Forex analysis review |

- #USDX vs EUR/USD vs GBP/USD vs USD/JPY - DAILY. Comprehensive analysis of movement options for November 26, 2019. APLs &

- Fractal analysis of the main currency pairs on November 26

- Technical analysis recommendations for EUR/USD and GBP/USD on November 25

- Developing USD/CAD pair and trading idea

- Pound: under pressure due to upcoming elections

- Goldman expects dollar to moderately weaken and prefers the pound

- Dollar will not stand for the price

- Pound lost the battle, but it won the war

- EUR/USD. November 25. Results of the day. The US currency needs new reasons to continue growth

- GBPUSD. Recent polls support the pound: Conservatives increase their lead from the Labour party

- GBP/USD. November 25. Results of the day. An insufficiently convincing Conservative victory could pull down the pound by

- BTC 11.25.2019 - Second target at the price of $6.547 has been met, watch for selling on the rallies

- Analysis and forecast for EUR/USD on November 25, 2019

- Fractal analysis for major currency pairs on November 25

- Evening review of EURUSD 11/25/2019

- GBP/USD: plan for the American session on November 25. Do not write off the sellers of the pound from the accounts

- EUR/USD: plan for the American session on November 25. The euro will continue to decline but subject to the breakdown of

- Trading idea for AUDUSD

- Preview of the trading week of October 25-29 on EUR/USD. The euro's hopes are in reports on long-term orders in the US and

- Preview of the trading week of October 25-29 on GBP/USD. Only Jerome Powell's performance and a few reports in the US can

- Simplified wave analysis of EUR/USD, AUD/USD, and GBP/JPY on November 25

- GBP/USD 11.25.2019 - Watch for breakout of the well defined balance

- November 25, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- November 25, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- Gold 11.25.2019 - Strong bullish divergence near the important support at $1.456

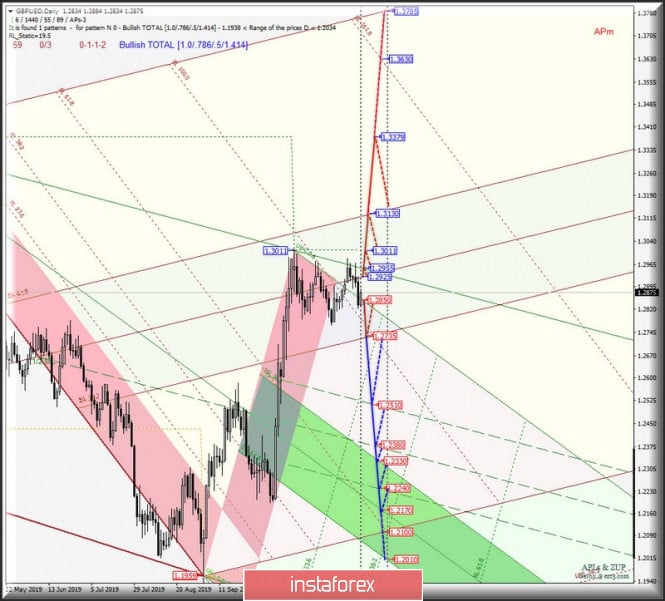

| Posted: 25 Nov 2019 06:58 PM PST It is the last week of autumn - what's next? Variants of movement of the main currency instruments - #USDX, EUR/USD, GBP/USD and USD/JPY - DAILY in a comprehensive form on November 26, 2019 Minor operational scale (Daily time frame) ____________________ US dollar Index From November 26, 2019, the development of the movement of the dollar index #USDX will be determined by the direction of the breakdown of the range :

In case of breakdown of the resistance level 98.65 by 1/2 Median Line Minor, the movement of the dollar index can continue to the upper boundary of the 1/2 Median Line channel (99.00) of the Minor operational scale forks and the boundaries of the equilibrium zone (99.20 - 99.60 - 100.00) of the Minuette operational scale forks. On the contrary, the breakdown of the lower boundary of the 1/2 Median Line channel (support level 98.30) of the Minor operational scale fork will make it urgent to resume the downward movement of #USDX to the SSL start line (98.05) of the Minuette operational scale fork and to the boundaries of the equilibrium zone (97.55 - 96.90 - 96.30) Minor operational scale fork. The markup of #USDX movement options from November 26, 2019 is shown on the animated chart. ____________________ Euro vs US dollar The direction of the breakdown of the range :

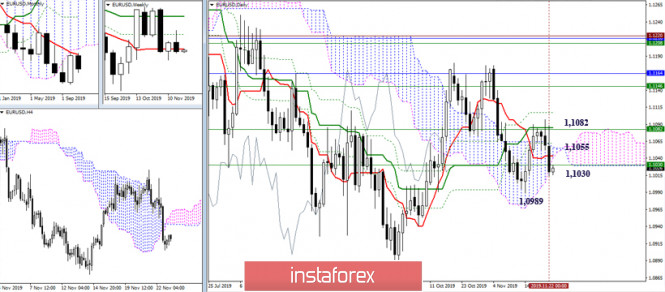

will determine the further development trend of the movement of the single European currency EUR/USD from November 26, 2019 The breakdown of the support level of 1.0980 will determine the development of the EUR / USD movement in the 1/2 Median Line channel (1.0980 - 1.0935 - 1.0890) and the equilibrium zone (1.0890 - 1.0845 - 1.0790) of the Minuette operational scale forks. Meanwhile, the breakdown of the resistance level of 1.1055 (the initial SSL line of the Minuette operational scale forks) will determine the development of the upward movement of the single European currency to the goals: the control line UTL Minuette (1.1105) - the 1/2 Median Line Minor (1.1130) - local maximum 1.1180, with the prospect of reaching the upper limit of ISL38 .2 (1.1405) equilibrium zones of the Minor operational scale forks The details of the EUR / USD movement options from November 26, 2019 are shown on the animated chart. ____________________ Great Britain pound vs US dollar Starting November 26, 2019, the development of Her Majesty's GBP / USD currency movement will continue based on the breakdown direction of the range :

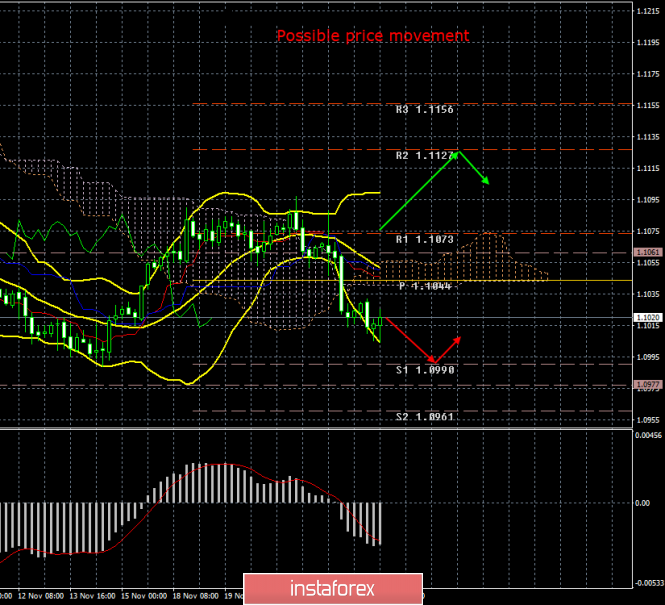

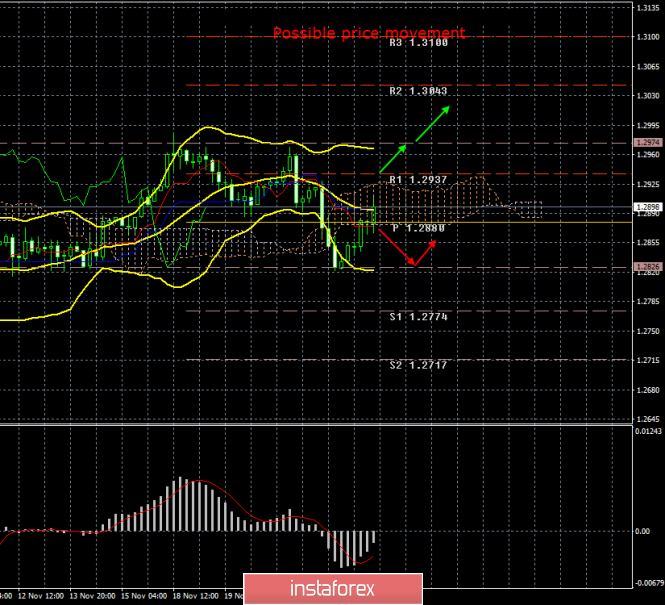

The break of the support level 1.2850 (the starting line of the SSL Minuette operational scale forks) - a variant of the downward movement of GBP / USD to the lower boundary ISL38.2 (1.2735) equilibrium zone of the Minor operational scale forks and the breakdown thereof, it will be possible for the instrument to reach the price boundaries channel 1/2 Median Line (1.2510 - 1.2380 - 1.2240) and equilibrium zones (1.2330 - 1.2170 - 1.2010) of the Minuette operational scale forks. Consecutive breakdown of resistance levels : - 1.2925 - 1/2 Median Line Minor; - 1.2955 - control line UTL of the Minuette operational scale forks; - 1.3011 - local maximum; will make it possible to continue the development of the upward movement of Her Majesty's currency to the upper boundary of ISL61.8 (1.3130) of the equilibrium zone of the Minor operational scale forks with the prospect of updating maximum 1.3630. The details of the GBP/USD movement from November 26, 2019 can be seen on the animated chart. ____________________ US dollar vs Japanese yen The development of the currency of the "country of the rising sun" USD / JPY from November 26, 2019 will also depend on the direction of the breakdown of the range:

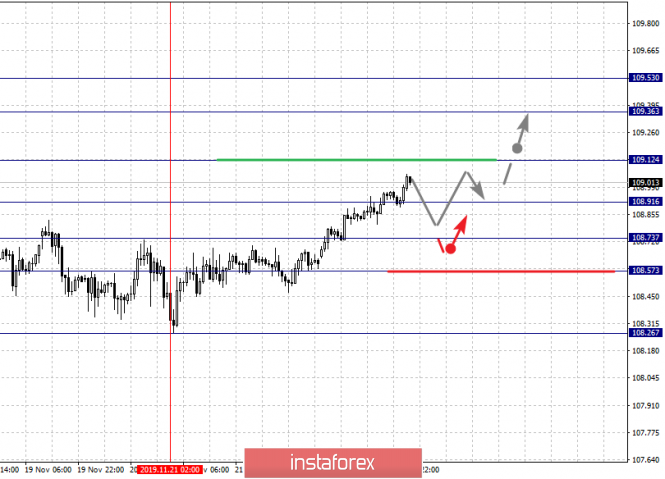

Combined breakdown of resistance levels : - 109.30 - 1/2 Median Line Minor; - 109.55 - control line UTL of the Minuette operational scale forks; will make it possible to develop the movement of the currency of the "land of the rising sun" to the upper boundary of ISL61.8 (110.30) of the equilibrium zone of the Minor operational scale forks with the prospect of updating maximum 112.42. On the other hand, the breakdown of the support level of 108.85 (the initial SSL line of the Minuette operational scale forks) will direct the movement of USD / JPY to the lower boundary of the ISL38.2 (108.25) equilibrium zone of the Minor operational scale forks, during which the breakdown of the downward movement of this currency instrument can continue to the boundaries of the 1/2 Median Line channels of the Minuette operational scale forks (107.70 - 107.10 - 106.50) and Minor (107.10 - 106.30 - 105.55). We look at the details of the USD / JPY movement on the animated chart. ____________________ The review is made without taking into account the news background. Thus, the opening of trading sessions of the main financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index : USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of the currencies in the basket: Euro - 57.6% ; Yen - 13.6% ; Pound Sterling - 11.9% ; Canadian dollar - 9.1%; Swedish Krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the start date of the countdown - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

| Fractal analysis of the main currency pairs on November 26 Posted: 25 Nov 2019 05:37 PM PST Forecast for November 26: Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1053, 1.1034, 1.1023, 1.1004, 1.0986, 1.0977 and 1.0957. Here, we are following the development of the downward structure of November 21. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.1004. In this case, the target is 1.0986. Price consolidation is in the range of 1.0986 - 1.0977. For the potential value for the bottom, we consider the level of 1.0957. Upon reaching this value, we expect a rollback to the top. Short-term upward movement is expected in the range 1.1023 - 1.1034. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 1.1053. This level is a key support for the downward structure. The main trend is the downward structure of November 21. Trading recommendations: Buy: 1.1023 Take profit: 1.1034 Buy: 1.1036 Take profit: 1.1050 Sell: 1.1004 Take profit: 1.0988 Sell: 1.0975 Take profit: 1.0958 For the pound / dollar pair, the key levels on the H1 scale are: 1.2969, 1.2932, 1.2899, 1.2817, 1.2765, 1.2710 and 1.2671. Here, we are following the formation of the initial conditions for the downward cycle of November 21. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.2817. In this case, the target is 1.2765. Price consolidation is near this level. The breakdown of the level of 1.2765 will lead to a pronounced movement. Here, the target is 1.2710. For a potential value for the bottom, we consider the level of 1.2671. Upon reaching which, we expect consolidation, as well as a rollback to the top. Short-term upward movement is possibly in the range of 1.2899 - 1.2932. The breakdown of the latter value will lead to the formation of an upward structure. Here, the potential target is 1.2969. The main trend is the formation of the downward structure of November 21. Trading recommendations: Buy: 1.2900 Take profit: 1.2930 Buy: 1.2933 Take profit: 1.2969 Sell: 1.2815 Take profit: 1.2770 Sell: 1.2763 Take profit: 1.2710 For the dollar / franc pair, the key levels on the H1 scale are: 1.0039, 1.0023, 1.0000, 0.9988, 0.9956, 0.9938 and 0.9919. Here, we are following the development of the ascending structure of November 18. Short-term upward movement is expected in the range 0.9988 - 1.0000. The breakdown of the last value will lead to a pronounced movement. Here, the target is 1.0023. We consider the level of 1.0039 to be a potential value for the top; upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 0.9956 - 0.9938. The breakdown of the last value will lead to an in-depth correction. Here, the target is 0.9919. The main trend is the upward structure of November 18. Trading recommendations: Buy : 0.9988 Take profit: 1.0000 Buy : 1.0003 Take profit: 1.0023 Sell: 0.9956 Take profit: 0.9940 Sell: 0.9937 Take profit: 0.9920 For the dollar / yen pair, the key levels on the scale are : 109.53, 109.36, 109.12, 108.91, 108.73, 108.57 and 108.26. Here, we are following the formation of the ascending structure of November 21. Short-term upward movement, as well as consolidation, are expected in the range of 108.91 - 109.12. The breakdown of the level of 109.12 should be accompanied by a pronounced upward movement. Here, the goal is 109.36. For the potential value for the top, we consider the level of 109.53. Upon reaching this value, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement, as well as consolidation, is expected in the range 108.73 - 108.57. The breakdown of the latter value will favor the formation of a downward structure. Here, the potential target is 108.26. The main trend: the formation of the ascending structure of November 21. Trading recommendations: Buy: 109.13 Take profit: 109.34 Buy : 109.37 Take profit: 109.53 Sell: 108.70 Take profit: 108.60 Sell: 108.54 Take profit: 108.30 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3404, 1.3387, 1.3355, 1.3334, 1.3298, 1.3278 and 1.3250. Here, we are following the ascending structure of November 19. Short-term upward movement is expected in the range of 1.3334 - 1.3355. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 1.3387. Price consolidation is in the range of 1.3387 - 1.3404, and from here, we expect a correction. Consolidated movement is possibly in the range of 1.3298 - 1.3278. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.3250. This level is a key support for the upward structure. The main trend is the upward structure of November 19, the correction stage. Trading recommendations: Buy: 1.3335 Take profit: 1.3355 Buy : 1.3357 Take profit: 1.3385 Sell: 1.3276 Take profit: 1.3252 Sell: 1.3248 Take profit: 1.3220 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6833, 0.6814, 0.6799, 0.6787, 0.6767, 0.6748, 0.6735 and 0.6717. Here, we are following the development of the downward structure of November 19. The continuation of the movement to the bottom is expected after the breakdown of the level of 0.6765. In this case, we expect a pronounced movement to the level of 0.6748. Price consolidation is in the range of 0.6748 - 0.6735. We consider the level of 0.6717 to be a potential value for the bottom; upon reaching this value, we expect a correction. Short-term upward movement is expected in the range of 0.6787 - 0.6799. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.6814. This level is a key support for the downward trend. The main trend is a local descending structure of November 19 Trading recommendations: Buy: 0.6787 Take profit: 0.6797 Buy: 0.6800 Take profit: 0.6814 Sell : 0.6766 Take profit : 0.6750 Sell: 0.6746 Take profit: 0.6736 For the euro / yen pair, the key levels on the H1 scale are: 121.12, 120.58, 120.35, 120.11, 119.60, 119.31, 118.96, 118.70 and 118.38. Here, we are following the formation of the downward structure of November 21. Short-term downward movement is expected in the range 119.60 - 119.31. The breakdown of the latter value will lead to a pronounced movement. Here, the target is 118.96. Short-term downward movement, as well as consolidation is in the range of 118.96 - 118.70. For the potential value for the bottom, we consider the level of 118.38. Upon reaching this value, rollback to the top. Short-term upward movement is expected in the range of 120.11 - 120.35. The breakdown of the latter value will lead to the formation of a local structure for the top. Here, the first goal is 120.58. The main trend is the formation of the downward structure of November 21 Trading recommendations: Buy: 120.11 Take profit: 120.33 Buy: 120.36 Take profit: 120.58 Sell: 119.60 Take profit: 119.34 Sell: 119.28 Take profit: 118.96 For the pound / yen pair, the key levels on the H1 scale are : 141.54, 140.82, 139.88, 139.46, 138.91 and 138.19. Here, the price forms the medium-term initial conditions for the downward movement of November 18 and at the moment, the price is close to canceling this structure, for which a breakdown of the level of 140.82 is necessary. Here, the potential target is 141.54. Short-term downward movement is possibly in the range of 139.88 - 139.46. The continuation of the development of the downward trend on the H1 scale is expected after the breakdown of the level of 139.46. In this case, the target is 138.91. Price consolidation is near this level. We consider the level 138.19 to be a potential value for the bottom. Upon reaching this level, we expect a pullback to the top. The main trend is the medium-term downward structure of November 18, the stage of deep correction Trading recommendations: Buy: 140.84 Take profit: 141.50 Buy: Take profit: Sell: 139.88 Take profit: 139.48 Sell: 139.44 Take profit: 138.94 The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis recommendations for EUR/USD and GBP/USD on November 25 Posted: 25 Nov 2019 03:35 PM PST Economic calendar (Universal time) The economic calendar did not contain important events. Thus, you can only pay attention to statistics from the Eurozone, which was released around 9.00 UTC+00, led by data on the state of the business climate in Germany. EUR / USD The players on the downside did not wait for Monday and showed activity already at the end of last week. Now, the pair is in the bearish zone relative to the clouds (daytime and H4), as well as under significant resistance levels of the higher halves. As a result, we can expect that at the close of the current month, the last working week of which began today, the players on the downside will seek to maintain their positions and mood. In the case of the continuation of decline, the interests of players to lower in the near future will be targeted at leaving the zones of corrections, which is limited by the extreme minimum of 1.0989 and 1.0879. On the other hand, a change in the situation and/or a return of uncertainty is possible when the pair consolidates above the nearest resistances, which continue to form a fairly wide zone of 1.1030 (weekly short-term trend) - 1.1055 (daily cloud) - 1.1082 (daily Kijun + weekly Fibo Kijun). In the lower halves, the long-term trend also belongs to the players downside. The support of the classic pivot levels has designated a fairly wide range of opportunities for the bears - 1.0993 (S1) - 1.0967 (S2) - 1.0919 (S3). With the development of an upward correction, the key resistance levels in the current situation on H1 are 1.1041 (central pivot level) and 1.1064 (weekly long-term trend). GBP / USD For the GBP/USD, another test of the weekly cloud failed again. Nevertheless, the players on the downside managed to close the week under all important resistance, clearing their way for a corrective decline to the weekly cross supports (the nearest levels are 1.2606 Tenkan + 1.2609 Fibo Kijun). Thus far, the weekly cross is strengthening the support for the daily cloud, and the monthly short-term trend, which is at 1.2669 in November, can also play a role in this area. The weakening of the bearish positions in the current situation is the proximity of significant levels, since, due to their distance from other benchmarks and high concentration, they provide not only resistance, but also a strong attraction. This is confirmed by the fact that the pair spent almost all of November in the area. The final week of the month has started today, so the nature and potential of the November monthly candle will depend on its result. In the lower halves, we are currently witnessing the development of an upward correction, which managed to close the last hour above the central pivot level of the day (1.2861) with the active support of technical indicators. Consolidation and development of the correction will allow us to consider the rise to the next significant level in the lower halves - the weekly long-term trend (1.2914). Breaking down this level will return the advantage of the bulls in the lower halves and the general uncertainty in the upper ones. Moreover, the resistance of the upper time intervals 1.2953 and 1.3012 will be relevant in this case. Leaving the correction zone and continuing the decline will also return relevance to the support of the classic pivot levels 1.2793 (S1) - 1.2755 (S2) - 1.2687 (S3). Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120) The material has been provided by InstaForex Company - www.instaforex.com |

| Developing USD/CAD pair and trading idea Posted: 25 Nov 2019 03:35 PM PST During the previous recommendation on Friday,it is advised to develop the pair at least on a false breakdown of the level of 1.3269. Actually, this is exactly the outcome we are observing - on the news, this level was falsely broken, and thus, the recommendation completely justified itself. The plan was this: Thus far, the intrigue of the instrument continues. False news breakdown of this level provides a good opportunity for the development of further medium-term upward trend. Since the end of October, there has been a prolonged upward trend on for this instrument, and the probability of its continuation is still high. For this reason, there is another recommendation for the same instrument today. I believe that the development will continue to a minimum to the level of 1.3326. Therefore, you can try to buy with a goal of updating it, limiting the risks at the price of 1.3254, since it makes no sense to keep purchases below the news last Friday. Updating Friday's minimum - the bullish scenario will be completely canceled. Wishing you all success in trading and huge profits! The material has been provided by InstaForex Company - www.instaforex.com |

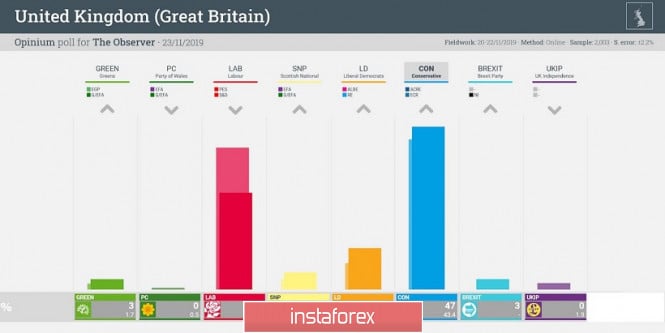

| Pound: under pressure due to upcoming elections Posted: 25 Nov 2019 02:57 PM PST Most analysts are wondering how the upcoming UK general elections, scheduled for December 12 this year, will affect the national currency. They seriously fear a currency crisis that could sweep the country. As a result, the British currency will be under heavy pressure and will undergo a powerful collapse. The pound will take the brunt after the election, experts said. They remind that the sterling was influenced by political forces that undermined its position for a long time. Currently, the pound is also resisting excessive political pressure, but with varying degrees of success. Leading economists, analyzing the current situation in the UK currency market, came to the conclusion that a currency crisis is not ruled out in the country in the near future. Llewellyn Consulting experts drew attention to a number of signs that preceded its appearance. These include the collapse of the exchange rate, the deficit of the current account and the balance of payments (that is, the difference between imports and exports), as well as the deficit of the state budget (the gap between taxes and expenses). As a rule, this difference exceeds 4% of GDP. Difficulties in the foreign exchange market arise if the current account deficit drives the national currency rate under pressure. A similar situation emerges if this deficit is not compensated by powerful cash injections of private capital. Difficulties are exacerbated if the budget deficit is superimposed on the current account deficit. The development of such a scenario could trigger inflation, experts warn. In 2019, the balance of payments in the UK exceeds 5% of GDP, which worries analysts. The fact that the current election campaign resembles a battle for raising rates on additional government spending adds fuel to the fire. According to experts, if the British parties fulfill their promises regarding expenditures, especially additional public investments, the state budget deficit will amount to 3% of GDP. A similar scenario is possible if Conservatives win, and if Labour is in the lead, the budget deficit may exceed the level of 4% of GDP. Nevertheless, there are factors that significantly reduce the threat of a currency crisis. These include changes in the monetary policy of leading regulators, due to which the increase in current account deficits and the state budget does not provoke inflation. According to experts, at the moment the financing of double deficits is made much more efficient and safer than before. Currently, the British currency feels much more confident than before the 2016 referendum. Recall that three years ago, after a referendum on Brexit, experts recorded a massive collapse of sterling. Subsequently, the British currency traded 20% below its fundamental level. At the moment, the pound is showing signs of growth. The GBP/USD pair started with low values on Monday morning, November 25, trading at 1.2851–1.2852. In the future, the pair's efforts that aimed at increasing were not in vain. The GBP/USD pair jumped, and now it is near the levels of 1.2873-1.2874. Experts record an upward trend, which may persist throughout the current week. According to analysts, the relative cheapness of the pound makes it less vulnerable to political shocks. The sterling does not lose stability even in the case of a negative scenario with double deficits. Many experts are certain that Brexit's negative consequences and double deficits are already included in the current sterling rate. For a long time, the pound resisted political and economic pressure, trying to withstand these overloads. Many experts are worried about its further dynamics, believing that sterling cannot avoid a collapse in the event of force majeure in the elections. However, the market relies on the stability of the pound and on the optimistic election results, thanks to which the fragile balance in the British currency field will remain. The material has been provided by InstaForex Company - www.instaforex.com |

| Goldman expects dollar to moderately weaken and prefers the pound Posted: 25 Nov 2019 02:57 PM PST According to Goldman Sachs, steady growth in the US economy and weak economic activity in China has so far prevented large sales of the US currency. "We do not see significant reasons to short the greenback broadly until early 2020. Nevertheless, the risks for the USD are shifted downward, on the basis that there will be a more stable recovery of the eurozone economy, a significant reduction in US tariffs on imports from China and/or a significant reduction in the Federal Reserve interest rate," they said. "Two components of the US currency can be distinguished: the domestic dollar, which behaves like an ordinary currency, and the international dollar, which reflects the global role of the currency. Accelerating global economic growth next year should lead to some downward pressure on the international dollar, although domestic dollar drivers look more positive. These factors, when combined together, indicate only a moderate decrease in the trade-weighted USD exchange rate by about 1.5–2.0% in 2020," experts said. They expect that next year a number of currencies may surpass the dollar, but given the current carry (high dollar rates), their recommendation is to: finance longs from Asian low-income currencies or from the euro early next year. At the same time, among the G10 currencies, Goldman Sachs prefers the pound against the expectation that the results of the early parliamentary elections, which will be held in the United Kingdom in December, will pave a clear path for the Brexit process. Bank strategists advise taking short positions in EUR/GBP with the target at 0.82 and with a stop at 0.88. "The primary risk is the suspended Parliament, which will tighten uncertainty over Brexit and push the Bank of England to lower interest rates. However, a number of possible government coalitions are likely to insist on close working relations with the EU. This gives reason to believe that we are unlikely to return to the lows in the pound sterling," they said. The material has been provided by InstaForex Company - www.instaforex.com |

| Dollar will not stand for the price Posted: 25 Nov 2019 02:57 PM PST The US currency, as many experts noted earlier, will not concede its position, especially when paired with the euro. The greenback has strengthened its position in the EUR/USD pair and is not going to part with the leadership. The European currency will have to make every effort to squeeze the greenback. At present, little can shake the USeconomy, including the difficulty in reaching a compromise between Washington and Beijing. However, the development of a negative scenario is unlikely: according to experts, the warring parties are approaching the signing of a comprehensive agreement. Experts were pleased with the rapid growth of the US purchasing managers index, which reached a 4-month high, as well as the growth of consumer sentiment, which increased from 95.5 to 96.8 points. According to the latest data, everything is in order with the US economy, analysts summarize. In the event of an implementation of a positive scenario, namely the complete cessation of the trade conflict between the United States and China, the market can hope for the restoration of the German economy that has suffered from this confrontation. In this situation, experts predict an active growth of the EUR/USD pair to the levels of 1,1500-1,1600. Otherwise, you should not count on the rise, analysts said. The EUR/USD pair was trading in the range of 1.1025–1.1026 on Monday, November 25. In the future, experts recorded a bearish trend, which was steadily gaining momentum. As a result, the pair was in a low position, trading within 1.1013–1.1014. The EUR/USD pair was stuck at this level in an attempt to grope the bottom, although analysts expect that it will gradually begin to move up in the near future. According to preliminary estimates, the further dynamics of the classic pair will depend on the level of 1.1000. Experts do not exclude its breakout. In this case, we should expect the EUR/USD pair to fall to 1.0600–1.0700. A similar situation is possible if America and China once again fail to agree, and Donald Trump will raise duties on imports of European cars. In the event of the end of the trade war, the implementation of the "soft" Brexit and the restoration of the German economy, the market can count on EUR/USD rally up to 1.1500–1.1600, analysts said. If the current situation is not very positive for the European currency, then there is no reason for a negative for the greenback. On the contrary, it feels more confident than ever. Analysts believe that the green light will turn on for the dollar for a long time, but the rise of the euro remains in question. The material has been provided by InstaForex Company - www.instaforex.com |

| Pound lost the battle, but it won the war Posted: 25 Nov 2019 02:57 PM PST Traded in the narrowest weekly range since July 2014, the British pound at the end of the five-day period by November 22 recorded the most significant sale since the beginning of the month amid disappointing statistics on Great Britain's business activity in October. The index of procurement managers in the services sector unexpectedly went into the critical zone (below 50), indicating a decline. The manufacturing PMI has been there for several months. The situation in the British economy continues to deteriorate, which increases the risks of an increase in the number of dissenters in the Monetary Policy Committee. Let me remind you, at the last meeting of the Bank of England, two out of ten officials voted to reduce the repo rate. However, the problems of the economy do not bother the bulls on GBP/USD. Despite the sales on November 22, the market is optimistic. Goldman Sachs includes sterling purchases in the TOP-10 strategies for 2020 and forecasts a EUR/GBP drop of 4% in the first quarter of next year. BlackRock and Eurizon SLJ Capital expect to see the pound at $1.35, while BofA Merrill Lynch is talking about a figure of $1.39. The forecasts are based on the assumption that the Conservative Party will be able to get an absolute majority in the December 12 elections, which will lead to a fairly quick exit of Britain from the EU. I must say that the chances of such an outcome are quite high. Recent opinion polls suggest the advantage of the Tories over the Labour Party in 11-15 points. The dynamics of the popularity of political parties Certainly, if we proceed solely from economic indicators, the GBP/USD prospects can be assessed as bearish. While Britain's PMI are in a critical zone, US business activity in November peaked in the past four months. This indicates a divergence in GDP growth of Great Britain and the United States. The Fed has made it clear that before the summer of 2020 it does not intend to change the rate on federal funds, while the chances of the Bank of England lowering its repo rates are growing by leaps and bounds. At the same time, the pound has been neglected over the past few years in the form of high political risk associated with disorderly Brexit. Currently, the market does not believe in this, and speculators are actively getting rid of short sterling positions, which allows large banks to make bullish forecasts, despite the worsening macroeconomic statistics. In my opinion, in the clash of politics and economics, the first will prevail, and the next televised debates with the participation of seven political parties can have a greater impact on the GBP/USD dynamics than disappointing statistics on business activity. Technically, the Expanding Wedge reversal pattern can be formed on the daily GBP/USD chart, which will become an alarming signal for buyers. Their main task is to keep the pair above support at 1.272-1.277. It will turn out - it will be possible to think about restoring the upward trend in the direction of the targets by 88.6% and 200% according to the Bat and AB=CD patterns. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. November 25. Results of the day. The US currency needs new reasons to continue growth Posted: 25 Nov 2019 02:56 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 40p - 21p - 28p - 45p - 74p. Average volatility over the past 5 days: 42p (low). On the first trading day of the new week, the EUR/USD currency pair was trading with a high volatility of 28 points. This is even below the average of the last five days, which is also defined as low. Thus, by and large, there is practically nothing to talk about in today's trading on the forex market. Traders extended their weekend by at least one day, but tomorrow they should be active, because on Tuesday, unlike today, there will be macroeconomic data and events that deserve attention. Today, in terms of fundamental events, there is practically nothing to highlight. Not a single important macroeconomic publication in the European Union or the United States. In the light of the situation with an empty fundamental background, we suggest once again trying to understand the question of why the trade war between China and the United States has a greater negative impact on the European currency, and not on the US dollar, and why this effect will continue for the currency pair in the future. Roughly speaking, trade disagreements between Beijing and Washington are hitting the entire global economy, which, of course, affects each country individually. The European Union, along with each of its individual country, and Great Britain are no exception. Since the United States and China have introduced import duties, the demand for these groups of goods has accordingly decreased, consumers are looking for alternatives, respectively, the production volumes of these goods are reduced, respectively, the supply of components and raw materials is reduced, and the volume of investment in the manufacturing sectors of these goods is reduced, and this whole whirlpool involves many countries. That is why the European Union and its currencies are under pressure, as well as the direct participants in the conflict, macroeconomic indicators are falling, the euro is weakening against the US currency. However, how come the dollar does not fall? If we consider it precisely in conjunction with the euro, then the situation remains exactly the same as it was a month ago, and six months ago, and before the start of the trade war. Everything is simple and banal: the US economy is stronger, more stable, showing a slower slowdown compared to the EU economy, and monetary policy in the United States is more hawkish. Accordingly, investment flows to a greater extent precisely in America, the US stock market, despite geopolitical tensions, feels great, while Europe is suffering not only from a slowdown in the economy, but also from Brexit. For these reasons, the US dollar continues to rise in the long run, and at the moment it's even difficult to say when and why the dollar trend may stop. It seems that in order for the demand for the US dollar to decrease, an even greater trade conflict should erupt between China and the United States, which will critically affect American companies and discourage international investors from investing in them. Demand for American goods should be greatly reduced, possibly due to the strong increase in cost and cost of production, which are possible due to the introduction of new economic sanctions and duties on American goods. US GDP should suffer much more than European GDP, only in this case will it be possible for traders to hope and investors will turn to the euro currency. But so far we do not see the reasons for this development of events. In addition, both the central banks and their respective heads do not work in favor of the European currency. For example, the recent speeches of Federal Reserve Chairman Jerome Powell were held under the neutral flag, that is, the Fed is not going to soften its monetary policy again in the near future. The ECB led by Christine Lagarde said that "the time has come for strategic changes," and the EU economy needs additional stimulation. Thus, if we expect a new reduction in the key rate, then it is in Europe, where the key tool for influencing the economy is already in the negative area. Powell is set to give another speech tonight. It is unlikely that his rhetoric will suffer serious changes in comparison with the previous speech, however, such an event always has a high degree of significance. From a technical point of view, the weakest downward movement in the euro/dollar pair after the formation of a new signal from Ichimoku dead cross continues. Bollinger Bands also indicate a downward trend. However, the pair is approaching the values at which there are fewer sellers of the euro. Recall the paradoxical situation, which we have already described several times earlier. If in the coming days the US dollar does not receive significant fundamental support, then it is likely that the pair's quotes will move upward. Trading recommendations: The EUR/USD pair resumed the downward movement, and volatility in trading sharply fell again on Monday. Thus, it is now recommended to remain selling the euro/dollar pair with targets at 1.0990 and 1.0977. It is recommended to consider pair purchases not earlier than the reverse consolidation of traders above the critical Kijun-sen line and the levels 1.1061 and 1.1073 with the first goal being the resistance level of 1.1127. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. Support / Resistance Classic Levels: Red and gray dotted lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movement options: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| GBPUSD. Recent polls support the pound: Conservatives increase their lead from the Labour party Posted: 25 Nov 2019 02:56 PM PST Only two and a half weeks left before the elections to the Lower House of the British Parliament. Elections will be held on December 12, and on December 17 a new composition of the House of Commons will gather for the first session. If the current British prime minister receives a majority and forms a government, the Queen will deliver her throne speech on December 19. After that, apparently, the MPs will disperse for the Christmas holidays, and will already begin to consider the Brexit issue in early January. If the Conservatives are unable to form a cabinet, this process will be delayed and respectively, discussion of the deal will take place later. However, the latest ratings continue to delight Tory representatives: Conservatives have the highest rating since 2017, gradually increasing the gap from the main competitors - the Laborites. The latest YouGov poll suggests that 45% of respondents support Johnson's party, while Jeremy Corbyn's party rating has not changed, remaining at 30%. Liberal Democrats also do not rise above their electoral ceiling of 15%. This survey was conducted last week, so GBP/USD traders anticipate more recent data. According to information published today, YouGov plans to publish new results the day after tomorrow, that is, November 27th. This release is likely to cause strong volatility for the pair, especially if they are in favor of Conservatives. If the Tories increase the margin from the Labour, the pound may again approach the 30th figure - the mark of 1.3000 is now the main resistance level for GBP/USD traders. Sociological studies of other institutions also speak of the successes of Conservatives. Today's surge in optimism for the pound was based on a survey conducted by Opinium commissioned by The Observer. The published figures demonstrate the phenomenal success of the Tories: almost half of the respondents (47%) are ready to vote for the Conservatives, while the Labour Party is still content with relatively modest support (28%). Liberal Democrats, according to Opinium, are also losing ground - they are supported by only 12% of respondents. Such results helped the pound move away from the lows of last week and return to the framework of the 29th figure. And although the rise in GBP/USD price is impulsive and unstable, the fact of growth speaks volumes. First of all, that the bearish moods in the pair are quite fleeting. Last week, the pound fell for several days, but the downward dynamics did not continue. The pound is still spinning around the 29th figure, being in orbit of the flat movement. And apparently, the pair will remain in this price range until December 12, until the real (and not expected) election results become known. Due to the specifics of the UK electoral system, experts do not undertake to identify the rating of Conservatives with the estimated number of seats in the House of Commons. For example, four years ago, during the next parliamentary elections, Conservatives had almost 37% of the vote, and they were able to form their own majority (330 seats). In 2017, when Theresa May initiated an early election, the Tories lost their majority, receiving only 317 mandates, although they received 42.5% in the elections. Such is the specificity of the British electoral system - the Parliament is elected by the majority system, but the parliamentary majority is formed by parties. Secondly, elections in the UK are often characterized by unexpected jerks of ratings of political forces. Again, returning to the 2017 elections, we can say that in just a month of the campaign, the rating of Laborites increased one and a half times - from 24% in April to 42% at the end of May. Thus, despite the Conservatives' impressive ratings, the GBP/USD bulls cannot break the 1.3000 mark to gain a foothold in the 30th figure. Last week, the pound was completely under pressure: weak British macroeconomic reports, Johnson's uncertain victory in the debate, as well as the general strengthening of the dollar, did their job. Nevertheless, the downward impulse again turned out to be false. At these minutes, the GBP/USD pair is again testing the 29th figure: fresh ratings and the weakening of the US currency returned the pair's confidence to the pair's bulls. In addition, according to the Global Times, Washington and Beijing came close to the final part of the trade agreement as part of the first phase of negotiations. Trump has also replaced anger with mercy - at least his rhetoric has become more friendly to China. He once again said that the parties are at the finish line of negotiations. He also tried to maintain balance in the Hong Kong issue. Trump said that he'll carefully study the bills to protect democracy in Hong Kong, and added that in addition to the rebellious Hongkongers, he also supports Xi Jinping. This attitude also somewhat relieved the market situation, although it is hard to imagine that the American president endorsed legislative initiatives that were unanimously supported by all senators - both Democrats and Republicans. Thus, the fresh sociology amid the decline in anti-risk sentiment in the foreign exchange market helped the pound regain its position. The GBP/USD pair continues to fluctuate in the price range of 1.2780-1.3000. If on Wednesday the data from YouGov again turns out to be in favor of the Conservatives, the pair will be able to approach the upper boundary of the above price range. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 Nov 2019 02:56 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 81p - 60p - 44p - 77p - 106p. Average volatility over the past 5 days: 74p (average). The British pound does not want to correspond to the fundamental background, which has long hinted at a strong decline in the British currency. Traders are still impressed by the possible significant victory of Conservatives in future elections, which will allow Boris Johnson to freely implement Brexit and put an end to the three-year epic of a "divorce" with the European Union. What are the reasons for traders to assume just such an option? Only sociological polls and studies that show that the Conservative Party's rating is growing, the Labour Party's rating is also growing, but at a slower pace, while the rest of the parties are losing their popularity. However, the gap between Conservatives and Labour does not widen and remains at 12-15%. We remind you that even if the current rating of the party of Johnson is about 43%, this does not mean that his party members will get 43% of the 650 seats in the British Parliament. Thus, we still recommend not to be in a stage of prematurity and unreasonable euphoria, so that you do not get upset because of unfulfilled dreams. During the first trading day of the week, the British pound managed to rise by 70 points, which is seen as out of the blue" There were no important macroeconomic publications during the day in either the UK or the US. Thus, traders could only respond to the general news background, which comes from regular media and periodicals, which now can only announce the course of election campaigns or how the rating of a political party has changed. That is, it turns out that today's strengthening of the British currency is again connected with the confidence of most traders in the victory of Conservatives in the elections, and not with macroeconomic statistics, which in the UK have been absolutely disastrous in the last 3-4 weeks. Last week, it became known that business activity in the service sector also slipped into the region below 50, as in the industrial sector. What is now to be expected from indicators of GDP, inflation, wages, industrial production? But macroeconomic statistics now have no effect on the pound. Traders were determined to wait for the results and elections and certainly see the Conservatives win at them. Assuming what happens to the pound if the Conservatives do not win enough parliamentary seats is not difficult. The pound has no actual reasons for growth, but a whole set of reasons and factors for the fall. If the assumption about the Conservatives' defeat or their insufficiently convincing victory comes true, then the pound may plummet back to multi-year lows and even lower. Furthermore, due to weak macroeconomic statistics, which traders can suddenly remember, and because of a sharp drop in the chances of completing the Brexit procedure in January. In addition, it will not be superfluous to think about the future value of the pound sterling in the foreign exchange market if the "divorce proceedings" nevertheless ends in January. This will be followed by long and difficult negotiations between the European Union and Britain regarding future trade relations between them. Negotiations with the US will begin, with which Johnson really wants to conclude a huge trade deal. However, as recent events show us, trading deals are not fast. The process can take several years, and as long as it lasts, the economy of any country that is not even involved in a trade conflict may show signs of a slowdown. Thus, if the Conservatives win, then the pound, according to various experts, will increase to $1.32–1.34. However, there will be full of possible reasons for disappointment among investors in 2020. Well, the last thing that needs to be reported: The British Parliament will resume its work five days after the re-election, that is, September 17th. A legislative agenda will already be worked out on the 19th, and by December 25 a proposal will be put to the vote on a deal between Johnson and the European Union. That is, in theory, before the New Year we will find out how Johnson's third attempt to push his agreement through Parliament ends. The technical picture of the pound/dollar pair resembles a frank flat more and more, which is clearly visible on the 24-hour timeframe. Quotations cannot fall below the level of 1.2780, above the level of 1.2970 they also cannot continue to grow. So it turns out that the pair is clamped into a side channel wide enough for a 4-hour timeframe. Hopes for a continued downward movement after the Friday impulse, it seems, are not destined to come true. Thus, we continue to wait for the elections and keep a flat in mind. Trading recommendations: GBP/USD started to move down, but very quickly finished. Thus, traders are encouraged to consider selling the pound this week with targets at 1.2826 and 1.2780 if quotes return to the area below the Ichimoku cloud. It is not recommended to buy the pound/dollar pair yet, as fundamental factors indicate a downward trend, and bulls are not able to consolidate the pair above 1.2980. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. Support / Resistance Classic Levels: Red and gray dotted lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movement options: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC 11.25.2019 - Second target at the price of $6.547 has been met, watch for selling on the rallies Posted: 25 Nov 2019 10:16 AM PST BTC has been trading downwards and the price reached my second main target at the price of $6.547. I saw retracement of our support but now resistance is on the test at $7.300. It is good sell zone for further downside. Ichimoku analysis:

The price is trading below the Ichimoku cloud and there was rejection of the $7.368 (Kijun-sen). Intraday trends are up but the1H,4H and Daily trends are down. I didn't see any kind of reversal yet and you should watch for selling opportunities with the targets at the price of $6.547 and $5.800. The material has been provided by InstaForex Company - www.instaforex.com |

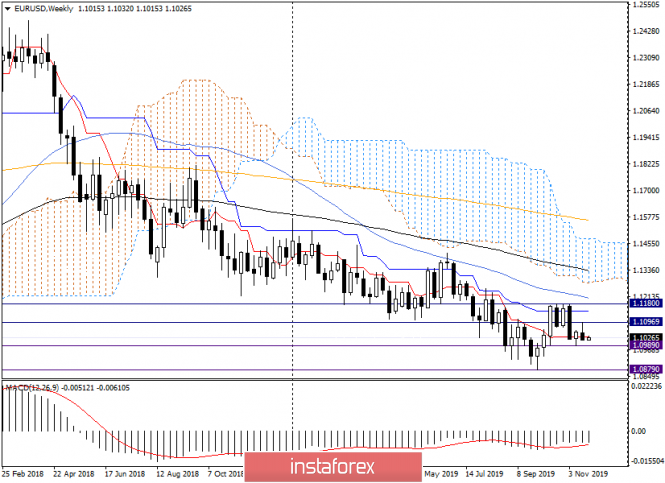

| Analysis and forecast for EUR/USD on November 25, 2019 Posted: 25 Nov 2019 09:42 AM PST Good day, dear colleagues! Well, another week in the foreign exchange market has ended, which the US dollar can bring to its asset. The US currency strengthened across a wide range of markets, including against the euro. Although the losses of EUR/USD were not so significant, only 0.24%, in my opinion, there were some changes in the technical picture of the pair, which in the future may affect the price direction of the instrument. Weekly

It's about the last two weekly candles. If the penultimate candle signaled a likely reversal of the pair in the north direction, the candle of the last five trading days actually showed the insolvency of growth. At least for now. The quote really started to grow, but after meeting strong resistance at 1.1097, the euro-dollar rate turned to decline. Moreover, the closing price coincided with the lows of trading on November 18-22, which may indicate the serious intentions of the European. It is also worth noting that in the last three weeks the pair is trading near the Tenkan line of the Ichimoku indicator. As you can see, the closing prices of the weekly sessions are either above or below this line, and this factor indicates the uncertainty of the market. Alternately, the appearance of black and white candles can also be considered an element of uncertainty. If the trading of the started week closes above the previous highs of 1.1097, we can expect further strengthening and tune in to buy. In this scenario, the next targets will be 1.1145 (Kijun) and 1.1207 (50 MA). If the bears have control over the pair, after the breakdown of the support of 1.0989, we expect the rate to decline to 1.0941, 1.0920, 1.0900, and 1.0880. Near the last two marks, I do not rule out a reversal on the rise, and in the case of the appearance in this price zone of candlestick signals characteristic of growth on the daily, 4-hour and hourly charts, we plan to buy the euro-dollar pair. Daily

In this timeframe, it is quite an interesting moment to open short positions. At 1.1042, the Tenkan, 50 MA lines converged, as well as the lower boundary of the Ichimoku indicator cloud. If we consider a false break of 1.1042, then the next resistance can be exerted already at 1.1056, where the upper boundary of the cloud passes. Even more distant zone for opening short positions can be considered the price area 1.1080-1.1097, where a strong technical level, the highs of several trading days, Kijun and 89 EMA. In my opinion, only a true breakdown of the resistance of 1.1097 and consolidation above 1.1100 will indicate the seriousness of the implementation of the bullish scenario. Meantime, the pair continues to so-called "buffeting", and with a bearish bias. However, the market can change very quickly and quite unexpectedly, so it is worth highlighting important events that this week can become a driver for possible and significant breakthroughs. US: consumer confidence indicator, durable goods orders, initial jobless claims, basic personal consumption expenditure price index. Eurozone: data on the German labor market and the eurozone as a whole. More information on these and other macroeconomic reports can be found in the economic calendar. Successful trading! The material has been provided by InstaForex Company - www.instaforex.com |

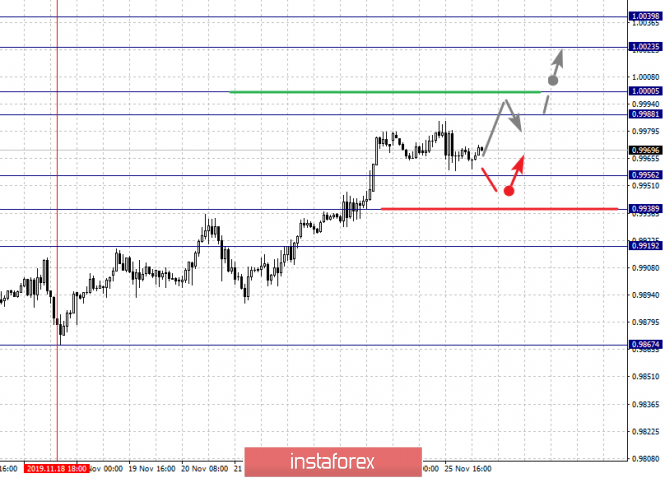

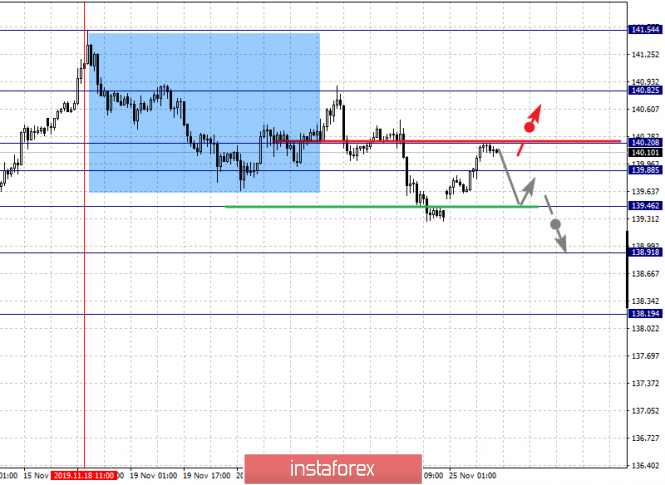

| Fractal analysis for major currency pairs on November 25 Posted: 25 Nov 2019 09:42 AM PST Hello, dear colleagues. For the euro/dollar pair, we follow the development of the downward structure from November 21 and the level of 1.1004 is the key resistance. For the pound/dollar pair, the price forms the potential for a downward movement from November 21 and the level of 1.2817 is the key resistance. For the dollar/franc pair, the subsequent development of the upward structure of November 18 is expected after the breakdown of 1.0000. For the dollar/yen pair, we are following the formation of the upward structure of November 21 and the level of 108.91 is the key resistance. For the euro/yen, the price forms the potential for a downward movement of November 21 and the level of 119.60 is the key resistance. For the pound/yen pair, the price is currently in the correction zone from the medium-term downward structure on November 18 and the level of 140.20 is the key support. Forecast for November 25: Analytical review of currency pairs on the H1 scale:

For the euro/dollar pair, the key levels on the H1 scale are 1.1053, 1.1034, 1.1023, 1.1004, 1.0986, 1.0977, and 1.0957. We follow the development of the downward structure of November 21. We expect the downward movement to continue after the breakdown of 1.1004. In this case, the target is 1.0986 and in the area of 1.0986 – 1.0977 is the price consolidation. The potential value for the bottom is the level of 1.0957, upon reaching this value, we expect a pullback upwards. The short-term upward movement is expected in the range of 1.1023 – 1.1034 and the breakdown of the last value will lead to an in-depth correction. The target is 1.1053 and this level is the key support for the downward structure. The main trend is the downward structure of November 21 Trading recommendations: Buy: 1.1023 Take profit: 1.1034 Buy: 1.1036 Take profit: 1.1050 Sell: 1.1004 Take profit: 1.0988 Sell: 1.0975 Take profit: 1.0958

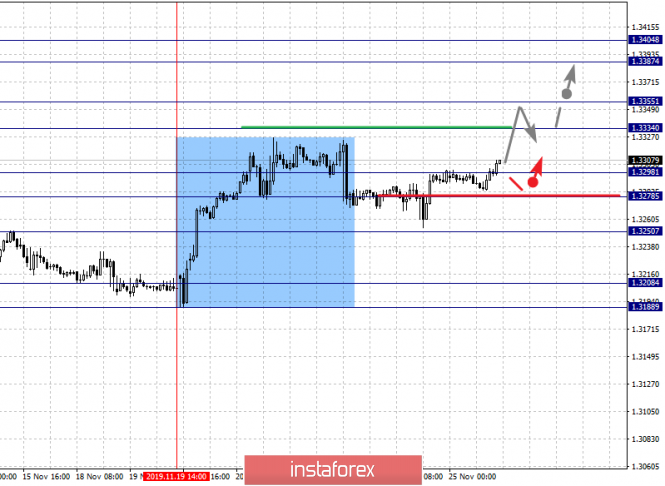

For the pound/dollar pair, the key levels on the H1 scale are 1.2969, 1.2932, 1.2899, 1.2817, 1.2765, 1.2710, and 1.2671. We follow the formation of the initial conditions for the downward cycle of November 21. We expect the downward movement to continue after the breakdown of 1.2817. In this case, the target is 1.2765 and near this level is the price consolidation. The breakdown of the level of 1.2765 will lead to a pronounced movement. The target is 1.2710. The potential value for the bottom is the level of 1.2671, after which we expect consolidation, as well as a pullback upwards. The short-term upward movement is possible in the area of 1.2899-1.2932 and the breakdown of the last value will have to form an upward structure. The potential target is 1.2969. The main trend is the formation of the downward structure of November 21 Trading recommendations: Buy: 1.2900 Take profit: 1.2930 Buy: 1.2933 Take profit: 1.2969 Sell: 1.2815 Take profit: 1.2770 Sell: 1.2763 Take profit: 1.2710

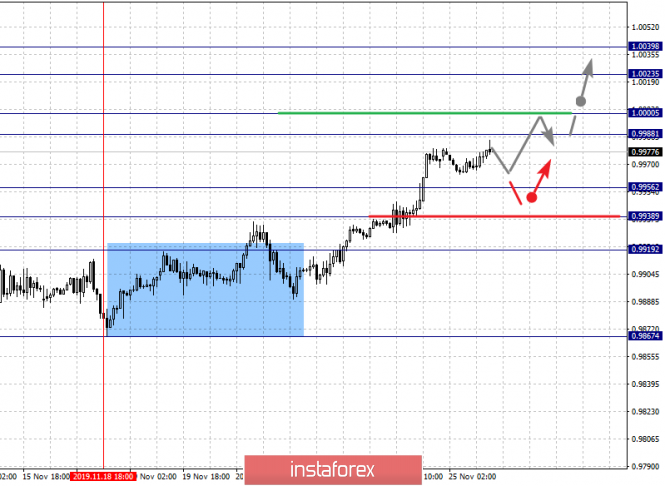

For the dollar/franc pair, the key levels on the H1 scale are 1.0039, 1.0023, 1.0000, 0.9988, 0.9956, 0.9938, and 0.9919. We follow the development of the upward structure of November 18. The short-term upward movement is expected in the range of 0.9988-1.0000 and the breakdown of the last value will lead to a pronounced movement. The target is 1.0023. We consider the level 1.0039 as a potential value for the top, after reaching this level, we expect a pullback downwards. The short-term downward movement is possible in the area of 0.9956-0.9938 and the breakdown of the last value will lead to a deep correction. The target is 0.9919. The main trend is the upward structure of November 18. Trading recommendations: Buy: 0.9988 Take profit: 1.0000 Buy: 1.0003 Take profit: 1.0023 Sell: 0.9956 Take profit: 0.9940 Sell: 0.9937 Take profit: 0.9920

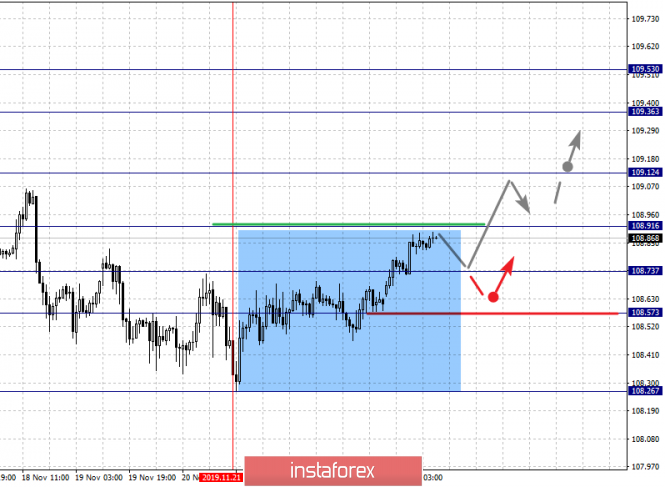

For the dollar/yen pair, the key levels in the scale H1 are 109.53, 109.36, 109.12, 108.91, 108.73, 108.57, and 108.26. We follow the formation of the upward structure of November 21. We expect the upward movement to continue after the breakdown of 108.91. In this case, the target is 109.12 and near this level is the price consolidation. The breakdown of the level of 109.12 should be accompanied by a pronounced upward movement. The target is 109.36. The potential value for the top is the level of 109.53, upon reaching this value, we expect consolidation, as well as a pullback downwards. The short-term downward movement, as well as consolidation, is expected in the range of 108.73-108.57 and the breakdown of the last value will have to form a downward structure. The potential target is 108.26. The main trend is the formation of an upward structure from November 21 Trading recommendations: Buy: 108.93 Take profit: 109.10 Buy: 109.13 Take profit: 109.34 Sell: 108.70 Take profit: 108.60 Sell: 108.54 Take profit: 108.30

For the Canadian dollar/dollar pair, the key levels on the H1 scale are 1.3404, 1.3387, 1.3355, 1.3334, 1.3298, 1.3278, and 1.3250. We follow the upward structure of November 19. The short-term upward movement is expected in the area of 1.3334-1.3355 and the breakdown of the last value should be accompanied by a pronounced upward movement. The target is 1.3387 and in the area of 1.3387-1.3404 is the price consolidation. The consolidated movement is possible in the area of 1.3298-1.3278 and the breakdown of the last value will lead to an in-depth correction. The target is 1.3250 and this level is the key support for the upward structure. The main trend is the upward structure of November 19, the correction stage. Trading recommendations: Buy: 1.3335 Take profit: 1.3355 Buy: 1.3357 Take profit: 1.3385 Sell: 1.3276 Take profit: 1.3252 Sell: 1.3248 Take profit: 1.3220

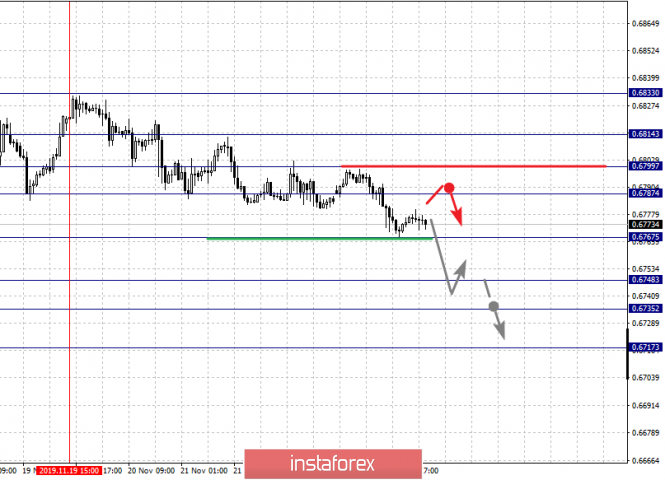

For the Australian dollar/dollar pair, the key levels on the H1 scale are 0.6833, 0.6814, 0.6801, 0.6783, 0.6767, 0.6748, 0.6735, and 0.6717. We follow the development of the downward structure of November 19. We expect the downward movement to continue after the breakdown of 0.6783. In this case, the target is 0.6767 and consolidation is near this level. The breakdown of 0.6765 will lead to the development of a pronounced movement. The target is 0.6748 and in the area of 0.6748-0.6735 is the price consolidation. The potential value for the bottom is 0.6717, after reaching this value, we expect a correction. The short-term upward movement is expected in the area of 0.6801-0.6814 and the breakdown of the last value will lead to the development of an upward structure. In this case, the first target is 0.6833. The main trend is the local downward structure from November 19 Trading recommendations: Buy: 0.6801 Take profit: 0.6812 Buy: 0.6817 Take profit: 0.6833 Sell: 0.6780 Take profit: 0.6768 Sell: 0.6765 Take profit: 0.6750

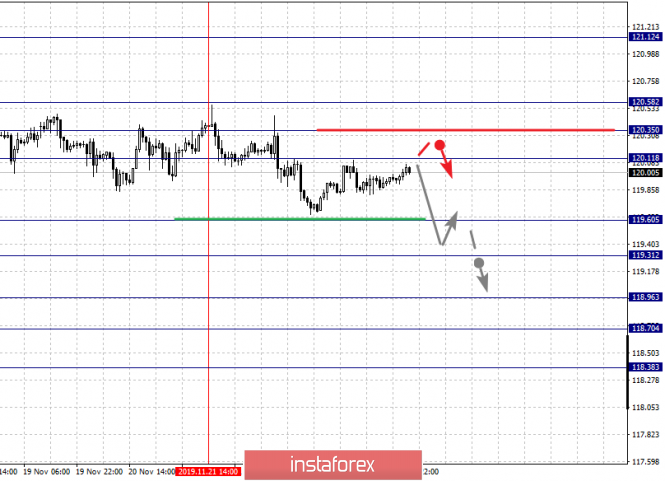

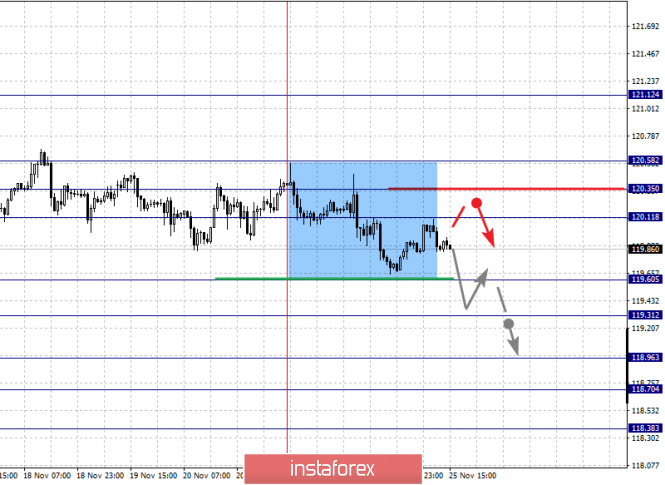

For the euro/yen pair, the key levels on the H1 scale are 121.12, 120.58, 120.35, 120.11, 119.60, 119.31, 118.96, 118.70, and 118.38. We follow the formation of the downward structure of November 21. The short-term downward movement is expected in the range of 119.60-119.31 and the breakdown of the last value will lead to a pronounced movement. The target is 118.96 and in the area of 118.96-118.70 is the short-term downward movement, as well as consolidation. The potential value for the bottom is the level of 118.38, upon reaching this value, the rollback up. The short-term upward movement is expected in the area of 120.11-120.35 and the breakdown of the last value will lead to the formation of a local structure for the top. The first target is 120.58. The main trend is the formation of a downward structure from November 21 Trading recommendations: Buy: 120.11 Take profit: 120.33 Buy: 120.36 Take profit: 120.58 Sell: 119.60 Take profit: 119.34 Sell: 119.28 Take profit: 118.96

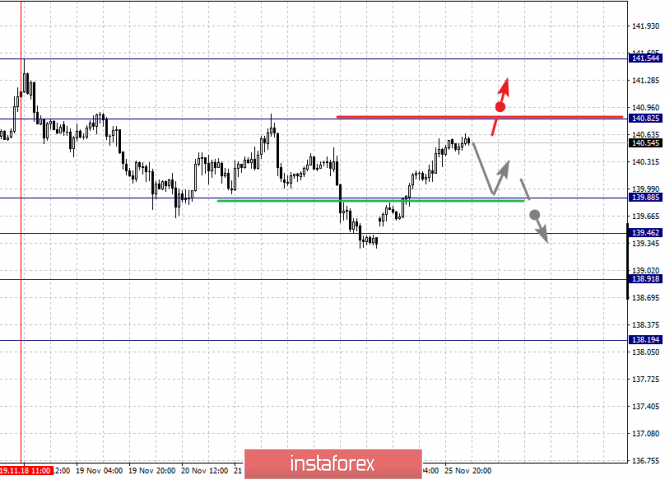

For the pound/yen pair, the key levels on the H1 scale are 140.82, 140.20. 139.88, 139.46, 138.91, and 138.19. The price forms the medium-term initial conditions for the downward movement from November 18. We expect the downward movement to continue after the breakdown of 139.46. In this case, the target is 138.91 and near this level is the consolidation. The potential value for the bottom is the level of 138.19, upon reaching this level, we expect a pullback upwards. The consolidated movement is possible in the range of 139.88-140.20 and the breakdown of the last value will lead to a deep correction. The target is 140.82 and this level is the key support for the downward structure. Its passage by the price will have to form the initial conditions for the upward trend. The main trend is the medium-term downward structure of November 18 Trading recommendations: Buy: 140.25 Take profit: 140.80 Buy: 140.84 Take profit: 141.52 Sell: 139.44 Take profit: 138.95 Sell: 138.86 Take profit: 138.24 The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review of EURUSD 11/25/2019 Posted: 25 Nov 2019 09:42 AM PST

Market sentiment on EURUSD is fully turned in the direction of the dollar. Unlike last week, there was no attempt to turn the euro up on Monday. Most likely, this is due to the loss of hope for a change in ECB policy with the arrival of the new head, Christine Lagarde. Her speech showed that she, like Draghi, is fully focused on combating the slowdown of the economy - it is not necessary to wait for a strengthening of rates. No important news. A huge package of news on the US economy is expected on Wednesday November 27 - GDP report, durable goods orders, and inflation. Plus a detailed report on the state of the economy from the Fed by region "Beige Book". Perhaps this will cause an increase in volatility in the market. We are ready to buy euro from 1.1100. We are ready to sell euro from 1.0985. The material has been provided by InstaForex Company - www.instaforex.com |

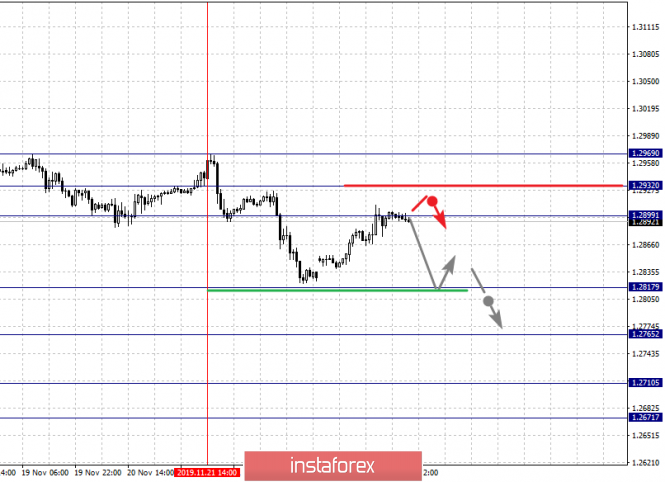

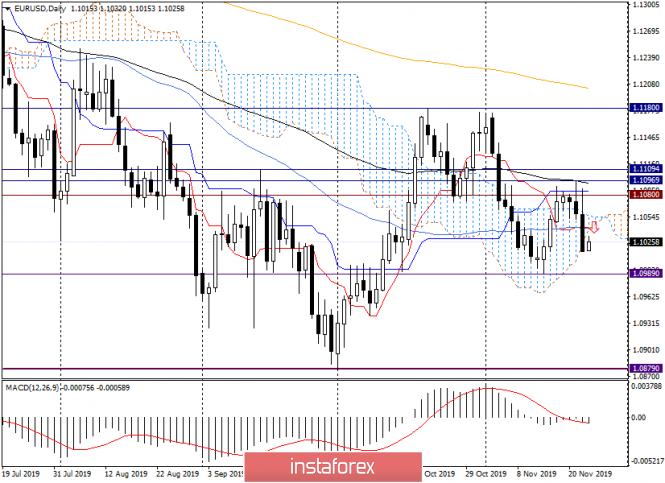

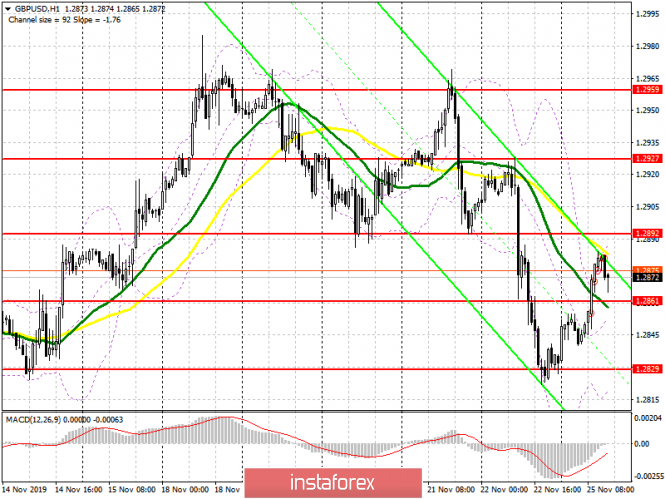

| Posted: 25 Nov 2019 09:42 AM PST To open long positions on GBP/USD, you need: The British pound managed to strengthen its positions against the US dollar and regained the resistance of 1.2861, which now acts as a support. Good news on retail sales, where the index was -3 points in November, after -10 points in October this year helped the pound also with the recovery. At the moment, the next target of GBP/USD buyers will be to update the resistance of 1.2892, the breakthrough of which will provide the pair with a return to the maximum of 1.2927, from which the whole fall began on Friday. If the bulls miss the level of 1.2861 in the second half of the day, it is best to count on new purchases only after updating the minimum of 1.2829 or open long positions immediately on a rebound from the support of 1.2800. To open short positions on GBP/USD, you need: The sellers still have some problems, but it is still very early to talk about the reversal of the downward correction, which was formed on November 18 this year. The best thing that the sellers of the pound will be able to do today is to return under the support of 1.2861, which will quickly push GBP/USD down to a minimum of 1.2829 and 1.2800, where I recommend taking the profits. However, another, no less important task for sellers is to maintain the resistance of 1.2892. The formation of a false breakdown at this level in the second half of the day will be a good signal to open short positions. Otherwise, it is best to sell the pound immediately on the rebound from the maximum of 1.2927. Indicator signals: Moving Averages Trading returned around the 30 and 50 daily averages, indicating a possible end to the bearish trend, but it is still very early to talk about it. Bollinger Bands A breakthrough of the upper limit of the indicator in the area of 1.2885 will lead to a new will of the pound's growth. The downward movement will be limited by the lower level of the indicator around 1.2820.

Description of indicators

|

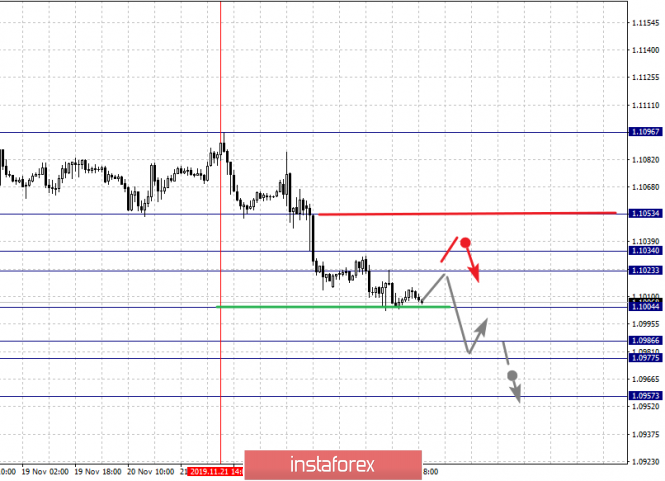

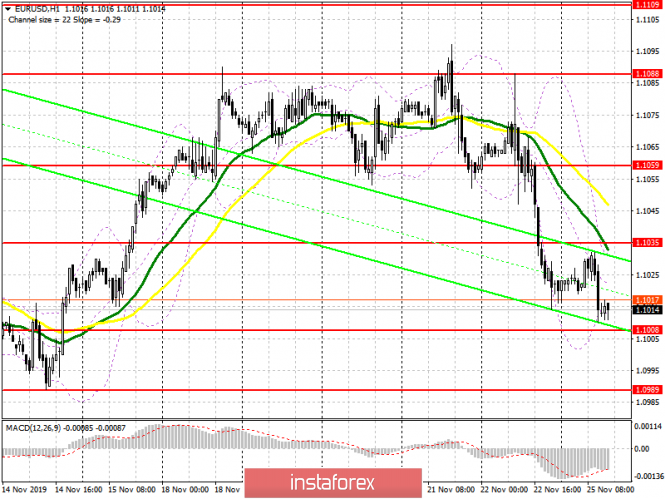

| Posted: 25 Nov 2019 09:42 AM PST To open long positions on EURUSD, you need: Data on Germany, namely on the indicator of economic expectations, which was worse than economists' forecasts, did not allow the European currency to continue the upward correction. At the moment, buyers are protecting the support level of 1.1008, which I paid attention to in the morning review. However, it is best to open long positions from it only after the formation of a false breakdown. You can buy immediately on the rebound from the larger support area of 1.0989. The main task of the bulls in the second half of the day will be a return to the resistance of 1.1035, where I recommend taking the profits. However, it is unlikely that the speeches of representatives of the European Central Bank will have any effect. To open short positions on EURUSD, you need: Given that no important fundamental statistics are expected in the afternoon, the entire focus will remain on the US-China trade talks. Any negative news will help sellers of the euro to break below the support of 1.1008, which buyers are trying to keep now. The breakout of this range will lead to another wave of sales of EUR/USD with the update of the lows in the area of 1.0989 and 1.0972, where I recommend taking the profits. In the absence of activity at the level of 1.1008, short positions can be returned after the formation of a false breakdown in the resistance area of 1.1035 or sell the euro immediately on the rebound from the maximum of 1.1059. Indicator signals: Moving Averages Trading is below the 30 and 50 moving averages, which indicates a further probability of a decline in the euro. Bollinger Bands Breaking the lower border of the indicator around 1.1008 will lead to a larger sell-off of the euro.

Description of indicators

|

| Posted: 25 Nov 2019 09:42 AM PST Good day, dear traders! I present to your attention a trading idea for AUDUSD. Recently, the AUDUSD pair is under division. This is due, among other things, to the lack of results in trade negotiations between the US and China. The manufacturing and services sectors in Australia are slowing, and against the backdrop of a strong dollar – a weak Aussie – this is a downward trend. The strengthening of the US dollar at the end of last week occurred on all fronts – in EURUSD, USDCAD, and gold. The stock sector is also growing. In this regard, I propose to work to lower the Australian against the US dollar on a daily scale: The probability of collecting buyers' stops in 2 weeks is very high in such a downward trend. The second target is as interesting as the base of the impulse bar, which attracts the feet of buyers like a magnet. If you want to hold short positions, then after the breakdown of the extremum on November 14, I recommend moving positions to breakeven. The analysis is provided as part of the strategy Price Action and "hunt for stops". Good luck in trading, and follow the money management! The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 Nov 2019 09:42 AM PST EUR/USD – 4H.

As seen on the 4-hour chart, the EUR/USD pair continued the process of falling and closed under the Fibo level of 50.0% (1.1030). Thus, the pair's quotes remain within the downward trend corridor and can continue falling towards the next correction level of 61.8% (1.0995). Today, the divergence is not observed in any indicator. A correction today, as well as highly active movements, is unlikely. Most likely, Monday will be held in very restrained trading, as the information background is empty today. Last week ended with the renewed interest of traders in the US currency against the background of absolutely unacceptable information background from Europe. Thus, it remains to be seen what information background will be present this week and how it will affect the euro-dollar currency pair. News this week will start arriving on early Tuesday. More precisely economic reports. News on the topics of Brexit, the trade war between China and the United States and the impeachment of Trump can arrive at least every day and it is good that they do not excite the currency markets too much, otherwise, it would be extremely difficult and inconvenient to predict the movement of the pair. Federal Reserve Chairman Jerome Powell will make a speech on Tuesday, and this event will certainly arouse strong interest among traders, especially after Christine Lagarde's speech, which stated the need to further stimulate the EU economy, change monetary policy and cooperate with all EU countries and governments to counter the economic recession caused by global political and trade tensions. Powell's latest statements hint that the Fed's monetary policy, on the contrary, is relaxed to the levels when the economy no longer needs additional stimulus, and to fully see the results of the three interest rate cuts, you need to wait a few months. Thus, if Powell's rhetoric remains unchanged, it will be another factor in the fall of the euro currency. On Wednesday, we recommend paying close attention to the report on durable goods orders in the United States, the preliminary value of GDP for the third quarter reports on changes in the volume of personal income and spending of Americans and the report on the employment rate of ADP. According to preliminary forecasts, the greatest concern is the report on orders for durable goods, which implies a new serious reduction in volumes. The last significant event of the week will be the publication of the report on inflation in the European Union for November (inconclusive value), where an unexpected acceleration to 0.9% y/y is expected. Thus, if the report on long-term orders on Wednesday fails, as is expected now, and inflation in the EU - accelerates, the euro will be able to count on an increase in traders' demand this week. Much will depend on the speech of Jerome Powell on Tuesday, which will set the tone of trading for the whole week, but I believe that the Fed Chairman will not announce anything new to his listeners. Forecast for EUR/USD and trading recommendations: On November 25, traders will continue to trade the euro-dollar pair lower, although there is no information background today. Until the closing of the pair quotes above the Fibo level of 50.0% (1.1030), I consider it appropriate to sell the pair with the target of 1.0995 and the stop-loss order above the level of 1.1030. But I recommend buying the euro currency only after the pair rate leaves the current trend corridor, which will mean a change in the mood of traders to the opposite. The Fibo grid is based on the extremes of October 1, 2019, and October 21, 2019. The material has been provided by InstaForex Company - www.instaforex.com |

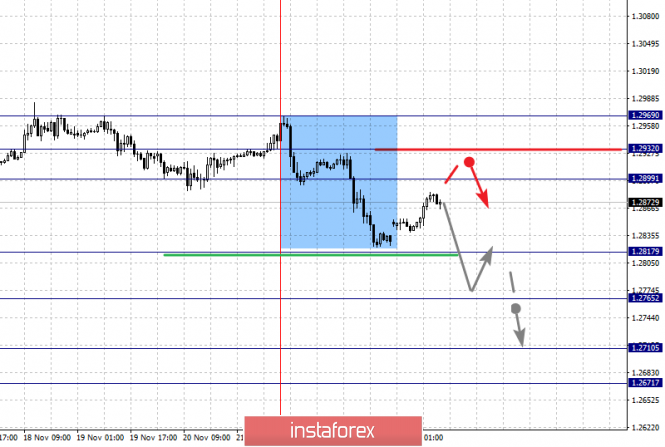

| Posted: 25 Nov 2019 09:42 AM PST GBP/USD – 4H.

As seen on the 4-hour chart, the GBP/USD pair performed a fall to the correction level of 61.8% (1.2836), rebound from it and a reversal in favor of the English currency. Thus, the pound-dollar pair may continue to trade above the level of 1.2836 this week, which will preserve its chances of resuming growth in the direction of the peak level of 1.3011. Closing the pair at 61.8% will work again in favor of the US currency and the resumption of the fall in the direction of the correctional level of 50.0% (1.2668). The information background for the pound-dollar pair last week was quite weak, so it will remain this week. No interesting report on the UK economy will be published, so traders will be able to pay attention only to news from America. Accordingly, the key days for the pair will be Tuesday (speech by Jerome Powell) and Wednesday (reports on durable goods orders, GDP, employment levels and personal income and spending of Americans). The most important topic for the "Briton" and the whole of the UK – Brexit – remains in pause mode, as the country continues to prepare for the elections and nothing interesting is happening at all. Only the comments of Boris Johnson and Jeremy Corbyn, who urge the electorate to vote for the conservatives or labor, familiarization of the population with the manifestos of each party participating in the elections and debates, interviews aimed at increasing the popularization of a particular political force. Probably because nothing interesting is happening in the UK now, and traders ignore a good half of all economic reports (mostly from the US). Thus, the pound remains in a state where it is difficult to trade it for the long term. Most of the trades close very quickly, and the trend movement is not obvious at all. Forecast for GBP/USD and trading recommendations: The pound-dollar pair stopped falling near the correction level of 61.8%. Thus, purchases, from my point of view, are again expedient, if we take into account the fact that it is unlikely that the quotes will continue to grow above 1.2975. Rebound from the Fibo level of 61.8% allows you to buy the pound. I recommend selling the pair this week, if there is a consolidation under the correction level of 61.8% with a target of 1.2668. We pay special attention to Jerome Powell's performance tomorrow night. The Fibo grid is based on the extremes of March 13, 2019, and September 3, 2019. The material has been provided by InstaForex Company - www.instaforex.com |

| Simplified wave analysis of EUR/USD, AUD/USD, and GBP/JPY on November 25 Posted: 25 Nov 2019 09:42 AM PST EUR/USD Analysis: The euro chart has been dominated by a bearish trend for the last 2 years. The last, unfinished bearish wave for today counts down from September 3. Wave correction, in the form of a stretched plane. It lacks the final part. Since November 14, the reversal structure is formed upwards. Forecast: Today, the completion of the downward pullback of the last days is expected. A change of the rate is likely within the framework of settlement support. The beginning of the rise can be expected by the end of the day. Potential reversal zones Resistance: - 1.1100/1.1130 Support: - 1.1030/1.1000 Recommendations: In the coming trading sessions, euro sales will be irrelevant. It is recommended to monitor the reversal signals to find the best points to buy the pair.

AUD/USD Analysis: In the short-term scale of the Aussie chart, the last wave of September 12 is bearish. The structure formed the first 2 parts (A+B). In the final part (C), over the past week, an intermediate rollback has been formed in the lateral plane. Forecast: Today, the general flat sentiment is expected to continue. In the first half of the day, the upward mood of the movement is likely. A short-term puncture of the upper boundary of the resistance zone is not excluded. Potential reversal zones Resistance: - 0.6820/0.6850 Support: - 0.6760/0.6730 Recommendations: The pair's purchases are relevant today only in the framework of intra-session trading. At the same time, it is necessary to reduce the trading lot. In the area of the resistance zone, it is recommended to monitor the reversal signals to find entry points to short positions on this instrument.

GBP/JPY Analysis: The main vector of movement of the cross in the last month and a half was "sideways". In the main upward wave, the price forms an intermediate correction. The wave entered its final phase. The price once again rebounded from the strong support level. Forecast: Today, the upward mood of the movement is expected. The target zone is the outer border of the price corridor. Given the incompleteness of the bearish wave, then we should expect a return to the bearish rate. The reversal is likely by the end of the day or tomorrow. Potential reversal zones Resistance: - 140.60/140.90 Support: - 139.80/139.50 Recommendations: In the next day, trading is possible only within the day. The main emphasis in cross trading is recommended to be paid to purchases. When the price reaches the resistance zone, the transaction should be closed at the first sign of a change of course. Next, you should change the vector of trade.

Explanations: in simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. Solid background arrows are shown formed in the structure for determining the expected movement. Attention: the wave algorithm does not take into account the duration of the tool movements in time! The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD 11.25.2019 - Watch for breakout of the well defined balance Posted: 25 Nov 2019 08:59 AM PST GBP/USD has been upwards today but still within the context of the larger balance area between the price of 1.3000 (resistance) and 1.2770 (support). Watch for breakout to confirm further direction.

MACD oscillator is showing negative reading below the zero and the slow line is on the downside but overall the balance is my full focus. To open long positions you need: Watch for breakout of 1.3000 and potential target at 1.3169 To open short positions you need: Watch for breakout of the support at 1.2771 and target at the price of 1.2580. The material has been provided by InstaForex Company - www.instaforex.com |

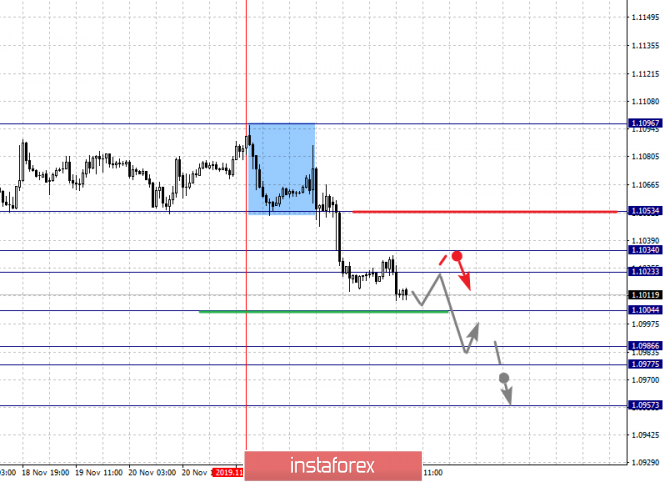

| November 25, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 25 Nov 2019 07:52 AM PST