Forex analysis review |

- #USDX vs EUR / USD vs GBP / USD vs USD / JPY - H4. Comprehensive analysis of movement options from September 26, 2019 APLs

- Gold does not like the president

- GBP/USD. Pound under attack: UK political crisis worsens

- September 25, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- September 25, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- Gold is dominated by multidirectional drivers

- Trading recommendations for the EURUSD currency pair – placement of trade orders (September 25)

- EUR / USD: the dollar does not look like a monolith but the euro is not able to stand on its feet

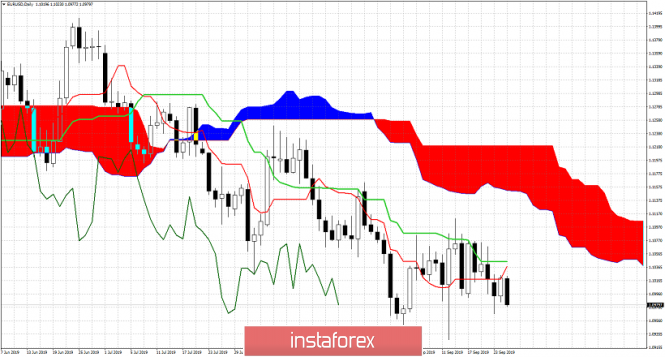

- EURUSD remains in a bearish trend as long as price is below 1.1050.

- EUR/USD for September 25,2019 - Broken bear flag pattern in the background, more downside yet to come

- USDCAD bulls remain hopeful of a move towards 1.35

- Gold 09.25.2019 - Is the Gold ready for new push higher?

- BTC 09.25.2019 - Both yesterday's targets are met and new momentum down on MACD

- Starbucks Corporation: Buy or sell? (There is a high probability of securities falling)

- GBP/USD: plan for the American session on September 25th. Buyers of the pound continue to lose optimism after the breakout

- EUR/USD: plan for the American session on September 25th. The US dollar is in demand amid the aggravation of the political

- Fractal analysis of major currency pairs as of September 25

- Technical analysis of EUR/USD for September 25, 2019

- Safe-haven assets will be in demand (We expect continued growth in the price of gold and a prospective decrease in the NZD/USD

- Review of EUR / USD and GBP / USD pairs as of September 25, 2019: The situation is gradually heating up

- Trading strategy for EUR/USD on September 25th. Two friendly leaders. Two impeachments. Part 1

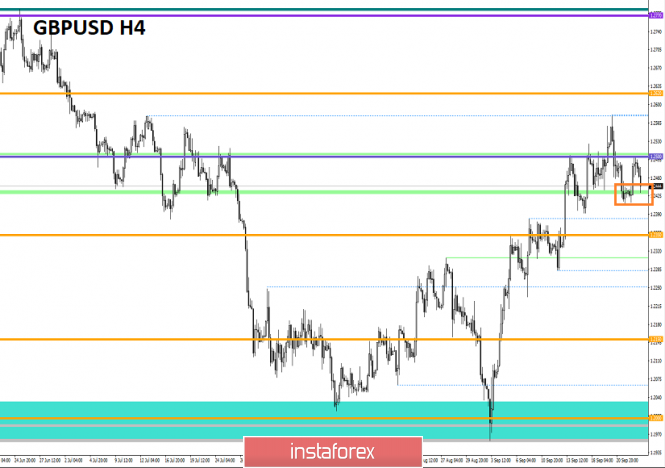

- Trading recommendations for the GBPUSD currency pair - placement of trade orders (September 25)

- Analysis of EUR / USD and GBP / USD for September 25. Parliament may pass a vote of no confidence in Boris Johnson

- Trading strategy for GBP/USD on September 25th. Two friendly leaders. Two impeachments. Part 2

- Where will the "pendulum" of the yen swing: you cannot resist from falling

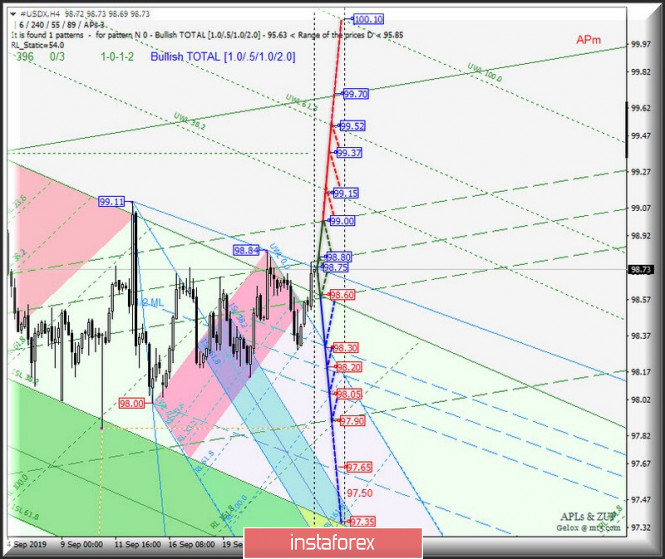

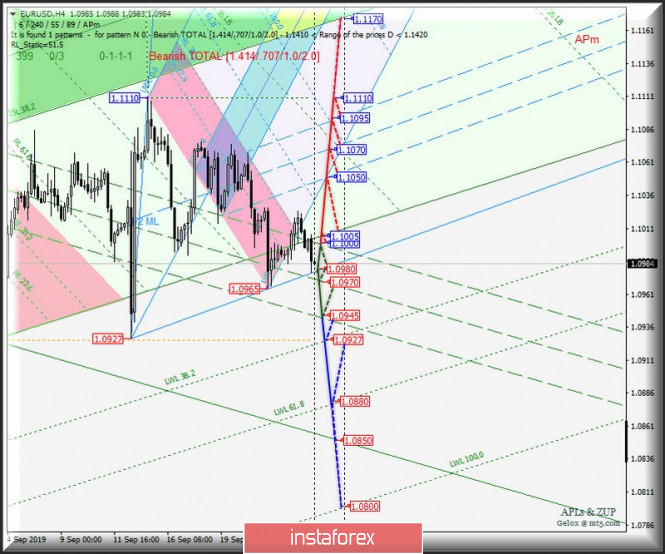

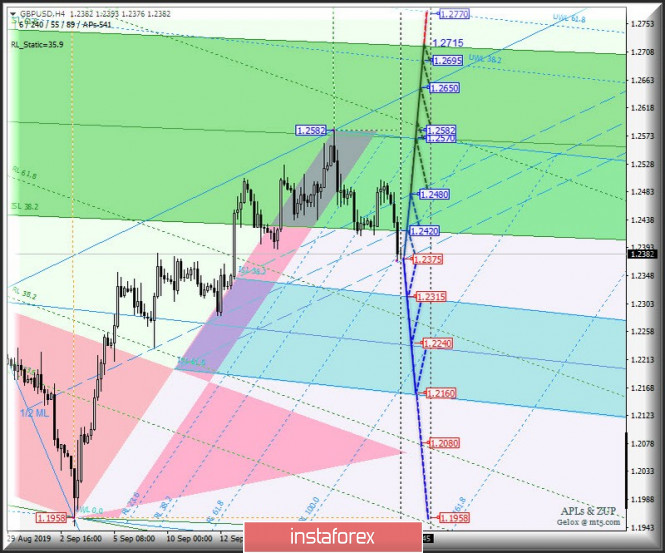

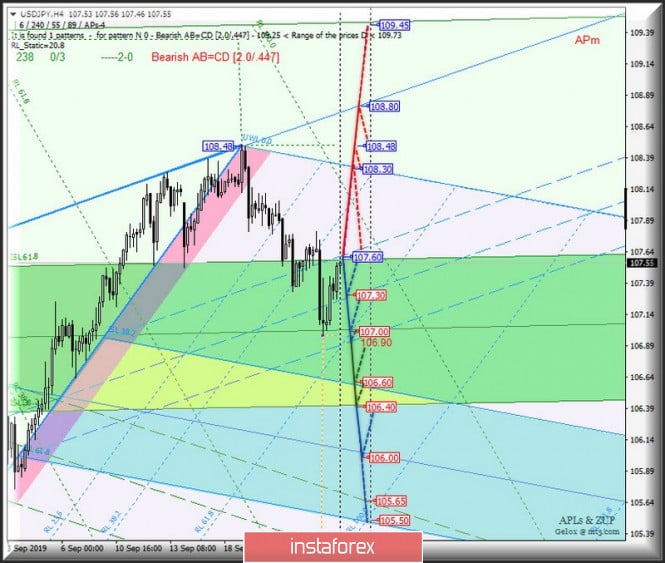

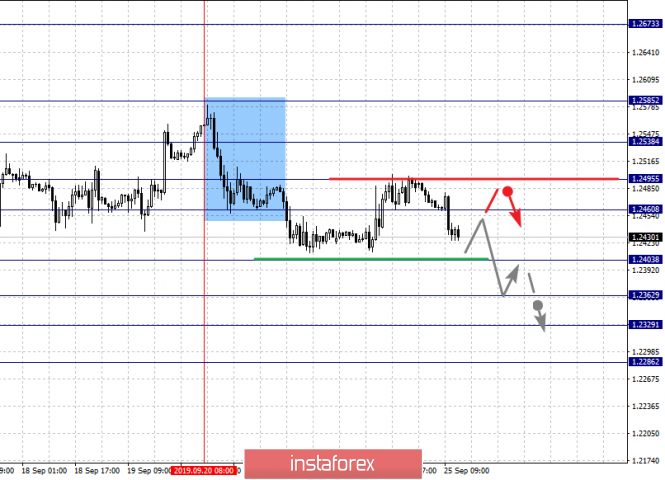

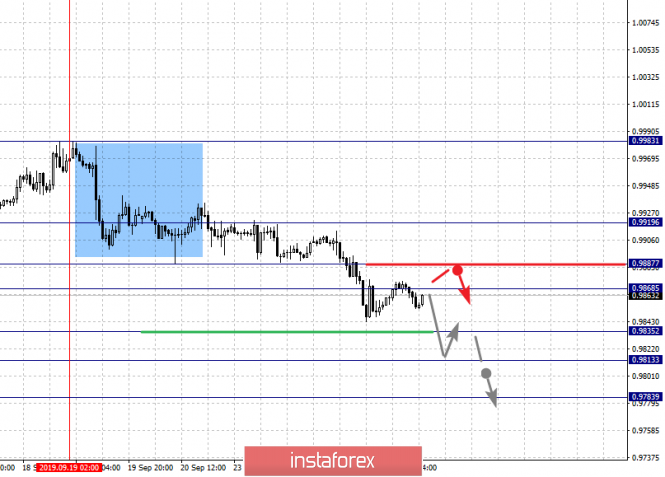

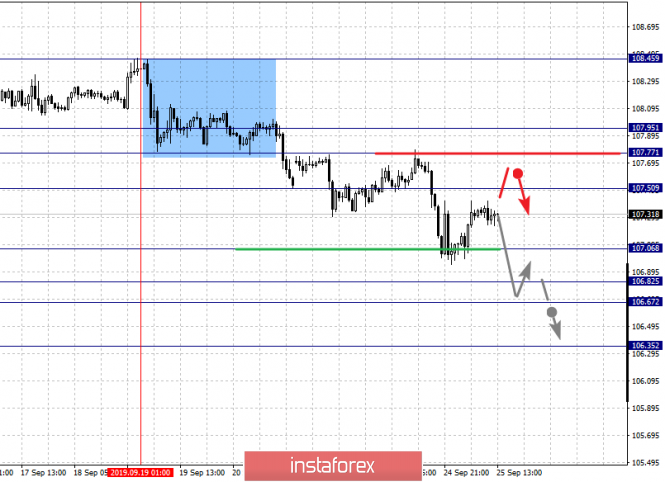

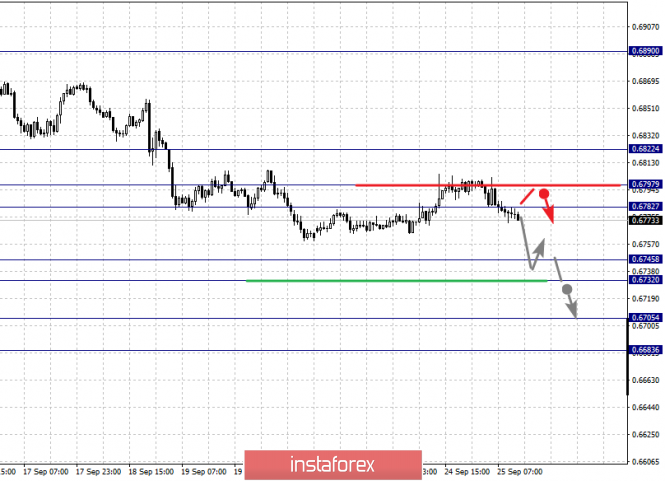

| Posted: 25 Sep 2019 05:31 PM PDT Let me bring to your attention, in an integrated form, the development options for the movement of currency instruments #USDX, EUR / USD, GBP / USD and USD / JPY from September 26, 2019. Minuette operational scale (H4 time frame) ____________________ US dollar index Further development of the movement of the dollar index #USDX from September 26, 2019 will be due to the development and direction of the breakdown of the boundaries of the 1/2 Median Line channel (99.00 - 98.80 - 98.60) of the Minuete operational scale fork. Look at the animated chart for the development of the above levels. The breakdown of the upper boundary of the 1/2 Median Line channel (resistance level of 99.00) of the Minuette operational scale fork will determine the option to continue the development of the upward movement of the dollar index to targets - warning line UWL38.2 Minuette (99.15) - local maximum 99.37 - warning line UWL61.8 Minuette (99.52). On the contrary, if there is a breakdown of support level 98.60 on the lower boundary of the 1/2 Median Line channel of the Minuette operational scale fork, then the downward movement #USDX will be directed to the boundaries of the 1/2 Median Line channel ( 98.30 - 98.20 - 98.05) of the Minuette operational scale fork with the prospect of reaching the final Schiff Line Minuette (97.90). The details of the #USDX movement are presented in the animated chart. ____________________ Euro vs US dollar Starting from September 26, 2019, the movement of the single European currency EUR / USD will also be determined by the development and direction of the breakdown of the boundaries of the 1/2 Median Line channel (1.1000 - 1.0970 - 1.0945) of the Minuette operational scale fork. The movement markings inside the mentioned channel are shown in the animated chart. In case of breakdown of the lower boundary of the 1/2 Median Line channel (support level of 1.0945) of the Minuette operational scale fork, the downward movement of the single European currency can be continued towards the targets - local minimum 1.0927 - warning line LWL61.8 Minuette (1.0880). A combined breakdown of the upper boundary of the 1/2 Median Line channel (resistance level of 1.1000) and the initial SSL line (1.1005) of the Minuette operational scale fork will make the development of the upward movement of EUR / USD to the boundaries of the 1/2 Median Line channel (1.1050 - 1.1070 - 1.1095) of the Minuette operating scale, relevant The details of the EUR / USD movement options are shown in the animated chart. ____________________ Great Britain pound vs US dollar Meanwhile, the development of Her Majesty's GBP / USD currency movement from September 26, 2019 will also be due to the development and direction of the breakdown of the boundaries of the 1/2 Median Line channel (1.2480 - 1.2420 - 1.2375) of the Minuette operational scale fork - the traffic markings in the 1/2 Median Line channel are presented in the animated graphics. In case of breakdown of the support level of 1.2375 on the lower boundary of the 1/2 Median Line Minuette channel, Her Majesty's currency movement will continue to the equilibrium zone (1.2315 - 1.2240 - 1.2160) of the Minuette operational scale fork. On the contrary, in case of breakdown of the upper boundary of the 1/2 Median Line channel (1.2480) of the Minuette operational scale fork, the GBP / USD movement will continue in the equilibrium zone (1.2420 - 1.2570 - 1.2715) of the Minuette operational scale fork taking into account the development - of the Median Line Minuette (1.2570) - local maximum 1.2582 - control line UTL Minuette (1.2650) and warning line UWL38.2 Minuette (1.2695). The details of the GBP / USD movement can be seen in the animated chart. ____________________ US dollar vs Japanese yen Starting from September 26, 2019, the movement of the currency of the "land of the rising sun" USD / JPY will also depend on the development and direction of the breakdown of the 1/2 Median Line channel (107.60 - 107.30 - 106.90) of the Minuette operational scale fork. Look at the animated chart for the details of the movement. The breakdown of the upper boundary of the 1/2 Median Line Minuette channel (resistance level of 107.60) will determine the continued development of the upward movement of the currency of the "country of the rising sun" to the initial SSL line (108.30) of the Minuette operational scale forks with the prospect of updating the local maximum of 108.48 and reaching the UTL Minuette control line (108.80). The breakdown of the lower boundary of the 1/2 Median Line Minuette channel (support level of 106.90) - an option for the development of the USD / JPY movement towards the targets - the upper boundary of the ISL38.2 (106.60) equilibrium zone of the Minuette operational scale fork - the lower boundary of the ISL38.2 (106.40) equilibrium zone of the Minuette operational scale fork - 1/2 Median line Minuette (106.00). We look at the details of the USD / JPY movement on the animated chart. ____________________ The review is made without taking into account the news background. Thus, the opening of trading sessions of the main financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index : USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of the currencies in the basket: Euro - 57.6% ; Yen - 13.6% ; Pound Sterling - 11.9% ; Canadian dollar - 9.1%; Swedish Krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the start date of the countdown - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold does not like the president Posted: 25 Sep 2019 03:39 PM PDT The worst dynamics of business activity in the manufacturing sector in Germany over the past 10 years, the fastest decline in the consumer sentiment index in the US since the beginning of the year and rumors about the impeachment of Donald Trump - what could be better for safe haven assets?. The frank and the yen grew steadily, Treasury yields collapsed, and bulls on gold resumed attacks aimed at updating the 6-year high. The precious metal is preparing to close in the green zone for the fifth month in a row, and we must admit that it has reason for this. When the leading economies of the world in the form of China, Germany and the US slow down, and central banks try to save the situation by easing monetary policy, the bulls on XAU/USD feel like a fish in water. Monetary expansion weakens major world currencies, and even the growth of the USD index does not scare fans of gold: it is not the dollar that is strong, its competitors are weak. Moreover, the Fed is cutting rates and, according to TD Securities forecasts, in order to eliminate the crisis in the money market, it will revive a program of quantitative easing in the amount of $515 billion in October. At the same time, political risks increased in the United States due to rumors about the impeachment of Donald Trump, which will contribute to the loss of steam by the US economy and global GDP. Is it any wonder that the treasury bond yields dropped sharply? The dynamics of gold and yield on US Treasury bonds The fact that the bullish XAU/USD trend is stronger than ever is evidenced by an increase in stocks of specialized exchange-traded funds to a 6-year high and an increase in Swiss precious metal exports to Britain to 112.5 tons, which is the highest value for the last 7 years . As a rule, when gold flows from the West (US, Britain) to the East (China, India), sellers dominate the market; when it changes its direction - buyers. Switzerland serves as a transit point and a kind of indicator of the activity of investors and jewelers. As for ETF reserves, they reached the level of 2494.3 tons and are ready to mark the best quarterly growth from April-June 2016. Yes, the impeachment of the current head of the White House seems unlikely, but it undermines the political authority of Donald Trump and unties the hands of China. It is possible that China will continue to pull the cat by the tail, sincerely hoping that the main enemy could resign himself long before the presidential election of 2020. The October talks in Washington and Beijing may not be as productive as financial markets expect, which will lead to the development of a correction on US stock indices and will allow the bulls to develop an attack on XAU/USD. Technically, the inability of the bears for gold to keep quotes below the trend line of the Burst stage of the "Bump and Run Reversal" pattern indicates their weakness. The precious metal quickly returned to the game and if the September high is updated, the AB=CD pattern will be activated. Its target of 161.8% corresponds to the mark of $1600 per ounce. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. Pound under attack: UK political crisis worsens Posted: 25 Sep 2019 03:39 PM PDT The optimism of traders regarding the court's unblocking of the British Parliament's work did not last long. After a short-term test of the 25th figure, the GBP/USD pair turned around and rushed to two-week lows. At the moment, the pair settled in the middle of the 23rd figure, responding to the worsening political crisis. The period of silence was replaced by loud battles in the walls of the House of Commons. The fault line passed not only between the government and the deputies, but even between members of the same party. The pound suddenly came under pressure from fundamental problems, including the lack of a unified position in the House of Commons, the impending early elections in Parliament, and pessimistic comments from representatives of the negotiating group. After the court verdict was announced, the Speaker of the House of Commons John Bercow immediately convened a meeting of Parliament. Today, deputies again gathered in the walls of the Palace of Westminster, where Prime Minister Johnson also arrived, who interrupted his participation in the session of the UN General Assembly and returned to London. Of course, the head of government today heard a lot of criticism addressed to him, as well as many calls for resignation. But if we ignore the emotional factor, then by and large, the British Parliament, as a result, again found itself in a dead end, primarily due to internal party contradictions. First of all, it is worth saying that Boris Johnson has already managed to declare that he is not going to resign. He said that he "completely disagreed" with the verdict of the Supreme Court, although he respected the decision of the judges. Nevertheless, he insists on the correctness of his position, so he sees no reason to resign. It is noteworthy that the leader of the Labour Party, Jeremy Corbin, is in no hurry to initiate the issue of declaring a vote of no confidence in the prime minister. In his opinion, the Parliament should first of all prevent the "hard" Brexit on October 31, and only after that solve the remaining issues - about distrust of the government and early elections. Not everyone in the camp of the Labour Party supports this algorithm of action. Moreover, according to the results of the party conference, the Labour Party will no longer directly advocate for the abolition of Brexit as such. At the insistence of Corbyn (and he was supported by the majority of delegates), the Labour Party will first get early elections, win them to form a majority in Parliament, hold talks with Brussels - and only then will they put this issue to a referendum. Boris Johnson is also pushing for early elections - but for a different purpose. According to some opinion polls, Conservatives can strengthen their success and, based on the results of an extraordinary plebiscite, form their own majority. In this case, the prime minister will have all the power - and even if Brexit has to be transferred on October 31, no one will put a spoke in the wheels on the threshold of the next "deadline". But here it is necessary to make an important remark: Conservatives had a significant advantage even before a series of scandals that could well change the picture of electoral preferences. We are talking not only about the last unprecedented case when the court recognized the Queen's decree unlawful. Other scandals can affect the rating of Johnson, and accordingly the Conservatives. In particular, we are talking about Johnson's allocation of public money from the budget of London to his friend from the United States. These events unfolded even when the prime minister was the mayor of the British capital, but details surfaced only now. According to the Sunday Times, between 2013 and 2014, Arcuri's company Innotech received sponsorship from the City Hall in the amount of 100 thousand pounds. According to reporters, the company was initially denied a grant, as its business did not meet the criteria. But after Johnson's intervention, the company was then given permission. Now, the prime minister's opponents are actively promoting this situation, demanding appropriate explanations from the head of government. Thus, the absence of a consolidated position among the opposition, as well as Johnson's intention to "pull out Britain from the EU at all costs" on October 31, puts strong pressure on the British currency. In other words, the British currency is once again losing ground: the House of Commons still rejects Theresa May's deal, Johnson does not take any real action to find a compromise with Brussels, and the prospects for early elections only increase the likelihood of a "hard" Brexit - not in October, so at the beginning of next year. Al this happens against the backdrop of the soft rhetoric of the Bank of England, whose head linked the prospects of Brexit with the prospects of monetary policy. Given such an array of negative fundamental factors, it can be assumed that the downward movement of the GBP/USD pair will continue (including after a possible price pullback). The intermediate target of the bulls of the pair is 1.2270 (the Kijun-sen line on the daily chart), while the main target is located lower - at 1.2190 (the lower border of the Kumo cloud on the same timeframe). Having overcome this target, the GBP/USD bears will open their way to the area of annual lows, that is, to the area of 20-19 figures. The material has been provided by InstaForex Company - www.instaforex.com |

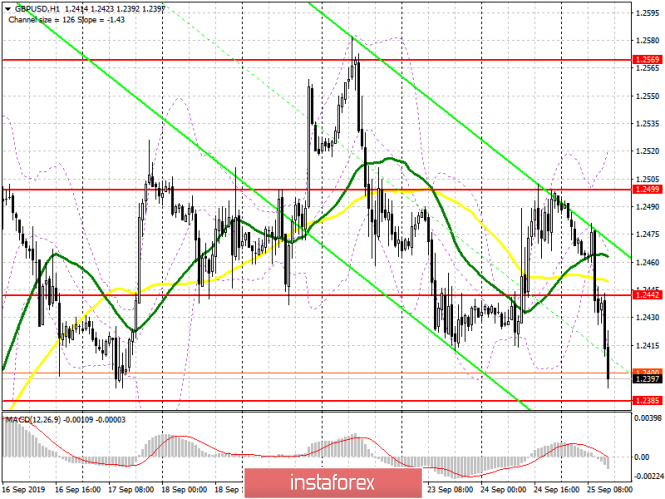

| September 25, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 25 Sep 2019 09:37 AM PDT

In Early August, another consolidation-range was temporarily established between the price levels of (1.2100 - 1.2220) except on August 9 when temporary bearish decline below 1.2100 was executed towards 1.2025 (Previous Weekly-Bottom). Since then, the GBP/USD pair has been trending-up within the depicted bullish channel except on September 3 when a temporary bearish breakout was demonstrated towards 1.1960. Around the price level of 1.1960, aggressive signs of bullish recovery (Bullish Engulfing candlesticks) brought the GBPUSD back above 1.2230 where the pair looked overbought. However, further bullish momentum was demonstrated towards 1.2320 maintaining the bullish movement inside the depicted movement channel. Moreover, Temporary bullish advancement was demonstrated towards 1.2550 where a reversal wedge pattern was established. As anticipated, the reversal wedge pattern was confirmed by the end of Monday's consolidations supported by obvious bearish price action demonstrating a successful bearish closure below 1.2450. The Long-term outlook remains bearish as long as the upper limit of the current movement channel around 1.2500 - 1.2550 remains defended by the GBP/USD bears. Yesterday, the backside of the confirmed reversal wedge was successfully re-tested around 1.2500 where a new episode of bearish rejection was expressed. Bearish persistence below 1.2440-1.2400 (Reversal-Pattern Neckline) allowed more bearish decline to occur towards the price level of 1.2360 which is currently being tested Trade Recommendations: Conservative traders can look for another SELL entry around the backside of the broken channel (Anywhere around 1.2400). T/P level to be placed around 1.2360, 1.2330 and 1.2280 while S/L should be set as a H4 candlestick closure above 1.2500. The material has been provided by InstaForex Company - www.instaforex.com |

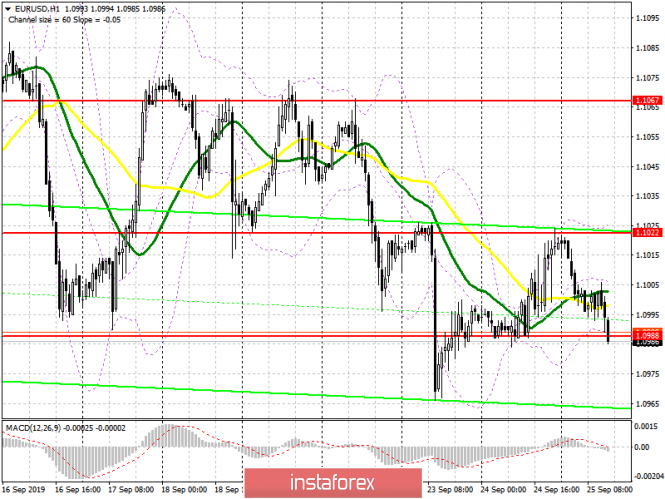

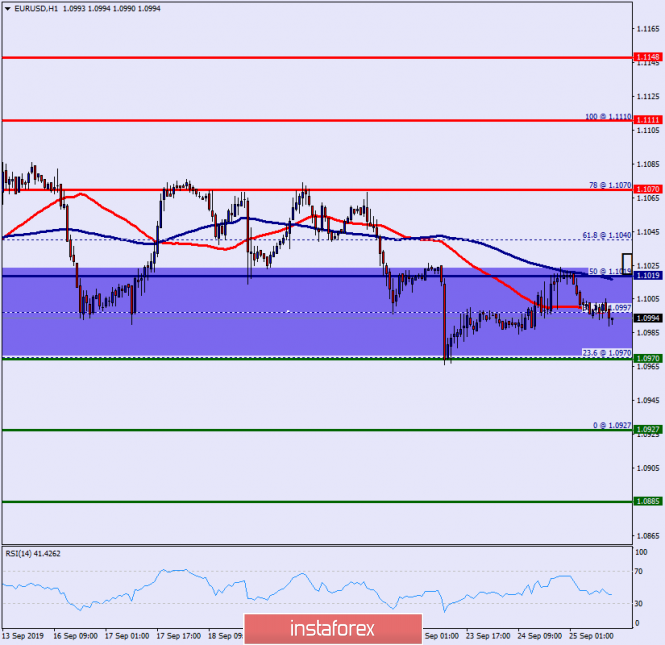

| September 25, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 25 Sep 2019 09:00 AM PDT

Few weeks ago, a quick bearish decline was demonstrated towards 1.0965 - 1.0950 where the backside of the broken channel came to meet the EURUSD pair again. Intraday traders were advised to search for a valid BUY entry anywhere around the price levels of 1.0950. Target levels were successfully reached within the recent bullish movement during last weeks' consolidations. Shortly After, the EUR/USD pair was testing the backside of both broken trends around 1.1060-1.1080 where significant bearish pressure pushed the pair directly towards 1.0940 (Prominent Weekly Bottom). Bearish Breakout below the price level of 1.0940 was needed to enhance further bearish decline towards 1.0900 and 1.0840 (Fibonacci Expansion Key-Levels). However, considerable bullish rejection was demonstrated as a quick bullish spike towards 1.1100 where another episode of bearish rejection was expressed. Currently, the EUR/USD is trapped within a narrow consolidation range extending between (1.0990 - 1.1090) until breakout occurs in either directions. By the end of last week's consolidations, Bearish Breakout below 1.1030 was demonstrated. This renders the recent bullish spike as a bullish trap. That's why, initial bearish decline was expected towards 1.0940-1.0920 while the price levels around 1.1030 remain significant supply levels where bearish rejection was anticipated. As Expected, the recent bullish pullback towards the price level of 1.1030 was Obviously rejected by the end of Yesterday's consolidations. Moreover, Bearish persistence below the price level of 1.0970 (recent daily bottom) is mandatory to enhance quick bearish decline towards 1.0930 and 1.0898 (Fibonacci Expansion 78.6%). Trade recommendations : Intraday traders were advised to look for a valid SELL entry around the price level of 1.1030. Target levels should be located at 1.0965, 1.0930 and 1.0898 while S/L should be lowered to 1.1060. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold is dominated by multidirectional drivers Posted: 25 Sep 2019 08:23 AM PDT

The rally of the yellow precious metal, which led it to historic highs, slowed down. According to experts, the rate of gold is now influenced by such multidirectional factors as the slowdown in the global economy, the strengthening of the US dollar and the current policy of the Fed to interest rates. After reaching the local bottom last August at $1,160 per 1 ounce, the precious metal was able to recover thanks to its status as a "haven" asset. In May, gold received an additional boost to growth amid expectations of easing the monetary policy of the Federal Reserve, which usually leads to a decrease in the USD rate and an increase in the value of the precious metal. At the September meeting, FOMC officials were divided, reducing the chances of new rounds of rate cuts. At the same time, the head of the Fed, Jerome Powell, continues to repeat that the regulator is monitoring the situation and is ready to continue easing policy as necessary. It is noteworthy that gold continues to grow even against the backdrop of a strengthening dollar. Why is greenback getting more expensive if the rally of the precious metal is the result of expectations of a federal funds rate cut that will harm the US currency? One of the reasons analysts call the increased demand for treasuries from abroad, where the onset of a recession seems almost inevitable, and almost zero or even negative rates make US state funds with their yield a kind of "Klondike". What to expect from gold next? Shortly, "bulls" on XAU/USD can once again test monthly highs in the area of $1,560 per 1 ounce. However, to do this, they will first need to overcome strong resistance in the area of $1,525 – 1,530. The only thing that worries – gold will storm the highs in the last decade of September. This is the end of the quarter and the fiscal year in the US. That is, time to take stock and record the results. As a rule, market reversals are often observed at such times. If at this time we see strong growth, it will soon be replaced by a decline. This could happen this time too. However, it is hardly worth waiting for a long correction of gold, although it can be quite sharp. Given the strong growth in the price of the precious metal in recent months, a decrease of $150 could be expected. The material has been provided by InstaForex Company - www.instaforex.com |

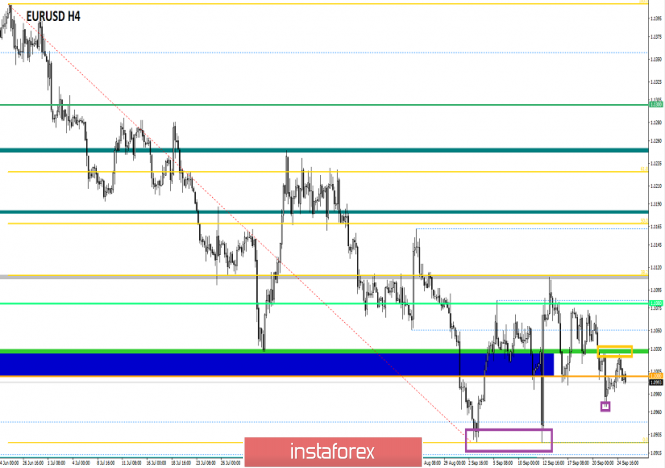

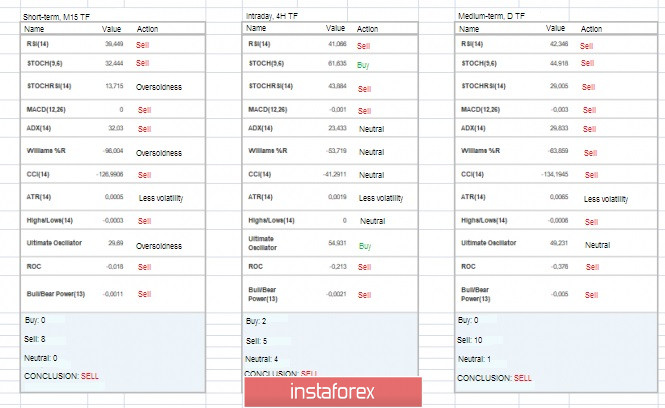

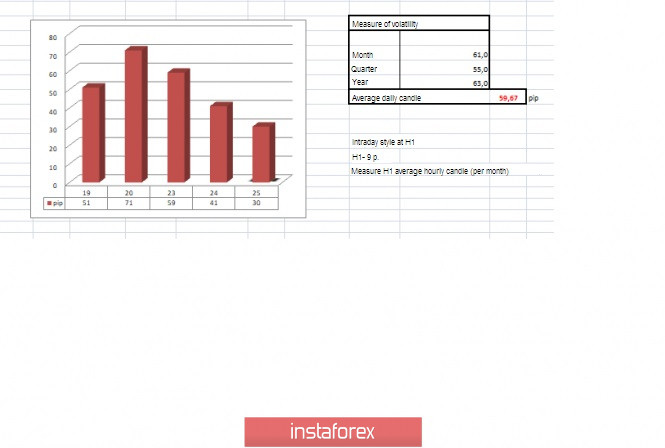

| Trading recommendations for the EURUSD currency pair – placement of trade orders (September 25) Posted: 25 Sep 2019 08:08 AM PDT The euro/dollar currency pair showed reduced volatility of 41 points over the last trading day, as a result of which a pullback was formed. From the point of view of technical analysis, we see that the theory of "Breakdown/Rollback" with respect to the psychological level of 1.1000 fell into existence, but the previously formed accumulation of 1.0980/1.1000 provided an opportunity, even if for a while, to enter the market. So, the breakdown of the upper limit of accumulation (1.0980/1.1000) made it possible to open long positions locally towards the nearest interaction point of 1.1025, where the mirror level passed in relatively smaller time periods (H1). Subsequently, stagnation and recovery followed, but this had already happened in the Pacific and Asian trading sessions. As discussed in the previous review, speculators were waiting for a downward movement, referring to the theory of "Breakdown/Rollback", but everything went wrong, as the upper limit of accumulation broke through. As a result, short-term buy positions were opened, but speculators' expectations did not quite coincide with reality. Examining the trading chart in the general terms (day time period), we see that the process of restoring the quotation is hovering around the psychological mark of 1.1000. Recall that the fulcrum of the correction movement is in the area of 1.0927, the peak of correction is 1.1080 (1.1115). The news background of the previous day had data on housing prices in the United States, where the forecasts of S&P/Case-Shiller did not come true in terms of acceleration from 2.1% to 2.2%, as a result, we got a slowdown to 2.0%. An hour later, the CB consumer confidence index came out, down from 134.2 to 125.1. The US dollar did not feel very bad, but it lost its position a little. The information background included comments by the head of the Federal Reserve Bank of St. Louis, James Bullard, who said he did not rule out a further reduction in the refinancing rate. "A sharper-than-expected slowdown in economic growth could make it harder for the Federal Open Market Committee to meet its 2% inflation target. The FOMC may decide to provide additional incentives in the future," the head of the Federal Reserve said. We conclude the column information and news background, as always, news from Brexit. So, yesterday the UK Supreme Court ruled that the actions of Prime Minister Boris Johnson regarding the suspension of the Parliament were illegal, and today (September 25) the Parliament returns to work. Thus, exit without a deal or refusal of the provided delay will be impossible. The "Brexit" show is delayed for an indefinite period, since an agreement on exit conditions until October 31 is extremely unlikely. Today, in terms of the economic calendar, data on the sale of new homes in the United States, where they expect a significant increase from 635K to 660K. Statistics may provide a local incentive for the US dollar ahead of the publication of GDP data. Further development Analyzing the current trading chart, we see a distinct hovering within the psychological mark of 1.1000, where the quote is again fixed below it, forming a small stagnation as a fact. Speculators, in turn, are again discussing short positions, where some want to enter them now, and others with a slight delay. It is likely to assume that the turbulence within the level of 1.1000 will not last long, and the probability of further decline is still high. If we refer to the theory of decline, the primary descent should be expected in the direction of the local minimum of Monday at 1.0966, and after that, we will talk about the course to the point of the main support of 1.0927. At the same time, hovering within the level of 1.1000 with the subsequent formation of a range of 30 – 40 points is also likely as an alternative theory. Based on the above information, we will derive trading recommendations:

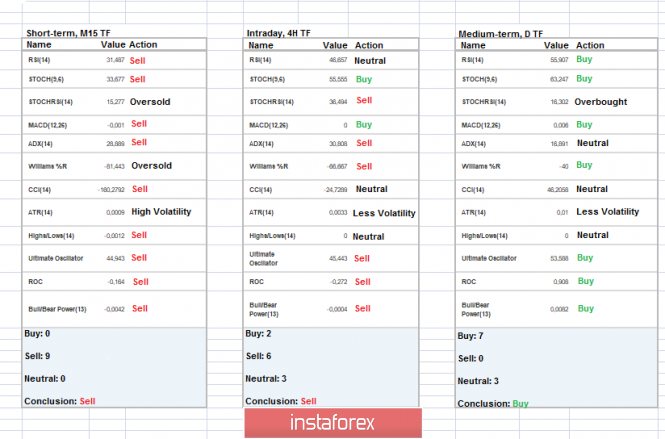

Technical analysis Analyzing different sectors of timeframes (TF), we see that the indicators on all major time intervals signal a further decline. It is worth noting that in the case of hovering within the psychological level of 1.1000, the indicators at smaller time intervals can arbitrarily jump in one place, misleading us. Volatility per week / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (September 25 was built taking into account the time of publication of the article) The volatility of the current time is 30 points. It is likely to assume that if the downward interest persists, the volatility of the day may still grow, unless, of course, we are sucked into a sideways movement along with the level of 1.1000. Key levels Resistance zones: 1.1000***; 1.1100**; 1.1180* ; 1.1300**; 1.1450; 1.1550; 1.1650*; 1.1720**; 1.1850**; 1.2100 Support zones: 1.0926*; 1.0850**; 1.0500***; 1.0350**; 1.0000***. * Periodic level ** Range level *** Psychological level **** The article is based on the principle of conducting transactions, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD: the dollar does not look like a monolith but the euro is not able to stand on its feet Posted: 25 Sep 2019 07:30 AM PDT Only the EUR/USD bulls came to their senses thanks to the decision of the British Supreme Court on the illegality of the actions of the country's Prime Minister Boris Johnson to "freeze" the national parliament, as well as the statement by the Bank of France governor Francois Villeroy de Galhau about disagreeing with the recovery of the European QE, as an increase in demand for safe-haven assets made them retreat. Messages about the launch of the impeachment proceedings against US President Donald Trump spurred demand for treasury, yen, franc, and gold. The pressure on the main currency pair is also exerted by news from the US-China trade front. The pressure on the common currency pair is also exerted by the news from the US-China trade front. A day earlier, in a speech at the UN General Assembly, D. Trump criticized Chinese trade policy and said that he would not make a "bad deal" with China. Investors have reacted negatively, given that trade representatives of the two countries are preparing to hold a meeting in Washington in the coming weeks. At the same time, the US consumer confidence index fell at its fastest pace in nine months, and the high liquidity demand of US banks are negative points for the Euro/USD bears. The demand for the two-week repo deals reached $62 billion and for one-day transactions amounted to $80.2 billion. Its supply reached $30 billion and $75 billion, respectively. The output of these data led to a decrease in the yield of US government bonds. Apparently, investors believe that the Federal Reserve will have to do more than just conduct operations to purchase bonds with an obligation to repurchase them. This increases the risk that the regulator will resume quantitative easing and a wake-up call for the US currency. However, if the greenback does not look like a monolith, the euro cannot stand firm. In the Old World, there are increasing calls for helicopter money when the European Central Bank directly buys bonds issued by national governments issued to stimulate economic growth. In this regard, Germany and other EU states have a great opportunity for fiscal stimulus. Thus, the ECB has exhausted far from its ability to mitigate monetary policy. This trump card sellers of the euro have not yet won back, as many would think. This circumstance, along with the weakness of the eurozone economy and trade disputes, allows the EUR/USD bears to hope in the continuation of the downward campaign, at least to the lower limit of the short-term consolidation range at 1.093-1.1095. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD remains in a bearish trend as long as price is below 1.1050. Posted: 25 Sep 2019 07:21 AM PDT EURUSD remains weak. Despite showing some signs of strength last week, the inability to close above 1.11 combined with the failure to hold above the 1,10 support, puts some pressure on the pair.

|

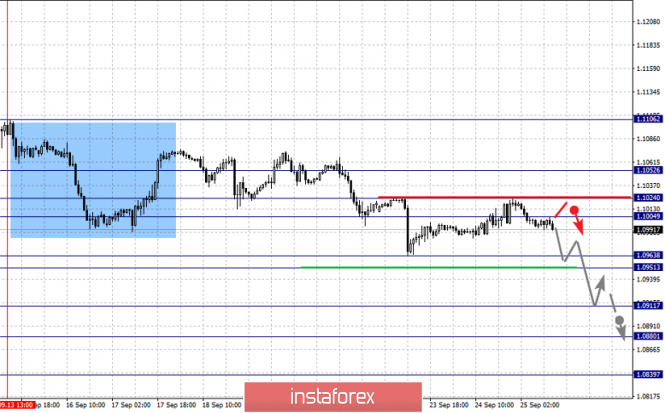

| Posted: 25 Sep 2019 07:14 AM PDT EUR/USD has been trading downwards. The price tested the level of 1.0980. Anyway, I still expect more downside and potential tests of 1.0967 and 1.0930. The EUR/USD did break the perfect bear flag pattern in the background.

Purple rectangle – Important resistance Yellow rectangles – Support levels and downward targets Purple falling line – Expected path MACD oscillator is showing negative reading below the zero the background and I do expect at least another move lower. Support levels are seen at 1.0967 and 1.0930. Key short term resistance is set at 1.1025. Bulls need to be very cautious as there is potential new wave down. As long as the EUR is trading below the 1.1025 there is a chance for more downside and potential testing of 1.0967 and 1.0930. The material has been provided by InstaForex Company - www.instaforex.com |

| USDCAD bulls remain hopeful of a move towards 1.35 Posted: 25 Sep 2019 07:14 AM PDT USDCAD remains still inside the long-term bullish channel and as long as price is above 1.3130 the bullish scenario for a move towards1.35 remains alive. The bullish scenario gets confirmed on a break above 1.3360-1.3380.

Green rectangle - important short-term resistance USDCAD is trading above the lower channel boundary and this is key for the bullish scenario. So far price has made a higher low near 1.3130 and if we see a higher high above the green rectangle resistance area, then the chances for a move towards 1.35 will be high. Short-term trend remains bullish. Support as we said earlier is at 1.3130 and bulls must protect this level at all cost otherwise there will be huge danger for a move below 1.30. The material has been provided by InstaForex Company - www.instaforex.com |

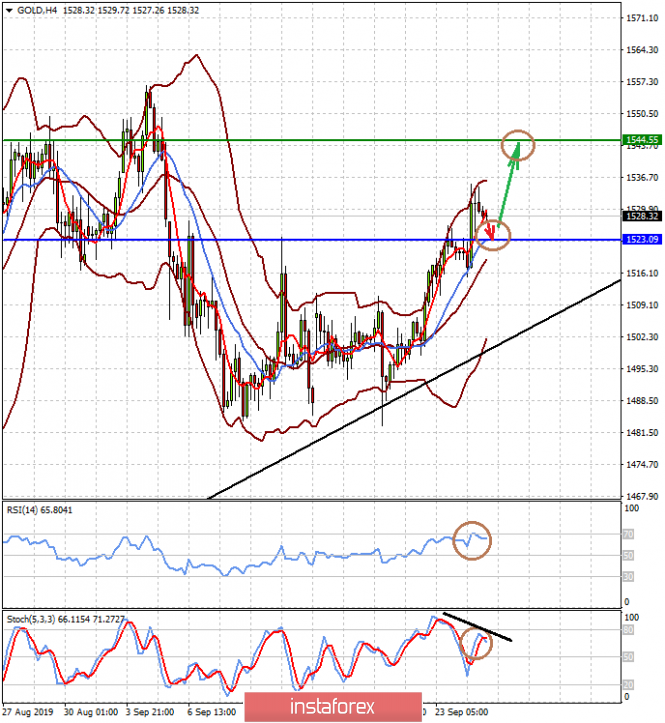

| Gold 09.25.2019 - Is the Gold ready for new push higher? Posted: 25 Sep 2019 07:03 AM PDT Gold price has been trading sideways in the consolidation mode as I expected but I do expect more upside yet to come since the Gold is on the 4H time-frame bull flag formation. My advice is to watch for potential buying opportunities with the first target at $1,533. Strong support is found at $1,524,

Pink rectangle – Important resistance and first upward objective Red rectangle – Second objective target and resistance Purple rising line – Expected path MACD oscillator is still showing positive reading above the zero the background and I do expect at least another push higher. Key support is at $1,524 and resistance at $1,553. Bears need to be very cautious as there is strong upward momentum in the background and the breakout of the symmetrical triangle pattern. As long as the Gold is holding above $1,524 there is a chance for potential test of $1,553. There is still potential buy the dip feeling on the Gold. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 09.25.2019 - Both yesterday's targets are met and new momentum down on MACD Posted: 25 Sep 2019 06:46 AM PDT Bitcoin did drop in the past 24h, exactly what I expected yesterday. Both our yesterday's targets at $9,250 and $9,050 are met and there is strong downside pressure for more downside. BTC traded all the way to $7,900 and most recently is trying to find some balance. I do expect potential small rally back to 20EMA and then another move lower. New down levels and targets are set at $7,500 and $6,645.

Blue horizontal lines – Important support levels and next objective targets Yellow rectangle – Broken support became resistance Purple falling line – Expected path MACD oscillator is showing good new momentum down in the background and I do expect at least move lower. Support levels are seen at $7,900, $7,500 and $6,650. Resistance levels are seen at $8,800 and $9,500.Bulls need to be very cautious as there is strong downward momentum in the background and potential selling the rally type of feeling. Selling opportunities are still preferable. The material has been provided by InstaForex Company - www.instaforex.com |

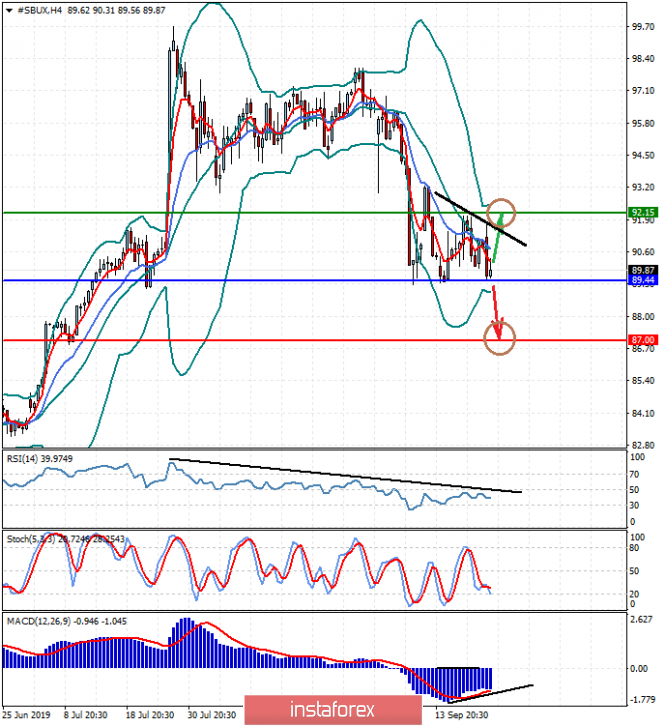

| Starbucks Corporation: Buy or sell? (There is a high probability of securities falling) Posted: 25 Sep 2019 06:36 AM PDT News background: The US stock market continues to be anxious amid several factors. First, they expect a near recession in the wake of the negative impact of uncertainty about the prospects for US-Chinese trade negotiations. The confrontation between the two largest world economies has already led to an increase in tariffs on imports of a number of goods to the States. Second, there is the uncertainty of the Fed's monetary policy in the near foreseeable future. Despite a 0.25% reduction in interest rates at the September meeting, investors do not understand what the regulator will do in the face of maintaining acceptable economic growth on the one hand According to the latest quarterly data, GDP is 2.0%, low inflation 1.7% and the level of unemployment at around 3.7%, which is the minimum over the past 50 years. And on the other hand, the risk of explosive inflation if Donald Trump fails to negotiate terms of trade with China. So far, the markets are waiting for the resumption of incentives, which Fed Chairman J. Powell hinted at last week. But no one knows how or when they will begin. In the face of uncertainty, even strong securities can come under noticeable pressure. In our opinion, you should pay attention to Starbucks Corporation (SBUX). Starbucks Corporation is the world's largest coffee chain operator, who also engaged in the production and sale of coffee. Starbucks has 19,767 establishments in 62 countries. Important indicators: The Annual income for 2018 24.7K. It is projected to grow to 26.4K in 2019. The EPS is projected to 2.824 in 2019 from 2.42 in 2018. The P/E indicator is at the level of 32.13. Overall, the company has stable financial performance, although it is expected to lower its profits in 2020. The average rating of 2.53 is shifted towards buying. Technical picture: The price is below the middle line of the Bollinger Bands, lower than the EMA 5 and EMA 14. The RSI moves horizontally below the level of 50% but the Stochastics are uninformative. The MACD forms a convergence to price pattern. Trading recommendation: The securities "lies" on the strong support level of 89.44. If the price holds above this mark, there is a possibility of its local growth to 92.15. However, this scenario may not materialize today against the background of a general backlash that investors in the US have taken. The dynamics of futures for major stock indices remain negative before the opening of trading. A more likely scenario is a breakout of the support level and a limited decline to 87.00. We consider it possible to sell after a breakthrough in the level of support. |

| Posted: 25 Sep 2019 05:14 AM PDT To open long positions on GBP/USD, you need: Even despite yesterday's decision of the UK Supreme Court, buyers of the pound are in no hurry to return to the market, and the breakthrough of the morning support of 1.2442 further aggravated the situation. The retail sales index, according to the Confederation of British Industrialists, also did not help the bulls very much, despite its slight increase. At the moment, it is best to consider new long positions in the pound only after the formation of a false breakdown in the support area of 1.2385, but I recommend postponing larger purchases until the minimum of 1.2323 is updated. The bulls' task in the afternoon will also be a return to the resistance of 1.2442, since only after that it will be possible to discuss the formation of an upward correction in the pair and continued growth. To open short positions on GBP/USD, you need: Bears coped with the morning task and managed to return to the level of 1.2442, which previously acted as support. At the moment, their new target is a minimum of 1.2385, the breakthrough of which will lead to the demolition of a number of stop orders of bulls and further downward correction of GBP/USD in the area of lows of 1.2323 and 1.2238, where I recommend fixing the profits. If the bulls manage to build an upward correction from the support of 1.2385 in the second half of the day, it is best to consider new short positions for a rebound from the resistance of 1.2442, just above which the upper limit of the current downward channel passes. It is important to note that the lower border of this channel is located between the levels of 1.2323 and 1.2385 in the range of 1.1240, from where the market will also be able to observe profit-taking on short positions. Signals: Moving Averages Trading is below 30 and 50 daily averages, indicating a resumption of the bearish trend. Bollinger Bands In the case of an upward correction, the resistance will be the middle of the indicator at 1.2465.

Description of indicators

|

| Posted: 25 Sep 2019 05:14 AM PDT To open long positions on EURUSD, you need: In the morning, I talked about the fact that US President Donald Trump wants to impeach, but there is no real reason for excitement yet. Against this background, the demand for safe-haven assets, which can be attributed to the US dollar, has increased, but essentially, from a technical point of view, nothing has changed. At the moment, buyers need to protect the support level of 1.0988, which was formed yesterday. Only the formation of a false breakdown there will allow us to count on another wave of growth of EUR/USD with an update of yesterday's resistance in the area of 1.1022. However, a more important task is to break through this range, which will provide the pair with a new upward wave to the maximum area of 1.1067, where I recommend taking the profit. In the scenario of a further decline in the euro and the absence of bulls at 1.0988, it is best to consider new long positions for a rebound from the support of 1.0955, or at the monthly minimum of 1.0925. To open short positions on EURUSD, you need: Given that no important fundamental statistics are planned for today, only statements by representatives of the European Central Bank and the Federal Reserve can lead to some surge in volatility. The bears coped with the morning task and returned the pair to the support area of 1.0988, the breakdown of which will be a clear signal to open short positions in order to further reduce the EUR/USD to the minimum area of 1.0955 and the minimum of the month – 1.0925, where I recommend taking the profit. If the bulls find the strength and hold the level of 1.0988 in the second half of the day, it is best to count on new short positions after an upward correction to the resistance area of 1.1022 or sell EUR/USD to rebound from the maximum of 1.1067. Signals: Moving Averages Trading is conducted just below 30 and 50 moving averages, however, a breakout of the support of 1.0988 is necessary for the formation of a bearish trend. Bollinger Bands In the case of euro growth, the upper border of the indicator in the area of 1.1022 will act as resistance, from where you can open short positions immediately for a rebound.

Description of indicators

|

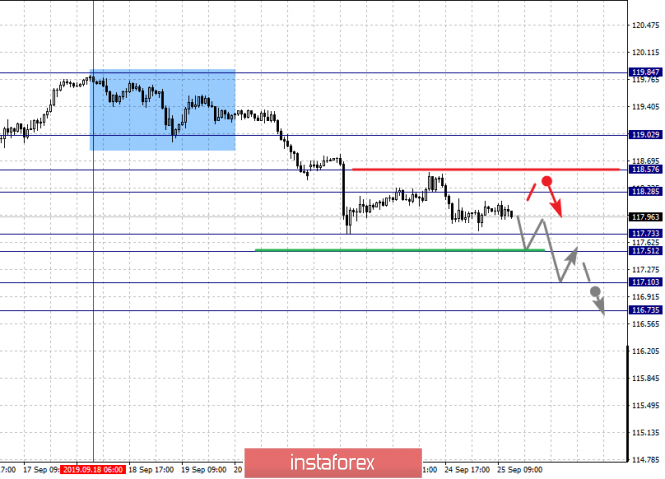

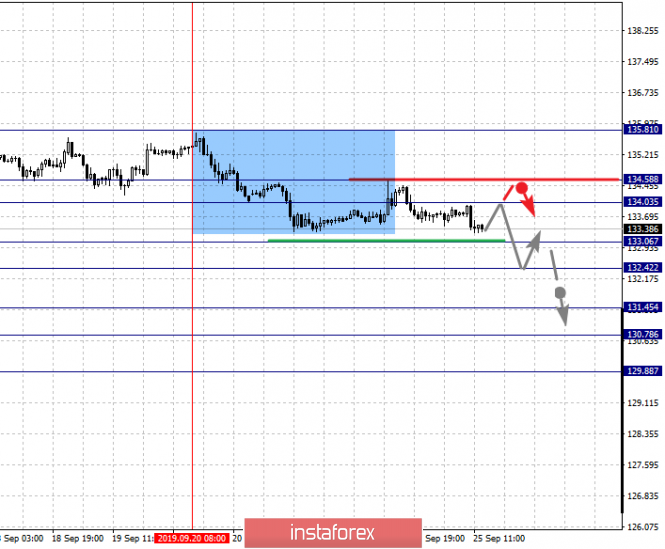

| Fractal analysis of major currency pairs as of September 25 Posted: 25 Sep 2019 04:40 AM PDT Hello, dear colleagues. For the Euro/Dollar pair, we expect the continuation of the downward movement after the breakdown of 1.0951 and the level of 1.1024 is the key support. For the Pound/Dollar pair, the price forms a potential structure for the bottom of September 20, we expect its development after the breakdown of 1.2400 and the level of 1.2495 is the key support. For the Dollar/Franc pair, the continuation of the downward movement is expected after the breakdown of 0.9835 and the level of 0.9887 is the key support. For the Dollar/Yen pair, the continuation of the downward movement is expected after the breakdown of 107.06 and the level of 107.50 is the key support. For the Euro/Yen pair, we follow the downward structure from September 18, the continuation of the downward movement is expected after the passage of the range of 117.73 – 117.51 and the level of 118.57 is the key support. For the Pound/Yen pair, subsequent targets were set against a downward structure from September 20 and the level of 134.58 is the key support for the bottom. Forecast for September 25: Analytical review of currency pairs on the H1 scale:

For the Euro/Dollar pair, the key levels in the H1 scale are 1.1052, 1.1024, 1.1004, 1.0963, 1.0951, 1.0911, 1.0880 and 1.0839. We continue to follow the development of the downward structure of September 13. We expect the continuation of the downward movement after the price passes the range of 1.0963 – 1.0951. In this case, the target is 1.0911 and near this level is the price consolidation. The breakdown of 1.0911 will lead to a movement to the level of 1.0880, from which we expect a pullback to the top. We consider the level of 1.0839 as a potential value for the bottom. A short-term upward movement is possible in the area of 1.1004 – 1.1024 and the breakdown of the last value will lead to an in-depth correction. The target is 1.1052 and this level is the key support for the bottom. The main trend is the downward structure of September 13. Trading recommendations: Buy: 1.1004 Take profit: 1.1024 Buy 1.1026 Take profit: 1.1050 Sell: 1.0950 Take profit: 1.0916 Sell: 1.0908 Take profit: 1.0884

For the Pound/Dollar pair, the key levels in the H1 scale are 1.2585, 1.2538, 1.2495, 1.2460, 1.2403, 1.2362, 1.2329 and 1.2286. The price forms the potential for a downward movement from September 20. The continuation of the downward movement is expected after the breakdown of 1.2403. In this case, the target is 1.2362 and in the area of 1.2362 – 1.2329 is the price consolidation. We consider the level of 1.2286 as a potential value for the bottom, upon reaching this value, we expect a rollback to the top. The short-term upward movement is expected in the range of 1.2460 – 1.2495 and the breakdown of the last value will lead to an in-depth correction. The target is 1.2538 and this level is the key support for the downward structure. Its passage by the price will have to develop an upward movement. In this case, the first target is 1.2585. The main trend is the local upward structure of September 12, the formation of the potential for the bottom of September 20. Trading recommendations: Buy: 1.2460 Take profit: 1.2495 Buy: 1.2497 Take profit: 1.2536 Sell: 1.2403 Take profit: 1.2362 Sell: 1.2360 Take profit: 1.2330

For the Dollar/Franc pair, the key levels in the H1 scale are 0.9919, 0.9887, 0.9868, 0.9835, 0.9813 and 0.9783. We follow the development of the downward cycle of September 19. We expect the continuation of the downward movement after the breakdown of 0.9835. In this case, the target is 0.9813 and near this level is the price consolidation. The breakdown of the level of 0.9813 will lead to a movement to the potential target – 0.9783, after which we expect a pullback to the top. A short-term upward movement is possible in the area of 0.9868 – 0.9887 and the breakdown of the last value will lead to an in-depth correction. The target is 0.9919 and this level is the key support for the downward structure from September 19. The main trend is the downward cycle of September 19. Trading recommendations: Buy: 0.9868 Take profit: 0.9885 Buy: 0.9890 Take profit: 0.9919 Sell: 0.9835 Take profit: 0.9815 Sell: 0.9811 Take profit: 0.9785

For the Dollar/Yen pair, the key levels in the H1 scale are 107.95, 107.77, 107.50, 107.06, 106.82, 106.67 and 106.35. We follow the development of the downward structure of September 19. The continuation of the downward movement is expected after the breakdown of 107.06. In this case, the target – 106.82 and in the area of 106.82 – 106.67 is the short-term downward movement and consolidation. We consider the level of 106.35 as a potential value for the bottom, upon reaching this level, we expect a rollback to the top. Going into a correction is expected after the breakdown of 107.50. In this case, the target is 107.77 and the level of 107.95 is the key support for the downward cycle. We expect the initial conditions for the upward movement to be formed. The main trend is the downward structure from September 19. Trading recommendations: Buy: 107.05 Take profit: 106.82 Buy: 106.65 Take profit: 106.37 Sell: 107.50 Take profit: 107.70 Sell: 107.78 Take profit: 107.95

For the Canadian dollar/Dollar pair, the key levels in the H1 scale are 1.3379, 1.3343, 1.3326, 1.3297, 1.3260, 1.3235, 1.3198 and 1.3172. We continue to monitor the development of the upward structure from September 10. At the moment, the price is in a correction. The continuation of the upward movement is expected after the breakdown of 1.3297. The target is 1.3326 and in the area of 1.3326 – 1.3343 is the consolidation. We consider the level of 1.3379 as a potential value for the top, upon reaching this level, we expect a rollback to the bottom. The short-term downward movement, as well as consolidation, are possible in the area of 1.3260 – 1.3235 and the breakdown of the last value will lead to an in-depth correction. The target is 1.3198 and this level is the key support for the top. Its breakdown will have a downward structure. In this case, the potential target – 1.3172. The main trend is the upward structure of September 10, the stage of correction. Trading recommendations: Buy: 1.3299 Take profit: 1.3226 Buy: 1.3344 Take profit: 1.3378 Sell: 1.3260 Take profit: 1.3237 Sell: 1.3233 Take profit: 1.3200

For the Australian dollar/Dollar pair, the key levels in the H1 scale are 0.6822, 0.6797, 0.6782, 0.6745, 0.6732, 0.6705 and 0.6683. We follow the development of the downward cycle from September 13. At the moment, the price is in a correction. We expect the continuation of the downward movement after the breakdown of 0.6760. In this case, the first target is 0.6745. The short-term downward movement is possible in the range of 0.6745 – 0.6732 and the breakdown of the last value should be accompanied by a pronounced downward movement. The target is 0.6705 and near this value is the consolidation. We consider the level of 0.6683 as a potential value for the bottom, at which we expect to go into correction. The short-term upward movement is possible in the area of 0.6782 – 0.6797 and the breakdown of the last value will lead to a prolonged correction. The potential target is 0.6822 and this level is the key support for the downward structure. The main trend is the downward cycle of September 13, the stage of correction. Trading recommendations: Buy: 0.6760 Take profit: 0.6745 Buy: 0.6782 Take profit: 0.6795 Sell: 0.6745 Take profit: 0.6734 Sell: 0.6730 Take profit: 0.6707

For the Euro/Yen pair, the key levels in the H1 scale are 119.02, 118.57, 118.28, 117.73, 117.51, 117.10 and 116.73. We follow the development of the downward structure of September 18. We expect the continuation of the downward movement after the price passes the range of 117.73 – 117.51. In this case, the target is 117.10. We consider the level of 116.73 as a potential value for the bottom, upon reaching this value, we expect a rollback to the top. The short-term upward movement is possible in the range of 118.28 – 118.57 and the breakdown of the last value will lead to an in-depth movement. The target is 119.02 and this level is the key support for the downward structure. The main trend is the downward structure of September 18. Trading recommendations: Buy: 118.28 Take profit: 118.55 Buy: 118.60 Take profit: 119.00 Sell: 117.50 Take profit: 117.10 Sell: 117.08 Take profit: 116.73

For the Pound/Yen pair, the key levels in the H1 scale are 135.81, 134.58, 134.03, 133.06, 132.42, 131.45, 130.78 and 129.88. We determined the next goals from the downward structure on September 20. The short-term downward movement is expected after the breakdown of 133.06. The target is 132.42 and the breakdown of which, in turn, should be accompanied by a pronounced downward movement. In this case, the target is 131.45 and in the area of 131.45 – 130.78 is the consolidation. We consider the level of 129.88 as a potential value for the downward movement, upon reaching this level, we expect a rollback to the top. The short-term upward movement is possible in the area of 134.03 – 134.58 and the breakdown of the last value will have to form an upward structure. In this case, the potential target – 135.81. The main trend is the formation of a downward structure from September 20. Trading recommendations: Buy: 134.03 Take profit: 134.55 Buy: 134.60 Take profit: 135.80 Sell: 133.04 Take profit: 132.44 Sell: 132.40 Take profit: 131.45 The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of EUR/USD for September 25, 2019 Posted: 25 Sep 2019 04:25 AM PDT The support level of EUR/USD pir is set at the spot of 1.1019 which represents the daily pivot. Any upside pullback from the price of 1.1019 now is normal, because on the whole we remain bullish at present. The bullish trend is still expected for the upcoming days as long as the price is above 1.1019. The EUR/USD pair reached a new maximmum at the price of 1.1030/1.1045. So, today the price may reach one more maximmum around the spot of 1.1073, which coincides with the ratio of 61.8% Fibonacci retracement levels. Today, the EUR/USD pair is challenging the psychological resistance at 1.1045. The EUR/USD pair will probably go up because an upward trend is still strong and the RSI is still signaling that the trend is upward. The breakthrough of 1.1045 will allow the pair to go further up to the levels of 1.1073 and 1.1112. As a result, it is gainful to buy above this price of 1.1019 with targets at 1.1073 and 1.1112. On the downside, a clear breakdown at the level of 1.1019 could trigger further bearish pressure testing 1.0982, which represents the major support.

|

| Posted: 25 Sep 2019 04:07 AM PDT The Korean export-oriented economy is going through hard times and the country is a leading global exporter of computer chips, ships, automobiles, and petroleum products. The collapse of exports clearly indicates that consumption in the world is experiencing significant problems and this decline is clearly gaining momentum, which investors cannot help but worry about it. Against the background of the increased risks of the recession, the board member of the Central Bank of Japan Takako Masai announced the regulator's readiness to hesitate in softening the monetary policy if the prospects of inflation growth to 2.0% remain unattainable. It seems that we are again witnessing an attempt by the world's largest Central Banks including Japan, the ECB, and in the future, the Fed to "treat" the long-standing problems that caused the global economic crisis of 2008-09 and a wide flow of liquidity. That is why extremely uncertain dynamics are now observed in all markets without exception. Stock markets are in a fever on a wave of conflicting signals about the growth prospects of national economies in the face of an impending global economic downturn. The commodity market is also nervously twitching in one direction or the other, not understanding how the tense situation in the Middle East and the protracted US-Chinese negotiations on terms of trade will end. The foreign exchange market also does not stand aside. The expectation of new incentives from the ECB, the Fed, as well as the Central Bank of Japan and most likely, several other major world banks, has led major currency pairs to move in no particular direction, responding to local economic statistics or news and rumors. The common currency paired with the US dollar was stuck in a "sideways", from which it would break out only after the Fed's position with respect to possible American incentives became known. Sterling is completely subordinate to Brexit's theme and new scandals in the British government. Commodities and commodity currencies are traded while eyeing the dynamics of crude oil prices and the trade negotiations between the United States and China. In general, we can say that the markets are in a pre-chaotic state. On this wave of uncertainty, investors remain interested in protective assets - gold, the Japanese yen, the Swiss franc and government bonds of economically developed countries. Forecast of the day: We believe that maintaining a general degree of uncertainty in global markets will push gold prices up in the short term. We consider it possible to buy gold at a decline of 1523.00 with a local target of 1544.55. The NZD/USD pair is trading above 0.6255 after the decision of the RBNZ to leave interest rates unchanged. But you should pay attention to the fact that the regulator outlined for the first time the topic of the likely start of stimulating the local economy. This is a strong obstacle to the growth of the New Zealand dollar. Given these prospects, we consider it necessary to sell the pair after it drops below 0.6310 with a probable target of 0.6255. |

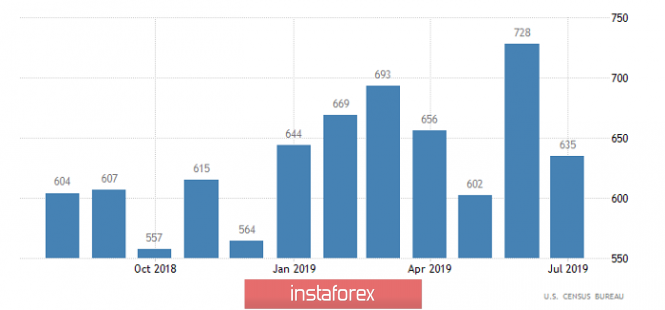

| Posted: 25 Sep 2019 03:34 AM PDT Nothing seemed to portend trouble and the market stood rooted to the spot for the whole day. However, as soon as the Americans finished their morning coffee, the portraits of the dead presidents began to noticeably cheaper. The growth rate of S & P / Case-Shiller data on housing prices in the United States slowed down from 2.2% to 2.0% that became a reason for sadness and gloom. Moreover, it was initially predicted that their growth rate would accelerate from 2.1% to 2.2%. The previous results were revised upward, and the current slowdown looks very impressive and somewhat frightening. Indeed, inflation has slowed so recently. Well, if the pace of growth in housing prices slows down, then inflation itself will have nothing to grow with. Nevertheless, after the Americans finish their morning coffee, the portraits of the dead presidents may well perk up. The reason for joy should be the data on the real estate market. In particular, sales of new homes may increase by 3.9% or 25 thousand, from 635 thousand to 660 thousand. If we take into account that sales fell as much as 12.8% in the previous month then the expected growth looks very impressive and encouraging. In addition, we do not forget that the situation on the market is heating up and many people's nerves can't stand it. After all, tomorrow the final data on the GDP of the United States for the second quarter will be published. Thus, it is possible that the reaction to data on home sales will be overly emotional. New Home Sales (United States): Against this background, the single European currency may fall to 1.0950. The pound will also be affected by data on sales of new homes in the United States. Therefore, it will drop to 1.2400. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading strategy for EUR/USD on September 25th. Two friendly leaders. Two impeachments. Part 1 Posted: 25 Sep 2019 02:54 AM PDT EUR/USD – 4H. As seen on the 4-hour chart, the EUR/USD pair returned to the correctional level of 127.2% (1.1024), rebounded from it and a reversal in favor of the US currency. As a result, the process of falling quotes resumed in the direction of the correction level of 161.8% (1.0918 or 1.0927). Also yesterday, a bearish divergence was formed at the CCI indicator, which significantly increases the probability of a fall of the euro/dollar pair. The pair is still trading inside the downward trend channel, and today, there is no reason to assume or expect the quotes to exit from its limits. Thus, the situation remains in the hands of bear traders, they continue to "rule the ball." The information background, at first glance, is zero for the pair. Only on Monday, there were important and interesting news and economic reports that caused the reaction of traders. Yesterday and today, there was no economic news and is not expected. But there is news of a political nature. We have somehow got used to the fact that only the UK receives interesting political messages that have a strong impact on the movement of the domestic currency. However, in America, whose leader is even more odious and unpredictable than the leader of the UK, there is also something to pay attention to. The case, of course, is the impeachment of Donald Trump, which may be announced soon. This news has already been covered by many media, but I will consider its possible impact on the movement of the EUR/USD pair. What is the essence of the problem first? The problem is that, like Boris Johnson in the UK, Trump has a huge number of opponents to his policy in the United States. There are presidents to whom the attitude is neutral. Everyone understands that a leader can make a single wrong decision, but he does not have the character and power to influence the economy so much as to cause strong structural changes in it. With Trump, the situation is the opposite. The US President does not disdain any measures to achieve what is desired. This is evidenced by trade wars, and intransigence in negotiations, and Trump's unwavering stance on his own beliefs, and pressure on the Fed, which never happened at all. And at the same time, if necessary, Trump changes his mind easily and naturally. It is Trump's unpredictability, his frequent game not according to the rules that have been formed for decades, that is the reason why he has enough opponents in Congress. Now, the presidential election looms, and Trump wants to be elected for a second term. This is precisely the reason for the possible impeachment of Trump. Trump's accusations are that the US President put pressure on Ukraine, called to investigate the activities of Joe Biden (Trump's main rival in the presidential election) and his son Hunter Biden in Ukraine in 2015, and froze military aid to Ukraine. Trump promised to provide a transcript of the conversation, saying that there was no pressure on Ukrainian President Vladimir Zelensky. Military aid was removed allegedly due to insufficient assistance from the European States, in particular, Germany and France. However, Trump's opponents have enough of this reason to start a war against him, similar to the war against Johnson on the sidelines of the British Parliament. What to expect today from the euro/dollar currency pair? On September 25, I expect the euro/dollar pair to fall further in the direction of the correction level of 161.8% (1.0918). Since the information background will be absent today, the activity of traders may not be at its height again. So far, the topic of a possible impeachment to Trump does not particularly affect the US currency. However, as new messages on this topic arrive, the mood of traders can change to the opposite. I recommend that you closely monitor the situation. The Fibo grid is based on the extremes of May 23, 2019, and June 25, 2019. Forecast for EUR/USD and trading recommendations: I recommend selling the pair today (or staying at the previously opened sales) with the target of 1.0927 since the rebound from the level of 1.1024 was performed. A stop-loss order above the level of 1.1029. It will be possible to buy a pair after closing above the downward trend channel, but it is better to wait until the consolidation above the correction level of 100.0% (1.1106). The material has been provided by InstaForex Company - www.instaforex.com |

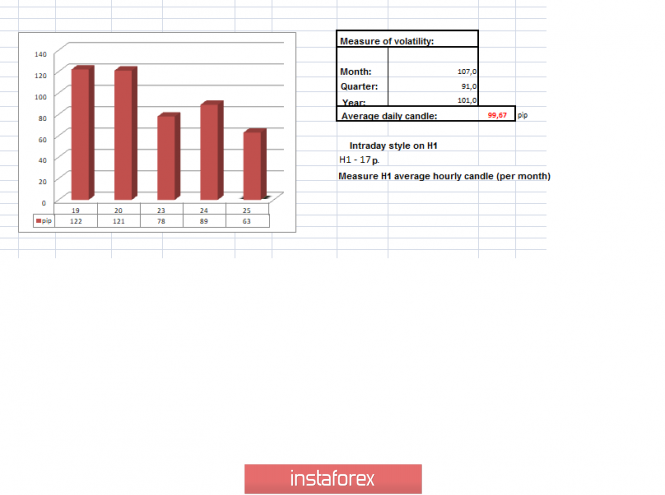

| Trading recommendations for the GBPUSD currency pair - placement of trade orders (September 25) Posted: 25 Sep 2019 01:45 AM PDT Over the past trading day, the pound / dollar currency pair showed volatility below the average daily value of 89 points, but this was enough to earn on the initial surge of quotes. From the point of view of technical analysis, we see that the consolidated slowdown of 1.2412 / 1.2450 served as an excellent platform for trade transactions, where the method of trading on the breakdown of borders played an excellent tactic to enter the market in the short term. The impulse move in question led to a local surge, temporarily returning the quotation to the level of 1.2500, where resistance was again found. As discussed in the previous review, speculators were already working in the market, but the formed stop in the form of remarkable consolidation did not disregard any traders, since everyone wants to make money on a local surge with a relatively low risk. Thus, I do not exclude the possibility that, even with the main transactions, traders opened short-term purchase transactions taking 30-50 points from the market. Considering the trading chart in general terms (the daily period), we see that the oblong correction has a range level in front of us with variable boundaries of 1.2500 / 1.2550 / 1.2580, where, after all, there is a certain ceiling, expressed in slowdown corrective course. The recovery process relative to the main trend has not yet arrived, but it is likely that the current platform in the form of deceleration and range level will serve as a platform for sellers to return to the market. The news background of the past day contained only housing prices in the United States, where S & P / CaseShiller forecasts did not materialize in terms of acceleration from 2.1% to 2.2%. As a result, we got a slowdown to 2.0%. I doubt that not the best statistics for the States somehow strongly affected the dollar in terms of considering the GBPUSD pair, since there was a strong information background on Britain yesterday. In addition, the Supreme Court of Great Britain also issued its verdict regarding the actions of the Prime Minister regarding the suspension of parliament yesterday. In short, the court ruled that the decision of Boris Johnson to send parliament to forced vacations was unlawful. An hour after the announcement of the court decision, some deputies symbolically took their seats in the lower house of parliament. What can I say, Johnson's next crushing defeat, "I invite Boris Johnson, in historical terms, to weigh his position and become the prime minister who was least in power!" Said Labor leader Jeremy Corbyn at the time of his speech in Brighton. The Prime Minister's response regarding the court's decision was not long in coming, and while he was in New York at the UN General Assembly at that moment, he was indignant at the court's verdict. "I completely disagree with the decision of the Supreme Court! I have great respect for our judicial system, but I do not think that such a verdict was justified. The dissolution of the parliament took place over the centuries without the difficulties that have arisen now, "said Boris Johnson. Johnson subsequently stated that we will comply with the court ruling, but we must continue to work and exit on October 31. Today, in terms of the economic calendar, we have data on the sale of new homes in the United States, where they expect a significant increase in sales from 635K to 660K. Statistics can provide a local incentive for the US dollar. In terms of informational background, the work of the British Parliament should resume today, and if you refer to the media, Her Majesty the Queen will deliver a throne speech. The opposition, in turn, is already planning to discuss a vote of no confidence in the prime minister and early elections. As you understand, the information background can again give a new round of volatility to the market. Further development Analyzing the current trading chart, we see that the downward interest is actively pouring into the market, returning the quote back to yesterday's consolidation 1.2412 / 1.2450. The inertial move against the background of the information flow is clearly stimulated by the emotions of the crowd, which can play into the hands of speculators. What are the actions of those speculators, so they are already in short positions, which were opened on Monday and were added yesterday within the level of 1.2500. It is likely to assume that the consolidation range of 1.2412 / 1.2450 will hold back sellers for a while, but it is unlikely to last long. Here, the key point is the informational background, which is desirable to monitor, since it can give local bursts. Thus, if we still do not have any deals for sale, it makes sense to wait for the price consolidating below 1.2400, where the entry will be already in terms of inertial movement. Based on the above information, we concretize trading recommendations: - Positions to buy are considered in the case of price fixing higher than 1.2500, with the supply of an informational background. - Positions for sale, if we do not have, then we are waiting for the fixing of the price lower than 1.2400. The prospect of running in the form of steps is 1.2350 --- 1.2300 --- 1.2150. Indicator analysis Analyzing a different sector of timeframes (TFs), we see that indicators in the short and intraday perspective signal a downward interest due to the general mood of the crowd. On the other hand, the medium-term outlook still retains upward interest amid an elongated correction. Volatility per week / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (September 25 was built taking into account the time of publication of the article) The volatility of the current time is 63 points, which is already good for this time section. It is likely to assume that, against the background of the information flow, volatility may still increase, exceeding as a result the daily average. Key levels Resistance zones: 1.2500 **; 1.2620; 1.2770 **; 1.2880 (1.2865-1.2880) **. Support areas: 1.2350 **; 1.2150 **; 1,2000 ***; 1.1700; 1.1475 **. * Periodic level ** Range Level *** The article is built on the principle of conducting a transaction, with daily adjustment The material has been provided by InstaForex Company - www.instaforex.com |

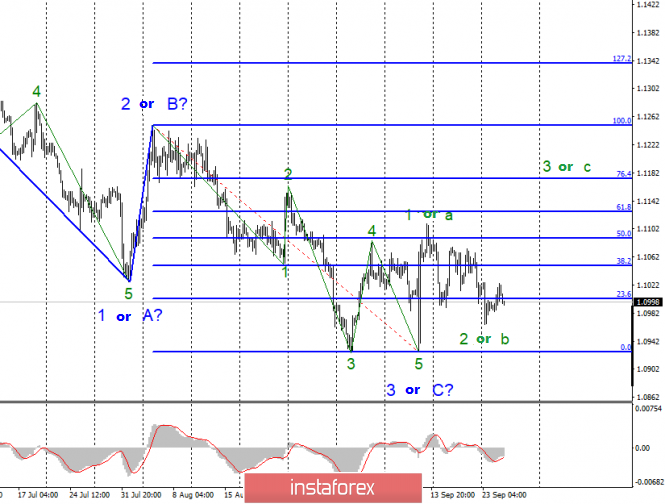

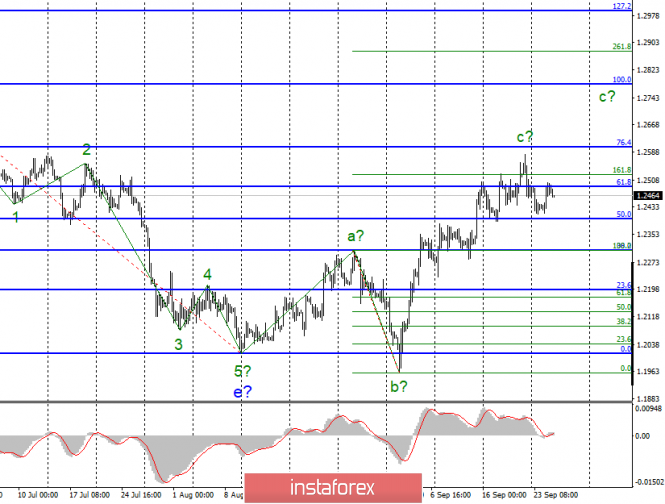

| Posted: 25 Sep 2019 01:35 AM PDT EUR / USD Tuesday, September 24, ended for the EUR / USD pair with an increase of 20 basis points. However, the instrument went down exactly the same this night and in the morning. Therefore, the expected wave 2 or b as part of a new upward trend section has the last chance to complete its construction. If there is another successful attempt to break through the minimum of this wave, then the entire wave pattern will require adjustments, and the trend section will transform into a bearish one. The news background is still the main opponent of wave marking, which involves the construction of an upward trend section. The news for the euro-dollar pair is either disappointing or not. Yesterday was the second option, the pair rose slightly, but, as we see today, it has already managed to drop, although the news background is still missing. Fundamental component: In this situation, it remains only to rely on the fact that markets will not continue to sell the instrument. That is, hope for the markets to ignore the general news background or hope to receive positive information for the euro currency in the near future. Unfortunately, there are no other options. After the markets witnessed a new "encouraging" performance by Mario Draghi, the euro is difficult to expect a more or less tangible increase again. "Stunning" business activity indices in services and production in Germany and the European Union perfectly complement the overall picture of a "chic" news background for the euro / dollar pair. Purchase goals: 1.1128 - 61.8% Fibonacci 1.1175 - 76.4% Fibonacci Sales goals: 1.0927 - 0.0% Fibonacci General conclusions and recommendations: The euro-dollar pair allegedly completed waves 2 or b as part of a new trend section, which originates on September 12. However, this wave runs the risk of transforming into a new bearish with adjustments to the entire wave pattern. I recommend buying the instrument in very small volumes with targets near the calculated levels of 1.1128 and 1.1175 calculated on the construction of wave 3 or s, but with a mandatory stop under the current low of September 23. GBP / USD On September 24, the GBP / USD pair gained about 60 base points, which was exactly the reaction of the markets to the verdict of the British Supreme Court in the case of the suspension of Parliament. The court fully and unanimously admitted that Boris Johnson had violated the law when he sent Parliament to "rest" for 5 weeks, while normal practice involves the dissolution of parliament for no more than 5-10 days in emergency situations. In addition, the court fully understood the case and ruled that the decision of Boris Johnson was connected with the desire to remove the deputies of the Parliament from the case so that they would not interfere with the implementation of the tough Brexit and could not hold the government accountable. Thus, the suspension of the Parliament recognized as illegal and invalid. Already today or tomorrow, deputies will be able to return to work. The pound, in turn, added a little paired with the US currency, as this news is regarded by the Forex market as positive. Any news that pushes the hard Brexit away is considered positive and any news of Boris Johnson's failure to implement plans deflects a tough Brexit. Fundamental component: On Wednesday, September 25, the UK economic news calendar is empty again, as is the US calendar. Thus, today, I am waiting for news from the Parliament of Great Britain, which should return to work. I am also waiting for the leaders of the opposition to speak in order to understand possible actions against Boris Johnson in the near future. It is no secret that far from everyone is satisfied with the Prime Minister in the Parliament, which he dismissed. In the near future, we can expect a vote of no confidence in Johnson, which calls for resignation voluntarily. However, Johnson is unlikely to leave his post voluntarily, but every such event and the opposition cast an ever greater shadow on the Prime Minister. All this will positively affect the pound. Sales goals: 1.2016 - 0.0% Fibonacci Purchase goals: 1.2602 - 76.4% Fibonacci 1.2784 - 100.0% Fibonacci General conclusions and recommendations: The upward trend section continues its construction. Thus, quotes are now expected to increase with targets located near the calculated levels of 1.2602 and 1.2784, which corresponds to 76.4% and 100.0% Fibonacci. The wave c could finish its construction, and thus, I recommend waiting for a new successful attempt to break through the 61.8% Fibonacci level for new purchases of the instrument. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading strategy for GBP/USD on September 25th. Two friendly leaders. Two impeachments. Part 2 Posted: 25 Sep 2019 01:29 AM PDT GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair has completed a return to the retracement level of 38.2% (1.2501), rebounding from this level and reversing in favor of the US dollar. The upward channel is slightly rebuilt, the angle of inclination has changed, new reference points have been taken into account. However, given the pair's rebound from the Fibo level of 38.2%, the probability of a new fall in the direction of the correction level of 23.6% (1.2293) is very high. But before that, I recommend waiting for the closing of the pound/dollar pair under the channel. The information background for the GBP/USD pair in recent days is purely political. The article on EUR/USD details the political upheavals of Donald Trump; this article highlights Boris Johnson's two-month political career as Prime Minister of Great Britain. These two politicians are extremely similar, openly showing a good attitude to each other. Both face impeachment (in the case of Johnson – a vote of no confidence, but the essence is the same). After Boris Johnson lost the court case on the suspension of the work of Parliament, the question remains whether to issue him a vote of no confidence. Yesterday, immediately after the announcement of the results of the High Court hearing, Jeremy Corbyn, the leader of the Labor Party, spoke openly and urged Johnson to resign. There were rumors of a vote of no confidence even before the so-called prorogation. However, then the Parliament was afraid to start this procedure, because, according to British law, a vote of no confidence is not an order to leave office, but only an expression of the desire of Parliament. That is, Boris Johnson can safely not accept the vote and remain in office. However, the process of removing the Prime Minister from his post (as well as the President in the United States) is very long and complicated. It consists of many parts of the overall "puzzle". And a vote of no confidence could be one of those parts. Another question is that the vote of no confidence may end with early parliamentary elections, which the deputies themselves did not want to hold twice. It is the early parliamentary elections that the Parliament itself fears, and it is for this reason that the vote may again be delayed. However, I consider it necessary to recall that if such an issue as a vote of no confidence is raised in the UK Parliament at all, the probability that everything will end with the resignation of the Prime Minister is high. Theresa May twice passed a vote, ended with the resignation. These are the realities in the time of Brexit. I also want to note that even a process such as the offset of Boris Johnson from office, is now considered by traders exclusively through the prism of a Brexit. That is, traders are interested in, first of all, not Johnson, but Brexit, and this is logical. The farther Brexit "No Deal", the better for the pound. Thus, Johnson's defeat, a vote of no confidence in him, any pressure on him and calls to resign are positive news for the pound. But they must also be supported by the concrete actions of opposing forces. What to expect from the pound/dollar currency pair today? The pound/dollar pair has fulfilled the rebound from the level of 38.2% (1.2501). Thus, today I expect a resumption of the fall in the direction of the corrective level of 23.6% (1.2293). There will be no economic reports in the UK again today, but the information background may still be saturated due to political events in the country. The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019. Forecast for GBP/USD and trading recommendations: I recommend buying the pair with the target of 1.2668 and a stop-loss order under the level of 1.2501 if a new close is performed above the Fibo level of 38.2%. I recommend considering selling a pair with a target of 1.2308 now with targets in the range of 1.2308 – 1.2293, with a stop-loss level of 38.2% (Fibonacci). You can wait for the closure under the upward channel. The material has been provided by InstaForex Company - www.instaforex.com |