Forex analysis review |

- September 20, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- September 20, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- Gold 09.20.2019 - Breakout is on the way

- GBP/USD 09.20.2019 - Broken rising wedge, watch for selling opportunities

- The dollar throws it hot and cold

- BTC 09.20.2019 - Resistance on the test, watfch for selling opportunties

- GBP/USD: plan for the American session on September 20th. The bulls were returned to the ground. The pound goes down and

- EUR/USD: plan for the American session on September 20th. Weak inflation in the eurozone returned the pair to the low of

- Trading recommendations for the EURUSD currency pair – prospects for further movement

- EUR/USD: central banks pass the baton to the negotiators of the United States and the Middle Kingdom

- Trading plan for Gold for September 20, 2019

- The second breath of the oil market: volatility as an impetus for growth

- Technical analysis of AUD/USD for September 20, 2019

- The dollar lost enthusiasm after Fed rate cuts

- Forecast for USD/JPY on September 20, 2019

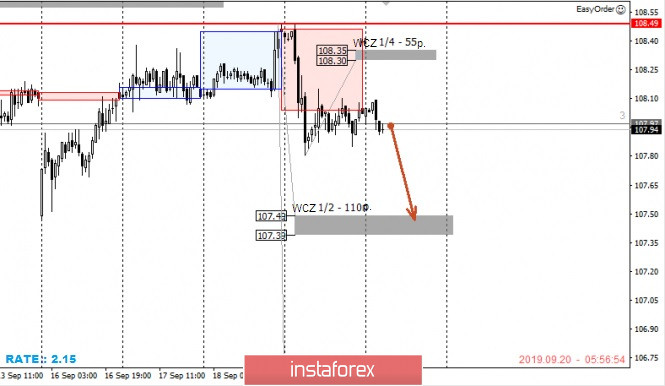

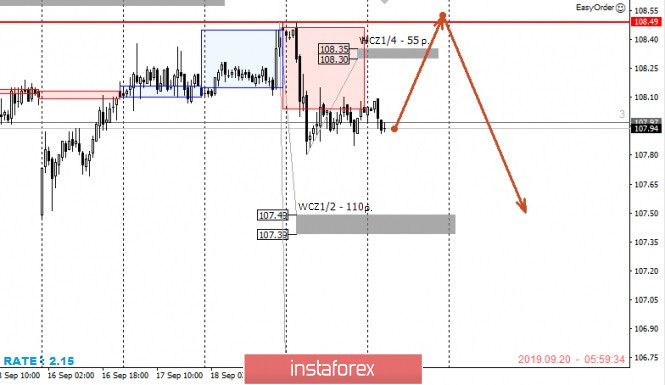

- Control zones USDJPY 09/20/2019

- Trading strategy for EUR/USD on September 20th. The euro does not know which way to move on

- Technical Analysis of USD/JPY for September 20, 2019

- Trading strategy for GBP/USD on September 20th. Boris Johnson realized that without a deal, the EU Parliament will not approve

- Trading recommendations for the GBPUSD currency pair - prospects for further movement

- Forecast for September 20th. GBP/USD: waiting for the long-awaited pullback, USD/JPY: a new weakening of the yen against

- Analysis of EUR / USD and GBP / USD for September 20. Bank of England did not surprise the markets

- Unstable equilibrium in the markets, USDCAD tends to grow, USD JPY loses momentum

- Trading plan for US Dollar Index for September 20, 2019

- Hot forecast for GBP / USD on 09/20/2019 and trading recommendation

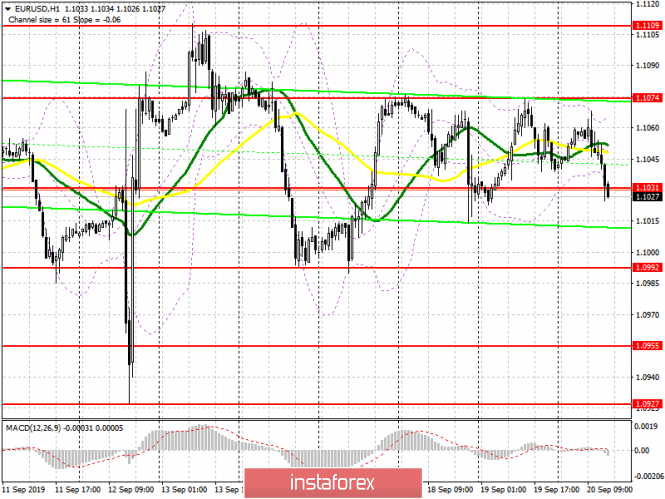

| September 20, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 20 Sep 2019 07:33 AM PDT

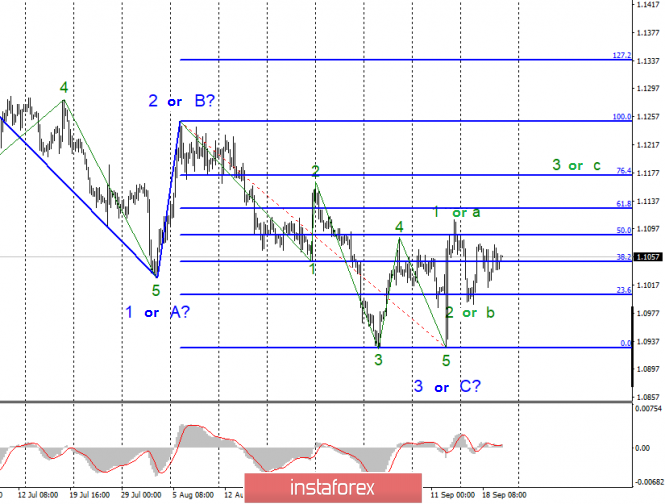

Two weeks ago, a quick bearish decline was demonstrated towards 1.0965 - 1.0950 where the backside of the broken channel came to meet the EURUSD pair again. Risky traders were advised to look for a valid BUY entry anywhere around the price levels of 1.0950. All T/p levels were successfully reached within the recent bullish movement during last weeks' consolidations. Earlier last week, the EUR/USD pair was testing the backside of both broken trends around 1.1060-1.1080 where significant bearish pressure pushed the pair directly towards 1.0940 (Prominent Weekly Bottom). Bearish Breakdown below the price level of 1.0940 was needed to enhance further bearish decline towards 1.0900 and 1.0840 (Fibonacci Expansion Key-Levels). However, SIGNIFICANT bullish rejection was demonstrated as a quick bullish spike towards 1.1100 where a recent episode of bearish rejection was expressed. Currently, the EURUSD is trapped within a narrow consolidation range extending between 1.1090 - 1.0995 until breakout occurs in either directions. Bearish Breakout below 1.1025 is needed to render the recent bullish spike as a bullish trap. If so, bearish decline would be expected initially towards 1.0940-1.0920. On the other hand, Bullish breakout above 1.1080 gives an early signal of short-term bullish reversal possibility as a bullish double-bottom pattern with a projected target towards 1.1175. Trade recommendations : Risky traders are advised to have a short-term SELL Entry upon bearish persistence below (1.1015-1.1025). S/L should placed above 1.1090. Target levels should be located at 1.0980 and 1.0930. The material has been provided by InstaForex Company - www.instaforex.com |

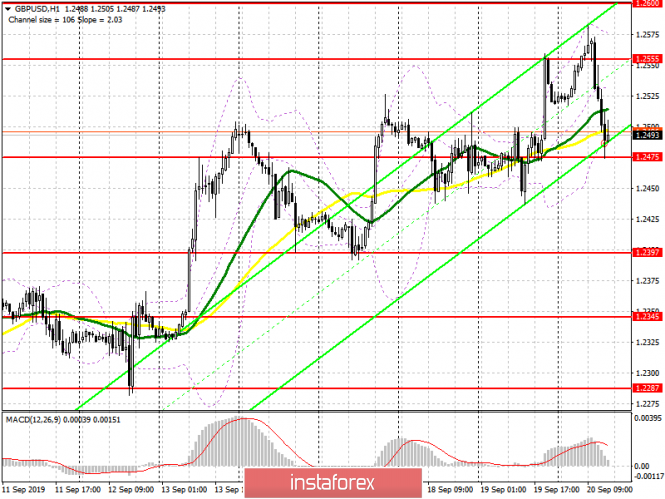

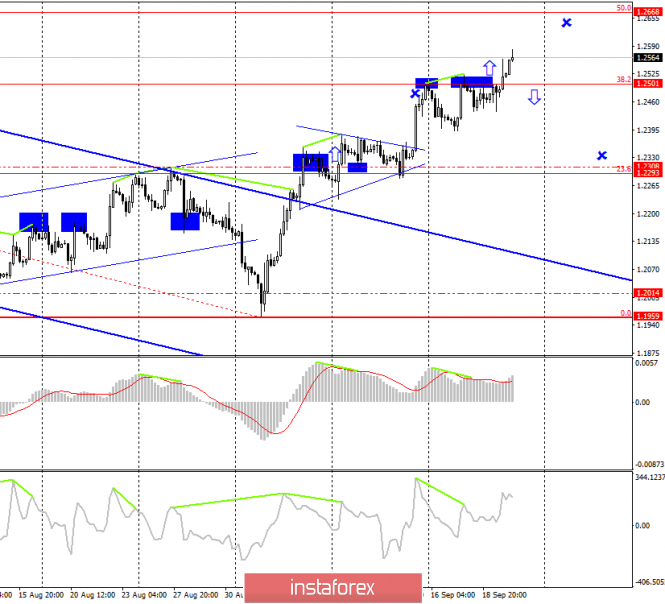

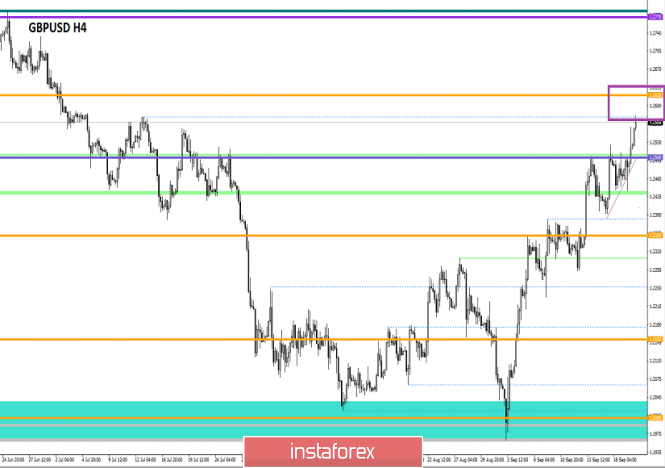

| September 20, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 20 Sep 2019 07:05 AM PDT

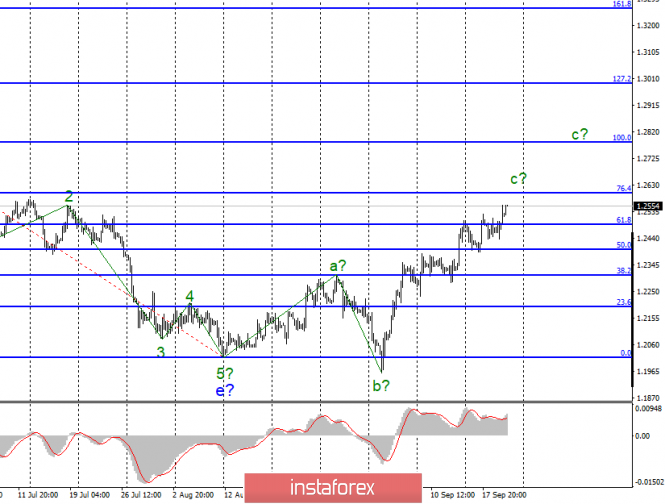

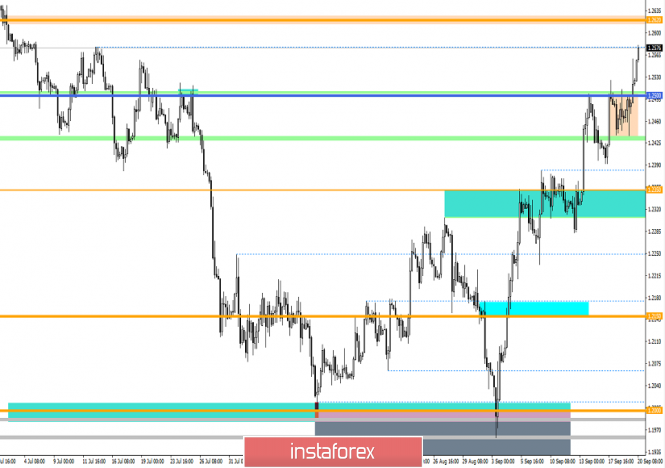

On July 26, Bearish breakdown below 1.2385 (Wedge-Pattern Key-Level) facilitated further bearish decline towards 1.2210 and 1.2100 which corresponded to significant key-levels on the Weekly chart. In Early August, another consolidation-range was temporarily established between the price levels of (1.2100 - 1.2220) except on August 9 when temporary bearish decline below 1.2100 was executed towards 1.2025 (Previous Weekly-Bottom). Since then, the GBP/USD pair has been trending-up within the depicted bullish channel except on September 3 when a temporary bearish decline was demonstrated towards 1.1960. Around the price level of 1.1960, early signs of bullish recovery (Bullish Engulfing candlesticks) brought the GBPUSD back above 1.2100 and 1.2220 where the GBPUSD pair looked overbought. However, further bullish momentum was demonstrated towards 1.2320 maintaining the bullish movement inside the depicted movement channel. As Expected, Temporary bullish advancement was demonstrated towards 1.2475 - 1.2500 where the upper limit of the current movement channel has been applying considerable bearish rejection since September 13. This week, recent bullish trials are being expressed towards 1.2500 - 1.2550 where bearish rejection and a possible reversal pattern is being demonstrated. The Long-term outlook remains bearish as long as the upper limit of the current movement channel around 1.2500 - 1.2550 remains defended by the GBPUSD bears. On the other hand, Bearish breakdown below 1.2440-1.2400 (Reversal-Pattern Neckline) can turn the short-term outlook into bearish, thus allowing more bearish decline towards the lower limit of the movement channel around 1.2330. Trade Recommendations: Conservative traders can look for a valid SELL entry anywhere around the price levels of 1.2500-1.2550 for a valid SELL entry. T/P level to be placed around 1.2400,1.2330, 1.2280 and 1.2220 while S/L should be set as H4 bullish closure above above 1.2550. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 09.20.2019 - Breakout is on the way Posted: 20 Sep 2019 06:44 AM PDT Gold continues to trade sideways at the price of $1,500 and there is potential for breakout very soon. Gold might need fundamental trigger for the next directional movement..

Blue horizontal line – Swing high (Right shoulder) Red rectangle – Upward target in case of the upward break Yellow rectangle – Neckline and key support Blue rectangle – Downward target in case of the down break My advice from yesterday is still valid and in play. Watch potential breakout of the consolidation zone. The breakout of $1,523 will confirm potential test of the $1.551 (failed head and shoulders). If you see the breakout of the $1,482, there is a chance for test of the $1,452. Be ready for both scenarios. Next week we got lots of high impact events, that I do expect potential breakout next week. The best thing to do is to wait patiently for the breakout. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD 09.20.2019 - Broken rising wedge, watch for selling opportunities Posted: 20 Sep 2019 06:34 AM PDT GBP/USD has been trading downward as the result of the bearish divergence on the 4H time-frame. I don't see any buyers to reaction on this GBP drop, which is sign that there is still more space for downside.

Orange lines – Broken rising wedge Blue rectangle – Support and downward tarrget Falling red line – Expected path My advice is to watch potential selling opportunities due to break out of the rising wedge in the background. The MACD showed bearish divergence, which is sign that there was losing up momentum on the most recent rallies. I do expect potential test of the 1.2400 level. The material has been provided by InstaForex Company - www.instaforex.com |

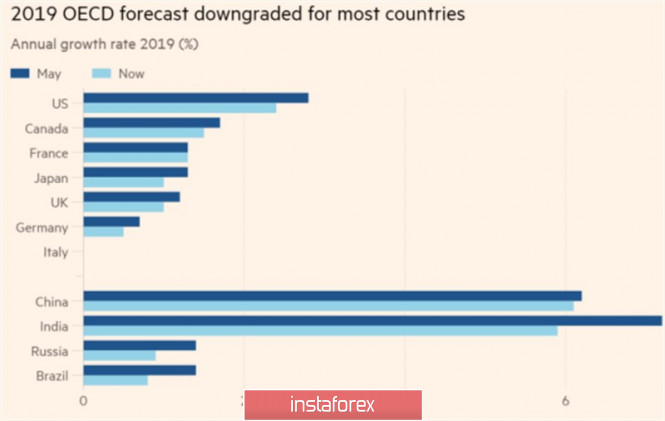

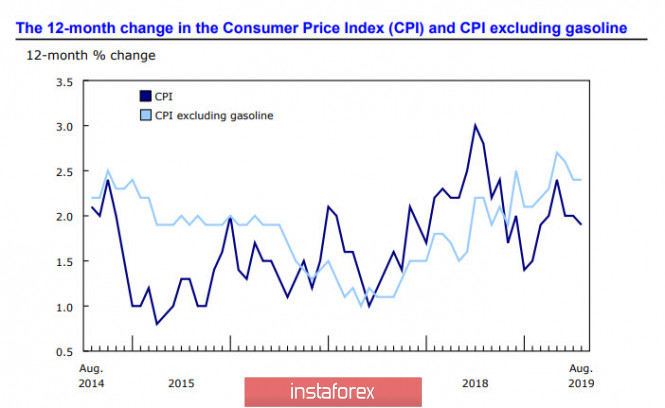

| The dollar throws it hot and cold Posted: 20 Sep 2019 06:23 AM PDT It has been a long time since I saw the main currency pair change its direction every trading day of the week. On Monday, the dollar took revenge on the euro for the ECB meeting amid the conflict in the Middle East, which inflated oil prices and increased demand for safe-haven assets. On Tuesday, the EUR/USD bulls recouped some of the losses due to the correction of Brent and WTI and the dissatisfaction of the ECB hawks with the results of the meeting of the Governing Council. On Wednesday, the "American" strengthened thanks to the Fed. On Thursday, it was time for the euro, which grew amid rumors of an orderly Brexit. On Friday, the ball was again ruled by the "bears" on the main currency pair. Investors get hot and cold, and uncertainty is to blame. Of course, the US economy looks better than the European one. Yes, the OECD has reduced US GDP forecasts for 2019-2020 from 2.8% to 2.4% and from 2.3% to 2%, but the latest figures are still better than for the currency bloc (+1% this year). Judging by the latest macro statistics and the strong growth of the index of economic surprises, the States are showing increased resistance to trade wars, while the conflict between Washington and Beijing is likely to send Germany into recession in the third quarter. Two-thirds of the old world debt market shares are trading at negative yields, while in the US borrowing rates look quite attractive. Donald Trump and the Fed will do everything possible to continue the S&P 500 rally, while EuroStoxx does not have such serious patrons. Why are the chances of "bulls" on EUR/USD estimated such as the "bears", and maybe even higher? OECD forecasts for the world's leading economies

For most of 2019, speculators actively built up short positions on the main currency pair due to fears of a disorderly Brexit, trade wars and expectations of an aggressive monetary stimulus from the ECB. In September, the British Parliament passed a law requiring the Prime Minister to write to the EU asking for the extension of the transition period from October 31 to January 31, if the parties fail to reach an agreement by that time. The chances of a no-deal plummeted, and the rates of European currencies, including the pound and the euro, went up. The proximity of the next round of trade talks between Washington and Beijing, the abolition of China's duties on certain American goods, Donald Trump's readiness to conclude a temporary agreement were perceived by investors as a de-escalation of the conflict. The ECB has not been able to give the markets everything they expected from it. As a result, the closing of short positions on the euro began. "Bulls" can develop their attack when there are signs of improvement in the health of the eurozone economy. To do this, they need strong statistics on the currency bloc's business activity and Germany's business climate. Technically, the EUR/USD pair fell into a consolidation in the range of 1.0995-1.1095. Breaking its upper limit will increase the risks of activating the Shark pattern with the target by 88.6% (1.137). On the contrary, a successful assault on the support of 1.0995 will allow the bears to continue their southern campaign towards the target by 127.2% according to the AB=CD model (1.087). The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 09.20.2019 - Resistance on the test, watfch for selling opportunties Posted: 20 Sep 2019 06:15 AM PDT BTC has been trading upwards in the past 24 hours but there is resistance on the test at the price of $10,300, which is the good level for potential new money selling. Be careful with long positions around the resistance and watch for potential selling opportunities.

Blue rectangle – Important resistance level Pink horizontal line – support level Blue horizontal lines – Profit targets and support levels Orange falling lines- Expected path BTC is trading in the middle of the Bollinger band and there is potential for new down movement. To confirm more downside, I would like to see the breakout of the $10,110. In case of the breakout of the support, the downward target will be set at $9,795 and $9,610. Resistance levels are seen at the price of $10,360-$10,450. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 Sep 2019 05:47 AM PDT To open long positions on GBP/USD, you need: In the morning review, I paid attention to the speculative reasons for the growth of the British pound against the US dollar yesterday afternoon, and also focused on the support of 1.2475, to which the pair have now returned. The formation of a false breakdown in this range already at the American session will be a signal for purchases to return to the maximum area of 1.2555, a breakthrough of which will provide a new influx of buyers and allow waiting for the test of the 26th figure. However, more rational purchases are best made after a downward correction from the weekly low at 1.2397. To open short positions on GBP/USD, you need: The bears quickly took advantage of the situation of an unsuccessful exit to the resistance of 1.2555 and resumed the downward correction in the pair, which is now limited to the support of 1.2475. The task for the second half of the day will be the breakdown of this level, which will provide GBP/USD with a bearish impulse to the area of 1.2397, where I recommend fixing the profits. If sellers do not cope with the support of 1.2475, and the bears show activity at this level, it is best to consider new short positions for a rebound from the resistance of 1.2555. Signals: Moving Averages Trading around 30 and 50 moving averages, indicating a market downward correction. Bollinger Bands If the pair grows in the second half of the day, the upper limit of the indicator around 1.2580 will act as a resistance level.

Description of indicators

|

| Posted: 20 Sep 2019 05:43 AM PDT To open long positions on EURUSD, you need: In the first half of the day, a report was released which indicated a decrease in producer prices in the eurozone, which is a rather bad signal for the economy, which is already gradually slipping into a recession. Against this background, the bulls failed to regain the level of 1.1075 again, which led to a decrease and an update of the support of 1.1030, on which the further movement of EUR/USD depends. Only the formation of a false breakdown at this level in the second half of the day will be a signal to open long positions. Given the fact that the release of important fundamental data is no longer planned, it is best to consider buying the euro on a rebound from the larger support of 1.0992. To open short positions on EURUSD, you need: Bears took advantage of the weak report on eurozone producer prices and returned EUR/USD down to the support of 1.1031. The next task is to break through this level, which can gradually lower the euro to larger weekly support of 1.0992, and even lead to an update of the minimum of 1.10955, where I recommend taking the profits. In the scenario of an unsuccessful breakdown of the area of 1.1031, due to the lack of important fundamental statistics, it is recommended to consider new short positions only for a rebound from the weekly maximum in the area of 1.1074. Signals: Moving Averages Trading is just below the 30 and 50 moving averages, but so far this does not indicate a resumption of the bearish trend. Bollinger Bands In the case of an upward correction in the second half of the day, the upper limit of the indicator around 1.1070 will act as a resistance.

Description of indicators

|

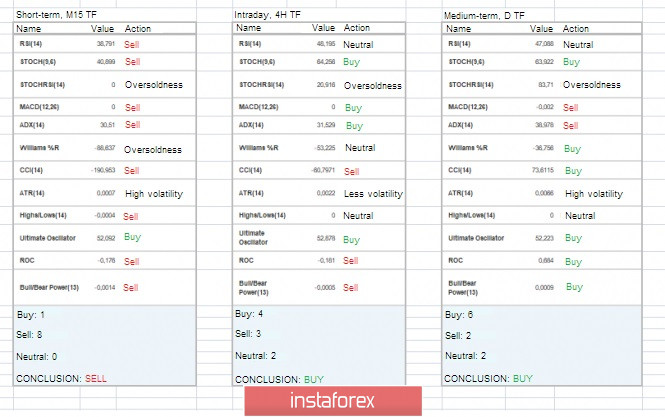

| Trading recommendations for the EURUSD currency pair – prospects for further movement Posted: 20 Sep 2019 04:57 AM PDT Over the last trading day, the euro/dollar currency pair showed volatility close to the average daily point of 51, but something cardinal did not happen on the trading chart. From technical analysis, we see that the current movement is still the same oscillation that originated in the first week of September. That is, whatever the volatility of the past days was, the quotation continues to move, strictly speaking, horizontally, with values such as 1.0927/1.1000/1.1080 (1.1115). The phenomenon is very interesting and there are quite a lot of factors, but mostly they (factors) came to us from the information and news background. As discussed in the previous review, the traders continue to work on the method of rebound/breakdown on existing boundaries, where conventionally, there was a short-term operation from the past points against the background of a slight recovery of the quotation from the upper frame (1.1080) downward. As you understand, small-amplitude jumping is of interest only to speculators, because a lot of sense is not here. Conservative traders stay away, tracking only fluctuations and fixing points relative to the values of 1.0927 and 1.1115. Looking at the trading chart in general terms (daily period), we see that the corrective move went into the lateral swing with the control points of 1.0927 (support) and 1.1115 (ceiling). The news background of the past day had a package of statistics on the United States, where there was good data on applications for unemployment benefits. So, given the fact that the previous data was revised, we saw a reduction in repeated applications by 13 thousand. Primary applications came out with a slight increase of 2 thousand, I recall, they expected an increase of 9 thousand. After that, data on sales on the secondary housing market were published, where they were waiting for a reduction from 5.42M to 5.37M, but received an increase to 5.49M. Thus, the outgoing statistics for the United States was not so bad, but how did the American dollar react to this? – growth in the recovery phase, no more The information background traditionally continued the discussion of the Brexit divorce proceedings. This time, European Commission President Jean-Claude Juncker suddenly changed his tough rhetoric to mercy, suggesting that London and Brussels could still reach a deal on exit conditions before October 31. Naturally, on such a positive note, the pound locally soared, which cannot be said about the euro, which moderately continued horizontal oscillation. The euro has already managed to adapt to the information background of Brexit, and there are plenty of problems in Europe, in addition to the whole, the EU is ready for hard entry in case of something that cannot be said about Britain, according to Juncker. Today, in terms of the economic calendar, we do not have standing statistics on Europe and the United States but do not worry, because the information background is not asleep and yet something can fly. For example, today a meeting is scheduled between two Brexit negotiators, Michel Barnier of the eurozone representative and Stephen Barkley, the representative of Britain. The topic of the meeting is the analysis of the proposals of Britain regarding the agreement. Let me remind you that a day earlier, London responded to the ultimatum of Brussels with a written document with proposals to break the deadlock on Brexit. The upcoming trading week in terms of the economic calendar stands out only by US data on GDP (Q2) and orders for durable goods. The rest is silence, and all hope is only on a spontaneous information background. The most interesting events displayed below: On Monday, 22nd of September EU 09:00 London time - a composite index of business activity in the manufacturing sector Markit (Preliminary): Prev 51.9 – Forecast 51.2 USA 14:45 London time - a composite index of business activity Markit (Preliminary): Prev 50.7 – Forecast 49.6 On Wednesday, 25th of September USA 15:00 London time - new home sales (Aug): Prev 635K – Forecast 645K On Thursday, 26th of September USA 13:30 London time - annual GDP data (Q2): Prev 2.0% – Forecast 2.0% On Friday, 27th of September USA 13:30 London time - orders for durable goods Further development Analyzing the current trading chart, we see that everything is stable in the literal and figurative sense. The horizontal movement remains in the market, and the amplitude fluctuation in some sense is compressed, that is, there are variable boundaries, for example, the main range is 1.0927/1.1115, a narrower fluctuation 1.1035 / 1.1075 appeared in it. All this is caused by variable interest together with versatile information and news background and is in some local accumulations that can serve for the subsequent amplification, in terms of movements. Speculators, in turn, jump in the available corridors, working mainly on the rebound, but at the same time, do not forget about the method of breaking the boundaries. It is likely to assume that the fluctuation in the given corridors will remain in the market for more than one day, where the variable boundaries will fall, and the main attention to the levels of 1.0927/1.1115 will remain. Regarding the current values, I would look at the values of 1.1030/1.1080 in terms of work on the breakdown. Based on the above information, we will derive trading recommendations:

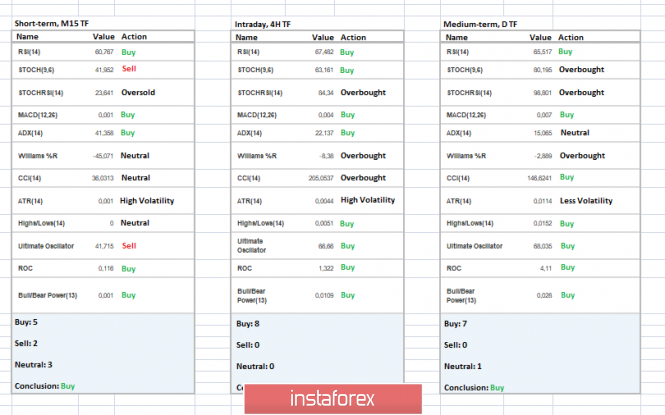

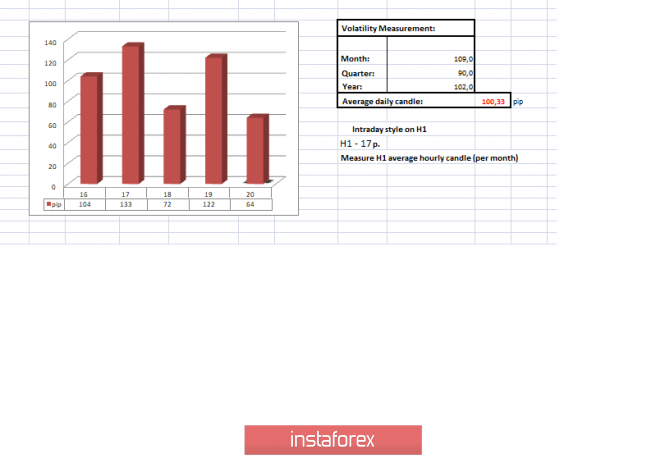

Technical analysis Analyzing different sectors of timeframes (TF), we see that the indicators in the short term are aimed at reducing, that is, the work is carried out in terms of the descent of the price to the lower border of the variable corridor. The intraday and mid-term prospects retain upward interest concerning an earlier move. Volatility per week / Measurement of volatility: Month; Quarter; Year. Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (September 20 was built taking into account the time of publication of the article) The volatility of the current time is 28 points, which is low for this period. It is likely to assume that if the quote keeps moving within the variable limits of accumulation, the volatility of the day will remain at a low level. A breakdown of accumulation of 1.1035/1.1075 can give a local burst, with increased volatility. Key levels Resistance zones: 1.1100**; 1.1180*; 1.1300**; 1.1450; 1.1550; 1.1650*; 1.1720**; 1.1850**; 1.2100 Support zones: 1.1000***; 1.0850**; 1.0500***; 1.0350**; 1.0000***. * Periodic level ** Range level *** Psychological level **** The article is based on the principle of conducting transactions, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: central banks pass the baton to the negotiators of the United States and the Middle Kingdom Posted: 20 Sep 2019 04:45 AM PDT

Traders continue to win back the results of the meetings of the leading central banks and wait for news from the trading front. A preparatory round of US-China trade talks started yesterday. During the two-day discussions, the parties should pave the way for high-level negotiations between the parties, scheduled for early October. Investors were encouraged that White House chief economic adviser Larry Kudlow said in an interview with Fox Business that he sees a slight improvement in sentiment at the meeting of trade representatives of both countries. The US dollar fell by 0.22% against the basket of major currencies, despite the words of the head of the Fed Jerome Powell that the regulator faces a situation that can be resolved and corrected by taking advantage of moderate adjustments to the federal funds rate. "The weakness of the greenback after the Federal Reserve lowered its interest rate by 0.25% on Wednesday is the main factor in the growth of EUR/USD," analysts at Commerzbank noted. It is obvious that the eurozone economy looks weaker than the US, the European debt market rates are lower than in the US, but there is a lot of negativity inherent in the euro. Many "bearish" factors, including QE, have already been played. Reducing tensions in trade relations between Washington and Beijing, as well as the likelihood of disordered Brexit allow investors to close the "shorts" on the main currency pair. The expected large-scale monetary stimulus from the ECB turned out to be a drop in the ocean. Experts predicted that it will be about €20-100 billion, and in fact – €3.4 billion. If we add to this the continuing demand for liquidity from American banks, which, contrary to statements by Fed Chairman J. Powell, increases the risks of resuscitation of the quantitative easing program, then the movement of EUR/USD to the upper limit of the consolidation range of 1.095-1.1095 seems logical. However, will the principle of "sell on rumors, buy on facts" be enough for the main currency pair to be able to enter the operational space? "The modest reaction of the US dollar to the "hawkish" statement of the Fed emphasizes the fact that it is not the US Central Bank that controls the sentiment on the USD, but the trade dispute between Washington and Beijing. As for the EUR/USD pair, steady growth is unlikely at the moment. The signals that ECB President Mario Draghi gave to the markets last week undoubtedly set a tougher "bottom" for EUR/USD in the area of 1.10, however, for a stable rally, the pair will need, firstly, a trade agreement between the US and China, secondly, fiscal stimulus provided by leading European countries in addition to the ECB measures," says by Citigroup experts. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading plan for Gold for September 20, 2019 Posted: 20 Sep 2019 04:43 AM PDT

Technical outlook: Gold prices dropped from $1,557 through $1,480/82 levels earlier in 5 waves, labelled as (1) on the charts here. The subsequent consolidation could be a potential A-B-C, out of which Waves A and B terminated at $1,524/25 and $1,483 respectively. If the subsequent price action breaks above $1,511, it would be considered a confirmation that Wave C is underway towards $1,528/40 levels going forward. As an alternative scenario, if prices break below $1,483 first, gold would continue drifting lower indicating that a meaningful top is in place at $1,524/25. It remains to be seen how price action develops in the next few trading sessions but please be prepared for a surprise rally towards above-mentioned levels before bears are back in the market. A trade setup description video has been posted below, explaining the above scenarios. Trading plan: Short around $1,528/40, stop at $1,560, target is open. Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| The second breath of the oil market: volatility as an impetus for growth Posted: 20 Sep 2019 04:32 AM PDT

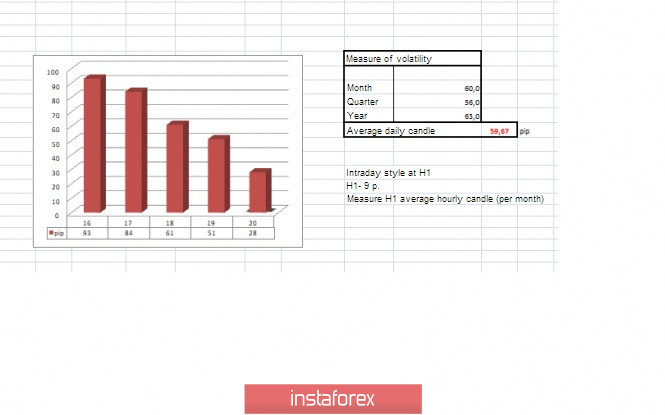

This week, the black gold market experienced unprecedented volatility, having experienced ups and downs, as well as a reduction in the Fed rate. According to analysts, this gave strength for further growth. Economists recorded volatility in the oil market throughout the week. Oil prices rose to the maximum values, then fell sharply by 6%. The reason for this was the attack on the refinery in Saudi Arabia earlier this week. In the future, the market will focus on the restoration of oil production at Saudi facilities, analysts believe. At the moment, some refineries managed to be put in order. In October, Saudi Arabia expects to return to previous production levels. At the moment, the supply of black gold is made through the use of reserves. The incident in the Kingdom caused the largest in world history disruptions in the extraction of raw materials. After the attack on oil facilities, Saudi Arabia is trying to negotiate with foreign producers to buy crude oil and other petroleum products to make up for its supplies. After the incident, the level of production in the Kingdom decreased by almost 50%, experts emphasize. The sharp decline in oil exports from Saudi Arabia has harmed the entire global supply chain. The authorities of the Kingdom had to negotiate with Iraq and ask it for about two million barrels to maintain oil exports at the proper level. "Black Swan", that is, recent force majeure circumstances seriously touched the black gold market with its wings. Experts do not exclude the redistribution of the oil market and the loss of leading positions of Saudi Arabia. Currently, companies from Qatar, UAE, USA, Russia, and Iraq have become more active in the oil market. They offered their raw materials, which turned out to be in demand.

The Saudi authorities have to restructure and operate in extremely constrained conditions, in particular, to replace some types of oil with others, of lower quality. For example, Saudi Aramco will not be able to supply Indian refiners with the premium Arab Light crude they have ordered. Instead, the corporation will send them heavy low-grade oil. The black gold market is at a loss amid the contradictions between the growth of commercial reserves in the United States and the tense situation in the Middle East. As a result, the cost of the brand Brent increased by 2.8% to $65.36 per barrel. It is currently trading between $64.87 and $64.94 per barrel. Futures for WTI crude oil rose by 1.6% to $59.01 a barrel. In the morning trading, the growth of oil prices stopped: the value of Brent fell by 0.3%, and WTI – by an impressive 0.14%. The price of light oil approached $58.77 per barrel. A day earlier, it was hovering in the range of $58.64 – $63.36 per barrel.

According to experts, oil completed the growth momentum, reaching $65.30 and adjusting around $64.30. Analysts predict the exit from this range up to the level of $67.67. If the low is updated near the mark of $63.44, the continuation of the correction and further falls are not excluded. However, experts believe that the main scenario is the continuation of the upward trend to the level of $71.30. Most experts are positive and predict a rise in the black gold market. The material has been provided by InstaForex Company - www.instaforex.com |

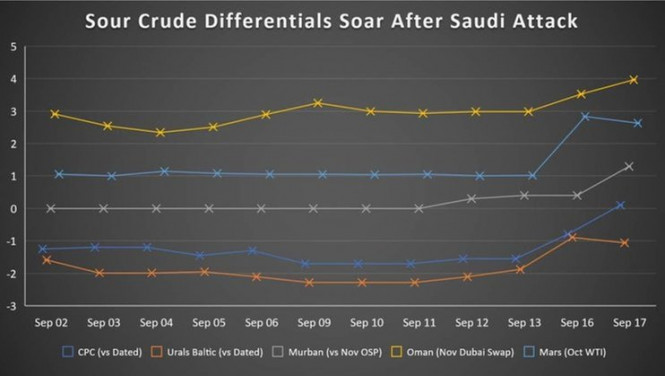

| Technical analysis of AUD/USD for September 20, 2019 Posted: 20 Sep 2019 03:28 AM PDT Overview: The downtrend of AUD/USD pair is still prominent in the In the 1-hour time frame. The AUD/USD pair shows us the former's quick decline since yesterday. The current areas on this chart are the lowest since Decemeber 16th, 2019. High resistance of AUD/USD pair is supposedly the zone of 0.6824, while low support is less clear (0.6780 or 0.6740). Intraday resistance level seen is at the 0.6824 price. The level of 0.6824 is coincided with the 38.2% of Fibonacci retracement areas here are based on the overall downward movement The RSI indicator is directed downwards and the price range is extending, which indicates the continuation of the downtrend. The RSI is leaving the overbought zone having formed a sell signal. 100-Moving average is in the negative spot keeping a strong sell signal fromthe levels of 0.6824 and 0.6852. Technical indicators on the H1 chart the AUD/USD pair generally suggest slowing downward movement. In other words, it will be a good sign to sell below the major key of today at the level of 0.6824 with a first target at 0.6780 in order to test the daily double bottom. If the the price of the AUD/USD pair breaks down 0.6780 and closes below it on H1, the market will indicate a bearish opportunity below 0.6780 then the trend will move the pair further downwards to 0.6700. However, the stop loss should be placed below the low reached near R1 (0.6852). Technical Analysis

Philosophy Buy-Sell in Forex

|

| The dollar lost enthusiasm after Fed rate cuts Posted: 20 Sep 2019 03:06 AM PDT

The key world currency has lost momentum for growth after the recent meeting of the US Federal Reserve and another interest rate cut. The dollar retreated slightly, sinking 0.22% against a basket of currencies, and entered a downward trend. Analysts do not exclude that the current weakening of the US currency is temporary, and the dollar is gathering strength before the next breakthrough. It fell significantly against most world currencies after a statement by Michael Pillsbury, US President Donald Trump's adviser on China. Recall, the representative of the US administration said that the president can raise duties on Chinese goods to 50% or even 100%. Pillsbury also does not rule out the introduction of other measures, for example, concerning financial markets, which may limit the access of Chinese companies to borrowed funds in the United States. Currently, the US dollar index, that is, the ratio of the US currency to a basket of other currencies – America's trading partners – continues to decline, playing back the softening of the Fed's rhetoric and policies. The weakness of the dollar helped the European currency to rise, analysts say. A moderate rise was recorded in the EUR/USD pair after the US Federal Reserve reduced the interest rate by a quarter of a percentage point in the range from 1.75% to 2%. The pair showed an increase of 0.2% to 1.1056. Note that the tandem seeks to break through the resistance level of 1.1071 throughout the trading week. On Friday, September 20, it is expected to overcome the resistance level and the movement of the EUR/USD pair to two target levels – 1.1145 and 1.1215. Analysts expect a positive scenario, despite the instability of the external background. Some degree of tension in world markets is due to the divergence of views of US officials on future incentives. This calls into question the further reduction of interest rates in 2019, which is negatively interpreted by the markets, experts emphasize. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for USD/JPY on September 20, 2019 Posted: 20 Sep 2019 03:06 AM PDT USD/JPY Over the past two weeks, the dollar has spent a lot of effort to grow against the yen in difficult technical and fundamental conditions. Yesterday, the price could not gain a foothold over the red line of the price channel (on the daily) and fell back down by more than 40 points. The Marlin Oscillator is also turning down, now the price is supported by the green upward price channel line (107.22).

As seen on the four-hour chart, the price was fixed under the balance and MACD lines, the Marlin oscillator is in a downward position. Continued growth is possible, but now after the correction.

|

| Control zones USDJPY 09/20/2019 Posted: 20 Sep 2019 03:06 AM PDT The downward movement on the pair is a priority, as the pair reached the monthly close of September, which led to a sharp increase in supply. A further reduction aims WCZ 1/2 107.49-107.39, the test of which will allow you to close part of the position. Further movement will depend on the reaction to the specified zone. Keeping sales open in yesterday's Asian session is the main plan. Repeated sales are possible from the current levels. The alternative growth model has a low probability since the formation of a reversal model occurred. In the case of repeated growth by a monthly short-term, a search for more favorable selling prices above a weekly maximum will be required. Daily CZ - daily control zone. An area formed by important data from the futures market that changes several times a year. Weekly CZ - weekly control zone. The zone formed by the important marks of the futures market, which change several times a year. Monthly CZ - monthly control zone. An area that reflects the average volatility over the past year. The material has been provided by InstaForex Company - www.instaforex.com |

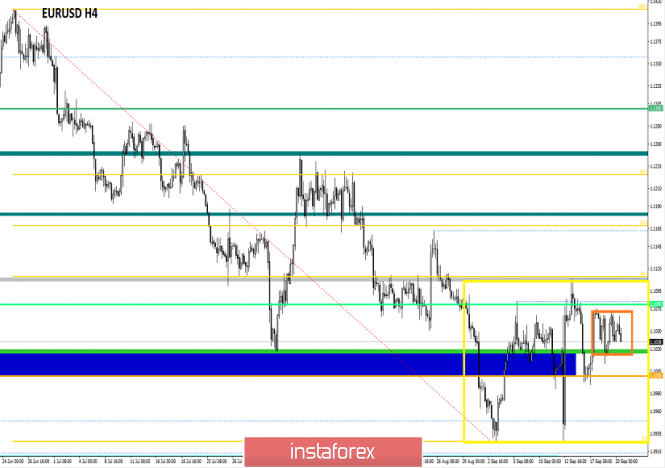

| Trading strategy for EUR/USD on September 20th. The euro does not know which way to move on Posted: 20 Sep 2019 02:12 AM PDT EUR/USD – 4H.

As seen on the 4-hour chart, the EUR/USD pair performed a rebound from the correction level of 127.2% (1.1024) and a new reversal in favor of the European currency. At the end of the trading day, the euro/dollar pair found itself near the upper line of the downward trend channel, near which it had recently spent a sufficient amount of time. I believe that such a long lull on the part of the bears suggests that the downward trend will end here. Of course, there are a lot of other possible scenarios, but today, September 20, the pair can perform a consolidation over the downward channel, which will allow traders to count on fairly strong growth shortly. Now, I do not recommend considering the pair's sales until the close under the Fibo level of 127.2%. From my point of view, several global factors can return bears to the market or, on the contrary, completely expel them from it. As we can see, the two meetings, the ECB and the Fed, did not particularly clarify the picture of the euro/dollar pair. Both central banks lowered key rates. "And what's next?", traders ask. Jerome Powell did not answer this question, and Mario Draghi is going to resign. Mr. Draghi has only one meeting of the regulator, in October, to once again weaken the monetary policy of the European Union. Further, the reins of power will be taken over by Christine Lagarde, who previously held the post of head of the IMF. But even without the change of leadership of the ECB, it is clear that the regulator will continue to reduce rates and stimulate the economy of the union by buying bonds and saturating the market with the money supply. The main question is how quickly the Fed will lower its key rate. Now, traders continue to be a little skeptical about easing the Fed's monetary policy, as they understand that this is not a necessary measure, as in the European Union, but rather the satisfaction of Donald Trump's convincing "requests". It is the US President who is "hindered" by the expensive dollar. It is Trump who believes that rates should be reduced to zero. It is Trump who leads trade battles and craves a depreciation of the US currency against the currencies of his trading opponents. Thus, the US dollar will become cheaper if the Fed reduces the rate at each meeting. Now, traders are thinking and are no longer eager to buy the American currency with all their might. With each new Fed key rate cut, there will be more doubts. The second factor is America's trade wars, or rather, a possible trade war with the European Union. According to many experts, Trump will not get involved in a second trade war until he finishes first, with China. It is very difficult to fight on two fronts. However, such a scenario cannot be completely ruled out. And I believe that the second trade war will harm the dollar again through the Fed rate, which the regulator will be forced to reduce faster. What to expect today from the euro/dollar currency pair? On September 20, I expect the euro/dollar pair to either close over the downward channel, which has been brewing for a long time. In this case, the growth of quotations can be continued towards the correction level of 100.0% (1.1106), from which the pair previously performed a rebound. In the second case – rebound from the channel line, followed by a fall to the correction level of 127.2% (1.1024). The Fibo grid is based on the extremes of May 23, 2019, and June 25, 2019. Forecast for EUR/USD and trading recommendations: I recommend today to sell the pair with the target of 1.0927 if a new consolidation is performed under the level of 1.1024. A stop-loss order above the level of 1.1029. It will be possible to buy a pair after closing above the downward trend channel, but it is better to wait until it also consolidates above the correction level of 100.0% (1.1106). The material has been provided by InstaForex Company - www.instaforex.com |

| Technical Analysis of USD/JPY for September 20, 2019 Posted: 20 Sep 2019 02:08 AM PDT When examining the "Big Picture" of USD/JPY on the daily chart, it can be clearly seen that the pair has recently bounced off the support level of well-established trading range that goes back to March of 2017, with the support level that goes back to March of 2018. The daily chart also shows volume spikes that happens each time whenever the price approaches the upper and lower range boundaries, including the latest recent test of the support level last August 26. Figure #1: USD/JPY Daily Chart

The shaded areas highlighted on the chart above show price dips as indicated by price action. When the moving averages of the MACD indicator dip below a threshold of -.051, which is derived from the low of the smallest dip. The return of the moving averages to a positive slope, and crossing back above -.51, is typically followed by a rise in price. These are favorable setups for long trades. The MACD moving averages has just recently crossed above the -.51 MACD threshold following a significant dip. If the pattern continues, a setup for a long trade exists. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 Sep 2019 01:56 AM PDT GBP/USD – 4H.

The British pound after two rebounds from the correctional level of 38.2% (1.2501) and the formation of a bearish divergence in the MACD and CCI indicators nevertheless completed fixing at this level, which allows traders to expect continued growth of quotations in the direction of the next correctional level of 50.0 % (1.2668). No new emerging divergences are observed in any indicator today. Purchases remain the most attractive for traders. Most of yesterday's news, the GBP/USD pair passed by. If the meeting of the Bank of England did not imply any reaction of traders since neither changes in monetary policy nor the speech of Chairman Mark Carney took place. For example, the economic report on changes in retail sales in the UK in August could be taken into account by traders. And if it had been taken into account, the pound would hardly have stayed in its position, as the growth rate of retail sales slowed down. In the meantime, I would like to draw traders' attention to one important fact. Both Theresa May and Boris Johnson are trying to push through Brexit's options through parliament. And so far, we can say with confidence that both Prime Ministers are not succeeding in this. With Theresa May, everything is clear. Three attempts to accept her version of the agreement failed and the resignation of the Prime Minister. With Boris Johnson, everything proceeds in a similar scenario. The only difference is that Johnson wanted to implement Brexit "No Deal", and now, according to rumors, he is trying to negotiate with the European Union. And the basis of this agreement is the very deal of Theresa May. As you can see, the circle closes. But the biggest stumbling block is not the "backstop" clause. It lies in the Parliament, which, it turns out, has already blocked the implementation of Brexit at least 4 times. Thus, it is time for Boris Johnson to consider the reasons for Theresa May's failures and realize that if Parliament cannot be persuaded, there will be no Brexit. And forcibly pushing through the parliament of Brexit "No Deal" will fail. Boris Johnson could already be convinced of this. Thus, the main option is to negotiate with both the Parliament and the European Union. The alternative is to abandon Brexit through a second referendum, which is advocated by Jeremy Corbyn. Both options suddenly appear on the side of the British pound, as they imply the impossibility of implementing Brexit "No Deal", which is so feared by the British currency. What to expect from the pound/dollar currency pair today? The pound/dollar pair closed above the Fibo level of 38.2% (1.2501). Thus, today I expect the pair to continue to grow in the direction of the next correction level of 50.0% (1.2668). An informational background today is unlikely to hinder the growth of the pound, but Brexit news is still the most important for GBP/USD traders. I recommend selling the pair below the psychological mark of $1.25. The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019. Forecast for GBP/USD and trading recommendations: I recommend buying the pair with the target at 1.2668 and a stop-loss order at the level of 1.2501 as a close above the Fibo level of 38.2% was performed. I recommend selling the pair with a target of 1.2308 after closing at 1.2501, with a stop-loss order above the Fibo level of 38.2%. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading recommendations for the GBPUSD currency pair - prospects for further movement Posted: 20 Sep 2019 01:33 AM PDT The volatility of pound / dollar has returned to the market again, having an amplitude of 122 points and, as a fact, a breakdown of the holding level. From the point of view of technical analysis, we see that the five-day accumulation within the 1.2500 level did not go in vain and the bulls still managed to regroup the trading forces and, as a fact, break through the ill-fated coordinates of 1.2500, thereby continuing the formation of an oblong correction. To some extent, the past deceleration played the role of a compression spring, where traders were reluctant to designate the formation as a graphic figure of the continuation of the "Rising Triangle". As discussed in the previous review, traders were in no hurry to work inside the existing accumulation, since working on a breakdown could bring much more profit than jumping in small amplitude. The robot's tactics for breaking down boundaries worked 100%, and traders took the first profit slice in the region of 1.2550 yesterday, moving the stop-loss restrictive order to the optimal risk zone. So congratulations to everyone on their next profit, I think we will not stop there. Considering the trading chart in general terms (the daily period), we see that the phase of the oblong correction is alive as never before, and the recent breakdown of the level of 1.2500 has proved this to us. If we look in detail at the current correctional movement, we will see that the quote managed to bounce off historical minimums by more than 620 points in some 14 trading days, and this, among other things, 43% of the entire downward measure of the current year. I think it's too early to talk about a change in the global trend, although I really want to shout it out, but do not rush to conclusions, since there are plenty of problems in the English currency. The news background of the past day contained data on retail sales in the UK, where the previous data was reviewed for the better, from 3.3% to 3.4%, but the current figures were worse than expected, having as a fact a slowdown from 3.4% up to 2.7%. If we consider the macroeconomic statistics for Britain together, then we have nothing good for British sterling, thereby talking about the growth of the quote rate, referring to statistics, is not worth it. As you may have guessed, the main impulse for the growth of the English currency came to us from the information background. Therefore, the head of the European Commission, Jean-Claude Juncker, said in an interview with Sky News that there are chances of concluding an agreement with Britain before October 31. "I think we can make an agreement. I'm doing everything to conclude a deal because I don't like the idea of an exit without an agreement, "said Jean-Claude Juncker. At the same time, Junker added that the EU is ready for a "tough" exit, but not sure that Britain is ready. In turn, London provided Brussels with informal documents with ideas on Brexit. The document deals with issues related to customs, production of goods and sanitary rules, after Britain left the EU. In fact, this document carries the UK response to the ultimatums of the EU, which obliged London to submit its proposals on Brexit by the end of the month. However, formal written decisions will be ready later. Today, in terms of the economic calendar, we do not have comprehensive statistics for more than one country. Thereby, all movement will be tied exclusively to the information background. Thus, today, the meeting is scheduled for the representative of the European Union, Michel Barnier, with the British Minister for Brexit, Stephen Barclay. The purpose of the meeting is to analyze the very unofficial document that London provided the day before. The upcoming trading week in terms of the economic calendar is rather boring compared to last, but do not be upset, Thursday and Friday still expects to be interesting. The most interesting events displayed below ---> Monday, September 22 USA 13:45 Universal time. - Composite index of business activity Markit Sep. (Preliminary): Prev 50.7 ---> Forecast 49.6 Wednesday September 25th USA 14:00 UTC+00. - New Home Sales (Aug): Prev 635K ---> Forecast 645K Thursday, September 26 USA 12:30 Universal time - Annual GDP data (Q2): Prev 2.0% ---> Forecast 2.0% Friday, September 27 USA 12:30 Universal time - Orders for durable goods Further development Analyzing the current trading chart, we see that the surge in prices led us to the values of July of the current year, where a small stop was formed. The movement that we saw is more related to the unjustified emotions of market participants against the background of the information flow. Speculators, in turn, continue to hold the remainder of the long position, but are already preparing to restore quotes back to the level of 1.2500. It is likely to assume that the remaining emotional mood associated with the statements on Brexit may push the quotation in the direction of 1.2600-1.2620, but as soon as the emotions subside, the return phase will not take long. Based on the above information, we derive trading recommendations: - If we do not have buy positions, then opening now does not make much sense. If we hold positions, then do not forget to partially exit by moving the stop loss order to breakeven. Further actions will be analyzed after fixing the price above the level of 1.2620. - Sales positions are considered in the recovery phase, thereby waiting for a clear stop with a reversal. Indicator analysis Analyzing a different sector of timeframes (TF), we see that indicators on all the main time intervals signal the formation of an oblong correction. In case of a stop, the first signals will be given by the minute and interval indicators. Volatility per week / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (September 20 was built taking into account the time of publication of the article) The volatility of the current time is 64 points, which is already good for this time section. It is likely to assume that volatility can still grow in the direction of the daily average, but is not yet sure that today we will see again high values in terms of volatility. We follow the news feed. Key levels Resistance Zones: 1.2620; 1.2770 **; 1.2880 (1.2865-1.2880) **. Support areas: 1.2500 **; 1.2350 **; 1.2150 **; 1,2000 ***; 1.1700; 1.1475 **. * Periodic level ** Range Level The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 Sep 2019 01:19 AM PDT GBP/USD The bullish wave of the pound from September 3 continues to develop. It completes a larger wave. It has a pulsed appearance, which is why all oncoming movements are minimal in size. The price approached the intermediate resistance zone. Forecast: Today, the price of the pound is sure to stall its course, forming a "sideways". The scope of the decline is limited by the estimated support. Further, a turn and an upward move are expected. A short breakthrough of its lower border is not ruled out when the course changes. Recommendations: Supporters of intra-session trading have the opportunity to sell the pound. A lot is better to reduce. The best trading tactic is to search for entry points to buy in the support area. Resistance zone: - 1.2580/1.2610 Support zone: - 1.2510/1.2880

USD/JPY The upward wave of August 6 continues to set the dominant course of the Japanese yen. From strong resistance, the price rolled back down. The basis for a new upward leap is being formed. Forecast: In the coming sessions, it is expected to complete the current decline in the last days. The reversal is likely within the support zone. The active phase of the rise can be expected by the end of the day or at the beginning of the next trading day. Recommendations: Sales of the pair today are unpromising. It is recommended to monitor the reversal signals to find the optimal entry points into long positions. Resistance zone: - 108.50/108.80 Support zone: - 107.80/107.50

Explanations to figures: Waves in the simplified wave analysis (UVA) consist of 3 parts (A-B-C). The last, incomplete wave is analyzed. Zones show the areas with the highest probability of reversal. The arrows indicate the wave marking according to the method used by the author, the solid background is the structure formed, the dotted one is the expected movements. Attention: The wave algorithm does not take into account the length of time the instrument moves. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of EUR / USD and GBP / USD for September 20. Bank of England did not surprise the markets Posted: 20 Sep 2019 01:19 AM PDT EUR / USD Thursday, September 19, ended for the pair EUR / USD with an increase of 10 basis points. Thus, the chances of continuing the construction of the alleged wave 3 or c as part of a new upward trend section remain. At the same time, given the reluctance of the market to invest in Euro currency right now, despite the Fed's decision to lower the key rate by 25 basis points, there are doubts that the instrument will not return to building a downward trend section. In the second case, wave 3 or c will be interpreted as c in 4, and the euro-dollar pair will resume its decline within wave 5. One way or another, before a successful attempt to break through the minimum of wave 2 or b, the pair remains likely to grow above 11th figure in any case. Fundamental component: Friday for the euro-dollar pair will be another rather boring day of the week. The news background on September 20 will be absent again. Thus, today, I do not expect major changes again in the wave pattern of the instrument. Certain hopes in determining the mood of the markets were associated with the results of the Fed meeting, but, as we can see, Jerome Powell only added more uncertainty to the foreign exchange market, without clarifying which direction the Fed would look in the near future. Towards a new easing of monetary policy or towards stabilization after 2 cuts in the key rate? Purchase goals: 1.1128 - 61.8% Fibonacci 1.1175 - 76.4% Fibonacci Sales goals: 1.0927 - 0.0% Fibonacci General conclusions and recommendations: The euro-dollar pair allegedly completed the construction of a bearish wave 3 or C, as well as wave 2 or b as part of a new trend section, which originates on September 12. If this is true, then the pair is still expected to increase quotes. I recommend buying a pair with goals near the calculated levels of 1.1128 and 1.1175 calculated on the construction of wave 3 or c. Also, do not forget about protective orders below the minimum of wave 2 or b. GBP / USD GBP / USD pair gained 50 base points on September 19 and continues to build an upward trend section within the framework of the proposed wave c, which takes on an increasingly complex and extended form. On the other hand, the new economic report from the UK was no better than the inflation report released a day earlier. Retail sales in August 2019 increased by 2.7% YoY, although markets expected growth of 2.8%. Excluding fuel costs, retail sales also increased by 2.2% against market expectations of 2.3%. After this not the best report, all attention was focused on the results of the meeting of the Bank of England, although no changes were expected here. However, the meeting of the Central Bank is always and in any case a significant event. But this time, nothing interesting really happened. The key rate has remained unchanged. When voting for a change in a key parameter of monetary policy, all 9 members of the committee voted "against" any changes. Fundamental component: On Friday, September 20, traders can breathe a little freely, as the news background will be extremely weak or completely absent today. We only hope for any new information from the fields of Brexit. If it does not exist, then the news background will be neutral. True, in the current environment, the pound sterling news background is not too necessary. Since September 3, the pound-dollar pair has been growing almost non-stop, although, as I already said, the latest economic reports from the UK were much worse than expectations of the Forex currency market. Nevertheless, the general good mood of the market regarding Brexit's prospects, or rather its postponement for three months, continues to push the pound up. Sales goals: 1.2016 - 0.0% Fibonacci Purchase goals: 1.2602 - 76.4% Fibonacci 1.2784 - 100.0% Fibonacci General conclusions and recommendations: The upward trend section continues its construction. Thus, quotes are now expected to increase with targets located near the calculated levels of 1.2602 and 1.2784, which corresponds to 76.4% and 100.0% Fibonacci. Wave c can still complete its construction in the near future, however, a successful attempt to break through the 61.8% Fibonacci level indicates that the market is ready for a new increase in the instrument. The material has been provided by InstaForex Company - www.instaforex.com |

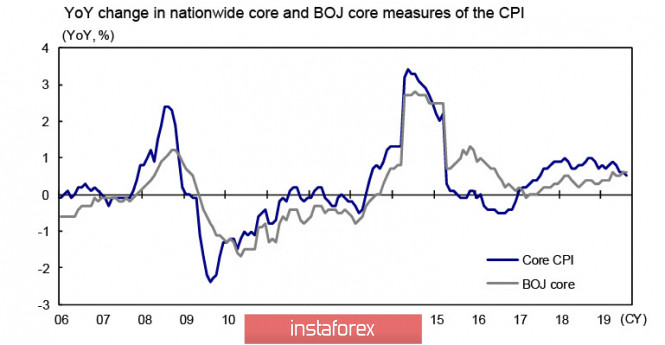

| Unstable equilibrium in the markets, USDCAD tends to grow, USD JPY loses momentum Posted: 20 Sep 2019 12:40 AM PDT Oil prices are stable after the shocks of September 14. The threat of rising risks in the Middle East remains hypothetical and does not have a noticeable effect on quotes. On the other hand, gold is trading in the range, while there is no news about changes in the positions of the USA and China before the October meeting, there are no reasons to leave the range either. The stock indices of the Asia-Pacific countries and Europe are in the green zone, however, the growth is minimal and indicates more likely an unstable balance than the growth of positive. USD CAD Canada's inflation rate remains high, but recent data are worse than expected. The basic index fell by 0.1% in August, year-on-year the index fell from 2.0% to 1.9%. The decline primarily relates to commodity prices, which is quite correlated with worsening expectations for the manufacturing sector. The attack on the refining capacities of Saudi Arabia and the subsequent surge in oil prices did not have a noticeable effect on the Canadian dollar. Such calmness of the "loonie" indirectly indicates that oil is close to its peak, and to support the growth of quotations against the backdrop of a global slowdown can only be the threat of a total deficit, which is unlikely in current realities. Neither OPEC, nor even the United States is ready to cut production so that quotes resume growth. Loonie is still holding onto due to lowering trade tensions and supply stability, but trends remain negative. PMI reports are also weak, the trade balance is slipping down, and although there are no clear signs of an approaching recession, there is no impulse that can support the growth of the Canadian dollar. USDCAD has formed a local minimum 1.3129 and resumes the movement to resistance 1.3383 with an eye to the next target 1.3440 / 50. The momentum is weak, and there is no reason to expect rapid growth. USDJPY The basic consumer price index rose in August by 0.5% y / y, which is slightly more than the forecasted 0.6%, Starting October 1, the consumption tax rate will increase from 8% to 10%. However, it should be noted that raising the rate does not encourage people to raise inflationary expectations, that is, they do not consider it obvious that suppliers of goods and services will also consistently and proportionally raise prices. The Japanese government raises the tax, guided by the results of studies that a tax increase of 1% will lead to the expectation of higher prices, but practice does not yet confirm this conclusion. In the foreground for the Japanese consumers are completely different criteria - the lack of growth in nominal wages and concerns about income after retirement. These are consequences of decades of dominant deflationary ideology, which the financial authorities of Japan have not been able to break since at least 2014, when a large-scale stimulus plan was launched and the consumption tax increased from 5% to 8%. The Bank of Japan left monetary policy unchanged during the meeting on Thursday, although the market was inclined to believe that some measures would be taken. Perhaps, the Bank of Japan intends to wait for the results of the increase in the consumption tax, but in any case, the absence of inflation before the increase in the consumption tax increases the chances that BoJ will decide on stimulus measures at the meeting in October. In the long run, the yen is thus influenced by the low inflation factor, the low income factor and, as a consequence, the need for stimulation. These factors are in favor of lowering the yen, as the chances of a full-fledged trade agreement between the US and China. However, all these calculations will fly into the pipe, if the threat of global slowdown dominates. In this case, raw materials will go down, and the yen will go up. In the short term, the yen has no direction. The factors pushing USDJPY up have been worked out. The yen will most likely form a peak, after which the movement towards strong support 104.40 / 60 will begin. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading plan for US Dollar Index for September 20, 2019 Posted: 20 Sep 2019 12:27 AM PDT

Technical outlook: The US Dollar Index is ready to accelerate its drop lower, as Wave (iii) is underway. We foresee 96.90 levels as wave (iii) is progressing. For this structure to hold, prices should ideally remain below 98.75 and 99.10 going forward. Please note that Wave (i) is sub divided into 5 waves, and wave (ii) unfolded into 3 waves a-b-c, terminating at fibonacci 0.786 resistance of wave (i). Ideally, the US Dollar Index should continue lower as waves (iii) (iv) and (v) are unfolding. It might be too early to confirm but a meaningful top could be in place at 99.30 levels. Trading point of view, remain short with risk above 99.10 at least. Immediate resistance stays at 99.10, followed by 99.30 while interim support is at 97.85, expected to be taken out soon. Trading plan: Remain short from here (98.16), risk above 99.10 or 99.30, target 97.00 minimum. Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| Hot forecast for GBP / USD on 09/20/2019 and trading recommendation Posted: 20 Sep 2019 12:13 AM PDT Jean-Claude Juncker decided to cheer up the pound a bit with a statement that he sees prospects for a divorce deal between the European Union and the UK, before October 31. Such good news greatly pleased investors who were always worried about the unpredictable risks associated with the unregulated Brexit, and they immediately increased their positions in the pound. True, they tried to stop all kinds of talking heads, who in unison sang a song about the inevitability of parity with the dollar, if the saga with the divorce agreement does not burn out. However, the best singer was Olli Rehn, the head of the Bank of Finland, who was suddenly visited by an insight, which he decided to immediately share with the whole world. It turns out that as a result of unregulated Brexit, the greatest economic damage will be inflicted on the economy of the United Kingdom, not the European Union. What can I say, even Jean-Claude Juncker himself concluded his speech by remarking that he does not strongly believe in the possibility of concluding a divorce deal, but nobody cared. After all, they said that there was a possibility, albeit insignificant, that the parties could still come to an agreement. The trouble is that the growth of the pound is due solely to emotions and faith in a brighter future, while reality is somewhat depressing. The Bank of England continues to pretend to be an ostrich, who hid his head in the sand, leaving the monetary policy parameters without any changes once again. It is clear that until this farce with Brexit is resolved, Mark Carney is afraid to take at least some steps, regardless of the real situation in the British economy. So this is not confident stability, but banal cowardice. Moreover, macroeconomic statistics showed a slowdown in retail sales growth from 3.4% to 2.7%. But inflation has also recently declined. Thus, there are no reasons for the growth of the pound. Retail Sales Growth Rate (UK): So let's be honest - if there are no real reasons for the growth of the pound, then as soon as emotions subside, reality will take its toll. And given that the macroeconomic calendar is completely empty today, market participants will have the opportunity to calmly think it over. These thoughts, may well lead to a gradual rebound of the pound. The GBP / USD pair was kept in the region of the level of 1.2500 for a long time, where it felt periodic resistance in front of itself, forming as a fact a deceleration with a subsequent surge towards the formation of an oblong correction. Considering the trading chart in general terms, we see that the corrective move has not gone away and already amounts to more than 600 points from historical minimums, which is more connected with the flow of information and news background. It is likely to assume that the upward interest still holds in the direction of the subsequent level of 1.2620 to some extent, where it is possible to expect a slowdown near it with a subsequent return to the level of 1.2500. Concretizing all of the above into trading signals:

From the point of view of a comprehensive indicator analysis, we see that indicators at all the main time intervals signal an upward interest, thereby confirming the further formation of an oblong correction. |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment