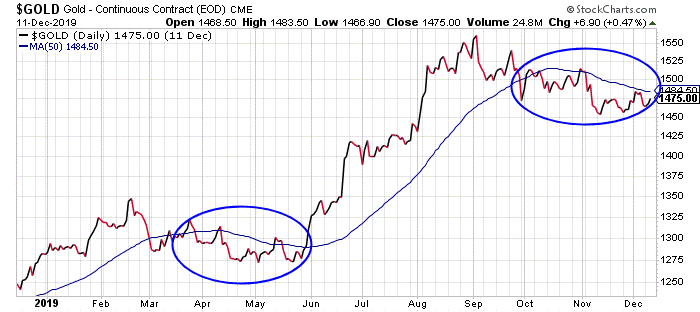

The last time the chart of gold looked the way it does today, gold ran $250 higher over the next three months. But, for reasons I’ll explain in today’s essay, I don’t think we’ll see that action again... | Recommended Link | | Can a 50¢ Stock Make You Rich? (Ask This Millionaire…) For most people, NO. But for millionaire Doug Casey, it’s “more times than I can count.” Now he’s spilling one of the biggest opportunities in decades. And why the best way to capitalize on this new trend is to buy 5 tiny gold stocks… (At this moment, one is trading for less than 50-cents.) But fair warning: This situation is unfolding quickly. You don't want to sit this opportunity out. Watch The Video Now. | | | -- | Take a look at this daily chart of gold…

Gold started off 2019 in rally mode. The price rallied about 10% from mid-December 2018 until mid-February 2019. Then gold spent the next few months chopping around in a relatively tight trading range just below its 50-day moving average (MA) line (the squiggly blue line on the chart). That “choppy” period gave gold a chance to consolidate its early-2019 gains, and it allowed the chart a chance to build up energy for the next trending move. That next move started in late May, and the price of the metal surged nearly 20% over the next three months. Ever since then, gold has been chopping around in a relatively tight trading range just below its 50-day MA. It’s consolidating the huge summertime rally, and it’s building energy for the next big move. Lots of folks see the similarity in the chart, and they expect the next move will be another big rally in the price of gold. But, the smart money disagrees. Commercial traders are the smart money in the gold market. They’re the merchants, miners, explorers, and bankers in the gold sector. They use futures contracts to hedge their exposure to the precious metal and protect themselves against adverse downside moves. When the smart money is confident the price of gold is headed higher, it reduces its hedges, usually to something less than 100,000 net-short futures contracts. When the smart money is concerned that gold may be headed lower, it increases its short exposure to gold. Last Friday’s CFTC Commitments of Traders report showed commercial traders are still net short more than 300,000 gold futures contracts. That’s a historically large short position. It signifies the smart money is nervous. And, it’s a stark contrast to the smart money position back in May. In May, the commercial traders net-short position was only about 50,000 gold futures contracts. That’s a very small hedge. The smart money wasn’t worried about a decline in the price of gold. And, that signaled the next move in gold would likely be higher. Today, the commercial trader net-short position is one of the largest in the 30+ years I’ve been following this report. That suggests to me the next big move in gold is more likely to be lower than higher. Of course, nothing is guaranteed. Commercial traders are certainly not perfect in their timing of gold price moves. But, they're referred to as the “smart money” for a reason. They are rarely wrong in the direction of major gold price moves. That’s the main reason I’m still cautious on gold as we head into 2020. Best regards and good trading,

Jeff Clark Mike’s note: If you weren’t able to attend last night’s Trade-a-Thon with market wizard Larry Benedict, you missed quite the show… Over 11,000 people showed up to see the results of Larry’s charity trading challenge. I won’t spoil it here… But let’s just say Boca Helping Hands is all set for a happy holiday season. Click here to see the full result of Larry’s challenge, down to the last cent… And to learn about a special, limited-time offer to get Larry’s best trading ideas straight to your inbox, up to three times per week. (His first idea, released just yesterday morning, is already up 13%.) Reader Mailbag Today, more feedback on the brand-new Jeff Clark Mobile app… (Have you downloaded it yet? If you haven’t, be sure to download it for iOS here and Android here.) Love the new layout and format of the smartphone app. It’s awesome. You aced this one. Nice job. Thanks, and cheers! – Thomas Thank you, as always, for your thoughtful comments. We look forward to reading them every day. Keep them coming at feedback@jeffclarktrader.com. In Case You Missed It… Market Wizard: "I want to reveal everything…" For the first time ever, Larry Benedict—a real-life Market Wizard—revealed his proprietary secrets in a live interview. If you’d like to learn Larry’s method… And where he thinks you should put your money right now… Claim $1,500 off a charter membership to his new service—The Opportunistic Trader—today, while the doors remain open. Larry believes anyone can generate $200,000 or more using his methods… Click here today, while there's still time.

|

No comments:

Post a Comment