Forex analysis review |

- Fractal analysis of the main currency pairs for September 10

- The expected continuation of the period of local consolidation of the cryptocurrency market (we expect a local decrease in

- #USDX vs EUR / USD vs GBP / USD vs USD / JPY. Comprehensive analysis of movement options on September 10, 2019 APLs &

- Canadian dollar in panic: USD/CAD on the verge of collapse

- GBP/USD. Johnson's Plan B and the positive Irish meeting

- GBP/USD. September 9. Results of the day. British Parliament is not afraid of a re-election, but wants guarantees to prevent

- EUR/USD. September 9. Results of the day. Mario Draghi is preparing to cut rates, the euro is bracing for a new fall

- EURUSD and GBPUSD: The UK economy may be able to avoid a recession. European Central Bank to cut interest rates this week

- Statements and thoughts

- The pound bounced off the bottom

- EURUSD needs to break and stay above 1.1088 in order to move towards 1.1150 or higher

- Gold challenges $1,500 while still vulnerable to a move lower towards $1,470.

- September 9, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- September 9, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- Trading recommendations for the EURUSD currency pair – placement of trade orders (September 9)

- Trading recommendations for the GBPUSD currency pair – placement of trade orders (September 9)

- Analysis for EUR/USD and GBP/USD on September 9th. Surprises in the British Kingdom

- GBP/USD: plan for the American session on September 9th. The UK economy gave a surprise and returned the demand for the British

- EUR/USD: plan for the American session on September 9th. Another failure of sellers at the level of 1.1020 maintains a balance

- BTC 09.09.2019 - First target reached, potential for second target

- EUR/USD for September 09,2019 - Buy zone for the EUR and potential end of downward correction

- Gold 09.09.2019 - Gold in the buy zone, more upside in play

- Gold will push off the bottom

- Review of EUR / USD and GBP / USD pairs on 09.09.2019: British showdown

- Technical analysis of GBP/USD for September 09, 2019

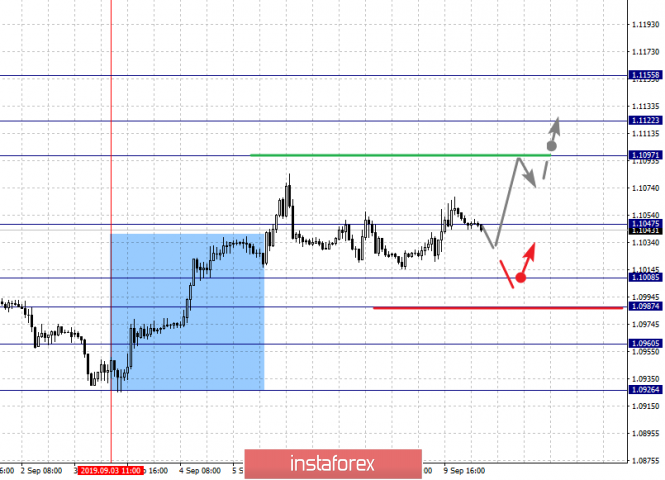

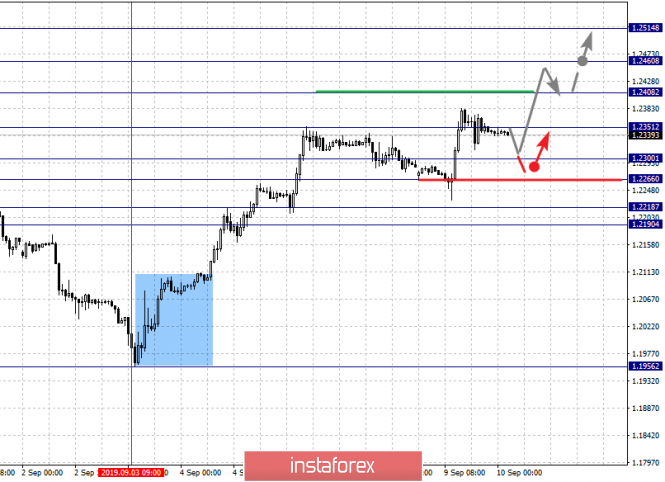

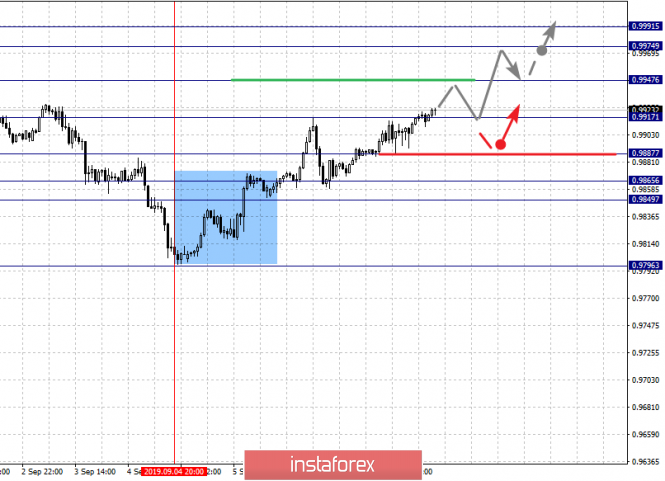

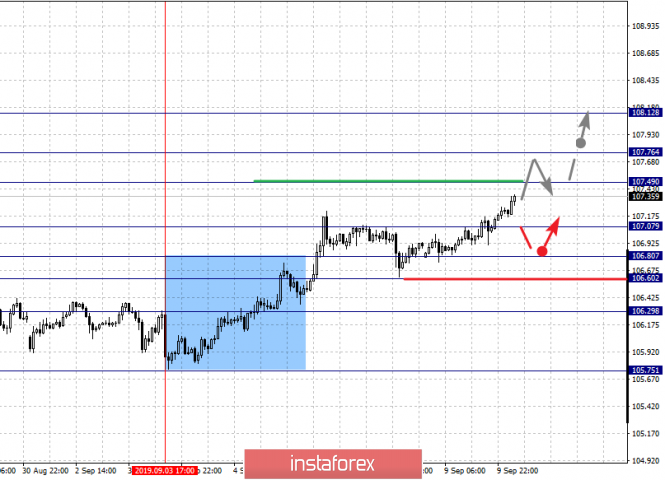

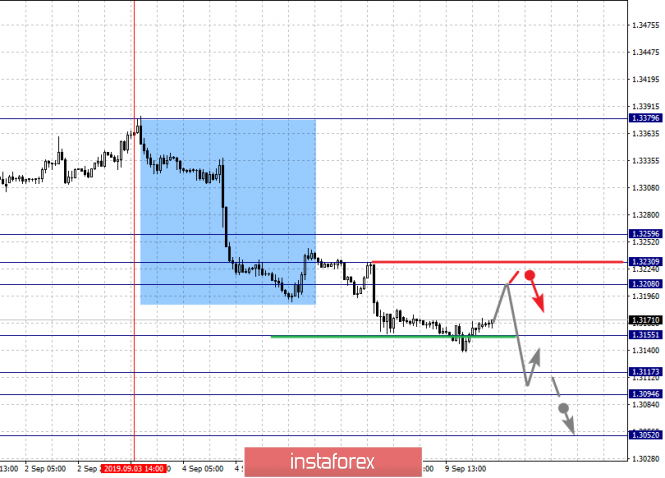

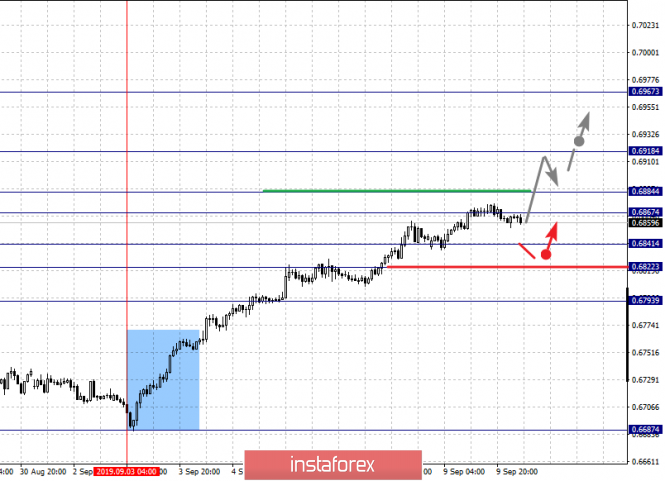

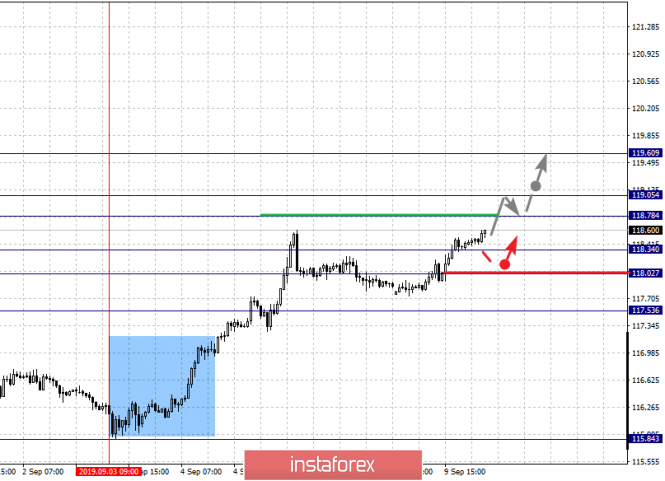

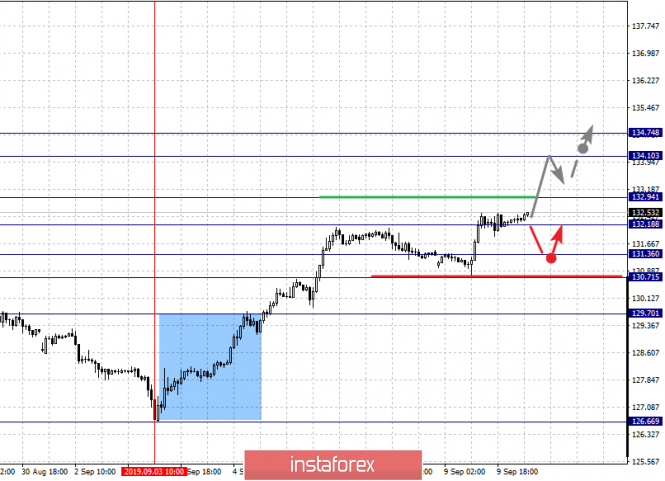

| Fractal analysis of the main currency pairs for September 10 Posted: 09 Sep 2019 06:23 PM PDT Forecast for September 10: Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1155, 1.1122, 1.1097, 1.1047, 1.1008, 1.0987, 1.0960 and 1.0926. Here, we continue to monitor the development of the ascending structure of September 3. The continuation of the movement to the top is expected after the breakdown of the level of 1.1047. In this case, the target is 1.1097. Short-term upward movement, as well as consolidation is in the range of 1.1097 - 1.1122. We consider the level of 1.1155 to be a potential value for the upward trend. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is expected in the range of 1.1008 - 1.0987. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.0960. This level is a key support for the upward structure. Its passage at the price will lead to the formation of a local downward structure. In this case, the first goal is 1.0926. The main trend is the upward structure of September 3. Trading recommendations: Buy: 1.1047 Take profit: 1.1095 Buy 1.1098 Take profit: 1.1120 Sell: 1.1008 Take profit: 1.0988 Sell: 1.0985 Take profit: 1.0960 For the pound / dollar pair, the key levels on the H1 scale are: 1.2460, 1.2408, 1.2351, 1.2300, 1.2266, 1.2218 and 1.2190. Here, we follow the development of the upward cycle of September 3. The continuation of the movement to the top is expected after the breakdown of the level of 1.2351. In this case, the target is 1.2408. The breakdown of which, in turn, will allow us to count on the movement to the potential target - 1.2460. Upon reaching this level, we expect a pullback to the bottom. Consolidated movement is expected in the range of 1.2300 - 1.2266. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.2218. The range of 1.2218 - 1.2190 is a key support for the upward cycle. The main trend is the upward cycle of September 3. Trading recommendations: Buy: 1.2351 Take profit: 1.2406 Buy: 1.2409 Take profit: 1.2460 Sell: 1.2300 Take profit: 1.2268 Sell: 1.2264 Take profit: 1.2218 For the dollar / franc pair, the key levels on the H1 scale are: 0.9991, 0.9974, 0.9947, 0.9917, 0.9865, 0.9849, 0.9824 and 0.9796. Here, we follow the development of the ascending structure of September 4. The continuation of the movement to the top is expected after the breakdown of the level of 0.9917. In this case, the target is 0.9947, near this level is a price consolidation. The breakdown of the level of 0.9947 will lead to movement to a potential target - 0.9974. Upon reaching this value, we expect consolidation in the range of 0.9974 - 0.9991, as well as a rollback to the bottom. Departure for correction is expected after the breakdown of the level of 0.9887. In this case, the target is 0.9865. Short-term downward movement is expected in the range of 0.9865 0.9849. The breakdown of the latter value will favor the development of a downward structure. The main trend is the rising structure of September 4. Trading recommendations: Buy : 0.9917 Take profit: 0.9945 Buy : 0.9948 Take profit: 0.9972 Sell: 0.9885 Take profit: 0.9867 Sell: 0.9865 Take profit: 0.9850 For the dollar / yen pair, the key levels on the scale are : 108.12, 107.76, 107.49, 107.17, 106.80, 106.60 and 106.29. Here, we follow the development of the ascending structure of September 3. Short-term upward movement is expected in the range of 107.49 - 107.76, hence the likelihood of a reversal in the correction. For the potential value for the top, we consider the level of 108.12. Upon reaching which, we expect a pullback to the bottom A correction can take place after the breakdown of the level of 107.07. Here, the target is 106.80. A short-term downward movement is in the range of 106.80 - 106.60. A breakdown of the last value will lead to the development of a downward trend. Here, the potential target is 106.29. Main trend: local upward structure from September 3. Trading recommendations: Buy: 107.50 Take profit: 107.74 Buy : 107.78 Take profit: 108.10 Sell: 107.05 Take profit: 106.82 Sell: 106.78 Take profit: 106.60 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3259, 1.3230, 1.3208, 1.3155, 1.3117, 1.3094 and 1.3052. Here, we follow the development of the descending structure of September 3. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.3155. In this case, the target is 1.3117. Price consolidation is in the range of 1.3117 - 1.3094. We consider the level of 1.3052 to be a potential value for the bottom; upon reaching this level, we expect a pullback to the top. Short-term upward movement is possibly in the range of 1.3208 - 1.3230. The breakdown of the last value will lead to a long correction. Here, the target is 1.3259. This level is a key support for the downward structure. The main trend is the descending structure of September 3. Trading recommendations: Buy: 1.3208 Take profit: 1.3230 Buy : 1.3232 Take profit: 1.3259 Sell: 1.3155 Take profit: 1.3120 Sell: 1.3116 Take profit: 1.3095 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6967, 0.6918, 0.6884, 0.6867, 0.6841, 0.6822 and 0.6793. Here, we follow the development of the ascending structure of September 3. Short-term upward movement is expected in the range of 0.6867 - 0.6884. The breakdown of the latter value will lead to a movement to the level of 0.6918. Price consolidation is near this value. For the potential value for the top, we consider the level of 0.6967. Upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 0.6841 - 0.6822. The breakdown of the last value will lead to a long correction. Here, the potential target is 0.6793. This level is a key support for the top. The main trend is the upward structure of September 3. Trading recommendations: Buy: 0.6886 Take profit: 0.6918 Buy: 0.6920 Take profit: 0.6965 Sell : 0.6840 Take profit : 0.6822 Sell: 0.6820 Take profit: 0.6795 For the euro / yen pair, the key levels on the H1 scale are: 119.60, 119.05, 118.78, 118.34, 118.02 and 117.53. Here, we continue to monitor the development of the ascending structure of September 3. Short-term upward movement is expected in the range of 118.78 - 119.05. The breakdown of the last value will lead to movement to a potential target - 119.60, when this level is reached, we expect a pullback to the bottom. Short-term downward movement is expected in the range of 118.34 - 118.02. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 117.53. This level is a key support for the upward structure. The main trend is the upward cycle of September 3. Trading recommendations: Buy: 118.78 Take profit: 119.05 Buy: 119.07 Take profit: 119.60 Sell: 118.34 Take profit: 118.04 Sell: 118.00 Take profit: 117.55 For the pound / yen pair, the key levels on the H1 scale are : 134.74, 134.10, 132.94, 132.18, 131.36, 130.71 and 129.70. Here, we continue to monitor the development of the upward cycle of September 3. We expect short-term upward movement, as well as consolidation, in the range of 132.18 - 132.94. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the goal is 134.10. For the potential value for the top, we consider the level of 134.74. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is possibly in the range of 131.36 - 130.71. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 129.70. This level is a key support for the upward structure. The main trend is the upward structure of September 3. Trading recommendations: Buy: 132.96 Take profit: 134.10 Buy: 134.10 Take profit: 134.72 Sell: 131.36 Take profit: 130.74 Sell: 130.68 Take profit: 129.80 The material has been provided by InstaForex Company - www.instaforex.com |

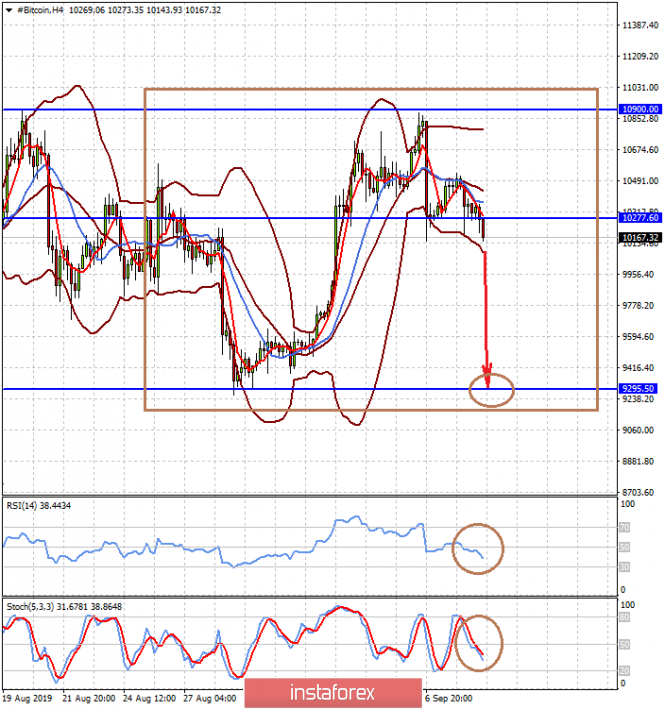

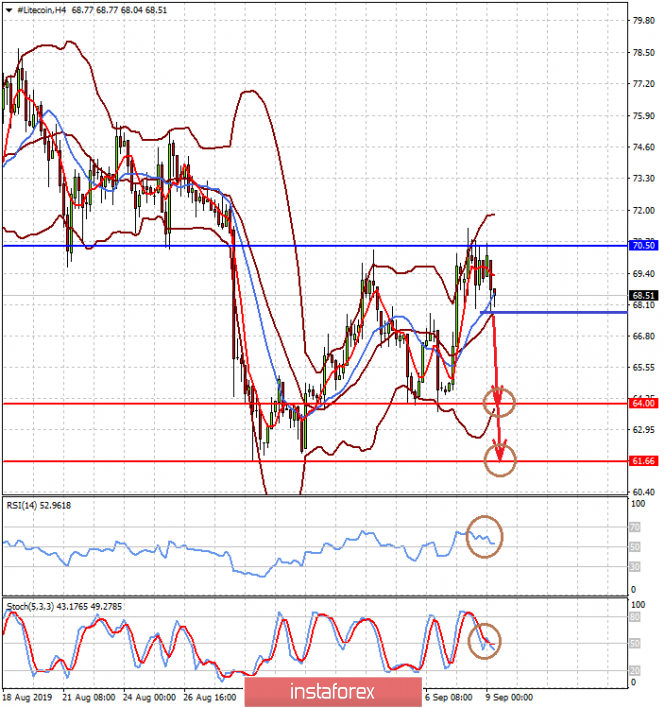

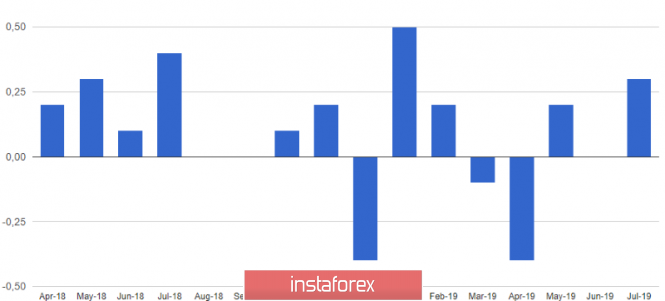

| Posted: 09 Sep 2019 05:21 PM PDT The dynamics of the cryptocurrency market are still strongly influenced by the uncertainty factor of the growth prospects of the global economy. These financial assets are fully influenced by the same reasons as other traditional financial instruments - stocks of companies, currencies, and assets of the commodity market. If the previous markets during the period of soft monetary policy of the World Central Banks, there was a wide interest in cryptocurrencies, the value of which was actively accelerated by speculative sentiments of the market participants due to the lack of volatility in the assets of traditional markets, and recently, investors are clearly reluctant to activate in the current conditions of uncertainty. The global attractiveness of cryptocurrencies, as shown by previous events, was supported not only by speculative interest, but also by the weakness of the US dollar, a decline in interest in gold - assets that do not generate interest income, and wide demand for stocks of companies. But with the beginning of this year, the smooth escalation of the US-China trade confrontation forced investors to "shift" from risky assets, including cryptocurrencies to protective ones, among which the first place was occupied by government bonds of economically developed countries. However, despite the local decline in widespread interest in these financial instruments, we expect that their active use will continue at present, primarily as instruments for hedging the risks of transactions in traditional assets. For example, one can highlight the importance of buying Bitcoin when hedging deals in stocks of US companies included in the S & P500 broad market index. In the past few months, some similar dynamics of this cryptocurrency and the S & P500 index manifested itself clearly and helped players in US stocks insure their financial risks. Let's go back to the possible trends in the cryptocurrency market in the near future. In our opinion, the suspended situation in the negotiations between Washington and Beijing on trade, the still remaining strong positions of the US dollar until the Fed's monetary policy meeting this month will restrain investor interest in second-level cryptocurrencies such as Litecoine and Ethereum. We expect continued limited decline to continue, or, at best, until the meeting of the Federal Reserve on consolidation rates near local minimums. Although in the dynamics of Bitcoin, we assume some revival upward due to its attractiveness as a hedging instrument. Technical picture and trading ideas: We expect that the Bitcoin / USD pair in the short-term will remain in the range of 9295.50-10900.00 in the wake of expectations of the news from the fields of the trade war between the United States and China, as well as the Fed's final monetary policy decision. We believe that a price reduction below $ 10277.60, the pair will open the way for a local decline to 9295.50. In our opinion, the Litecoin / USD pair, having failed to increase above the level of 70.50, will be adjusted downward first to 64.00, and then to 61.66. But from a technical point of view, it is necessary to overcome the level of 60.00. The Ethereum / USD pair also has the potential for a local decline to 164.80 if it falls below 176.35. We believe that, like the two previous cryptocurrency pairs, it will remain in the short-term in the lateral range 164.80-182.50. |

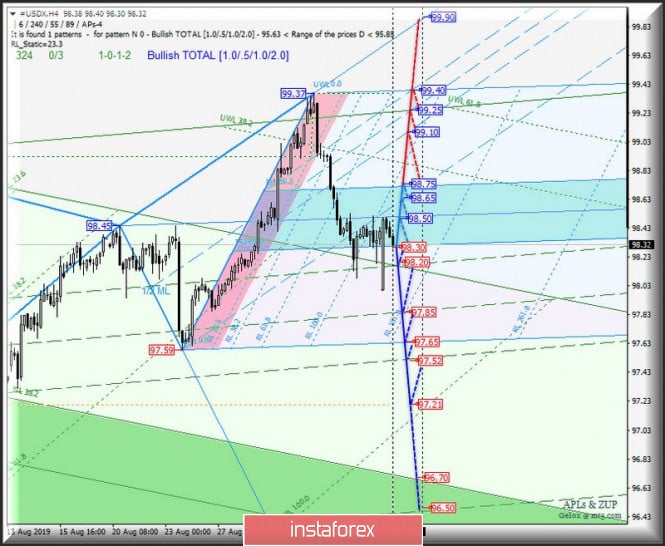

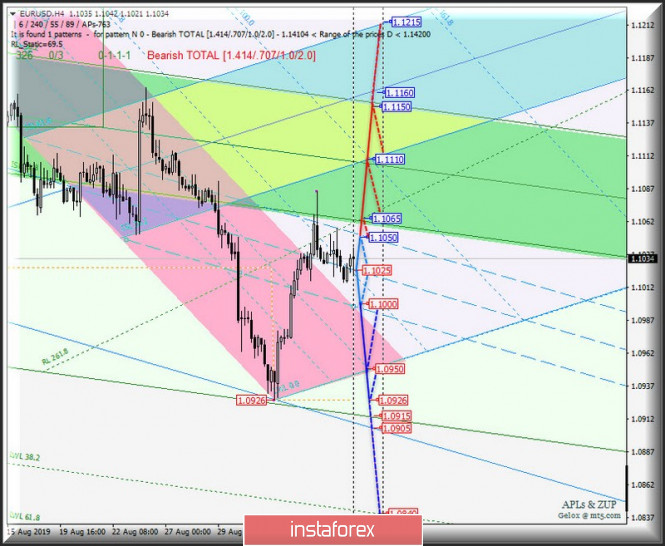

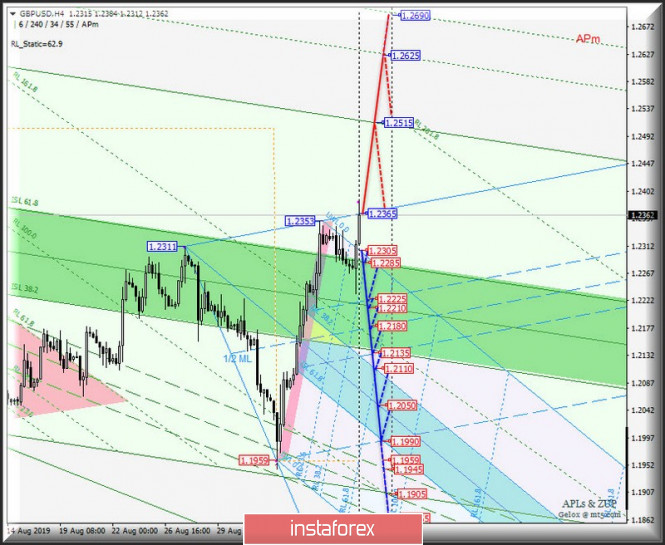

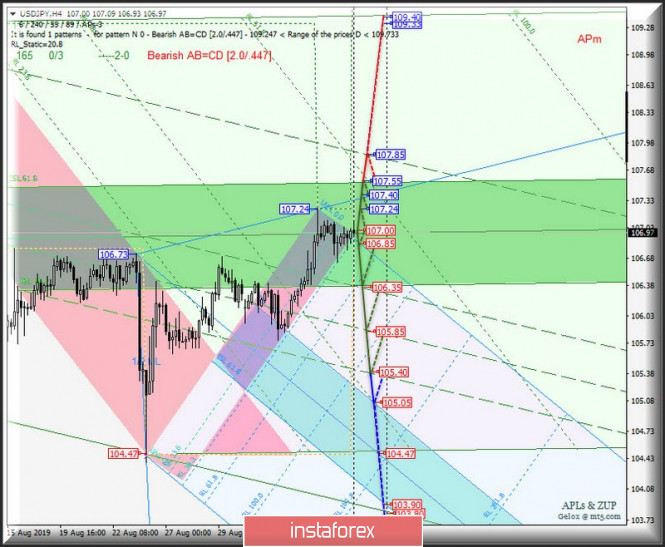

| Posted: 09 Sep 2019 05:21 PM PDT Let me bring to your attention a comprehensive analysis of the movement of currency instruments #USDX, EUR / USD, GBP / USD and USD / JPY from September 10, 2019 Minuette (H4 time frame) ____________________ US dollar index The development of the movement of the dollar index #USDX on September 10, 2019 will continue to be determined by working out and the direction of breakdown of the boundary of the equilibrium zone (98.75 - 98.50 - 98.30) of the Minuette operational scale. The marking of the movement inside this zone is presented in the animated chart. The breakdown of the lower boundary of ISL61.8 (support level of 98.30) the equilibrium zone of the Minuette operational scale fork with the subsequent breakdown of the support level of 98.20 - an option for the development of the movement of the dollar index in the 1/2 Median Line channel (98.20 - 97.85 - 97.52) of the Minuette operational scale fork with the prospect of reaching a local minimum of 97.21. On the other hand, the breakdown of the resistance level of 98.30 (the upper boundary of the ISL38.2 equilibrium zone of the Minuette operational scale fork) will make it relevant to continue the development of the upward movement of #USDX to the boundaries of the 1/2 Median Line Minuette channel (99.10 - 99.25 - 99.40). The details of the #USDX movement are presented in the animated chart. ____________________ Euro vs US dollar The movement of the single European currency EUR / USD on September 10, 2019 will be determined by the direction of the breakdown of the boundaries of the 1/2 Median Line channel (1.1050 - 1.1025 - 1.1000) of the Minuette operational scale fork. Look at the animated chart for the details of this movement. The breakdown of the resistance level of 1.1050 (the upper boundary of the 1/2 Median Line channel of the Minuette operational scale fork) - the movement of the single European currency will continue to the boundaries of the equilibrium zones of the Minuette operational scales fork (1.1065 - 1.1110 - 1.1150) and Minuette (1.1110 - 1.1160 - 1.1215). In case of breakdown of the lower boundary of the 1/2 Median Line Minuette channel (support level of 1.1000), the downward movement of EUR / USD will be directed to the targets - initial SSL (1.0950) of the Minuette operational scale fork - local minimum 1.0926. The details of the EUR / USD movement options are shown in the animated chart. ____________________ Great Britain pound vs US dollar Range Breakdown Direction:

will begin to determine the development trend of Her Majesty's GBP / USD currency movement on September 10, 2019. The breakdown of the UTL control line (resistance level of 1.2365) of the Minuette operational scale fork will determine the continued development of the upward GBP / USD to the final line FSL (1.2515) of the Minuette operational scale fork and warning line UWL38.2 Minuette (1.2625). In the event of a sequential breakdown of the SSL initial line (support level of 1.2305) of the Minuette operational scale forks and ISL61.8 Minuette (1.2285), the development of Her Majesty's currency movement will continue in the equilibrium zone (1.2285 - 1.2210 - 1.2135) of the Minuette operational scale fork taking into account the working out of the boundaries of the 1/2 Median Line Minuette channel (1.2225 - 1.2180 - 1.2135) with a possible prospect of reaching the equilibrium zone (1.2110 - 1.2050 - 1.1990) of the Minuette operational scale fork. The details of the GBP / USD movement can be seen in the animated chart. ____________________ US dollar vs Japanese yen Starting from September 10, 2019, the movement of the USD / JPY currency of the country of the rising sun will become determined by mining and the direction of the breakdown of the boundaries of the channel of the equilibrium zone (107.55 - 107.00 106.35) of the Minuette operational scale. The development options are shown in the animated chart. In case of the breakdown of the support level of 106.35 (the lower boundary of the equilibrium zone ISL38.2 of the Minuette operational scale fork), it will determine the development of the currency of the "country of the rising sun" in the 1 / 2 Median Line Minuette channel (106.35 - 105.85 - 105.40) with the prospect of reaching the upper boundary of ISL38.2 (105.05) of the Minuette operational scale fork. And if the breakdown of the upper boundary of ISL61.8 (resistance level of 107.55) of the equilibrium zone of the Minuette operational scale takes place, then it will be possible to continue the development of the upward movement of USD / JPY to the final Schiff Line Minuette (107.85), maximum of 109.33 and the final line FSL Minuette (109.40). We look at the details of the USD / JPY movement in the animated chart ____________________ The review is made without taking into account the news background. The opening of trading sessions of the main financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index : USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where power factors correspond to the weights of the currencies in the basket: Euro - 57.6% ; Yen - 13.6% ; Pound Sterling - 11.9% ; Canadian dollar - 9.1%; Swedish Krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the start date of the countdown - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

| Canadian dollar in panic: USD/CAD on the verge of collapse Posted: 09 Sep 2019 04:30 PM PDT The beginning of the current week was not favorable for the Canadian dollar: the USD/CAD pair plunged against the background of not too positive data from the US and Canada. Labor market reports from these states have sharply pulled down Canada's currency. The publication of the US Employment Report last Friday slightly weighed on the US currency. However, the dollar eventually managed to recoup the losses. The situation with the Canadian dollar is more complicated, analysts say. Despite the creation of a sufficient number of jobs in Canada (81 thousand), the loonie was unable to hold on to its positions. According to analysts, the results of this month became the second most powerful in 2019 and some of the best over the past five years. They confirm the neutral position of the regulator. At a recent meeting, the Bank of Canada announced the desirability of ongoing monetary stimulus. At the moment, it will remain at the same level, the central bank of Canada emphasized. At the same time, the leadership of Canada recognizes that the escalation of the trade conflict between the United States and China significantly affects the economy of the state, and this effect cannot be called positive. Authorities allow easing monetary policy, but not in the near future. According to analysts' forecasts, we should expect further weakening of the USD/CAD pair and potential testing of the mark below 1.3155. Currently, the Canadian currency is trading at 1.3157–1.3162. This week, the pair's sharp fall and the breakdown of the 1.2905 area are not ruled out. In the event of a negative scenario, a breakdown of the lower boundary of the channel and a continuation of the fall below the level of 1.2545 are possible. However, in the event of a positive development of events, the pair's growth and closing above the level of 1.3495 are not excluded. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. Johnson's Plan B and the positive Irish meeting Posted: 09 Sep 2019 04:30 PM PDT The news background regarding Brexit's prospects is changing with kaleidoscopic speed. Before the pound could react to the verdict of the House of Lords, traders again came under pressure from the rhetoric of the French foreign minister, which cooled GBP/USD bulls. Today, the fundamental background again contributes to the British currency's growth - already thanks to statements by Boris Johnson. Although all the fundamental factors listed above have a "short shelf life", it is necessary to dwell on each of them in more detail. Last Friday night, the House of Lords of the British Parliament approved a bill requiring Johnson's cabinet to ask Brussels for another postponement of the country's exit from the EU. It is noteworthy that, contrary to various assumptions, this bill was approved in the final third reading without a vote - members of the Upper House of Parliament did not introduce a single (!) amendment to it. Although some political analysts have warned that the House of Lords and the House of Commons can "play table tennis" making endless changes and sending each other a draft of this law. But the Lords showed amazing unity in this matter, as it managed to do so in just a few days. Now the bill has gone through all stages of parliamentary consideration, and will gain the force of law after the queen signs it (it is expected that this will happen today or tomorrow). But the optimism of the traders was offset by the comments of the head of the French Ministry of Foreign Affairs, who questioned the feasibility of another Brexit delay. According to him, the European Union is not going to grant Britain a deferment "every three months", especially amid the impasse of the British parliament. Jean-Yves Le Drian recalled that the House of Commons opposed both the "hard" scenario and the deal approved by the EU countries. This thought was picked up by Boris Johnson. He in his own way interpreted the above law, approved by the House of Lords. According to him, the law will only matter if London is offered (!) a delay, but if such a proposal does not follow, then Johnson will not be able to fulfill the requirements of the adopted law. In addition, as British journalists found out, the prime minister intends to convince the EU not to agree to a new delay by sending a corresponding appeal to Brussels. A harsh statement by the French foreign minister was evidence that this scenario could well come true. Paris even declared that it could veto the EU's decision to extend the negotiation process - if London doesn't present "convincing arguments regarding the expediency of this delay". In addition, according to analysts, Boris Johnson can use the current situation to his advantage, provoking the Parliament to dismiss him, calling for an early election. Let me remind you that last week the prime minister initiated this issue, however, MPs did not support his idea of re-election. The members of the House of Commons primarily wanted to legislatively block the hard Brexit on October 31, and then consider the issue of early elections. But if Johnson's team makes deferring Brexit legally impossible, the House of Commons will have no choice but to re-election. The implementation of this scenario will be the victory of the current prime minister, given the current rating of the Conservative Party. In this case, Johnson will only strengthen his position in Parliament, which will allow him to realize his political ideas - including regarding the prospects of Brexit. Thus, a possible retaliatory move by Boris Johnson did not make it possible for the British currency to continue an offensive throughout the market. The GBP/USD pair fell to 1.2230 today in the morning, with the clear intention of entering the area of the 21st figure. But the pair turned sharply and jumped by almost 150 points at the beginning of the US session. Market participants reacted to the outcome of the meeting of the prime ministers of Britain and Ireland. And although there are still no definite results, the rhetoric of the parties inspired GBP/USD bulls - traders again had a ghostly hope for a deal before October 31. However, this hope is too illusory, and the reaction of traders is too emotional. Boris Johnson once again stated that he wants to achieve a deal and believes that this can be done before October 18. He called the hard Brexit version a "failure", although he did not rule out its implementation. The British prime minister also assured that under no circumstances would London allow a tight border between Ireland and Northern Ireland. Summarizing the outcome of the meeting, Johnson noted that he and his Irish colleague had found "common ground on a number of issues." At the same time, politicians unanimously stated that a breakthrough in the negotiations has not yet occurred and significant differences remain. Let's face it - this is a rather dubious reason for corrective growth. In addition, it is worth noting that today, members of the House of Commons will re-vote for holding early elections (the discussion and voting process can keep going until late in the evening or at night). The results of this vote can provoke strong volatility for the pair, therefore, it is now impractical to open trading positions in one of the parties. By the way, parliamentary speaker John Bercow has already announced that he will resign if Parliament votes for re-election. This fact exerted short-term pressure on the pair, but then the bulls regained their positions. In my opinion, the corrective growth of the pair will be short-term. London and Brussels are still at different poles regarding the prospects for backstop and other equally important Brexit issues. Today's "constructive meeting" of Johnson and Varadkar is unlikely to have any far-reaching political consequences. As soon as this fact is voiced by one of the EU leaders, the market will recall the "plan B" of the British prime minister, who intends to legally circumvent the action of the Brexit deferment law. In this case, the pound will again be under significant pressure, and will return to the middle of the 21st figure against the dollar. The material has been provided by InstaForex Company - www.instaforex.com |

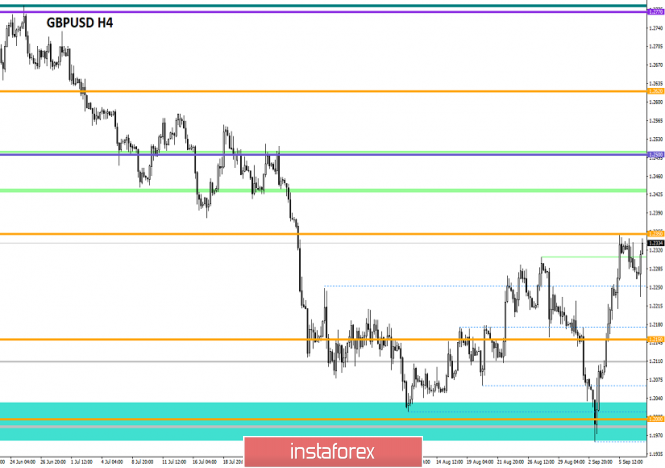

| Posted: 09 Sep 2019 04:30 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 139p - 147p - 176p - 144p - 65p. Average volatility over the past 5 days: 134p (high). In London, the last session of Parliament kicked off before its forced leave for five weeks by Boris Johnson. Of the interesting moments of the meeting, it can already be noted that Parliament speaker John Bercow announced his resignation if Parliament approves early elections today (voting will take place a little later). Otherwise, he will leave his post on October 31. According to insider information from the Parliament, the Opposition parties have already decided not to support the government's proposal for early elections, as for the first time. According to Labour and Opposition Leader Jeremy Corbyn, the government must guarantee the impossibility of a "hard" Brexit BEFORE the re-election. The position of Boris Johnson in this matter is clear and obvious. He understands that the current composition of the Parliament will put "sticks in the wheels" to the last. Even if the prime minister tries to circumvent the decision of the Parliament and ask the EU not to grant a postponement for Brexit, MPs can initiate the opening of a criminal case against Johnson for disobeying British law. Thus, Johnson wants to form a new Parliament, hoping to get the majority of the seats in it, which will allow him to make decisions almost solely through the members of his party. Boris Johnson has already begun to implement internal cleansing - 21 party members have left its ranks. It is clear that the opposition will not approve early elections, as this means additional chances for the Johnson government to still implement Brexit without an agreement with the European Union until October 31. In general, today we will witness the final session of Parliament before the holidays and, possibly, even re-elections. Meanwhile, macroeconomic reports from the UK pleased traders. In July, GDP grew by 0.3% m/m, and industrial production by 0.1% m/m. Unfortunately, production fell by 0.9% in annual terms. However, the pound sterling is still growing on September 9, either responding to generally good news, or to traders' expectations that MPs will not accept Johnson's proposal for re-election. Most likely, based on both of these factors. We state the fact: the mood among traders now remains "bullish" due to the events of last week, or rather, the defeats of Boris Johnson in the Parliament, because of which the likelihood of a hard Brexit has significantly decreased. However, any victory of Boris Johnson will again bring the country closer to leaving the EU on October 31, and the pound to a new fall against the US currency. Trading recommendations: The GBP/USD currency pair, after a slight correction, resumed the upward movement, which is still completely substantiated fundamentally. Thus, in the coming hours, it is recommended to continue to trade on the rise while aiming for the first resistance level of 1.2437. Further dynamics of the pound/dollar pair will depend on the results of the vote on Boris Johnson's proposal to dissolve the Parliament and form a new composition. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 09 Sep 2019 04:15 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 39p - 53p - 69p - 68p - 37p. Average volatility over the past 5 days: 53p (average). The euro currency ends the first trading day of the week, September 9, quite positively. Given the fact that no macroeconomic statistics were published today, the euro was still able to show growth by 40 points from the low of the day it had reached at night. Not bad for the euro. If the price does not sharply retreat in the coming hours, then the EUR/USD pair will overcome the Senkou Span B line, which is a strong resistance. Accordingly, the signal to buy a "golden cross" will increase, which will give confidence to the bulls in their own strengths. In the near future we are waiting for the euro/dollar pair at the resistance level of 1.1099. From a fundamental point of view, as we have already said, there is absolutely nothing to note today. Thus, we can only speculate about the euro's prospects ahead of the ECB meeting, which will be held this Thursday. According to the absolute majority of economists, Mario Draghi will announce not only a reduction in rates, but also announce the use of other instruments that stimulate the economy of the eurozone. First of all, we are talking about the resumption of the quantitative stimulus program, that is, the redemption of bonds from the open market, filling the market with cash at the same time. To do this, you will have to turn on the printing press, which until recently worked continuously since 2008. These measures are designed to spur inflation, business activity, consumer confidence and economic growth. However, if the ECB goes for monetary policy easing this week, it almost guarantees itself criticism from US President Donald Trump, from whom we expect a new batch of accusations of deliberate undervaluation of the euro. Of course, the ECB is not obliged to respond to criticism of the odious US leader. But it is worth remembering and understanding that the angrier Trump is then the higher the probability of a trade war between the United States and the EU. Trump believes that the European Union, first, particularly understates the euro exchange rate to have an advantage in production, and secondly, the advantage in production plus a cheap euro gives an advantage in world markets for products from the EU. Accordingly, products from the European Union displace American products from world markets, becoming more competitive. This is reason enough to accuse the European Union of "unfair treatment of the US" and impose duties on the automotive industry, which is popular in the United States. In addition, Trump is likely to again bring down a barrage of criticism on the Federal Reserve and Jerome Powell, because the Fed will hold a meeting a week after the ECB meeting. As Trump needs much lower rates than current, but Powell goes to mitigation rather reluctantly, moreover, in his last speech, he in no way hinted at a possible rate cut in September, it needs a little "spur" to remind you that monetary policy should be more flexible as quickly as possible. In general, the war between Powell and Trump is also likely to get its continuation this week and next. Well, what about the euro/dollar currency pair? The euro is still growing, and this is positive. However, if the ECB softens monetary policy, the euro will begin to decline almost guaranteed. It is difficult to imagine now what can make traders refuse new sales of the euro if the regulator lowers rates to a record -0.5% and revives the QE program? Trading recommendations: The EUR/USD pair resumed the upward movement as part of a very unstable upward trend. Thus, it is now recommended to buy the euro while aiming for 1.1099. The market may remain in a "bullish" mood until Thursday. It is recommended to return to selling the pair not earlier than when the price is consolidated below the Kijun-sen critical line. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. The material has been provided by InstaForex Company - www.instaforex.com |

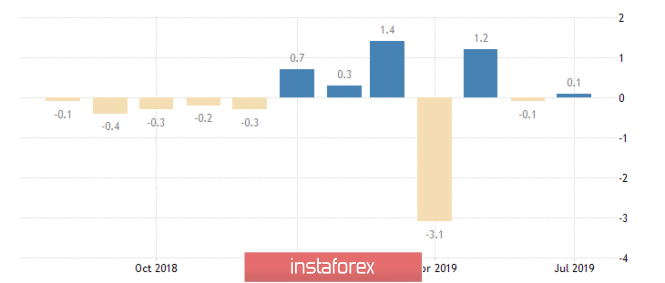

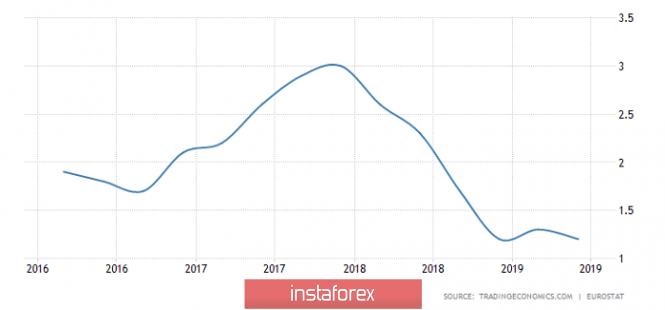

| Posted: 09 Sep 2019 03:56 PM PDT The euro ignored data on German export growth, while the British pound strengthened against the US dollar after data that the UK economy will be able to avoid a recession at the end of this year. According to the data, German exports unexpectedly increased in July this year, which is the only positive news for the European Central Bank in the past two weeks, when a terrible series of fundamental statistics came out According to the report of the Federal Bureau of Statistics, exports grew by 0.7% in July compared with the previous month, amounting to 115.2 billion euros. Economists expected it to decline by 0.6%. Exports grew by 3.8% compared to July 2018. But imports, on the contrary, decreased by 1.5% compared with June, amounting to 93.7 billion euros. In general, the positive balance of foreign trade in Germany in July amounted to 21.4 billion euros. Despite this, the likelihood of a recession continues to roll like a snowball. Therefore, the measures of the European Central Bank, which will be announced this Thursday, will be very helpful. Talking about a sharp depreciation of the European currency will also not be entirely correct, since the market has already partially laid down lower interest rates and a return to the asset repurchase program. The ECB is expected to lower its deposit rate by at least 10 basis points and announce the resumption of its quantitative easing program. If the actions of the European regulator are sharper, then in this case, the pressure on the euro will return. Today, US Secretary of the Treasury Mnuchin made a statement, who, in an interview with Fox Business, said he did not expect a recession in the US in the foreseeable future and looked forward to a healthy and steady economic growth before the end of the year. Mnuchin also noted that he was ready to sign an agreement with China if it would be beneficial for the United States and that the continuation of trade negotiations should be positively assessed. Let me remind you that at the end of last week the demand for safe haven assets and gold fell sharply after it became known that the parties would continue negotiations in October this year. As for the technical picture of the EURUSD pair, it remained unchanged. At the beginning of the week you should not count on active movements. Most likely, the bears will attempt a return below the support of 1.1020, but the demand for the euro will resume after updating lows around 1.0990 and 1.0950. However, only a breakthrough of the 1.1055 range will strengthen the demand for the trading instrument and lead to the updating of local highs in the region of 1.1090 and 1.1120. GBPUSD Another thing is the British pound, the demand for which returned after an unsuccessful attempt to break through the lows in the region of 1.2260. The data on the growth of the UK economy, which has stabilized from May to July thanks to the services sector amid the risk of a hardBrexit scenario, led to a sharp increase in GBPUSD. According to the report of the UK National Bureau of Statistics, UK GDP in July of this year grew immediately by 0.3% compared to the previous month and by 1.0% compared to July 2018. The growth of industrial production over the same reporting period helped to level weak data on the deficit in foreign trade in goods. Thus, UK industrial production increased by 0.1% in July compared with June, while economists expected it to decline. Compared to July 2018, production decreased by 0.9%. The main decline was noted in the manufacturing industry, where production from May to July decreased by 1.1%, and in the construction sector - by 0.8%. But as I noted above, support was provided by the service sector, which grew by 0.2%. Demand for the pound is also associated with a reduction in the fears of the hard Brexit scenario. It is expected that this week the queen will sign a decree that will not allow the country to exit the EU without a deal. However, this may not be enough for the British prime minister, and he will try to withdraw the country from the EU, even contrary to the above bill. As for the technical picture of the GBPUSD pair, counting on such "cheerful" growth in the future will not be entirely correct. Updating the highs on one positive news is not a reason to increase long positions, since the political situation with Brexit has come to a complete standstill. It is best to wait for the correction of the trading instrument in the region of 1.2240, which could become the boundary of the side channel, and open long positions in this range. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 09 Sep 2019 03:52 PM PDT Pound Despite the crushing blows that he received from Parliament last week, Prime Minister Boris Johnson said Britain would leave the EU no later than October 31, 2019. Let me remind you that the Parliament blocked Johnson's right to leave the EU without an agreement, and then the Parliament blocked Johnson's ability to hold early elections. A possible option was opened by Ireland: as you know, the key problem for leaving the EU and the agreement was the need for Britain to enter the customs border with Ireland if it leaves. Johnson seems to have received Ireland's readiness to resolve the border issue with Britain directly - upon exit. This opens up the possibility of an agreement with the EU. Euro The main event for the euro - ECB decisions on Thursday September 12 - The ECB has promised a new stimulus package. The idea expressed in the media: new incentives are practically useless for the EU economy - however, the ECB cannot allow the euro to strengthen ... Thus, perhaps the main goal of the ECB now is precisely the undervaluation of the euro exchange rate. The material has been provided by InstaForex Company - www.instaforex.com |

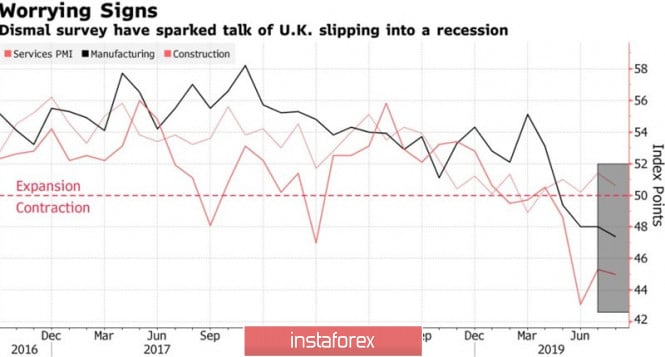

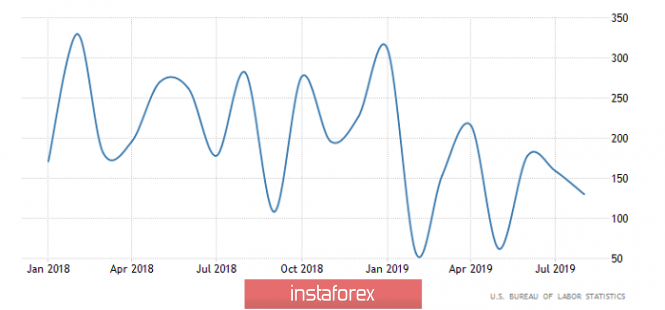

| The pound bounced off the bottom Posted: 09 Sep 2019 03:41 PM PDT The British economy is blinking red, and the pound marks its fastest weekly rally since May and rightfully tops the list of the best performers of the G10 in this time period. This happens when politics rules the ball. Great Britain's Parliament is pushing Prime Minister Boris Johnson to commit suicide by prolonging the transitional period by 3 months until January 31, which reduces the risks of a messy Brexit. The prime minister said that he would rather die in a ditch than agree to a divorce from the EU later than October 31, and the sterling rises from the ashes, sincerely hoping thatJeremy Corbyn's rise to power would allow it to grow to $1.3, and then to $1.35. A strong economy is a strong currency. The pound has repeatedly violated this principle over the past few years. Once again in September, when business activity in the manufacturing and construction sectors fell below a critical level of 50, disappointing PMI statistics in the services sector and retail sales, as well as problems in the housing market, suggested that the recession was near. As a rule, in such a situation, central banks, seeking to pull the economy out of the abyss, lower rates, and the exchange rate of the national currency drops. In the case of sterling, everything happened just the opposite. The dynamics of British business activity The British Parliament did not just prolong the transition. It is opposed to Boris Johnson's desire to organize a snap election on October 14. According to the Labour Party, they should be held a couple of weeks later so that the current prime minister does not have the opportunity to bring his ploy to life and make messy Brexit a reality. The chances of the country's exit from the EU without a treaty are falling, and the pound continues to please its few fans. According to State Street Bank, Societe Generale SA and MUFG, the GBP/USD pair will rise by about 5% to 1.3 if, as a result of early elections, Jeremy Corbyn takes over as prime minister. The ideas of the leader of the Labour Party about nationalization, increasing borrowings and budget spending are liked by few people, but of the two evils it is customary to choose the least. If with the participation of Corbyn, London succeeds in signing an agreement with the European Union, sterling has a good opportunity to jump to $1.35. UBS Wealth Management believes that for the growth to $1.3 pounds the mere fact of prolonging the transition period until January 31 will be enough. The British currency comes back to life, although uncertainty has not disappeared. History repeats itself, and the extension of the transitional period from March 29 to October 31 showed that sterling's successes were temporary: in March, it rose to 9-month highs, and then it fell to a 3-year low. It will be even more interesting to observe the upheavals of the political struggle and the release of data on the labor market of Great Britain during the week of September 13. Technically, quotes going beyond the short-term downward channel and activating the inverted "Shark" pattern increase the chances of the "bulls" to realize its target by 88.6%. It is near the 1.27 mark. The material has been provided by InstaForex Company - www.instaforex.com |

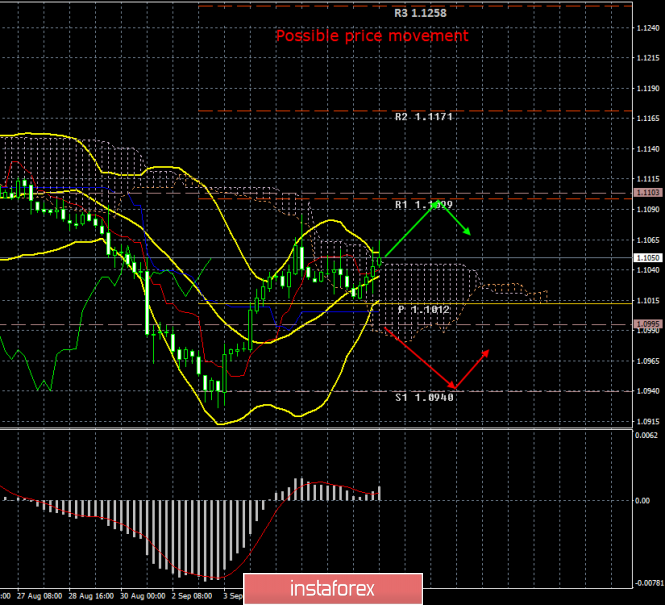

| EURUSD needs to break and stay above 1.1088 in order to move towards 1.1150 or higher Posted: 09 Sep 2019 11:46 AM PDT EURUSD is challenging the previous support now resistance at 1.1050-1.1080 once again. Last time we were here price got rejected. If we see a break above 1.1090 then we will have a bullish short-term signal.

EURUSD is challenging the resistance area once again. A break above it will at least push price at the 61.8% Fibonacci extension of the first leg up. There we also find the important downward sloping trend line resistance.

|

| Gold challenges $1,500 while still vulnerable to a move lower towards $1,470. Posted: 09 Sep 2019 11:40 AM PDT Gold price remains in a short-term bearish trend. Although medium-term trend remains bullish, I expect soon to see price challenge the bullish medium-term channel. This test is at $1,470-80 area.

Gold price remains inside the medium-term bullish channel. Price is moving lower to test the $1,470-80 support area. This was noted in our past analysis since the break of $1,533. Bulls should be patient. Bears need to break at least below $1,475 and stay below $1,500 on any bounce in order to hope for a bigger correction towards $1,400-$1,350. Until then medium-term trend remains bullish.

|

| September 9, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 09 Sep 2019 09:28 AM PDT In Mid-August, the EUR/USD has been trapped between 1.1235-1.1175 for a few trading sessions until bearish breakout below 1.1175 occurred on August 14. Bearish breakout below 1.1175 promoted further bearish decline towards 1.1075 where the backside of the broken bearish channel has provided temporary bullish demand for sometime (Bullish Triple-Bottom pattern). Bullish persistence above 1.1115 was needed to confirm the short-term trend reversal into bullish. However, the depicted Triple-Bottom pattern was invalidated especially after the EURUSD pair bulls have failed to establish Bullish persistence above 1.1115. Moreover, the recently established short-term uptrend line has been invalidated as well thus rendering the short-term outlook as bearish. Two weeks ago, a quick bearish decline was demonstrated towards 1.0965 - 1.0950 where the backside of the broken channel came to meet the EURUSD pair again. Risky traders were advised to look for a valid BUY entry anywhere around the price levels of 1.0950. All T/p levels were successfully reached. Trade recommendations : Conservative traders should be looking for a valid SELL entry around the current price levels 1.1050-1.1070. S/L should be placed just above 1.1115 while target levels to be located at 1.1025, 1.0988 and 1.0935. The material has been provided by InstaForex Company - www.instaforex.com |

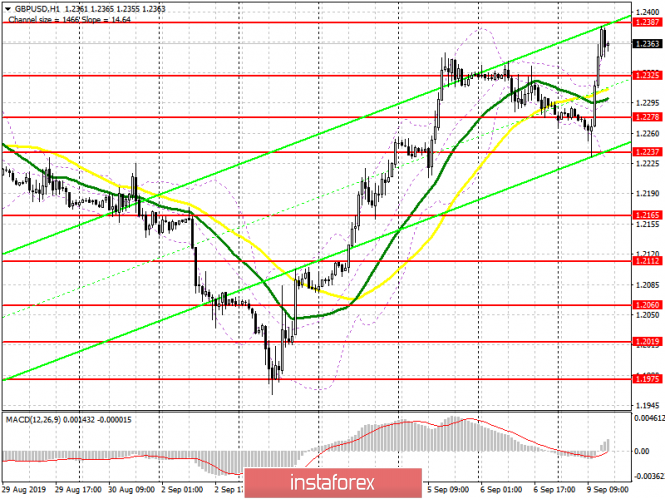

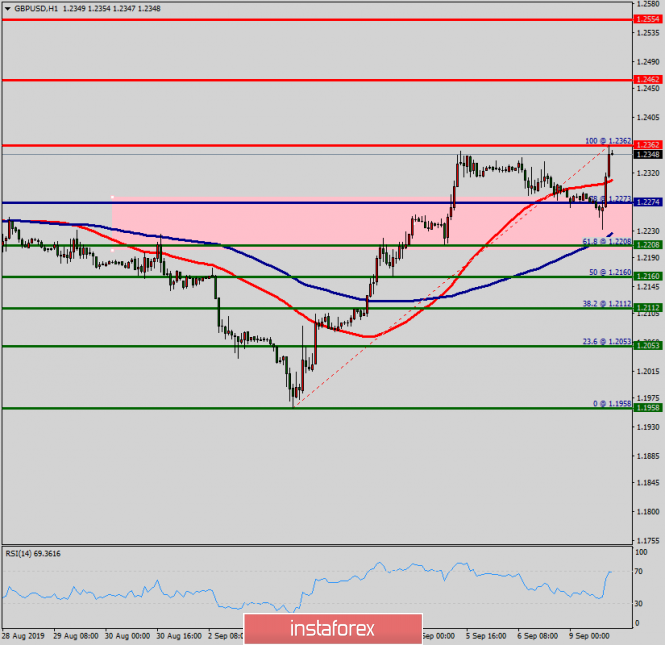

| September 9, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 09 Sep 2019 09:01 AM PDT

On July 26, Bearish breakdown below 1.2385 (Wedge-Pattern Key-Level) facilitated further bearish decline towards 1.2210 and 1.2100 which corresponded to significant key-levels on the Weekly chart. In Early August, another consolidation-range was temporarily established above 1.2100 before August 9 when temporary bearish movement was executed towards 1.2025 (Previous Weekly-Bottom). Recent bullish recovery was demonstrated off the recent bottom (1.2025). This brought the GBP/USD pair back above 1.2100 (Lower limit of the recently established consolidation-zone) within the depicted short-term bullish channel. As expected, further bullish advancement was demonstrated towards 1.2230 then 1.2280 where recent bearish rejection was demonstrated (near the upper limit of the recent movement channel). Bullish persistence above 1.2160 (the recent consolidation range pivot-point) was needed to enhance further bullish advancement. Instead, another quick bearish decline was demonstrated towards 1.2100 then 1.2000 (corresponding to the previous bottom established on August 9). Last Week, Early signs of bullish recovery (Bullish Engulfing candlesticks) were manifested around 1.1960 bringing the GBPUSD back above 1.2100. As expected, further bullish advancement was demonstrated towards 1.2200 where the GBPUSD pair looked overbought. However, recent bullish momentum was demonstrated towards 1.2320 bringing the pair back inside the depicted movement channel again. Further bullish advancement should be expected towards 1.2400 - 1.2420 where the upper limit of the current movement channel comes to meet the pair. The Long-term outlook remains bearish as long as the upper limit of the current movement channel around 1.2400 remains defended by the GBPUSD bears. Trade Recommendations: Conservative traders should wait for the current bullish movement to pursue towards 1.2400-1.2420 (upper limit of the depicted movement channel) for a valid SELL entry. T/P level to be placed around 1.2300, 1.2250 then 1.2220 while S/L should be placed above 1.2450. The material has been provided by InstaForex Company - www.instaforex.com |

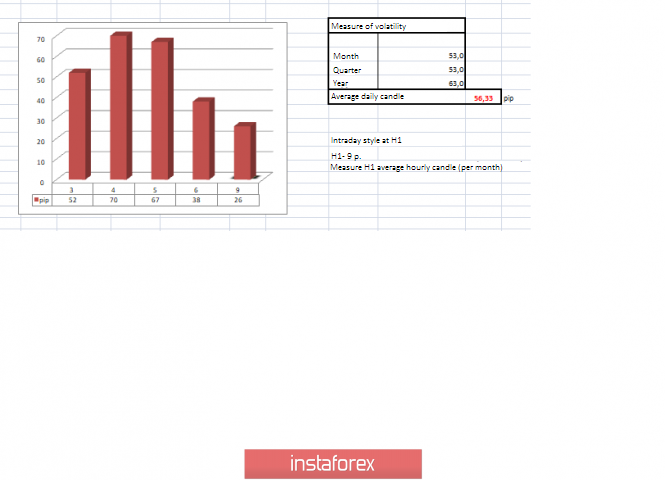

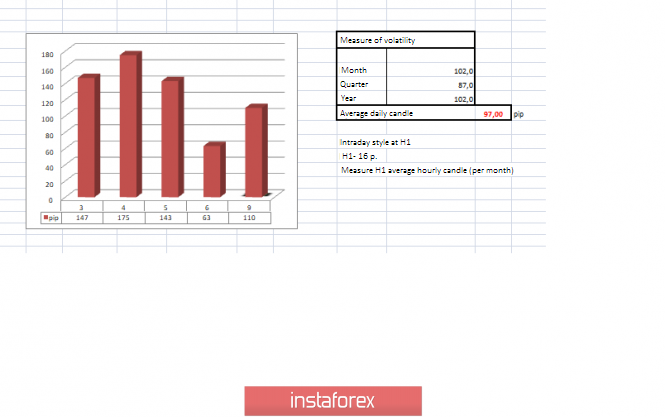

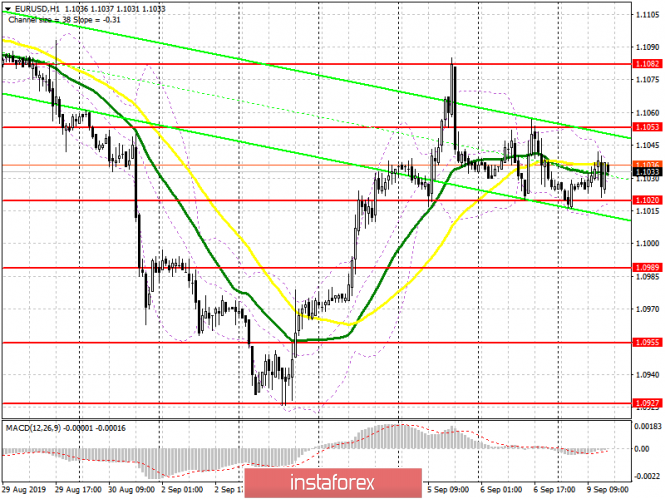

| Trading recommendations for the EURUSD currency pair – placement of trade orders (September 9) Posted: 09 Sep 2019 07:39 AM PDT The euro/dollar currency pair showed a low volatility of 38 points by the end of last week, as a result of which there was an attempt to recover. From technical analysis, we see that there was an attempt to restore the downward trend, and the level of 1.1080 still plays the role of resistance. There is only one "but", the restraint of sellers is felt in the market, which can result in a certain range fluctuation. As discussed in the previous review, speculators had hoped for a recovery process, but the result was a sluggish swing. It is not yet known whether further work will be carried out in the correction phase since the freezing in the form of a narrow flat can be delayed, but more on that later. Considering the trading chart in general terms (daily period), we see that the corrective move is still preserved on the market when considering everything that happens as a global trend, but there is a characteristic slowdown with a resistance point of 1.1080. The level of 1.1080, where the quotation rested, displays the lower limit of an accumulation from August. Friday's news background was full of statistics, and so, the first indicators of Europe's GDP flew in, where they predicted a slowdown in economic growth, which, in principle, was obtained, not only to 1.1%, as expected, but to 1.2%. After that, more worthwhile data came out in the form of a report by the United States Department of Labor, where they expected a reduction in the number of people employed in the non-agricultural sector, in principle, they received it from 159K to 130K. In this case, the decline did not have a catastrophic effect, and, in principle, market participants were ready for this. In addition to everything, the average working week increased from 34.3 hours to 34.4 hours, as did the average hourly wage by 0.4%. The information background was imprisoned in the divorce proceedings, so this time we had the approval of the House of Lords regarding the prohibition of a hard exit of Britain from the EU, in particular, this bill carries a request for a new delay. The French Foreign Minister, who criticized the delay in the process, said in particular, "We are not going to do this every three months." Europe needs clear explanations in terms of the need for deferment, with subsequent guarantees. In turn, British Prime Minister Boris Johnson is still unable to acknowledge his mistakes and continues to assert a 100% exit on October 31, even contrary to the intention of the United Kingdom Parliament to achieve a new postponement. He made such a statement today at a joint press conference with the Prime Minister of Ireland, Leo Varadkar, in Dublin, where the issue of borders was discussed. Today, in terms of the economic calendar, we do not have any solid data on Europe and the United States, thereby all hope for a further information background. Further development Analyzing the current trade chart, we see sluggish fluctuations within 1.1015/1.1050 where the quote seems to come to halt in expectation of something valuable, perhaps, of the upcoming ECB meeting (September 12). Traders, in turn, are in no hurry to make hasty actions, as, referring to the information and news background and, in particular, to the upcoming meeting of the ECB, there are good prerequisites for the depreciation of the euro. Thus, if there will be local jumps to the recent resistance point, they are temporary and are not so interesting in terms of laying the main trade deals. It is likely to assume a temporary fluctuation within the previously indicated limits of 1.1015/1.1050, were entering the market from current points is not entirely acceptable, so it makes sense to wait for the most acceptable moment. Based on the above information, we will derive trading recommendations:

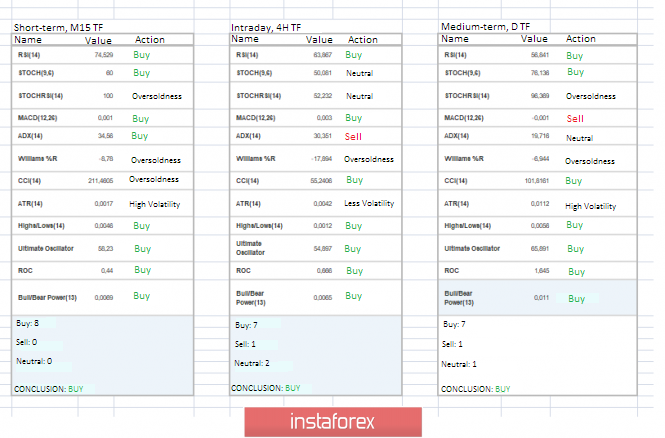

Technical analysis Analyzing different sectors of timeframes (TF), we see quite an interesting picture, so, indicators in the short term assess the current slowdown in the form of a sell signal, but the intraday took a neutral position. The medium-term outlook barely took a downward trend, although it is at the limit, and it is rational to designate it as neutral. Volatility per week / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (September 9 was built taking into account the time of publication of the article) The volatility of the current time is 26 points. If the information background will not be able to interest market participants, we will remain in a sluggish oscillation with low volatility. Key level Resistance zones: 1,1100**; 1,1180* ; 1,1300**; 1,1450; 1,1550; 1,1650*; 1,1720**; 1,1850**; 1,2100 Support zones: 1,1000***; 1,0850**; 1,0500***; 1,0350**; 1,0000***. * Periodic Level ** Range Level *** Psychological level **** The article is based on the principle of conducting transactions, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading recommendations for the GBPUSD currency pair – placement of trade orders (September 9) Posted: 09 Sep 2019 07:39 AM PDT At the end of the last trading week, the pound/dollar currency pair showed low volatility of 63 points, resulting in a sluggish amplitude fluctuation. From technical analysis, we see that the week was intense and hot, which is only the movement itself, more than 360 points of vertical growth. So where did the quotation go – to the range level of 1.2350, where it formed the primary slowdown and, as a fact, a gradual recovery process. From logic and technical analysis, the level of 1.2350 is an excellent point of resistance, but in terms of FOMO and panic of the information flow, you cannot be 100% sure that the upward move is completed. As discussed in the previous review, traders took a wait-and-see position, analyzing the possibility of breaking into a downward move in terms of restoring quotes. In some ways, they managed to enter the market, but Friday's volatility was low and the expected coordinates were not achieved. Considering the trading chart in general terms (daily period), we see that the quote has returned to the peak level of the previous correction, which is not bad, but not good either. As I have repeatedly mentioned, this kind of return of quotes beyond the previous correction is not a good signal in terms of a healthy trend. Whether the slowing trend, as it was in late 2016 and early 2017, is still unknown, traders are still guilty of a strong informational noise, which unjustifiably lifted the quote. Friday's news background contained a report from the United States Department of Labor, which expected a reduction in the number of people employed in the non-agricultural sector, and it was received from 159K to 130K. At the same time, the unemployment rate was confirmed at 3.7%, but the average hourly wage rose to 0.4%. Did the news have pressure on the US dollar? No way. The information background continues to revolve around the divorce proceedings, where on Friday it became known that the House of Lords approved the bill banning hard Brexit, that is, the bill on the postponement will already hit the table of Queen Elizabeth II for further signing. In turn, Boris Johnson is not discouraged and tries to prepare a plan according to which any further delay in the country's exit from the EU will be legally impossible. There are no details of Barbaross's plan yet. From the European side, the first criticism from the French Foreign Minister, Jean-Yves Le Drian, appeared. So, the French Foreign Minister is very worried about another delay and wants the British to hear what they want at all. Le Drian also added that we are not going to provide a respite every three months. Criticism is a completely normal occurrence, but they will give a delay, let's recall only the statement of the European Commission back in August when they proposed this delay. Finally, there was news that Boris Johnson's office was again under pressure, and so, Minister for Labor and Pensions Amber Rudd resigned due to disagreements with the Prime Minister. Today, in terms of the economic calendar, we have data on industrial production in Britain, where, as expected, there is a decrease of 0.9%. In the center of events, of course, is the background information about the vote in Parliament on early elections. However, the House of Commons, although it is ready to go to early elections, is not October 15, as Johnson wishes, but October 30. Thus, pressure in terms of background will remain in the market, which again can play into the hands of volatility. Further development Analyzing the current trade chart, we see that the pound once again reeling, recovery quotes is at the limit of return, which contributed to forcing the background information. Speculators, in turn, are insured and fix previously opened short positions in the sense that due to the upcoming vote, trading forces can change, and you need to be ready for this. It is likely to assume that the fluctuations within the corridor of 1.2270/1.2350 will remain for a long time, but it is possible to exit the framework today. Therefore, we analyze the boundaries for breakdown and try to enter the market precisely on the branch of the movement. Based on the above information, we will derive trading recommendations:

Technical analysis Analyzing a different sector of timeframes (TF), we see that the indicators in all major time areas again took an upward position, but due to the high background indicators bear a variable character again. Volatility per week / Measurement of volatility: Month; Quarter; Year. Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (September 9 was built taking into account the time of publication of the article) The volatility of the current time is 110 points, which already exceeds the daily average by 13%. It is likely to assume that the volatility of the day can still rise to the limits of 140 points due to the same information background. Key level Resistance zones: 1,2350**; 1,2430; 1,2500; 1,2620; 1,2770**; 1,2880 (1,2865-1,2880)**. Support zones: 1,2150**; 1,2000***; 1,1700; 1,1475**. * Periodic Level ** Range Level *** The article is based on the principle of conducting transactions, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis for EUR/USD and GBP/USD on September 9th. Surprises in the British Kingdom Posted: 09 Sep 2019 07:35 AM PDT EUR/USD

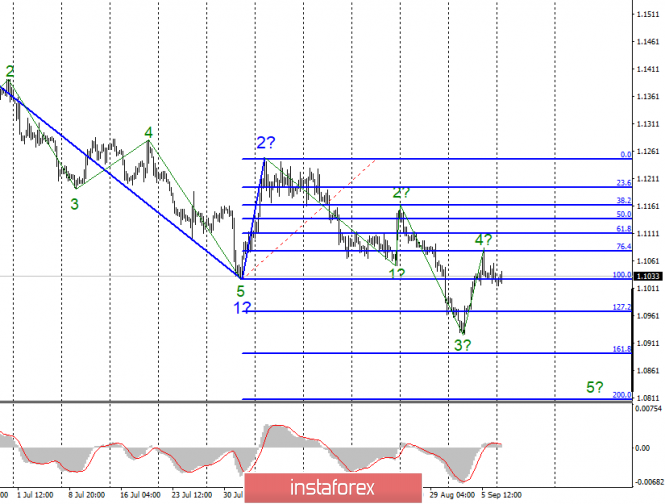

On Friday, September 6, the EUR/USD pair ended with a decrease of 5 basis points, which did not affect the current wave pattern, suggesting the construction of a downward wave 5 in the expected 3. Thus, an unsuccessful attempt to break through the 76.4% of the Fibonacci level – still sends the euro/dollar instrument down to 9 and 8 figures. Most of Friday's economic reports in America were not received by the foreign exchange market. Neither Nonfarm, nor unemployment, nor salary data entailed serious exchange rate fluctuations. This is odd. Today, tomorrow and the day after tomorrow, there will be no interesting reports in the EU and the US. Monday, thus, could be used by the market to "close" Friday's events. But, as we can see, today the activity of the currency market leaves much to be desired. Hence the conclusion: the markets are focused on the ECB meeting, which will be held on Thursday, and until the moment when its results will be known, they do not want to open new deals. To build wave 5, it will be very helpful if the ECB lowers its key rate. However, in the last months of the presidency, anything can be expected from Mario Draghi. By and large, he does not care whether to lower the rate or not. Over the past two months, it is unlikely that the dramatically deteriorating economic situation of the eurozone can be corrected. It would even be better if there were no changes in monetary policy in recent months, so that Christine Lagarde, who is likely to take Draghi's place, could begin to implement her plans, not with ultra-low rates. Purchase targets: 1.1248 – 0.0% according to Fibonacci Sales targets: 1.0893 – 161.8% according to Fibonacci 1.0807 – 200.0% according to Fibonacci General conclusions and recommendations: The euro/dollar pair continues to build a downward wave 3 and presumably completed the construction of an internal corrective wave 4. I recommend selling the pair with the targets located near the calculated levels of 1.0893 and 1.0807, which corresponds to 161.8% and 200.0% of Fibonacci, the MACD signal "down" (already available) in the calculation of the construction of the wave 5. GBP/USD

The GBP/USD pair lost about 50 base points on September 6, but today it resumed the increase and thus continues to build the expected wave C as part of the upward correction section of the trend. Today in the UK, reports on GDP and industrial production came out. Against the background of all that is happening in the United Kingdom, meaning Brexit and the political crisis associated with it, it is very strange to see a GDP growth in July of 0.3%, instead of the projected + 0.1%, and an increase of 0.1% in industrial production in July, instead of a projected decline.

Against the background of recent months, the increase of + 0.1% looks weak and unconvincing, and in annual terms, production fell by 0.9%, which is still higher than forecasts. Despite the contradictory and unexpected statistics, the pound takes advantage of the given chances and continues to rise. Today, there will be no interesting publications, but wave c takes on a 5-wave form and threatens to turn out to be very long. Will he be hindered by any new developments around Brexit? After all, the latest data suggests that Boris Johnson is not going to give up after the defeat in Parliament. Today, by the way, there will be a vote on the issue of early elections or rather re-elections. Thus, the evening for GBP/USD can be very interesting. Sales targets: 1.2016 – 0.0% according to Fibonacci Purchase targets: 1.2401 – 50.0% according to Fibonacci 1.2489 – 61.8% according to Fibonacci General conclusions and recommendations: The downward trend is still considered complete. Thus, it is expected to continue the construction of the upward wave with targets located near the calculated marks of 1.2401 and 1.2489, which corresponds to 50.0% and 61.8% of Fibonacci. You can buy a pound now when the news tension has subsided a bit, but I still do not recommend doing so in large volumes. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 09 Sep 2019 07:35 AM PDT To open long positions on GBP/USD, you need: The British pound rose in the first half of the day after a more than excellent report indicating the growth of the UK economy in July this year by 0.3% compared to June. Given that economists had hoped for a minimum growth of 0.1%, bulls quickly returned to the market, which allowed them to break above the highs of last week and gain a foothold. At the moment, the task of buyers is to break the resistance of 1.2387, which limited the upward potential and which I pointed out in my morning forecast. This will allow you to keep the bullish market, which will target the highs of 1.2427 and 1.2460, where I recommend fixing the profits. If the bears build a downward correction in the second half of the day, the support will be provided by the level of 1.2325, and it is possible to open long positions for a rebound near the minimum of 1.2278. To open short positions on GBP/USD, you need: Sellers will actively protect the maximum of 1.2387, and the formation of a false breakdown there in the second half of the day will lead to a correction of GBP/USD to the support area of 1.2325, where I recommend fixing the profits. With a larger closing of long positions, the pair can test the area of 1.2278. If the bullish momentum in the North American session leads to a breakthrough of the resistance of 1.2387, it is best to consider new short positions after updating local highs in the areas of 1.2427 and 1.2460. However, without Brexit news, and preferably positive, counting on a larger growth of GBP/USD will be very problematic, as the market is in balance and a new informational occasion is required. Signals of indicators: Moving Averages Trading is above 30 and 50 moving averages, indicating a further bullish scenario. Bollinger Bands In the case of a decline in the pair in the second half of the day, the average border of the indicator around 1.2295 will provide support.

Description of indicators

|

| Posted: 09 Sep 2019 07:35 AM PDT To open long positions on EURUSD, you need: From a technical point of view, in the absence of important fundamental statistics, nothing has changed. In the first half of the day, buyers of the euro managed to protect the level of 1.1020, which keeps the balance in the market and hope for the continuation of the upward trend amid expectations of lower interest rates in the United States. Currently, the emphasis remains on breaking through the level of 1.1053, which will lead to the updating of last week's maximum in the area of 1.1082 and to the test of new resistance of 1.1115, where I recommend taking the profits. In the scenario of EUR/USD decline, you can count on support in the area of 1.1020, however, opening long positions from there is best after a false breakdown, or buy a pair for a rebound from a minimum of 1.0989. To open short positions on EURUSD, you need: Sellers of the euro activated after updating the resistance of 1.1053, and the formation of a false breakdown there will be the first signal to open short positions in the expectation of a return and correction to the support of 1.1020. However, the more important task is to break through and consolidate below this minimum, which will push EUR/USD to the area of large levels of 1.0989 and 1.0955, where I recommend taking the profit. In a scenario of further growth above the resistance of 1.1053, it is best to count on sales on a rebound from the maximum of 1.1082, which kept the pair yesterday from further growth last week. Signals of indicators: Moving Averages Trading is conducted in the area of 30 and 50 moving averages, which indicates the lateral nature of the market. Bollinger Bands Volatility is low, which does not give signals to enter the market.

Description of indicators

|

| BTC 09.09.2019 - First target reached, potential for second target Posted: 09 Sep 2019 06:32 AM PDT Industry news: As reported by Business Times, the BitMEX exchange run by Arthur Hayes is demonstrating the biggest trading volume of Bitcoin futures - $1.06 bln or – open interest, in other words. Major BTC traders are trying to make profits on digital gold by trading BTC-based derivatives, such as futures contracts. Technical view:

Bitcoin did exactly what I expected last week and our first target at the price of $10.390 has been reached. Next potential downward target is set at the price of $9.450. Pink lines – Larger symmetrical triangle in play Black lines - Channel Green falling line – Expected path I still expect potential new wave for potential fulfill of the lower symmetrical triangle boundary. Additionally, I found that momentum on the upside decreasing in last up wave, which is indication for the weak buyers on the market. Key support is at $9.450 and resistance at $11.000 and $11.200. Bulls need to be very cautious as there is strong aggressive selling from the key resistance. As long as the Bitcoin is trading below $11.200, I would watch for selling opportunities. Watch for selling opportunities on the rallies on lower frames 5/15 for better timing.The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD for September 09,2019 - Buy zone for the EUR and potential end of downward correction Posted: 09 Sep 2019 06:03 AM PDT EUR has been trading downwards in past 24hours after the potential end of the downward correction ABC in the background. There is potential for re-test of the 1.1086.

Blue horizontal lines – Important resistance levels and upward objectives Yellow rectangle – major short-term support area Green rising line – Expected path I still expect potential new wave up and re-test of the 1.1086 due to potential end of the downward correction ABC. Additionally, I found that momentum is picking up on the MACD oscillator , which is another good indication for upward price. Key support is at 1.1017 and resistance at 1.1086 and 1.1115. Bears need to be very cautious as there is strong aggressive buying and potential end of the downward correction ABC. As long as the EUR is holding above 1.1015 there is a chance for potential test of 1.1086. Don't forget that short-term and long-term trends are bullish. Watch for buying opportunities on the dips on lower frames 5/15 for better timing.The material has been provided by InstaForex Company - www.instaforex.com |

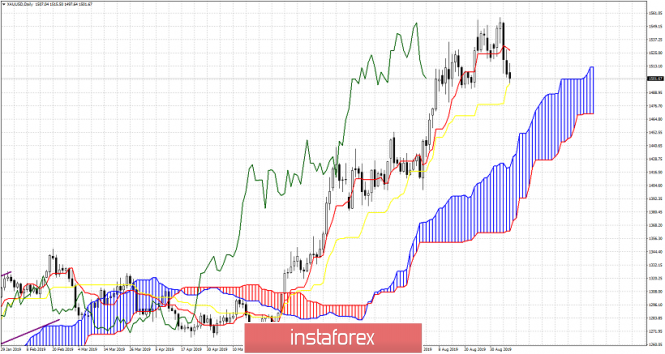

| Gold 09.09.2019 - Gold in the buy zone, more upside in play Posted: 09 Sep 2019 05:40 AM PDT Gold has been trading downwards in past 24hours but our support that we marked last week at the level of $1,505 is still holding well, which is very good sign for the further upward price. I still see more upside on the Gold and potential re-test of the $1,533 and $1,553.

Red horizontal lines – Important resistance levels and upward objectives Green rectangle - major support area Green rising line – Expected path My analysis didn't change much from last week.I found double bottom confirmed pattern and strong rejection of the key support, which is for me sign that new money started with buying. Additionally, I found bullish divergence on the MACD oscillator , which is another good indication for upward price. Key support is at $1,504 and resistance at $1,533 and $1,553. Bears need to be very cautious as there is strong aggressive buying and potential end of the downward correction ABC. As long as the Gold is holding above $1,500 there is a chance for potential test of $1,553. Don't forget that short-term and long-term trends are bullish. Watch for buying opportunities on the dips on lower frames 5/15 for better timing.The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 09 Sep 2019 03:47 AM PDT According to analysts, the yellow metal will need some time to recover. It is possible that this week gold will be able to regain lost ground. Last week, the precious metal reached a new multi-year high at $1,557 per 1 troy ounce. Subsequently, its price dropped significantly, reaching $1,506. Experts believe that this week gold will be able to exceed this indicator. A significant drop in gold prices last Thursday was caused by information about the possibility of a new stage in trade negotiations between the United States and China. It is possible that this will happen next month. According to experts, in the event of a long-term trade conflict, China's economic losses will be greater than those of the United States, but this will not give America any advantages. At the moment, the trade conflict between Washington and Beijing is far from being resolved. At the same time, US President Donald Trump announced a possible trade war with the European Union. This will significantly increase the risk of recession and lead to an increase in demand for safe assets, primarily gold, experts remind. The precious metals market is currently under pressure. The reason for this is an unstable geopolitical situation and the way out of which is not visible. In this regard, experts admit a possible consolidation of prices in the "gold" market. Experts are sure that the conditions for a possible consolidation of precious metals have arisen a long time ago. For example, the American futures market has created the potential for correction of the yellow metal. Pessimistic forecasts of experts suggest a decrease in gold quotes to $1,500 per 1 ounce. In the event of adverse events, the cost of precious metals may fall to $1,425 per 1 ounce. The fact is that the uptrend, which began in August this year, is showing a slowdown, experts emphasized. Nevertheless, a number of short-term and medium-term forecasts for gold suggests a further increase in quotations. At the same time, there is a high probability of a stock market crash in the near future, which could trigger a rise in the price of precious metals. Markets are now waiting for further cuts in interest rates after a speech by Jerome Powell, head of the Fed last week. There is an assumption that the rate cut in September is not the last measure adopted by the Federal Reserve. The regulator is able to continue easing monetary policy in the first half of 2020, experts say. This week, the ECB may also reduce the rate, and the Bank of England - to make a similar decision if the UK leaves the EU without a deal. The active implementation of a stimulating monetary policy by leading regulators has led to the growth of gold to a maximum level since 2012, and this is not the limit. The ECB may also reduce the rate this week. At the same time, the Bank of England may make a similar decision if the UK leaves the EU without a deal. According to optimistic forecasts, the precious metal is expected to recover to resistance levels from $1510 to $ 1515 next week. In the future, market players expect to increase to $ 1,520 and $1,525 per 1 troy ounce. The material has been provided by InstaForex Company - www.instaforex.com |