Forex analysis review |

- Draghi "shakes out" the euro from a narrow range

- Expectations of a rapid decline in interest rates, the Fed and the ECB continue to conduct markets

- Funny elections in the UK, boring meeting of the ECB and much more (weekly review of EUR/USD and GBP/USD from 07.22.2019)

- GBP/USD. Boris Johnson - five minutes to the prime: we continue to sell the pound

- GBP/USD. July 22. Results of the day. Boris Johnson's victory in the elections is more likely a negative than a positive

- EUR/USD. July 22. Results of the day. The market is completely calm. The situation is unlikely to change until Wednesday

- The euro is waiting, the ECB is not

- AUDUSD back tests break out area

- EURUSD tests 1.12 support

- Short-term bear flag pattern in Gold

- July 22, 2019 : EUR/USD maintains short-term bearish outlook below 1.1235.

- July 22, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- BTC 07.22.2019 - Sell zone at the price of $11.000

- Gold 07.22.2019 -Bearish flag pattern in creation

- GBP/USD: the moment of truth for the pound, who will be the next UK Prime Minister?

- Bullish rally about to begin in USD/CHF

- EUR/USD for July 22,2019 - Potential rally incoming

- Bitcoin: Local bullish opportunity

- GBP/USD: plan for the American session on July 22. Bears continue to push the pound down, achieving a breakthrough of the

- Gold falls below $1440. July 22, 2019

- BITCOIN struggling to hold above $10,500. July 22, 2019

- EUR / USD plan for the US session on July 22. The lack of news and the calm before the storm

- Technical analysis of GBP/USD for July 22, 2019

- Technical analysis of USD/CHF for July 22, 2019

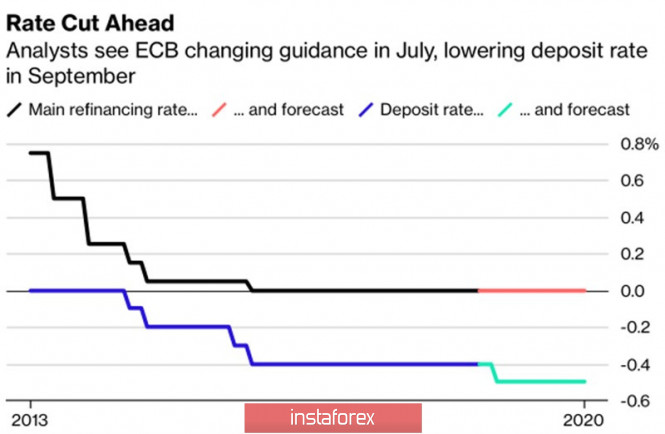

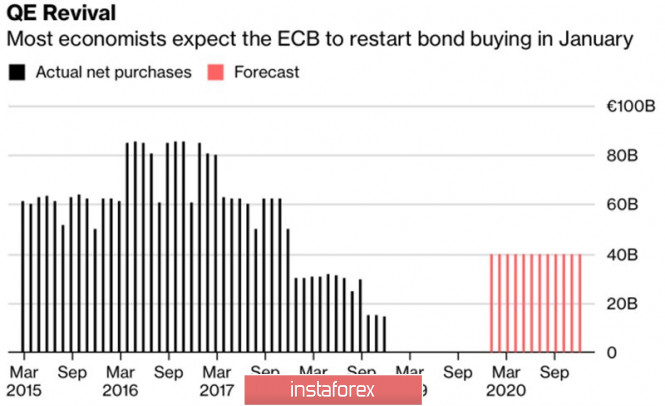

- Control zones for NZD/USD pair on 07.22.19

| Draghi "shakes out" the euro from a narrow range Posted: 22 Jul 2019 05:38 PM PDT Attention in the foreign exchange markets is focused on the world central banks' decisions on rates. This week, traders have switched to the eurozone and its economy looks bleak. If the Fed wants to act proactively, the ECB, perhaps, cannot do without this measure. Under the influence of weak external demand, the German economy may slow growth this year to 0.5%. Inflation in Europe, despite a large-scale stimulus, is not able to exceed the level of 1.3%. The ECB, meanwhile, constantly cuts GDP estimates in the region. Many Bloomberg respondents believe that the European regulator at the July meeting will signal the easing of monetary policy in September. Representatives of UBS, HSBC and Nomura are waiting for the second rate cut on deposits in December, and analysts at Commerzbank saw an opportunity to cut it by 20 bp this week. It should be noted that this bank is not alone in its opinion. The probability of reducing the cost of funds raised at the upcoming meeting of the Governing Council exceeded 50%, whereas a month ago it was about 25%. Market expectations of Mario Draghi's "dovish" rhetoric are extremely high and can provoke a rebound in the euro on the facts. When most of the "bearish" drivers are already taken into account in the value of the currency, a sharp leap is catching newbies unawares, while professional participants are not surprised. Drawing attention to the ratio of premiums between options for the purchase and sale of the single currency, it can be understood that the number of bulls in the market is gradually increasing. It is possible that on the expectations of signals from Draghi, sellers of the EUR/USD pair will try to test support at the level of $1.12. However, traders need to brace for the fact that this time EUR/USD will also ride on a roller coaster. In short, the week for the main pair promises to be complex and extremely volatile. I must say that just a day before the ECB meeting, the sale of the euro may increase. Such a movement will contribute unfavorable reports on activity in the services sector and the production of the region. The new batch of weak statistics is expected to be another proof that the eurozone economy cannot do without new incentives. It is worth noting that the proximity of the FOMC meeting at the end of this month could keep the euro from a strong decline. What will the Fed say? The chances of a strong easing of the Fed policy are rather weak, but there still are. Fed as a preventive measure will reduce rates by a quarter percentage point. By the more courageous actions that traders are waiting for, the US central bank is hardly ready. In addition, now there is no need to cut rates by 50 bp, as the latest data does not signal a sharp decline in the US economy. A low profile is taken into account in the quotes, so do not expect a strong weakening of the dollar. Traders will carefully study the text of the accompanying statement in order to understand further plans regarding US rates. The Fed's position is not only interesting to participants of financial markets, but also the ECB. European financiers will probably want to listen to American ones before deciding to resume the quantitative easing program and lower interest rates. If the members of the European regulator decide on some measures, this will happen not in July, but in September. In this regard, the focus of the market on Thursday will be sent to the press conference of the ECB. In previous periods, the comments of Mario Draghi, voiced after the meeting, moved the euro by 3% or more in a short time. Will the Bank of Japan follow its colleagues? The Bank of Japan's target inflation is 2%, However, so far this level can only be dreamed of. In June, the figure was exactly the same as a year ago - 0.7%. The regulator may well begin to reflect on the rate cut, as has already been done by his colleagues from the APR - Australia, India, Indonesia and South Korea. On Monday, Japanese Prime Minister Shinzo Abe declared his readiness to take all necessary measures, flexibly and without hesitation, if the situation requires. The risks to the Japanese export-dependent economy are increasing. The slowdown in China's GDP growth, its trade war with the United States and the spread of protectionism led to the seventh monthly drop in Japanese exports and a weakening of industry. "There is still uncertainty about the prospects for the global economy, such as trade friction and the exit of the UK from the European Union. We will not hesitate to respond to the risks associated with a fall, and we will take flexible and all possible steps. If necessary, the cabinet will take more aggressive and bolder economic measures than ever, " said Abe at a press conference after his ruling coalition retained a solid majority in the elections to the upper house. Most analysts believe that the Bank of Japan will not take emergency measures yet, which cannot be said about the Fed. In this situation, the USD/JPY pair can not only descend to the horizon of 106.75, but, breaking through it, rush to the low of the beginning of the year - 105. |

| Expectations of a rapid decline in interest rates, the Fed and the ECB continue to conduct markets Posted: 22 Jul 2019 05:19 PM PDT For the second week in a row, the EUR/USD pair has been trading in a fairly narrow range, limited by the levels of 1.1190 and 1.1285. The markets continue to lead expectations of a quick decline in interest rates of the Fed and the ECB. "The moment of truth is not far off, as soon the leading central banks of the world will have to reveal intentions on their monetary policy," JPMorgan Chase experts noted. This week, July 25, the ECB will hold a regular meeting at which, as expected, the regulator will lay the foundation for future monetary easing. "Mario Draghi effectively began his term of office as president of the ECB, lowering the rate at the first meeting. On Thursday, he can prepare the ground for a no less spectacular care and give a signal of a softening of the monetary rate in September," Bloomberg Economics predicts. While some analysts believe that the European Central Bank may announce a reduction in the key rate at the next meeting, others believe that the rate will remain unchanged until the end of September, that is, zero. It is assumed that in the first case, the EUR/USD pair may sharply go down, and in the second case, there should not be strong fluctuations in quotations. As for the Fed, there is no doubt that the regulator intends to soften its policy and, most likely, will do so already in July. However, the question still remains: how much will the US central bank cut the rate by 25 or 50 basis points? According to the head of the Federal Reserve Bank of St. Louis, James Bullard, a decrease of only 25 basis points would be appropriate. "The greenback can significantly weaken if the Fed gives grounds to believe that it is open not only for insurance (one-off) rate cuts," said Hans Redecker, strategist at Morgan Stanley. BNP Paribas analysts, in turn, draws attention to the fact that the Fed's ability to mitigate policy in response to weak inflation, slowing economic growth and external risks are much more significant than those of the ECB, and the effect of lowering rates in the US, given the role of the dollar in the world, will be more palpable. "In the near future, the single European currency may be under pressure, but we do not expect serious losses from it," said the financial institution representatives. According to the BNP Paribas forecast, in the third quarter the EUR/USD pair will rise to the level of 1.18 and to 1.19 in the fourth. Of the events that may have an impact on the formation of short-term trends, it is worth mentioning the publication of July releases on business activity in the eurozone and the US (July 24) and the release of data on US GDP in the United States for the second quarter (July 26). The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Jul 2019 04:41 PM PDT In fact, all week we have been contemplating a sluggish dollar strengthening, which unexpectedly gave way to a weakening on Thursday evening. Such a quick leap was caused by the statements of John Williams, who heads the Federal Reserve Bank of New York, and who is also a member of the Federal Commission on Open Market Operations. It is safe to say that the second member of the Federal Commission on Open Market Operations has openly announced his intention to vote for lowering the refinancing rate, not only at the end of July, but one more time before the end of this year. Yes, the market has long been ready for such a development of events, but it is based only on rumors, speculation and assumptions. In fact, only James Bullard not only openly expresses his opinion, but even during the last vote he voted just to soften the parameters of monetary policy. Now there are already two of them. And where there are two, there are three. In short, investors have received final confirmation that by the end of the year the Federal Reserve will reduce the refinancing rate twice. This was the reason for the sudden weakening of the dollar. Which, however, was short. At the same time, the dollar had a serious reason for growth in the form of data on retail sales, whose growth rates accelerated from 2.9% to 3.4%. Not only does this growth in retail sales indicate a high likelihood of renewed inflation, but a number of other indirect data on inflation also indicated that its slowdown is temporary. So, retail sales data dispelled all doubts about further inflation dynamics. In addition, the total number of applications for unemployment benefits fell by 34 thousand instead of the expected 20 thousand. In particular, the number of initial applications, as predicted, increased by 8 thousand. And the turn, the number of repeated applications for unemployment benefits fell not by 28 thousand, and 42 thousand. And considering the fact that it is inflation and the labor market that are the main indicators for financial markets, it is not surprising that the dollar has steadily strengthened, and even Williams' speech only halted this process. But the question immediately arises: why then does the Federal Reserve plan to lower the refinancing rate twice already, if the most important indicators look very good. The point is in other indicators that reflect the state of other sectors of the economy, and they are not so joyful. For example, the growth rate of industrial production slowed down from 2.1% to 1.3%, while the utilization of production capacity decreased from 78.1% to 77.9%. Inventories rose another 0.3%, continuing to grow for twenty-five months. The combination of slower growth in industrial production and growth in stocks clearly indicates the growing risks of the development of a crisis of overproduction. In addition, the number of building permits decreased by 6.1%, while the number of construction projects started decreased by 0.9%. So the state of affairs in the American economy is really not as rosy as it may seem at first glance. Especially if you look only at the labor market and retail sales. Europe responded with an unexpected increase in inflation, from 1.2% to 1.3%. But this did not impress the market at all. The dollar's growth only stopped momentarily. The fact is that everyone has long been accustomed to the periodic acceleration of inflation in Europe, which is rather quickly replaced by its slowdown. Mario Draghi can refer to various studies and scientific works, which predict a rapid increase in inflation from year to year. Who and now there. Moreover, the European Central Bank does not seem to believe all of these studies conducted on its request, otherwise it would not have postponed consideration of the issue of the refinancing rate in the middle of next year. British statistics were also ignored, although they were clearly optimistic. Inflation remained unchanged, while the growth rate of retail sales accelerated from 2.2% to 3.8%. The situation is not bad in the labor market, where, despite the increase in the number of applications for unemployment benefits from 24.5 thousand to 38.0 thousand, the unemployment rate remained unchanged. Moreover, the average wage growth rate accelerated from 3.4% to 3.6%, and taking into account premiums, that is, with processing, from 3.2% to 3.4%. Although the latter indicator expected a slowdown. But here everything is connected with the expectations of the outcome of the election of the new head of the Conservative Party. All the more so about Brexit again reminded, and in a rather interesting form. For many, it was a surprise that the UK and the European Union continue to negotiate on this issue. Europe, which, through the words of Jean-Claude Juncker, has repeatedly stated that there will be no new negotiations and no concessions should be expected, it is still trying to find some compromise to avoid an unregulated Brexit, since its consequences are rather difficult to predict. But the very same Jean-Claude Juncker has repeatedly stated that Europe has already prepared the necessary regulatory framework, designed to protect Europe from the most negative consequences. But once negotiations continue, he is somewhat cunning. At the same time, the representatives of Great Britain are extremely optimistic about the course of the negotiations, but the Europeans openly say that the British are banal blackmailing them, demanding that they make inadmissible concessions, right now. If not, then Boris Johnson will become prime minister and immediately declare withdrawal from the European Union without a deal at all, and let Europe itself rake the consequences. In other words, the parties cannot come to a compromise in any way, and they just once again reminded everyone that the consequences of an unregulated Brexit are unpredictable. And it always scares investors much more than understanding what will be bad. To be honest, this week there are not too many important macroeconomic data, and we will start with good news. Thus, housing sales in the secondary market of the United States should grow by 0.2%, and new homes, by as much as 6.6%. So expectations of rising inflation will receive new justification. Also, orders for durable goods can grow by 0.7%. Last but not least, preliminary data on business indices should fairly please investors. In particular, the business activity index in the services sector should grow from 51.5 to 51.6, and production from 50.6 to 51.4. As a result, the composite index of business activity may show an increase from 51.5 to 52.1. But the good news ends there. Although this is a lot. True, if this week the GDP growth rate for the second quarter does not come out, which will almost certainly show a slowdown in economic growth from 3.1% to 1.8%. And such a serious slowdown in economic growth will obviously greatly disappoint market participants. True, these data will already complete the week, so that during all the previous days the dollar will be able to continue to grow. True, the dollar will be able to grow only if it does not interfere with the single European currency. But this is extremely unlikely. The fact is that, unlike the United States, preliminary data on European business activity indices should show a slightly different result. Yes, the production index can grow from 47.6 to 47.7, but in the service sector it is expected to decrease from 53.6 to 53.3. The result of all this will be a decrease in the composite index of business activity from 52.2 to 52.0. But of course the main event will be the meeting of the Board of the European Central Bank. True, its results will bring nothing, except for regular streamlined phrases about the need to closely monitor the situation, as well as the intention to return to the question of the size of the refinancing rate no earlier than the middle of next year. They may still refer again to new studies that already promise a year of rising inflation, which no one has seen in their eyes for many years. In other words, the dollar has no choice but to continue to grow, and it will be able to complete the week at a mark of 1.1150. No macroeconomic data will be published in the UK, but even without this it will be a lot of fun, since on Tuesday the results of the election of the new head of the Conservative party, and the prime minister will be known. Virtually no one doubts that they will be Boris Johnson, who promised to withdraw the United Kingdom from the European Union in October. Obviously, the outcome of the victory of Boris Johnson will be precisely unregulated Brexit, with all its unpredictable consequences, so that the pound will be under severe pressure. It turns out that the pound will have to decline all week, and only on Friday this fascinating process will be stopped by data on the GDP of the United States for the second quarter. The benchmark for the pound is 1.2350. |

| GBP/USD. Boris Johnson - five minutes to the prime: we continue to sell the pound Posted: 22 Jul 2019 04:40 PM PDT So, the political struggle in Britain reached the final stage: a large-scale voting among 160 thousand "ordinary" Conservatives ended tonight, tomorrow we will know the name of the new leader of the Conservative Party, and the day after tomorrow - he will begin his duties as prime minister of the country. However, there is no intrigue here: throughout the entire period of the election race, Boris Johnson was an obvious and inaccessible favorite - even numerous scandals and protests could not significantly lower his rating. Therefore, today we can confidently say that the odious ex-foreign minister will be the new owner of the office in Downing Street. The inevitability of this fact is also indicated by the beginning resignations of the ministers of the Theresa May government. In particular, the representative of the British Foreign Ministry, Alan Duncan, said that he would not work in Johnson's cabinet. Similar statements were made by other ministers (in particular, justice, finance), only in a hypothetical context. Johnson himself, in his turn, has already managed to "fire" his opponent Jeremy Hunt, who today is still the Minister of Foreign Affairs. Obviously, when Johnson's victory becomes a legal fact, many (overwhelmingly) government members will also leave their posts. Growing political uncertainty in any conditions puts pressure on the national currency. However, in this case, the uncertain prospects of Johnson's political relationship (with both the government members and the House of Commons deputies) will be multiplied by the uncertainty about Brexit's prospects. Although traders have already managed to "accept" the victory of the ex-minister of foreign affairs, his harsh remarks about Brussels, expressed in the role of the prime minister, will put additional pressure on the pound. In general, the game against the pound has been a win-win character for several months. Even if the GBP/USD pair showed large-scale growth (to be more precise, a large-scale correction), bears have subsequently not only returned the price to their previous positions, but also "captured" new price horizons, thus consolidating a new (two-year) low - 1.2385. Now a regular price pullback followed, but the trend, as it was downward, remained so - and the factors putting pressure on the pound, in the near future will only increase their influence. Also, the pound ignored the promises of Boris Johnson that he would conclude a free trade agreement with the European Union. In his opinion, a compromise between London and Brussels is possible and necessary - and a common denominator can be reached within the framework of a free trade agreement, which he intends to negotiate after the British leaves the EU. He also called the problem of border control between Ireland and Northern Ireland "the only problem in the way of the Brexit deal." He also promised to look into this issue - but again, in the context of his understanding of the "compromise". In other words, Johnson demonstrates his "contractual capacity", however, the ideas declared by him are unlikely to be realized, given the rather rigid position of Brussels. Therefore, the market ignored such seemingly friendly rhetoric. In general, according to most analysts, the first political decisions of Johnson will be made in respect of members of the House of Commons. Considering the results of the previous polls, the British Parliament is unlikely to be led by the new prime minister and will support the "hard" Brexit. Not only Labour, but many Conservatives are against this scenario and Johnson is well aware. Therefore, in order for his scenario to be realized, he will first need to enlist the support of the deputies' corps - and, most likely, no longer of the current convocation. Thus, according to The Times, Johnson plans to hold early Parliamentary elections in the near future in order to implement all of his legislative initiatives that accompany the "hard" Brexit (primarily in the tax field). True, according to other information, the deputies plan to prevent this - Johnson can take a vote of no confidence almost during the first months of his term in power. Especially if he tries to withdraw the country from the European Union without a deal on October 31. According to anonymous sources in the British press, the Labour Party initiates a Parliamentary vote on this issue at the end of the summer, and it will be supported by Conservatives from among the "centrists". Here it is worth noting that last Thursday the House of Commons had already adopted an amendment that is intended to complicate Johnson's ability to terminate the activities of Parliament, in order to bypass the deputies to withdraw Britain from the Alliance without a deal. The MPs supported the Benn-Burt amendment, the essence of which is as follows: even if the work of the House of Commons is terminated, deputies can still hold meetings for five days, in particular, to consider the work of the Irish parliament. This amendment alone will not be able to stop the chaotic Brexit, but it will provide MPs with a temporary gap to pass laws that de jure and de facto block the country's exit from the EU without a deal. All this suggests that the main political battles involving Johnson will unfold in the first place not in Brussels, but in London, where the British Parliament will become the "battlefield". And although in the end, deputies can save the country from a hard Brexit, the very fact of political confrontation will put a lot of pressure on the pound. That is why a further game against the British has a practical meaning: paired with the dollar, the pound retains the potential to decline to the support level of 1.2380 (the bottom line of the Bollinger Bands indicator on the daily chart). This target pair can test in the coming days, against the background of Johnson's first statements in the role of the British prime minister. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Jul 2019 04:23 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 67p - 125p - 75p - 134p - 80p. Average amplitude for the last 5 days: 96p (92p). The British pound sterling has adjusted to the Kijun-sen line, which is supporting the pair's upward prospects. The price rebound from it may provoke a resumption of the upward movement, but there is a more significant factor for the GBP/USD pair for the coming days - these are the results of the election of the leader of the Conservative Party and the prime minister of Great Britain. The results will be known tomorrow in the morning. It is difficult to say how the market will react, for example, to the victory of Boris Johnson. On the one hand, Johnson supports the hard Brexit, which, according to many analysts and Mark Carney, will be destructive for the country's economy. On the other hand, Parliament has already insured itself against this case and will not allow Johnson to exit without a "deal". Thus, by and large, all of Johnson's campaign promises already look dubious. If there is no hard Brexit, Theresa May's Brexit deal, then what will happen? It is this question that perfectly illustrates everything that is happening in the UK in recent months or years. We do not even have a relatively probable scenario. Thus, in such a situation, we, the traders, are left to observe what is happening and react to the news, data, performances, and the pound remains to pray that the traders do not begin to get rid of it again. Consolidating the price below the critical line will make the bears more active, which will most likely return the pair to a support level of 1.2395. Trading recommendations: The pound/dollar currency pair continues to make a downward correction. Formally, long positions remain relevant with the target level of 1.2588, after the completion of the current round of correction. However, longs are still associated with increased risks. It will be possible to buy the US dollar after the reverse consolidation of the pair below the Kijun-sen line which will lead to a change in the trend into a downward one. The first goal is the support level of 1.2395. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chikou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

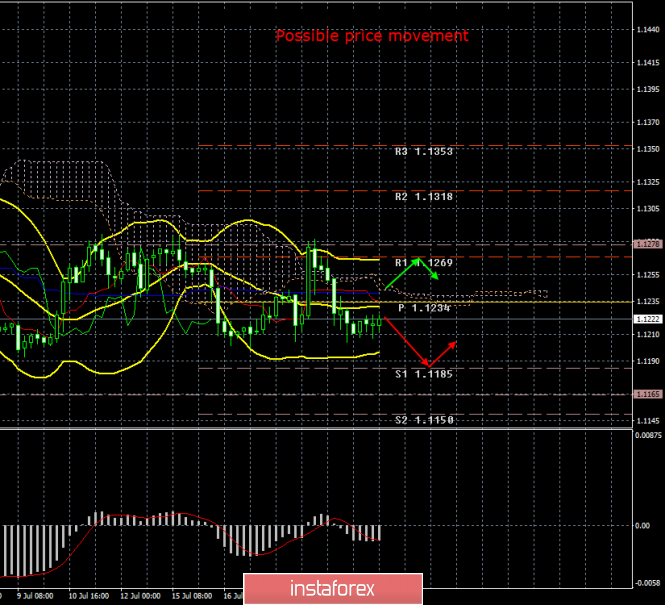

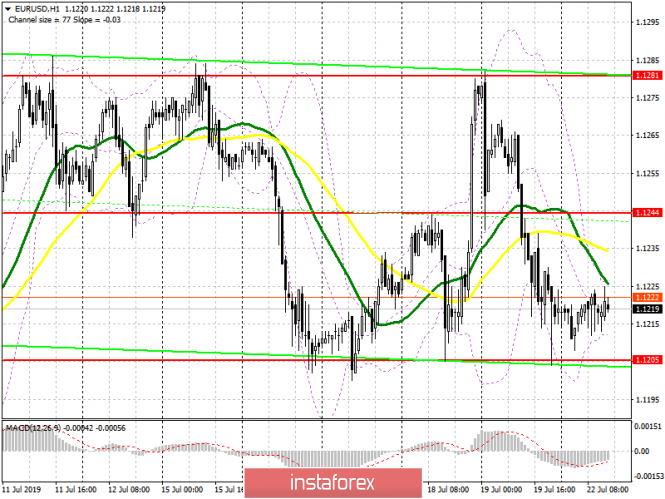

| Posted: 22 Jul 2019 04:08 PM PDT 4-hour timeframe The amplitude of the last 5 days (high-low): 31p - 62p - 34p - 75p - 78p. Average amplitude for the last 5 days: 56p (48p). The first trading day for the EUR/USD pair ends as expected with a full flat and low volatility. Traders are fully focused on the ECB meeting, which will be held this Thursday. Today, there was no news or macroeconomic publications either in the United States or in the European Union. Thus, the market lethargy is quite logical and explainable. Tomorrow the situation for the euro/dollar is unlikely to change. No news and economic reports will be available tomorrow, unless it is not planned. Moreover, all the attention of the public, traders and experts will be focused on the results of the election of the prime minister of Great Britain, which will become known in the morning. Accordingly, the whole trading day will work out of these results, Jeremy Hunt and Boris Johnson will certainly give an interview. Most likely, any statements from the side of the first persons of the European Union will follow. All this information will be crucial to the pound sterling. Returning to the euro currency, the situation is completely clear. Traders simply have no choice but to wait for important news and the ECB meeting. Only after the announcement of the results, when the foreign exchange market realizes how much Mario Draghi's rhetoric will be dovish in his last months of the presidency will it be possible to draw certain conclusions. Most likely, the euro's fall will continue, as too many factors are in favor of this, including technical ones. At the moment, the pair is trading near its local low, but the bulls still show a very weak desire to take the initiative, despite the attractiveness of current price levels for purchases. Support from the United States does not come in recent days, and the reduction in the Fed's key rate is most likely already laid in the pair's current course. Trading recommendations: The EUR/USD pair completed the next round of upward correction. Thus, it is now again recommended to sell the euro currency with targets at levels of 1.1185 and 1.1165, as the pair has consolidated below the Kijun-Sen line. Or wait for the completion of the flat. We recommend buying the euro/dollar not earlier than when the price consolidates above the Kijun-sen line with the first target at 1.1269, but with minimal lots, as the bulls remain extremely weak. In addition to the technical picture should also take into account the fundamental data and the time of their release. Explanation of the illustration: Ichimoku indicator: Tenkan-sen - the red line. Kijun-sen - the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dotted line. Chikou Span - green line. Bollinger Bands indicator: 3 yellow lines. MACD Indicator: Red line and histogram with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| The euro is waiting, the ECB is not Posted: 22 Jul 2019 03:53 PM PDT The release of statistics on European business activity and the German business climate, voting by the Conservative Party for the new leader who will become the British prime minister, and the ECB meeting make the euro the only alternative for the most interesting currency of the last full week of July. Even the next manifestation of the political crisis in Great Britain will surely affect the regional monetary unit, since Brexit influences not only Britain, but also the eurozone. The ECB meeting rightly claims to be the key event of the five-day session. The consensus assessment of Bloomberg analysts suggests that Mario Draghi will signal a reduction in the deposit rate from -0.4% to -0.5% at the September meeting of the regulator. At the beginning of 2020, the QE program is likely to be revived at €2.6 trillion. The European Central Bank will buy €40 billion in bonds each month. There are more aggressive predictions. For example, UBS, HSBC and Nomura expect two rate cuts to -0.6% in September and in December. Commerzbank claims it will happen in July. Dynamics of ECB rates Dynamics of bond purchases Investors are serious about easing monetary policy, as evidenced by the exceeding chances of reducing the rate by 10 bp at the July meeting of the Governing Council of 50%. A month ago, the figure was at 25%. We all know about such a principle as "sell on rumors, buy on facts", so if the ECB does not give the market what it wants, we can expect the euro to strengthen. Many negative factors are already embedded in its quotes, and the dynamics of EUR/USD, first of all, is determined by the sensitivity of the US dollar to the change in the probability of a decrease in the federal funds rate by 25 bp or 50 bp The euro is quite capable of responding to the deterioration of European business activity or the German business climate from the IFO Institute. Indicators are leading for GDP. At the same time, the fact that the ECB has lowered economic growth forecasts for 2020–2021 from 1.6% and 1.5% to 1.4% indicates that it remains concerned about the negative impact of Donald Trump's protection policies on German and European exports. Eurozone GDP Forecasts The European Commission believes that Germany's GDP in 2019 will expand by a modest 0.5%, which, coupled with sluggish inflation (consumer prices increased by 1.3% in June), provides all the reasons for the ECB to ease monetary policy. Another interesting event of the week by July 26 will be the release of data on the gross domestic product of the United States for the 2nd quarter. The US economy is likely to slow down from 3.1% to 1.8% q/q. The best result will raise the yield of US Treasury bonds and allow the "bulls" on EUR/JPY and USD/JPY to go to the counter-attack. Technically, the positions of euro buyers against the yen look hopeless. If they fail to maintain support at 120.5-120.6, the risks of target implementation by 200% with the AB = CD pattern will increase. It turns out to protect an important level - there will be a chance to form and play the reversal wedge pattern. The material has been provided by InstaForex Company - www.instaforex.com |

| AUDUSD back tests break out area Posted: 22 Jul 2019 01:05 PM PDT AUDUSD has marginally broken above a major downward sloping trend line resistance last week but now price is pulling back below the trend line. AUDUSD is back testing this break out area.

Green line - trend line resistance (broken) AUDUSD has support at 0.7030-0.7040 and resistance at 0.7060. A daily close below support or above resistance would provide an important short-term trend signal. As long as price is above 0.6910 medium-term trend remains bullish. Reclaiming 0.71 would also be a bullish sign and would give me 0.73-0.75 target. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Jul 2019 12:58 PM PDT EURUSD is trading just above 1.12. Trend remains bearish in the short-term and only a break above 1.1280 would bring bulls back in control of the trend. So far they remain vulnerable and prone to breaking support.

Green rectangle - support area Green line - major support trend line EURUSD is challenging both the green rectangle support area and the upward sloping green trend line support. Bulls need to recapture 1.1250 resistance and then break above the triple top at 1.1280 area. If support at 1.12-1.1180 fails to hold we should expect price to move lower towards 1.11-1.10. The material has been provided by InstaForex Company - www.instaforex.com |

| Short-term bear flag pattern in Gold Posted: 22 Jul 2019 12:53 PM PDT Gold price has formed a bearish pattern called bearish flag. Gold price has the potential to activate this bear flag if price breaks below $1,415-20 giving us a target of $1,400-$1,390. Bulls have lost control of the short-term trend.

Black line - major resistance trend line Gold price has support at $1,420-15 and next at $1,400-$1,390. Resistance is at $1,431 abd bext at $1,453. Breaking below the $1,415 level the flag is enabled and more selling pressure should come targeting $1,400. If resistance breaks we should expect Gold price to move above $1,455. Medium-term trend remains bullish as price continues to make higher highs and higher lows. The material has been provided by InstaForex Company - www.instaforex.com |

| July 22, 2019 : EUR/USD maintains short-term bearish outlook below 1.1235. Posted: 22 Jul 2019 09:43 AM PDT

Back in June 24, the EURUSD looked overbought around 1.1400 facing a confluence of supply levels. Thus, a bearish movement was initiated towards 1.1275 followed by a deeper bearish decline towards 1.1235 (the lower limit of the newly-established bullish channel) which failed to provide enough bullish support for the EUR/USD. Recent bearish breakdown below 1.1235 invited further bearish momentum to move towards 1.1175. However, significant bullish momentum was earlier demonstrated around 1.1200 bringing the EUR/USD pair again above 1.1235. That's why, extensive bullish pullback was expected to pursue again towards the price zone around 1.1275 where a double-top Bearish pattern was demonstrated. Recent Bearish breakdown of the pattern neckline around (1.1235) confirmed the short-term trend reversal into bearish towards 1.1175. By the end of last week, lack of enough bearish momentum below 1.1235 brought another bullish pullback towards the depicted key zone around 1.1235 spiking up to 1.1275 (a Weekly High) where significant bearish rejection and a bearish engulfing candlestick were demonstrated. Fortunately, evident bearish momentum (bearish engulfing H4 candlestick) could bring the EURUSD back below 1.1235 which stands as Intraday Supply zone to be watched for Intraday SELL entries upon any bullish pullback. Further bearish decline is expected to pursue towards 1.1175 where new price action should be watched. On the other hand, any bullish breakout above (1.1235-1.1250) should be watched as it brings the EUR/USD pair again between depicted price-zones (1.1235-1.1275) until another breakout attempt is demonstrated in either directions (More probably to the downside). Trade recommendations : For Intraday traders, another valid SELL entry can be offered anywhere around the broken neckline around 1.1235. Initial Target levels to be located around 1.1200 and 1.1175 while Stop Loss should be placed above 1.1260. The material has been provided by InstaForex Company - www.instaforex.com |

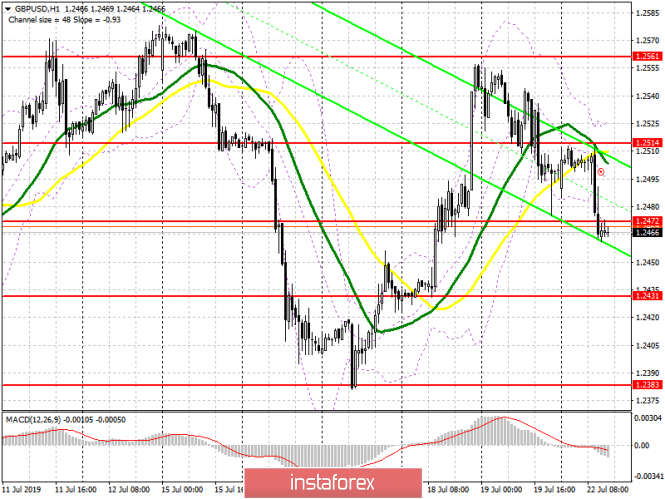

| July 22, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 22 Jul 2019 08:04 AM PDT

Since May 17, the previous downside movement within the depicted bearish channel came to a pause allowing the recent sideway consolidation range to be established between 1.2750 - 1.2550 with a prominent key-level around 1.2650. In June , temporary bullish consolidation patterns were demonstrated above 1.2650 for a few trading sessions. However, the price level of 1.2750 (consolidation range upper limit) has prevented further bullish advancement few times so far. Moreover, signs of bearish rejection have been manifested (Head & Shoulders reversal pattern with neckline located around 1.2650). Bearish breakdown below 1.2650 (reversal pattern neckline) confirmed the reversal pattern with bearish projection target located at 1.2550, 1.2510 and 1.2450. Intermediate-term technical outlook remains under bearish pressure as long as the market keeps moving below 1.2550 (the lower limit of the depicted consolidation range). In July 18, another Bullish pullback was demonstrated towards the depicted price zone 1.2480-1.2500 (61.8% - 50% Fibonacci levels) which failed to provide enough bearish pressure temporarily. That's why, further bullish pullback was demonstrated towards the backside of the broken consolidation range (1.2550) where another valid SELL entry was offered by the end of last week's consolidations. It's already running in profits. Bearish persistence below 1.2500-1.2460 (61.8% - 38.2% Fibonacci levels) is mandatory to ensure further bearish decline towards 1.2360 where the lower limit of the depicted movement channel comes to meet the GBP/USD pair. Bearish breakdown below 1.2360 invites a quick bearish decline towards 1.2320 and 1.2270 which correspond to significant key-levels on the Weekly chart. On the other hand, please note that any bullish breakout above 1.2560 invalidates the previously mentioned bearish scenario. Trade Recommendations: Conservative traders can have another SELL Entry upon any upcoming bullish pullback towards 1.2550. Initial T/P levels to be located around 1.2480, 1.2430 and 1.2360 while S/L should be placed above 1.2590. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 07.22.2019 - Sell zone at the price of $11.000 Posted: 22 Jul 2019 07:29 AM PDT Industry news: As for private cryptocurrencies, given the risks associated with them and volatility in their prices, the Group has recommended banning of the cryptocurrencies in India and imposing fines and penalties for carrying on of any activities connected with cryptocurrencies in India. Trading recommendation:

BTC has been trading sideways at the price of $10.500 in past 24 hours. BTC did test my important resistance level around $10.800 and found sellers, which is first sign of the potential down turn. Pay attention to the resistance at the price of $11.000 cause it is good sell zone up there. Yellow rectangle – Resistance ($11.000) Blue horizontal line- Support 1 ($9.083) MACD oscillator is showing the decreasing momentum and BTC is trading near the resistance, which confirms my bearish view. Additionally, MACD oscillator is also showing that slow line did turn from bullish into bearish, which is another good confirmation for further downside. Bollinger % oscillator did show new momentum down few days ago, which is indication and BTC my at least try to re*visit the low at $9.083. Watch for selling opportunities with the first target at $9.083 as long as the BTC is trading below the $11.000. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 07.22.2019 -Bearish flag pattern in creation Posted: 22 Jul 2019 07:14 AM PDT Gold has been trading exactly like I expected on Friday. Our Friday's downward target has been met in at $1.420. Since there is strong downward movement in the background and fake breakout of the 20-day high $1.440, I still see potential for more downside. Trading recommendation:

Red rectangle – Resistance ($1.433) Yellow rectangle- Support 1 ($1.415) Yellow rectangle – Support 2 ($1.401) Bearish flag pattern on the 1H time-frame is in creation and there is possibility for new downward leg on the Gold. My advice is to watch for potential selling opportunities on the down break. Downward targets are set at the price of $1.415 and at $1.401.As long as the Gold s trading below the $1.442, I would look for selling opportuntiies. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: the moment of truth for the pound, who will be the next UK Prime Minister? Posted: 22 Jul 2019 07:00 AM PDT

Tomorrow will be an important event for the United Kingdom and all of Europe – the name of the country's new Prime Minister will be known. Recall that this post is claimed by two candidates: Former British Foreign Minister Boris Johnson and the current Foreign Minister Jeremy Hunt. The fate of Brexit depends on which of them will take this position: how will the process of withdrawal of Albion from the European Union proceed, whether it will be brought to an end and on what conditions. On Tuesday, the Conservative Party of Great Britain will announce the name of the new Prime Minister after counting the votes, and on Wednesday, he will enter Downing Street. At the same time, he will immediately have to deal not only with Brexit but also with the conflict in the Persian Gulf, where Iran was detained by a British tanker on Friday. The chances of winning in the fight for the chair of the head of government B. Johnson, who is ready to withdraw the country from the EU or die, are maximal. However, the negative from the election campaign and possible problems in the negotiations between London and Brussels have already been included in the quotes. Both houses of the British Parliament managed to ratify the amendment, which will not allow a "hard" divorce from the EU until October 31 without the consent of Parliament. However, the exit of the country without an agreement with the alliance can become a reality if the early elections of the Parliament significantly replenished with eurosceptics. The statement by the EU's main Brexit negotiator, Michelle Barnier, that the unit is open to discussing the status of the Irish border inspired investors to buy pounds. Data on retail sales in the UK in June also added a positive, but the growth above the 1.25 mark for the GBP/USD pair is still difficult. While the EU is ready to offer the United Kingdom an extension of the Brexit deadline after October 31 for negotiations on a future agreement, and too tough B. Johnson's position is unlikely to be appropriate. Against this background, more loyal J. Hunt can get extra points from Tories. According to experts, in the event of an unexpected victory of John Hunt, the pound will have a chance for a small recovery. "If the current foreign minister does lead the government, the GBP/USD pair will rise above the level of 1.27 for some time," Societe Generale predicts. At the same time, the aggressive rhetoric of the new Prime Minister in the person of B. Johnson after taking office can cause a decrease in GBP/USD by 1.5-2 figures from the current levels. The material has been provided by InstaForex Company - www.instaforex.com |

| Bullish rally about to begin in USD/CHF Posted: 22 Jul 2019 06:47 AM PDT

There're prospects of developing a Wolfe Wave pattern in USD/CHF. As we can see on the 60M chart, the market is about to finish wave 5. The main target is the 0.618 retracement level of the previous upward price movement at 0.9791. The subsequent pullback from this level could be a departure point for a sixth-wave rally. The main target is the 78.6% extension level (0.9993) of the last bullish rally, which crosses the upper side of the Wolfe Wave pattern. However, if the price goes through this level, we should watch the 100% level (1.0048) as the next bullish target. Besides, if line 1-3 turns out to be broken and the market moves below the 0.618 level (0.9791), this scenario will be at risk. If this happens, we should wait for the pair's return above this line as the first step into wave 6. The final confirmation will be a breakout of line 2-4. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD for July 22,2019 - Potential rally incoming Posted: 22 Jul 2019 06:47 AM PDT EUR has been trading sideways at the price of 1.1218. EUR didn't have power to test or break the important low at 1.1204, which is sign of the strength. The Bollinger band % indicator is showing the bullish divergence in the background and the band squeeze (narrow range of the bands), which is sign for the potential up breakout.

Trading recommendation: Yellow rectangle – Support (1.1200) Blue horizontal line- Resistance 1 (1.1239) Blue rectangle – Resistance 2 1.1255) Bullish divergence on the % Bollinger oscillator in the background is the sign of the potential rally incoming. EUR is trading in well defined trading range and there is no imbalance on this market. It is very unlikely that EUR take the major swing low at the price of 1.1200. Watch for buying opportunities with the upward targets at 1.11239 and 1.1260.The material has been provided by InstaForex Company - www.instaforex.com |

| Bitcoin: Local bullish opportunity Posted: 22 Jul 2019 06:42 AM PDT

There's a bullish opportunity in Bitcoin because of a three-wave price movement, which is supposed to be wave ((ii)). Previously, we saw a huge upward impulse in wave ((i)). That's why we could expect another five-wave rally after the bearish correction. As you can see on the chart, there's a bullish impulse in wave (i) right after the end of wave ((ii)). This is a key moment for this scenario, because it means that after a correction we're going to have another bullish impulse. It could be wave i of (iii) under the main wave count, but there are some alternative counts as well, so we should be careful. Wave ((ii)) is relatively small compearing with wave ((i)). We should keep in mind that wave ((ii)) could continue. Thus, when wave i of (iii) arrives, there'll be a critical juncture for the bullish count because a price movement from the local low (ending of wave ((ii)) on the chart) could be a finished zigzag as a part of wave ((ii)). The bottom line is where the price is going form an upward impulse after wave (ii) ends. Then, we should be extremely careful here because of an option to have more extended wave ((ii)), probably as a double zigzag pattern. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 22 Jul 2019 06:42 AM PDT To open long positions on GBP/USD, you need: Buyers of the pound failed to catch on to the important support level of 1.2472, which I drew attention to in my morning review, and the task for the second half of the day will be to return to this range, which will only slightly change the lower limit of the upward price channel, the minimum of which is formed on July 17. Only in this way will buyers be able to return to the highs of 1.2514 and 1.2561 and maintain an upward trend. In the scenario of further decline, support and new customers can be expected only after the update of a larger level of 1.2431. To open short positions on GBP/USD, you need: Bears coped with the task in the morning and managed to return to the level of 1.2472. While trading will be conducted below this range, the pressure on GBP/USD will remain, which will lead to an update of the lows of the area of 1.2431 and 1.2383, where I recommend taking the profit. If the bulls return to the resistance of 1.2472 in the second half of the day, it is best to look at the short positions after updating the maximum of the day in the area of 1.2514. Indicator signals: Moving Averages Trading is below 30 and 50 moving averages, which keeps the bearish momentum. Bollinger Bands With the growth of the pound in the second half of the day, the average border of the indicator in the area of 1.2495 will act as resistance, and you can sell immediately on the rebound from the upper border in the area of 1.2525.

Description of indicators

|

| Gold falls below $1440. July 22, 2019 Posted: 22 Jul 2019 06:40 AM PDT Gold is trading at $1400-40 area. Recently, the price has broken above $1440 with a daily close but failed to sustain momentum. Recent gains on gold were supported by IMF's comments that the US dollar is overvalued, and US President Donald Trump's call for lower interest rates. The Fed is widely expected to cut rates by at least a quarter-point this month, and some believe rates will be 50 basis points lower after the September policy meeting which is expected to help gold gain ground. According to Fed official James Bullard, an interest rate cut can be a necessary element for current economic condition but it is not confirmed by the Fed. Cutting rates could reset people's expectations for inflation and reset relative US government bond prices to a level more conducive to growth but it may take time to see who has endorsed a 25 basis point rate cut at the July 30-31 meeting. Worse outcomes in US trade negotiations or a poor response by inflation to Fed easing could create reasons to ease policy further. If it happens, gold is likely to grow. TECHNICAL OVERVIEW: The bullish daily candle which broke above $1440 area was engulfed completely by the Friday's daily candle which indicated downward pressure. The price may retrace towards $1400 area again but not below. As the price remains above $1400 area, the bullish bias is expected to continue for the ultimate target of the $1500 area. TECHNICAL LEVELS: SUPPORT: 1380, 1400 RESISTANCE: 1440, 1450, 1500 BIAS: Bullish MOMENTUM: Volatile Image link - https://drive.google.com/file/d/10snuhvKAmT1Zirwvd_mHkasQS2KTEqk_/view?usp=sharing The material has been provided by InstaForex Company - www.instaforex.com |

| BITCOIN struggling to hold above $10,500. July 22, 2019 Posted: 22 Jul 2019 06:38 AM PDT Bitcoin has been quite volatile recently. It has been residing at the edge of $10,500 for a few hours. It is expected to continue to push higher as the price remains above $10,000 area with a daily close. Despite Bitcoin's throwbacks below $10,000 area, it is expected to inch up. Daily volume has tailed off quite a bit over the weekend, however, and is now down to $16 billion as markets remain range bound. As per recent observation, the longer Bitcoin consolidates the bigger the next move usually is. One of the biggest obstacle Bitcoin is facing right now is the regulatory pressures from governments and regulatory bodies which is affecting the consistent growth of the value like 2017. Recently Indian Government officially banned Bitcoin despite having many government facilities running under Blockchain technologies. The price is currently residing at the edge of $10,500 area while being held by the dynamic levels like 20 EMA, Tenkan and Kijun line as resistance. The price also breached below the Kumo Cloud support area. MACD has no strong histogram emotion and MACD crossovers indicate divergence. As the price manages to push higher above $10700 area, it is expected to continue the upward trend pressure. If it breaks below $10,500, it will lead to further correction and probable rebound off the $10,000 area. TECHNICAL LEVELS: SUPPORT: 9500, 9800, 10000 RESISTANCE: 10500, 11000, 11500, 12000 BIAS: Bullish MOMENTUM: Volatile Image link - https://drive.google.com/file/d/10Nv4-m2QYrwJgzHPOh3twvjvxZNu2aMs/view?usp=sharing The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD plan for the US session on July 22. The lack of news and the calm before the storm Posted: 22 Jul 2019 05:07 AM PDT To open long positions on EUR/USD pair, you need: Quite expectedly, nothing significant happened in the first half of the day against the background of the absence of important fundamental statistics. At the same time, traders prepare for an important meeting of the European Central Bank, at which the regulator can change its monetary policy. Buyers still need to form a false breakdown in the support area of 1.1205, and only under this condition when you can open long positions for return and consolidation above the middle of the side channel in the area of 1.1244 and for updating the upper border in the area of 1.1281, where I recommend fixing the profit. If there is no demand for the euro at a minimum of 1.1205, I recommend buying the EUR/USD pair immediately for a rebound only from the new support area of 1.1167. To open short positions on EUR/USD pair, you need: For sellers, the technical picture also has not changed. The bears need a breakdown of a large support level of 1.1205-1.1200, which has saved the euro from further decline throughout the past week. The breakthrough of this range will increase the pressure on the pair, which will lead to an update of the new monthly lows in the area of 1.1167 and 1.1138, where I recommend taking profits. Only good news on the eurozone economy can save the euro from falling but one cannot wait for them today. False breakdown in the area of resistance 1.1244 will be an additional signal to open short positions in the EUR/USD pair. Otherwise, you can sell on a rebound from a maximum of 1.1281. Indicator signals: Moving averages Trade is conducted below 30 and 50 moving average, however, it is still very early to talk about the complete surrender of buyers. Bollinger bands The downward impulse is limited by the lower boundary of the indicator in the region of 1.1210, however, its breakthrough may lead to an update of monthly lows. Description of indicators MA (moving average) 50 days - yellow MA (moving average) 30 days - green MACD: fast EMA 12, slow EMA 26, SMA 9 Bollinger Bands 20 The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of GBP/USD for July 22, 2019 Posted: 22 Jul 2019 03:50 AM PDT The GBP/USD pair continues to move downwards from the level of 1.2580. This week, the pair dropped from the level of 1.2580 to the bottom around 1.2454. But the pair rebounded from the bottom of 1.2454 then closed at 1.2560. Today, the first support level is seen at 1.2454, the price is moving in a bearish channel now. Furthermore, the price has been set below the strong resistance at the level of 1.2529, which coincides with the 23.6% Fibonacci retracement level. This resistance has been rejected several times confirming the veracity of a downtrend. Additionally, the RSI starts signaling a downward trend. As a result, if the NZD/USD pair is able to break out the first support at 1.2454, the market will decline further to 1.2375 in order to test the weekly support 2. Consequently, the market is likely to show signs of a bearish trend. So, it will be good to sell below the level of 1.2454 with the first target at 1.2375 and further to 1.2315. However, stop loss is to be placed above the level of 1.2580. The material has been provided by InstaForex Company - www.instaforex.com |

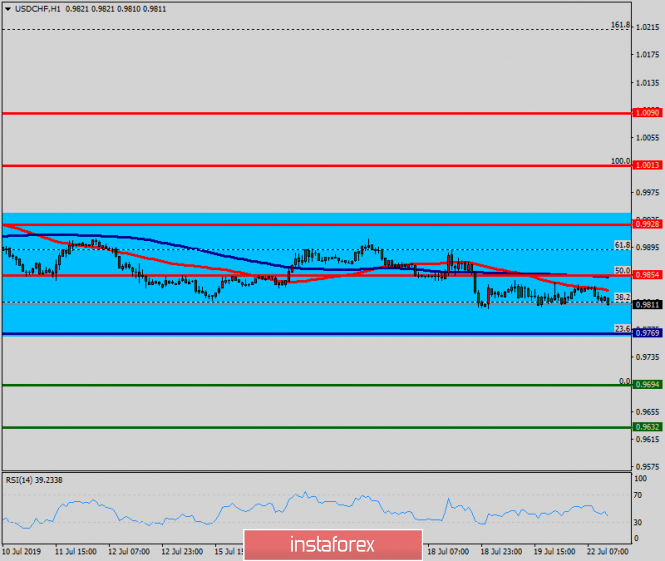

| Technical analysis of USD/CHF for July 22, 2019 Posted: 22 Jul 2019 03:41 AM PDT The USD/CHF pair fell sharply from the level of 0.9854 towards 0.9694. Now, the price is set at 0.9748. The resistance is seen at the level of 0.9854 and 0.9928. Moreover, the price area of 0.9854 and 0.9928 remains a significant resistance zone. Therefore, there is a possibility that the USD/CHF pair will move downside and the structure of a fall does not look corrective. The trend is still below the 100 EMA for that the bearish outlook remains the same as long as the 100 EMA is headed to the downside. Thus, amid the previous events, the price is still moving between the levels of 0.9770 and 0.9694. If the USD/CHF pair fails to break through the resistance level of 0.9770, the market will decline further to 0.9694 as as the first target. This would suggest a bearish market because the RSI indicator is still in a negative spot and does not show any trend-reversal signs. The pair is expected to drop lower towards at least 0.9632 so as to test the daily support 2. On the other hand, if a breakout takes place at the resistance level of 0.9854, then this scenario may become invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

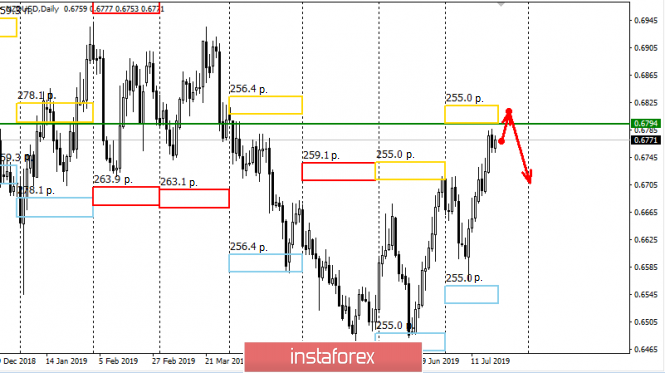

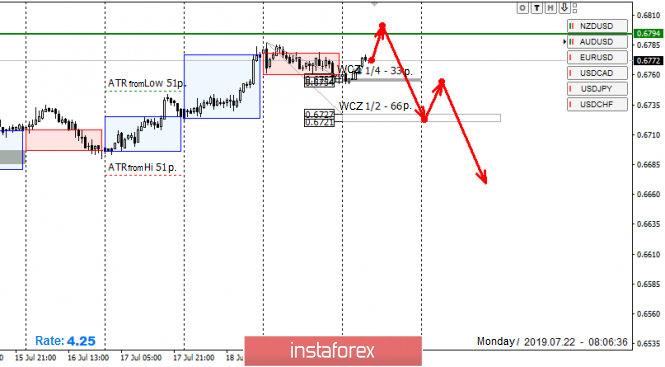

| Control zones for NZD/USD pair on 07.22.19 Posted: 22 Jul 2019 03:18 AM PDT Today, the pair continues its upward movement, however, the monthly CZ of July is in the range of 20 points, which indicates the need for a complete closure of purchases during its test. Testing the zone will also allow considering sales since the probability of closing trades outside the middle course is 30%. The work within the framework of the monthly average move will provide an opportunity to enter corrective sales since there is still a week and a half before the next control zones are formed. An alternative model will be to continue to grow despite testing the monthly control zone. The probability of this event is 30%, therefore it is better to refuse purchases from current grades and higher. If a pattern for the sale of an instrument is not received, it is better to be out of the market for this instrument. Daily CZ - daily control zone. The area formed by important data from the futures market, which changes several times a year. Weekly CZ - weekly control zone. The area formed by marks from the important futures market, which changes several times a year. Monthly CZ - monthly control zone. The area is a reflection of the average volatility over the past year. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment