Forex analysis review |

- #USDX vs EUR / USD vs GBP / USD vs USD / JPY. Comprehensive analysis of movement options from September 20, 2019 APLs &

- Fractal analysis of the main currency pairs for September 20

- The dollar is trying to unravel the Fed's plans

- Dramatic roles of the pound: a candidate for decline and a source of tension for the market

- EURUSD and GBPUSD: the time of the pound buyers is coming to an end, and the Bank of England has taken a wait-and-see position.

- GBP/USD. September 19. Results of the day. No reaction from traders over the Bank of England meeting

- EUR/USD. September 19. Results of the day. A trade war between the United States and the European Union is almost inevitable

- Fed rate cut in September may be the last; USD/JPY rises to 110 - Scotiabank

- September 19, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- September 19, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- Missed Chance: Bitcoin Ignored Fed Decision

- USD/JPY. Is it worth believing the growth of the Japanese currency?

- Gold missed a blow from the Fed

- Trading recommendations for the EURUSD currency pair – placement of trade orders (September 19)

- EUR/USD for September 19,2019 - Broken symmetrical trriangle to the upside

- GBP/USD: plan for the American session on September 19th. Weak retail sales led to a decline in the pound. Bank of England

- Gold 09.19.2019 - Do we have valid HSS pattern or fake one?

- EUR/ USD: plan for the American session on September 19th. The growth is limited by the resistance of 1.1075, above which

- BTC 09.19.2019 - First downward target reached and new momentum down on the MACD oscilaltor, more downward yet to come

- The Fed, having cut rates, limited itself to new promises (We consider it possible to sell the AUD/USD pair and buy the USD/CAD

- Technical analysis of GBP/USD for September 19, 2019

- Trading plan for EUR/USD for September 19, 2019

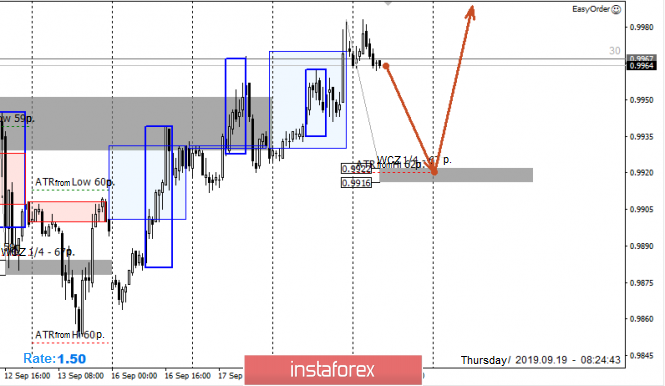

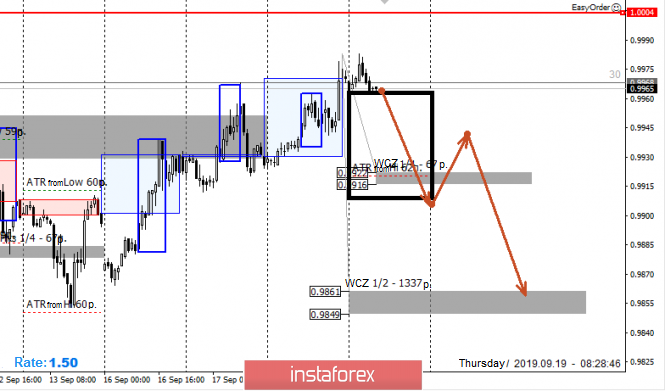

- Control zones of USD / CHF pair on 09/19/19

- Trading strategy for EUR/USD on September 19th. The Fed cut rates, but Trump still criticized Jerome Powell

- Trading strategy for GBP/USD on September 19th. Scotland is going to leave the UK and remain in the European Union

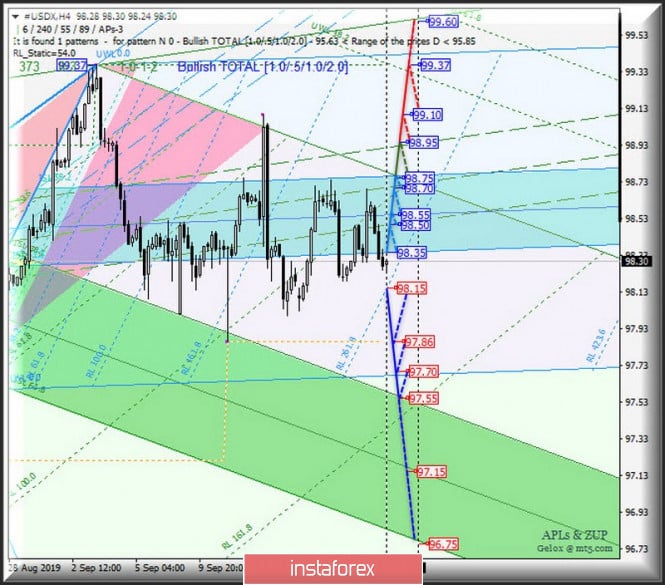

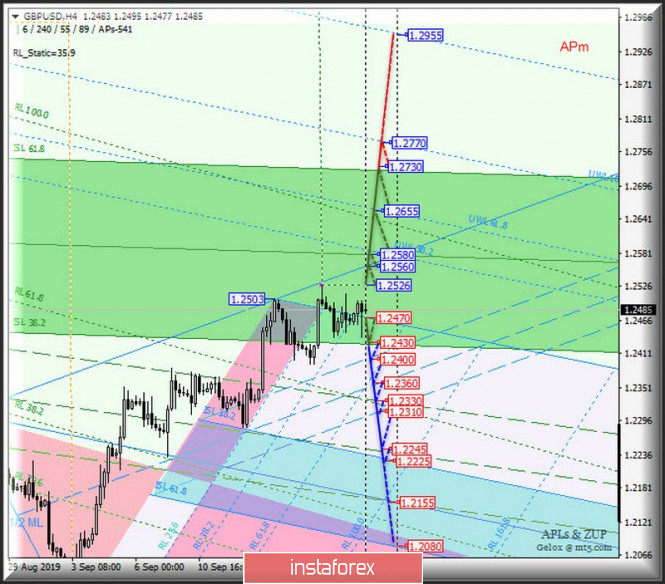

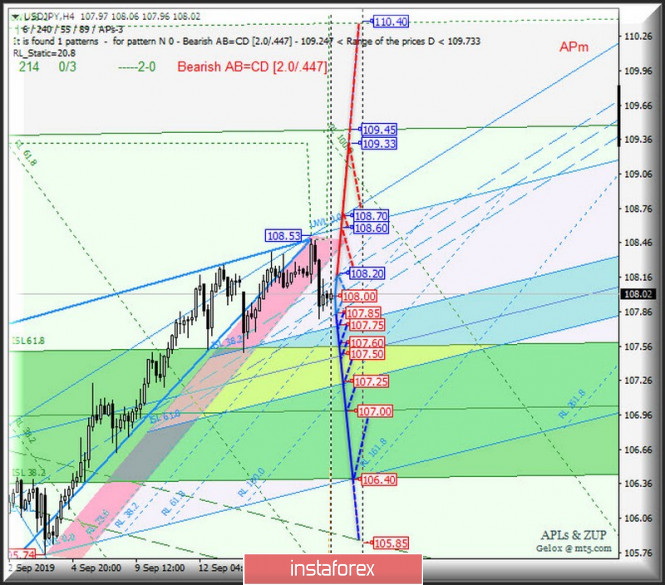

| Posted: 19 Sep 2019 06:46 PM PDT Let us consider, in a comprehensive manner, how the development of the movement of currency instruments #USDX, EUR / USD, GBP / USD and USD / JPY will begin from September 20, 2019 Minuette (H4 time frame) ____________________ US dollar Index Further development of the movement of the dollar index #USDX from September 20, 2019 will be determined by the direction of the breakdown of the range :

The breakdown of the reaction line RL261.8 Minuette (support level of 98.15) will determine the continued development of the downward movement of the dollar index to targets - a local minimum of 97.86 - the end line FSL Minuette (97.70) - the upper boundary of the ISL38.2 (97.55) equilibrium zone of the Minuette operational scale fork. In the event of a breakdown of ISL61.8 Minuette (resistance level of 98.35), it will be possible to develop the #USDX movement within the equilibrium zone (98.35 - 98.55 - 98.75) of the Minuette operational scale forks and 1/2 Median Line channel (98.50 - 98.70 - 98.95) of the Minuette operational scale forks with the prospect of updating maximums (99.10 - 99.37). The details of the #USDX movement are presented in the animated chart. ____________________ Euro vs US dollar The development of the movement of the single European currency EUR / USD from September 20, 2019 will also be determined by the direction of the breakdown of the range :

The breakdown of the warning line UWL38.2 Minuette (resistance level of 1.1125) - option for the development of the upward movement of EUR / USD to targets - local maximum1.1110 - control line UTL (1.1130) of the Minuette operational scale fork - equilibrium zone (1.1145 - 1.1200 - 1.1250) of the Minuette operational scale fork. The breakdown of the support level of 1.1060 will determine the development of the movement of the single European currency within the 1/2 Median Line channels of the Minuette operating scales (1.1060 - 1.1040 - 1.1017) and Minuette (1.1017 - 1.0990 - 1.0960). The details of the EUR / USD movement options are shown in the animated chart. ____________________ Great Britain Pound vs US Dollar The development of Her Majesty's GBP / USD currency movement from September 20, 2019 will be limited to the equilibrium zone (1.2430 -1 1.2580 - 1.2730) of the Minuette operational scale fork, taking into account the working out of the Minuette scale operational fork - the layout of this development is presented in the chart. If the upper boundary of ISL61.8 (resistance level of 1.2730) of the equilibrium zone of the Minuette operational scale fork is broken, then we can continue to the warning lines UWL100.0 (1.2770) and UWL161.8 (1.2950) Minuette operating scale fork. On the contrary, if a breakdown of the lower boundary of ISL38.2 (support level of 1.2430) of the equilibrium zone of the Minuette operational scale fork is seen as more probable, in which case the downward movement of Her Majesty's currency can continue to the boundaries of the 1/2 Median Line channel of the Minuette operational scales (1.2400 - 1.2360 - 1.2310) and Minuette (1.2330 - 1.2245 - 1.2155). The details of the GBP / USD movement can be seen in the chart. ____________________ US dollar vs Japanese yen The development of the USD / JPY currency movement of the country of the rising sun from September 20, 2019 will be due to the development and direction of the breakdown of the boundaries of the 1/2 Median Line channel (108.20 - 108.00 - 107.85) of the Minuette operational scale (see the details on the chart). The breakdown of the lower boundary of the 1/2 Median Line Minuette channel (support level of 107.85) is an option for the USD / JPY to reach the boundaries of the equilibrium zones of the Minuette operational scales fork (107.75 - 107.50 - 107.25) and Minuette (107.60 - 107.00 - 106.40). In case of breakdown of the upper boundary of the 1/2 Median Line channel Minuette (resistance level of 108.20) will make it relevant to resume the upward movement of the currency of the "country of the rising sun" to the targets - the initial SSL line (108.60) of the Minuette operational scale fork - the control line UTL Minuette (108.70) - maximum 109.33. We look at the details of the USD / JPY movement in the chart. ____________________ The review is made without taking into account the news background. Thus, the opening of trading sessions of the main financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index : USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of the currencies in the basket: Euro - 57.6% ; Yen - 13.6% ; Pound Sterling - 11.9% ; Canadian dollar - 9.1%; Swedish Krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the start date of the countdown - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

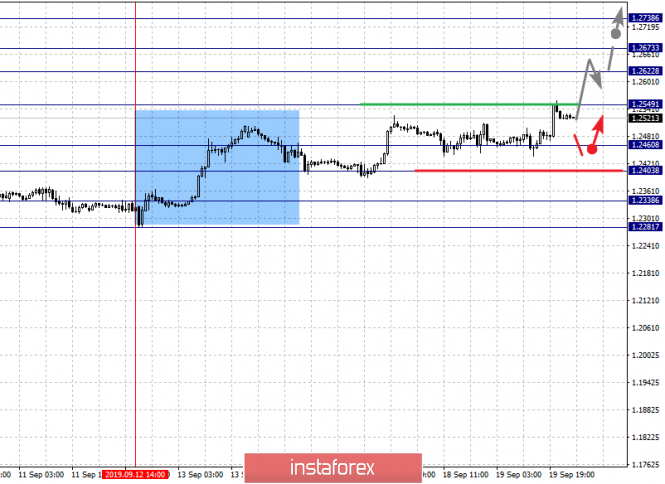

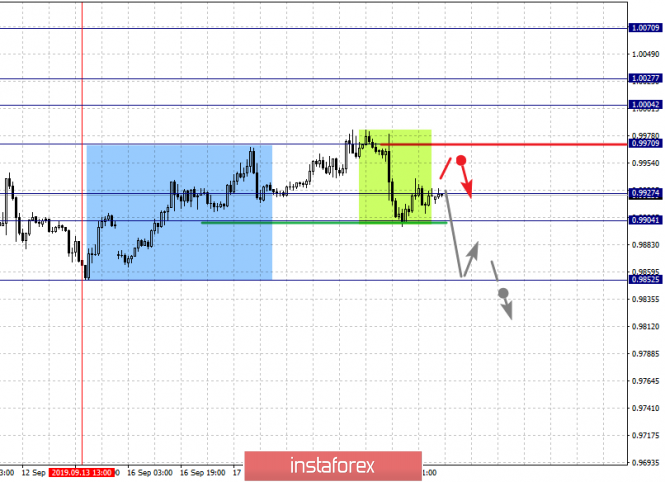

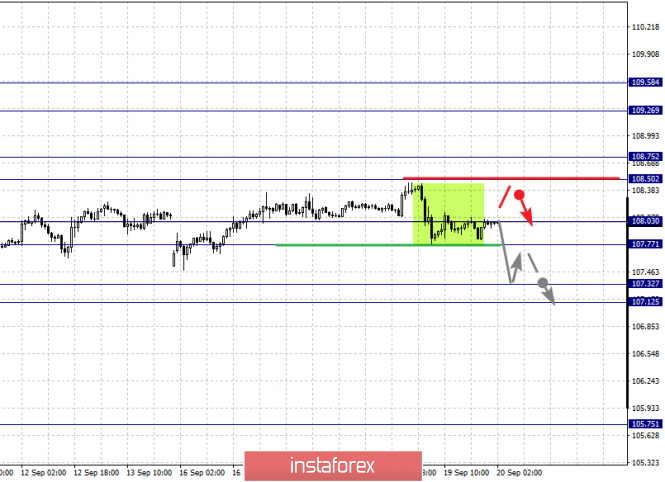

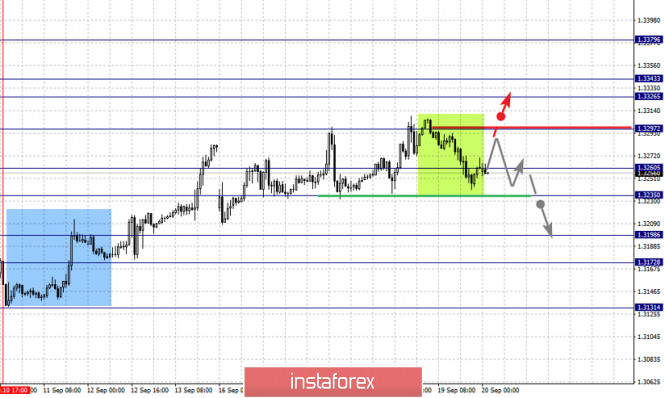

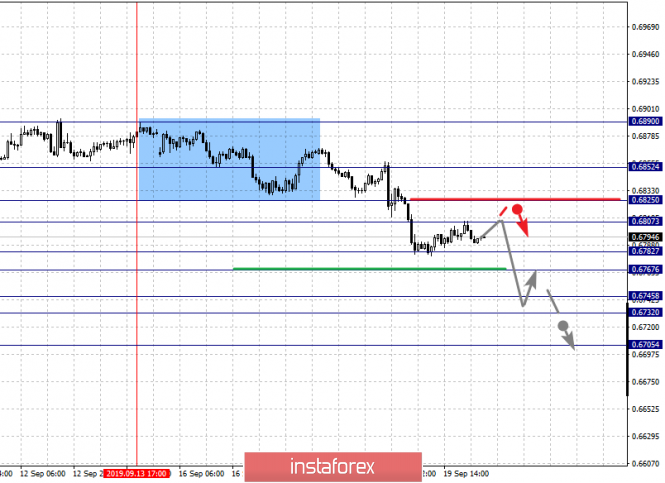

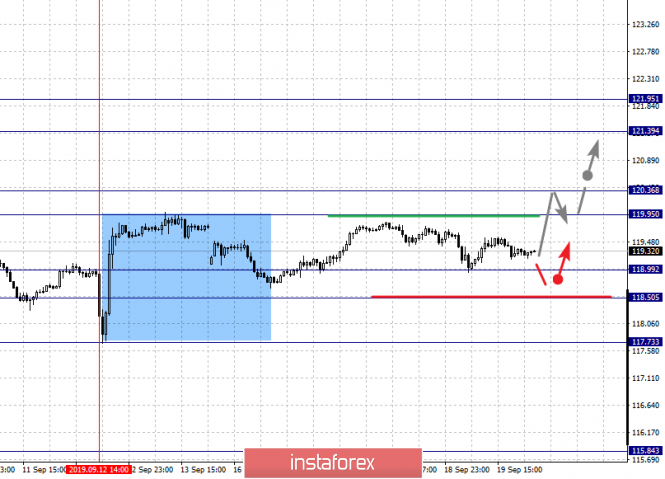

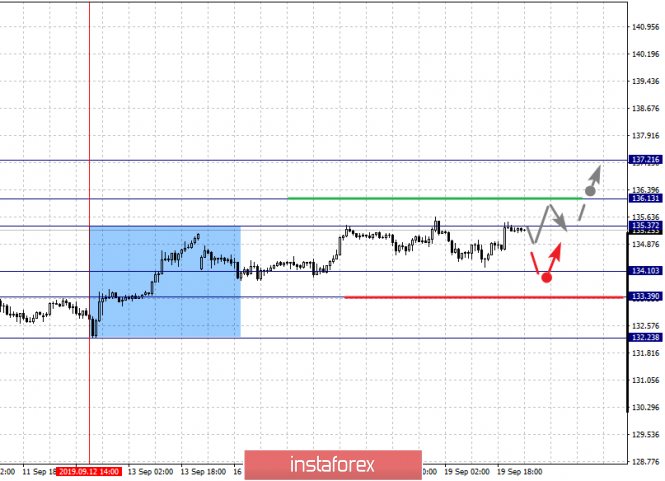

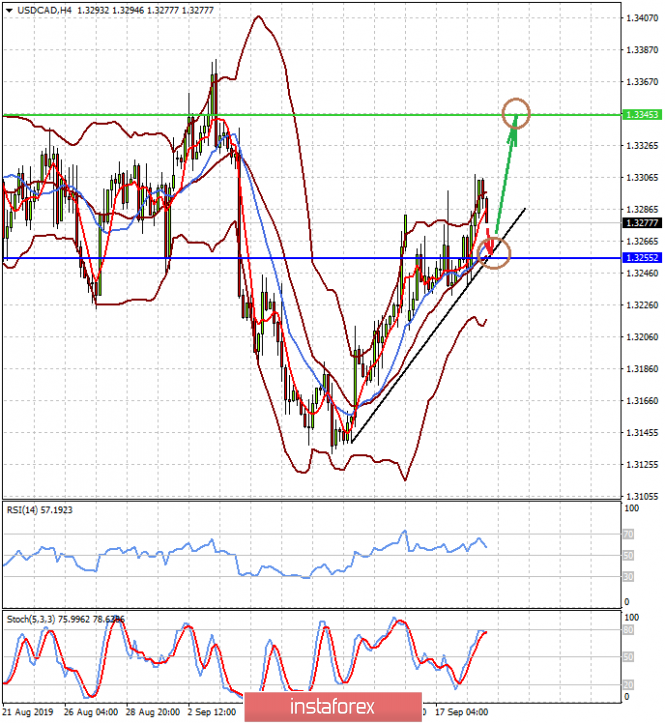

| Fractal analysis of the main currency pairs for September 20 Posted: 19 Sep 2019 05:46 PM PDT Forecast for September 20: Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1227, 1.1188, 1.1135, 1.1114, 1.1019, 1.0987 and 1.0932. Here, we continue to monitor the ascending structure of September 12. The continuation of the movement to the top is expected after the breakdown of the level of 1.1080. In this case, the first goal is 1.1114. The passage at the price of the noise range 1.1114 - 1.1135 should be accompanied by a pronounced upward movement. Here, the goal is 1.1188. For the potential value for the top, we consider the level of 1.1227. Upon reaching this value, we expect a pullback to the bottom. Short-term downward movement is expected in the range of 1.1019 - 1.0987. The breakdown of the latter value will lead to the development of a downward trend. In this case, the first potential target is 1.0932. The main trend is the local structure for the top of September 12. Trading recommendations: Buy: 1.1080 Take profit: 1.1114 Buy 1.1135 Take profit: 1.1188 Sell: 1.1019 Take profit: 1.0990 Sell: 1.0985 Take profit: 1.0935 For the pound / dollar pair, the key levels on the H1 scale are: 1.2738, 1.2673, 1.2622, 1.2549, 1.2460, 1.2403, 1.2338 and 1.2281. Here, we continue to monitor the local ascendant structure from September 12. The continuation of the movement to the top is expected after the breakdown of the level of 1.2549. In this case, the target is 1.2622. Price consolidation is in the range of 1.2622 - 1.2673. For the potential value for the top, we consider the level of 1.2738. Upon reaching which, we expect a pullback to the bottom. We expect consolidated movement in the range 1.2460 - 1.2403. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.2338. This level is a key support for the top. Its passage at the price will lead to the development of a downward structure. In this case, the first goal is 1.2281. The main trend is the local ascending structure of September 12. Trading recommendations: Buy: 1.2550 Take profit: 1.2620 Buy: 1.2674 Take profit: 1.2736 Sell: 1.2401 Take profit: 1.2340 Sell: 1.2336 Take profit: 1.2282 For the dollar / franc pair, the key levels on the H1 scale are: 1.0070, 1.0027, 1.0004, 0.9970, 0.9927 and 0.9904. Here, the price is close to the cancellation of the upward structure from September 13, which requires another breakdown of the level of 0.9904. Short-term downward movement, as well as consolidation is expected is in the range of 0.9927 - 0.9904. The continuation of the movement to the top is expected after the breakdown of the level of 0.9970. In this case, the target is 1.0004. Short-term upward movement, as well as consolidation is in the range of 1.0004 - 1.0027. For the potential value for the top, we consider the level of 1.0070. Upon reaching which, we expect a pullback to the bottom. The main trend is the formation of potential for the top of September 13, the stage of deep correction. Trading recommendations: Buy : 0.9972 Take profit: 1.0004 Buy : 1.0006 Take profit: 1.0025 Sell: 0.9900 Take profit: 0.9855 For the dollar / yen pair, the key levels on the scale are : 109.58, 109.26, 108.75, 108.50, 108.03, 107.77, 107.32 and 107.12. Here, we are following the development of the ascending structure of September 3. At the moment, the price is in the correction zone. Short-term upward movement is expected in the range of 108.50 - 108.75. The breakdown of the last value will lead to a pronounced movement. Here, the target is 109.26. For the potential value for the top, we consider the level of 109.58. Upon reaching this value, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is possibly in the range 108.03 - 107.77. The breakdown of the last value will lead to an in-depth correction. Here, the target is 107.32. The range of 107.32 - 107.12 is the key support for the top, before which, we expect the expressed initial conditions for the downward cycle to be formed. Main trend: local upward structure from September 3. Trading recommendations: Buy: 108.50 Take profit: 108.72 Buy : 108.77 Take profit: 109.26 Sell: 108.03 Take profit: 107.80 Sell: 107.74 Take profit: 107.45 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3379, 1.3343, 1.3326, 1.3297, 1.3260, 1.3235, 1.3198 and 1.3172. Here, we are following the development of the ascending structure of September 10. The continuation of the movement to the top is expected after the breakdown of the level of 1.3297. Here, the target is 1.3326. Price consolidation is in the range of 1.3326 - 1.3343. For the potential value for the top, we consider the level of 1.3379. Upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 1.3260 - 1.3235, The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3198, This level is a key support for the top. Its breakdown will lead to the development of a downward structure. In this case, the potential target is 1.3172. The main trend is the ascending structure of September 10, the correction stage. Trading recommendations: Buy: 1.3299 Take profit: 1.3226 Buy : 1.3344 Take profit: 1.3378 Sell: 1.3260 Take profit: 1.3237 Sell: 1.3233 Take profit: 1.3200 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6852, 0.6825, 0.6807, 0.6782, 0.6767, 0.6745, 0.6732 and 0.6705. Here, we are following the development of the downward cycle of September 13. The continuation of movement to the bottom is expected after the price passes the noise range 0.6782 - 0.6767. In this case, the target is 0.6745. Price consolidation is in the range of 0.6745 - 0.6732. For the potential value for the top, we consider the level of 0.6705. Upon reaching which, we expect a pullback to the top. Short-term upward movement is possibly in the range of 0.6807 - 0.6825. The breakdown of the last value will lead to a long correction. Here, the potential target is 0.6852. This level is a key support for the downward structure. The main trend is the downward cycle of September 13. Trading recommendations: Buy: 0.6808 Take profit: 0.6825 Buy: 0.6827 Take profit: 0.6850 Sell : 0.6767 Take profit : 0.6745 Sell: 0.6730 Take profit: 0.6705 For the euro / yen pair, the key levels on the H1 scale are: 121.95, 121.39, 120.36, 119.95, 118.99, 118.50 and 117.73. Here, we continue to monitor the ascending structure of September 12. Short-term upward movement is expected in the range of 119.95 - 120.36. The breakdown of the level of 120.36 should be accompanied by a pronounced upward movement. Here, the goal is 121.39. For the potential value for the top, we consider the level of 121.95. Upon reaching which, we expect a pullback to the bottom. Short-term downward movement is possibly in the range 118.99 - 118.50. The breakdown of the latter value will lead to the cancellation of the upward structure from September 12. Here, the first potential target is 117.73. The main trend is the local structure for the top of September 12. Trading recommendations: Buy: 119.95 Take profit: 120.34 Buy: 120.38 Take profit: 121.35 Sell: 118.99 Take profit: 118.53 Sell: 118.46 Take profit: 117.80 For the pound / yen pair, the key levels on the H1 scale are : 137.21, 136.13, 135.37, 134.10, 133.39 and 132.23. Here, we are following the local ascending structure of September 12. Short-term upward movement is expected in the range of 135.37 - 136.13. The breakdown of the last value will lead to movement to a potential target - 137.21, when this level is reached, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 134.10 - 133.39. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 132.23. This level is a key support for the upward structure. The main trend is the ascending structure of September 3 and the local ascending structure of September 12. Trading recommendations: Buy: 135.38 Take profit: 136.10 Buy: 136.15 Take profit: 137.20 Sell: 134.10 Take profit: 133.42 Sell: 133.35 Take profit: 132.30 The material has been provided by InstaForex Company - www.instaforex.com |

| The dollar is trying to unravel the Fed's plans Posted: 19 Sep 2019 04:32 PM PDT The central event of this week - the next meeting of the Federal Reserve - did not bring clarity. Analysts continue to wonder what to expect from the regulator in the future. However, unlike US President Donald Trump, who called Fed Chairman Jerome Powell "a terrible communicator," financial markets seem to have clearly understood the hints of the latter. The Federal Reserve chief's statement that the central bank is ready to aggressively reduce the interest rate in the event of a deterioration in the well-being of the US economy, caused the S&P 500 to grow most rapidly over the past six weeks. Prior to that, the index dipped under the influence of the regulator's rate forecasts: 7 out of 17 FOMC members believe that it should be reduced by 25 basis points by the end of the year, 5 believe that it will remain unchanged, and 5 would like to see not one, but two acts of monetary expansion. Apparently, investors were frightened not by the easing of the Fed's monetary policy (of which I have been certain for a long time already), but by the fact that the rate on federal funds is likely to remain at 1.75% until the end of next year. Of course, you can talk for a long time about what affected the split in the ranks of the FOMC (3 out of 10 Committee members voted against lowering the interest rate from 2.25% to 2%), but when so much uncertainty is observed on the market, pluralism of opinions is inevitable. Experts call the current situation as "Powell's puzzle": the Fed is forced to balance between strong macro statistics in the United States, which allowed it to increase the country's GDP for the current year from 2.1% to 2.2%, and international threats, including trade conflicts and Brexit. The mixed reaction of the markets and the lack of a clear signal from the Fed about the weakening of monetary policy in 2019 caused another bout of anger from the head of the White House, Donald Trump. "Jay Powell and the Federal Reserve Fail Again. No "guts", no sense, no vision! A terrible communicator!", D. Trump wrote on Twitter. Although the Fed chairman prefers to ignore such attacks against him, this time he commented on the idea of negative interest rates called for by the US president. According to J. Powell, if the situation begins to deteriorate, then the central bank will revive QE rather than lower the federal funds rate below zero. The day before, the greenback slightly strengthened across the entire spectrum following the results of the September FOMC meeting, but today it is gradually losing ground, since the Fed still does not have a consensus on further actions to adjust the monetary rate. The market is not completely sure how the US central bank will behave. Most analysts expect the regulator to further trim the rate on federal funds this year, but only one reduction is laid. Probably, investors will wait for some new signals. In recent days, the trade war between the US and China has left the information field. If another escalation of the conflict occurs, the market may perceive this as a signal for more active easing of the monetary policy of the Federal Reserve. "It is obvious that the Fed does not have a consensus on what to do next: on the one hand, D. Trump presses, blaming the central bank leadership for incompetence and demanding an urgent interest rate cut to zero or lower, on the other, there are no formal reasons for this," he said ING chief economist James Niley. Valentin Marinov, Head of Currency Research at Credit Agricole, calls the FOMC decision to trim rates as "hawkish" cuts, believing that such a move is positive for the greenback. "I believe that currencies that are more closely correlated with investor sentiment regarding risky assets will be more vulnerable to the dollar than the euro, yen and gold," he said. "I think the Fed will succeed if it can slightly weaken the dollar's position, and make the curve of its fall rate a little steeper. Markets have already shown the expectation of another cut in the base interest rate in December, "said Jim Caron of Morgan Stanley. The material has been provided by InstaForex Company - www.instaforex.com |

| Dramatic roles of the pound: a candidate for decline and a source of tension for the market Posted: 19 Sep 2019 04:24 PM PDT The UK currency is constantly under the scrutiny of market participants. The reason for this, analysts believe that it is the tense situation around Brexit, creating a danger for the pound itself as well as other currencies. Many world currencies are involved in the orbit of the British pound. The currency of Great Britain in one way or another affects the means of payment of other countries, and currently this effect is negative. The pound's dynamics were significantly affected by weak macroeconomic statistics from the UK on inflation. According to the report, the base consumer price index fell to 1.5% in August, which is the lowest level since November 2016. According to analysts, the current situation indicates the need to reduce interest rates in the UK. Weak macroeconomic statistics indicate that in the coming months the regulator may reduce interest rates. This is negative news for the British pound, analysts emphasize. It can noticeably lose in price. Currently, the GBP/USD currency pair is trading in the consolidation range near the levels of 1.2453–1.2445. According to preliminary forecasts, in the event of a decrease in the current level, a further drop is possible to the level of 1.2400. With the implementation of a more optimistic scenario and the breakdown of the upper region of 1.2490, growth is likely to reach 1.2555. After that, the potential to decline to the 1.2400 level is growing, analysts summarize. An alarming situation in European markets is provoked by uncertainty about Brexit. Currently, the European Parliament has approved, by a majority vote, a deferral for the UK if it so requests. However, this event has already been taken into account by the market, and the pound will not receive strong support from this news. In this situation, investors and traders will invest in more reliable assets, analysts are certain. The material has been provided by InstaForex Company - www.instaforex.com |

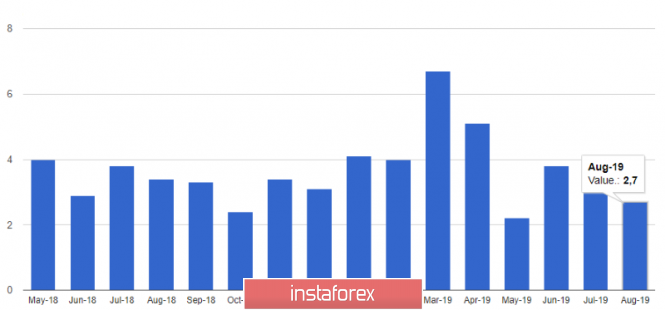

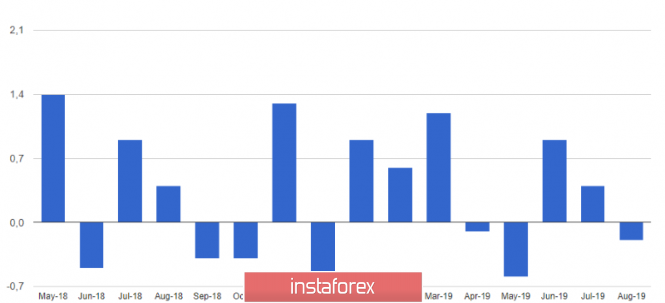

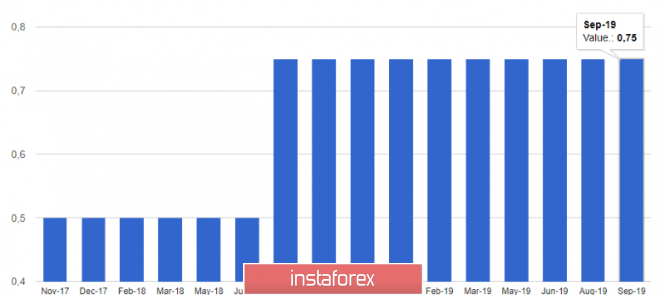

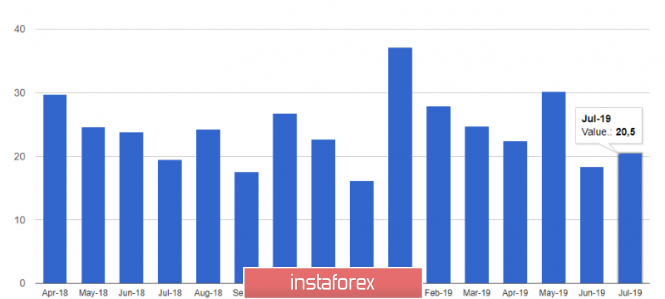

| Posted: 19 Sep 2019 04:14 PM PDT Another attempt to raise the British pound in the morning was unsuccessful following the release of data on the volume of retail sales in the UK. Growth gradually began to slow down in August, and even decreased compared with July, indicating another sign of weakness in the British economy. According to the National Bureau of statistics, retail sales in August 2019 increased by 2.7% compared to the same period of the previous year after an increase of 3.4% in July. Compared with the previous month, retail sales fell 0.2% in August. All this once again confirms the fact of a more cautious approach of consumers on the threshold of the next date of the UK's exit from the EU, as well as increasing political uncertainty. The slowdown in the global economy also poses a threat to consumers. Let me remind you that just recently, during his meeting with EU representatives, British Prime Minister Boris Johnson promised to withdraw the country from the EU with or without an agreement at the end of October. However, the opposition and other members of Parliament are taking steps to prevent leaving the EU without a deal. A bill ruling out Brexit without an agreement was passed last week, but the UK government looks at it very differently. Today, the Bank of England also left its key interest rate unchanged, as well as the volume of bond purchases. According to the data, the key interest rate was kept at 0.75%, and this decision was made with a vote ratio of 9 to 0. The Bank of England still sees the need for a limited rate hike if Brexit goes smoothly and the global economy stabilizes. However, the reaction to a hard Brexit can have any direction. The regulator also said in a statement that longer uncertainty around Brexit will only weaken economic growth and put pressure on inflation. As we remember, yesterday's inflation report indicated a slowdown in its growth. A report by the Organisation for Economic Co-operation and Development was published today, which downgraded the UK's growth forecast. The economy is expected to grow by only 1% this year and only 0.9% next year. If the UK leaves the EU without a trade agreement, the country's GDP may be reduced by 2% or more. As for the forecast of the Bank of England, the UK economy is expected to grow by 1.3% in 2019 and 2020. From a technical point of view, nothing has changed in GBPUSD. The resistance of 1.2505 is still a problem for bulls, the breakthrough of which will provide the market with new buyers able to update the local highs in the area of 1.2550 and 1.2600. If in the near future the bulls will not be able to regain the level of 1.2505, it is likely another bearish correction in the area of this week's low 1.2395. EURUSD The European currency has managed to slightly strengthen its position after the data on the current account balance of the balance of payments, but trade continues to be conducted within the weekly side channel, exit from which is possible only when major players appear in the market. According to a report by the European Central Bank, the current account surplus in the eurozone grew to 21 billion euros in July this year from 18 billion euros in June. The total positive current account balance of the eurozone balance of payments for the year was 2.7% of GDP compared to 3.3% in the previous 12 months. From a technical point of view, nothing serious has happened on the market. Only a breakthrough of the peak in the region of 1.1080 will cause larger purchases of the trading instrument, which will lead to an update of the levels of 1.1110 (last week's high) and 1.1150. Under the EURUSD decline scenario, the support will be at the level of 1.0990, and larger areas are already located at the lows of this month in the areas of 1.10950 and 1.0920. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. September 19. Results of the day. No reaction from traders over the Bank of England meeting Posted: 19 Sep 2019 03:59 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 84p - 178p - 104p - 134p - 73p. Average volatility over the past 5 days: 115p (high). The British currency has not paid much attention to macroeconomic events and reports in recent days. Yesterday, the Fed meeting and its results were completely ignored, and a little earlier - the consumer price index in the UK, which had every chance of causing strong sales of the pound, turned out to be very weak. But no, pound selloffs did not follow. When was the last time that the pound did not fall, having fundamental grounds for this? But anyway, the British currency holds a leading position against the US currency in September. Today, there were two more important fundamental events for the UK currency, both of which were again ignored by market participants. Everything is clear with the meeting of the Bank of England: the key rate remained unchanged (0.75%), the repurchase volume of bonds remained unchanged (375 billion pounds), the alignment in the vote on the change in the rate remained unchanged (9 - 0), and the speech of Bank of England head Mark Carney was nothing at all. But the data on retail sales on Great Britain in August was the next report in a series of unsuccessful ones. In annual terms, the growth amounted to only 2.7%, and it completely decreased by 0.2% in the monthly indicator. Forecasts, of course, were higher. But the bears did not react to this report at all. What does this mean? From our point of view, this can only indicate one thing. Market participants were so keen on the topic of Brexit and its possible transfer date to January 31 that they do not see or do not want to see other events and news. On the one hand, this is correct, since for the UK it's really not inflation or retail sales that is important right now, but how the process of the country's exit from the European Union will end. All other problems are secondary. However, traders will not be able to ignore all the news until October 31, and possibly until January 31, 2020. Although this is the case at the moment. Meanwhile, the UK, represented by the government of Boris Johnson, continues to "play" cat and mouse with the European Union. According to unofficial information, the UK has submitted to Brussels "confidential technical documents reflecting ideas, according to Brexit." However, according to a representative of the British government, these documents will receive official status when the European Union "shows a clear desire to deal with the issue of replacing the back-stop mechanism." At the same time, Finnish Prime Minister Antti Rinne said that Britain should submit alternative proposals for a Brexit agreement in writing and formally if it wants the EU to consider them. It is also reported that the EU is not going to negotiate on Brexit at the summit on October 17-18. Moreover, many EU leaders are inclined to believe that a UK Brexit deferment should not be granted at all, as there must be "good reason" for this (for example, re-election to Parliament or a second referendum, or Johnson's desire to conclude an agreement). Since there is no reason now, there is no need to carry out the date transfer, the leaders of some EU member states are certain. In general, the EU's position is simple: Brexit's transfer date will be approved, but there will be no concessions in the Brexit agreement previously agreed upon; alternatives to the agreement will be considered, but they must first be submitted for consideration by the Johnson government. The technical picture of the pound/dollar pair remains the same. The upward trend persists, however, Bollinger bands indicate a high probability of a flat. Trading recommendations: The pound/dollar currency pair is trying to resume the upward movement, but so far it is more and more inclined to flat. Thus, it is now recommended to stay in pound purchases with a target of 1.2590, but we would not recommend opening new long positions. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 19 Sep 2019 03:45 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 160p - 54p - 94p - 85p - 62p. Average volatility over the past 5 days: 91p (high). The Federal Reserve meeting and the second consecutive key rate cut were left behind. It is time for traders to turn their attention to other macroeconomic data and forget about yesterday's event. No important macroeconomic statistics were published in the European Union and the United States today on September 19. There were only a few minor reports that attracted no attention from market participants. Meanwhile, without any problems, the euro offset all of yesterday's losses and without fundamental grounds. It is on the basis of this fact that we believe that traders simply ignored all the results of the Fed meeting, simply not impressed by them. Forex market participants were certain of a rate cut, they worked out this decision in advance. Yes, there was a small reaction, perhaps the reaction of small players, but most of the foreign exchange market did not work out the easing of the Fed's monetary policy by 0.25%, as well as a speech by Jerome Powell, as well as another angry tweet from Donald Trump. On this topic, the Fed meeting can be closed. No more interesting information from the United States and Europe is expected this week, and according to the EUR/USD pair chart, it is now clear that traders no longer understand where to move next. Sell the euro currency in the same way as in the last nine months? But the Fed trimmed the rate twice in a row and may well do so in the future, given Trump's constant pressure on the Fed. Buy the euro? But macroeconomic indicators of the eurozone leave much to be desired. And if a trade war with America also begins, then you will not envy the EU economy at all. Here it will be no longer about keeping the euro exchange rate, but about saving the bloc's economy. Without the trade war, the EU is already experiencing serious problems with economic growth and inflation. So serious that it lowers the negative deposit rate and resumes the quantitative stimulus program. But Trump is exactly what is needed: so that competitors feel bad. It is on the basis of this consideration that we believe that a trade war between the European Union and the United States is inevitable. The US president, most likely, will simply undertake to "finish off" the economy of the European Union, simultaneously trying to get a more favorable trade agreement for his country. In any case, profit: either the EU economy will begin to experience even greater problems, or the United States will receive a profitable deal. The only thing that Trump will be unprofitable in this war with the European Union is that the US dollar is almost guaranteed to continue to rise, and the euro to fall. Thus, the effect of the introduction of trade duties on imports from Europe will be somewhat offset by the falling exchange rate of the European currency. Here the odious US leader will have to come up with something new. Or simply continue to exert verbal pressure on the Fed and Jerome Powell, who formally remain beyond his control. Moreover, there are results in the form of two easing of monetary policy. From a technical point of view, the euro/dollar pair may go into flat. Firstly, today and tomorrow no important publications will take place. Secondly, since September 5, the pair's rate has not changed much, there were just a few volatile days. Thirdly, the Fed meeting did not clarify the situation for the pair in the medium term. Fourth, the Bollinger Bands indicator has turned sideways and is narrowing. Thus, it is advised that you keep the idea of a possible flat in mind in the coming days. Trading recommendations: The EUR/USD pair is trying to continue the upward movement, but the Ichimoku indicator has already formed a "dead cross" and is also weak, while the Bollinger Bands have turned sideways. In general, the technical picture for trading the euro/dollar pair is now completely unattractive. The fundamental background will be absent today and tomorrow, which again does not add a desire to open new positions. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Fed rate cut in September may be the last; USD/JPY rises to 110 - Scotiabank Posted: 19 Sep 2019 03:43 PM PDT The US dollar will continue to rise against the Japanese yen after the Fed cut its interest rate in September, which could well be the last monetary policy easing in the United States if its economy remains strong, said Sean Osborne, Scotiabank's currency strategist. "The USD/JPY pair is going to test 109," the analyst said after the Fed's decision, but before the Bank of Japan issued a verdict on monetary policy. "The rebound in stocks and the restoration of US Treasury bond yields after the Fed's decision has pulled down the yen," S. Osborne said. "Wider market/geopolitical events are likely to strengthen the yen in the short term. Nevertheless, the dollar will try its best to take full advantage of the "hawkish" Fed rate cuts, so the growth of USD/JPY can only slow down in the range of 109-110, "he added. Following the announcement of the Fed's monetary policy verdict, USD/JPY hit a session high of 108.48, the highest level since August 1. The yen went up by 0.5%, to $107.92 - a high since August 23 - after the decision of the Bank of Japan to maintain the status quo on Thursday. The regulator left the target yield of 10-year government bonds at around zero, the interest rate on deposits of commercial banks in the central bank - at -0.1%. The material has been provided by InstaForex Company - www.instaforex.com |

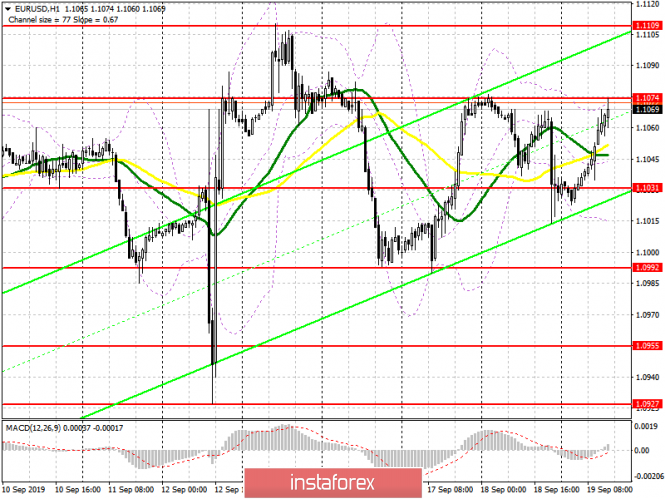

| September 19, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 19 Sep 2019 08:39 AM PDT

Two weeks ago, a quick bearish decline was demonstrated towards 1.0965 - 1.0950 where the backside of the broken channel came to meet the EURUSD pair again. Risky traders were advised to look for a valid BUY entry anywhere around the price levels of 1.0950. All T/p levels were successfully reached within the recent bullish movement during last weeks' consolidations. Earlier last week, the EUR/USD pair was testing the backside of both broken trends around 1.1060-1.1080 where significant bearish pressure pushed the pair directly towards 1.0940 (Prominent Weekly Bottom). Bearish Breakdown below the price level of 1.0940 was needed to enhance further bearish decline towards 1.0900 and 1.0840 (Fibonacci Expansion Key-Levels). However, SIGNIFICANT bullish rejection was demonstrated as a quick bullish spike towards 1.1100 where a recent episode of bearish rejection was expressed. Currently, the GBPUSD is trapped within a narrow consolidation range extending between 1.1090 - 1.0995 until breakout occurs in either directions. Bearish Breakout below 1.1030 is needed to render the recent bullish spike as a bullish trap. If so, bearish decline would be expected initially towards 1.0940-1.0920. On the other hand, Bullish breakout above 1.1080 gives an early signal of short-term bullish reversal possibility as a bullish double-bottom pattern with a projected target towards 1.1175. Trade recommendations : Risky traders are advised to have a short-term BUY Entry upon bullish breakout above (1.1090-1.1110). S/L should placed below 1.1050 while target level should be located at 1.1175. The material has been provided by InstaForex Company - www.instaforex.com |

| September 19, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 19 Sep 2019 08:11 AM PDT

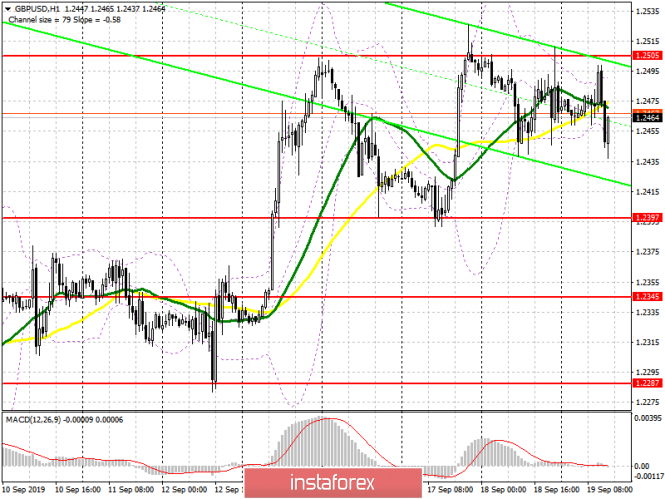

On July 26, Bearish breakdown below 1.2385 (Wedge-Pattern Key-Level) facilitated further bearish decline towards 1.2210 and 1.2100 which corresponded to significant key-levels on the Weekly chart. In Early August, another consolidation-range was temporarily established between the price levels of (1.2100 - 1.2220) except on August 9 when temporary bearish movement was executed towards 1.2025 (Previous Weekly-Bottom). Since then, the GBP/USD pair has been trending-up within the depicted bullish channel except on September 3 when a temporary bearish decline was demonstrated towards 1.1960. Around the price level of 1.1960, early signs of bullish recovery (Bullish Engulfing candlesticks) brought the GBPUSD back above 1.2100 and 1.2220 where the GBPUSD pair looked overbought. However, further bullish momentum was demonstrated towards 1.2320 maintaining the bullish movement inside the depicted movement channel. As Expected, Temporary bullish advancement was demonstrated towards 1.2475 - 1.2500 where the upper limit of the current movement channel applied considerable bearish rejection on September 13. Today, another bullish trial is currently being expressed towards 1.2500 where a possible Double-Top reversal pattern may be established. The Long-term outlook remains bearish as long as the upper limit of the current movement channel around 1.2475-1.2500 remains defended by the GBPUSD bears. On the other hand, Bearish breakdown below 1.2400 (Reversal-Pattern Neckline) can turn the short-term outlook into bearish, thus allowing more bearish decline towards the lower limit of the movement channel around 1.2330. Trade Recommendations: Conservative traders can look for a valid SELL entry anywhere around the price levels of 1.2475-1.2500 for a valid SELL entry. T/P level to be placed around 1.2330, 1.2280 and 1.2220 while S/L should be placed above 1.2550. The material has been provided by InstaForex Company - www.instaforex.com |

| Missed Chance: Bitcoin Ignored Fed Decision Posted: 19 Sep 2019 07:32 AM PDT Opportunities, which fate sometimes gives, can turn the whole future life. This is especially true for the financial market, particularly in the cryptocurrency sphere. Seizing a chance in this innovative field is a special skill. The leader of the crypto market, Bitcoin, was usually lucky in such situations, but not this time. According to some analysts, cryptocurrency No. 1 missed a good chance to grow, ignoring another reduction in the key rate of the US Federal Reserve on Wednesday, September 18. At the same time, many experts predicted a rise in the price of military-technical cooperation at this event. However, a miracle did not happen. On Thursday, September 19, the leading digital asset fell below an important psychological level of $10,000. Now, it needs to survive amid quantitative easing and a potential reduction in rates, experts emphasized. They admit that due to emergency measures taken by the US Federal Reserve, bitcoin can fly up to $ 20,000, but not in the near future. According to Travis Kling, the manager of the cryptocurrency fund, a number of specific characteristics of the MTC makes it a safety mechanism that protects capital from the negative effects of the monetary policy of world central banks. Experts believe that the current price of bitcoin near the $ 10,000 mark indicates the consolidation of the leading cryptocurrency. They believe that in the near future, the main digital asset will become a little cheaper but in the future it will regain lost ground. The material has been provided by InstaForex Company - www.instaforex.com |

| USD/JPY. Is it worth believing the growth of the Japanese currency? Posted: 19 Sep 2019 07:19 AM PDT The Bank of Japan at today's meeting maintained the status quo, leaving all the parameters of monetary policy in the same form. This fact in itself is not remarkable, because the Japanese regulator has not taken any active action since September 2016, when it began an experiment with targeting the yield of 10-year government securities. In July this year, the Bank of Japan adjusted the volume of securities of exchange-traded index funds purchased annually. But in general, the parameters of monetary policy have remained unchanged for several years: the central bank has kept the target yield of 10-year government bonds at "about zero" and the interest rate on deposits of commercial banks at -0.1%.

Although nothing changed at the September meeting, the Japanese currency received some support, strengthening throughout the market (including in the pair with the dollar, falling back to 107th figure). The USD/JPY bears simply took advantage of the situation, turning the "passing" meeting in their favor. The market has been escalating the situation regarding the possible actions of the Japanese Central Bank for several weeks. In particular, 10 days before the meeting, Harukiko Kuroda said in an interview that the issue of reducing the rate further into the negative area is still "on the agenda". Many journalists picked up the phrase, bringing it to the headlines. At the same time, most of them distorted the context of the voiced position. After all, in fact, the head of the Bank of Japan was not so unambiguous in his assessments – moreover, he immediately made a reservation that at the moment the situation is "not so bad" that the regulator resorted to decisive action now, especially against the background of steady growth in consumer spending and investment. But the market heard what he wanted to hear, so the yen was actively getting cheaper for several days, paired with the dollar going from the 105th to the middle of the 108th figure. The devaluation of the yen contributed to the overall fundamental background in the foreign exchange market. Anti-risk sentiment fell markedly after Washington and Beijing set a date for high-level talks. Events in the Middle East had only a short-term impact on the dynamics of protective instruments. The oil market stabilized quite quickly (although quotes have not yet returned to their previous positions), and the Saturday incident did not receive its military continuation. Yesterday, Saudi Arabia officially accused Iran of involvement in the attack on oil fields, but the country's defense minister did not talk about any retaliatory measures. The US President also stated his unwillingness to fight with Tehran, while instructing his aides to increase sanctions pressure. In other words, the worst-case scenario has not been realized (yet), so the "Middle East" fundamental factor has ceased to support protective assets, including the yen. To date, we see a corrective southern pullback on the USD/JPY pair, but in the medium term, the price retains its growth potential, up to the level of 108.90 (the upper line of the Bollinger Bands indicator on the daily chart). The market was surprised by the absolutely "passing" meeting, and this fact provided temporary support for the Japanese currency. But short positions in this situation look risky. First, the Bank of Japan announced that it will review economic and price changes at its next meeting, the results of which we will learn on October 31. At the October meeting, Central Bank members will conduct a quarterly review of their long-term growth and inflation forecasts. According to experts, the regulator will take additional incentive measures. This factor will exert background pressure on the yen.

In favor of the further growth of the USD/JPY pair, the events of the external fundamental background also speak. Relations between the US and China have recently warmed significantly, on the eve of the next round of talks. China exempted certain categories of US imports (including agricultural products) from additional duties, while the United States postponed the date of the increase in duties. Just yesterday, Donald Trump "boasted" to journalists that China has begun to purchase agricultural products from the United States again. At the same time, he expressed hope that the "historic trade agreement" will be concluded before November next year, that is, before the American presidential elections. Of course, relations between Beijing and Washington are quite windy – in October, the parties may again slam the door and increase mutual sanctions pressure. But until then, the Japanese currency, like all other protective instruments, will be vulnerable. In other words, the southern momentum of USD/JPY is corrective, and upon completion of the correction, the pair can continue to grow to the first resistance level of 108.90. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold missed a blow from the Fed Posted: 19 Sep 2019 05:42 AM PDT The Fed will resort to aggressive monetary expansion if things get worse with the announcement by Jerome Powell that the US economy is doing well and also the federal funds rate is down from 2.25% to 2% for preventive purposes. This has made a wicked golden joke. If in 2014-2018, a "bearish" trend established against the background of normalization of monetary policy in the precious metal market. Then, in 2019, it changed to "bullish" due to the Fed's intentions to lower the rate and the September FOMC meeting left more questions than answers. Why did the XAU/USD pair go decline if the federal funds rate fell by 25 bp and the Committee's forecasts indicate its readiness to reduce it to 1.75% by the end of 2019? Where is the logic? In my opinion, the dog is buried in the recently increased correlation of gold with American stock indices. Jerome Powell dismisses suspicions that he is following Donald Trump, but his speeches at press conferences say that the central bank is dancing in tune to the stock market. The chairman dropped the S&P 500 several times and then was forced to justify himself to rectify the situation. The last time this happened was in July when the phrase "mid-cycle adjustment" shocked investors. In September, Powell was careful. "The economy is strong, but if its condition worsens, the Fed will aggressively lower rates." These words pulled the S&P 500 from the bottom, where the stock index fell after the publication of FOMC forecasts. S&P 500 reaction to the results of the Fed meeting Gold changed its side in 2019. If in previous years it went in the opposite direction to the US dollar, now it is sensitive to the behavior of the American stock market. It behaves like a classic safe-haven asset. Therefore, Powell's optimism led to the sale of precious metals. It seems that a recession should be expected only if the Fed begins to actively cut bets until that moment you can sleep peacefully. Moreover, there is a thaw in relations between Washington and Beijing. The risks of promiscuous Brexit after parliament passes a law on the need for a prime minister's letter to the EU to prolong the transition period and Saudi Arabia claims that it will be able to quickly restore oil production after the attacks on its manufacturing sector. Thus, the degree of the three key international threats has somewhat weakened, but the Fed still lowered the rate. Does the central bank still listen to criticism of Donald Trump, who once again accused Jerome Powell of shortsightedness and inability to communicate with financial markets? Say, the Fed chairman has a small intestine to reduce the rate by 1 pp, or even bring it to zero! Technically, the "Surge and reversal of acceleration" pattern on the daily gold chart is relevant. The bears stormed the trend line of the burst stage and if they manage to gain a foothold below $1,498 per ounce, the risks of continuing the correction to $1462 and $1404 will increase. We are talking about the level of 23.6% of the last rising wave, as well as the target at 88.6% based on the "Shark" pattern. On the contrary, the bulls are counting on the return of quotes above the trend line of the burst stage. Gold daily chart |

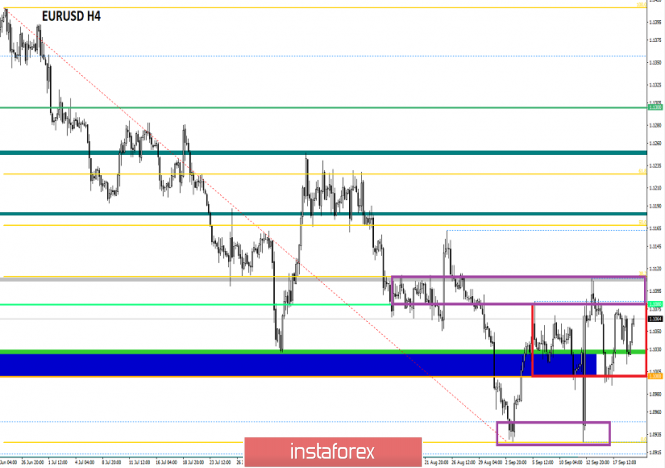

| Trading recommendations for the EURUSD currency pair – placement of trade orders (September 19) Posted: 19 Sep 2019 05:36 AM PDT Over the last trading day, the euro/dollar currency pair showed volatility slightly above the daily average of 61 points, resulting in a zigzag amplitude. From technical analysis, we see that the past days on the EURUSD pair were extremely volatile, the quote jumped up and down. The movement in the previously set limits of 1.1000/1.1080 remains to this day. As discussed in the previous review, speculators worked at the stage of recovery quotes, outlining the goal of 1.1025-1.1000, where the first point was touched, but the main trading idea in terms of ride on the information and news background did not succeed due to the lack of due market reaction. Considering the trading chart in general terms (daily period), we see not just a corrective move, but a kind of multidirectional interest. Analyze the past ten trading days, and you will see that the movement has a horizontal character, with variable interest, which plays into the hands of the main market trend. Let me remind you that our fulcrum is 1.0926, and the resistance point is 1.1080/1.1115. The news background of the last day had data on inflation in the eurozone, where the figures were confirmed at the same level of 1.0%, which surprised no one. In the afternoon, we published data on the construction sector in the United States, where the volume of construction of new homes increased from 1,215 M to 1,215 M, and the number of issued building permits increased from 1,317 M to 1,419 M. The key event of the last day was certainly the meeting of the Federal Open Market Committee, where the interest rate was reduced by 25 basis points for the second time in a year. Now, it is 2.0%, and this decision fully coincided with the expectations of most analysts, thus there was no surprise in this regard. After the announcement of the interest rates, a press conference was traditionally held, where Fed Chairman Jerome Powell talked about the reasons for the rate cut – "Although GDP continues to grow at a moderate pace and the labor market remains strong, the Fed lowered the rate in light of the impact of the global situation on economic development prospects and restrained inflationary pressure." At the same time, the head of the Fed noted that the forecasts for the US economy are favorable, and the situation in the job market is stable, in turn, inflation will soon return to the target level of 2.0%. Powell also stressed that he does not expect a recession in the US economy, which has been talked about so much lately. In turn, US President Donald Trump was not satisfied with such a sluggish move by the Fed in terms of reducing the refinancing rate and traditionally outlined his criticism on Twitter. "Jerome Powell and the Federal Reserve are failing again. No courage, no sense of reality, no vision of the situation!" – twitter @realDonaldTrump Trump's systematic criticism does not go unanswered, and at a press conference last week, Jerome Powell recalled the independence of the Federal Reserve from direct political control. "I continue to believe that the Fed's independence from direct political control has worked well in the past. I assure you that my colleagues and I will continue to pursue monetary policy regardless of political considerations," said Jerome Powell. By tradition, we conclude our column of information and news background with divorce proceedings – Brexit. So, the plenary session of the European Parliament was held, where the majority of voters supported the resolution on the extension of the postponement of the UK's exit from the European Union, stipulated by Article 50 of the Lisbon Treaty if there are reasons and purpose for this. In turn, London is committed to providing good reasons for the delay, to keep the free movement on the Irish border, and to fulfill financial obligations to the EU even in the absence of a deal with Brussels. At the same time, the EU issued an ultimatum to Boris Johnson that he must submit his proposals for Brexit by the end of the month or prepare for a hard exit from the EU. Today, in terms of the economic calendar, we have a package of statistics on the United States. So, the first data are released regarding applications for unemployment benefits, where they expect growth from primary by 9 thousand and repeated by 2 thousand. After that, data on sales on the secondary housing market will be published, where they are expected to decrease from 5.42M to 5.37M. In general terms, statistics can put local pressure on the US dollar. Further development Analyzing the current trade chart, we see the return of quotations within the upper limits of the lateral movement of the 1.1000/ 1.1080 (of 1.1115). There are no major changes in the quotes, which reflects moderate volatility in the market. Speculators, in turn, considering both works on the principle of testing the upper bounds of a return, at the same time focus on the method of the breakdown of the main boundaries of the 1.1000/1.1080(of 1.1115) to identify key move. It is likely to assume that in the absence of proper pressure on the dollar, we will feel the periodic ceiling in the area of 1.1080/1.1115 with the subsequent appearance of short positions. Thus, the chosen tactic above – work on the rebound/breakdown – is the most appropriate technique. Based on the above information, we will derive trading recommendations:

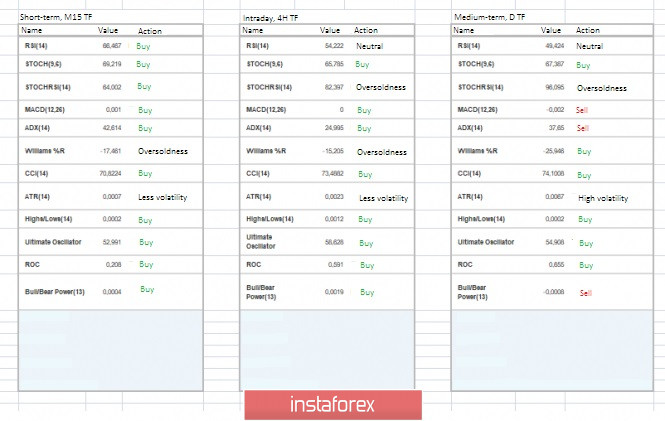

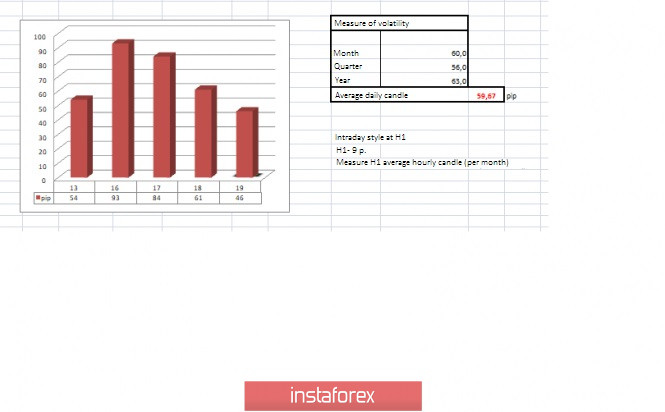

Technical analysis Analyzing different sector timeframes (TF), we see that the indicators unanimously signal an upward interest. It is worth considering such a moment that when considering the current movement, we see a distinct divergence of interests, thus when working with indicators, it is worth considering this moment. Volatility per week / Measurement of volatility: Month; Quarter; Year. Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (September 19 was built taking into account the time of publication of the article) The volatility of the current time is 46 points, which, in principle, is not bad for this period. It is likely to assume that volatility may still rise slightly, but for now, we have a limitation in terms of the available price framework. Key levels Resistance zones: 1,1100**; 1,1180*; 1,1300**; 1,1450; 1,1550; 1,1650*; 1,1720**; 1,1850**; 1,2100 Support zones: 1,1000***; 1,0850**; 1,0500***; 1,0350**; 1,0000*** * Periodic level ** Range level *** Psychological level **** The article is based on the principle of conducting transactions, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

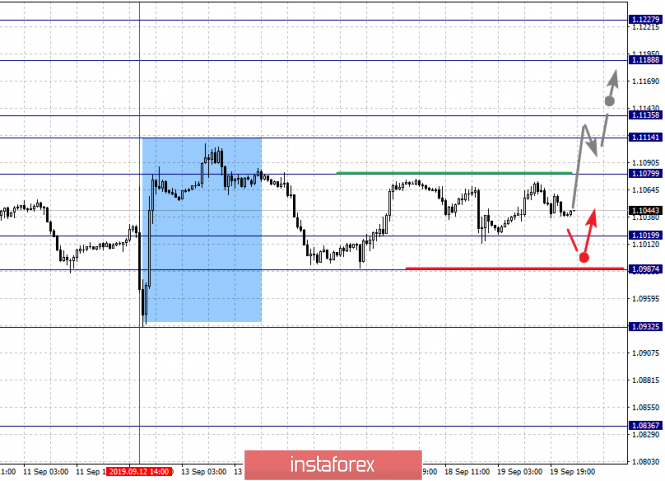

| EUR/USD for September 19,2019 - Broken symmetrical trriangle to the upside Posted: 19 Sep 2019 05:26 AM PDT EUR/USD has been trading upwards in the past 12 hours. The price tested the level of 1.1070. I found the breakout of the symmetrical triangle to the upside, which is the indication for the bullish strength.

Yellow rectangle – Resistance and profit target Purple lines – Broken symmetrical triangle Pink rising trendline – Expected path My advice is to watch for buying opportunities on the EUR due to break out of the symmetrical triangle in the background and potential new money buying. There is also breakout of the downward channel in the background, which is another indication of the strength. Resistance levels are seen at the price of 1.1075 and 1.1110 and support levels at 1.1016-1.1000. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 19 Sep 2019 05:20 AM PDT To open long positions on GBP/USD, you need: The expected decision on interest rates from the Bank of England and a weak retail sales report all led to a slight decline in the pound in the first half of the day to the lows of yesterday. However, a larger downward movement was not formed again, which locks the pair in an even larger narrow side channel. At the moment, buyers need to break through the resistance of 1.2505, which was formed last week. Only such a scenario will allow us to count on new highs in the area of 1.2555 and 1.2600, where I recommend fixing the profits. If the data on the US economy will help the dollar in the second half of the day, I recommend returning to long positions only for a rebound from the week's low in the area of 1.2397, or the new support of 1.2345. To open short positions on GBP/USD, you need: Due to the weak report on the volume of retail sales in the UK, sellers are still able to keep the pair below 1.2505, but the breakdown of this range can create quite serious problems. As long as the trade is conducted under the resistance of 1.2505, the pressure on the pound will remain, which leaves hope for a downward correction to the support area of 1.2397 and for a larger exit to the minimum of 1.2345, where I recommend taking the profits. If reports on the US economy led to the growth of GBP/USD above the resistance of 1.2505, it is best to consider new short positions after updating the maximum of 1.2555 or sell the pound on a rebound immediately from the level of 1.2600. Signals: Moving averages Trading around 30 and 50 moving averages, indicating some market uncertainty. Bollinger Bands Volatility is very low, which does not give signals to enter the market.

Description of indicators

|

| Gold 09.19.2019 - Do we have valid HSS pattern or fake one? Posted: 19 Sep 2019 05:11 AM PDT Gold continues to trade sideways at the price of $1,500 and there is potential for breakout very soon. Gold might need fundamental trigger for the next directional movement..

Blue horizontal line – Swing high (Right shoulder) Red rectangle – Upward target in case of the upward break Yellow rectangle – Neckline and key support Blue rectangle – Downward target in case of the down break My advice from yesterday is still valid and in play. Watch potential breakout of the consolidation zone. The breakout of $1,523 will confirm potential test of the $1.551 (failed head and shoulders). If you see the breakout of the $1,482, there is a chance for test of the $1,452. Be ready for both scenarios. The FOMC meeting minutes yesterday didn't produce any breakout and only thing that we got is test and reject of the key support at $1,483. Watch for potential breakout of symmetrical triangle to confirm next direction. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 19 Sep 2019 05:11 AM PDT To open long positions on EURUSD, you need: Bulls completed the set for the first half of the day and managed to return to the resistance of 1.1075 on the background of good data on the current account balance of the ECB. However, a more important task is to break through this level, which will lead to the demolition of sellers' stop orders and a further upward trend to the highs of 1.1110 and 1.1151, where I recommend fixing the profits. However, the second half of the day is filled with important reports on the US economy, which may put pressure on the pair. In the scenario of EUR/USD decline, it is best to return to long positions on a false breakdown from the support of 1.1031 or buy immediately on a rebound from the minimum of 1.0992. To open short positions on EURUSD, you need: It is best to open short positions in EUR/USD after the formation of a false breakdown at 1.1075, which may occur after the release of good fundamental statistics on the US economy. Only this will be the first sell signal, which will push EUR/USD down to the support of 1.1031, and then to the larger level of 1.0992, where I recommend taking the profit. If the bears are unable to protect the resistance of 1.1075, it is best to count on new sales after the pair returns to the previous week's maximum area of 1.1110 or to open short positions immediately on a rebound from 1.1151. Signals: Moving Averages Trading is conducted in the area of 30 and 50 moving averages, which again indicates no market uncertainty.

Bollinger Bands In the case of a downward correction in the second half of the day, the lower limit of the indicator around 1.1015 will act as support. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 19 Sep 2019 05:04 AM PDT BTC did exactly what I expected yesterday. The price did hit our first objective target at the price of $9.865 and almost met second target at $9,512.Further selling opportunities are still preferable.

Yellow rectangle – Broken support Green arrow – Next expected direction Horizontal purple line – Second target (Fibo 100%) MACD oscillator is showing good new momentum down in the background and I do expect at least another move downward. Key support is at $9,600 and resistance at $9,900 and $10.050. Bulls need to be very cautious as there is strong downward momentum in the background and potential selling the rally type of feeling. As long as the BTC is trading below that $10,050 there is a chance for potential more downside and re-test of the $9,600-$9,512. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 19 Sep 2019 05:01 AM PDT The Fed meeting did not bring any surprises. As expected, the regulator lowered its key interest rate by 0.25% to 2.00%, but their leader Jerome Powell made it clear that the launch of a new asset purchase is expected. In fact, he said that the Fed will begin the fourth round of the quantitative easing program. In any case, the markets appear to be so. Indeed the words of the head of the Central Bank of the United States stirred up the markets. American stock indices crawled up against the backdrop of his words, but they couldn't add significantly as Powell, following the promises, did not reveal the details of the new stimulus measures. He only hinted that "it is quite possible for us (the Fed) to renew organic balance growth earlier than we thought." After these words, investors tried to listen to what he said to understand when to begin but they never listened. Powell was limited by the fact that the decision on incentives will be taken between meetings of the regulator. It seems that the fed's QE4 will be decided on only after a significant deterioration of the U.S. economy. Again, this uncertainty put pressure on the local stock market, and the American dollar managed to maintain its position in the foreign exchange markets as a whole, although it remained in the red to the basket of major currencies. In General, evaluating such investors' eagerly-awaited event, the meeting of the Federal reserve, it can be argued that it has not actually brought anything truly important, but just regular words and vague promises. Observing this whole picture, we note that the indecision of the Fed and its leader personally can be explained by the ambiguity of the outcome of the trade war between Washington and Beijing. The general prospects for the growth of the world economy and the impact of the customs war on inflation in the United States. We have repeatedly pointed out earlier that Powell's words signify the bank expecting inflation to grow based on this factor. The increase in customs duties also carries the cost of imports, which, of course, contributes to the promotion of inflation. By the way, the US still imports more than they export. In this case, according to monetarist views, lowering rates is in contradiction with the need but on the contrary, raise them to curb inflation. Given this state of uncertainty, we can assume that in the near future the dollar will at least be held at about current levels in relation to major currencies. At the same time, we should recognize that the local market share or by injecting fresh air in the form of lower borrowing costs to climb higher. Forecast of the day: The AUD/USD pair is trading lower with the expectation of a continued decline in RBA rates. At the same time, the Fed did not give a clear signal on the likely start of a new program to stimulate the country's economy. We believe that the pair needs to be sold either at a pullback, from about 0.6800.0 or at the continuation of the decline below the level of 0.6785 with a probable target of 0.6700. The USDCAD remains in a short-term uptrend. If the price of oil does not continue to rise, we expect that the price will resume its growth to 1.3345 after the likely decline to 1.3255. |

| Technical analysis of GBP/USD for September 19, 2019 Posted: 19 Sep 2019 04:34 AM PDT

As expected, the bullish trend of GBP/USD pair for the upcoming sessions as long as the price is above the 1.2404 level. A upward impulse is anticipated to persist up to a area high at the 1.2526 at least. Note that intraday resistance level seen is at the 1.2526 price. Major resistance is seen at 1.2568, while immediate support is found at 1.2404 . The depicted support level of 1.2404 acted as a prominent key level offering a valid buy entry. The signal for entering the market is formed to buy again. The RSI shows an increase in the volume of long positions and 100 and 50-moving avergae are directed upwards. Further close above the high end may cause a rally towards 1.2420. Nonetheless, the daily resistance level and zone should be considered. Accordingly, the USD/CHF pair is showing signs of strength following a breakout of a high at 1.2420. So, buy above the level of 1.2404 with the first target at 1.2526 in order to test the daily resistance 1 and move further to 1.2568. Also, the level of 1.2568 is a good place to take profit because it will form the second resistance today. Amid the previous events, the pair is still in an uptrend; for that we foresee the GBP/USD pair to climb from 1.2404 to 1.2605 in coming hours. Alternative scenario In case a reversal takes place and the GBP/USD pair breaks down the support level of 1.2404, then a stop loss should be placed at 1.2375. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading plan for EUR/USD for September 19, 2019 Posted: 19 Sep 2019 04:30 AM PDT

Technical outlook: The EUR/USD pair looks to be preparing to push higher towards 1.1144/80 levels in the next few trading sessions. The wave structure indicates that EUR/USD is producing at least a corrective rally, that had begun from 1/0925 levels earlier. As labelled here, Waves 1 and 2 seem to be complete while Wave 3 is in progress. Please note that wave ii has dropped to fibonacci 0.618 support of wave i, terminating at 1.0990 levels earlier. Ideally, prices should remain above 1.0990 going forward and push through 1.1145/80 levels, to terminate potential wave 3. EURUSD is still expected to rally which is likely to unfold into 5 waves pushing higher. This would confirm that a meaningful top is in place at 1.0990. Intermediate resistance is seen at 1.1110, while potential support is at 1.0990 levels respectively. Trading point of view, one could remain long with risk at 1.0990 levels. Trading plan: Long now @ 1.1069, stop @ 1.0990, target @ 1.1145 and 1.1180 Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| Control zones of USD / CHF pair on 09/19/19 Posted: 19 Sep 2019 04:16 AM PDT Strong impulses in the previous days indicate the presence of interest of large players in the continuation of the ascending medium-term model. Favorable purchase prices must be considered after reducing the pair to 1/4 WCZ of 0.9922-0.9916. The zone is located on the border of the average daily move, which makes it convenient for setting a limit buy order. In the past two days, the pair was trading within the flat. So, the lower limit of this range will be decisive for the entire upward impulse. An alternative model will be developed if the closing of today's trading occurs below the level of 0.9916. This will open the way for further decline. The first goal of the fall will be the minimum of last week and further outcome of the upward impulse will be determined at 1/2 WCZ of 0.9861-0.9849. 3 Daily CZ - daily control zone. The area formed by important data from the futures market, which changes several times a year. Weekly CZ - weekly control zone. The area formed by marks from the important futures market, which changes several times a year. Monthly CZ - monthly control zone. The area is a reflection of the average volatility over the past year. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 19 Sep 2019 03:18 AM PDT EUR/USD – 4H.

As seen on the 4-hour chart, the EUR/USD pair performed a reversal in favor of the US currency near the upper line of the downward trend channel and returned to the correctional level of 127.2% (1.1024). Thus, traders did not receive a signal to buy, as the bulls did not have enough strength to close over the downward channel. However, there was no closure under the Fibo level of 127.2%. In general, the situation with the euro/dollar pair is confusing. Given that the downward channel continues to hold the pair's quotes within its limits, it still tends to fall. I do not consider buying the EUR/USD pair before closing over the 11th figure. Today, the divergence is not observed in any indicator. Now, let's get to the fun part. To the results of the Fed meeting, which traders have been waiting for since the beginning of the week. The results of the meeting turned out to be very banal and expected. There were no surprises from Jerome Powell. Thus, a very restrained reaction of traders fully reflects the essence of the information that the markets received yesterday. By and large, Jerome Powell has been torn in recent months, or even a calendar year, into two fronts. On the one hand, US economic indicators and reports show that the country's economy is in very good condition. That is, it does not need an acute weakening of monetary policy. On the other hand, US President Donald Trump continues to not only criticize the Fed and Powell personally, accusing them of not having the courage to admit their mistakes (earlier rate hikes) and even calling them "enemies of the country", he continues to blame the Fed for others countries whose governments have control over their central banks outperform the US. Yesterday, the Fed decided to lower the key rate by 0.25%, but Donald Trump, even in this case, immediately criticized the Central Bank that the rate was lowering too slowly. The US president needs rates comparable to the rates of his competitors, that is, for example, the EU. In the European Union, interest rates of 0% – credit (refinancing), and -0.5% – deposit. Accordingly, Trump needs zero rates or even lower. But the Fed is not under the control of Trump and probably performs some functions that are unknown to the general public. This may explain the fragmentation of actions and the difference in goals between the US government and the Fed. Thus, Trump can only criticize the Fed further, and Jerome Powell, meanwhile, reminded Trump in his speech yesterday that the regulator does not obey the president. Powell also said that the Fed took this step (lower rate) to keep the US economy in good shape in the face of certain events and to provide insurance against existing risks. Powell did not say what the events were. The "risks" are probably related to the trade wars that Trump is initiating left and right, and which hamper the global economy. What to expect today from the euro/dollar currency pair? On September 19, I expect the euro/dollar pair to fall in the direction of the corrective level of 161.8% (1.0918 or 1.0927) if there is a new signal to close below the level of 127.2%. The euro had yesterday a chance to grow, as the Fed still eased monetary policy. But traders did not take advantage of the chance. Today, when the news calendar is empty, we can hardly expect a sharp growth of the pair. In any case, before the closing of quotations over the channel, I do not recommend buying EU currencies. The Fibo grid is based on the extremes of May 23, 2019, and June 25, 2019. Forecast for EUR/USD and trading recommendations: I recommend today to sell the pair with the target of 1.0927 if a new consolidation is performed under the level of 1.1024. A stop-loss order above the level of 1.1029. It will be possible to buy a pair after closing above a downward trend channel, but it is better to wait until it consolidates above the correction level of 100.0%. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 19 Sep 2019 03:18 AM PDT GBP/USD – 4H.

The British pound did not pay any attention to the Fed meeting, at which the US regulator eased monetary policy for the second time in a row. The pound did not pay attention to the inflation report, which recorded its decline to 1.7% y/y, although traders expected a much higher value. As a result, the GBP/USD pair made a return to the correction level of 38.2% (1.2501), then rebound from it, and now returned to this level. In total, the pair have fought back from the level of 38.2% three times, but the bulls are trying hard to push this level while ignoring the information background, which was not with them for a long time. It was the information background yesterday that should have sent the pound/dollar pair far down. But this did not happen, moreover, the pair continues to try to close above the psychologically important mark of $1.25. If traders do manage to do this, there will be immediately new reasons to buy the pound. The pound has ignored not only yesterday's news, which was not related to Brexit but also ignores incoming information regarding the exit from the EU. For example, today it became known that Scotland has once again stated its desire to withdraw from the United Kingdom if Boris Johnson implements his Brexit "No Deal". In this case, the Prime Minister of Scotland Nicola Sturgeon notes that the country will suffer heavy financial losses. Moreover, Scotland does not want to leave the EU in principle. In the 2016 referendum, the majority of Scots voted against Brexit. Thus, there is a question of holding a referendum on independence in Scotland. Nicola Sturgeon also expressed the hope that Britain will remain in the European Union, but "there are really few chances for this," the Prime Minister summed up. Well, new interesting information comes from Boris Johnson. Let me remind you that on Monday, Juncker and Johnson met in Luxembourg, immediately after which the British Prime Minister said about the mythical "progress" in the negotiations on Brexit, and just a few hours later, the European Union denied this statement. Now, Johnson's office said that he had a telephone conversation with European Commission President Juncker, during which the parties discussed their meeting on Monday and were "overwhelmed with determination to agree." I wonder when the refutation of this information from Jean-Claude Juncker himself will follow? The pound ignores this information as well. It seems that traders openly believe that all Johnson's plans will fail, Brexit will not be until October 31, the Parliament will return to its work in the coming week, and the Prime Minister will eventually resign. What to expect from the pound/dollar currency pair today? The pound/dollar pair continues to "push" near the retracement level of 38.2% (1.2501). Thus, I expect the pound/dollar pair to close above this level, which will allow traders to expect further growth towards the next Fibo level of 50.0% (1.2668). However, until then, I recommend not to rush with purchases of pounds. The UK retail sales report for August will be released today in Britain, but the chances that traders will ignore this data are also large. The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019. Forecast for GBP/USD and trading recommendations: I recommend buying the pair with a target of 1.2668 and a stop-loss order below the level of 1.2501 if a close above the Fibo level of 38.2% is performed. You can stay in small (or even scanty) sales of the pair with a target of 1.2308, since 3 rebounds from the level of 1.2501 were made and a bearish divergence was formed (there are still some chances of falling), with a stop-loss order above Fibo level of 38.2%. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment