TradingTips.com |

- This Sector’s So Hated that It’s Worth Buying Now

- Insider Activity: Encana (ECA)

- Trump Slams Strong Dollar

- Unusual Options Activity: Apple (AAPL)

- Mortgage Rates Hit Three-Year Low

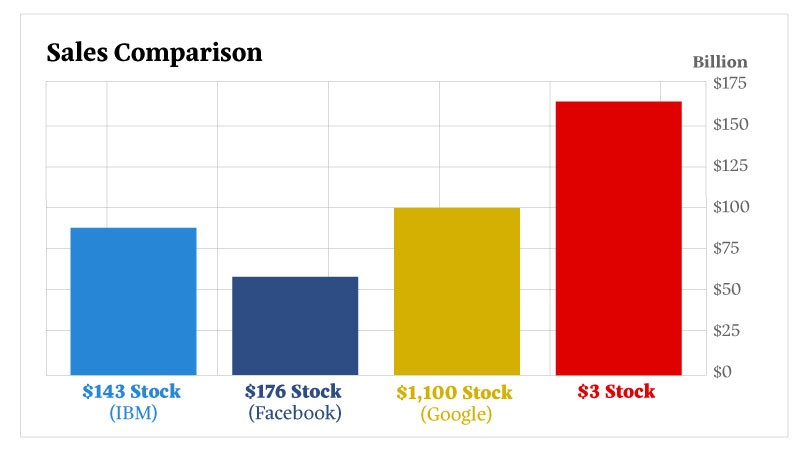

| This Sector’s So Hated that It’s Worth Buying Now Posted: 09 Aug 2019 11:35 AM PDT SPONSORED CONTENT Most Profitable $3 Stock in the World?Dear Reader, Let me show you a chart. It shows the revenue of four tech stocks. One is IBM. One is Facebook. One is Google. And that big red one to the right? It brings in more cash than any of the other three tech giants. And yet… While IBM trades for $143, Facebook for $176 and Google for more than $1,100… This other company trades for just $3. It’s mind-blowing. Sincerely, Matthew Benjamin Editorial Director, The Oxford Club P.S. This stock probably won’t be $3 for long. President Trump just visited with the CEO and said the company is working on the “eighth wonder of the world.” Get details on the groundbreaking project here.

|

| Insider Activity: Encana (ECA) Posted: 09 Aug 2019 03:00 AM PDT

CEO, Directors, continue to pick up shares. On Wednesday, August 7th, Encana (ECA) CEO Douglas Suttles picked up another 6,000 shares of the oil and gas exploration company. The $24,000 he spent raised his total stake to over 200,000 shares. This isn't his first buy this month. He also bought 10,000 shares on August 6th, paying nearly $42,000 as well. And he isn't alone, as multiple directors have been buyers since the start of the month. Director Fred Fowler picked up 25,000 shares—paying about $100,000—on August 7th. And Director Howard Mayson picked up 5,000 shares on August fist, paying about $22,500. Action to take: We like companies where there is a group of buys by insiders, especially when the CEO is one of them. With oil prices hitting a low for the year, any rebound in oil prices should translate into higher prices for energy companies like Encana. We like shares up to $5.00 at current prices on a rebound in energy, although on a down day traders may be able to get in under $4.00, the lowest price paid by insiders recently. Speculators may want to look at the January 2020 $7.00 call options, which trade for about $15 per contract and could move far higher on a percentage basis—although shares may not move that high before expiration.

|

| Posted: 09 Aug 2019 03:00 AM PDT

President blames Fed on policy errors. President Trump took to Twitter on Thursday to—once again—criticize policymakers at the Federal Reserve, to say: "As your President, one would think that I would be thrilled with our very strong dollar. I am not!" Trump went on to criticize how high interest rates are keeping the dollar high against other currencies, and thus impacting their appeal in international markets. Citing the lack of inflation, the President then went on to suggest that substantial cuts in interest rates could be achieved, which would improve the competitiveness of American industries operating abroad relative to other economies. The U.S. dollar dropped briefly on the Tweets, suggesting that the President may have been jawboning—the practice of trying to move an asset class on talk alone without action—however, the dollar quickly rebounded. The dollar looks like one of the most attractive currencies on the planet right now thanks to high interest rates relative to other currencies, the solid, but slowing rate of economic growth in the United States, and better investment opportunities in the United States relative to other countries. While a weaker dollar would help boost the economy, a weaker dollar could only be achieved against other currencies if they got relatively stronger. That seems unlikely in a slow global growth environment, even with actions to back the latest Tweets.

|

| Unusual Options Activity: Apple (AAPL) Posted: 09 Aug 2019 03:00 AM PDT

Bet on shares collapsing by late October. Shares of Apple (AAPL) could fall by nearly 50 percent in the next 70 days—at least, if the surge in October $105 put options on Thursday is any indication. With shares around $202, the $105 strike price is essentially a bet that shares will drop in half. With over 2,800 of these contracts trading against an open interest of 190, that's a 15-fold surge in volume on this deeply bearish trade. These options cost the buyer $0.02, or $2 per contract. So it's likely that it won't be held until the option's expiration. But on a big down day for markets, it's easy to see this $0.02 cent option move to $0.10, a five-fold increase. Barring a worse-than-2008 meltdown in markets, this option is unlikely to move in-the-money. Action to take: We like Apple as an overall proxy for the stock market, and buying a put option against the consumer technology company is an easy way to hedge long positions. But we would use a strike price closer to the current market price, such as $180, even though it means paying far more. And, given how long market corrections tend to play out, we'd want to look at June 2020 or even January 2021. While a put option trade like that may not increase fivefold, it would be more likely to move in-the-money.

|

| Mortgage Rates Hit Three-Year Low Posted: 09 Aug 2019 03:00 AM PDT

Drop in carrying costs could boost home prices. 30-year fixed rate mortgages averaged 3.60 for the week ending Thursday, down from 3.75 percent the week before, based on data from Freddie Mac's Primary Mortgage Market Survey. That's down nearly one full point from the same time a year ago, when the 30-year rate averaged 4.59 percent. 15-year rates also fell, averaging 3.05 percent, down from 3.20 percent one week ago and 4.05 percent one year ago. Mortgage rates are essential to the economy, as they impact the price of housing. Many consumers base their home buying on affordability, and lower mortgage rates allows buyers to pay more—or afford a larger home than they otherwise could at higher rates. Although a three-year low for mortgage rates, they could decline further as interest rate cuts by the Federal Reserve have just begun, and as global interest rates continue to likewise decline. Action to take: As a home serves as the largest investment for most Americans, lowering the cost of that home could be the best investment of 2019. You may be able to save thousands of dollars over the life of a mortgage by refinancing a property now. If you can get an interest rate at least 1 full point below your current rate, the first-year savings alone would pay for the cost of the refinancing paperwork.

|

| You are subscribed to email updates from TradingTips.com. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment