Forex analysis review |

- GBPUSD approaching resistance, potential for big drop!

- AUDUSD pullback below resistance

- Fractal analysis of the main currency pairs as of October 30

- Trading strategy for GBP/USD for October 29. The UK can leave the EU whenever it wants

- Trading strategy for EUR/USD on October 29. Traders believe in the Fed's third consecutive decline of the rate

- Pound - pawn in a big game called Brexit?

- Yen stumbled on the strategy of leading central banks

- GBPUSD and EURUSD: Slowing lending in the UK is a bad sign. Labour is not against holding general elections in December this

- October meeting of the Fed: the results are a foregone conclusion, but the intrigue remains

- EUR/USD. October 29. Results of the day. The Fed has plenty of reason to lower rates, but Jerome Powell's rhetoric is more

- GBP/USD. October 29. Results of the day. Labour has several "joker" cards on hand

- BTC 10.29.2019 -Potential gap fill on the Bitcoin

- The euro is predicting a bleak future after Draghi leaves

- EUR/USD for October 29,2019 - Daily bull potential increased

- USD/CAD analysis for October 29, 2019 - Upside breakout of the falling wedge, buying opportunitiy is present

- Trading recommendations for the EURUSD currency pair – placement of trade orders (October 29)

- October 29, 2019 : GBP/USD showing respect for demand level around 1.2780 awaiting for bearish breakout.

- October 29, 2019 : EUR/USD technical outlook predicts further bearish decline below 1.1090.

- Trading idea for the currency pair CADCHF

- GBP/USD: plan for the American session on October 29th. The pound fell on data on credit growth but returned on Labor Party's

- EUR/USD: plan for the American session on October 29th. The euro returned to weekly lows, but volatility remains low

- Technical analysis of GBP/USD for October 29, 2019

- Will the dollar substitute for oil?

- USD/JPY – take profit + 500!

- USDJPY reaching resistance, watch out!

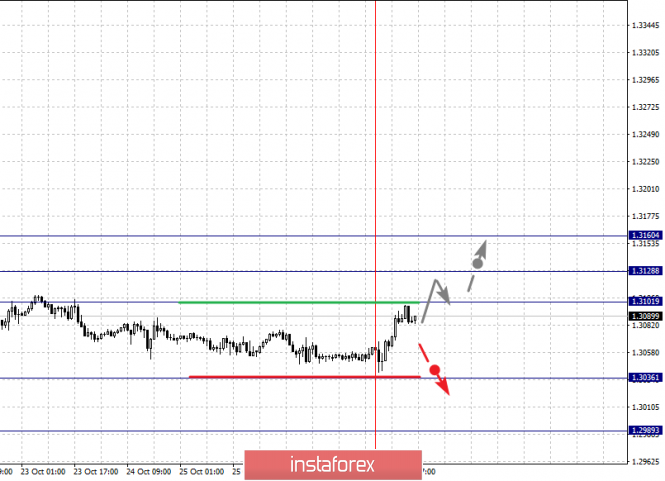

| GBPUSD approaching resistance, potential for big drop! Posted: 29 Oct 2019 07:24 PM PDT Entry: 1.2903 Why is it good: Horizontal swing high resistance, 100% fibonacci extension, 50% fiboancci retracement Take Profit : 1.2800 Why is it good: Horizontal swing low support, 100% fibonacci extension, 23.6% fibonacci retracement Stop loss: 1.2700 Why is it good: horizontal overlap support, 38.2% fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

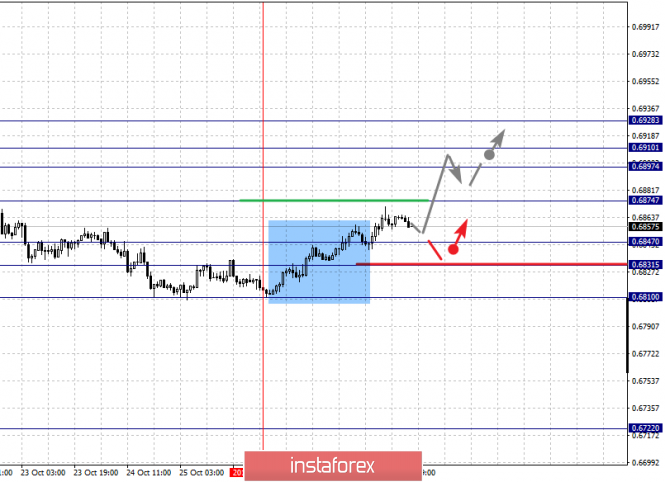

| AUDUSD pullback below resistance Posted: 29 Oct 2019 07:02 PM PDT

Entry: 0.68715 78.6% Fibonacci retracement Take Profit : 0.68363 Why it's good : 61.8% Fibonacci retracementThe material has been provided by InstaForex Company - www.instaforex.com |

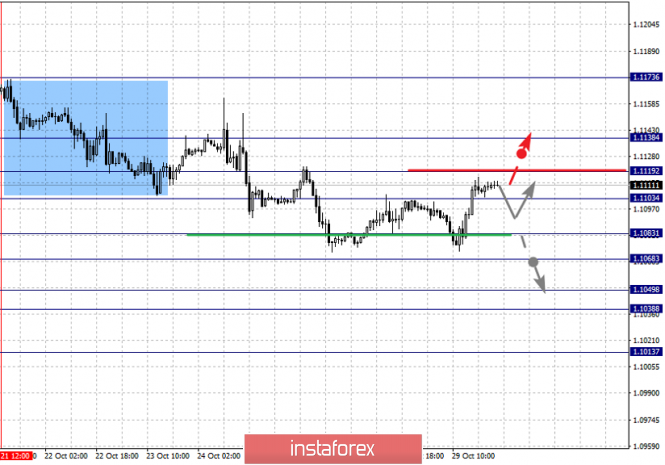

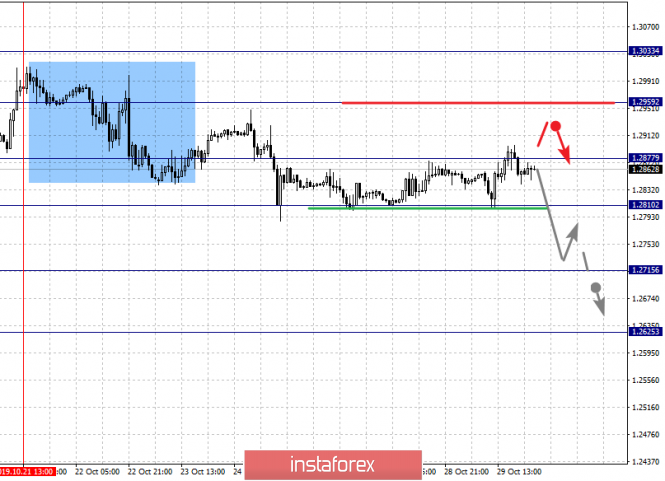

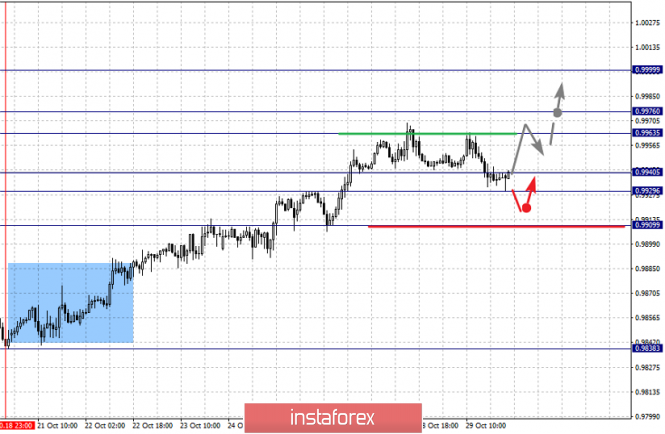

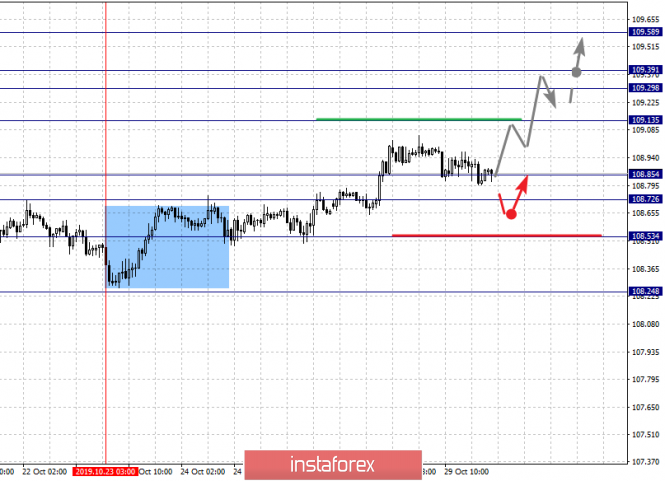

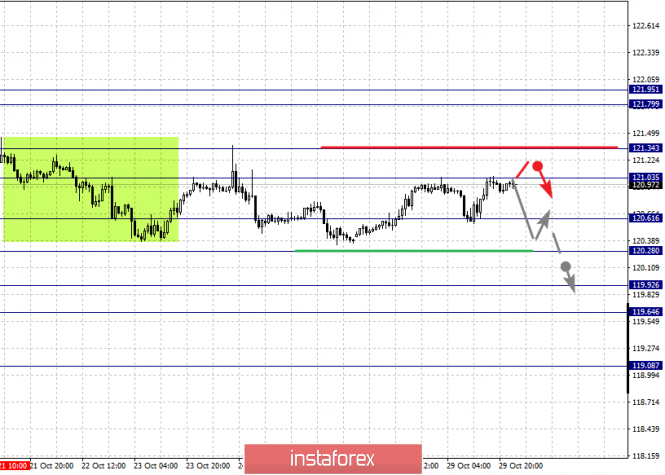

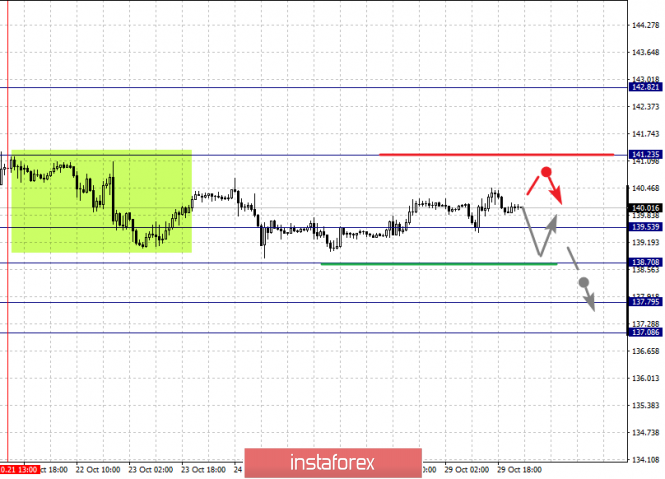

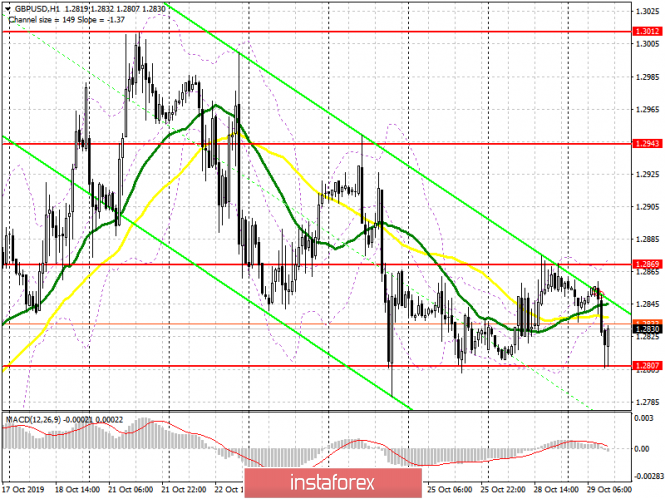

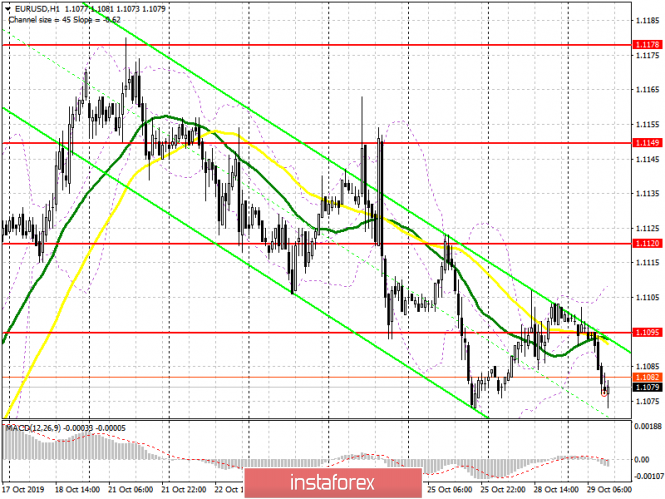

| Fractal analysis of the main currency pairs as of October 30 Posted: 29 Oct 2019 05:28 PM PDT Forecast for October 30: Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1138, 1.1119, 1.1103, 1.1083, 1.1068, 1.1049, 1.1038 and 1.1013. Here, we are following the development of the descending structure of October 21. Short-term downward movement is expected in the range of 1.1083 - 1.1068. The breakdown of the latter value will lead to a pronounced movement. In this case, the target is 1.1049. Price consolidation is in the range of 1.1049 - 1.1038. For the potential value for the bottom, we consider the level of 1.1013. Upon reaching which, we expect a pullback to the top. We expect a consolidated movement in the range 1.1103 - 1.1119. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.1138. This level is a key support for the downward structure. Its passage at the price will lead to the development of an upward trend. In this case, the potential target is 1.1173. The main trend is the descending structure of October 21, the correction stage. Trading recommendations: Buy: 1.1120 Take profit: 1.1137 Buy: 1.1142 Take profit: 1.1170 Sell: 1.1083 Take profit: 1.1070 Sell: 1.1068 Take profit: 1.1050 For the pound / dollar pair, the key levels on the H1 scale are: 1.3215, 1.3141, 1.3033, 1.2939, 1.2810, 1.2734 and 1.2625. Here, we are following the development of the upward cycle of October 9. At the moment, the price has expressed a pronounced potential for the downward movement of October 21. The continuation of the movement to the top is expected after the breakdown of the level of 1.2959. In this case, the first target is 1.3035. The breakdown of the level of 1.3035 will lead to a pronounced upward movement. Here, the potential target is 1.3141. Price consolidation is in the range of 1.3141 - 1.3215. We expect consolidated movement in the range of 1.2877 - 1.2810. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.2715. This level is a key support for the top. Its breakdown will lead to the formation of potential for the downward cycle. Here, the goal is 1.2625. The main trend is the ascending structure of October 9, the formation of the descending structure of October 21. Trading recommendations: Buy: 1.2960 Take profit: 1.3031 Buy: 1.3035 Take profit: 1.3140 Sell: 1.2808 Take profit: 1.2717 Sell: 1.2713 Take profit: 1.2627 For the dollar / franc pair, the key levels on the H1 scale are: 0.9999, 0.9976, 0.9963, 0.9940, 0.9929 and 0.9909. Here, we are following the development of the ascending structure of October 18. Short-term upward movement, we expect in the range 0.9963 - 0.9976. The breakdown of the last value will lead to a pronounced movement. Here, the target is a potential target - 0.9999, when this value is reached, we expect a pullback to the bottom. Consolidated movement is possibly in the range of 0.9940 - 0.9929. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 0.9909. This level is a key support for the upward structure. The main trend is the ascending structure of October 18, the correction stage. Trading recommendations: Buy : 0.9963 Take profit: 0.9974 Buy : 0.9978 Take profit: 0.9999 Sell: Take profit: Sell: 0.9927 Take profit: 0.9912 For the dollar / yen pair, the key levels on the scale are : 109.58, 109.39, 109.29, 109.13, 108.85, 108.72 and 108.53. Here, we are following the development of the upward cycle of October 23. The continuation of the movement to the top is expected after the breakdown of the level of 109.13. In this case, the target is 109.29. Price consolidation is in the range of 109.29 - 109.39. For the potential value for the top, we consider the level of 109.58, upon reaching which, we expect a pullback to the bottom. Short-term downward movement is expected in the range of 108.85 - 108.72. The breakdown of the last value will lead to an in-depth correction. Here, the target is 108.53. This level is a key support for the top. Main trend: local structure for the top of October 23. Trading recommendations: Buy: 109.13 Take profit: 109.29 Buy : 109.40 Take profit: 109.56 Sell: 108.85 Take profit: 108.74 Sell: 108.70 Take profit: 108.55 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3160, 1.3128, 1.3101, 1.3036 and 1.2989. Here, we are following the development of the downward trend of October 10. At the moment, the price forms a small potential of October 29 for the movement in correction. The continuation of movement to the bottom is expected after the breakdown of the level of 1.3036. In this case, the target is the potential target 1.2989. Upon reaching this level, we expect a pullback to the top. Short-term upward movement is possibly in the range of 1.3101 - 1.3128. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3160. This level is a key support for the downward structure. The main trend is the downward cycle of October 10, the correction stage. Trading recommendations: Buy: 1.3101 Take profit: 1.3126 Buy : 1.3130 Take profit: 1.3160 Sell: Take profit: Sell: 1.3034 Take profit: 1.3000 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6928, 0.6910, 0.6897, 0.6874, 0.6847, 0.6831 and 0.6810. Here, the price registered the local upward structure of October 28. The continuation of the movement to the top is expected after the breakdown of the level of 0.6874. In this case, the target is 0.6897. Price consolidation is in in the range of 0.6897 - 0.6910. For the potential value for the top, we consider the level of 0.6928. Upon reaching which, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 0.6847 - 0.6831. The breakdown of the latter value will lead to the formation of a downward structure. Here, the potential target is 0.6810. The main trend is the local structure for the top of October 28. Trading recommendations: Buy: 0.6875 Take profit: 0.6896 Buy: 0.6910 Take profit: 0.6928 Sell : 0.6846 Take profit : 0.6831 Sell: 0.6828 Take profit: 0.6810 For the euro / yen pair, the key levels on the H1 scale are: 121.95, 121.79, 121.34, 121.03, 120.61, 120.28, 119.92 and 119.64. Here, price has entered an equilibrium state. Short-term upward movement is expected in the range 121.03 - 121.34. The breakdown of the level of 121.35 should be accompanied by a pronounced upward movement. Here, the target is 121.79. Price consolidation is in the range of 121.79 - 121.95. From here, we expect a correction. We expect consolidated movement in the range of 120.61 - 120.28. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 119.92. This level is a key support for the top. Its passage at the price will lead to the formation of initial conditions for the downward cycle. In this case, the first goal is 119.64. The main trend is the rising structure of October 15 and the formation of potential for the bottom of October 21. Trading recommendations: Buy: 121.05 Take profit: 121.34 Buy: 121.36 Take profit: 121.76 Sell: 120.25 Take profit: 119.94 Sell: 119.90 Take profit: 119.66 For the pound / yen pair, the key levels on the H1 scale are : 142.82, 141.23, 139.53, 138.70, 137.79 and 137.08. Here, price has entered an equilibrium state. The continuation of movement to the top is expected after the breakdown of the level of 141.23. In this case, the potential target is 142.82. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement, as well as consolidation, are possible in the range of 139.53 - 138.70. The breakdown of the last value will lead to a long correction. Here, the target is 137.79. The range of 137.79 - 137.08 is the key support for the top. The main trend is the medium-term upward structure of October 8, the formation of potential for the downward movement of October 21. Trading recommendations: Buy: 141.25 Take profit: 142.80 Sell: 139.50 Take profit: 138.75 Sell: 138.65 Take profit: 137.80 The material has been provided by InstaForex Company - www.instaforex.com |

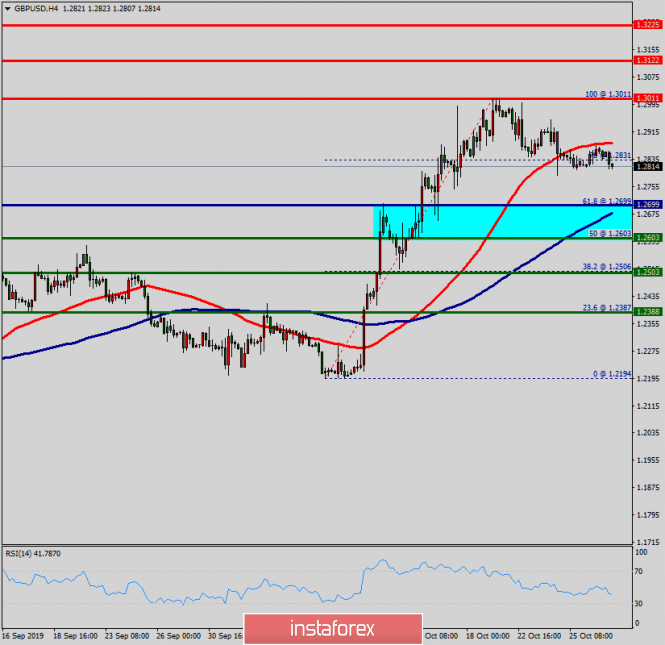

| Trading strategy for GBP/USD for October 29. The UK can leave the EU whenever it wants Posted: 29 Oct 2019 04:51 PM PDT GBP/USD - 4 H. On October 4, the GBP / USD pair completed consolidation above the Fibo level of 61.8% - 1.2836 on the 4-hour chart, and the bullish divergence of the CCI indicator has not been canceled. Thus, now, traders can expect some growth of quotations in the direction of the correctional level of 76.4% - 1.3044. On the other hand, new brewing divergences are not observed on October 29. The information background for the pair can be interpreted in different ways, and tomorrow, it can make big changes in the dynamics of the pound-dollar pair. News of the Brexit delay agreement is good news for the British pound. The European Union has officially announced the granting of flexible postponement to London, which means a formal postponement of the new release date to January 31, but the UK may withdraw earlier as soon as Boris Johnson is able to agree with Parliament on ratification of the agreement. Meanwhile, the main opposition of Boris Johnson and the ruling Conservative Party, Jeremy Corbyn, whose party yesterday refused to accept the Prime Minister's proposal for early parliamentary elections on December 12, sharply changed his mind today. According to Jeremy Corbyn, his party has achieved the most important thing - the impossibility of holding Brexit's "No Deal", and is now ready to agree to hold early parliamentary elections. Let me remind you that it is through re-election that Boris Johnson will try to win more seats for his party than he currently has. This will be necessary in the future in order to freely adopt any bills that the conservatives or Boris Johnson will need. First of all, it concerns Brexit so with or without a deal, it doesn't matter. Moreover, Johnson is sorely lacking in parliament right now (thanks to the elections held by Theresa May), but where are the guarantees that there will be more after the new elections? The Labour party themselves also announced their readiness for the election, as well as for the largest and most ambitious election campaign. Corbyn and his party members understand that either they will get no less votes than they have now, or all efforts to prevent Brexit from "No Deal" can be considered in vain. At the same time, the people of Great Britain cannot but understand this, who, according to various sociological studies, is not so sure of the expediency and necessity of Brexit, especially without an agreement. In any case, we can witness some of the most interesting and fateful elections. For the pound, it all now boils down to the fact that Brexit's "No Deal" will not be in the near future, which is good. Therefore, bull traders are happy to buy the British currency. If tomorrow it turns out that America's GDP will slow down and the Fed will lower its key refinancing rate, then there will be even more bullish factors for the pound-dollar pair. What to expect today from the pound-dollar currency pair? The pound-dollar pair consolidated above the correction level of 61.8%. Today, I expect continued growth to resume, and tomorrow, increase in the activity of traders, as there will be much more news and reports on October 30. Only fixing the pair's exchange rate at the Fibo level of 61.8% can be interpreted in favor of the US currency and count on the resumption of the fall in the direction of the correction level of 50.0% - 1.2668. The Fibo grid was built at the extremes of March 13, 2019 and September 3, 2019. Forecast for GBP/USD and recommendations for traders: I recommend buying a pair with a target of 1.3044, since it closed at 61.8% with a Stop Loss of 1.2836. I recommend considering the sales of the pair with the target of 1.2668 if consolidation under the last low of bullish divergence is completed. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Oct 2019 04:45 PM PDT EUR/USD - 4 H. On October 4, the EUR/USD pair performed a return to the correction level of 100.0% - 1.1106 on the 4-hour chart, and rebounded from it; however, it could not resume the process of falling. At the moment, the euro-dollar pair has completed a return to this Fibo level again and is threatening to close it. If this happens, then I will state the reversal of the pair's quotes in favor of the European currency and expect some growth in the direction of the level of 1.1164, to which the pair has already approached twice. In addition, another rebound from the correction level of 100.0% will work again in favor of the US dollar. Information background: If you start the countdown from Monday last week, then only one day out of all the workers was really interesting in terms of news. All other days can be safely identified as half-days, as no economic reports were published. Nevertheless, the head of the European Central Bank, Mario Draghi, delivered a speech twice (once just last Thursday), both times his speech could not be called positive for the European currency, and his last speech was frankly just a farewell. This Thursday, Christine Lagarde will officially take over his post, and the ECB will turn over a page dedicated to the 8-year reign of Mario Draghi. But all this time, the Euro currency practically didn't respond at all, since most of the traders took their places "on the fence" and were waiting for news, and the news will only be tomorrow. However, today at the American session, signs of growth of the Euro currency were noticed, although there seemed to be no reason for this. On the other hand, a day before the Fed summarizes the results of the meeting, a dollar fall is a sign that traders believe in a third consecutive rate reduction and begin to get rid of the US currency. Burning, by the way, is not too strong. As a result, a day before the most important event of October, we have a rather blurry situation. If we take into account the worsening economic statistics in the US - the Fed has reason to weaken monetary policy. If you take into account the ongoing trade war with China - the Fed has reason to lower rates. If you take into account the ongoing criticism of Jerome Powell by Donald Trump - the Fed has reason to weaken monetary control. Thus, traders are not in vain expecting a decrease in rates by another 0.25%. What will be the reaction of traders to this event? It is unlikely that the US dollar will fall too much, yet many forecasters predict this decision by the Fed, it will not come as a surprise. What to expect today from the euro-dollar currency pair? October 29, traders, most likely, will relatively calmly bring the day to an end, and the most interesting event will be tomorrow. If the euro-dollar pair closes above the correction level of 100.0% - 1.1106, I will expect continued growth of the pair. Meanwhile, weak GDP data in America, Fed rate cuts, a portion of dovish comments from Jerome Powell - all of these will support bull traders in their desire to buy European currency. The Fibo grid was built at the extremes of May 23, 2019 and June 25, 2019. Forecast on EUR/USD and recommendations to traders: I recommend selling the pair with a target of 1.1024 if a new rebound from the level of 1.1106 (100.0% Fibonacci) is performed. Stop Loss - Above 1.1106. I recommend buying a pair with targets 1.1164 and 1.1232 and Stop Loss level at 1.1106, if closing is performed above the Fibo level of 100.0%. The material has been provided by InstaForex Company - www.instaforex.com |

| Pound - pawn in a big game called Brexit? Posted: 29 Oct 2019 03:39 PM PDT The dynamics of the British currency amid heated debate around the least traumatic option for Britain to exit the EU left much to be desired. The pound experienced the strongest price fluctuations and hardly held the gained positions. He has a little respite now, but for how long? A short pause in the dynamics of the pound is caused by a three-month delay by Brexit, to which European leaders agreed. Earlier it was reported that the European Union has ratified the flexible terms of the delay in relation to the British exit from the eurobloc. Recall that the country was supposed to leave the EU this Thursday, October 31, but now the deadline has been moved. It was announced that 27 participating countries agreed on a deferral of Brexit. The date of exit from the EU is now postponed to January 31, 2020. If the British Parliament ratifies the withdrawal agreement in November, the country will leave the bloc on December 1, 2019, and if it ratifies in December, the "divorce" will take place on January 1, 2020. Brussels is currently awaiting formal agreement from London regarding the postponement granted until the end of January. According to experts, such conditions are favorable for the UK, since early parliamentary elections can be held in the country on December 12, 2019. In this case, British Prime Minister Boris Johnson can accelerate the ratification of the agreement with the European Union. According to the law, signed by the British Parliament, Johnson is obliged to accept the offer of deferment at the time of its receipt. Earlier, the prime minister said that the country will leave the eurobloc on October 31 in any case, with or without a deal. However, the politician had to reconsider his plans. He submitted to Parliament, counting on the approval of the new elections scheduled for December 12, in exchange for his postponement. According to Johnson, a new election is an urgent need and the best way to break the current impasse. Monday's political debate around Brexit did not affect the pound too much. It stabilized within 1.2859–1.2861, pausing to vote on the issue of holding general elections. The political clouds hanging over Britain for a long time have been a bit dispelled. This positively affected the dynamics of the pound, which gradually began to grow. On Tuesday, October 29, the GBP/USD pair rose to 1.2870. Subsequently, the pair traded in the range of 1.2855–1.2856, showing a downward trend. According to analysts, the pound will be able to return to the 1.2950 area if the ratification processes in the House of Commons go more intensively. The GBP/USD pair is testing the 1.2841–1.2842 marks at the moment. According to currency strategists at Bank of America Merrill Lynch, relatively quiet times are coming for sterling. The risk of an uncontrolled exit from the EU, that is, the "hard" Brexit, tends to zero, and this is a very positive factor for the British currency. If Parliament approves the Brexit deal, the pound may rise above 1.3000, the bank believes. Experts are certain that the pound will test the level of 1.3500 in the near future, which is 5% higher than the current figures. In general, experts assess the condition of the British currency as not very stable. This is not surprising: the pound, along with the European currency, was experiencing severe congestion due to difficulties with Britain's exit from the European Union. The long search for a compromise between London and Brussels negatively affected the currency of Great Britain. The pound involuntarily became a bargaining chip in a political game called Brexit, a pawn in the hands of financiers, and this does not suit anyone. Analysts are confident that, having received a respite, the pound will gather strength and again rush into the battle, which will be able to win. The material has been provided by InstaForex Company - www.instaforex.com |

| Yen stumbled on the strategy of leading central banks Posted: 29 Oct 2019 03:38 PM PDT The Japanese currency suspended the upward movement, which was not too intense, in anticipation of the decision to soften the monetary policy of the leading regulators - the Federal Reserve and the Bank of Japan. The decline was small, but noticeable, analysts said. On Monday, October 28, the yen was trading in a narrow range of 108.67–108.72 after falling to its lowest level in the past week. Experts believe that the Fed's super soft position and a possible decision by the Bank of Japan to mitigate monetary policy have become the main drivers of this decline. This halted the growth of the USD/JPY pair, which climbed less than 0.1% to 108.74. Later, the pair reached the level of 108.79, which was the highest since October 17 this year. Investors were very enthusiastic about the possible Fed rate cut this week. Usually, a reduction in rates is preceded by a weakening of the currency, but yesterday the USD/JPY pair reached a seven-week high, exceeding 109.00. Earlier, the Federal Reserve announced the start of the purchase of treasury bonds at $60 billion per month to restore reserves. Experts consider this news favorable for the Japanese currency. However, analysts expect the USD/JPY pair to retreat before the announcement of the Fed decision on monetary policy. They believe that the yen will give up its positions, and the 200-day moving average, located near 109.00, will become a barrier to the Japanese currency's further growth. At the moment, the USD/JPY pair runs in the range of 108.91-108.92, having slightly risen from the low morning levels. On the morning of Tuesday, October 29, the pair dropped to the levels of 108.85–108.86, but subsequently managed to gain a foothold in the gained positions. Comparing the volatility of interest rates in the US and the volatility in the USD/JPY pair, the currency strategists of Citigroup Bank note that the US currency is the winner in this situation. The difference in interest rates will decrease if the Fed rates fall to zero, but this will not affect the volatility of the dollar, analysts said. The USD/JPY pair is quite sensitive to the differential of long-term rates, experts emphasize. An important role for the Japanese currency exchange rate is played by the current monetary policy, the instruments of which, in addition to the Fed rate, include a quantitative easing program (QE) and fiscal stimulus. These factors strongly affect the US dollar. As for the actions of the Bank of Japan, it has practically nothing to strive for, analysts said. They do not expect drastic decisions from the regulator at today's meeting. However, the current situation is extremely unfavorable for the yen, experts emphasize. At the same time, they doubt the further weakening of the Japanese currency, which always remains stable in difficult situations. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Oct 2019 03:38 PM PDT The slowdown in consumer lending is very bad news for the Bank of England, which poses a threat to the UK economy. A report was released today that stated that the number of approved mortgages in the UK remained virtually unchanged, while consumer credit growth slowed to a five-year low. GBPUSD So, the number of approved mortgages in September 2019 amounted to 66,000, while economists expected the indicator to be at 65,100. The figure was 65,680 in August. Net mortgage lending in the UK rose to 3.8 billion pounds in September against 3.7 billion pounds in August, indicating stability in the housing market. However, net consumer lending in the UK amounted to 4.6 billion pounds in September against the same figure of 4.6 billion pounds in August. Unsecured consumer lending grew by 6.0% year on year, representing the weakest growth since 2014. The report indicated that unsecured consumer lending in the UK increased by 0.8 billion in September pounds against 1.0 billion pounds in August, while economists had forecast it at 0.9 billion pounds. The situation with Brexit leaves its mark on lending, which in general slows down for the third straight year, after a referendum at which it was decided to withdraw the country from the EU. The slowdown in lending suggests that consumers are worried about Brexit's economic impact, pushing them away from expensive purchases that require borrowed funds. The pound managed to strengthen its position after the news appeared today that Jeremy Corbyn was ready to support the general election. In his statement, the head of the Labour Party said that now that the EU has granted Brexit a three-month delay, we can safely talk about choosing a date for the general election in the UK. Corbyn also noted that he was ready to launch the most ambitious company that the country had ever seen. They said at Downing Street that they were planning to hold general elections on December 12 in their bill, but they did not rule out the possibility of making concessions to the conditions proposed by liberal democrats and the SNP. It's about the elections the day before, December 11th. As for the GBPUSD technical picture, the bulls confidently defended the level of 1.2800, not allowing the pair to go below the support of 1.2730 and 1.2660. Bulls still need to go above the resistance of 1.2870, which will lead to the demolition of a number of stop orders of sellers and will reach a high of 1.2950. EURUSD The euro also reacted with growth to Brexit news, but this did not lead to major changes from a technical point of view. A weak report on US retail sales put pressure on the US dollar. According to The Retail Economist and Goldman Sachs, the US retail sales index for the week from October 20 to October 26 fell immediately by 3.8%, but rose by 1.9% compared to the same period in 2018. According to Redbook, US retail sales for the first 3 weeks of October remained unchanged, but grew by 4.3% compared with the same indicator in 2018. From October 20 to 26, year on year, sales grew by 4.6%. It is possible that the euro receives support from how the trade conflict between the US and China develops, which is one of the key reasons for the slowdown in economic activity in the eurozone. Yesterday, Donald Trump was optimistic about this, which could add confidence to buyers of risky assets with today's decline in the pair in the support area of 1.1080. From a technical point of view, the bulls will continue to seek to regain the resistance of 1.1120, which will lead to a more powerful upward impulse to the area of highs at 1.1150 and 1.1180. The material has been provided by InstaForex Company - www.instaforex.com |

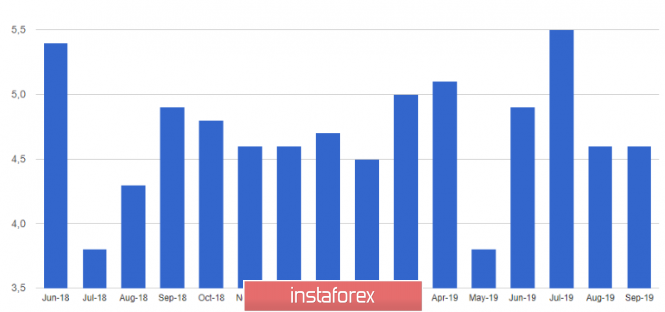

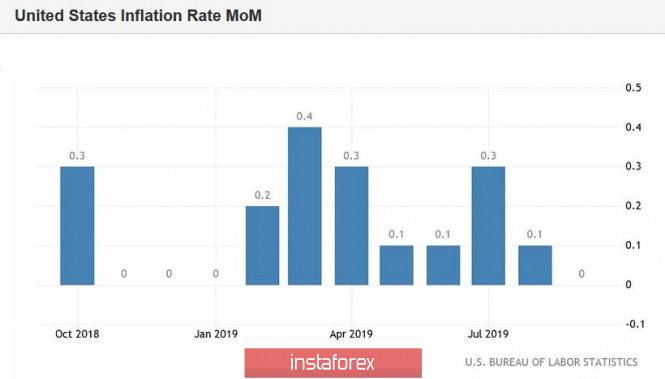

| October meeting of the Fed: the results are a foregone conclusion, but the intrigue remains Posted: 29 Oct 2019 03:38 PM PDT The euro-dollar pair has been trading flat for the second day in anticipation of a key event of the current week. We are talking about the October meeting of the Federal Reserve, following which Jerome Powell will hold the next press conference. Let me remind you that earlier (before the beginning of 2019), the Fed chairman spoke with journalists only after four meetings out of eight scheduled for the year. Over the years, the market has become accustomed to the fact that key decisions or intentions were voiced precisely at extended meetings, when the head of the Fed could give relevant comments and further clarify a particular position. The rest of the meetings, as a rule, were obviously "passing" - traders did not expect anything unusual from them. But the situation has changed since January this year: Powell decided to hold briefings at the end of each meeting, so traders assess the likelihood of one or another regulator's move on the eve of each meeting of Fed members. However, there is little doubt about the outcome of tomorrow's meeting: with a 95% probability, the US central bank will lower its interest rate by 25 basis points. This fact will not surprise any participant from the market, and the dollar is unlikely to demonstrate high volatility. Over the past few weeks, there have been too many factors that indicate the feasibility of this step on the part of the Fed: conflicting Nonfarm, a weak increase in inflation indicators and a record low value of production ISM. The members of the Federal Reserve for the most part did not deny the presence of a high probability of easing monetary policy at the penultimate meeting this year. Therefore, the main intrigue of tomorrow's meeting is different. Traders are interested in the further steps of the US regulator - both this year and early next. Here, the opinions of analysts are divided. According to some currency strategists, the Fed will take a break after the October rate cut. Others believe that at the beginning of next year, the central bank will once again lower the rate. Jerome Powell warned in the summer (on the eve of the first decline) that the regulator would adjust the interest rate "for preventive purposes" - that is, the long-term cycle was not discussed initially. The most sensitive areas of the US economy have already responded to the Fed's first steps in this direction. The results of the US-Chinese talks also speak in favor of the Fed's wait-and-see attitude. And although the parties could not conclude a deal, they took several steps towards each other and did not allow another escalation of the trade war. In addition, lowering the interest rate further, the Federal Reserve risks narrowing the space for maneuver, which may come in handy in the future (for example, if the US and China resume a trade conflict with renewed vigor). Before the start of the trade war, the US regulator managed to reduce the balance sheet and raise the interest rate, so it "has room to retreat." In this regard, its position looks somewhat more profitable relative to many other central banks of the leading countries of the world. In other words, Jerome Powell will certainly not be in a hurry with further decisions, at least in the context of the December meeting. However, according to some experts (in particular, ING), the regulator will still resort to another round of rate cuts at the beginning of next year, and then take a break until the end of 2020. Proponents of this scenario primarily indicate the dynamics of US inflation. The consumer price index published in October was indeed very weak. The overall monthly index unexpectedly slowed to zero, contrary to growth forecasts to 0.1%. In annual terms, the CPI remained in place: in September, the indicator reached 2.4% YOY, although economists had expected growth to 2.5%. Core inflation was also disappointing. The core index, excluding food and energy prices, fell more than expected. In monthly terms, the index reached 0.1% last month, although experts predicted more substantial growth. Slowing core inflation is an alarming sign, especially amid slowing wage growth. Let me remind you that the inflationary component of Nonfarm also disappointed the market, being in the red zone. Now the negative picture was supplemented by an inflationary release. It is very likely that the "softness" of the Fed's rhetoric will also depend on preliminary data on the growth of the US economy in the third quarter (the release is expected tomorrow, October 30, at the start of the US session). According to general forecasts, US GDP growth will significantly slow - to 1.6% (after falling to 2% in the second quarter). If this forecast is true, it will be the weakest growth rate since the fourth quarter of 2015. Thus, given the totality of fundamental factors, we can assume the following. After lowering the interest rate following the results of the October meeting, Jerome Powell, most likely, will not announce further steps in this direction. He will again remind reporters that the regulator does not make decisions "ahead of time", so everything will depend on current conditions. In addition, given the weak growth in inflation, Nonfarm and (possibly) US GDP in the third quarter, the tone of the accompanying statement will become more dovish (pessimistic). The market may interpret this fact as a signal for further easing of monetary policy, after which the dollar will be under significant pressure. If Powell sufficiently clearly signals a long-term pause in this matter, then the demand for the US currency will sharply increase, despite the third rate cut this year. Therefore, it is advisable to make trading decisions on the EUR/USD pair not based on the results of the Fed meeting, but following the results of Jerome Powell's press conference, since the fundamental picture for the dollar can change significantly. The material has been provided by InstaForex Company - www.instaforex.com |

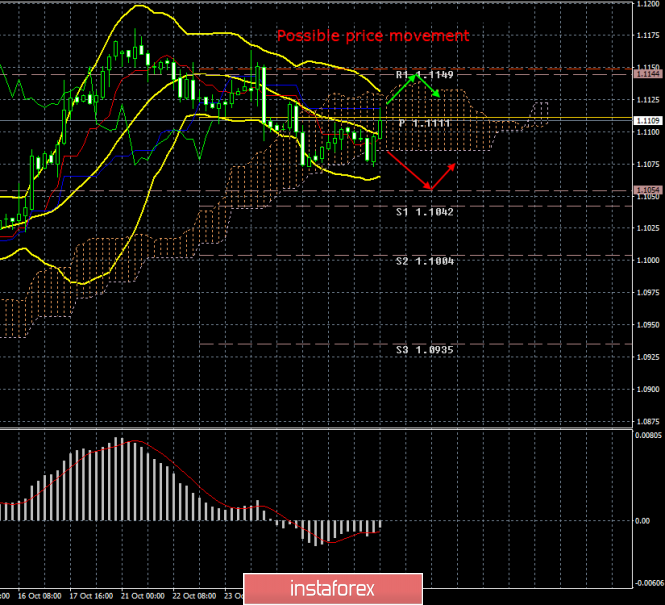

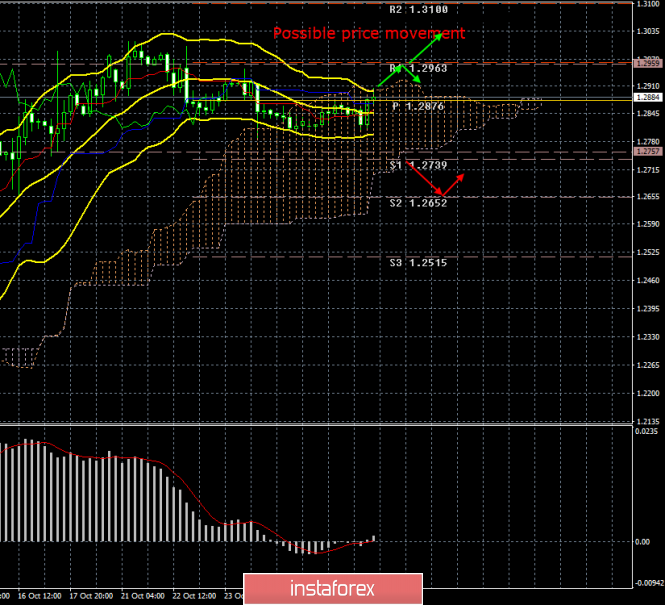

| Posted: 29 Oct 2019 03:38 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 39p - 34p - 70p - 50p - 31p. Average volatility over the past 5 days: 45p (average). The second trading day of the week for the EUR/USD currency pair again passed in absolutely calm trading, without a pronounced trend movement. Volatility marginally increased compared to Monday, only by 20 points and no more. On the whole, the pair remained inside the Ichimoku cloud, for the second time, failed to overcome the level of 1.1075, along which the Senkou Span B line ran yesterday, and provided significant support today. The pair returned to the critical Kijun-sen line at the end of the day. All these movements from the pair in no way specify the current technical picture. The euro/dollar continues to be traded inside the Ichimoku cloud, which according to the guide to the indicator itself is considered an unattractive area for trading. As for macroeconomic publications during the day, we can note one - the indicator of US consumer confidence in October - which slightly decreased compared to the previous month and amounted to 125.9, and which did not particularly affect the course of trading, as is a secondary indicator. Thus, we can say that today nothing interesting in the fundamental sense for the EUR/USD pair has happened in the world. But traders will really have something to turn their attention to tomorrow. We will not once again list all the events of tomorrow, we only report that, to the general disappointment of traders, the volatility of tomorrow may not differ too much from today. The problem is that most of tomorrow's macroeconomic events are either already taken into account by market participants or are preliminary. For example, data on US GDP for the third quarter. A slowdown is expected to grow to 1.7% YOY, but this value is not final and if there is no serious deviation from the forecast, then there will be no reaction. Furthermore, the report on the change in the number of employed in the private sector from ADP is an indicator characterizing the state of the US labor market, however there is NonFarm Payrolls, which is objectively more important and significant. In addition, the Federal Reserve meeting and it is very likely it would lower the key rate. The decrease is so likely that it is probably already taken into account by the forex market. Although this thesis is the most controversial. Given the fact that the US dollar has risen in price in recent days, even if this growth was corrective, then traders might still not have time to reject the possible easing of monetary policy. In this case, we can expect a serious strengthening of the European currency tomorrow. Another interesting indicator that might be ignored by traders on Wednesday is inflation in Germany, also a preliminary value for October. If the consumer price index slows down again, then pan-European inflation may be expected to slow down. Recall that inflation in the EU already breaks all the records of weakness in recent months and has slipped to 0.7% YOY. Well, the last one will be a press conference by Jerome Powell, from which one also can't expect anything new. The only thing that Powell can do to surprise the markets is phrases and hints of completing a short-term cycle of lowering rates. If this happens, then despite not even lowering the rate following the results of the October meeting, the US dollar can significantly strengthen its position. We almost forgot about another important event, which is not listed in any news calendar. This is a message from U.S. President Donald Trump on Twitter right after the announcement of the Fed's bid decision. It will probably be criticism again, and if Powell hints at a pause in easing monetary policy, Trump will definitely not leave it that simple. In general, tomorrow's Fed meeting can easily become a passing one, despite even a rate cut, and can become a serious fundamental basis for a new dollar trend. The fact is that in the confrontation between the euro and the dollar, even taking into account the three cuts in the Fed's key rate, the balance of power has not changed much. The situation in Europe is still worse than in the United States, monetary policy is much "softer". Thus, the "softening" break announced by Powell could provide a strong additional support to the US currency. From a technical point of view, everything remains quite lackluster. In order for the pair to be able to continue moving down, it is necessary to wait for the Senkou Span B. line to cross. In order for the euro to resume the upward trend, it will at least need to overcome the Kijun-sen critical line. Trading recommendations: EUR/USD continues to adjust, as it is inside the Ichimoku cloud. Slowly you can look closely at selling the euro, especially if the bears manage to overcome the Ichimoku cloud. However, tomorrow afternoon, we recommend that it be wary of opening any positions, as the results of the Fed meeting and the press conference of its chairman may bring surprises. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. Support / Resistance Classic Levels: Red and gray dotted lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. October 29. Results of the day. Labour has several "joker" cards on hand Posted: 29 Oct 2019 03:38 PM PDT 4-hour timeframe Amplitude of the last 5 days (high-low): 139p - 80p - 161p - 59p - 64p. Average volatility over the past 5 days: 101p (high). Tuesday, October 29, is also a quiet trading day with low volatility for the GBP/USD pair, as well as for EUR/USD. By and large, nothing interesting can be said about today. The British currency surprisingly stopped responding to any messages regarding Brexit, or traders felt that the most important thing was that Brexit is postponed. Anyway, following a strong growth of 800 points last week, the pound/dollar currency pair is practically immobilized, of course, within its average volatility, which remains quite high. There have been no macroeconomic publications today, and they have not been observed for a week and a half in the UK. Well, the hit parade of the latest news on the topic of Brexit looks something like this: 1) Boris Johnson initiated a vote in the Parliament on December 12th. Parliament rejected the proposal by the prime minister. 2) The European Union officially gave the UK a postponement until January 31, 2020, with the possibility of early release on the 1st day of each month, if Parliament suddenly decides to agree to a deal. Boris Johnson agreed with the postponement and reluctantly announced the delay. 3) The Labour Party, led by Jeremy Corbyn, announced their agreement to hold elections on December 12, because now, according to them, the risk of implementing a "hard" Brexit is reduced to zero. Therefore, a new vote could be held for holding early elections in the Parliament today, which from the fourth attempt can be approved by the majority of MPs. However, an extremely important question now arises which cannot be left out in this article. As we said earlier, Labour needs either an election victory or an increase in its own strength in Parliament with a simultaneous decrease in the strength of Conservatives. Otherwise, the hard Brexit will loom again on the horizon. That is why Boris Johnson initiates the elections in order to win a more convincing victory than Theresa May. In the future, Johnson expects that he will have enough votes to realize any Brexit, including the hard one, if something does not work out with the deal again. And if Labor agreed to the election, how do they expect to achieve their goals? The answer to this question came very recently. According to British law, the definition of the "election" procedure is not in itself unshakable. That is, its order, electorate and various aspects can change from time to time. Roughly speaking, the Labour Party, through the same voting in the Parliament, can amend its process. According to the latest information, the Laborites want to change the minimum age of the electorate from 18 to 16 years, as well as allow citizens of other countries residing in the European Union to vote. Of course, it is precisely in these two potential changes that the intention of the main opposition party lies. Potentially, we are talking about several million additional voters, who, for the most part, should be against Brexit, and therefore against Boris Johnson and the Conservatives. As for the Europeans living in the UK, nearly everyone would not vote for the Conservative Party. Thus, now the Parliament will have to discuss the entire election procedure, as well as vote on the aspects proposed by the Labor Party. If they are approved, then Boris Johnson and his party can get the opposite of the effect they expected. Well, the whole Brexit process, in case the Laborites win the election, can result in either holding a second referendum, or it could go on for many more years, since those who are against and the opposition are not of the same opinion as the ruling party. There's nothing to talk about right now from a technical point of view. The pound/dollar is trading inside the Ichimoku cloud, right next to the Kijun-sen line. Bollinger Bands narrowed to a low, indicating a strong fall in volatility and the absence of a trend. The main hopes are now connected with the fundamental events of tomorrow. In the current conditions, it is impractical to conduct trade. Trading recommendations: GBP/USD pair is part of the lateral correction. Thus, sales of the British currency with the target of 1.2757 are formally relevant now, however the "dead cross" is very weak, the trend for the pair is absent even in the context of intraday trading, and the price is inside the Ichimoku cloud. Thus, we recommend that you wait until the situation is clarified, the flat is completed and the pair leaves the Ichimoku cloud, as well as the results of the Fed meeting and Jerome Powell's press conference. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. Support / Resistance Classic Levels: Red and gray dotted lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 10.29.2019 -Potential gap fill on the Bitcoin Posted: 29 Oct 2019 08:38 AM PDT BTC is still trading inside of the consolidation zone at $9.329. I see potential chance for the gap fill and test of $8.757. As long as the swing high at 9.934 is holding, there is the chance for the downside.

Yellow rectangle – Resistance level Falling purple line – Expected path Horizontal line – Support level Based on the 4H time-frame, there is potential for the gap fill and test of $8.757. The middle Bollinger line is now set at $8.645 and eventually the price will try to reach that line. MACD is showing decreasing on the upside but still above the zero reading. My advice is to watch for potential selling opportunities on the rallies as long as the BTC is holding swing high at $9.934. The material has been provided by InstaForex Company - www.instaforex.com |

| The euro is predicting a bleak future after Draghi leaves Posted: 29 Oct 2019 08:31 AM PDT

For ECB President Mario Draghi, the battle to save the euro seems to be over, however, according to some experts, the risk of further decline of the single European currency remains for investors. "The euro is a big short position for us. The trade war between Washington and Beijing has quite a strong impact on Europe since Germany is heavily dependent on China. While global sentiment has improved somewhat recently, the topic of trade friction is likely to be relevant for many years or even decades," said James Binny of State Street Global Advisors. Rabobank expects that by the end of this year, the EUR/USD pair will drop to 1.07, as growing concerns about global growth put pressure on exports from Germany and fuel interest in the US dollar as a safe-haven currency. "Of course, it would be good if the Brexit deal took place, but the prospects for Germany are not so positive. The ECB will have to further soften the monetary rate. All these factors are negative for the euro," said Jane Foley, the bank's currency strategist. Experts from Columbia Threadneedle Investments give an even more bearish forecast for the euro. They believe that the main currency pair can reach parity for the following reasons. Firstly, the US debt market rates are higher than in most developed countries. Secondly, the dynamics of American inflation indicate that the US economy is doing better than in other countries. Third, global GDP forecasts continue to deteriorate. Lowering the interest rate of the Federal Reserve, it would seem, should lead to a weakening of the position of the greenback, but high investor demand for protective assets and the vulnerability of other world currencies give the opposite result: the easing of monetary policy of the Fed contributes to the strengthening of the USD. According to BofA Merrill Lynch analysts, something similar happened at the beginning of the 21st century, when the American Central Bank lowered the interest rate eleven times, but due to the increased interest in reliable assets, greenback prices rose by 6.6% during the year. Now the story is repeating itself. Investors are encouraged by the prospect of a Fed interest rate cut this week. They have little doubt that the regulator will once again cut the rate by 25 basis points. However, the market may quickly lose its optimistic mood if the chairman of the Federal Reserve Jerome Powell signals that this will reduce the rates. The regulator does not need to cut the federal funds rate too much yet. Also, the central bank has returned to asset purchases, and although it prefers not to call it QE, its balance sheet has started to grow again. If Jerome Powell's rhetoric turns out to be too "hawkish" following the October FOMC meeting, it will trigger a correction on the S&P 500 index, which managed to update historical highs, and lead to a deterioration in global risk appetite, which will become an occasion for purchases not only of the yen and gold, but also of the dollar. Meanwhile, Germany's long-standing commitment to a balanced budget means it has so far failed to take advantage of ultra-low borrowing costs to boost spending to spur economic growth. It is predicted that in the third quarter, the "locomotive" of the eurozone will fall into a technical recession, and there are signs that the entire currency bloc will slip to it. The fate of the euro also depends largely on the outcome of the trade war between Washington and Beijing. Business confidence and investment spending around the world have been hit hard by trade tensions, but the eurozone may be at a greater disadvantage than other regions because it is a net exporter. "The eurozone's economic outlook indicates that the ECB will need to do more, and given that Germany's fiscal stimulus is not enough, the quantitative easing and lowering of interest rates by the ECB will be negative for the euro," said Claire Dissaux of Millennium Global Investments. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD for October 29,2019 - Daily bull potential increased Posted: 29 Oct 2019 08:15 AM PDT EUR/USD is setting the bull-flag based on the daily time-frame, which is sign that there is potential for further upside continuation. Tomorrow is the FOMC day so you should be extra careful taking any swing position before FOMC meeting minutes .Anyhow, I see potential for the test of 1.1175 in case of the up-break.

Yellow rectangle – Resistance and upward target Falling purple lines – Broken bull flag pattern Rising purple line – Expected path Based on the daily time-frame, there is the breakout of the bull flag pattern, which is a sign that bullish trend may resume. I would like to see the EUR holds 1.1073 in order to sustain further upward break. Main resistance is set at 1.1175. Watch for buying opportunities on the dips... The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Oct 2019 08:02 AM PDT USD/CAD is breaking very well defined falling wedge in the background and I do expect more upside in the future. Tomorrow is the important day for Canadian dollar due to the Bank of Canada Monetary Policy Report and the FOMC later tomorrow. I see potential for the upside and test of 1.3117.

Yellow rectangle – Resistance and upward target Falling purple lines – Broken falling wedge Rising purple line – Expected path Based on the 4H time-frame, there is bullish divergence that is building for past few days on the MACD oscillator, which is sign that selling power lost momentum. The breakout of the falling wedge is good confirmation for the further upside. Important support level is seen at 1.3040 and resistance at 1.3117. Watch for buying opportunities on the dips... The material has been provided by InstaForex Company - www.instaforex.com |

| Trading recommendations for the EURUSD currency pair – placement of trade orders (October 29) Posted: 29 Oct 2019 06:35 AM PDT The slowdown in volatility for the second trading day in a row worries market participants, and whether it is as bad as it may seem, we will try to understand in the current article. From technical analysis, we see the so-called rollback that occurred when the support level of 1.1080 was touched, where the quote almost immediately worked it out, but at the same time showed low volatility. This kind of restraint signaled that sellers were still in the market, and in some way, there was a process of regrouping trading forces. Thus, the volatility, which was extremely low for two trading days (49 and 30 points), reflected the mood of market participants and the attitude to the very rebound from the level of 1.1080. Let me remind you that the oblong correction, paired with the inertial course, overheated long positions, and when there was a chance to restore the quotation, many clung to it. To summarize, open the H4 chart, you will take away a fairly healthy beat (October 21-28) in the intermediate movement and the current rollback was in place. All of the above applies to the theory of restoration of the initial course. Analyzing the hourly past day, we see a pullback with a rather sluggish oscillation, where the most remarkable candles were only at the time of the period 13:00-14:00 hours (time on the trading terminal), which coincides with the information background. The subsequent swing was in terms of a narrow movement around the mark of 1.1100. As discussed in the previous review, speculators were working on a local rebound, which, in principle, was possible, although the yield was not so great. The main deals were considered in terms of further recovery, but after fixing the price below 1.1070, which never happened. Considering the trading chart in general terms (daily period), we see a real chance of restoring the original movement, where the quote has already formed one of the stages of the move when it approached the level of 1.1080. The further recovery process will occur at the time of the passage of the level of 1.1080, where the next coordinator will be the psychological level of 1.1000, which will display 60% of the working out relative to the oblong correction. Let me remind you that the oblong correction did not disrupt the overall market tact of the downward trend, and the chance of recovery is still high. The news background of the last day did not have strong statistical indicators for Europe and the United States, thus the main focus of market participants was on monitoring the information background. So, the European Union nevertheless went to the next deferral of Brexit, having agreed on the deadline for Britain to leave the EU on January 31, 2020, with the amendment that England has every chance to quit earlier if they still manage to ratify the agreement. On such positive news, British Prime Minister Boris Johnson asked the heads of EU countries to promise that there will be no further delays, no matter what happens. "If the British Parliament would resist (holding early elections and approving the deal), then I would urge the EU member states to make it clear that further postponement – after January 31 – is impossible. There is enough time ahead to consider the terms of the transaction. I'm not letting the parliament just renew the membership in the European Union again and again," the letter of Boris Johnson says. Today, in terms of the economic calendar, we have only data for the United States. So, indicators are published on pending home sales transactions, where they expect a decline from 2.5% to 1.4%. At the same time, the consumer confidence index will be released, which is slightly increasing from 125.1 to 128.0. In terms of emotional and informational background, we see that many market participants are waiting for tomorrow's meeting of the Federal Committee for Open Markets, where they will announce the decision on the interest rate, and according to preliminary forecasts, they are waiting for its reduction. In terms of Brexit, the noise is almost constant, and you need to monitor it. Further development Analyzing the current trading chart, we see a perfect touch of the local minimum of 1.1073 (October 25), where the quote again found a foothold and made a local rebound. So, the fact that the quote again managed to go down below the level of 1.1080 and touch the local value, suggests that the recovery process is alive as ever and there is still a chance of further decline. In terms of volatility and the emotional component of the market, we still maintain a low level, but perhaps it will only benefit the current tact, which, in principle, we have now. Detailing the available time interval per minute, we see that almost from the very beginning of the day the process was going on. The return of the quotation to the limits of the previously developed level, without showing sharp fluctuations and only in the interval 12:30-13:00 (time on the trading terminal), there was a local surge just at the moment of approaching with a minimum of the previous loss of 1.1073. Perhaps the surge is due to local fixation of short positions at the moment of approaching with a value of 1.1073. In turn, speculators are waiting for a clear price fixation lower than 1.1070, as this could signal a resumption of the downward course. It is likely to assume that the fluctuation within the level of 1.1080 may be delayed for some time, and there it is already worth monitoring the price-fixing points. The best technique in this segment can be wait-and-see, where we monitor the price-fixing below 1.1070, working on short positions. The alternative scenario is considered in terms of another rebound from the level of 1.1080, but the main transactions are better analyzed in terms of a failure of the recovery process and fixing the price higher than 1.1110-1.1120. Based on the above information, we derive trading recommendations:

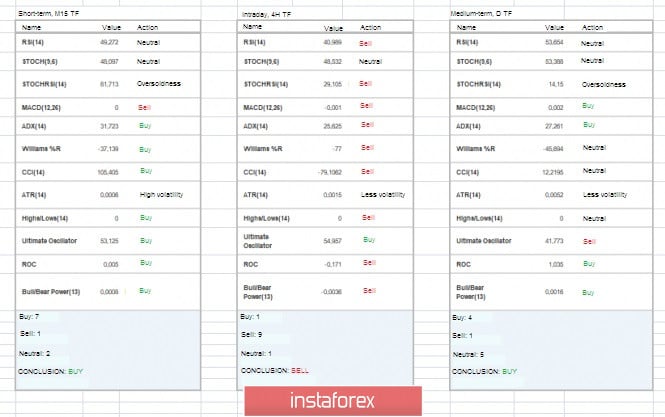

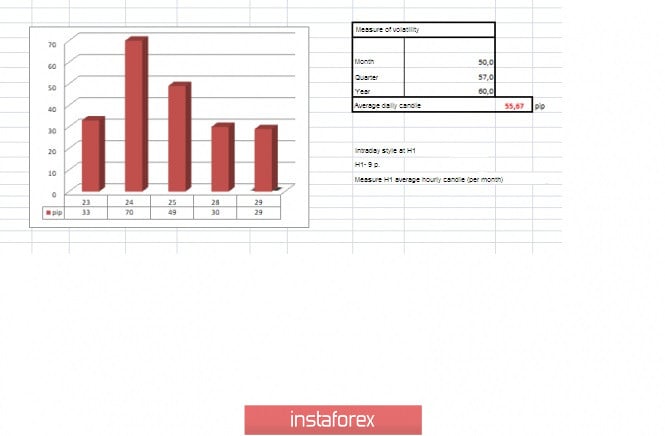

Indicator analysis Analyzing different sector timeframes (TF), we see that the indicators in the short term worked on the fulcrum, showing a variable signal to buy. The intraday outlook is focused on the recovery process, which reflects the reality of the market. The medium-term perspective still can not get off the earlier inertial course, but there is progress. Look at the indicators, we are smoothly changing the mood, which is already good. Volatility per week / Measurement of volatility: Month; Quarter; Year. Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (October 29 was built taking into account the time of publication of the article) The volatility of the current time is 29 points, which is the average for this period. It is likely to assume that if the stagnation is formed again with a rebound from the level of 1.1080, no drastic changes will occur, thus the volatility will be extremely small. In the case of the passage of the key level and the preservation of the inertial push, we can see an acceleration in terms of volatility. Key levels Resistance zones: 1.1180*; 1.1300**; 1.1450; 1.1550; 1.1650*; 1.1720**; 1.1850**; 1.2100. Support zones: 1.1080**; 1.1000***; 1.0900/1.0950**; 1.0850**; 1.0500***; 1.0350**; 1.0000*** * Periodic level ** Range level *** Psychological level ***** The article is based on the principle of conducting transactions, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Oct 2019 05:29 AM PDT

Few weeks ago, the neckline of the depicted Double-Bottom pattern (1.2400-1.2415) was breached to the upside allowing further bullish advancement to occur towards 1.2800 then 1.3000 where the GBP/USD pair looked OVERBOUGHT. Earlier last week, the GBP/USD pair has failed to achieve a persistent bullish breakout above the depicted SUPPLY-zone (1.2980-1.3000) which corresponds to a previous Prominent-TOP that goes back to May 2019. Moreover, the depicted ascending wedge reversal pattern has been confirmed indicating a high probability of bearish reversal around the price levels of 1.2950-1.2970. That's why, a quick bearish movement was initiated towards 1.2780 (Key-Level) where bullish recovery and a sideway consolidation Range are currently being demonstrated. The current Bullish rejection around the price levels of 1.2780, indicates another temporary bullish movement near 1.2980-1.3000 where another long-term bearish swing can be initiated. On the other hand, earlier bearish breakout below 1.2780 enables further bearish decline towards 1.2600-1.2650 where bullish recovery should be anticipated. Trade Recommendations: Risky traders were advised to look for a valid BUY entry anywhere around 1.2780 with S/L to be located below 1.2740. S/L should be advanced to entry levels to offset the associated risk. On the other hand, Intraday traders can wait for a bearish breakout below 1.2780 as a valid SELL entry with T/P levels projected towards 1.2650. The material has been provided by InstaForex Company - www.instaforex.com |

| October 29, 2019 : EUR/USD technical outlook predicts further bearish decline below 1.1090. Posted: 29 Oct 2019 04:51 AM PDT

Since September 13, the EUR/USD has been trending-down within the previous short-term bearish channel until an Inverted Head & Shoulders Pattern was demonstrated around 1.0880. Shortly After, a bullish breakout above 1.0940 confirmed the mentioned reversal Pattern which opened the way for further bullish advancement towards (1.1000 -1.1020) maintaining bullish movement above the recent bullish trend. On October 7, a sideway consolidation range was demonstrated around the price zone of (1.1000 -1.1020) before another bullish swing could be initiated towards 1.1180. The recent bullish breakout above 1.1120 (100% Fibonacci Expansion) enhanced further bullish advancement towards the price zone of (1.1175-1.1195) where the current bearish pullback was recently originated. The intermediate-term outlook has been bullish until bearish breakdown below 1.1090 was achieved (the depicted uptrend line and 50% Fibonacci Retracement Level ). Hence, short-term technical outlook remains bearish as long as the EUR/USD maintains its bearish movement below 1.1090. That's why, further bearish decline should be expected towards 1.1025 and 1.0995 provided that no bullish breakout occurs above 1.1090. Trade recommendations : Conservative traders can have a valid SELL entry anywhere around the backside of the broken uptrend line (1.1100). Initial T/P levels to be projected towards 1.1065 and 1.1020 while S/L should be placed above 1.1135. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading idea for the currency pair CADCHF Posted: 29 Oct 2019 04:18 AM PDT Trading idea for the currency pair CADCHF Good day, dear traders! I present to your attention a trading idea for the currency pair CADCHF. Few people know, but this tool has incredible potential and, in my opinion, is underestimated by traders. By far, the most popular trading pair is EURUSD, but do not forget that 98% of traders regularly lose. It is easy to draw a parallel between these events. I use cross trading as a risk diversification between instruments. There is one very clear pattern in certain cross-rates where the franc is present. They are very "short." The maximum wavelengths for them are several hundred points in 4-digit. And often after each update of large extremes – a pretty impressive rollback follows. At the moment, the pair is showing a bullish trend, which originated in July. The pair passed 350p and is near the annual extremes. It is important to remember that tomorrow at 13:30 London time, a decision will be made on the interest rate on CAD and at 16:15 – a press conference of the Bank of Canada. At this time, increased volatility of instruments with CAD is expected, and CADCHF will be no exception. I propose a trading idea – a set of short positions on the net in a growing market to catch kickbacks, closing the entire bundle of sales for the total take profit: Good luck with trading and see you in the next reviews! The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Oct 2019 04:18 AM PDT To open long positions on GBP/USD, you need: From a technical point of view, nothing has changed compared to the morning forecast. The pound fell to a major support level of 1.2807 after the release of data on UK consumer credit growth, which declined. However, the bulls managed to hold this area, which led to renewed demand for the pair. The main task of buyers is to return to the resistance of 1.2870 and its breakdown, which will be a signal for an additional opening of long positions capable of updating the highs of 1.2943 and 1.3012, where I recommend taking the profits. If the pressure on the pound returns in the second half of the day, only the next formation of a false breakdown in the support area of 1.2807 will be a signal to open long positions. Otherwise, it is best to buy GBP/USD on a rebound from the low of 1.2735 or even lower, in the area of 1.2664. To open short positions on GBP/USD, you need: Bears successfully returned to the support of 1.2807, but once again failed to break below this level after the news that the Labor Party is ready to support the general election in the UK, the date of which will be December 11, 2019. Only the breakthrough of the minimum of 1.2807 will increase the pressure on the pound, which will collapse it to the support area of 1.2735 and 1.2664, where I recommend taking the profits. However, the primary goal of the bears now remains to keep the pair below the resistance of 1.2870, which the bulls will try to regain in the second half of the day. In the case of a breakthrough in this range, it is best to consider short positions in GBP/USD from larger highs around 1.2943 and 1.3012. Indicator signals: Moving Averages Trading is conducted around 30 and 50 daily averages, which indicates the lateral nature of the market. Bollinger Bands A break of the upper border of the indicator in the area of 1.2870 will lead to a new wave of growth for the pair.

Description of indicators

|

| Posted: 29 Oct 2019 04:18 AM PDT To open long positions on EURUSD, you need: Sellers continue to push the euro down, and activity from buyers is not visible. The focus is shifted to tomorrow's Fed meeting, at which the leadership can take a "technical pause" in lowering interest rates, which will further support the US dollar. From a technical point of view, nothing has changed. At the moment, the task of buyers is to return to the level of 1.1095, and only under this condition can we expect a larger upward correction in the area of the highs of 1.1120 and 1.1149, where I recommend taking the profits. If the pressure on the euro continues, and this may happen after good data on consumer confidence in the US, it is best to consider new long positions after a false breakdown in the support area of 1.1066 or buy for a rebound from the minimum of 1.1026. To open short positions on EURUSD, you need: Sellers coped with the task for the first half of the day and returned the pair under the resistance of 1.1095. At the moment, while trading is below this level, the pressure on the EUR/USD will continue, and the data on the consumer confidence index may lead to an even greater sell-off with the update of the weekly low of 1.1066. However, the main target of the bears remains support in the area of 1.1026 and 1.0994, where I recommend taking the profits. If the bulls regain the resistance of 1.1095, it is best to return to short positions to rebound from the highs of 1.1120 and 1.1149. An unsuccessful consolidation above 1.1095 will be an additional sell signal. Indicator signals: Moving Averages Trading is conducted below 30 and 50 moving averages, which indicates the predominance of sellers in the market. Bollinger Bands The upper limit of the indicator in the area of 1.1110 acts as a resistance.

Description of indicators

|

| Technical analysis of GBP/USD for October 29, 2019 Posted: 29 Oct 2019 03:42 AM PDT Overview: The GBP/USD pair continues to move upwards from the level of 1.2699. Today, the first support level is currently seen at 1.2699, the price is moving in a bullish channel now. We expect the price to set above the strong support at the level of 1.2699; because the price is in an uptrend since yesterday. The RSI starts signaling a downward trend. Consequently, the market is likely to show signs of a bullish trend. Hence, the GBP/USD pair is probably continuing to trade in a bullish trend from the new support level of 1.2699. According to the previous events, we expect the pair to move between 1.2699 and 1.3011. Also, it should be noted major resistance is seen at 1.3122, while immediate resistance is found at 1.3011. Then, we may anticipate potential testing of 1.3011 to take place soon. Moreover, if the pair succeeds in passing through the level of 1.3011, the market will indicate a bullish opportunity above the level of 1.3011. A breakout of that target will move the pair further upwards to 1.3122. This would suggest a bullish market because the 100-moving avergae is still in a positive spot and does not show any trend-reversal signs. The pair is expected to rise higher towards at least 1.3122 so as to test the daily resistance 2. However, it would also be sage to consider where to place a stop loss; this should be set above the second support level of 1.2503. The material has been provided by InstaForex Company - www.instaforex.com |

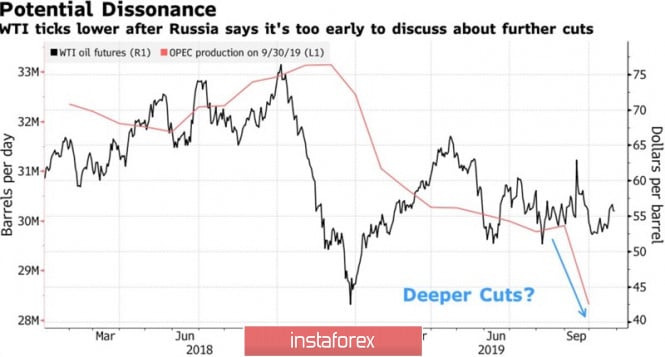

| Will the dollar substitute for oil? Posted: 29 Oct 2019 03:28 AM PDT As soon as net long positions in oil grew for the first time in several weeks, rumors immediately appeared on the market that black gold had formed the bottom. According to the results of the five days, by October 22, speculative net-longs for WTI increased by the amount equivalent to 22 million barrels, although before that they had decreased by 206 million barrels for three consecutive weeks. Investors noticed that the ratio of long-term to short-term short positions fell to 2.6 to 1, which is the lowest level since January. In April, the indicator was 8.7 to 1. The total superiority of the "bears" against the background of de-escalation of the US-China and Britain-EU conflicts looks quite strange. OPEC, Russia and other producing countries are on the verge of extending the agreement on production cuts, the growth rate of shale production in the United States is slowing, and the reduction of trade and political risks should have a positive impact on global oil demand. Donald Trump is ready almost today to sign an agreement with Beijing, which is good news for China's tormented economy. Let me remind you that this country is the largest consumer of black gold in the world. Trade duties are higher today than 3 months ago. The issue of Brexit is not finally resolved, but investors are optimistic about the future. The "bulls" on Brent and WTI may be preparing a bridgehead for the attack, but for now, they are held back by pitfalls. In particular, Sanford C. Bernstein estimates that to prevent the North Sea grade from falling below $60 per barrel, OPEC + should add another 0.5 million b/s to the current cut of 1.2 million b/s. According to Russia, it is too early to talk about an increase in obligations. Dynamics of WTI and OPEC production volumes

The reduction in the growth rate of shale production in the United States looks like a natural process. Manufacturers are looking at the slowdown in global demand, do not increase investment. Only their faith in the successful conclusion of the trade conflict between Washington and Beijing can save the situation, but if this happens, the oil will react much faster to a potential increase in world demand than to a gradual increase in shale production in the States. When there is a delicate balance in the market, even a minor new driver can start a wave of purchases or, conversely, sales. It is quite possible that after the Fed meeting and the release of data on the US labor market for October, the US dollar will become such a joker. Jerome Powell will have a difficult task – to protect the stock markets from correction. His "hawkish" rhetoric, including the mention of a long pause in the process of reducing the rate, is fraught with a fall in the S&P 500. Having wished to be safe, the Fed chairman may leave the door open for further reduction of the federal funds rate, which will negatively affect the USD index and allow the oil to grow up. Technically, on the Brent daily chart, after the implementation of the first target according to the "Wolfe wave" pattern, the formation of a "double bottom" is planned. A confident breakthrough of resistance at $ 62 and $63.7 per barrel will allow the "bulls" to count on the continuation of the rally in the direction of $70.75 and $72.5. Brent, the daily chart

|

| Posted: 29 Oct 2019 02:17 AM PDT Good day, dear traders! I am pleased to report that once again our trading recommendation has been fully implemented. Today, we are talking about USD/JPY, where I recommended buying in my previous recommendation:

In fact, after the weekend before the US session on Monday, USD/JPY rose to the desired level, the breakdown of which I had previously expected:

Profit amounted to 500p. At the moment, the Japanese yen is no longer interesting, so it is possible to pay attention to other instruments that I will consider in the afternoon. I remind you that tomorrow evening will be the decision on the USD interest rate, the FOMC statement and the day after tomorrow – the NFP. Be careful when trading at this time. I wish you success in trading and big profits! The material has been provided by InstaForex Company - www.instaforex.com |

| USDJPY reaching resistance, watch out! Posted: 29 Oct 2019 02:13 AM PDT |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment