Forex analysis review |

- BTC 12.06.2019 - Contraction period, watch for the breakout of the trading range to confirm further direciton

- Gold 12.06.2019 - Gold is near multi-pivot supporrt at $1.57, more downside yet to come

- EUR/USD for December 02,2019 - Rejection of the main resistance at 1.1109, potential for downside and test of 1.1029

- December 6, 2019 : GBP/USD Intraday technical analysis and trade recommendations.

- Evening review for EURUSD on 12/06/2019

- December 6, 2019 : EUR/USD Intraday technical analysis and trade recommendations.

- The euro felt the freedom

- Technical analysis of USD/CAD for Decembre 06, 2019

- Is the dollar the engine of EUR/USD pair while euro is the trailer car?

- Trader's Diary: EURUSD on 12/06/2019, US Employment Report

- Analysis of EUR/USD and GBP/USD for December 6. All focus is on Nonfarm payrolls and US payroll data

- EUR/USD: will NFP report confirm the "bearish" mood of the dollar?

- Overview for AUD/USD as of December 6, 2019

- Simplified wave analysis of EUR/USD, AUD/USD, and GBP/JPY on December 6

- Oil and OPEC meeting

- Eternal impeachment (EUR/USD and GBP/USD review on 12/06/2019)

- EURUSD: The euro has little chance of growth after data on the US labor market

- Pound: The climb on financial everest continues

- Hot forecast for EUR/USD on 12/06/2019 and trading recommendation

- GBP/USD: plan for the European session on December 6. The pound will be satisfied with any data on the state of the American

- EUR/USD: plan for the European session on December 6. Buyers of the euro will fight for 1.1114

- Overview of the GBP/USD pair on December 6. Donald Tusk: Brexit is one of the most serious mistakes in the history of the

- Overview of the EUR/USD pair on December 6. Trump is threatening to impose duties against countries that are not providing

- Technical analysis of ETH/USD for 06/12/2019:

- Today, the focus of the markets is on US employment data (we expect the decline of EUR/USD pair and resumption of gold decline)

| Posted: 06 Dec 2019 07:19 AM PST Bitcoin is trading sideways at the price of $7.390. Price action on the hourly time-frame looks very flat and we got Bollinger bands contraction. Watch for potential breakout of the contraction. The resistance is set at $7.478 and the support at $7.253.

To open long position: Watch for breakout of $7.478 and target at $7.722 To open short position: Watch for breakout of the support $7.253 and target at $7.087 MACD oscillator is showing very low momentum , which confirms the sideways regime. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 12.06.2019 - Gold is near multi-pivot supporrt at $1.57, more downside yet to come Posted: 06 Dec 2019 07:04 AM PST Gold has been trading downside after the NFP news today. In my opinion, it confirmed another down cycle and eventual test of $1.452 and $1.446. My advice is to watch for selling opportunities on the rallies on lower frames (5-15 time-frames).

MACD oscillator is showing increase on the downside momentum, which is good sign that sellers are in control and that selling on the rallies is preferable strategy for today. Resistance levels are seen at $1.471 and $1.480. Support levels are set at $1.452 and $1.446 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Dec 2019 06:57 AM PST EUR rejected of our main multi pivot resistance at 1.1109. As I mentioned, after the price reached Pitchfork median line, we would form several smaller swings before new direction.

Full focus is now on the support at 1.1066. The potential downside breakout of support may lead for test of 1.1029. MACD oscillator is showing increase on the downside momentum, which is good sign that sellers are in control and that selling on the rallies is preferable strategy for today. The material has been provided by InstaForex Company - www.instaforex.com |

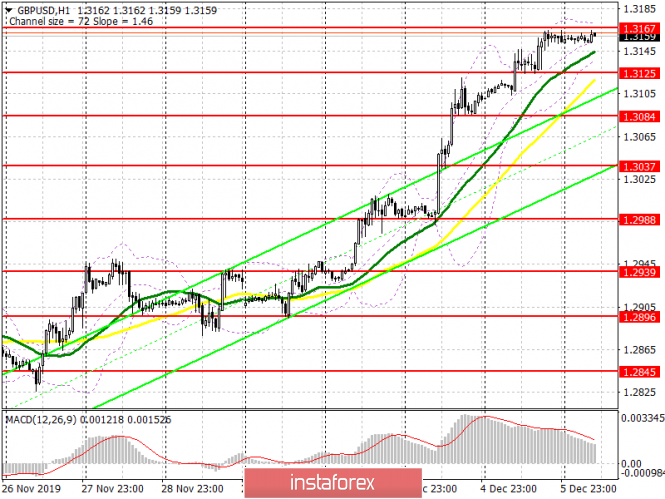

| December 6, 2019 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 06 Dec 2019 06:46 AM PST

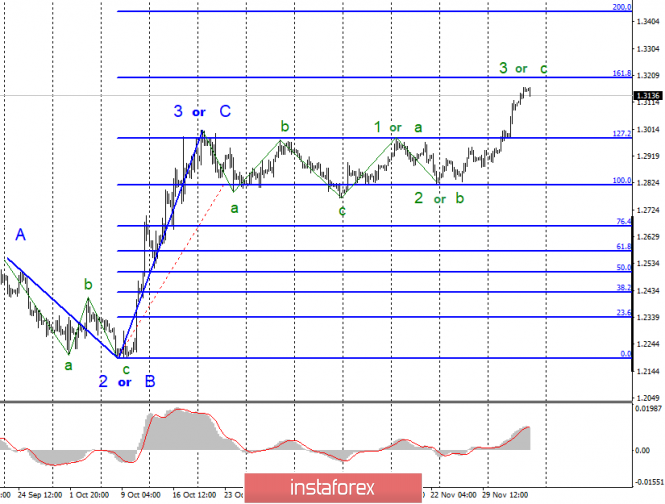

On October 21, the GBP/USD pair was demonstrating an ascending wedge reversal pattern while approaching the depicted SUPPLY-zone (1.2980-1.3000). This pattern was confirmed on October 22. Since Then, the GBP/USD pair has failed to achieve a persistent bullish breakout above the depicted SUPPLY-zone (1.2980-1.3000) which corresponds to a previous Prominent-TOP that goes back to May 2019. This indicated a high probability of bearish reversal around the mentioned price zone. Hence, a quick bearish movement was initiated towards 1.2780 (Key-Level) where bullish recovery was demonstrated on two consecutive visits. That's why, the GBP/USD pair has been trapped between the mentioned price levels (1.2780-1.3000) until Wednesday when bullish breakout above 1.3000 was achieved. Short-term technical outlook remains bullish as long as consolidations are maintained above 1.3000 on the H4 chart. On the other hand, the pair is currently testing the upper limit of the newly-established depicted short-term bullish channel. That's why, high probability of bearish rejection exists around the current price levels. Conservative traders may have to wait for a bearish pullback towards 1.2980-1.3000 for a valid BUY signal. Estimated bullish target would be located around 1.3120 and 1.3150. On the other hand, please note that any bearish closure below 1.2980 invalidates the bullish scenario for the short-term allowing further bearish decline towards 1.2900 then 1.2850. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review for EURUSD on 12/06/2019 Posted: 06 Dec 2019 06:23 AM PST

Nonfarm +266 K. In the private sector +254 K. The unemployment rate fell to 3.5% from 3.6%. Very strong data and completely uncorrelated with the report from ADP two days earlier (a total of +67k). The euro made a noticeable decline. We keep purchases from 1.1035. You can put a stop at breakeven. Entry down from 1.0980. The material has been provided by InstaForex Company - www.instaforex.com |

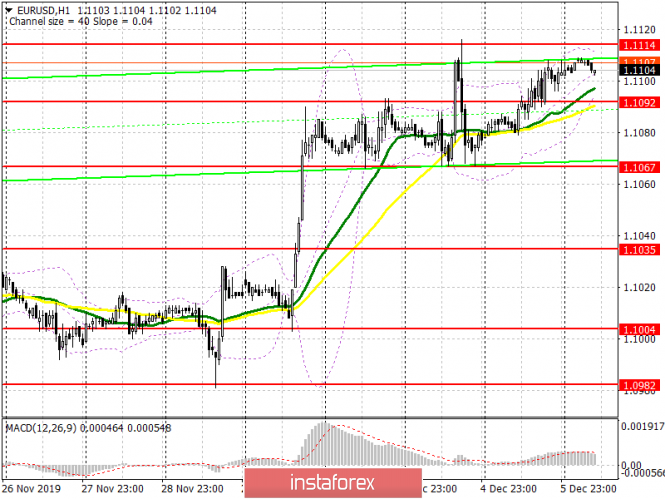

| December 6, 2019 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 06 Dec 2019 06:00 AM PST

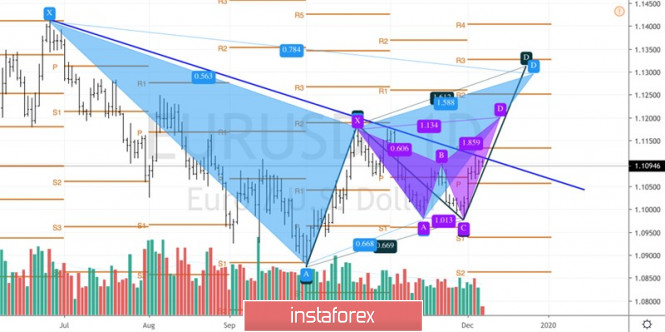

Since October 2, the EURUSD pair has been trending-up until October 21 when the pair hit the price level of 1.1175. The price zone of (1.1175 - 1.1190) stood as a significant SUPPLY-Zone that demonstrated bearish rejection for two consecutive times in a short-period. Hence, a long-term Double-Top pattern was demonstrated with neckline located around 1.1075-1.1090 offering valid bearish positions few weeks ago. Shortly After, two consecutive bearish movements were executed towards 1.1000-1.0995 where another two episodes of bullish rejection were demonstrated. That's why, the price zone of 1.1065-1.1085 where a cluster of supply levels were located (61.8% Fibo - 50% Fibo levels) prevented further bullish advancement. Thus, the EUR/USD Pair has been trapped between the price levels of 1.1000 and 1.1085 (where a cluster of supply levels is located) until Wednesday when a bullish spike was demonstrated above 1.1085 (towards 1.1110). Initial bearish rejection was anticipated around 1.1110 to bring bearish decline towards 1.1065. Moreover, a Head & Shoulders reversal pattern is being demonstrated with neckline located around 1.1065. Hence, a valid SELL entry can be offered upon bearish breakout below 1.1065. Initial bearish target would be located around 1.1010. Please also note that any bullish breakout above 1.1100 will probably bring further bullish advancement towards 1.1140 and 1.1175. The material has been provided by InstaForex Company - www.instaforex.com |

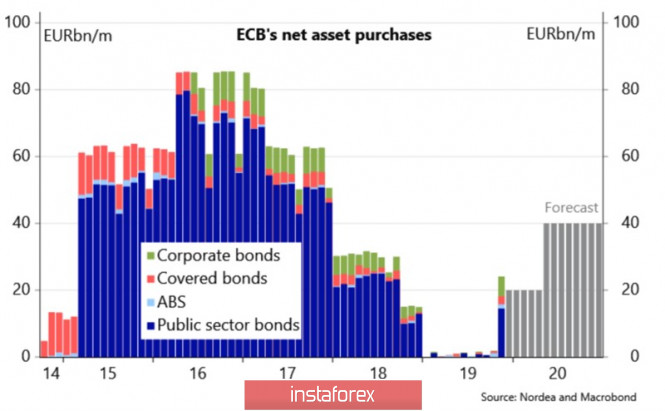

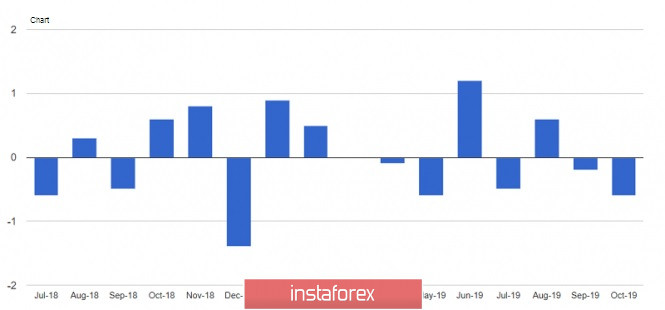

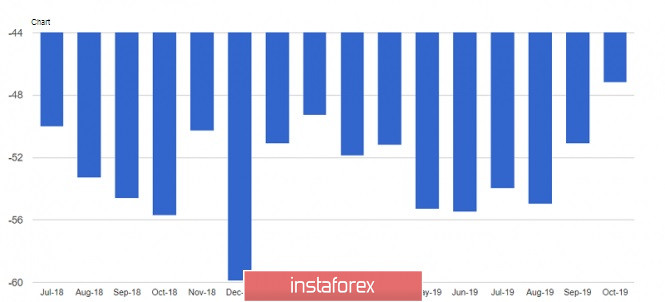

| Posted: 06 Dec 2019 05:13 AM PST The parliamentary elections in Britain, the meetings of the Fed and the European Central Bank, as well as the answer to the question of whether the US will impose new duties against China from December 15 - are the factors that drove the euro and the dollar throughout 2019. The main currency pair will have a very stormy week, after which emotions are likely to calm down and investors will begin to balance their positions, preparing for the Christmas holidays and the New Year. From December 9 to 15, their focus will be on monetary policy, trade wars, and Brexit. The futures market gives almost 100% probability of maintaining the federal funds rate in December and expects monetary expansion only in September 2020. Bloomberg experts do believe that until 2021, the Fed will not make adjustments to monetary policy, no matter how much Donald Trump calls for a rate cut and QE resuscitation. At the same time, the story of how at the end of 2018 Jerome Powell woke the S&P 500 bears with his careless phrases about the remoteness of the federal funds rate from the neutral level is still fresh in the memory of investors. The probability that the Fed chairman will again step on the same rake is small. A much more interesting event is the ECB meeting. First, Christine Lagarde will talk about her position in the field of politics. Second, finally, after the resignation of Mario Draghi, the "hawks" of the Governing Council can feel the freedom and openly declare their position. The fact that inside the European Central Bank dissatisfaction with the policy of negative rates is growing as evidenced by yesterday's "dovish" speech of one of the head of the Bank of Italy, Ignazio Visco. He argues that he would rather expand QE than further reduce the deposit rate. Dynamics of ECB bond purchases under QE

In my opinion, if Christine Lagarde pays much attention to the side effects of the ECB's monetary stimulus policy, the markets will consider her a centrist, and not the "dove" that they imagined as Mario Draghi. As a result, the euro may continue to rally against major world currencies. Moreover, the support for the EUR/USD bulls is likely to be provided by the results of the parliamentary elections in Britain. According to opinion polls, conservatives will win, which increases the likelihood of an orderly Brexit and eliminates the uncertainty associated with the divorce of Albion with the EU. Likely, the States will not impose new duties against China from December 15. Donald Trump believes that the negotiations are going well, the parties agree on the details of the agreed contracts. However, the end of the trade war is positive for the euro on the medium and long-term investment horizon. In the short term, support is at risk of receiving US stock indices and the dollar. Technically Technically, the exit of EUR/USD quotes outside the descending trading channel increases the risks of implementing targets by 88.6% and 78.6% on the "double top" and Hartley patterns. They correspond to the marks of 1.12 and 1,129. While the quotes are above 1.1055-1.106, the situation in the pair is under the control of the bulls. EUR/USD, the daily chart

|

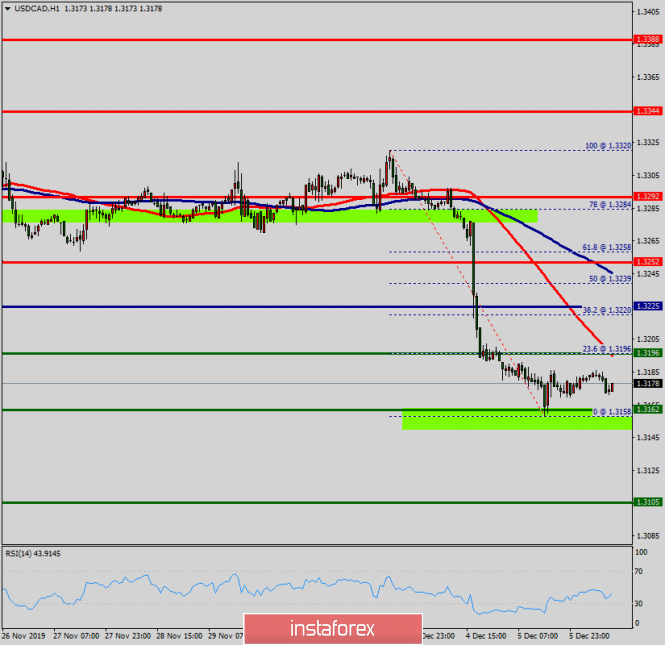

| Technical analysis of USD/CAD for Decembre 06, 2019 Posted: 06 Dec 2019 02:37 AM PST Overview: The USD/CAD pair is trading at the spot of 1.3196 and 1.3252. Right now, the pair has already been corrected by 50.0% and may yet continue trading towards 61.8% or 38.2% Fibonacci retracement levels at 1.3252 or 1.3196. The USD/CAD pair was argumentative as it was trading in a narrow sideways channel, the market showed signs of instability. Resistance and support are seen at the levels of 1.3252 and 1.3196 respectively. The support is the low at 1.3196. Equally important, the USDCAD pair is still moving around the key level at 1.3225, which represents a daily pivot in the H1 time frame at the moment. All these signals taken together indicate further sideways trend movement. Immediate resistance is seen around 1.3252 levels, which coincides with the first resistance. In case of a successful breakout at 1.3252 , the next target will be at the level of 1.3291. This would suggest a bulish market because the RSI indicator is still in a positive area and does not show any trend-reversal signs. The pair is expected to rise higher towards at least 1.3344 so as to test the daily support 3. On the other hand, if a breakout happens at the support level of 1.3196, then this scenario may be invalidated. The material has been provided by InstaForex Company - www.instaforex.com |

| Is the dollar the engine of EUR/USD pair while euro is the trailer car? Posted: 06 Dec 2019 02:08 AM PST The end of the current week did not bring the EUR/USD pair any particular disappointments or victories. As expected, the dollar has strengthened its position, and the euro is striving for the same leadership, but with varying success. Thus, analysts predict a moderate rise for the pair in the near future. According to experts, sharp movements of the EUR / USD pair are not expected before the release of the report on the American labor market (NFP). It can be recalled that this report shows the real number of jobs created. According to preliminary estimates, 186 thousand jobs appeared last month in the US economy. In this situation, the American currency feels at its best. Even possible negative NFPs will not be able to shake its confidence. The European currency is also positive, despite the instability of its position. On Thursday, December 5, the EUR / USD pair was in an upward trend, and today, there will be attempts to resume it. Also yesterday, the pair managed to step over the bar 1.1100 and move up quickly. Subsequently, the EUR / USD pair reached the correctional level of 1.1104, which became a significant obstacle for traders. Yesterday, the pair confused the market, since it did not show movements in a certain direction, but moved in waves - up and down. According to analysts, the consolidation of the upward trend of the EUR / USD pair should be expected after the breakdown of the level of 1.1114. Currently, the pair is close to this level. On Friday, December 6, the EUR / USD pair is trading within 1.1107–1.1109, and sometimes falling slightly. In turn, the market froze in anticipation of NFP data, and this explains the pair playing within the same range. At the moment, the EUR / USD pair is showing a downward mood, which cannot do anything but worry the market. It also went to a peak, dropping the bar sharply to 1.1096. Thus, experts are perplexed: will the EUR / USD pair finally lose their positions? Analysts are still expecting on a favorable outcome. The dollar tried to strengthen its position and "take out" the EUR / USD pair to new heights while the European currency was growing amid market expectations regarding the conclusion of the first phase of a trade agreement between Washington and Beijing. Most often, the "American" succeeded. At the same time, many experts are optimistic regarding the immediate prospects for the dollar. Danske Bank's currency strategists are confident that the key event in 2020 will be the strengthening of USD. Moreover, experts do not observe negative signs that can radically change the current Fed policy or affect the preferences of investors choosing the dollar. According to experts, the dollar will remain the leader in the pair EUR / USD in the short and medium term, and the euro - the slave. This alignment is not excluded even in the case of the growth of the "European" against the backdrop of positive news, such as the ECB's refusal to soften monetary policy and the strengthening of the pound as a result of the "soft" Brexit. Nevertheless, upcoming political events will somehow affect the EUR / USD pair, however, the dollar will be able to withstand the pressure of possible adverse factors, and it is much more difficult for the European currency to do this, experts believe. The material has been provided by InstaForex Company - www.instaforex.com |

| Trader's Diary: EURUSD on 12/06/2019, US Employment Report Posted: 06 Dec 2019 01:31 AM PST

News: A German industry report showed a new drop in the output of -1.7% for October, due to this, analysts expect growth. Nonetheless, this did not weaken the mood of euro buyers for growth, as you can see in the chart above and this also means a good signal for the bulls. The official report on US employment on the nonfarm payrolls for the month of November will be released at 08:30 UTC -5 today. Experts predict a good report of 180K and this is somewhat surprising since just two days ago a private report from ADP showed the growth in the number of jobs is very low with only about 67K by as much as 100K less than the forecast. Which gives us all the more reason to see the news. In the old times of the "early history of the euro", the EURUSD rate for the nonfarm went rapidly from 100 points up to a 4-digit in just 1-2 hours after the release of the data, where a large number of traders made good money on these movements. At one point, that fed up with then-legendary Fed head Alan Greenspan where he said "This indicator is overvalued by the market" and the movements became noticeably less. But finally killed the nonfarm, as the introduction of a report from ADP directly hit in front of the nonfarm. We don't see such strong movements on the report from ADP as before but we also encounter strong movements on nonfarm much less than often. And we could only hope that something will come out. EURUSD: We keep purchases from 1.1035, we expect a break up to 1.1115 and 1.1180 and look at the closing of the day and week. The material has been provided by InstaForex Company - www.instaforex.com |

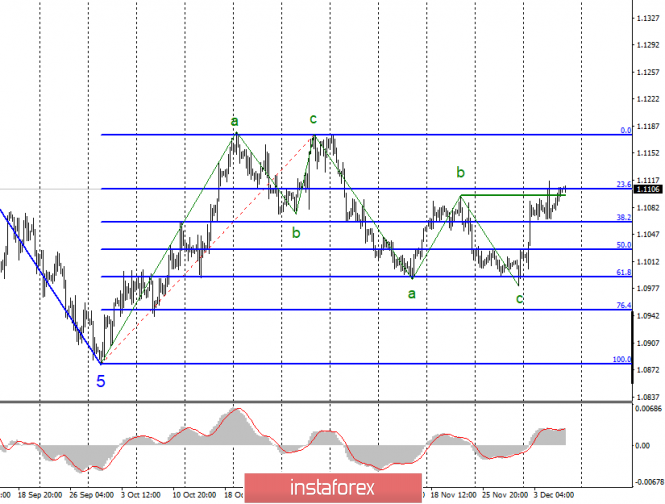

| Analysis of EUR/USD and GBP/USD for December 6. All focus is on Nonfarm payrolls and US payroll data Posted: 06 Dec 2019 01:25 AM PST EUR / USD On December 5, the EUR / USD pair completed with an increase of 25 basis points and exceeded the maximum of wave b for the second time. Thus, another unsuccessful attempt to break through the 23.6% Fibonacci level may lead to a departure of quotes from the reached highs again. Until a breakthrough of the level of 1.1106 occurs, the option to build an upward wave and an upward trend section is not working, although the current wave marking suggests just such a development of events. Fundamental component: On Thursday, the news background for the euro-dollar instrument was quite interesting and strong. As I said yesterday, the euro needed strong figures for economic reports on GDP and retail sales in the eurozone. However, in reality, strong values were not needed. Retail sales in October showed an increase of 1.4%, which means a strong slowdown in growth rates from 3.1% y / y, and GDP amounted to 1.2% y / y, which coincided with the expectations of the currency market. Thus, none of the released indicators exceeded the forecast At the same time, euro currency increased during the day, however, this movement can hardly be called strong. Today, the chances of a really strong movement will be much greater, since several important economic reports will be released in America at once. Also today, markets are waiting for strong statistics from the United States. Recent business activity reports have been a little disappointing, and the US dollar has recently begun to lose ground. Now, reports on the number of new jobs outside the agricultural sector and wages should be stronger than market expectations (+ 180K and + 3.0% y / y) to regain market confidence. However, exceeding the forecast of + 180K will be extremely difficult. In turn, nonfarm value for the last year exceeded 180K for only three times. But if it happens for the fourth time today, the US dollar will certainly receive market support. However, this is bad for the current wave marking, which involves the construction of an upward trend section. Thus, for this scenario, it is necessary that statistics from America be weaker than market expectations. General conclusions and recommendations: The euro-dollar pair allegedly completed the downward trend. Thus, I recommend buying an instrument with targets near the calculated level of 1.1176, which equates to 0.0% Fibonacci. However, I also recommend waiting for a successful attempt to break through the peak of wave b before this and the level of 23.6% Fibonacci. GBP / USD On December 5, the GBP / USD pair gained about 55 basis points, and presumably remains within the framework of constructing the alleged wave 3 or C, an upward trend section, which may well now take the form of a 5-wave one and can be defined as wave 5 at the highest level. If the current wave counting is correct, then the increase in quotes will continue, and if not today, then on Monday. However, much will also depend on the news background for December 6. In this regard, strong data from the USA can lead to quotes moving away from the reached highs. If it's very strong - to the completion of wave 3 or c. Fundamental component: On Thursday, there was no news background for the GBP / USD instrument. However, the "Briton" is now not needed in order to be in demand in the currency market. Day by day, I observe an increase in quotes of the instrument, which is not the reactions of the market to strong economic reports from the UK or weak from the USA. Moreover, markets continue to look favorably towards the pound, which was not a long time ago because of high hopes for the successful implementation of Brexit in late January. Thus, divorce proceedings between the UK and the European Union have already bothered everyone. The period of uncertainty does not allow us to consider the future of the United Kingdom from any particular angle. Indeed, it is impossible to say for sure even now whether Brexit will take place at all. Laborites will unexpectedly win the election and there will be no Brexit on January 31, in the same way as it was not on October 31, and March 31. The conservatives will not get enough votes - and the Parliament will not allow the adoption of an agreement between Boris Johnson and the EU again. Thus, now, the pound is growing, but the situation may change dramatically, as well as with the mood of the currency market after December 12. General conclusions and recommendations: The pound / dollar instrument continues to build an upward trend. I recommend that you should consider closing purchases on the way to the estimated level of 1.3201, which is equivalent to 161.8% Fibonacci. As today, the market may be on the dollar side, especially in the afternoon, when several important reports are released in the USA. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: will NFP report confirm the "bearish" mood of the dollar? Posted: 06 Dec 2019 01:25 AM PST The USD index sank to its lowest level in almost a month amid the release of weak US statistics and reports that Washington and Beijing negotiations on the first phase of the trade agreement are continuing, despite an exchange of aggressive remarks regarding Hong Kong and other issues. Today, the focus is on the report on the American labor market in November, which is traditionally one of the most powerful drivers of the currency market. Analysts expect accelerated wage growth, continued unemployment at 3.6% and an increase in the number of jobs in the non-agricultural sector of the US economy by 186 thousand after expanding by 128 thousand a month earlier. At the same time, leading indicators published ahead of Nonfarm Payrolls paint a negative rather than a positive picture. Data from ADP reflected an increase in employment by only 67 thousand in November against a forecast of 140 thousand. The number of people receiving benefits rose to 1.693 million, although the unemployment benefit rate fell in the last week of the month. Moreover, the employment component of manufacturing ISM was weak for the third month in a row, dropping below 50 - to 46.6. The Challenger report reflected a reduction in layoff intentions, but it did not show an increase in job offers. The only positive indicator was the component of employment in the services sector from ISM, which rose to 55.5 in November from 53.7 recorded a month earlier. Thus, a pleasant surprise from NFP is not expected at this stage. However, if this does happen, the dollar can sharply rise in price against the background of profit taking before the weekend. At the same time, if the employment report is weaker than forecasts, it will only worsen the already "bearish" mood of the USD. Moreover, the reaction of different currency pairs is unlikely to be the same. Major currencies such as the pound sterling and the loonie, as well as safe haven assets, including the yen, are more likely to grow. The euro may also grow, but it is not yet clear whether it will be able to maintain its position. The EUR/USD pair finds it difficult to determine the direction since the October rally. In recent weeks, it has twice formed the base near 61.8% correction of the rally. The weekly high is located at 1.1115 and its breakdown will target the pair at 1.1150 and 1.1180. Thus, the NFP report must be terrible so that the bulls can break through the last level. The main support is located at 1.1065 and its breakdown will send the pair to 1.1000. However, the bears will need more than just good NFP data to break this level. The material has been provided by InstaForex Company - www.instaforex.com |

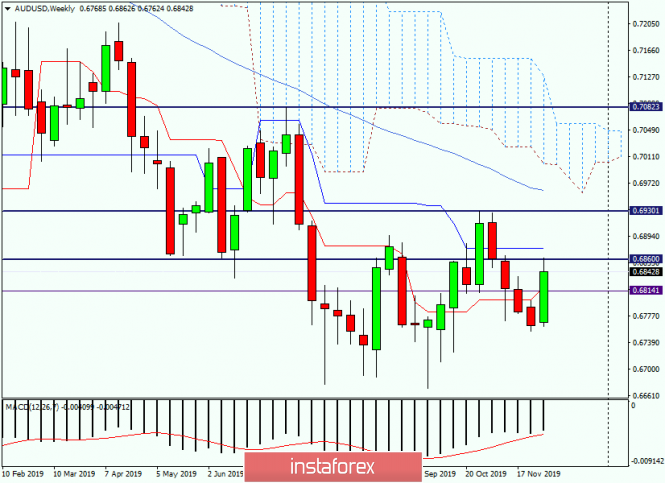

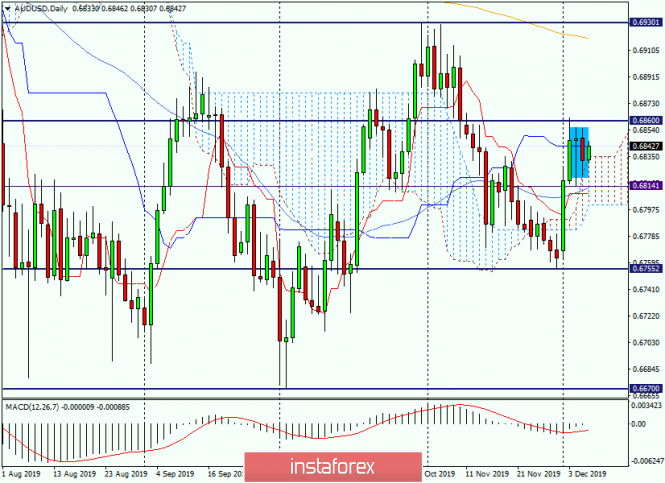

| Overview for AUD/USD as of December 6, 2019 Posted: 06 Dec 2019 01:25 AM PST Hello! At the time of writing this article, the AUD/USD currency pair demonstrates a fairly decent strengthening, however, the final results of trading on December 2-6 will be known after the US labor market data are published at 14:30 (London time). Let me remind you that these are some of the most important indicators that have a strong impact on the course of trading. Unemployment in the United States is expected to remain at 3.6% in November. The coincidence with the forecast will have a neutral impact on the US dollar. If the indicator comes out better or worse than expected, the US currency will strengthen or be under selling pressure, respectively. Hourly wage growth in the US is forecast at 0.3%, which will be a moderately positive factor for the USD. The deviation of the indicator in one direction or another will significantly affect the dynamics of the US currency. As for the number of new jobs in the non-agricultural sectors of the US economy, it is projected to add 180 thousand new vacancies in November. Expectations are quite high, especially when you consider that the last figure was 128 thousand. As for the Australian data, which came out this week, they were quite divergent. For example, data on GDP and retail sales in Australia fell short of economists' expectations and came out worse than forecast values. Weekly

Nevertheless, this did not prevent the AUD/USD currency pair from rising to a strong and significant resistance level of 0.6860, where the quote suspended growth and froze in anticipation of labor reports from the United States. If the US data is negative, the pair will continue to strengthen and test for a breakdown on the strong Kijun line of the Ichimoku indicator, which passes at 0.6877. The further targets of the likely growth will be the resistance level of 0.6930 and the level of 0.6961, where the 50 simple moving average is located. In the case of a downward trend, the pair may lose all current growth and fall to past lows at 0.6755. Further targets of a possible fall will take place in the price area of 0.6720-0.6680. In general, the technical picture on the weekly chart looks in favor of continued growth, but much will depend on today's US statistics. Also important will be the closing price of weekly trading relative to the Tenkan line, the resistance level of 0.6860 and Kijun. Daily

But on the daily chart, everything is far from clear. The last two candlesticks indicate the probability of a downward movement. If that happens, the bears' closest targets for the Aussie will be around 0.6815-0.6800. Below, the pair may fall into the price zone of 0.6760-0.6750. At the same time, in the case of negative Nonfarm data for the US dollar, we are likely to see strong growth, the absorption of the previous two candlesticks and the breakdown of the resistance of 0.6860. In this scenario, the pair may rise to the 200 area of the exponential moving average, which passes at 0.6919. From here we can expect a slight corrective pullback to the zone of 0.6900-0.6880, after which the "Aussie" is likely to resume the upward direction. According to trading ideas, I can say that today is not the best day to open new positions. First, the end of weekly trading, and secondly, data on the US labor market, which will lead to increased volatility and risks. For those who want to take a risk, I suggest considering buying when the pair declines in the price area of 0.6820-0.6800 and (or) on the breakout of the resistance of 0.6860. Although the pair is trading at the resistance of 0.6860, it is better to refrain from selling due to the bullish mood of the market. Have a successful trading and a good weekend! The material has been provided by InstaForex Company - www.instaforex.com |

| Simplified wave analysis of EUR/USD, AUD/USD, and GBP/JPY on December 6 Posted: 06 Dec 2019 01:25 AM PST EUR/USD Analysis: On the chart of the European currency since September, an upward wave structure has been developing. In its appearance, it most resembles a stretched plane. The wave lacks the final part. The price has reached the level of resistance on a large scale. Forecast: In the first half of the day, today is expected to move in the lateral plane with a downward vector. By the end of the day, it is possible to decrease to the support zone. After that, it is expected to resume the upward course. Potential reversal zones Resistance: - 1.1100/1.1130 Support: - 1.1040 / 1.1010 Recommendations: Trading on the euro market today is possible only within the intraday. At sales, it is necessary to consider the high probability of counter kickbacks. The best tactic would be to wait for the downside rollback to complete and track the buy signals.

AUD/USD Analysis: From September 12, the latest unfinished wave construction in the Australian dollar market is bearish. The wave structure develops the final part (C). Within its framework, a correction is formed. The price is at the lower border of a wide area of a potential reversal. Forecast: In the coming days, the completion of the price rise, the formation of a reversal and the beginning of the pair's downward movement are expected. The decline can take an impulse form. The support zone demonstrates the expected scope of the daily course. Potential reversal zones Resistance: - 0.6850/0.6880 Support: - 0.6790/0.6760 Recommendations: Buying a pair today is risky. It is recommended to focus on finding entry signals in short positions.

GBP/JPY Analysis: On the cross chart since August, the upward trend moves the price of the 150th price figure. For the past month, the price has been adjusted. On November 22, a new section of the main trend started. A corrective pullback is needed before a further upswing. Forecast: In the first half of the day today, a flat mood of the movement is expected. It is possible to reduce the price in the area of settlement support. By the end of the day, it is expected to intensify and return to the main vector of movement. With the rise, a sharp increase in volatility is likely. Potential reversal zones Resistance: - 144.40/144.70 - 143.20/143.50 Support: - 142.40/142.10 Recommendations: Sales of the pair today are very risky, not recommended. At the end of all counter-movements, it is proposed to look for entry points in the long position.

Explanations: In the simplified wave analysis (UVA), waves consist of 3 parts (A-B-C). The last incomplete wave is analyzed. The solid background of the arrows shows the formed structure for determining the expected movement. Attention: The wave algorithm does not take into account the duration of the tool movements in time! The material has been provided by InstaForex Company - www.instaforex.com |

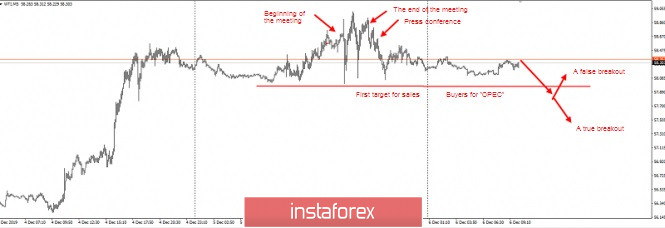

| Posted: 06 Dec 2019 01:25 AM PST Good day, dear traders! I present to your attention the review of oil after the OPEC meeting. So, following the meeting of the OPEC member countries, which was held in Vienna, the participants agreed to reduce oil production by 500 thousand barrels per day after March 20. This is where the good news on oil ends. The fact is that the participants did not agree on the size of quotas. Moreover, disputes over non-compliance with the existing quotas by some participating countries have flared up. Because of these disputes, the ministers even canceled a joint dinner and a press conference. These points show that not everything inside OPEC is as smooth as it sounds in the headlines. And the reductions are getting harder for the participating countries, there are disputes about non-compliance with production quotas by each country, which are very difficult to control. In my opinion, these negotiations cannot be called successful. Now let's look at the oil chart. As you can see, the expectations of these negotiations far exceeded their outcome. Oil met "OPEC" on the "highs" of the month. But judging by the intraday schedule, at the meeting itself, especially after the cancellation of the dinner and the press conference, the bullish mood among traders ended. In this regard, I recommend working to lower the price of American oil until the breakdown of yesterday's lows at 55, and in the case of consolidation under this level - to hold profitable positions up to $55 per barrel. Good luck with trading and follow the rules! The material has been provided by InstaForex Company - www.instaforex.com |

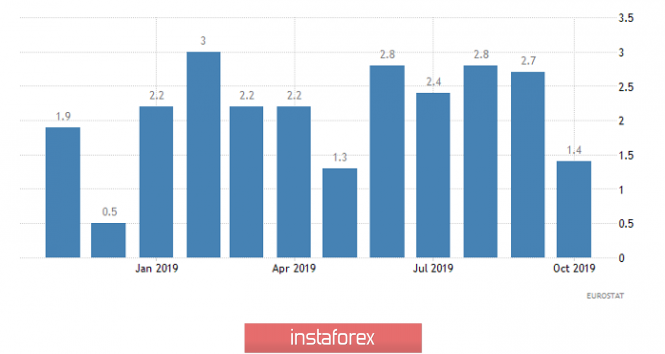

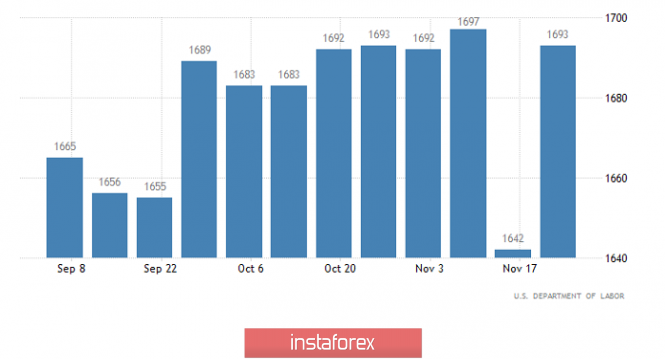

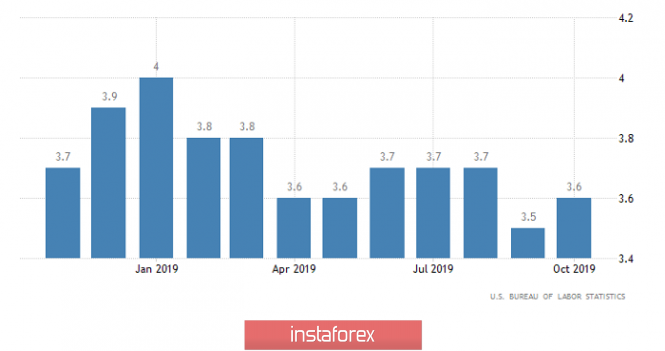

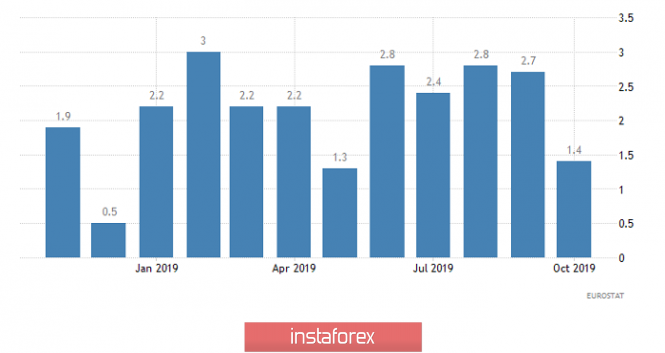

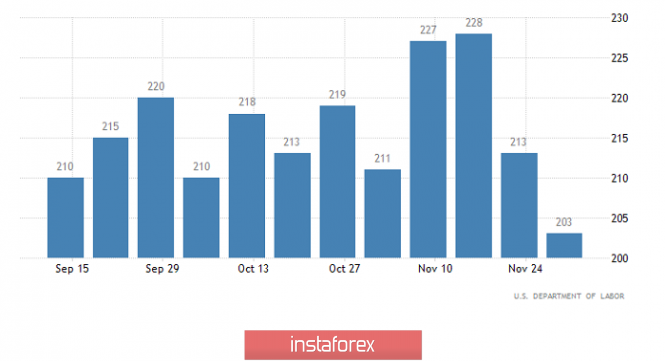

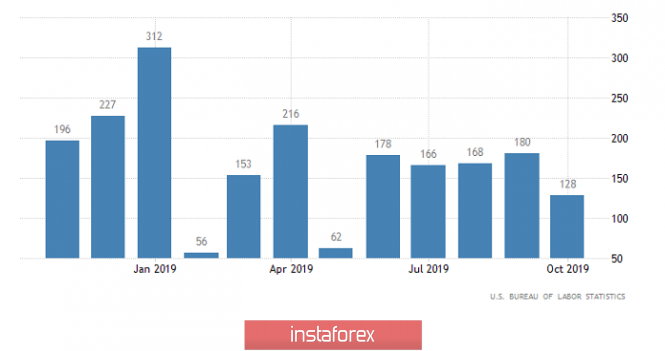

| Eternal impeachment (EUR/USD and GBP/USD review on 12/06/2019) Posted: 06 Dec 2019 12:39 AM PST Democrats are not giving up their attempts to impeach Donald Trump, trying to deprive the Republicans of any hope in the upcoming presidential election. After all, the Republicans have no other candidate, and if Donald Trump is impeached, they will not have time to prepare for a new candidate for the presidency of the United States. The circus arranged by the Democrats include the participation of several law professors. One of whom agreed to the point where by his actions, Donald Trump seeks to establish a monarchy in the United States, despite all his comicality and absurdity, seriously worries investors. After all, this increases the uncertainty that investors fear like the devil. All previous attempts at impeachment in the history of the United States have failed, and no one can predict the political consequences if everything works out this time. It's clear that nothing good will happen, because it's like opening Pandora's box. Once you release this gin from the bottle, you can't get it back. In fact, if Democrats reach their goal, then one can forget about the presidential election in the United States since political opponents will regularly impeach each other. Therefore, certain concern of investors which were reflected in yesterday's weakening dollar, is quite understandable. However, if you look at at least European statistics, it is quite obvious that there is simply no reason to weaken the dollar. Yes, another assessment of European GDP for the third quarter showed that the pace of economic growth remained unchanged. However, data on retail sales for October showed a slowdown in their growth rates from 2.7% to 1.4%. And not only did they expect a slowdown to 1.8%, they also reviewed the previous results for the worse, from 3.1%. But we are talking about the largest segment of the economy, so the slowdown in economic growth is clearly not far off. As an additional illustration to all this, you can look at retail sales in France, where their growth rate slowed down from 2.6% to 1.4%. At the same time, the previous value was revised from 4.1%, which suggests that that the final GDP data for the third quarter may turn out to be slightly worse than preliminary estimates. So what can I say? even the volume of industrial orders fell by 0.4% in Germany, although it was supposed to grow by 0.3%. Well, the data on Spain became a sort of "cherry on the cake", as the growth rate of industrial production in 0.6% was replaced by a decline of 1.3%. Now, we were waiting for the acceleration of industrial production growth rates to 1.0%. Retail Sales (Europe): American statistics turned out to be clearly better than forecasts, although they were more likely to be negative. They also looked better than European ones to some extent. In particular, the total number of applications for unemployment benefits increased by 41 thousand. They forecasted growth by as much as 68 thousand. Meanwhile, the number of initial applications for unemployment benefits, which should have increased by 13 thousand, decreased by 10 thousand. The number of repeated applications for unemployment benefits increased by 51 thousand instead of 55 thousand. In addition, the volume of production orders increased by 0.3%, although they expected growth by 0.5%. In any case, the picture is somewhat better than in Europe, but the hysteria surrounding the impeachment of Donald Trump has done its dirty work. Repeated Unemployment Insurance Claims (United States): It is clear that the focus for today is on the publication of the report of the United States Department of Labor, so investors will not look at anything else since there's nothing special to watch. With all due respect to Italy, but the expected slowdown in retail sales growth from 0.9% to 0.4% can hardly excite anyone. Thus, all the most interesting will happen in the late afternoon. In connection to this, the unemployment rate is expected to increase from 3.6% to 3.7%. This is partly indicated by recent ADP data. However, this can happen due to the banal increase in the share of able-bodied people in the total population from 63.3% to 63.4%. This also indicates that young people will actively seek work, which means that it is extremely important how things are going with the creation of new jobs. And it's predicted that the pace of creating new jobs outside of agriculture should increase from 128 thousand to 175 thousand. Therefore, yesterday's teenagers should find a job for themselves without any problems. In turn, only the growth rate of the average hourly wage, as well as the average duration of the working week, will remain unchanged. Unemployment Rate (United States): It is highly possible that the single European currency will decline to 1.1050, given the slight overbought common European currency, as well as expectations for the contents of the report of the United States Department of Labor. The pound is much stronger overbought due to the election hysteria, as well as the disappearance of all doubts about the victory of Boris Johnson. However, even it will have to take into account the contents of the report of the United States Department of Labor. Thus, it is quite possible to expect a decline in the pound to 1.3075. |

| EURUSD: The euro has little chance of growth after data on the US labor market Posted: 06 Dec 2019 12:23 AM PST Although the data on the eurozone economy yesterday failed to please traders, as retail sales fell more than expected, which is sure to slow the pace of US GDP growth in the 3rd quarter of this year, traders do not lose confidence before the meeting of the European Central Bank, which is scheduled for December 12 this year. It will be the first time the new ECB President Christine Lagarde will announce her interest rate policy. Also, buyers of risky assets feed some optimism about the general election in the UK, which will provide support for the euro and the pound in the event of a victory for the Conservative Party. As noted above, retail sales in the eurozone failed to please traders, since in October of this year they fell by 0.6% and grew by only by 1.4% compared to the same period in 2018. For September, sales were revised up to -0.2% and 2.7% respectively. Given that the eurozone economy is already troubled and close to a technical recession, yesterday's GDP growth report for the 3rd quarter also disappointed. According to the data, GDP was not revised and showed growth of only 0.2% compared to the 2nd quarter, which fully coincided with the preliminary estimate and expectations of economists. On an annual basis, GDP grew by only 1.2%. The data on the US economy was also not seen as a call to action. The US foreign trade deficit narrowed in October, but not enough to curb the ambitions of the US President. The decline was because imports of consumer goods continued to fall. According to the US Department of Commerce, the US foreign trade deficit in October 2019 amounted to 47.20 billion dollars, while economists had predicted it at 48.5 billion dollars. Imports fell by 1.7% in October. Unsurprisingly, exports also fell by 0.2% to $207.1 billion from $207.6 billion in September, a negative sign for the US economy. Weekly data on unemployment in the United States did not have an impact on the market, as all attention was transferred to today's report. According to the US Department of Labor, the number of initial applications for unemployment benefits for the week of November 24-30 fell by 10,000 to 203,000. Economists had forecast the number of applications to be 215,000. Manufacturing orders in the US showed growth and fully coincided with economists' forecasts, which keeps the chance of a recovery in activity in the sector by the end of the year. According to the data, US manufacturing orders rose by 0.3% in October 2019, while orders excluding transportation rose only by 0.2% in October. US durable goods orders for October were revised up to + 0.5% from +0.6%. As for the technical picture of the EURUSD pair, further growth can be provided only after a weak report on the number of people employed in the non-agricultural sector of the United States. Weak indicators will lead to the breakout of this week's highs and the continuation of the upward correction to the resistance of 1.1140 and 1.1180. The scenario of the unsuccessful breakdown of the level of 1.1115 and the downward correction to the lower border of the side channel 1.1065 seems to be more likely. The material has been provided by InstaForex Company - www.instaforex.com |

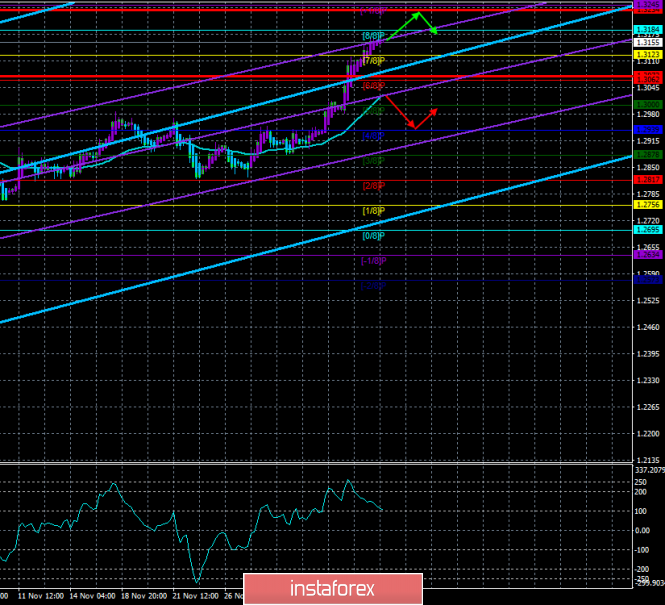

| Pound: The climb on financial everest continues Posted: 06 Dec 2019 12:08 AM PST

The British currency continues to surprise the market. The pound, breaking through the resistance levels, confidently moves to new heights. Experts expect a further rise, meeting market expectations. Recall that in the middle of the week, the pound "shot" on the news because of the belief on the victory of the Conservative Party of Great Britain, and on Thursday, December 5, it continued to grow actively. The British currency broke the barrier of 1.3100 - a level that has been beyond its control since May 2019. On the morning of Friday, December 6, the pound, set to win, began with an update of local highs. Currently, the GBP / USD pair is trading in the range of 1.3161–1.3162, trying to break through to new heights. However, the path to the ascent was thorny. However, the path to the ascent was thorny. After a while, the GBP / USD pair fell to 1.3150-1,1.3151, disturbing the market. Nevertheless, experts believe that in the near future, the pound will recover. According to experts, the GBP / USD pair is moving in the direction of the correctional level of 1.3378, methodically overcoming the obstacles that arise. On this way, small declines are possible, but experts are confident in the consolidation of the upward trend. Experts do not rule out the emergence of a new trend corridor of the pound in the near future. Financial analysts are a little worried about the fact that the sympathies of most Britons have shifted towards Prime Minister Boris Johnson. Experts remind that in August 2019, the fall of the pound to multi-year lows was provoked by the arrival of the said politician to power. Recall that at that time, the GBP / USD pair cruised near the lowest values in the last 30 years. This month, the dynamics of the British currency has undergone dramatic changes. The pound rose by 10% against the dollar and the euro, strengthening the position of B. Johnson to his advantage. Experts believe that the reason for this sympathy is connected with the hopes of the British for a successful resolution of the situation around Brexit. Economists conclude that the confidence in the victory of the Conservative Party accelerates the implementation of initiatives regarding Brexit, which is very favorable for the market in general and for the pound in particular. The material has been provided by InstaForex Company - www.instaforex.com |

| Hot forecast for EUR/USD on 12/06/2019 and trading recommendation Posted: 05 Dec 2019 11:33 PM PST Fear is beginning to overwhelm many investors and manipulate the market. Another activation with the impeachment of Trump seriously worried market participants, because this increases the uncertainty, which investors fear the most. Moreover, it is precisely the fact that the Democrats intend to submit to the Congress a vote on the impeachment of Donald Trump before the end of the year that has undermined the position of the dollar. If you look at macroeconomic statistics, it can be seen that there was no reason to lower the dollar. Rather, the opposite. Indeed, the growth rate of retail sales in Europe has slowed down from 2.7% to 1.4%. Thus, it is worth noting that a slowdown was initially predicted from 3.1% to 2.2%. That is, the data themselves came out worse, and the previous results were reviewed for the worse. We are talking about the largest segment of the economy, which makes the largest contribution to the structure of GDP. This means that economic growth will only slow down. However, estimates of GDP for the third quarter stubbornly show that the pace of economic growth remains unchanged. But for now, there will still be a slowdown in economic growth most likely in the fourth quarter. Retail Sales (Europe): At the same time, American statistics were more likely positive, since the total number of applications for unemployment benefits increased by 41 thousand instead of 68 thousand. In particular, the number of repeated applications for unemployment benefits increased by 51 thousand, although it should increase by 55 thousand. The number of initial applications for unemployment benefits, instead of increasing by 13 thousand, decreased by 10 thousand, which is in anticipation of the publication of the report of the United States Department of Labor. Therefore, there are no reasons to strengthen the single European currency. Number of Initial Jobless Claims (United States): So, today, the focus is on the very notorious report of the United States Department of Labor, and it is not surprising that investors are experiencing some anxiety and excitement given the multi-directional nature of indirect data published over the previous two days. Most likely, the actual data will not coincide with the forecasts. Nevertheless, these same forecasts show that almost all indicators of the labor market will remain unchanged. The only exceptions are the unemployment rate and the number of new jobs created outside agriculture. Due to this, the unemployment rate could rise from 3.6% to 3.7%. This is also indicated by ADP employment data. However, yesterday's data on applications for unemployment benefits quite indicate that the unemployment rate may remain unchanged. Besides, 175 thousand new jobs should be created outside agriculture, compared to 128 thousand in the previous month, and only ADP data cast doubt on these forecasts. The number of new jobs created outside of agriculture (United States): From a technical point of view, the euro was not able to break through the level of 1.1100 and hangs around this level. The euro itself continues to be overbought, and in case of breakdown of the level of 1.1070, the direction will open to 1.1000. |

| Posted: 05 Dec 2019 11:27 PM PST To open long positions on GBPUSD, you need: The growth of the pound continues and we can talk about new purchases after a breakthrough and consolidation above the upper border of the side channel of 1.3167, which will immediately provide growth in the area of new highs of 1.3227 and 1.3265, where I recommend taking the profits. However, downward correction of the pound after the release of the US report is not excluded, so the formation of a false breakout at the level of 1.3125 will be the first signal to buy, but it is best to open long positions for a rebound from the minimum of 1.3084. To open short positions on GBPUSD, you need: Sellers are still hoping for a strong report on the growth of employment in the non-agricultural sector of the United States, as only it will provide active purchases of the dollar and lead to a downward correction in the area of lows of 1.3125 and 1.3084, where I recommend fixing the profits. If the bullish trend continues, and the bears fail to achieve a false breakout in the resistance area of 1.3167, it will be possible to count on sales only after the highs of 1.3227 and 1.3265 are updated. Indicator signals: Moving Averages Trading is conducted above 30 and 50 moving averages, which keeps the probability of growth of the pound. Bollinger Bands Breaking the upper limit of the indicator at 1.3167 will lead to a more powerful bullish impulse.

Description of indicators

|

| EUR/USD: plan for the European session on December 6. Buyers of the euro will fight for 1.1114 Posted: 05 Dec 2019 11:27 PM PST To open long positions on EURUSD, you need: Yesterday's scenario of breaking the resistance of 1.092 fully worked. Now, the euro buyers are focused on the maximum of the week in the area of 1.1114 and the breakdown of which will provide the pair with new upward momentum in the area of 1.133 and 1.1155, where I recommend taking the profits. However, we can expect such growth only after the release of a weak report on the state of the American labor market. In the scenario of a downward correction, it is best to return to long positions on a false breakout from the middle of the channel of 1.1092 or buy on a rebound from its lower border of 1.1067. To open short positions on EURUSD, you need: Sellers of the euro will wait for a good report on the US labor market and act on a false breakout from the week's high of 1.1114. In the absence of pressure on the euro in this range, I recommend postponing short positions to update the maximum of 1.1131 or sell immediately on the rebound from 1.1155. The more important task of the bears will be the return of the pair under the middle of the channel of 1.092 and the update of the minimum of 1.1067, where I recommend fixing the profit. Indicator signals: Moving Averages Trading is above the 30 and 50 moving averages, which keeps the hope of euro growth in the short term. Bollinger Bands Volatility is very low before important data, which does not give signals to enter the market.

Description of indicators

|

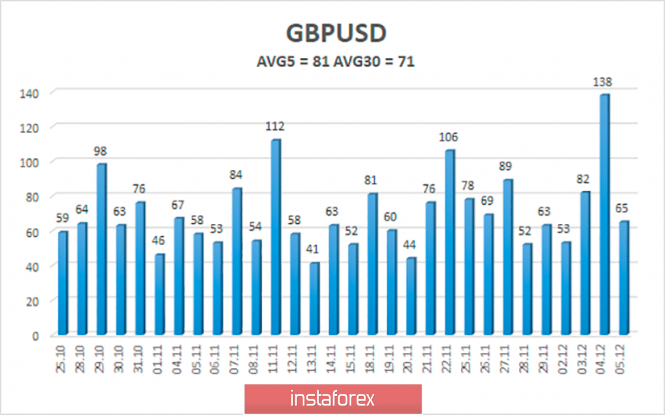

| Posted: 05 Dec 2019 11:26 PM PST 4-hour timeframe

Technical data: The upper channel of linear regression: direction - up. The lower channel of linear regression: direction - up. The moving average (20; smoothed) - up. CCI: 104.8293 This has not happened for a long time, when for the EUR/USD and GBP/USD pairs, absolutely all trend indicators are directed upward. Both linear regression channels, the moving average, the Heiken Ashi indicator - all indicate an upward trend. But is it always possible to benefit and profit from this? For example, both channels of linear regression were directed upwards during the month when the pair traded exclusively in the 200-point side channel when there was no trend as such. In the vast majority of cases, not only in the last 2 months but also in the last 3 years, the pound grew exclusively on rumors of an early "divorce" of the UK and the EU as part of the Brexit process. Now, the pound is growing, and no one can explain why it is growing. More precisely, there can only be one explanation: it is simply bought by traders expecting the conservatives to win the election on December 12, allowing Boris Johnson to complete Brexit until January 31, 2020. Perhaps before that, the pound was too oversold and now we see some rebalancing. One way or another, but the upward movement of the British currency continues, and the downward movement of all UK statistics continues. Thus, macroeconomic data and the direction of movement of the GBP/USD pair now do not coincide at all. Meanwhile, former European Council President Donald Tusk said that Brexit is the main mistake of the European Union and the UK in their history. According to Tusk, the UK will now become a "second-class country" that will not be able to assert itself fully on the international stage. "I have repeatedly heard from Brexit supporters that leaving the EU will again make the UK a global force, they believe that only alone can it be great but the reality is exactly the opposite," Tusk said. Also, the former head of the European Council said that it is a pure illusion to believe that it will be possible to establish good relations with the UK when it is outside the EU. We also believe that Brexit, whatever it is, will harm the UK economy. Deterioration should be expected necessarily, thus, if Boris Johnson still manages to implement Brexit, then after that, the pound may be again inclined to fall, as macroeconomic indicators will continue to deteriorate. Moreover, it will take years to conclude trade agreements with the European Union, America, and other trading partners to trade effectively. Based on all of the above, in the long term, we are still waiting for the fall of the British currency. By the way, it is impossible not to recall once again the two members of the Bank of England monetary committee who voted in favor of the rate cut at the last meeting. I wonder if the rate were lowered right now, would the pound fall in price or continue to rise as if nothing had happened? However, this is a lyric. In reality, the Bank of England can go to the easing of monetary policy at the next meeting, which is a bearish factor for the pound/dollar pair. And of course, trade wars, which will affect both the UK economy and the US economy. The only question is whose economy will suffer the most. If suddenly it will be the American economy (which is unlikely), the pound will have a chance for a long-term upward trend paired with the dollar. Otherwise, it will not appear. However, although the fundamental component says that the only growth factor for the British pound now is the parliamentary elections, we recommend paying attention to technical factors, which, as we have already said, clearly indicate an upward trend. Thus, as long as it persists, it is recommended to trade on the increase.

The average volatility of the pound/dollar pair in the last 5 days decreased to 81 points, in the last 30 days - to 71 points. Thus, volatility decreases again. Based on the average volatility of the pound/ dollar pair, the maximum possible level for today is 1.3234, if the pair continuously moves up all day. Based on the same indicators of volatility, we can conclude that the sale of the British currency today will not be relevant, as the price is unlikely to be able to consolidate today below the moving average line. In the US trading session, volatility may increase due to a large number of important macroeconomic publications. Nearest support levels: S1 - 1.3123 S2 - 1.3062 S3 - 1.3000 Nearest resistance levels: R1 - 1.3184 R2 - 1.3245 R3 - 1.3306 Trading recommendations: The GBP/USD currency pair continues its upward trend. Thus, in these conditions, it is recommended to continue to buy the pound until the reversal of the Heiken Ashi indicator down to 1.3234. It is not recommended to return to sales today, as the price is too far from the moving average line. All macroeconomic statistics are still ignored by traders, political and technical factors are in the foreground. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustrations: The upper channel of linear regression - the blue line of the unidirectional movement. The lower channel of linear regression - the purple line of the unidirectional movement. CCI - the blue line in the regression window of the indicator. The moving average (20; smoothed) - the blue line on the price chart. Support and resistance - the red horizontal lines. Heiken Ashi - an indicator that colors bars in blue or purple. Possible variants of the price movement: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Dec 2019 11:26 PM PST 4-hour timeframe

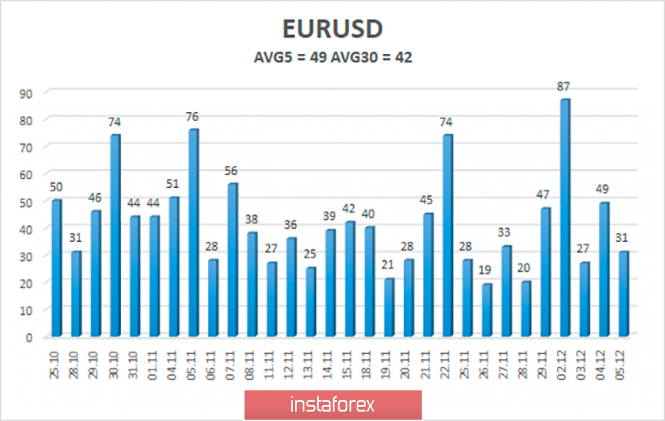

Technical data: The upper channel of linear regression: direction - up. The lower channel of linear regression: direction - up. The moving average (20; smoothed) - up. CCI: 93.8712 The last trading day of the first week of December has come. And to this day, the EUR/USD currency pair is coming in a completely ambiguous state. Yesterday, we said that the reaction of traders to the published macroeconomic data this week was not always logical, and sometimes simply absent. Thus, we assumed that market participants now either do not pay attention to macroeconomic statistics, or the market is too "thin" and the transactions of traders reacting to the news are covered by the transactions of large players who buy a particular currency for their own needs and purposes. In light of such findings, today's data package, which is due to be published in the States, becomes much less interesting, although it is full of important and interesting information. Now traders need to guess whether the majority of market participants will work out data from overseas? But anyway, we cannot pass by such important reports that will be released today in the United States. The least significant report today is the unemployment rate. Recall that it has been at its lowest levels in the United States for several decades, but traders rarely pay attention to this indicator, since unemployment itself does not matter, the strength of the labor market and the strength of the economy matter. Unemployment only reflects the burden on the country's budget due to the payment of unemployment benefits. A more important indicator is the average wage. The more people earn, the more they spend, which is good for any economy and spurs inflation. The forecast is 3% y/y in November. Even more important is the number of jobs created outside the agricultural sector or Nonfarm Payrolls, with a forecast of 180,000. From our point of view, the forecast is very high, and the real value will be lower, especially given the failed indicator of the state of the private sector of the labor market from ADP. The latest will be the University of Michigan consumer confidence index for December with a forecast value of 96.5, which is slightly less than a month earlier. Thus, the greatest concern is the Nonfarm Payrolls, which can significantly lag behind its forecast value. And in this case, traders will be able to count on some growth of the euro/dollar pair today, as weak NonFarm will not be in favor of the US dollar. Meanwhile, the list of countries on which Donald Trump imposed trade duties or deprived of trade preferences may expand soon. Turkey, China, Argentina, and Brazil are now on the list. They may be joined by France, as well as NATO countries, which, according to Trump, contribute an insufficient amount of money to the defense organization. "Many countries are close and getting closer to the necessary level of NATO funding. And some are not so close, and we can take measures related to trade. It's not fair: they get protection from the US and do not increase spending," Donald Trump said. Thus, knowing the manner of conducting international affairs of Trump, it is possible to count on the introduction of new duties soon. As for China, the situation remains confusing and tense. According to many insiders, negotiations are ongoing, but there were no details. And until December 15, it's not so much time. And on December 15, Trump will need to decide whether to impose new trade duties against China for $160 billion or not. And the second option is possible if there is significant progress in the negotiations and the proximity of the signing of the agreement or if the deal is signed before December 15. We still believe that the option with the introduction of new duties has a higher probability. The overall technical picture of the euro currency now implies the continuation of the upward movement, since absolutely all trend indicators speak in favor of this. The price came back to the Murray level of "4/8" - 1.1108, and only overcoming this target will allow traders to continue to trade on the increase. At the same time, the pair's movements remain ragged, with frequent pullbacks and corrections, low volatility, and rarely coincide with the nature of the news.

As for the average volatility of the euro/dollar pair, it is now 49 points. Thus, in the maximum case, we can expect today to move between levels of 1.1055 and 1.1153. Macroeconomic data from overseas may trigger more volatile trading, but we believe the more realistic target for today is the Murray level of "5/8" - 1.1139. Nearest support levels: S1 - 1.1078 S2 - 1.1047 S3 - 1.1017 Nearest resistance levels: R1 - 1.1108 R2 - 1.1139 R3 - 1.1169 Trading recommendations: The euro/dollar resumed its upward movement. Thus, now purchases of the euro with targets between 1.1139 and 1.1153 remain relevant. The reversal of the Heiken Ashi indicator downwards will indicate a new round of corrective movement. It is recommended to return to the EUR/USD pair sales not earlier than the reverse consolidation of bears below the moving average line. In addition to the technical picture, fundamental data and the time of their release should also be taken into account. Explanation of the illustrations: The upper channel of linear regression - the blue line of the unidirectional movement. The lower channel of linear regression - the purple line of the unidirectional movement. CCI - the blue line in the indicator window. The moving average (20; smoothed) - the blue line on the price chart. Support and resistance - the red horizontal lines. Heiken Ashi - an indicator that colors bars in blue or purple. Possible variants of the price movement: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of ETH/USD for 06/12/2019: Posted: 05 Dec 2019 11:22 PM PST Crypto Industry News: The US Securities and Exchange Commission (SEC) has appointed a new head of its cyber branch. Kristina Littman, who took over the position of Robert A. Cohen, will become the new head of the Cyber Unit division, according to a published SEC announcement. Joining the SEC as an employment attorney in 2010, Littman climbed the rungs to become a senior advisor to the SEC chairman, Jay Clayton, in summer 2017. In this role, she advised Clayton on regulatory and policy issues regarding cryptocurrencies and digital assets, and also international affairs, trade and markets. "Kristy's innovative thinking and extensive experience in the Commission have made her an invaluable adviser and, most importantly, a tireless defender of American investors. It will be an excellent leader of a cybernetic unit that will continue to work in this critical and constantly developing area" - Clayton said. The Cyber Unit was founded in 2017 as a way to solve cybersecurity problems and protect investors from dishonest members of the growing cryptocurrency and Blockchain industry. Under the leadership of Robert Cohen, the unit was acting against the ICO, which the agency found unfair. Littman will inherit significant ongoing processes, including against Kik Interactive, for alleged involvement in an unregistered $ 100 million securities offer. The telegram is also fighting for a similar case brought by the SEC regarding a gram token. Cohen left the SEC for a position of partner at the Davis Polk & Wardwell LLP law firm - a company that represented cryptographic companies, including Coinbase, as well as major financial institutions. Technical Market Overview: The ETH/USD pair has retraced all of the sudden spikes up from the level of 4142.51 to $151.40 already, so the bears are in full control over the market. The market still trades under the short-term trendline resistance. The last low was made at the level of $142.26, which is below the 50% Fibonacci retracement located at the level of $143.74. If this level is violated again, then the next target for bears is seen at the level of $140.67, which is a 61% Fibonacci retracement. The technical supports are located at the levels of $136.98 and at the swing low at $130.68. The nearest technical resistance is seen at the level of $147.94. Weekly Pivot Points: WR3 - $187.69 WR2 - $171.75 WS3 - $162.01 Weekly Pivot - $146.28 WS1 - $136.26 WS2 - $119.53 WS3 - $110.92 Technical recommendations: The best strategy in the current market conditions is to trade with the larger timeframe trend, which is down. All the shorter timeframe moves are still being treated as a counter-trend correction inside of the downtrend. When the wave 2 corrective cycles are completed, the market might will ready for another wave up.

|

| Posted: 05 Dec 2019 11:20 PM PST Today, the attention of the markets will be turned to the publication of data on US employment, which will play an important role in the Fed's final decision on monetary policy as early as next week, December 11. According to the consensus forecast, the American economy received 175,000 new jobs in November, against 131,000 a month earlier. It is also expected to maintain unemployment at around 3.6%. These data are really very important, since the latest production indicators were not so positively clear, which could hit the labor market in America amid signals of a slowdown in the country's economy. In addition to these values, you should pay attention to the numbers of the index of consumer expectations from the University of Michigan today. The indicator is forecasted to grow to 88.0 points in December against 87.3 points in November. The average hourly wage will also be important, which is expected to grow in November by 0.3% against the October increase of 0.2%. It can be assumed that this will undoubtedly have a supporting effect on the US dollar exchange rate if the statistics do not disappoint, which has been declining in its index terms to the basket of major currencies for the last six trading sessions. Moreover, the latest noticeable blow came from the weak data on the number of new jobs from ADP, which caused a wave of pessimism, supported by the problems of US-Chinese trade negotiations. At the moment, there is some correlation between the dynamics of the dollar and negotiations. Thus, if optimism is noted, then this supports the American currency, while negative news, on the contrary, puts pressure on it. In general, we remain optimistic by observing the situation in the markets, since we believe that a trade agreement between Washington and Beijing will probably be concluded after the New Year holidays, and this, in turn, will significantly affect the Fed's position in deciding on interest rates. The conclusion of the negotiations will restrain the Federal Reserve from the desire to lower further the level of borrowing costs. Forecast of the day: EUR/USD is trading above 1.1090. Strong US employment data will put pressure on it. Meanwhile, a decline below 1.1090 will lead to a fall in prices to 1.1050, and then to 1.0990. Gold is declining amid D. Trump's positive rhetoric regarding trade negotiations with China. Strong values for the number of new jobs from the US Department of Labor can only increase the price reduction, which could fall to 1451.40. |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment