Forex analysis review |

- BTC 10.04.2019 - Sell zone for Bitcoin, bearish flag in creation

- October 4, 2019 : GBP/USD Intraday technical outlook and trade recommendations.

- October 4, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- Gold 10.04.2019 - Is the Gold ready another move lower?

- GBP/USD 10.04.2019 - New down leg is expected, watch for selling opportunities

- GBP / USD: plan for the American session on October 4. Problems with the implementation of the new Brexit plan scare potential

- EUR / USD: plan for the American session on October 4. The bulls are trying to return above 1.0993, but one desire is not

- Fractal Analysis of Ethereum on October 4

- Fractal analysis of the main currency pairs on October 4

- Trading recommendations for the EURUSD currency pair - prospects for further movement

- EUR / USD: will the black streak of the dollar continue and will J. Powell's speech become a control shot for him?

- Technical analysis of GBP/USD for October 04, 2019

- The Australian trend

- Simplified wave analysis for October 4th. GBP/USD: bears – get ready; USD/JPY: no conditions for growth

- Weak data on employment in the US will lead to a new fall in the markets (we expect NFP data and in accordance with this,

- Brilliant victory of the precious metal: Gold is the undisputed leader

- GBPUSD and EURUSD: Jerome Powell's speech may shed light on US interest rates. Concerns remain over EU on the Irish border

- Hot forecast for EUR / USD on 10/04/2019 and trading recommendation

- Weak positive background gives a chance to recover risky assets, NZD and AUD go to the side range

- Trading plan 10/04/2019 EURUSD

- Indicator analysis. Daily review on October 4, 2019 for the GBP / USD currency pair

- Indicator analysis. Daily review on October 4, 2019 for the EUR / USD currency pair

- Technical analysis of ETH/USD for 04/10/2019

- Technical analysis of BTC/USD for 04/10/2019

- Control zones USD/JPY 10/04/19

| BTC 10.04.2019 - Sell zone for Bitcoin, bearish flag in creation Posted: 04 Oct 2019 08:02 AM PDT BTC has been trading downside as we expected yesterday. Our yesterday's target at $8,046 has been met. Most recently, I found that bearish flag is in creation based on the 1H time-frame.

Purple lines – Bear flag Purple falling line – Expected path Green rectangle – Important support My advice is to watch for selling opportunities on the BTC since it is still in the downtrend. The downward channel is active and there is more chance for downside. Potential downward targets are set at the price of $8,046 and $7,755. The material has been provided by InstaForex Company - www.instaforex.com |

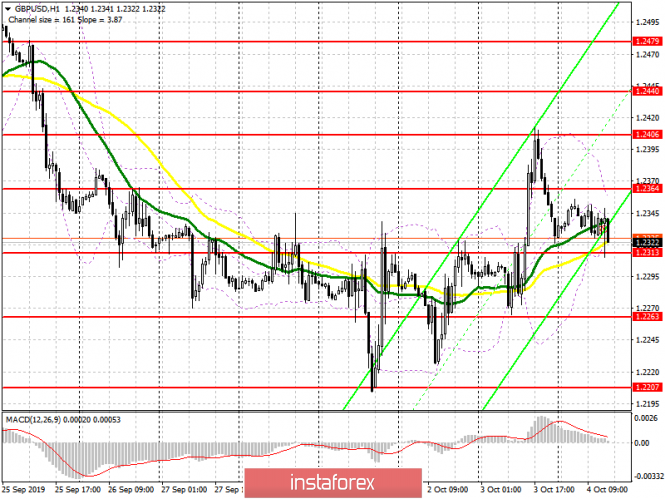

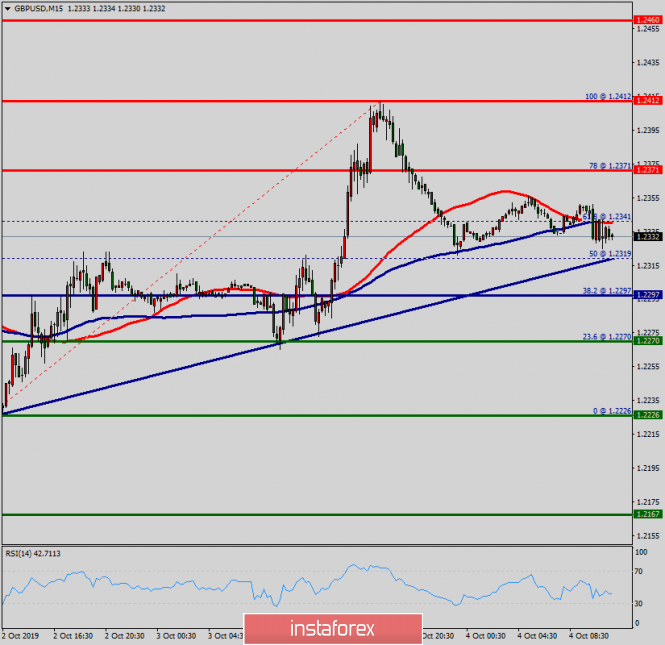

| October 4, 2019 : GBP/USD Intraday technical outlook and trade recommendations. Posted: 04 Oct 2019 07:52 AM PDT

Since August 9, the GBP/USD pair has been trending-up within the depicted bullish channel except on September 3 when a temporary bearish breakout was demonstrated towards 1.1960. Around the price level of 1.1960, aggressive signs of bullish recovery (Bullish Engulfing candlesticks) brought the GBPUSD back above 1.2230 where the pair looked overbought. However, further bullish momentum was demonstrated towards 1.2320 maintaining the bullish movement inside the depicted movement channel. Moreover, Temporary bullish advancement was demonstrated towards 1.2550 where a reversal wedge pattern was established. As anticipated, the reversal wedge pattern was confirmed Last week on Monday's consolidations supported by obvious bearish price action demonstrating a successful bearish closure below 1.2450. On September 24, the backside of the confirmed reversal wedge was successfully re-tested around 1.2500 where a new episode of bearish rejection was expressed. The Long-term outlook remains bearish as long as the most recent top established around 1.2500 remains defended by the GBP/USD bears. Moreover, the recent bullish channel (established on August 9) has been invalidated on September 25. Thus, the short-term outlook turned into bearish as well. Bearish persistence below 1.2400-1.2440 (Reversal-Pattern Neckline) allowed more bearish decline to occur towards the price levels of 1.2210 where the previous bullish pullback towards 1.2400 was originated on Tuesday. Today, bearish persistence below 1.2220 is mandatory to allow further bearish decline towards 1.2160 and 1.2120. Trade Recommendations: Conservative traders were advised to consider the recent bullish pullback towards the neckline of the confirmed Head & Shoulders reversal pattern (Anywhere around 1.2400-1.2450) as a valid SELL entry. It's already running in profits. Remaining T/P levels to be placed around 1.2280, 1.2240 and 1.2160 while S/L should be lowered to 1.2370 to offset the associated risks. The material has been provided by InstaForex Company - www.instaforex.com |

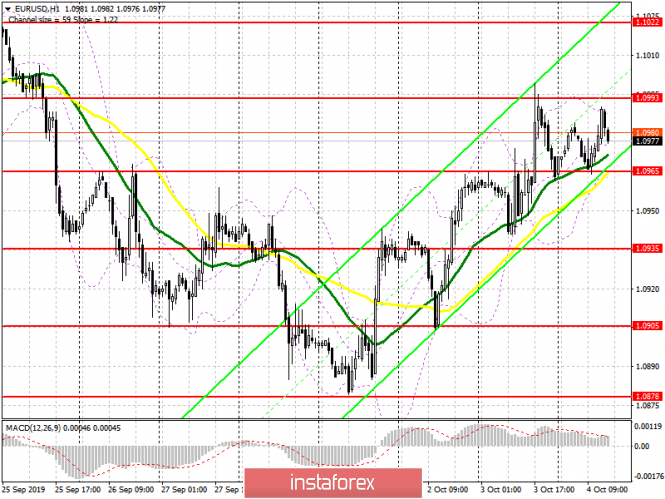

| October 4, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 04 Oct 2019 07:32 AM PDT

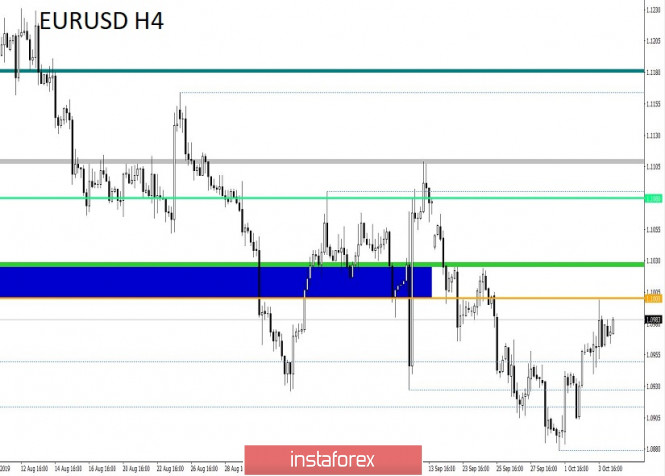

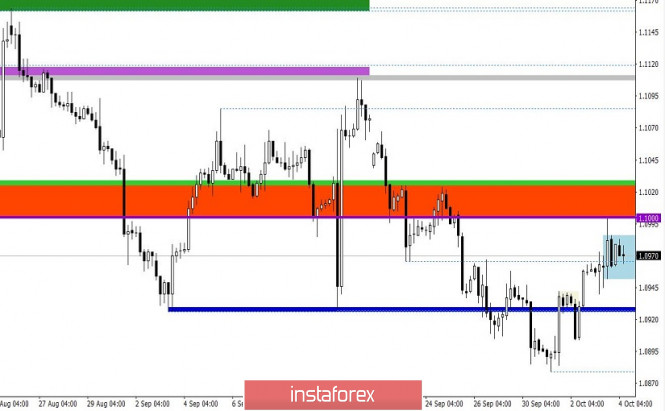

On September 13, the EUR/USD pair was testing the backside of both broken trends around 1.1060-1.1080 where significant bearish pressure was demonstrated. Shortly-After, Few DESCENDING-Tops were established around 1.1075 and 1.1060. This rendered the recent bullish spike as a bullish trap. Since then, the EURUSD has been trending-down within the depicted short-term bearish channel. Bearish persistence below 1.0965 (recent daily bottom) enhanced more bearish decline towards 1.0943 and 1.0920 (Fibonacci Expansion 78.6% and 100% Levels) where recent signs of bullish recovery were recently demonstrated (Inverted Head & Shoulders Pattern). Thus, a bullish breakout above 1.0960 confirmed the mentioned reversal Pattern which opened the way for further bullish advancement towards 1.1000 where another episode of bearish rejection should be expected. In the Long-Term, the EUR/USD is demonstrating atypical Head & Shoulders continuation pattern extending between (1.0930 - 1.1080) with neckline located around 1.0940. If bearish persistence below 1.0920 (100% Fibonacci Expansion) is re-established, the long-term Pattern projection target would remain projected towards 1.0840 (Low Probability). Trade recommendations : Intraday traders were advised to consider the recent bullish breakout above 1.0960 as a valid BUY signal. Initial bullish target level was already reached around 1.1000. Another Intraday BUY entry can be considered upon a bearish pullback towards 1.0920-1.0940 (Backside of the broken bearish channel). S/L should be placed below 1.0870. Initial T/P levels to be located at 1.0960, 1.1000 and 1.1029. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 10.04.2019 - Is the Gold ready another move lower? Posted: 04 Oct 2019 07:12 AM PDT Gold has been trading sideways at the price of $1,500. I found rejection of the important resistance at the price of $1,512 and I expect further downside movement.

Yellow rectangle – Important resistance level Green rectangles – Important support levels Purple falling line – Expected path I found good rejection of the important resistance at $1,512, which is sign that sellers are in control .MACD oscillator is showing bear divergence, which is another confirmation for the further downside. My advice is to watch for selling opportunities on tha rallies on 5/15 min time-frames. Resistance levels are seen at: $1,510 $1,512 Support levels are seen at: $1,486 $1,467 The material has been provided by InstaForex Company - www.instaforex.com |

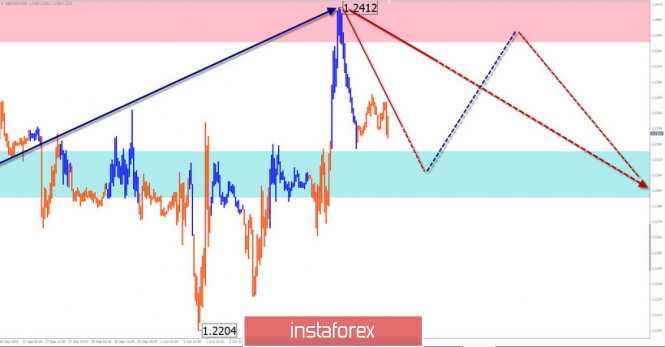

| GBP/USD 10.04.2019 - New down leg is expected, watch for selling opportunities Posted: 04 Oct 2019 06:55 AM PDT GBP is trading lower exactly what I expected yesterday. The price did test our first downward target at the level of 1.2330 and Is heading to test the second target at 1.2218.

Red rectangle – Important support level Green rectangle – Important resistance levels Purple falling line – Expected path I found good rejection of the important resistance at 1.2390, which is sign that sellers are in control . My advice is to watch for selling opportunities due to rejection of the important resistance in the background. Additionally, I found that potential completion of the ABC type of upward correction. The downward target is set at the price of 1.2218. MACD entered into negative territory below the zero line. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 04 Oct 2019 05:57 AM PDT To open long positions on GBP / USD you need: Rumors that it is unlikely that the EU will be able to trust the Brexit plan proposed by London, scare away new buyers of the pound. However, from a technical point of view, nothing has changed in the morning. The bulls have already defended the support level of 1.2313, having formed a false breakdown there, and while trading is above this range, we can expect continued growth of GBP / USD, which will lead to a breakthrough and consolidation above resistance 1.2364. Only such a scenario will provide the pound with a new wave of growth to a maximum of 1.2406, where I recommend taking profits. If the bulls miss the support of 1.2313, it is best to count on new long positions on a rebound from a minimum of 1.2263. To open short positions on GBP / USD you need: Only the formation of a false breakdown at 1.2364 will be the first signal to open short positions on the pound in order to break through and consolidate below the support of 1.2313, which will provide the pair with new sellers that can return GBP / USD to a minimum of 1.2263, where I recommend taking profits. If the bulls manage to break above the resistance 1.2364 after the release of the report on the American labor market, new short positions can be considered from the upper border of 1.2406-1.2410. Indicator signals: Moving averages Trading is carried out in the area of 30 and 50 daily averages, which indicates market uncertainty. Bollinger bands A breakdown of the upper border of the indicator at 1.2364 will lead to a new wave of pound growth. Description of indicators

|

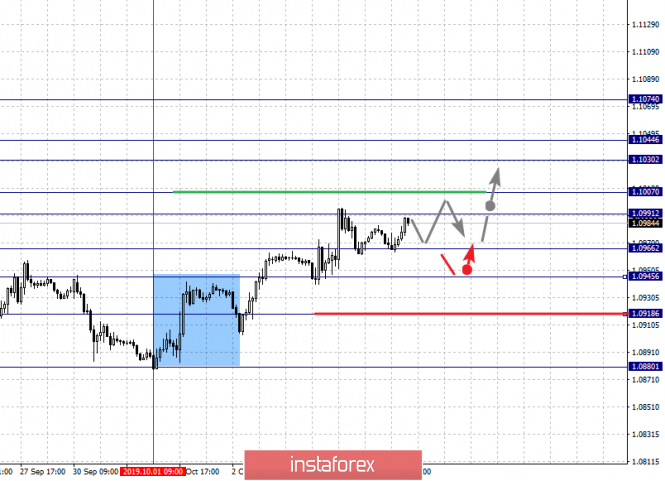

| Posted: 04 Oct 2019 05:48 AM PDT To open long positions on EURUSD you need: From a technical point of view, the situation in the first half of the day has not changed due to the lack of important fundamental statistics. To talk about further growth of EUR / USD, without a weak report on the number of people employed in the non-agricultural sector of the USA, will not be entirely true. Bulls need to break above resistance 1.0993, which will provide them with growth to the highs of the previous week to the area of 1.1022, where I recommend taking profits. However, the more important task for the second half of the day is to protect the support of 1.0965, on which a lot depends today. The formation of a false breakdown on it is a direct signal to euro purchases. If the bulls miss this range, you can return to long positions immediately to the rebound from a minimum of 1.0935. To open short positions on EURUSD you need: Sellers will be waiting for a report on the US labor market and the formation of a false breakdown in the resistance area of 1.0993. Only in this scenario we can expect a return and consolidation below the support of 1.0965, which will push EUR / USD to the minimum of yesterday at 1.0935, where I recommend taking profits. If buyers of the euro will be able to regain the resistance of 1.0993 in the afternoon and continue to move along the trend, it is best to consider short positions for a rebound from a maximum of 1.1022. Indicator signals: Moving averages Trading is conducted slightly above 30 and 50 moving averages, which indicates the preservation of buyers in the market. Bollinger bands The breakdown of the upper border of the indicator in the area of 1.0989 will lead to a larger wave of euro growth, while a breakdown of the lower border in the area of 1.0965 will increase the pressure on the euro.

Description of indicators

|

| Fractal Analysis of Ethereum on October 4 Posted: 04 Oct 2019 05:24 AM PDT Dear colleagues, Ethereum is the most optimal instrument for intraday trading, both for working in a trend and in correction zones. This instrument has a pronounced structure of the initial conditions and moderate noise of the time series. Currently, we are following the development of the ascending structure of September 26. The level of 178.09 is the key resistance, while the level of 163.87 is the key support. Forecast for October 4: Analytical review of cryptocurrency on a scale of H1: For the Ethereum instrument, the key levels on the H1 scale are: 202.53, 195.98, 186.28, 178.09, 168.27, 163.87, 160.78 and 153.76. Here, the price entered an equilibrium state: the ascending structure of September 26, as well as the descending structure of October 1. We expect the continuation of the upward movement after the breakdown of the level of 178.10. In this case, the target is 186.28. The breakdown of which, in turn, should be accompanied by a pronounced upward movement to the level of 195.98. The potential value for the top is considered to be the level of 202.53. Upon reaching which, we expect consolidation, as well as a pullback downward. Short-term downward movement is expected after the breakdown of the level of 168.27. In this case, the target is 163.87. The range of 163.87 - 160.78 is the key support for the upward structure. Its passage at the price will favor the development of a downward trend. In this case, the potential target is 153.76. The main trend is the equilibrium situation. Trading recommendations : Buy: 178.10 Stop Loss: 168.40 Take Profit: 186.20 Buy: 187.00 Stop Loss: 178.00 Take Profit: 196.00 Sell: 168.20 Stop Loss: 178.30 Take Profit: 164.00 Sell : 160.50 Stop Loss: 169.50 Take Profit: 154.00 The material has been provided by InstaForex Company - www.instaforex.com |

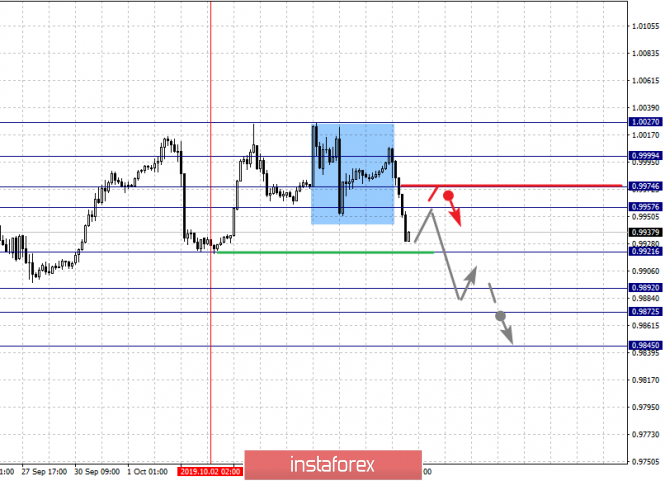

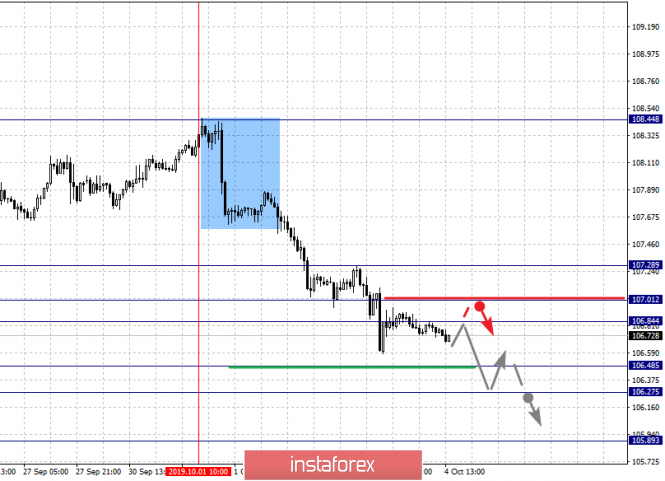

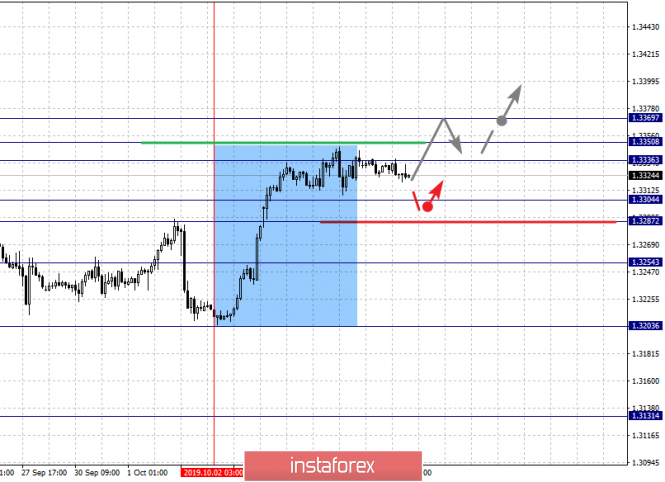

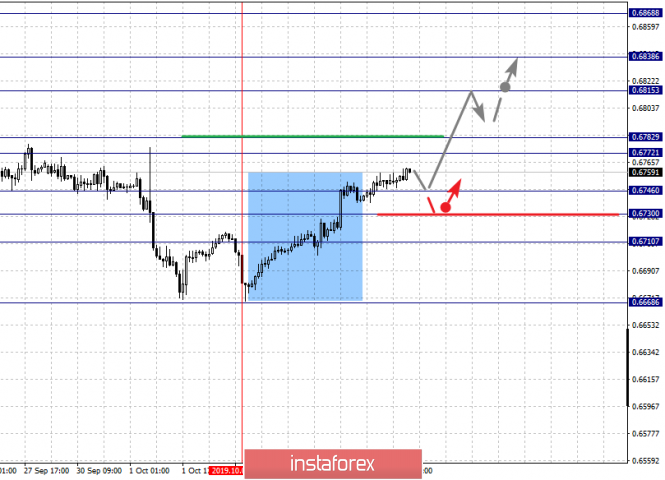

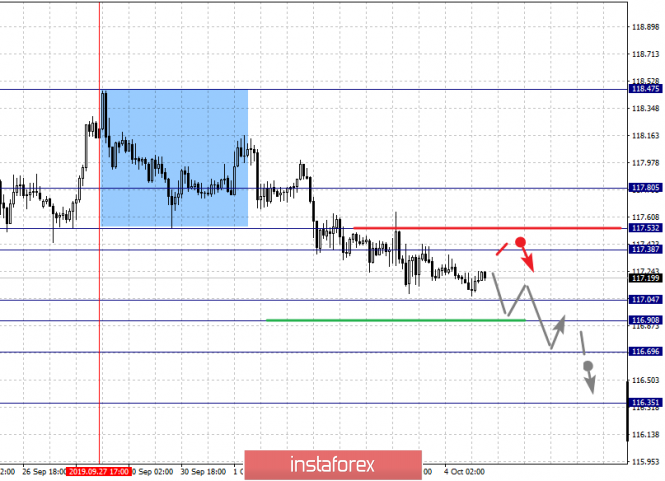

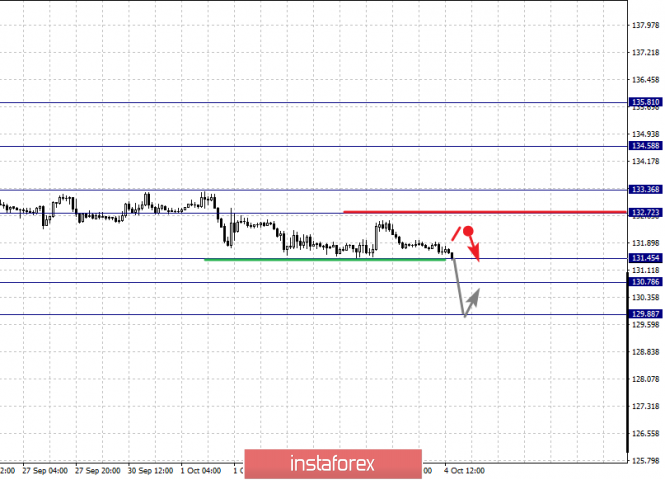

| Fractal analysis of the main currency pairs on October 4 Posted: 04 Oct 2019 04:49 AM PDT Forecast for October 4: Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1074, 1.1044, 1.1030, 1.1007, 1.0991, 1.0966, 1.0945 and 1.0918. Here, we follow the development of the ascending structure of October 1. Short-term upward movement is expected in the range 1.0991 - 1.1007. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 1.1030. Price consolidation is in the range of 1.1030 - 1.1044. We consider the level of 1.1074 to be a potential value for the top; upon reaching this value, we expect a rollback to correction. Short-term downward movement is possibly in the range 1.0966 - 1.0945. Hence, the high probability of a reversal to the top. A breakdown of the level of 1.0945 will lead to the development of a protracted corrective movement. Here, the target is 1.0918. The main trend is the upward structure of October 1. Trading recommendations: Buy: 1.1007 Take profit: 1.1030 Buy 1.1045 Take profit: 1.1074 Sell: 1.0966 Take profit: 1.0947 Sell: 1.0943 Take profit: 1.0920 For the pound / dollar pair, the key levels on the H1 scale are: 1.2573, 1.2493, 1.2422, 1.2374, 1.2311, 1.2279, 1.2243 and 1.2203. Here, the price forms the medium-term initial conditions for the upward movement of October 1. The continuation of the movement to the top is expected after the breakdown of the level of 1.2374. In this case, the target is 1.2422. The breakdown of which should be accompanied by a pronounced upward movement. Here, the target is 1.2493. Price consolidation is near this level. For the potential value for the top, we consider the level of 1.2573. Upon reaching which, we expect a pullback to the bottom. Short-term downward movement is expected in the range 1.2311 - 1.2279. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.2243. This level is a key support for the top. The main trend is the formation of a medium-term upward structure from October 1. Trading recommendations: Buy: 1.2375 Take profit: 1.2420 Buy: 1.2424 Take profit: 1.2490 Sell: 1.2310 Take profit: 1.2280 Sell: 1.2277 Take profit: 1.2245 For the dollar / franc pair, the key levels on the H1 scale are: 1.0027, 0.9999, 0.9974, 0.9957, 0.9921, 0.9892, 0.9872 and 0.9845. Here, the price canceled the formation of the upward structure from October 2, and at the moment, we are following the formation of the downward potential from October 3. The continuation of the development of the downward trend is expected after the breakdown of the level of 0.9921. In this case, the target is 0.9892. Price consolidation is in the range of 0.9892 - 0.9872. For the potential value for the bottom, we consider the level of 0.9845. Upon reaching which, we expect a pullback to the top. Short-term upward movement is possibly in the range of 0.9957 - 0.9974. The breakdown of the last value will lead to an in-depth correction. Here, the target is 0.9999. This level is a key support for the downward structure. Its breakdown will lead to the development of the upward movement. Here, the potential target is 1.0027. The main trend is the formation of potential for the bottom of October 3. Trading recommendations: Buy : 0.9976 Take profit: 0.9999 Buy : 1.0003 Take profit: 1.0027 Sell: 0.9920 Take profit: 0.9892 Sell: 0.9870 Take profit: 0.9845 For the dollar / yen pair, the key levels on the scale are : 107.28, 107.01, 106.84, 106.48, 106.27 and 105.89. Here, we follow the development of the downward cycle of October 1. Short-term downward movement is expected in the range of 106.48 - 106.27. The breakdown of the last value will lead to movement to a potential target - 105.89, after reaching which, we expect a pullback to the top. Short-term upward movement is expected in the range of 106.84 - 107.01. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 107.28. This level is a key support for the downward structure. The main trend: the downward cycle of October 1. Trading recommendations: Buy: 106.84 Take profit: 107.00 Buy : 107.03 Take profit: 107.26 Sell: 106.48 Take profit: 106.28 Sell: 106.25 Take profit: 105.90 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3369, 1.3350, 1.3336, 1.3304, 1.3287 and 1.3254. Here, the price forms the medium-term initial conditions for the top of October 2. Short-term upward movement is possibly in the range 1.3336 - 1.3350. From here, we expect a key reversal in the correction. For the potential value for the top, we consider the level of 1.3369. Short-term downward movement is possibly in the range of 1.3304 - 1.3287. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3254. This level is a key support for the top. The main trend is the formation of medium-term initial conditions of October 2. Trading recommendations: Buy: 1.3336 Take profit: 1.3350 Buy : 1.3352 Take profit: 1.3369 Sell: 1.3304 Take profit: 1.3390 Sell: 1.3285 Take profit: 1.3260 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6868, 0.6838, 0.6815, 0.6782, 0.6772, 0.6746, 0.6730 and 0.6710. Here, we follow the development of the ascending structure of October 2. The continuation of the upward movement is expected after the price passes the noise range 0.6772 - 0.6782. In this case, the target is 0.6815. Short-term upward movement, as well as consolidation is in the range of 0.6815 - 0.6838. For the potential value for the top, we consider the level of 0.6868. The movement to which, is expected after the breakdown of the level of 0.6840. Short-term downward movement is possibly in the range of 0.6746 - 0.6730. The breakdown of the last value will lead to a long correction. Here, the potential target is 0.6710. This level is a key support for the upward structure. The main trend is the upward structure of October 2. Trading recommendations: Buy: 0.6782 Take profit: 0.6815 Buy: 0.6817 Take profit: 0.6836 Sell : 0.6746 Take profit : 0.6732 Sell: 0.6729 Take profit: 0.6710 For the euro / yen pair, the key levels on the H1 scale are: 117.80, 117.53, 117.38, 117.04, 116.90, 116.69 and 116.35. Here, we continue to monitor the development of the downward cycle of September 27. Short-term downward movement is expected in the range 117.04 - 116.90. The breakdown of the last value will lead to a movement to the level of 116.96. Price consolidation is near this level. For the potential value for the bottom, we consider the level of 116.35. The movement to which is expected after the breakdown of the level of 116.65. Short-term upward movement is possibly in the range 117.38 - 117.53. The breakdown of the latter value will lead to in-depth movement. Here, the goal is 117.80. This level is a key support for the downward structure. The main trend is the local descending structure of September 27. Trading recommendations: Buy: 117.38 Take profit: 117.52 Buy: 117.55 Take profit: 117.80 Sell: 117.04 Take profit: 116.90 Sell: 116.88 Take profit: 116.70 For the pound / yen pair, the key levels on the H1 scale are : 134.58, 133.36, 132.72, 131.45, 130.78 and 129.88. Here, we follow the development of the descending structure of September 20. Short-term movement to the bottom is expected in the range 131.45 - 130.78. The breakdown of the latter value will lead to movement to a potential target - 129.88, when this level is reached, we expect a pullback to the top. Short-term upward movement is possibly in the range of 132.72 - 133.36. The breakdown of the last value will lead to a long correction. Here, the target is 134.58. We also expect the formation of expressed initial conditions for the upward cycle to this level. The main trend is the descending structure of September 20. Trading recommendations: Buy: 132.72 Take profit: 133.30 Buy: 133.40 Take profit: 134.55 Sell: 131.43 Take profit: 130.80 Sell: 130.74 Take profit: 129.90 The material has been provided by InstaForex Company - www.instaforex.com |

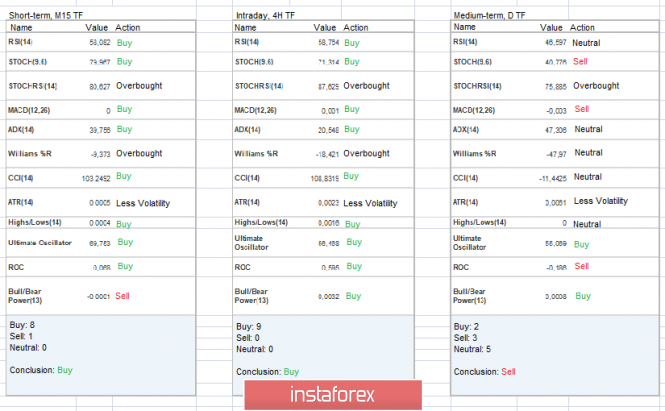

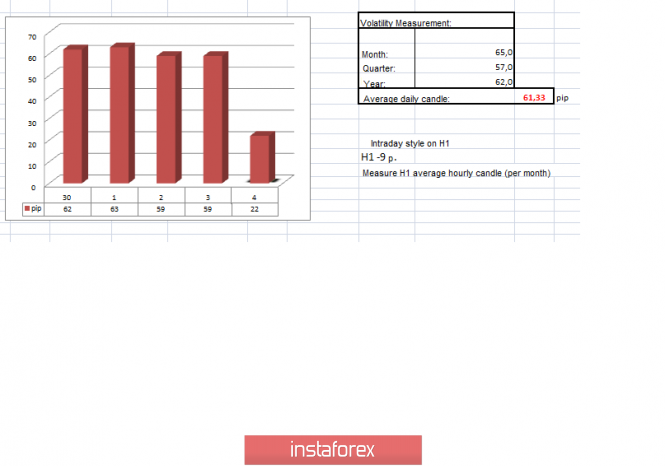

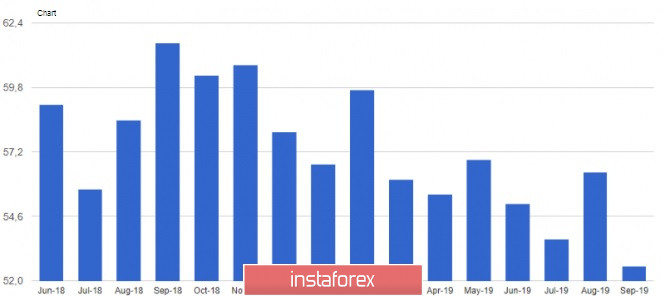

| Trading recommendations for the EURUSD currency pair - prospects for further movement Posted: 04 Oct 2019 04:25 AM PDT Over the past trading day, the euro / dollar currency pair showed moderate volatility within the daily average, resulting in a local surge in the direction of the psychological level. From the point of view of technical analysis, we see a very interesting picture, so for starters, we will look at volatility, which is stably kept at around 60 points (see the summary table at the end of the article). In fact, we see a holding speculative interest, which can only please. Analyzing the past day in detail, we see that the main move came at 14: 00-15: 00 UTC+00 [time at the trading terminal], after which there was a partial recovery and, as a fact, the accumulation of 1.0960 / 1.0990 already in the Pacific and Asian trading session. As discussed in a previous review, traders worked with alternative trading positions, locally examining the past surge. Earlier short positions were liquidated to a greater extent, and work is already underway regarding the current coordinates. Considering the trading chart in general terms (daily period), we see a correction phase from the value of 1.0880, which develops mainly in a downward trend. Are there any prerequisites for a trend change? No way, as well as the formation of an oblong correction. The news background of the past day had a considerable package of statistical data. Thus, in Europe, we have weak data on business activity indices, where in the service sector we recorded a decrease from 53.5 to 51.6. The composite index likewise decreases from 51.9 to 50.1. The statistics for Europe does not end there, and so, after the indices came producer prices, which showed a decline to -0.8, but retail sales came out slightly better than expected, a decline from 2.2% to 2.1%. In the afternoon, data came out for the United States, and not everything is so good there. Thus, the number of applications for unemployment benefits was reviewed for the better, but still recorded growth: primary + 4tys. repeated -5 thousand. The main blow to the dollar declined at 14:00 Universal time, where the ISM index of business activity in the services sector came out, with a clear decline from 56.4 to 52.6. In terms of informational background, we see a wide discussion regarding the proposal for Brexit by British Prime Minister Boris Johnson. Thus, the President of the European Council, Donald Tusk, said that Boris Johnson's proposal for Brexit does not look convincing, although the EU remains open. "Today [October 3], I had two phone calls about Brexit, first with Dublin, then with London. My message to Prime Minister Leo Varadkar: We fully support Ireland. My message to Prime Minister Boris Johnson: we remain open, but not convinced" - Twitter @eucopresident In turn, the British Parliament gave Johnson exactly one week to finalize the existing proposal. Today, in terms of the economic calendar, the long-awaited day. The report of the United States Department of Labor will be published, which is likely to betray speculators. Thus, according to preliminary forecasts, the indicators should remain at the same level, but if the employment data coincide with the ADP report and we see a characteristic decrease in the number of new places outside the agricultural sector, then the dollar will come under pressure. Toward the close of the working week [18:00 Universal time], Jerome Powell will speak at the Fed's hearings on the problems of population employment and price stability. The upcoming trading week in terms of the economic calendar stands out only the minutes of the Fed meeting, the data for Europe is practically not available, but the United States has something to sort out. The most interesting events displayed below ---> Tuesday October 8th USA 12:30 Universal time. - Producer Price Index (PPI) (YoY) (Sept): Prev 1.8% ---> Forecast 1.7% Wednesday October 10th USA 14:00 Universal time. - The number of open vacancies in the labor market JOLTS (Aug): Prev 7,217M USA 18:00 Universal time. - Minutes of the meeting of the US Federal Open Market Committee Thursday, October 11 USA 12:30 Universal time. - Basic Consumer Price Index (September) Friday October 12th Germany 7:00 Universal time. - Harmonized Consumer Price Index (YoY): Prev 0.9% ---> Forecast 1.0% Further development Analyzing the current trading chart, we see that the amplitude fluctuation of 1.0960 / 1.0990 persists even now, in fact reflecting to us a certain expectant position. In turn, speculators are waiting for a distinct breakdown of control points for further trading operations. It is likely to assume that the current fluctuation will not last so long where trading within it does not make much sense. Thus, the trading method will be built on the principle - analysis of breakdown points of borders. Based on the above information, we derive trading recommendations: - We consider purchase positions in case of price fixing higher than 1.1000. - We consider selling positions lower than 1.0956, with the prospect of a move to 1.0940-1.0900. Indicator analysis Analyzing a different sector of timeframes (TF), we see that indicators in the short and intraday perspective signal upward interest, but due to the fact that the quotation is in the accumulation stage, indicators can be variable. On the other hand, the medium-term outlook remains downward in the face of the general trend. Volatility per week / Measurement of volatility: Month; Quarter; Year Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (October 4 was built taking into account the publication time of the article) The volatility of the current time is 24 points, which is the average for this time section. It is likely to assume that the volatility of the day will be locally limited by the previously indicated frames. Key levels Resistance zones: 1,1000 ***; 1,1100 **; 1,1180 *; 1.1300 **; 1.1450; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1,2100 Support areas: 1.0900 / 1.0950 **; 1.0850 **; 1,0500 ***; 1.0350 **; 1,0000 ***. * Periodic level ** Range Level *** Psychological level **** The article is built on the principle of conducting a transaction, with daily adjustment The material has been provided by InstaForex Company - www.instaforex.com |

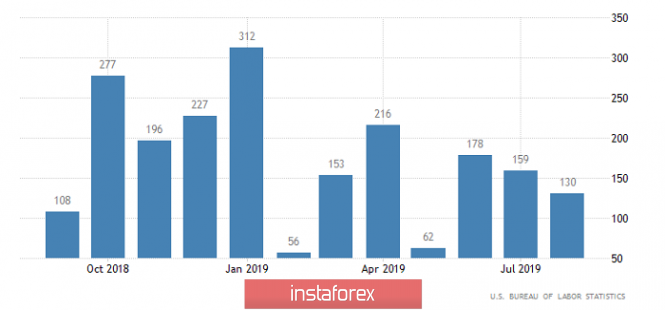

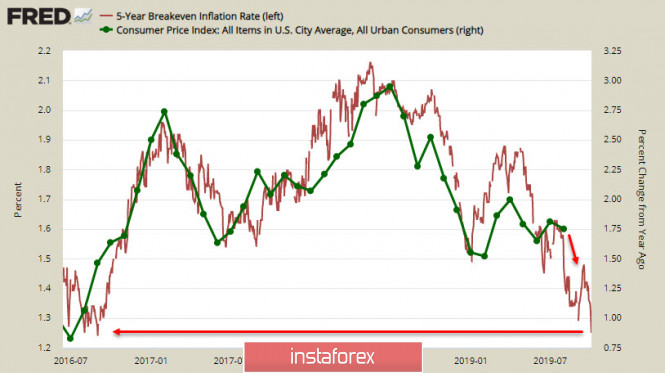

| Posted: 04 Oct 2019 02:58 AM PDT It seems that a decrease in business activity in the eurozone to a minimum since 2013 and Markit forecasts of a 0.1% increase in the GDP of the currency block in the third quarter will not surprise anyone. The United States is another matter. Until September, they looked like an island of stability, which is not afraid of headwinds blowing from abroad. On the other hand, ISM US Purchasing Manager Indexes which were released this week showed that the US economy is not as strong as many believe. Following the weak PMI release in the US manufacturing sector, a disappointing US service activity report came out. Last month, the indicator dipped to the lowest level since 2016 - 52.6. "There were signs of a slowdown in the US economy before, but there were few who suggested that the wheels were already falling off the cart," said Robert Burgess, an expert at Bloomberg. "Some argue that domestic demand in the United States will remain high, even if external demand weakens. However, over time, consumption in the country will inevitably depend on what is happening outside. The US companies are becoming more cautious about hiring a new workforce, as well as spending planning, "said Minori Uchida, Chief currency strategist at MUFG Bank. "The US economy is now working on one engine - consumption. Whether the longest economic boom in the history of the country will continue will depend on the ability of American consumers to continue spending so as to compensate for the decline in manufacturing sectors in the context of a trade war with China, "said Stephen Gallagher, Chief Economist at Societe Generale. Apparently, the American manufacturing sector, burdened by trade disputes, begins to drag the services sector into a quagmire, employment in which, according to ISM, showed the slowest growth in September since 2014. Perhaps, not the best news in anticipation of the September release on the labor market. In August, the number of people employed in the non-agricultural sector of the United States increased by 130 thousand, in June-August - an average of 156 thousand, which is significantly lower than the average since the 2008 economic crisis (190 thousand). If everything goes the same way, then the US economy will create only 1.9 million new jobs in 2019, which will be the worst indicator since 2010 and significantly lower than 2.7 million recorded in 2018. The EUR / USD pair is growing amid growing talk that the Fed has a much broader potential for monetary expansion compared to the ECB, as interest rates are higher in the US. Following the release of disappointing statistics on business activity in the United States, the chances of easing the Fed's monetary policy in October increased from 40% to 88%. "The market is almost certain that the Fed at the October meeting will reduce the interest rate by 25 basis points. The step could be sharper - by 50 basis points, if the data on the labor market for September turned out to be dull, and the yield on US bonds continues to fall, "said John Lonski, chief economist at Moody's. By the end of 2019, the Federal funds rate is expected to fall by 42 basis points and 100 basis points by the end of 2020. In this regard, the ECB has practically no room for retreat, although the limited potential of monetary expansion may indicate an inability to save the European economy from recession. It is assumed that if the governments of the eurozone countries do not respond to the call of the ECB President Mario Draghi and do not go to the fiscal stimulus, then the euro against the US dollar will drop to $ 1.05. However, few still believe in such a pessimistic scenario. According to the consensus forecast of economists recently surveyed by Reuters, the EUR / USD pair will finish the current year at 1.1, and will reach 1.13 in 12 months. Thus, the "bulls" on EUR / USD are playing out different speeds of the European and American economies falling into the abyss, as well as the potential for monetary expansion of the Fed and the ECB. The September US labor market report and today's Fed statement by Jerome Powell may add fuel to the fire. The "dovish" rhetoric of the head of the Federal Reserve, combined with weak data on US employment, could push EUR / USD to 1.104-1.105. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of GBP/USD for October 04, 2019 Posted: 04 Oct 2019 02:15 AM PDT Overview: Pivot point: 1.2297. The GBP/USD pair broke resistance at 1.2297 which turned into strong support yesterday. This level coincides with 38.2% of Fibonacci retracement which is expected to act as major support today. The RSI is still signaling that the trend is upward, while the moving average (100) is headed to the upside. Accordingly, the bullish outlook remains the same as long as the EMA 100 is pointing to the uptrend. This suggests that the pair will probably go above the daily pivot point (1.2297) in the coming hours. So, we expect that The GBP/USD pair will continue to move upwards from the level of 1.2300. Amid the previous events, the price is still moving between the levels of 1.2300 and 1.2412. It will be good to buy at 1.2300 with the first target of 1.2371. It will also call for an uptrend in order to continue towards 1.2412. The strong weekly resistance is seen at the 1.2412 level. At the same time, in case a reversal takes place and the GBP/USD pair breaks through the support level of 1.2270, a further decline to 1.2226 can occur, which would indicate a bearish market. The material has been provided by InstaForex Company - www.instaforex.com |

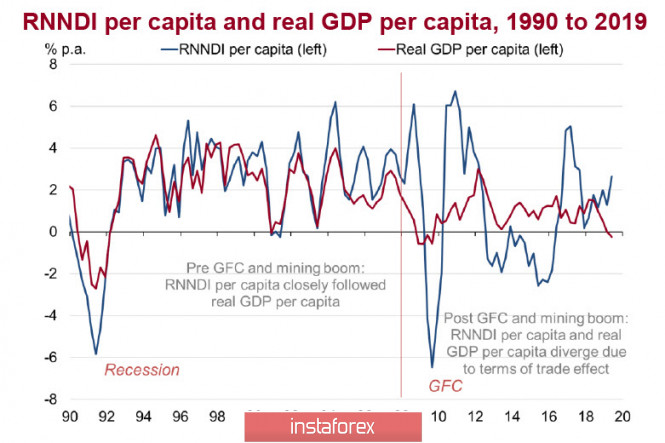

| Posted: 04 Oct 2019 01:48 AM PDT Good afternoon, dear traders. I present to your attention a trading recommendation for the AUD/USD currency pair. Today, an explosive day for the US dollar is expected, as the market expects the publication of unemployment data in the US, including in the non-agricultural sector. As for the Australian dollar itself, this week it lowered the interest rate by 0.25%, and against this background, it was possible to observe a culminating collapse with the breakdown of annual lows, because six months ago, the Central Bank of Australia assured that it would never lower rates.

Now, after the breakdown of the annual extremum at 0.6678, I expect, if not a reversal, then at least a good pullback with an update to the level of 0.6782. This level will be broken sooner or later, and even if today's news will be strong for the dollar, it will only slow down the working out. Why exactly the level of 0.6782? The thing is that this level is extremely important for late sellers who, after reducing the % rate, took short positions and believe in its endless decline. As a result, I expect at least a false breakdown of the level of 0.6782, which can happen even today if the news is weak. I wish you all success in trading and big profits! The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 04 Oct 2019 01:38 AM PDT GBP/USD Analysis: On September 13, the bearish wave has been forming on the British pound chart. After the first dash down, the price rolled back upward, forming a correction (B). By the current day, the rollback structure looks complete. Since yesterday, the price forms a downward movement with high potential. Forecast: There is a high chance of early completion of the current bullish wave. In the coming sessions, you can expect a flat mood of movement between the nearest zones. The growth rate of the pair is likely by the end of the day. Potential reversal zones Resistance: - 1.2390/1.2420 Support: - 1.2320/1.2290 Recommendations: Before the appearance of clear signals of a trend change, trading in British currency is shown only within the intraday. Sales conditions have not yet been created. It is recommended that you focus on pound purchases.

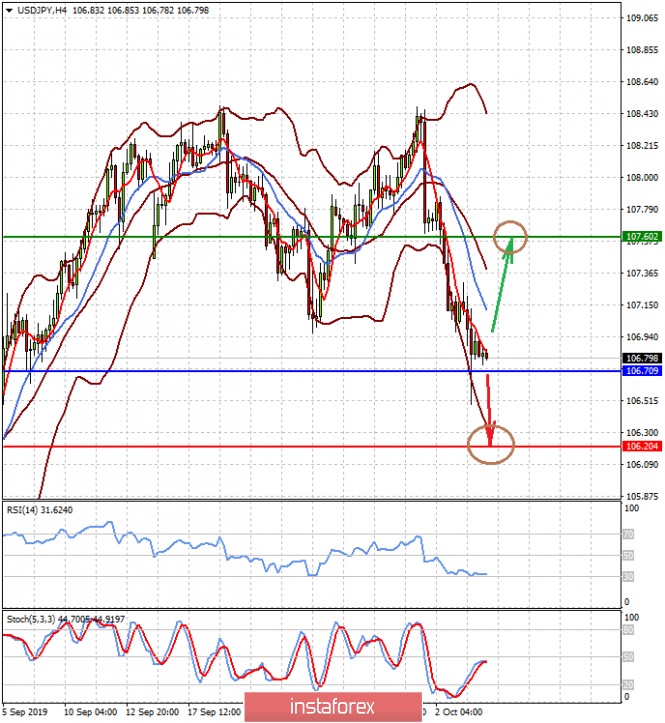

USD/JPY Analysis: The price fluctuations of the Japanese yen over the past couple of days have made changes to the preliminary wave forecast. The downward wave of September 13 was continued. Full correction is being formed to the previous segment of the trend of August 26. Forecast: Today, it is expected to continue the current downward trend this week. At the European session, a short upward rollback is possible, which should be replaced by a new spurt of prices down by the end of the day. Potential reversal zones Resistance: - 106.90/107.20. Support: - 106.20/105.90. Recommendations: Buying the yen today will be unproductive due to the small expected move up. At the end of the upcoming lift, it is recommended that you track the selling signals of the instrument.

Explanations: In the simplified wave analysis (UVA), the waves consist of 3 parts (A-B-C). The last unfinished wave is analyzed. The solid background of the arrows shows the formed structure, dotted - the expected movement. Attention: The wave algorithm does not take into account the length of time the tool moves! The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 04 Oct 2019 01:24 AM PDT By the publication of updated data on employment in the US, the US economy came with clear and fairly clear signals of the risk of a new economic downturn (recession) before the end of this year. Over the past two months, the US economy has begun to "confidently" demonstrate a decline in production and business activity, which, in the wake of a slowdown in economic growth of 2.0% and a slowdown in the growth of new jobs, indicates a high probability of failure in the recession. The economic data coming in over the past two weeks has been steadily demonstrating this, confirming these concerns. As we indicated earlier, production indicators have already "fallen" below the Rubicon level of 50 points, which indicates a lack of growth in the manufacturing sector. On Thursday, ISM non-manufacturing sector activity index (PMI) was presented. Although it has decreased, it still balances above the 50 point level, and at the same time, we note that the decline turned out to be significant. According to the data presented, the index of business activity in the non-manufacturing sector (PMI) from the ISM Institute for Supply Management in September declined to 52.6 points from 56.4 points, while a decline to 55.0 points was expected. Moreover, the indicator stayed above the "red line", but this does not guarantee that it will cross it in October. On Thursday, in anticipation of the release of important data from the US labor market, a noticeable closure of short positions was observed both in the US stock market and in the foreign exchange market, where the dollar has come under pressure in recent days due to a surge in demand for protective assets, including safe haven currencies. This is caused by the desire to take a wait-and-see position before the publication of employment values, which, by their dynamics, can either push the Fed to more active actions aimed at further lowering interest rates and at the beginning of QE4, or continue to monitor the situation on the markets. According to the forecast, it is estimated that the US economy received 140,000 new jobs in September compared to 130,000 in August. It is also expected that the unemployment rate will remain at 3.7%. How can the market react to certain data? It seems to us that if the value of the number of new jobs is lower than expected, for example, 130,000 or even lower, this will lead to a resumption of a fall in the US stock market, weakening the dollar against the safe haven currencies - the yen and the Swiss franc. Gold will also receive support. However, in our opinion, this decline will be local in nature, since the Fed, if not at the October meeting, will be forced to lower rates and start QE4 or something like that. If the data, on the contrary, turn out to be positive, above expectations, this will lead to a limited increase in risk demand and a stronger dollar. But again, this dynamics is likely to be local in time. Forecast of the day: Spot gold is consolidating above the level of 1505.50 in anticipation of the publication of updated US employment data. If they turn out to be worse than the forecast, gold, breaking the level of 1505.50, will rush to 1523.00. Conversely, positive values will lead to a local fall in prices to 1491.60. Meanwhile, USD/JPY will behave the same as gold. On the positive, it can grow to 107.60, but on the negative, on the contrary, it can break the level of 106.70 and rush to 106.20. |

| Brilliant victory of the precious metal: Gold is the undisputed leader Posted: 04 Oct 2019 01:24 AM PDT Yellow metal has always been the focus of attention of investors, attracting capital with its prospects. Most often, its role was reduced to the status of a safe haven asset, and it remains to this day. It was this perception of the precious metal that raised its quotes to an unprecedented height and brought considerable profit. Summing up the preliminary results of the third quarter of 2019, experts analyzed the situation and came to the conclusion that gold coped with the role of a protective asset by 100%. Yellow metal showed higher returns than the DAX and Dow Jones stock indices. Since the beginning of this year, the cost of precious metals traded in US dollars has increased by 16.8%, while in European currency the increase amounted to 22.3%. The reason for this imbalance was the gradual depreciation of the euro against the "American." As a result, European investors received more profit from investments in gold than American ones. In the global stock markets, yellow metal also took a leading position. Analyzing income from the German DAX index and the American Dow Jones index, experts concluded that gold overtook them in this indicator. Profit from investing in precious metals, which is traditionally perceived as an asset-refuge, exceeded analysts' forecasts. At the beginning of last month, the value of gold traded in euros set a new record, reaching € 1,413. Unfortunately, precious metals traded in dollars did not have enough 27% to reach price peaks, analysts say. Nevertheless, the yellow metal was still at its best and retains first place on the "profitable" pedestal. One of the key factors behind the price increase of gold was the decline in the yield on 10-year US government bonds. It declined in price by 37%, and this gave odds to precious metals. As a result, most investors around the world turned their attention to yellow metal, raising its quotes with active purchases. But experts do not exclude the high probability of capital outflows from the stock market to the precious metals market, in particular to gold. This may provoke another price rally among precious metals, experts are sure. Over the past three days, yellow metal has been striving to the top to reach a correction, soaring to the level of $ 1,520 per 1 ounce. However, the gold rally was interrupted by growing demand for the US dollar and the subsequent appreciation of the US currency. At this time, gold slightly "gave back", dropping to a local minimum of $ 1,480. Thus, analysts expect further testing of the target support level of $ 1,460 per ounce, which will be a stepping stone for the next growth. Now, precious metal is currently trading in the range of $ 1,513– $ 1,514 per ounce. The increase in the price of yellow metal this year brought not only positive moments. It provoked a small effect with a minus sign - high gold volatility. However, the level of this volatility is much lower than the quotes of oil or silver. Analysts believe that these indicators fit into the framework of permissible price fluctuations. Therefore, they recommend that investors and traders keep up to 10% of their gold quotes in their investment portfolios in order to minimize risks on other assets. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 04 Oct 2019 01:04 AM PDT The US dollar weakened yesterday against the euro and other world currencies after reports showed that the number of Americans applying for unemployment benefits for the first time grew for the third week in a row, and non-manufacturing activity declined slightly. Another infusion of funds under the repo procedure also weakened the position of the US dollar. According to the US Department of Labor, the number of initial applications for unemployment benefits for the week of September 22-28 increased by 4,000 and amounted to 219,000. Economists had expected the number of applications to be 215,000. The number of secondary applications fell by 5,000 to 1,651,000. As noted above, the indicator of business activity of private companies in the US services sector, although marked by growth in September, remained close to 50 points. The weakness of the index is directly related to the slow growth of new orders. According to IHS Markit, the purchasing managers' index (PMI) for the US services sector was 50.9 points in September against 50.7 points in August. Index values above 50 still indicate an increase in the activity. Expectations for business activity remain subdued, and several companies have already expressed concerns about their prospects due to the deterioration of forecasts for the global economy. According to the Institute for Supply Management (ISM), the PMI for the non-manufacturing sector of the United States in September fell immediately to 52.6 points, while in August was at 56.4 points. Weak data on activity in the manufacturing sector and the service sector are further evidence that the Federal Reserve will not stop lowering interest rates, and, most likely, at the end of this year at the December meeting, it will lower the key interest rate by another 25 points. In confirmation of the weak manufacturing sector, a report was released yesterday, which indicated a reduction in production orders. According to the US Department of Commerce, US production orders fell by 0.1% in August 2019 compared to the previous month. Durable goods orders fell by 0.2%, while orders for non-durable goods decreased by 0.3%. As noted above, the Federal Reserve Bank of New York made another infusion of liquidity in the amount of 33.55 billion US dollars. The funds were provided through repo operations, which helps to eliminate the lack of liquidity in the short-term debt market. All the applications that the banks requested were satisfied. Yesterday, the President of the Federal Reserve Bank of Cleveland Loretta Mester spoke, who said that low-interest rates can exacerbate financial imbalances, but financial risks are currently moderate. Mester also expressed concern that the Fed does not have a large number of tools at its disposal to deal with financial risks. All traders' attention today will be focused not on data on the US labor market and on the report on employment in the non-agricultural sector, and the speech of Fed Chairman Jerome Powell, which will take place in the middle of the North American session. Traders will look for any hint of further interest rate cuts, which will lead to further weakening of the US dollar. As for the technical picture of the EURUSD pair, the larger support levels are seen around 1.0935 and 1.0900. The task of buyers of risky assets is to return to the resistance level of 1.1000, which will lead to the continuation of the upward trend to the highs of 1.1030 and 1.1070. GBPUSD The pound fell back yesterday after breaking a large resistance at 1.2315, which now acts as a support. Statements by EU officials that the British government's proposals to overcome the stalemate in the Brexit negotiations are not credible put pressure on the pair in the afternoon. According to the representative of the European Parliament, Philip Lambert, the proposal of London contradicts the promise of the British side on the absence of a rigid border on the Irish island. Such half measures, as well as the proposal to vest the Parliament of Northern Ireland with a veto over the establishment of uniform regulatory standards with the Republic of Ireland, mean that the EU will be obliged to open its border in case of a dispute, without achieving unification of this process. The chairman of the European Commission, Jean-Claude Juncker, spoke about these "nuances" in his recent address to Boris Johnson. As for the technical picture of GBPUSD, despite yesterday's decline after active growth, bulls have a chance to continue the upward correction. To do this, it is necessary to regain the resistance level of 1.2370, which will strengthen the demand for the trading instrument and lead to an update of the highs in the area of 1.2440 and 1.2530. The downward correction will be limited by a large support at 1.2260. The material has been provided by InstaForex Company - www.instaforex.com |

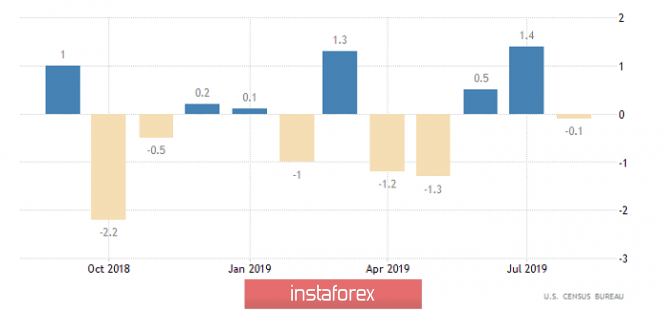

| Hot forecast for EUR / USD on 10/04/2019 and trading recommendation Posted: 04 Oct 2019 12:59 AM PDT The single European currency pretty much left from side to side. That's just the result of all these throwings, zero, because they stayed exactly in the same place where the day started. Initially, the dollar strengthened vigorously, amid weak totals on business activity indices in Europe. Thus, the index of business activity in the services sector decreased from 53.5 to 51.6, and not to 52.0%, as a preliminary estimate showed. The composite index of business activity was supposed to decline from 51.9 to 50.4, but in fact, it fell to 50.1. Naturally, this alignment does not add optimism to the single European currency. In addition, the growth rate of producer prices gave way to a decline, from 0.1% to -0.8%, although they expected a decline of 0.5%. And perhaps, the only thing that could please investors was retail sales. The growth rate of which slowed down from 2.2% to 2.1%, with a forecast of 1.9%. However, the dollar failed to consolidate the success, which was already extremely insignificant. This happened due to weak macroeconomic data in the United States itself. The first thing that catches your eye is applications for unemployment benefits, the total number of which has decreased by 1 thousand. Although the figure is ridiculous, you need to understand that they were waiting for a decrease of 11 thousand, which is in anticipation of the publication of the report of the United States Department of Labor. The data on business activity indices completely coincided with the forecasts, and confirmed the preliminary assessment. Thus, the index of business activity in the service sector increased from 50.7 to 50.9, and the composite index from 50.7 to 51.0. On the other hand, the index of business activity in the service sector from ISM, declined from 56.4 to 52.6. Thus, the multidirectional movement of the two indices somewhat confused the market participants. Finally, the dollar's positions was undermined by production orders, which, after increasing by 1.4%, decreased by 0.1%. In fairness, it should be noted that they expected a decrease of 0.2%. Production Orders (USA): Today, all attention is only on the content of the report of the United States Department of Labor, which can determine the mood of market participants in the coming weeks. On the positive, all indicators should remain unchanged, with the exception of the number of new jobs created outside agriculture, which should be 145 thousand, against 130 thousand. This suggests that the pace of job creation is increasing, and the situation on the labor market is improving. However, given the recent data on ADP and applications for unemployment benefits, there is not a zero chance that the data will turn out worse than expected, which will become a reason for a serious correction for the dollar. And the fact that it is brewing was seen yesterday, when, against the background of extremely weak data on Europe. The single European currency was extremely reluctant to give up its positions but not so terrible data on the United States, led to a sharper movement. The number of new jobs created outside agriculture (USA): The EUR / USD pair moved closer to the psychological level of 1.1000 once again, where they felt resistance and slowed down as a fact. In fact, we got amplitude fluctuation with an approximate frame of 1.0960 / 1.0990 by the end of the day, and a control resistance in the form of a psychological level (1,1000). Considering what is happening in general terms, we see a correctional phase in a downward trend, with a support level of 1.0880. It is likely to assume that the amplitude fluctuation of 1.0960 / 1.0990 (1.1000) will continue for some time, where it is better not to rush and work precisely on the breakdown of the main boundaries. The driver of the jumps, of course, will be the statistics, as I wrote above. Concretizing all of the above into trading signals:

From the point of view of complex indicator analysis, we see a characteristic versatile interest, with respect to all the main time intervals. This is due to the correctional movement, which gradually turned into accumulation. That is, the minute intervals took a neutral line. The sentries began to work on correction (upward interest), but the day period due to correction changed the downward interest to neutral. |

| Weak positive background gives a chance to recover risky assets, NZD and AUD go to the side range Posted: 04 Oct 2019 12:26 AM PDT On Friday morning, Asian stocks rose after two days of falling. The growth is due to the reaction of the US stock market to weak statistics, which increases the possibility of another reduction in the base rate. Another positive factor contributing to the recovery is the expectation regarding the upcoming meeting between the US and China on October 10-11. Markets assess the likelihood of a temporary trade agreement as high, since this outcome is in the interest of both parties. Moreover, risky assets can take advantage of positive expectations and win back some of the losses in the short term. At the same time, experience shows that any interim agreement lasts hardly longer than a month - the contradictions between the USA and China are much deeper and can hardly be resolved without significant losses of one of the parties. Thus, US positions can greatly weaken. Inflation data in September will be published on October 10. Forecasts are currently neutral, but markets may be very disappointed after the publication - the yield of 5-year tips bonds fell to a 3-year low: A sharp decline, in turn, is a reaction of investors to weak ISM reports. After a failed production report on Thursday, an index was published on the services sector, which declined from 56.4p to 52.6p. The result was much worse than expected, and despite the fact that the index is still in the positive zone, the current value is minimal since June 2016, and further dynamics are beyond doubt. Falling tips yields sharply increases the likelihood of a further decline in inflation. If the report on the labor market turns out to be worse than expected today, then the markets may have a clear understanding that the approaching recession in the United States is caused not by external, but purely internal reasons, to which the Fed will have to quickly respond with measures to mitigate monetary policy. Together, these expectations lead to an increase in demand for risky assets in the short term. NZDUSD This week, most of New Zealand's economy indicators look neutral. The threat of another reduction in the RBNZ rate is small, inflationary expectations remain stable, and there is no tendency to reduce them. At the same time, nothing has changed in the long run - a quarterly study of NZIER business opinions shows a further decline in business confidence in the 3rd quarter. A net 35 percent of enterprises expect general economic conditions to deteriorate, and this is the lowest level since March 2009. Kiwi, as expected, updated the minimum. A further decline is doubtful, and thus, the kiwi goes into the side range. The support level is 0.6265, while resistance level is 0.6348. Out of range will occur mainly under the influenced by external factors. AUDUSD RBA, as expected, lowered the rate to 0.75%, which is another record low. Since the market was expecting a decline, the RBA decision did not cause strong Australian sales. The support zone 0.6674 / 86 stood firm again , and now, the Australian currency has a chance to develop corrective growth. The resistance for which will be the level of 0.6820. The support for the possible growth of the Australian currency are macroeconomic indicators. The NAB online retail sales index returned to strong growth (+ 5.7%) in August compared with July, the Commonwealth Bank and AiG PMI indices remained at the August levels in September, despite negative forecasts. In addition, the raw materials price index in September showed an increase of 1.8% with a forecast of a fall of 17.7%. Ai Group's performance indicators for the manufacturing and service sectors, on the other hand, provide encouraging signs of improvement in some segments of the economy. Despite weak GDP growth, real net national disposable income (RNNDI) per capita looks confident. Therefore, there is reason to hope for strong consumer demand and inflation. At this stage, the RBA completed the declined cycle, so the down impulse is weakened. Now, the fate of the Australian dollar will be decided by the pace of slowdown in the global economy, and if these rates increase, the AUD will inevitably resume its decline. In the coming weeks, trading will go mainly in the lateral range. The probability of another assault on support 0.6674 / 86 is small. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading plan 10/04/2019 EURUSD Posted: 04 Oct 2019 12:21 AM PDT EURUSD grew on weak data on the US economy. The September ISM Industrial Index was below 50 for the second time in a row; ISM services sector index - released at 52.6 - above 50, but significantly below the forecast. Market attention is now on the September employment report, which will be released today, at 12:30 London time. Forecasts +150 +160 thousand new jobs. We keep purchases from 1.0945, stop 1.0900. Sell from 1.0875. The material has been provided by InstaForex Company - www.instaforex.com |

| Indicator analysis. Daily review on October 4, 2019 for the GBP / USD currency pair Posted: 04 Oct 2019 12:08 AM PDT Trend analysis (Fig. 1). On Friday, the price from the level of 1.2350 (red dashed line) will move down, with the target of 1.2309 - a pullback level of 50.0% (blue dashed line). Fig. 1 (daily chart). Comprehensive analysis: - indicator analysis - down; - Fibonacci levels - down; - volumes - down; - candlestick analysis - up; - trend analysis - down; - Bollinger Lines - up; - weekly schedule - up. General conclusion: On Friday, before the news, the price may begin to pullback down from the level of 1.2350 (red dashed line). News can greatly influence developments. The first lower target 1.2334 is a pullback level of 38.2% (blue dashed line). The main target for today is 1.2309 - a pullback level of 50.0% (blue dashed line). An unlikely scenario is an upward movement to the upper fractal - 1.2413 (blue dashed line). The material has been provided by InstaForex Company - www.instaforex.com |

| Indicator analysis. Daily review on October 4, 2019 for the EUR / USD currency pair Posted: 04 Oct 2019 12:08 AM PDT On Thursday, the pair moved on a side channel having tested the pullback level of 50.0% - 1,0996 (blue dashed line) and 21 average EMA - 1.0971 (black thin line). Breaking up this cloud, consisting of two levels, will be difficult for the bulls, although the bulls will try to do it again. On Friday, strong calendar news is expected at 13.30 and 19.00 London time (dollar). Also today, a downward pullback is possible. Trend analysis (Fig. 1). On Friday, candlestick analysis also gives a strong bottom (last three consecutive white candles, decreasing over the body). Before the news, a downward pullback may begin, with an intermediate target of 1.0972 - a pullback level of 23.6% (yellow dashed line) and the final target 1.0954 - a pullback level of 38.2% (yellow dashed line). Much will depend on the news that comes out at 13.30 London time. Fig. 1 (daily chart). Comprehensive analysis: - indicator analysis - up; - Fibonacci levels - down; - volumes - up; - candlestick analysis - down; - trend analysis - up; - Bollinger Lines - down; - weekly schedule - up. General conclusion: On Friday, before the news, a pullback downward is possible. The lower target is 1.0954 - a pullback level of 38.2% (yellow dashed line). The intermediate target is 1.0972 - a pullback level of 23.6% (yellow dashed line). An unlikely scenario is the upper work with the target 1.1035 - resistance line (blue bold line). The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of ETH/USD for 04/10/2019 Posted: 03 Oct 2019 11:43 PM PDT Crypto Industry News: Mark Branson, head of the Swiss financial regulator FINMA, said he was more worried about the dark corners of cryptocurrency than Facebook's stablecoin Libra. Reuters reported that Bronson is more distrustful of cryptographic projects that are developing outside official control than the Libra project, which he believes is "transparent." "I'm more worried about projects that develop somewhere in a dark corner of the financial system, spread to cyberspace and one day become too big to stop" - he added. Branson explained that Libra will be subject to the same strict rules that apply to banks, in addition to strict anti-money laundering rules, and that Switzerland will do nothing to block the project by adding: "We are not here to prevent such projects. We will respond to them with an open mind, with the attitude that the same risk requires the same principles. Our principles and standards are not negotiable." Technical Market Overview: The ETH/USD pair has broken below the short-term trendline support located around the level of $175.00. Moreover, all of the technical supports located close to this level has been violated as well and the market made a new local low at the level of $168.57. In the case of another spike down, the nearest technical support is located at the level of $163.98 - $162.50. Please notice, that so far the move upward does not look like an impulsive wave, but more like a kind of a Zig-Zag pattern, which is corrective pattern. Weekly Pivot Points: WR3 - $256.80 WR2 - $233.68 WR1 - $197.61 Weekly Pivot - $174.45 WS1 - $137.03 WS2 - $112.52 WS3 - $77.73 Trading Recommendations: The best strategy in the current market conditions is to trade with the larger timeframe trend, which is still up. All the shorter timeframe moves are still being treated as a counter-trend correction inside of the uptrend. When the wave 2 corrective cycles are completed, the market might will ready for another impulsive wave up of a higher degree and uptrend continuation.

|

| Technical analysis of BTC/USD for 04/10/2019 Posted: 03 Oct 2019 11:37 PM PDT Crypto Industry News: Patrick Harker, president of the Federal Reserve Bank of Philadelphia, said central bank digital currencies are inevitable. The financier, however, believes that the United States should not lead the way, given the role of the dollar as a global reserve currency: "It's inevitable ... I think it's better for us to start doing it," he said. Harker spoke in response to a question about the Federal Reserve's decision to create its own instant payments system - known as FedNow - announced in early August. "I'm looking at the next five years after that. What's next? I think it's something around the digital currency," he says. As the financial media recently reported, banks in the Federal Advisory Council have informed the Federal Reserve that the Libra cryptographic project will potentially create a "parallel banking" system - risking a potential decrease in the number of demand deposit accounts and the size of bank payments. Technical Market Overview: Another lower low was made after the BTC/USD pair has failed to rally above the level of $8,474, which is a technical resistance for the price. The bears have pushed the price back to the new lows and the technical support at the level of $7,935 has been tested again. There is still a chance for the wave (C) terminated already, but if the bears will keep making pressure on bulls then the price might reverse and target the level of $7,419. The upward momentum is decreasing, so are the chances for another leg higher, which is why it is worth to keep an eye on the current situation on Bitcoin. Weekly Pivot Points: WR3 - $11,446 WR2 - $10,627 WR1 - $9,093 Weekly Pivot - $8,403 WS1 - $6,727 WS2 - $6,011 WS3 - $4,444 Trading Recommendations: Due to the short-term impulsive scenario invalidation, the best strategy in the current market conditions is to trade with the larger timeframe trend, which is still up. All the shorter timeframe moves are still being treated as a counter-trend correction inside of the uptrend. When the wave 2 corrective cycles are completed, the market might will ready for another impulsive wave up of a higher degree and uptrend continuation.

|

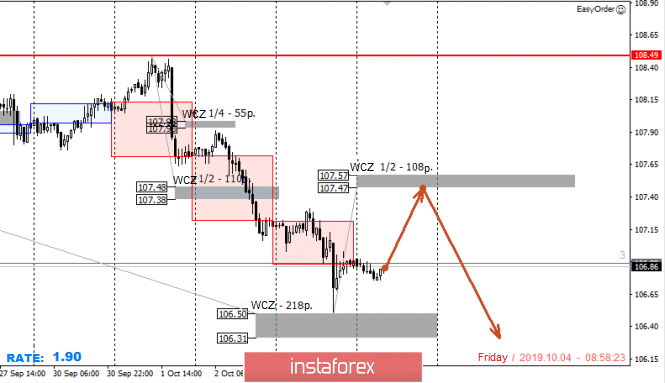

| Control zones USD/JPY 10/04/19 Posted: 03 Oct 2019 11:36 PM PDT Today's plan is to find a favorable price for the purchase of the instrument, as the pair is trading below the average weekly rate. The best price is within the weekly control zone 106.50-10631. The formation of the "false breakdown" pattern of yesterday's minimum will allow us to enter into corrective purchases. It is important to note that the downward movement is an impulse. Therefore, any growth in the medium term should be considered as an opportunity to get favorable prices for the sale of the instrument. An alternative decline model has a probability below 30%, which makes sales from current marks unprofitable. To enter a short position, growth to one of the correction zones will be required again. Daily CZ - daily control zone. The zone formed by important data from the futures market that changes several times a year. Weekly CZ - weekly control zone. The zone formed by the important marks of the futures market, which change several times a year. Monthly CZ - monthly control zone. The zone that reflects the average volatility over the past year. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment