Forex analysis review |

- GBP/USD approaching support, potential bounce!

- AUD/USD approaching support, potential bounce!

- USD/JPY to test resistance, a drop is possible!

- Fractal analysis of major currency pairs on June 11

- EUR / USD h4 vs #USDX h4. Comprehensive analysis of movement options from June 11, 2019. Analysis of APLs & ZUP

- The risk returns to Forex, the ECB says one thing, and is going to do another

- The pound sterling may fall to $1.24

- Is it intended to change the dollar's trend, or is it still too early to mark the greenback as an outsider?

- Fed: to lower the rate or prove independence?

- EUR/USD. June 10th. Results of the day. The euro currency is prone to growth if it receives news from the US

- GBP/USD. June 10th. Results of the day. UK GDP and industrial production sent the pound to a new peak

- June 10, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- June 10, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- Bitcoin analysis for June, 10.2019

- Analysis of Gold for June 10,.2019

- GBP/USD analysis for June 10,.2019

- Technical analysis for the GBP/USD currency pair for the week from June 10 to 15, 2019

- Technical analysis of EURUSDfor June 11, 2019

- Technical analysis of Gold for June 11, 2019

- Pound chooses the Prime Minister

- GBPUSD: The UK economy has slowed sharply compared with the previous month after a good first quarter

- GBP/USD: plan for the American session on June 10. UK economy slows down due to uncertainty with Brexit

- EUR/USD: plan for the American session on June 10. Euro buyers found support around 1.1290

- Technical analysis of AUD/USD for June 10, 2019

- Technical analysis of GBP/USD for June 10, 2019

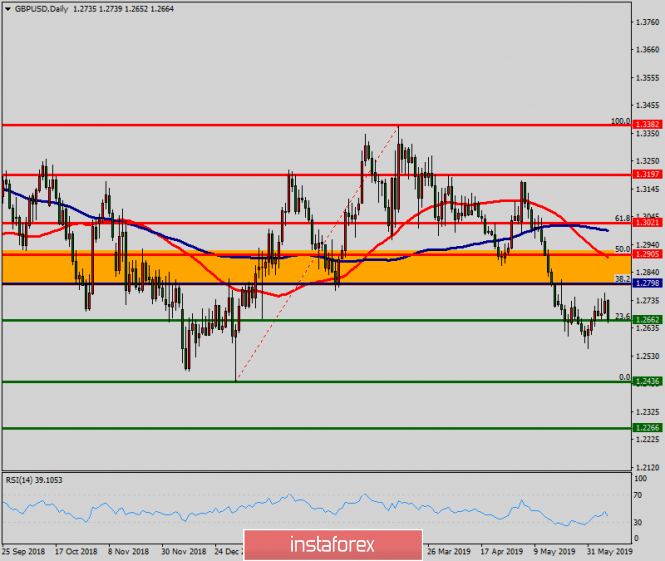

| GBP/USD approaching support, potential bounce! Posted: 10 Jun 2019 07:09 PM PDT

Price is testing its support where we expect to see a bounce up to its resistance. Entry :1.2652 Why it's good : 61.8% Fibonacci retracement, 61.8% Fibonacci extension, horizontal overlap support Stop Loss : 1.2558 Why it's good : horizontal swing low support Take Profit : 1.2764 Why it's good : Horizontal swing high resistance, 61.8% Fibonacci extension

|

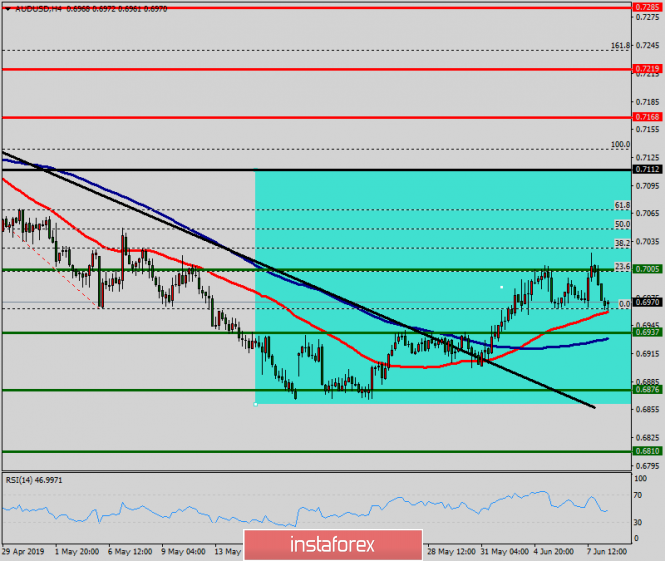

| AUD/USD approaching support, potential bounce! Posted: 10 Jun 2019 07:06 PM PDT

Price is testing its support where we expect to see a bounce up to its resistance. Entry : 0.6951 Why it's good : 38.2% & 50% Fibonacci retracement, 100% Fibonacci extension, horizontal pullback support Stop Loss : 0.6923 Why it's good : 61.8% Fibonacci retracement Take Profit : 0.6989 Why it's good : Horizontal overlap resistance, 61.8% Fibonacci extension

|

| USD/JPY to test resistance, a drop is possible! Posted: 10 Jun 2019 07:03 PM PDT

USDJPY to test key resistance, a drop to 1st support is possible Entry: 109.012 Why it's good : 61.8% Fibonacci extension, 23.6% Fibonacci retracement, horizontal pullback resistance Stop Loss : 109.914 Why it's good :50% Fibonacci retracement,horizontal swing high resistance Take Profit : 107.854 Why it's good: 61.8% Fibonacci retracement, 100% Fibonacci extension, horizontal swing low support

|

| Fractal analysis of major currency pairs on June 11 Posted: 10 Jun 2019 05:57 PM PDT Forecast for June 11: Analytical review of H1-scale currency pairs: For the euro / dollar pair, the key levels on the H1 scale are: 1.1435, 1.1416, 1.1384, 1.1363, 1.1305, 1.1286, 1.1259 and 1.1214. Here, we are following the local ascending structure from June 5th. Short-term upward movement is possible in the range of 1.1363 - 1.1384. The breakdown of the latter value will lead to a pronounced movement. Here, the target is 1.1416. We consider the level of 1.1435 to be a potential value to the top. Upon reaching this level, we expect a consolidation in the range of 1.1416 - 1.1435, as well as a rollback to the correction. Short-term downward movement is possible in the range of 1.1305 - 1.1286. The breakdown of the last value will lead to a prolonged correction. Here, the goal is 1.1259. This level is a key support for the upward structure. Its price will have the formation of the initial conditions for the downward cycle. Here, the potential goal is 1.1214. The main trend is the local structure for the top of June 5th. Trading recommendations: Buy 1.1363 Take profit: 1.1382 Buy 1.1386 Take profit: 1.1416 Sell: 1.1305 Take profit: 1.1286 Sell: 1.1284 Take profit: 1.1262 For the pound / dollar pair, the key levels on the H1 scale are: 1.2808, 1.2789, 1.2754, 1.2727, 1.2687, 1.2667 and 1.2633. Here, we continue to monitor the development of the upward cycle of May 31. At the moment, the price is in the correction area. Continuation of the movement to the top is expected after the breakdown of the level of 1.2727. In this case, the goal is 1.2754. Near this level is a price consolidation. The breakdown of the level of 1.2755 should be accompanied by a pronounced upward movement. Here, the goal is 1.2808. Price consolidation is in the range of 1.2789 - 1.2808 and from here, we expect a rollback to the bottom. Short-term downward movement is possible in the corridor 1.2687 - 1.2667. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 1.2633. This level is a key support for the ascending structure. The main trend is the upward cycle of May 31. Trading recommendations: Buy: 1.2728 Take profit: 1.2752 Buy: 1.2755 Take profit: 1.2787 Sell: 1.2686 Take profit: 1.2668 Sell: 1.2664 Take profit: 1.2638 For the dollar / franc pair, the key levels on the H1 scale are: 0.9987, 0.9961, 0.9930, 0.9911, 0.9858, 0.9846, 0.9816 and 0.9795. Here, the price forms a local structure to continue the downward trend of June 6. Continuation of the movement to the bottom is expected after the price passes the noise range 0.9858 - 0.9846. In this case, the goal is 0.9816. For the potential value to the bottom, we consider the level of 0.9795, near which, we expect a consolidation. Short-term upward movement is possible in the range of 0.9911 - 0.9930. The breakdown of the last value will lead to the cancellation of the downward structure of June 6. In this case, the first potential target is 0.9961. To the level of 0.9987, we expect the initial conditions for the upward cycle to be completed. The main trend is the downward cycle of May 30, the local structure for the bottom of June 6. Trading recommendations: Buy : 0.9911 Take profit: 0.9928 Buy : 0.9932 Take profit: 0.9960 Sell: 0.9846 Take profit: 0.9816 Sell: 0.9814 Take profit: 0.9796 For the dollar / yen pair, the key levels on the scale are : 108.84, 108.43, 107.76, 107.44 and 106.99. Here, we continue to monitor the downward structure of May 30. Short-term downward movement is expected in the range of 107.76 - 107.44. The breakdown of the last value will lead to the movement of the potential target - 106.99. Upon reaching this level, we expect a rollback to the top. Short-term upward movement, as well as consolidation, are possible in the range of 108.45 - 108.84. The level of 108.84 is a key support for the downward structure. Its price passage will lead to the formation of the initial conditions for the upward cycle. The main trend: the local structure for the bottom of May 30, the stage of correction. Trading recommendations: Buy: 108.45 Take profit: 108.82 Sell: 107.74 Take profit: 107.45 Sell: 107.42 Take profit: 107.00 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3403, 1.3379, 1.3339, 1.3299, 1.3250, 1.3225, 1.3167 and 1.3122. Here, we are following the development of the downward structure of May 31. The continuation of the development of the main trend is expected after the price passes the noise range of 1.3250 - 1.3225. In this case, the goal is 1.3167, wherein consolidation is near this level. For the potential value to the bottom, we consider the level of 1.3122. And from which, we expect a rollback to the top. Short-term upward movement is possible in the range of 1.3299 - 1.3339. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 1.3379. The noise range is between 1.3379 - 1.3403. Before it, we expect the registration of the expressed initial conditions for the ascending cycle. The main trend is the downward structure of May 31. Trading recommendations: Buy: 1.3300 Take profit: 1.3337 Buy : 1.3342 Take profit: 1.3379 Sell: 1.3225 Take profit: 1.3170 Sell: 1.3165 Take profit: 1.3124 For the pair Australian dollar / US dollar, the key levels on the H1 scale are : 0.6990, 0.6974, 0.6964, 0.6944, 0.6933, 0.6911 and 0.6893. Here, the price has canceled the formation of a local structure for the top and currently forms the potential for the bottom of June 7. Short-term downward movement is expected in the range of 0.6944 - 0.6933. The breakdown of the last value should be accompanied by a pronounced downward movement. Here, the target is 0.6911. For the potential value for the bottom, we consider the level of 0.6893. After reaching which, we expect a rollback to the top. Short-term upward trend is possible in the range of 0.6964 - 0.6974. The breakdown of the last value will lead to a prolonged correction. Here, the goal is 0.6990. This level is a key support for the downward structure,. Its price passage will have to form the initial conditions for the top. In this case, we have a potential target - 0.7021. The main trend is the formation of potential for the bottom of June 7. Trading recommendations: Buy: 0.6975 Take profit: 0.6990 Buy: 0.6995 Take profit: 0.7010 Sell : 0.6933 Take profit : 0.6913 Sell: 0.6909 Take profit: 0.6895 For the euro / yen pair, the key levels on the H1 scale are: 124.10, 123.77, 123.47, 123.06, 122.87, 122.54, 122.31 and 121.98. Here, we continue to monitor the ascending structure of June 3. Continuation of the movement to the top is expected after the price passes the noise range 122.87 - 123.06. In this case, the goal is 123.47. Price consolidation is in the range of 123.47 - 123.77. For the potential value to the top, we consider the level of 124.10. After reaching which, we expect a departure to the correction. Short-term downward movement is expected in the range of 122.54 - 122.31. The breakdown of the last value will lead to a prolonged correction. Here, the goal is 121.98. This level is a key support to the top. The main trend is the ascending cycle of June 3. Trading recommendations: Buy: 123.06 Take profit: 123.45 Buy: 123.48 Take profit: 123.75 Sell: 122.54 Take profit: 122.33 Sell: 122.25 Take profit: 122.00 For the pound / yen pair, the key levels on the H1 scale are : 139.44, 138.98, 138.67, 138.19, 137.47, 137.25, 136.97 and 136.52. Here, we are following the development of the ascending structure of June 4. Continuation of the movement to the top is expected after the breakdown of the level of 138.20. In this case, the goal is 138.67. Short-term upward movement, as well as consolidation, is in the range of 38.67 - 138.98. For the potential value to the top, we consider the level of 139.44. After reaching which, we expect a rollback to the bottom. Short-term downward movement is expected in the range of 137.47 - 137.25. The breakdown of the last value will lead to a prolonged correction. Here, the goal is 136.97. This level is a key support to the top. The main trend is the ascending structure of June 4. Trading recommendations: Buy: 138.20 Take profit: 138.65 Buy: 138.69 Take profit: 138.96 Sell: 137.47 Take profit: 137.27 Sell: 137.20 Take profit: 136.98 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 10 Jun 2019 05:23 PM PDT We bring to your attention a comprehensive markup options for the movement of EUR/USD vs #USDX from June 11, 2019. Minuette (h4) ____________________ US Dollar Index The movement of the dollar index #USDX from June 11, 2019 will be due to the development of the borders of the 1/2 Median Line channel (96.75 <-> 96.90 <-> 97.00) of the Minuette operating scale. The details of the #USDX movement in channel 1/2 Median Line Minuette are shown in the animated graphic. The breakdown of the lower boundary of the channel of the 1/2 Median Line Minuette (level of support of 96.75) will make the actual continuation of the downward movement of the dollar index to targets -> local minimum (96.47) <-> initial line of the SSL (96.40) Minuette operational scale fork <-> equilibrium zone (96.05 <-> 95.65 <-> 95.20) of the Minuette operational scale fork. In the case of the breakdown of the upper boundary of the channel 1/2 Median Line Minuette (level of resistance of 97.00) -> option to continue movement #USDX to equilibrium zone (97.05 <-> 97.25 <-> 97.44), the Minuette operating scale fork with a view to achieving the boundaries of channel 1/2 Median Line (97.60 <-> 97.85 <-> 98.10) of the Minuette operational scale fork. Details of the movement of #USDX can be seen at the animated graphics. ____________________ Euro vs US Dollar As in the case with #USDX, the development of the movement of the single European currency EUR/USD from June 11, 2019 will be conditioned by the mining of border levels (1.1295 <-> 1.1310 <-> 1.1330) of the 1/2 Median Line channel of the Minuette operational scale. Marking options for movement within the 1/2 ML channel Minuette is presented on the animated graphic. In the case of the breakdown of the upper boundary of the channel of the 1/2 Median Line Minuette (the level of resistance of 1.1330), the upward movement of the single European currency will continue to targets -> local maximum 1.1348 <-> control line UTL (1.1360) Minuette operational scale fork <-> control line UTL (1.1395) Minuette operating scale <-> warning line UWL61.8 Minute ( 1.1425). On the other hand, in the case that EUR / USD returns below the support level of 1.1295 (lower border of the 1/2 Median Line channel Minuette), the downward movement of this currency instrument will be directed to the borders of the channel 1/2 Median Line Minute (1.1280 <-> 1.1260 <-> 1.1240) and zones balances of operational scales fork -> Minuette (1.1240 <-> 1.1215 <-> 1.1190) and Minuette (1.1240 <-> 1.1205 <-> 1.1170). The details of the EUR / USD movement are presented in the animated graphic. ____________________ The review was compiled without taking into account of the news background. The opening of trading sessions of the main financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The material has been provided by InstaForex Company - www.instaforex.com |

| The risk returns to Forex, the ECB says one thing, and is going to do another Posted: 10 Jun 2019 03:35 PM PDT The Mexican peso avoided a collapse and even rose by more than 2% at the beginning of the week after the US and Mexico concluded a migration agreement to prevent a new tariff war. The agreement supports the restoration of risk appetite on the part of investors, which had a positive effect on the dollar and lowered the value of the yen. Investors have been actively buying the yen in recent weeks, after US President Donald Trump threatened Mexico with tariffs, but is now moving away from the safe haven. On Monday, the dollar began to recover, which includes the reason that investors realized that their assessment of the likelihood of the Fed lowering interest rates was too high. The dollar index rose 0.3% to 96.824 points. In relation to the euro, the currency also went up by 0.3%, to $1.1304, while the single currency was under the pressure of ECB officials, who are ready to lower rates in the event of a weaker economic growth. In turn, the Mexican peso grew by more than 2%, to 19.2275 pesos per dollar, after the signing of the migration agreement. However, despite the fact that the demand for risky assets is expected to increase at the beginning of the week, one should be careful about the stability of risk appetite recovery, at any moment Trump may start other trade conflicts. The yen systematically surrenders previously captured heights. The Japanese currency lost 0.4%, dropping to 108.65 yen to the dollar after, although it remains 3.3% stronger than its April levels. Positive, growing against the background of the agreement between the US and Mexico, is likely to spread to the trade dispute with China, perhaps the market will see some progress in this direction. The euro pulled back from recent highs reached on Friday after the ECB meeting, which investors viewed as more aggressive than expected. The ECB did without hints at lowering rates due to worsening economic prospects, but instead said that rates would remain "at their current levels" until mid-2020. But on Sunday, two sources immediately said that the regulator could again lower the ECB interest rate if economic growth weakens, because a strong euro harms the bloc. The material has been provided by InstaForex Company - www.instaforex.com |

| The pound sterling may fall to $1.24 Posted: 10 Jun 2019 03:34 PM PDT The rate of the British currency against the US dollar can plummet to its lowest level in two years if the new prime minister of the United Kingdom becomes a supporter of a "hard" Brexit, Bloomberg reported. Recall, on Friday, the head of the British Cabinet of Ministers Theresa May left the post of chairman of the Conservative Party. Now the Tories will have to choose their new leader, who will then take the helm of the government. According to a consensus forecast of economists who were recently polled by Bloomberg, if an adherent of the "hard" option on Great Britain's exit from the EU (such as, for example, ex-foreign minister Boris Johnson) takes the position, the pound sterling may slump to $1.24 According to experts, despite the fact that the coming to power of a hard Brexit supporter at the moment seems to be the most likely scenario (the odds are estimated at 70%), there is still hope that the British Parliament will prevent the country from leaving the EU without a deal, which could hold back a more significant weakening of the pound. In addition to B. Johnson, current foreign minister Jeremy Hunt, head of the Ministry of Environment, Food and Agriculture Michael Gove, as well as former Brexit Minister Dominic Raab, are currently applying for the Conservatives' leadership. According to analysts, if the British government is led by a supporter of the "soft" Brexit (the probability of which is only 30%), the pound may rise to $1.30. Over the past month, the British currency has lost more than 2% in weight and is now trading near the $1.27 mark. It is expected that the name of the new Tory leader will be known until the end of July. Thus, T. May may remain in the post of the country's prime minister for several more weeks. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 10 Jun 2019 03:34 PM PDT For more than a week and a half, the USD index showed a decline of one and a half figures, having slumped from 98 points to 96.5 points. The idea of a quick easing of monetary policy by the Fed continues to gain popularity among investors. The conference of the Federal Reserve Bank of Chicago last week was initially presented as a platform for discussion on the possible change of the inflation target, but ended with the promise of the regulator to act properly in the face of the risks associated with the protracted trade war between the US and China. If earlier only the most ardent "doves" of the FOMC were speaking in this vein, now Fed Chairman Jerome Powell spoke in a similar format. The market interpreted the words of the chairman of the Federal Reserve about the readiness of the US central bank to abandon its patient position as an opportunity to speedily reduce the federal funds rate. Most analysts agree on the need for this step, given the direct impact of the trade conflict between Washington and Beijing on the US economy. In addition, the inversion of the yield curve for short-term and long-term US bonds became even more pronounced, continuing to signal the risk of a recession in the country. The weak data on the US labor market for May released last Friday became another argument in favor of the Fed rate cut. It is assumed that the regulator may consider reducing the rate already at the September meeting. Against the background of a noticeable softening of the Fed's rhetoric, the EUR/USD pair reached highest levels in 2.5 months. Following the meeting of the ECB, which took place last Thursday, the euro rose, breaking the mark of $ 1.13. The position of the regulator was regarded by investors as less pigeon than the Fed, which caused the strengthening of the single European currency against the dollar. According to some experts, the growth of EUR/USD may turn out to be short-term, since the eurozone still has many problems of its own. Reuters reported that representatives of the ECB are considering the possibility of lowering the interest rate if the EU economy continues to slow down. Also, the regulator is concerned that inflation expectations can get out of control and that markets do not believe in the ability of the central bank to bring inflation to the target level of 2%. However, if we proceed from the fact that the vectors of monetary rates of the ECB and the Fed will gradually converge, the EUR/USD pair may well shift closer to 1.14. The material has been provided by InstaForex Company - www.instaforex.com |

| Fed: to lower the rate or prove independence? Posted: 10 Jun 2019 03:34 PM PDT The dollar is not able to hold back after a weak employment report. On Monday, its growth is fairly restrained, despite the positive market relative to the conclusion of a deal with the Mexicans. This is due to the high expectations of a change in the course of monetary policy in the United States. In the run-up to the Fed's meeting, traders are most interested in not so much the fact of the rate reduction as the date, that is, when exactly the regulator will decide to soften. It is worth noting that the expectations of a reduction in rates at the July meeting are currently increased to 80%, in June - to 23%. Nobody doubts that the growth of the US economy is slowing down. This, including, confirmed the reports on retail, factory orders, real estate purchases. In addition, according to the results of the study, the IMF reported that the fiscal actions undertaken in 2017–2018 - tax cuts, increased military and other expenses - will disappear in the coming years. According to the results of the current year, the real GDP of the United States will expand by 2.6%, and then the growth rates will fall below 2%, representatives of the Fund predicted. It will be extremely difficult for the Fed to take such a step as lowering the rate, as this will to some extent affect the authority of the regulator and cast doubt on its independence. Donald Trump since last year accuses Jerome Powell and his team of excessively high rates, calling for monetary expansion. Therefore, as soon as the US central bank really starts easing monetary policy, rumors will spread around the market that this has been done to please the White House. On Monday, Trump again attacked the Fed in his favorite manner, noting that Powell did not listen to him, that the central bank made a big mistake - it raised interest rates too quickly. Obviously, the bright future of the US economy is in doubt, this is also indicated by the bond market. After the release of the disappointing release on employment in the country in May, the yield on 10-year-old treasuries updated the lowest mark for 2019 and is located at the very bottom of the autumn of 2017. The yield curve is in the red zone. In the old days, this was a clear signal of recession. But there is one "but." About 20% of the $55 trillion debt market worldwide is characterized by negative rates. Their fall in America speaks of increasing concern for the fate of the world economy. If in the short term macroeconomic statistics for the United States does not get worse, and the S&P 500 is not adjusted, then why lower the rate? The indications of the debt and derivatives markets will begin to look aggressive, and this is a "bullish" factor for the greenback. The dollar is now in connection with the rising expectations of the Fed rate cut in June looks weaker than the euro. However, a single currency has its own problems, a cart and a small cart. Revaluation will complicate the ECB's already difficult task of achieving an inflation target of 2%. Slow economic growth in China will continue to put pressure on German exports, and the resumption of tensions between the EU and Italy will increase political risks. In addition, the Brexit issue has not yet been removed from the agenda. By the way, in May, many banks in developing countries trimmed rates, and last week they were joined by regulators from Australia and India. The European Central Bank is ready to change the policy course. However, Jerome Powell's dovish comments will have a greater impact on the euro than the similar rhetoric of Mario Draghi. This is due to the fact that market participants consider the impact of the Fed rate more significant. In addition, Americans have much more room for maneuver. The ECB rate is already at zero, and the range of rates in the US is at 2.25–2.50. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 10 Jun 2019 03:34 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 102p - 50p - 88p - 108p - 97p. Average amplitude for the last 5 days: 89p (79p). The first trading day of the week was quite confident for the EUR/USD. A correction took place, but the pair did not reach the critical line, and the last two bars were bullish, which indicates a possible resumption of the uptrend. It will be difficult for the MACD indicator to turn up at its current values, so it can react to the completion of the correction with a long delay. In general, based on the technical analysis, the upward trend is maintained, so in any case it is recommended to trade for an increase. From a fundamental point of view, on Monday, June 10, there is absolutely nothing to analyze, since no important macroeconomic reports were published in the US and the eurozone today. The attention of traders shifted to the UK, where there were several important indicators. From our point of view, as long as the technique speaks in favor of the euro, it should maintain an upward mood. The foundation currently says that the euro's growth can be short-lived, and its main reason now is the extremely failed statistics from overseas in the last two weeks. However, the economic indicators of the EU also leave much to be desired, as well as the attitude of the ECB head Mario Draghi, as well as the monetary policy of the European Union. Therefore, sooner or later, traders will take into account that weak statistics from the United States is equal in importance to weak statistics from the EU and there are no good reasons for strengthening the European currency. If a trade war with the United States begins, it will be another major blow to the EU economy. In general, despite the euro's growth in recent weeks, the prospects for the single currency remain very vague. Trading recommendations: The EUR/USD pair is still being adjusted. Thus, now it is still recommended to trade for an increase with a target resistance level of 1,1400, but after the completion of the current round of correction. It will be possible to sell the euro/dollar pair in small lots if the bears manage to gain a foothold below the critical line, with the first target of 1.1226. In this case, the initiative for the pair will return to the bears. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chikou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 10 Jun 2019 03:34 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 63p - 72p - 66p - 73p - 74p. Average amplitude for the last 5 days: 70p (72p). The British pound sterling failed to show impressive growth on disappointing macroeconomic statistics from the United States. Moreover, today, on June 10, reports were published in the UK on GDP (-0.4% in April), industrial production (-2.7% in April m/m and -1.0% y/y), and also an estimate of GDP growth rates from NIESR in May (+ 0.1%, with a forecast of + 0.5%). From our point of view, it's not even worth saying that the statistics were disappointing. The pound sterling reacted with pleasure to this data through a decline. Thus, the British currency has every chance of starting a new downward trend, because, as we all see, even American aid did not trigger the purchase of the pound sterling. Moreover, the political component continues to have the strongest influence on the preferences of traders. Market participants are now afraid to buy the pound, because it is not even clear who will be the next prime minister. And on this name, will depend on what foreign policy will adhere to the country. From our point of view, the British currency, like the UK itself, is simply vital to quickly elect a new leader and complete Brexit. After all the troubles in the last three years, when the pound sterling fell significantly, the loss of a few more cents against the US dollar is not as important. But the longer the period of uncertainty remains, the longer the pound will be prone to a systematic decrease, which may cause far greater losses in the future, rather than from the "hard" Brexit right now. From our point of view, it is not even particularly important for the pound as to who will become the new prime minister and leader of the Conservatives, since in any case one person cannot decide on how the UK will leave the EU. As proven by Theresa May. Thus, even if Boris Johnson comes to power, this does not mean that a "divorce" will take place according to a "hard" scenario. Recall that the Parliament has already blocked the scenario of a disordered exit once. Trading recommendations: The pound-dollar currency pair has consolidated below the Kijun-sen line, so now it is recommended to sell the pound sterling again with targets of 1.2642 and 1.2616. Buy orders can be considered if traders manage to return the GBP/USD pair above the Kijun-sen line. In this case, the bulls will have a new small chance of strengthening with a target of 1.2757. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chikou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| June 10, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 10 Jun 2019 10:51 AM PDT

Since January 19th, the EURUSD pair has been moving within the depicted channel with slight bearish tendency. For Intraday traders, the price zone around 1.1235 stood as a temporary demand area which paused the ongoing bearish momentum for a while before bearish breakdown could be executed on April 23. Short-term outlook turned to become bearish towards 1.1175 (a previous weekly bottom which has been holding prices above for a while) On the period between May 17th and 20th, a bearish breakdown below 1.1175 was temporarily achieved. As expected, further bearish decline was expected towards 1.1115 where significant bullish recovery was demonstrated bringing the EURUSD pair back above 1.1175. Recently, The EURUSD pair has maintained bullish persistence above the highlighted price levels (1.1175) and (1.1235). That's why, further bullish advancement was expected towards 1.1320 which failed to apply instant bearish pressure on the EURUSD pair on the previous Friday. Recent Bullish breakout above 1.1320 renders it a newly-established demand level to be watched for BUY entries when bearish pullback occurs. Please also note that Bullish persistence above 1.1320 enhances quick bullish advancement towards 1.1420 - 1.1450. On the other hand, re-closure below 1.1320-1.1300 would probably allow another bearish pullback to occur towards 1.1235 where recent price action should be considered. Trade recommendations : A valid BUY entry was suggested around the price levels of (1.1220-1.1235). It's already running in profits. Remaining Target levels to be located around 1.1380. Stop loss should be advanced to 1.1280 to secure some profits. The material has been provided by InstaForex Company - www.instaforex.com |

| June 10, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 10 Jun 2019 10:29 AM PDT

On March 29, a visit towards the price levels of 1.2980 (the lower limit of the newly-established bearish movement channel) could bring the GBPUSD pair again towards the upper limit of the minor bearish channel around (1.3160-1.3180). Since then, Short-term outlook has turned into bearish with intermediate-term bearish targets projected towards 1.2900 and 1.2850. On April 26, another bullish pullback was initiated towards the price zone of 1.3130-1.3170 where the depicted bearish Head and Shoulders reversal pattern was demonstrated on the H4 chart with neckline located around 1.2980-1.3020. Hence, Bearish breakdown below 1.2980 allowed the recent significant bearish movement to occur. Initial bearish Targets were already reached around 1.2900-1.2870 (the backside of the broken channel) which failed to provide any bullish support for the GBPUSD pair. Further bearish decline was demonstrated towards the lower limit of the long-term channel around (1.2700-1.2650) where the GBPUSD pair looked oversold obviously. That's why conservative traders were suggested NOT to consider any SELL signals around those low price levels. As anticipated, bullish breakout above 1.2650 has already been achieved. This enhanced the bullish side of the market towards 1.2750 which prevented further bullish advancement Temporarily. For the bulls to remain dominant, another bullish breakout above 1.2750 is needed to extend potential bullish targets towards 1.2800 then 1.2890 if sufficient bullish momentum is demonstrated. On the other hand, the price level of 1.2650 stands as a prominent demand level to be watched for a valid BUY entry (demonstrating a bullish Head & Shoulders reversal pattern). However, any bearish breakout below which, invalidates the mentioned bullish scenario. Trade Recommendations: For Intraday traders, A valid BUY entry can be offered upon bullish breakout above 1.2750. T/P level to be located around 1.2820 & 1.2900. S/L should be placed below 1.2690. Conservative traders should wait for an extensive bullish movement towards 1.2870-1.2905 (newly-established supply zone) to look for valid long-term SELL entries. S/L should be placed above 1.2950. The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin analysis for June, 10.2019 Posted: 10 Jun 2019 09:04 AM PDT Bitcoin has been trading upwards in past 10 hours. We found the break of the key resistance trendline in the background, which is sign that buyers may continue with new buying. Watch for buying opportunities.

White line – Broken resistance trendline Yellow line – Fibonacci expansion 100% at $8.17 Yelow line 2- Fibonacci expansion 161.8% at the price of $8.513 In the background we got broken resistance trendline and bullish flag in creation, which is indication of the further upward movement. The MACD oscillator turned into positive teritory but the Stochastic is overbought at this zone, so you will need patiance for potential long position. The bull flag is in creation and you should watch for potential breakout to confirm further upside. The upward targets are set at the price of $8.117 and $8.513. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of Gold for June 10,.2019 Posted: 10 Jun 2019 08:54 AM PDT Gold has been trading downwards in past 24 hours. We found the breakout of the important support trendline, which is warning for buyers that we have changing in trend behaivor from bullish to bearish.

Gray rectangle – swing low acting like resistance $1.330 Yellow rectangle – Support $1.320 Pink rectangle – Support 2 ($1.310) We found the breakout of the support trendline in the backround and the bearish flag in creation, which Is sign that downward movement may continue. The MACD oscillator is showing us strong bearish divergence, which is another sign of weakness. Stochastic oscillator is looking overbought and it is another great confirmation for further downside. The projected targets are set at $1.320 and $1.310. As long as the Gold is trading below the $1.348, we will be bearish. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD analysis for June 10,.2019 Posted: 10 Jun 2019 08:44 AM PDT GBP/USD has been trading downwards. The price tested the level of 1.2670 and it rejected. We see the current market situation like potential end of the downward corrective phase (abc).

Gray rectangle – swing low support (1.2670) Red horizontal line – Upward objective 1.2760 GBP/USD has been trading downward but GBP found support at 1.2645. According to the H4 time-frame, seems like the downward correction has been completed, which is sign that upward movement is expected. Stochastic oscillator seems on the oversold zone and MACD is still in positive teritory, which is sign that buyers are still present. The projection for the upward target is set at the price of 1.2760. Watch for buying opportunities. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis for the GBP/USD currency pair for the week from June 10 to 15, 2019 Posted: 10 Jun 2019 08:20 AM PDT Trend analysis. In the coming week, the price will move up with the first target - 1.2872, pullback level of 38.2% (yellow dotted line). Fig. 1 (weekly chart). Complex analysis: - Indicator analysis – up; - Fibonacci levels – up; - Volumes – up; - Candle analysis – up; - Trend analysis – up; - Bollinger Bands – up; - Monthly chart – up. The conclusion from the complex analysis – upward movement. The overall result of the calculation of the GBP/USD currency pair candle on the weekly chart: the price in the week is likely to have an upward trend with the presence of the first lower shadow of the weekly white candle (Monday – down) and the presence of the second upper shadow (Friday – down). The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of EURUSDfor June 11, 2019 Posted: 10 Jun 2019 07:05 AM PDT EURUSD is pulling back towards 1.13 and a bit lower. EURUSD price has broken out of a long-term downward sloping wedge pattern. Now we are most probably in the process of back testing the broken upper wedge boundary. Bulls want to see price touch the wedge from the outside and bounce. This would be a very good sign for bulls. Key support is found at the previous resistance area of 1.1260-1.1230. Respecting this support is crucial for the long-term bullish scenario.

Failure to hold above 1.12 will most probably lead to a steep decline below 1.11. My expectations are mixed. I see a short-term pull back and then continuation of the bearish trend. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of Gold for June 11, 2019 Posted: 10 Jun 2019 06:59 AM PDT Gold price has reached very close to our break out target of $1,350-60 area. Price is getting rejected right below the major resistance. Bulls need to hold above $1,300 in order to hope for more upside.

Black line - short-term resistance Red line - major support Blue line - major resistance Short-term support is found at $1,320 where we also find the 38% Fibonacci retracement level. Gold price got rejected at the long-term resistance trend line. Breaking below $1,320 would be a bearish sign. If price breaks below $1,320-15 then there will be a lot off probabilities that the next big selling leg has started. Until then bulls continue to control the trend.The material has been provided by InstaForex Company - www.instaforex.com |

| Pound chooses the Prime Minister Posted: 10 Jun 2019 06:31 AM PDT "Bulls" on GBP/USD for the first time in the last five weeks closed the five-day period in the green zone, but the pound cannot take it to its asset. The main reason for the growth of the pair was the increased likelihood of a reduction in the federal funds rate in 2019 after disappointing statistics on US employment. Non-farm payrolls rose by more than a modest 75 thousand, the average salary slowed from 3.4% in February to 3.1% y/y in May, which strengthened the position of "dovish" FOMC. Investors believe that the Fed considers the current situation in the context of such a phenomenon in economic theory as a demand shock when protectionism leads to a slowdown in GDP but does not accelerate inflation. In this situation, it is necessary to weaken monetary policy. Alas, sterling is not able to take full advantage of the weakness of its opponent due to the political factor. No matter how strong the macroeconomic indicators of Britain are, the Bank of England will not raise the repo rate due to uncertainty about Brexit. On the contrary, the deterioration of statistics becomes a catalyst for GBP/USD sales. The economy of Albion is not much different from other developed countries: only a strong position in the service sector can keep it afloat, while industrial problems are associated with weak external demand. Its negative dynamics, according to Bloomberg Economics, could lead to a slowdown in British GDP from 0.5% to 0.2% q/q in the second quarter. The dynamics of business activity in Britain If the political landscape begins to improve, then, according to the median forecast of 60 Reuters experts, the pound will cost $1.3 and $1.34 in 6 and 12 months. On the contrary, a divorce from the EU without a deal will lead to a drop in the GBP/USD quotation to 1.15-1.2 within 4-5 weeks. In this respect, for fans of sterling, it is imperative that the authorities do not come as supporters of Brexit, in the person of former Minister of Foreign Affairs Boris Johnson or the ex-Secretary of Brexit Dominic Raab. Both of them are not averse to seeing Britain's disorderly exit from the European Union. Johnson intends to raise the minimum income, in which the income tax is paid at a rate of 40%, from £ 50,000 to £ 80,000. In addition, Bloomberg experts believe that you should not exaggerate. The GBP/USD pair will most likely collapse to 1.24 in case Brexit supporters become head of the Cabinet of Ministers but then begins to recover, as the Parliament will not allow political chaos in the country. Along with the struggle for the post of Prime Minister, sterling must pass the test release of data on the UK labor market. Until now, it has been a bright spot on the map of the economy, but if the employment situation begins to deteriorate, the pound will lose important support. Technically, after reaching the convergence zone identified by the Shark and AB=CD patterns near the mark of 1.26, a natural rollback occurred. If the "bulls" on GBP/USD manage to return the quotes to the neckline of the "head and shoulders" model and storm the resistance by 1.276, the risks of the development of the correction will increase. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 10 Jun 2019 06:31 AM PDT The pound has collapsed because it became known that in April of this year, compared with March, UK GDP dropped significantly. The economic slowdown is returning after a good first quarter since the UK exit from the EU was postponed again until this fall, which is why the uncertainty in this direction began to put pressure again on companies and the financial sector. Let me remind you that Britain's withdrawal from the EU has already been postponed twice due to internal confrontations and political struggle around the conditions of the divorce. Now, the release date is scheduled for October 31. According to the National Bureau of Statistics, in April this year, the UK economy declined by 0.4% compared with March. As expected, the main problem was in the manufacturing sector. Even despite Brexit, production activity is also slowing down amid concerns about trade conflicts. According to the data, the industrial production of Great Britain in April of this year fell sharply by 2.7% compared with March and by 1.0% compared with the same period of 2018. It was expected that industrial production in the UK in April will decrease by 1.0% compared with March and grow by 0.7% compared to the same period last year. Manufacturing production in the UK fell immediately in April by 3.9% and 0.8%, while a decrease of only 1.5% was expected and an increase of 1.7% compared with the same period of 2018. Production of cars compared with March fell by 24%. The negative contribution was also made by a sharp reduction in stocks compared to March when growth was still observed due to the probability of the UK leaving the EU. The deficit of foreign trade in goods of Great Britain in April decreased slightly and amounted to 12.1 billion pounds against 15.4 billion pounds in March (revised value). Economists had expected the UK foreign trade deficit to be at 13.1 billion pounds. As for the technical picture of the GBPUSD pair, the upward trend has broken, and now, with any growth from large resistance levels around 1.2690 and 1.2730, new players will return to the market, putting on a decrease in the pound. The first targets of the sellers will be the support levels at 1.2620 and 1.2560. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 10 Jun 2019 06:31 AM PDT To open long positions on GBP/USD, you need: The break in the upward trend, the possibility of which I drew attention to in my morning forecast, led to a major drop in the pound against the backdrop of a weak report on the growth of the UK economy. The task of the bulls for the second half of the day will be to hold the support of 1.2644, from which it is possible to open long positions with a false breakout, as well as a consolidation above the resistance of 1.2691, which will make it even more difficult. Only after that can we expect the growth of demand for GBP/USD and the maximum test of 1.2728, where I recommend fixing the profit. In a breakout scenario of 1.2644, it is best to open long positions on the pound by rebounding from the minimum of 1.2612. To open short positions on GBP/USD, you need: The sellers of the pound coped with the morning task and broke below the lower limit of the upward channel. At the moment, the bears' goal is to test the support of 1.2644, the consolidation of which will increase the pressure on the pair and will lead to a minimum of 1.2612, where I recommend fixing the profits. In the scenario of an upward correction in the second half of the day, you can look at short positions on a false breakout from the resistance of 1.2691 or on a rebound from the maximum of 1.2728. Indicator signals: Moving Averages Trading is below 30 and 50 moving averages, which indicates a trend reversal and a return to the seller's market. Bollinger Bands The upward correction of the pound will be limited by the average border of the indicator around 1.2710. Description of indicators

|

| EUR/USD: plan for the American session on June 10. Euro buyers found support around 1.1290 Posted: 10 Jun 2019 06:30 AM PDT To open long positions on EURUSD, you need: It is expected that buyers of the euro began to return to the market after the test of the support level of 1.1290, as sellers again took a wait-and-see position and did not push the pair below. At the moment, while trading is above the range of 1.1290, the demand for EUR/USD will remain, which can lead to an update of the resistance of 1.1330 and even to its breakthrough. Only after that, it will be possible to talk about the continuation of the upward trend with an exit to a maximum of 1.1366 and 1.1392, where I recommend fixing the profit. In the scenario of a repeated decline in the support area of 1.1290, it is best to return to long positions on the rebound from the minimum of 1.1253. To open short positions on EURUSD, you need: Bears need to push the pair again to the support of 1.1290, which will necessarily lead to its breakthrough and the descent of EUR/USD to the minimum area of 1.1253, where I recommend fixing the profits. A false breakout and an unsuccessful consolidation above the resistance of 1.1330 in the second half of the day will also be a signal to open short positions. Otherwise, it is better to sell the euro on a rebound from the new monthly high around 1.1366 and 1.1392. Indicator signals: Moving Averages Trading is conducted in the area of 30 and 50 moving averages, which indicates the uncertainty of the market. Bollinger Bands In the case of the growth of the euro in the second half of the day, the upper limit of the indicator in the area of 1.1350 will act as resistance. A break of the lower border in the area of 1.1300 will lead to a decline in the euro. Description of indicators

|

| Technical analysis of AUD/USD for June 10, 2019 Posted: 10 Jun 2019 05:48 AM PDT The AUD/USD pair is set above strong support at the levels of 0.6937 and 0.6980. This support has been rejected four times confirming the uptrend. The major support is seen at the level of 0.6937, because the trend is still showing strength above it. Accordingly, the pair is still in the uptrend in the area of 0.6937 and 0.6980. The AUD/USD pair is trading in the bullish trend from the last support line of 0.6937 towards thae first resistance level of 0.7000 in order to test it. This is confirmed by the RSI indicator signaling that we are still in the bullish trending market. Now, the pair is likely to begin an ascending movement to the point of 0.7000 and further to the level of 0.7112. The level of 0.7112 will act as the major resistance and the double top is already set at the point of 0.7112. At the same time, if there is a breakout at the support levels of 0.6937 and 0.6980, this scenario may be invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of GBP/USD for June 10, 2019 Posted: 10 Jun 2019 05:40 AM PDT Pivot: 1.2798. The GBP/USD pair continues to move downwards from the level of 1.2905. This week, the pair rose from the level of 1.2905 to a top around 1.2800 and it set around the spot of 1.2800. The first resistance level is seen at 1.2905 followed by 1.2963 , while daily support 1 is seen at 1.2798 (38.2% Fibonacci retracement). According to the previous events, the GBP/USD pair is still moving between the levels of 1.2700 and 1.2610; so we expect a range of 90 pips in coming hours. Furthermore, if the trend is able to break out through the first support level at 1.2662, we should see the pair climbing towards the double bottom (1.2436) to test it later. Therefore, sell below the level of 1.2800 with the first target at 1.2610 in order to test the daily resistance 1 and further to 1.2436. Also, it might be noted that the level of 1.2436 is a good place to take profit because it will form a double bottom. On the other hand, in case a reversal takes place and the GBP/USD pair breaks through the resistance level of 1.2905, then the stop loss should be placet at 1.2930. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment