Forex analysis review |

- GBP/USD broke out of descending resistance line, potential for further rise!

- GBP/JPY is approaching its resistance, potential reversal!

- USD/JPY Approaching Resistance, Prepare For A Drop

- Rising oil prices pose a problem for the global economy - Morgan Stanley

- Gold will choose its way

- Agreed? the pound grows on rumors around Brexit

- Gold price inability to break above resistance will lead prices towards $1,260.

- Bearish rejection at short-term resistance in EURUSD

- May 1, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- May 1, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

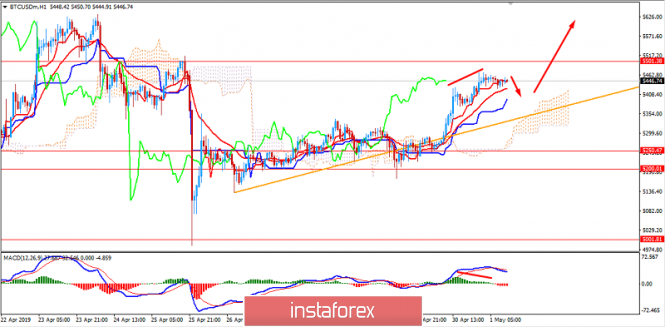

- Bitcoin analysis for May 01, 2019

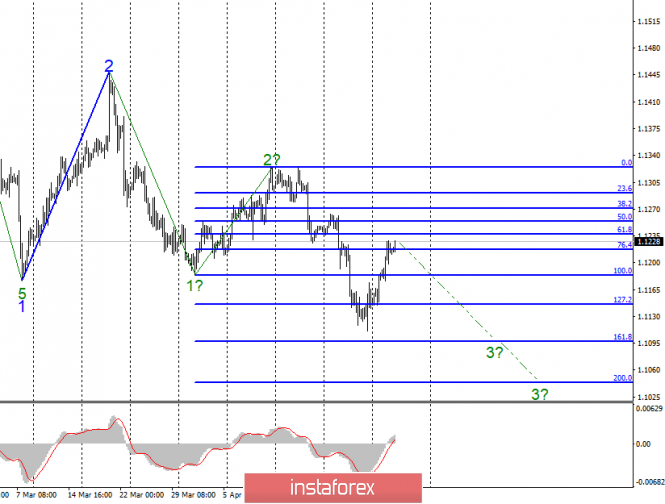

- EUR./USD analysis for May 01, 2019

- Analysis of Gold for May 01, 2019

- BITCOIN Analysis for May 1, 2019

- Technical analysis of NZD/USD for May 01, 2019

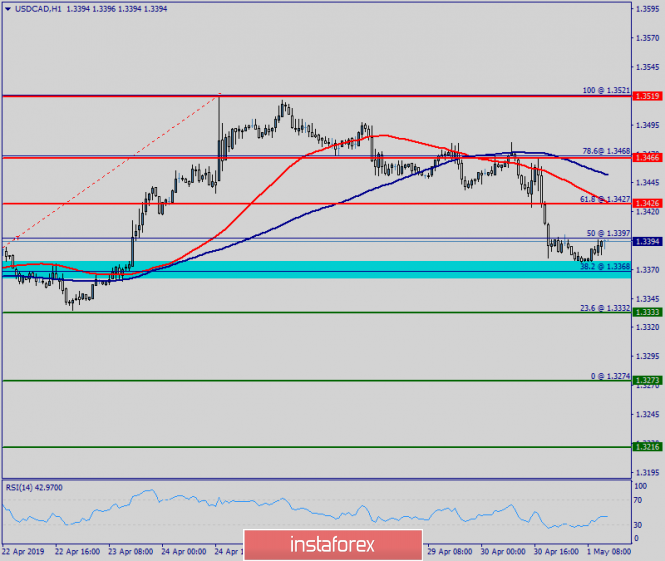

- Technical analysis of USD/CAD for May 01, 2019

- Simplified wave analysis and forecast of EUR/USD and GBP/USD for May 1

- EURUSD: Good data on the US economy limited the upward potential of the euro

- Wave analysis of GBP/USD for May 1. The Fed can return the instrument to the downward channel

- Wave analysis for EUR/USD on May 1. Eurozone GDP grew by 1.2% in the first quarter

- Bitcoin. Bitcoin exchange rate is gaining strength

- GBP/USD. 1st of May. The trading system "Regression Channels". Theresa May can lose the support of the Conservatives

- EUR/USD. 1st of May. The trading system "Regression Channels". Fed press conference – the main event of the first day of

- GBP/USD: plan for the European session on May 1. The demand for the pound may remain, but a small correction to the bulls

- EUR/USD: plan for the European session on May 1. Divergence on the MACD may limit the growth of the Euro in the first half

| GBP/USD broke out of descending resistance line, potential for further rise! Posted: 01 May 2019 07:28 PM PDT Price broke our resistance line and we might see a further rise above our first support level to our first resistance level. Ichimoku cloud is also showing signs of bullish pressure. Entry : 1.3013 Why it's good : horizontal overlap support, 38.2% fibonacci retracement Stop Loss : 1.2979 Why it's good : 50% fibonacci retracement Take Profit : 1.3122 Why it's good : horizontal swing high resistance, 50% Fibonacci retracement

|

| GBP/JPY is approaching its resistance, potential reversal! Posted: 01 May 2019 07:26 PM PDT Price is approaching a key resistance at 145.73 where it could potentially reverse to its support. Entry : 145.73 Why it's good : horizontal swing high resistance, 61.8% fibonacci retracement, 100% fibonacci extension Stop Loss : 146.36 Why it's good : 78.6% Fibonacci retracement Take Profit : 145.01 Why it's good : 38.2% fibonacci retracement, horizontal pullback support |

| USD/JPY Approaching Resistance, Prepare For A Drop Posted: 01 May 2019 07:24 PM PDT Price is approaching a key resistance at 111.608 where it could potentially reverse to its support. Entry : 111.608 Why it's good : horizontal swing high resistance,38.2% fibonacci retracement, 61.8% Fibonacci extension Stop Loss : 111.910 Why it's good :61.8% fibonacci retracement,100% Fibonacci extension, horizontal swing high resistance Take Profit : 111.045 Why it's good : horizontal swing low support,50% fibonacci retracement.61.8% Fibonacci extension

|

| Rising oil prices pose a problem for the global economy - Morgan Stanley Posted: 01 May 2019 03:49 PM PDT According to analysts of the largest bank Morgan Stanley Wealth Management, the markets underestimate the risks associated with rising oil prices. Investors are careless over this fact, although they should purchase low-cost energy stocks to hedge their portfolios so as not to lose. At the beginning of this week, the situation on the stock markets developed favorably, which is why investors have lost their vigilance, bank experts say. On Monday, April 29, the S&P 500 index updated its record high. The main catalyst for its growth were US data. By the end of March 2019, consumer spending in America rose substantially, and the base rate of inflation, which the Fed carefully monitors, fell to an annual low. This can affect the decision of the regulator about the interest rate, analysts believe. The positive dynamics of the S&P 500 index suggests that investors are satisfied with oil prices, which is not very good, Morgan Stanley believes. Experts advise market participants not to rest on their laurels, noting that the current rise in oil prices could be a problem for the global economy. If the cost of oil remains at the current level until the end of this year, the consumer price index may exceed 3%, creating a problem for the Fed. At the same time, the purchasing power of the population will significantly decrease, putting pressure on corporate profits and slowing economic growth in China and in emerging markets, Morgan Stanley believes. Recall that the prices of Brent and WTI crude oil have recently reached their highest level in the last six months. On Tuesday, April 30, Brent crude rose by 1.10% to $ 72.74 per barrel. According to experts, the price of black gold will remain high or continue to grow, if OPEC and its allies extend the term of the agreement on the restriction of raw materials supply. It is possible that a decision will be taken at the next meeting in June of this year. In the current situation, bank analysts recommend buying cheap oil stocks to hedge their portfolio, especially if so-called "growth stocks" prevail. These include papers purchased for the cyclical recovery of the economy. This will help lower the risks in the future, according to Morgan Stanley. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 May 2019 03:49 PM PDT The stabilization of gold on the eve of the announcement of the FOMC meeting's results reminds us of the calm before the storm. The precious metal has always been sensitive to the Federal Reserve's decisions, and now it does not know how to behave because the US central bank's position is not as transparent as investors would like. The acceleration of US GDP to 3.2% in the first quarter suggests the idea of a possible resumption of the monetary policy normalization cycle in order to prevent the economy from overheating. On the contrary, sluggish inflation allows CME derivatives to increase the chances of reducing the federal funds rate by at least 25 bp in 2019 to almost 70%. Which way will the Fed choose? The fate of many financial assets depends on the regulator's decision. If Jerome Powell hints at monetary expansion, the US dollar will weaken and gold, on the contrary, will strengthen. The Fed chairman's optimism and his belief in a rate hike, if not in this, and next year may directly lead to opposite results. The precious metal is highly dependent on the US currency. This assures its rapid rally in January, followed by a close in the red zone for three consecutive months. At the beginning of the year after the Fed changed its outlook, investors were betting on weakening the dollar, but the divergence in the economic growth of the US and other countries of the world, the high attractiveness of US-issued securities and dovish rhetoric of central banks and competitors of the Fed forced them to change their opinion. At the same time, hopes for the end of the trade war between Washington and Beijing, the V-shaped recovery of China's economy, the growth of global demand and the recovery of German exports makes it possible for the euro to feel for the bottom. In the first quarter, eurozone GDP grew by 1.5%. This is less than its US counterpart, but we must understand that the American economy has accelerated due to a large-scale fiscal stimulus, and the effect of tax reform will gradually come to naught. At the same time, the countries of the currency bloc can afford fiscal stimulus, which will accelerate GDP. The dynamics of the US GDP and the eurozone Strong statistics on the European economy reduces the likelihood of a generous LTRO from the ECB. Frankfurt does not have to weaken monetary policy if the currency bloc is not as bad as is commonly believed. This circumstance makes it possible for us to count on the growth of the EUR/USD quotes, the correction of the USD index and gives optimism to the bulls on gold. Along with a strong dollar, precious metals also have problems with stock indices. The US stock market rewrites record highs, the global risk appetite is high, and in such circumstances, safe haven assets feel at ease. On the other hand, the low rates of the US debt market support the bulls on AUD/USD. Gold is waiting for clues from the Fed in order to understand in which direction the financial markets will move, and finally choose their own path. Technically, the task for bulls on the precious metal is to lock in its quotes within the short-term consolidation range of $1282-1310 per ounce. In this situation, the chances of activating the "Wolfe Wave" pattern will increase. Its first target is located near the $1,330 mark. Gold daily chart The material has been provided by InstaForex Company - www.instaforex.com |

| Agreed? the pound grows on rumors around Brexit Posted: 01 May 2019 03:49 PM PDT After a few weeks of lull, the topic of Brexit once again emerged. The information vacuum formed around this topic put quite a lot of pressure on the pound. Traders reacted to a wide variety of rumors regarding the prospects of the "divorce process." Most of them were negative, so over the past two weeks, the GBP/USD pair systematically tumbled, dropping from the 31st figure to the mid-28th. But now the bulls of the pair are actively restoring their positions: traders once again have hope for a "soft" Brexit. However, at the moment there is no specific information - at least officially. Investor optimism is due to news from one of the influential newspapers in Britain. According to insider information from journalists, Theresa May's cabinet ministers have achieved some success in negotiations with the Labour party. These negotiations started a month ago, on the eve of the next EU summit. Theresa May assured the Europeans that she could find a common language with her opponents and convince them to support the deal with Brussels. Since then, there has been no news regarding the effectiveness of this dialogue. But according to the source of the newspaper, this time, the parties were not idle and tried to find a common denominator. According to preliminary data, they managed to get the situation off the ground. As one of the Laborites, who is familiar with the negotiations, assures, members of the British government finally showed flexibility by changing their position on the UK customs union with the EU. If earlier Theresa May in categorical form rejected the possibility of creating this union, now such a scenario is one of the probable ones. In addition, according to Labour, the British prime minister agreed to implement the revised text of the political declaration of Britain and the EU into the system of national legislation. This is one more step for the UK's civil exit from the EU. All of the above information is unofficial, so it must be treated with some caution. However, official comments are also very optimistic. Today, a Labour spokesman announced that the Cabinet has really changed its approach to the prospects for Brexit. He clarified that at the moment there are no joint decisions, but the parties will meet again next week to continue the negotiation process. But Theresa May's spokesman left vague comments on the situation. He said that members of the government "would like to see progress" in negotiations with the opposition. He also added that the deal agreed with Brussels guarantees the country the advantages of a customs union with the additional possibility of an independent trade policy. These words from May's representative can be interpreted differently, but traders prefer to hope for the best, ignoring the alarming signals. In general, according to the British press, Theresa May plans to go to the polls next week, despite the fact that Brussels agreed to a delay until October 31. Such a rush on the part of the British prime minister is quite explicable and justified. Let me remind you that at the start of the negotiation process, Theresa May set an "internal deadline" until the end of May, so as not to take part in the elections to the European Parliament. The prime minister's motives lie on the surface: firstly, participation in these elections looks, to put it mildly, ridiculous: Britain, on the one hand, declares its intention to "just about" leave the EU, on the other hand, takes part in the formation of the legislative body of the Alliance. Secondly, the European elections are quite a costly event. In other words, the British will have to pay from their own pockets for politically useless elections - only because the Theresa May government (and the conservatives associated with it) cannot put an end to the negotiation process. Here it is worth noting that the Conservative Party's rating has been steadily declining: recent polls do not promise anything good to the Conservatives. If the elections were held today, the Tories would have suffered a crushing defeat, losing power to the Labour Party. Thus, Theresa May's sudden flexibility is due to weighty political arguments. Given the official comments of the Labour Party, it can be concluded that the rumors about the prospects of the negotiation process are not far from the truth. This means that the pound will soon receive a reason for large-scale growth. However, in this case one should not rush to trade decisions. Today, Theresa May has a rather busy day: she will speak in the House of Commons, then she will speak to the chairman of Parliamentary committees, and then hold a government meeting. As a result of these events, the market will receive relevant information - confirming or refuting. If on the horizon the likelihood of approval of the notorious deal really appears, the GBP/USD pair will easily overcome the first resistance level of 1.3160 (upper Kumo cloud border, coinciding with the Bollinger Bands line on the daily chart), heading to the next resistance level of 1.3340 (upper line Bollinger Bands on the weekly chart). The material has been provided by InstaForex Company - www.instaforex.com |

| Gold price inability to break above resistance will lead prices towards $1,260. Posted: 01 May 2019 01:49 PM PDT Gold price as expected since $1,270 has bounced for a back test of the major support area of $1,280-90. Now there are a lot of chances that the entire back test is over as bulls remain too weak to break above $1,290-$1,300. The next leg down should follow soon.

Red line -RSI support trend line Red rectangle - major confluence area of resistance (previous support) Gold price remains below the blue trend line resistance and shows rejection signs once again at the red rectangle area that is now resistance and was once support. Inability by the bulls to recapture the $1,280-90 level is a bearish sign. Since this support area was broken we said that we expect prices to move lower towards $1,250-60. Price fell as low as $1,266 and we said expect a back test and then maybe another move lower. As long as price is below $1,300 we continue to expect prices to move lower towards $1,250-60 or even lower. Any bounce is considered a selling opportunity. Gold should see $1,250-60 if price breaks below $1,270. The material has been provided by InstaForex Company - www.instaforex.com |

| Bearish rejection at short-term resistance in EURUSD Posted: 01 May 2019 01:36 PM PDT EURUSD bounced as expected towards 1.12 and closer to the upper channel boundary and got rejected. Medium-term trend remains bearish as long as we trade below 1.1350 and any bounce is still considered as selling opportunity.

Red lines - bearish channel EURUSD remains inside the red bearish channel since 1.1550 and continues to make lower lows and lower highs. At the same time price is getting rejected once price reaches the upper channel boundary. Price was oversold at 1.1115 and as we expected price bounced towards 1.12. Price topped today at 1.1264 and the daily candle so far is very bearish. Bulls need to break and close above today's highs for a meaningful bounce to follow. Until then we expect price to continue lower towards 1.11. The material has been provided by InstaForex Company - www.instaforex.com |

| May 1, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 01 May 2019 10:13 AM PDT

Few weeks ago, a bullish Head and Shoulders reversal pattern was demonstrated around 1.1200. This enhanced further bullish advancement towards 1.1300-1.1315 (supply zone) where significant bearish rejection was demonstrated on April 15. Short-term outlook turned to become bearish towards 1.1280 (61.8% Fibonacci) then 1.1235 (78.6% Fibonacci). For Intraday traders, the price zone around 1.1235 (78.6% Fibonacci) stood as a temporary demand area which paused the ongoing bearish momentum for a while before bearish breakdown could be executed on April 23. Currently, the price zone around 1.1235-1.1250 has turned into supply-zone to be watched for bearish rejection. Two days ago, a recent bullish head and shoulders pattern was being demonstrated around 1.1140 on the H4 chart. That's why, conservative traders were suggested to wait for another bullish pullback towards 1.1230-1.1250 for a valid SELL entry. Trade recommendations : Conservative traders can look for a valid SELL entry anywhere around the current price levels (1.1250). S/L should be located above 1.1280 while Target levels canbe located around 1.1170 and 1.1130. The material has been provided by InstaForex Company - www.instaforex.com |

| May 1, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 01 May 2019 09:40 AM PDT

On January 2nd, the market initiated the depicted uptrend line around 1.2380. On March 11, a Weekly bearish gap pushed the pair below the uptrend line (almost reaching 1.2960) before the bullish breakout above short-term bearish channel could be achieved. Shortly after, the GBPUSD pair demonstrated weak bullish momentum towards 1.3200 then 1.3360 where the GBPUSD failed to achieve a higher high above the previous top achieved on February 28. Instead, the depicted recent bearish channel was established. Significant bearish pressure was demonstrated towards 1.3150 - 1.3120 where the depicted uptrend line failed to provide any bullish support leading to obvious bearish breakdown. On March 29, the price levels of 1.2980 (the lower limit of the newly-established bearish movement channel) demonstrated significant bullish rejection. This brought the GBPUSD pair again towards the price zone of (1.3160-1.3180) where the upper limit of the depicted bearish channel as well as the backside of the depicted uptrend line demonstrated significant bearish rejection. Since then, Short-term outlook has turned into bearish with intermediate-term bearish targets projected towards 1.2900, 1.2800 and 1.2750 where the lower limit of the depicted channel comes again to meet the GBPUSD pair. This week, As expected, a bullish pullback occurred towards price levels around 1.3050 which is currently failing to provide immediate bearish supply for the pair affected by negative fundamental data from the US. For the bullish side to regain dominance, quick bearish closure should be achieved below 1.3070. Trade Recommendations: Bearish rejection should be anticipated around the current price levels (1.3090) as long as the market fails to achieve any bullish breakout above 1.3130 (78.6% Fibo). The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin analysis for May 01, 2019 Posted: 01 May 2019 06:50 AM PDT BTC has traded upward as we expected. The price tested the level of $5.610. Anyway, there is a strong resistance near $5.610 and our advice is to watch for potential selling opportunities.

Purple rectangle – Swing high (resistance) Smaller yellow channel – short-term channel BTC did stop going upward exactly at the resistance and the upper diagonal of the channel ($5.610), which is sign that buying looks risky at this stage. Support levels are seen at the price of $5.444 and $5.346. The larger yellow channel is still active and the trend is still bullish but with no serious demand involved, which may result further near-term weakness. Watch for selling opportunities with the first target at $5.444. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR./USD analysis for May 01, 2019 Posted: 01 May 2019 06:39 AM PDT EURUSD traded higher as we expected yesterday. The price tested the level of 1.1239. The bearish divergence on the oscillator is building but the price is still trading in the well-defined upward channel.

Orange rectangle – 20EMA acting like support Green lines – Upward channel Purple rectangle – Strong resistance based on price action EURUSD is trading near the lower upward diagonal and at the previous day high at 1.1223, which act like support. Technically, there is no serious signs of potential trend reverse and only potential downside limited correction is possible. The EUR is making higher highs and higher lows, which is clear sign of well-defined trend. Resistance levels are seen at the price of 1.1260 and 1.1280. Support levels are seen at the price of 1.1223 and 1.1195. Watch for buying opportunities and the break of the 1.1240 would confirm potential test of 1.1260-1.1280. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of Gold for May 01, 2019 Posted: 01 May 2019 06:25 AM PDT Gold did test again the key short-term support cluster at the price of $1.278. We expect further upward movement and potential test of upper references.

Yellow rectangle – Short-term resistance, which became key support Blue moving average – 20EMA acting like support Green rectangle – Resistance based on price action Green rectangle – Resistance 2 based on price action Green rectangle – Resistance 3 based on price action According to the H4 time-frame, we found the breakout of the supply trendline and the rejection of key support (yellow rectangle). Which is sign that buyers are still present. Our advice is to watch for buying opportunities. Upward references are set at the price of $1.294.30, $1.300.95 and $1.310.00. As long as the Gold is trading above the $1.265.00, the short term-trend remains bullish. Medium Keltner average (20EMA) is acting like support together with rising ADX reading, which adds more potential for upside. The material has been provided by InstaForex Company - www.instaforex.com |

| BITCOIN Analysis for May 1, 2019 Posted: 01 May 2019 05:19 AM PDT Bitcoin has been extending a climb with proper sustainability along the way towards $5,500, though the price is making downward corrections along the way. There are no weighty reasons for Bitcoin to disrupt the bullish bias. Thus, BTC is expected to develop a steady rally with a target towards $6,000. The price clearing above the $5,200-50 area indicates the upward pressure in the coming days, but certain volatility may strike the price momentum which would not only subdue the upcoming bullish gains but also clear up certain speculations on impulsive pressure in the market. After the impulsive climb higher, the price is currently making a correctional decline for a few hours. Being above the dynamic levels which are holding as support, the price is currently expected to move higher after a correctional decline towards $5,400. The price is being supported by 20 EMA, Tenkan, and Kijun line. Besides, the Kumo Cloud also widened significantly indicating strong bullish pressure underway. Moreover, the Chikou Span above the price line also signals further upward momentum as the price is now consolidating. According to the current price action formation, the bias is clearly bullish with a series of downward corrections along the way. Then, the price will be able to regain momentum to break above $5,500 and climb towards $6,000 in the future. SUPPORT: 5,000, 5,200-50, 5,400 RESISTANCE: 5,500, 5,850, 6,000 BIAS: BULLISH MOMENTUM: VOLATILE

|

| Technical analysis of NZD/USD for May 01, 2019 Posted: 01 May 2019 04:44 AM PDT Overview: The NZD/USD pair is showing signs of weakness following a breakout of the lowest level of 0.6648. On the H1 chart. the level of 0.6648 coincides with 23.6% of Fibonacci, which is expected to act as minor support today. Since the trend is below the 23.6% Fibonacci level, the market is still in a downtrend. But, major resistance is seen at the level of 0.6690. Furthermore, the trend is still showing strength above the moving average (100). Thus, the market is indicating a bearish opportunity below the above-mentioned support levels, for that the bearish outlook remains the same as long as the 100 EMA is headed to the downside. Therefore, strong resistance will be found at the level of 0.6690 providing a clear signal to buy with a target seen at 0.6575. If the trend breaks the minor resistance at 0.6575, the pair will move downwards continuing the bearish trend development to the level 0.6544. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of USD/CAD for May 01, 2019 Posted: 01 May 2019 04:26 AM PDT |

| Simplified wave analysis and forecast of EUR/USD and GBP/USD for May 1 Posted: 01 May 2019 03:24 AM PDT EUR/USD Over the past six months, a complex upward corrective pattern has been developing on the European currency chart. The unfinished wave of short-term scale is bearish, starting from March 20. By the current day, it forms the final part (C), within which, in turn, an upward corrective pullback is completed. The price of the pair pushed the minimum level of elongation, coming close to the lower border of the strong resistance zone. Forecast: At the next sessions, the price rise, which has taken place in the last days, is expected to complete, with the overall flat nature of the fluctuations. A short-term puncture of the upper border of the reversal zone is not excluded. The change of course of the pair can last all day. Recommendations: Before the appearance of reversal signals, euro pair purchases make sense in the form of short-term transactions "scalping". For longer trading, it is recommended to refrain from trading until a clear signal appears that the euro will change. Resistance zones: - 1.1230 / 1.1260 Support zones: - 1.1090 / 1.1060 GBP/USD On the British pound chart, a bearish wave is formed from mid-March, in which the first 2 parts (A + B) are fully completed. As part of the weaving finishing area, a counter-lift has developed since the end of last week. The level of minimum lengthening of the correction was broken yesterday, the price reached the lower boundary of the strong zone of potential reversal. Signals of an emergency change of course is not observed on the chart. Forecast: The reversal zone is strengthened by the resistance level of the highest TF, so the probability of completion of the entire rise in this zone is very high. In the upcoming sessions, the end of the upward section of the movement, the formation of a reversal and the beginning of the price move down are expected. Recommendations: Buying the pound today is hopeless. In the settlement zone, it is recommended to track reversal signals on your trading systems to find the entry point to short positions. Resistance zones: - 1.3050 / 1.3080 Support zones: - 1.2950 / 1.2920 Explanations for the figures: Waves in the simplified wave analysis consist of 3 parts (A – B – C). The last unfinished wave is analyzed. Zones show areas with the highest probability of reversal. The arrows indicate the wave marking according to the method used by the author, the solid background is the formed structure, the dotted ones are the expected movements. Note: The wave algorithm does not take into account the duration of tool movements over time. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD: Good data on the US economy limited the upward potential of the euro Posted: 01 May 2019 01:50 AM PDT Good data on the US economy limited the upside potential of the euro, which was observed after more than excellent reports in Germany and the eurozone. According to S&P and Case-Shiller, house price growth in the US slowed down in February 2019. The national housing price index in February rose by 4% compared with the same period last year, after rising 4.2% in January. Such news is favorable for consumers who buy housing for the first time. Lower prices and lower mortgage rates can stimulate sales in the primary housing market. It is not surprising that the number of signed contracts for the sale of housing in March increased. According to the National Association of Realtors, the index of signed contracts for the sale of housing in March rose by 3.8% compared with the previous month, reaching 105.8 points. Economists had expected the March index to show an increase of 1.5%. Despite this, compared with March 2018, the index decreased by 1.2%, which is directly related to the growth in mortgage rates over the past year. Meanwhile, the confidence of American consumers in April of this year has grown, which may also stimulate the economy in the future. According to the Conference Board, the consumer confidence index in April was 129.2 points against 124.2 points in March. Economists had expected the index to be 126 points in April. Chicago Purchasing Managers' Index (PMI) fell slightly in April. According to MNI Indicators, the index fell to 52.6 points from 58.7 points in March, but remained above the value of 50 points, indicating an increase in activity. Today, the Federal Reserve is scheduled to publish a decision on interest rates in the United States, as well as a press conference. Many expect the committee to change its tone and signal a likely lowering of rates in the future, if necessary. This is precisely what President Donald Trump has long sought, who yesterday once again appealed to the Federal Reserve to lower the key interest rate by 1 percentage point and resume the crisis program to buy bonds. In his opinion, this will allow us to start once again stimulating the growth of the American economy. According to the forecasts of economists, the Fed will leave rates unchanged. Let me remind you that back in March of this year, the committee refused to raise interest rates this year and announced plans to stop the reduction of its asset portfolio of $ 3.9 trillion. As for the technical picture of the EURUSD pair, further growth is limited by the resistance of 1.1235, the breakthrough of which can maintain an upward momentum, which will lead to the updating of large levels of 1.1280 and 1.1330. If the Fed continues to adhere to its interest rate plan, the demand for risky assets will be limited, which will help return the lost positions to the US dollar and will lead the trading instrument to the lows of 1.1170 and 1.1120. Despite the weak report that the Canadian economy contracted slightly in February, not meeting the expectations of economists, the USDCAD pair also declined. The slowdown in economic growth is directly related to the downturn in the mining sector. According to the data, gross domestic product in February decreased by 0.1% compared with the previous month and amounted to 1.946 trillion Canadian dollars. Economists had expected GDP to remain unchanged. Compared with the same period last year, Canadian GDP in February increased by 1.1%. The material has been provided by InstaForex Company - www.instaforex.com |

| Wave analysis of GBP/USD for May 1. The Fed can return the instrument to the downward channel Posted: 01 May 2019 01:50 AM PDT

Wave counting analysis: On April 30, the GBP/USD pair gained about 100 base points and now there are doubts about the readiness of the pair to continue building the downward trend. Wave marking is not quite the standard form. The latest news regarding Brexit can be interpreted in different ways. They relate to the negotiations of Theresa May with the Labor Party on the agreement on Brexit. There are no unambiguously positive reports, but the market may see some positive moments in these negotiations. In theory, they increase the likelihood of accepting an agreement on the next ballot in parliament. Nevertheless, I still allow the resumption of the construction of the downward trend. An unsuccessful attempt to break the 76.4% Fibonacci mark or turn the MACD down will be signal that will make you think about the readiness of the instrument for a new decline. Purchase goals: 1.3118 - 61.8% of Fibonacci 1.3168 - 50.0% of Fibonacci Sales targets: 1.2954 - 100.0% of Fibonacci 1.2838 - 127.2% of Fibonacci General conclusions and trading recommendations: The wave pattern still involves building a downward trend, especially after the break of the lower line of the triangle. Now I recommend waiting for the completion of the correction wave and selling the pair with targets located near the calculated levels of 1.2839 and 1.2693, which corresponds to 127.2% and 161.8% Fibonacci. The signals can be the readings of the MACD indicator or an unsuccessful attempt to break one of the Fibonacci levels, the nearest one is 76.4%. The material has been provided by InstaForex Company - www.instaforex.com |

| Wave analysis for EUR/USD on May 1. Eurozone GDP grew by 1.2% in the first quarter Posted: 01 May 2019 01:50 AM PDT

Wave counting analysis On April 30, trading ended for the EUR/USD pair with an increase of 55 bp. Thus, the euro has been growing for the third day in a row, and the internal corrective wave 3 turns out to be very long. The MACD indicator shows growth and passed the zero mark. I am waiting for a signal from this indicator in the form of a reversal downward, which will lead to the conclusion about the completion of the construction of the upward wave. This moment may be the beginning of the resumption of the construction of wave 3. But at the time of the reversal, it is of great importance how high the euro will soar. While this signal is not available, I do not recommend selling a pair. The news background supported the euro yesterday. Today, it can create pressure on this currency, as news on business activity indices will come out, and the results of the Fed meeting will also be known. Sales targets: 1.1097 - 161.8% of Fibonacci 1.1045 - 200.0% of Fibonacci Purchase goals: 1.1324 - 0.0% of Fibonacci General conclusions and trading recommendations: The pair continues to build a downward trend but a corrective wave is currently developing. The current wave counting assumes the resumption of the pair reduction with the closest targets at 1.1097 and 1.1045, which is equal to 161.8% and 200.0% Fibonacci. Upon completion of the rollback to the top, I recommend selling a pair with these goals. A signal to sell will make a turn down MACD. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin. Bitcoin exchange rate is gaining strength Posted: 01 May 2019 12:56 AM PDT Apparently, the Bitcoin exchange rate is gaining strength again after a small consolidation, which was observed at the beginning of this week. The cryptocurrency is close to a large annual maximum in the region of 5660, which will generate a new impulse wave of growth. Signal to buy Bitcoin (BTC): To resume the upward trend, the main goal of buyers is to break the maximum of 5660, where the market can continue its rapid growth in the area of 5880 and 6025 levels, where I recommend fixing the profit. In the scenario of another unsuccessful growth attempt, you can look at the long positions on the support test 5500 and on the rebound from the area of 5360. Signal to sell Bitcoin (BTC): Another unsuccessful consolidation above the resistance of 5660 can again push potential buyers of Bitcoins, which will be a sell signal with the main purpose of returning to the support area of 5500 and 5360, where I recommend fixing the profits. In a scenario of breakthrough 6605, you can count on sale after you have upgraded your highs at 5880 and 6025. |

| Posted: 01 May 2019 12:56 AM PDT 4-hour timeframe Technical details: The upper linear regression channel: direction - sideways. The lower linear regression channel: direction - down. The moving average (20; smoothed) - up. CCI: 169.3072 The pair GBP/USD continues its upward movement. But much more interesting events are now taking place in the UK. It is not a secret for anyone that Theresa May made a bid for negotiations with the Labor Party in order to use her to still accept her version of the Brexit agreement with the EU. However, these negotiations, even if they succeed, may have the opposite effect. The fact is that the Laborists support the idea of a Customs Union with the EU, while the conservatives reject it. Consequently, if May succeeds in reaching an agreement with the Labor Party, yielding precisely to the question of the Customs Union, the number of votes from the conservatives may sharply decrease. Considering far to the best moods within this party, Theresa May may not get the necessary result on the next ballot anyway. However, so far this is just unverified information. We continue to monitor developments. The British pound has grown seriously in recent days, but we can not say that due to good fundamental reasons. Most likely, there is another technical correction. For the GBP/USD pair, today will also be extremely important, as today traders will receive a lot of interesting information from the States. Nearest support levels: S1 - 1.3031 S2 - 1.3000 S3 - 1.2970 Nearest resistance levels: R1 - 1.3062 R2 - 1.3092 R3 - 1.3123 Trading recommendations: The pair GBP/USD continues to move up. Thus, it is now recommended to consider long positions with targets at 1.3062 and 1.3092. Closer to the beginning of the publication of US reports and the results of the Fed meeting, increased caution is recommended. Sell positions are recommended to be considered after the consolidation of the pair below the moving average with the first targets at 1.2939 and 1.2909. Given the degree of importance of fundamental data, the option of changing the trend today should not be excluded. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanations for illustrations: The upper linear regression channel is the blue lines of the unidirectional movement. The lower linear channel is the purple lines of the unidirectional movement. CCI is the blue line in the indicator regression window. The moving average (20; smoothed) is the blue line on the price chart. Murray levels - multi-colored horizontal stripes. Heiken Ashi is an indicator that colors bars in blue or purple. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 May 2019 12:56 AM PDT 4-hour timeframe Technical details: The upper linear regression channel: direction - down. The lower linear regression channel: direction - down. The moving average (20; smoothed) - up. CCI: 115.9561 On Wednesday, May 1, the currency pair EUR/USD fixed above the moving average line, thus, the trend in the instrument has changed to an upward one. However, today is an extremely important day due to a large number of important fundamental events. First, the United States will publish indices of business activity in the production of ISM and Markit in April. Secondly, there will be a report on the change in the number of people employed in the private sector. Third, the results of the Fed meeting will be announced late in the evening, and a press conference will be held. Absolutely all this data will be of great importance for the pair. Strong business indexes support the US dollar, as does the employment report. In the case of the Fed, there are few hopes for "hawkish" statements. And precisely the rhetoric of the Fed may not provide support for the US currency. Monetary policy is unlikely to tolerate any changes, the rates will remain the same. However, we believe that surprises are possible, so you need to be ready for the resumption of a downward trend. All the more so, despite the overcoming of the MA, the position of the euro still remains very weak. Thus, the current binding may be short. Therefore, all attention today on the designated reports. Nearest support levels: S1 - 1.1169 S2 - 1.1108 Nearest resistance levels: R1 - 1.1230 R2 - 1,1292 R3 - 1.1353 Trading recommendations: The EUR/USD currency pair has started an upward movement but has not yet managed to overcome the Murray level of "0/8" - 1.1230. If the news from the States today does not disappoint, then the downward trend may resume. Sell orders advised to open no earlier than the consolidation of the pair below the moving with the targets at 1.1169 and 1.1108. Again, this option is very likely, given the importance of today's macroeconomic events. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanations for illustrations: The upper linear regression channel is the blue lines of the unidirectional movement. The lower linear regression channel is the violet lines of the unidirectional movement. CCI - the blue line in the indicator window. The moving average (20; smoothed) is the blue line on the price chart. Murray levels - multi-colored horizontal stripes. Heiken Ashi is an indicator that colors bars in blue or purple. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 May 2019 12:56 AM PDT To open long positions on GBP/USD, you need: After yesterday's strong growth of the pound, it is best to return to long positions today after the formation of a false breakdown in the support area of 1.3018, but larger players can go only after a deeper downward correction to the area of 1.2983, where you can immediately buy a rebound. The main task will be a breakthrough and consolidation above the resistance of 1.305 but in the first half of the day, there may be a divergence on the MACD indicator, which will limit the upward potential. The goal is a maximum of 1.3093, where I recommend fixing the profit. To open short positions on GBP/USD, you need: The bears will expect unsuccessful consolidation in the first half of the day above the resistance of 1.3057 with confirmation of divergence on the MACD indicator, which will be the first signal to open short positions in order to return to the support area of 1.3018, the breakdown of which will lead to a larger downward correction to the minimum of 1.2983, where I recommend fixing the profits. When the GBP/USD growth scenario is above the resistance of 1.3057, it is best to consider short positions for a rebound from the maximum of 1.3093. Indicator signals: Moving Averages Trading is above 30 and 50 moving averages, which indicates the bullish nature of the market. Bollinger bands In the case of a decrease in the pound, support may be provided by the lower limit of the indicator in the area of 1.3018, the impulse of which will increase the pressure on the pair. Description of indicators

|

| Posted: 01 May 2019 12:08 AM PDT To open long positions on EURUSD, you need: The divergence that was formed on the MACD indicator may limit the further growth of the euro today in the first half of the day. Given the fact that Europe is celebrating Labor Day today, volatility will be low. It is best to consider long positions after a downward correction to the support area of 1.1200 or a rebound from a larger area of 1.1178. The entire focus will shift on the second half of the day when the Federal Reserve will issue an accompanying statement on interest rates. The main task of the bulls remains to update the highs in the area of 1.1260 and 1.1282, where I recommend fixing the profits. To open short positions on EURUSD, you need: An unsuccessful attempt to consolidate at the level of 1.1235 when forming a divergence on the MACD indicator will be the first signal to open short positions in the euro in order to reduce and consolidate under the middle of the channel 1.1206, the breakdown of which will push EUR/USD to the support area of 1.178, and then to a minimum of 1.1150, where I recommend fixing the profits. With the growth of the euro above the resistance of 1.1235 in the first half of the day, it is best to open short positions on the rebound from the maximum of 1.1260. Indicator signals: Moving Averages Trading is conducted above 30 and 50 moving averages, which indicates that the upward correction is maintained. Bollinger Bands The upper limit of the indicator around 1.1230 will limit the upward potential of the euro. In case of a decrease, the lower limit of the indicator in the area of 1.1206 may provide temporary support, the breakthrough of which will lead to a larger sale. Description of indicators

|

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment