Forex analysis review |

- Fractal analysis of the main currency pairs on November 21

- #USDX vs EUR/USD vs GBP/USD vs USD/JPY - H4. Comprehensive analysis of movement options for November 21, 2019. APLs &

- The dollar is still in balance, however, the balance of factors is not in its favor

- Trading idea for the AUD/USD pair

- EUR/USD. November 20. Results of the day. The dollar shows amazing resistance to the threats of escalating trade conflict

- GBP/USD. November 20. Results of the day. The US dollar is showing growth ahead of the publication of the Fed minutes

- Fears of a trade war: The loonie ignored inflation data and keeps getting cheaper

- Pound could soar or collapse on the results of the early elections to the British Parliament

- Diary of a trader 11/20/2019 EURUSD

- EURUSD: Fed minutes could weaken the dollar's position, however, disruption of the US-China trade deal poses a big threat,

- Gold went to the Rubicon

- At the turning point: the euro could turn into stablecoin

- Pound is set to win

- Ichimoku cloud indicator short-term analysis of EURUSD for November 20, 2019

- Technical analysis of Gold for November 20, 2019

- November 20, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- November 20, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- BTC 11.20.2019 - Watch for selling oportunites on the rallies

- Gold 11.20.2019 - Rejection of the main multi-pivot resistance at $1.480, downside in play

- EUR/USD for November 20,2019 - Rejection of the major resistance at 1.1080, downside pressure and selling opportuntiies preferable

- GBP/USD: plan for the American session on November 20th. Bears are trying to gain a foothold below the support of 1.2900

- EUR/USD: plan for the American session on November 20th. The probability of a trade agreement breakdown and a fall in German

- Trading recommendations for the EURUSD currency pair – placement of trade orders (November 20)

- Technical analysis of AUD/USD for November 20, 2019

- Trading strategy for EUR/USD on November 20th. Trump's method of "tariff" – whip and "verbal" – carrot does not work in the

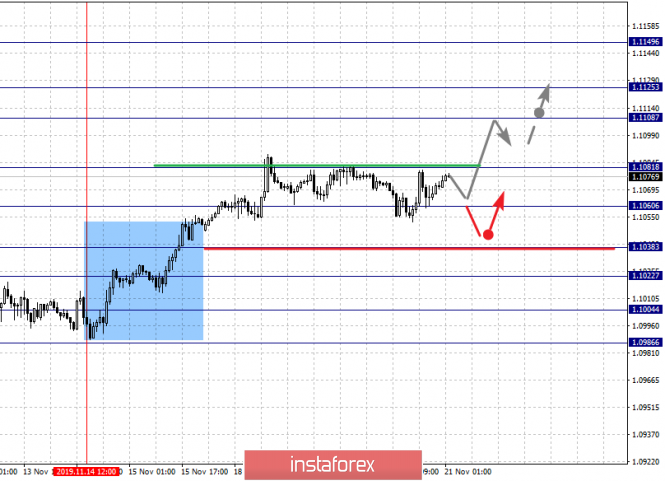

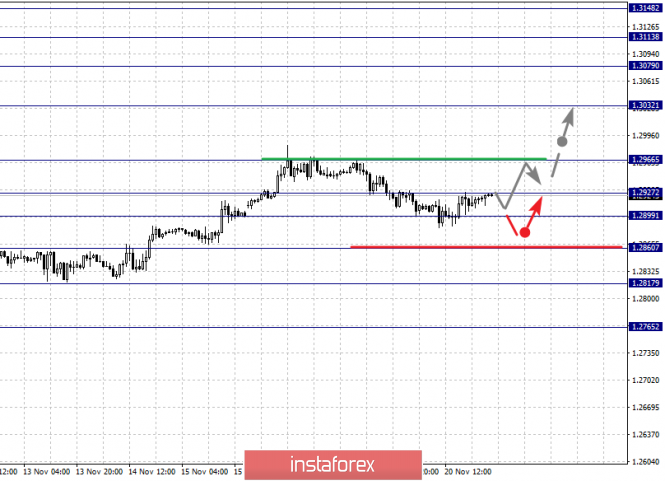

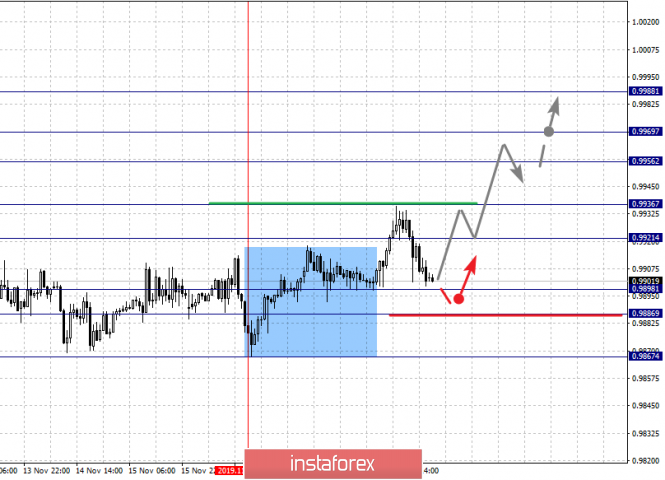

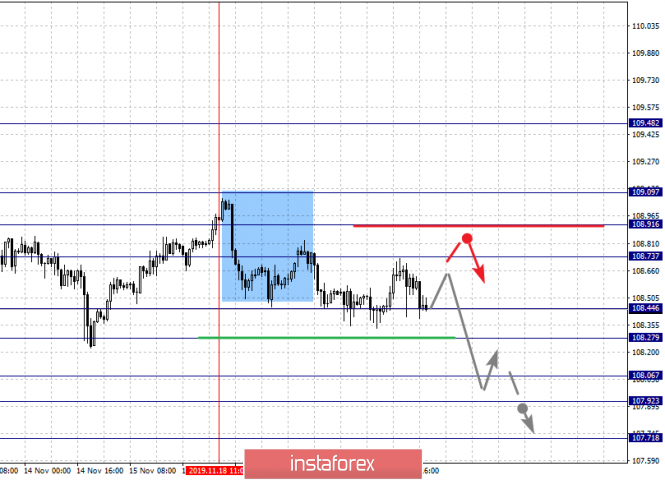

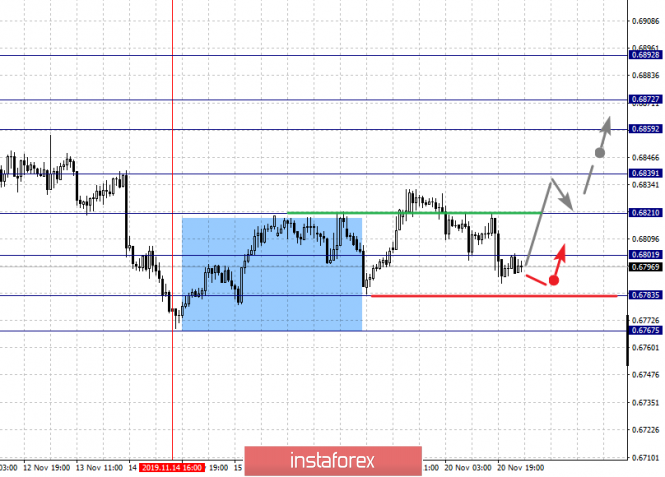

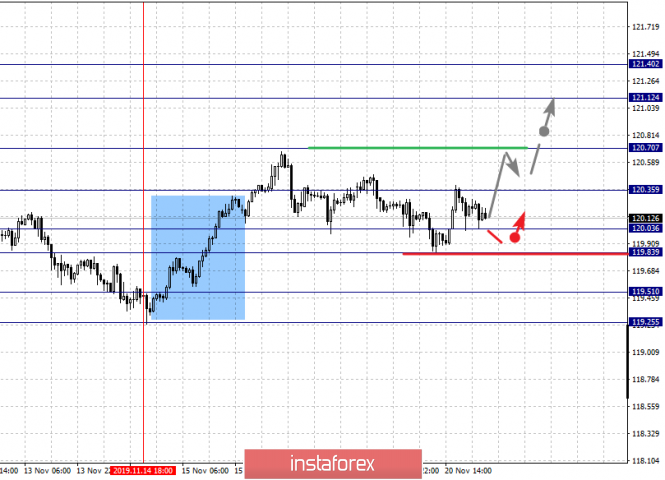

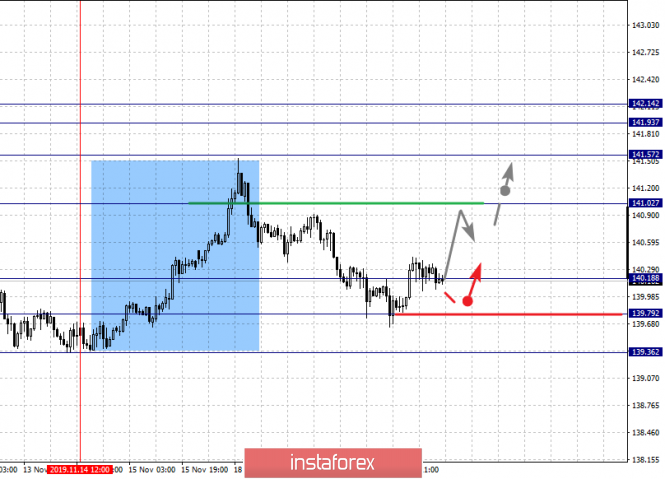

| Fractal analysis of the main currency pairs on November 21 Posted: 20 Nov 2019 05:12 PM PST Forecast for November 21: Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1149, 1.1125, 1.1108, 1.1081, 1.1060, 1.1038, 1.1022 and 1.1004. Here, we are following the development of the ascending structure of November 14. We expect short-term upward movement, as well as consolidation, in the range of 1.1060 - 1.1081. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 1.1108. Price consolidation is in the range of 1.1108 - 1.1125. For the potential value for the top, we consider the level of 1.1149. Upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is expected in the range of 1.1038 - 1.1022. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.1004. This level is a key support for the upward structure. Its breakdown will allow us to count on movement to the first potential target - 1.0986. The main trend is the upward structure of November 14. Trading recommendations: Buy: 1.1083 Take profit: 1.1106 Buy: 1.1025 Take profit: 1.1146 Sell: 1.1038 Take profit: 1.1022 Sell: 1.1021 Take profit: 1.1005 For the pound / dollar pair, the key levels on the H1 scale are: 1.3113, 1.3079, 1.3032, 1.2966, 1.2927, 1.2899, 1.2860 and 1.2817. Here, we continue to monitor the development of the upward cycle of November 8. The continuation of the movement to the top is expected after the breakdown of the level of 1.2966. In this case, the target is 1.3032. Price consolidation is near this level. The breakdown of the level of 1.3032 should be accompanied by a pronounced upward movement. Here, the target is 1.3079. For the potential value for the top, we consider the level of 1.3113. Upon reaching this value, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is possibly in the range of 1.2927 - 1.2899. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.2860. This level is a key support for the upward structure from November 8. Its passage in price will lead to the development of a downward trend. Here, the first goal is 1.2817. The main trend is the upward cycle of November 8. Trading recommendations: Buy: 1.2967 Take profit: 1.3030 Buy: 1.3034 Take profit: 1.3079 Sell: 1.2896 Take profit: 1.2860 Sell: 1.2858 Take profit: 1.2818 For the dollar / franc pair, the key levels on the H1 scale are: 0.9988, 0.9969, 0.9956, 0.9936, 0.9921, 0.9898, 0.9886 and 0.9867. Here, we are following the development of the ascending structure of November 18. Short-term upward movement is expected in the range 0.9921 - 0.9936. The breakdown of the latter value will lead to pronounced movement. Here, the target is 0.9956. Short-term upward movement, as well as consolidation is in the range of 0.9956 - 0.9969. For the potential value for the top, we consider the level of 0.9988. Upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 0.9898 - 0.9886. Hence, there is a high probability of a reversal to the top. The breakdown of the level of 0.9886 will lead to the development of a downward movement. Here, the first goal is 0.9867. The main trend is the upward structure of November 18. Trading recommendations: Buy : 0.9921 Take profit: 0.9934 Buy : 0.9938 Take profit: 0.9955 Sell: 0.9898 Take profit: 0.9887 Sell: 0.9884 Take profit: 0.9868 For the dollar / yen pair, the key levels on the scale are : 109.09, 108.91, 108.73, 108.44, 108.27, 108.06 and 107.92. Here, we are following the development of the local descending structure of November 18. Short-term downward movement is expected in the range of 108.44 - 108.27. The breakdown of the last value should be accompanied by a pronounced downward movement. Here, the target is 108.06. We consider the level of 107.92 to be a potential value for the bottom. Upon reaching this value, we expect consolidation, as well as a rollback to correction in the range of 108.06 - 107.92. Short-term upward movement, as well as consolidation, are expected in the range of 108.73 - 108.91. We consider the level 109.09 to be the potential value for the top. We expect the initial conditions for the ascending cycle to be formed until this level. The main trend: the downward structure of November 7; the local structure of November 18. Trading recommendations: Buy: 108.73 Take profit: 108.90 Buy : 108.94 Take profit: 109.07 Sell: 108.44 Take profit: 108.29 Sell: 108.25 Take profit: 108.06 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3404, 1.3387, 1.3355, 1.3334, 1.3298, 1.3278 and 1.3250. Here, we are following the ascending structure of November 19. Short-term upward movement is expected in the range of 1.3334 - 1.3355. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 1.3387. Price consolidation is in the range of 1.3387 - 1.3404, and from here, we expect a correction. Short-term downward movement is possibly in the range of 1.3298 - 1.3278. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3250. This level is a key support for the upward structure. The main trend is the upward structure of November 19. Trading recommendations: Buy: 1.3335 Take profit: 1.3355 Buy : 1.3357 Take profit: 1.3385 Sell: 1.3296 Take profit: 1.3278 Sell: 1.3276 Take profit: 1.3252 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6892, 0.6872, 0.6859, 0.6839, 0.6821, 0.6801, 0.6783 and 0.6767. Here, we are following the development of the ascending structure of November 14. The continuation of the movement to the top is expected after the breakdown of the level of 0.6821. In this case, the first target is 0.6840, wherein price consolidation is near this level. Its breakdown will allow you to expect pronounced movement. Here, the goal is 0.6859. Short-term upward movement, as well as consolidation is in the range of 0.6859 - 0.6872 For the potential value for the top, we consider the level of 0.6892. Upon reaching this level, we expect a pullback to the bottom. Short-term downward movement, as well as consolidation, are expected in the range of 0.6801 - 0.6783. The breakdown of the latter value will lead to the development of a downward structure. In this case, the first target is 0.6767. The main trend is the upward structure of November 14. Trading recommendations: Buy: 0.6821 Take profit: 0.6837 Buy: 0.6840 Take profit: 0.6857 Sell : 0.6780 Take profit : 0.6768 Sell: Take profit: For the euro / yen pair, the key levels on the H1 scale are: 121.40, 121.12, 120.70, 120.35, 120.03, 119.83, 119.51 and 119.25. Here, we are following the ascending structure of November 14. The continuation of the movement to the top is expected after the breakdown of the level of 120.35. Here, the goal is 120.70. Price consolidation is near this level. The breakdown of the level of 120.70 should be accompanied by a pronounced upward movement. Here, the goal is 121.12. For the potential value for the top, we consider the level of 121.40. Upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is expected in the range of 120.03 - 119.83. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 119.51. This level is a key support for the upward structure. The main trend is the upward structure of November 14. Trading recommendations: Buy: 120.35 Take profit: 120.68 Buy: 120.72 Take profit: 121.10 Sell: 120.03 Take profit: 119.83 Sell: 119.80 Take profit: 119.51 For the pound / yen pair, the key levels on the H1 scale are : 142.14, 141.93, 141.57, 141.02, 140.49, 140.18 and 139.79. Here, we are following the development of the ascending structure of November 14. At the moment, the price is in deep correction. The continuation of the movement to the top is expected after the breakdown of the level of 141.02. In this case, the first goal is 141.57. The breakdown of which will allow us to count on movement to the level of 142.14. Upon reaching this value, we expect consolidation in the range of 141.93 - 142.14. Short-term downward movement is possibly in the range 140.18 - 139.79. The breakdown of the latter value will lead to the cancellation of the ascending structure of November 14. In this case, the first target is 139.36. The main trend is the rising structure of November 14, the stage of deep correction. Trading recommendations: Buy: 141.02 Take profit: 141.55 Buy: 141.58 Take profit: 141.93 Sell: 140.16 Take profit: 139.84 Sell: 139.76 Take profit: 139.38 The material has been provided by InstaForex Company - www.instaforex.com |

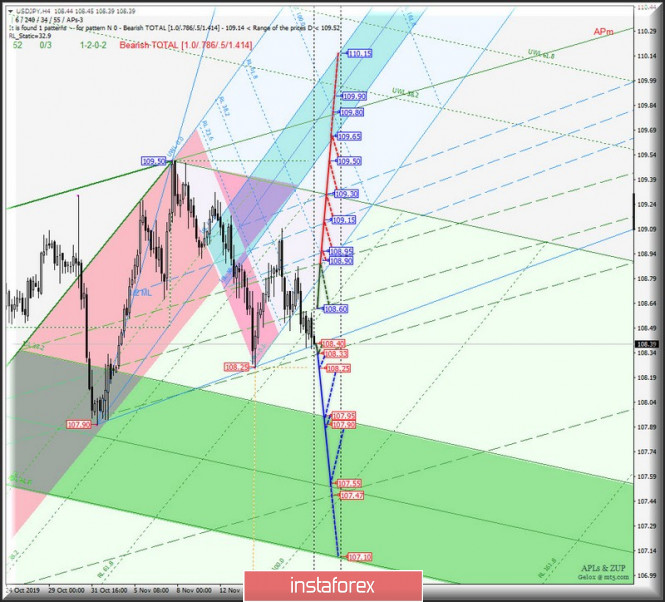

| Posted: 20 Nov 2019 04:41 PM PST Once again, let's talk about the "majors". Here's a comprehensive analysis of the movement options of #USDX, EUR/USD, GBP/USD and USD/JPY on H4 for November 21, 2019 on the Minuette operational scale forks. ____________________ US dollar index From November 21, 2019, the development of the movement of the dollar index #USDX will be due to the development and direction of the breakdown of the range :

Consecutive breakdown of resistance levels : - 98.10 (starting line SSL Minuette); - 98.15 (the upper boundary of the 1/2 Median Line Minuette channel); - 98.23 (control line UTL Minuette); will determine the continuation of the upward movement of the dollar index to the local maximum of 98.45 and the equilibrium zone (98.53 - 98.90 - 99.25) of the Minuette operational scale forks. In case of breakdown of 1/2 Median Line Minuette (support level of 97.90), the option of developing a downward movement of #USDX to targets: the lower boundary of the channel 1/2 Median Line Minuette (97.65) - start line SSL Minuette (97.37) - equilibrium zone (97.30 - 97.05 - 96.82) of the Minuette operational scale forks, will continue. The details of the #USDX movement are presented on the animated chart. ____________________ Euro vs US dollar Similarly, the development of the movement of the single European currency EUR / USD from November 21, 2019 will also be determined by the development and the direction of the breakdown of the range :

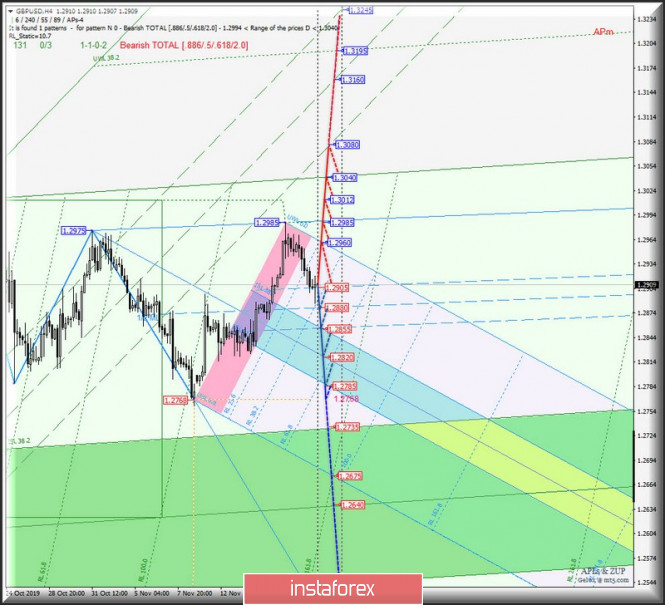

The breakdown of the support level of 1.1045 will cause the EUR/USD movement to be developed in the 1/2 Median Line channel again (1.1045 - 1.1025 - 1.1010) of the Minuette operational scale forks, and in case of breakdown of the lower boundary (1.1010) of this channel, the downward movement of this currency instrument may be continued towards goals: start line SSL Minuette (1.0995) - local minimum 1.0989 - end Schiff Line Minuette (1.0980) - control line LTL Minuette (1.0960) - upper line ISL38.2 (1.0945) equilibrium zones of the Minuette operational scale forks. On the contrary, in case of breakdown of the resistance level 1.1070 (ISL38.2 Minuette), the development of the single European currency movement will begin to occur in the equilibrium zones (1.1070 - 1.1095 - 1.1115) of the Minuette operational scale forks with the prospect of reaching the warning line UWL38.2 (1.1150) of the Minuette operational scale. The details of the EUR/USD movement options are shown on the animated chart. ____________________ Great Britain pound vs US dollar On November 21, 2019, the development of Her Majesty's currency movement GBP/USD will also be determined by the development and the direction of the breakdown of the boundaries of the 1/2 Median Line channel (1.2905 - 1.2880 - 1.2855) of the Minuette operational scale forks. Look at the animated chart for the movement details within this channel. In case of breakdown of the lower boundary of the 1/2 Median Line Minuette channel (support level of 1.2855), the development of the GBP / USD movement will continue in the equilibrium zones (1.2855 - 1.2820 - 1.2785) of the Minuette operational scale forks with the prospect of updating the local minimum 1.2768 and reaching the upper boundary of ISL38.2 (1.2735) equilibrium zone of the Minuette operational scale forks. Alternatively, the breakdown of the upper boundary of the 1/2 Median Line Minuette channel (resistance level of 1.2905) will direct the development of Her Majesty's currency movement towards the goals: initial SSL line (1.2960) of the Minuette operational scale forks - local maximums (1.2985 - 1.3012) - initial SSL line (1.3040) of the Minuette operational scale forks - the lower boundary of the 1/2 Median Line Minuette channel (1.3080). The details of the GBP / USD movement can be seen on the animated chart. ____________________ US dollar vs Japanese yen The development of the currency movement of the "country of the rising sun" USD/JPY from November 21, 2019 will be due to the development and direction of the breakdown of the range:

The breakdown of the 1/2 Median Line Minuette (resistance level of 108.60) - option for the development of the upward movement of the currency of the "country of the rising sun" to goals: upper boundary of the 1/2 Median Line Minuette channel (108.90) - 1/2 Median Line Minuette channel (108.95 - 109.15 - 109.30) - maximum 109.50 - lower boundary of the ISL38.2 (109.65) equilibrium zone of the Minuette operational scale forks. Consecutive breakdown of support levels : - 108.40 - control line LTL of the Minuette operational scale forks; - 108.33- lower boundary of the 1/2 Median Line Minuette channel; - 108.25 - local minimum; will confirm the continuation of the development of the downward movement of USD / JPY to the boundaries of the equilibrium zone (107.95 - 107.55 - 107.10) of the Minuette operational scale forks. The details of the USD / JPY movement are presented on the animated chart. ____________________ The review is made without taking into account the news background. Thus, the opening of trading sessions of the main financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index : USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of the currencies in the basket: Euro - 57.6% ; Yen - 13.6% ; Pound Sterling - 11.9% ; Canadian dollar - 9.1%; Swedish krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the start date of the countdown - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

| The dollar is still in balance, however, the balance of factors is not in its favor Posted: 20 Nov 2019 03:55 PM PST The US dollar has stabilized against major currencies as continuous uncertainty about the fate of Washington and China's trade negotiations forces investors to exercise caution. Over the past three days, the USD index lost about 0.5%. Today, it is trading with an increase near the level of 97.9. "There is a mood of weak risk aversion in the markets. The tone is somewhat cautious, and reports on US-China trade negotiations are mixed." Westpac's analysts said. Thus, traders are waiting for the publication of the minutes from the last Fed meeting, which took place at the end of last month. Investors are hoping to get more hints regarding the future plans of the regulator after three consecutive cuts in Federal funds rates in July, September and October. The futures market, in turn, puts in the quotes a probability of 55% that the rate will remain at the current level (1.5-1.75%) at least until the middle of next year. Meanwhile, a short-term publication of the minutes of the October meeting of the Fed may support the dollar, given the fact that several non-voting FOMC members expressed their dissent on the issue of reducing the Federal funds rate to 1.75%. The split in the ranks of the Central Bank, as a rule, plays into the hands of the national currency. At the same time, the long-term prospects of the follar are far from being drawn in rosy colors. Fed Chairman Jerome Powell is of the opinion that the US economy is still strong, but a slowdown suggests a stimulating nature of the monetary policy of the regulator. According to the head of the Federal Reserve, the US labor market has developed a favorable situation, but it remains a mystery why we are not seeing a sharp increase in wages. This may be due to suppressed inflation and the fact that weak economic growth has already become the norm. At the same time, J. Powell acknowledges the presence of the downside risks. The global economic slowdown and trade issues are still on the agenda. Of course, everything can change if US President Donald Trump decides to postpone the December round of tariffs on Chinese products or abandon it altogether. Washington can combine this step with the abolition of previously imposed duties, but so far, adheres to a tough negotiating position. On Tuesday, D. Trump threatened China again with an increase in duties if a favorable US trade agreement is not concluded. The escalation of the trade war and the associated slowdown in the US economy may be the main reasons why the Fed will resume the cycle of easing the monetary policy. A day before, the head of the Federal Reserve Bank of New York, John Williams, said that if the US GDP would grow below the trend as a result of the influence of global factors, then the US Central Bank could make monetary policy more accommodative than it is now. He also said that large-scale interventions of the Fed in the money market have had the desired effect. "Since the Fed began to increase the supply of short-term and long-term liquidity through the purchase of government bonds, we saw that the markets are really calming down and the rates are becoming stable. We are very focused on the end of the year and we hope that clearly announced monetary interventions will help to keep calm. So far, everything looks very good." said J. Williams. Meanwhile, experts from Morgan Stanley believe that the Federal Reserve Bank of New York has overdone the issue of eliminating the crisis in the money market. Thus, they predict the appearance of an excess supply of American currency. "So far, the liquidity provided by the Fed is absorbed due to the end-of-year demand from commercial banks. As soon as this period ends, the dollar deficit may turn into its excess, which will contribute to the weakening of the USD along with the reduction in divergence in the economic growth of the USA and other countries."strategists at Morgan Stanley noted. On the other hand, according to analysts at Standard Chartered, the expansion of the monetary base in the United States since 2011 has invariably served as a good indicator of the strength of the euro. "The uncertainty caused by the impeachment against D. Trump, as well as the US presidential election in 2020, may reduce the attractiveness of the dollar against the euro," they believed. Thus, despite the fact that the American currency feels quite confident, the balance of factors is not in its favor. The material has been provided by InstaForex Company - www.instaforex.com |

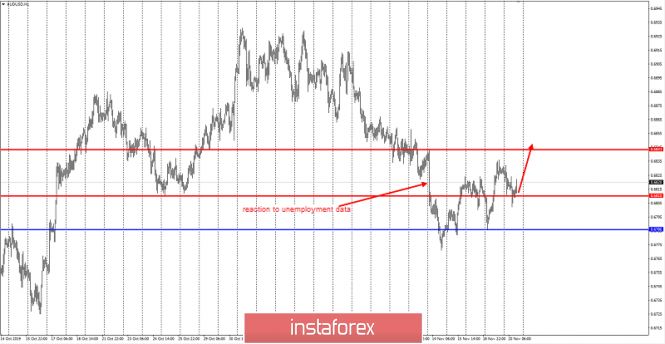

| Trading idea for the AUD/USD pair Posted: 20 Nov 2019 03:34 PM PST Good evening, dear traders! The growth of AUD / USD is what is interesting today. As we remember, unemployment data was published in Australia last week on November 14, to which this instrument reacted negatively: the AUD/USD currency pair was declining throughout the whole day. An important detail is that during the fall, an important extreme at 0.6810 was updated. Thus, I believe that this was a culmination of the downward trend in November, and given the reaction of the Australian dollar to this week's news, I think that local growth is possible to the level of 0.6843, which is the news' high on Wednesday. Now, why exactly this level? It's simple - every seller who believes in a further fall of this instrument will clearly depend precisely on the news impulse on November 14, so the price can go there with a high degree of probability. Recommendation: try to buy in order to update the level of 0.6943. At the same time, losses can be limited to the lowest level of 0.6788 - there is no sense in holding purchases below, and in case of updating this minimum, the bullish scenario can be considered invalid. Wishing you all success in trading and huge profits! The material has been provided by InstaForex Company - www.instaforex.com |

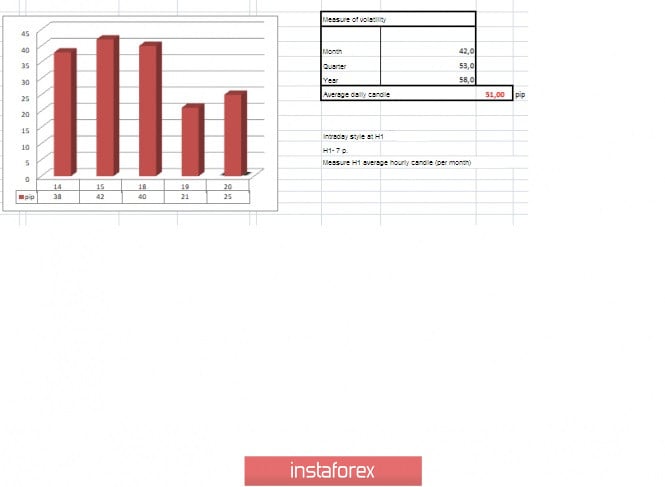

| Posted: 20 Nov 2019 03:01 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 25p - 39p - 42p - 40p - 21p. Average volatility over the past 5 days: 33p (low). The EUR/USD currency pair started a downward correction against a weak upward trend, which is likely to end near the upper boundary of the Ichimoku cloud. The upward trend still persists at the moment, as the euro/dollar continues to trade above the critical line. A price rebound from this line may provoke a resumption of the upward movement, but now everything looks like a call to a new long-term drop in the European currency. We also do not expect the euro to fall below two-year lows from a fundamental point of view. There are no good fundamental reasons for this, but they are not for the serious strengthening of the euro. Not a single important macroeconomic report was made available to traders in the first three trading days of the week. Therefore, the markets and the international community can only continue to discuss a possible new round of escalation of the trade conflict between China and the United States, the topic of the impeachment of Donald Trump and the Federal Reserve minutes, which will be published tonight and with a 90% probability its content can be predicted now. Let us consider in more detail each of these factors. In recent days, amid new statements and threats by Trump against China, traders again began to discuss a trade war and look for an answer to the question of what will happen if the parties do not agree and introduce new duties against each other. Indeed, China has not yet announced the introduction of duties, if the parties fail to agree, then there is no doubt that it will do so, since it has always responded with mirror measures to Trump's actions. In addition to threats about the introduction of new duties on Chinese imports, Trump also said that China should sign the deal that is beneficial to America. The US president does not mention why China should sign an unprofitable deal for it. However, it is not a secret for anyone that the US leader believes that Beijing needs this deal and, from his point of view, China still has to convince Washington of the advisability of signing a trade agreement. Expediency will only come when the agreement is the way Trump wants it. We believe that Trump's position obviously will not lead to de-escalation of the trade conflict. Political ratings of the US president will also suffer, although again, according to Trump himself, the current ratings are at its highest for his entire presidency. However, the topic of ratings already refers to the Congress's investigation of the illegal activities of Trump, which, theoretically, could lead to impeachment. Few people now believe in impeachment, even the Democrats, although in public, of course, they say that the president who exceeded his authority deserves such a sentence. Trump himself said that Democrats use the topic of impeachment exclusively for political dividends, but they have the exact opposite effect. "Democrats do what they considered impossible and what the founding fathers of the United States did not want, they use falsified impeachment to receive political dividends. They try to harm the Republican Party, the US president, but achieve the opposite effect. You saw the poll - I have the highest level of support for all time," the US president said. Anticipating the question of what kind of rating he has now and where it was published, Trump said: "You won't hear about it on television, because the media and the democrats are one and the same." Well, as for the evening publication of the minutes of the FOMC meeting, here, from our point of view, everything is as simple as possible. After three consecutive cuts in the key rate, the Federal Reserve is unlikely to go to fourth. There is no reason for this now, and many experts are even asking the question - is the Fed going lower and lower? Trump's criticism and pressure on Powell is certainly a good reason, but nonetheless. Thus, given the escalation of the trade conflict with China, the Fed, of course, can soften its monetary policy one or more times in the future, but not in the near future. Jerome Powell hinted at this, and most experts agree that three cuts would be enough to stop the impending recession. Thus, the Fed minutes is unlikely to contain any dovish notes and, for obvious reasons, will be clear of hawkish theses. Based on this, we believe that the minutes will not contain anything overly important and interesting. The technical picture of the euro/dollar pair is also as clear as possible. The pair is correcting, maintaining the chances of continued upward movement. However, as long as it is inside the Ichimoku cloud, there remain some doubts about the strength of the bulls and their desire to continue buying the euro without any fundamental reasons and macroeconomic statistics. By the way, the growing likelihood of an escalation of the trade war with China has no negative impact on the US dollar, nor does the development of the theme of the impeachment of Trump. Trading recommendations: The EUR/USD pair began to adjust. Thus, it is now recommended at least to wait until the completion of the current correction, and then consider the purchase of the pair, but only in small lots, since the current movement is still identified as corrective. We recommend that you wait until the level of 1.1101 is overcome when buying the euro. It is advised to return to purchasing the US dollar no earlier than the reconsolidation of the euro/dollar pair below the critical Kijun-sen line with the aim of the support level of 1,1008. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. Support / Resistance Classic Levels: Red and gray dotted lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 Nov 2019 03:01 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 41p - 63p - 52p - 81p - 60p. Average volatility over the past 5 days: 59p (average). The British pound paired with the US currency began a rather strong downward correction (based on its size in the graph), which in absolute terms is quite small and weak, like all of the pair's movements in the last few weeks, when the GBP/USD pair is "sick" with a kind of flat. At the moment, the pair has dropped to the critical Kijun-sen line, which it has almost overcome, but it looks like the pair will slightly pull back in the US trading session. One way or another, the bulls did not manage to overcome the previous local high of 1.2975, but only pierced it. Thus, we believe that, from a technical point of view, there are now much more chances for the pair to continue to fall than to grow. If we add the fundamental background to this, which remains sharply negative in the long term for the British currency, then it seems that it is inevitable for the pound. Only positive expectations from the election results can keep traders from selling the British currency, which is set to take place after three weeks. It was with this factor that the pound managed to rise in price to the level of 1.3000. Now the bears need to successfully overcome the Kijun-sen line, which will open the pair down to the support levels of 1.2836 and 1.2818. About the elections to the Parliament of Great Britain, until which, we recall, in another three weeks, it has already been written so much that it can not be counted. However, all this information, which, in essence, boils down to calculating the likelihood of a Conservative victory with the required number of deputy mandates, is now of little significance. No one can accurately predict how the election will end - no opinion polls and studies, no TV debates, no loud statements by leaders. Therefore, we propose to move slightly away from the topic of elections and concentrate on the question "when will traders begin to respond to macroeconomic statistics and why do not they respond to it now?" This is a very interesting question, as, as we all remember, last week traders immediately ignored five major macroeconomic reports from the UK, including GDP, industrial production, inflation, and wages. It seems that most traders believe that the current slowdown in the UK economy is absolutely unimportant, since Brexit will take place and all problems will be resolved by the mere presence of a divorce with the European Union. Well, or Boris Johnson, who, recall, has not won a single victory as prime minister, will solve all the problems. After all, the prime minister has repeatedly stated that Brexit is not as scary as the opposition and opponents of withdrawing from the EU describe it. He was talking about the "hard" Brexit. But Brexit with the deal, according to Johnson, is not at all scary. Yes, there will be a certain negative impact on the economy, but the country will conclude a huge trade agreement with the United States, which was promised by Donald Trump. We believe that such a development is unlikely. How the elections will end are unclear. If Conservatives do not win by a significant margin, then Brexit will drag on for some time. Trump's words often mean completely different from what they really are. Thus, the optimism of traders who rushed to buy the British pound is excessive and premature. Well, from a technical point of view, we believe that the downward movement of the pair will continue. For this, of course, you need to wait for the critical line to be overcome, after which it will be possible to count on a fall to the level of 1.2836 and 1.2818, at least. We should not forget about the rather weak volatility. Trading recommendations: The GBP/USD pair began to adjust. Thus, it is recommended that traders now consider buying the British pound with a target at the resistance level of 1.2951 and higher if a rebound from the Kijun-sen line occurs. However, we advise opening long positions in small lots, since there are still few reasons for the pair to grow from a fundamental point of view. It is recommended to return to sales no earlier than when the bears consolidate below the Kijun-sen line, also in small lots with the target of 1.2836. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. Support / Resistance Classic Levels: Red and gray dotted lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movement options: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

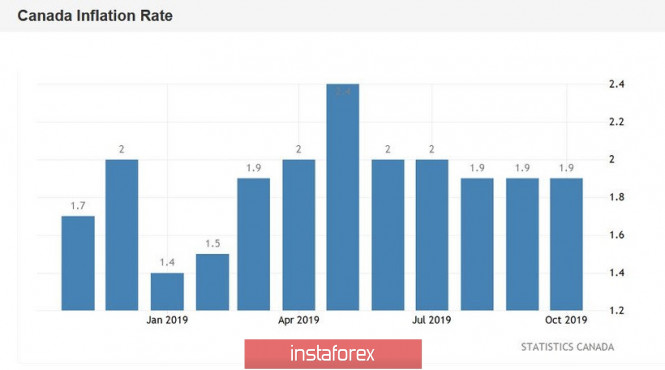

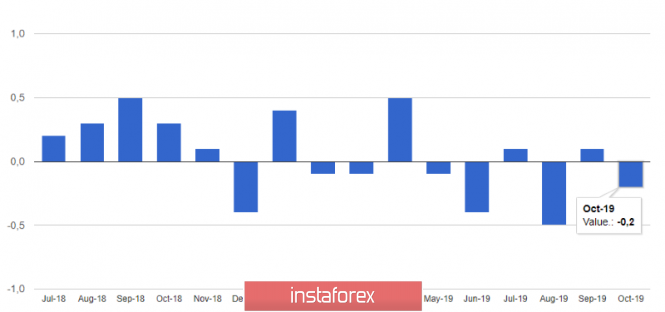

| Fears of a trade war: The loonie ignored inflation data and keeps getting cheaper Posted: 20 Nov 2019 03:01 PM PST The Bank of Canada's final meeting for this year will take place exactly two weeks from now on December 4. But already now, disputes regarding the further actions of the Canadian regulator are not ceasing among experts. The contradictory fundamental picture does not allow any unambiguous conclusions to be drawn: there are arguments both in favor of maintaining a wait-and-see attitude and in favor of easing monetary policy. Today's data on the growth of Canadian inflation did not help resolve this rebus, as a result of which the USD/CAD pair showed increased volatility, continuing the trend of recent days. After the release, the price initially fell to daily lows, and then jumped to 1.3320, updating the monthly high. After a short pause, the bulls of the pair continued to test this resistance level, which corresponds to the upper line of the Bollinger Bands indicator on the daily chart. Thus, the reaction of USD/CAD traders to today's release turned out to be quite fleeting. In fact, the market reacted in a fleeting manner to the published figures (all the more so since they reached the forecast level), after which the loonie returned to more pressing problems. The Canadian dollar is getting cheaper for the second day in a row, and even relatively good data on inflation growth could not significantly affect the situation. The market is primarily concerned with external risks, especially in light of the previous rhetoric of Bank of Canada representatives. Stephen Poloz focused on the continuing uncertainty in the light of the ongoing trade conflict at the last meeting of the Canadian central bank The regulator also downward revised its forecasts for Canada's GDP growth next year (from 1.9% to 1.7%). Poloz expressed concern about the level of consumer spending, declining business investment and export volumes. The latest release on Canada's GDP growth came out in the red zone, not justifying the forecasts of most analysts: on an annualized basis, the indicator was at zero level (with a weak forecast of growth to 0.1%), while in annual terms it dropped to 1. 3% (with a forecast of growth to 1.4%). The labor market data was also disappointing: for the first time since July, the employment growth rate was in the negative area - the number of jobs decreased by almost two thousand. And this despite the fact that for two months, experts marked a record increase in the indicator (in August it grew by 80 thousand, and in September - almost 54 thousand). Despite the October forecast of growth of 14 thousand jobs, the indicator showed a negative trend. Today's inflation growth data could offset investors' concerns about monetary policy prospects. The core consumer price index continues to stay close to target levels, and this fact could allow the Canadian regulator to continue to pause. But the possible escalation of the trade war has mixed up all the cards: the market is seriously concerned that Washington and Beijing will resume hostilities in the near future, raising the degree of tension in the financial world. Trade negotiations between the countries stalled last week, when the parties refused to make mutual concessions: the Chinese refused to agree to a fixed volume of purchases of American agricultural products, the White House, in turn, refused to cancel the September duties and (planned) December duties. The situation was significantly aggravated today when the Congress Senate unanimously voted for the Hong Kong Human Rights and Democracy Act. It is noteworthy that all senators, both Republicans and Democrats, voted for this document. This suggests that it will be difficult for Trump to argue his refusal to sign it. Now the bill has been sent to the House of Representatives, and from there (if approved) it will fall into the Oval Office. If the bill becomes law, it will impose certain sanctions on the Hong Kong administration, and will also oblige the US Secretary of State to confirm at least once a year that Hong Kong maintains a sufficient level of autonomy. If the answer is yes, the United States may grant "special trade status" to Hongkongers. China's reaction to the bill was predictable: they protested and warned that Beijing would retaliate "if the bill becomes law." According to China, Washington is interfering in the internal affairs of China, thereby violating the fundamental formula of the relationship "one country, two systems." Such a political background suggests that no friendly steps can be expected from China or the United States in the context of trade negotiations. Markets are gradually preparing for a possible escalation of the global trade conflict, and the Canadian dollar is reacting most sharply to recent events. Bank of Canada representatives have repeatedly warned investors that they could resort to preventive measures if trade uncertainty increases. In the light of such prospects, the Canadian dollar has lost its foothold - and judging by the reaction to today's release, internal statistics are not able to regain the loonie's self-confidence. All this suggests that the USD/CAD pair retains the potential for its growth to the main resistance level of 1.3400 - at this price point, the upper line of the Bollinger Bands indicator coincides with the upper boundary of the Kumo cloud on the weekly chart. The material has been provided by InstaForex Company - www.instaforex.com |

| Pound could soar or collapse on the results of the early elections to the British Parliament Posted: 20 Nov 2019 03:01 PM PST The outcome of the early elections to Parliament set to be held in the United Kingdom next month, puts the pound before two choices, according to analysts at HSBC, the largest bank in the UK. According to them, no option has been taken into account in quotes. "A political outcome will determine the future of the British currency," analysts said. They predict that the outcome of the election, which will set the stage for a Brexit agreement between London and Brussels, could push the pound to $1.45 by the end of next year. Meanwhile, Great Britain's exit from the European Union without a deal can cause the GBP/USD pair to fall to 1.10. "Any resolution to this situation is good, whether it be another referendum or a Brexit deal. Political disputes will begin to subside, the national economy may receive a fiscal impetus, and the Bank of England may begin to consider raising interest rates. A reverse outcome may increase concerns about a recession in the country," HSBC said. "According to recent polls, the Conservative Party is a favorite of the race. However, all the scenarios are still open, anything can happen. The situation with a suspended Parliament, in which neither Conservatives or Labour will get a majority, will be the worst option for the pound," analysts said. The material has been provided by InstaForex Company - www.instaforex.com |

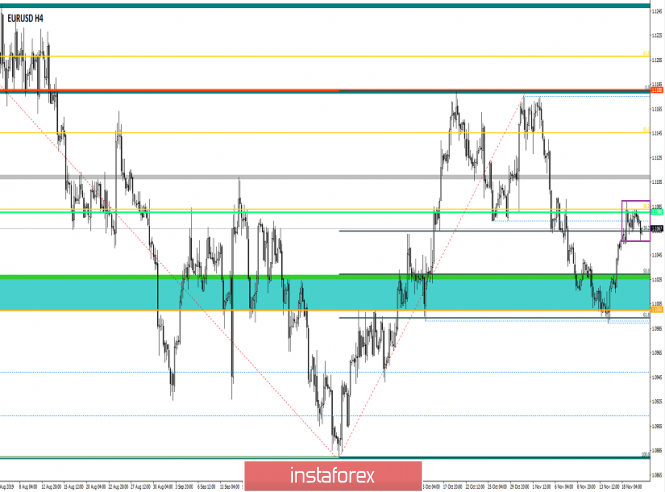

| Diary of a trader 11/20/2019 EURUSD Posted: 20 Nov 2019 03:01 PM PST As you can see from the chart above, the situation has not changed in general for the third day - the EURUSD rate is consolidating under the resistance of 1.1080 - despite a slight decrease on Wednesday, while an attempt to go higher seems more likely. The reason for the stagnation is an incomprehensible situation in the market as a whole. The US market has reached new highs - historic ones, and it is increasingly difficult to stay at these heights. Savvy investors are sitting in money/bonds - and are waiting for a good downward correction. However, other experienced ones - large funds - want to show beautiful numbers in the reports at the end of the year - and continue to drive the market up. A difficult situation. As I said earlier, it is quite possible that you will have to wait until December 11-12 for a strong movement/trend. Current situation: EURUSD. We buy at the breakout of 1.1080. We sell from 1.0985. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 Nov 2019 03:01 PM PST Trade agreement issues in the US and China have a negative impact on markets. Demand for risky assets sharply slowed following news that the signing of the "first phase" of the trade agreement could be disrupted due to a lack of compromise on both sides. Let me remind you that they still can't agree on key issues. First of all, we are talking about the abolition of trade duties, which Beijing insists on. The White House administration is demanding an increase in China's purchases of US agricultural products. Many have already managed to forget the statements of the presidential administration on October 11 that the parties reached an agreement in principle on these issues. As I noted in my morning review, as a result of this, the American leader made a number of statements yesterday that inspired pessimism in further progress and expectations. US President Donald Trump said he was very pleased with the course of trade negotiations with China, but did not disclose any details about the deal. There is no information regarding when exactly the first stage of the agreement will be signed. At the same time, Trump announced that he was ready to increase import duties if a trade agreement is not reached. Let me remind you that the parties refused to introduce new duties in December following news that the first stage of the agreement could be signed in the near future. Trump also said that China will have to conclude a deal that suits the United States. Duties will increase again if the deal is not concluded in the near future. Of course, there will be no talk about any December cancellation. Let me remind you that in October of this year, Trump proposed a scheme that includes large purchases of US agricultural products by China and a currency agreement in exchange for easing duties, which Beijing is clearly not happy with. The data released today in the morning on inflation in Germany drove the euro even further down. According to the report, the German producer price index fell by 0.2% in October this year after a slight increase of 0.1% in September. Compared to the same period in 2018, prices fell immediately by 0.6%. Economists predicted that in October, prices will remain unchanged and fall by only 0.4% compared with 2018. Weak inflation rates remain a key problem for the European Central Bank, which this summer further lowered its negative deposit rate and launched an asset buyback program, which began operating this month. This afternoon, the focus will be shifted to the October minutes of the Federal Reserve, where they decided to lower the key rate by a quarter percentage point to the range of 1.5% -1.75%. This was done for the third time this year. From today's minutes, traders want to get a guide on how the central bank will continue to operate and whether the bar will change to further ease monetary policy at the meeting scheduled for December 10-11. Let me remind you that in October, eight members of the Open Market Committee voted in favor of the rate cut. Two were against it. Judging by the statements made by the Fed representatives last week, many expect a pause in the cycle of easing monetary policy, but after a recent meeting between the US president and the Fed chairman, the likelihood of lowering rates has increased significantly. As for the technical picture of the EURUSD pair, the market is now on the side of sellers of risky assets. However, the bullish scenario can still be realized only after it is possible to overcome a high of 1.1090. This will continue the upward correction to the area of highs 1.1110 and 1.1140. However, one should not exclude the possibility of a downward correction, since a break of intermediate support at 1.1050, which is currently approaching the trading instrument, may push the pair to the lower boundary of the upward channel in the area of 1.1020. The material has been provided by InstaForex Company - www.instaforex.com |

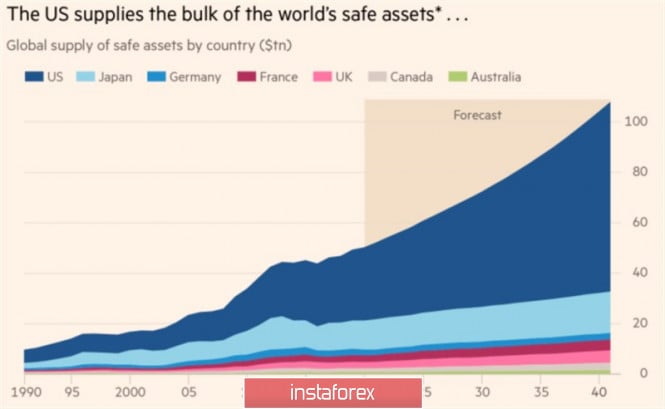

| Posted: 20 Nov 2019 03:00 PM PST Despite the fact that the sky above the gold is overcast, the fact that the rays of the sun are already beginning to break through them, XAU/USD bulls are still hopeful. Yes, US stocks are rising in response to good news from the US-China negotiating table and often ignore the negative, indicating a consistently high global risk appetite. Yes, the dollar feels confident ahead of the publication of the minutes of the October FOMC meeting. Yes, the yield on 10-year Treasury bonds still wanders around the psychologically important mark of 2%. Nevertheless, gold may have a new trump card in 2020, and the old ones should not be discounted. One of the main drivers of the XAU/USD rally in August 2018 and September 2019 was the falling rates of the global debt market. The volume of bonds traded with negative yields approached a whopping $17 trillion. Only de-escalation of the US-China trade conflict and a portion of strong macroeconomic statistics for the United States offset the situation and launched a wave of correction for precious metals. Nevertheless, bond prices depend not only on the risk appetite of investors, but also on the balance sheet. According to studies by Oxford Economics, over the next five years, the volume of debt issuance will increase by $1.7 trillion. Of these, $1.2 trillion will come from the United States. Demand is estimated to be higher by an average of $400 million, and the deficit will push prices up, and yields down, which is very good news for gold. Debt issuance dynamics TD Securities predicts that in 2020 financial markets will face increased volatility due to increased US political risks. Donald Trump may not be re-elected to the presidency of the United States, and an increase in the likelihood of such an outcome on the eve of the election will lead to a correction in stock indices and also to strengthen the position of gold. By the way, large-scale sales of US stocks can start as early as 2019, if Washington and Beijing do not sign a trade agreement. The owner of the White House for the second time in the last few days threatened China with a massive increase in tariffs if Xi Jinping refuses to sign the agreement. Thanks to a pause in the process of the Fed's preventive reduction, the federal funds rate received trumps from the US dollar. Nevertheless, as early as 2020, the situation could radically change. The cessation of the trade war will be a good thing to those economies that have suffered more from it. First of all, we are talking about Germany and the eurozone. Restoring the GDP of the currency bloc will force investors to actively buy the euro, which will lead to a correction in the USD index and will lend a helping hand to the bulls on XAU/USD. Technically, the future fate of gold will depend on the assault on resistance at $1,475 an ounce. If the bulls manage to return quotes within the previous consolidation range of $1475- $1515, the risks of an upward trend recovery will increase. On the contrary, the rebound will create the prerequisites for the development of correction in the direction of $1435-1440. The material has been provided by InstaForex Company - www.instaforex.com |

| At the turning point: the euro could turn into stablecoin Posted: 20 Nov 2019 03:00 PM PST The contact of the two worlds - the traditional financial market and the cryptocurrency sphere - is difficult to implement in reality. The market already encountered obstacles when it tried to give Bitcoin the status of a fiat currency. Some enthusiasts want to conduct a similar experiment with the euro, which could turn the entire financial market. Recently, the European currency has been very turbulent. It experienced serious volatility due to problems with a slowdown in the eurozone economy and the UK's exit from the EU. At the moment, the situation has stabilized, but experts fear a more serious flurry of economic and geopolitical difficulties that could completely undermine the euro. One of the former employees of Deutsche Bank proposes to create a digital euro as an alternative to the fiat single currency. The first step towards innovation could be the introduction of a bank deposit, fully secured by the ECB. The regulator could get the money needed to cover the deposit by purchasing outstanding eurozone government bonds. In the future, this deposit will become the digital money of the central bank. They will be transferred both from one private person to another, and from company to company using blockchain technology. Some analysts believe that in this case, the euro will become a stable cryptocurrency (stablecoin), fully secured by government bonds. Only the ECB will be responsible for issuing these means of payment. The regulator has the function of protecting new money from any fraud. The money supply will be able to increase due to the further purchase of state bonds, the former chief economist of Deutsche Bank said. At the same time, it is necessary to assess the development prospects of both the eurozone and the single currency. In such a situation, the money supply of the digital euro will increase taking into account the expected growth potential of the eurozone economy. The advent of digital euro will radically change the work of commercial banks. Their functions will be reduced to accepting deposits from the public and issuing loans to investors. The work of banks will become identical to the activities of investment funds. The activities of the regulator will also undergo revolutionary changes. The central bank will no longer be able to use interest rates to manage the creation of credit money, experts said. The transition to a virtual euro currency will help reduce the debts of the eurozone states, as well as protect the euro itself from unnecessary shocks. A serious side effect of this transition may be the fact that the market will lose government bonds worth €7 trillion. At the same time, the public debt of all eurozone countries will fall below 25% of gross domestic product. Thanks to this, each country will be able to conduct a reasonable fiscal policy. According to preliminary estimates, the digital euro issued by the ECB and provided with the means of the regulator will be much stronger than usual. An innovative currency will be able to compete not only with the dollar, but also with other digital assets. In the future, it will be able to achieve the status of a global reserve currency, the former representative of Deutsche Bank said. The new single currency, which appeared at the intersection of tradition and innovation, could take the best of both worlds. It is assumed that the digital euro will be characterized by the reliability of fiat currencies, as well as flexibility and openness to the new - qualities inherent in virtual assets. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 Nov 2019 02:59 PM PST The future of the British currency is very controversial, experts said. A pound pendulum can swing both in the direction of growth and decline. However, most analysts believe in the victory of the pound, which occasionally proves itself in full force. The actively growing sterling slightly slowed down on Tuesday, November 19. The GBP/USD pair reached 1.2945, but after a while it fell. The pair began a smooth fall last night, dropping to 1.2940. Earlier, the GBP/USD pair was pushed up by the positive attitude of investors who believed in the upcoming victory of the Conservative Party in the December elections. Recall, in the case of the implementation of such a scenario, a deal with the EU regarding Brexit, initiated by Prime Minister Boris Johnson, may receive approval in Parliament. The deal can be considered done if the Conservatives win, experts said. According to opinion polls, the likelihood of such a scenario is very high. One of the drivers for the pound's growth may be an increase in budget spending. Similar plans are being developed by two key UK parties - Conservatives and Laborites. Recall that these parties promised to increase government spending ahead of the general elections scheduled for December 12, 2019. According to analysts of the largest bank JP Morgan, this can cause a rapid increase in government bond yields. In case the yield of state bonds increase, one can expect the national currency to grow the bank emphasizes. A similar situation will be in the hands of the pound, which slightly lost yesterday's supply of vigor. The pound was trading in the low range of 1.2908–1.2909 on Wednesday morning, November 20, making timid attempts to rise. According to analysts, a slight decrease in the GBP/USD pair may be corrective. They allow a slight drop after eight days of almost continuous rise. At the moment, the pound is trying to move up, although it lacks momentum. The GBP/USD pair runs in the range of 1.2913-1.2914, trying to stay on the conquered positions. Experts consider the psychologically important bar of 1.3000 as the pair's immediate target. The sterling was close to it yesterday as never before, but could not overcome this barrier. Unfortunately, it had to retreat, but experts are sure that this pullback is temporary. The current dynamics of the British currency is not too volatile, but from time to time there are strong differences. Most likely, the upcoming elections will enhance this effect, but the pound is determined to hold on to the last and not give up its positions. The market is counting on the success of the sterling, keeping its finger on the pulse in anticipation of future changes. The material has been provided by InstaForex Company - www.instaforex.com |

| Ichimoku cloud indicator short-term analysis of EURUSD for November 20, 2019 Posted: 20 Nov 2019 09:42 AM PST EURUSD is trading at 1.1061 after getting rejected at the upper cloud boundary resistance. EURUSD has yet not managed to push above the 4 hour cloud and this is another bearish sign. EURUSD bulls need to reclaim 1.11 in order for short-term trend to change to bullish.

|

| Technical analysis of Gold for November 20, 2019 Posted: 20 Nov 2019 09:37 AM PST Gold price reached $1,478 today but price could not stay for long above the 38% Fibonacci retracement resistance. This is a sign of weakness. Price is now trading below this resistance at $1,467. Gold price is pulling back towards short-term support of $1,464 but as long as price is above $1,455 we could see another move higher towards $1,490. Medium-term trend remains bearish as long as price is below $1,500-$1,525.

Gold price is making higher highs and higher lows in the 4 hour chart after bottoming below $1,450. We warned bears then that a bounce was coming. This bounce might yet be not finished. We could see price move towards the 61.8% Fibonacci retracement level. This bounce is considered a selling opportunity. I'm bearish Gold as long as we trade below $1,500. The material has been provided by InstaForex Company - www.instaforex.com |

| November 20, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 20 Nov 2019 09:14 AM PST

Few weeks ago, Further Bullish advancement was demonstrated towards 1.2650 then 1.3000 after the neckline of the depicted Double-Bottom pattern (1.2400-1.2415) was breached to the upside. Since October 21, the GBP/USD pair has failed to achieve a persistent bullish breakout above the depicted SUPPLY-zone (1.2980-1.3000) which corresponds to a previous Prominent-TOP that goes back to May 2019. Moreover, an ascending wedge reversal pattern was confirmed on October 22. This indicated a high probability of bearish reversal around the mentioned price zone. Hence, a quick bearish movement was anticipated towards 1.2780 (Key-Level) where bullish recovery was recently demonstrated on two consecutive visits. Recent bullish rejection around the price levels of 1.2780 indicated another bullish movement towards 1.2980-1.3000. Since then, the GBP/USD pair has been trapped between the mentioned price levels (1.2780-1.2980) until now. Technical outlook remains bearish as long as consolidations are maintained below 1.3000 on the H4 chart. Moreover, negative divergence is being demonstrated on the H4 chart. That's why, high probability of bearish rejection exists around the price levels 1.2980-1.3000. A quick bearish breakout below 1.2875 (short-term uptrend) is needed to enable further bearish decline towards 1.2780 where a better decision can be taken upon recent price action. The material has been provided by InstaForex Company - www.instaforex.com |

| November 20, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 20 Nov 2019 09:07 AM PST

On October 2, an Inverted Head & Shoulders reversal Pattern was confirmed after a bullish breakout above 1.0940 (neckline) was achieved. This enabled further bullish advancement towards (1.1000 -1.1020) maintained above the depicted bullish trend. On October 7, temporary sideway consolidation range was demonstrated between the price levels of (1.1000 -1.0940) before further bullish movement was resumed towards 1.1175 where significant bearish rejection was originated. The price zone around (1.1175 - 1.1190) stood as a significant SUPPLY-Zone that demonstrated bearish rejection for two consecutive times in a short-period. Hence, a long-term Double-Top pattern was demonstrated with neckline located around 1.1075-1.1090 which offered valid bearish positions two weeks ago. That's why, further bearish decline was executed towards 1.1025 and 1.0995 where the current bullish rejection was demonstrated. Recently, another episode of bullish pullback was being demonstrated towards 1.1065-1.1085 where a cluster of supply levels are located (61.8% Fibo - 50% Fibo levels). The current price levels 1.1065-1.1085 is demonstrating early bearish rejection and another valid SELL entry can be taken here. Estimated initial bearish targets are located at 1.1020 and 1.1000. Please note that any bullish breakout above 1.1110 invalidates the mentioned bearish scenario allowing further bullish advancement towards 1.1150. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 11.20.2019 - Watch for selling oportunites on the rallies Posted: 20 Nov 2019 06:22 AM PST BTC has been trading sideways in past 24 hours and I do expect more downside but after the rally. My advice is to watch for sell zone around $8.240-$8.300 with the target at the price of $7.500.

The short-term trend is still downside and there is no indication of any reversal yet, which is clear indication that sellers are in control. Downward sloping trend line would act like resistance and you should pay attention to that. MACD oscillator is showing negative reading below the zero and slow line is in negative territory, which adds more downside potential. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 11.20.2019 - Rejection of the main multi-pivot resistance at $1.480, downside in play Posted: 20 Nov 2019 05:57 AM PST Gold did reach main multi pivot resistance (swin

g lows became resistance) at the price of $1.478 and got solid rejection of it. There is the chance for the further downside movement and potential test of $1.457. There resistance cluster (blue rectangle) at the price of $1.478 held successful and my advice is to watch for selling opportunities with the downward targets at $1.457 and $1.446. According to the Daily time-frame, there is potential for bear flag and further downside continuation. Only in case of the upside breakout of resistance at $1.480, I would watch for buying opportunities with the target at $1.493. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 Nov 2019 05:47 AM PST EUR/USD rejected of our major resistance at the

price of 1.1080 that we mentioned yesterday. Yesterday was the NR7 (narrowest daily range in past 7 days) and today we got down break. Due to strong rejection of our main pivot resistance at 1.1080, we do expect further downside and potential test of the support at 1.1000. Watch for selling opportunities on the rallies on the lower frames 5/15 minute time-frames to better time your entries. Today is the FOMC day and you should be extra careful with positing sizing. My advice is to establish short position with the potential target at 1.1000 and max stop loss at 1.1090 The material has been provided by InstaForex Company - www.instaforex.com |

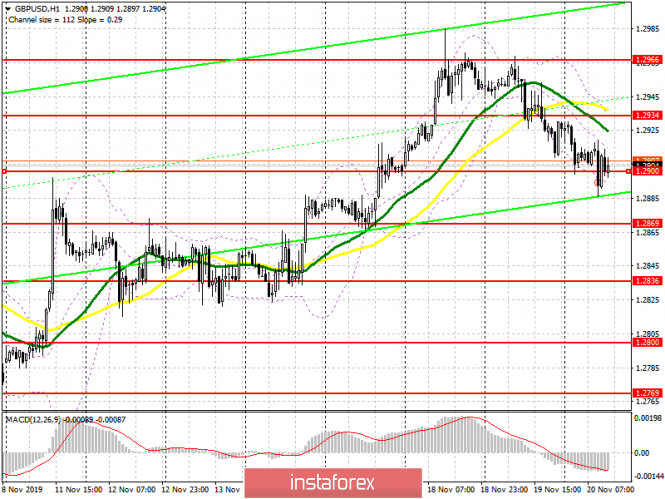

| Posted: 20 Nov 2019 04:36 AM PST To open long positions on GBP/USD, you need: In the first half of the day, sellers of the British pound took advantage of negative news related to the US-China trade agreement and tried to break below the support of 1.2900, but buyers are still desperately fighting for this level. Given that there was no active upward movement from this range after the formation of a false breakdown, I recommend to postpone new purchases of GBP/USD until the update of the larger lows of 1.2869 and 1.2836. The main objective of the bulls remains the resistance of 1.2934, as only a return to it will lead to the formation of a new upward trend in the area of the highs of 1.2966 and 1.3017, where I recommend fixing the profits. In the afternoon, the focus will be shifted to the Fed minutes, so it is possible to put pressure on the US dollar and the strengthening of the pound closer to the middle of the North American session. To open short positions on GBP/USD, you need: Sellers coped with the task for the first half of the day and tried to gain a foothold below the support of 1.2900, but the resistance of the bulls and the lack of fundamental statistics do not allow to form a larger downward trend. The more there is no upward movement from the level of 1.2900, the higher the probability that the pound will continue to decline. Fixing below the level of 1.2900 in the second half of the day may lead to a larger downward correction in the support area of 1.2869 and 1.2836, where I recommend taking the profits. However, a more powerful downward movement will depend on the Federal Reserve minutes and the situation with the future of US interest rates. In the scenario of an upward correction of GBP/USD, it is best to consider short positions after the formation of a false breakdown in the resistance area of 1.2934 or sell for a rebound from the maximum of 1.2966. Indicator signals: Moving Averages Trading is below the 30 and 50 day averages, which indicates a possible further decline in the pound in the short term. Bollinger Bands If the pound rises, the upward correction will be limited to the upper level of the indicator around 1.2935.

Description of indicators

|

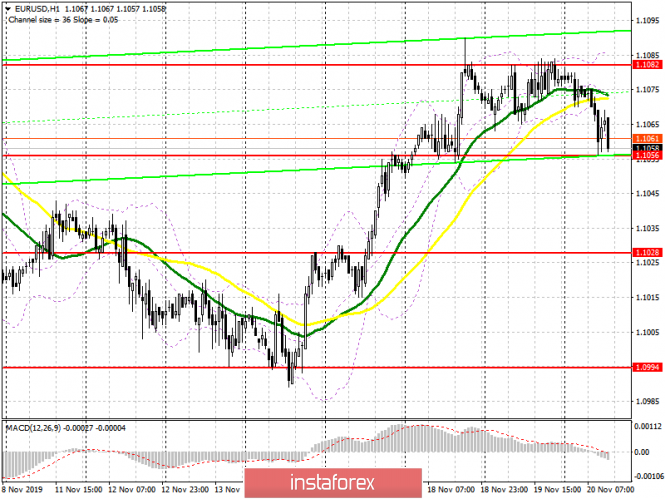

| Posted: 20 Nov 2019 04:15 AM PST To open long positions on EURUSD, you need: The euro fell in the first half of the day against the US dollar after the release of a report on German producer prices, which in October this year decreased by 0.2% compared to September, indicating continued problems. Yesterday's statements by Donald Trump about the agreement and the introduction of new trade duties also dampened risk appetite and reduced demand for the European currency, returning the EUR/USD pair to the lower border of the side channel of 1.1056. Buyers of the euro have already made a successful attempt to keep this level, but rapid growth is not yet observed, which ultimately can keep the downward trend. A more important task is to break through and consolidate above the resistance of 1.1082, as only this will keep the upward trend and lead to an update of the highs in the area of 1.109 and 1.131, where I recommend taking the profits. In the afternoon, we are waiting for the publication of the Fed minutes, which may already weaken the position of the US dollar. In the scenario of a further decline in EUR / USD, you can only look at the rebound from the minimum of 1.1028. To open short positions on EURUSD, you need: Sellers coped with the morning task and reached the support level of 1.1056, however, it was not possible to gain a foothold below this range. Most likely, the emphasis will be shifted to the Federal Reserve System protocols, and if there is no talk of further lowering interest rates in the USA, then a break of the support of 1.1056 will push the pair even lower to the lows of 1.1028 and 1.0994, where I recommend taking the profit. However, it will be possible to talk about the formation of a new downward trend only if the support breaks 1.1028. If the demand for the euro returns today in the first half of the day, it is best to return to short positions on a false breakdown of the resistance of 1.1082, but you can sell EUR/USD on a rebound from the maximum of 1.1109, or sell the euro even higher – from the level of 1.1131. Indicator signals: Moving Averages Trading is just below the 30 and 50 moving averages, but it is too early to talk about the exact alignment of the downward correction. Bollinger Bands A break of the lower border of the indicator in the area of 1.1056 will lead to a larger sale of the euro, but growth will be limited by the upper level in the area of 1.1090.

Description of indicators

|

| Trading recommendations for the EURUSD currency pair – placement of trade orders (November 20) Posted: 20 Nov 2019 03:29 AM PST The control level of the first stage plays the role of resistance, extremely slowing down the quote, what it led to and what else to expect – you will find answers to these and many other questions in the article. From technical analysis, we see a rather sharp stop of the quote at the moment of convergence with the range level of the first stage of the recovery of 1.1080. What do we have? Two-day accumulation in an extremely narrow framework of 1.1065/1.1085, where the quote showed extremely low volatility and almost no trading volumes. That is, we had all the signs of readiness of market participants for future actions. What happens if the range level of 1.1080 so firmly took its positions, and traders who have previously opened purchase transactions switched to massive fixations due to the increased risk of a rebound, then the fact that the recovery phase has been preserved is confirmed, which cannot but rejoice. It remains for small – to return to the market a sufficient number of sellers who will be able to send the quote back to the stage #2 in the face of the psychological level of 1.1000, and here we are faced with not quite a stable emotional background of the market. So, market participants are not experiencing the best period due to the massive flow of information that feeds them day after day not by facts, but by ambiguous judgments that do not allow them to form an understanding of the future in terms of strategic moves. Against this background, the dynamics of volatility decreases disappointingly, and we can no longer overcome even the daily average, and the work is mostly carried out on low fluctuations. Analyzing hourly the past day, we see the accumulation of all in the same framework of 1.1065/1.1085, where the structure of the movement has in its composition an extremely large number of candles like "Doji", which once again confirmed the indecision and a kind of readiness. As discussed in the previous review, speculators closely followed the framework of 1.1065/1.1080, working on the method of identifying momentum and touching the necessary areas for the production of trading operations. No deals were opened. Looking at the trading chart in general terms (the day), we see that the recovery process relative to the oblong correction was at risk of fracture, but the level of 1.1080 still managed to hold the quote, and we are again at 33% recovery. The main downward trend of EURUSD sets the market interest, but for how long will the strategic positions last, there is no clear answer to this question yet. The news background of the last day had data on the volume of production in the construction sector of the European Union, where they expected acceleration to 2.7%, and received a slowdown to -0.7% for September. In the afternoon, data on the construction sector in the United States were released, where the statistics were even better than expected. So, the number of issued building permits shows an increase of 5%, and the volume of construction of new homes has 3.8%. The market reaction, as you may have guessed, was absent, probably due to the characteristic wariness and the influence of the restraining information background. So, US President Donald Trump once again contributed to the contention between US-Chinese trade relations. Yesterday, Mr. President told reporters at a meeting of his cabinet in the White House that, as it were, everything is fine in the negotiations, but China does not agree to conclude a deal, then duties will continue to increase. "China is interested in a deal that I like. If not, then no. I am now very pleased with China. We have a lot of money for our farmers, I help people. I have a good relationship with China. Let's see what happens. If we don't conclude a deal, I will raise duties even higher," Donald Trump said. Blackmail, you say, no way, diplomacy in the American way. Thus, one should not be surprised that the process of concluding a transaction will be delayed for an indefinite period, although many media sources predicted the deal in the spring of 2018, then in the spring of 2019, in the fall of 2019, etc., this is almost the same as with the Brexit deal, just a little on a different level. What to say, we follow the processes and try to be on time. As for everyone beloved by Brexit, fear reignited here that Jerome Corbyn could win the British parliamentary elections, who would try to prevent the deal with the EU from going forward, thereby delaying the country's exit for an indefinite period. Such a conclusion was reached by experts after yesterday's television debate, where Boris Johnson overtook his opponent Corbyn by only two percent during a vote among interviewed viewers. Let me remind you that Corbyn is not enthusiastic about the deal that the Prime Minister concluded, and if he wins the election on December 12, he will set the goal of agreeing on a new deal with the EU in three months and submitting this deal to the people for six months. Now, we understand the kind of pressure that was present in the market, where at first everyone was rosy about Johnson's early victory in the elections and the conclusion of a deal with the EU, and now the probability of a conservative victory has decreased and the risk, like the fear of failure of another Brexit deal, has increased. n the end, a few words about one more news, yesterday the US Senate unanimously adopted its version of the bill on "Protecting Human Rights and Democracy in Hong Kong." This bill is an open interference in the affairs of Hong Kong and the internal affairs of China, which may, as a fact, affect American-Chinese relations. Today, in terms of the economic calendar, we have the publication of the minutes of the meeting of the Federal Committee for Open Market Operations, which may arouse the interest of market participants. The interest lies in the fact that such a rapid decrease in the refinancing rate unnecessarily scared investors, and now everyone needs specifics in the regulator's further actions. Further development Analyzing the current trading chart, we see that the framework of 1.1065/1.1080, which restrains the interest of speculators, was broken in the downward direction, but the area of 1.1060/1.1055 was never closed. Thus, the main trading volumes have not passed, and conditionally we continue to be within the accumulation. In terms of volatility, a slight acceleration was recorded, but in a quarter of capacity, thus there is still a chance of acceleration, but I would like to correct that it is possible within the average. By detailing the available time interval, we see that a surge of activity occurred at the start of the European trading session, where to this day one feels a kind of energy in terms of actions, which can play into the hands of private market participants. In turn, some speculators could not stand it and have already entered into short positions, while other market participants more rationally assess the existing fluctuation, and the entry will be made after fixing the price below the area of 1.1060/1.1055, as it was originally designated. Alternative positions are still being considered since the quote is still within the accumulation. It is likely to assume that some kind of fluctuation within the accumulation boundaries is still possible, where the goal for traders is in terms of identifying the price-fixing point. So, to resume the recovery process, we need to conditionally work out the range level of 1.1080, fixing lower than 1.1060/1.1055. The reversal of the recovery process will signal a price fixation higher than 1.1080 and a price exit higher than the area of 1.1095/1.1100, where the price will rush to the peak of 1.1180. Based on the above information, we derive trading recommendations:

Indicator analysis Analyzing different sector timeframes (TF), we see that at this time there is a distinct divergence in trading interests in connection with the existing stage of accumulation, where almost all technical indicators confirm this. Volatility per week / Measurement of volatility: Month; Quarter; Year. Measurement of volatility reflects the average daily fluctuation, calculated for the Month / Quarter / Year. (November 20 was built taking into account the time of publication of the article) The volatility of the current time is 25 points, which is close to low than average. It is likely to suggest that acceleration in terms of volatility is still possible, but clear flights regarding the accumulation framework are needed, perhaps the FOMC protocol will give activity to the market. Key levels Resistance zones: 1.1080**; 1.1180* ; 1.1300**; 1.1450; 1.1550; 1.1650*; 1.1720**; 1.1850**; 1.2100. Support zones: 1.1000***; 1.0900/1.0950**; 1.0850**; 1.0500***; 1.0350**; 1.0000***. * Periodic level ** Range level *** Psychological level ***** The article is based on the principle of conducting transactions, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of AUD/USD for November 20, 2019 Posted: 20 Nov 2019 02:30 AM PST Overview: The AUD/USD pair will keep moving downwards from the level of 0.6859 (this level coincides with the 61.8% of Fibonacci retracement levels in H1 chart). Accordingly, the Aussie is going to show signs of strength at the lowest price of 0.6820. Thus, it will be a good deal to sell below the level of 61.8% of Fibonacci retracement levels on H1 chart with the first target at 0.6771 and further at 0.6726. Equally important, 0.6726 will be acting as a strong support so it is going to be a good place to take profit, it also should be noted that this level of taking profit will coincide with around last bearish wave. On the other hand, in case a reflection takes place and the AUD/USD pair is not able to break through the resistance at the 0.6820 level, the market will further decline to 0.6726 in order to indicate a bearish market. Indicators: Additionally, the RSI is still calling for a strong bearish market as well as the current price is also below the moving average 100. Trading recommendations: According to previous events, the AUD/USD pair has still been trapped between the level of 0.6859 and the 0.6726 level (those levels coincided with the fibonacci retracement levels 61.8% and last bearish wave respectively). It should be noted that the 0.6914 price (around double top at the level of 0.6914) will act as a strong resistance on November 7, 2019. Therefore, it will be too gainful to sell short below 0.6859 and look for further downside with 0.6771 and 0.6726 targets. It should also be reminded that stop loss must never exceed the maximum exposure amounts. Thus, stop loss should be placed at the 0.6914 level today. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 20 Nov 2019 01:09 AM PST EUR/USD – 4H.