 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 78p - 19p - 27p - 69p - 84p. Average amplitude for the last 5 days: 55p (48p). As we expected in the morning review, macroeconomic events have little effect on the currency pair. For example, today, the US dollar continued to rise in price against the European currency since the morning, although there were no fundamental reasons for this. There were no fundamental reasons but there were technical ones. The main one is to overcome the level of 1,1200, which opens the way down to the pair. The reports on durable goods orders for March were released during the US trading session. Excluding transportation, and subject to, and without regard to defense, and excluding defense and aircraft, all indicators have exceeded forecast values. Thus, the dollar receives additional fundamental support and can continue to strengthen against the euro. From a technical point of view, everything is very simple now: the pair continues its downward movement without any signs of an upward correction. The upward turn of the MACD indicator may signal an upward correction reversal, but with its indications now you need to be careful, since it could begin to discharge while it is at its lowest values. On the last trading day of the week, that is, tomorrow, a correction for the pair may begin, since this week's losses for the euro are quite large. Tomorrow, the preliminary value of US GDP will be published and it is expected that it will slightly decline compared to the previous period. This report may be the basis for the reduction of short positions on the pair. Trading recommendations: The EUR/USD continues a downward movement with targets of 1,1107 and 1,1084. The upward turn of the MACD indicator can be interpreted as a beginning of the correction, but the price should also rise. It is recommended to consider purchase orders in small lots for a goal of the Senkou span B line not earlier than when the price is consolidated above the critical line. In this case, the initiative will go into the hands of bulls for some time. In addition to the technical picture, one should also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chikou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: Guindos' resounding statement and the anticipation of Friday's data Posted: 25 Apr 2019 03:51 PM PDT The US currency shows growth throughout the market for the second day in a row. With rare exceptions (for example, USD/JPY), the greenback dominates in all dollar pairs, and for the first time since May 2017, the dollar index tested the area with 98 points. The euro-dollar pair also set a kind of price record, falling to two-year lows (to be more precise, to the troughs of January 2017). After the EUR/USD bears were able to penetrate the support level of 1.1170 (the bottom line of the Bollinger Bands indicator on the daily chart), on the horizon, there were real prospects for a decline to the 10th figure. But this is not an easy task - as early as the US session on Thursday, the price moved from the low of the day to 1.1119 in anticipation of tomorrow's release of data on the growth of the American economy. However, many currency strategists refer to the dollar's "April rally" with a certain skepticism. In their opinion, the dynamics of dollar pairs is largely due to the weakness of other currencies, and not the strengthening of the greenback. For example, the yen successfully opposes itself to the dollar, "monetizing" the status of the defensive asset. The Canadian dollar also halted its decline after the Bank of Canada's dovish meeting. The euro-dollar pair is in a losing situation in this context. First of all, the uncorrelation of the positions of the ECB and the Fed has been significantly enhanced lately. If the Fed has taken a strictly wait-and-see attitude, retaining the likelihood of a rate hike at the beginning of next year (or even in December of this year), the European Central Bank already allows for policy easing. Thus, ECB Vice President Luis de Guindos said today that the regulator is ready to resume the quantitative easing program (QE) in order to provoke a rise in inflation. Let me remind you that the core consumer price index has been falling for the second month in a row. The pace of deceleration is depressing - if in March, core inflation was at the level of 1%, then in April it was already at the level of 0.8%, contrary to more optimistic expectations of experts. And although Mario Draghi did not talk about the resumption of QE, following the April meeting of the ECB, he hinted quite transparently that the regulator would react to the incoming statistical reports. Today, Guindos has actually clarified exactly how the central bank can respond to a further decline in inflation in the eurozone. By and large, this statement has become today's catalyst for the EUR/USD pair's decline. It sounded almost simultaneously with the publication of the ECB Economic Bulletin, the tone of which reflects the sentiments of the members of the regulator at the last meeting. The essence of this document comes down to the fact that the eurozone economy still needs "extensive accommodation measures", while the risks of growth of the EU economy remain downward. And how can we not remember the insider information of American journalists? According to their data, some members of the ECB questioned the accuracy of the forecast models used by the regulator. In their opinion, this model gives a distorted picture and does not fully take into account the revised macroeconomic indicators. The ECB minutes published today, as well as Guindos' statement, confirmed the "dovish" attitude of the members of the European regulator. Growing concern over the slowdown in the eurozone's economic growth is putting the background pressure on the single currency. At the same time, positive statistical reports from the US only aggravate the position of the EUR/USD bulls. In particular, the March sales of new buildings grew by 4.5%, exceeding the expectations of most experts. In terms of annual rates, this result is the highest since November of the year before last. Today an important release was also published: the volume of orders for durable goods. This indicator exceeded even the most daring expectations. The total volume of orders increased immediately by 2.7% (with a growth forecast of 0.7%), and excluding transport - by 0.4% (with a forecast of 0.2%). Such figures against the backdrop of favorable corporate reporting again supported the US currency. Now the dollar will have to pass the main "test" of this week. We are talking about the publication of data on the growth of the US economy. Here it should be recalled that the US economy reached its "local" high in the second quarter of last year, when US GDP reached its peak – 4.2%. After that, the indicator began to gradually decline, reaching 2.2% in the 4th quarter of 2018. According to the forecasts of most analysts, the US economy will show a similar result in the first quarter of this year. If the real figures do not coincide with the forecast, the dollar will significantly lose its positions throughout the market, and the EUR/USD pair will not be an exception. It is also worth paying attention to the price index of GDP – according to forecasts, it should significantly decrease (from 1.7% to 1.3%). This fact can put strong pressure on the dollar, even if GDP growth is at the projected level. From a technical point of view, the bears need to enter the 10th figure in order to finally declare their intention to approach the key resistance level of 1.1000. Bulls have a more difficult task: buyers need to return the price above 1.1240 (the average Bollinger Bands line on D1 coinciding with the Tenkan-sen line). And although the bears of the pair have absolute priority at the moment, Friday's "test" can return the price to the framework of the 12th figure. The material has been provided by InstaForex Company - www.instaforex.com |

| April 25, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 25 Apr 2019 10:12 AM PDT

On January 10th, the market initiated the depicted bearish channel around 1.1570. Since then, the EURUSD pair has been moving within the depicted channel with slight bearish tendency. On March 7th, recent bearish movement was demonstrated towards 1.1175 (channel's lower limit) where significant bullish recovery was demonstrated. On March 18, a significant bullish attempt was executed above 1.1380 (the upper limit of the Highlighted-channel) demonstrating a false/temporary bullish breakout. On March 22, significant bearish pressure was demonstrated towards 1.1280 then 1.1220. Few weeks ago, a bullish Head and Shoulders reversal pattern was demonstrated around 1.1200. This enhanced further bullish advancement towards 1.1300-1.1315 (supply zone) where recent bearish rejection was being demonstrated. Short-term outlook turned to become bearish towards 1.1280 (61.8% Fibonacci) then 1.1235 (78.6% Fibonacci). For Intraday traders, the price zone around 1.1235 (78.6% Fibonacci) stood as a temporary demand area which paused the ongoing bearish momentum for a while before bearish breakdown could be executed few days ago. Conservative traders were advised to wait for a bullish pullback towards the newly-established supply zone around 1.1235 for a valid SELL entry. On the long-term, bearish persistence below 1.1235 enhances further bearish decline towards 1.1150, 1.1085 then 1.1050 and if enough bearish momentum is expressed. Trade recommendations : A valid SELL entry was suggested around 1.1235 upon the recent bullish pullback. Remaining TP levels to be located around 1.1115 and 1.1050. SL should lowered to 1.1170 to secure more profits. The material has been provided by InstaForex Company - www.instaforex.com |

| April 25, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 25 Apr 2019 08:42 AM PDT

On January 2nd, the market initiated the depicted uptrend line around 1.2380. A weekly bearish gap pushed the pair below the uptrend line (almost reaching 1.2960) before the bullish breakout above short-term bearish channel was achieved on March 11. Shortly after, the GBPUSD pair demonstrated weak bullish momentum towards 1.3200 then 1.3360 where the GBPUSD failed to achieve a higher high above the previous top achieved on February 27. Instead, the depicted recent bearish channel was established. Significant bearish pressure was demonstrated towards 1.3150 - 1.3120 where the depicted uptrend line failed to provide any bullish support leading to obvious bearish breakdown. On March 29, the price levels near 1.2980 (the lower limit of the depicted movement channel) demonstrated significant bullish rejection. This brought the GBPUSD pair again towards the price zone of (1.3160-1.3180) where the upper limit of the depicted bearish channel as well as the backside of the depicted uptrend line demonstrated significant bearish rejection. Since then, Short-term outlook has turned into bearish towards 1.2900, 1.2800 and 1.2750 where the lower limit of the depicted channel comes to meet the GBPUSD pair. Trade Recommendations: Conservative traders should be waiting for a bullish pullback towards 1.3045-1.3080 for a valid SELL entry. TP levels to be located around 1.2950, 1.2905 and 1.2800 and S/L to be located above 1.3100. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin analysis for April 25, 2019 Posted: 25 Apr 2019 08:31 AM PDT BTC price has been trading upwards in past few hours and the level of $5.462 got tested. There is potential for more upside on the near term.

Red line – major resistance trend line * broken Green rectangle – strong support based on price action Blue horizontal line – Major short-term resistance BTC price broke above the important $5.443 resistance trendline and on that way confirmed further strength. Most recently that price did reject from the strong support zone (green rectangle) at $5.368, which is sign that buyers came into the market. MACD is showing bullish divergence, which is another sign of the potential strength. Upward target at the price of $5.596. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD: Orders for durable goods in the US have grown, which is a good signal for the US economy Posted: 25 Apr 2019 07:27 AM PDT The US dollar once again rose against the European currency and the British pound after the report on the demand for durable goods in the United States. Just excellent performance over the past seven months, which exceeded all expectations of economists, only increased the demand for the US dollar. The report indicates that the growth was due to increased orders for civil and military aircraft, which are very volatile. According to the US Department of Commerce, orders for durable goods, which have a service life of more than three years, in March of this year increased by 2.7% compared with February and amounted to $258.52 billion. Economists had expected orders to grow only by 0.8% in March compared with the previous month. Data for February has also been revised for the better. The report indicates that the February drop in orders was 1.1%, while the initial estimate stated a decline of 1.6%. If we take the general data for the 1st quarter of 2019, then the demand for durable goods increased by 3% compared with the same period of 2018. As mentioned earlier, orders for non-defense goods, excluding aircraft, rose by 1.3% in March, after rising by 0.1% in February. For the first quarter, orders in this category increased by 2.8% compared to the same period in 2018. Orders for civil aircraft in March increased by 31.2% compared with February, and orders for defense goods increased by 7.4% compared with the previous month. Given the good growth rates of orders, everything suggests that the investments of American companies in the 1st quarter of this year will also show an excellent result, which will benefit the American economy and lead to its growth. Today, a report on the labor market was also published, in which optimism among traders diminished compared with previous figures. According to the US Department of Labor, the number of Americans applying for unemployment benefits for the first time has increased dramatically. Despite the growth, the data are only weekly and do not greatly affect the overall situation. Thus, the number of initial applications for unemployment benefits for the week from April 14 to 20 increased by 37,000 and amounted to 230,000. Economists had expected the number of applications to be 200,000. The moving average of applications for four weeks also increased by 4,500 and amounted to 206,000. Such data also indicate a small deficit in the labor market, as employers do not want to dismiss their employees. Let me remind you that last month, the unemployment rate in the United States was 3.8%. As for the technical outlook for the EURUSD pair for the next few days, the sellers will still strive to upgrade the major support level at 1.1080, and the buyers will try to reach the resistance of 1.1180, which could put further bearish momentum in risky assets into question. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: plan for the American session on April 25. Pound sellers remain in the market Posted: 25 Apr 2019 06:47 AM PDT To open long positions on GBP/USD, you need: Buyers of the pound cannot find a good level of support from which it would be possible to build an upward correction. At the moment, the task of the bulls is to break and consolidate above the resistance of 1.2900, which will lead to the growth of the pound in the resistance area of 1.2929, where I recommend fixing the profits. In the scenario of further pair decline, it is best to consider long positions after the formation of a false breakout in the area of 1.2867 or a rebound from a larger minimum of 1.2812. To open short positions on GBP/USD, you need: Bears will try to prevent the growth of the pound above the resistance of 1.2899, and the formation of a false breakdown there after the correction in the second half of the day will lead to a repeated decline in GBP/USD to the minimum of 1.2867. The main task of the sellers of the pound will be to consolidate below this range with the update of the level of 1.2812, where I recommend fixing the profit. When the growth scenario is above the resistance of 1.2899, you can sell a pound to rebound from a maximum of 1.2929. Indicator signals: Moving Averages Trading is conducted below 30 and 50 moving averages, which indicates the preservation of the bearish nature of the market. Bollinger Bands In the case of growth, the upper limit of the Bollinger Bands indicator around 1.2924 will act as resistance, from which you can sell a pound for a rebound. Description of indicators

|

| EUR/USD: plan for the American session on April 25. Buyers of the euro work out the divergence Posted: 25 Apr 2019 06:46 AM PDT To open long positions on EURUSD, you need: Euro buyers are expected to return to the market after updating the support level of 1.122, which I paid attention to in my morning forecast. At the moment, the main task of the bulls will be to break and consolidate above the resistance of 1.1150, which was formed in the first half of the day. Only then can we expect a larger upward correction with the test of the upper limit, perhaps a new side channel 1.1177, where I recommend fixing the profits. With a repeated decline of the euro in the area of 1.1122, it is best to return to long positions on the rebound from 1.1079. To open short positions on EURUSD, you need: Bears coped with the morning task and reached the support of 1.122. At the moment, an unsuccessful attempt to consolidate at the level of 1.1150 will be a new signal to open short positions in order to re-update the minimum of 1.1122 and its breakdown, which will lead EUR/USD to the support area of 1.1079, where I recommend fixing the profit. With the growth of EUR/USD above the resistance of 1.1150, it is possible to open short positions on a rebound from the maximum of 1.1177, which can act as the upper limit of the new side channel. Indicator signals: Moving Averages Trading is below 30 and 50 moving averages, which indicates the bearish nature of the market. Bollinger Bands In the case of growth, the upper limit of the Bollinger Bands indicator in the area of 1.1170 will act as resistance from which you can sell the euro for a rebound. Description of indicators

|

| EUR./USD analysis for April 25, 2019 Posted: 25 Apr 2019 05:46 AM PDT EUR/USD price continues to trade lower at the price of 1.1124. New downside momentum is present. Selling still favorable.

Yellow line – major resistance trend line (supply trendline) White lines- broken bearish flag pattern in background Purple line – Fibonacci expansion 100% EUR/USD price broke below the important 1.1183 support area and on that way confirmed further weakness. Most recently that price did break 12-H balance low at 1.1135, which is another confirmation of the strong selling pressure. MACD showed new momentum down and increasing of selling power. As long as the EUR is trading below the yellow supply line, the short-term trend is bearish. Downward target is set at the price of 1.1065. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold analysis for April 25, 2019 Posted: 25 Apr 2019 05:34 AM PDT Gold price continues to trade sideways at the price of $1.275.00. Potential bearish flag in creation suggests further downward continuation.

Purple rectangle - major resistance trend line Yellow lines – bearish flag channel White large lines - major down trending channel Gold price broke below the important $1,280.00 support area and on that way completed the complex head and shoulders pattern, which is sign of the further weakness on the Gold. Current rally-test is normal after the breakout in order to go further lower. As long as the price is getting accepted below the $1.280.00, we are bearish on the Gold. Watch for potential breakout of the bearish flag to confirm further downward continuation. The downward targets are set at the price of $1.249.50, $1.231.40 and $1.211.30. The material has been provided by InstaForex Company - www.instaforex.com |

| The Technical Analysis for BCH/USD during US Market Opening on Thursday April 25, 2019. Posted: 25 Apr 2019 04:59 AM PDT

When the US market opened, the BCH/USD pair seemed to be trying to reach its first target at the 295.44 level. If this level is hit, the pair is likely to move up towards its second target at the middle Pitchfork Channel. As long as the BCH/USD pair does not break through and close below the 279.55 level, the bias is bullish. The material has been provided by InstaForex Company - www.instaforex.com |

| The winning rally of the dollar continues and it seems that the greenback is not getting weak Posted: 25 Apr 2019 04:33 AM PDT Despite the fact that previously many experts predicted a weakening of the greenback, the dollar has strengthened against its main competitors by almost 2% since the beginning of this year. On the eve of the USD index, it rose above the level of 98 points, reaching peak values from May 2017. "The US has the most dynamic economy. Therefore, when investors see weak data around the world, they look to the dollar, "said Axel Merck, president of Merk Investments. According to Commerzbank currency strategist Thu Lan Nguyen, the United States now looks like an oasis because it seems that the country's economy is not connected with the rest of the world. The weak economic performance of the eurozone makes the ECB be even more cautious than the Fed, which announced its intention to "show patience" in the matter of monetary policy. At the same time, the Bank of Canada recognizes that "soft" monetary policy is still in demand. The position of the Central Bank of Australia is also shifting to the "dovish" side. In turn, the Bank of Japan intends to keep the interest rates low at least until next spring. It should be noted that the yield on 10-year US Treasury securities is about 2.5% and this is the highest rate among developed countries. Similar securities of Canada and Australia are traded with a yield of less than 2% while in Germany and Japan, the indicator is in negative territory. "When investors see that something is wrong in the world, they usually go to buy US Treasury bonds. Now a lot of things are brewing and the inflow of investments in dollar bonds is not weakening, "said Thomas Vacker from UBS Global Wealth Management. According to experts, the US currency can still update its best levels, since investors are positive about the data on US GDP for the first quarter, which will be published tomorrow. According to forecasts, the economic growth of the world's largest economy will be 2.2%. The material has been provided by InstaForex Company - www.instaforex.com |

| Simplified wave analysis and forecast for EUR/USD, GBP/USD, AUD/USD pairs on April 25 Posted: 25 Apr 2019 04:08 AM PDT After yesterday's breakthrough of strong support today, we can expect a counter pullback of the price on the chart. Most likely part of the resistance zone will be completed. EUR / USD pair On the daily scale of the euro since September last year, a corrective bullish wave is being formed. Until recently, it developed as a standard plane but it took the form of a descending triangle this week. The last wave is bearish starting from March 20th and its structure is not yet complete. Since April 12, the final part (C) has developed. Forecast: Before the final downward movement in the coming sessions, the probability of a flat rollback remains and possibly with a rising vector. The reference point of lifting the limit is the zone of resistance. Recommendations: The descending wave has stepped into the final phase, therefore, trading against its trend is irrelevant. The upcoming traffic is recommended to use in entering the sales of the pair on more favorable terms. Resistance zones: - 1.1190 / 1.1220 Support areas: - 1.1090 / 1.1060 GBP / USD pair On the chart from March 13, the pound is forming a downward wave. In the last wave model of daytime timeframe, it will take the place of correction. The final part (C) is developing in the wave structure to the current day. Forecast: After yesterday's breakthrough of strong support, we can expect a counter pullback of the price today. The most likely part of its completion is the resistance zone. Recommendations: Purchases against the dominant fall in the course are very risky. When the price approaches the reversal settlement zone, it is recommended to track the signals of your vehicle for sale to the pound. Resistance zones: - 1.2930 / 1.2960 Support areas: - 1.2850 / 1.2820 AUD / USD pair The directions of the intraday trends of the Aussies fit into the algorithm of the unfinished bearish wave of January 31. On April 17, the final part (C) started. After breaking through a strong support level, the beginning of a small-scale rising wave appeared on the chart. Forecast: In the near future, a strong price level will become the point of attraction for the price of the pair. Today, there is a high probability that the current decline will be transferred to the side area, the upper boundary of which is the calculated resistance zone. Recommendations: Despite the possible price increase, purchases are not recommended. Given the rich news background, there is a high probability of increased volatility of the pair in the market today. In the area of resistance, it is suggested to follow the reversal signals with the prospect of opening deals for sale. Resistance zones: - 0.7050 / 0.7080 Support areas: - 0.7000 / 0.6970 - 0.6850 / 0.6820 Explanations to the figures: Waves in the simplified wave analysis consist of 3 parts (A – B – C). The last incomplete wave has been analyzed. Zones show the areas where it will most likely to turn. The arrows indicate the wave marking according to the method used by the author, as well as, the formed background with a solid background. The expected movements are dotted. Note: The wave algorithm does not take into account the duration of tool movements over time. The material has been provided by InstaForex Company - www.instaforex.com |

| Four factors affecting the rise in the price of gold Posted: 25 Apr 2019 04:01 AM PDT According to experts, the short-term price dynamics for the yellow metal depends on a number of fundamental factors. In the future, conjuncture on inflation, interest rates, and the US dollar will affect the value of gold. They will be decisive for the precious metals market, analysts say. Long-term investors do not always pay attention to the dynamics of the price of gold. It is much more important for them to fix the yield from the many-year price increase for the yellow metal. However, it is necessary to monitor short-term fluctuations in value if you need to increase investment in the precious metal. Experts pay attention to a number of factors that cannot be ignored when assessing the situation on the gold market.

Currently, market participants are seeking to actively influence the market for precious metals. In this case, experts advise to buy gold, focusing on the long term, so as not to depend on short-term price fluctuations. The material has been provided by InstaForex Company - www.instaforex.com |

| BITCOIN to retrace to $5,250 again? April 25, 2019 Posted: 25 Apr 2019 03:54 AM PDT Bitcoin has made a correctional decline to near $5,250 after the price had been rejected off $5 500 recently with a daily close. The price has been quite impulsive and still non-volatile with the upward pressure which could resume bullish momentum in the short term. The price is currently expected to retrace towards $5,250 where there are dynamic level as well as the strong Horizontal Support level. After a bearish daily close yesterday, the price is currently stalling to find a definite momentum to push the price with strong pressure. As the bias is bullish, the upcoming bearish pressure is expected to trigger a retracement in the longer trend. So, the price is likely to reach $6,000 in the coming days. As the price remains above $5,000 with a daily close, the bullish bias is expected to continue further in the coming days. SUPPORT: 5,000, 5,250 RESISTANCE: 5,500, 5,850, 6,000 BIAS: BULLISH MOMENTUM: NON-VOLATILE

|

| Fundamental Analysis of EUR/USD for April 25, 2019 Posted: 25 Apr 2019 03:42 AM PDT EUR/USD has been quite non-volatile and impulsive amid the recent bearish pressure which pushed the pair below 1.1200. Now the pair is heading towards 1.10 support area. Yesterday, an IFO survey revealed a surprise deterioration in business sentiment in Germany and the eurozone. meanwhile, USD is taking advantage of EUR weakness. The ECB mentioned in its last monthly economic bulletin that the instant impact of US car tariffs would be small for the European economy. This indicates that the monetary authorities aren't too anxious about the prospects of tariffs. The comments gave some help to the single currency. But the overall bearish pressure still persists as the other economic data was not seen to be positive. The euro area's real Gross Domestic Product rose by 0.2% in Q4 2018. Annual HICP inflation eased to 1.4% in March 2019, the annual growth rate of loans to non-financial corporations rebounded to 3.7% in February 2019. The slowdown in the eurozone's economy is pushing the EUR/USD pair down. EUR/USD remains under pressure and continues to challenge the 1.12 area. French Flash Services PMI was better than expected at 50.5 while German Flash Manufacturing PMI became 44.5. Yesterday, an IFO survey added to the negative sentiment on EUR as Business climate index for Germany dropped to 99.2 from 99.6. The current assessment of Business climate index sank to 103.2 from 103.8 while business expectations weakened to 95.2 from 95.6. The Spanish Flash GDP will be published next week along with the Core CPI Flash Estimates. The market sentiment on EUR is expected to be bearish in the short term. On the USD side, the amazing rise in new home sales amid lower mortgage rates suggests that the US housing markets could be on a better path than originally predicted. The core durable goods orders are expected to increase from -0.1% to 0.2%. Besides, flash GDP is predicted to be unchanged. The current sentiment on GDP is better than expected as FED has expressed confidence about the labor market and GDP to grow in Q2 of 2019. Under the current market conditions, EUR/USD is facing a key area of 1.2 where it might be more bearish if US GDP can beat the expectations. USD is expected to set the tone in the pair if the forecasts of the economic reports come true. In case if the economic reports are worse-than-expected, the pair could respond with weakness and a volatility spike. Now let us look at the technical view. The price broke below a key support area recently with a strong bearish daily close that suggests further bearish momentum in the coming days. The impulsive bearish pressure could push the price lower towards 1.1000-50 support area from where certain bullish intervention may occur. As the price remains below 1.1300 area with a daily close, the pair is goig to trade under bearish pressure.

|

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment