Forex analysis review |

- Fractal analysis of the main currency pairs on October 29

- EUR/USD approaching support, potential bounce!

- #USDX vs EUR / USD vs GBP / USD vs USD / JPY - DAILY. Comprehensive analysis of movement options on November 2019. Analysis

- GBP/USD: the pound plays solitaire

- GBP/USD. Early elections in Britain: intrigue persists - Liberal Democrats put forward a counter demand

- GBP/USD. October 28. Results of the day. Boris Johnson makes a second "knight's move"

- EUR/USD: the euro is watching the fate of Brexit, and the dollar is waiting for the Fed's verdict

- EUR/USD. October 28. Results of the day. Will the "Donald Trump factor" work for the third time in a row?

- GBPUSD and EURUSD: The EU approved another UK postponement for another 3 months. Eurozone lending is in line with economic

- Phoenix rises from the ashes: Bitcoin has surpassed itself

- The dollar is leading, while the euro is on fire. For how long?

- EURUSD bulls step in at the last minute....

- Gold reverses below $1,500 as our bearish warning is confirmed

- October 28, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- October 28, 2019 : GBP/USD awaiting for bearish breakout below 1.2780 for further bearish decline.

- BTC 10.28.2019 Main Fibonacci confluence at $9.800 held successfully, potential downside on the way

- Gold 10.28.2019 - Friday's target reached and potential fresh downside swing in creation

- EUR/USD for October 28,2019 -Broken important support trendline and good sell zone, watch for selling opportunities

- GBP/USD: plan for the American session on October 28th. The pound ignored the EU's decision to grant a flexible deferral

- EUR/USD: plan for the American session on October 28th. Data on Germany and the decision to postpone only temporarily supported

- Fractal analysis of cryptocurrencies BTCUSD and Ethereum on October 28th

- Trading idea for EURUSD

- The yen took the front sight of the Fed

- Trading recommendations for the EURUSD currency pair – placement of trade orders (October 28)

- Trading strategy for EUR/USD on October 28th. Informational calm will be replaced this week by a parade of news

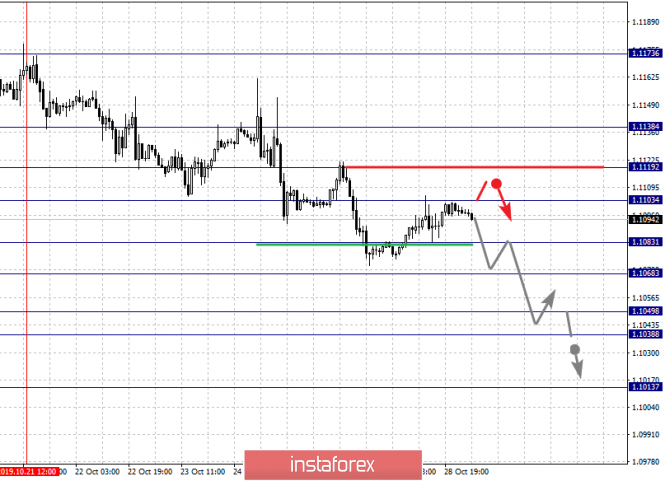

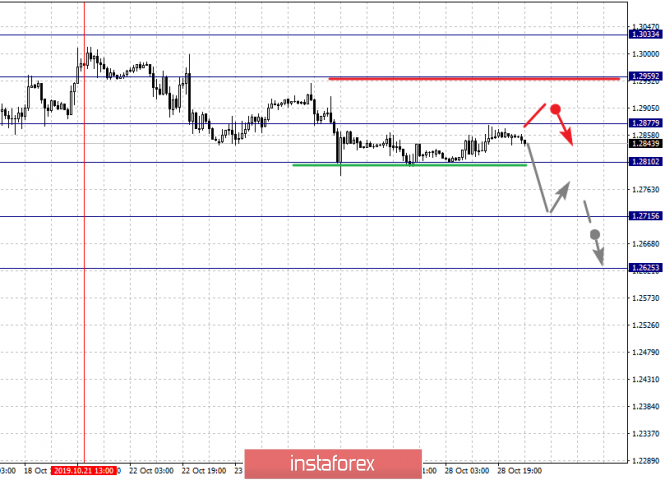

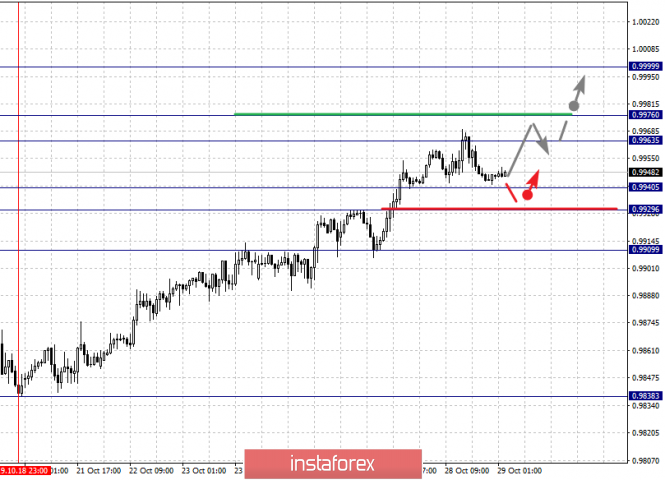

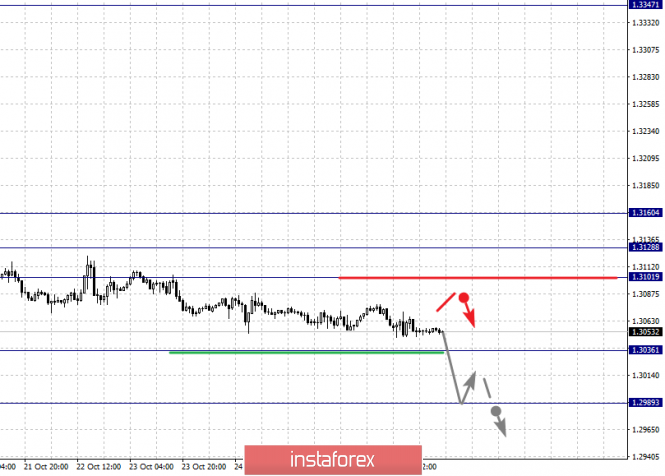

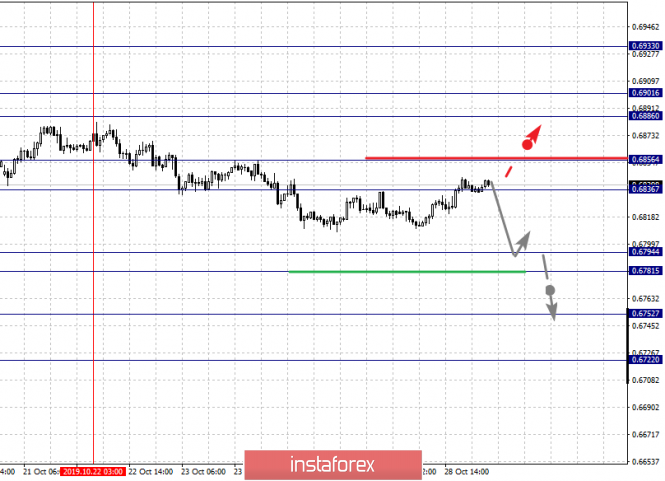

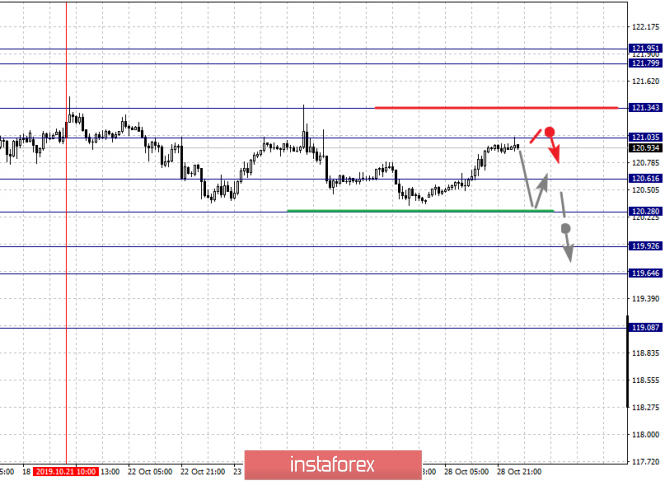

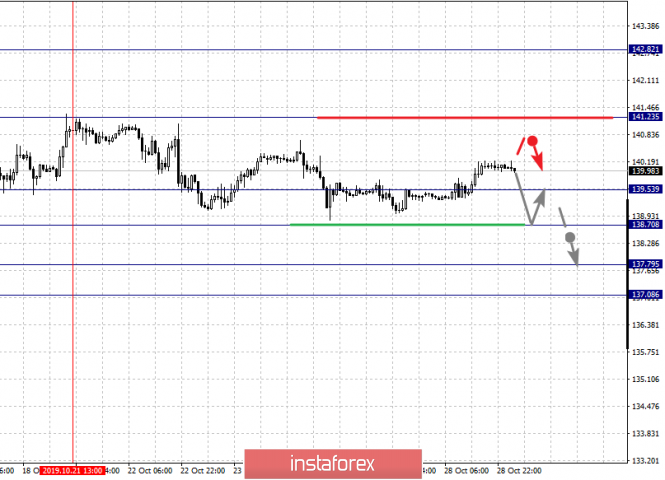

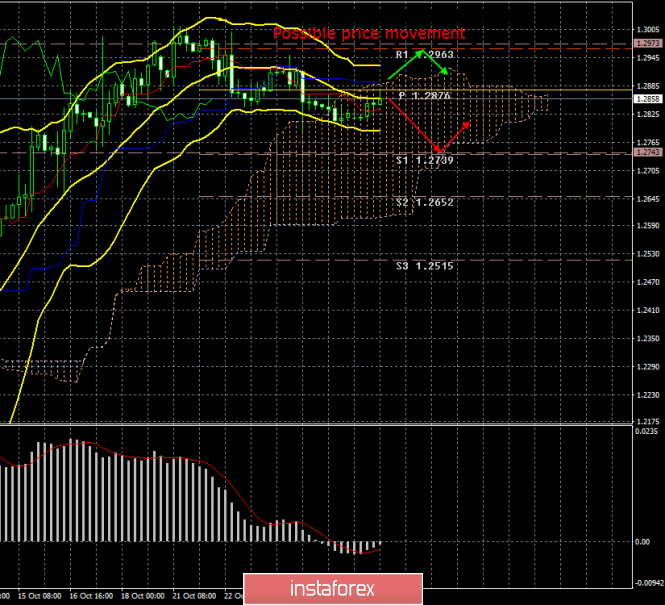

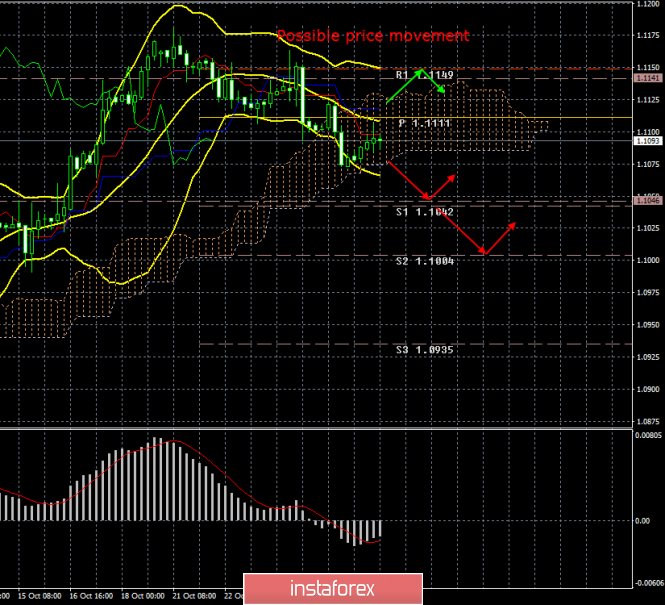

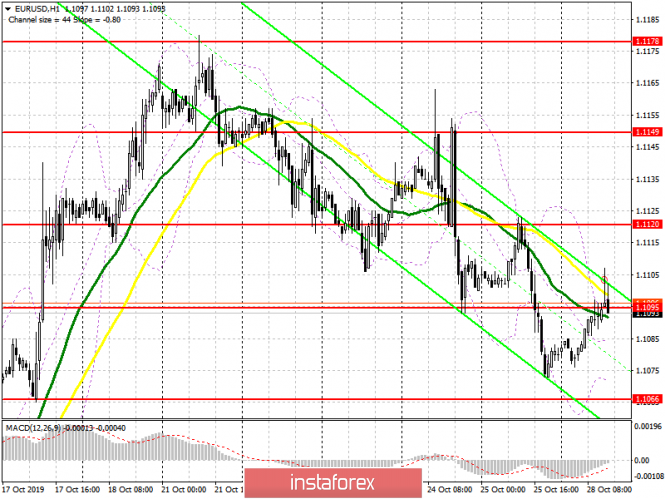

| Fractal analysis of the main currency pairs on October 29 Posted: 28 Oct 2019 07:10 PM PDT Forecast for October 29: Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1138, 1.1119, 1.1103, 1.1083, 1.1068, 1.1049, 1.1038 and 1.1013. Here, we are following the development of the descending structure of October 21. Short-term downward movement is expected in the range of 1.1083 - 1.1068. The breakdown of the latter value will lead to a pronounced movement. In this case, the target is 1.1049. Price consolidation is in the range of 1.1049 - 1.1038. For the potential value for the bottom, we consider the level of 1.1013. Upon reaching which, we expect a pullback to the top. Short-term upward movement is expected in the range 1.1103 - 1.1119. The breakdown of the last value will lead to an in-depth correction. The goal here is 1.1138. This level is a key support for the downward structure. The main trend is the descending structure of October 21. Trading recommendations: Buy: 1.1104 Take profit: 1.1117 Buy: 1.1120 Take profit: 1.1137 Sell: 1.1083 Take profit: 1.1070 Sell: 1.1068 Take profit: 1.1050 For the pound / dollar pair, the key levels on the H1 scale are: 1.3215, 1.3141, 1.3033, 1.2939, 1.2810, 1.2734 and 1.2625. Here, we are following the development of the upward cycle of October 9. At the moment, the price has expressed a pronounced potential for the downward movement of October 21. The continuation of the movement to the top is expected after the breakdown of the level of 1.2959. In this case, the first target is 1.3035. The breakdown of the level of 1.3035 will lead to a pronounced upward movement. Here, the potential target is 1.3141. Price consolidation is in the range of 1.3141 - 1.3215. We expect consolidated movement in the range of 1.2877 - 1.2810. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.2715. This level is a key support for the top. Its breakdown will lead to the formation of potential for the downward cycle. Here, the goal is 1.2625. The main trend is the ascending structure of October 9, the formation of the descending structure of October 21. Trading recommendations: Buy: 1.2960 Take profit: 1.3031 Buy: 1.3035 Take profit: 1.3140 Sell: 1.2808 Take profit: 1.2717 Sell: 1.2713 Take profit: 1.2627 For the dollar / franc pair, the key levels on the H1 scale are: 0.9999, 0.9976, 0.9963, 0.9940, 0.9929 and 0.9909. Here, we are following the development of the ascending structure of October 18. Short-term upward movement, we expect in the range 0.9963 - 0.9976. The breakdown of the last value will lead to a pronounced movement. Here, the target is a potential target - 0.9999, when this value is reached, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 0.9940 - 0.9929. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 0.9909. This level is a key support for the upward structure. The main trend is the upward structure of October 18. Trading recommendations: Buy : 0.9963 Take profit: 0.9974 Buy : 0.9978 Take profit: 0.9999 Sell: 0.9940 Take profit: 0.9931 Sell: 0.9927 Take profit: 0.9912 For the dollar / yen pair, the key levels on the scale are : 109.58, 109.39, 109.29, 109.13, 108.85, 108.72 and 108.53. Here, we are following the development of the upward cycle of October 23. The continuation of the movement to the top is expected after the breakdown of the level of 109.13. In this case, the target is 109.29. Price consolidation is in the range of 109.29 - 109.39. For the potential value for the top, we consider the level of 109.58, upon reaching which, we expect a pullback to the bottom. Short-term downward movement is expected in the range of 108.85 - 108.72. The breakdown of the last value will lead to an in-depth correction. Here, the target is 108.53. This level is a key support for the top. Main trend: local structure for the top of October 23. Trading recommendations: Buy: 109.13 Take profit: 109.29 Buy : 109.40 Take profit: 109.56 Sell: 108.85 Take profit: 108.74 Sell: 108.70 Take profit: 108.55 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3160, 1.3128, 1.3101, 1.3036 and 1.2989. Here, we are following the development of the downward trend of October 10. The continuation of movement to the bottom is expected after the breakdown of the level of 1.3036. In this case, the target is the potential target 1.2989. Upon reaching this level, we expect a pullback to the top. Short-term upward movement is possibly in the range of 1.3101 - 1.3128. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3160. This level is a key support for the downward structure. The main trend is the downward cycle of October 10. Trading recommendations: Buy: 1.3101 Take profit: 1.3126 Buy : 1.3130 Take profit: 1.3160 Sell: Take profit: Sell: 1.3034 Take profit: 1.3000 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6933, 0.6901, 0.6886, 0.6856, 0.6836, 0.6794, 0.6781, 0.6752 and 0.6722. Here, we are following the descending structure of October 22. At the moment, we expect to reach the level of 0.6794. Price consolidation is in the range of 0.6794 - 0.6781. The breakdown of the level of 0.6780 will lead to a pronounced movement. Here, the target is 0.6752. Price consolidation is near this level, and there is also a high probability of a rollback to the top. For the potential value for the bottom, we consider the level of 0.6722. Upon reaching which, we expect a departure in the correction. Short-term upward movement is possibly in the range of 0.6836 - 0.6856. The breakdown of the latter value will favor the formation of an ascending structure. Here, the potential target is 0.6886. The main trend is the descending structure of October 22. Trading recommendations: Buy: 0.6836 Take profit: 0.6854 Buy: 0.6858 Take profit: 0.6886 Sell : 0.6780 Take profit : 0.6752 Sell: 0.6750 Take profit: 0.6724 For the euro / yen pair, the key levels on the H1 scale are: 121.95, 121.79, 121.34, 121.03, 120.61, 120.28, 119.92 and 119.64. Here, the price has entered an equilibrium state and forms the potential for the downward movement of October 21. Short-term upward movement is expected in the range 121.03 - 121.34. The breakdown of the level of 121.35 should be accompanied by a pronounced upward movement. Here, the target is 121.79. Price consolidation is in the range of 121.79 - 121.95. From here, we expect a correction. We expect consolidated movement in the range of 120.61 - 120.28. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 119.92. This level is a key support for the top. Its passage at the price will lead to the formation of initial conditions for the downward cycle. In this case, the first goal is 119.64. The main trend is the upward structure of October 15 and the formation of potential for the bottom of October 21. Trading recommendations: Buy: 121.05 Take profit: 121.34 Buy: 121.36 Take profit: 121.76 Sell: 120.25 Take profit: 119.94 Sell: 119.90 Take profit: 119.66 For the pound / yen pair, the key levels on the H1 scale are : 142.82, 141.23, 139.53, 138.70, 137.79 and 137.08. Here, the price has entered an equilibrium state and currently forms a potential for the bottom of October 21. The continuation of movement to the top is expected after the breakdown of the level of 141.23. In this case, the potential target is 142.82. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement, as well as consolidation, are possible in the range of 139.53 - 138.70. The breakdown of the last value will lead to a long correction. Here, the target is 137.79. The range of 137.79 - 137.08 is the key support for the top. The main trend is the medium-term upward structure of October 8, the formation of potential for the downward movement of October 21. Trading recommendations: Buy: 141.25 Take profit: 142.80 Sell: 139.50 Take profit: 138.75 Sell: 138.65 Take profit: 137.80 The material has been provided by InstaForex Company - www.instaforex.com |

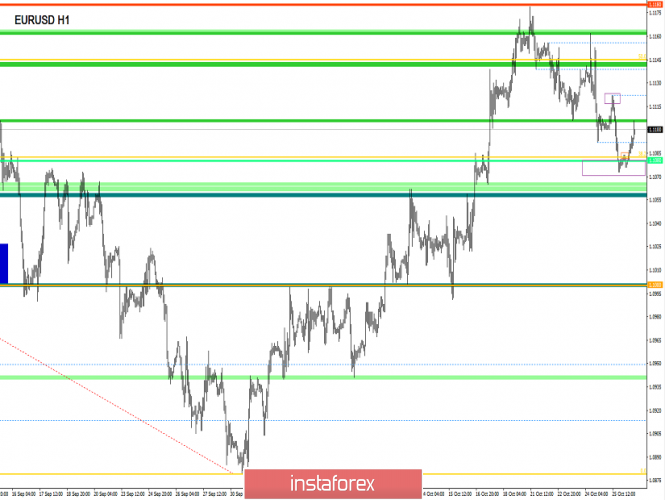

| EUR/USD approaching support, potential bounce! Posted: 28 Oct 2019 06:59 PM PDT Entry: 1.10670 Why is it good: horizontal overlap support, 38.2% fibonacci retracement Take profit: 1.11650 Why is it good: Horizontal swing high resistance, 50% fibonacci retracement Stop loss: 1.09950 Why is it good: horizontal overlap support, 61.8% fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

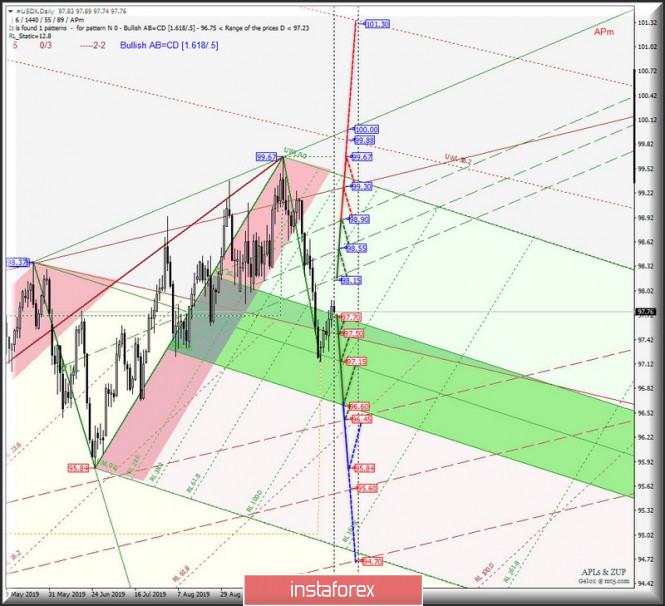

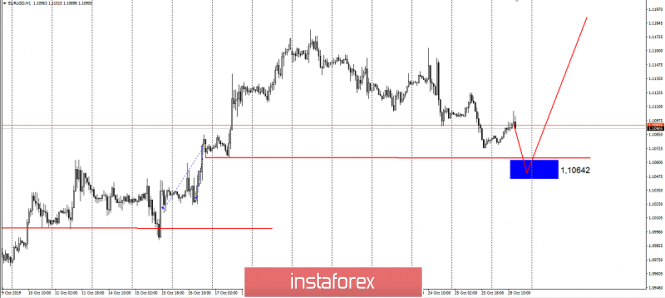

| Posted: 28 Oct 2019 05:06 PM PDT November 2019 is getting near. Thus, we will consider the DAILY movement options - #USDX, EUR / USD, GBP / USD and USD / JPY in a comprehensive form. Minor operational scale (Daily Time Frame) ____________________ US dollar Index The movement of the dollar index #USDX on November 2019 will receive its development depending on the development and the direction of the breakdown of the range :

Combined breakdown of support levels : - 97.70 (ISL38.2 Minuette); - 97.50 (the initial line of SSL Minor operating scale forks); will confirm that the development of the movement of the dollar index will again occur within the equilibrium zones (97.70 - 97.15 - 96.60) of the Minuette operational scale forks, and in case of breakdown of ISL61.8 Minuette (96.60), it will become possible for the price of this currency instrument to reach the upper boundary of the 1/2 Median Line channel of Minor (96.45) and local minimum 85.84. With the breakdown of resistance level of 98.15, the development of the #USDX movement will continue in the 1/2 Median Line Minuette channel (98.15 - 98.55 - 98.90) with the prospect of reaching the UTL control line (99.30) of the Minor operational scale forks and updating the maximum 99.67. The markup of #USDX movement options on November 2019 is shown in the animated chart. ____________________ Euro vs US dollar Direction of the breakdown of the range :

will determine the further development trend of the movement of the single European currency EUR / USD on November 2019. Combined breakdown of resistance levels : - 1.1115 (ISL38.2 Minuette); - 1.1140 (1/2 Median Line Minor); will confirm the return of the single European currency to the equilibrium zones (1.1115 - 1.1180 - 1.1250) of the Minuette operational scale forks and the development of movement in this zone, with the prospect (after the breakdown of ISL61.8 Minuette - 1.1250) of continuing the development of the upward movement to maximum 1.1412. In case of breakdown of the support level of 1.1055, the development of the EUR / USD movement will continue in the 1/2 Median Line channel (1.1055 - 1.1010 - 1.0960) of the Minuette operational scale forks with the prospect of reaching the initial SSL Minuette line (1.0895) and updating minimum 1.0879. The details of the EUR / USD movement options on November 2019 are shown in the animated chart. ____________________ Great Britain pound vs US dollar On November 2019, the development of Her Majesty's GBP / USD currency movement will continue based on the direction of the breakdown of the range :

The breakdown of the resistance level of 1.2875 - the development of the GBP / USD movement will be directed to the goals - the final Schiff Line Minuette (1.2930) - the upper boundary of the ISL61.8 (1.3015) equilibrium zone of the Minuette operational scale forks - 1/2 Median Line Minor (1.3165) - the lower boundary ISL3.2 (1.3300) equilibrium zone of the Minor operational scale forks - In case of breakdown of the Median Line Minuette (support level of 1.2825), Her Majesty's downward movement of currency can be continued towards the targets - the lower boundary of ISL38.2 (1.2635) equilibrium zone of the Minuette operational scale forks - 1/2 Median Line channel of the Minuette operational scale forks (1.2500 - 1.2380 - 1.2245). The details of the GBP / USD movement in November 2019 can be seen in the animated chart. ____________________ US dollar vs Japanese yen The currency of the "country of the rising sun" USD / JPY on November 2019 will also begin to develop its movement depending on the direction of the breakdown of the range :

Consecutive breakdown of support levels : - 108.40 (the initial SSL line of the forks of the Minuette operational scale forks); - 108.10 (lower boundary of the ISL38.2 equilibrium zone of the Minor operational scale forks); will make it relevant to continue the downward movement of the currency of the "land of the rising sun" to the boundaries of 1/2 Median Line channels of the Minor operational scale forks (107.50 - 106.75 - 105.90) and Minuette (107.05 - 106.50 - 105.90). The upward movement of USD / JPY may take place in the case of a combined breakdown of resistance levels : - 108.90 (control line UTL of the Minuette operational scale forks); - 109.15 (Median line of the Minor operational scale forks); and the target of this movement will be the upper boundary of the ISL61.8 (110.15) equilibrium zone of the Minor operational scale forks, and if the breakdown of ISL61.8 Minor occurs, then the price of this currency instrument can continue to grow to a maximum of 112.43. We look at the details of the USD / JPY movement in the animated chart. ____________________ The review is made without taking into account the news background. Thus, the opening of trading sessions of major financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index : USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of the currencies in the basket: Euro - 57.6% ; Yen - 13.6% ; Pound Sterling - 11.9% ; Canadian dollar - 9.1%; Swedish Krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the start date of the countdown - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: the pound plays solitaire Posted: 28 Oct 2019 05:04 PM PDT The prospect of concluding an agreement on the terms of the UK's exit from the European Union, which loomed on the horizon, allowed the GBP / USD pair to soar by more than 5% in two weeks. However, due to the refusal of the British Parliament to consider the option of an accelerated deal presented by the Prime Minister of the country, Boris Johnson, the risks of a pound reversal began to shift to "bearish" territory. Moreover, the fact that the chances of implementing a "hard" Brexit are minimal since the 2016 referendum indicates a limited potential for a decline in GBP / USD. It can be recalled that B. Johnson managed to do the almost impossible - to agree with Brussels on the Irish border. In addition, the House of Commons approved a draft agreement for the first time on the UK's exit from the EU in general terms. However, parliamentarians considered that the three days proposed by the prime minister for the full approval of the deal would not be enough. This automatically launched a procedure for the extension of Article 50 of the Lisbon Treaty. Thus, the EU is ready to give Britain a three-month deferral of Brexit. Meanwhile, Goldman Sachs experts believe that the issue of the release of Misty Albion from the alliance will be resolved within three to four weeks, which ultimately will cause a rally of the pound in the direction of $ 1.35. In the meantime, B. Johnson is dreaming of holding early parliamentary elections. According to the British prime minister, the confident victory of the conservatives will allow him to implement his plan for Brexit. According to recent polls, the Tory rating has risen to 32–37%, while Labor is gaining 22–24%. It is paradoxical, but a fact: the head of government suffers one defeat after another in the House of Commons, has lost the majority, and the popularity of conservatives is growing in the country. According to experts, the conservative's strong support is associated with their reputation as a real "party in power", which can be entrusted with running the country without fear of shocks, imposing new taxes or irresponsible spending, unlike the Labor with their social assistance programs and the nationalization of certain sectors of the economy. In addition, potential supporters of the Labor Party are also alarmed by their half-hearted position on Britain's exit from the EU - they seem to be against it, but they also want to respect the "will of the people". Moreover, the party itself has both a pro-European wing and the so-called "Brexiters". Last week, 19 Labor deputies voted in favor of a draft deal by B. Johnson, contrary to the call of party leader Jeremy Corbyn. Thus, a convincing victory for the Labor Party in the upcoming elections is not yet in sight. However, they can bet on a coalition combination, the probability of which is theoretically possible if the Liberal Democrats make a powerful breakthrough and the Scottish National Party seriously strengthens their positions. In this case, there may be a situation of a "suspended" parliament, that is, without a definite majority, which means that a field for maneuver will arise. Although experts do not exclude the possibility of forming a coalition of Labor with the Scots: at least in terms of socio-economic positions, the parties are close. After then, J. Corbyn will have a chance to become prime minister. After several weeks of rapid rally, the GBP/USD pair may be stuck in the range of 1.275-1.32 against the backdrop of continued uncertainty around Brexit. At the same time, a drop in quotations in the direction of the lower boundary of the specified range will create a good opportunity for the formation of long positions on the pound. However, the main risk for this scenario is the early parliamentary elections in the UK. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 28 Oct 2019 04:23 PM PDT The European Union granted Great Britain an extension of Brexit. Despite the "traditional" resistance of the French, Brussels agreed to prolong the negotiation process until January 31, 2020. However, the British do not have to wait for the final date: the postponement is flexible, so London can prematurely initiate the completion of the Brexit procedure. But for this, the deputies of the House of Commons need to support the proposed draft deal with the EU. Fulfillment of this condition is the most difficult stage of the negotiation process. That is why the pound almost ignored today's decision of the Europeans. If Paris continued to block the deferral agreement, the GBP/USD pair would accordingly continue the downward movement. But by and large, traders were sure that in the end Brussels would agree on this step, therefore, a positive verdict on this issue provided little support to the pair. But the issue of holding early elections to the House of Commons excites the minds of traders. After all, the fate of the orderly Brexit is now completely in the hands of the British Parliament, the current composition of which, to put it mildly, is very unfavorable to the current prime minister. So, in the House of Commons there are 650 deputies, 294 of which are Conservatives. A few months ago, there were 315 Tory representatives, but Johnson expelled 21 deputies from the party for "political indiscipline" - they supported the law obliging him to ask Brussels for deferment of Brexit. In order to overcome the threshold of a simple majority, the prime minister needs another 31 votes (provided that the Conservatives vote "yes"). The Tory's temporary ally is the Democratic Union Party — at the expense of their representatives, the Conservatives had a majority in Parliament. But this is in a "peaceful" time, while now the Unionists are also categorically against the approval of the deal. Other parties represented in the British Parliament - the Scottish National Party, the Greens and the Party of Wales - are long-standing opponents of the Conservatives in general and Boris Johnson in particular, so it will be extremely difficult for the prime minister to entice them to his side. Meanwhile, a snap election in Britain could be called with the support of two-thirds of Parliament (434 MPs). Labour has twice blocked the government's initiative to hold elections, and this time also promised to vote in a similar way. According to the British press, Downing street is also discussing a "plan B": Johnson's supporters initiate a vote of no confidence in the government – after the completion of the two-week period, which is allotted for the formation of a new Cabinet, the Parliament "automatically" dissolves. In this case, Johnson will need a simple majority, but there are risks: for example, during the allotted 14 days, opposition parties can hypothetically unite around another leader, depriving the Conservatives of power. Another way to early elections is to change the electoral law itself. However, any such bill can get bogged down in parliamentary discussions for a long time. Labour could amend the proposal to Johnson's disadvantage by adjusting the timing or procedure of the election. In addition, the opposition may delay consideration of the bill for a long time by introducing various amendments, for example, on the right to vote for 16-year-olds. The first battles in the British Parliament on the issue of early elections ended in nothing today. On Monday, Labour again reaffirmed their position - they will not support Johnson's initiative. When the speaker put this issue to a vote, 299 deputies spoke in favor, which is 135 less than the required number. But the Liberal Democrats announced that they would support early elections, but they did not propose holding them on December 12, but on December 9. At first glance, the difference of three days is not significant, but not in this case. The fact is that on December 9, students of most universities will still be in their educational institutions (and are more likely to take part in the elections). But on December 10-11, the Christmas holidays begin: many students may not wait for the end of the week and will leave for a vacation. Libdems are popular among young people, so this nuance has strategic importance for them. Boris Johnson announced that he would discuss the proposal of Liberal Democrats, after which the parliament would return to this issue again - most likely, on Tuesday. It is worth noting that a survey conducted from Wednesday to Friday last week showed that Conservative support reached 40%, while Labour remained at the same level - 24%. Compared with the survey the week before last, Tory support grew by 3%, but the result of the Labour Party did not change. Liberal Democrats, in turn, received 15% support in the latest poll, and Nigel Farage's Brexit party received 10%. All this suggests that following the results of early elections, Johnson will be able to form a majority in the House of Commons and, accordingly, agree on a deal with Brussels. Thus, the first round of the struggle for elections ended to no avail. At the same time, the intrigue in this matter still persists, especially amid the prolongation of the negotiation process until January 31 and the position of Liberal Democrats. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. October 28. Results of the day. Boris Johnson makes a second "knight's move" Posted: 28 Oct 2019 04:01 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 138p - 139p - 80p - 161p - 59p. Average volatility over the past 5 days: 115p (high). Monday, October 28, for the GBP/USD pair also takes place in quiet trading with low volatility. Even the news that the EU officially gave the go-ahead for the transfer of Brexit for another three months did not affect the currency pair's movement. Indeed, why should traders get nervous? Everything went to the next Brexit date postponement in recent weeks, despite the fact that Boris Johnson and the EU leaders have agreed on a deal. We have repeatedly said that, in fact, there is no sense in Johnson's agreements with the European Union until they are approved by the British Parliament. In practice, it was the House of Commons that once again stood in the way of the "divorce" of London and Brussels. And the deal of Boris Johnson, in fact, is not much different from Theresa May's deal, which the deputies blocked three times. Thus, today traders had nothing to react to. But Boris Johnson has no choice but to push through the idea of re-election to the Parliament and hope that the electorate will vote for as many Conservatives as possible in order to allow Johnson to make decisions individually. One way or another, now everything will depend not on Johnson, Corbyn, political parties, but on the population of Great Britain. Will there be a second referendum or will parliamentary re-elections take place, it is the people who will decide the fate of the country, as well as the question "Do British citizens want to renew Brexit every three months or leave the EU without any deals?" If the majority of voters still want to leave the EU according to any scenario, then they should vote for the Conservatives, but if they want to stay in the European Union or try to get out according to the mildest scenario, then they should vote for the Labour Party. The problem is that the distribution of votes can again be ambiguous, as in the 2016 referendum itself, when it is impossible to say unequivocally that most citizens support one opinion or another, one or another party. The British prime minister is going to agitate the population in such a situation. But not for themselves, but against the Parliament, against the House of Commons, which blocked Brexit for the fourth time. Accordingly, Johnson received an additional trump card. Now he can, speaking to the people, declare that the Parliament rejected both an exit without a deal and an exit with a deal. If this works, then the Conservatives will win the parliamentary elections. But will there be an election? Labour and opposition cannot help but realize that elections can give Johnson the necessary edge. And if this advantage is obtained, Johnson will not be interested in the opinion of the opposition. He and the opinion of the whole Parliament were not very interested, since initially he was going to single-handedly withdraw the country from the European Union by means of the propaganda of the work of the MPs. Thus, it does not make sense for the opposition to approve the re-election. Fortunately, their implementation requires the approval of at least 434 MPs, that is 2/3. There are still so many votes in favor that need to be collected. Voting for the December 12 parliamentary elections will take place tonight, so tomorrow we will know for sure whether Boris Johnson will get the chance of his first victory at the helm of the UK or not. As for macroeconomic statistics, nothing interesting has been published either in the United States or in the UK today. In the UK, no macroeconomic indicators have been published for more than a week, so the drop in volatility is also partly due to this factor. We again do not expect any economic data from Great Britain tomorrow, and only a couple of minor reports will be published in the United States. From a technical point of view, the pair is being traded inside the Ichimoku cloud, so the "dead cross" is weak and the sales of the pound are mixed. The upward trend may well resume if the bulls manage to return the pair above the Kijun-sen critical line, which could happen with the help of the Fed's actions on Wednesday. But Brexit should not be overlooked. It should be remembered how the 800-pound upward movement began. From the banal news that Leo Varadkar and Boris Johnson announced the possible (!!!) achievement of a deal on Brexit with the European Union, which at the moment does not make much sense. Trading recommendations: GBP/USD within the downward correction has consolidated below the critical line. Thus, formally, sales of the British currency are currently relevant with a target of 1.2743, which, if opened, is only done in small lots. It is recommended to return to buying if the pair is re-secured above the Kijun-sen line, but also in small lots, since the foundation does not yet suggest strong growth of the pair. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. Support / Resistance Classic Levels: Red and gray dotted lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movement options: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: the euro is watching the fate of Brexit, and the dollar is waiting for the Fed's verdict Posted: 28 Oct 2019 04:01 PM PDT The euro began a new week on a positive note, primarily due to reports that the EU has agreed to provide Britain with a three-month deferral of Brexit. After falling to local lows near 1.1070, the EUR/USD pair rebounded to 1.1090 and aimed for a key resistance level of 1.1100. However, the potential for further recovery of the main currency pair seems limited due to the fact that the uncertainty surrounding the UK exit from the EU remains high, despite the extension of the Brexit deadline until January 31. In addition, a regular meeting of the Federal Reserve will take place on Wednesday, the decision of which on monetary policy may put pressure on EUR/USD, since dovish expectations are already included in the quotes, and the regulator will have to try very hard to surprise the market with something else. According to the results of the October meeting, the Fed is expected to lower the interest rate by another 25 basis points, to 1.5-1.75%. The main intrigue is what the further plans of the US central bank are: will it pause in easing monetary policy or continue what it started. In anticipation of the Fed meeting on October 30, data on US GDP will be released and, according to forecasts, they will demonstrate a slowdown in the US economy (from 2.0% in April – June to 1.6% in the third quarter). If this is true, then Donald Trump will receive another lever of pressure on Fed Chairman Jerome Powell and his colleagues. Earlier, the head of the White House called on the regulator to act more actively and reduce the interest rate to zero. Among other releases of the current week that may affect the EUR/USD rate, one should pay attention to the reports on European GDP for the third quarter and inflation in the eurozone (October 31), as well as data on the US labor market and business activity in the USA from ISM (November 1). According to a number of experts, even though the risks of UK exit from the EU without a deal have substantially decreased and the country will receive another deferral of Brexit, this can still negatively affect the single European currency, as a result of which the EUR/USD pair could update its October 1 low at 1.0880 in November. It is expected that the inability of EUR/USD to break monthly highs in the region of 1.1180 will provoke a slight consolidation, and then fall to the area of 1.1040, below which the upward pressure on the pair will weaken, and it will first recede to 1.0920, and then to 1. 0879. The signing of the "divorce" agreement between the United Kingdom and the EU, supported by the British Parliament, will push the main currency pair to 1.1350-1.1400. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 28 Oct 2019 03:47 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 41p - 39p - 34p - 70p - 50p. Average volatility over the past 5 days: 47p (average). The first trading day of the week for the EUR/USD currency pair was held in absolutely calm trading with a total volatility of 26 points. This is much lower than the instrument's average volatility over the last five days. Such low activity of market participants is not surprising, given the absolutely empty calendar of macroeconomic events. There is a feeling that the previous week continues, in which the fundamental events were only on Thursday. This week, of course, it's not that bad. News and macroeconomic reports will be received and published starting from Wednesday. Today was also formally an event that could have an impact on the course of trading in the US trading session, but, as we warned in the morning, this event was only with a loud name, and in fact nothing interesting has brought life to the Forex market. We are talking about the speech of Mario Draghi, who will officially leave his post this Thursday. Unfortunately, the last months of Mario Draghi's work were marred by a split in the ranks of the ECB's monetary committee, where not all members of the organization shared the initiative of its chairman to resume the asset purchase program, simultaneously filling the economy with cash. However, none of this matters. Today, according to many, this was Draghi's farewell speech and nothing interesting was heard. Now traders should expect the speech of Christine Lagarde, who previously promised to adhere to the policies of Mario Draghi, however, it is likely that there will still be some differences in the ways of managing the central bank. It is in this and should understand all market participants in the first place. To understand what policy Lagarde will follow and whether to expect the end of monetary easing or the ECB will adhere to the policy of "responding to changes in economic conditions". There's no point in guessing yet. Although traders are likely to get answers to questions from the previous paragraph this week, the Federal Reserve meeting, the results of which will be announced late Wednesday, is more important. Why is this meeting so important? First, because the regulator can go for a third consecutive easing of monetary policy, and then no one can say that this is an accident, coincidence, correction of rates after a period of increase, and so on. And if such a statement is made by any of the representatives of the Fed itself, it is unlikely that market participants will believe it. Macroeconomic statistics in the United States are indeed deteriorating, but if the ECB reacted to the deterioration of its "figures" each time by lowering the rate, then we would now see figures of about -2% for the deposit rate, and possibly even lower. So we believe that the "Trump factor" works and it works perfectly. Yes, at first the Fed resisted, Powell said that he was not too interested in what opinion the US president holds, since the US central bank does not obey the president. Nevertheless, in fact, the Fed is following Trump's lead in the last three months. Secondly, because the euro currency moved away from two-year lows against the US dollar with great difficulty, but this is clearly not enough to declare the end of the downward trend. The euro and the bulls really need macroeconomic support. Without it, sooner or later, the bears will again begin to put pressure on the currency pair. After all, the situation in the eurozone is objectively worse than in the United States. Thus, even the euro's growth by two cents in recent weeks is not too justified. But if the Fed continues to cheerfully cut rates, then the euro will have global grounds for strengthening. Thirdly, because there will be a speech by the head of the Fed Jerome Powell, and this is always interesting. It is likely that Powell will again say nothing new, confining himself to listing the risks associated with trade wars and geopolitical tensions in some regions of the world, but in any case, attention will be focused on his words. From a technical point of view, the euro/dollar began a small upward correction on Monday, October 28, but the volatility is extremely low and the price is located inside the Ichimoku cloud, so the general situation does not imply active trading. Overcoming the Ichimoku cloud will significantly improve the position and mood of the bears, which can persuade the pair to move down until Thursday (Wednesday evening). However, it is the Fed that can support the European currency if it lowers the key rate. Thus, the entire downward movement may end near the Senkou Span B line and receive the status of an extended correction. Trading recommendations: The EUR/USD pair began to adjust, being inside the Ichimoku cloud. Slowly you can look closely at euro sales, especially if the bears manage to overcome the Ichimoku clouds. However, ahead of the announcement of the results of the Fed meeting, we do not recommend opening large sales. The strengthening of the US dollar may continue if monetary policy is not changed in October. It is recommended to return to the pair's purchases no earlier than the bulls crossing the Kijun-sen line. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. Support / Resistance Classic Levels: Red and gray dotted lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movement options: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 28 Oct 2019 03:46 PM PDT The euro only instantly strengthened, like the British pound, after it became known that the EU agreed to postpone the release of the UK. Considering that this news was quite expected, this did not lead to serious market changes, and now it is up to the British prime minister and his actions in Parliament. GBPUSD According to statements by European Council President Donald Tusk, the EU agreed to postpone the Brexit date to January 31, 2020. This decision opens up the possibility of holding early elections in the UK, however, it also retains the possibility of adopting a Brexit deal if Prime Minister Boris Johnson manages to force the opposition to agree to such a scenario. However, Donald Tusk also said that the extension would be flexible, and the postponement of the Brexit deadline means that the UK could leave the EU before January 31 if the Brexit deal is ratified. Considering that overcoming a delayed exit is positive news for buyers, any movement towards a new agreement through the House of Commons will lead to the strengthening of the pound against a number of world currencies. The further short-term direction of the pound will also be determined by the struggle between the Tories and the Labour Party on a vote related to the date of the general election, which the British prime minister is focused on. The technical picture in the pair remained unchanged. An unsuccessful attempt to return the resistance of 1.2860 by the bulls may lead to the formation of another downward wave in the trading instrument with the update of the lows of 1.2760 and 1.2600. If the bulls are able to overcome the level of 1.2860 today, we can expect purchases and updates of the resistance at 1.2950. EURUSD The European currency attempted to grow above the resistance level of 1.1095 today, but failed to gain a foothold at this level. The good news on rising import prices in Germany, as well as data on lending in the eurozone, is far from a reason for the European Central Bank to at least think about changing its super-soft monetary policy. According to the report, import prices in Germany in September of this year immediately grew by 0.6% after falling by 0.6% in August of this year. On an annualized basis, prices fell by 2.5%, which is slightly better than forecasts of economists who expected prices to fall by 2.7%. But the growth in lending to companies in the eurozone in September this year slightly slowed amid increased external risks. According to the report of the European Central Bank, the annual growth in lending to companies in September was 3.7% compared to 4.3% in August. But lending to the private sector remained unchanged and amounted to 3%, as in August. Considering that the policy of the European Central Bank is rather soft, the availability of financing is not a problem, as it is now observed in the US. However, bank lending has not recovered to the rates of pre-crisis levels in 2007 and 2008, when growth in lending to the eurozone exceeded 12%. As for the M3 money aggregate, in September it showed a decrease, it amounted to 5.5% against 5.8% in August. Economists predicted that the indicator growth in September will be at the level of 5.7%. Nothing significant has happened from a technical point of view. Only a breakout of the resistance of 1.1100 will lead to a larger upward trend in the area of highs 1.1150 and 1.1210. As for the pressure on the euro, which will gradually return as the Federal Reserve meeting approaches, it will be limited to key support levels in the region of 1.1060 and 1.1020. The material has been provided by InstaForex Company - www.instaforex.com |

| Phoenix rises from the ashes: Bitcoin has surpassed itself Posted: 28 Oct 2019 03:46 PM PDT The leading digital currency does not cease to amaze the cryptocurrency market. At the end of last week, Bitcoin predicted a serious collapse, and now, like the legendary phoenix bird, it is again full of strength and is ready to fight for a place under the cryptocurrency sun. Recall, last Friday, according to the tag characteristic of one of the analysts, the head of Facebook Mark Zuckerberg "drove the last nail into the cryptocurrency coffin lid." This was facilitated by statements by members of the US House of Representatives Financial Services Committee. Congressmen expressed concern about the spread of digital currencies, and also stated that they pose a threat to the traditional foreign exchange market and may be used for fraudulent activities. During the meeting, a proposal was also made for a complete ban on virtual currencies. Experts recall that the cryptocurrency market is very dependent on the news background. Not surprisingly, such information powerfully hit Bitcoin. Last week, the reference cryptocurrency collapsed to a five-month low, having lost almost $1000 per day and hit the bottom at $7330. However, the surprises did not end there. Toward the close of last week, the cryptocurrency market demonstrated incredible opportunities comparable to the phoenix that rose from the ashes. It exploded amid a PTS take-off that made a jump of $3,000. As a result, the leading digital asset added 40% and reached $10500. On Sunday, October 27, maintaining cosmic speed, Bitcoin stayed at its highest values in excess of $10,000. Other digital assets pulled up behind the reference cryptocurrency. Many altcoins also gained speed. Among them were Ethereum (ETH/USD), which rose by nearly 30%, Ripple (XRP / USD), up 31%, and Litecoin (LTC/USD), soared 35%. On the morning of Monday, October 28, Bitcoin was trading in the range of $9410– $9411, while analysts recorded a downward trend. According to experts, the current rise was the largest since February 2014. The colossal driver of this take-off was the news from China. Chinese President Xi Jinping in his speech supported the development of blockchain technology in general and bitcoin in particular. He formed an impressive momentum for the market, improving the situation significantly. According to the Chinese leader, the country is ready to increase investment in the further development of blockchain technology and major cryptocurrencies. According to experts, the growth of investment by Chinese investors is another catalyst for the growth of the digital asset market. They could become more active after the speech of President Xi Jinping. According to the head of China, the country has every chance to take a leading position in the field of blockchain technology. Xi Jinping drew attention to the need for its integration into the real economy and information technology, such as artificial intelligence, Big Data and the Internet of Things. The statement of the Chinese leader provoked an almost instantaneous response from the National People's Congress (Parliament of China). The agency approved a law on cryptography, which defines the standards of cryptographic applications and the process of managing public/private keys. However, price drops were not in vain for bitcoin. Currently, it has rolled back below $10,000, and the cryptocurrency market has entered the consolidation phase. At the moment, the BTC/USD pair was trading at fairly low values, around $9380– $9381, causing market tension to cause a further fall. In general, the fears of experts were not in vain. Bitcoin was able to recover to an impressive mark of $9492– $9493, but for a long time it was not possible for it to gain a foothold in its positions. At the moment, the cryptocurrency pair runs in the low range of $9380– $9381, previously tested, but is not going to surrender completely. As a result of the powerful breakthrough, holders of the number one cryptocurrency and traders with open long positions in bitcoin and other digital assets received impressive profits. The remaining market players after the reversal of the BTC/USD pair and its collapse to the level of $9055 expected losses. According to experts, this was a significant level of support, on which the pair relied, starting from mid-June 2019. Now the market will have to carefully monitor both the situation in general and the actions of the Chinese leader in particular, so as not to miss the capricious bird of fortune, which so suddenly fluttered into the cryptosphere and suddenly left it. The material has been provided by InstaForex Company - www.instaforex.com |

| The dollar is leading, while the euro is on fire. For how long? Posted: 28 Oct 2019 03:46 PM PDT The US remains in the lead in the currency ring in the EUR/USD pair. The greenback feels very confident amid the weakening euro and pound. The European currency along with the British pound are in turmoil in anticipation of the upcoming difficult week. The past week has not clarified the situation, and the current one promises to be very eventful, but it can also be confusing. The market is destabilized by the information that British Prime Minister Boris Johnson plans to hold early parliamentary elections on December 12, 2019. This further aggravates the already difficult situation with the country's exit from the EU. The foreign exchange market is experiencing severe congestion. The euro and pound fell against the US dollar following weak statistics last week, difficulties with Brexit and "farewell" statements by Mario Draghi. This situation was in the hands of the US currency, analysts said. Due to the growing uncertainty in the financial market, many investors prefer to hedge the risks of a drop in the pound. A weakened British currency is pulling the euro along with it, risking a complete collapse of the single euro. Moreover, a high probability of a pause in the course of easing the monetary policy of the Fed gives strength to the bears that are working with the EUR/USD pair. The vast majority of experts (85%) are confident that the Federal Reserve will reduce the rate on federal funds at the next meeting, which will be held on October 29-30, that is, this week. According to experts, a long pause in the process of such monetary expansion is favorable for the US currency. The dollar will not miss its point, analysts said. They note that while the Fed and the ECB are in thought, the EUR/USD pair risks getting stuck in the consolidation zone. On the morning of Monday, October 28, the pair was trading within 1.1087–1.1088, not too eager to increase. Nevertheless, now the US dollar is on the rise. The greenback's positive mood was promoted by the statements of the Chinese and US leaders on improving relations, as well as corporate reporting by US companies, which turned out to be better than expected. The dollar is leading in the EUR/USD pair, while the euro is being driven. Currently, thanks to the greenback, the pair is showing a growth trend, rapidly rising to the levels of 1.1094–1.1095. However, the positive stubbornly avoids the European. Experts consider early elections in the UK as the main risk factor for the single currency. In addition to the endless uncertainty with Brexit, the slowdown in the European economy also has pressure on the euro. Despite all the efforts of the ECB, inflation in the eurozone does not reach the target level of 2%. Recall that last month the regulator reduced the interest rate to negative -0.5% and announced the revival of the quantitative easing (QE) program. Experts believe that with the advent of Christine Lagarde, the new head of the ECB, we should wait for the next change. But at the moment, the advantage was on the side of the dollar, since the US Federal Reserve rate is positive and is at 2%. According to experts, the appropriateness of expanding the monetary stimulus in the eurozone, initiated by M. Draghi, is doubtful, and the Fed's passivity may be the reason for the consolidation of the EUR/USD pair. Experts admit the possibility of such consolidation at the level of 1.1065–1.1115. Currently, the pair is trading in the range of 1.1091-1092. They believe that the subsidence of the European currency will continue in the short term, but in the future they expect it to turn upward. In the event of the implementation of such a scenario, the US currency will have to make concessions and make some room on its pedestal. |

| EURUSD bulls step in at the last minute.... Posted: 28 Oct 2019 11:31 AM PDT EURUSD is bouncing off the 1.1070 support area and the line in the sand for our bullish scenario. Bulls have stepped in and are pushing price higher. But nothing is clear yet. There is lots of work to be done by bulls and first to recapture 1.1130.

Black line - support trend line Red line -RSI resistance EURUSD is bouncing towards 1.11. The RSI is still below the resistance trend line. This tells me that bulls are not out of danger yet. Bulls need to continue moving higher and recapture the short-term resistance at 1.1130. If the RSI resistance breaks to the upside this would support at least the short-term bullish trend. Support remains key at 1.1060-1.1070. This is our line in the sand. Below this level we turn bearish. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold reverses below $1,500 as our bearish warning is confirmed Posted: 28 Oct 2019 11:27 AM PDT In our last analysis we noted the bearish reversal signal we got by the hammer candlestick pattern in the Daily chart. The rejection at $1,520 confirmed the importance of the resistance above $1,520 and confirmed the strength of bears.

Black line -trend line resistance Gold price got rejected at the orange resistance area. The RSI got rejected at the resistance trend line again. The daily bearish hammer pattern that we noted has a bearish follow through confirming our worries. Price is back below $1,500 and if support at $1,490 fails to hold, we could see Gold price move towards $1,450-60 in early November. Resistance remains key at $1,520-25. We remain bearish as long as price is below that level. The material has been provided by InstaForex Company - www.instaforex.com |

| October 28, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 28 Oct 2019 09:42 AM PDT

Since September 13, the EUR/USD has been trending-down within the depicted short-term bearish channel until signs of trend reversal were demonstrated around 1.0880 (Inverted Head & Shoulders Pattern). Shortly After, a bullish breakout above 1.0940 confirmed the mentioned reversal Pattern which opened the way for further bullish advancement towards (1.1000 -1.1020) maintaining bullish movement above the recent bullish trend. On October 7, a sideway consolidation range was demonstrated around the price zone of (1.1000 -1.1020) before another bullish swing could be initiated towards 1.1180. The recent bullish breakout above 1.1120 (100% Fibonacci Expansion) enhanced further bullish advancement towards the price zone of (1.1175-1.1195) where the current bearish pullback was recently originated. The intermediate-term outlook has been bullish until bearish breakdown below 1.1090 was achieved (the depicted uptrend line and 78.6% Fibonacci Expansion Level ). That's why, further bearish decline should be expected towards 1.1025 and 1.0995 as long as the EUR/USD maintains bearish persistence below 1.1090. Trade recommendations : Conservative traders can have a valid SELL entry anywhere around the backside of the broken uptrend line (1.1100). Initial T/P levels to be projected towards 1.1060 and 1.1020 while S/L should be placed above 1.1135. The material has been provided by InstaForex Company - www.instaforex.com |

| October 28, 2019 : GBP/USD awaiting for bearish breakout below 1.2780 for further bearish decline. Posted: 28 Oct 2019 09:07 AM PDT

Few weeks ago, the neckline of the depicted Double-Bottom pattern (1.2400-1.2415) was breached to the upside allowing further bullish advancement to occur towards 1.2800 then 1.3000 where the GBP/USD pair looked OVERBOUGHT. Earlier last week, the GBP/USD pair has failed to achieve a persistent bullish breakout above the depicted SUPPLY-zone (1.2980-1.3000) which corresponds to a previous Prominent-TOP that goes back to May 2019. Moreover, the depicted ascending wedge pattern has been confirmed indicating a high probability of bearish reversal around the price levels of 1.2950-1.2970. That's why, a quick bearish movement was initiated towards 1.2780 (Key-Level) where bullish recovery is currently being offered. The current Bullish rejection around the price levels of 1.2780 may indicate another temporary bullish movement near 1.2980-1.3000 where another bearish swing can be initiated. On the other hand, any earlier bearish breakout below 1.2780 enables further bearish decline towards 1.2600-1.2650 where bullish recovery should be anticipated. Trade Recommendations: Risky traders are advised to look for a valid BUY entry anywhere around 1.2780 with S/L to be located below 1.2740. Intraday traders can wait for a bearish breakout below 1.2780 as a valid SELL entry with T/P levels projected towards 1.2650. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 10.28.2019 Main Fibonacci confluence at $9.800 held successfully, potential downside on the way Posted: 28 Oct 2019 08:41 AM PDT BTC has been trading upside with strong momentum but the resistance was found at $9.800 and exactly at the Fibonacci Retracement confluence (38.2% combined with 61.8%). As long as the BTC can hold the level of 9.900$, there is the chance for downside.

Purple horizontal lines – Major Fibonacci retracements Green horizontal lines – Sub major Fibonacci retracement Yellow rectangle - Support level Falling purple line – Expected path Based on the 4H time-frame, I found that Stochastic oscillator looks way overbought and that there is chance for the pullback into the $8.705 zone. Due to overbought condition, buying looks extremely risky.Another great indication that buying is risky is that Fibonacci resistance confluence zone is holding well, which is clean sign that sellers are still present. Support levels is seen at the price of $8.700 and main resistance at $9.900. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 10.28.2019 - Friday's target reached and potential fresh downside swing in creation Posted: 28 Oct 2019 08:17 AM PDT Gold price had a strong positive week with a high at $1,518 while in the end it closed near $1,504. Our Friday's target at $1.518 was reached. Anyway, the overall mid-term trend is still neutral and I found the fake breakout of the falling resistance trendline, which is important clue for further analysis. Gold did back into the old channel range and it gave us clear bear sign.

Green rectangle – Important resistance Orange rectangles – Support levels and downward objectives Falling purple line – Expected path Based on the 4H time-frame, I found the breakout of the mini upward support trendline and the back into the old trending channel. Support levels are seen at the price of $1.478 and $1.461. My advice is to watch for potential rallies for selling opportunities. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 28 Oct 2019 08:06 AM PDT

EUR/USD has been trading sideways at the price of 1.1090. Anyway, I found the breakout of very important support trend line in the background, which is sign that sellers are still present. My advice is to watch for selling opportunities with the first target at 1.1060. Green rectangle – Support became resistance Orange rectangles – Support levels and downward objectives Falling purple line – Expected path Based on the 4H time-frame, I found the bearish flag pattern in creation just after the breakout of the upward trendline, which is good sign for potential downward continuation. Resistance level is seen at the price of 1.1106 and support levels at 1.1060 and 1.1000. MACD oscillator did show new momentum down based on the last down move, which is another good confirmation of the EUR weakness. Selling opportunities are preferable with targets at 1.1060 and 1.1000. The material has been provided by InstaForex Company - www.instaforex.com |

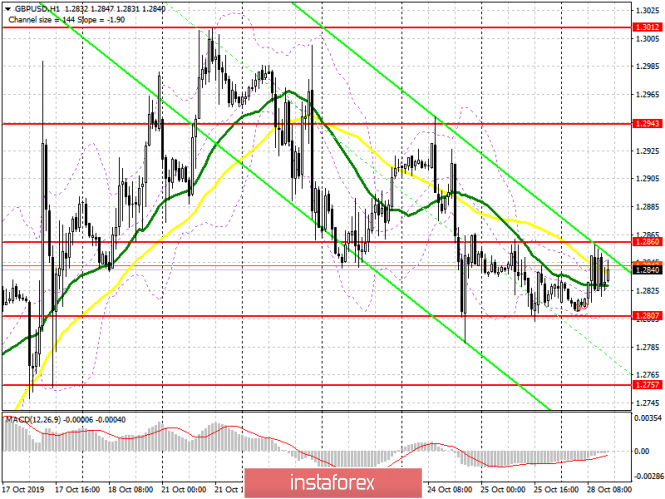

| Posted: 28 Oct 2019 06:23 AM PDT To open long positions on GBP/USD, you need: From a technical point of view, nothing has changed compared to the morning forecast. The pound has completely ignored the EU's decision to grant a flexible deferral that allows the UK to leave the EU at any point before January 31, 2020. Bulls today need to return to the resistance of 1.2860, which will be a signal to open long positions capable of updating the highs of 1.2943 and 1.3012, where I recommend taking the profits. If the pressure on the pound returns in the second half of the day, only the formation of a false breakdown in the support area of 1.2807 will be a signal to open long positions. Otherwise, it is best to buy GBP/USD on the rebound from the low of 1.2757 or even lower, in the area of 1.2664. To open short positions on GBP/USD, you need: Several attempts at price growth, which occurred after the news about the delay, were easily restrained by the sellers of the pound, and the formation of a false breakdown in the resistance area of 1.2860 allows us to count on a larger downward correction in the support area of 1.2807, which was formed last Friday. However, a more distant goal will be the level of 1.2757, and the main task of sellers will be to return to the minimum of 1.2664, where I recommend fixing the profits. In the case of positive news on Brexit, and everything depends on the further actions of British Prime Minister Boris Johnson, as well as the breakthrough of the resistance of 1.2860, it is best to consider short positions in GBP/USD from larger highs around 1.2943 and 1.3012. Indicator signals: Moving Averages Trading is conducted around 30 and 50 daily averages, which indicates the lateral nature of the market. Bollinger Bands Volatility has decreased, which does not give signals to enter the market.

Description of indicators

|

| Posted: 28 Oct 2019 06:23 AM PDT To open long positions on EURUSD, you need: A good report on the growth of wholesale prices in Germany supported the euro in the first half of the day, but as I expected, it was not possible to break above the resistance of 1.1095 and gain a foothold there. News that the EU approved the postponement of the UK's exit also did not provide much support to the bulls. At the moment, the task of buyers is to return to the level of 1.1095, and only under this condition can we expect a larger upward correction in the area of the highs of 1.1120 and 1.1149, where I recommend taking the profits. If the pressure on the euro returns, and this may happen during the speech of the President of the European Central Bank Mario Draghi, it is best to consider new long positions after a false breakdown in the support area of 1.1006 or buy for a rebound from the minimum of 1.1026. To open short positions on EURUSD, you need: Sellers coped with the task for the first half of the day and did not let the pair above the resistance of 1.1095, forming a false breakdown there, which is a signal to sell the euro. I spoke about this in more detail in my morning forecast. At the moment, while trading below the resistance of 1.1095, pressure on the pair will remain and the ECB President Mario Draghi may cause the upgrade to a new weekly low of 1.1066, and to its breakthrough, which will hit the bulls with stop orders and push the euro even lower, to support 1.1026, where I recommend taking the profits. If Draghi's performance is ignored, it is best to return to short positions from the resistance of 1.1120 or to rebound from a new high of 1.1149. Indicator signals: Moving Averages Trading is conducted around 30 and 50 moving averages, which indicates market uncertainty. Bollinger Bands The lower border of the indicator around 1.1075 acts as a support.

Description of indicators

|

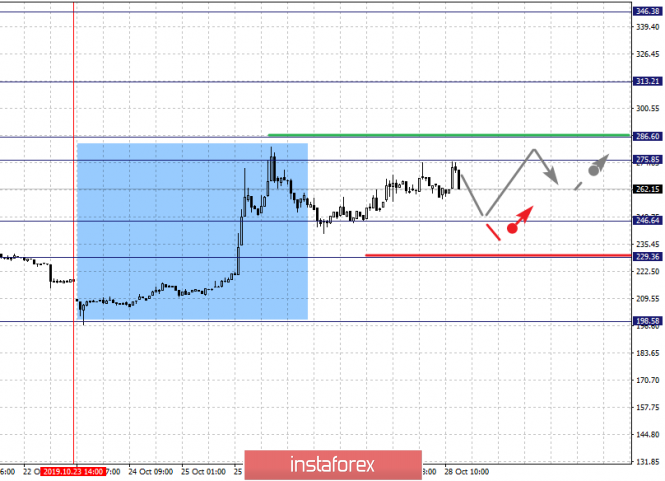

| Fractal analysis of cryptocurrencies BTCUSD and Ethereum on October 28th Posted: 28 Oct 2019 06:23 AM PDT Hello, dear colleagues. According to BTCUSD, the price has issued long-term initial conditions for the upward cycle of October 23 and at the moment, we expect a weekly movement in the horizontal corridor of 288.00 – 229.50. According to Ethereum, the price has issued long-term initial conditions for the upward cycle of October 23 and at the moment, we expect a weekly movement in the horizontal corridor of 201.00 – 167.50, which is more convenient to trade in the corridor than on BTCUSD. Forecast for October 28: Analytical review of cryptocurrency in H1 scale:

For the BTCUSD instrument, the key levels on the H1 scale are 346.38, 313.21, 286.60, 275.85, 246.64, 229.36, and 198.58. At the moment, the price has issued long-term initial conditions for the upward cycle of October 23. We expect the development of the main trend after the price passes the range of 275.85 – 286.60. In this case, the first target is 313.21 and near this level is the consolidation. The breakdown of 313.50 should be accompanied by a pronounced upward movement. The potential target – 346.38. A short-term downward movement is possible in the range of 246.64 – 229.36, hence we expect a key reversal to the top. The breakdown of the level of 229.36 will lead to the development of a downward trend. The potential target – 198.58. The main trend is the long-term initial conditions for the top from October 23rd. Trading recommendations: Buy: 286.60 Stop Loss: 246.50 Take Profit: 313.00 Buy: 313.50 Stop Loss: 276.00 Take Profit: 346.00 Sell: 246.64 Stop Loss: 286.60 Take Profit: 229.50 Sell: 228.00 Stop Loss: 247.00 Take Profit: 200.00

For the #Ethereum tool, the key levels on the H1 scale are 231.77, 214.78, 200.42, 189.47, 175.10, 167.47, 163.99, and 153.32. The price has issued long-term initial conditions for the upward cycle from October 23. The continuation of the upward movement is expected after the breakdown of 189.50. In this case, the target is 200.40 and near this level is the consolidation. The breakdown of 200.50 will lead to a pronounced movement. The target is 214.78 and there is also consolidation near this level. We consider the level of 231.77 as a potential value, from this level we expect a pullback to the correction. The short-term downward movement is possible in the range of 175.10 – 167.47, hence the high probability of a reversal to the top. The passage of the price of the range of 167.47 – 163.99 will have to develop a downward trend. The target – 153.32. The main trend is the long-term initial conditions for the top of October 23rd. Trading recommendations: Buy: 189.50 Stop Loss: 173.00 Take Profit: 200.00 Buy: 201.00 Stop Loss: 189.00 Take Profit: 214.50 Sell: 175.00 Stop Loss: 189.50 Take Profit: 167.50 Sell: 163.50 Stop Loss: 180.00 Take Profit: 153.50 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 28 Oct 2019 06:23 AM PDT Good evening, dear traders! I congratulate everyone on the beginning of the trading week. I present to your attention a trading idea for the EURUSD pair. The global weakening of the US dollar, associated with weak macrostatistics and a high probability of an interest rate increase at the next meeting of the Fed, pushed the pair EURUSD for the quote 1.1, and in the first half of October, we observed a steady trend in the euro, which broke through the downward trend of the instrument and, thus, formed a wave A, the classic three-wave ABC. After the ECB press conference, we see a pullback wave of "B", which, in my opinion, is in its final phase:

Within this large structure – general recommendations – for purchases in order to update quotes 1.11783 and 1.12500. But before that, EURUSD can capture the stops of buyers presented in the screenshot below:

It is possible to work out both a decrease to the goal in the short term and an increase in the medium term. There's a lot of important news this week like the FOMC on Wednesday and the NFP on Friday. Be careful when trading at this time. The material has been provided by InstaForex Company - www.instaforex.com |

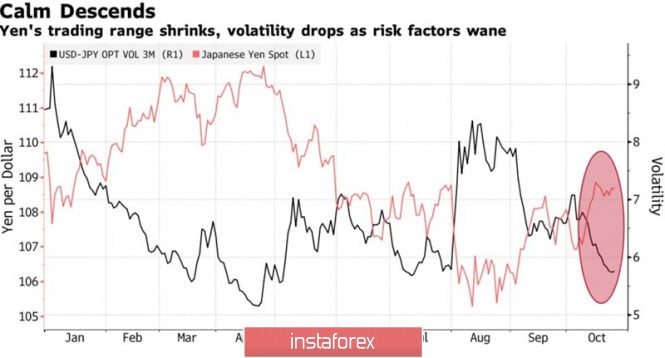

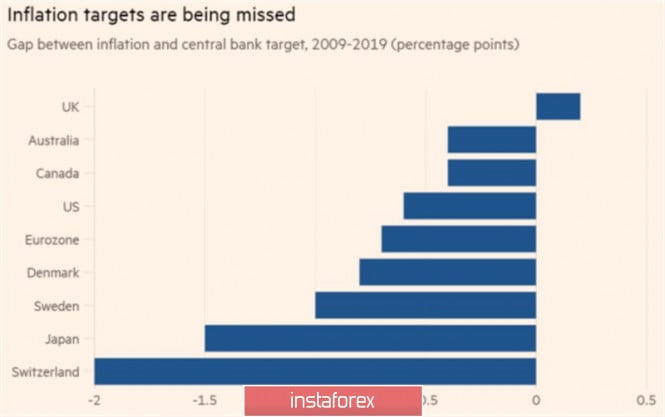

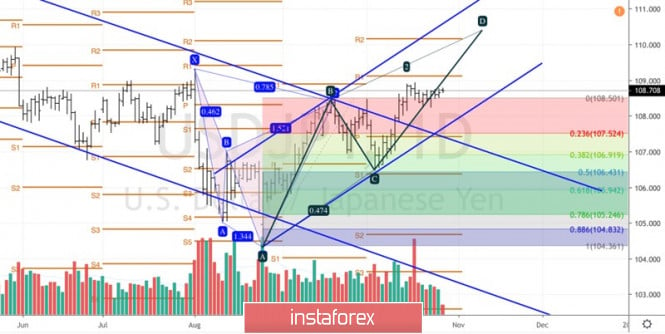

| The yen took the front sight of the Fed Posted: 28 Oct 2019 05:58 AM PDT Improving global risk appetite amid the de-escalation of the US-China trade conflict and progress in Britain-EU relations on Brexit have made the Japanese yen one of the outsiders on Forex. Back in August, it seemed that the currency of the Land of the Rising Sun could compete with the Canadian dollar in the struggle for the title of best performer of the year among G10 monetary units, but everything turned upside down in the fall. Washington and Beijing are ready to finalize the first part of the trade agreement and submit it for the signature to the presidents of the two countries, while London and Brussels have finally found a common language on the issue of the Irish border. The three-month volatility of the yen fell to the lowest level since July, which increases investor interest in carrying trade operations, contributes to the sale of funding currencies and may put an end to the "bearish" forecasts of major banks for USD/JPY. In particular, Goldman Sachs recommended selling the pair with a target of 103, while BNP Paribas and Morgan Stanley saw it even lower. At around 102 and 101, respectively. Mathematically, the current level of volatility suggests that before the end of the year, the dollar is likely to trade in the range of £105.4-111 with a 75% probability. Dynamics of USD/JPY and yen volatility

The yen rightfully claims to be the most interesting currency of the week to November 1 due to the saturated important macro statistics of the economic calendar, rumors of Boris Johnson initiating early elections in Britain and the development of the situation in the field of trade wars. Also, we are expected to meet the Fed and the Bank of Japan. The release of data on US GDP and the labor market should show a further slowdown in the US economy. Bloomberg experts expect its growth in the third quarter to decline from 2% to 1.6%, and employment in October will grow by less than 100 thousand. Fears that the easing of monetary policy by the Fed and ECB will lead to a strengthening of the yen, contributed to the growth of rumors about additional monetary stimulus from the Bank of Japan. The currency of the Land of the Rising Sun did not revalue, so BoJ can afford passive behavior. Moreover, as practice shows, increasing the balance with QE is not the best way to accelerate inflation. In Japan and Switzerland, central bank balances exceed GDP, but the deviation of actual consumer price data from the targets is the most significant among regulators that issue G10 currencies. The deviation of the actual CPI from target

Thus, further dynamics of USD/JPY will depend on the external background, macro statistics for the Thus, further dynamics of USD/JPY will depend on the external background, macro statistics for the States and meetings of central banks. If Jerome Powell after reducing the federal funds rate to 1.75% manages to convince the stock market that a pause in the process of monetary expansion is not a problem, the bulls in the analyzed pair will be able to continue the attack. Technically, a breakthrough in the resistance of 108.9-109.1 will allow USD/JPY to resume the northern campaign in the direction of the target by 200% according to the AB = CD pattern. It is located near 110.4. USD/JPY, the daily chart |

| Trading recommendations for the EURUSD currency pair – placement of trade orders (October 28) Posted: 28 Oct 2019 05:57 AM PDT Although the euro/dollar currency pair showed relatively low volatility (49 points) by the end of last week, the quote still managed to touch the key level that many were waiting for. From technical analysis, we see a stunning inertial move in the recovery phase, which, although it was not large in terms of movement, it still managed to touch the key level for this period 1.1080. What we have – working off the mirror level of 1.1180, where the phase of stunning overbought began to emerge initially uncertain short positions. After that, there was a gradual acceleration and reaching the first control point of 1.1080. The emotional component of market participants, paired with volatility, experienced a considerable shock at the moment of inertia (October 1-21), but after October 21, a distinct healing process began, where emotions subsided and rational steps appeared in terms of cyclicity. Analyzing the hourly Friday day, we see that the main turn of the course fell on the period of 12:00-19:00 hours (time on the trading terminal), after which the price touched the level of 1.1080 and there was a local rebound. As discussed in the previous review, the main part of traders was waiting for a clear fixation of the price below the level of 1.1080, which, in principle, happened, but after the initial breakdown, a rollback occurred immediately, which as a fact did not confirm the breakdown. Looking at the trading chart in general terms (the daily period), we see one of the stages of the recovery course relative to the oblong correction, where we have already received 33% of mining. This may be only the beginning if the quote still manages to fix below the level of 1.1080, but it is too early to talk about the prospects since there is still a risk of entering the long-playing sideways 1.1080/1.1180. Friday's news background in terms of the economic calendar seemed to be absent, as there were no statistics worthy of attention in Europe and the United States. In terms of information background, on the contrary, we had discussions about the postponement of Brexit, where the Commonwealth countries decided to grant a postponement, but did not announce its term. We will return to the Brexit divorce process today, and now I would like to touch upon such a momentous event as the meeting of the Federal Committee for Open Markets, which is scheduled for this Wednesday (October 29-30). So, many eminent experts (Goldman Sachs; Bloomberg) are inclined to believe that the regulator will still succumb to the onslaught of the public and reduce the refinancing rate to 1.75%. However, there is an opinion that the Fed will change the key language that indicates that this step, the third easing of the policy for the year, will correspond to the adjustment in the middle of the regulator cycle, referred to by the Chairman of the Federal Reserve Jerome Powell in July. In turn, US President Donald Trump decided to prepare public opinion, accusing the Federal Reserve of high rates and calling for its omission. "The Federal Reserve will not fulfill its obligations if it does not reduce the rate and, ideally, does not introduce stimulus measures. Look at our competitors all over the world. Germany and others get paid for their borrowing. Fed raises rate too fast and lowers it too slowly," – twitter @realDonaldTrump Today, in terms of the economic calendar, we did not have statistics on Europe and America, but there was an array of Brexit information background. So, the European Union has agreed to make further concessions to England, giving it an additional delay of three months, this was stated by the head of the European Council Donald Tusk in his Twitter. "The EU, consisting of 27 countries, agreed that it would accept the UK request for an extension of Brexit until January 31, 2020. It is expected that the decision will be formally formalized following a written procedure," – twitter @eucopresident Further development Analyzing the current trading chart, we see a rebound from the level of 1.1080, where the quote rose quite confidently up to the value of 1.1106. The consecutive oscillation (impulse/correction) stretches for the fifth day in a row, which may indicate a healthy emotional composition of the market. By detailing the available time interval, we see that from the Pacific-Asian trading session there was a gradual upward process at the rebound phase, but a more or less strong momentum fell at 13:15 (time on the trading terminal), which just threw the quote to the limits of 1.1106. In turn, cunning speculators decided to earn extra money in the phase of the rebound from the level of 1.1080, where local long positions were laid in the area of 1.1085. The focus, in this case, was precisely on the local pullback, analyzing the H1 period at the time of the Pacific-Asian trading session. It is likely to assume that the return to the limits of the level of 1.1080 is still possible, but the strategic entry into the market will be made after fixing the price below 1.1080 or to be more precise, below 1.1070. Based on the above information, we derive trading recommendations:

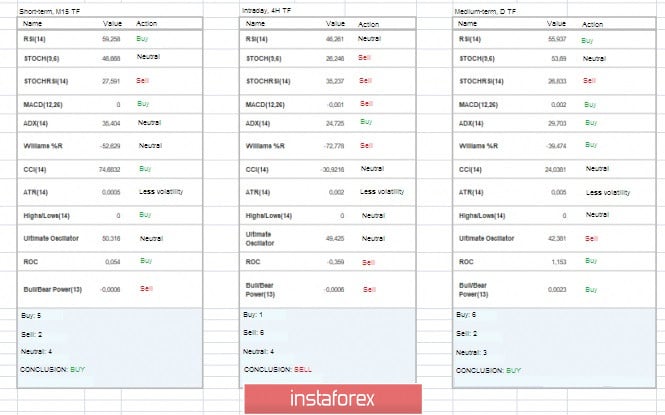

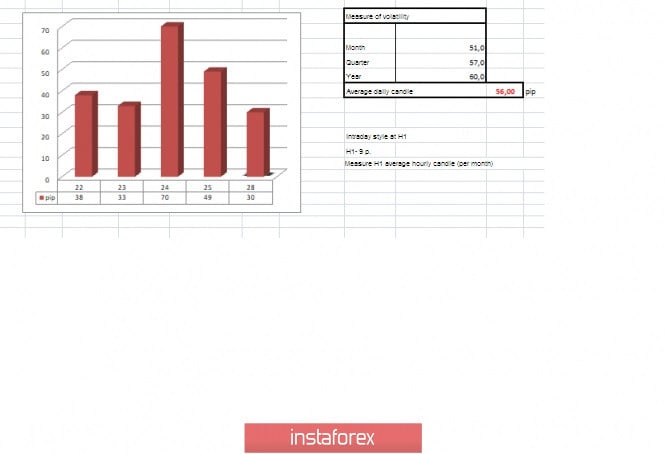

Indicator analysis Analyzing the different sectors of timeframes (TF), we see that the indicators in the short term are working on the pullback phase, signaling purchases. Intraday indicators, on the contrary, work in the recovery phase of the movement, signaling sales. The medium-term period retains an upward interest against the background of inertia, but there is already some progress, the indicators are gradually changing their mood. Volatility per week / Measurement of volatility: Month; Quarter; Year. Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (October 28 was built taking into account the time of publication of the article) The volatility of the current time is 30 points, which is the average for this period. It is likely to assume that in the event of a slowdown and return to the limits of the fulcrum, we will see low activity in the market. We need not just a characteristic background but also fixing the price below the level of 1.1080 to increase volatility. Key levels Resistance zones: 1.1180*; 1.1300**; 1.1450; 1.1550; 1.1650*; 1.1720**; 1.1850**; 1.2100. Support zones: 1.1080**; 1.1000***; 1.0900/1.0950**; 1.0850**; 1.0500***; 1.0350**; 1.0000***. * Periodic level ** Range level *** Psychological level * * * * FOMO – loss of profits Syndrome ***** The article is based on the principle of conducting transactions, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 28 Oct 2019 05:57 AM PDT EUR/USD – 4H.