Forex analysis review |

- Fractal analysis of the main currency pairs on August 29

- AUD / USD vs USD / CAD vs NZD / USD vs #USDX. Comprehensive analysis of movement options since August 29, 2019 APLs &

- Britain on the verge of a constitutional crisis

- Trading idea for the EURUSD on August 28, 2019

- Is it possible to pull down the euro to $1.05?

- EUR/USD: Should the Fed soften the blow or refuse to play along with Trump?

- EUR/USD. August 28. Results of the day. Five factors of dollar growth and one in favor of strengthening the euro

- "Queen's move": Johnson tries to neutralize the House of Commons

- GBPUSD: Pound crashes after Boris Johnson announces possible suspension of UK Parliament

- Gold changes the standards

- August 28, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- August 28, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- BTC 08.28.2019 - Test of the major supply trendline, more downside yet to come

- Gold 08.28.2019 - Steady rising with no signs of reversal

- Analysis for EUR/USD and GBP/USD on August 28th. The euro remains calm and waiting for news

- Technical analysis of GBP/USD for August 28, 2019

- GBP/USD 08.27.2019 -SStrong downward movementum, watch for selling the rally

- Makes sense to buy precious metals on dips

- Trading recommendations for the EUR/USD currency pair on August 28: placement of trade orders

- Short-term bullish warning signs for USDJPY

- GBP/USD: plan for the US session on August 28. The pound collapsed

- EUR/USD: plan for the US session on August 28. The euro continues to stagnate in one place

- EURUSD remains in bearish trend but could see 1.0950 if support at 1.1050 fails to hold

- Gold price forming a cup with handle bullish pattern

- Third wave in EUR/USD to begin anytime soon

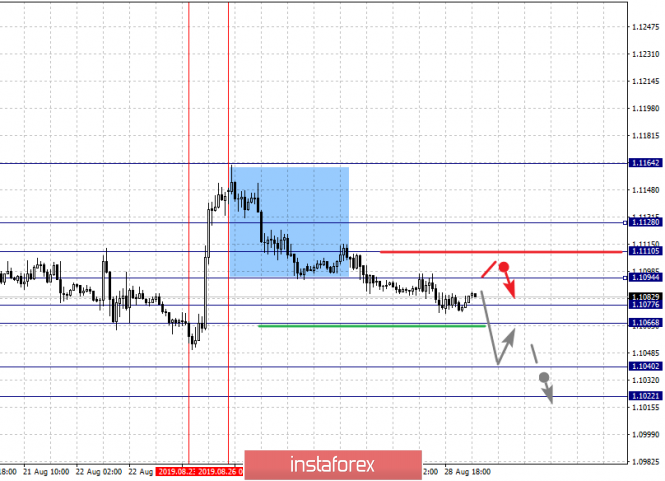

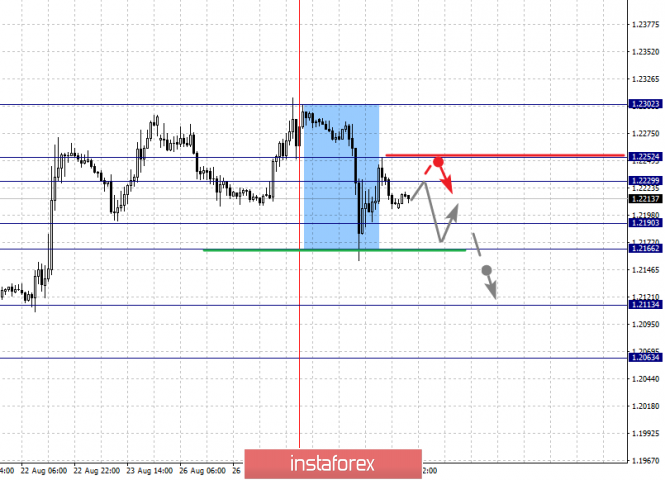

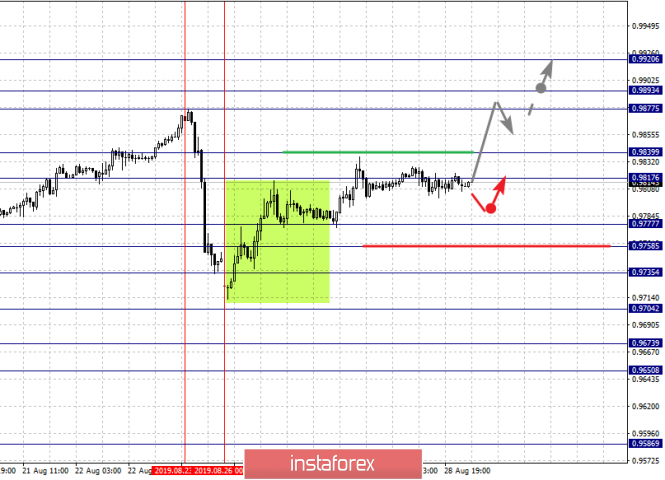

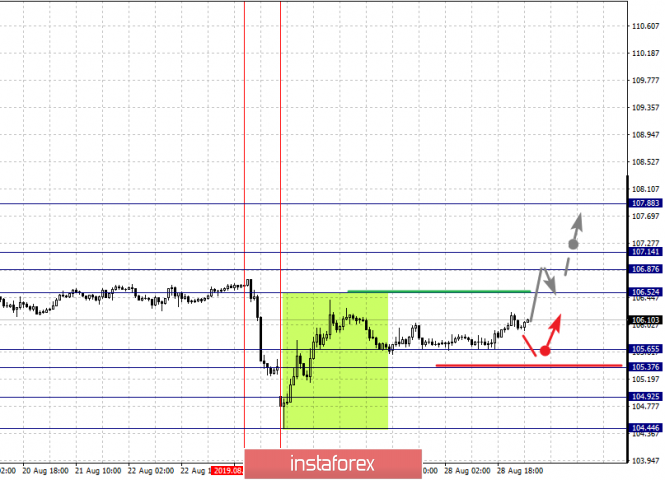

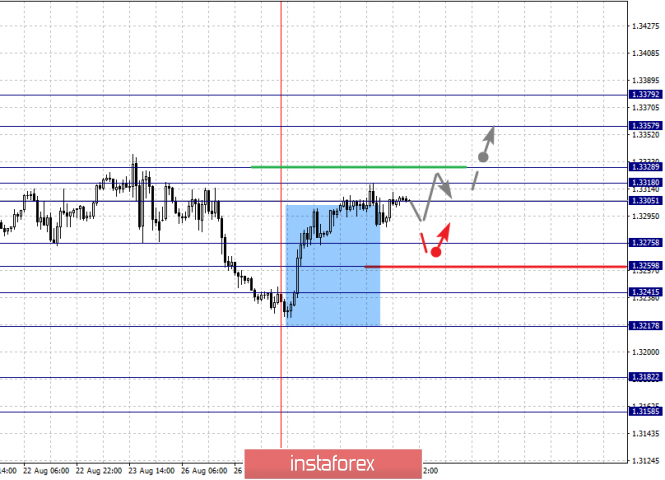

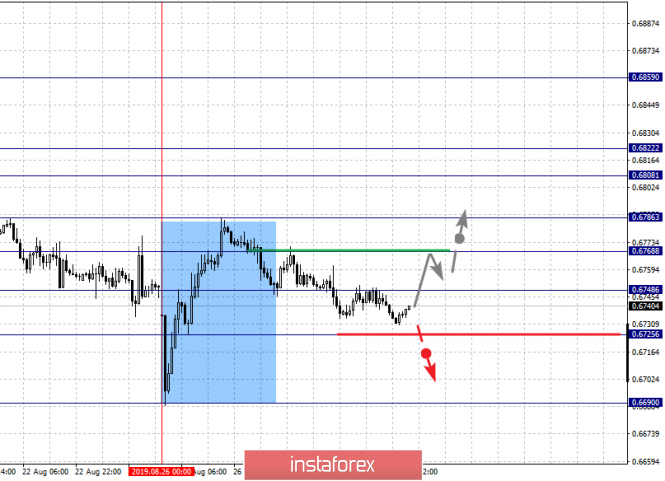

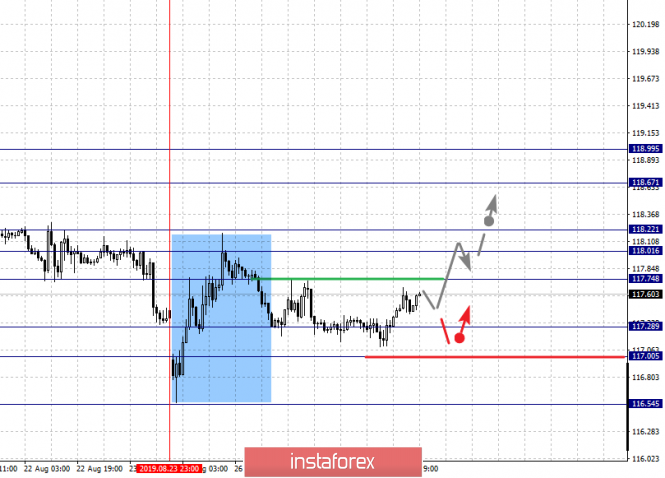

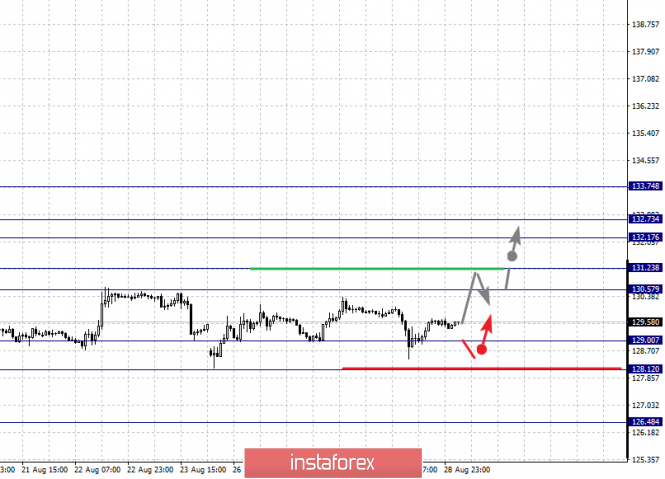

| Fractal analysis of the main currency pairs on August 29 Posted: 28 Aug 2019 05:33 PM PDT Forecast for August 29 : Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1128, 1.1110, 1.1094, 1.1077, 1.1066, 1.1040 and 1.1022. Here, we expect the development of the downward structure from August 26, which requires a breakdown of the noise range 1.1077 - 1.1066. In this case, the goal is 1.1040. For the potential value for the bottom, we consider the level of 1.1022, and near which, we expect consolidation, as well as a rollback to the top. Short-term upward movement is expected in the range of 1.1094 - 1.1110. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.1128. This level is a key support for the downward structure. Its passage in price will lead to the development of the upward movement. In this case, the potential target is 1.1164 . The main trend is the downward potential of August 26. Trading recommendations: Buy 1.1095 Take profit: 1.1110 Buy 1.1112 Take profit: 1.1126 Sell: 1.1064 Take profit: 1.1042 Sell: 1.1040 Take profit: 1.1024 For the pound / dollar pair, the key levels on the H1 scale are: 1.2302, 1.2252, 1.2229, 1.2190, 1.2166, 1.2113 and 1.2063. Here, the price forms a pronounced potential for the downward movement of August 27. Short-term downward movement is expected in the range of 1.2190 - 1.2166. The breakdown of the last value should be accompanied by a pronounced downward movement. Here, the target is 1.2113. For the potential value for the bottom, we consider the level of 1.2063. Upon reaching this level, we expect a pullback to the top. Short-term upward movement is expected in the range of 1.2229 - 1.2252. The breakdown of the latter value will favor the formation of an upward structure. Here, the potential target is 1.2302. The main trend is the formation of potential for the bottom of August 27. Trading recommendations: Buy: 1.2230 Take profit: 1.2252 Buy: 1.2255 Take profit: 1.2300 Sell: 1.2190 Take profit: 1.2167 Sell: 1.2164 Take profit: 1.2115 For the dollar / franc pair, the key levels on the H1 scale are: 0.9920, 0.9893, 0.9877, 0.9839, 0.9817, 0.9777, 0.9756, 0.9704, 0.9673, 0.9650 and 0.9586. Here, the price is in equilibrium: the downward structure of August 23, as well as the formation of the potential for the top of August 26. Short-term downward movement is expected in the range of 0.9777 - 0.9758. The breakdown of the latter value will lead to a movement to the level of 0.9735. Consolidation is near this level. The breakdown of the level of 0.9735 will lead to the development of a downward structure from August 23. In this case, the first target is 0.9704. Short-term upward movement is possibly in the range of 0.9817 - 0.9839. The breakdown of the latter value will lead to the development of the ascending structure from August 26. Here, the target is 0.9877. Price consolidation is in the range of 0.9877 - 0.9893. For a potential value for the top, we consider the level of 0.9920. Upon reaching which, we expect a pullback to the bottom. The main trend is the equilibrium situation. Trading recommendations: Buy : 0.9817 Take profit: 0.9836 Buy : 0.9842 Take profit: 0.9875 Sell: 0.9777 Take profit: 0.9760 Sell: 0.9756 Take profit: 0.9735 For the dollar / yen pair, the key levels on the scale are : 107.88, 107.14, 106.87, 106.52, 105.65, 105.37, 104.92 and 104.44. Here, the price is in equilibrium: the descending structure of August 23, as well as the ascending structure of August 26. The continuation of the movement to the top is expected after the breakdown of the level of 106.52. In this case, the target is 106.87, where consolidation is near this level. The passage at the price of the noise range 106.87 - 107.14 should be accompanied by a pronounced upward movement. Here, the potential target is 107.88. Consolidation is near this level. Short-term downward movement is possibly in the range of 105.65 - 105.37. The breakdown of the latter value will lead to the development of a downward structure. In this case, the first target is 104.92. For the potential value for the bottom, we consider the level of 104.44, where consolidation is near this level. The main trend: the equilibrium situation: the descending structure of August 23, as well as the ascending structure of August 26. Trading recommendations: Buy: 106.52 Take profit: 106.85 Buy : 107.15 Take profit: 107.88 Sell: 105.35 Take profit: 104.94 Sell: 104.90 Take profit: 104.46 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3379, 1.3357, 1.3328, 1.3318, 1.3305, 1.3275, 1.3259, 1.3241 and 1.3217. Here, the price forms a pronounced potential for the upward movement of August 27. The continuation of the movement to the top is expected after the breakdown of the level of 1.3305. In this case, the target is 1.3318. Consolidation is near this level. The passage at the price of the noise range 1.3318 - 1.3328 should be accompanied by a pronounced upward movement. Here, the target is 1.3357. For the potential value for the top, we consider the level of 1.3379. Upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 1.3275 - 1.3259. The breakdown of the last value will lead to a long correction. Here, the target is 1.3241. This level is a key support for the upward structure. Its passage at the price will lead to the development of a downward movement. In this case, the first potential target is 1.3217. The main trend is the formation of potential for the top of August 27. Trading recommendations: Buy: 1.3305 Take profit: 1.3318 Buy : 1.3328 Take profit: 1.3357 Sell: 1.3275 Take profit: 1.3262 Sell: 1.3257 Take profit: 1.3241 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6859, 0.6822, 0.6808, 0.6786, 0.6768, 0.6748 and 0.6725. Here, we are following the formation of the ascending structure of August 26. At the moment, the price is close to the cancellation of this structure, which requires the breakdown of the level of 0.6725. In this case, the potential target for the downward movement is 0.6690. The continuation of the upward trend is expected after the breakdown of the level of 0.6768. In this case, the first target is 0.6786. The breakdown of which, in turn, will allow you to count on movement to 0.6808. Short-term upward movement, as well as consolidation is in the range of 0.6808 - 0.6822. The breakdown of the level of 0.6822 should be accompanied by a pronounced upward movement. Here, the target is 0.6859. Price consolidation is near this level, as well as a pullback to the bottom. The main trend is the formation of the ascending structure of August 21, the stage of deep correction. Trading recommendations: Buy: 0.6786 Take profit: 0.6808 Buy: 0.6809 Take profit: 0.6820 Sell : 0.6745 Take profit : 0.6728 Sell: 0.6722 Take profit: 0.6695 For the euro / yen pair, the key levels on the H1 scale are: 118.99, 118.67, 118.22, 118.01, 117.74, 117.28, 117.00 and 116.54. Here, the price forms the potential for the top of August 23. The continuation of the upward movement is expected after the breakdown of the level of 117.74. In this case, the first target is 118.01. The passage at the price of the noise range 118.01 - 118.22, will lead to a pronounced movement. In this case, the target is 118.67. Consolidation is near this level. For the potential value for the top, we consider the level of 118.99. Upon reaching this level, we expect a pullback to the bottom. The range 117.28 - 117.00 is a key support for the upward structure. Its passage at the price will favor the development of a downward movement. In this case, the first potential target is 116.54. The main trend is the downward cycle of August 13, the formation of the potential for the top of August 23. Trading recommendations: Buy: 117.75 Take profit: 118.01 Buy: 118.22 Take profit: 118.65 Sell: 117.28 Take profit: 117.05 Sell: 117.00 Take profit: 116.55 For the pound / yen pair, the key levels on the H1 scale are : 133.74, 132.73, 132.17, 131.23, 130.57, 129.00 and 128.12. Here, we follow the development of the ascending structure of August 12. Short-term upward movement is expected in the range of 130.57 - 131.23. The breakdown of the latter value will lead to a pronounced upward movement. Here, the target is 132.17 Short-term upward movement, as well as consolidation is in the range of 132.17 - 132.73. For the potential value for the top, we consider the level of 133.74. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. The range of 129.00 - 128.12 is the key support for the ascending structure of August 12. The breakdown of the level of 128.12 will favor the development of the downward movement. In this case, the first potential target is 126.48. The main trend is the ascending structure of August 12. Trading recommendations: Buy: 130.58 Take profit: 131.23 Buy: 131.26 Take profit: 132.17 Sell: 128.96 Take profit: 128.12 Sell: 128.10 Take profit: 126.55 The material has been provided by InstaForex Company - www.instaforex.com | |||||||

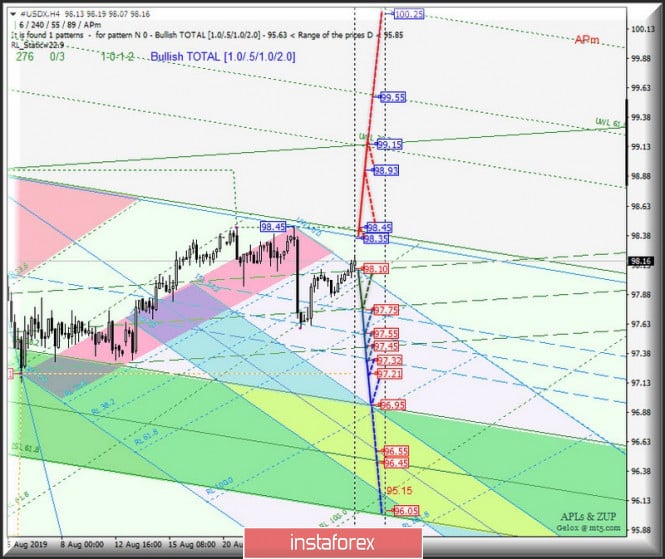

| Posted: 28 Aug 2019 05:33 PM PDT Minuette operational scale (H4) Let me bring to your attention a comprehensive analysis of the options for the development of the movement of AUD / USD vs USD / CAD vs NZD / USD vs #USDX from August 29, 2019 through the Minuette operational scale (H4) ____________________ US dollar Index From August 29, 2019, the development of the movement of the dollar index #USDX will be determined by the direction of the breakdown of the range:

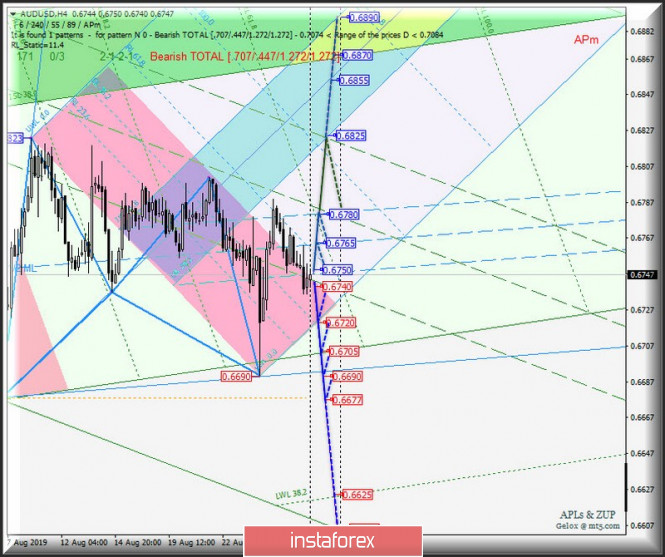

The breakdown of the support level of 98.10 - the development of the dollar index movement will continue within the boundaries of 1/2 Median Line channels of the Minuette operational scales fork - (98.10 - 97.75 - 97.45) and Minuette (97.75 - 97.55 - 97.32) with the prospect of reaching the boundaries of the equilibrium zones of the Minuette operational scales fork (96.95 - 96.55 - 95.10) and Minuette (96.95 - 96.45 - 96.05). With a combined breakdown of the UTL control line (resistance level of 98.35) of the Minuette operational scale fork and updating the local maximum 98.45, the upward movement of #USDX can be continued to the targets - maximum 98.93 - UTL Minuette control line (99.15). We look at the layout of the #USDX movement options in the animated chart. ____________________ Australian dollar vs US dollar The development of the movement of the Australian dollar/US dollar (AUD / USD) from August 29, 2019 will also be determined by the direction of the breakdown of the range:

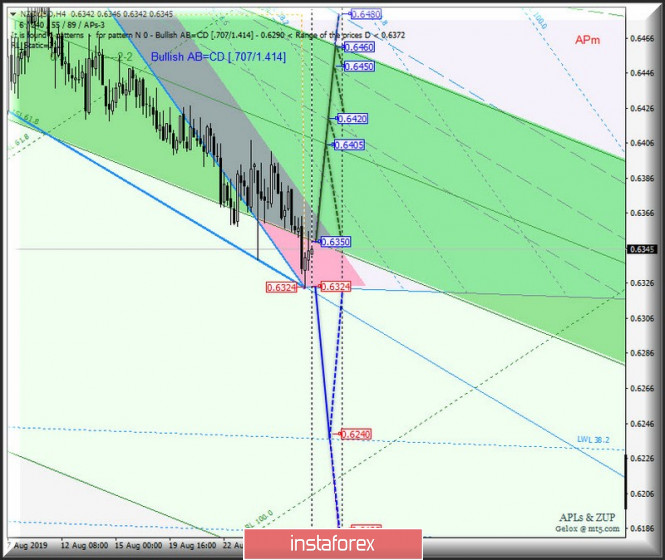

The breakdown of the resistance level of 0.6750 will determine the development of the movement of the Australian dollar in the 1/2 Median Line Minuette channel (0.6750 - 0.6765 - 0.6780) with the prospect of reaching the boundaries of the equilibrium zone (0.6825 - 0.6855 - 0.6890) of the Minuette operational scale fork. The breakdown of the support level of 0.6740 (the lower boundary of the 1/2 Median Line Minuette channel) will make it relevant to continue the downward movement of AUD / USD to the targets - the initial SSL line (0.6720) of the Minuette operational scale fork - the initial line SSL (0.6705) of the Minuette operational scale fork - minimums (0.6690 - 0.6677). We look at the layout of the AUD / USD movement options in the animated chart. ____________________ New Zealand dollar vs US dollar Now, similarly, the development of the movement of the New Zealand dollar/ US dollar (NZD / USD) from August 29, 2019 will also depend on the direction of the breakdown of the range:

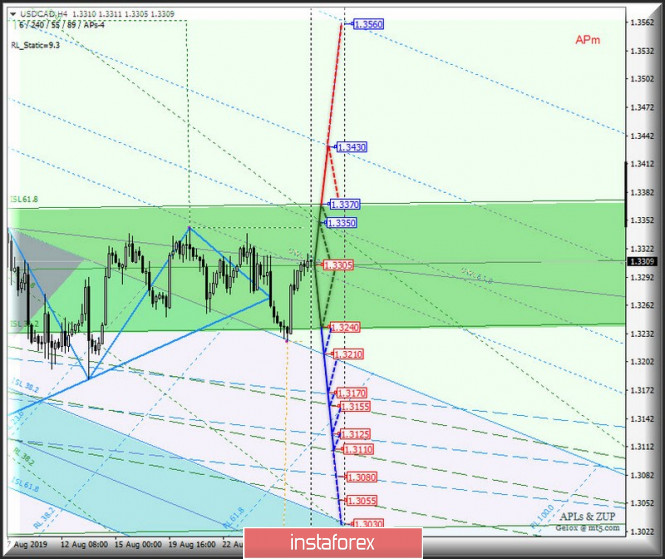

The breakdown of the resistance level of 0.6350 and ISL61.8 Minuette will determine the development of the movement of the NZD/USD within the boundaries of the equilibrium zone (0.6350 - 0.6405 - 0.6460) of the Minuette operational scale fork. In case of the breakdown of the initial SSL line of the Minuette operational scale fork (support level of 0.6324), the downward movement of NZD / USD can continue to the warning line LWL38.2 Minuette (0.6240). We look at the layout of the NZD / USD movement options in the animated chart. ____________________ US dollar vs Canadian dollar The development and direction of the breakdown of the boundaries of the channel of the equilibrium zone (1.3370 - 1.3305 - 1.3240) of the Minuette operational scale fork will begin to determine the development of the movement of the Canadian dollar/US dollar (USD / CAD) from August 29, 2019. The options for movement inside this equilibrium zone are presented on the animation chart. The downward movement of USD / CAD will be possible after the breakdown of the support level of 1.3240 at the lower boundary of the ISL38.2 equilibrium zone of the Minuette operational scale fork and this will be directed to the boundaries of the 1/2 Median Line channels of the Minuette operational scales fork (1.3170 - 1.3125 - 1.3080) and Minuette (1.3155 - 1.3110 - 1.3055). The upward movement of USD / CAD will take place as a result of breakdown of the upper boundary of ISL61.8 (resistance level of 1.31550) of the equilibrium zone of the Minuette operational scale and its targets will be the warning lines UWL100.0 (1.3430) and UWL161.8 (1.3560) of the Minuette operational scale fork. We look at the layout of the USD / CAD movement options in the animated chart. ____________________ The review is made without taking into account the news background. The opening of trading sessions of major financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index: USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of the currencies in the basket: Euro - 57.6%; Yen - 13.6%; Pound Sterling - 11.9%; Canadian dollar - 9.1%; Swedish Krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the start date of the countdown - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com | |||||||

| Britain on the verge of a constitutional crisis Posted: 28 Aug 2019 05:29 PM PDT The pound fell sharply by 100 points on the news that Boris Johnson could try to interrupt parliament for a month - from September 11 to October 14 - so that Parliament could not stop Johnson from withdrawing Britain out of the EU without an agreement. This is a constitutional crisis. The queen has such a right to suspend the work of the parliament, at the proposal of the prime minister. However, such an action on this occasion is a clear crisis. Given the minimal majority of conservatives in parliament - it is very likely - to have a political crisis and new elections. The material has been provided by InstaForex Company - www.instaforex.com | |||||||

| Trading idea for the EURUSD on August 28, 2019 Posted: 28 Aug 2019 04:44 PM PDT The dollar weakening impulse that gave rise to bullish sentiment on the EURUSD pair of August 23 did not develop into the third wave of purchases. Thus, players with long positions in Chinese duties and Powell are drawn into the market, and they are now trapped, which will be discussed in this article. Trading idea for the pair EURUSD The developments Recently, the most popular pair in the world of trading EURUSD was shocked by a series of very controversial events and news that I put on the daily chart of this pair (see below). The most important of these are Jerome Powell's speech and the US announcement of the imposition of duties on Chinese goods, as well as China's response itself. All these events dragged a large number of players into the market, relying on fundamental analysis and news. And this is normal. All this gigantic mass of orders - concentrated in the relatively small news range of 100p between quotes 1.105 - 1.1150 - it was in this zone that all the latest news came out. The technical picture In my analytics, I am guided by the "Hunting for stops" system, which assumes a price movement with a higher probability in the direction where the stops (money) of small and medium bidders accumulate, as well as signal bars from the D1 "Price Action" Let me remind you that the EURUSD pair is trading at the lows of the current (and last) year, and all long-term and medium-term buyers can hide their risks only for a round extremum of 1.1. In other words, everyone who has gone from dollars to euros on "duties" is now being held at 1.1 and they simply have no other place. The news impulse of 08/23/19 did not lead to the emergence of a third growth wave. Moreover, it is almost completely absorbed. The stops of medium-term buyers are now below this day at 1.1050, and this is the first target for EURUSD sales. The second goal is a minimum of a year, as well as around level of 1.1 - under which are the risks of buyers throughout the month of August. In addition, as practice shows, trading near such extremes lead to breakdowns of such levels. The material has been provided by InstaForex Company - www.instaforex.com | |||||||

| Is it possible to pull down the euro to $1.05? Posted: 28 Aug 2019 04:40 PM PDT Market sentiment is generally balanced between fears of a slowdown in the global economy and hopes of a degree decline in the trade conflict between the US and China. While this is not noticeable, on the contrary, all sorts of steps of the conflicting parties reveal the gambling tendency of officials to eternal confrontation. It is indicative that neither Beijing nor Washington have so far lost ground on such important issues as technology and intellectual property rights. Without a breakthrough in trade negotiations in the near future, current trends may well be negatively developed. The yuan is likely to remain under pressure and may well carry out a forecast of a fall to the level of 7.22 against the dollar. A strong weakening of the Chinese currency promises to be the main source of deflation in the world. This pressure will be less felt in the US, as the introduced tariffs lead to higher prices. Due to the fact that the parties are constantly adding fuel to the "bonfire" of trade disagreements, the dollar risks becoming more expensive in the future not only to the euro, but also to other major currencies. The fact is that the Federal Reserve will have less space to ease policy. If the United States and China do not come to a compromise, the dollar will head for a 14-year high and rise to 104 against a basket of 6 major competitors. The EUR/USD pair may suffer the most, as additional pressure on the euro comes from the ECB. The regulator promises to lower rates in September, if it keeps its word, then the main pair can fall to $1.05 by Christmas. At this point, the euro runs the risk of being stuck for the entire first quarter of next year. The ECB officials are unlikely to be bothered by the fall of the euro, even if the exchange rate reaches parity with the dollar. The main goal is to help the economy and avoid excessive buildup of debts. Meanwhile, the head of the Bundesbank, Jens Weidmann, believes that the ECB does not need to rush to resume mitigation and "act for action." The speculation about the rate cut at the September meeting is less and less consistent with the latest news from the economic front. It is worth noting that Weidmann is a traditional hawk, and only with the advent of a vacant seat as head of the ECB began to play the role of a pragmatist. This did not last long, since the place went to Christine Lagarde. The material has been provided by InstaForex Company - www.instaforex.com | |||||||

| EUR/USD: Should the Fed soften the blow or refuse to play along with Trump? Posted: 28 Aug 2019 04:40 PM PDT The EUR/USD pair is still stuck in the range of 1.1050-1.11150 and so far has not found a reason to exit this side trend. The day before, former head of the Federal Reserve Bank of New York William Dudley voiced what many probably thought, but did not dare to say out loud. "If the re-election of Donald Trump in 2020 poses a threat to the US economy, then the Fed should stop being apolitical and indulge the head of the White House," said the former vice president of FOMC. One of the reasons for the slowdown in US GDP, indeed, is the trade war between Washington and Beijing, which adversely affects investment and exports. Tariffs are a heavy burden on US citizens. The question is, why then should the Fed follow the lead of a person who is pushing the country to the abyss? According to W. Dudley, attempts by the regulator to protect the US economy from the negative effects of a trade war may not only be ineffective, but will worsen the situation even more. "What if easing monetary policy would only provoke the US president, allowing him to further escalate the trade conflict and increase the risk of recession?" he said. D. Trump raises old and introduces new tariffs, putting pressure on the Fed, urging it to cut the interest rate by 1% and to revive the quantitative easing (QE) program. He does all this in order to win the trade war, which harms the US economy. This is the truth that people refuse to listen. However, as you know, he will not get away from it. Another round of escalation of trade tension has led to a decrease in the differential yield of ten- and two-year US government bonds to -5.3 basis points for the first time since March 2007. At the same time, the spread between ten-year and three-month bonds fell to -51.4 basis points. Thus, the chances of a recession in the United States are growing by leaps and bounds, and there is no need to look for the culprit. Most of all, Trump' statement at the G7 summit on a phone call from the representatives of China regarding the resumption of trade negotiations seems to have surprised the Chinese themselves. So far, Beijing has not given any confirmation of the conversation. The trade war continues, the risks of a slowdown and recession in the US economy increases, and the USD index is growing. The reasons for the greenback's strengthening primarily lies in the weaknesses of its main competitors. At the same time, Washington's fears of currency interventions with the aim of weakening the US currency are holding back EUR/USD bears from taking action. Neither the deterioration of the political situation in Italy, nor the decrease in German GDP by 0.1% in April-June in quarterly terms led to a breakthrough of support at 1.1050-1.1065 for the EUR/USD pair. It is possible that market participants decided to wait for the release of data on US GDP for the second quarter, as well as the August release on European inflation, which will be released this week. The material has been provided by InstaForex Company - www.instaforex.com | |||||||

| Posted: 28 Aug 2019 04:28 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 28p - 49p - 101p - 70p - 30p. Average volatility over the past 5 days: 56p (average). A completely empty calendar of macroeconomic events makes traders stay out of the market. Those positions that are already open remain open, but new ones do not open, since there are no drivers for this. Thus, volatility fell to the lowest. Yesterday it amounted to only 30 points, so far it was at 24 today. There was not a single one from even minor publications today. Based on this, the emphasis on the forex market is again shifting towards the GBP/USD pair, on which there is clearly more news. Today, it was just like a bolt from the blue that Boris Johnson turned to Queen Elizabeth II of Great Britain with a request to suspend the work of the Parliament for a period of about one month. Naturally, market participants immediately rushed to sell the pound, and everyone forgot about the euro currency. In the current situation, we have only one thing to do. To speculate on the topic, what are the prospects of the European currency paired with the US dollar in the near future? Here we have some interesting factors to predict the future dynamics. The first is a perfect rebound of the pair from the Kijun-sen line on the daily chart using the Ichimoku indicator with standard settings. Every trader can see this rebound, and it is quite a strong sell signal. The second is a rebound from the Senkou span B line on the 4-hour chart, which is seen above. It is also a strong sell signal, as the Senkou span B line itself is strong. The third is a year and a half downward trend for the euro, which is difficult to break a priori. The fourth is the readiness of the ECB to cut rates at the next meetings, to revive the quantitative stimulus program and the lending program for commercial banks. The fifth is the proximity of prices to two-year lows. It usually happens that near lows, traders place either take profit orders in short positions or pending orders against the trend, which leads to sharp price rebounds from areas close to lows. In our case, traders do not expect the euro to strengthen and are going to stop the medium-and long-term sales of the euro/dollar pair. From our point of view, all these factors almost unambiguously speak in favor of the continuation of the downward trend. In favor of its completion, there are much fewer factors, or rather, one - the escalation of the trade conflict between China and the United States may lead in the future to a strong drop in US macroeconomic indicators and to a repeated reduction in the key Fed rate. That is what can lead to a drop in demand for the US currency and its depreciation. However, even this factor is, so to speak, long-term. On the technical side, the euro/dollar pair has now fallen to the support level of 1.1078. Consolidation below this level will open the way for bears to the level of 1.1023. Trading recommendations: EUR/USD continues to move down. At the moment, we can consider sell orders while aiming for the support level of 1.1023, if there are no problems with overcoming the 1.1078 level. Bulls once again showed their weakness, having failed to overcome the Senkou Span B line, so buying the pair is not recommended yet. In addition to the technical picture, fundamental data and the time of their release should also be considered. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com | |||||||

| "Queen's move": Johnson tries to neutralize the House of Commons Posted: 28 Aug 2019 04:10 PM PDT The pound-dollar pair plunged to the middle of the 21st figure today, reacting to the latest news around Brexit's prospects. Despite the rather rapid decline, bears of the pair could not overcome the support level of 1.2140, which corresponds to the average line of the Bollinger Bands indicator on the daily chart. Sellers retreated, but did not give up, continuing to put pressure on the British currency. In my opinion, this price impulse will not continue - at least on today's news. But in general, the closer to the start of the political season in Britain (which will begin next week), the more often such price spikes will occur. After all, by and large, the British currency is preparing for the main political battle of the year, between Prime Minister Boris Johnson and the deputies of the House of Commons. The fate of Brexit is at stake. In the next two months, Britain will either leave the EU without an agreement or extend the negotiation process for an indefinite (or very long) term. Given such a valuable "prize", politicians are thoroughly preparing for the upcoming battle. The unprecedented nature of this process is evidenced by the intentions of the parties to use even the Queen in their plans, which, as a rule, stands apart from such confrontations. But in this case, the government of Johnson and his opponents are ready to resort to the help of Elizabeth II. Today's price impulse, by the way, was also associated with the royal person. So, the head of the British government today quite officially asked the Queen to suspend the work of the Parliament of the United Kingdom until October 14. The corresponding appeal was published on the website of the British government. Johnson asked Elizabeth II to close the current Parliamentary session in the second week of the September meeting. Here it should be noted that the second session of the current Parliament should begin on Monday, October 14, - on this day the Queen's speech is planned with a detailed description of the legislative agenda. In other words, the prime minister, with the help of Elizabeth II, decided to neutralize the House of Commons, suspending its work for 5 weeks, that is, from September 9 to October 14. According to the plan of the head of government, the deputies in this case will not be able to take appropriate decisions that will actually block the "hard" Brexit. Naturally, such an unprecedented step on the part of the prime minister caused the effect of an exploding bomb. The pound dipped across the market, responding to Johnson's desperate desire to pull the country out of the EU at all costs. Here it is worth recalling that in July, the GBP/USD pair slumped from the 25th figure to its current positions just after the beginning of active actions by the current prime minister in preparation for the "hard" Brexit. He created the so-called "military cabinet" from among his ministers, launched a large-scale information campaign and urged the Treasury to prepare for the corresponding changes. All this testified to the fact that Downing Street is not bluffing, but seriously preparing to leave the EU without a deal. Today, Johnson once again confirmed the seriousness of his intentions in his letter to the Queen. But in this case, the devaluation of the pound was limited. There are several reasons for this. Firstly, according to many analysts, Elizabeth II is unlikely to take such a step. According to the British edition of The Sunday Times, the queen has recently expressed dissatisfaction with the way the current political elite rules the country. According to sources, since then, the discontent of Elizabeth II has only grown. Secondly, we must not forget that the House of Commons can also prepare countermeasures. Speaker of the British Parliament, John Bercow, said today that Johnson's decision was a "flagrant violation of the constitution." In turn, the representative of the Parliament from the Conservative Party, Dominic Grieve also commented quite harshly on the prime minister's intentions. He accused his party member of trying to usurp power by attempting to rule the country without a Parliament. Naturally, the British opposition did not stand aside - Jeremy Corbyn called the prime minister's actions "a threat to democracy." At the same time, both the Labour Party and the majority of Conservatives expressed confidence that the House of Commons would block the government's plans in the near future, and Johnson himself would be declared a vote of no confidence. Representatives of the Cabinet of Ministers retorted that the deputies would not stop the hard Brexit anyway, since they would not be able to form a government of "national unity", which means they would have to go to early Parliamentary elections, the date of which the prime minister appoints. At the same time, they have already announced on Downing Street that in this case, the elections will be scheduled for November 1-5, that is, after the country's actual exit from the EU. In other words, the main intrigue now is whether political opponents in the House of Commons will be able to form an interim government or will Johnson realize his plan? Thus, the prevailing fundamental background continues to put pressure on the pound. At the same time, short positions in the GBP/USD pair now look risky, since Johnson's recent actions may prompt former political opponents in Parliament to temporarily cooperate to achieve two goals: firstly, blocking the hard Brexit, and secondly, the resignation of Johnson. In this case, the British currency will receive very strong support and it could increase by at least a few figures against the dollar. The material has been provided by InstaForex Company - www.instaforex.com | |||||||

| GBPUSD: Pound crashes after Boris Johnson announces possible suspension of UK Parliament Posted: 28 Aug 2019 04:00 PM PDT The British pound collapsed by more than 100 points on Wednesday after an interview with British Prime Minister Boris Johnson as he asked Queen Elizabeth II to allow Parliament to stop working for several weeks. We are talking about a complete suspension of the work of Parliament, supposedly in order to develop a new program on Brexit, which was discussed last week with representatives of the European Union. However, it is clear to many that such actions of the prime minister, of course, are not aimed at developing a program, but are a kind of response to opposition legislators in order to complicate their work related to blocking proposals for Brexit. First of all, such measures will reduce the time required for lawmakers to draft and adopt bills that prevent Britain from "divorcing" the European Union without an agreement. According to the report, the prime minister intends to stop current Parliamentary session on September 11, and resume work only on October 14. The UK exit from the EU should happen on October 31. Opposition lawmakers immediately criticized the plan to suspend Parliament, as Johnson's appeal to the Queen makes Brexit more likely without an agreement, which hit the British pound. If in the first half of the day traders cautiously bought the British pound, now only Queen Elizabeth's refusal can return their faith in growth. EURUSD The euro continued to trade near the support level of 1.1080 in the morning. Pressure on risky assets continued even after the report that consumer sentiment in Germany in September this year will remain at a high level. According to a report by the GfK research group, the leading GfK consumer confidence index in September 2019 was 9.7 points, while economists expected it to decline to 9.6 points. Gfk cited the fact that domestic demand will continue to remain at a fairly high level in the coming months, which will provide support in the face of a slowing economy. Another not very good news for the ECB was the less active growth of lending to the private sector, while the growth of the money supply in the region increased. According to data, lending to companies in the eurozone grew by 3.9% in July compared with the same period last year, and lending to households accelerated to 3.4% from 3.3% in June. Economists expected more active growth in private sector lending. Eurozone money supply indicator M3 grew by 5.2% in July, while economists had expected growth to reach 4.8%. The technical picture remained unchanged. Bulls will need a lot of effort to return to the resistance of 1.1120 and break above this range, since only after that it will be possible to again discuss the topic of continuing the euro's growth to a peak of 1.1160. A break of support of 1.1080 will provide bears with new forces, which will push the trading instrument into the region of August lows to the level of 1.1050. The material has been provided by InstaForex Company - www.instaforex.com | |||||||

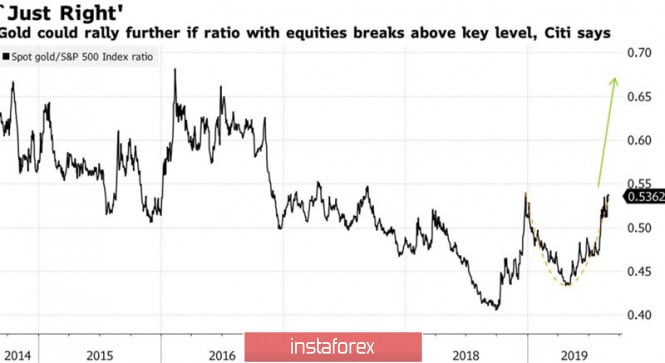

| Posted: 28 Aug 2019 03:49 PM PDT "Bulls" continue to dominate the gold market, while one little correction was immediately redeemed. Futures quotes and stocks of specialized exchange-traded funds have reached highest levels since 2013, and rumors about the return of the era of the gold standard only fuel interest in precious metals. This idea is being actively promoted in China, where they believe that the United States untied the dollar from gold several decades ago, because they wanted to take responsibility for order in the global financial system. Now Donald Trump has destroyed this order, so it's time to return to past values. If this happens, then XAU/USD can easily reach 2000. In fact, the main driver of the growth of precious metals are trade wars, which help slow down the US economy and force the Fed to lower the rate on federal funds. As a result, the yield on treasury bonds and the US dollar should fall. The first behaves as it should, but the second, on the contrary, strengthens due to the weaknesses of its main competitors, which is also good news for gold. When the main world currencies, under the influence of the ultra-soft monetary policy of central banks-issuers, feel unwell, investors increase the share of precious metals in portfolios. Some doubts about the continuation of the upward trend on XAU/USD emerged after the statement of the ex-president of the New York Federal Reserve, William Dudley, that the Fed should stop ignoring criticism of the president. Donald Trump is a threat to the US economy, and in order for him not to be re-elected in 2020, the central bank is obliged to raise rates. In 2013, following Ben Bernanke's announcement to stop asset purchases under QE, financial markets plunged into a tantrum, gold plummeted due to a soaring Treasury bond yield. The same situation could be repeated now if the Federal Reserve unexpectedly returns to monetary tightening. However, few people believe in this. According to Citi research, if the ratio of S&P 500 and precious metal can rewrite the peak of 2018, the figure will increase by 25%. In this situation, gold can easily break through $1,600 per ounce and move higher. UBS predicts that it will reach $1,650 within 12 months. S&P 500 to Gold Ratio The precious metal is supported by central banks that are not tired of buying it. According to ANZ estimates, total purchases in 2019 will exceed 650 tons. Dedollarization, sanctions and a trade war force regulators to diversify their reserves. The People's Bank of China has significant potential in this direction: the share of gold in its reserves is a modest 3%. Thus, the weakness of major world currencies, the fall in the yield of US treasury bonds (both nominal and real), high demand from central banks and ETF fans create a solid foundation under the bullish XAU/USD trend. Technically, the implementation of the AB = CD and Bat patterns continues. Their targets at 161.8% and 88.6% correspond to marks of $1630 and $1815 per ounce. The material has been provided by InstaForex Company - www.instaforex.com | |||||||

| August 28, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 28 Aug 2019 09:09 AM PDT

Back in June 24, the EURUSD looked overbought around 1.1400 facing a confluence of supply levels which generated significant bearish pressure over the pair. Shortly after, In the period between 8 - 22 July, a sideway consolidation-range was established between 1.1200 - 1.1275 until a triple-top reversal pattern was demonstrated around the upper limit. Then, Evident bearish momentum (bearish engulfing H4 candlestick) could bring the EURUSD below 1.1175. This facilitated further bearish decline towards 1.1115 (Previous Weekly Low) then 1.1025 (the lower limit of the depicted recent bearish channel) where significant signs of bullish recovery were demonstrated. Risky traders were advised to look for bullish breakout above 1.1050 as a bullish signal for Intraday BUY entry with bullish targets around (1.1115, 1.1175 and 1.1235). All of which were successfully reached. Shortly-After in Mid-August, the EUR/USD has been trapped between 1.1235-1.1175 for a few trading sessions until bearish breakout below 1.1175 occurred on August 14. Bearish breakout below 1.1175 promoted further bearish decline towards 1.1075 where the backside of the broken bearish channel has been providing significant bullish demand so far (A Bullish Triple-Bottom pattern is in progress). Bullish persistence above 1.1115 is needed to confirm the short-term trend reversal into bullish. This would enhance another bullish spike towards 1.1175 as an initial bullish target. Trade recommendations : Conservative traders are advised to have a valid BUY entry anywhere around 1.1090. Initial T/P levels should be located around 1.1150, 1.1175 and 1.1200. S/L should be placed just below 1.1040 ( the depicted newly-established uptrend line). The material has been provided by InstaForex Company - www.instaforex.com | |||||||

| August 28, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 28 Aug 2019 08:52 AM PDT

On July 5, a consolidation range bearish breakout was demonstrated below 1.2550 corresponding to the lower limit of the depicted consolidation range. Moreover, Bearish breakdown below 1.2385 (Prominent Bottom) facilitated further bearish decline towards 1.2320, 1.2270 and 1.2100 which corresponded to significant key-levels on the Weekly chart. The previously-mentioned price levels were risky for having new SELL entries. That's why, Long-term SELLERS were advised to have their profits gathered. In Early August, a temporary consolidation-range was established above 1.2100 before August 9 when temporary bearish movement was executed towards 1.2025. Recent bullish recovery was demonstrated off the recent bottom (1.2025). This brought the GBP/USD pair back above 1.2100 (recently-established demand Level). As expected, recent bullish movement was demonstrated towards 1.2230 then 1.2280 where recent bearish rejection was previously manifested towards 1.2215-1.2200. For the intermediate-term, Further bullish advancement is expected to pursue towards 1.2320 then 1.2380 as long as the current bullish momentum is maintained above 1.2200 and 1.2160 (the recent consolidation range pivot-point) on a daily basis. On the other hand, If the current bullish movement pursued further bullish momentum, price action should be watched cautiously around 1.2380 as bearish rejection maybe anticipated around this price level (being a correspondent to a broken Key-Support dating back to July 17). Trade Recommendations: Intraday traders were advised to look for a valid bullish entry anywhere around 1.2200-1.2170. It's already running in profits. Next T/P level to be placed around 1.2290, 1.2340 and 1.2385 while S/L should be placed below 1.2130. The material has been provided by InstaForex Company - www.instaforex.com | |||||||

| BTC 08.28.2019 - Test of the major supply trendline, more downside yet to come Posted: 28 Aug 2019 07:20 AM PDT Bitcoin 4H time-frame:

Bitcoin is trading sideways at the price of $10,150 but still in the overall downtrend. The 4-hour chart completed bear flag and I do expect more downside to come. The main supply trendline is on the test ($10,200) again and this should provide solid sell area. I don't see any signs of the reversal yet and I would avoid the bullish entries. Bitcoin Forecast and recommendations for traders: Bitcoin is in overall consolidation phase but most recently I found confirmed bear flag below the downward slopping trendline, which is sign that there is chance for more downside and potential of $9,727 or $9,106. Thus, I recommend selling cryptocurrency with a target of $9,727, with a Stop Loss level of $10,700.Daily pivot points S3 S2 S1 Pivot R1 R2 R3

| |||||||

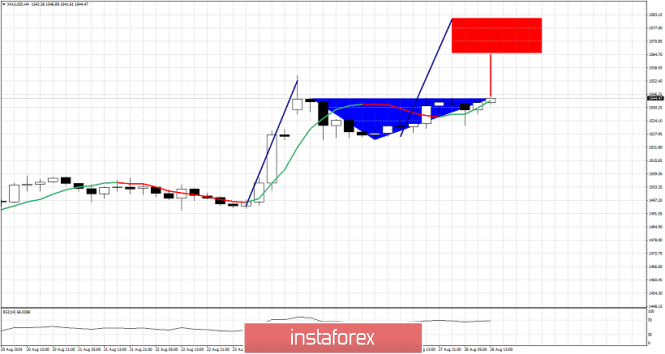

| Gold 08.28.2019 - Steady rising with no signs of reversal Posted: 28 Aug 2019 06:59 AM PDT Gold price did push higher as we expected and the Gold is heading to our upward target at $1,555.There are no signs of any reversal yet and I am still bullish on the Gold.

Brown diagonal trend line– Rising support Yellow rectangle – Resistance became support Red horizontal line – Resistance and our upward target MACD oscillator is still showing stable up momentum in the background and I do expect at least another movement higher. Key resistance is at $1,555 and support at $1,525. Bears need to be very cautious as there is still a overall bullish trend. I will stay bullish as long we don't see any big reversal sign. As long as the Gold is trading above the $1,525, I would watch for buying opportunities on the dips with target at $1,555. If you got long position from yesterday is is good idea to secure position on the breakeven and watch for potential target at $1,555. The material has been provided by InstaForex Company - www.instaforex.com | |||||||

| Analysis for EUR/USD and GBP/USD on August 28th. The euro remains calm and waiting for news Posted: 28 Aug 2019 06:41 AM PDT EUR/USD

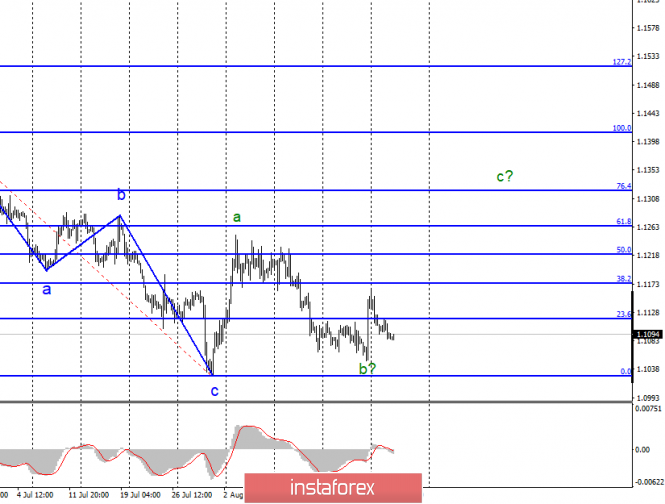

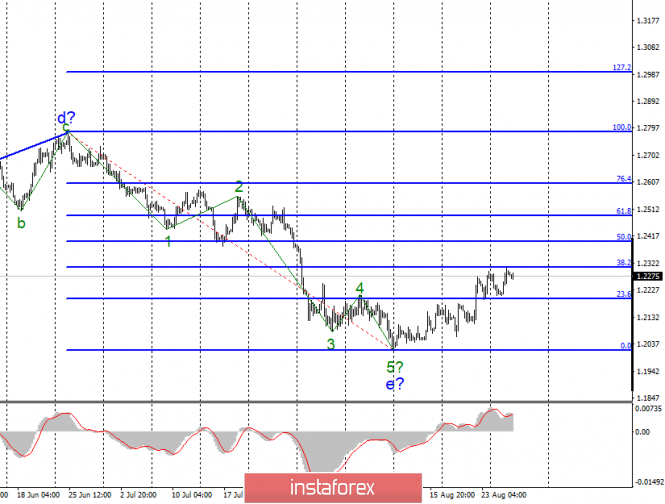

On Tuesday, August 27, the EUR/USD pair ended with a decrease of only a few base points. The wave pattern remains the same, has not changed yesterday and, most likely, will not change today. The only news of yesterday was the consumer confidence index in America, which could hardly have a strong impact on the movement of the euro/dollar pair. Today, no economic reports are expected in the foreign exchange market from either America or Europe. Based on this, the market can only wait for new data and hope that they will not be in favor of the dollar, as the current wave marking implies the construction of an upward wave with targets located around 13 figures. But even with such a simple task (growth of 200 basis points), buyers are now unable to cope. The news background, as I said, is absent in recent days, but in general, it remains permanently in favor of the US currency. Therefore, many traders are frankly afraid of buying the euro. Perhaps the situation will change tomorrow or the day after tomorrow when America and the EU will release some really important and interesting economic reports. Purchase targets: 1.1264 – 61.8% according to Fibonacci 1.1322 – 76.4% according to Fibonacci Sale targets: 1.1027 – 0.0% according to Fibonacci General conclusions and trading recommendations: The euro/dollar pair has supposedly completed the construction of wave b. I recommend buying a pair with targets located above the mark of 1.1250. I recommend selling the instrument not before receiving confirmation of the readiness of the market to build a new downward set of waves, that is, after a successful attempt to break the minimum of the wave C. GBP/USD

On August 27, the GBP/USD pair gained 70 bp, thus offsetting the loss of the previous day, but today, it fell after it became known about Boris Johnson's intention to appeal to Queen Elizabeth II with a request to suspend the parliament until October 14. Naturally, Mr. Johnson must implement Brexit without hindrance until October 31. It is also reported that Johnson wants to suspend Parliament from mid-September. Now the opposition, led by Jeremy Corbyn, has very little time to oppose anything to Johnson's ploy. Well, what will happen to the pound if Mr. Johnson implements his plan, you can see in the first minutes of the market's reaction to the message about the suspension of parliamentarians. An unsuccessful attempt to break the Fibonacci mark of 38.2% also played a role. The downward section of the trend threatens to take an even more complex and extended form, however, until the breakthrough of its current minimum, the construction of at least three waves up is still more promising. Sale targets: 1.2016 – 0.0% according to Fibonacci Purchase targets: 1.2306 – 38.2% according to Fibonacci 1.2401 – 50.0% according to Fibonacci General conclusions and trading recommendations: The downward section of the trend is previously considered completed. Thus, the anticipated creation of the upward correctional channel with the first order placed near the settlement marks of 1.2306 and 1.2401, which corresponds to 38.2% and 50.0% of Fibonacci. You can buy a pound, but I do not recommend doing it in large volumes. The material has been provided by InstaForex Company - www.instaforex.com | |||||||

| Technical analysis of GBP/USD for August 28, 2019 Posted: 28 Aug 2019 06:28 AM PDT Overview: In the H1 chart, The GBP/USD pair faced strong resistances at the level of 1.2300, the pair is likely to try to approach it in order to test it again. The price has set below the level of 1.2309, which coincides with the 100% Fibonacci retracement level (double top). This resistance has rejected four times confirming the veracity of a downtrend. We expect the GBP/USD pair to trade between the levels of 1.2300 and 1.2157. The trend is still bearish as long as the level of 1.2309 is not breached. As well as, the current price is also below the moving average 100 and 50. If the pair fails to pass through the level of 1.2309, the market will indicate a bearish opportunity below the levels of 1.2309 and 1.2300. So, the market will decline further to 1.2215 in order to return to the daily pivot point (1.2215). Moreover, a breakout of that target will move the pair further downwards to 1.2157 and 1.2121. Stop loss should always be taken into account, accordingly, it will be beneficial to set the stop loss above the last bullish wave at 1.2300. The material has been provided by InstaForex Company - www.instaforex.com | |||||||

| GBP/USD 08.27.2019 -SStrong downward movementum, watch for selling the rally Posted: 28 Aug 2019 06:28 AM PDT GBP price did drop in early morning session all the way to test the level of 1.2160. The momentum was very strong on the last down swing, which is sign that at least there can be re-test of the low at 1.2161.

Brown diagonal trend line– Important Support became resistance Blue rectangle – Support 1 Silver rectangle– Support 2 MACD oscillator is showing good new momentum down in the background and I do expect at least another movement lower. Key support is at 1.2161 and resistance at 1.2335.. Bulls need to be very cautious as there is strong downward momentum in the background and potential selling the rally type of feeling. Additionally, I found intraday symmetrical triangle in creation, which is sign for potential continuation of the down movement. As long as the GBP is trading below the 1.2270, there is potential for more downside... The material has been provided by InstaForex Company - www.instaforex.com | |||||||

| Makes sense to buy precious metals on dips Posted: 28 Aug 2019 06:10 AM PDT Gold found support just below $1,530 per ounce on Tuesday with dips in early Asia limited to $1,532 before a rally to the $1,545 area ahead of Wednesday's New York open. Silver still finds strong support on dips with 18-month highs close to $18.50 per ounce on Wednesday. There are strong expectations that the ECB will launch an aggressive monetary stimulus package at the 12th policy meeting in September with Vice President de Guindos calling on the bank to act with determination. German bond yields remain on negative territory across the curve with the 10-year yield at -0.60%. There is also a strong likelihood that the Federal Reserve will cut interest rates again at the September policy meeting with futures markets expecting at least a further 0.25% rate cut. Confidence in the Federal Reserve has been damaged by persistent attacks on the central bank and Chair Powell by President Trump. The US Administration approach to policy making will also be a key corrosive factor to dent sentiment on the US dollar. Barring a breakthrough in US-China trade talks, underlying risk appetite is likely to remain fragile with strong underlying demand for precious metals. European political factors will make a crucial impact with a fresh row erupting over Brexit as the UK government proposed suspending parliament for a month ahead of October 14th. A lack of confidence in the US and European political prospects will also reinforce demand for precious metals while the euro's vulnerability will tend to weaken the shared currency rather than reverse gains. Immediate technical resistance for silver is seen at near $18.70 with a medium-term target of $20.00 per ounce. Short-term silver support is likely to be on dips to $18.20 per ounce. Initial gold resistance is expected at near $1,560 with a longer-term target of $1,600 per ounce and short-term support near $1,535.

| |||||||

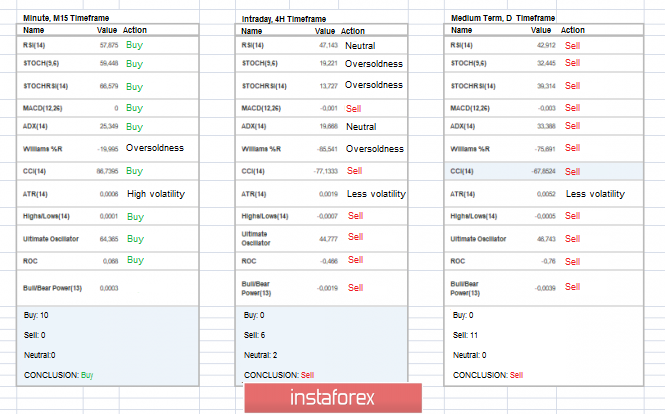

| Trading recommendations for the EUR/USD currency pair on August 28: placement of trade orders Posted: 28 Aug 2019 05:52 AM PDT Over the past trading day, the Euro/Dollar currency pair showed volatility two times lower than the daily average, but this fluctuation was enough to restrain the recovery process. From the point of view of technical analysis, we can see that the quotation aimed at the recovery phase after the recent surge in prices, having 80% of the impulse running. As a result, we have quotes returned back to the previously held flat of 1.1066/1.1100. As discussed in the previous review, only aggressive traders who have already taken almost two stages are actually working. The first stage was in the framework of restoring and returning the price to 1.1100 and the second stage was considered in terms of returning the price in the framework of the early flat at 1.1100-1.1066. Conservative traders continue to be outside the market, but already received a good signal at the time the price returned to 1.1100-1.1066. Considering the trading chart in general terms, we see that the impulse jump did not change the overall picture even if it was high. The global downtrend remains on the market. The news background of the past day contained S&P/Case-Shiller data on housing prices in the United States, which showed a decrease from 2.4% to 2.1% with a forecast of 2.1%. This indicator played an insignificant role in the market, so it was practically not noticed in terms of the dollar. The main support for the sustainable recovery of the dollar was induced by the background information. Hence, investors overestimated the risks of a trade war between the US and China after Donald Trump said that Beijing would like to solve the problems in a calm manner. According to the head of the United States, a telephone conversation with representatives of the PRC leadership, which took place on Monday and brought a bit of optimism, saying that his team is ready to sit at the negotiating table. It is still very early to talk about the conclusion of a deal. Nevertheless, negotiations were stopped due to duties, but fleeting optimism of investors was felt. In turn, there was a new newsletter regarding the beloved Brexit. A telephone conversation took place between British Prime Minister Boris Johnson and European Commission President Jean-Claude Juncker, where once again the newly-made prime minister focused on the "Backstop" item and on the determination to exit without a deal if this item is not corrected. The head of the European Commission expressed his willingness to work with Johnson, but noted that exit without a deal would be a solution exclusively for Great Britain, and not for the EU. Already today the news appeared that Boris Johnson kept his promise and announced that the work of the British parliament will be suspended until October 14, which significantly reduces the chances that the deputies will have time to prevent the country from leaving the EU without an agreement. Based on this news, the sterling pound naturally flew down. In turn, the euro/dollar reacted more restrained to the information, but still under pressure. Today, in terms of the economic calendar, there is not a single piece of good news. Thus, all hope for an informational background that already pleases us. Further development In analyzing the current trading chart, we can see that the quotation froze within the periodic value of 1.1080, forming versatile candlesticks like a Doji. The fact that we returned to the framework of the previous flat at 1.1066/1.1100 is endless for sellers, and the fact that there is still support for the information background adds positive emotions. Hence, traders continue to regard the current amplitudes as a good chance to make money (of course, we are talking about speculators). Conservative traders are waiting for the price to drop to the psychological level of 1.1000, where the main positions will already be produced. It is likely that in case of the pressure from the background information and passing short positions, the quote will remain in the recovery phase, where the primary point is the lower border of the flat 1.1066. In any case, the persistence of fluctuations within 1.1066/1.1100 will give us confirmation of the initial market interest. Based on the above information, we derive trading recommendations: - In case of fixing the price at 1.1120, we can consider buying positions with the prospect of a move to 1.1150-1.1160. - In case of fixing of the price lower than 1.1075, we can consider selling positions with the prospect of a move to 1.1066 -1.1050 - 1.1030. Indicator analysis Analyzing a different sector of timeframes (TF), we can see that the indicators signal a decline to a greater extent, thereby confirming the fact of recovery. In the short term, indicators temporarily turned upside down but the quotation is still within the framework of stagnation. Volatility per week / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (August 28 was built taking into account the time of publication of the article) The volatility of the current time is 15 points, which is a low indicator for this timeframe. It is likely that volatility may increase in the case of reflection of the information background and the preservation of the recovery process. Key levels Resistance zones: 1,1100 **; 1,1180 *; 1.1300 **; 1.1450; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1.2100 Support Areas: 1,1000 ***; 1,0850 ** * Periodic level ** Range Level *** Psychological level **** The article is built on the principle of conducting a transaction, with daily adjustment The material has been provided by InstaForex Company - www.instaforex.com | |||||||

| Short-term bullish warning signs for USDJPY Posted: 28 Aug 2019 05:33 AM PDT There are bullish divergence warning signs in the RSI of USDJPY. This is a warning that we could see at least a short-term bounce soon. A bounce towards 107.80 or even 109 is not out of the question.

Red line - resistance Green line - 2nd resistance Black lines- triangle pattern (broken downwards) USDJPY is trading around 105.70. Price has the potential of a bigger bounce towards 108 if price breaks above the red downward sloping trend line resistance and above 106.50. First important test for bulls will be at 107.50 and next at 109. There are bullish divergence signs in the RSI. Although trend remains bearish, these signs should not be taken lightly. Traders should better be cautious and protect their gains. As long as price is below 106.50 we remain bearish. The material has been provided by InstaForex Company - www.instaforex.com | |||||||

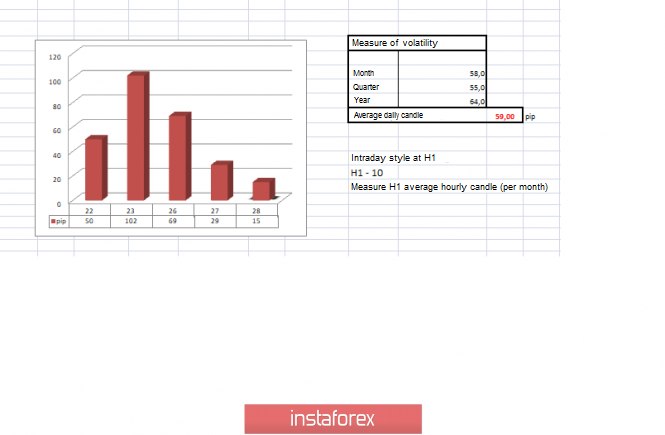

| GBP/USD: plan for the US session on August 28. The pound collapsed Posted: 28 Aug 2019 05:32 AM PDT To open long positions on GBP/USD, you need: The pound collapsed after the Prime Minister announced a possible suspension of the UK Parliament, which is a kind of response to yesterday's meeting of the opposition in an attempt to prevent uncontrolled Brexit. Buyers managed to keep the pair only in the support area of 1.2158, which I paid attention to in my morning review. The current challenge is maintaining trade above the support of 1.2195 that will lead to the growth of the pound to the area of the resistance of 1.2243, where I recommend taking the profit. If the situation in the pair only worsens with the opening of the North American session, you can return to long positions on a false breakdown near the low of 1.2158 or a rebound from the support of 1.2123. To open short positions on GBP/USD, you need: Bears will try to return the pair to the level of 1.2195 in the second half of the day, which will again lead to active sales of the pound and update the support of 1.2158. However, the main goal of sellers is to reach a new low in the area of 1.2123, where I recommend fixing the profits. Much will depend on whether Boris Johnson succeeds in getting Parliament suspended, which will largely hit the British pound and return the market to a bearish location. If the pound grows in the second half of the day, short positions can be returned to the rebound from the resistance of 1.2243. Signals of indicators: Moving Averages Trading is below 30 and 50 moving averages, indicating a return to the seller's market. Bollinger Bands If the pound grows, the average limit of the indicator in the area of 1.2250 will act as a resistance, from which you can open short positions immediately on the rebound.

Description of indicators

| |||||||

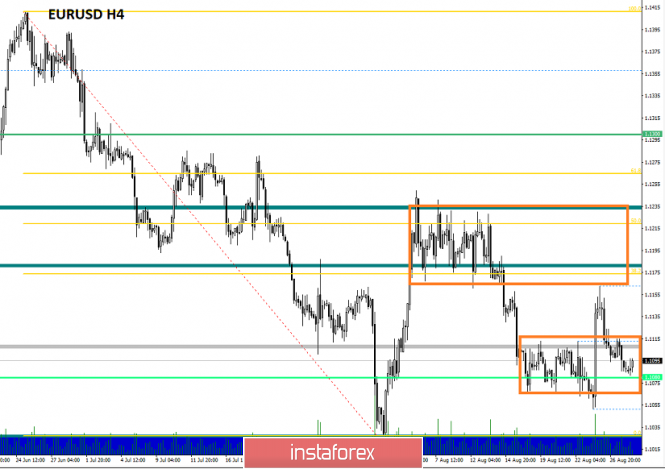

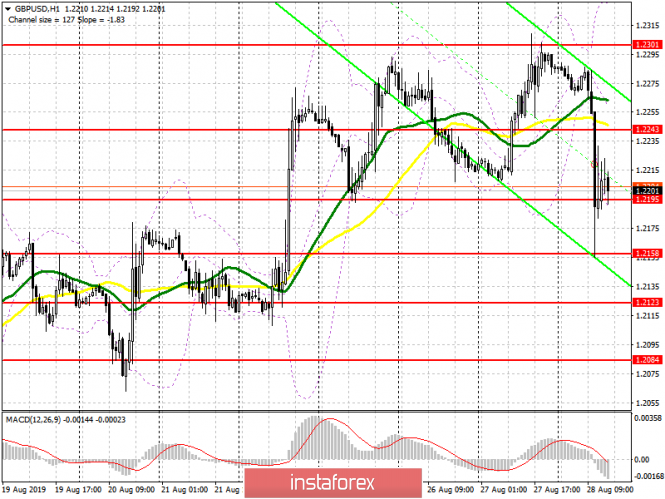

| EUR/USD: plan for the US session on August 28. The euro continues to stagnate in one place Posted: 28 Aug 2019 05:32 AM PDT To open long positions on EURUSD, you need: The released data on the decline in German import prices and the fall in lending to the private sector of the eurozone put pressure on the European currency in the morning, which remained to trade near the support level of 1.1086, which I drew attention to in my morning review. While buyers are not in a hurry to return to the market, therefore, I recommend postponing long positions until the minimum of 1.1055 is updated, which can be tested today in the afternoon. A return to the resistance level of 1.1119 remains an equally important task for buyers since only this will allow resuming the upward correction and updating the maximum of 1.1151, where I recommend taking the profit. To open short positions on EURUSD, you need: Sellers continue to knock at the support level of 1.1086, but only a consolidation below this range will increase the pressure on EUR/USD and lead to a further downward trend in the support area of 1.1055, where I recommend fixing the profits. In the case of the euro growth in the second half of the day, which may occur against the background of the absence of important fundamental statistics, only the formation of a false breakout in the resistance area of 1.1119 will signal the opening of short positions. Selling immediately on the rebound is best from a maximum of 1.1151. Signals of indicators: Moving Averages Trade is carried out near about 30 and 50 moving averages, which indicates more market uncertainty with the prospect of a further decline in the euro. Bollinger Bands The break of the lower limit of the indicator in the area of 1.1075 will lead to a further decrease in the euro.

Description of indicators

| |||||||

| EURUSD remains in bearish trend but could see 1.0950 if support at 1.1050 fails to hold Posted: 28 Aug 2019 05:27 AM PDT EURUSD remains below key resistance levels and continues to make lower lows and lower highs. Trend remains bearish despite the warning bullish divergence signs from RSI. No reversal signal yet.

Blue line - major resistance trend line Green rectangle - support area Red rectangle - target are if support area fails to hold price EURUSD is trading right above the green support area at 1.1050-1.1075. Breaking below this level will push price towards 1.0950-1.0970. Trend in the short-term is bearish as long as price is below 1.1150 (recent local high) and 1.1175 (blue downward sloping trend line resistance). Only a break above this area will change trend to neutral. Recapturing 1.12-1.1250 will turn trend to bullish. The material has been provided by InstaForex Company - www.instaforex.com | |||||||

| Gold price forming a cup with handle bullish pattern Posted: 28 Aug 2019 05:23 AM PDT Gold price has formed a bullish cup with handle pattern. Breaking above $1,547 could push price between $1,565 and $1,580. As long as Gold price holds above $1,530-25 area short-term trend remains bullish.

Red rectangle -target area Gold price is near its recent highs and continues to make higher highs and higher lows. After back testing and respecting the $1,500 support level, Gold bulls target $1,570 area. This short-term cup with handle pattern shows us exactly this and confirms the bullish trend. Target is between $1,564 and $1,580. Key support to keep this pattern valid is at $1,525. A four close above $1,547 will be a bullish signal. The material has been provided by InstaForex Company - www.instaforex.com | |||||||

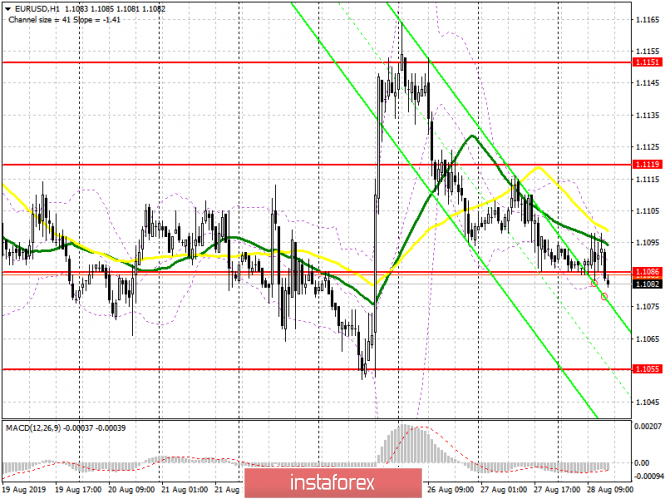

| Third wave in EUR/USD to begin anytime soon Posted: 28 Aug 2019 04:30 AM PDT

Wave C likely finished as an ending diagonal pattern, that's why there's an upward impulse, which supposed to be wave (i). In this case, the following decline is wave (ii), so there's an opportunity to have a third-wave rally. As you can see, there's a smaller upward impulse, which is probably the first wave of wave (iii). If so, we're about to have wave iii of (iii) in the coming hours. The main critical level for this scenario is the low of wave (ii) at 1.1051. If the price goes through this level, the bullish scenario will be at risk. If the third wave of wave (iii) is underway, the pair should break the high of wave i at 1.1165 in the short term, which brings more evidence for the bullish outlook. The main target for ongoing wave (iii) is the 1.618 multiple of wave (i) at 1.1411, which could be a departure point for a downward correction. If this level turns out to be broken, there'll be a green light for even more aggressive bullish rally. The bottom line is that there's a significant bullish opportunity in EUR/USD. The second wave of wave (iii) is almost over, so a third-wave rally is going to begin anytime soon. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment