Forex analysis review |

- Forecast for GBP/USD on November 27, 2019

- Forecast for USD/JPY on November 27, 2019

- Fractal analysis of the main currency pairs on November 27

- AUD/USD vs USD/CAD vs NZD/USD vs #USDX - DAILY. Comprehensive analysis of movement options for November 27, 2019. APLs &

- Take profit on AUD/USD pair

- Technical analysis recommendations for EUR/USD and GBP/USD on November 26

- EUR/USD: the dollar bathes in positive, the euro is crushing a load of problems

- Dollar has no reason for pessimism

- Gold on the crest of a positive wave

- Oil is losing patience

- Pound expects Conservatives to win, but also keeps "suspended" Parliament in mind

- EUR/USD. November 26. Results of the day. Jerome Powell is overwhelmed with optimism. China announces US protest

- GBP/USD. November 26. Results of the day. The pre-election "swing" continues. The gap between Conservatives and Labour is

- GBPJPY. Open longs on downward turns: the pound temporarily lost ground

- BTC 11.26.2019 - WEekly long term analysis, the level at $3.800 in play

- EUR/USD for November 26,2019 - Bear flag pattern in play, watch for further downside move

- Gold 11.26.2019 - Massive shakeout below the previous day low at $1.452.

- EURUSD and GBPUSD: Progress has been made in US-China trade negotiations. Conservatives lost a few percentage points

- Trading recommendations for the GBPUSD currency pair - placement of trade orders (November 26)

- Evening review of EURUSD 11/26/2019

- GBP/USD: plan for the US session on November 26. Bulls are waiting for new benchmarks to buy, and bears are taking advantage

- EUR/USD: plan for the US session on November 26. The euro will continue to decline but subject to the breakdown of the support

- EUR/USD. November 26. Jerome Powell: economic expansion

- GBP/USD. November 26. The UK will face serious challenges after Brexit

- Trading idea for GBPUSD

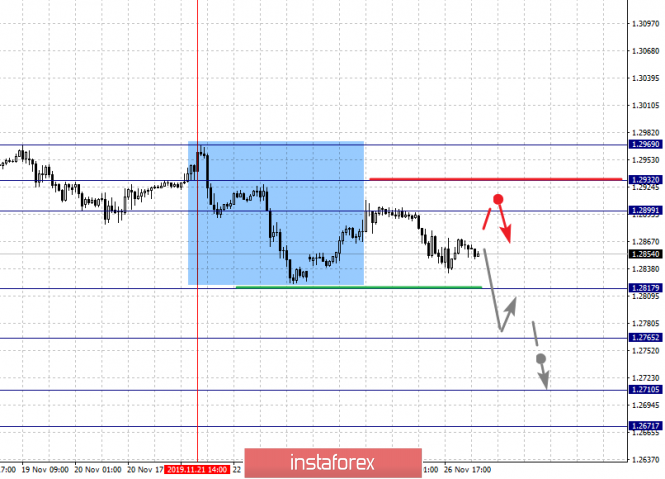

| Forecast for GBP/USD on November 27, 2019 Posted: 26 Nov 2019 07:28 PM PST GBP/USD Correctional growth of the pound stopped quite quickly. The price did not continue to grow on Monday and fell by 36 points on Tuesday. The Marlin oscillator continued to fall in the negative trend zone. The price was supported by the convergence zone of the MACD line with a Fibonacci level of 38.2% on a four-hour chart. The signal line of the Marlin oscillator has turned from the boundary with the growth territory. Leaving prices at yesterday's low of 1.2834 will open the closest target at 1.2765 (Fibonacci level of 23.6% on daily). Decreasing to the level opens the second target at 1.2703, the MACD line of the daily scale is aiming for it. Consolidation at 1.2703 will provoke a medium-term decline in the British pound (target 1.2360 - correction of 61.8% per day). The material has been provided by InstaForex Company - www.instaforex.com |

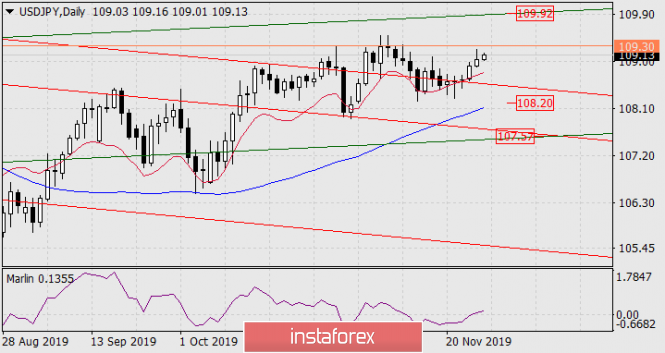

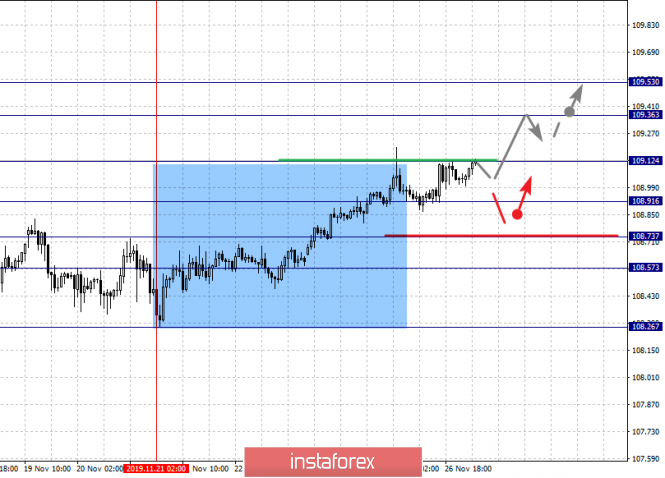

| Forecast for USD/JPY on November 27, 2019 Posted: 26 Nov 2019 06:49 PM PST USD/JPY The dollar is rising for the third consecutive day against the yen, helped by moderate stock market growth. Yesterday, the S&P 500 grew by 0.22%, while the Nikkei 225 is adding 0.38% today. The greatest danger to the global stock market is now the Chinese segment. From November 6, the China A50 index is currently losing 3.82%, today's decline is 0.49%. The markets fear that the fall of Chinese indices will pull the rest of the market. In this case, the USD/JPY pair will decline regardless of other circumstances. Earlier, we noted that the biggest investors reduced investments in US stocks by 30%, that is, they closed their positions in this volume. Thus, the growth of the pair represents an increased risk for purchases. At the moment, the price is approaching the control level of 109.30 (peak on October 30), overcoming which opens the target 109.92. The Marlin oscillator has infiltrated the growth zone, there is the potential for continued movement. On the four-hour chart, a steady rise in prices continues, the Marlin signal line lies in the horizon, but does still not show signs of a reversal. The material has been provided by InstaForex Company - www.instaforex.com |

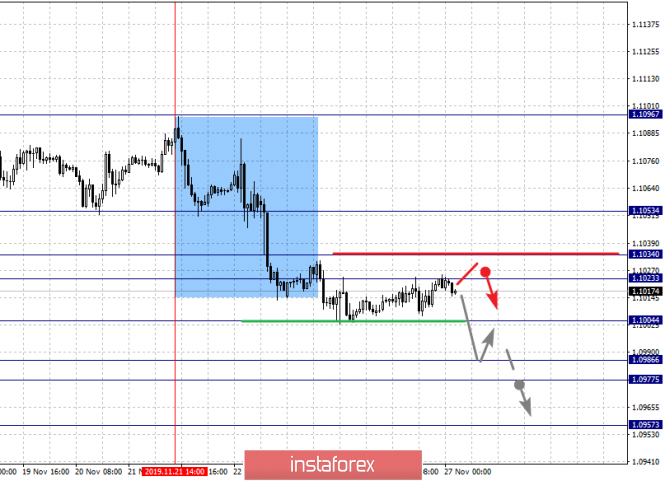

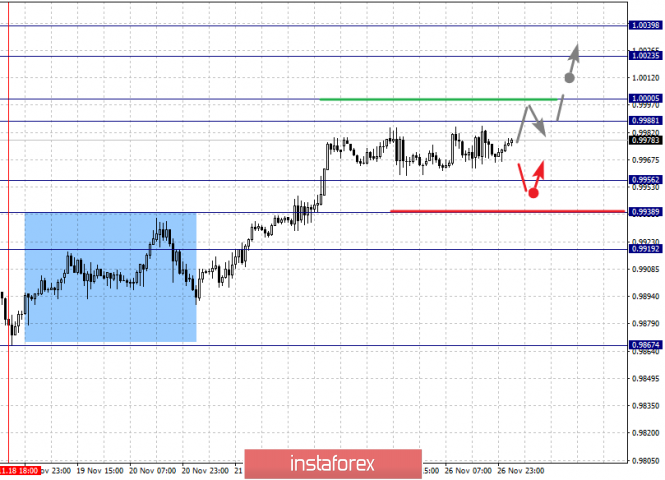

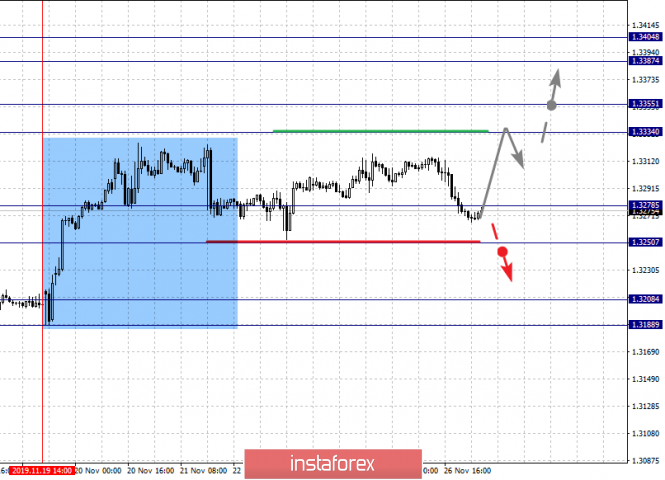

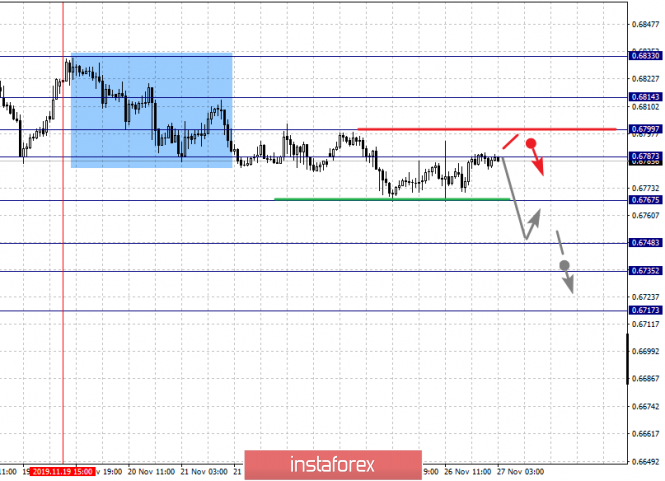

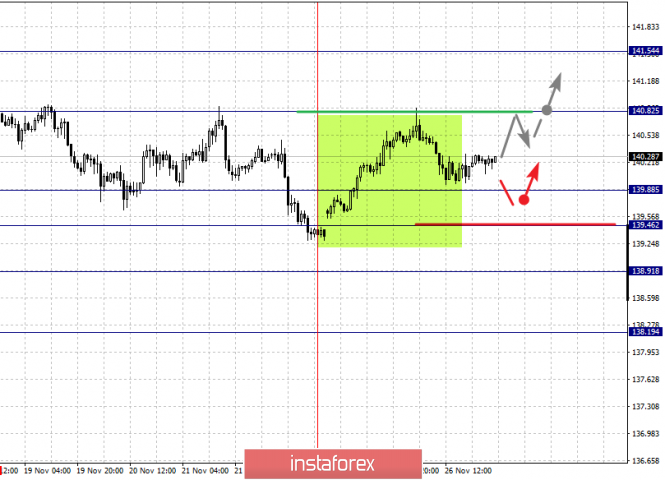

| Fractal analysis of the main currency pairs on November 27 Posted: 26 Nov 2019 05:39 PM PST Forecast for November 27: Analytical review of currency pairs on the scale of H1: For the euro / dollar pair, the key levels on the H1 scale are: 1.1053, 1.1034, 1.1023, 1.1004, 1.0986, 1.0977 and 1.0957. Here, we continue to monitor the development of the downward structure of November 21. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.1004. In this case, the target is 1.0986. Price consolidation is in the range of 1.0986 - 1.0977. For the potential value for the bottom, we consider the level of 1.0957. Upon reaching this value, we expect a rollback to the top. Short-term upward movement is expected in the range 1.1023 - 1.1034. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 1.1053. This level is a key support for the downward structure. The main trend is the downward structure of November 21 Trading recommendations: Buy: 1.1023 Take profit: 1.1034 Buy: 1.1036 Take profit: 1.1050 Sell: 1.1004 Take profit: 1.0988 Sell: 1.0975 Take profit: 1.0958 For the pound / dollar pair, the key levels on the H1 scale are: 1.2969, 1.2932, 1.2899, 1.2817, 1.2765, 1.2710 and 1.2671. Here, we are following the formation of the initial conditions for the downward cycle of November 21. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.2817. In this case, the target is 1.2765. Price consolidation is near this level. The breakdown of the level of 1.2765 will lead to a pronounced movement. Here, the target is 1.2710. For a potential value for the bottom, we consider the level of 1.2671. Upon reaching which, we expect consolidation, as well as a rollback to the top. Short-term upward movement is possibly in the range of 1.2899 - 1.2932. The breakdown of the latter value will lead to the formation of an upward structure. Here, the potential target is 1.2969. The main trend is the formation of the downward structure of November 21 Trading recommendations: Buy: 1.2900 Take profit: 1.2930 Buy: 1.2933 Take profit: 1.2969 Sell: 1.2815 Take profit: 1.2770 Sell: 1.2763 Take profit: 1.2710 For the dollar / franc pair, the key levels on the H1 scale are: 1.0039, 1.0023, 1.0000, 0.9988, 0.9956, 0.9938 and 0.9919. Here, we are following the development of the ascending structure of November 18. Short-term upward movement is expected in the range 0.9988 - 1.0000. The breakdown of the last value will lead to a pronounced movement. Here, the target is 1.0023. We consider the level of 1.0039 to be a potential value for the top; upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 0.9956 - 0.9938. The breakdown of the last value will lead to an in-depth correction. Here, the target is 0.9919. The main trend is the upward structure of November 18 Trading recommendations: Buy : 0.9988 Take profit: 1.0000 Buy : 1.0003 Take profit: 1.0023 Sell: 0.9956 Take profit: 0.9940 Sell: 0.9937 Take profit: 0.9920 For the dollar / yen pair, the key levels on the scale are : 109.53, 109.36, 109.12, 108.91, 108.73, 108.57 and 108.26. Here, we are following the formation of the ascending structure of November 21. Short-term upward movement, as well as consolidation, are expected in the range of 108.91 - 109.12. The breakdown of the level of 109.12 should be accompanied by a pronounced upward movement. Here, the goal is 109.36. For the potential value for the top, we consider the level of 109.53. Upon reaching this value, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement, as well as consolidation, is expected in the range 108.73 - 108.57. The breakdown of the latter value will favor the formation of a downward structure. Here, the potential target is 108.26. The main trend: the formation of the ascending structure of November 21 Trading recommendations: Buy: 109.13 Take profit: 109.34 Buy : 109.37 Take profit: 109.53 Sell: 108.70 Take profit: 108.60 Sell: 108.54 Take profit: 108.30 For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3404, 1.3387, 1.3355, 1.3334, 1.3298, 1.3278 and 1.3250. Here, we are following the ascending structure of November 19. We expect short-term upward movement in the range of 1.3334 - 1.3355. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 1.3387. Price consolidation is in the range of 1.3387 - 1.3404, and from here, we expect a correction. Short-term downward movement, as well as consolidation are possible in the range of 1.3298 - 1.3278. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.3250. This level is a key support for the upward structure. The main trend is the upward structure of November 19, the correction stage. Trading recommendations: Buy: 1.3335 Take profit: 1.3355 Buy : 1.3357 Take profit: 1.3385 Sell: 1.3276 Take profit: 1.3252 Sell: 1.3248 Take profit: 1.3220 For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6833, 0.6814, 0.6799, 0.6787, 0.6767, 0.6748, 0.6735 and 0.6717. Here, we are following the development of the downward structure of November 19. The continuation of the movement to the bottom is expected after the breakdown of the level of 0.6765. In this case, we expect a pronounced movement to the level of 0.6748. Price consolidation is in the range of 0.6748 - 0.6735. We consider the level of 0.6717 to be a potential value for the bottom; upon reaching this value, we expect a correction. Short-term upward movement is expected in the range of 0.6787 - 0.6799. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.6814. This level is a key support for the downward trend. The main trend is a local descending structure of November 19 Trading recommendations: Buy: 0.6787 Take profit: 0.6797 Buy: 0.6800 Take profit: 0.6814 Sell : 0.6766 Take profit : 0.6750 Sell: 0.6746 Take profit: 0.6736 For the euro / yen pair, the key levels on the H1 scale are: 121.12, 120.58, 120.35, 120.11, 119.60, 119.31, 118.96, 118.70 and 118.38. Here, we are following the formation of the downward structure from November 21. At the moment, the price is in the correction zone from this structure. Short-term downward movement is expected in the range 119.60 - 119.31. The breakdown of the latter value will lead to a pronounced movement. Here, the target is 118.96. Short-term downward movement, as well as consolidation is in the range of 118.96 - 118.70. For the potential value for the bottom, we consider the level of 118.38. Upon reaching this value, rollback to the top. Short-term upward movement is expected in the range of 120.11 - 120.35. The breakdown of the latter value will lead to the formation of a local structure for the top. Here, the first goal is 120.58. The main trend is the formation of the downward structure of November 21, the correction stage Trading recommendations: Buy: 120.11 Take profit: 120.33 Buy: 120.36 Take profit: 120.58 Sell: 119.60 Take profit: 119.34 Sell: 119.28 Take profit: 118.96 For the pound / yen pair, the key levels on the H1 scale are : 141.54, 140.82, 139.88, 139.46, 138.91 and 138.19. Here, the price forms the medium-term initial conditions for the downward movement of November 18 and at the moment, the price is close to canceling this structure, for which a breakdown of the level of 140.82 is necessary. Here, the potential target is 141.54. Short-term downward movement is possibly in the range of 139.88 - 139.46. The continuation of the development of the downward trend on the H1 scale is expected after the breakdown of the level of 139.46. In this case, the target is 138.91. Price consolidation is near this level. We consider the level 138.19 to be a potential value for the bottom. Upon reaching this level, we expect a pullback to the top. The main trend is the medium-term downward structure of November 18, the stage of deep correction Trading recommendations: Buy: 140.84 Take profit: 141.50 Sell: 139.88 Take profit: 139.48 Sell: 139.44 Take profit: 138.94 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Nov 2019 05:04 PM PST Minor (H4) What is the first month of winter preparing for us on "raw" instruments? Here's a comprehensive analysis of the development options for the movement AUD / USD vs USD / CAD vs NZD / USD vs #USDX from November 27, 2019 on the Minor operational scale (daily timeframe). ____________________ US dollar Index The dollar index is in the 1/2 Median Line channel of the Minor operational scale forks, therefore, the further development of the #USDX movement from November 27, 2019 will become determined by the development and direction of the breakdown of the boundaries (98.30 - 98.65 - 99.00 ) of the mentioned channel/ A combined breakdown of the upper boundary of the 1/2 Median Line channel (resistance level of 99.00) of the Minor operational scale forks and the 1/2 Median Line Minute (99.05) will make it relevant for the dollar index to reach the upper boundary ISL61.8 (99.45) of the equilibrium zone of the Minuette operational scale forks, the initial line SSL Minor (99.55) and maximum (99.67). On the other hand, the breakdown of support level 98.30 on the lower boundary of the channel 1/2 Median Line Minor will determine the movement#USDX to the boundaries of the 1/2 Median Line channel (98.00 - 97.75 - 97.50) of the Minuette operational scale forks and the equilibrium zone (97.50 - 96.90 - 96.30) of the Minor operational scale forks. The markup of #USDX movement options from November 27, 2019 is shown on the animated chart. ____________________ Australian dollar vs US dollar The movement of the Australian dollar AUD / USD from November 27, 2019 will depend on the direction of the breakdown of the range :

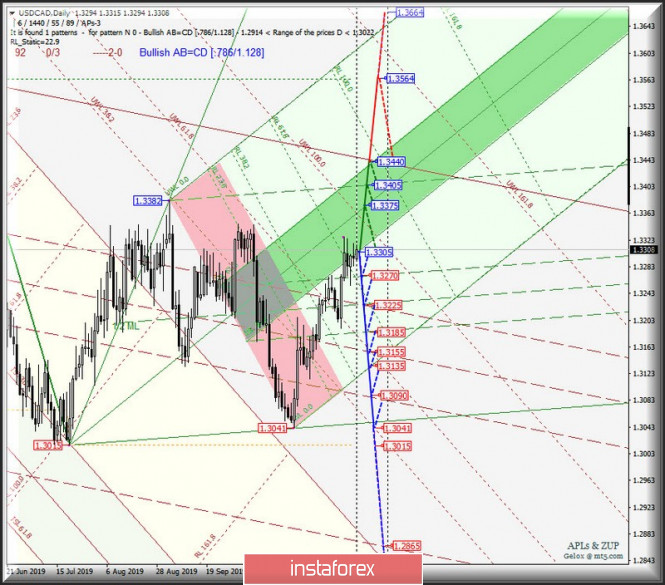

The breakdown of the lower boundary of the 1/2 Median Line channel of the Minor operational scale forks - support level of 0.6770 - continue the downward movement of the Australian dollar to the equilibrium zone (0.6720 - 0.6675 - 0.6630) of the Minuette operational scale forks. Alternatively, the breakdown of the resistance level of 0.6800 will determine the development of the AUD / USD movement in the 1/2 Median Line channel (0.6800 - 0.6830 - 0.6860) of the Minuette operational scale forks, and if the upper boundary (0.6860) of this channel is broken, the upward movement of this currency instrument will continue to the local maximum 0.6931 and the lower boundary of ISL38.2 (0.6960) equilibrium zone of the Minor operational scale forks. From November 27, 2019, we look at the layout of the AUD / USD movement options on the animated chart. ____________________ US dollar vs Canadian dollar Starting November 27, 2019, the development of the movement of the Canadian dollar USD / CAD will be determined by the development and direction of the breakdown of the boundaries of the equilibrium zone (1.3305 - 1.3375 - 1.3440) of the Minuette operational scale forks. The markup of movement inside this equilibrium zone is shown in the animated chart. In case of breakdown of the upper boundary of ISL61.8 (resistance level of 1.3440) of the equilibrium zone of the Minuette operational scale forks, it will be possible to continue the upward movement of USD / CAD to the local maximum 1.3564. However, if you return below the support level 1.3305 (lower boundary of the ISL38.2 equilibrium zone of the Minuette operational scale forks), the USD / CAD movement will continue to the boundaries of the 1/2 Median Line channels of the operational scale - Minuette (1.3270 - 1.3225 - 1.3185) and Minor (1.3225 - 1.355 - 1.3090) with the prospect of reaching a local minimum of 1.3041. From November 27, 2019, we look at the markup of the USD / CAD movement options on the animated chart. ____________________ New Zealand dollar vs US dollar Development and the breakdown direction of the range :

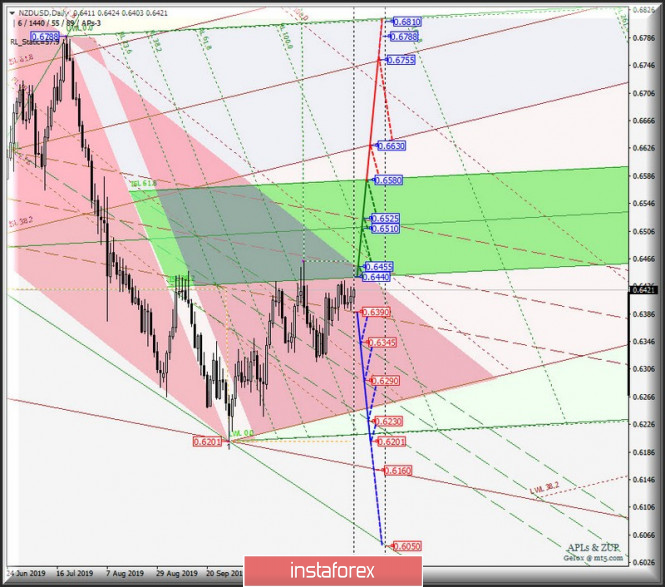

The breakdown of the lower boundary of the 1/2 Median Line Minor channel (support level of 0.6390) is a continuation of the downward movement of NZD / USD to the boundaries of the 1/2 Median Line Minuette channel (0.6345 - 0.6290 - 0.6230) with the prospect of updating the local minimum 0.6201. Consecutive breakdown of resistance levels : - 0.6440 - lower boundary of the ISL38.2 equilibrium zone of the Minuette operational scale forks; - 0.6455 - 1/2 Median Line Minor; will make the development of the movement of the New Zealand dollar in the equilibrium zone relevant (0.6440 - 0.6510 - 0.6580)of the Minuette operational scale forks, and in case of breakdown ISL61.8 Minuette (0.6580), it will become possible for the price of this instrument to reach the lower border of ISL38.2 (0.6630) equilibrium zone of the Minor operational scale forks and the 1/2 Median Line Minor (0.6755). From November 27, 2019, we look at the markup of the NZD / USD movement on the animated chart. ____________________ The review was prepared without taking into account the news background. Thus, the opening of trading sessions of major financial centers does not serve as a guide to action (placing orders "sell" or " buy"). The formula for calculating the dollar index: USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0. 119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of the currencies in the basket: Euro - 57.6%; Yen - 13.6%; Pound Sterling - 11.9%; Canadian dollar - 9.1%; Swedish Krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the start date of the countdown - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

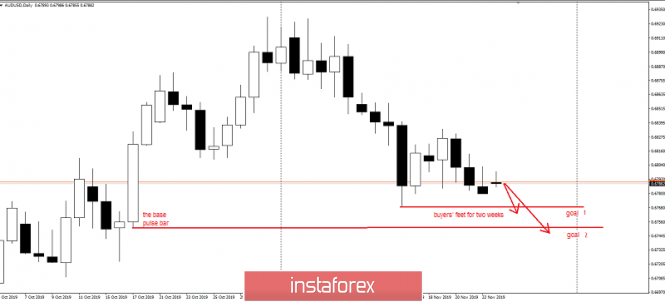

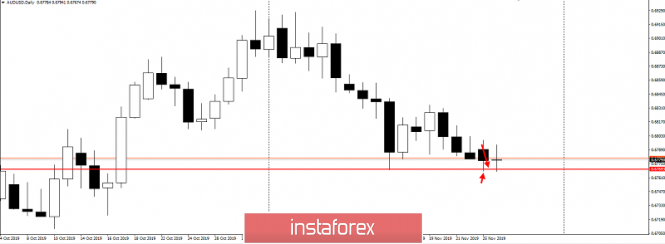

| Posted: 26 Nov 2019 04:18 PM PST Good evening, dear traders! Congratulations to those who took advantage of our trading idea for the AUD/USD pair, which was provided last November 25. Let me remind you that the idea was to develop the lower daily area in a downward trend: As you can see, the first goal is taken: The collapse did not follow, so I recommend taking profits. Good luck in trading and see you tomorrow morning! The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis recommendations for EUR/USD and GBP/USD on November 26 Posted: 26 Nov 2019 04:06 PM PST Economic calendar (Universal time) Today, the most important economic calendar news was expected at 15:00 from the United States. Moreover, data on the consumer confidence index was already announced, as well as indicators on sales volumes in the primary housing market. EUR / USD Players on the downside continued to decline yesterday, but the previous activity has not yet been observed. The closest important reference point in this situation is the minimum extremum of 1.0989. On the other hand, resistance is a fairly wide zone, combining the levels of different time intervals 1.1030 (weekly short-term trend) - 1.1055 (daily cloud) - 1.1082 (daily Kijun + weekly Fibo Kijun). GBP / USD Yesterday, the players on the downside made a very successful attempt to reach all of the opponent's levels at the end of last week. Due to this, the pair returned to the area of 1.2882 levels (daily cross + lower border of the weekly cloud + monthly Fibo Kijun). At the same time, maintaining the current positions will return the relevance of testing the weekly cloud (1.2892-53), so now it is extremely undesirable for players on the downside to take positions and lose levels. To maintain further prospects, they need to update the lows of the sideways movement and current uncertainty minimum (1.2822 - 1.2768) as soon as possible. In the lower halves, it can be observed how a weekly long-term trend leads the fight for the interests of players to lower. If the players on the downside can now continue to decline and update the last week's low (1.2822), then we can hope to realize the potential of the last week and reach new bearish prospects. If support comes in, for example, 1.2850 (classic Pivot level S1), and the pair fails to leave the correction zone, then when consolidating above the zone of key levels 1.2880 - 1.2901 (central Pivot level of the day + weekly long-term trend ) the balance of forces in the lower halves will change and the first significant resistance of the upper time intervals 1.2882 (daily cross + lower border of the weekly cloud + monthly Fibo Kijun) will be lost. Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120) The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: the dollar bathes in positive, the euro is crushing a load of problems Posted: 26 Nov 2019 02:39 PM PST The contrast of recent macroeconomic data demonstrates how responsive the American economy is to monetary incentives, while economic stagnation is developing in Europe. Strong data from the US at this stage support the greenback, reinforcing the belief that the Federal Reserve will take a long pause in the process of lowering the interest rate. It is difficult to say the same thing about the eurozone, where there are more and more signs of decline. According to IFO analysts, the German manufacturing sector managed to get out of the recession. This comment exerted strong pressure on the single European currency, despite the quite decent IFO business climate indices. As preliminary PMI data on manufacturing activity in Germany showed, the pace of decline in this sector has slowed. However, this positive news was offset by indicators of the service sector, which turned out to be worse than forecasts and showed that the weakening went beyond the manufacturing sector. In general, the indicators of the locomotive of the eurozone continue to adversely affect the rate of the single European currency. The EUR/USD rate was near the psychological level of 1.1000. The main currency pair managed to stay above this mark primarily due to optimistic news on the subject of US-Chinese trade negotiations. Last Sunday, there was information that the Chinese authorities intend to toughen the punishment for the theft of intellectual property. This is a key issue in the trade dispute between Washington and Beijing. A day earlier, on Saturday, White House National Security Advisor Robert O'Brien said that the United States and China could sign the first phase of a trade agreement before the end of this year. The renewed hope that a trade deal - even a partial one - nevertheless will be concluded, has improved the mood of market participants. However, if we move away from a very unpredictable history with trade disputes between the US and China, the difference in the dynamics of economic indicators will play on the side of the dollar and against the euro. While the United States is recovering at a normal rate, the light of economic growth continues to quietly fade in Europe. Inaugurated on November 1, the European Central Bank head Christine Lagarde called on national eurozone governments to increase budget spending to support economic growth in the region. Without fiscal stimulus, the regulator will have to take new mitigation measures, which is a negative factor for the euro. This week, investors will monitor the release of inflation indices in Germany and the eurozone. We can expect the EUR/USD pair to be tested at 1.1000 with a further decline if the indicators do not reach forecasts. A break into the November lows near 1.0995 will indicate a strengthening of the downward trend with targets at support levels of 1.0940, 1.0900. Moreover, any corrective growth is likely to be limited by the resistance levels of 1.1125, 1.1170, as long-term negative dynamics of EUR/USD remains. The material has been provided by InstaForex Company - www.instaforex.com |

| Dollar has no reason for pessimism Posted: 26 Nov 2019 02:39 PM PST The US currency began the week on a positive and intends to continue the fight in the same vein. The greenback upward trend is helped by the stability of the American economy and the peppy mood in the market with respect to the EUR/USD pair. Many analysts are confident that the dollar will strengthen its position in the near future. The current market sentiment towards the EUR/USD pair has fully turned towards the greenback, experts emphasize. Analyzing the situation with the European currency, they note that there were no attempts to raise the euro on Monday, November 25. According to experts, the reason for this was the loss of hope for a change in the ECB policy after the arrival of Christine Lagarde. Recall that in her speech, the new leader confirmed the position of Mario Draghi, making it clear that it is useless to wait for the strengthening of rates. As a result, the European currency was under strong pressure and could not rise, analysts say. Unlike its counterpart in the EUR/USD pair, the dollar feels at the height, again showing the desire to move up. Support for the greenback is provided by strong macroeconomic data from the US, published at the end of last week. The current situation is setting the market for the Federal Reserve to take a long pause on the issue of cutting rates. The next rung of the ladder leading with the rise in USD was the active growth of the purchasing managers' indices for the manufacturing sector and the services sector (PMI), as well as the consumer sentiment index. An important role in strengthening the greenback is given to the US economy, which skillfully resists negative external and internal factors, while maintaining amazing stability in the conditions of international trade conflicts. At the moment, the market is positive, as it is inspired by the fact of continuing negotiations between Washington and Beijing. This gives hope, albeit illusory, to the abolition of the December tariff increase, which will affect Chinese goods worth $156 billion. At the same time, stock markets are gradually gaining height, and volatility is declining. In this situation, investors are afraid of a surge in volatility, which may be caused by the fact of the conclusion of the deal, as well as another round of mutual increase in duties. Current changes are favorably reflected in the dollar, which cannot be said about the stalled European currency. On the morning of Tuesday, November 26, the EUR/USD pair was almost at the same low level as the day before. Recall that yesterday the pair tested the 1.1012–1.1013 marks . According to analysts, any negative news regarding the negotiations between the United States and China could contribute to a possible euro sagging in the EUR / USD pair. In the case of the implementation of this scenario, the pair will fall below the support of 1.1008. A breakthrough of this bar may cause a wave of sales of EUR / USD and the fall of the tandem to a minimum of 1.0989. At the moment, the EUR/USD pair is trying to leave the low range, moving away from the level of 1.1014–1.1015. Analysts note the upward dynamics of the pair. At the time, the EUR/USD pair reached 1.1016, but returned to its original position again. Market participants believe that such translational movements will be characteristic of the pair for a long time. Most experts rely on the dollar, strengthening the already strong position of the US currency. Analysts do not record clear reasons for pulling down the greenback. On the contrary, much testifies to the benefit of its strengthening. The market is watching the dynamics of negotiations between the United States and China, on which the further movement of the classic pair will largely depend. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold on the crest of a positive wave Posted: 26 Nov 2019 02:39 PM PST The global precious metals market is on the rise, especially gold. The cost of the yellow metal goes through a phase of consolidation. Experts offer bold forecasts for next year, and the market expects the next driver of precious metal growth. Having reached the $1,460 mark, gold slightly retreated from its positions on Tuesday, November 26. The precious metal traded at $1,459 per ounce yesterday. Experts consider the $1,447 level as the immediate goal of the XAU/USD pair, while they allow a fall to $1,444 per ounce. The XAU/USD pair slightly adjusted in the morning, reaching $1,457.15 per ounce. The pair went up in the future, trading near the level of $1458.06. In the short and medium term, experts predict an upward trend in precious metals. The upward movement will continue next year, experts said. The main driver of pressure on the gold market, analysts believe the increased likelihood of signing a trade deal between the United States and China. Another factor restraining the growth of precious metals is the Federal Reserve's policy aimed at slowing down the process of lowering interest rates. Nevertheless, the currency strategies of the largest investment banks did not revise their previous forecasts. Most of them are optimistic and offer positive scenarios for gold in the long run. 1) Goldman Sachs According to the forecast of the leading US bank, the cost of the yellow metal will reach $1,600 per ounce in 2020. Experts believe that global political tensions and weak market data will support the precious metal market. 2) UBS Specialists of the Swiss bank adhere to a similar position, believing that the price of gold will increase to $1600 per ounce in 2020. UBS is confident that the current consolidation in the precious metal market is a natural process, thanks to which investors can earn on further growth. Support for the yellow metal will have uncertainty in the markets and a further reduction in interest rates. 3) Morgan Stanley Analysts at the largest US investment bank believe that the price of gold will be $1,511 per ounce. Morgan Stanley believes that the reasons for this will be a weakening stock market and a slight decrease in the US currency. According to some analysts, the yellow metal market is currently waiting for a powerful driver for growth. In the coming year, gold will continue to rise, and this trend will continue for a long time, experts said. The material has been provided by InstaForex Company - www.instaforex.com |

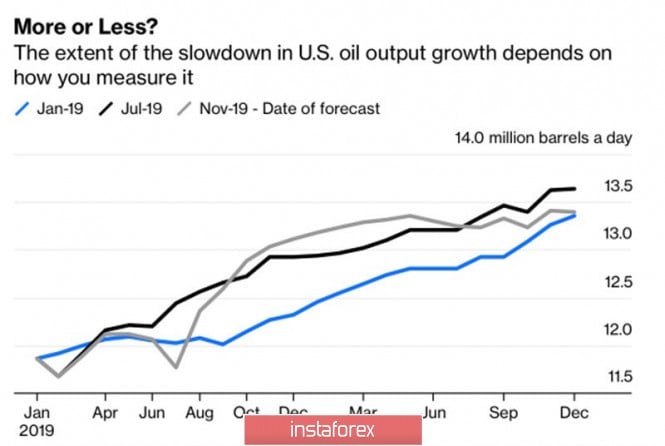

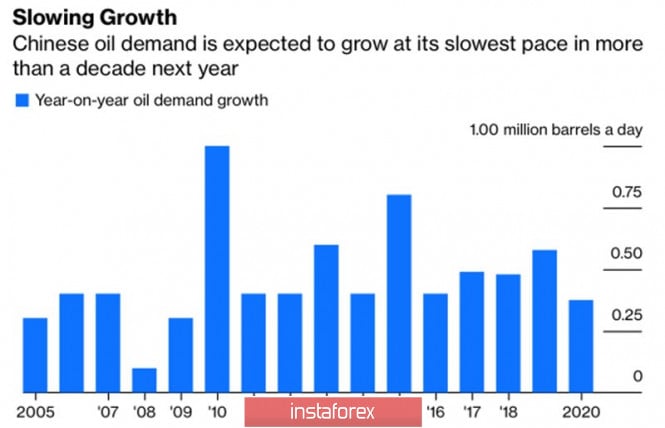

| Posted: 26 Nov 2019 02:39 PM PST The golden rule of trade is: keep your losses low and let your profits grow. However, far from all investors can withstand the nerves. The longer the uncertainty associated with trade negotiations between the United States and China, the more often fear is present in the oil market. There is talk that the factor of signing the US-China "phase one" trade deal has already been taken into account in Brent and WTI quotes, and if so, then in fact there may be an avalanche-like folding of speculative long positions. Isn't it better to play it safe and wait aside? The question of which factor is already in the quotes and which is not is extremely important for the pricing of any asset. The next OPEC meeting will be held at the beginning of December, from which the markets are waiting for the extension of the agreement to reduce production by 1.2 million bpd, at least until the end of 2020. If this does not happen, Brent and WTI futures are likely to collapse. However, it is believed that even if the cartel and Russia give the market what it expects, prices will still fall due to the implementation of the principle of "buy by rumor, sell by facts". OPEC+ needs to be extremely careful so as not to trigger a wave of sales. It may even be necessary to extend the agreement beyond 2020 or to scale up production cuts. From a fundamental point of view, the slowdown in shale production in the United States, the prolongation of the OPEC agreement and the acceleration of global demand under the influence of the signing of a trade agreement by Washington and Beijing should lead to an increase in black gold. However, the United States and China have not yet agreed, we mentioned the cartel's situation, and the question of slowing down US production remains open. They have been gossiping about this for a long time, so this factor may be ... already laid down in quotes. In addition, the dynamics of forecasts by the US Energy Information Administration indicate that not everything is as bad as is commonly believed. The dynamics of EIA forecasts for US oil production When predicting the future fate of an asset, it is also necessary to take into account the time factor. For example, in 2017, investors believed that tax reform would accelerate the US economy, but this only happened in 2018. That is, with a time lag. It is possible that a large-scale increase in the White House's tariffs on Chinese imports this year will affect the economy of China and oil demand only in 2020. For example, the IEA expects the latter to grow by only 375 thousand b / s, which will become worst dynamics since the global financial crisis. Dynamics of Chinese oil demand Thus, if we assume that the prolongation factors of the Vienna OPEC+ agreement on the production cut and the US production slowdown of black gold are already taken into account in Brent and WTI quotes, and the factor of the slowdown in the growth of Chinese oil demand is not there yet, then the market conditions will begin to not look bullish at all. Technically, buyers of the North Sea variety still have hope for fulfilling the targets for the Wolfe Wave and Shark patterns, however, falling quotes below supports by $62-62.4 and $59.4-59.8 per barrel can return the initiative to sellers. The material has been provided by InstaForex Company - www.instaforex.com |

| Pound expects Conservatives to win, but also keeps "suspended" Parliament in mind Posted: 26 Nov 2019 02:39 PM PST The volatility of the pound against the US dollar remains high in anticipation of early parliamentary elections in the UK. Voting can result in many options: from the release of Great Britain from the European Union without a deal, to a second referendum and maintaining the country's membership in the bloc. The GBP/USD pair rose above the level of 1.29, but could not develop an upward movement and updated local lows in the region of 1.2850. According to the latest Kantar opinion poll, Conservatives continue to outpace their key rivals, the Labour Party, but this gap narrowed by 7%. Compared to the previous week, the advantage of the Tories was reduced from 18 to 11%. Support to Conservatives was expressed by 43% of respondents, and by Labour - 32%. The pound will win if the Tories get a majority in the December elections, but only temporarily, Rabobank experts say. "GBP/USD may rise to 1.32 in response to the Conservative victory due to the expectation of a reduction in political uncertainty. However, given the risk that trade negotiations between the United Kingdom and the EU will not be as easy as British Prime Minister Boris Johnson has indicated, we see many opportunities for disappointment in 2020. Most likely, many moderate Conservative deputies will be replaced by hard-wired brexiters, which means that the threat of disordered Brexit may return at the end of next year after the transition period," they noted. UBS experts, in turn, believe that GBP/USD will be stuck in a narrow range if the election does not reveal a winner. "If the election results lead to a suspended Parliament, we expect Article 50 of the Lisbon Treaty to be renewed again, followed by a second referendum on Britain's exit from the EU. If this scenario is realized, the GBP/USD pair will be traded in the band of 1.25–1.30," they said. The material has been provided by InstaForex Company - www.instaforex.com |

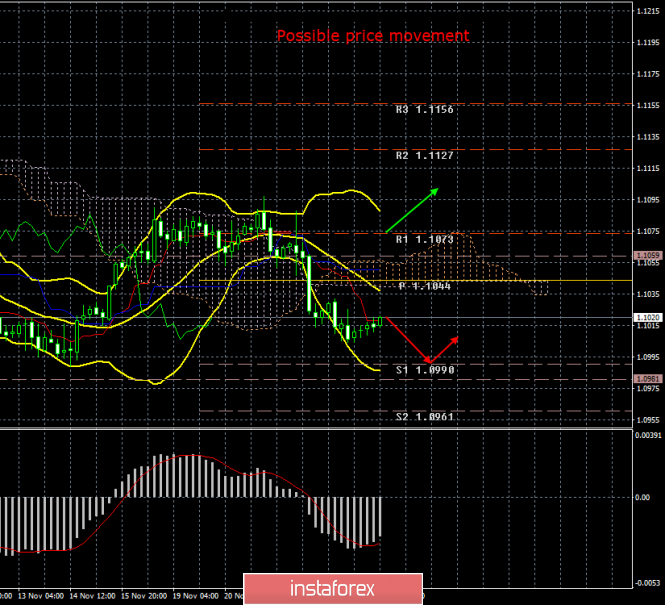

| Posted: 26 Nov 2019 02:39 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 21p - 28p - 45p - 74p - 28p. Average volatility over the past 5 days: 39p (low). The EUR/USD currency pair continues to trade with low volatility on the second trading day of the week, maintaining a downward trend and correcting against it amid the complete absence of any macroeconomic information. The euro is not like the pound sterling, which stubbornly ignores any statistics and awaits parliamentary elections and decisions on Brexit. On the contrary, the euro is prone to reaction to economic data, only, unfortunately, now no economic data is at the disposal of traders, but the media and periodicals are full of news, so to speak, on near-economic topics and frankly political, which create a common fundamental background, and will also affect the economic performance of the European Union and the United States in the future, therefore they are extremely important. The first thing to note is the speech of Federal Reserve Chairman Jerome Powell, the first after he was called by Donald Trump. Then (during this meeting) opinions among traders differed. According to official information, Trump called Powell for an "intimate conversation," which he did not forget to mention after the meeting. Some traders were inclined to believe in this version. Another version says that the US president, through the media, was tired of exerting pressure on the Fed chief and urging him to lower key rates as quickly as possible. Be that as it may, we see after Powell's speech today that the conversation with Trump had no effect. The Fed chairman said that the market is still very far from the recession, and even at the current stage of economic development, despite the trade wars, he "sees the glass half full, not empty." According to Powell, interest rates will remain on standby, that is, unchanged in the near future, and the phrase "changing the key rate if the situation requires it" has disappeared from the most common formulations. Thus, we believe that it is definitely not worth expecting a new easing of US monetary policy in the next three to four months. Furthermore, everything will depend on the trade conflict between the United States and China and its escalation/de-escalation. It is not yet clear as to what Trump will do at this point. We have repeatedly said that the US president needs zero rates, and possibly even lower. Most likely, pressure on Powell will resume through the media. Meanwhile, the Chinese Foreign Ministry on Monday called on US Ambassador Terry Branstad to protest the United States over Congressional approval of the Hong Kong Human Rights and Democracy Act. Official Beijing believes that this position of the US government is a direct intervention in the internal affairs of the country and urged Washington to correct its mistakes and not interfere in the events in Hong Kong. Chinese Deputy Foreign Minister Zheng Zeguang said that Hong Kong is a Chinese city, and all its affairs relate to the internal affairs of China and no state has the right to intervene in them. "The US Congress is openly interfering in the internal affairs of China, flagrantly violating international law and fundamental norms of international relations. The Chinese side expresses deep indignation and declares a protest!", the statement said. Zeguang also warns that "if America does not stop intervening, then all responsibility for the consequences will fall on its shoulders." As you can see, the conflict between the United States and China is heating up. The appeal of the Chinese side is unlikely to be satisfied by the US government. It is not yet clear whether this law will be approved by Trump, whether it will veto it, and whether it will bypass the veto of the Senate, which may well pass this law without Trump's participation. Thus, this story will certainly still be developed. Perhaps the US is using the Hong Kong situation to put additional pressure on Beijing in negotiations on a trade agreement. In this case, again, we can only wait for new information. From a technical point of view, the situation looks much less confusing than with a fundamental one. The pair is in a downward movement, and at the moment there is a weak correction. After its completion, a resumption of the downward movement is expected with good prospects for updating the two-year lows located around 1.0879. Trading recommendations: The EUR/USD pair began a round of correction against the downward trend, and the volatility in trading remains extremely low on Tuesday. Thus, it is now recommended to wait until the correction is completed and sell the euro/dollar pair again with targets at 1.0990 and 1.0981. It is recommended to consider buying the euro no earlier than the reverse consolidation of traders above the critical Kijun-sen line and levels 1.1059 and 1.1073 with the first goal of the resistance level of 1.1127. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. Support / Resistance Classic Levels: Red and gray dotted lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movement options: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Nov 2019 02:39 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 60p - 44p - 77p - 106p - 78p. Average volatility over the past 5 days: 73p (average). The GBP/USD currency pair continues to jump up and down, and these movements are not associated with macroeconomic publications, nor with Brexit news, nor with data from any party's election campaigns. On the first two topics, there was simply no news or message in the first two trading days of the week. On the third topic, all the news comes down to the publication of manifestos and interviews with their leaders. However, this did not stop the British pound from gaining 80 points yesterday, and today it got cheaper by 45. In the long run, flat movement remains inside the side channel with a width of about 200 points. But on the 4-hour timeframe, this movement does not look like a flat, but rather rather abrupt changes in the pair's course, with frequent reversals without a long-term trend. Thus, from its current position, the pound/dollar pair can rush in any direction, since its course is now not affected by fundamental data, political news, or election messages. Meanwhile, while traders are openly waiting for parliamentary elections, according to recent sociological studies, the gap between Conservatives and Labour is narrowing and is currently no more than 11%. It is difficult to say why it is narrowing, since this moment is extremely important. If it is at the expense of the Conservatives' position, then this is bad for both Johnson's party and the prospects for Brexit. If due to weaker parties, the electorate of which goes over to the side of the Labour Party, then the balance of power between the two main parties does not change much. The main question is, how many seats will be allocated to Conservatives and deputies of other parties who will support Boris Johnson's deal on Brexit? If there are 51% of them in the Parliament, and even 49% of the seats will be taken by Labour and their allies, then Brexit will be approved by the majority of deputies, and in fact the difference in political ratings will not exceed 2%. This is just the case when every vote counts, every seat in Parliament will be worth its weight in gold. Experts note that the risk of forming a "suspended Parliament" is very high. The Conservatives will certainly win, but their representation in Parliament will not be enough to support the agreement of Boris Johnson. In this case, Brexit may remain in limbo for a few more years, or the matter will still come to a second referendum. In addition, more and more experts doubt that the government of Boris Johnson will be able to conclude a trade agreement with the European Union in 2020. Earlier, the British prime minister had already promised that he would leave the EU before October 31, and did not keep his word. Now, according to political experts, he will not be able to agree with the European Union until the end of the transition period, which applies to the whole of 2020. According to Ivan Rogers, a former British ambassador to the EU, "the farther the UK is from the EU, the more time negotiations on a trade agreement will take." Rogers also believes that by the end of 2020 you can only have time to conclude a "superficial, cheap agreement, and even that is unlikely." Rogers also predicted the "biggest crisis in the Brexit situation" next year. We, in turn, recall that the current prime minister still has 0 victories. The first may be a convincing election victory, and the second - the withdrawal of Britain from the EU. But if there is no first victory, then the second will not take place. Important macroeconomic publications from the UK are not expected this week, so the pound/dollar pair is likely to remain inside a wide side channel. At the moment, we have a downward trend within this channel, therefore, we have the right to expect a decrease to the level of 1.2790. Trading recommendations: GBP/USD resumed its downward movement as part of a sideways trend. Thus, traders are again encouraged to consider the sale of the pound with targets at 1.2826 and 1.2790, as pound quotes rebounded from the critical Kijun-sen line. It is not recommended to buy the pound/dollar pair yet, as fundamental factors take the side of a downward trend, and bulls are not able to consolidate the pair above 1.2980. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicator window. Support / Resistance Classic Levels: Red and gray dotted lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movement options: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| GBPJPY. Open longs on downward turns: the pound temporarily lost ground Posted: 26 Nov 2019 02:38 PM PST Before the pound had time to celebrate the latest opinion polls in favor of the Conservatives, fresh sociology entered the market, which outlined pessimistic prospects for the Tories. A Kantar poll found that Labour began to gain momentum, while Boris Johnson's party lost a few percentage points from previous studies. The closer to the election (which will be held on December 12), the British currency is more sensitive to such news. Therefore, it is not surprising that the pound fell across the market today - including the dollar and the yen. The GBP/USD pair is under additional pressure from the external fundamental background: the latest news regarding the prospects for the US-Chinese dialogue has supported the greenback. If the likelihood of signing a deal (its first phase) grows, the dollar will continue to strengthen, exerting a corresponding effect on all dollar pairs. But with the GBP/JPY cross pair, the situation is somewhat different. Reducing external risks is not on the side of the pair's bears due to a corresponding decrease in demand for the yen. As you know, the Japanese currency is a safe-haven currency, so the decline in anti-risk sentiment has weakened the yen's position in a basket of major currencies - for example, the USD/JPY pair tested the 109th figure again today. In other words, the yen now does not have "its own resources" for independent growth, and also when paired with the pound, the currency follows the British events. This state of affairs distinguishes the GBP/JPY cross from the GBP/USD pair, where the dollar can play an independent game, even despite the unconditional priority of the Brexit theme. In turn, the yen is virtually helpless in relatively calm periods of time - especially against the backdrop of recent statements by the chairman of the Bank of Japan. All this suggests that the British currency rules today in the GBP/USD cross-pair . The price chart (especially on the four-hour timeframe) has a wave-like character: optimism is replaced by pessimism and vice versa. Since mid-October, the pair has been fluctuating in the 200-point range of 139.30-141.30 - only occasionally and briefly beyond the boundaries of the price range. And now the cross is in the downward movement, heading for the 139th figure. Meanwhile, the pair probably will not overcome the lower limit of the above price range. Moreover, tomorrow the situation may change dramatically, as the research agency YouGov will unveil new survey results. We can expect another upward impulse for the pound if it is in favor of the Conservatives, and the GBP/JPY pair will not be an exception here. Let me remind you that sociological studies of other agencies speak of the successes of Conservatives. For example, yesterday's surge in optimism for the pound was based on a survey conducted by Opinium commissioned by The Observer. The published figures demonstrate the success of the Johnson party: almost half of the respondents (47%) are ready to vote for the Conservatives, while the Labour Party is still content with relatively modest support (28%). Liberal Democrats, according to Opinium, are also losing ground - they are supported by only 12% of respondents. In other words, at the moment it is impossible to talk about any trend that would indicate a decrease in the rating of Conservatives. In addition, the British electoral system does not allow identifying party ratings with possible political developments in a future Parliament. For the formation of the majority, Conservatives need not only to win in their constituencies, but also to win victory in those areas where the positions of Labour are traditionally strong. Vice versa - even if the rating of the Laborites will continue to grow, this does not mean at all that they will be able to take the House of Commons, that is, to form a majority there. By the way, if Johnson cannot form a majority, there are several possible scenarios for further events (Corbyn's premiership or Labour's participation in the government, Conservative alliance with smaller parties, etc.). But in order to consider these or those options, real figures of the election results are necessary, and not the expected result. Therefore, the intrigue in this matter will continue until December 12, and the pound will continue to respond to opinion polls. Thus, traders should not trust the current downward momentum of the GBP/JPY pair. One needs only to look at a four-hour or daily chart (starting from mid-October) to assess the variability of the cross. On the other hand, the pair did not go beyond the above price range during this period of time. All this allows us to consider long positions when approaching the support level of 139.30 (the lower line of the Bollinger Bands indicator on the daily chart). The target of the upward pullback is 140.45 (the upper boundary of the Kumo cloud on the same timeframe). If the data from YouGov will pleasantly surprise investors (for example, with a significant jump for Conservatives), then the cross can go up to the upper boundary of the price band, that is, at around 141.30. The material has been provided by InstaForex Company - www.instaforex.com |

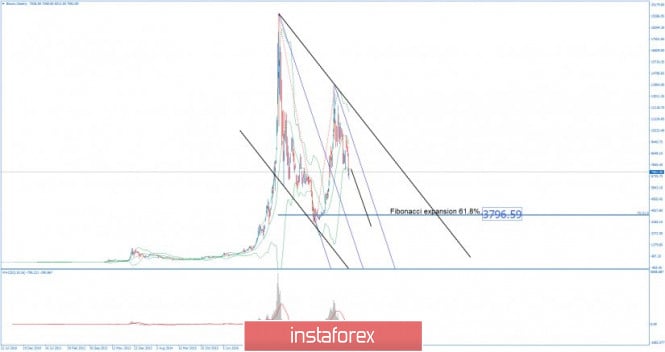

| BTC 11.26.2019 - WEekly long term analysis, the level at $3.800 in play Posted: 26 Nov 2019 07:39 AM PST Based on the weekly time-frame, I found that there is potential for the more downside and larger drop. I found very important Fibonacci expansion 61.8% at the price of $3.800 (main target).

MACD Oscillator is showing downside pressure in the background and it seems that there is no any reversal pattern yet to counter strong selling pressure. Additionally, I found that BTC is trading inside of the downward channel and below the resistance trend line, which is another good confirmation for our short bias. Resistance levels are set at: $7.700 $9.850 The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD for November 26,2019 - Bear flag pattern in play, watch for further downside move Posted: 26 Nov 2019 07:32 AM PST EUR/USD has been trading sideways at the price of 1.1015. Anyway, I expect-further downside break due to bearish flag in creation and short-term downward trend. Watch for selling opportunities with the targets at 1.0992 and 1.02946.

MACD Oscillator is showing downside pressure in the background and it seems that current rally is only corrective for the more downside. Resistance levels are seen at the price of 1.1031 and 1.1048 Support levels are seen at the price of 1.0992 and 1.0946. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 11.26.2019 - Massive shakeout below the previous day low at $1.452. Posted: 26 Nov 2019 07:24 AM PST Gold has been trading downwards. The price reached the level of $1.450 but it reversed aggressively of our key support zone. My advice is still to watch for buying opportunities and eventual test of the $1.461 and $1.472.

MACD had 3pushes down and bullish divergence in the background, which was key technical condition that caused Gold to rally. Additionally, there was the breakout of the downward channel in the background. Key support level is set at the price of $1.450 and important resistance levels are set at $1.461 and $1.472. The material has been provided by InstaForex Company - www.instaforex.com |

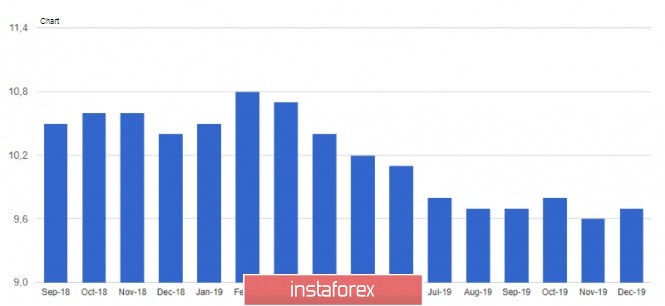

| Posted: 26 Nov 2019 06:02 AM PST News that representatives of China and the United States held telephone talks allowed risky assets to stay at their levels. As it became known, the negotiations were quite positive, which raises hopes for the possibility of concluding an interim deal. According to the data, Chinese Vice Premier Liu He had a telephone conversation with US trade representative Robert Lighthizer and US Treasury Secretary Steven Mnuchin. Immediately after that, the Ministry of Commerce of the PRC reported that the parties had reached a consensus. First of all, we are talking about the protection of intellectual property, which is so sought by the American side. Let me remind you that the Communist Party of China and the Cabinet of Ministers issued an order to strengthen protection on this issue, which allowed to resume negotiations. Today, data on consumer sentiment in Germany will be released, which may improve in December this year. According to the leading indicator, the growth of expectations about the economic outlook, as well as the calculation of an increase in household income, supported the index. The GfK research group report indicated that the consumer confidence index in December 2019 will be 9.7 points against 9.6 in November. Economists had expected the December index to remain unchanged. Experts of the center note that a sharp increase in the level of confidence of German consumers allowed to keep the German economy from recession in the 3rd quarter of this year. The subindex of economic expectations in November rose to 1.7 points, and the subindex of income expectations increased to 45.5 points. As for the technical picture of EURUSD, the very low volatility in the first half of the day left the forecasts unchanged. The breakthrough of the support of 1.1005 will lead to the renewal of this month's lows in the area of 1.0989 and the area of 1.0950. The worsening of US-China trade relations will be an important component in the bearish movement of risky assets. The upward trend is limited to the upper level of 1.1040, the breakout of which will lead to the return of risky assets to the area of the maximum of 1.1060 and 1.1090. The British pound returned to earth after the release of another report conducted by ICM commissioned by Reuters, which indicated that the number of respondents supporting the conservatives fell to 41%, but the number of supporters of the Labor Party, on the contrary, rose to 34%. This is bad news for the pound, as the lack of a majority in the Lower House will not allow Boris Johnson to pass Brexit without parliamentary approval. Another important statement, but relating to Australia, tool place today in the first half of the day. The Australian dollar has shuddered after the possibility emerged that the Reserve Bank of Australia may enter quantitative easing policy territory for the first time. Before this step, there are only two interest rate cuts. The RBA Governor spoke about this in more detail today. Philip Lowe said that there may come a time when quantitative easing is needed, but this issue will be considered only if the key rate is lowered to 0.25%. This will mean that the Central Bank has approached the zero-rate zone. Lowe said he is very hopeful of other options and quantitative easing is not currently on the agenda. Such statements led to a sharp spike in volatility in the AUDUSD pair, but eventually, the balance returned to the market. Philip Lowe also pointed out that negative interest rates are extremely unlikely, as the probability of a recession is low, and rising house prices are not much of a concern. As for the technical picture of the AUDUSD pair, the bulls need to stay at these levels, as only this scenario will lead to the renewal of the resistance of 0.6840 and the return of leadership positions. If the support breaks 0.6770, we can expect AUDUSD to fall further to the lows of 0.6739 and 0.6680. The material has been provided by InstaForex Company - www.instaforex.com |

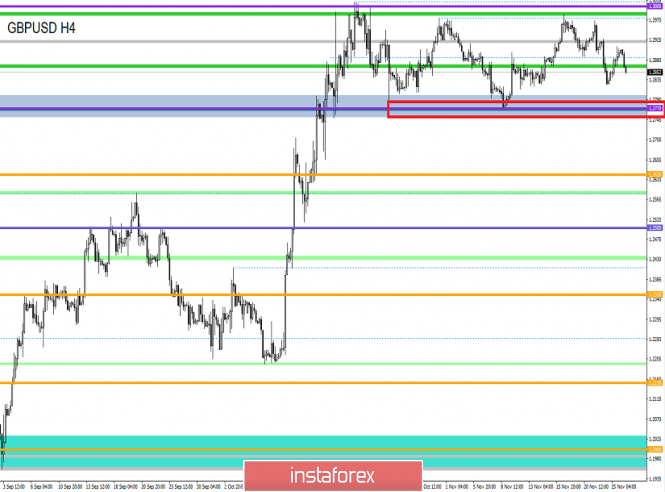

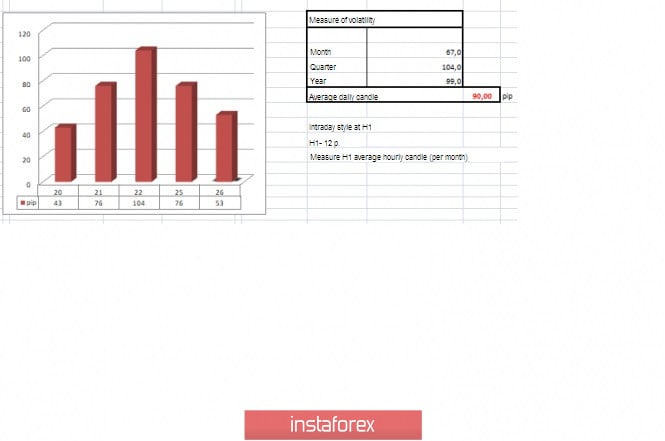

| Trading recommendations for the GBPUSD currency pair - placement of trade orders (November 26) Posted: 26 Nov 2019 05:56 AM PST From technical analysis, we see that after Friday's rally, a rather rapid recovery began, where the cluster played a variable fulcrum on November 12-14. There was a complete recovery, where the quote locally rose above the mirror level of 1.2885, from which it all began, but the bulls failed to hold on to these limits, so we hung in the middle of a long-playing flat of 1.2770/1.3000. What we have in fact - a downward movement in the structure of the side channel, where, against the backdrop of a sharp rally at the end of last week, a local overheating of short positions formed, probably during the first acceleration of volatility in twenty trading days. Thus, local fixation of transactions was made, and again everyone remembered the downward trend, only the trading volumes were already insufficient, so we see a chaotic oscillation with an attempt to align trading interests. As for volatility, we cannot say that everything is very bad; those who read my articles remember that there were periods and worse. So, 76 points, which reflect yesterday's trading day, is 15.5% below the daily average, and especially after Friday's rally (104 points), we have a completely normal fluctuation. In terms of the emotional state of market participants, improvements are visible, and they are displayed in terms of volatility, but in terms of the overall background, the ambiguity remains, and it is expressed within such a wide flat of 1.2770/1.3000. Analyzing the hourly past day, we see that the movement almost from the beginning to the end of the day carried an upward character, and only in the period of transition between the days, we saw a sharp slowdown, expressed in consolidation. As discussed in the previous review, a considerable part of traders still hoped for the resumption of the downward course, for this reason, at the time of Friday's rally, an incomplete volume of trading operations was recorded. In turn, fixing the price higher than 1.2885 led to a local surge in long positions, this is reflected by the candles of 16:00-17:00 (time on the trading terminal), but the desire to top up in short positions prevailed, thus we saw an almost instantaneous surge back. Looking at the trading chart in general terms (daily period), we see a perfect flat of 1.2770/1.30000, which is not often seen in the market. It is necessary to be extremely attentive to its borders, as the breakdown of a particular framework will lead to an increase in the activity. At the same time, traders continue to discuss the possible graphic figure "Triple Top", which is now in the final phase. The news background of the last day did not have in itself noteworthy statistics on the UK and the United States, thus the discussion of Brexit and the leaders of the election race to the Parliament of the United Kingdom once again captured the entire remaining background. So, now everyone is actively discussing the election manifesto of the Conservative Party, which was presented on Sunday by its leader Boris Johnson. As always, there were a lot of loud statements, the most popular slogan sounded in terms of promises to send the Brexit agreement to parliament for a vote by December 25. At the same time, Johnson will promise not to increase several key tax measures if he wins next month's general election, of course. Boris Johnson and his campaign team decided to keep up with Corbyn and said Labor with the Scottish National Party could end up spending 150 million pounds ($194 million) by 2020 on a new referendum on Scottish independence and Britain's membership of the European Union. The Labor Party, meanwhile, unveiled a pledge card for pensioners, including a £ 10.8 billion social care package, and said the tories could not be trusted to care for the elderly. In turn, according to the ICM poll, the Conservative Party is slightly in the lead in the election race - 41%, while Labor is slightly behind - 34%. The emphasis of the Labor Party, particularly Jeremy Corbyn, deserves respect, and many economists agree. So, a former member of the Bank of England's monetary policy committee Danny Blanchflower and more than 160 economists and scientists supported the election promises of the Labor Party as the best way to help the UK economy. In a letter published in the Financial Times, economists said productivity growth over the past decade had virtually stalled and more public investment was needed, especially in green technologies aimed at energy, transport, housing, industry, and agriculture. "As economists and people working in various spheres of economic policy, we have carefully looked at the economic prospects of political parties. It seems obvious to us that the Labor Party has not only understood the deep problems we face but has developed serious proposals to address them," an excerpt from the economists' letter reads. Today, in terms of the economic calendar, we had statistics for the United States, where new home sales are projected to grow by 1.2%. At the same time, the composite index of housing costs also expects growth from 2.0% to 2.1%. Further development Analyzing the current trading chart, we see that the stagnation of the night period has turned into a sharp descent, confirming the previously announced information regarding the opening of short positions. Many flatter themselves with the hope of a characteristic gain in terms of decline and touching the lower border of 1.2770. In principle, everything is possible, judging by the walking cycles in the channel, right now we have a downward beat. Detailing the minute-by-minute movement, we see that the characteristic impulse was born from the very morning of 9:00, where the breakdown of the night consolidation occurred. Now the momentum has turned into inertia, which stimulates short positions. In turn, traders continue to work on the decline, just having topped up the transaction. Having a general picture of the actions, we can assume that the probability of descent up to the control level of 1.2770 is still there, which confirms the current oscillation. Thus, the work on the decline still makes sense, where the top-up has already been made and may still be at the time of the passage of the mark of 1.2823. Based on the above information, we derive trading recommendations:

Indicator analysis Analyzing different sector timeframes (TF), we see that the indicators in all major time areas signal the prevailing downward interest, which is confirmed on the trading chart. The volatility for the week / Measurement of volatility: Month; Quarter; Year Volatility measurement reflects the average daily fluctuation, with the calculation for the Month / Quarter / Year. (November 26 was built taking into account the time of publication of the article) The volatility of the current time is 53 points, which is within the normal range for the current period. It is likely to assume that in the case of maintaining the existing mood, the acceleration of volatility and, as a fact, the excess of the average daily norm is still possible. Key levels Resistance zones: 1.3000; 1.3170**; 1.3300**. Support zones: 1.2885*; 1.2770**; 1.2700*; 1.2620; 1.2580*; 1.2500**; 1.2350**; 1.2205 (+/-10p.)*; 1.2150**; 1.2000***; 1.1700; 1.1475**. * Periodic level ** Range level *** The article is based on the principle of conducting transactions, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review of EURUSD 11/26/2019 Posted: 26 Nov 2019 05:39 AM PST

The only important news in the business media is still optimistic statements from China that the US and China are about to conclude the first trade deal. In my opinion, before we rejoice - we must wait for statements from old Trump - this is the negotiator. One gets the impression that the US is winning this tug-of-war game - of course, the US is also losing something from Trump's duties - but it seems that China is losing a lot more. Trump understands this too, and the desire to "squeeze" the opponent is great. We'll see. There was talk that the Fed might cut rates again. Of course, this benefits Trump - any easing of monetary policy objectively pushes back the moment of future crisis - and Trump needs a year exactly to be elected. But on the other hand, the more financial bubbles are inflated, the more painful the fall will be. Are there bubbles? Well, for example - the US stock market right now at historic highs. Growth from the lows of 2008-2009 was +300%. Well, I object to not correctly evaluate the assets price of panic selling in the winter of 2008-2009, Let's take an assessment of S&P500 index prices to the previous high of September-October 2007, - approximately 1540. From this level, the growth of the index is +100%. That is, a correction of, say, 30-40% could be quite real - and this is a huge drop in the market, huge stress on the economy. Bubble-2, associated with the first - huge property prices in the most expensive US state - California. The fall of the Internet giants will inevitably cause a drop in prices - it is not so easy to sell houses for 2-3 million dollars. This will hurt some banks. Bubble-3 is huge. China's debt market. In the event of a big decline in China, this is a huge risk. That is, there is gunpowder for the explosion - but so far there is no strong tension - and the growth can continue. EURUSD: We buy from 1.1100. We sell from 1.0985. The material has been provided by InstaForex Company - www.instaforex.com |

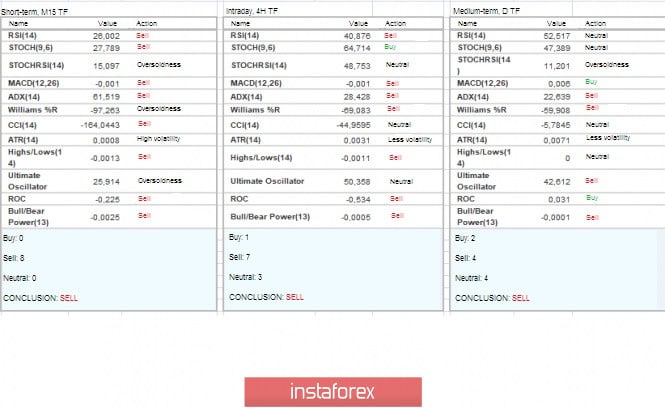

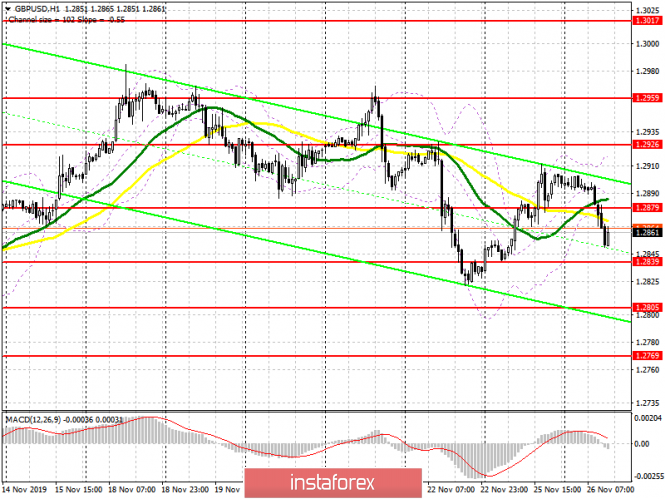

| Posted: 26 Nov 2019 05:39 AM PST To open long positions on GBP/USD, you need: Back in the morning review, I paid attention to the likely decline of the pound after the breakdown of the support of 1.2890, which happened. At the moment, the struggle will be for the resistance of 1.2879, on which it depends whether the upward correction will continue or the market will be pushed further down. Only a return and consolidation above the level of 1.2879 on weak data on the US economy will allow you to return to the maximum of 1.2926 and update it, reaching the resistance of 1.2959, where I recommend taking the profits. However, a scenario with a decline in the support area of 1.2839 and the formation of a false breakdown there, which will be the first signal to buy the pound, seems more likely. Otherwise, I recommend opening long positions immediately on the rebound at the minimum of 1.2805, but this is subject to good statistics for the US and the absence of significant news on the elections in the UK. To open short positions on GBP/USD, you need: Sellers did a great job with the morning task, and now the important point is to keep GBP/USD below the resistance of 1.2879. The formation of a false breakdown at this level will lead to a larger downward correction to the support area of 1.2839 and, quite possibly, to the update of the minimum of 1.2805, where I recommend taking the profits. However, such a strong bearish momentum will be realized only with good data on consumer confidence in the US, where the index is expected to rise to 126.9 points. If the bulls manage to regain the resistance of 1.2879, the big players will leave the market. In this case, it is possible to maintain the side channel or a larger upward correction to the maximum area of 1.2926, from where I recommend opening short positions immediately on the rebound. Indicator signals: Moving averages Trading returned around the 30 and 50 daily averages, indicating that the market may remain in the side channel. Bollinger Bands Growth will be limited by the upper level of the indicator around 1.2915, while bears should cope and not let the pair above the average border of the indicator around 1.2885, which will keep the pound in a downward channel.

Description of indicators

|

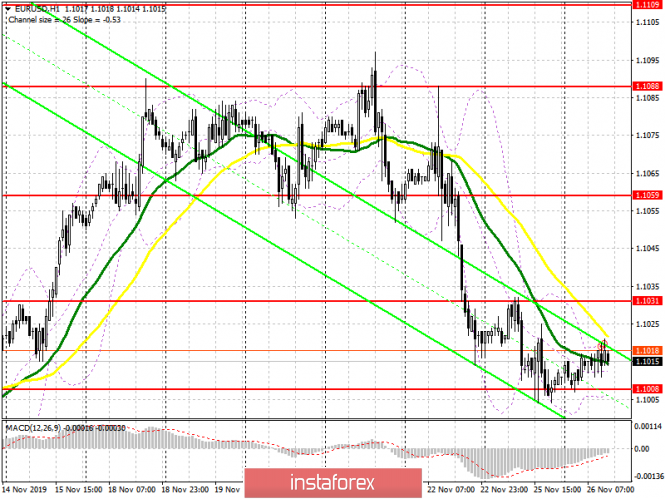

| Posted: 26 Nov 2019 05:39 AM PST To open long positions on EURUSD you need: Data on Germany, namely on the consumer climate index, which reached 9.7 points against 9.6 points in October this year, did not make any changes in the market and left it near weekly lows. Buyers are still defending the support level of 1.1008, which I paid attention to back in the morning review. However, it is best to open long positions from it only after the formation of a false breakdown. You can buy immediately on the rebound from the larger support area of 1.0989. The main task of the bulls in the second half of the day will be a return to the resistance of 1.1031, where I recommend taking the profits. However, this can be done under the condition of weak fundamental statistics, the release of which is scheduled for the American economy in the second half of the day. Particular attention will be drawn to the report on the consumer confidence indicator, which is expected to grow to 126.9 points in November this year. Weak data will test the resistance of 1.1031 again, a breakthrough of which will lead to an update of the maximum of 1.1059. To open short positions on EURUSD you need: On the contrary, good indicators on the US economy and consumer confidence growth will allow bears to increase their short positions in EUR/USD. The breakout of the support of 1.1008, which buyers are trying to keep now, will lead to another wave of sales of EUR/USD with the update of the lows in the area of 1.0989 and 1.0972, where I recommend taking the profits since the lower border of the current downward channel passes in this range. In the absence of activity at the level of 1.1008, short positions can be returned only after the formation of a false breakdown in the resistance area of 1.1031 or sell the euro immediately on the rebound from the maximum of 1.1059. Indicator signals: Moving Averages Trading is below the 30 and 50 moving averages, which indicates a further probability of a decline in the euro. Bollinger Bands Breaking the lower border of the indicator around 1.1008 will lead to a larger sell-off of the euro.

Description of indicators

|

| EUR/USD. November 26. Jerome Powell: economic expansion Posted: 26 Nov 2019 05:38 AM PST EUR/USD - 4H.

As seen on the 4-hour chart, the EUR/USD pair continued the process of falling after closing under the Fibo level of 50.0% (1.1030). Thus, the pair's quotes remain within the downward trend corridor and can continue falling towards the next correction level of 61.8% (1.0995). Today, the divergence is not observed in any indicator. The rebound of the pair from the Fibo level of 61.8% will work in favor of the European currency and the beginning of growth, but in the current conditions, growth above the upper line of the trend range is unlikely. The only event of the past day, which can be highlighted, was the speech of Jerome Powell, President of the Fed. It took place already tonight, thus, on Monday, traders unsuccessfully tried to find interesting information to conduct more active trading. Powell's speech can be called neutral, as there were no new hints about the need to reduce the key rate, and Powell did not express any fears about the deterioration of the economic situation. The Fed President said monetary policy is now appropriate to support the labor market and could encourage inflation to return to the 2% target. It is also noted that the US Central Bank in 2018 raised rates 4 times on the basis of positive economic forecasts, however, due to geopolitical tensions and trade wars, forecasts began to decline, but the economic outlook in 2019 remained favorable, mainly due to the timely reaction of the Fed in the form of three key rate cuts. According to Jerome Powell, "economic expansion will expand, and he sees no reason why it would not be possible." Thus, the Fed President did not confirm the expectations of experts and traders that the Federal Reserve takes a pause in the cycle of interest rate cuts, which is a "bullish" factor for the US currency. It is impossible to say how long the pause will be, as everything will depend on the results of trade negotiations between the US and China. If we assume that the conflict will only flare up, and not extinguish, Beijing and Washington will likely impose new duties and sanctions against each other. Many world experts and political analysts already fear that the current relationship between America and China may well be called a "cold war", and some fear that the trade conflict does not escalate into military action. Accordingly, in the future, the world economy may continue to slow down, and with it the American economy. Thus, the Fed may return to monetary policy easing more than once. Don't forget about the factor of Donald Trump, who will surely continue to exert verbal pressure on both Powell and the Fed. The US President still needs low rates to get more trumps in the confrontation with China, but the Fed does not obey him, so Trump can only constantly criticize the inaction of the Fed. We cannot say that such tactics of Trump do not bring results. Forecast for EUR/USD and trading recommendations: On November 26, traders will continue to trade the euro-dollar pair lower, although there is no information background today. Until the closing of the pair quotes above the Fibo level of 50.0% (1.1030), I consider it appropriate to sell the pair with the target of 1.0995 and the stop-loss order above the level of 1.1030. But I recommend buying the euro currency only after the pair rate leaves the current downward corridor, which will mean a change in the mood of traders to "bullish". The Fibo grid is based on the extremes of October 1, 2019, and October 21, 2019. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. November 26. The UK will face serious challenges after Brexit Posted: 26 Nov 2019 05:38 AM PST GBP/USD - 4H.