Forex analysis review |

- Fractal analysis of major currency pairs on July 17

- GBP/USD: the chances for a "soft" Brexit are rapidly decreasing, the pound has fallen to two-year lows

- #USDX vs GBP / USD H4 vs EUR / USD H4. Comprehensive analysis of movement options from July 17, 2019. Analysis of APLs &

- The euro's clipped wings, takeoff is impossible

- EUR/USD: potential decline to 1.1170 and a "powder keg" for dollar bulls

- GBP/USD. July 16. Results of the day. Salaries in the UK rose, but it did not help the pound sterling

- EUR/USD. July 16. Results of the day. Reports from the United States were not needed, as the dollar resumed growth without

- EUR and GBP: Euro and pound failed even amid good reports, which indicates a large downward potential

- July 16, 2019 : EUR/USD confirms a recent double-top reversal pattern around 1.1235.

- Analysis of BITCOIN for July 16, 2019: BTC struggling to overcome $10,000

- July 16, 2019 : GBP/USD is about to establish a sideway-range near 1.2400 before resuming bearish decline.

- GBP/USD: plan for the American session on July 16. The pound continued to fall, and bears are not going to stop

- BTC 07.16.2019 - Brerakout of the flag and downside momentum

- EUR/USD: plan for the American session on July 16. Bears are back in the market, and 1.1214 is not the limit

- Gold 07.16.2019 - Volatility down break

- EUR/USD for July 16,2019 - Down move is about to end for today

- Technical analysis of EUR/USD for July 16, 2019

- Technical analysis of AUD/USD for July 16, 2019

- AUDUSD shows rejection signs at major resistance

- EURUSD pull back breaks short-term support and increases chances of breaking to new 2019 lows.

- Gold price vulnerable to more downside as long as price is below $1,420.

- Brent on the eve of war

- Analysis of EUR/AUD for July 16, 2019: EUR could rebound ahead of Australian Employment reports

- The ECB should not rely too much on market inflation expectations

- Analysis of EUR/USD for July 16, 2019: USD holds ground

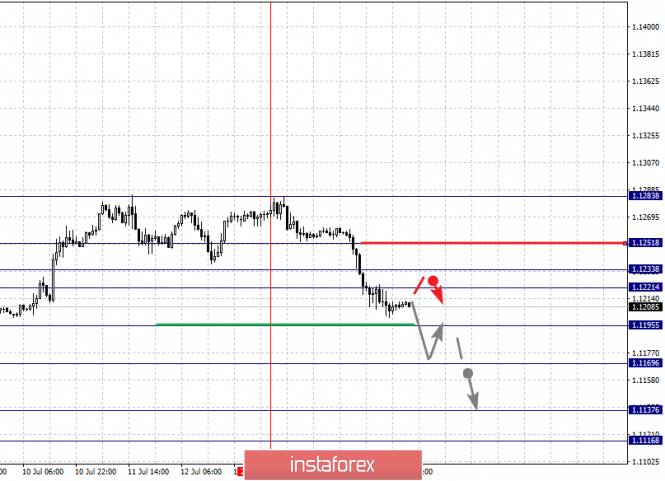

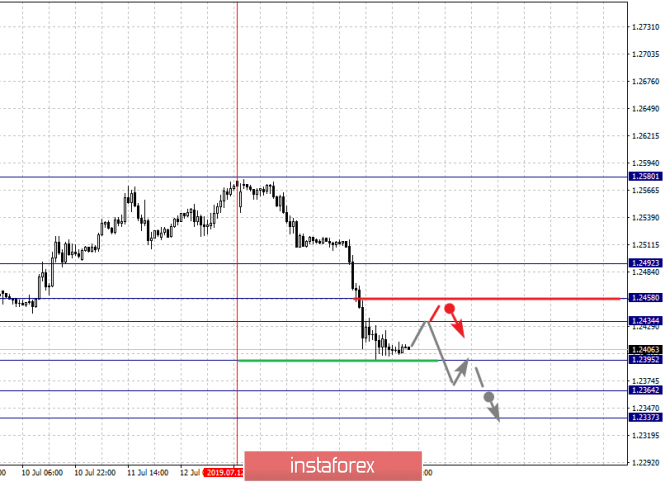

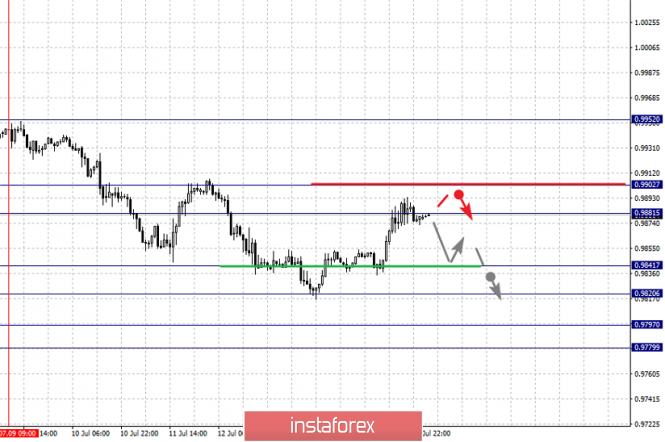

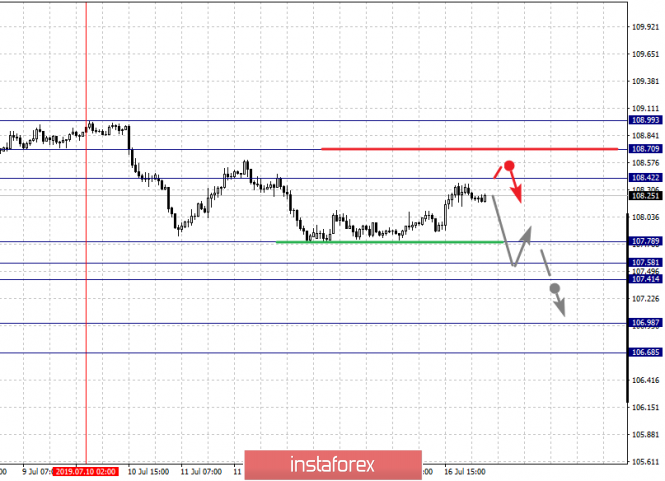

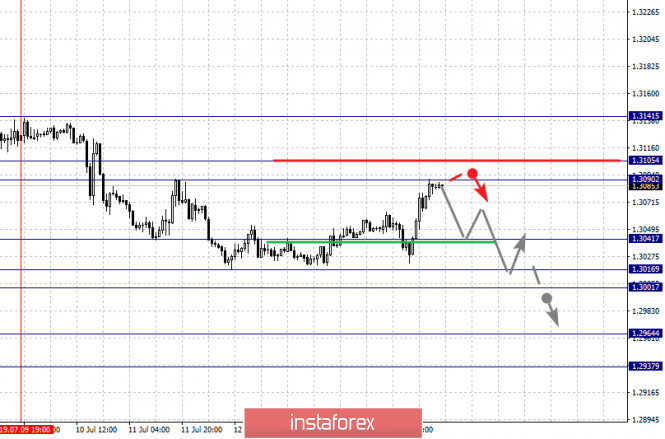

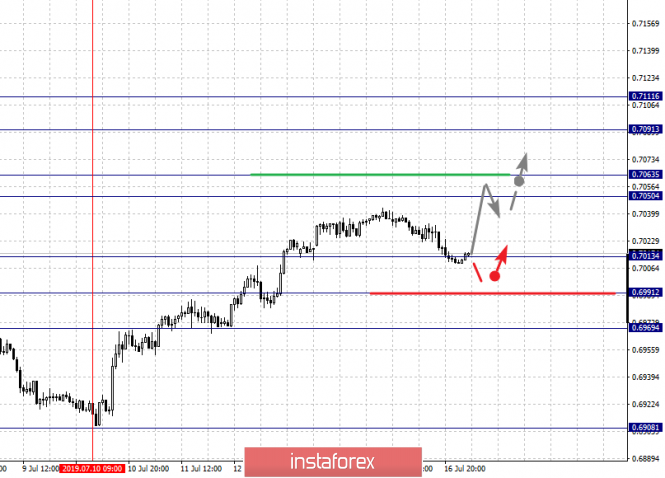

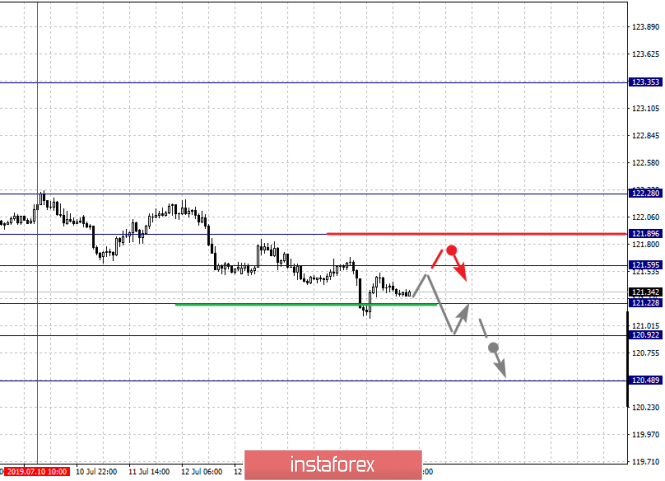

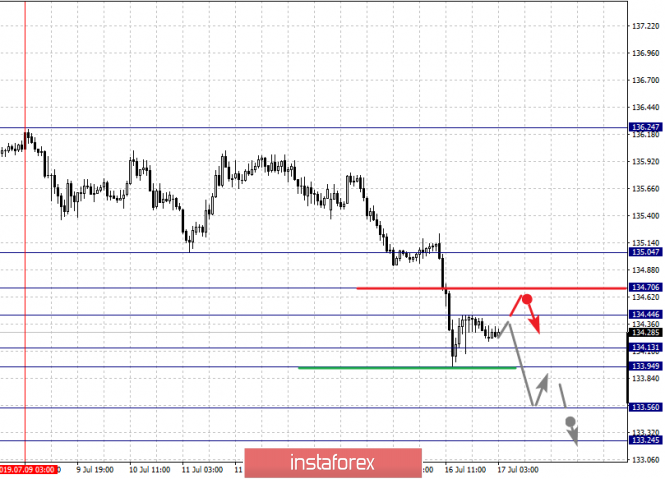

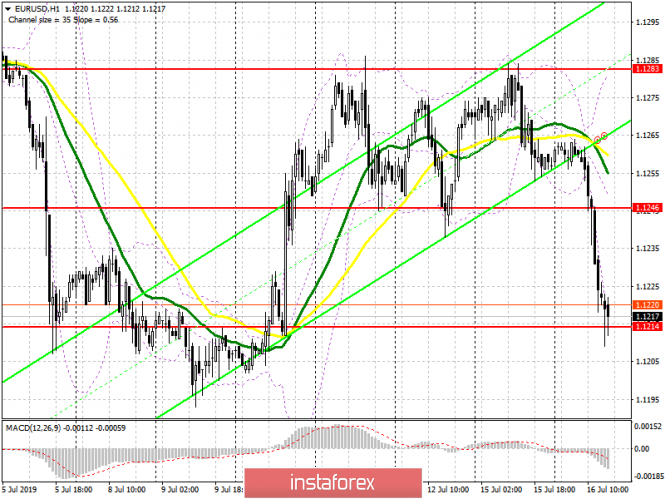

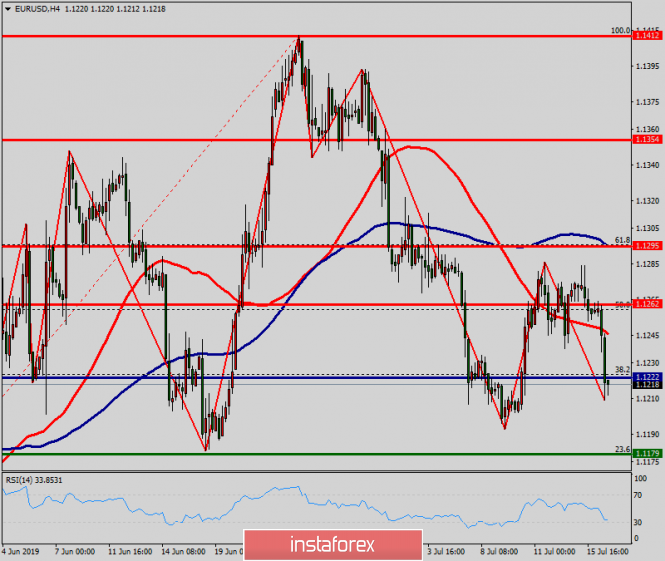

| Fractal analysis of major currency pairs on July 17 Posted: 16 Jul 2019 05:56 PM PDT The forecast for July 17: Analytical review of H1-scale currency pairs: For the euro / dollar pair, the key levels on the H1 scale are: 1.1283, 1.1251, 1.1233, 1.1221, 1.1195, 1.1169, 1.1137 and 1.1116. Here, the price canceled the development of the ascending structure and at the moment, we are watching the formation of the potential for the bottom of July 15. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.1195. In this case, the goal is 1.1169, wherein consolidation is near this level. The breakdown of the level of 1.1169 should be accompanied by a pronounced downward movement. Here, the target is 1.1137. For the potential value for the bottom, we consider the level of 1.1116. After reaching which, we expect consolidation, as well as rollback to the top. Short-term upward movement is possible in the range of 1.1221 - 1.1233. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.1251. This level is a key support for the downward structure. Its breakdown will have to form the initial conditions for the upward cycle. Here, the potential target is 1.1283 . The main trend - the formation of potential for the bottom of July 15 Trading recommendations: Buy 1.1221 Take profit: 1.1232 Buy 1.1335 Take profit: 1.1250 Sell: 1.1295 Take profit: 1.1170 Sell: 1.1167 Take profit: 1.1140 For the pound / dollar pair, the key levels on the H1 scale are: 1.2492, 1.2458, 1.2434, 1.2395, 1.2364 and 1.2337. Here, the price canceled the development of the ascending structure and we are following the downward trend of July 12. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.2395. In this case, the target is 1.2364. For the potential value for the bottom, we consider the level of 1.2337. After reaching which, we expect a rollback to the top. Short-term upward movement is expected in the range of 1.2434 - 1.2458. The breakdown of the last value will lead to a prolonged correction. Here, the target is 1.2492. This level is a key support for the downward structure of July 12. The main trend - the downward structure of July 12. Trading recommendations: Buy: 1.2435 Take profit: 1.2457 Buy: 1.2460 Take profit: 1.2492 Sell: 1.2395 Take profit: 1.2365 Sell: 1.2362 Take profit: 1.2337 For the dollar / franc pair, the key levels on the H1 scale are: 0.9952, 0.9902, 0.9881, 0.9841, 0.9820, 0.9797 and 0.9779. Here, we are following the development of the downward structure of July 9. At the moment, the price is in the correction zone. The continuation of the movement to the bottom is expected after the breakdown of the level of 0.9841. In this case, the goal is 0.9820. The breakdown of which, in turn, will allow us to count on the movement to 0.9797. For the potential value for the downward trend, we consider the level of 0.9779. Upon reaching this level, we expect a rollback to the correction. Consolidated movement is possible in the range of 0.9881 - 0.9902. We expect the formation of the initial conditions for the upward cycle to the level of 0.9902. The main trend is the formation of the downward structure of July 9, the stage of correction. Trading recommendations: Buy : 0.9881 Take profit: 0.9902 Buy : 0.9910 Take profit: 0.9950 Sell: 0.9840 Take profit: 0.9822 Sell: 0.9818 Take profit: 0.9797 For the dollar / yen pair, the key levels on the scale are : 108.99, 108.70, 108.42, 107.78, 107.58, 107.41, 106.98 and 106.68. Here, we are following the downward structure of July 10th. The continuation of the movement to the bottom is expected after the breakdown of the level of 107.78. Here, the goal is 107.58, and near this level is a price consolidation. A passage at the price of the noise range 107.58 - 107.41 will lead to the development of a pronounced movement. In this case, the goal is 106.98. For the potential value for the bottom, we consider the level of 106.68. From which, we expect a rollback to the top. Short-term upward movement is possible in the range of 108.42 - 108.70. The breakdown of the latter value will have to form an upward structure. Here, the potential target is 108.99. The main trend: the formation of a downward structure of July 10. Trading recommendations: Buy: 108.43 Take profit: 108.70 Buy : 108.72 Take profit: 108.99 Sell: 107.78 Take profit: 107.58 Sell: 107.40 Take profit: 107.00 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3141, 1.3105, 1.3090, 1.3041, 1.3016, 1.3001, 1.2964 and 1.2937. Here, we are following the development of the downward structure of July 9th. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.3041. In this case, the first goal - 1.3016. The price pass of the noise range 1.3016 - 1.3001 should be accompanied by a pronounced downward movement. In this case, the target is 1.2964. For the potential value for the bottom, we consider the level of 1.2937. After reaching which, we expect a rollback to the top. The range of 1.3090 - 1.3105 is a key support for the downward structure. Its price passage will have to form an upward structure. In this case, the potential target is 1.3141. The main trend - the downward structure of July 9. Trading recommendations: Buy: 1.3105 Take profit: 1.3140 Buy : Take profit: Sell: 1.3041 Take profit: 1.3016 Sell: 1.3000 Take profit: 1.2965 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.7111, 0.7091, 0.7063, 0.7050, 0.7013, 0.6991 and 0.6969. Here, we are following the development of the ascending structure of July 10. Short-term upward movement is possible in the range of 0.7050 - 0.7063. The breakdown of the latter value should be accompanied by a pronounced upward movement. In this case, the target is 0.7091. For the potential value for the top, we consider the level of 0.7111. After reaching which, we expect a rollback to the bottom. Short-term downward movement is possible in the range of 0.7013 - 0.6991. The breakdown of the latter value will have to form the initial conditions for the downward cycle. Here, the goal is 0.6969. The main trend - the ascending structure of July 10. Trading recommendations: Buy: 0.7050 Take profit: 0.7063 Buy: 0.7065 Take profit: 0.7090 Sell : 0.7011 Take profit : 0.6993 Sell: 0.6988 Take profit: 0.6972 For the euro / yen pair, the key levels on the H1 scale are: 122.28, 121.89, 121.59, 121.22, 120.92 and 120.48. Here, we are following the downward structure of July 10th. The continuation of the movement to the bottom is expected after the breakdown of the level of 121.22. In this case, the target is 120.92, wherein consolidation is near this level. For the potential value for the bottom, we consider the level of 120.48. After reaching which, we expect a rollback to the top. Short-term upward movement is possible in the range of 121.59 - 121.89. The breakdown of the latter value will have to the formation of the potential for the top. Here, the goal is 122.28. The main trend - the downward structure of July 10. Trading recommendations: Buy: 121.59 Take profit: 121.87 Buy: 121.94 Take profit: 122.28 Sell: 121.20 Take profit: 120.94 Sell: 120.90 Take profit: 120.50 For the pound / yen pair, the key levels on the H1 scale are : 135.04, 134.70, 134.44, 134.13, 133.94, 133.56 and 133.24. Here, we are following the development of the downward structure of July 9th. The continuation of the movement to the bottom is expected after the price passes the noise range 134.13 - 133.94. In this case, the goal is 133.56. We consider the level of 133.24 to be a potential value for the bottom. After reaching which, we expect a rollback to the top. Short-term upward movement is possible in the range of 134.44 - 134.70. The breakdown of the latter value will lead to a prolonged correction. Here, the target is 135.04. This level is a key support for the downward structure. The main trend is the downward cycle of July 9. Trading recommendations: Buy: 134.45 Take profit: 134.65 Buy: 134.72 Take profit: 135.04 Sell: 133.94 Take profit: 133.56 Sell: 133.50 Take profit: 133.25 The material has been provided by InstaForex Company - www.instaforex.com |

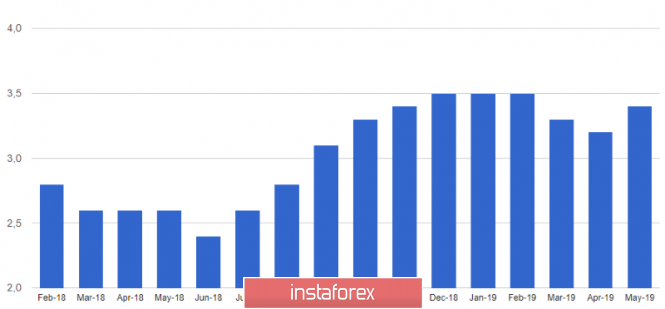

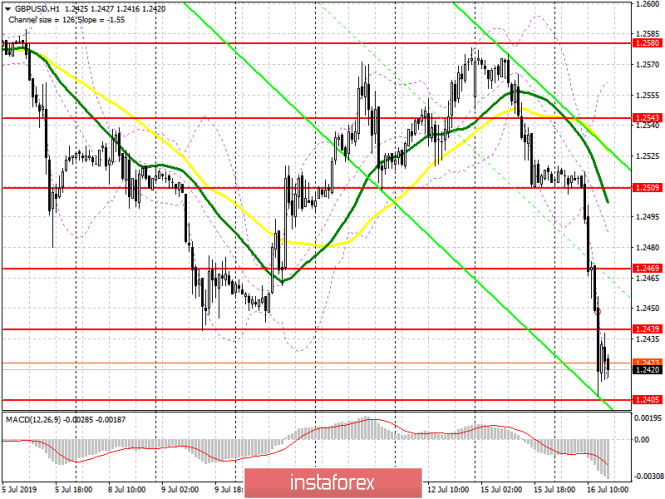

| Posted: 16 Jul 2019 05:01 PM PDT TheGBP/USD pair slipped to the lowest level since 2017 (to the level of 1.2420). Several factors are playing against the British currency at once: this is a high probability of the implementation of a "hard" Brexit, and a moderate economic growth in the country, and the fact that the monetary policy of the Bank of England can move to a more "soft" course. On the eve of the two candidates for prime minister, Boris Johnson and Jeremy Hunt, stated that even substantial concessions on the part of the European Union on the regulation of the Irish border may not be enough to ratify the "divorce" agreement. This heightened concerns that the new British government's stance on Brexit would be more rigid, which could lead to the breakdown of the London-Brussels talks and the withdrawal of the United Kingdom from the EU on October 31 without a deal. According to analysts, the dynamics of the GBP/USD pair reflects the general mood of the market in relation to the pound. In this regard, it is noteworthy that the British currency was unable to use even the positive statistics on the country's labor market today. According to the National Statistical Office (ONS), the average salary (including premiums) increased by 3.4%, in March-May with an expected growth of 3.1%. At the same time, unemployment remained at the lowest from October-December 1974 - 3.8%. The employment sector in the country remains one of the few that remains stable despite the constant stress caused by Brexit. The futures market is already expecting a 50% chance of lowering interest rates by the Bank of England in 2019 due to the risk of Great Britain's chaotic exit from the EU, as the policy outweighed stronger than expected labor market data. This month, the pound sterling hit a two-year low against the US dollar. Analysts polled recently by Bloomberg report that the situation may worsen next month. Moreover, this is an established trend: the fall of the pound against the dollar in August has been noted over the past five years. "In any case, we will have enough cause for concern in August, with the arrival of the new prime minister of Great Britain, as we are approaching October 31," the currency strategists of Royal Bank of Canada believe. "Since the British Parliament has gone on summer vacation, the deadline for the UK's withdrawal from the EU is inexorably expiring," said MUFG analyst Lee Hardman. ING Group believes that B. Johnson will become a leader who will not succeed in concluding a new agreement with Brussels. This will increase the likelihood that Great Britain will leave without a deal. The main message of B. Johnson during the Brexit campaign was that this event would not have a negative impact on the British economy. However, the irony is that the ex-foreign minister may become the prime minister of the country just at the moment when the national economy will fully experience all the Brexit. The material has been provided by InstaForex Company - www.instaforex.com |

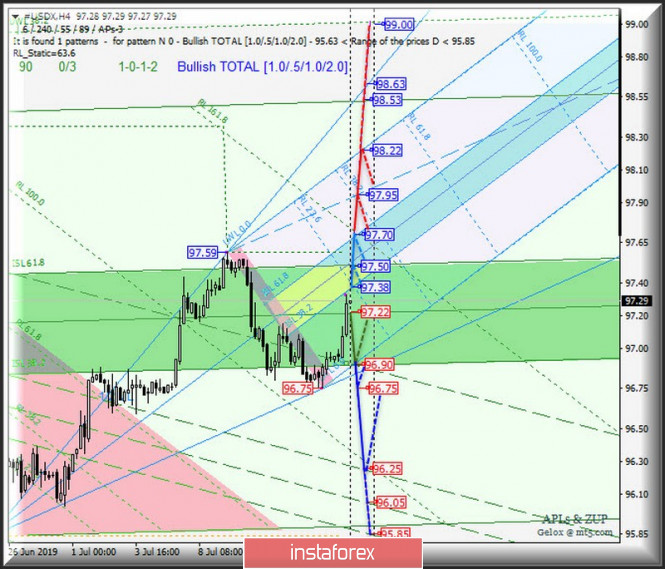

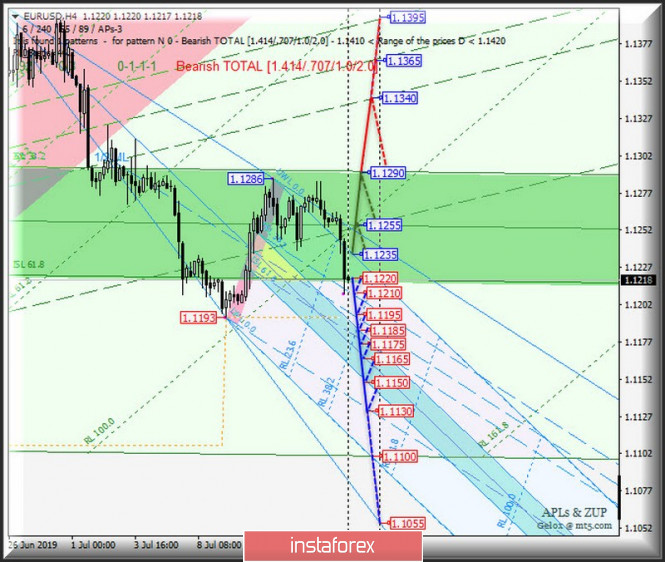

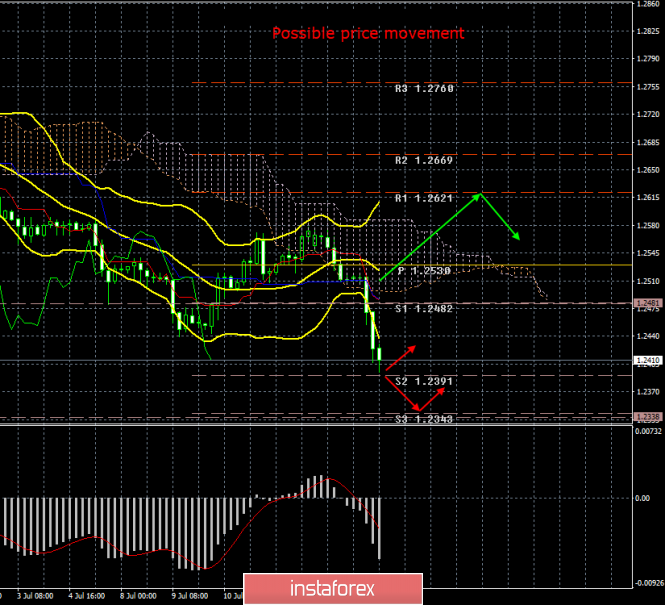

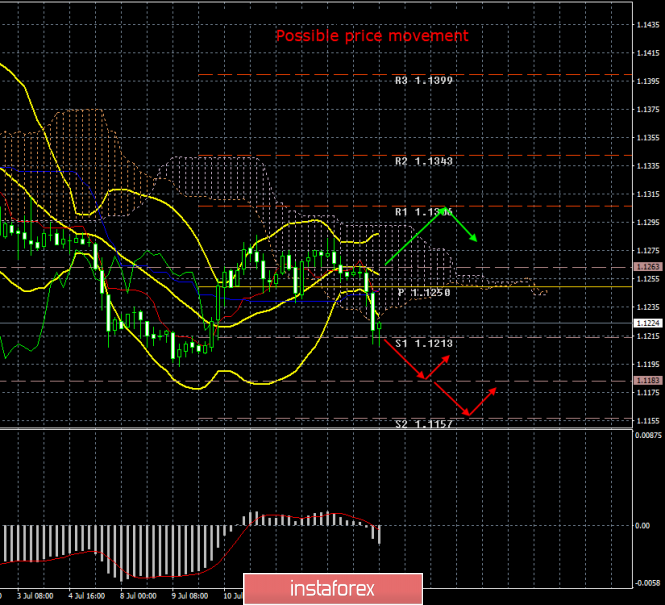

| Posted: 16 Jul 2019 05:01 PM PDT Everything becomes clear in comparison... In this regard, we look at yesterday's options for #USDX vs EUR / USD H4 vs GBP / USD H4 and relate them to the current situation on FOREX today, and then try to determine the prospects for the development of these instruments from July 17, 2019. Minuette (H4) ____________________ US dollar Index After the breakdown of the resistance level of 96.95 (the final Schiff Line Minuette) #USDX was in the range again : - resistance level of 97.38 (lower boundary of the ISL38.2 equilibrium zone of the Minuette operating scale fork); - support level of 97.22 (a Median Line channel Minuette); The direction of the breakdown of which will determine the development trend of the movement of the dollar index from July 17, 2019. The breakdown of the resistance level of 97.38 - the development of the #USDX movement will continue in the equilibrium zone (97.38 - 97.50 - 97.70) of the Minuette operating scale with a perspective (after the breakdown of ISL61.8 Minuette - the resistance level of 97.70) to reach the final Shiff Line Minuette (97.95) and the final FSL line Minuette (98.22). When the dollar index returns below the 1/2 Median Line channel Minuette (support level of 97.22), the development of the #USDX movement can be continued towards the goals - the lower boundary of the ISL38.2 (96.90) equilibrium zone of the Minuette operational scale fork - local minimum 96.75 - 1/2 Median Line channel Minuette (96.25 - 96.05 - 95.85). The details of the #USDX movement from July 17, 2019 are presented in the animated graphic. ____________________ Euro vs US Dollar The 1/2 Median Line channel of the Minuette operational scale (support level of 1.1255) could not stop the downward movement of the single European currency, and EUR / USD was in the range formed by the levels: - resistance level of 1.1235 (SSL start line for the Minuette operating scale); - support level of 1.1220 (lower boundary of ISL61.8 equilibrium zone of the Minuette operational scale fork); Accordingly, the further development of the EUR / USD movement from July 17, 2019 will be due to the direction of the breakdown of this range. The breakdown of the support level of 1.1220 at the lower boundary of the ISL61.8 equilibrium zone of the Minuette operational scale fork , together with the breakdown of the support level of 1.1210, will determine the further development of the movement of EUR / USD in the channel boundaries of the 1/2 Median Line (1.1210 - 1.1195 - 1.1175) and equilibrium zone (1.1185 - 1.1165 - 1.1150) of the Minuette operational scale fork with the prospect of reaching the ultimate Schiff Line Minuette (1.1130). On the other hand, if the EUR / USD returns above the initial SSL line (resistance level of 1.1235) of the Minuette operating scale fork, then there may be a development of the upward movement of the single European currency to the targets - the 1/2 Median Line channel of the Minuette (1.1255) - the upper boundary of the ISL38.2 (1.1290) the equilibrium zone of the Minuette operational scale fork with the prospect of reaching the lower boundary of the channel of the 1/2 Median Line Minuette (1.1340). The details of the EUR / USD movement options from July 17, 2019 are shown in the animated graphic. ____________________ Great Britain Pound vs US Dollar 1/2 Median Line Minuette (support level of 1.2510) was safely broken. As a result of which, Her Majesty's currency (GBP) found itself in an equilibrium zone (1.2460 - 1.2415 - 1.2375) of the Minuette operating scale. The breakdown direction of which will determine the further development of the GBP / USD movement from July 17, 2019. The breakdown of the lower boundary of ISL61.8 (support level of 1.2375) of the Minuette operational scale fork along with the LWL38.2 Minuette warning line (1.2385) will make it possible to continue the downward movement of GBP / USD to the control line LTL Minuette (1.2315) and the warning line LWL61. 8 Minuette (1.2287). In the case of the breakdown of the upper boundary of ISL38.2 (resistance level of 1.2460) of the Minuette operational scale, the development of Her Majesty's currency movement will continue to the 1/2 Median Line Minuette channel (1.2460 - 1.2500 - 1.2540) with the prospect of reaching the initial line SSL Minuette (1.2580) and the lower boundary of the 1/2 Median Line channel Minuette (1.2645). The details of the GBP / USD movement from July 17, 2019 are presented in the animated graphic. ____________________ The review was compiled without taking into account of the news background. The opening of trading sessions of the main financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index : USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where power ratios correspond to the weights of currencies in the basket: Euro - 57.6% ; Yen - 13.6%; Pound sterling - 11.9% ; Canadian dollar - 9.1%; Swedish krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula gives the index value to 100 on the starting date - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

| The euro's clipped wings, takeoff is impossible Posted: 16 Jul 2019 04:48 PM PDT Factors such as trade wars, the weakness of the eurozone, the soft monetary policy of the ECB are not in favor of the euro. Another escalation of the US-China conflict, which may well occur, will strike at European exports and increase the risks of recession in the region. The owner of the White House argues that the slowdown of China's economy to its lowest level for 27 years is nothing but an effective US tariff policy. Washington is likely to increase pressure on Beijing if the latter does not accept the conditions proposed by the Americans. Recall that Chinese authorities have repeatedly emphasized that they will not participate in this kind of dialogue. The risks of a downturn in the euro bloc are also discussed in the OECD. The government does not stimulate the economy enough, representatives of a reputable organization believe. The contribution of state support to GDP growth is insignificant 0.3 pp, while the forecasts of an increase in the economy are significantly adjusted downward. Activities, in the first place, are expected from Germany, which is working with a budget surplus. German debt rates on 15-year securities are negative, which leads to additional investor spending, and these funds could go into the real economy. As an example, here you can take France with its fiscal stimulus of 17 billion. Thus, the country's economy for the first time in 6 years will grow faster than the average for the eurozone. Accelerate the process of restoring the eurozone economy by 0.75 percentage points stimulating fiscal policy is quite capable in the next two years, according to the OECD. However, experts warn that the ECB can not cope with the approaching recession on their own. Based on ING research, the likelihood of a recession will increase with a slowdown in the industry. But there is one positive thing that allows us to expect that the negative growth rates of the economy will be avoided - employment in the manufacturing sector continues to expand. In principle, the euro is not averse to grow, but the burden of problems prevents. On top of everything else, a trade conflict between the European Union and the USis brewing. In such conditions, it's hard for euro bulls to dream about $1..15, and even more so about $1.17. However, when there is a currency war, it is almost impossible to predict the result. According to representatives of PIMCO, the White House will definitely intervene in the life of foreign exchange markets, and this will happen very soon. The effectiveness of direct dollar sales against the background of a constant stream of statements about a weak national currency exchange rate and the Fed's readiness to lower rates can be very high. Now traders refrain from any active actions, preferring to wait for the release of data on retail sales and industrial production from the United States. Information in the releases can be a signal of how much the Fed will loosen monetary policy at a meeting in July. After Jerome Powell's speeches before Congress, the likelihood of a 50 percent reduction in the rate increased from 2% to 29%. The statistics, deprived of optimism, will raise the chances even higher and help EUR/USD buyers to push quotes to the bottom of the 13th figure. The material has been provided by InstaForex Company - www.instaforex.com |

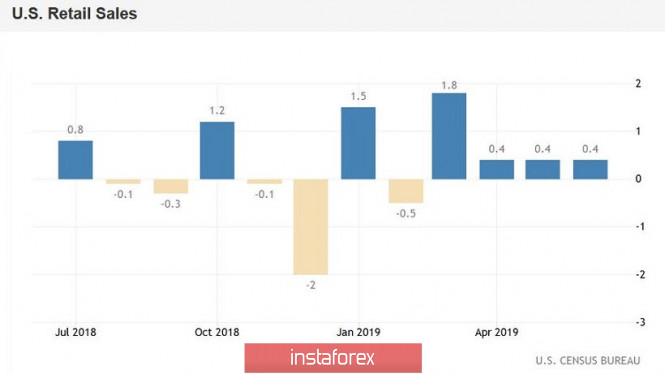

| EUR/USD: potential decline to 1.1170 and a "powder keg" for dollar bulls Posted: 16 Jul 2019 04:34 PM PDT Bears of the EUR/USD pair managed to overcome the support level of 1.1230, which corresponded to the Kumo cloud boundaries on the daily chart, and then headed towards the 11th figure - or more precisely, to the next support level of 1.1170 (the bottom line of the Bollinger Bands indicator on D1). The overall market situation is unequivocally negative for the euro and fairly neutral for the dollar. However, today the US currency received support from retail sales in the US, while the single currency received another blow from the German statistics. Thus, the euro was pressured by figures from the ZEW Institute. In particular, the sentiment index in the business environment of Germany dropped immediately to the level of -24.5 points - this is the most negative result since last November. Analysts expected a negative trend, but, according to their forecasts, the indicator should have dropped to -22.7 points. In Europe as a whole, this indicator also remained at semi-annual lows, having stood at -20.3 points. At the same level, the indicator was released last month. After the surge of optimism in April, when for the first time in 2 years, both in Germany and in the EU as a whole, they were above zero, this dynamic looks depressing, and this fact had a corresponding impact on the single currency. Judging by the rhetoric of members of the ECB, the central bank is ready to use its whole arsenal of available actions in the fall. In particular, we are talking about the bond purchasing program and reducing the interest rate. Not so long ago, the head of the ECB acknowledged that many of the early indicators warn of a worsening situation in the eurozone, so the risks for forecasts remain downward. By the way, tomorrow's data on the growth of European inflation may put additional pressure on the euro if they are revised downward. We will know the final data for June. According to initial estimates, the overall consumer price index rose to 1.2%, while the core index rose to 1.1%. According to the general opinion of experts, core inflation will be subject to revision - the indicator can be reduced to 1%. In this case, bears of the EUR/USD pair will have another reason to sell the single currency, and the price will certainly be consolidated within the 11th figure. Moreover, the greenback's growth is fueled by fairly good statistics from the United States. Today, dollar bulls have pleased retail sales. Contrary to negative forecasts, indicators of consumer activity have not decreased, but in fact remained at the level of the previous period. The overall figure, as well as the figure excluding car sales, grew in June by 0.4% (with a decline forecast to 0.1%). Excluding auto and fuel sales, the indicator has been growing for the second month in a row, reaching 0.7%. Against the background of the growth of key macroeconomic indicators (strong Nonfarm and positive dynamics of inflation), these figures have provided significant support to the dollar. I note that Jerome Powell, in the course of his speeches and without this release, stated the intensification of consumer activity. He associated the main risks for the Fed with other factors (first of all, we are talking about geopolitical risks and reducing the volume of business investments). Nevertheless, today's release made it possible for dollar bulls to once again show character - in almost all pairs, the greenback strengthened their positions, and the EUR/USD pair was no exception. In general, the dollar is gradually gaining momentum throughout the market, and either Powell or Trump can hinder this process. Here it is necessary to emphasize the fact that the Fed's July interest rate cut is largely taken into account in prices, so any reminder about this on the part of the US central bank's members is quite calmly perceived by the market. Dollar bulls fear only aggressive rates of monetary policy easing - for example, a one-time cut in the rate by 50 basis points or the beginning of a decline cycle. The "precautionary" rate cut of 0.25% was largely played by the market, especially after the Fed head's dovish speech in Congress, during which he actually announced the relevant intentions of the regulator. In my opinion, the greatest danger to the dollar is not the Fed, but Donald Trump, who repeatedly expressed outrage at the overvalued exchange rate of the national currency. According to Bloomberg, the US president has already instructed his advisers to develop a strategy to weaken the dollar. According to insider sources, Larry Kudlow, the chief economic adviser to the president, and Stephen Mnuchin, the minister of finance, opposed any US intervention to weaken the greenback. But according to Trump, an overly expensive dollar is almost the key obstacle to a country's economic growth. In turn, economic growth, according to the head of the White House, should provide him with a second presidential term. Here it is worth noting that the overwhelming majority of opinion polls are giving a definite advantage to former Vice-President Joe Biden. Even the Fox News channel, which clearly sympathizes with Trump, acknowledged this fact. According to their polls, Trump is almost 10% behind Biden. Thus, good news for dollar bulls is that the greenback has acquired "immunity" regarding the Fed's stated intentions to cut the rate by 25 points (and more aggressive measures are unlikely to be applied). In addition, US statistics also provide background support for the dollar. The bad news is that Trump may initiate currency interventions, especially if the US currency continues to rise in price across the entire market. Taking into account such (possible) perspectives, dollar bulls sit on a "powder keg", which can jerk at any moment. From a technical point of view, the EUR/USD pair has the potential to fall to the bottom line of the Bollinger Bands indicator on the daily chart, which corresponds to the mark of 1.1170. If the bears overcome this support level (which is unlikely within the next few days), the pair will head to the bottom of the 11th figure, that is, to the bottom line of the Bollinger Bands indicator on the weekly chart. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 16 Jul 2019 04:18 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 81p - 77p - 74p - 60p - 67p. Average amplitude for the last 5 days: 72p (66p). The British pound began to fall against the US dollar in the morning, just like the euro. Thus, the conclusion is that the US dollar was more expensive and in demand today. If the euro showed a very modest fall, which has already stopped, the British currency continues to fall down and has already dropped by more than 100 points. Now the most interesting thing: the pound completely ignored the reports on wages in the UK for May, which showed a positive trend and exceeded forecast values. It turns out that UK data is not even particularly interesting for market participants. What is the use of it, if there is political chaos in the country, and the chances that it might be a "hard" Brexit or even postponed to a later date has increased for the second time? New Parliamentary elections or even a second referendum are possible. The most interesting is that all these options are quite probable and none should be given preference in determining the degree of probability of its execution. Large corporations continue to leave the country amid all the same uncertainty, in which Great Britain has been bathed in for the past 3 years. Mark Carney did not say anything interesting to the foreign exchange market during his speech today, but on the whole his position has long been known. He repeatedly warned the British government that the hard Brexit would be a crushing blow to the economy. But Boris Johnson and Jeremy Hunt believe that the hard Brexit is not so terrible and there is no other option. Well, let's see who wins the election and what will happen before October 31. Trading recommendations: The pound/dollar currency pair resumed a downward trend. Thus, traders are advised to trade again for a fall with targets at 1.2391 and 1.2343 before the MACD indicator turns up or the price rebounds from any target. It will be possible to buy the British currency after the pair is re-consolidated above the Kijun-Sen line, which will lead to an upward trend. The targets are the Senkou Span B line and the 1.2621 level. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chikou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 16 Jul 2019 03:58 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 26p - 62p - 41p - 37p - 31p. Average amplitude for the last 5 days: 39p (39p). Traders did not wait for Jerome Powell's speech in Paris and the publication of macroeconomic reports in the US, but just from the very beginning of the European trading session started to buy the US currency. We have repeatedly said that traders, as well as the media and analysts are paying too much attention to a possible reduction in the Fed rate, forgetting that the ECB rate remains 2.5% lower and can also be lowered at the central bank meeting in July. Moreover, this may happen sooner than a similar action from the Federal Reserve. What kind of fundamental support at this time can be discussed in the context of the European currency? Euro bulls could not even overcome the Ichimoku cloud in order to strengthen the "golden cross". Reports on retail sales and industrial production in the United States in June only complemented today's picture. The first report showed a larger increase than predicted (+0.4% m/m against the forecast of +0.1%), its derivative report excluding car sales also exceeded the expectations of traders, and the second report showed zero growth, but no one was forced to change their trading strategy on Tuesday, July 16. As a result, the euro/dollar pair fell to the first support level of 1.1213 and overcame the critical line Kijun-Sen. Thus, the trend for the pair has changed into a downward one, and the euro may once again begin to fall in price against the US dollar. On the eve of the meetings of the ECB and the Fed, this eloquently shows the mood of market participants and their expectations from these events. Trading recommendations: EUR/USD resumed its downward movement, breaking the Kijun-sen line. Thus, selling the euro with target levels of 1.1183 and 1.1157 are now relevant. It is recommended to buy the euro/dollar pair not earlier than when you consolidate the price back above the critical line with the first target of 1,1306. In this case, euro bulls will get a new chance to form an upward trend. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chikou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

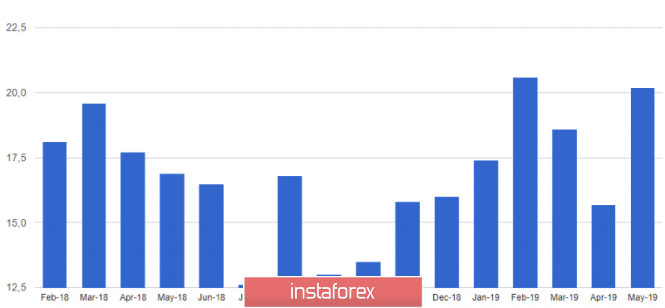

| Posted: 16 Jul 2019 03:42 PM PDT The euro continued its downward movement, despite the fact that exports of goods from the eurozone increased in May this year, while imports declined. EURUSD Many analysts have already started talking about the fact that the eurozone economy has stood firm against the background of a sharp deterioration in trade relations and a slowdown in overall world economic growth, but there was hardly a single growth in May, following a landslide in April, is a sure signal to avoid a recession. According to the statistics agency, the eurozone foreign trade surplus in May 2019 rose to 20.2 billion euros from 15.7 billion euros in April. Exports showed growth in May by 1.4% compared with April, while imports declined immediately by 1.0%. I recall that in April of this year there was a sharp decline in exports, which was caused by weak external demand. Without taking into account the correction for seasonal factors, the positive balance of foreign trade in the eurozone rose to 23.0 billion euros in May from 16.9 the previous year. Let me remind you that recently the ECB leaders have again started talking about the introduction of additional measures to stimulate the economy in order to support its growth. They signaled their willingness to lower interest rates or resume the asset purchase program if necessary. In the first half of the day, a report was also issued by the ZEW Institute, in which it stated that the current conditions index in Germany in July of this year dropped sharply to -1.1 points against 7.8 points in June. Such a serious fall in the index is directly related to the latest data indicating the problems of growth in the German economy. The index of economic expectations in Germany fell even more and amounted to -24.5 points in July against -21.1 points in June. Economists had expected the ZEW index of economic expectations in Germany for July 2019 to be -22.5 points. In the euro area as a whole, sentiment also deteriorated. According to the data of the same ZEW institute, the sentiment index in the business environment of the eurozone in July dropped to -20.3 points against -20.2 in June of this year. As for the technical picture of EURUSD, the downward movement in the trading instrument was not unexpected. The breakthrough of support and going beyond the channel of 1.1240 increased the pressure on the trading instrument, which led to the update of a larger level in the area of 1.1200. The next target of risky asset sellers is a low of this month - 1.1160. GBPUSD The British pound continued to fall against the US dollar, completely ignoring a good report on wage growth in the UK and unemployment. According to the National Bureau of Statistics, in the period from March to May of this year, the average salary in the UK rose by 3.6% at once, which in the future will necessarily affect the increase in retail sales and citizens' spending for the better. Unemployment in the UK during the reporting period remained at 3.8%. However, despite this, the prospects for the country's economy are overshadowed by the unclear situation with Brexit, since, apparently, the new receiver of Theresa May's post will be Boris Johnson, who is a supporter of a hard scenario. The material has been provided by InstaForex Company - www.instaforex.com |

| July 16, 2019 : EUR/USD confirms a recent double-top reversal pattern around 1.1235. Posted: 16 Jul 2019 08:54 AM PDT

Initially, Temporary Bullish breakout above 1.1335 was demonstrated (suggesting a high probability bullish continuation pattern). However, the EURUSD pair has failed to maintain that bullish persistence above 1.1320 and 1.1275 (the depicted price levels/zones). This was followed by a deeper bearish pullback towards 1.1175 where significant bullish price action was demonstrated on June 18. The EURUSD looked overbought around 1.1400 facing a confluence of supply levels. Thus, a bearish pullback was initiated towards 1.1275 as expected in a previous article. Further Bearish decline below 1.1275 enhanced a deeper bearish decline towards 1.1235 (the lower limit of the newly-established bullish channel) which failed to provide enough bullish support for the EUR/USD. The recent bearish breakdown below 1.1235 invited further bearish momentum to move towards 1.1175. However, significant bullish momentum was earlier demonstrated around 1.1200 bringing the EUR/USD pair again above 1.1235. That's why, the recent bullish pullback was expected to pursue towards the price zone around 1.1275 where a confluence of resistance/supply levels came to meet the pair. A recent double-top Bearish pattern was demonstrated around the price zone of 1.1275 where a valid Intraday SELL position was suggested in previous articles. Recent Bearish breakdown of the pattern neckline around (1.1235) confirms the short-term trend reversal into bearish towards 1.1175. Any bullish pullback towards the depicted key zone around 1.1235 should be considered for a valid SELL entry. On the other hand, a bullish breakout above (1.1235-1.1250) brings the EUR/USD pair again between depicted price-zones (1.1235-1.1275) until another breakout attempt is demonstrated in either directions (More probably to the downside). Trade recommendations : For Intraday traders, another valid SELL entry can be offered at retesting of the broken neckline around 1.1235. Initial Target levels to be located around 1.1200 and 1.1175. Stop Loss should be placed above 1.1260. The material has been provided by InstaForex Company - www.instaforex.com |

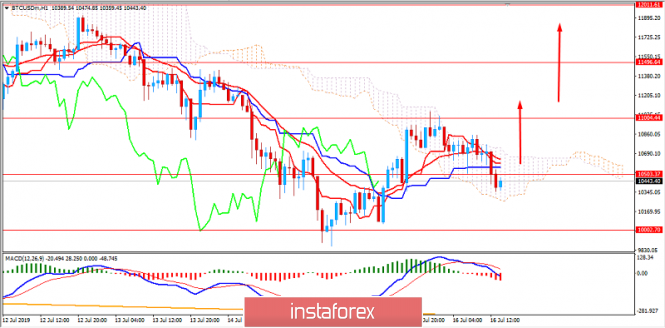

| Analysis of BITCOIN for July 16, 2019: BTC struggling to overcome $10,000 Posted: 16 Jul 2019 08:04 AM PDT Bitcoin is still struggling to sustain the bullish pressure above $10,500. As the price remains above $10,000 with a daily close, Bitcoin bulls have a good chance to push the price higher. Bitcoin and the overall crypto market have faced prolonged downward pressure that they have been battling with over the past several weeks. The downward pressure that led Bitcoin back towards the four-figure price region was first sparked when the crypto currency sharply jumped to $13,800 which proved to be an unsustainable rally that subsequently led to an extended period of sideways trading. A daily volume has fallen off marginally as the digital asset continues to make lower highs and lower lows. The head and shoulders pattern is in progress. A break of the neckline is yet to come. Recently, the American Treasury Secretary was fairly bearish on cryptocurrencies, mentioning their ability to be used by criminals for illicit activities, like money laundering, the sale of illicit drugs, and hacking which had diverted the overall market sentiment to bearish. Bitcoin is expected to lose momentum as currently the price is trading below $10,500. BTC is expected to spend a few days sideways from $10,000 to $10,500 before any definite trend momentum. As the price remains above $10,000, there will be certain possibility of a bounce soon. TECHNICAL OVERVIEW: The price is trading inside the Kumo cloud resistance area holding below $10,500 with a strong intraday bearish close. The dynamic levels like 20 EMA, Tenkan and Kijun line are above the current price which can act as resistance. The Chikou Span has found support in the price line which might lead to certain bullish pressure, but no other bullish pressure can sustain until the price clears above $10,500 again to establish a strong momentum. For further upward thrust to continue, a break above $10,500 with a daily close is required. TRADING LEVELS and BIAS: SUPPORT: 9,500, 9,800, 10,000 RESISTANCE: 10,500, 11,000, 11,500, 12,000 BIAS: Bearish MOMENTUM: Volatile

|

| Posted: 16 Jul 2019 08:02 AM PDT

Since May 17, the previous downside movement within the depicted bearish channel came to a pause allowing the recent sideway consolidation range to be established between 1.2750 - 1.2550 with a prominent key-level around 1.2650. In June , temporary bullish consolidation patterns were demonstrated above 1.2650 for a few trading sessions. However, the price level of 1.2750 (consolidation range upper limit) has prevented further bullish advancement few times so far. Moreover, signs of bearish rejection have been manifested (Head & Shoulders reversal pattern with neckline located around 1.2650). Bearish breakdown below 1.2650 (reversal pattern neckline) confirmed the reversal pattern with bearish projection target located at 1.2550, 1.2510 and 1.2450. Intermediate-term technical outlook remains under bearish pressure as long as the market keeps moving below 1.2650 (mid-range key-level and neckline of the reversal pattern). Moreover, the recent Bearish breakdown below 1.2570 - 1.2550 (the lower limit of the depicted consolidation range) confirms a trend reversal into bearish on the short-term. On the other hand, the recent bullish pullback towards 1.2550-1.2570 was recommended as a valid SELL opportunity for Intraday traders. All bearish Target levels have already been reached. Quick bearish decline was expected to occur towards 1.2450-1.2400 (the lower limit of the current movement channel) where early signs of bullish rejection and a bullish pullback should be considered. Intraday traders can have a short-term BUY trade anywhere around (1.2400 - 1.1450) provided that no bearish breakdown occurs below 1.2400 (the lower limit of the depicted movement channel). Trade Recommendations: Intraday traders can have a valid BUY Entry anywhere around the lower limit of the current movement channel (1.2400). T/P levels to be located around 1.2450 and 1.2510. S/L should be placed below 1.2370. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 16 Jul 2019 07:19 AM PDT To open long positions on GBP/USD, you need: Despite the good data on the unemployment rate in the UK, the pound continued to move down, which indicates the weakness of buyers. At the moment, it is best to return to long positions after the formation of a false breakout in the support area of 1.2405 or a rebound from a larger area of 1.2374. The main task of the bulls will be to return to the resistance of 1.2439 and test the area of 1.2469, where I recommend taking the profit. To open short positions on GBP/USD, you need: Bears have exceeded their plan for today, but are not going to stop. An unsuccessful consolidation above the resistance of 1.2439, or a test of the maximum of 1.2469 will be new signals for opening short positions. The aim of the sellers will be an intermediate minimum of 1.2405, the breakdown of which today in the afternoon will lead to a further downward trend of GBP/USD to the area of the lows of 1.2374 and 1.2342, where I recommend taking the profit. Indicator signals: Moving Averages Trading is below 30 and 50 moving averages, indicating a further bearish market. Bollinger Bands In the case of an upward correction, the average border of the indicator, which is currently in the area of 1.2475, will be a good level for opening short positions.

Description of indicators

|

| BTC 07.16.2019 - Brerakout of the flag and downside momentum Posted: 16 Jul 2019 07:16 AM PDT Industry news: Stablecoin issuer Tether accidentally created $5 billion-worth of its USDT stablecoin at the weekend, before promptly destroying them again. The mess-up occurred when the company was helping cryptocurrency exchange Poloniex conduct a chain swap, moving tethers from the Omni to the Tron blockchains, according to Tether CTO Paolo Ardoino. Technical view:

BTC broke a nice bearish flag pattern in the background based on the 1H time-frame. The trend is bearish and the market is making lower highs and lower lows. Important resistance level is found at the price of $11.000. I also found the breakout of the lower Bollinger band, which is sign that there is volatility breakdown. Watch for selling opportunities on the rallies. The downward targets are set at the price of $9.643 and at the price of $9.023.$ The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 16 Jul 2019 07:10 AM PDT To open long positions on EURUSD, you need: Buyers failed to hold the pair above the support of 1.1242, the breakdown of which led to the sale of the euro. At the moment, the emphasis is on a minimum of 1.1214, however, there is no active action of bulls. The most optimal scenario will be purchased in the area of large support, which is located in the area of 1.1182. The task of the bulls at the end of the day will be to return to the resistance of 1.1246, where I recommend taking the profit. To open short positions on EURUSD, you need: The bears will try to break below the support of 1.1214, but it is not quite right to expect a further major decline in the afternoon. Most likely, a false breakdown in the area of 1.1214, after updating the low of today, will lead to an upward correction to the level of 1.1246, from where new sales of EUR/USD can be considered. The key target of sellers at the end of the day will be a new monthly minimum in the area of 1.1182. Indicator signals: Moving Averages Trading is below 30 and 50 moving averages, indicating a bearish market. Bollinger Bands In the case of an upward correction, the average border of the indicator, which is currently in the area of 1.1246, will be a good level for opening short positions.

Description of indicators

|

| Gold 07.16.2019 - Volatility down break Posted: 16 Jul 2019 06:57 AM PDT The Gold has been trading downwards in past few hours. Gold did test the level at $1.407.27. Anyway, I found interesting breakout of the triangle pattern in the background, which is sign that Gold may continue with the downward pressure. My advice is to watch for the downside.

The numbers: Sales at U.S. retailers rose solidly in June for the fourth month in a row, pointing to a strong rebound in consumer spending in the second quarter that suggests the economy is not as fragile as the Federal Reserve apparently believes. On the 30M time-frame I found that there is a new momentum down on the %Bollinger oscillator, which is indication that sellers are in control. Also, you will notice that Bollinger tighten the range prior to the down breakout, which is example of volatility down break condition. My advice is to watch for selling opportunities with the target at the price of $1.401. Resistance level is set at the price of $1.412. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD for July 16,2019 - Down move is about to end for today Posted: 16 Jul 2019 06:42 AM PDT The EURUSD has been trading downwards in the Asia and Europe session and there are high odds that EUR may rally on the US session. EUR did stop going down exactly at the support 1.1214. I expect upside during the rest of the day and potential testing of resistance levels at 1.1240 and 1.1254.

The numbers: Sales at U.S. retailers rose solidly in June for the fourth month in a row, pointing to a strong rebound in consumer spending in the second quarter that suggests the economy is not as fragile as the Federal Reserve apparently believes. On the 30M time-frame I found that there is a bullish divergence on the %Bollinger indicator, which is indication that even the EUR went lower the Bollinger % oscillator didn't fallow. This is for me strong sign that down move for today is about to end on the EUR. My advice is to watch for buying opportunities with the upward targets at the price of 1.1240 and 1.1254. As long as the EUR is trading above the 1.1195, you should watch for buying opportunities. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of EUR/USD for July 16, 2019 Posted: 16 Jul 2019 06:27 AM PDT |

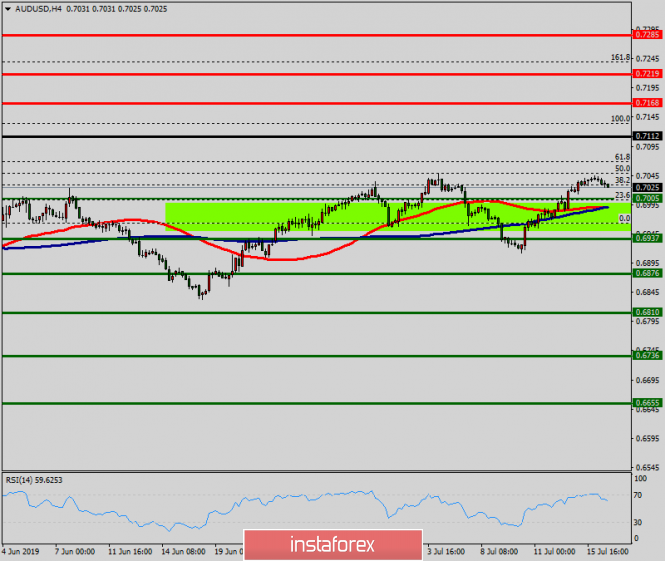

| Technical analysis of AUD/USD for July 16, 2019 Posted: 16 Jul 2019 06:15 AM PDT The AUD/USD pair is set above strong support at the levels of 0.6876 and 0.6810. This support has been rejected four times confirming the uptrend. The major support is seen at the level of 0.6810, because the trend is still showing strength above it. Accordingly, the pair is still in the uptrend in the area of 0.6810 and 0.6876. The AUD/USD pair is trading in the bullish trend from the last support line of 0.6876 towards thae first resistance level of 0.6937 in order to test it. This is confirmed by the RSI indicator signaling that we are still in the bullish trending market. Now, the pair is likely to begin an ascending movement to the point of 0.6937 and further to the level of 0.7005. The level of 0.7005 will act as the major resistance and the double top is already set at the point of 0.7005. At the same time, if there is a breakout at the support level 0.6810, this scenario may be invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

| AUDUSD shows rejection signs at major resistance Posted: 16 Jul 2019 06:13 AM PDT AUDUSD has reached important resistance area at 0.7040-0.7050 and shows weakness and reversal signs. It is important for bulls to break above this resistance area in order to hope for a move towards 0.72 and higher, otherwise there will be danger of falling towards 0.68 or lower.

Red rectangle -major horizontal resistance AUDUSD has reached the green downward sloping resistance trend line. Price has so far made a double top at the 0.7045 area inside the red rectangle. In order for bulls to retain control of the trend, they will need to break above this resistance area. Otherwise bears will take over control of the trend. Support is found at 0.6910 and failure to hold above this level will open the way for a move towards 0.68 and lower. The material has been provided by InstaForex Company - www.instaforex.com |

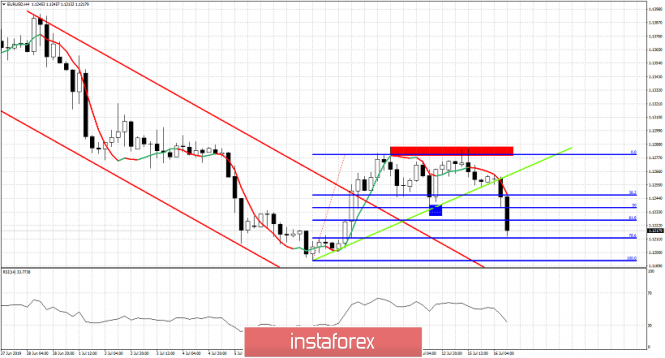

| EURUSD pull back breaks short-term support and increases chances of breaking to new 2019 lows. Posted: 16 Jul 2019 06:08 AM PDT EURUSD has broken short-term support. This makes bulls more vulnerable and price prone to falling further towards 1.10. This bearish scenario will get confirmed if price breaks below 1.1180 and will get canceled if bulls recapture 1.1250.

Red rectangle - resistance Green line - support (broken) EURUSD has reached 1.1280 resistance area once again and got rejected. This was a bearish sign. This lead to a break of the green trend line. Price has now retraced 78.6% of the entire upward move from 1.1193 to 1.1281. Bulls need to step in now and recapture 1.1250 in order to have hopes for a move towards 1.1350-1.14. Any bounce that shows weakness and inability to recapture 1.1250 will be a bearish sign that will increase chances of breaking below 1.12. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold price vulnerable to more downside as long as price is below $1,420. Posted: 16 Jul 2019 05:56 AM PDT Gold price is turning lower as Dollar strengthens. Gold price remains inside the trading range we have been talking about and has given no clear signal as price is trading sideways. Gold price however has shown weakness breaking above $1,420 that is why it is vulnerable to see $1,400 or lower again.

Red rectangle - support Gold price is still inside the trading range of $1,385-$1,440. Resistance is also found at $1,420 and as long as price is below that area, I expect Gold to be under pressure and push price towards $1,400 or lower. Breaking above $1,420 will increase the chances of breaking above $1,440 and moving towards $1,500. Until then we should expect a move to $1,400 and why not break the major support level at $1,385. This will lead to a deeper decline towards $1,350-$1,330. The material has been provided by InstaForex Company - www.instaforex.com |

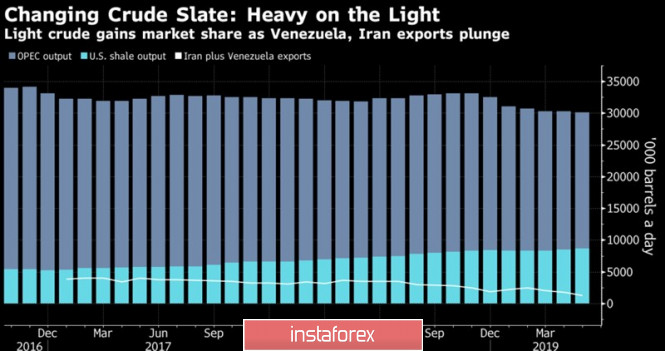

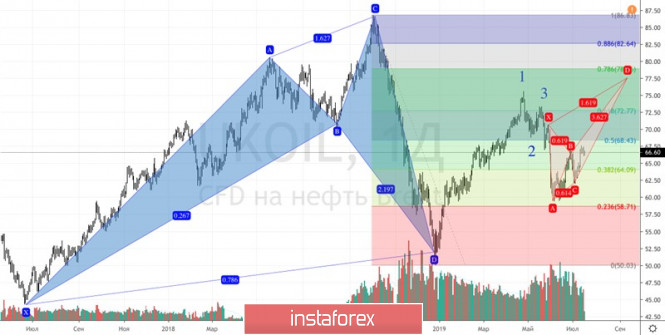

| Posted: 16 Jul 2019 05:17 AM PDT The oil market sighed with relief after it became known that the tropical hurricane Barry did not cause much harm to the companies operating in the Gulf of Mexico. This region accounts for about 16% of the black gold production in the United States. Also, the fact that about 74% of the oil-producing and refining companies have been closed, it has driven Brent's quotes to its highest levels since the end of May. The gradual return of the Gulf of Mexico to its normal functioning, as well as the slowdown of China's economy to 6.2% in the second quarter, made bulls in both varieties take profits. Also, the unpleasant news from the IEA, which reported global growth, contributed to it. According to estimates by the US Energy Information Administration, the volume of shale production in the United States in August will increase by 49 thousand b/d to a record of 8.55 million b/s, which is the main bearish driver in the black gold market along with the trade wars and the associated slowdown in global demand. However, WTI is growing faster than shares of US energy companies, which indicates the unwillingness of shareholders to spend money on the expansion of production. This is confirmed by the fall of drilling rigs from Baker Hughes and with the fifth consecutive reduction in US oil reserves. According to a consensus estimate of Bloomberg experts, the figure will drop by 2.75 million barrels by the end of the week by July 15. This allows the bulls in Brent and WTI to be confident. Dynamics of oil and stocks of US energy companies Moreover, the conflict in the Middle East can turn into a real war at any time. Also, the agreement of OPEC and other countries of producers keeps global stocks from growing. Production dynamics of OPEC, US, and Iranian exports If Tehran overlaps the Strait of Hormuz, black gold will soar by $ 15-20 per barrel at the moment, according to the American consulting company, Rapidan. But then, speculators will begin to take profits amid expectations of the introduction of US troops into the region. The second peak will follow the first peak, hence, the dynamics of Brent and WTI will resemble the letter "M". With regard to the potential price increases, it should be made dependent on the duration of the conflict. A week-long standoff between the United States and Iran will drive up prices for the North Sea variety to $80-90 per barrel. Three-digit numbers will become a reality if the conflict drags on for a month or more. The US dollar plays an important role in the fate of oil. At first glance, the Fed's intention to ease monetary policy and Donald Trump's verbal interventions should have put an end to the uptrend in the USD index. Nevertheless, the world economy is in a state of a currency war, when the central banks-competitors of the Federal Reserve weaken monetary policy, which then contributes to the devaluation of their own monetary units and keeps the "American" from falling. Technically, updating the July highs with the subsequent successful assault of resistance at $68.45 per barrel activates the Crab pattern with a target of 161.8% of XA wave. It corresponds to $77.5. Brent daily chart |

| Analysis of EUR/AUD for July 16, 2019: EUR could rebound ahead of Australian Employment reports Posted: 16 Jul 2019 05:01 AM PDT EUR/AUD has been trading with the bearish trend recently which appeared as a result of a drastic EUR's fall from 1.6350. The price is expected to move lower in the coming days. EUR is under pressure amid downbeat statistics from the eurozone. The appointment of Christine Lagarde as the ECB President hints at a continuation of the current soft monetary policy. However, investors don't expect the ECB to cut the key interest rate, awaiting any signs of additional measures to stimulate the eurozone's economy and the renewal of previously suspended courses. Another pain for EUR is the looming trade conflict with the United States and the introduction of duties on European imports. However, in comparison with the AUD, EUR is still stable despite the extensive economic downturn in the EU, including Germany. Today German ZEW economic sentiment report was published with a decrease to -24.5 from the previous figure of -21.1 which was expected to be at -22.1. Besides, the eurozone's trade balance proficit widened to 20.2B from the previous figure of 15.3B which was expected to be at 16.4B. Tomorrow the eurozone is due to release a final CPI which is expected to show a flat reading of 1.2%. Despite the pause in the trade conflict between China and the United States, the predictions remain uncertain and investment in commodity currencies is still too risky. The key factor in AUD weakness this month was a rate cut by the Reserve Bank of Australia and its plans to continue with their dovish rhetoric amid external risks. Macroeconomic reports only increase the likelihood of a further cut of the key cash rate. The consumer sentiment index published last week showed a decline of 4.1% in the index to 96.5 points, which is the lowest level for the last two years. Moreover, Australia is due to publish a report on employment change which is expected to decrease from 42.3K to 9.1K while the unemployment rate is expected to be unchanged at 5.2%. Australia's labor market is rapidly adding jobs but that is still not enough to pull the unemployment rate below 5% as more people are looking for work. Recently the RBA also stated the intention to cut interest rates again, if needed to support employment, wages growth, and inflation. In total, the RBA has already eased monetary policy twice in June and July to a record low of 1%. The minutes of the latest RBA policy meeting read that its board decided that cutting rates by another quarter-point together with a similar move in the previous month would help speed up the economy. TECHNICAL OVERVIEW: The price has been quite impulsive with the recent bearish momentum. The pair is expected to reach 1.5900 support area before any strong bullish pressure is observed in the pair. As the preceding trend is bearish and quite a strong one, further momentum on the downside will not be a surprise to market participants. Keeping an eye on 1.5900 will help to take profits out of the market. A break below 1.5900 will lead to further downward pressure in the coming days.

|

| The ECB should not rely too much on market inflation expectations Posted: 16 Jul 2019 03:52 AM PDT Central banks should be independent not only of political pressure but also of short-term pressure, such as the perception of inflation by financial markets, said ECB spokesman Francois Villeroy. World central banks are facing increasing pressure from politicians on both sides of the Atlantic to ease monetary policy in line with their plans. At the same time, bond yields have recently decreased amid weak economic data, which forced central banks to take radical new stimulus measures to keep inflationary expectations from falling. "We take into account market characteristics but we should not depend on the market; this means that one should not rely solely on inflationary expectations in the market, "said Villeroy. A key indicator of the long-term expectations of financial markets regarding inflation in the Eurozone recently fell to 1.1%. Despite the fact that it has risen to 1.3% since then, this is not only well below the inflation target of the ECB, close to 2%, but less than when the Central Bank launched its bond purchase program in 2015. Villeroy said he regretted the need to remind the importance of the independence of the Central Bank, which is the foundation of modern monetary policy and is increasingly being attacked by politicians. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of EUR/USD for July 16, 2019: USD holds ground Posted: 16 Jul 2019 03:33 AM PDT EUR/USD has been trading impulsively amid the bullish momentum which is currently being engulfed as the price has broken below 1.1250 under strong bearish pressure. The ECB has been under pressure dealing with the budget deficit and sluggish inflation that is to blame for EUR's weakness. Bond yields dropped recently in light of downbeat economic data, putting pressure on central banks to carry out drastic new monetary stimulus to prop up inflation from further deceleration. Moreover, a key gauge of financial markets' long-term expectations for inflation in the euro zone recently fell to as low as 1.1%. Greece's new conservative government is going to speed up economic growth and maintain healthy public finances by every measure possible which aroused hawkish attention among market participants but not quite strong to have an immediate effect on EUR's gains. Today German ZEW economic sentiment report was published with a decrease to -24.5 from the previous figure of -21.1 which was expected to be at -22.1. Besides, the eurozone's trade balance proficit widened to 20.2B from the previous figure of 15.3B which was expected to be at 16.4B. Tomorrow the eurozone is due to release a final CPI which is expected to show a flat reading of 1.2%. On the other hand, the Federal Reserve, especially Chairman Jerome Powell, has been targeted by the US government for its rhetoric. So, the US central bank has to resort to a rate hike. Some Fed officials believe that lower interest rates would help to achieve the inflation goal. Investors are betting that the Federal Reserve will announce a decrease in the benchmark overnight interest rate on July 30-31. Recently Powell's testimony for Congress cemented expectations for a rate cut this month. The policymaker also acknowledged for the first time publicly that officials have potentially tightened monetary policy too much because they underestimated shifts in the US economy. The biggest news is that Powell has made a major concession about a policy error over the past four years. Today US retail sales and core retail sales reports are due in the North American trade. Retail sales are likely to contract to 0.1% from the previous value of 0.5%. Import prices is also expected to drop to -0.7% from the previous value of -0.3%. To sum it up, USD is currently drifting lower amid negative expectations of pending macro economic reports. At the same time, EUR is struggling to maintain momentum. The pair could face correction under higher volatility. TECHNICAL OVERVIEW: The price is currently trading below 1.1250 under impulsive bearish pressure which is expected to push the price lower towards 1.1200 and later towards 1.1120 support area in the coming days. As the price recently broke below the medium-term trend line support, further bearish pressure is more likely. However, as the price remains below 1.1250 with a daily close, this opens the door to the bearish bias.

|

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment