Forex analysis review |

- Bank of America: Selling the yen is in focus

- In the event of a chaotic Brexit, the pound could fall to $1.10

- Theresa May's bait: British prime minister's new tactic disappointed traders

- EUR/USD 5 Star Buy Signal | Fundamental + Technical Analysis

- Technical analysis of Dollar Index for May 21, 2019

- Technical analysis for Gold for May 21, 2019

- May 21, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- Bitcoin analysis for May 21, 2019

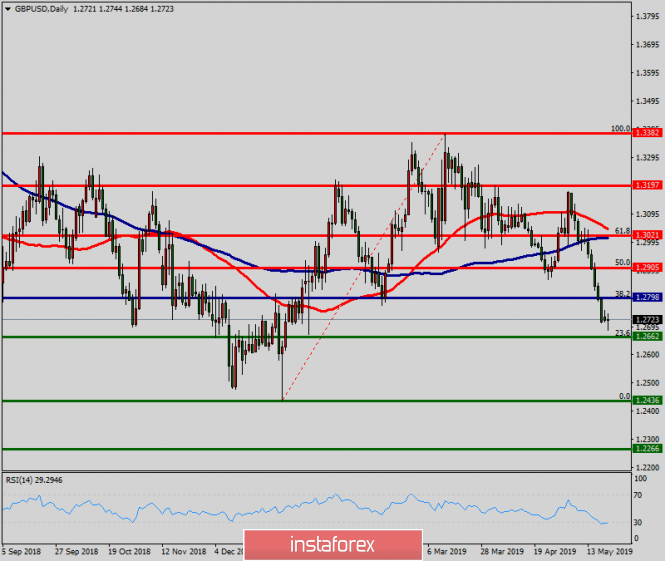

- May 21, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- USD/CAD analysis for May 21, 2019

- The Australian dollar is under pressure again: the head of the RBA announced a rate cut

- Analysis of Gold for May 21, 2019

- The market is waiting for a surge in euro volatility

- GBP/USD: plan for the American session on May 21. The pound has recovered a little before the speech of Theresa May

- EUR/USD: plan for the American session on May 21. A good indicator of consumer confidence stopped the fall of the euro

- Technical analysis of GBP/USD for May 21, 2019

- Technical analysis of USD/CHF for May 21, 2019

- Brent is preparing for war

- Control zones for EUR/JPY pair on 21.05.19

- Control zones of AUD / USD pair on 05/21/19

- Italian behind-the-scenes games can be the main driving force for the euro

- Trading plan for EUR / USD and GBP / USD pairs on 05/21/2019

- The Central Bank of Australia signals a decrease in rates in June

- The dollar will continue to rise, the euro and the "Aussie" under pressure

- Overview of GBP/USD on May 21. The forecast for the "Regression Channels". The collapse of the pound will continue this week

| Bank of America: Selling the yen is in focus Posted: 21 May 2019 03:56 PM PDT According to Bank of America analysts, in the current situation, market participants can count on solid profits when opening short positions in the EUR/JPY pair. They recommend selling the Japanese currency due to the growing demand for it. Bank analysts emphasize that in the current unstable conditions it is very difficult to predict further developments in world markets. This makes it difficult to trade and baffles even experienced traders. Not adding optimism and an impressive list of risks, including weak global data, the trade conflict between the US and China, the situation around Brexit and military action between the US and Iran. Negative moments, in particular, related to the latest events in the trade confrontation between Washington and Beijing, provoked a market reaction in the form of a fall in key indices, as well as an increase in demand for yen. The Japanese currency has become a kind of "safe haven" for market players. Many prefer to invest in this defensive asset. Bank of America analysts believe that in the short term, the situation in the foreign exchange market may worsen. Implied currency volatility increased by several times and exceeded the realized volatility, which is able to rise to higher levels. This may adversely affect the yen, which is stable for now. Analysts of the bank also shared a forecast for the Chinese currency: at the end of this year, USD/CNY will reach 6.63, but USD/CNY has an upper limit of about 8.12 in the case of tariff increases up to 25% for additional imports from China. The material has been provided by InstaForex Company - www.instaforex.com |

| In the event of a chaotic Brexit, the pound could fall to $1.10 Posted: 21 May 2019 03:48 PM PDT The GBP/USD pair has retreated by more than 4 figures from the highest levels it marked in May. Uncertain situation around Brexit continues to put pressure on the pound sterling, reinforcing the position of the "bears". Apparently, market participants, despite the recent announcement by British Prime Minister Theresa May that she is ready to submit a bold new proposal with an improved package of measures to the House of Commons, are still skeptical about the possibility of forming a deal. The leader of the Labour Party, Jeremy Corbyn, has already said that he will not support T. May's proposal for Brexit, if it is in many ways the same as the previously rejected three-way version of the divorce agreement. "The British media report that the May package is a revision of old ideas, and if this is true, then it's not surprising that the market is skeptical," said Jane Foley, Rabobank's currency strategist. According to the latest polls, Boris Johnson, the ex-foreign minister who resigned in July 2018 due to disagreements on the Brexit procedure, is the best candidate for the post of head of the Cabinet of Ministers instead of T. May. However, according to ING Bank specialist James Smith, the chances of the new British leader will not differ much from the chances of the current prime minister in making the deal, since the Parliamentary majority still supports the country's withdrawal from the EU with the obligatory condition of reaching an agreement with the alliance. According to Bank of America analysts, in the event of a chaotic Brexit, the pound sterling could drop in price to $1.10. A certain pressure on the British currency is also exerted by the fact that expectations of a rise in interest rates by the Bank of England are significantly reduced. If two weeks ago the market implied a probability of 30% that the rate would increase in December, now the chances of tightening monetary policy in 2019 have decreased to 11%. The material has been provided by InstaForex Company - www.instaforex.com |

| Theresa May's bait: British prime minister's new tactic disappointed traders Posted: 21 May 2019 03:29 PM PDT Today, Theresa May stirred up markets, providing unexpected support to the British currency. The pound jumped more than 100 points against the dollar when traders heard a phrase about a new referendum from the British prime minister. The upward impulse did not receive its continuation - almost immediately the pair pulled back to the area of the 27th figure. The "devil", as you know, lies is in the details, therefore, in the face of the House of Commons, May began to specify the conditions for holding a repeated referendum, optimism in the market began to sharply fade: too many "buts" and too many "ifs." As a result, it became clear that the head of the British government was trying to maneuver between the interests of the Conservatives and the demands of the Labour Party, hoping to get the votes of both parties. But such political overtures were not to the liking of market participants. Traders doubt that the new strategy of the government will find its response in the camp of the two largest deputy factions. According to some experts, the opposite is more likely, in which both Labour and most Conservatives will turn away from May. The main problem is that the British prime minister has linked the issue of the second referendum with the question of the deputies' approval of the deal with the EU. May promised the MPs to put the question of a referendum to a vote - but only after they had voted on the first reading for the agreement. She also assured MPs that they would be able to vote for different options for future trade relations with the EU. At the same time, she threatened the deputies with early elections or the cancellation of Brexit as a whole, if they rejected the proposed project for the fourth time. The updated version of the draft itself will be published in the coming days, and a more detailed justification of the proposed changes will be published within 7-10 days. Therefore, today the deputies could only listen to the prime minister's oral report. In words, May tried to "please" all political forces on which the fate of the deal depended – she referred to the issues of ensuring the rights of workers (a key issue for the Labour party), the backstop mechanism (a nod to the Unionists), the protection of the environment, and, of course, a temporary membership in the customs Union with the EU. On the one hand, the prime minister really tried to combine the interests of the majority of political forces represented in Parliament in one speech. But on the other hand, it was this fact that alerted traders. After all, it is obvious that certain concessions for the sake of Labor will be hostile to the Conservatives. And vice versa - the points satisfying the interests of Tories will be rejected by the opposition As a result, in pursuit of the votes of both parties, May may be left with nothing, even despite the promise of a "incentive prize" in the form of a vote for a new referendum. There is one more nuance that weakens May's position on the eve of the fourth vote on the draft deal - this is her proposed resignation. According to the British press, she assured members of the Parliamentary "199 Committee" (a group of British conservative deputies who are authorized to express a vote of no confidence in the current prime minister) that she would leave her post regardless of the outcome of the vote. It is supposed that May will leave the posts of the head of the Conservative Party and, accordingly, the prime minister during the summer. Therefore, now the deputies are forced to think not only about the conditions of the deal with the EU, but also about how and who will fulfill these conditions. Here it is worth noting that the current leader of the political race is ex-Foreign Minister Boris Johnson - the most zealous and consistent supporter of hard Brexit. This is the most undesirable candidate for Laborites and/or for supporters of maintaining close business contacts with the European Union. In this context, the leader of the Labour Party rather accurately compared Theresa May's Cabinet of Ministers with the Titanic in the final minutes of its ill-fated voyage. At the same time, he expressed doubts that the agreements reached with the May government would "work" under her successor (especially if this is Johnson). Although he voiced these words after the failure of negotiations between the government and the Labour Party, his position hardly changed in the context of the upcoming voting for the deal. Thus, today there are no clear reasons for optimism. The dynamics of the pound-dollar pair fully reflects the sentiments of market participants, who rightly doubt that May's policy "to reach an agreement with everyone" will end in another failure. The only hope for GBP/USD bulls is a political "bait" in the form of a vote on a new referendum. Many deputies are really lobbying for this idea, and they may be ready to give their vote for the deal in exchange for the opportunity to vote for a repeated plebiscite. The mood of the deputies will be known in the coming days, when MPs "digest" the information received today. In turn, the pound will dutifully follow the news flow regarding the prospects for the fourth vote, ignoring all other fundamental factors. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD 5 Star Buy Signal | Fundamental + Technical Analysis Posted: 21 May 2019 01:05 PM PDT

Fundamental: EUR steadied as Germany's PPI index performed better than expected showing a 0.5% increase, surpassing estimates of a 0.2% increase. However, recovery for the region remains fragile as trade tensions between China and US escalates. Zhang Ming, China's envoy to EU indicated that China will retaliate against Trump's recent order to restrict Huawei and ZTE corporations from doing business in US and warns of China's unwavering resolve to fight US bullying saying that "We've been holding for 5000 years, why not another 5000 years?" Meanwhile, Trump vowed to prevent China's economy from surpassing US, indicating that he is "very happy" with the trade war. With the trade negotiations collapsing entirely and world's 2 largest economies showing signs of a slow down, as seen in the latest retail sales data, this could hamper EU's recovery in the manufacturing sector and stall economic growth with its heavily export-dependent economy. Elsewhere, rising populism added to the weakening sentiment as Italy's ruling populists have repeatedly threatened to break European Union's budget rules and a strong performance by Salvini could spur greater volatility for the currency as it would mean another budget clash with the European Commission, adding on the global uncertainty. Italy market would also take the biggest hit with Salvini's emergence as "it implies persistent widening pressure on Italian bonds, with investors using relief phases to offload risks rather than treating dips as buying opportunities" according to Michael Leister, head of rates strategy at Commerzbank AG. Technical: Entry: 1.1136 Stop loss : 1.1117 Take profit : 1.1174 Today we're seeing that EUR/USD is very close to major support at 1.1136 and a strong bounce could occur from here pushing prices up to our 1st resistance level at 1.1174. It's important to note that Stochastic is also at a corresponding support level which increases our confidence on this trade. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of Dollar Index for May 21, 2019 Posted: 21 May 2019 10:55 AM PDT The Dollar index just below the previous high made in April at 98.03. Short-term trend remains bullish as price is also approaching a major Fibonacci resistance area that has already been tested twice.

Red rectangle - resistance area Green rectangle - support area The Dollar index remains in a bullish trend as long as price is above the green support area. Resistance is found at 98 and breaking above it would open the way for a move towards 100. So far price has broken above a triple top at 97.17 reached the 61.8% Fibonacci retracement and pulled back as a back test. Support was respected and price has bounced once again towards 98. Maybe this time we will see the break of the major Fibonacci resistance. The only warning we get for the bullish scenario are the bearish divergence signs by the RSI on a weekly basis. Price however continues to make higher highs and higher lows. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis for Gold for May 21, 2019 Posted: 21 May 2019 10:48 AM PDT Gold price has broken below $1,276 and is trading just above $1,270. Gold price has broken below important support trend line. Gold price is at the edge of a cliff that could lead price much lower towards $1,250-25 area.

Green line - support trend line (broken) Black line - resistance Blue downward sloping line - major resistance trend line Gold price is breaking below the green trend line support that has lasted for several tests so far. Next support is at $1,266 and if broken I expect Gold to continue lower at least towards $1,250 if not $1,225 area. Resistance is at $1,276-80 and next at $1,302. As long as Gold remains below $1,300 we remain bearish as we have been saying for the last few weeks. The material has been provided by InstaForex Company - www.instaforex.com |

| May 21, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 21 May 2019 09:40 AM PDT

On January 10th, the market initiated the depicted bearish channel around 1.1570. Since then, the EURUSD pair has been moving within the depicted channel with slight bearish tendency. Few weeks ago, a bullish Head and Shoulders reversal pattern was demonstrated around 1.1200. This enhanced further bullish advancement towards 1.1300-1.1315 (supply zone) where significant bearish rejection was demonstrated on April 15. Short-term outlook turned to become bearish towards 1.1235 (78.6% Fibonacci) then 1.1175 (100% Fibonacci level). For Intraday traders, the price zone around 1.1235 (78.6% Fibonacci) stood as a temporary demand area which paused the ongoing bearish momentum for a while before bearish breakdown could be executed on April 23. Since then, the mentioned price zone around 1.1235-1.1250 has turned into supply-zone to be watched for bearish rejection. On May 13, another bullish pullback was executed towards the mentioned price zone (1.1230-1.1250) where the current bearish movement was initiated. On the other hand, the EURUSD pair has been maintained above the next key-zone (1.1175) until last Friday when a bearish breakout below 1.1175 was achieved. Further bearish decline should be expected towards 1.1115 provided that the price level of 1.1190 remains defended by the EURUSD bears. Trade recommendations : Conservative traders who were advised to have a SELL entry around the supply zone (1.1235-1.1250) should lower their S/L towards 1.1190 to secure more profits. Remaining Target level should be projected towards 1.1115. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin analysis for May 21, 2019 Posted: 21 May 2019 09:26 AM PDT Bitcoin has been trading sideways at the price of $7.847 in past 24h. Watch for selling opportunities.

Nothing specially changed since our previous analysis. According to the H4 time-frame, we found that the buying climax in the background followed by the up-thrust (reversal bar) is still dominating, which is sign that buying at this stage looks risky. Also, key swing high at the price of $8.312 is still we defended and as long as this swing high is holding, we will watch for selling opportunities. Additionally, we found that breakout of the support trendline (green trendline) For upward scenario, we would like to see clean break of $8.312 to confirm further upward continuation. Upward references are set: Swing high – $8.225 Major swing high – $8.312 Downward references are set at: Swing low – $7.030 Swing low 2– $6.820 The material has been provided by InstaForex Company - www.instaforex.com |

| May 21, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 21 May 2019 09:18 AM PDT

On March 29, the price levels of 1.2980 (the lower limit of the newly-established bearish movement channel) provided significant bullish support for the GBPUSD pair. This brought the GBPUSD pair again towards the upper limit of the depicted bearish channel around (1.3160-1.3180). Since then, Short-term outlook has turned into bearish with intermediate-term bearish targets projected towards 1.2900 and 1.2850. On April 26, another bullish pullback was initiated towards the price levels around 1.3000 (the bottom of March 29) which has been breached to the upside until May 13 when evident bearish rejection was demonstrated. Hence, a bearish Head and Shoulders pattern was expressed on the H4 chart with neckline located around 1.2980-1.3020. That's why, the price zone of 1.3000-1.3020 turned to become a prominent supply-zone where a valid bearish entry was offered two weeks ago. Bearish persistence below 1.2980 (Neckline of the reversal pattern) enhanced further bearish decline. Initial bearish Targets were already reached around 1.2900-1.2870 (the backside of the broken channel) which failed to provide any bullish support for the pair. Further bearish decline was demonstrated towards the lower limit of the depicted long-term channel around (1.2680-1.2700). The GBPUSD pair looked oversold around these mentioned price levels (1.2680-1.2700) with some early signs of bullish recovery being manifested on the H4 chart. Bullish persistence above 1.2750 is needed to enhance the bullish side of the market on the short-term. If so, initial bullish targets would be located around 1.2870-1.2900. Trade Recommendations: Conservative traders should wait for another bullish pullback towards 1.2870-1.2905 (newly-established supply zone) to look for valid sell entries. S/L should be placed above 1.2950. The material has been provided by InstaForex Company - www.instaforex.com |

| USD/CAD analysis for May 21, 2019 Posted: 21 May 2019 09:00 AM PDT USD/CAD has been trading downwards and the CAD tested the level of 1.3397. We are expecting potential upside because we found strong rejection from the key support.

According to the H1 time-frame, we found that there is strong test and reject from the key support at 1.3399, which is sign that sellers got no interest in CAD. Additionally, we found that bullish divergence on the Stochastic oscillator, which is another sign of the potential strength. There is also a breakout of the down channel, which adds more potential for the upside. Watch for potential buying opportunities on the pullbacks with the first target at 1.3446. Upward references: Purple rectangle- 1.3446 Swing high – 1.3476 Downward reference: Swing low – 1.3397 Key swing low – 1.3375 The material has been provided by InstaForex Company - www.instaforex.com |

| The Australian dollar is under pressure again: the head of the RBA announced a rate cut Posted: 21 May 2019 08:54 AM PDT The results of the parliamentary elections in Australia almost returned the AUD/USD pair to the area of the 70th figure, but the growing general pessimism about the prospects of the world economy did not allow the buyers of Aussie to strengthen their success. As a result, the pair fell down again, testing the levels of multi-year lows at the moment. The growth of anti-risk sentiment is due to many factors that resonate with each other, provoking panic among traders. The list of these factors is very impressive: the aggravation of the trade conflict between the US and China, a significant deterioration in relations between Washington and Tehran, vague prospects for Brexit and the growing popularity of right-wing political forces in the main EU countries on the eve of the elections to the European Parliament. The market clearly feels nervousness, which is spurred by loud statements of politicians and comments of many financial experts, who voice the apocalyptic scenarios for the near future. The Australian currency is quite sensitive to changes in the external fundamental background. But in this case, the pressure on the currency is intensified by the position of the Reserve Bank of Australia, the head of which actually announced a decrease in the interest rate at the next meeting. This factor played a key role in the resumption of the southern trend, not allowing the bulls to return the price above the mark of 0.7000. It is worth noting that the Australian Central Bank over the past six months maintained, if not optimistic, then rather restrained position regarding the prospects of the national economy. Contrary to the "dovish" expectations, members of the RBA did not follow the path of their colleagues from the RBNZ, who voiced soft rhetoric since the beginning of the year, and began to reduce the interest rate at the last meeting. After that, AUD/USD traders concluded that Australians will follow their example, given the slowing GDP growth of the country. But the head of the Department Philip Lowe still bent his line and denied rumors about the upcoming easing of the parameters of monetary policy. This firmness of the head of the RBA supported the Australian dollar, which in pair with the US currency remained stable above the key support level of 0.7000. But after the elections to the Parliament of Australia (which took place last weekend), his rhetoric has softened dramatically. Whether it is a coincidence or not is an open question, but the fact remains. During today's speech, Lowe said that the June meeting will consider the issue of reducing the interest rate. According to him, low rates will support the labor market and contribute to the growth of inflation to the target level. I would like to note that inflation and the labor market has recently shown a negative trend. It is likely that this factor was the "last straw" in the patience of the RBA, if we exclude the political factor of a possible change of power (by the way, the ruling party suddenly won the elections in Australia, which means the Prime Minister will retain his position). Thus, according to the latest data, the consumer price index in Australia suddenly fell to zero (on a monthly basis), while experts expected a decline of only 0.2%. In annual terms, the growth of the indicator slowed to 1.3%, although the overall forecast was at 1.5% (from 1.8% in the fourth quarter of last year). Core inflation rose only 0.2% during the first quarter (after seasonal adjustments) – this fact again disappointed market participants who expected the growth of the key indicator by 0.4%. On an annualized basis, baseline quarterly inflation fell to 1.4%, well below the minimum target value of the Australian regulator. These figures were published at the end of April – and even then led to rumors of a reduction in the interest rate until the end of this year. Some of the experts even allowed the easing of monetary policy at the next meetings – that is, on May 7 or June 4. Today, Philip Lowe actually confirmed the forecasts of experts, "appointing" consideration of this issue for June. Disappointing data on the labor market only strengthened the confidence of traders that the members of the RBA will take this step in early summer. The unemployment rate has been rising for the third month – after a decline in February to 4.9%, in March it reached 5.1%, in April – 5.2%. The growth of the Australian economy also leaves much to be desired (0.8% in annual terms), primarily due to the decline in consumer spending. In other words, the southern dynamics of the Australian is quite justified – the currency is under pressure from both internal and external fundamental background. In terms of technique, the AUD/USD pair is within the downward movement, as evidenced by the trend indicators on all "higher" timeframes (from H4 and above). The nearest support level is at 0.6790 (the lower line of the Bollinger Bands indicator on the monthly chart). The goal of a possible corrective pullback is 0.6940 (Tenkan-Sen line on the daily chart), if AUD/USD bulls overcome it, they will test the 70th figure again. However, given the fundamental picture, it will be difficult for bulls to find a reason for such a significant Northern breakthrough. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of Gold for May 21, 2019 Posted: 21 May 2019 08:46 AM PDT Gold has been trading downwards as we expected. The price tested the level of $1.269. Anyway, we are expecting potential rally since there is momentum lost on the last leg down.

According to the H4 time-frame, we found that there is the buy divergence on the Stochastic oscillator, which is sign that potential rally is about to happen. Also, Gold is trading near the key support at $1.266. There is the test-reject of the Keltner channel lower band at $1.270, which is another confirmation that rally might come. Upward targets are set at the price of $1.279 and $1.288. Upward references: 20EMA (blue average line) - $1.279 Top of the Keltner channel - $1.288 Downward reference: Key swing low - $1.266 The material has been provided by InstaForex Company - www.instaforex.com |

| The market is waiting for a surge in euro volatility Posted: 21 May 2019 07:56 AM PDT Euro buyers are now in a very depressed state. Their position has weakened and the burden of problems, which puts pressure on the single currency, is becoming increasingly difficult. In the second half of last year, the German economy nearly fell into recession, as local exports were severely affected by trade wars and falling external demand. In January, there was hope for improvement, but yet another outbreak of conflict between the United States and China brought everything back to square one. At the same time, eurosceptics and the British pound with their Brexit are pulling the euro to the bottom. It would seem that Marine Le Pen, two years ago, lost the election to Emmanuel Macron, and the Italian populists had to admit that their plans did not come true. Elections to the European Parliament – a special case that allows you to remember the old ideas, especially since a wave of protests swept France, and the economy of Italy is barely alive. Strange, but the increasing political risks in Europe does not swing the volatility of the euro, as it was before. Perhaps the reason lies in the "dovish" rhetoric of the world's leading Central Bank. Investors are not particularly worried about the lack of liquidity. A combination of two factors constrains the euro from sharp fluctuations: weak volatility and deterioration of risk appetite. The euro goes in a narrow range during the whole month of May. The EUR/USD pair started the new week very sluggishly, but maybe the busy calendar of the second part of the five-day period will bring it out of sleep. Ahead of the publication of minutes of meetings of the Fed and the ECB. For EUR/USD, the combination of these two drivers is explosive. Mario Draghi's rhetoric may weaken the European currency, and the dollar, on the contrary, will demonstrate another wave of growth. However, the dollar index is now at its highs, and it is possible that at a press conference, it can give up. It is not necessary to focus only on the comments of the Central Bank, as one of the main roles can draw on additional factors, such as news about trade wars. A big fan of provocations – Donald trump – can write another post on Twitter, and the market will spread rumors. In favor of the weakening of the US currency after the publication of the minutes of the FOMC meeting is the fact that inflation expectations are at minimum levels. The Fed may well lower the interest rate. From the European Central Bank, too, should not expect "hawkish" rhetoric. In April, the regulator was not yet aware of the acceleration of the European and German economies, or the acceleration of inflation. The single currency is under pressure from fears of a further decline in business activity, because purchasing managers were already aware of the new round of trade wars. Thus, the breakthrough of $1.13 will increase the risks of further depreciation of EUR/USD to $1.1. For the pair to grow, buyers need to move the quotes above $1.12. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 21 May 2019 07:56 AM PDT To open long positions on GBP/USD, you need: Buyers of the pound formed a new support level of 1.2687, which should help them break above the resistance of 1.2744 in the afternoon, but much will depend on the performance of Theresa May. Fixing above 1.2744 will lead to the demolition of stop orders of sellers and to an update of the maximum of 1.2802, where I recommend fixing the profits. With a further decline and breakthrough of the support of 1.2687, it is best to return to long positions after the test of the minimum of 1.2614 and 1.2564. To open short positions on GBP/USD, you need: An unsuccessful performance of Theresa May can lead to a repeat test and the breakdown of the support of 1.2687, which will only increase the pressure on the pound and collapse the pair to the lows of 1.2614 and 1.2564, where I recommend fixing the profits. In case of growth above 1.2744 and good support from buyers, you can take a closer look at short positions after the resistance test of 1.2744 or at a rebound from the maximum of 1.2802. Indicator signals: Moving Averages Trading is conducted in the area of 30 and 50 moving averages, which indicates a slowdown in the downward trend. Bollinger Bands The volatility of the indicator is low, which does not give signals to enter the market. Description of indicators

|

| Posted: 21 May 2019 07:56 AM PDT To open long positions on EURUSD, you need: Euro buyers revived after a good report on consumer confidence, which improved slightly. To return to the market, bullish sentiment requires a breakdown and consolidation above the resistance of 1.1159, which will allow us to count on updating the maximum of 1.1180, where I recommend fixing the profits. In the event of a further decline in the euro, support will be provided by the new level of 1.1138, where it is best to open long positions when forming a false breakdown. I recommend buying for a rebound only after the test of a minimum of 1.1112. To open short positions on EURUSD, you need: Bears need to form a false breakdown in the resistance area of 1.1159, which will maintain the downward potential and lead to a further reduction of EUR/USD to the support area of 1.1138, where today I recommend fixing the profits. The main target will be the low of 1.1112. If the growth scenario is higher than 1.1159 in the second half of the day, short positions can be considered to rebound from a maximum of 1.1180. Indicator signals: Moving Averages Trading is conducted in the area of 30 and 50 moving averages, which indicates a slowdown in the downward trend. Bollinger Bands The volatility of the indicator is low, which does not give signals to enter the market. Description of indicators

|

| Technical analysis of GBP/USD for May 21, 2019 Posted: 21 May 2019 06:45 AM PDT The GBP/USD pair continues to move downwards from the level of 1.2905. This week, the pair rose from the level of 1.2905 to a top around 1.2800 and it set around the spot of 1.2800. The first resistance level is seen at 1.2905 followed by 1.2963 , while daily support 1 is seen at 1.2798 (38.2% Fibonacci retracement). According to the previous events, the GBP/USD pair is still moving between the levels of 1.2700 and 1.2610; so we expect a range of 90 pips in coming hours. Furthermore, if the trend is able to break out through the first support level at 1.2662, we should see the pair climbing towards the double bottom (1.2436) to test it later. Therefore, sell below the level of 1.2800 with the first target at 1.2610 in order to test the daily resistance 1 and further to 1.2436. Also, it might be noted that the level of 1.2436 is a good place to take profit because it will form a double bottom. On the other hand, in case a reversal takes place and the GBP/USD pair breaks through the resistance level of 1.2905, then the stop loss should be placet at 1.2930. The material has been provided by InstaForex Company - www.instaforex.com |

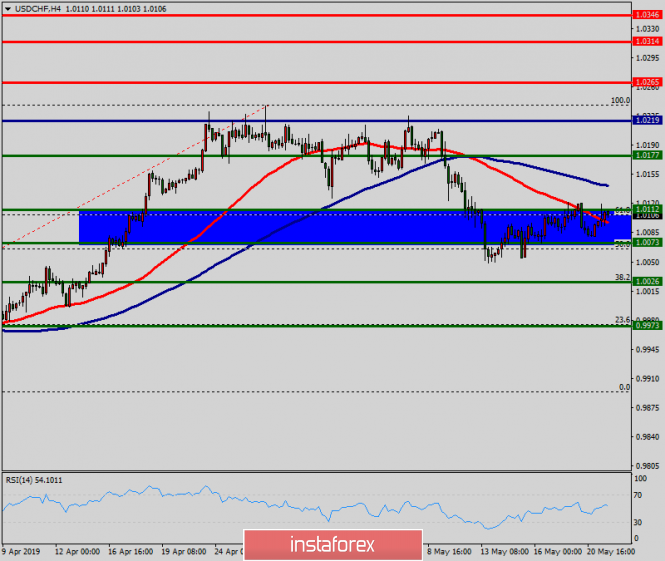

| Technical analysis of USD/CHF for May 21, 2019 Posted: 21 May 2019 06:39 AM PDT Overview: The USD/CHF pair continues moving in a bullish trend from the support levels of 1.0123 and 1.0177. Currently, the price is in an upward channel. This is confirmed by the RSI indicator signaling that the pair is still in a bullish trend. As the price is still above the moving average (100), immediate support is seen at 1.0177. Consequently, the first support is set at the level of 1.0177. So, the market is likely to show signs of a bullish trend around 1.0177. In other words, buy orders are recommended above the level of 1.0177 with the first target at the level of 1.0265. Furthermore, if the trend is able to breakout through the first resistance level of 1.0265, we should see the pair climbing towards the point of 1.0314. However, it would also be wise to consider where to place a stop loss; this should be set below the second support of 1.0123. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 21 May 2019 05:23 AM PDT Donald Trump scares Iran with "enormous power." When there are groups that drive the market in multiple directions. As a rule, the price of an asset regularly slips into consolidation. Oil is no exception. Since the beginning of the year, its main varieties have grown by about 40% on expectations that the end of the trade war will increase global demand, and a reduction in production by OPEC and other producing countries, including Russia, will balance the market. BofA Merrill Lynch is sure that this will happen already in 2019, and black gold will face a deficit in 2020. The resumption of the trade conflict between the United States and China made adjustments to this coherent theory and it would seem that they should have forced speculators to take profits on long positions if Iran had not intervened. For the time being, Tehran's loud statements to close the Strait of Hormuz through which about 16.8 million b/s passes or about one-third of all deliveries in the world using sea and ocean tankers, seemed to be idle shots into the air. However, the attacks of four ships and two of which belonged to Saudi Arabia, which forced investors to reconsider their views. In response to the bombings in Baghdad, Iran could have applied, according to the White House. Donald Trump began to threaten the latter with "enormous force". Dynamics of oil transportation Growth of Brent and WTI was promoted by the information on the desire of OPEC led by Saudi Arabia to prolong the agreement on the reduction of production to the end of 2019. Riyadh asks not to be deceived about the current price increase and to continue the implementation of the plan to balance the market. There is information that with current oil prices that suit Russia. Moscow will insist on reducing the cut from 1.2 million b/s to 201 million b/s as specified in 2018, but the Saudis call this idea not the best solution. At the same time, it is necessary to understand that the "bulls" in Brent and WTI deprived an important Trump card in the form of expectations of growth in global demand for black gold after the end of the trade war. Donald Trump said he would not allow China to overtake the United States while he was in office. If Hillary Clinton won in 2016, the castling took place during her tenure in power. The policy of protectionism causes a serious blow to the GDP of the Middle Kingdom, which already this year can slow down to less than 6%. The last time such figures occurred three decades ago. Despite the fact that oil is not yet an object on which tariffs are charged, China has reduced its imports from the United States. About 24% of US exports went to the Middle Kingdom In March 2018 and then, the figure dropped to 4% in March 2019. Donald Trump said he would not allow China to overtake the United States while he was in office. If Hillary Clinton won in 2016, the castling took place during her tenure in power. The policy of protectionism causes a serious blow to the GDP of the Middle Kingdom, which already can slow down to less than 6% this year. The last time such figures occurred was three decades ago. Technically, Brent continues to form a consolidation range of $ 68.6-74.5 per barrel in the Splash and Shelf pattern on the daily chart. Breaking through its upper boundary will create prerequisites for the realization of target by 161.8% on AB = CD. On the contrary, a successful assault of $68.6 support will open to the bears the way to a decline in the direction of the target by 88.6% based on the Bat model. Brent daily chart |

| Control zones for EUR/JPY pair on 21.05.19 Posted: 21 May 2019 04:28 AM PDT Today's testing of 1/4 WCZ of 122.95-122.87 provides an opportunity to enter the sale. The first goal is a decline at least last week and a test of which will allow closing the part of the position. If sales are already open, it is necessary to keep them until the pair consolidates above the level of 122.95, which will allow changing the direction of work. Today we can expect a decline in the framework of the average daily rate and the achievement of which will oblige to transfer the position to breakeven in the event of large demand. An alternative model will be developed in case the pair can consolidate above the level of 122.95 in today's US session. It will oblige to close all sales and consider further growth to the next 1/2 WCZ of 123.85-123.69 at the resistance zone, where the fate of the downward bearish momentum will be determined. Daily CZ - daily control zone. The area formed by important data from the futures market, which changes several times a year. Weekly CZ - weekly control zone. The area formed by marks from the important futures market, which changes several times a year. Monthly CZ - monthly control zone. The area is a reflection of the average volatility over the past year. The material has been provided by InstaForex Company - www.instaforex.com |

| Control zones of AUD / USD pair on 05/21/19 Posted: 21 May 2019 04:09 AM PDT Today's movement in the Asian session has already exceeded the average daily rate, which indicates a high probability of a fall to stop. It is important to understand that any growth will be corrective. Therefore, it is necessary to look again for favorable prices for the sale of the instrument. The first goal of the fall is a weekly minimum, testing of which will require partial fixation of a short position. The next reduction target will be the 1/2 WCZ of 0.6844-0.6837, formed from the previous control zone. Achieving this zone will allow you to completely close sales and expect further developments. An alternative model will be developed if the closure of today's US session occurs above the Asian maximum. This will indicate the appearance of a large buyer and a possible trend change to an upward one. The probability of implementing this model is 30%, which makes it auxiliary. Purchases from the current rates are not profitable. Daily CZ - daily control zone. The area formed by important data from the futures market, which changes several times a year. Weekly CZ - weekly control zone. The area formed by marks from the important futures market, which changes several times a year. Monthly CZ - monthly control zone. The area is a reflection of the average volatility over the past year. The material has been provided by InstaForex Company - www.instaforex.com |

| Italian behind-the-scenes games can be the main driving force for the euro Posted: 21 May 2019 04:02 AM PDT The EUR/USD pair quickly lost the points scored yesterday with the target at the area of 1.1150. It is assumed that if the pair drops below the level of 1.1100, this will mark the breakthrough of an important support level and cause more intense pressure on the bears. According to experts, the EUR/USD pair is stronger this week than all the others threatened by a surge in volatility. Tomorrow, the European Central Bank President Mario Draghi will give a speech. It is possible that investors will look in the words of the head of the ECB for hints on the specific parameters of the next program of long-term lending to banks and on possible incentives. On Thursday, there will be releases of eurozone business activity indicators, which will help to form an updated assessment of the state of the currency block economy. In addition, elections will be held in the European Parliament (from 23rd to 26th May) this week. At the moment, there is a tense struggle between supporters and opponents of the EU and the main issue remains the degree of support that populists enjoy. If euro skeptics succeed in taking a significant number of seats in parliament, they can stop any progress for the next 5 years. According to Citi experts, after May 26, when the results of the elections to the European Parliament will be made public, backstage games of Italian politics can become the main driving force for the euro. "The European elections will determine the balance of power within the Italian coalition. The results in favor of the right wing are likely to mean further confrontation with the EU. Moreover, the confident victory of the right-wing candidates may result in new elections in the country, "said Citi representatives. Analysts believe that the threat of a change of power in Italy, along with the uncertain situation around Brexit and weak macroeconomic indicators in the EU, will hamper the strengthening of the euro. In particular, Deutsche Bank revised downward forecast for EUR/USD pair from 1.25 to 1.13 for 2019. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading plan for EUR / USD and GBP / USD pairs on 05/21/2019 Posted: 21 May 2019 03:51 AM PDT The market has stopped and it is not clear whether everyone was stunned by how quickly the dollar has strengthened in recent days or they decided to take a short break. Although the fact is rather that they simply could not find any reasons for purchases or sales because yesterday was completely empty from the point of view of any information that could help in making a decision. No statistics were published and all hope was only for the speech of Jerome Powell, who spoke on the risks to the American financial system. However, the head of the Federal Reserve did not say anything new. For several months in a row, all the representatives of the Federal Reserve System deal only with what they say about the rather unfortunate consequences for the economy that the trade conflict between the United States and China entails. However, they constantly indicate that all these risks are only in the future and can still be avoided. Moreover, Mr. Powell did not say anything about the refinancing rate and the possibility of reducing it. Although his colleagues in the Federal Commission on operations on the open market deal only with those who claim that they see no reason for such steps. British politicians also did not bring anything new, deciding to wait with yet another loud statements regarding Brexit. Hence, investors had to sit and wait for the weather by the sea as they see no reason for such steps. British politicians also did not bring anything new, deciding to wait with yet another loud statements regarding Brexit. Hence, investors had to sit and wait for the weather by the sea. Today, the situation is not much better since only data on home sales in the secondary market of the United States, which can grow by 2.6%, is released from macroeconomic statistics. The data is not that important, so there will be no special effect. Moreover, the lull in the market is largely due to the upcoming publication of the text of the minutes of the meeting of the Federal Commission on Open Market Operations, in which they hope to find answers to questions regarding further actions by the regulator, especially in terms of the refinancing rate. For the reason that the market participants themselves are not particularly tuned to sudden movements. It is better to be safe and remain cautious until there is any specificity. The euro/dollar currency pair, similarly to a fellow, showed a movement standing in one place, where a bearish interest remains in the market after all. Probably, it suggests a further decline towards 1.1135, which was the local minimum on May 3. The pound/dollar currency pair has dramatically slowed the movement for the last trading day, remaining all the time in the same place, to say the least. It is likely that against the general background. The downward movement will continue, lowering us towards 1.2665. |

| The Central Bank of Australia signals a decrease in rates in June Posted: 21 May 2019 03:27 AM PDT The Central Bank of Australia will consider lowering interest rates next month to support the economy, head of the Central Bank Philip Lowe said, calling on the recently re-elected government to make its contribution by reducing income taxes and increasing spending. "The lower rate will promote employment growth and bring closer the time when inflation will meet the goal. Given these factors, at our meeting in two weeks, we will consider the issue of lowering interest rates," said Lowe. The reduction will be the first after the Reserve Bank of Australia (RBA) in August 2016 lowered rates to a record low of 1.50%. Investors and analysts welcomed this move, saying that it could help revitalize the housing market in the country. The main result of the changes should be a significant increase in the maximum volume of loans for the purchase of real estate. Australian economic growth has slowed to 0.8% year on year, and there are signs that the recession will continue. Inflation also remains below the RBA target range of 2-3%, while the unemployment rate has risen to an eight-month high of 5.2%. Lowe pointed to the slowdown in household consumption as the main cause of the economic downturn. The head of the Central Bank called on the government to help accelerate economic growth, including through additional fiscal support, infrastructure spending and changes in government policies to increase business investment. The material has been provided by InstaForex Company - www.instaforex.com |

| The dollar will continue to rise, the euro and the "Aussie" under pressure Posted: 21 May 2019 03:27 AM PDT The dollar does not plan to leave the recently occupied 2-week maximum in the near future, support for the currency provides the status of a safe haven amid growing concerns that trade tensions between the US and China may escalate after Washington's statements about Huawei. The dollar has established itself as a safe haven, it is in high demand when stocks fall and market volatility increases. In addition, a rebound in the yield of US Treasury bonds is another factor supporting the dollar. Given that the Fed did not give clear hints of a rate cut this year, the recovery in yield may continue for some time. Recall, Fed Chairman Jerome Powell said that it is too early to talk about the impact of trade conflicts on monetary policy. The yield on 10-year Treasury bonds rose to an eight-day high of 2.428%, while a few days ago the yield fell to 2.354%, its lowest level since March 28. Currently, among industrialized countries, only Italy has a higher rate than the United States. In such conditions, traders have almost no other choice but to turn to the dollar. The euro fell to $1.1165 and is likely to feel downward pressure until the end of the European parliamentary elections scheduled for May 23-26. The Australian dollar fell by 0.25% to $0.6891, its growth was stopped by a statement from the head of the Reserve Bank of Australia, Philip Lowe, that the Central Bank will consider reducing interest rates at its policy meeting in June. The decline will be the first since August 2016. The Australian added almost 0.6% a day earlier after the unexpected victory of the country's conservative government in elections. Investors evaluated the economic policies of the opposition Labor Party as less favorable to business, and the unexpected defeat of the Labor Party led to a rally in Australian markets. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 21 May 2019 03:27 AM PDT 4-hour timeframe Technical data: The upper linear regression channel: direction – down. The lower linear regression channel: direction – down. The moving average (20; smoothed) – down. CCI: -110.1798 The pound spent the first trading day of the week in absolute calm, and the bulls did not have enough strength even to start the correction against the background of a complete lack of macroeconomic events. Thus, the conclusion suggests itself, there are currently no bulls in the Forex market for the pair GBP/USD. Unfortunately, there are no new data on the topic of Brexit now either. Theresa May announced a "new and bold" proposal to Parliament, however it is unknown when it will be announced. It is only known that a new vote on the "deal" should take place in early June, that is, in two weeks. Meanwhile, the pound continues to depreciate, because the patience of traders banal ended. Three years after the referendum, Theresa May has been actively negotiating with the EU for the last year, but she hasn't been able to agree on a "deal". Local elections in the UK have shown that Theresa May and her party believe less and less of the electorate. And if earlier, the pound often grew on the expectations that the government of Theresa May will still be able to settle all the differences between the Parliament and the European Union, now there is almost no hope. But on the horizon looms the "wonderful" prospect of a second referendum, which the Parliament itself can initiate, if, for example, the fourth attempt to accept Theresa May's agreement fails. Nearest support levels: S1 – 1.2695 S2 – 1.2634 S3 – 1.2573 Nearest resistance levels: R1 – 1.2756 R2 – 1.2817 R3 – 1.2878 Trading recommendations: The pair GBP/USD continues its downward movement. Thus, short positions with targets at 1.2695 and 1.2634 are now relevant, before Heiken Ashi's indicator turns to the top, which will indicate a turn of upward correction. It is recommended to consider long positions after consolidation of the pair above the moving average with the targets at 1.3000 and 1.3062. However, at the moment, there are almost no bulls on the market. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of illustrations: The upper linear regression channel – the blue line of the unidirectional movement. The lower linear regression channel – the purple line of the unidirectional movement. CCI – the blue line in the indicator regression window. The moving average (20; smoothed) is the blue line on the price chart. Murray levels – multi-colored horizontal stripes. Heiken Ashi is an indicator that colors bars in blue or purple. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment