Forex analysis review |

- Fractal analysis of the main currency pairs for September 19

- Canadian dollar promised stagnation and slight growth

- Reflections on EURUSD

- GBP/USD. Weak inflation and harsh statements by Junker: what is the secret of the pound's "stress resistance"?

- EURUSD and GBPUSD: the resumption of the quantitative easing program in the US will put pressure on the dollar. Pound declines

- GBP/USD. September 18. Results of the day. The pound, like the euro, waited for the outcome of the Fed meeting and stood

- EUR/USD. September 18. Results of the day. The results of the Fed meeting. Traders stood waiting

- September 18, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- September 18, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- BTC 09.19.2019 - Broken Pitchfork trendline, more downside yet to come

- Gold 09.18.2019 - Failed HSS pattern or real? Watch for the breakout

- GBP/USD 09.18.2019 - First target at the price of 1.2500 has been reached, second target at 1.2545 is in play

- Trading recommendations for the EURUSD currency pair – placement of trade orders (September 18)

- GBP/USD: plan for the American session on September 18th. The pound fell after data on the slowdown in annual inflation in

- EUR/USD: plan for the American session on September 18th. The ECB's problems remain, as inflation in the eurozone is consistently

- Dollar may remain strong even though Fed cuts

- The dollar will fall if the Fed cuts rates immediately by 0.50% (We sell or buy EUR/USD and GBP/USD pairs based on the Fed's

- Control zones for NZD / USD pair on 09/18/19

- Technical analysis of EUR/USD for September 18, 2019

- Trading strategy for GBP/USD on September 18th. The graphical analysis predicts a new fall in the pound

- Review of EUR / USD and GBP / USD pairs on 09/18/2019: We will see

- Trading strategy for EUR/USD on September 18th. Ahead of the Fed meeting, the US currency is inclined to growth again

- Analysis of EUR / USD and GBP / USD for September 18. EU and UK inflation could hinder the growth of the euro and the pound

- Technical Analysis of EUR/USD for September 18, 2019

- Trading recommendations for the GBPUSD currency pair - placement of trade orders (September 18)

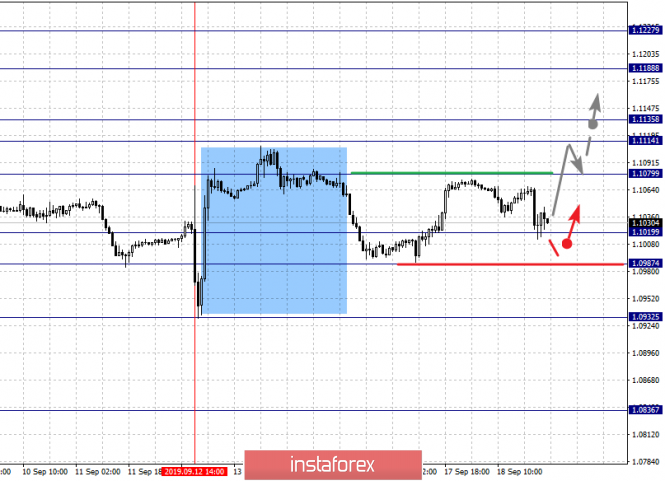

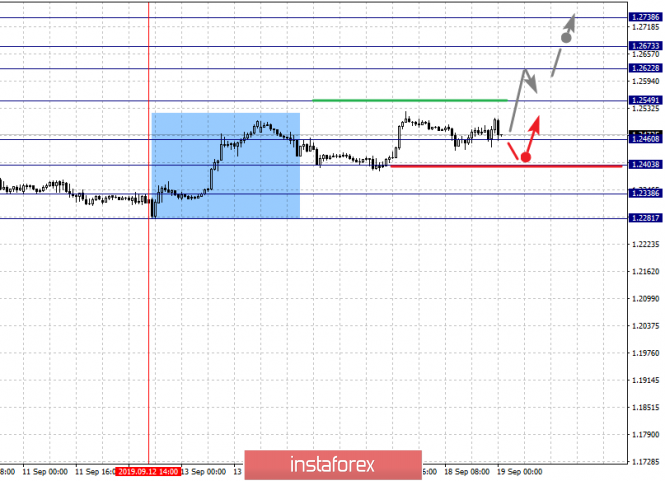

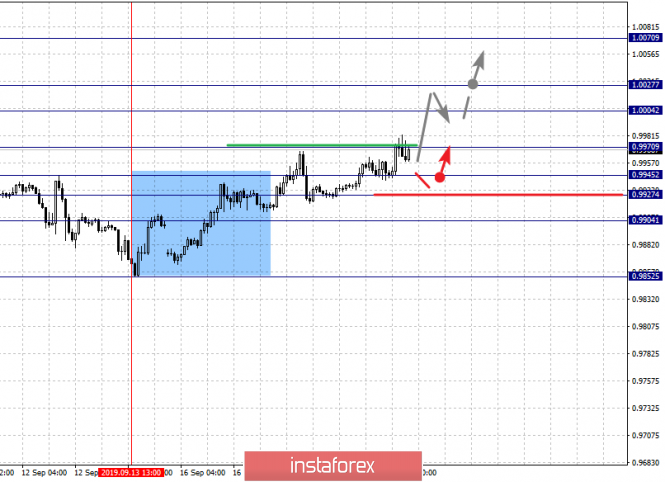

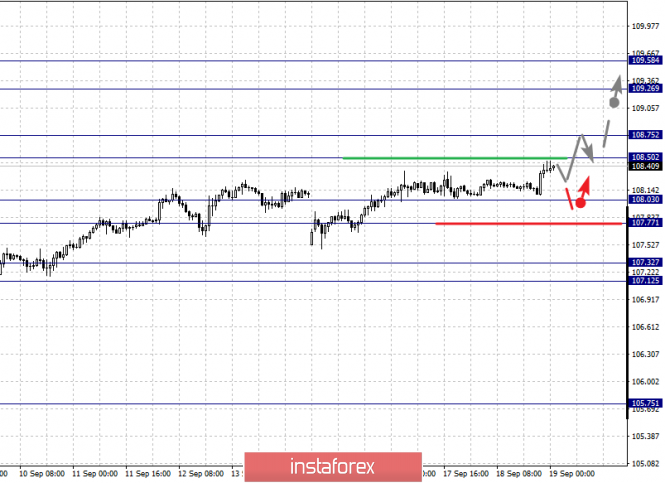

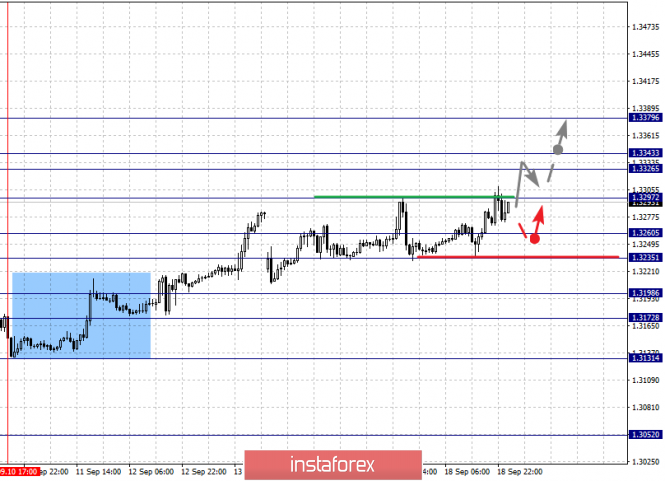

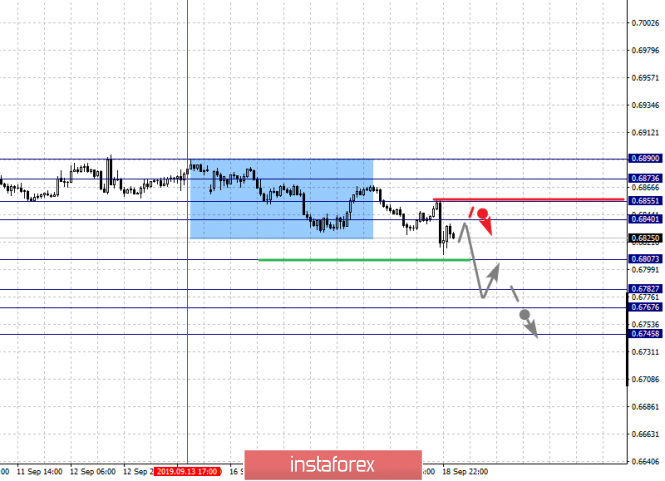

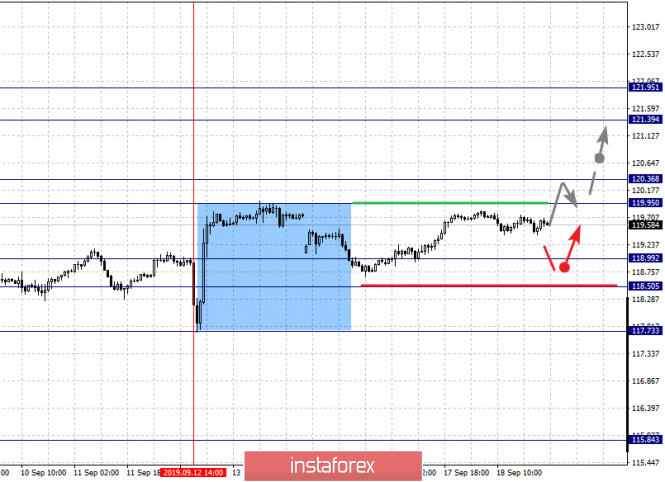

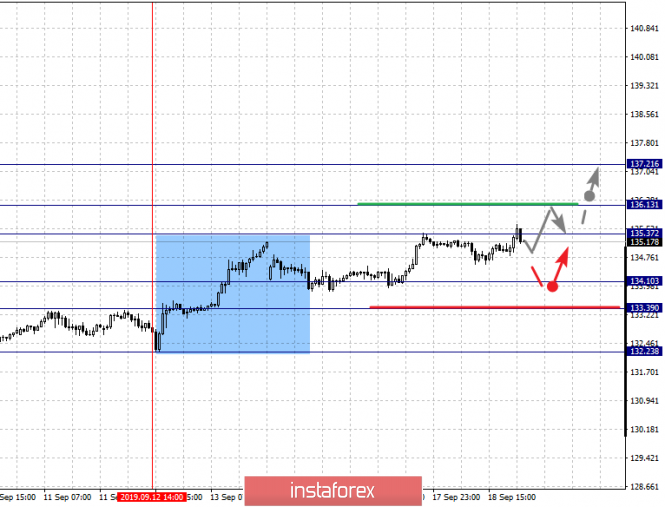

| Fractal analysis of the main currency pairs for September 19 Posted: 18 Sep 2019 05:19 PM PDT Forecast for September 19: Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1227, 1.1188, 1.1135, 1.1114, 1.1019, 1.0987 and 1.0932. Here, we continue to monitor the ascending structure of September 12. The target is 1.0932. The continuation of the movement to the top is expected after the breakdown of the level of 1.1080. In this case, the first goal is 1.1114. The passage at the price of the noise range 1.1114 - 1.1135 should be accompanied by a pronounced upward movement. Here, the goal is 1.1188. For the potential value for the top, we consider the level of 1.1227. Upon reaching this value, we expect a pullback to the bottom. Short-term downward movement is expected in the range of 1.1019 - 1.0987. The breakdown of the latter value will lead to the development of a downward trend. In this case, the first potential target is 1.0932. The main trend is the local structure for the top of September 12th. Trading recommendations: Buy: 1.1080 Take profit: 1.1114 Buy 1.1135 Take profit: 1.1188 Sell: 1.1019 Take profit: 1.0990 Sell: 1.0985 Take profit: 1.0935 For the pound / dollar pair, the key levels on the H1 scale are: 1.2738, 1.2673, 1.2622, 1.2549, 1.2460, 1.2403, 1.2338 and 1.2281. Here, we continue to monitor the local ascendant structure from September 12. The continuation of the movement to the top is expected after the breakdown of the level of 1.2549. In this case, the target is 1.2622. Price consolidation is in the range of 1.2622 - 1.2673. For the potential value for the top, we consider the level of 1.2738. Upon reaching which, we expect a pullback to the bottom. We expect consolidated movement in the range 1.2460 - 1.2403. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.2338. This level is a key support for the top. Its passage at the price will lead to the development of a downward structure. In this case, the first goal is 1.2281. The main trend is the local ascending structure of September 12. Trading recommendations: Buy: 1.2550 Take profit: 1.2620 Buy: 1.2674 Take profit: 1.2736 Sell: 1.2401 Take profit: 1.2340 Sell: 1.2336 Take profit: 1.2282 For the dollar / franc pair, the key levels on the H1 scale are: 1.0070, 1.0027, 1.0004, 0.9970, 0.9945, 0.9927 and 0.9904. Here, we are following the formation of the upward potential of September 13. The continuation of the movement to the top is expected after the breakdown of the level of 0.9970. In this case, the target is 1.0004. Short-term upward movement, as well as consolidation is in the range of 1.0004 - 1.0027. For the potential value for the top, we consider the level of 1.0070. Upon reaching which, we expect a pullback to the bottom. Short-term downward movement is expected in the range of 0.9945 - 0.9927. The breakdown of the last value will lead to an in-depth correction. Here, the target is 0.9905. This level is a key support for the upward structure. The main trend is the potential formation for the top of September 13. Trading recommendations: Buy : 0.9972 Take profit: 1.0004 Buy : 1.0006 Take profit: 1.0025 Sell: 0.9945 Take profit: 0.9928 Sell: 0.9925 Take profit: 0.9905 For the dollar / yen pair, the key levels on the scale are : 109.58, 109.26, 108.75, 108.50, 108.03, 107.77, 107.32 and 107.12. Here, we are following the development of the ascending structure of September 3. Short-term upward movement is expected in the range of 108.50 - 108.75. The breakdown of the last value will lead to a pronounced movement. Here, the target is 109.26. For the potential value for the top, we consider the level of 109.58. Upon reaching this value, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is possibly in the range 108.03 - 107.77. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 107.32. The range 107.32 - 107.12 is the key support for the top. Before which, we expect the expressed initial conditions for the downward cycle to be formed. Main trend: local upward structure from September 3. Trading recommendations: Buy: 108.50 Take profit: 108.72 Buy : 108.77 Take profit: 109.26 Sell: 108.03 Take profit: 107.80 Sell: 107.74 Take profit: 107.45 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3379, 1.3343, 1.3326, 1.3297, 1.3260, 1.3235, 1.3198 and 1.3172. Here, we are following the development of the ascending structure of September 10. The continuation of the movement to the top is expected after the breakdown of the level of 1.3297. Here, the target is 1.3326. Price consolidation is in the range of 1.3326 - 1.3343. For the potential value for the top, we consider the level of 1.3379. Upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 1.3260 - 1.3235, The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3198, This level is a key support for the top. Its breakdown will lead to the development of a downward structure. In this case, the potential target is 1.3172. The main trend is the ascending structure of September 10. Trading recommendations: Buy: 1.3299 Take profit: 1.3226 Buy : 1.3344 Take profit: 1.3378 Sell: 1.3260 Take profit: 1.3237 Sell: 1.3233 Take profit: 1.3200 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6890, 0.6873, 0.6855, 0.6840, 0.6807, 0.6782, 0.6767 and 0.6745. Here, we are following the formation of the descending structure of September 13. The continuation of the movement to the bottom is expected after the breakdown of the level of 0.6807. In this case, the target is 0.6782. Price consolidation is in the range of 0.6782 - 0.6767. For the potential value for the bottom, we consider the level of 0.6745. Upon reaching this value, we expect a rollback to the top. Short-term downward movement is possibly in the range of 0.6840 - 0.6855. The breakdown of the last value will lead to a long correction. Here, the potential target is 0.6873. This level is a key support for the downward structure. Its breakdown will allow you to expect movement to a potential target - 0.6890. The main trend is the formation of the downward structure of September 13. Trading recommendations: Buy: 0.6840 Take profit: 0.6853 Buy: 0.6856 Take profit: 0.6873 Sell : 0.6805 Take profit : 0.6782 Sell: 0.6765 Take profit: 0.6745 For the euro / yen pair, the key levels on the H1 scale are: 121.95, 121.39, 120.36, 119.95, 118.99, 118.50 and 117.73. Here, we continue to monitor the ascending structure of September 12. Short-term upward movement is expected in the range of 119.95 - 120.36. The breakdown of the level of 120.36 should be accompanied by a pronounced upward movement. Here, the goal is 121.39. For the potential value for the top, we consider the level of 121.95. Upon reaching which, we expect a pullback to the bottom. Short-term downward movement is possibly in the range 118.99 - 118.50. The breakdown of the latter value will lead to the cancellation of the upward structure from September 12. Here, the first potential target is 117.73. The main trend is the local structure for the top of September 12. Trading recommendations: Buy: 119.95 Take profit: 120.34 Buy: 120.38 Take profit: 121.35 Sell: 118.99 Take profit: 118.53 Sell: 118.46 Take profit: 117.80 For the pound / yen pair, the key levels on the H1 scale are : 137.21, 136.13, 135.37, 134.10, 133.39 and 132.23. Here, we are following the local ascending structure of September 12. Short-term upward movement is expected in the range of 135.37 - 136.13. The breakdown of the last value will lead to movement to a potential target - 137.21, when this level is reached, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 134.10 - 133.39. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 132.23. This level is a key support for the upward structure. The main trend is the ascending structure of September 3 and the local ascending structure of September 12. Trading recommendations: Buy: 135.38 Take profit: 136.10 Buy: 136.15 Take profit: 137.20 Sell: 134.10 Take profit: 133.42 Sell: 133.35 Take profit: 132.30 The material has been provided by InstaForex Company - www.instaforex.com |

| Canadian dollar promised stagnation and slight growth Posted: 18 Sep 2019 04:44 PM PDT The Black Swan, which suddenly plunged the oil market, affected a number of world currencies. The Canadian dollar did not bypass this fate. After an attack on an oil refinery in Saudi Arabia, the loonie can stay in the range of 1.3150–1.3250 for a long time, Scotiabank analysts said. According to Sean Osbourne, Scotiabank's currency strategist, the dynamics of the loonie are significantly affected by short-term regression models, which include the cost of oil, bonds, stocks and current volatility. These factors reflect the fair value of the loonie, which is approaching 1.2994, S. Osborne asserts. The expert does not exclude short-term retesting of the level of 1.3300, however, he emphasizes that the possibilities for the loonie's significant growth are currently limited. According to Scotiabank analysts, the USD/CAD pair can trade within 1.3150–1.3250 for a long time, until a more clear trend appears. S. Osborne is confident that the loonie will "settle" in the range of 1.3150 to 1.3250, as it will continue to respond to events in the black gold market after attacks on the oil infrastructure of Saudi Arabia. Currently, the loonie is trading near the marks of 1.3259-1.3263. Bipan Rai, Head of North American Currency Strategy at CIBC, agrees with Scotiabank. Predicting the further dynamics of the Canadian currency, he expects to consolidate it in the range of 1.3150-1.3220. B. Paradise also takes into account the relationship of the loonie with the dynamics of the price of light oil WTI. When the correlation of the CAD – WTI pair was low, an increase in the realized volatility of raw materials helped to strengthen the CAD – WTI connection, the analyst emphasizes. With a decrease in the CAD – WTI correlation, the possibility of the benefits that the loonie gains from rising oil prices is reduced. More optimistic expectations regarding the Canadian dollar came from analysts at JP Morgan. They increased the forecast for the loonie from 1.3200 to 1.3100 by the end of this year, and in the third quarter of 2020 they expect a figure of 1.3000. The calculations of specialists are based on a possible one-time rate cut by the Bank of Canada. It is possible that this will happen next month, according to JP Morgan. Analysts take into account the current policy of the Canadian regulator, which does not always coincide with the decisions of the US Federal Reserve. The material has been provided by InstaForex Company - www.instaforex.com |

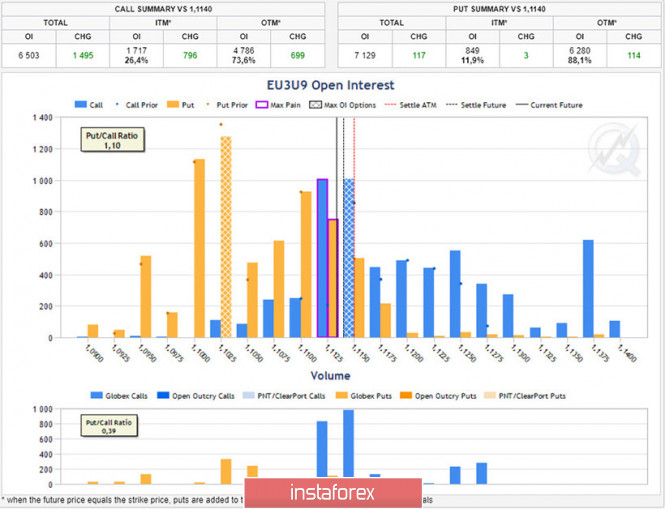

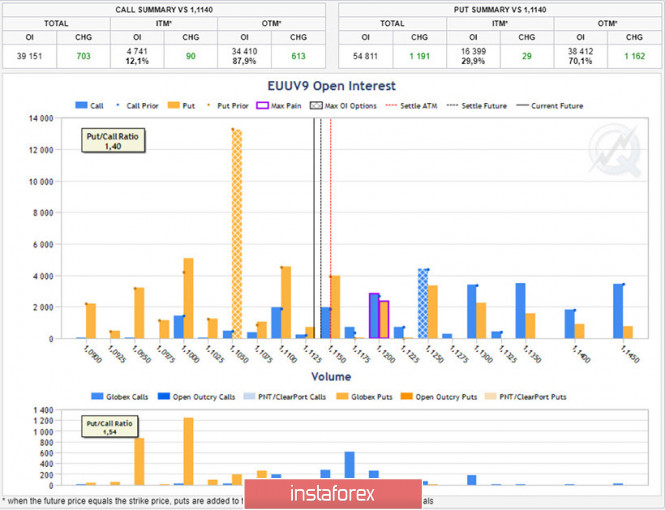

| Posted: 18 Sep 2019 04:29 PM PDT Predicting the movement of assets before the publication of such news as the decision of the US Federal Open Market Committee is a futile task. It is much easier to do this when the solution has already been published, and then you can very thoroughly explain why it happened this way and not otherwise. But I still take the risk and try to propose the most likely scenario for the development of events, all the more subsequently it will be interesting to see if I turned out to be right or not. Actually, the question that I want to answer in this article is whether the Fed's decision and Jerome Powell's speech can turn the dollar back, or at least to provoke it to a correction. If the upward trend in the US currency has already been going on for a year and a half, and Trump is very dissatisfied with this. The answer to this question will help me make the EURUSD rate, especially since the dollar index consists of almost 60 percent of the euro. In addition, EURUSD is the most popular and complex currency pair, so I think it will be interesting to everyone to understand what is happening in the European currency. To analyze the situation, I will not draw graphs, patterns and clutter up the article with an abundance of indicators. I hope that my fundamental approach based on the analysis of the futures market will help someone create their own strategy for assessing the situation. I will use the data of the futures market provided by the CME exchange on option positions of traders, and I will proceed from the hypothesis that the sellers of options are big players, and most of the options bought burn up without being in the money. Alas, this is so, buying options is a game with a negative mathematical expectation, which, however, does not make strategies with their application automatically unprofitable. So what do we know at the moment? We will use the CME exchange data for weekly and monthly option positions, which determine the dynamics of the asset for an hour and four hour time. At the same time, we will take into account the fact that now the difference between the cash contract that we see in the terminal and the December futures, the so-called forward point, is 72 points. EU3U9 weekly option, basic contract 6EZ9 This EU3U9 option contract closes on Friday, September 20, and gives the right or obligation to buy or sell the December futures euro contract 6EZ9 at a pre-agreed price. Since there is still a lot of time before the futures close (expiration), the contact is not of great value, especially in the conditions of the expected strong volatility inherent in the decisions of the US Federal Reserve. However, the EU3U9 option contract implies a disposition equivalent to an hour time in InstaForex terminals (Fig. 1), which makes it a valuable analysis tool for traders working in that time. First of all, pay attention to the ratio of the number of put options and Put/Call Ratio calls equal to 1.10, which means a slight excess of the number of put options over call options, and suggests that the futures rate is slightly easier to move up than down. Fig. 1: Positioning of the EU3U9 option contract. Source - CME Exchange Chart 1 attracts two large levels of put options located at 1.10 and 1.1025, which for a cash contract will correspond to levels 1.0925 and 1.0950. This is the so-called lower limit of the market. On the right is the level of 1.1150, which corresponds to the value of 1.1075, in the InstaForex terminal and this is the upper boundary of the market. In the center is the so-called Max Pain point, level 1.1125, where option buyers will incur maximum losses. Sellers, in turn, want the price to be as close to this level as possible when closing the contract on Friday. In a calm market, one could make the assumption that the price in InstaForex terminals on Friday, September 20, will close there, near the level of 1.1050 (remember the forward point 72 points between the cash and the futures contract), but today is a special case, and we it is necessary to make an amendment to the publication of the decision of the US Federal Reserve. EUUV9 monthly option, basic contract 6EZ9 This EUUV9 option contract closes on October 4 and gives the right or obligation to buy or sell the December euro futures at a pre-agreed price. This option contact is more valuable than the EU3U9 weekly contract, especially amid expected strong volatility inherent in the decisions of the US Federal Reserve. The EUUV9 option contract assumes a disposition equivalent to a four-hour half-time in InstaForex terminals (Fig. 2). Fig. 2: Positioning of the EUUV9 option contract. Source - CME Exchange As can be seen from chart 2, the open interest in this monthly option contract is about ten times higher than the EU3U9 weekly contract. The ratio of put and call options is 1.40, i.e., the number of puts is much higher than the number of open calls, which makes it difficult for the price to move down and facilitates the growth of the rate. The MP point is at a value of 1.12, which corresponds to the level of 1.1125 in InstaForex terminals. The lower boundary of the market is at the level of 1.1050 or 1.0975 for the cash contract. The upper boundary of the market is located at 1.1250 or 1.1175 for a cash contract. Based on the current disposition corresponding to the four-hour time, it can be assumed that in the future, until October 4, the euro exchange rate in the terminals will tend to the zone of 1.1125 and may try to rise slightly higher and gain a foothold at the level of 1.12. Summing up the results of this analysis, we can conclude that by October 4, with a probability of 68%, the EURUSD rate at InstaForex terminals will be in the range of 1.0925 –1.1200. Higher levels are not yet available for EURUSD, since they are limited by significant option barriers in the futures market. From below, the course will support levels 1.0925 - 1.0950. The situation in the EURUSD course, in the long term from one to four weeks, can be described as a range for the breakthrough of which a significant news background is needed. Thus, it is likely that the decision on the rate will really be able to reverse the euro. However, this will be very difficult to do, and with a high probability the formation of a wide range of 1.0950 - 1.1250 will continue until the Fed meeting in December. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 18 Sep 2019 04:13 PM PDT The pound moved away from its peak of the week and month (1.2526) against the dollar today, returning to the framework of the 24th figure. In general, during the European session, the GBP/USD pair showed weak price fluctuations, literally within the 40-point range. But this fact is rather surprising, given the entire array of negative fundamental factors. The current behavior of the British currency is indeed anomalous. After extremely weak data on inflation in the UK, after pessimistic statements by Jean-Claude Juncker and the same pessimistic statements by Boris Johnson, the pound not only did not collapse to last week's levels, but also restored points lost in the morning at the beginning of the US session. According to some analysts, such a "stress tolerance" of the pair is associated with future events. Like, on the eve of the announcement of the results of the Fed meeting, no one risks opening large positions - neither against the dollar, nor against the pound. In addition, the Bank of England's meeting is expected tomorrow as well as the publication of a summary of monetary policy. The above events, of course, restrain many market participants - in such periods it is much safer to "sit on the fence." But in my opinion, the stability of the British currency is primarily due to the Brexit issue. Leaving aside the warlike statements of Juncker and Johnson, the market focused on other facts that speak in favor of the negotiability of the parties. The first fact is obviously optimistic. Today, the European Parliament agreed to delay Brexit. Although the text of the corresponding decision abounds with a multitude of "ifs," the market reacted positively to this. By and large, Europe has taken the first step towards London, and now the only question is for Johnson to make a similar maneuver towards Brussels. But the odious prime minister does not get tired of repeating that he does not intend to ask for a postponement at the summit of EU leaders on October 17-18. Instead, he will try to make a new deal, hoping to agree on a solution to the problem along the Irish border. The European Commission has already expressed bewilderment in this regard: Jean-Claude Juncker said that Britain has not yet submitted a single proposal for Brexit. At the same time, the head of the EC specified that the risk of a "hard" scenario is growing every day, since there is very little time left to conclude an agreement. But this, so to speak, is only the external side of the issue. But "behind the scenes" is a completely different political game, the details of which became known to journalists of the influential publication The Guardian. With reference to their sources in the British government, the authors of the sensational material argue that in fact London is negotiating with Brussels on a new agreement, however, very peculiarly. The British negotiators are conducting "oral consultations", but at the same time they refuse to provide any written proposals to their European colleagues. As informed sources told reporters, the British are afraid of "very long discussions" or public criticism, therefore they want to submit written proposals to Brussels literally in the last minutes before the October summit. According to the draft version of the deal (in Johnson's interpretation), London will exclude the backstop clause from the text of the agreement, and instead of this mechanism will propose an alternative (which one is still unknown). By and large, this information, which, of course, is unconfirmed, is in good agreement with Johnson's political behavior and his earlier statements. In the summer, he announced that if the backstop mechanism was abandoned, the parties would make rapid progress on the issue of concluding an agreement. Here are just some alternative ideas for the "back stop" he did not voiceso - neither the public nor to the negotiating group. In addition, there is a version that Johnson leads the country "at full speed" to the hard Brexit only so that the EU "flinches at the last moment", that is, literally on the last day before the "X-hour". Allegedly, in this case, Brussels may succumb to blackmail and show political flexibility, at least in the matter of back-stop. Of course, given the eccentricity of Johnson, this option was initially "on the lips" of many analysts. Insider information of The Guardian only confirmed the realism of this scenario. Thus, traders do not give up hope for a deal, especially against the background of today's decision of the European Parliament and insider British press. Due to these factors, the pound is actually kept at the boundaries of the 25th figure, ignoring all other signals. Indeed, in other conditions, the sterling would have fallen in price by at least 1-2 figures, after the release of data on the growth of British inflation (I recall that the core consumer price index collapsed to around 1.5%). This fact suggests that traders of the GBP/USD pair may just as well ignore the overall growth of the US currency if the results of the Fed meeting are in favor of the greenback. The Brexit theme still takes precedence over other fundamental factors, so any positive rumors or comments in this context will lead the pair to at least 1.2540 (the upper line of the Bollinger Bands indicator on the daily chart). The material has been provided by InstaForex Company - www.instaforex.com |

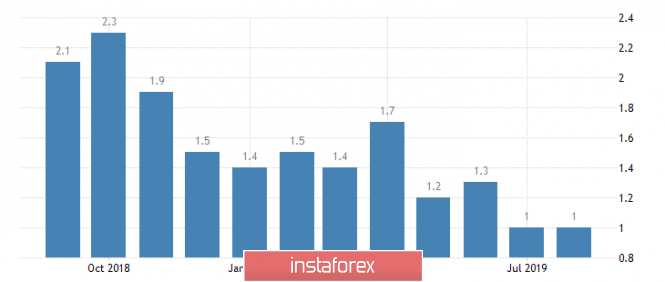

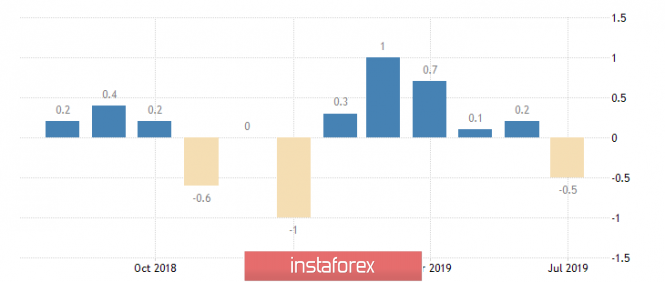

| Posted: 18 Sep 2019 04:02 PM PDT The British pound slightly fell against the US dollar after yesterday's attempt to break the weekly highs, which turned out to be unsuccessful. Pressure on the pound was formed by a weak report on inflation growth, which many traders expected. It is a good report on achieving the target level of the consumer price index with a probability of exceeding it in the next few months that would allow speculative players to build up new long positions in the expectation that whatever the result of Brexit on October 31, the Bank of England will again begin to signal the likelihood of an increase in interest rates to contain inflationary pressures. According to data, inflation in the UK sharply slowed in August. In the report, one of the reasons indicates a fall in prices for information technologies, including computer games. Thus, the report of the National Bureau of Statistics indicated that the annual inflation rate in the UK was 1.7% in August, while in July, compared with the same period last year, consumer prices rose by 2.1%. However, in the near future an increase in energy prices is expected, which may occur as a result of a rise in the cost of raw materials due to attacks on a key Saudi refinery. As for the growth of the consumer price index CPI in the UK, it increased by 0.4 in August compared with July,. Economists had expected inflation to rise by 0.5% and 1.8%, respectively. Core inflation, which does not take into account volatile categories, rose by 0.4% in August compared with July and by 1.5% compared to the same period in 2018. Although the chances that the Bank of England will raise interest rates are illusively small, especially when the Federal Reserve and the European Central Bank ease monetary policy, it should be recalled that at its last meeting, the English regulator signaled that it may raise interest rates three times in the next two years. This will be done in order to restrain inflation if the UK exit from the EU goes smoothly. As for the technical picture of the GBPUSD pair, the pound's further growth depends on the weakness of the US dollar and on the results of today's Fed meeting. If the ceiling near 1.2530 is broken, then, most likely, the demand for the trading instrument will increase, which will lead to the renewal of new local highs around 1.2600 and 1.2640. Eurozone inflation data went unnoticed for the EURUSD pair, which slightly adjusted after yesterday's growth. According to the report, the Eurozone CPI CPI grew by only 0.1% in August this year compared with July and by 1.0% compared to August 2018, which is bad news for the European Central Bank, which last week already lowered the rate on deposits, saying that it would resume the asset repurchase program in November this year. The data almost coincided with the forecasts of economists who expected monthly growth of 0.2% and 1.0%, respectively. As for core inflation, it grew by 0.2% and 0.9% per annum. The eurozone consumer price index excluding tobacco products increased by only 0.1% in August compared with July. In my morning review, I pointed out that today the Fed will lower its key interest rate by 25 basis points due to concerns about a slowdown in the global economy. The market has already taken into account this decline. Another thing is whether the Fed will announce the resumption of quantitative easing. If this happens, the pressure on the US dollar may increase significantly, which will lead to its fall against a number of world currencies. As for the technical picture, it remained unchanged. A break of last week's high in the region of 1.1110 will cause larger purchases of the trading instrument, which will lead to an update of the levels of 1.1150 and 1.1230. Under the EURUSD decline scenario, the support will be at the level of 1.0990, and larger areas are already located at the lows of this month in the areas of 1.10950 and 1.0920. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 18 Sep 2019 03:46 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 58p - 84p - 178p - 104p - 134p. Average volatility over the past 5 days: 111p (high). The British pound, as, in principle, and the euro, ignored the UK inflation report for August. Despite the fact that the annual rate fell to 1.7%, although the previous value was 2.1% and the forecast was 1.9% y/y, there were no sales of the pound. But at the same time, no upward movement was observed during the day. In this situation, there can only be one explanation: traders are waiting for the results of the Federal Reserve meeting, fear of possible surprises, so they simply do not want to take risks and enter the market. The most interesting thing is that no matter what the results of the meeting of the Fed's monetary committee today, the results of the Bank of England meeting will be announced tomorrow, respectively, the pound will remain in limbo until tomorrow and with full combat readiness to move in any direction. It makes no sense to guess what decision the US regulator made and what the market will react to this decision. The results will be followed by a speech from Jerome Powell, in which he will orient the markets on the Fed's further policy, expectations and forecasts of the regulator. Meanwhile, 544 members of the European Parliament supported the bill today, allowing Britain to get a respite on Brexit. Only 126 deputies voted "against" and another 126 abstained from voting. This resolution implies that if the UK needs to postpone Brexit and there will be some "specific purpose" behind this decision (probably a hint of an agreement with the European Union or a possible second referendum), the European Parliament will meet London halfway. At the same time, if a "hard" Brexit takes place, the responsibility for it will be borne by London, and this does not absolve it from financial obligations to the EU, as stated in the document. From our point of view, this is a very competent step by Brussels. It is no secret that the European Union is not eager to lose the UK and still hopes to keep it in its composition. Perhaps that is why it persists in the issue of "backstop" and does not want to categorically make concessions. But the postponement of Brexit to a later date, firstly, gives new chances to come to an agreement and get amicable, and secondly, new chances for a second referendum and/or the removal of Boris Johnson from his prime minister's position, which will definitely move hard Brexit from the horizon. The EU also makes it clear to the public that it is ready for a dialogue on a "deal" (but the UK does not offer any alternatives to the back-stop mechanism), or to postpone the Brexit date (but the British prime minister refuses any delays). As for Boris Johnson, it can be said that his next plan completely failed. Unless, of course, the information about the "second letter" to the leaders of the European Union, in which Johnson asked not to grant an extension on Brexit, was not a "sham". Now, Johnson is obliged by British law to ask for a delay, which the EU is already ready to provide, unless an agreement between London and Brussels is signed by October 17-18, which will be approved by (!!!) Parliament. That is, even if it is purely hypothetical to imagine that Johnson somehow manages to come to an agreement with the EU, this does not mean that the deal will suit the British MPs, who previously blocked Theresa May's deal three times. From a technical point of view, the upward trend for the pound/dollar pair is maintained. However, extremely important fundamental events will take place today and tomorrow that can completely change the current technical picture. Trading recommendations: The GBP/USD pair completed another small round of downward correction and is again trying to resume the upward movement. Thus, it is now recommended that you stay in pound purchases while aiming for 1.2590, but also remember Stop Loss orders just in case. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. September 18. Results of the day. The results of the Fed meeting. Traders stood waiting Posted: 18 Sep 2019 03:36 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 70p - 160p - 54p - 94p - 85p. Average volatility over the past 5 days: 93p (high). Since summing up and announcing the results of the Fed monetary committee meeting is as if isolated from other macroeconomic events and will finally take place, so far we are drawing the attention of traders to the only macroeconomic report of the day that was related to the EUR/USD pair. Inflation for the EU in August was published this morning . It turned out that the consumer price index rose 1.0% compared with August of the previous year. Annual inflation in the EU at the moment is only 1%. We remind you that the target inflation rate, which the Fed and the ECB are striving for, is 2.0% a year. Things are even worse on a monthly basis. An increase of 0.2% was expected, but in reality prices rose by 0.1% compared to July. The annual indicator fully coincided with the forecast value. What does this mean? There is still nothing good for the euro. The single currency has excellent chances to strengthen today, and in the coming weeks, and even months, if the Fed really took a targeted course to reduce the key rate. However, if macroeconomic statistics from Europe continue to disappoint market participants, no easing of US monetary policy will help the euro. Today it will become known what course the Fed has taken. At the last meeting in July, Jerome Powell said that the rate cut was corrective after several increases, so to speak stabilization. Today, the rate can be reduced by 0.25% and 0.50%, that is, the second time in a row. In any case, this will mean that the regulator headed for a systematic reduction in the rate, whatever Jerome Powell would say. By and large, any reduction in the rate will mean that the Fed nevertheless heeded Trump's regular angry statements and his arguments. However, there is an option in which the rate will not be lowered, and it will be a real bomb for the foreign exchange market. According to many experts, the reduction in the rate by 25 basis points has already been worked out by traders and laid in the current rate. But there are actually not so many macroeconomic reasons for a new easing of monetary policy. Only a slowdown in inflation in August up to 1.7% can be singled out. Is this enough argument for Powell and company to lower the rate? Or does macroeconomic statistics now play no role at all, and the Fed will simply follow Trump's plan, which will allow the country to improve its position in the trade war with China? If the Fed refuses to mitigate monetary policy in September, the US dollar could rise in price across the entire spectrum of the market. Well, Donald Trump will bring a new flurry of criticism to Fed Chairman Jerome Powell. Taking into account all these factors, we believe that in reality the probability of a rate change to a lower value is not more than 50% at the moment, since no one knows what motives the monetary committee will be guided by when making a decision. From a technical point of view, we have an upward trend, a double bottom pattern and a rebound in prices from important levels of 61.8% Fibonacci and 38.2% Fibonacci. Thus, the technique speaks almost unambiguously in favor of continued growth. However, at the last meeting of the ECB, when the regulator lowered the deposit rate by 0.1%, the euro first fell by 100 points, and then grew by 150. And all this for several hours. Thus, something like this is quite possible today. Trading recommendations: The EUR/USD pair resumed the upward movement. Thus, it is now recommended to reconsider the purchases with targets of 1.1110 and 1.1146. However, in any case, we recommend that you be careful with opening and maintaining any positions during the announcement of the results of the Fed meeting and Jerome Powell's speech at a press conference. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

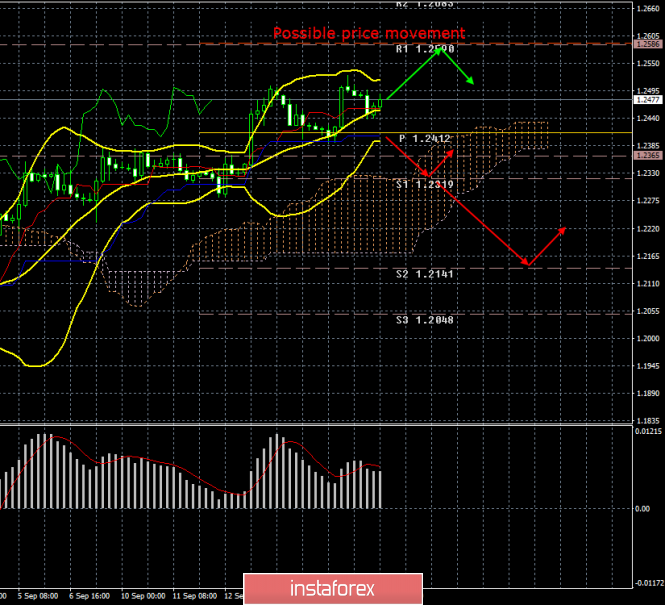

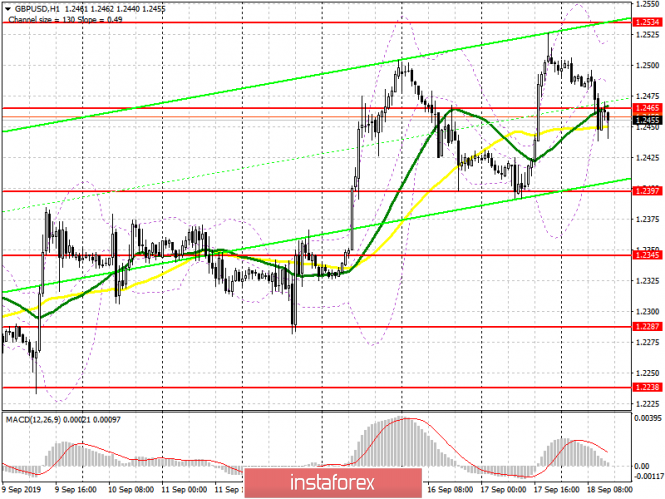

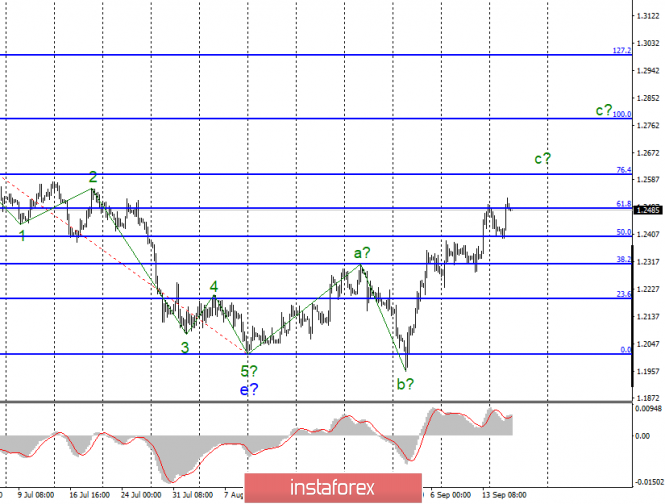

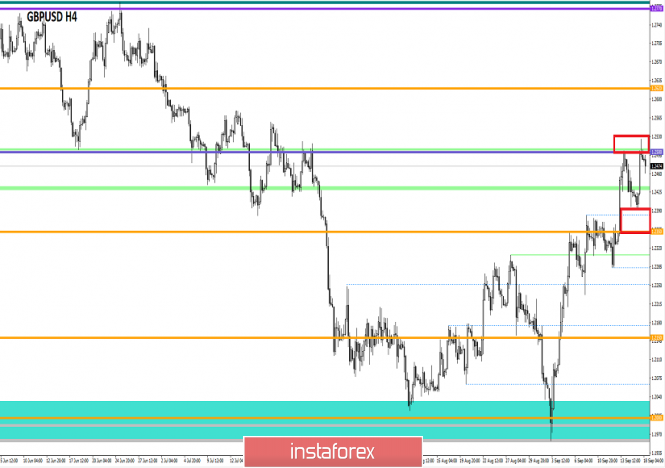

| September 18, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 18 Sep 2019 09:53 AM PDT

On July 26, Bearish breakdown below 1.2385 (Wedge-Pattern Key-Level) facilitated further bearish decline towards 1.2210 and 1.2100 which corresponded to significant key-levels on the Weekly chart. In Early August, another consolidation-range was temporarily established above 1.2100 before August 9 when temporary bearish movement was executed towards 1.2025 (Previous Weekly-Bottom). Recent bullish recovery was demonstrated off the recent bottom (1.2025). This brought the GBP/USD pair back above 1.2100 (Lower limit of the recently established consolidation-zone) within the depicted short-term bullish channel. As expected, further bullish advancement was demonstrated towards 1.2230 then 1.2280 where recent bearish rejection was demonstrated (near the upper limit of the recent movement channel). That's why, another quick bearish decline was demonstrated towards 1.2100 then 1.2000 (corresponding to the previous bottom established on August 9). Last Week, Early signs of bullish recovery (Bullish Engulfing candlesticks) were manifested around 1.1960 bringing the GBPUSD back above 1.2100 and 1.2220 where the GBPUSD pair looked overbought. However, further bullish momentum was demonstrated towards 1.2320 bringing the pair back inside the depicted movement channel again. As Expected, Temporary bullish advancement was demonstrated towards 1.2475 - 1.2500 where the upper limit of the current movement channel comes to meet the GBP/USD pair. Another bullish trial is currently being expressed towards 1.2500 where a possible Double-Top reversal pattern may be established. The Long-term outlook remains bearish as long as the upper limit of the current movement channel around 1.2475-1.2500 remains defended by the GBP/USD bears. On the other hand, Bearish breakdown below 1.2400 (Reversal-Pattern Neckline) can turn the short-term outlook into bearish, thus allowing more bearish decline towards the lower limit of the movement channel around 1.2330. Trade Recommendations: Conservative traders can look for a valid SELL entry anywhere around the price levels of 1.2475-1.2500 for a valid SELL entry. T/P level to be placed around 1.2330, 1.2280 and 1.2220 while S/L should be placed above 1.2550. The material has been provided by InstaForex Company - www.instaforex.com |

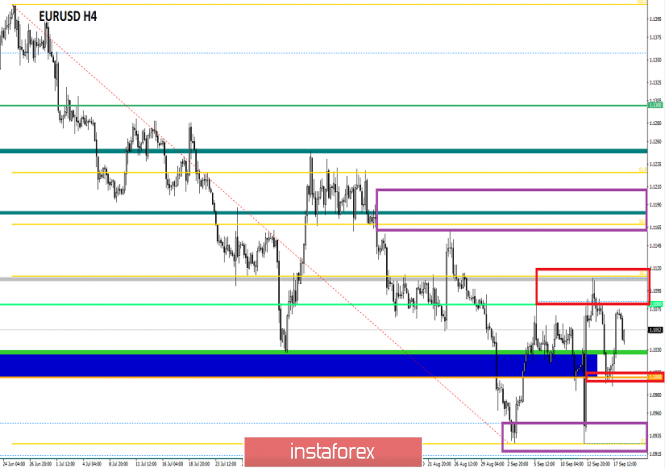

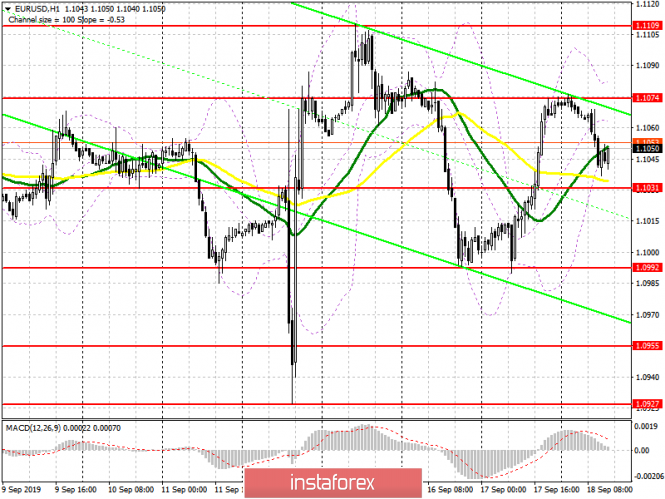

| September 18, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 18 Sep 2019 09:41 AM PDT

Two weeks ago, a quick bearish decline was demonstrated towards 1.0965 - 1.0950 where the backside of the broken channel came to meet the EURUSD pair again. Risky traders were advised to look for a valid BUY entry anywhere around the price levels of 1.0950. All T/p levels were successfully reached within the recent bullish movement during last weeks' consolidations. Earlier last week, the EUR/USD pair was testing the backside of both broken trends around 1.1060-1.1080 where significant bearish pressure pushed the pair directly towards 1.0940 (Prominent Weekly Bottom). Bearish Breakdown below the price level of 1.0940 was needed to enhance further bearish decline towards 1.0900 and 1.0840 (Fibonacci Expansion Key-Levels). However, SIGNIFICANT bullish rejection was demonstrated as a quick bullish spike towards 1.1100 where a recent episode of bearish rejection was expressed. Currently, the GBPUSD is trapped within a narrow consolidation range extending between 1.1090 - 1.0995 until breakout occurs in either directions. Bearish Breakout below 1.1030 is needed to render the recent bullish spike as a bullish trap. If so, bearish decline would be expected initially towards 1.0940-1.0920. On the other hand, Bullish breakout above 1.1080 gives an early signal of short-term bullish reversal possibility as a bullish double-bottom pattern with a projected target towards 1.1175. Trade recommendations : Risky traders are advised to have a short-term BUY Entry upon bullish breakout above (1.1090-1.1110). S/L should placed below 1.1050 while target level should be located at 1.1175. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 09.19.2019 - Broken Pitchfork trendline, more downside yet to come Posted: 18 Sep 2019 07:25 AM PDT Bitcoin has been trading downwards since our last forecast exactly what I expected. BTC did test the level of $10,058 Anyway, the downward channel is in control and do expect more downside on the Bitcoin and potential test of $9,850.

Downward purple lines – Downward channel Yellow rectangle – Support level and potential downward target Falling purple line – Expected path My advice is still to watch potential selling opportunities on the BTC due because the downward channel is still in control and new selling is expected. I found the breakout of the larger Pitchfork upward channel, which is another confirmation of the downward movement. Selling opportunities are preferable with the target at $9,850 and $9,600 and stop at $10,550. I do expect larger volatility due to FOMC meeting minutes today. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 09.18.2019 - Failed HSS pattern or real? Watch for the breakout Posted: 18 Sep 2019 07:12 AM PDT Gold has been trading sideways at the price of $1,500 for few days and in mu opinion Gold might need fundamental trigger for the next directional movement. Be prepared for both scenarios. Today is FOMC day and I give equal chances for both sides.

Blue horizontal line – Swing high (Right shoulder) Red rectangle – Upward target in case of the upward break Yellow rectangle – Neckline and key support Blue rectangle – Downward target in case of the down break My advice is to watch potential breakout of the consolidation zone. The breakout of $1,523 will confirm potential test of the $1.551 (failed head and shoulders). If you see the breakout of the $1,482, there is a chance for test of the $1,452. Be ready for both scenarios. The FOMC meeting minutes today might be good fundamental trigger for the next directional movement. The material has been provided by InstaForex Company - www.instaforex.com |

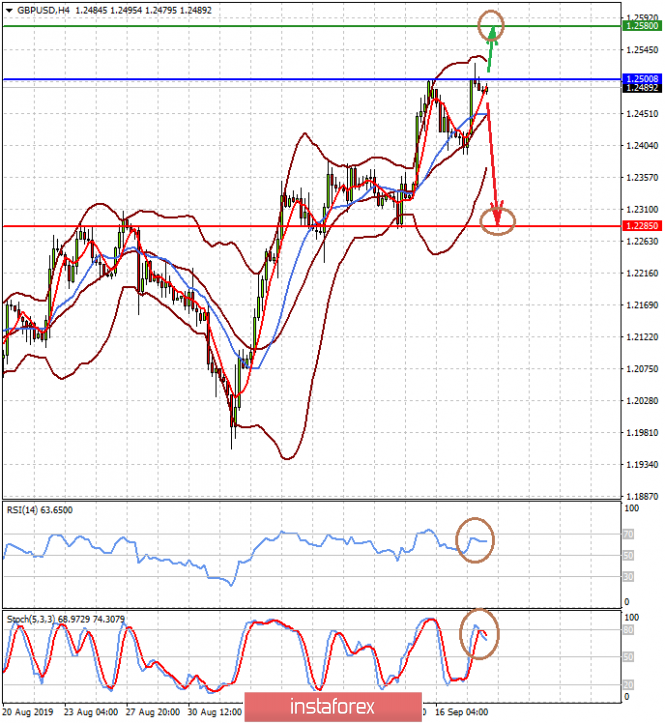

| Posted: 18 Sep 2019 06:52 AM PDT GBP/USD did exactly what I expected yesterday. My yesterday's first target got tested at the price of 1.2500. The price went for another pullback after the test of 1.2500 but I still expect more upside and potential re-test of the 1.2500 and 1.2544.

Purple horizontal lines – Broken trading range Blue horizontal lines – Resistance levels and take profits Rising purple line – Expected path My advice is to watch potential buying opportunities on the GBP/USD due to potential buying on the dips based on the 4H time-frame. MACD oscillator did star to pick momentum up again, which is sign that longer frame money is still bullish. Watch for 5/15 minutes bull flags/abc down to time your long entries better. Middle Bollinger line (20SMA) did decent job like support and there is still more upside potential. Another confirmation for the bullish momentum is the bullish outside day from yesterday The material has been provided by InstaForex Company - www.instaforex.com |

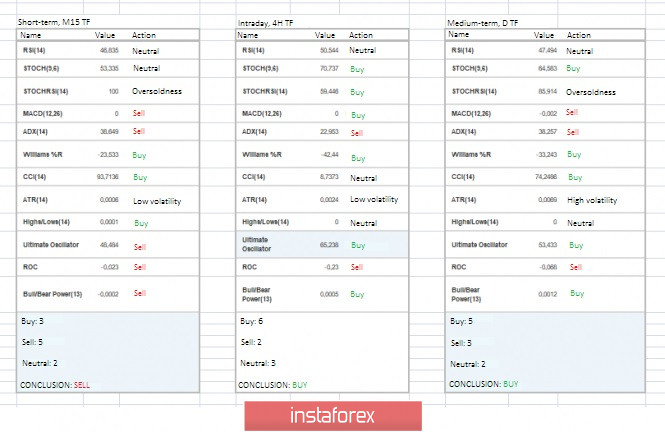

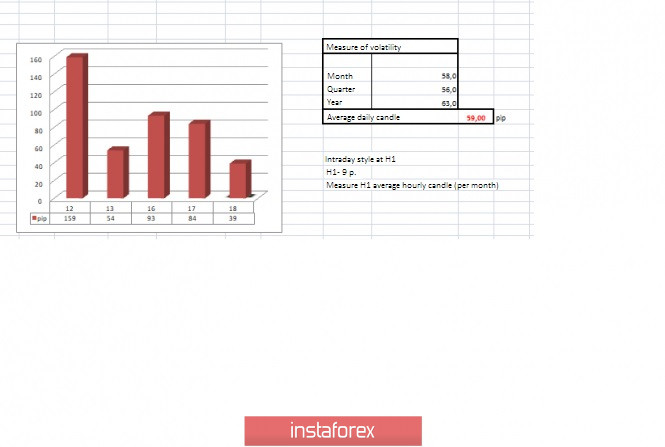

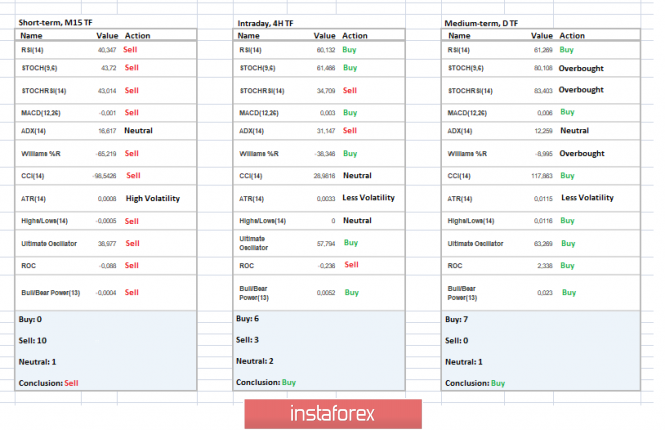

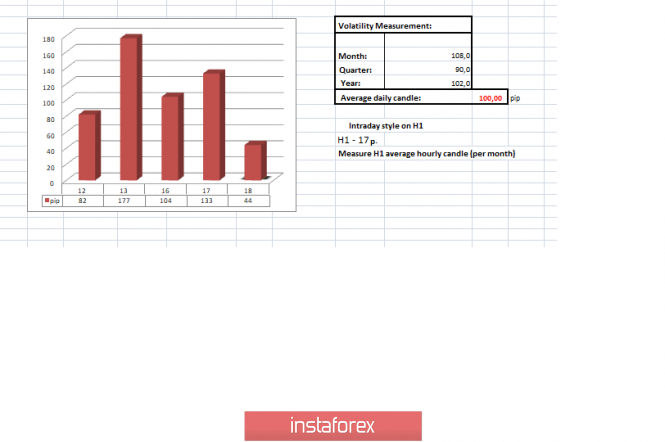

| Trading recommendations for the EURUSD currency pair – placement of trade orders (September 18) Posted: 18 Sep 2019 06:29 AM PDT The euro/dollar currency pair showed high volatility of 84 points for the last trading day, as a result of which we saw the return of the quote to the base point of the week. From technical analysis, we see that the psychological level of 1.1000 played the role of support again, slowing down the quote and returning us to the resistance level of 1.1080, where it all began. If we analyze in detail the past movement, we will see that the structure of the candles carried a pulse, inertial character in the time interval of 08:00-17:00 London time, which reflects not just a technical rebound but the foundation of external factors. As discussed in the previous review, speculators considered the scenario of a rebound from the psychological level of 1.1000 but no one expected such a strong change in the quote. In any case, the entry point was both at the time of the slowdown within the level, and at the time of the price move, the coordinates were specified. Considering the trading chart in general terms (daily period), we see not just a corrective move, but a kind of ambiguity, expressed in the divergence of interests. The resistance point remains in the range of 1.1080/1.1115. The fulcrum of the main course is located at 1.0926. The news background of the day contained data on industrial production in the United States, where there was a slowdown from 0.5% to 0.4%, but, according to preliminary forecasts, expected a stronger decline to 0.2%. The market reaction to the statistics was because the news was in the background. What did the market react? – Federal Reserve's action. The Federal Reserve for the first time since 2008 entered the repo market due to the catastrophic jump in the repo rate on the interbank market from 2.5% to 10.0%. The financial system of the United States faced an acute deficit of dollars, which effectively paralyzed the interbank market, for the reason that the Fed began to urgently pour dollars. The amounts of injections are staggering, and so, the first gulf of $53.15 billion, the second even more than $75 billion is scheduled for Wednesday, and this, gentlemen, for more than $128 billion. I think now, the question of the jump in the quotation is removed and a new question arises, was this a show on the eve of a reduction in the refinancing rate or the idea of the great equalizers deeper? Today, in terms of the economic calendar, we had data on inflation in the eurozone, where the figures were confirmed at the same level of 1.0%. The key event of the day and week remains in the form of a meeting of the Federal Committee on Open Market Operations, where at 19:00 London time, the decision on the refinancing rate will be announced, and at 19:30 London time, everyone's beloved Jerome Powell will speak. Preliminary forecasts and expectations of many experts agree that the rate will still be reduced from 2.25% to 2.00%, which will put pressure on the US dollar and, as a fact, on the local growth of the euro. In anticipation of the event, it is advised to monitor the news feed, in particular, Bloomberg, as well as Twitter of Mr. Trump (@realDonaldTrump), who can traditionally contribute to the Fed and in particular, Jerome Powell. Further development Analyzing the current trading chart, we see that the recovery of the quotation was not long in coming, and this is understandable, local overheating still plays a role in the market. Speculators, in turn, have already managed to ride on the recovery process, now there is a monitoring of what is happening on the eve of an important event, as flights are still expected, and if the rate is still reduced, the current recovery process can play into the hands of speculators for the most profitable entry into the market. It is likely to assume that in the pre-FOMC meeting, a temporary slowdown is possible, where, depending on the incoming information, jumps will take place and already at the time the rate is announced (19:00 London time), the main movement will occur. In this case, you need to carefully and, most importantly, soberly assess the incoming information background, so if at the last moment, the scales outweigh the decision to leave the rate at the current level, then what kind of surge will occur in the market, believe me, it will be greater than in the case of an increase in the rate. Based on the above information, we will derive trading recommendations:

Technical analysis Analyzing different sector timeframes (TF), we see that the indicators in the short term are variably inclined to decrease due to the recovery process. Intraday and mid-term indicators are still showing upward interest. When setting up an indicator analysis, it is worth considering that with a strong information and news background, the indicators can be volatile. Volatility per week / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (September 18 was built taking into account the time of publication of the article) The volatility of the current time is 39 points. It is likely to assume that due to the meeting of the Federal Committee on Open Market Operations and the announcement of the refinancing rate, volatility is expected to be high. Key levels Resistance zones: 1.1100 ** ;1.1180 *; 1.1300 **; 1.1450; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1.2100 Support zones: 1.1000 ***; 1.0850 **; 1.0500 ***; 1.0350 **; 1.0000 ***. * Periodic level ** Range level *** Psychological level **** The article is built on the principle of conducting a transaction, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 18 Sep 2019 06:02 AM PDT To open long positions on GBP/USD, you need: Buyers of the pound retreated after the release of the report, which indicated a slowdown in the annual growth of inflation in the UK. At this point, I drew attention in my morning review and gave recommendations on how to proceed. Now, the bulls need to return to the resistance level of 1.2465, which can push the pair to the area of this week's high – 1.2354, where I recommend taking the profit since without support from the report of the Federal Reserve System, it is hardly possible to count on a larger upward trend. In the scenario of GBP/USD decline in the second half of the day, long positions can be looked at immediately on the rebound from the large support of 1.2397, which limits the likelihood of a bear market development this week. To open short positions on GBP/USD, you need: Sellers coped with the morning task and returned to the level of 1.2465. While trading will be conducted below this range, we can expect a further bearish correction of the pound in the area of a large weekly low of 1.2397, where I recommend taking the profit. The formation of a false breakdown in the resistance area of 1.2465 in the second half of the day will also be an additional signal to open short positions. If the bears miss the level of 1.2465, it is best to consider short positions in GBP/USD after the publication of the Fed's decision on interest rates, the higher, the better – preferably from the highs of 1.2563 and 1.2640. Signals: Moving Averages Trading around 30 and 50 moving averages, indicating some market uncertainty. Bollinger Bands In the case of an upward correction before the Fed's decision, the upper limit of the indicator around 1.2520 will act as a resistance.

Description of indicators

|

| Posted: 18 Sep 2019 06:02 AM PDT To open long positions on EURUSD, you need: The euro fell in the first half of the day after yesterday's sharp growth, which could be seen during the North American session. In my morning forecast, I drew attention to the data on inflation in the eurozone, which led to a small downward correction of EUR/USD, as it completely coincided with the forecasts of economists. From a technical point of view, nothing much has changed. Buyers will also try to break above the resistance of 1.1074, which will lead to the continuation of yesterday's growth of the euro in the maximum area of 1.1110, as well as to update a larger resistance level of 1.1151, where I recommend taking the profits. However, the market will focus on the Fed report, so it is best to consider purchases after lowering and updating the support of 1.1031 or a rebound from a larger low near 1.0992. To open short positions on EURUSD, you need: Sellers will wait for lower interest rates and a corresponding market reaction. And only if during a press conference Jerome Powell declares that no further cuts in interest rates are planned this year, the bears will begin to open short positions in the euro. The formation of a false breakdown in the resistance area of 1.1074 will lead to a downward correction of EUR/USD to the support area of 1.1031, but a further target of sellers will be at least 1.0992, where I recommend fixing the profits. In the scenario of growth of the pair above the resistance of 1.1074 after the Fed's decision, short positions can be looked at on the test of last week's high of 1.1110 or sold immediately on a rebound from the new resistance of 1.1151. Signals: Moving Averages Trading is conducted in the area of 30 and 50 moving averages, which indicates no market uncertainty again. Bollinger Bands In the case of an upward correction before the Fed's decision, the upper limit of the indicator around 1.1080 will act as resistance.

Description of indicators

|

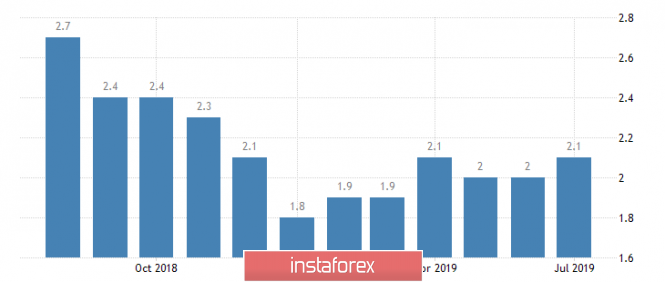

| Dollar may remain strong even though Fed cuts Posted: 18 Sep 2019 05:30 AM PDT The main event of this week will be the upcoming Fed decision on monetary policy. Today, it will Already become clear whether the Federal Reserve will lower the interest rate and what actions should be expected from it in the future. Although the market expects the US Central Bank to cut interest rates a second time this year, the USD/JPY pair is still trading near monthly highs. Typically, a decrease in interest rates leads to a weakening of the national currency. However, as the aggressive rebound of the euro against the backdrop of a large-scale stimulus package by the ECB has shown, it may not be so simple in reality. One of the main drivers of increased demand for the dollar against the yen is market expectations in anticipation of the meeting of the US Central Bank. The market has fully taken into account the quotes and its prospects for lowering the federal funds rate by 0.25%. However, the Fed may not go beyond this framework. Since the FOMC meeting in July, both positive and negative changes have occurred in the US economy. Growth in retail sales, employment, and activity in the manufacturing sector slowed, and consumer sentiment worsened. At the same time, the base consumer price index in annual terms is at the level of 2.4%, which is equal to the peaks of 2018. Unemployment is close to the minimum values over the past 5 years. Last week's economic releases speak in favor of the Fed taking an even more wait-and-see stance. According to the latest report on the US labor market in August, job growth slowed while average hourly wages accelerated. Despite the fact that lowering the federal funds rate this month is already considered a settled issue, the signals that Fed chairman Jerome Powell will send to the markets at the end of the next FOMC meeting can help the dollar rather than harm it. The tone of the accompanying statement may be more hawkish than expected. If Jerome Powell is optimistic about lowering the federal funds rate, indicating that this is a correction of monetary policy in the light of the existing risks instead of changing it, then the USD/JPY pair will break 109 and the EUR/USD pair will fall below 1.10. If the head of the Fed declares the need for further easing of monetary policy, allowing for a reduction in interest rates in December, then the pair USD/JPY pair will test the level of 107. As for the EUR/USD pair, it will rise above the base of the 11th figure. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 18 Sep 2019 05:04 AM PDT More recently, market participants believed that the problem of America's trade war against China is the slowdown in the country's economy. According to the latest quarterly data, it declined from 3.1% to 2.0%, as well as a drop in some production indicators. Moreover, the business activity would force the Central Bank not only to reduce interest rates by another 0.25% this month, but a further general cut in the cost of borrowing is also likely. Therefore, in early September, the market believed that the bank would lower its key interest rate by 0.25% from 96% probability in accordance with the dynamics of futures on federal funds rates. Yet, everything turned out to be not so simple and unambiguous. Firstly, it seems to us that the Federal Reserve did not give clear signals about the beginning of a cycle of reduction in rates. The reason for such is because it remains acceptable for economically developed countries as a whole even if the economic growth has declined. Secondly, the labor market still showed positive positive dynamics. The unemployment rate of 3.7% has remained low over the past 50 years. And thirdly, the bank quite reasonably believes that there is a real risk of rising inflation just in the wake of increasing customs duties due to the unleashing of trade wars unleashed by D. Trump with almost the whole world. Of course, in this situation, lowering interest rates is a very risky action. On the other hand, one should also pay attention to the fact that the regulator will have to continue to cut rates in case that the economic growth continues to decline while maintaining the risk of rising inflation. What the bank chooses, time will tell. But again, according to the dynamics of rates on the Federal Funds, the market also expects a possible reduction in rates immediately by 0.50% today. This probability is estimated to be 43.5%. But if the Fed cuts rates immediately by half a percentage point and lowers by only 0.25%, and at the same time Jerome Powell says that this is not the last decrease, it is highly likely that we should expect a surge in investor interest in risky assets to US stocks above all, as well as a noticeable depreciation of the US dollar. Forecast of the day: The EUR/USD pair is consolidating in the range 1.0995-1.1095 until the Fed final decision. If a decision is made to reduce rates by 0.50%, the pair will fly to 1.1160. At the same time, if there is a decrease by the expected 0.25% and the absence of a signal of a prospective possible further decrease, the pair may turn around and fall to 1.0930, since this cut in rates has already been taken into account in the quotes. The GBP/USD pair seems to be responding to the Fed's decision, as well as to the EUR/USD pair. A breakthrough to the price level of 1.2500 may lead to an increase in the pair to 1.2580. At the same time, the Fed's positive decision for the dollar may deploy the pair and it will rush to 1.2280. |

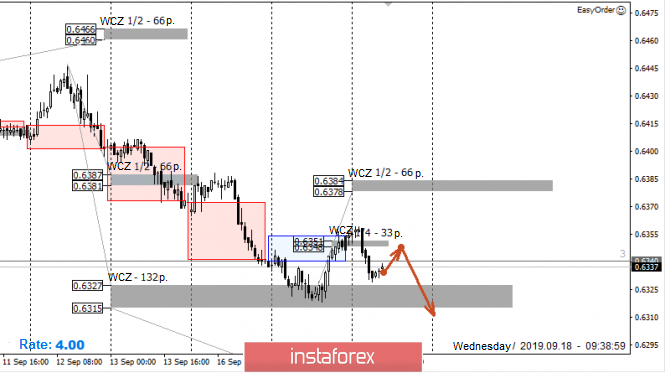

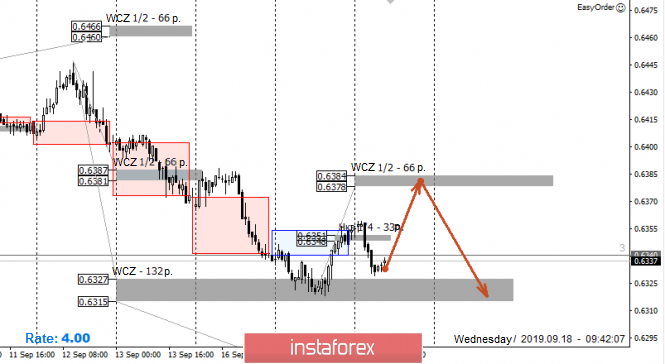

| Control zones for NZD / USD pair on 09/18/19 Posted: 18 Sep 2019 04:53 AM PDT Working within the framework of the current movement involves the formation of corrective upward movement. The main resistance of 1/2 WCZ is at 0.6384-0.6378. While the pair is trading below this zone, the bearish movement remains an impulse and the probability of updating the weekly minimum is 70%. Before the release of important news tonight, it is necessary to bring all open positions to breakeven. If unused limit orders remain, then they must be liquidated. An alternative model will be the growth to 1/2 WCZ of 0.6384-0.6378. Testing this zone will allow you to get the most favorable prices for the sale of the instrument. The resulting accumulation zone will serve as a starting point in determining further priority. To break the downward impulse, it will be necessary to close today's trading above a WCZ. Daily CZ - daily control zone. The area formed by important data from the futures market, which changes several times a year. Weekly CZ - weekly control zone. The area formed by marks from the important futures market, which changes several times a year. Monthly CZ - monthly control zone. The area is a reflection of the average volatility over the past year. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of EUR/USD for September 18, 2019 Posted: 18 Sep 2019 04:44 AM PDT Pair : EUR/USD Pivot: 1.1052. The Euro traded a brief upside movement against the US Dollar during european trading session. Today's trading session began with bullish momentum from the area of 1.1003. As a result, a breakout occurred through the higher limit of a dominant ascending channel pattern at the 1.1052 price. Currently, the price is still moving around the daily pivot point (1.1052) in the 4-hour time frame. It should be noted that the EUR/USD pair could face support of the 50 and 100-hour EMAs, as well the weekly pivot point in the 1.1003/1.1052 range. The RSI reflect increasing positive momentum, as the 100 EMA above its trigger, is falling in the positive zone, moreover the RSI is rising in the bullish territory. Overall, we still prefer the bullish scenario which suggests that the pair will stay above thesupport level of 1.1003. From this point, buy deals are recommended above the levels of 1.1003/1.1052 with the first target at 1.1127. If the trend breaks the support level of 1.1127, the pair is likely to move upwards continuing the development of bullish trend towards the level 1.1179. However, if a breakout happens at the double bottom (1.0927), this scenario may be invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 18 Sep 2019 03:17 AM PDT GBP/USD – 4H.

The British pound was unable to close above the retracement level of 38.2% (1.2501). This is the conclusion I make, based on yesterday's and today's trading of the pound/dollar pair. There were two attempts to close above the 25th figure. The first is an eloquent retreat from the level of 38.2%, the second is a little less clear, but still a retreat, and even with the formation of a bearish divergence in the CCI indicator. Thus, now I expect the pair to fall in the direction of the correction level of 23.6% (1.2293) or the peak of August 27 – 1.2308. Despite the recent upward mood of traders, I now consider it possible to buy the pair not earlier than the close above the correction level of 38.2%. News background. It was he who helped the pound to win back a tiny part of the positions lost over the past three years, but still very tangible in absolute terms. Today, in the next few hours, the value of inflation for August in the UK will be known. Traders are waiting for the CPI to decline to 1.9% y/y, the core consumer price index is also waiting for a decline to 1.8% y/y, according to forecasts of the UK Office for National Statistics. Together with inflation, the retail price index will be released, which is expected to decline to 2.6%. Thus, until the evening, when Jerome Powell begins to acquaint us with the results of the Fed meeting, traders may remain bearish. However, do not prematurely put an end to inflation in the Kingdom of Great Britain. Perhaps the decline has not yet taken place. However, all the same, I would not carry out new purchases of the pound before closing above the psychological level of $1.25. It's even somehow unusual to start a review of the pound not with events related to Brexit. However, there is little important information now. Prime Minister Boris Johnson and European Commission President Jean-Claude Juncker met in Luxembourg on Monday. Immediately after its completion, Johnson told the press again that the deal is being worked on and even visible progress. Within hours, EU officials denied Johnson's words that the parties had made any progress in the negotiations. Today, Jean-Claude Juncker himself said that the probability of Brexit "No Deal" is very high, as there is too little time to sign the agreement. Juncker's position is expressed in the hope of the European Union to agree with London, but the reality shows that there is almost no chance of this. "Johnson said he wants to agree, but is also ready to leave without it," – summed up Juncker. Well, the stumbling block in the agreement itself remains the backstop clause, which defines all legal aspects on the border between Ireland and Northern Ireland, which will leave the EU with the UK. What to expect from the pound/dollar currency pair today? The pound/dollar pair has performed two rebounds from the retracement level of 38.2% (1.2501). Thus, I expect the quotes to fall on Wednesday, September 18, in the direction of the correction level of 23.6% (1.2293). This option can be prevented by the information background, which will be strong today. Therefore, I recommend that you first understand what inflation will be in Britain, after which it will be relatively easy to trade the GBP/USD pair. The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019. Forecast for GBP/USD and trading recommendations: I recommend buying the pair with a target of 1.2668 and a stop-loss order below the level of 1.2501 if a close above the Fibo level of 38.2% is performed. I recommend selling the pair now with the target of 1.2308, since 2 rebounds from the level of 1.2501 were made and a bearish divergence was formed, with the stop-loss order above the Fibo level of 38.2%. The material has been provided by InstaForex Company - www.instaforex.com |

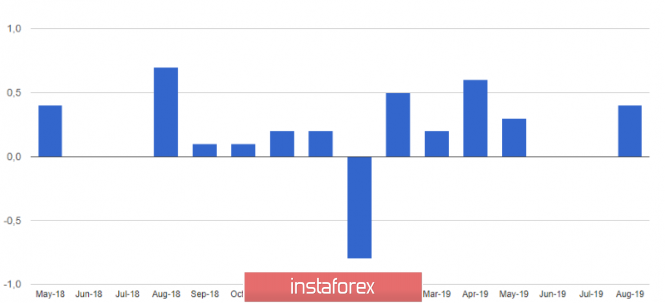

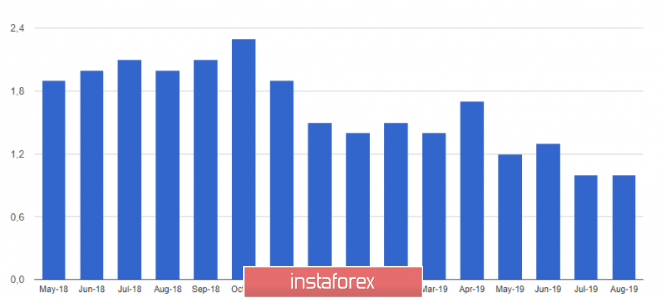

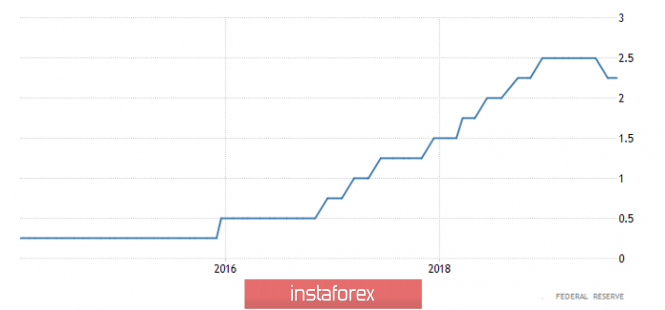

| Review of EUR / USD and GBP / USD pairs on 09/18/2019: We will see Posted: 18 Sep 2019 02:40 AM PDT Looking at what is happening, obviously, you do not have to be bored. Yesterday, data on industrial production in the United States just came out as the cost of portraits of the dead presidents went down. Formally, everything is true, considering the growth rate of industrial production slowed down from 0.5% to 0.4%. However, they expected a slowdown to 0.2% but a cute fluffy animal always sneaks up unnoticed. It's just that market participants were a little stunned by the fact that the Federal Reserve System entered the repo market for the first time since 2008. At the same time, they were not empty-handed and immediately handed out to poor traders. Somehow, they made ends meet that is already 53.2 billion dollars. Moreover, he promised to return on Wednesday with another 75.0 billion dollars. The reason for such unprecedented generosity lies in the fact that on Monday, repo rates on the interbank market in the United States jumped from 2.5% to 10.0%. This is possible only if there is no money on the market. In this case, we are talking about short-term liquidity, which mysteriously disappeared somewhere. With the help of titanic efforts, the Federal Reserve System was able to reduce repo rates to 4.0%, and the fact that this was not enough was the reason for announcing the continuation of the banquet. Simply put, the Federal Reserve is again putting out the fire with money. And of course, simply the unprecedented generosity in the form of 128.3 billion dollars for two days was the reason for the weakening of the dollar. After all, this is a factor in monetary policy easing. . In this whole story, what's interesting is not the Federal Reserve System forced to almost throwing money from a helicopter, but that it all happened exactly before the meeting of the Federal Committee for Open Market Operations. From every iron, they tirelessly shout that the Federal Reserve will lower the refinancing rate from 2.25% to 2.00%. At first glance, many believe that the situation with repo rates is yet another proof that there is no other way out. Hence, you need to lower the refinancing rate, which will lower the cost of borrowing, and everything will be fine at once with liquidity. In other words, lowering the refinancing rate is not the solution and in principle, the direct injections of money from the regulator are more like fixing holes. You need to understand in addition to Donald Trump, most of the need to reduce the refinancing rates are voiced by speculators who trade on their money and borrowed. For them, a decrease in the refinancing rate automatically entails an increase in their profits due to a decrease in the cost of borrowing. However, putting ourselves in the place of all these silent and faceless lenders, who are the suppliers of liquidity in the market. For them, lowering the refinancing rate would mean a decline in their own profits. I dare to suggest that what has happened over the past couple of days is nothing more than a kind of flashmob designed to show the Fed that they are dissatisfied with the possibility of lowering the refinancing rate from the very same liquidity providers. Ironically, this is indicated by the fact that, as soon as the repo rate jumped to 10.0%. The target level for federal funds rose from 2.00% to 2.25%. Indeed, if the market is experiencing an explosive jump in rates, both up and down, then the refinancing rate must be raised in order to cool the market. Moreover, the fact that the Federal Reserve System perfectly understood such a signal is indicated by the statements of a number of representatives of the regulator that they are not talking about a systemic problem, which led to panic in the market. Federal Reserve Refinancing Rate: By and large, it is also worth noting that macroeconomic statistics in the United States also provide no reason to lower the refinancing rate. Yes, inflation fell from 1.8% to 1.7%. However, this happened just the other day, making it too early to say that this is a steady trend. Moreover, this was offset by retail sales data, the growth rate of which accelerated from 3.6% to 4.1%. In general, the state of the labor market can be described as one of the best in history, and the pace of creating new jobs exceeds the growth rate of the workforce. On the contrary, it is necessary to increase the refinancing rate in order to prevent overheating in this situation. Of course, Donald Trump is now blatantly pointing his finger at an industry that is experiencing incredibly low growth rates, and that will begin to decline. But all questions regarding industry are removed by simply looking at inventories that have been growing without stopping for almost two years in a row. It smells more like a crisis of overproduction, which is not solved by lowering interest rates. Finally, Jerome Powell, himself, said earlier that this year only one reduction in the refinancing rate is planned. So the question is extremely interesting: will the Fed respond to financial markets, which like drug addicts, are struggling with no dose of low-interest rates, or will it be decided on the basis of economic realities? Of course, the focus is on the meeting of the Federal Committee on Open Market Operations. But before the announcement of its results in Europe, the final data on inflation are published, which should confirm its stabilization at around 1.0%. To some extent, this will confirm the assumption that the European Central Bank will continue to mitigate monetary policy. However, today, few people will pay attention to this. It all depends on the decision of the Federal Open Market Committee. If the aspirations of speculators come true and the refinancing rate is reduced from 2.25% to 2.00%, then the single European currency will continue to grow in the direction of 1.1100 and higher. If the Federal Reserve System makes an informed decision and leaves it as it is, then it is worth waiting for a decline to 1.1000 and further. The situation with the pound is even more interesting since inflation data has already been released and showed a decrease from 2.1% to 1.7%, which has already led to a decrease in the pound. However, it is likely that the Federal Reserve will save the pound if it lowers the refinancing rate. In this case, it will quickly return to the value of 1.2525. But if Jerome Powell decides to leave the pound to its own devices, it is worth waiting for it to decline to at least 1.2375. |

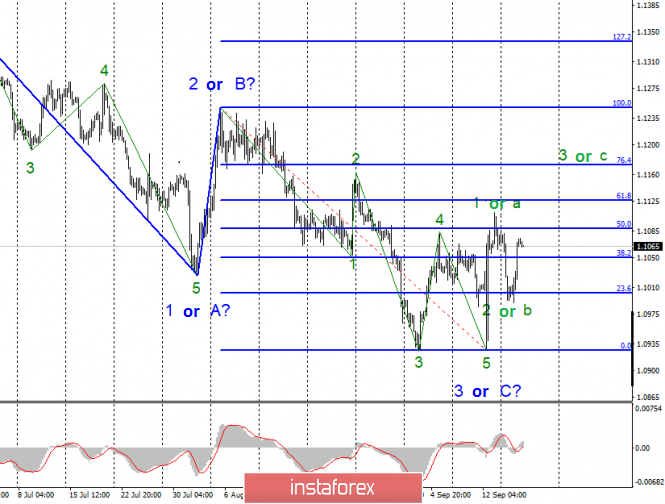

| Posted: 18 Sep 2019 02:29 AM PDT EUR/USD – 4H.

As seen on the 4-hour chart, the EUR/USD pair performed a reversal in favor of the European currency, consolidating above the correction level of 127.2% (1.1024) and growing towards the upper line of the downward trend channel. A reversal in favor of the US dollar was made near the upper line of the channel. Thus, in the next few hours, the euro/dollar pair may fall again to the Fibo level of 127.2%. There was no signal to buy. I have already said that buying a pair near the upper line of the downward channel is very risky and completely impractical. For purchases, it is necessary that the trend changed to the opposite. Now, it is still necessary to consider the sale of the euro and the purchase of the US dollar. All the attention of traders remains fully focused on the results of the Fed meeting, which will be announced in the evening. However, on Monday, the EUR/USD pair significantly decreased, and on Tuesday – it increased significantly. Today – falls again. Thus, it is impossible to draw an unambiguous conclusion in the question of what traders expect from the Fed. Moreover, traders are now showing that there is no unity in the question of reaction to the evening speech by Jerome Powell, the accompanying FOMC statement and the FOMC economic forecast. The first three trading days of the week are multidirectional movements. Accordingly, we can observe something similar today and tomorrow. Probably, this behavior of traders is because in recent days, there are more doubts about the question and whether there is any reason for the Fed to cut the rate in September? Recall that there are several main indicators of the state of the economy, which is guided by the Fed when making decisions on amendments to the monetary policy of the United States. GDP, inflation, labor market, unemployment. Unemployment in America is at its lowest level in many years -3.7%. GDP – is at a good level of about 2% per annum. The state of the labor market is often measured by Nonfarm Payrolls, which has only shown twice the number of new non-agricultural jobs less than 100,000 per month. That is, by and large, a reduction in the rate, if it takes place, will be necessary only to make it easier for the country to confront the European Union and China. With the former, America is on the brink of a trade war and could be said to have already entered a currency war. With the second, the US is in the midst of both a trade and currency war. Thus, reducing the rate, and not one-time, is necessary first of all to Donald Trump, who draws the country into trade wars, which now need to be won, and this can be done only if the dollar becomes cheaper against the yuan and the euro. What to expect today from the euro/dollar currency pair? On September 18, I expect a further fall of the euro/dollar pair in the direction of the corrective level of 161.8% (1.0918 or 1.0927) on the new signal of closing below the level of 127.2%. This is the conclusion that allows you to make an indicator and graphical analysis. However, I do not recommend losing sight of the inflation report in the European Union and, of course, the evening summing up of the Fed meeting. It seems that there will be surprises today. Let me also remind you that you should not buy the EUR/USD pair before it breaks out of the downward trend channel. The Fibo grid is based on the extremes of May 23, 2019, and June 25, 2019. Forecast for EUR/USD and trading recommendations: Today, I recommend selling the pair with the target of 1.0927 if a new consolidation is performed under the level of 1.1024. A stop-loss order above the level of 1.1029. It will be possible to buy the pair after the close above the downward trend channel. The material has been provided by InstaForex Company - www.instaforex.com |