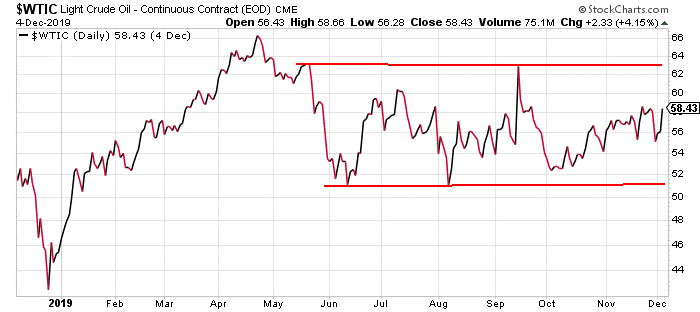

Lots of folks are talking about oil this week. The Organization of the Petroleum Exporting Countries (OPEC) met in Vienna yesterday to discuss possibly cutting production in order to help boost the price of oil. Representatives of OPEC and non-OPEC countries will meet today to come to some sort of agreement. There’s lots of speculation OPEC members could agree to cut production anywhere from 500,000 barrels per day (bpd) to 1.5 million bpd. The price of oil has moved a bit higher this week in anticipation of such a cut. Here’s an updated chart of West Texas Intermediate Crude (WTIC)…

Oil closed yesterday just about right in the middle of its six-month-long trading range between $51 per barrel and $62 per barrel. Back in early October when we pointed out this pattern, we suggested the best trading plan for oil was to buy it when the price of the gooey black stuff came down to the support line of the pattern, near $51. And then sell oil as it ran up to the resistance line of the pattern near $63. Buying oil here at $58 is a trade that has just about as much potential reward as it does risk. So, it doesn’t look like a very good trade from a risk/reward perspective. But, if you bought oil back in October, then you’re sitting on a respectable gain for a couple of months. You might as well hold on and see if oil can rally back up towards its resistance at $63. Just to be on the safe side, though, it’s a good idea to set a stop at the most recent low from late November, near $55 per barrel. That way, you’ll be sure to lock in a profit on the trade just in case oil starts heading the other way. Best regards and good trading,

Jeff Clark Mike's note: Before you go, I wanted to let you know about an interesting, free mini-series that just launched… It involves a former hedge fund trader, Larry Benedict, who made more than $1 million on 509 separate occasions… and all the secrets that brought him to where he is today. These documentary-style videos will give a glimpse into Larry Benedict’s life as a top trader. From what makes him tick, to his methodology, to what he’s focusing on now. Do not miss this series – it’s a chance to get into the mind of one of the greatest traders of our time. This exclusive, limited-edition series is completely free to access. But they’ll only be available online for a short time. To watch the first video, secure your access with one click right here. Reader Mailbag Today, a subscriber brags about his gains using Jeff’s premium trading service, The Delta Report… Jeff's trading style definitely comports with mine. Made $8000 on a Delta Report trade today and $11,000 on another last month. – Harry Thank you, as always, for your thoughtful comments. We look forward to reading them every day. Keep them coming at feedback@jeffclarktrader.com. In Case You Missed It… Retirement "reset" coming on 12/11/19 On Wednesday, December 11th, 2019, retirement will essentially "reset" for thousands of people, overnight. Make sure you're there when it happens… and see how it could help you make $200,000 next year. Click here for the full story.

|

No comments:

Post a Comment