Forex analysis review |

- Will the Fed lower the rate in July?

- Why OPEC+ extended the deal - SEB

- GBP/USD. July 2. Results of the day. Exit from the EU without a "deal" will cost the UK £90 billion

- EUR/USD. July 2. Results of the day. The producer price index in the European Union warns of a possible slowdown in inflation

- Oil and AUD: A deal to reduce oil production has been extended. RBA will lower rates if necessary

- EUR/USD: doubts of dollar bulls and an insider for the euro

- Oil: puppeteers and puppets

- Gold 07.02.2019 - Resistance on the test

- GBP/USD 07.02.2019 - New momentum low on the oscillator, downward move still in play

- BTC 07.02.2019 - Sell zone at the price of $10.600

- EURUSD no sign of reversal yet, trend remains bearish in the short-term

- Gold bounce could be near

- Dollar: do not retreat or surrender. Australian won back the decision of the Central Bank

- It seems the market understands that a trade truce is not the same as a deal, so the dollar is strengthening

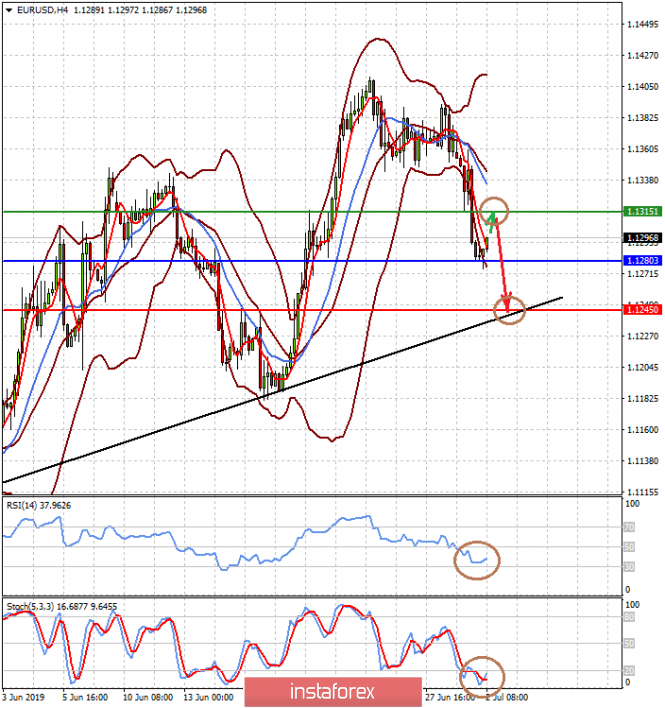

- July 2, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- GBP/USD: plan for the US session on July 2. Bears press the pound down, but the movement is given with great difficulty

- EUR/USD: plan for the US session on July 2. Poor data on the eurozone spoiled the mood of buyers again

- BITCOIN completing winning streak?

- July 2, 2019 : GBP/USD is demonstrating a high-probability short-term trend reversal.

- GBPUSD: USD to gain momentum over GBP. July 2, 2019

- AUDUSD: USD to regain momentum ahead of RBA rate decision. July 2, 2019

- The active easing of the policy by the ECB may give a fresh impetus to the decline of the euro

- The positive was short-lived: the RBA lowered the rate, the RBNZ is in line, the kiwi and Aussies are ready for further weakening

- The dollar is still growing at a slower pace due to weak growth of the American economy than in other regions of the world

- Burning forecast 07.02.2019 EURUSD and trading recommendation

| Will the Fed lower the rate in July? Posted: 02 Jul 2019 05:10 PM PDT Financial market participants are overwhelmed with emotions, and they are trying to run ahead of the statistics. Derivative contracts are still confident in easing the Fed's monetary policy at a meeting in July, although they reduced the likelihood of its reduction by as much as 50 bp from 40% to 21%. Despite a strong slowdown in business activity in the US manufacturing sector, US stock indexes reached a new record high, and the S&P 500 in the first half of the year showed the best dynamics in two decades. The euphoria over the resumption of the US-China trade negotiations swept the markets, but not for long. Moods have deteriorated, since Donald Trump again began to bend his line - "America first." In his opinion, the terms of the trade agreement should be most beneficial for the United States, and not for China. At first glance, the slowdown in the index of purchasing managers in the US manufacturing sector increases the chances of a Fed rate cut. This should have a negative impact on the dollar, but the EUR/USD pair cannot consolidate above the 13th figure. The fact is that everyone perfectly sees the advantages of the US economy over other countries that are weaker compared to it. World PMI for the second month in a row ends up in the red zone. This was not seven years. Economic expansion in America has reached a new record high. The current expansion lasts twice as long as the average. No need to be surprised at the strong dollar and record highs of the S&P 500. US stock indexes look better than world peers. The divergence of their dynamics was recorded last year due to trade disputes between the United States and China. Now one of the main drivers of the rally in the US securities market is the expectation of a rate cut by the Fed. But here everything is very difficult. So, the head of the Federal Reserve Bank of Richmond Tom Barkin announced the existence of two worlds. In the first, more realistic, consumer spending is strong, and business investment is flat due to prolonged trade disputes. There is no need to reduce the rate. In the second world, company managers are starting to lay off workers, which reduces consumption and the economy is slowly growing. In the case of reducing its rate of recovery to less than 2%, the US central bank will have to resort to monetary expansion. It is possible that the Fed officials will decide to wait after all, while the ECB, led by super-Mario, will lower rates. Lead economist Philip Lane says that ultra-soft policies have previously shown themselves to be the best, so the central bank can return to them. Klaas Knot, positioning himself as a "hawk", notes the indisputable fact of low inflation. The head of the Bank of Spain, Pablo Hernandez de Cos, is confident that the ECB's CPI forecast of 1.6% for next year is far from true. Differences in economic growth and the monetary policy of the two largest regulators are the most important drivers of the EUR/USD pair, which push it down. An impressive report on the US labor market for June is needed to develop the success and get the main pair out of the consolidation range of $1.12-1.14. However, today the representatives of the ECB have mentioned that the regulator is not planning to return to quantitative easing just yet. On this message, the euro surged and reached a new intraday high. Officials prefer to wait for data on the economic situation in the region. According to Bloomberg, at the July meeting, the regulator may change its rhetoric and the text of the final statement. It is worth noting that the ECB often uses a similar method of communication with the market. Thus, it checks the reaction of traders to one or another information. The material has been provided by InstaForex Company - www.instaforex.com |

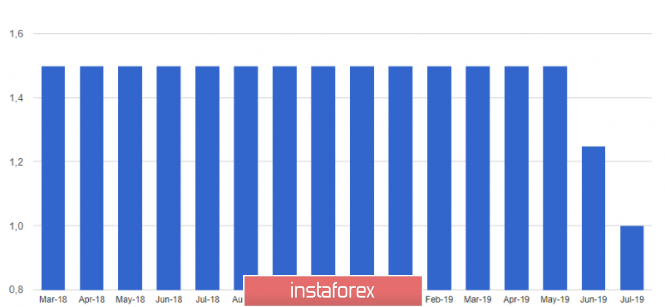

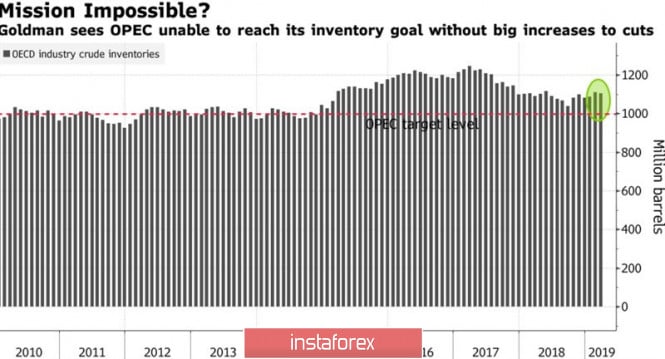

| Why OPEC+ extended the deal - SEB Posted: 02 Jul 2019 04:55 PM PDT According to analysts of the largest Swedish bank Skandinaviska Enskilda Banken (SEB), OPEC countries and independent oil producers have easily agreed to prolong the deal to limit oil production for several reasons. The main one is that the continuation of the agreement has a positive effect on the current state of the largest oil producers, Russia and Saudi Arabia, and strengthens their position in the global oil market. Over the past 28 years, since 1991, the share of OPEC in the oil market has dropped to its lowest levels. At the same time, the countries of the cartel are trying to keep prices at a favorable level within the OPEC+ deal. SEB analysts pay attention to the fact that the share of key participants in the agreement on limiting production - Russia and Saudi Arabia - remains almost unchanged. Analysts believe that the main reason for the decline in the share of OPEC is a drop in production in Venezuela and Iran. SEB believes that the indicators of oil production in Russia, despite compliance with the transaction, exceed the average values over the past four years. As for Saudi Arabia, its production is slightly less than the average four-year value. In such conditions, the key players in the oil market feel comfortable, making a decision to extend the transaction and pushing other cartel members to this. SEB is sure: the only thing that is required from Saudi Arabia and Russia is to stop increasing production following the growth in demand. If such a scenario is implemented, the price of oil will remain in the range of $60– $70 per barrel, which will favorably affect all market participants, analysts say. Recall, on Monday, July 1, the OPEC+ agreement on current conditions was extended for 9 months. The decision of the cartel and independent oil producers was expected, but the cost of oil was adjusted by 2%. The correction in oil prices was affected by a reduction in the severity of the trade conflict between the United States and China, experts believe. The current situation has made a positive impact on the black gold market, although the possibility of extending the transaction and its impact on prices were incorporated into the price of oil. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Jul 2019 04:38 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 112p - 45p - 63p - 72p - 74p. Average amplitude for the last 5 days: 73p (70p). Brexit is increasingly overgrown with new details, expectations and forecasts. Today, Britain's Treasury Secretary Philip Hammond held a speech, he said that Brexit without a "deal" would cost the government 90 billion pounds, which would be a crushing blow to the economy. According to Hammond, whoever takes the chair of the prime minister, if he does Brexit without an agreement, he will lead the country to a catastrophe. At the same time, the main candidate for the post of prime minister, Boris Johnson, is ready to offer the EU a free trade option after Brexit. If the EU refuses such a proposal, the UK will be released without any agreement. According to Johnson, if the European Union is serious, then it should begin negotiations. Thus, we see that Johnson is not particularly afraid of Brexit without a "deal". At the same time, the second contender for the prime minister post, Jeremy Hunt, said that the government provides financial assistance worth $25 billion to small businesses, fishermen, farmers, in short, everyone who could suffer from a "hard" Brexit. That is, if it becomes clear that Brexit will be unorganized, then the UK government will "smooth out" customs duties. Interestingly, Philip Hammond has already noted that there is no money for such programs in the country's budget. It is difficult to decide who to believe and believe in the promises of Hunt and Johnson at all. One thing is clear: the uncertainty around Brexit has not decreased one bit. This process is increasingly complicated and confusing. So far, the pound sterling has suffered, which has resumed falling against the US dollar, and the British economy. But these are just flowers in comparison with the blow that can be inflicted in the event of a disordered exit. Trading recommendations: The pound/dollar currency pair continues its downward movement. Thus, traders are advised to sell the pound sterling with targets of 1.2591 and 1.2521 before the MACD indicator turns upwards, which will indicate a correctional turn. It will be possible to buy the British currency when the pair has consolidated above the Kijun-sen line. In this case, the upward trend may resume with the first target of a pivot-level of 1.2713. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chikou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

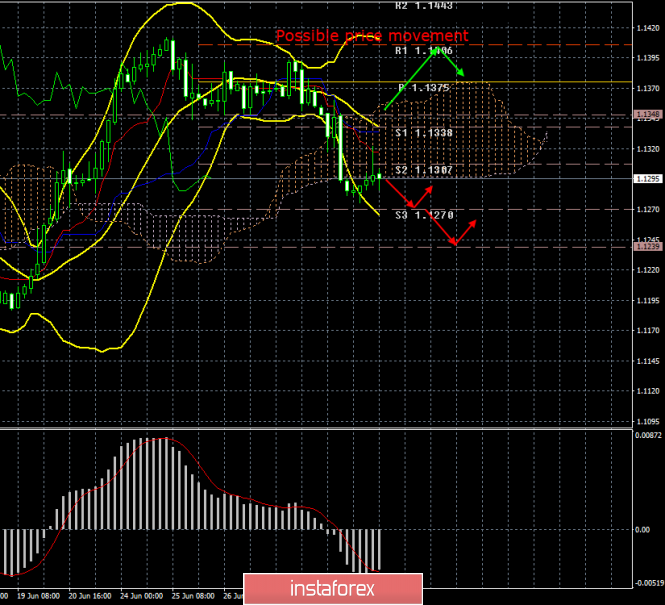

| Posted: 02 Jul 2019 04:28 PM PDT 4-hour time frame The amplitude of the last 5 days (high-low): 68p - 43p - 34p - 42p - 90p. Average amplitude for the last 5 days: 55p (45p). The European currency started the minimum upward correction on the second trading day of the week, to which the MACD indicator has not even had time to react to, so it is weak. During today, only one macroeconomic report was published - a report on producer prices in the eurozone for May. It turned out that this index slowed down from 2.6% to 1.6% y/y. Such a report is a very bad forerunner of the future report on inflation in the EU, which has already slowed down to 1.2%. Thus, in the future, inflation could be the basis for the ECB to reduce the key rate in the negative zone. This indicates a knockout for the euro. However, let's not talk about sad things until this happens. Today there is information that the ECB is not ready to cut rates in July. However, it is noted that monetary policy easing is almost inevitable, and if it does not happen in July, it will happen in September. Recall that the trade issue between the United States and the EU is not over. Trump has claims to Brussels. Regarding duties on the products of the automotive industry, the decision was postponed to a later date, but Trump is not satisfied with the issue of subsidizing the Airbus concern and has expanded the list of European goods that may be affected in the future. Needless to say, for the euro currency, the introduction of any duties would be a low blow, as well as for the entire economy of the European Union. Based on this and taking into account the fact that the trade war will affect the US economy, we still believe that the European currency will continue to be the outsider in the euro/dollar pair. Trading recommendations: The EUR/USD pair started a weak correction. Thus, it is now recommended to expect its completion and re-sell the euro with targets of 1.1270 and 1.1239. It is recommended to buy the euro/dollar pair no earlier than when the price consolidates above above the critical Kijun-sen line. However, bulls will need good fundamental reasons to do so. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chikou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Oil and AUD: A deal to reduce oil production has been extended. RBA will lower rates if necessary Posted: 02 Jul 2019 04:19 PM PDT Oil prices began to gradually decline from their highs in the region of $60 for the WTI brand, after it became known that the OPEC partner countries agreed to cooperate with the cartel, as well as to extend the current transaction to reduce oil production. As it became known, OPEC, as well as a number of countries that are not members of the cartel, including Russia, have finalized and adopted an agreement on the next extension of the transaction to tighten oil production. According to the conditions, the reduction in the aggregate supply of the coalition of oil-producing countries will be 1.2 million barrels per day until March 31, 2020. OPEC also concluded a long-term cooperation agreement with Russia, which will help balance the growth of shale oil production in the United States, weakening the cartel's influence on the market. As the Russian Energy Minister A. Novak stated, the degree of compliance with the agreement in the first half of 2019 was very high, and the actions of OPEC+ significantly reduced market volatility. In his opinion, the decision to extend production cuts will help maintain stability in the oil market and strengthen the position of the cartel. As for the current technical picture of oil, the level of 60.50 USD is problematic for buyers. However, its breakdown will make it possible to preserve the upward momentum that was observed before the adoption of an agreement on the extension of oil production cuts, which will lead to a test of larger ranges of $64 and $66. Today, the Australian dollar continued to strengthen its position against the US dollar, despite the statements made by the governor of the RBA. As stated by Philip Lowe, the bank's management is ready to lower interest rates again if necessary, since achieving full employment and target inflation rates are key. In his opinion, a lower unemployment rate is achievable, however, support from the fiscal policy is also desirable for the economy. Trade wars remain a problem, as well as the prospect of softening the policies of central banks, which will have a negative impact on the country's economy. Let me remind you that today the RBA lowered the interest rate from 1.25% to 1.00%. With regard to the technical picture of the pair AUDUSD, then there is a downward correction, which may continue even if the sellers manage to form the upper boundary of the channel in the resistance area of 0.7000. This will lead to a repeated decrease in the area of weekly lows to the area of 0.6955 and breakdown with the subsequent exit to larger levels of 0.6905 and 0.6850. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: doubts of dollar bulls and an insider for the euro Posted: 02 Jul 2019 03:58 PM PDT The single currency in the EUR/USD pair continues to be under pressure from the US currency, which is in demand among traders. However, the initial euphoria of dollar bulls, observed after the summit of the G20, is gradually fading away. Paired with the euro, the dollar managed to break through the support level of 1.1305 (the middle line of the Bollinger Bands indicator, which coincides with the Tenkan-sen line on D1), but could not overcome the next support level of 1.1280 (the upper Kumo cloud boundary on the same timeframe). The dollar index also ceased to gain momentum, barely going into the region of the 96th figure. But the yield of 10-year-old treasurers began to decline at a fairly active pace - the figure keeps at around 2.007% and at any moment can "dive" at a 2 percent level. In general, the situation with the dollar unfolds according to a fairly predictable scenario: the market "celebrated" the trade war's temporary truce, but then asked a logical question - is a full-fledged peace possible between the US and China, given the volume of demands placed on each other? And how does the Fed interpret the G20 results, given the fact that all the additional duties introduced earlier continue to have a negative impact on the US economy? These issues are unable to resume the upward trend of EUR/USD, but at the same time they are able to sow the corresponding doubts among traders, thus extinguishing the downward price impulse. And here it is worth recalling that the US trading platforms will work tomorrow in a reduced mode (on the eve of US Independence Day), and they will be completely closed on Thursday, as the country will celebrate Independence Day. Therefore, in the full-fledged mode, the foreign exchange market will resume its work only on Friday, when key data on the growth of the US labor market will be published. It is to this release that the main attention of traders will be shifted, since the Nonfarms will largely determine the fate of the Fed interest rate. In the meantime, dollar bulls will trade by the inertia of the latest events in Osaka and in anticipation of the comments of representatives of the US regulator after the G20 summit. Of course, price "delays" in the direction of lowering EUR/USD are possible until Friday, but if we talk about the continuation of the downward trend (or the resumption of corrective growth), Nonfarms will play a key role here - until they are published, market makers are unlikely to decide on any or large scale actions. Especially after the disappointing May data. An interesting situation with the single currency. Let me remind you that the latest release of data on the growth of European inflation actually passed by traders - the market was completely absorbed by the expectations of the G20. Nevertheless, the published figures deserve attention, even if in hindsight. And although the general level of inflation in the eurozone remained at the level of May (1.2%), core inflation was surprised by a rather rapid growth of up to 1.1% (with a growth forecast of up to 1% and a previous decrease of 0.8%). The day before this release, the German consumer price index was published, which for the first time in two months moved away from the lows of the year and rose to 0.3% (forecast - 0.2%). On an annualized basis, a positive trend was also recorded: the index reached 1.6%, while the growth forecast was up to 1.4%. The regional reports of the German CPI reflected a general improvement in inflation rates in annual terms. But political events muffled this release: traders initially reacted to rumors about the prospects for US-China relations, and after the G20 followed the general trends, they "reflexively" bought the dollar. Nevertheless, today, the euro emerged with the help of the American news agency Bloomberg, which published insider information on possible actions by the ECB. Referring to anonymous sources in the camp of the Board of Governors, the journalists stated that it is very likely that the European Central Bank will maintain the status quo at its next meeting. According to unnamed sources, members of the regulator will take the appropriate decision in the fall, when key macroeconomic indicators will form a more detailed and comprehensive picture of economic growth in the eurozone. At the same time in July, the ECB may prepare the ground for a possible mitigation of monetary policy parameters in the future. The regulator may change the text of the accompanying statement accordingly, and Mario Draghi soften the tone of his rhetoric. At first, the European currency reacted positively to the news, "shooting" to the level of 1.1320. However, the EUR/USD bulls could not keep this peak, as the likelihood of the introduction of additional monetary incentives from the ECB still remains. In addition, in the afternoon, the chief economist of the European Central Bank Philip Lane aggravated the situation for the euro, saying that, despite certain changes, inflation has not yet reached its target levels, forcing the central bank to maintain accommodative policies. True, he noted that negative interest rates are a temporary phenomenon (and a forced measure), but traders ignored this remark, focusing on expectations of easing monetary policy. Thus, the situation for the euro-dollar pair remains uncertain. The downward impulse died away, but at the same time dollar bulls are able to keep the situation under control - an attempt at corrective growth of EUR/USD has not been crowned today. On the other hand, for the development of the downward movement, the bears of the pair need a strong informational occasion, which is not currently available. As a result, the pair got stuck in the flat, entrenched in the 12th figure. If sellers still push the mark of 1.1280 (and consolidate below it), then the next support level will be the 1.1170 mark (the bottom line of the Bollinger Bands indicator on the daily chart, which coincides with the lower boundary of the Kumo cloud). But ahead of the Nonfarms release, this target is unlikely to be in the teeth for EUR/USD bears. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Jul 2019 03:45 PM PDT When the OPEC summit turns into a farce, one should not be surprised that cartel members feel like outcasts. At the G20 meeting, Russian President Vladimir Putin was impatient to tell his colleagues some important news, which he did. The Russian leader said he agreed with the proposal of Saudi Arabia to prolong the agreement to reduce oil production by 6 or 9 months. "Most likely, we will extend it by 9". A natural question arises, what did the rest of OPEC do at the July 1-2 meeting if Moscow and Riyadh had already made a decision? According to Tehran, who threatened to impose a veto, but in the end still agreed, the cartel may eventually end its existence. All contracts are concluded between Russia and Saudi Arabia, the rest of OPEC members are forced to raise their hands like puppets. However, it is necessary to recognize that the conditions of any market are made by strong players. Only an alliance of the largest producers is able to stop the invasion of American shale companies in the world oil market. Mining in the United States rose to 12.16 million b/d in April. If it were not for the prolongation of the Vienna agreement until the end of March 2019, it would have been difficult for the "bulls" in Brent and WTI to count on a continuation of the rally. 0.8 million out of 1.2 million bbl (about 1.2% of world demand for black gold) will be obliged to reduce OPEC, the rest - Russia and other producing countries. This will stabilize the market and cut off oxygen to the growth of global stocks. Their increase in recent months has become a catalyst for the peak of Brent and WTI. Dynamics of global oil reserves Iran rolls barrels to the Russian Federation absolutely in vain. Without its participation it would be difficult to expect victory over the Americans. Moscow can afford oil at $40 a barrel, but Tehran needs prices to rise as high as possible. The White House's sanctions against it reduced local exports of black gold from 2.8 million bpd in April 2018 to 1 million bpd in November 2018 - April 2019. The end of the grace period for Iranian oil buyers, according to FGE consulting company, could pull down the figure to 0.5 million b/d, of 0.2 million b/d will be accounted for by China, which currently closes its eyes to the threats of the United States to deal with bypassing the sanctions countries. After OPEC revealed the cards, investor attention shifted to issues such as the potential improvement in global demand amid the de-escalation of the Washington-Beijing trade conflict and the sluggish dynamics of the manufacturing sector throughout the world. Business activity in this area of the US economy collapsed to its lowest level since autumn 2016, the global PMI closes below the critical level of 50 for the second month in a row, which has not happened to it since 2012. Technically, a necessary condition for the continuation of Brent's upward course in the direction of $68.4 and $72.8 seems to be keeping bulls above support at $64.1 per barrel. If this level is left for the bears, the risks of updating the May lows and the implementation of the 5-0 pattern will increase. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 07.02.2019 - Resistance on the test Posted: 02 Jul 2019 10:09 AM PDT IIndustry news: Additional comments from White House trade advisor Peter Navarro continue to cross the wires, via Reuters, as he speaks in an interview with CNBC. Below are some key quotes. "I hope the Fed will lower interest rates going forward." "U.S. policy toward Huawei and 5G has not changed, Huawei remains on the entity list." "Selling a small amount of chips to Huawei is small in the scheme of things." Trading recommendation:

Gold has been trading higher n past 24 hours but the resistance at the price of $1.404 came to the test and it is not good for buying here. In my opinion there is the potential for more down as long as the Gold is trading below the $1.424. Yellow rectangle – Resistance ($1.405) Blue trendline- Support ($1.382) Red trendline – Downward sloping trendline MACD oscillator is still in the negative territory below the zero, which is sign that sellers are still in control even there was a rally on the Gold. As long as the Gold is trades below the level of $1.424, I would watch for selling opportunities. Sell zone is set at the price of $1.405 (yellow rectangle). Downward target is set at the price of $1.382. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD 07.02.2019 - New momentum low on the oscillator, downward move still in play Posted: 02 Jul 2019 09:19 AM PDT Industry news: In her prepared remarks to be delivered in London, Cleveland Federal Reserve Bank President Loretta Mester on Tuesday argued that cutting rates now could reinforce negative sentiment and encourage financial imbalances and added that she'd like to gather more information before considering a change in the monetary policy. The US Dollar Index didn't react to these hawkish remarks and was last seen virtually unchanged on the day near 96.80 . Trading recommendation

: GBP traded according to my yesterday's game plan. GBP did almost tested our first target at the price of 1.2565. Anyway, I still see strong downside pressure and potential of downward targets at 1.2565 and 1.2515. Green rectangle – Support (1.2565) Blue rectangle- Support 2 (1.2515) Yellow rectangle – Intraday resistance (1.2630) MACD oscillator is showing the new momentum low in the background and the GBP is trading in the negative territory, which confirms my bearish view. Stochastic oscillator is in oversold zone together with the RSI oscillator, which is sign that we can see rally before new wave down. The level of 1.2600 is round number and potential good zone for selling, so pay attention to that level. As long as the GBP is trading below the 1.2665, I would watch for selling opportunities. The material has been provided by InstaForex Company - www.instaforex.com |

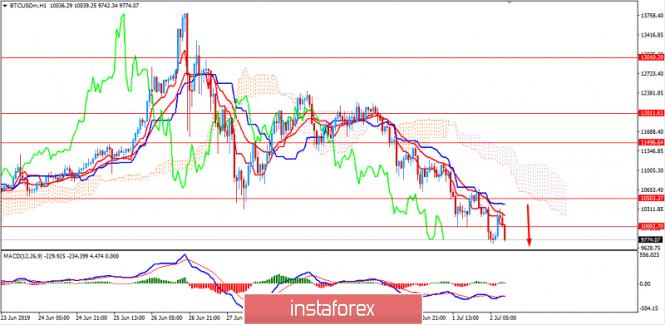

| BTC 07.02.2019 - Sell zone at the price of $10.600 Posted: 02 Jul 2019 08:57 AM PDT Industry news: Binance, the world's largest cryptocurrency exchange by trading volume, is soon to launch futures trading. During a presentation at the Asia Blockchain Summit in Taipei on Tuesday, Changpeng "CZ" Zhao, founder and CEO of the exchange, showcased a futures trading interface on Binance with features including longs and shorts on crypto assets. .Trading recommendation:

BTC did exactly what I expected yesterday. BTC did test our first target at the price of $9.695 and after then rejected. Pay attention to the resistance at the price of $10.612 cause it is good sell zone up there. Red rectangle – Support ($9.695) Green rectangle- Support 2 ($9.200) Purple rectangle – Resistance ($10.612) MACD oscillator is showing the new momentum low in the background and the BTC is trading in the negative territory, which confirms my bearish view. RSI oscillator and Stochastic are showing the potential rally before new selling wave. As long as the BTC is trading below $11.376, I would watch for selling opportunities on the rallies, level of $10.612 looks like a solid sell zone. Downward targets are set at the price of $9.695 and $9200.The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD no sign of reversal yet, trend remains bearish in the short-term Posted: 02 Jul 2019 07:17 AM PDT EURUSD is trading right above 1.13 but I believe this bounce from 1.1275 is just a pause to the down trend. Price is expected to move lower towards 1.1250 where we will see a big test of the trend.

Red rectangle - target area of possible reversal EURUSD is in a bearish short-term trend. Price is expected to move towards the red rectangle area and test the green trend line. EURUSD is at the 61.8% Fibonacci retracement of its last move higher, but I believe we might see price move a bit lower first before reversing. There is still no sign of trend reversal in the short-term, but I expect to see first signs of bullish divergence soon. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Jul 2019 07:13 AM PDT Gold price remains in a short-term bearish trend but medium-term trend remains bullish as long as price is above the break out area of $1,350-60. Gold price could make one minor new lower low but is expected to bounce strongly towards at least $1,400.

Red rectangle- broken support Gold price is trading right above the green trend line support. Price so far has retraced 50% of the rise from $1,320 and only 38% of the rise from $1,275. Gold price is expected to bounce from around current levels at least towards $1,400. Gold price has resistance the previous support at $1,400. Major resistance next is found at $1,425. If broken we expect Gold to see $1,500. Until then price is vulnerable to the downside. The material has been provided by InstaForex Company - www.instaforex.com |

| Dollar: do not retreat or surrender. Australian won back the decision of the Central Bank Posted: 02 Jul 2019 06:39 AM PDT The US dollar settled near a three-month low amid weak indicators of industrial production, while the Australian rose after the Central Bank lowered interest rates expectedly, but at the same time voiced a more balanced forecast. JPMorgan's global production index fell to its lowest level in almost seven years, the sector shrank for the second month in a row, and Morgan Stanley reports also showed a decline in world production for the first time since 2016. The dollar index versus the basket of major currencies fell by 0.1% to 96.75 points, not far from the three-month low of 95.84 reached last week, as traders are confident that the Fed will lower interest rates at least three times by the end of the year. Nevertheless, dollar's losses were relatively insignificant compared with a 0.6% rebound on Monday, when risky assets rose amid progress in relations between Washington and China. The Australian dollar is the only one in the world currency markets with strong growth, the AUD gained 0.3% after the Central Bank reported a rate cut and signaled a future weakening of monetary policy. The regulator lowered interest rates by 25 basis points, to a record low of 1.00%, in line with economists' expectations. In a statement, the bank said that it will resort to reducing rates again "if necessary." Some analysts called this phrase "the promise" of an additional rate cut, which previously seemed less likely. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Jul 2019 06:39 AM PDT

Another G20 summit ended with the conclusion of a trade truce between the United States and China. However, the market seems to doubt that all the difficulties have been left behind, because a trade truce is not the same as a deal. Morgan Stanley experts call the situation a "pause of uncertainty". "On the one hand, Washington and Beijing managed to avoid an immediate escalation of the trade conflict, and on the other – the path to a comprehensive agreement remained unclear," the experts noted. It is assumed that if US tariffs against China are not reduced or canceled, then the second largest economy in the world will face serious difficulties. Investors fear that if China "sneezes", then the rest of the world will " get sick". There is already evidence that this is possible: production activity in Australia, Britain and the eurozone is slowing. At the same time, the US is probably the only one who benefits from trade tariffs. Recent data show that production activity in the United States is ahead of forecasts, and in all other countries – behind them. Thus, protectionist policies of Donald Trump harms all other countries more than the United States, and this is one of the reasons why the greenback is becoming stronger in recent days. "We will remain in a long position on the dollar until the global economy shows signs of recovery, and until real prospects for a trade deal become clear," said George Bourbouras, Director of the Salter Brothers Asset Management. Morgan Stanley analysts warn that if the US does raise duties on the remaining Chinese goods of $300 billion, the world business cycle will be in great danger, and the global economy may plunge into recession in about three quarters. Apparently, the dollar is already beginning to show the nature of a protective asset in response to the expected slowdown in the world economy. Meanwhile, the head of the White House, Donald Trump, once again decided to aggravate the situation, saying that the deal with the Chinese should be concluded with some preferences for the American side, as China had a great advantage in trade with the US for many years. It is unlikely that such a twist will appeal to Beijing. If the latter refused to make concessions, the trade war could continue until a new president appears in the United States. The material has been provided by InstaForex Company - www.instaforex.com |

| July 2, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 02 Jul 2019 06:10 AM PDT

Since February 28, the EURUSD pair has been moving within the depicted channel with slight bearish tendency. Short-term outlook turned to become bearish towards 1.1175 (a previous weekly bottom which has been holding prices above for some time. On the period between May 17th and June 5th, temporary bearish breakdown below 1.1175 was demonstrated on the chart. This allowed further bearish decline to occur towards 1.1115 where significant bullish recovery brought the EUR/USD pair back above 1.1175 which stands as a prominent DEMAND level until now. Although Temporary Bullish breakout above 1.1335 was initially demonstrated (suggesting a high probability bullish continuation pattern), the EURUSD pair has failed to maintain that bullish persistence above 1.1320 and 1.1275 (the depicted price levels/zones). This was followed by a deeper bearish pullback towards 1.1175 where significant bullish price action was demonstrated on June 18. The EURUSD looked overbought around 1.1400 facing a confluence of supply levels. Thus, a bearish pullback was initiated towards 1.1275 as expected in a previous article. Further Bearish decline below 1.1275 calls for a deeper bearish pullback towards 1.1235 where the lower limit of the newly-established bullish channel comes to meet the pair. Overall, Short-term outlook remains bullish as long as bullish persistence above 1.1235 (Demand-Zone) is maintained on the H4 chart. Otherwise, short-term outlook will turn into bearish Trade recommendations : For Intraday traders, a valid BUY entry can be considered anywhere around 1.1235. Initial Target levels to be located around 1.1275 and 1.1320. Bearish breakout below 1.1200 invalidates this mentioned scenario. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Jul 2019 05:13 AM PDT To open long positions on GBP/USD, you need: The bear market continues to prevail. Buyers of the pound today in the afternoon need a return to the resistance of 1.2642, which was formed at the European session. Only after that, you can expect to update the highs of 1.2673 and 1.2705, where I recommend fixing the profit. In the scenario of further decline of the pound to the support area of 1.2608, it is best to look at long positions only after the test of the minimum of 1.2582 or buy GBP/USD for a rebound from large support of 1.2544. To open short positions on GBP/USD, you need: Bears will be counting on the speech of the Governor of the Bank of England, who can signal a longer period of current interest rates, which will put pressure on the pound. The repeated support test of 1.2608 will collapse the British pound in the area of the lows of 1.2582 and 1.2544, where I recommend fixing the profit. In case of an upward correction, a false breakout near the maximum of 1.2642 will be a signal to sell the pound. With the growth of GBP/USD above the maximum of 1.2642, you can count on short positions from the resistance of 1.2673. Indicator signals: Moving Averages Trading is below 30 and 50 moving averages, indicating a further decline in the pound. Bollinger Bands The growth of the pair will be limited by the upper boundary of the indicator around 1.2650.

Description of indicators

|

| Posted: 02 Jul 2019 05:13 AM PDT To open long positions on EURUSD, you need: A weak inflation report on producer prices, which fell, once again allowed euro buyers to form only a small upward correction, which was limited by the resistance of 1.1307. At the moment, the task of the bulls remains the same. A break and consolidation above 1.1307 will lead to further growth of EUR/USD with an update of the maximum of 1.1338, where I recommend fixing the profit. If the downward movement continues, it is best to return to the long positions on a false breakout from the support of 1.1273 or on a rebound from the new monthly low around 1.1239. To open short positions on EURUSD, you need: Like yesterday, the bears will try to form a false breakout in the resistance area of 1.1307, and the return under it in the afternoon will be a signal for the continuation of the downward trend, which will push EUR/USD to the low area of 1.1273 and will lead to the renewal of a larger support of 1.1239. If the demand for the euro continues, the upward potential will be limited by the resistance of 1.1338, just above which the upper limit of the downward channel passes. With their breakthrough, you can sell immediately on the rebound from the maximum of 1.1364. Indicator signals: Moving Averages Trading is conducted below 30 and 50 moving averages, and their test from the bottom up in the morning is a kind of signal to open short positions. Bollinger Bands The growth of EUR/USD is limited by the upper boundary of the indicator around 1.1310. A breakthrough in this area could lead to a larger euro growth in the afternoon.

Description of indicators

|

| BITCOIN completing winning streak? Posted: 02 Jul 2019 04:20 AM PDT Bitcoin is trading impulsively in a non-volatile market under bearish pressure. The price is currently trading below the $10,000 psychological support area. Bitcoin is fundamentally robust at present. Someone thinks that any volatile trading in the present is simply a flash in the pan that will ultimately be futile. Indeed, the crypto market recently impressed investors with its stellar rally. However, Bitcoin has been facing mounting selling pressure over the past week. The price has failed to rebound with confidence since it reached its year-to-date high of $13,800. This appears to be a near-term top that may not be revisited for some time. This bearish price action has caught many Bitcoin bulls off guard as the overall market sentiment turned sharply bullish after the price had broken above $10,000. The recent rapid rally triggered an influx of euphoria which has since subsided. After a solid rally, any asset makes a correctional decline. Bitcoin correction has accelerated today as BTC fell back below $10k, having hit $9,950 twice over the past few hours. Bitcoin has lost another 7 percent today and is currently trading just above $10k but may not stay there for much longer. A daily volume is shrinking and is currently back below $28 billion as lower lows start to appear on the hourly chart. From the technical viewpoint, the price is being held by the dynamic level of 20 EMA, Tenkan, and Kijun line as resistance with no signs of Bullish Divergence in MACD. This indicates further downward pressure. The price is currently quite impulsive under bearish pressure. BTC price is expected to move lower towards $8,500-9,000 before the most popular crypto currency regains bullish momentum. SUPPORT: 8,000, 8,500, 9,000 RESISTANCE: 10,000, 10,500, 11,000, 12,000 BIAS: BEARISH MOMENTUM: NON-VOLATILE

|

| July 2, 2019 : GBP/USD is demonstrating a high-probability short-term trend reversal. Posted: 02 Jul 2019 04:07 AM PDT

Since May 17, the previous downside movement within the depicted bearish channel was paused allowing the recent sideway consolidation range to be established between 1.2750 - 1.2570 with a prominent key-level around 1.2650. On June 4, temporary bullish consolidations above 1.2650 were demonstrated for a few trading sessions. However, the price level of 1.2750 (consolidation range upper limit) has prevented further bullish advancement. That's why, the GBP/USD failed to establish a successful bullish breakout above 1.2750. Instead, early signs of bearish rejection have been manifested (Head & Shoulders reversal pattern with neckline located around 1.2650). A quick bearish pullback towards 1.2650 was expected shortly. Bearish breakdown below 1.2650 (reversal pattern neckline) confirms the reversal pattern with bearish projection target located at 1.2550 and 1.2510. Short-term outlook remains under bearish pressure as long as the market keeps moving below 1.2650 (mid-range key-level and neckline of the reversal pattern). Moreover, Obvious Bearish breakdown below 1.2570 confirms a trend reversal into bearish on the intermediate term. Immediate bearish decline would be expected towards 1.2505 initially. On the other hand, a bullish position can ONLY be considered if EARLY Bullish persistence above 1.2650 is re-achieved on the current H4 chart. Trade Recommendations: Intraday traders can have a valid SELL Entry anywhere around the neckline of the depicted reversal pattern near 1.2650. T/P levels to be located around 1.2600, 1.2550 and 1.2505. S/L should be placed above 1.2700. The material has been provided by InstaForex Company - www.instaforex.com |

| GBPUSD: USD to gain momentum over GBP. July 2, 2019 Posted: 02 Jul 2019 03:50 AM PDT The GBP/USD pair was attempting to break above 1.2700 area but failed. Overall, the pair is trading in a bullish channel. According to the latest reports, the British manufacturers reported that the domestic orders have fallen to its lowest in seven years as Brexit uncertainty and the global slowdown take their toll. The British Chamber of Commerce recently stated that Manufacturing factories showed the weakest picture for export orders in four years in the April-June period while a slight pick-up for services firms was not strong enough to make up for a weak start to the year. Britain's economy began 2019 strongly, but the growth came largely from a surge in stockpiling by manufacturers seeking to protect themselves against the risk of border delays after the original March 29 Brexit deadline. Today UK Construction PMI report has been published. The reading decreased to 43.1 from the previous figure of 48.6. economists predicted an increase to 49.4. Moreover, tomorrow the UK Services PMI report is going to be published. The figure is expected to be unchanged at 51.0. Additionally, MPC Member Broadbent is going to give a speech about the monetary policy. The US dollar lost its gains despite a trade truce between the US and China. US President Donald Trump and his Chinese counterpart Xi Jinping have agreed during a bilateral meeting at the summit in Osaka, Japan, to hold off on imposing new tariffs on imports of each other's goods and to move forward with trade negotiations. The news sent stocks higher, but investor sentiment was later hit by disappointing manufacturing data from the U.S., as it showed growth of the country's manufacturing activities slowed last month and fell to its lowest level since September 2016. Market participants are awaiting the NFP report which is going to be published on Friday. What is more, the Average Hourly Earnings report is going to be released. The reading is expected to show an increase to 0.3% from the previous value of 0.2%, Non-Farm Employment Change is likely to grow to 164k from the previous figure of 75k and Unemployment Rate is expected to be unchanged at 3.6%. Today, FOMC member Williams is going to speak about the upcoming interest key rate cut decision. Investors hope that he'll give some hints about the future of the monetary policy. Now let us look at the technical view. The price is currently residing below 1.2700 area after surging up to 1.2700 area with a daily close. The price is heading towards 1.2500 area and expected to reach the area sooner than expected. As the preceding trend is bearish, further gains on the downside will not come as a surprise for market participants. |

| AUDUSD: USD to regain momentum ahead of RBA rate decision. July 2, 2019 Posted: 02 Jul 2019 03:46 AM PDT The Australian dollar has lost ground against the US dollar after the RBA announced its intention to lower its interest rate. What is more, the greenback was supported by optimistic NFP expectations. The RBA Official Cash Rate report has been published today. It indicated a decrease to 1.00% as expected from the previous value of 1.50%. RBA governor Philip Lowe made hints about a possible key rate cut in the future. He said that the RBA would be poised to act appropriately if the risks of the global economic slowdown and trade uncertainty remained. The head of the RBA noted low borrowing costs, high commodity prices, a weaker currency, and rising household incomes were cause for optimism. According to certain observation and analysis, the Australian economy is still open for reasonable growth, low unemployment, and inflation. As the global risks are quite high, the RBA is expected to be flexible with the inflation and rate decisions in the coming months. The US dollar lost its gains despite a trade truce between the US and China. US President Donald Trump and his Chinese counterpart Xi Jinping have agreed during a bilateral meeting at the summit in Osaka, Japan, to hold off on imposing new tariffs on imports of each other's goods and to move forward with trade negotiations. The news sent stocks higher, but investor sentiment was later hit by disappointing manufacturing data from the U.S., as it showed growth of the country's manufacturing activities slowed last month and fell to its lowest level since September 2016. Market participants are awaiting the NFP report which is going to be published on Friday. What is more, the Average Hourly Earnings report is going to be released. The reading is expected to show an increase to 0.3% from the previous value of 0.2%, Non-Farm Employment Change is likely to grow to 164k from the previous figure of 75k and Unemployment Rate is expected to be unchanged at 3.6%. Today, FOMC member Williams is going to speak about the upcoming interest key rate cut decision. Investors hope that he'll give some hints about the future of the monetary policy. Now let us look at the technical view. The price is currently residing below 0.70 area with a daily close after significant bearish pressure. The price recently formed Bearish Divergence pushing the price lower towards 0.6850 support area in the coming days. Though the price managed to soar up today, it still remains below 0.7000-50 area with a daily close indicating a further decrease. |

| The active easing of the policy by the ECB may give a fresh impetus to the decline of the euro Posted: 02 Jul 2019 02:12 AM PDT

According to Goldman Sachs, the active policy easing by the European Central Bank (ECB) could give a fresh impulse to the euro decline. "Strengthening the expectations regarding the reduction of the interest rate the Fed provided some support for the EUR / USD pair , but attempts to grow because it may be unsustainable. We believe that the ECB will not be long in coming and will strike back, "said strategists at an investment bank. They believe that the European regulator may lower the rate on deposits by 20 basis points, and in September even launch a new program of quantitative easing (QE). According to experts, the ECB has room for maneuver in the framework of the asset purchase program. "Within the framework of the existing restrictions, the financial institution can only purchase government bonds worth up to 400 billion euros. Also, the European Central Bank may increase purchases of corporate securities, but we are inclined to believe that the new QE program will be discreet and will limit purchases of assets in the amount of 30 billion euros for nine months, "said representatives of Goldman Sachs. "We expect the ECB to demonstrate the "pigeon" bias already at the July meeting. At the end of which, the regulator will report that the potential of rates for further reduction. And for this purpose, he will remove the phrase "mid-2020" as an alleged period of maintaining rates at current low levels. In addition, the Financial Institute may consider introducing a multi-level system of rates depending on the size of excess reserves that banks hold in the ECB," they added. The material has been provided by InstaForex Company - www.instaforex.com |

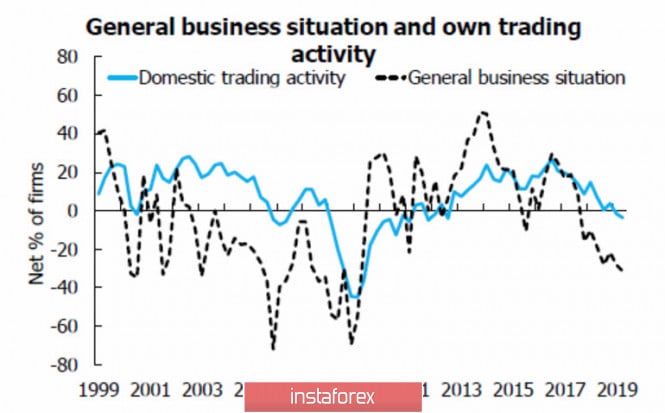

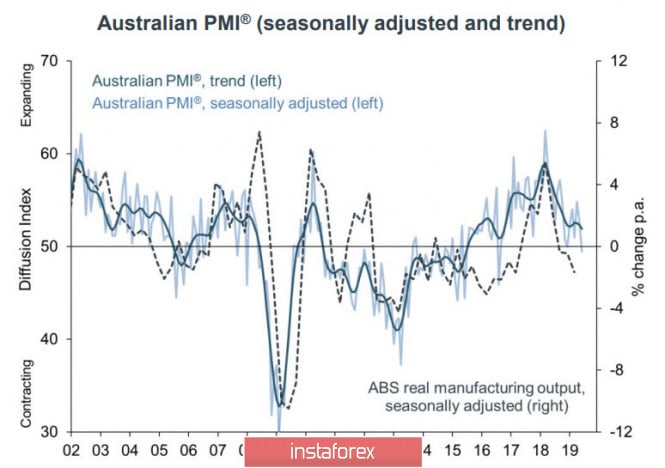

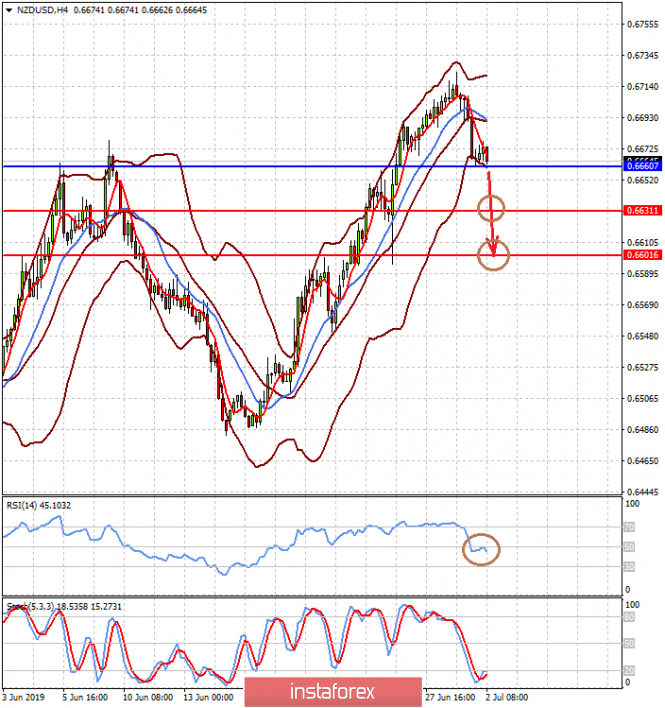

| Posted: 02 Jul 2019 01:48 AM PDT Markets continue to play the optimism achieved at the G20 summit, yet its stability is already being questioned. Stock indices are trading in the green zone but after a strong downward roll, gold is approaching $1,400 again. Bond yields have sharply gone down, indicating an increase in demand for defensive assets. The Caixin PMI index in China's industry dropped to 49.4p, repeating the result from NBS and the threat of a slowdown forces the Chinese authorities to apply incentives to maintain activity. In particular, it announced an intention to reduce the required reserves ratio for banks and lower real interest rates in order to facilitate the financing of small enterprises. This is certainly not the last thing. The threat of a slowdown in China means the threat of a slowdown in the entire global economy. NZD/USD pair The NZIER quarterly study showed a deterioration in the basic health indicators of the New Zealand economy. Business confidence fell to its lowest level since March 2009 and a net of 31% of enterprises expect a deterioration in overall economic conditions in the coming months. Demand is declining. Enterprises are waiting for the development of negative dynamics in the next quarter, which suggests a decrease in GDP growth below 2% in the second half of 2019. The most visible pessimism is in the manufacturing sector. Confidence among producers fell to its lowest level since December 2008, that is, in fact, to the level of panic in the most acute phase of the crisis. More than half of manufacturers expect to deteriorate in the coming months. The overall profitability of the business has fallen to its lowest level since March 2011 and only one indicator allows us to hope that a massive failure can be avoided given the still-growing investment in business and the associated growth wages and a stable labor market. Despite the fact that the RBNZ left the key rate unchanged at the last meeting, his comment became even more dovish. The deterioration in the prospects for the world economy led to a number of statements by the leading Central Bank about the intention to continue the stimulus. The yield of bonds plummeted, thus it went down, as well as the local incomes. Most banks expect two rate cuts in the current year, which coincides with expectations at the Fed rate. It means that the RBNZ will generally maintain parity with the Fed at the rate and the Kiwi rate will not be subjected to strong pressure from this side in any direction. While the markets reigned complacency caused by a pause in the trade war between China and the United States, the Kiwi will look confident against the dollar. Now, the support of 0.6660/80 is being tested. If it stands, the NZD/USD pair will return to the maximum of 0.6727 in order to update it. If the bears increase the pressure, then a decrease to 0.6610 / 20 is possible, followed by a departure to the lateral range. However, this is a slightly less likely scenario. AUD/USD pair On the eve of the meeting, the RBA AiG confirmed the worst fears. Report on the fall in manufacturing PMI from 52.7% to 49.4% in June actually confirmed the start of the production reduction phase. This is the lowest level since August 2016. Monetary stimulation in Australia is more justified than in New Zealand since Australia looks worse for a number of key parameters. Inflation in Australia is only 1.3% against the RBNZ forecast of 1.7% for Q2. Unemployment is 5.2% with 66% of the working-age population in the labor force while in New Zealand, these figures are 4.2% and 70%, respectively. The growth rate of the average wage is also not in favor of Aussie as ANZ Bank predicts a growth of 2.3% in New Zealand and only 1.8% in Australia. As a result, today's decision of the RBA to lower the rate for the second time in a row to 1% did not cause any surprise in the markets as it was confidently predicted. Moreover, the RBA has reserved the right to further rate cuts and therefore it is not necessary to expect an increase in Aussies in the near future. he most likely scenario is a decrease in the AUD/USD pair to the nearest support of 0.6955 with a further breakout to 0.6926. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Jul 2019 01:35 AM PDT The central banks of economically developed countries seem to be confident that the Fed will start lowering interest rates this year, which was clearly manifested in the decision of the Reserve Bank of Australia. They decided to lower the key interest rate by 0.25%, from 1.25% to 1.00% at today's meeting. As it seems to us, this is a strong signal for investors, indicating that the American regulator might be sure to lower interest rates in July following the June meeting. The question of how much remains. It will either by 0.25% or, as it was expected more recently by the markets by 0.50%. the moment, according to the dynamics of futures on federal funds rates, markets expect lower interest rates by 0.25% with a 78.6% probability as a result of the recent Fed meeting. This is a fairly high value. Note that the Central Bank of economically developed countries responded earlier at the beginning of this year to the change in Fed sentiment about continuing the interest rate increase cycle only by stopping changes in their monetary policies. In other words, they simply left their interest rates unchanged, carefully watching the Fed's actions. On Monday, the dollar received significant support against major currencies despite expectations of lower rates in America. On the one hand, it is strange in the context of the forecast of lowering central bank rates and on the other, it is justified. The decision of the RBA to lower the rates just explains it. It seems that while the Fed will balance its decision to lower rates or not, and considering the negotiation process between Washington and Beijing on trade the growth dynamics of the global economy and the output of economic statistics, the ECB and other regulators of economically developed countries will begin to soften their monetary policies. For example, the head of the Finnish Central Bank Olli Rehn, who is a potential successor to Mario Draghi as president of the ECB, said that "the Board of Governors is ready (based on the conditions) to adjust all of its instruments. The ECB is being pushed towards such radical actions by negative dynamics in the economy of Germany and a number of other eurozone countries, as well as clear signs of recession in the region as a whole, which was clearly shown by the data of business activity indices in the manufacturing sector of Germany, Italy, France and the eurozone in general. Indicators have been long below the threshold of 50 points. At the same time, this indicator for the USA showed a decline to 51.7 points in June against 52.1 points in May, but it is still above the level of 50 points. In general, we note that the local growth of the dollar so far can be explained by the slower growth of the American economy compared to Europe as an example. However, the situation may change dramatically if in the near future weaker economic statistics will come in, which may force the Fed to act more resolutely. However, the situation may change dramatically if in the near future weaker economic statistics will come in, which may force the Fed to act more resolutely. Forecast of the day: The EUR/USD pair found support at 1.1380 after falling the day before. It may correct upwards to 1.1315 on the wave of local oversold. We consider it possible to sell it from this mark with the target of 1.1245. The NZD/USD pair is trading above the level of 0.6660. The pair may be under pressure and continue to decline to 0.6630. Then, it will likely go to 0.6600 on rising expectations of lowering RBNZ interest rates after what the RBA did today. |

| Burning forecast 07.02.2019 EURUSD and trading recommendation Posted: 02 Jul 2019 12:58 AM PDT

Negative news on the possible trade war Trump - Europe - due to claims against Airbus from Boeing (Airbus has government support that prevents equal competition) - this led to a strong decline in the euro, which is below 1.1300. The growth trend for the euro stopped, then return to the range - the boundaries of 1.1180 and 1.1395. From the point of view of technical analysis, we buy at the breakthrough of 1.1395. Sales are possible at the breakdown of 1.1180. In case of growth to 1.1350 and above, the last minimum in the region of 1.1275 will be a new level to enter down. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment