Forex analysis review |

- #USDX vs EUR / USD vs GBP / USD vs EUR / GBP - H4. Comprehensive analysis of movement options for November 15, 2019 APLs

- Evening review of EURUSD 11/14/2019

- Dollar rejoices, yen grieves: USD strengthening is not far off

- Fidelity warns: Get out of the US market. S&P 500

- EURUSD and GBPUSD: German economy walks on thin ice. The pound almost ignored weak retail sales in the UK

- GBP/USD: the pound continues to ignore the economy, focusing on politics

- EUR/USD. November 14. Results of the day. Donald Trump warns China of new duties if deal fails

- GBP/USD. Results of the day. UK retail sales have declined. Tusk calls for voters not to give up on stopping Brexit

- AUDUSD: devastating labor market data and the obstinate China

- Trading idea for AUD/CAD. Crosses are back in the game.

- November 14, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- November 14, 2019 : Bullish recovery is demonstrated around 1.2780. However, further bearish decline for the GBPUSD should

- BTC 11.14.2019 - Sellers in control, Ichimoku analysis

- Gold 11.14.2019 - Rejection of the main pivot support, potential for more rally in next few days

- GBP/USD 11.14.2019 - Triple bottom formation and rejeciton of the Fibonaci 61.8%

- Trading plan for EUR/USD for November 14, 2019

- Technical analysis of AUD/USD for November 14, 2019

- GBP/USD: plan for the American session on November 14th. Another attempt to increase the pound crashed on weak UK retail

- EUR/USD: plan for the American session on November 14th German and eurozone GDP did not inspire euro buyers. Bulls missed

- Trading recommendations for the EURUSD currency pair – placement of trade orders (November 14)

- Two factors that can raise EURUSD

- EUR/USD: hopes for a US-China trade agreement keep the euro from falling into the abyss

- Trader's diary EURUSD 11/14/2019

- Overview of EUR/USD as of November 14, 2019

- Chinese data put pressure on AUD, NZD after RBNZ's unexpected decision, claims to be "the best among commodity currencies"

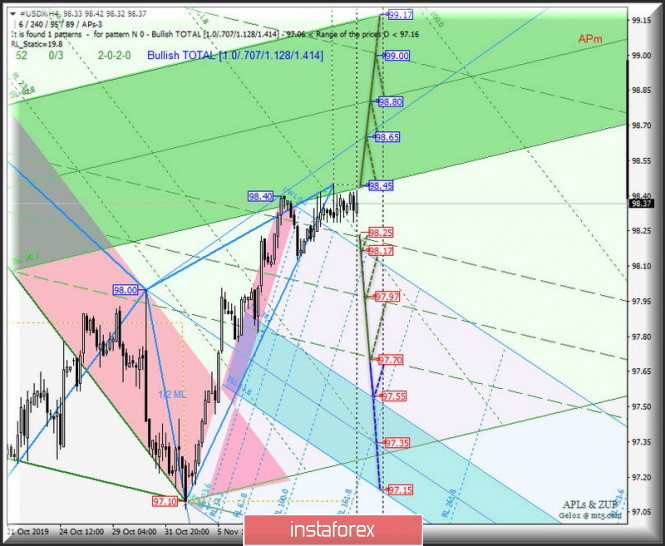

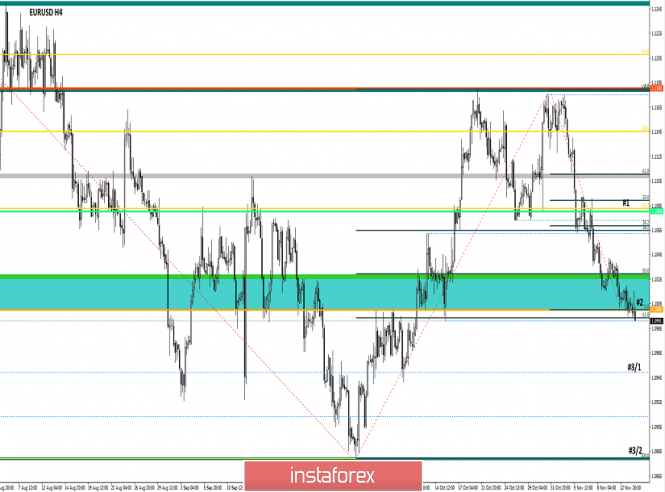

| Posted: 14 Nov 2019 05:01 PM PST How will the flat end? Here's a comprehensive analysis of the #USDX, EUR / USD, GBP / USD and EUR / GBP movement options for November 15, 2019 on the Minuette operational scale fork. ____________________ US dollar Index The movement of the dollar index #USDX from November 15, 2019 will be due to the development and direction of the breakdown of the range :

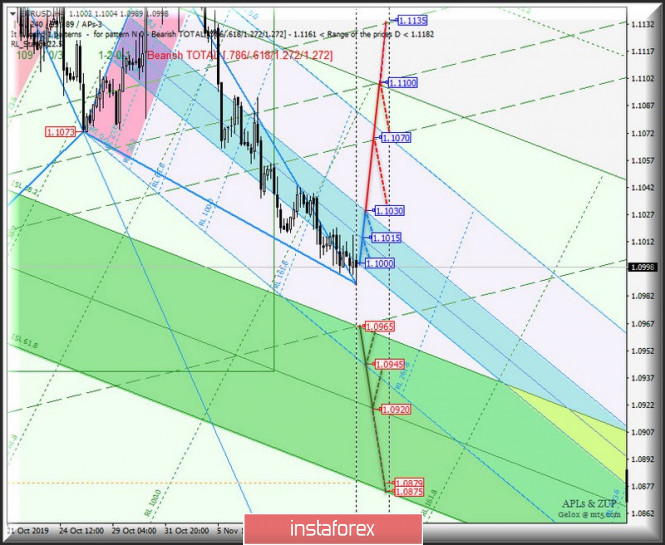

During the breakdown of ISL38.2 Minuette (resistance level of 98.45), the movement of the dollar index will continue in the equilibrium zone (98.45 - 98.80 - 99.17) of the Minuette operational scale fork. On the other hand, the breakdown of support level of 98.25 together with the initial SSL line (98.17) of the Minuette operational scale forks will determine the development of the #USDX movement in the 1/2 Median Line channel (98.25 - 97.97 - 97.70) of the Minuette operational scale forks with the prospect of reaching the upper boundary of ISL38.2 (97.55) Minuette operational scale forks. Marking up #USDX movement options from November 15, 2019 is shown in the animated chart. ____________________ Euro vs US dollar The development of the movement of the single European currency EUR / USD from November 15, 2019 will be determined by the development and the direction of the breakdown of the range :

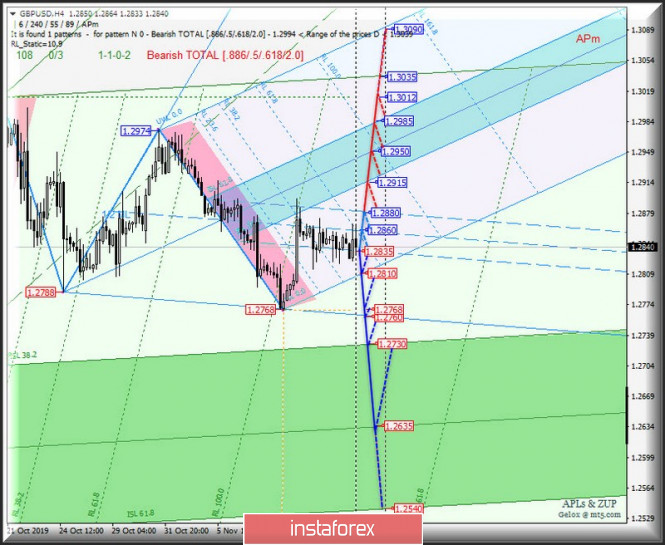

With the breakdown of the resistance level of 1.1000 on ISL61.8 Minuette, the development of the movement of the single European currency will begin to occur in the equilibrium zone (1.1000 - 1.1015 - 1.1030) of the Minuette operational scale fork, and with the breakdown of ISL38.2 Minuette (1.1030) will make the continuation of the development of the upward movement of this currency instrument to the boundaries of the 1/2 Median Line channel (1.1070 - 1.1000 - 1.1135) of the Minuette operational scale fork. On the contrary, the breakdown of ISL38.2 Minuette (support level of 1.0695) will confirm the development of the EUR / USD movement within the equilibrium zone (1.0965 - 1.0920 - 1.0875) of the Minuette operational scale fork. The details of the EUR / USD movement options are shown in the animated chart. ____________________ Great Britain pound vs US dollar SImilarly, the development of Her Majesty's GBP / USD currency movement from November 15, 2019 will also depend on the development and direction of the breakdown of the 1/2 Median Line (1.2880 - 1.2860 - 1.2835) of the Minuette operational scale fork. Look at the movement details on the animated chart. The breakdown of the upper boundary of the channel 1/2 Median Line Minuette (resistance level of 1.2880) - an option to achieve GBP / USD boundaries of the equilibrium zone (1.2915 - 1.2950 - 1.2985) of the Minuette operational scale fork with the prospect of updating maximum 1.3012. In case of breakdown of the lower boundary of the 1/2 Median Line Minuette channel (support level of 1.2835), the downward movement of the currency of Her Majesty can be extended to the objectives - initial line Minuette the SSL (1.2810) - the local minimum 1.2768 - Control line Minuette LTL (1.2760) - the equilibrium zone (1.2730 - 1.2635 - 1.2540)of the Minuette operational scale fork. The details of the GBP / USD movement can be seen on the animated chart. ____________________ Euro vs Great Britain pound The development of the movement of the "main" cross-instrument EUR / GBP from November 15, 2019 will be determined by the development and direction of the breakdown of the boundaries of the equilibrium zone (0.8580 - 0.8530 - 0.8480) of the Minuette operational scale fork. The details are shown in the animation chart. A combined breakdown of the upper boundary of ISL38.2 (resistance level of 0.8580) of the equilibrium zone of the Minuette operational scale fork and the start line SSL Minuette (0.8590) will direct the development of the upward movement EUR / GBP to the boundaries of the 1/2 Median Line Minuette channel (0.8640 - 0.8675 - 0.8710) with the prospect of reaching the initial SSL Minuette line (0.8725) and the lower boundary of ISL38.2 (0.8760) of the equilibrium zone of the Minuette operational scale fork. On the contrary, the breakdown of the support level of 0.8480 at the lower boundary of the ISL61.8 equilibrium zone of the Minuette operational scale fork will make it possible to continue the downward movement of the "main" cross-instrument to the targets: reaction line RL100.0 Minuette (0.8425) - control line LTL (0.8340) of the Minuette operational scale fork. We look at the details of the EUR / GBP movement on the animated chart. ____________________ The review is made without taking into account the news background. Thus, the opening of trading sessions of the main financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index : USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of the currencies in the basket: Euro - 57.6% ; Yen - 13.6%; Pound Sterling - 11.9% ; Canadian dollar - 9.1%; Swedish Krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the start date of the countdown - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review of EURUSD 11/14/2019 Posted: 14 Nov 2019 03:54 PM PST As you can see on the chart (picture at 12:40 London time) - the euro's fall nearly stopped, the level of 1.1000 became a serious obstacle for sellers. On the whole, it's very calm, and the choice of direction continues - both options are possible, and a failure in the direction of 1.0900 - and growth. We are ready to buy from 1.1045. The level for selling so far is only 1.0880. The material has been provided by InstaForex Company - www.instaforex.com |

| Dollar rejoices, yen grieves: USD strengthening is not far off Posted: 14 Nov 2019 03:54 PM PST The Japanese currency, paired with the market leader US dollar, does not feel very confident. The yen showed some growth this week, however, there were no significant shifts in the USD/JPY pair. Many experts expect the greenback to strengthen against the yen. According to analysts, an increase in Treasury bond yields stimulates demand for US government debt from Japanese investors. On Wednesday, November 13, bond yields, which showed volatility, slightly stabilized and raised the yen. Note that earlier the Japanese currency strengthened due to a surge in the yield of long bonds of Japan The US currency, unlike the Japanese, feels great. Most analysts agree that the greenback will strengthen its position both in the short and long term. The pep was boosted by a speech by Fed Chairman Jerome Powell. According to the Fed chief, the US economy is on the rise for the eleventh consecutive year, and the unemployment rate in the United States is at a half-century low, which cannot but inspire optimism. The greenback uses this, not missing the opportunity for growth. The only risks to the US economy, according to J. Powell, are the low growth rates of the global economy and an impressive level of public debt. At the statements of the head of the regulator, the dollar strengthened against leading world currencies, including the yen. The strengthening of the greenback in relation to the "yen is also predicted in the large investment company Nissay Asset Management. The company's currency strategists are confident that at the beginning of next year, namely in March – April, the USD exchange rate will reach 112 yen per one unit of American currency. Nissay Asset Management experts consider the main reason for this sharp rise to be a slowdown in the reduction of interest rates. Recall, the Fed recently decided to take a break in the process of lowering the key rate, and analysts find it difficult to answer how long it will last. Experts believe that the increase in the yield of treasury bonds is another important reason for the strengthening of the greenback in relation to the yen. They act as catalysts for demand for US public debt from Japanese investors. According to preliminary estimates, when the yield on 10-year US bonds approaches 2% per annum, Japanese traders will increase demand for this asset. At the moment, the yield on 10-year bonds is 1.916% per annum and has continued to increase steadily since mid-October 2019. It is possible that investors in Japan will buy treasuries with less hedging of currency risk. These processes actively stimulate the strengthening of the US currency, experts emphasize. Currently, the USD/JPY pair is demonstrating stability. The pair was near the level of 108.75 on Thursday morning, November 14. Strong volatility was not observed. After a while, the USD/JPY pair allowed themselves to slide to extremely low levels. At the moment, the pair is trading within the range of 108.65-108.66, causing concern for investors who counted on long-term stability. Nissay Asset Management believes that in the near future the USD/JPY pair will run in the range of 107–110 yen per US dollar. Experts say that support between levels 107 and 108 will be quite powerful. At the same time, analysts admit that the pair may not have enough drivers to grow to 115 yen per 1 unit of the US currency. The material has been provided by InstaForex Company - www.instaforex.com |

| Fidelity warns: Get out of the US market. S&P 500 Posted: 14 Nov 2019 03:54 PM PST You see the monthly chart of the main US stock index - S&P 500. Here you can see the entire growth cycle of the US market - from the lows of winter-spring 2008-2009, all ten years of growth. We are at the peak. Fidelity Investments Fund compellingly warns investors of the high risk of significant losses that remain in the stock market now. The chart above is current, now it looks that way. Prices at such heights. The potential for further growth is unlikely to be high. But even if there is growth potential, do this: wait for a strong correction, clearly visible on the monthly chart. Think about strategic purchases only then. The material has been provided by InstaForex Company - www.instaforex.com |

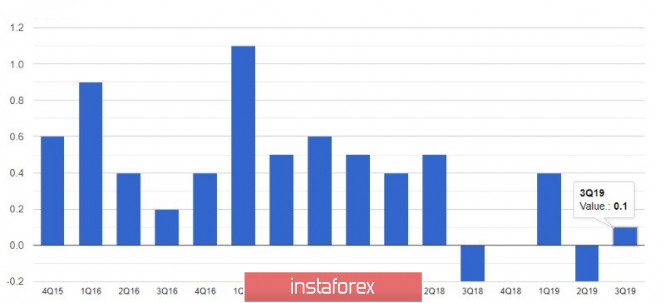

| Posted: 14 Nov 2019 03:54 PM PST Recession, stagnation, crisis in the economy - these are the terms that are increasingly used by economists when talking about Germany and its future prospects. The locomotive of the European economy, apparently, continues to slow down, and the small growth that was recorded in the third quarter of this year is far from being a cause for pride. Although the recession in Germany was delayed, it is unlikely that it will be possible to cancel it in the current situation in the economy during its stagnation. Basically, the prospects are overshadowed by numerous political and economic risks - starting with Brexit and the US trade war with the eurozone and ending with the introduction of negative interest rates from the European Central Bank. The only thing that keeps the German economy afloat is the strong domestic demand, which is clearly lacking, as export problems continue to have a serious impact on the industry. According to today's report by the Federal Bureau of Statistics Destatis, Germany's GDP grew by 0.1% in the third quarter of this year, compared with the second quarter. Economists had expected GDP to fall by 0.1%. A larger decline in Germany's GDP for the second quarter by 0.2%, rather than 0.1%, also does not add optimism. Germany's GDP grew by 1% compared with the same period last year, which fully coincided with the forecasts of economists. Adjusted for inflation, growth was only 0.5%. Today, a report of the European statistical agency Eurostat was also published, which indicated that the eurozone GDP grew in the third quarter, but the data fully coincided with expectations. The weak growth of the European economy justifies the recent actions of the European Central Bank to lower deposit rates and the resumption of the bond purchase program since November this year. According to data, eurozone GDP grew by only 0.2% in the third quarter compared with the second. The economy showed growth of only 1.2% compared to the same period of 2018. Economists predicted that annual GDP growth would be 1.1% and quarterly growth 0.2%. In the morning, the report on the unemployment rate in France is higher, which rose to 8.6% in the third quarter of this year, against 8.5% in the second quarter. Economists expected unemployment unchanged. The current situation in the eurozone economy indicates the need for further stimulus measures by the ECB, which will continue to exert medium-term pressure on the European currency. From a technical point of view, a breakthrough of support at 1.1000 opens a direct path for sellers of risky assets to lows in the areas of 1.0970 and 1.0940. Only a trend reversal above the resistance of 1.1025 will return some confidence to buyers, which will lead to the closure of a number of short positions and a more powerful upward momentum to the highs of 1.1060 and 1.1100. GBPUSD The British pound was not able to cling to the resistance of 1.2860, which the bulls are seeking throughout the week. A weak report on retail sales in the UK in October this year once again pointed to problems in the economy. The decline has been observed for the third consecutive month, which is an alarming call for the Bank of England. According to the UK National Bureau of Statistics, in October 2019, retail sales decreased by 0.1% compared to September. The fall was due to lower sales of volatile categories, in particular, food and household items. Sales grew by 3.1% compared to October 2018. Most likely, the persistence of uncertainty associated with Brexit makes consumers more cautious about their costs. As for the technical picture of the GBPUSD pair, a break of the support level of 1.2820 will increase pressure on the pound and push it into the region of this month's lows, in the areas of 1.2800 and 1.2770. It will be possible to talk about the continuation of the upward correction only after the trading instrument consolidates above the resistance of 1.2860, which will open real prospects for updating the highs of 1.2900 and 1.2940. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: the pound continues to ignore the economy, focusing on politics Posted: 14 Nov 2019 03:54 PM PST Although UK statistics continue to disappoint, the pound is in no hurry to throw a white flag. Apparently, like UK Prime Minister Boris Johnson, it sincerely believes in the victory of the Tories in the upcoming elections. If the British currency did not respond to strong data before, the question is, why should it now be hypersensitive to weak indicators, if the political landscape in the country has not changed much? In July-September, the British economy expanded by 0.3% in quarterly terms, not reaching the forecast of 0.4%. On an annualized basis, the indicator increased by 1%, demonstrating the lowest growth rate since 2010. In the third quarter, the number of working Britons fell by 58 thousand, to 32.753 million, which was the highest decline since the summer of 2015. The number of vacancies has declined in annual terms at the highest rate since the financial crisis. In October, consumer prices in the country increased by 1.5% in annual terms, noting the worst dynamics since November 2016. Last month, retail sales decreased by 0.1% compared to September. The annual rate increased by 3.1% against the forecast of 3.7%. Data turned out to be worse than market expectations. Obviously, the protracted Brexit process is having a negative effect on the British economy. Therefore, it is not surprising that at the last meeting of the Bank of England, two out of nine members of the Monetary Policy Committee spoke in favor of lowering the interest rate. However, it is unlikely that the BoE will weaken the monetary policy in December. Most likely, the central bank will prefer to evaluate the results of early elections to the national Parliament and only after that will begin to act. Therefore, forecasts for the pound are still based on the political factor. According to a consensus estimate by Bloomberg analysts, if the Conservatives confidently win the upcoming elections, the GBP/USD pair will rise to 1.34. The probability of such an outcome is estimated at 40%. At the same time, the chances of unconditional victorious Laborites, according to experts, are still extremely low (5%), but if it does happen, then amid investors fleeing from the country, concerned about the nationalization policy, the pound could fall to $1.23. According to recent polls, Conservatives are ready to support 42% of voters, while Labour - 28%. The dovish rhetoric of the Bank of England allowed the bears on GBP/USD to carry out a counterattack. However, the bullish trend is still in force. Therefore, the statement by Nigel Faraj that the Brexit Party headed by him will not compete with the Tories in the upcoming elections, threw the pound to $1.2900. "Brexit's very low risks without a deal should help the pound keep its recent profit against the US dollar and trade in the $1.2600-1.3200 range by the end of this year," UBS strategists said. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. November 14. Results of the day. Donald Trump warns China of new duties if deal fails Posted: 14 Nov 2019 03:54 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 56p - 38p - 27p - 36p - 25p. Average volatility over the past 5 days: 36p (low). The fourth trading day of the week for the EUR/USD currency pair was again in the lowest volatility movement, and today it is not even possible to say that the downward trend has continued, since quotes have not dropped much during the day. It seems that the outbursts of the bears dried up, and we already wrote about the reasons for this in previous reviews. A paradoxical situation persists for the euro/dollar pair. By this term we mean a situation in which the bulls have no reason to buy the euro, and the bears do not have good reasons for further selling the pair near its 2-year lows. As a result, all this can lead to the exit of the market and the bears, the volatility will fall even more, and the pair will increase, starting an upward correction, which will not be substantiated either fundamentally or technically. Traders again received a fairly large amount of important macroeconomic information during the day. This week is generally surprisingly plentiful for various kinds of macroeconomic statistics and just interesting news. However, that very paradoxical situation, unfortunately, blocks the development by traders of all this interesting information. For example, today German GDP by preliminary value showed an increase of 0.1% in quarterly terms, although experts expected a decrease of 0.1%. In annual terms, GDP grew by 0.5%, which, of course, is very small, but still more than a quarter earlier. Eurozone GDP also unexpectedly pleased, although this is also an inconclusive value indicator. The increase in the third quarter was + 0.2% QOQ and + 1.2% in annual terms (forecast + 1.1% YOY). Thus, certain grounds for strengthening the euro were received during the European trading session. However, the bulls continued to remain outside the market, considering that the preliminary values are not final and can still change for the worse. In general, market participants simply ignored data from Europe. There was not a single important publication in the United States, but the euro/dollar pair began to grow during the US trading session, which so far can not be called either strong or even average in strength. Nevertheless, it takes place and can be the beginning of at least a correction of the pair. One of the most interesting news of today is the announcement of Beijing's refusal from the annual purchase of US agricultural products for a fixed amount of $50 billion. China does not refuse the earlier promise to purchase pork, soybeans and other agricultural products from America, but does not consider it a profitable option to deal with a strictly prescribed amount. In addition, it is reported that Beijing is not going to take any action in the field of intellectual property protection, which Washington insists. Now the most important thing! What have we heard in recent weeks on the US-China trade war? "Progress in the negotiations", "the parties are close to an agreement in the first phase" and so on. What do we have in fact? China and the United States cannot agree again on several key points of the agreement. Moreover, at what points the parties reached an agreement, not reported. What do we have in the bottom line? Only that trade negotiations can be considered stalled once again. Donald Trump has already managed to cover this topic, saying in the Economic Club in New York that the US will significantly increase duties on Chinese products if agreements cannot be reached. That is, in fact, Donald Trump continues to adhere to the previously chosen strategy, which implies either the consent of China to the conditions of the United States, or an increase in duties on all imports from China. The American leader believes that it is China that can fail negotiations for the second time in a row, since the parties could have signed the agreement earlier, but Beijing refused to comply with "some of the agreements reached earlier." "We will only agree to a deal if it is beneficial to American workers and companies," Trump concluded. At the current stage of negotiations between Washington and Beijing, we can assume that the trade war will drag on for many years, and Donald Trump will not continue it in a year. Well, the technical picture of the currency pair currently seems to be unambiguous, but at the same time implying non-standard options for the development of events. We have already said that from a fundamental point of view that the pair's fall is justified. But at the same time, the fundamental background is not so strong that traders continue to sell the pair near its 2-year lows. It is this factor that can play in the euro's favor in the coming days and weeks. We believe it is highly likely that an upward correction will begin today, despite the macroeconomic statistics that have already been published this week and will be published. Trading recommendations: The EUR/USD pair still retains the prospects for a downward trend. Thus, it is now recommended to continue to sell the currency pair with targets at 1.0977 and 1.0966. At the same time, overcoming the Kijun-sen critical line by traders will confirm our hypothesis that the trend direction will change to an upward one and sell positions will lose their relevance. New pair sales are now risky, purchases are not fundamentally substantiated. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. Support / Resistance Classic Levels: Red and gray dotted lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 14 Nov 2019 03:54 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 84p - 54p - 112p - 58p - 41p. Average volatility over the past 5 days: 70p (average). The British pound on Thursday, November 14, stood for most of the day in one place as part of the flat, which we have already written about several times. Even a slight growth during the US trading session cannot indicate the completion of the correction, especially since it is rather difficult to say exactly what caused this surge of emotions among traders. Traders again ignored weak macroeconomic statistics from the UK today, although it was expected that it would finally please traders. However, these hopes were not destined to come true. Retail sales decreased by 0.1% in October compared with the previous month and added 3.1% in annual terms, which is much worse than forecasted. Thus, the pound has not received support, traders just once again did not pay any attention to macroeconomic statistics. But quotes increased in the afternoon, however, this movement can end very quickly, like the previous surge, based on information about the creation of a coalition in the elections between the parties of Boris Johnson and Nigel Faraj. In fact, there can only be two reasons for a sharp, but not strong fall in the US currency. We covered the first in sufficient detail in an article on the EUR/USD currency pair - this is a possible escalation of the trade conflict between the United States and China and another "dead end" in negotiations on a trade agreement between the countries. The second is Jerome Powell's new congressional statement, this time to the budget committee. However, what could Jerome Powell say such that it would cause a fall in the US currency? It is unlikely that today he hinted at a reduction in the key rate, when after the day before in the same Congress he had almost openly declared that the monetary policy of the Fed would not require intervention in the near future. We will learn about this later, but in any case, we do not believe that the Fed chief said anything extraordinary. Instead of guessing at the coffee grounds about what Powell said, we suggest focusing again on the question "Why do market participants stubbornly ignore macroeconomic statistics from the UK?" If in the case of the euro currency, we said that there was a situation where there is no good reason for new sales or purchases, then in the case of the British pound, this does not work. The GBP/USD pair is far enough from its lows, so traders this week could calmly get rid of the pound again on the basis of all the same failed macroeconomic information that we have witnessed. If the markets really now pay attention only to news of a political nature and on the Brexit topic, then we can explain the complete calm on the pound/dollar pair. After all, there is no news and cannot be any news on the topics identified above. Brexit paused, political parties getting ready for re-election. Parliament dissolved. What kind of news could there be? Meanwhile, European Council President Donald Tusk called on the British people to continue to fight against Brexit. He said that if Britain exits the European Union, it will become an "outsider and minor player" on the world stage. Donald Tusk leaves his post on December 1 after Mario Draghi and Jean Claude Juncker. If earlier he had to maintain an official position on the Brexit issue, now he can speak more informally. The fact that the EU wants to keep Britain in its composition is not a secret for anyone. In fact, the European Union continues to fight to keep Britain in its composition, not giving it what could lead to the approval by the British Parliament of the deal on Brexit. Well, it all comes down again to the Parliament elections on December 12, from which the future of both Great Britain and the European Union will depend. The technical picture of the currency pair shows only a full flat, despite the upward movement in the US trading session. Bollinger Bands narrowed to an absolute low and directed to the side. The volatility of the pair decreased to the level of 70 points a day, which is formally an average value, but this is a rather low value for the pound. The pair returned to the area of the Ichimoku cloud, so the uncertainty with the direction of movement became even greater. Thus, from our point of view, this is not the most favorable time to open any position, especially given the complete ignoring by investors of the fundamental background. Trading recommendations: The GBP/USD pair finally turned into a sideways movement. Thus, traders are advised to wait until the completion of a flat and the resumption of trend movement. However, it should be recognized that a flat may last several days and several weeks if traders continue to wait for news on Brexit and on the elections to the British Parliament. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. Support / Resistance Classic Levels: Red and gray dotted lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| AUDUSD: devastating labor market data and the obstinate China Posted: 14 Nov 2019 03:54 PM PST The Australian dollar is paired with the US currency demonstrates a downward impulse. The aussie is getting cheaper across the market after the release of disappointing data on the growth of the labor market in the country. Almost all the components of the release came out in the red zone, while updating multi-month lows. This release is important in itself, but in this case it must also be viewed through the prism of the last meeting of the Reserve Bank of Australia. Chinese data on industrial production were also disappointed. Even the general weakening of the US dollar did not help the AUD/USD bears- the aussie shows a rapid decline, which may end in the area of annual lows. Looking ahead, it is worth noting that the greenback is also getting cheaper because of China - apparently, the historical trade deal was again in jeopardy. But this fact is as disastrous for the Australian currency as it is for the US dollar. We'll talk about the prospects for a trade war a little lower, but let's start with the Australian macro statistics. The labor market report really turned out to be devastating. The unemployment rate unexpectedly rose to 5.3% (against the forecast of 5.2%), and the employment rate collapsed into the negative area. Moreover, this indicator has updated three-year lows - the number of employees fell by 19 thousand. The negative dynamics in October was demonstrated by both the component of full employment and the component of part-time employment. Let me remind you that the number of employees increased by only 16 thousand in September - but mainly due to the full-time component. This fact made it possible for the aussie to stay afloat, as regular positions require higher salaries. However, the October results disappointed "on all fronts." But more recently, the Australian currency showed optimism. The results of the last RBA meeting were in favor of the aussie, after which the AUD/USD pair impulsively jumped to around 0.6930. Contrary to pessimistic forecasts, the RBA announced that the previously taken measures to reduce rates "are already bearing fruit." According to RBA members, easing monetary policy parameters supported the growth of employment and income, stimulating inflation indicators to return to the target range. Today's data served as a kind of refutation of this thesis. It is worth noting that, following optimistic estimates, the Australian regulator did not rule out further easing of monetary policy. RBA members noted that they could reduce the rate in the foreseeable future "in the event of such a need." It is obvious that a decline in key economic parameters amid a possible escalation of the trade war will again bring the issue of rate cuts back on the agenda. There are certain prerequisites for this. Indeed, in addition to disappointing statistics, negative rumors have come to the market today regarding the prospects for US-Chinese dialogue. According to an influential publication of the Wall Street Journal, Beijing is not going to make a commitment under the deal to annually purchase US agricultural products for a certain amount (namely, $50 billion). According to newspaper sources, the parties could not find a compromise at this stage of negotiations, after which the dialogue actually stalled. The Chinese quite reasonably believe that a deal without specifying the exact amount will allow them to act "more flexibly." In addition, in this case, Beijing remains the lever of pressure on Washington if the Americans backtrack. Now it's clear why Trump recently voiced a rather tough stance towards China. Speaking at the Economic Club in New York, he threatened Beijing with new fees if the parties did not sign the deal. He added that the White House would agree to a trade agreement only if it would be beneficial to the United States. After that, the Australian dollar was under additional pressure. Which is understandable, because we are talking about the risk of resuming a large-scale trade war, which will aggravate the already difficult situation in the world economy. Australia is at the forefront in this context, since China is the country's main trading partner, and the further economic recession of China will have a strong negative impact on key Australian indicators. Moreover, the head of the RBA in one of his interviews separately focused on this, not excluding the option of lowering the interest rate. Therefore, in this case, we are talking not only about the prospects for US-Chinese relations, but also about the prospects for Australian monetary policy. Given the prevailing fundamental background, we can assume that the AUD/USD pair will continue the downward trend, at least to the level of 0.6750 (the lower boundary of the Kumo cloud on the daily chart). If the bears gain a foothold under this target, the next target of the downward movement will be the mark of 0.6660 - this is the area of annual lows that coincides with the lower line of the Bollinger Bands indicator already on the weekly chart. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading idea for AUD/CAD. Crosses are back in the game. Posted: 14 Nov 2019 03:51 PM PST Good evening, dear traders! I present to you the trading idea for the AUD / CAD pair. If you carefully look at my analytics, you probably have noticed that I regularly trade "dense" cross-rates more than once and, frankly, the results on them delight me with no less regularity. The fact is that certain crosses have a very narrow range of moves, which allows them to successfully trade them in a "grid way" and regularly withdraw profits. One such instrument is the AUD/CAD. Let me remind you that AUD/CAD has been in a downward trend for a year now, periodically giving very impressive pullbacks. The average recoilless stroke of this instrument is 7000 5-digit. Thus, if you look closely at the spring trend - it is precisely these 7000 p. And this means that it can be "picked up from the loyalties" for a pullback. We have bought it several times with you, and it regularly gave us profit. Thus, now, AUD/CAD is rolling back down again - which means that it is time to buy, although this should not be done exactly as is customary in the classical trade in "majors". This is done with a grid of orders. In fact, you split the work lot into 3-5 parts and buy the first part at the current price. The remaining parts, on the other hand, are set by limit buy orders in increments of 500p by 5-digit. Thus, you form a network of buy orders with a common take at one quote. In addition, a common stop on this network should also be considered. I will give an example of how to do this below. It will be the trading idea for a set of longs on AUD/CAD. Tomorrow, I will give one more cross with good potential! I wish you all success in trading and control risks. The material has been provided by InstaForex Company - www.instaforex.com |

| November 14, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 14 Nov 2019 08:30 AM PST

On October 2, a bullish breakout above 1.0940 confirmed the depicted Inverted Head & Shoulders reversal Pattern which enabled further bullish advancement towards (1.1000 -1.1020) This bullish movement has been maintained above the depicted bullish trend. On October 7, temporary sideway consolidation range was demonstrated around the price zone of (1.1000 -1.1020) before further bullish movement was resumed towards 1.1175 where significant bearish rejection was originated. The price zone around (1.1175 - 1.1190) stood as a significant SUPPLY-Zone that demonstrated bearish rejection for two consecutive times in a short-period. Moreover, the short-term technical outlook has turned into bearish after breakdown below 1.1090 was achieved (the depicted uptrend line and 50% Fibonacci Retracement Level). On the other hand, a long-term Double-Top pattern was demonstrated with neckline located around 1.1075-1.1090 which offered valid bearish positions upon last week's retesting. As anticipated, further bearish decline was executed towards 1.1025 and 1.0995 where temporary bullish rejection is being demonstrated. Currently, signs of bullish recovery are manifested around 1.1000 with expected bullish target projected towards 1.1085. Any bullish pullback towards 1.1065-1.1085 should be watched for early bearish rejection and another valid SELL entry. On the other hand, earlier bearish breakout below 1.1000 will probably enable quick bearish decline towards 1.0945 where a prominent demand level was previously located. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 14 Nov 2019 07:36 AM PST

Few weeks ago, Further Bullish advancement was demonstrated towards 1.2650 then 1.3000 after the neckline of the depicted Double-Bottom pattern (1.2400-1.2415) was breached to the upside. Since October 21, the GBP/USD pair has failed to achieve a persistent bullish breakout above the depicted SUPPLY-zone (1.2980-1.3000) which corresponds to a previous Prominent-TOP that goes back to May 2019. Instead, an ascending wedge reversal pattern was confirmed on October 22. This indicated a high probability of bearish reversal around the mentioned price zone. Hence, a quick bearish movement was anticipated towards 1.2780 (Key-Level) where some bullish recovery was recently demonstrated on October 24. The recent Bullish rejection around the price levels of 1.2780, indicated another temporary bullish movement towards 1.2980-1.3000 where another long-term bearish swing towards 1.2780 was initiated as expected. Since last week, lack of enough bearish pressure has been demonstrated on the chart. Instead, sideway Carolina consolidation movement is being expressed between 1.2780-1.2900. The short-term outlook remains bearish as long as consolidations are maintained below 1.2900. On the other hand, a quick bearish breakout below 1.2780 is needed to enable further bearish decline towards 1.2600-1.2650 where another episode of bullish recovery should be anticipated. Please note that bullish breakout above 1.2900 invalidates the previous bearish scenario allowing a bullish movement to pursue towards 1.2970 again. Trade Recommendations: Intraday traders should wait for bearish breakout below 1.2780 as a valid SELL entry. Expected Bearish target is projected towards 1.2650 then probably 1.2560. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 11.14.2019 - Sellers in control, Ichimoku analysis Posted: 14 Nov 2019 07:17 AM PST Bitcoin has been trading downwards. The price reached our first downward target from yesterday at the price of $8.540. Watch for selling opportunities due to the current downward trend. Main downward target is still set at the price of $7.500.

Ichimoku analysis: Multi frame Ichimoku sitation: H1 – Below the Cloud H4 - Below the cloud Daily - Inside of the Cloud Currently, BTC is trading below the support (Tenkan-sen) at the price of 8.600. Resistance levels are set at the price of $8.670 (Tenkak-sen) and $8.800 (Kijun-sen).BTC did the breakout of the Ichimoku cloud to the downside and I see more downside in the next period.The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 11.14.2019 - Rejection of the main pivot support, potential for more rally in next few days Posted: 14 Nov 2019 07:02 AM PST Gold did exactly what I expected yesterday. Gold rejected from the main Fibonacci confluence at $1.449 and is heading towards the support at the price of $1.480-$1.485. Watch for buying opportunities on the dips.

Due to potential end of the downward correction in the background, I am expecting new up leg and potential re-test of the resistances at $1.485 and. Stochastic oscillator is showing bull cross and oversold condition, which is adding more potential upside into our bullish view. Watch for buying opportunities. The material has been provided by InstaForex Company - www.instaforex.com |

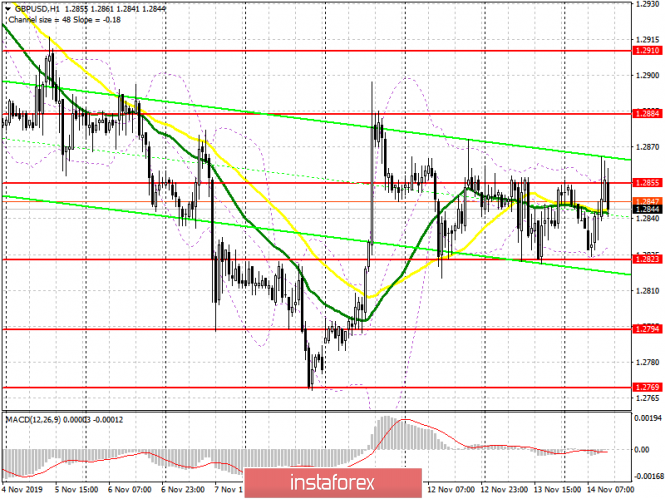

| GBP/USD 11.14.2019 - Triple bottom formation and rejeciton of the Fibonaci 61.8% Posted: 14 Nov 2019 06:51 AM PST GBP created nice triple bottom exactly at the Fibonacci retracement 61.8% support (1.2818) and I do expect further upside continuation on this currency pair.

Due to strong upward trend in the background, I am expecting new up leg and potential re-test of the resistances at $1.2895 and eventual test of 1.2950.Major short-term support level set at 1.2818. Stochastic oscillator is showing bull cross, which is adding more potential upside into our bullish view. Watch for buying opportunities. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading plan for EUR/USD for November 14, 2019 Posted: 14 Nov 2019 05:39 AM PST

Technical outlook: The EUR/USD pair dropped to the anticipated convergence level at 1.0991 today. The pair is seen to be trading right at the fibonacci convergence at this point in writing and a bullish reversal signal on the 1-4 hour charts would confirm that a meaningful low is in place. Furthermore, a push above 1.1020/40 resistance will add further confidence to the bullish scenario that we have presented for a few trading sessions. Please note that prices are testing fibonacci 0.618 retracement, alongside the past resistance turned into the support zone. So, probabilities for a bullish bounce is high around these levels. The wave structure has been set nicely with a 5-wave rally between 1.0879 and 1.1180, followed by a corrective drop between 1.1180 and 1.0991 until now. Besides, note that a failure at this price could test 1.0940 before reversing higher, tough such probability is less. Trading point of view, it would be a good idea to remain long against 1.0879 from here. Trading plan: Remain long against 1.0879, the target is above 1.1500 Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of AUD/USD for November 14, 2019 Posted: 14 Nov 2019 04:50 AM PST Overview: The AUD/USD pair continues to move in a downtrend from the level of 0.6833 since yesterday. So, major resistance is seen at 0.6864, while immediate support is found at 0.6833 (pivot). Additionally, it should be noted that the resistance coincides with the ratio of 61.8% Fibonacci. Today, we guess that the pair will be traded lower in the early session and try to reach the first support at the level of 0.6783. The bias is neutral in the nearest term probably with a little bearish bias testing 0.6740 area, which needs to be clearly broken to the down side to keep the bearish scenario. A clear break below that area (0.6783) could lead the price to the downtrend zone in the nearest term testing 0.6740 (first support). Thence, we confirm the bearish scenario. Right now, the pair will probably go down because a downward trend is still strong and the RSI indicator is still signaling that the trend is downward. Therefore, it is a good idea to sell below the resistance of 0.6783 with the first target at 0.6740. If the AUD/USD pair is able to break the first target, then the pair will face a strong bearish bias towards the 0.6687 level. Otherwise, the breakdown of 0.6884 will allow the pair to go further up to the levels of 0.6914 and 0.6961. Besides, is should be noted that all positions must be closed before the closing bell in New York session tomorrow. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 14 Nov 2019 04:16 AM PST To open long positions on GBP/USD, you need: From a technical point of view, nothing has changed. A weak report on retail sales in the UK limited the upward potential of the pound in the resistance area of 1.2855. According to the data, the volume of retail trade in October this year decreased by 0.1% compared to September. In the morning forecast, I talked about the upper limit of the side channel of 1.2855. Only a breakthrough of this resistance will lead to a more powerful growth of GBP/USD in the area of weekly highs 1.2884 and 1.2910, where I recommend taking the profits. In the scenario of a decline in the pound after the data on the US labor market, only the formation of a false breakdown in the support area of 1.2823 will be a signal to open long positions. Otherwise, I recommend postponing purchases until the update of larger lows in the area of 1.2794 and 1.2769. To open short positions on GBP/USD, you need: Weak retail sales in the UK allowed sellers of the pound to form an unsuccessful breakdown of resistance at 1.2855. In my morning review, I drew attention to this situation and recommended opening short positions. While trading will be conducted below this range, we can expect a decline in GBP/USD to the lower border of the side channel of 1.2823, but the more important task will be to break this range, which will increase the pressure on the pound and push it to the monthly support levels of 1.2794 and 1.2769, where I recommend fixing the profit. In the scenario of a breakdown and exit above the resistance of 1.2855, which may occur against the background of weak data on the US economy, or after positive news on the general election in the UK, it is best to consider new short positions on the update of the highs of 1.2884 and 1.2910. Indicator signals: Moving Averages Trading is around the 30 and 50 daily averages, indicating some market uncertainty. Bollinger Bands A break of the lower border of the indicator at 1.2823 will lead to a sell-off of the pound. The upward movement will be limited to the upper level of the indicator at 1.2855.

Description of indicators

|

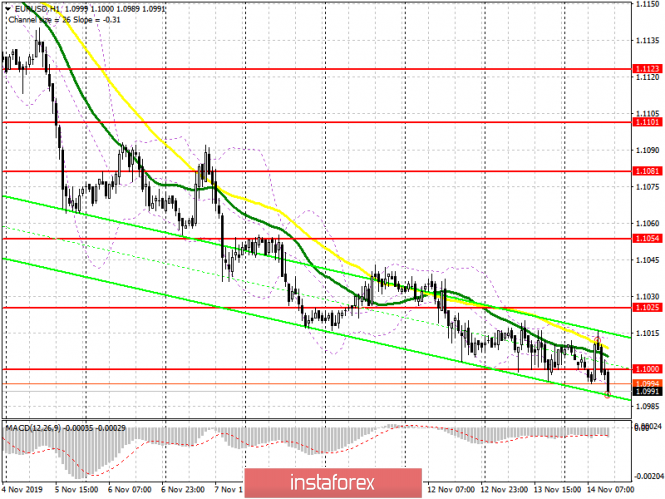

| Posted: 14 Nov 2019 04:16 AM PST To open long positions on EURUSD, you need: In the first half of the day, I paid attention to the report on GDP growth in Germany. As can be seen from the report, the economy showed a barely noticeable growth of 0.1% in October this year compared to September, which negatively affected the European currency and its prospects. The bulls missed the support of 1.1000 and now all the focus is shifted to the data on the US labor market and producer prices. In the case of weak reports, it is best to consider long positions after returning to the resistance of 1.1000, after which it will be possible to talk about an upward correction to the highs of 1.1025 and 1.1054, where I recommend taking the profits. While the pressure on the euro remains, and there are still very few reasons for growth, it is worth paying attention to purchases only after the update of the lows of 1.0972 and 1.0943. To open short positions on EURUSD, you need: Against the background of weak indicators on economic growth in the eurozone, euro sellers coped with the task in the first half of the day and managed to gain a foothold below the support of 1.1000, which keeps the downward momentum in the market. Good data on the US labor market and inflation can lead to a further decline in EUR/USD in the area of lows of 1.0972 and 1.0942, where I recommend taking the profits. If the euro does not fall by the middle of the North American session, the bulls can take matters into their own hands and return the pair to the resistance of 1.1000. In this scenario, the first active short positions can be observed only in the area of the maximum of 1.1025, but larger sellers will prefer to return to the market only after the test area of 1.1054. Indicator signals: Moving Averages Trading is conducted below 30 and 50 moving averages, which indicates a bearish nature of the market. Bollinger Bands If the euro rises in the second half of the day, the upper limit of the indicator around 1.1015 will act as a resistance.

Description of indicators

|

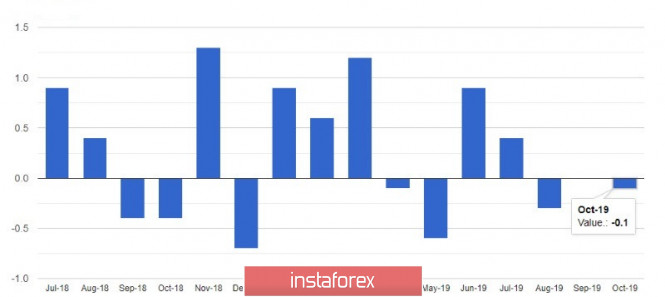

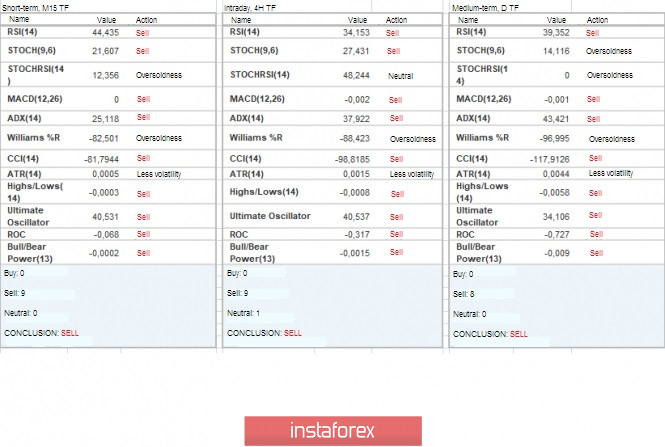

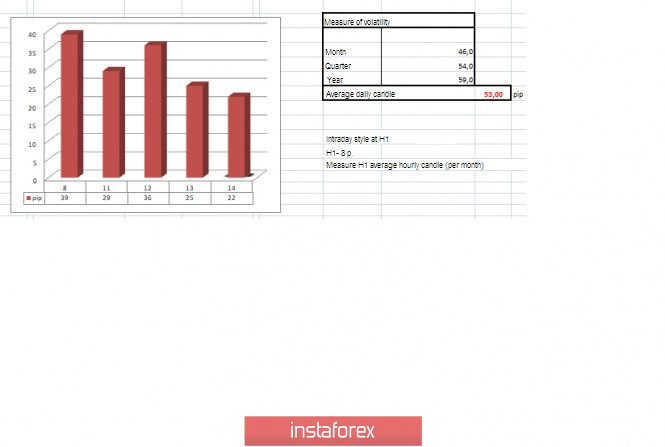

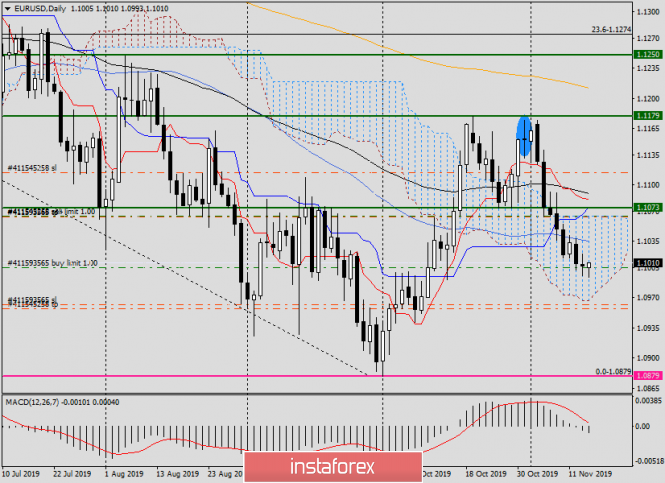

| Trading recommendations for the EURUSD currency pair – placement of trade orders (November 14) Posted: 14 Nov 2019 04:16 AM PST The psychological level of 1.1000 serves as a reference point, in which direction you should expect an acceleration of the breakdown/rebound – we will answer this question in our article. From technical analysis, we see how the psychological level concentrates market participants on itself for several days in a row. On the one hand, we have almost completed the second stage of recovery relative to the oblong correction, where there is a stable downward interest. On the other hand, the control level of the second stage (1.1000, escalates fear into market participants, which does not allow as quickly as many would like to go through such an ill-fated process. It turns out that we are walking on a conditional boundary, where, with the slightest advantage of the trading forces, a local surge may well form. In terms of volatility, we encountered such a weak indicator of 25 points (on November 13), that I can't remember in terms of statistics when this happened again. This phenomenon in terms of extremely low indicators often signals the readiness of the market to jump. In terms of the emotional component of the market, we have a pretty good recovery, it may seem strange due to the decline in volatility, but still, the quote is not squeezed into the conventional framework of the sideways move, there is a certain cyclicality and direction. Analyzing the hourly past day, we saw an extremely weak fluctuation by market standards, but it's worth paying tribute to, even with this amplitude, interest remained in the downward phase, concentrating on the psychological mark of 1.1000. There were no jumps or impulses; the hourly average candle weighted 6 points. As discussed in the previous review, traders are divided into two groups, some remain faithful to short positions, although they use a conservative method of money management. Others, on the contrary, decided to work on the breakdown/rebound method relative to the psychological level of 1.1000. In principle, the tactics of both of them are clear to me, but nevertheless, in such tasks, it's worth personally setting the scope for perspectives for yourself, what do you expect and how long do you plan to work in one direction or another. Looking at the trading chart in general terms (daily period), we see the recovery process relative to the oblong correction, which already lasts nine trading days (conditionally from the progress of the breakdown of the first stage). If you switch to the overall picture of cycles and trends, there is always a downward trend. Let me remind you that the pivot point of the current trend is the value of 1.0879, which was formed on October 1, 2019. The news background of the past day had inflation data in the United States, where the outcome was a shock to everyone. Initially, we expected the inflation rate to remain at 1.7%, at the same time, there were rumors that a decrease to 1.6% was possible. As a result, we got neither one nor the other; inflation grew to 1.8%. Seeing such indicators and a complete discrepancy of expectations, we can say that for the US dollar, a white streak has come and a sharp strengthening of the green paper awaits us, but it wasn't there. It was as if a stupor had struck everyone, including the market, there was no reaction, from the word in general. The information background included the start of a two-day meeting in the US Congress, where Fed Chairman Jerome Powell will address the Joint Economic Committee. From Powell's comments, it can be noted that, from his point of view, the regulator's path has been chosen correctly, a flexible monetary policy will help support the economy and enable it to grow. "We believe that the current position of monetary policy is likely to remain appropriate as long as the incoming economic information is broadly consistent with our forecasts of moderate economic growth, a strong labor market and inflation close to our symmetric 2 percent target," the head of the Fed said. He also noted that the regulator's words tend to have a lagging effect, meaning it will take time to assess what impact they have. In turn, news emerged from the fields of the US & China trade war. According to the official representative of the Ministry of Commerce of the People's Republic of China, Gao Feng, the negotiators are actively considering the issue of mutual removal of increased duties. "The abolition of higher tariffs should fully reflect the significance of the first stage of the China-US trade deal. Both sides are now an in-depth discussion of this issue," Gao Feng said. In the end, a few comments regarding the beloved Brexit process. So, the former head of the European Council Donald Tusk almost expressed his opinion on Britain leaving for sunset. "I have repeatedly heard from the Brexiters that they wanted to leave the European Union to make Britain strong and independent again, believing that a country alone can be great. However, in these statements, the yearning for the empire sounds, but in fact, the opposite is happening. Only within the European Union, within the framework of unity, can Britain play a global role. Only together can we stand up to the world's greatest powers," European Council President Donald Tusk said. Today, in terms of the economic calendar, preliminary data on Europe's GDP for the third quarter (second estimate) have already been released. There is confirmation that the level of GDP will remain at 1.2%, although a slowdown to 1.1% was predicted. A few hours before the publication of unified data on GDP, preliminary data on the GDP of Germany were published, but there was recorded growth from 0.3% to 0.4%. By the way, for this reason, in the morning period, we saw a local jump in prices, but after which everything returned to normal. In the afternoon, we are waiting for data on producer prices in the United States, which, according to forecasts, should fall from 1.4% to 0.9%, but due to the latest data on inflation in the United States, it may be the opposite. Further development Analyzing the current trading chart, we see the same fluctuation within the psychological mark of 1.1000, where the quote is trying hard to reverse the existing mood in the downward direction. The deterrent factor within the level of 1.1000, as already mentioned in the previous review, is very similar to the behavior of the quote at the time of passage of the first stage (1.1080). If the theory repeats, then a repeated attempt to break the control point (1.1000) will still result in a full-fledged move, which will resume the flow of short positions in the direction of the subsequent support points: #3/1 (1.0950) and #3/2 (1.0950). In terms of volatility, there is still a characteristic weakness, but once the issue with the level of 1.1000 is resolved, we will see an acceleration. By detailing the time interval available per minute, we see that between 09:00 - 10:00 hours (time on the trading terminal), there was a local surge in long positions, which had a short-term effect and was provoked by statistics from Germany. The next move was in terms of returning the price to the level of 1.1000, almost similar in structure candles. In turn, traders are hoping for a repeat of the plot and yet the breakdown of the second stage of the level of 1.1000. Many market participants already have short positions, and think about topping up as soon as the quote will be able to break out of the framework of the holding accumulation. Alternative positions are considered, but, as last time, in terms of short-term trading operations. It is likely to assume that the fluctuation within the psychological level of 1.1000 is already on its side and left to wait quite a long time. Many are now guided by the value of 1.0990, which was reflected on October 15, where there was a slight stagnation within the existing level. That is, a passage below this value to some extent may signal a level fracture, but still, it is advisable to see not just a puncture with a shadow, but an obvious move. Based on the above information, we derive trading recommendations:

Indicator analysis Analyzing different sectors of timeframes (TF), we see that indicators in a single composition signal a decline. It is worth considering such a moment that in the short-term intervals the signal is not stable due to the existing accumulation within the control level. Volatility per week / Measurement of volatility: Month; Quarter; Year. Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (November 14 was built taking into account the time of publication of the article) The volatility of the current time is 22 points, which is still low for this period. We are waiting for the completion of the existing fluctuation within the psychological level of 1.1000, after which the acceleration of volatility is possible today. Key levels Resistance zones: 1.1000***; 1.1080**; 1.1180*; 1.1300**; 1.1450; 1.1550; 1.1650*; 1.1720**; 1.1850**; 1.2100. Support zones: 1.1000***; 1.0900/1.0950**; 1.0850**; 1.0500***; 1.0350**; 1.0000***. * Periodic level ** Range level *** Psychological level ***** The article is based on the principle of conducting transactions, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| Two factors that can raise EURUSD Posted: 14 Nov 2019 03:11 AM PST Good day, dear traders! The EURUSD pair is in a downward trend for the ninth day in a row. And many analysts naturally recommend selling this tool. It is logical – as the great trader of the last century Jesse Livermore said: "the probability of continuation of the trend is higher than the probability of a reversal." But as practice and analysis of open positions of traders on forex shows – the stronger the downward trend, the more speculators in purchases. This paradox cannot be changed. It has always been and will continue to be so. But let's look at the situation with EURUSD objectively. If you did not sell the instrument at 1.1 or 1.115 – then now it is not profitable to do it. "Sell – because falling" can end up being expensive. If you pay attention to the EURUSD daily candles, there is a slowdown in the fall. Of course, everyone will predict a further fall or even collapse. But how to make money on it? The answer is no. In my opinion, selling so low with obscure risks is not objective, but there is no initiative for purchases. Therefore, I propose to wait for two events. Event number 1. Trump's impeachment hearings on Capitol Hill continues, and new facts and witnesses may emerge in this story that could shift the situation. This can be monitored, naturally, in the evening in the American session. In the case of negative news for Trump – the dollar may weaken significantly Event number 2. Today, at 14:30, the producer price index (PPI) will be released, which can also weaken the dollar, thereby rendering a bullish service to the EURUSD pair. Technically, on the "spot", buyers can catch the level of 1.099 – this is the minimum of October 15. It is likely a false breakdown of this level, which is also interesting to watch. But I note that this level has already been passed on in the future. Good luck with trading and follow money management! The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: hopes for a US-China trade agreement keep the euro from falling into the abyss Posted: 14 Nov 2019 01:42 AM PST

During yesterday's speech in the US Congress, Fed Chairman Jerome Powell said that the current position of the regulator on monetary policy will remain appropriate as long as the incoming information on the state of the US economy is in line with Central Bank forecasts. If earlier the "bulls" on EUR / USD still had hope that the Fed would continue to follow the lead of the White House owner Donald Trump and would not limit himself to three interest rate cuts, then the head of the Fed dispelled them the day before. He said that the very low-interest rates that take place abroad are not practical for the American economy. According to him, negative rates arise when the growth rate of GDP and inflation is very low. In the first half of this year, economic growth in the United States was 2.5%, and in the third quarter, it slowed to 1.9%. "Moderate growth in the third quarter is due to the aftermath of the strike by the United Automobile Workers Union at General Motors Corporation. Also, this serves as an indication of a decrease in total investment, which is associated with low economic growth rates abroad and with trade problems," J. Powell said. In October, consumer prices in the United States rose by 1.8% year-on-year after rising by 1.7% a month earlier, and core inflation accelerated by 2.3%. "In the future, we expect steady growth in the national economy, a stable situation on the labor market and an inflation rate close to the target of 2%," the chairman of the Federal Reserve said. The US economy remains resilient to slowing global demand. If we add to this the termination of the cycle of preventive easing of monetary policy by the Fed, the decline of EUR/USD looks quite logical. In October, the single European currency strengthened against the greenback amid talk of a slowdown in US GDP growth due to the fading effect of fiscal stimulus, as well as hopes that the eurozone will be able to withstand the onslaught of headwinds, including in the form of trade wars. In November, after the statements of the head of the White House, Donald Trump, about a significant increase in tariffs on Chinese products (in the case of non-signing of a trade deal by Beijing), the market returned to the previous fears. The question is, why then, against an unfavorable background for itself, the main currency pair does not slide into the abyss? It seems that investors still believe that Washington and Beijing will sign a trade agreement, and the euro will be able to cling to if not at $1.1000, then at the support level of $1.0965. The material has been provided by InstaForex Company - www.instaforex.com |

| Trader's diary EURUSD 11/14/2019 Posted: 14 Nov 2019 01:42 AM PST

"It is easy to quit smoking – I have quit more than 40 times..." (c) We are on sale at EURUSD from 1.1070 – however, already at 1.1045, we turn over and get up. The state of the market remains – range. There are clear upper (1.1180) and lower (1.0880) range boundaries. The real trend movement, if it is destined to happen, will begin after the breakthrough of one of these borders – and the closing of the day beyond this border. What is the problem for the novice trader now? The development of the situation is unbearably slow. You can simply say: "The trader must be able to wait" – and this is true – the trader must have a huge reserve of patience and composure – especially in case the market knocks your stops over and over again, as if specially. However, there is a simple recipe against impatience – the trading system. When trading on the trading system, you just have to strictly follow their own rules. No signal – stay out of the market. There is no change in the situation – well, there are no problems, we save on the cost of a trade. There is a signal – we open a deal without hesitation. The presence of a trading system saves you from any thoughts about psychology. All these books on the psychology of trading – not worth the paper on which printed – if you have a trading system. To be continued. The material has been provided by InstaForex Company - www.instaforex.com |

| Overview of EUR/USD as of November 14, 2019 Posted: 14 Nov 2019 01:41 AM PST Hello! This article will focus on both fundamental factors and technical analysis of the main currency pair of the market. To begin with, briefly about the important events and macroeconomic reports that took place yesterday, as well as what is expected today. As you know, yesterday, Fed Chairman Jerome Powell spoke before the Joint Economic Committee of the US Congress. The main thing from Powell's report is the assessment of monetary policy, which the head of the Federal Reserve, in general, considers adequate to the current situation. In other words, given the strong labor market and finding inflation near the 2% target, the Federal Reserve will probably not change the parameters of monetary policy shortly and will leave rates unchanged. At the same time, among the risks, the head of the Fed noted the inflationary global weakening of economic growth, as well as trade tensions between the US and China. Speaking of inflation. A report by the US Department of Labor yesterday showed that in October, consumer prices in the United States rose more than economists had expected. On an annualized basis, growth was 1.8% against the forecast of 1.7%, while monthly, the consumer price index rose 0.4% despite expectations of 0.3%. Today, the main events for EUR/USD will be the eurozone GDP data, as well as the continuation of the Fed chairman's speech on monetary policy. From the American statistics, it is worth highlighting the producer price index and primary applications for unemployment benefits. Both figures will be published at 14:30 (London time). Well, it's time to move on to the charts of the main euro/dollar currency pair. Daily

According to the results of yesterday's trading day, a Doji candle appeared with approximately equidistant shadows. As a rule, such candles indicate market uncertainty or some respite, which investors took before continuing the existing dynamics. I think there is no doubt that the current trend is downward. However, everything ends sooner or later, so you should never say "never". In the market, as in life, everything happens and you have to be ready for everything. What is it? And to the fact that today, we should not exclude the possibility of growth of EUR/USD. Moreover, the trading week is nearing its end and a correction of the pair is quite possible against the background of profit-taking. If this happens, I expect the quote to rise to the price zone of 1.1035 and possibly higher, to the area of 1.1050/60. Do not discount the presence of EUR/USD near the important psychological and technical level of 1.1000, which only increases the probability of a rebound up. At least a rebound. In the case of the continuation of the downward dynamics, I assume today's goals in the area of 1.0967. It is here that the lower border of the Ichimoku Indicator cloud passes, the exit from which will only confirm the strength of the bears for this currency pair. H4

The probability of an upward scenario on this timeframe is confirmed by the presence of a bullish divergence (or simply convergence) of the MACD indicator. The second interesting point. If the current candle closes above the opening price of the previous one, it will absorb it, which can also be considered as a basis for opening long positions on the euro/dollar. So. What we have – Doji candle on the daily chart, which often turns the price, divergence in growth, and possible bullish absorption. In such a situation, it is worth waiting for the closing of the current 4-hour candle above 1.1003, and if that happens, try to buy the pair with a small stop and targets in the area of 1.1060. You can also consider the sale of EUR/USD, and confirmation will be bearish candlestick signals on the 4-hour and (or) hourly chart. Good luck and big profits! The material has been provided by InstaForex Company - www.instaforex.com |

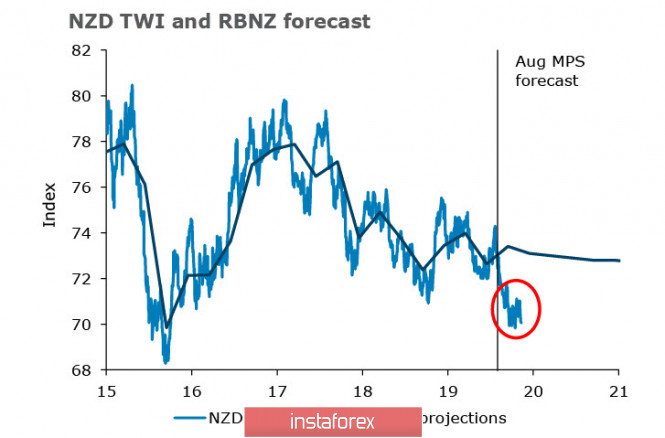

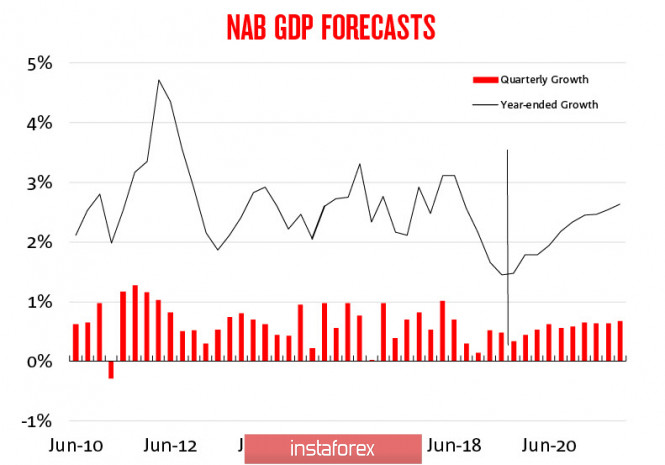

| Posted: 14 Nov 2019 12:48 AM PST The US inflation report for October came out broadly in line with expectations and did not have a significant impact on the markets. The growth of core inflation by 2.3% is slightly lower than a month ago, but it allows the Fed to maintain the illusion of sustainable consumer demand and, as a result, stop the panic that will inevitably arise with the advent of a new wave of economic crisis. The prospects for US and Chinese trade negotiations have deteriorated again as both countries play by their own rules. The United States needs to make significant concessions from China before the recession covers the economy. China dragged out negotiations and does not make concessions, based on the simple understanding that every new day worsens the position of the United States. Therefore, markets are pulsing up and down, reacting to the leak of information about the negotiations. So today, after the publication of reports of new difficulties, the demand for bonds and protective assets as a whole began to grow, risky assets are returning to a falling trajectory. NZD/USD The RBNZ did not lower the rate at a meeting on Tuesday, despite a significant deterioration in the short-term growth forecast. As a result, kiwi added more than 1%, breaking out of the general trend for commodity currencies. Due to this, the market was taken by surprise, since the probability of a rate cut was estimated at no less than 80%, and was frantically looking for the answer to the main question - is the pause just a pause or does RBNZ really believe that the economic decline has bottomed out and further aggressive actions are no longer needed. Perhaps, the answer lies in the fact that against the background of the expected reversal of macroeconomic indicators. The RBNZ did not need to lower the rate, since the trade-weighted kiwi rate (NZD TWI) was much lower before the meeting than the Central Bank expected. Accordingly, the income of exporters was not threatened, again due to higher import prices, Thus, this component can be expected to increase in the general calculation of inflation. In addition, before the meeting, the RBNZ received a very positive report on the labor market, recorded an increase in commodity prices, primarily for dairy products, so a pause in the reduction in the rate is justified. On the other hand, banks are hastily updating forecasts. If, prior to the meeting, the consensus was that the RBNZ would reduce the rate by the middle of next year to 0.25%, well now, there is no such certainty. ANZ suggests there will be only two declines, with the second only in August. These changes significantly change the prospects of kiwi, and if earlier it was assumed that NZD would look "a little worse than others", now the rating is "a little better than others." Therefore, the bulls get the basis for an attempt to resume growth, until the end of the week, the maximum update of 0.6418 and testing of 0.6465 are likely. If previously such an opportunity was practically excluded, then at the moment the chances of successful testing and consolidation are higher and the movement to 0.6500 has significantly increased. AUD/USD The Australian dollar continued to decline after the publication of a noticeably weaker-than-expected China Industrial Production Report for October. At the same time, both the RBA and the Australian government adheres to the agreements previously adopted. It was decided not to make any changes to the current statement (which is essentially an agreement on coordination of actions). As a result, Australia's financial authorities continue to insist that "the proper goal is to keep consumer price inflation at an average of 2-3% over time." The Melbourne Institute's updated inflation expectations report released this morning showed growth to 4.0% from 3.6%, while 3.2% was forecast, and NAB is confident that Australia's economic slowdown has bottomed out and next year growth will return to above 2.5%. As it turned out, all these factors, which were supposed to contribute, if not to strengthen, then at least stabilize the Australian currency, have no significance for the market. AUD reached the next support zone 0.6790 / 6810, and if it is technically possible to roll back to the zone 0.6820 / 30, then such a rollback will not mean that a minimum has formed. On the contrary, any growth attempts will increase the chances of another wave down, and therefore, it is more logical to use growth to enter short positions. In turn, the medium-term target lies at the lower border of the channel 0.67, which began to form in September, and a test of this level is becoming more and more likely. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment