Forex analysis review |

- Short-term analysis on EURUSD

- Gold reaches our first short-term target

- January 24, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- January 24, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- BTC analysis for 01.24.2020 - Important pivot-resistance level is set at the price of $8.470

- EUR/USD. January 24. The breakout of the trend line has been completed! We are waiting for a further fall in the euro

- GBP/USD. January 24. Business activity in the UK has grown, and the British – fell

- EUR/USD for January 24,2020 - First downwad target at the prrice of 1.1040 reached, second downwarrd target on the way at

- Trading recommendations for EUR/USD on January 24

- Gold 01.24.2020 - Breakout of the upward Pitchfork channel, selling oppotuntiies preferable

- Evening review for EURUSD on January 24, 2020. We are waiting for a correction

- Euro has lost its illusions

- Canadian dollar could not keep balance

- Trading recommendations for GBP/USD

- Technical analysis of EUR/USD for January 24, 2020

- Analysis and forecast for GBP/USD on January 24, 2020

- Mario Draghi still ECB's head? (Review of EUR/USD and GBP/USD on 01.24.2020)

- Where is the best place to buy euro?

- Euro accepted the fight and... lost?

- EUR/USD buyers trap slammed at ECB

- Technical analysis recommendations for EUR/USD and GBP/USD on January 24

- Trader's Diary: EUR/USD on 01/24/2020, What's next, ECB?

- GBP/USD: Pound believed in the economy. Will it live up to expectations?

- Analysis of EUR/USD and GBP/USD for January 24. EU's economic statistics may help eurocurrency

- The SELL Side Liquidity Pool will attract the EUR/USD For Jan 24, 2020

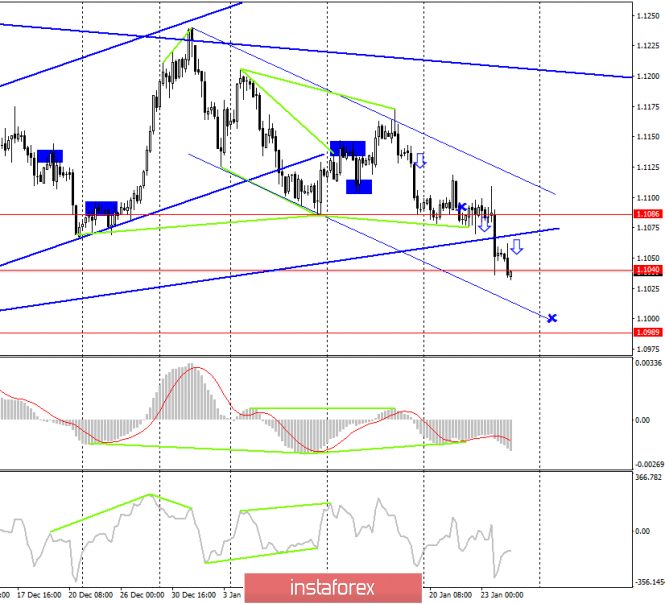

| Posted: 24 Jan 2020 01:24 PM PST EURUSD remains in a short-term bearish trend having clearly broken down all support levels. Yesterday we talked about the bearish Ichimoku cloud signal. EURUSD bulls need to recapture 1.11 to regain control of the trend.

Red line - support trend line Green rectangle -support area Green lines - wedge pattern EURUSD is moving further away and below 1.1060 area where support was found. The second consecutive losing day for EURUSD is a bad sign. RSI is far from oversold and no sign of an upward reversal yet. Since the support area was broken, my expectations are to see EURUSD much lower not that key support has broken. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold reaches our first short-term target Posted: 24 Jan 2020 01:10 PM PST In our past analysis we noted the bullish formation of higher highs and higher lows in Gold, as well as the upside potential towards $1,578 if $1,560-65 was broken. Price today reached very close to $1,576 and so far I believe we should expect more upside.

Red lines - Fibonacci extension targets Gold price has made a higher high and price is approaching our first target. I believe we can see Gold price move higher as trend seems strong. Support is at $1,550-$1,540. Bulls do not want to see price break below $1,556 as this would put the short-term trend in danger. The material has been provided by InstaForex Company - www.instaforex.com |

| January 24, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 24 Jan 2020 07:25 AM PST

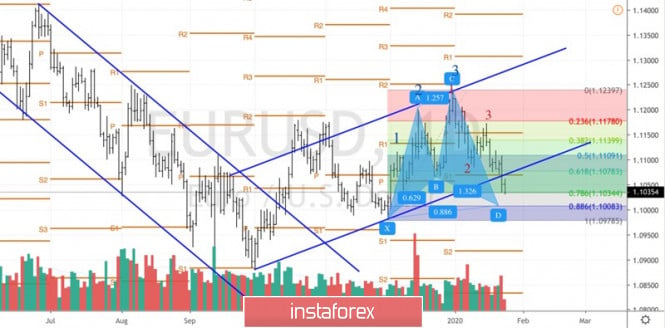

On December 6, a bullish swing was initiated around 1.1040 allowing another bullish breakout above 1.1110 to pursue towards 1.1175 within the depicted short-term bullish channel. Initial Intraday bearish rejection was expected around the price levels of (1.1175). On December 20, bearish breakout of the depicted short-term channel was executed. Thus, further bearish decline was demonstrated towards 1.1065 where significant bullish recovery has originated. Shortly-after, another bullish pullback towards 1.1235 (Previous Key-zone) was suggested to be watched for bearish rejection and another valid SELL entry. Suggested bearish position has achieved its targets while approaching the price levels around 1.1110. However, the Key-Level around 1.1110 has provided some bullish demand. This was followed by a bullish pullback towards 1.1140 and 1.1175 where the depicted key-zone as well as the recently-broken uptrend were located. Recently, evident signs of bearish rejection were demonstrated around 1.1175. That's why, quick bearish decline was executed towards 1.1110. As expected in a previous article, bearish persistence below 1.1110 enabled further bearish decline towards 1.1060 then 1.1040 where some bullish rejection may be expressed. Currently, the EURUSD pair has a recently-established Supply Level around 1.1080-1.1090 to be watched for new SELL entries if any bullish pullback is expressed. Trade recommendations : Few days ago, Intraday traders were advised to consider the recent bullish pullback towards 1.1110-1.1120 as a valid SELL signal. Bearish projection targets were achieved around 1.1060 and 1.1040.Any bullish pullback towards the backside of the recently-broken trend around 1.1080-1.1090 should be considered for another valid SELL entry. The material has been provided by InstaForex Company - www.instaforex.com |

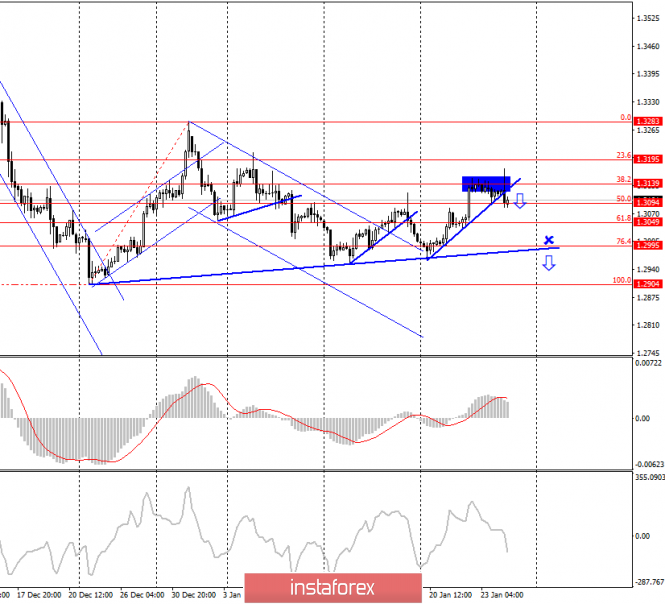

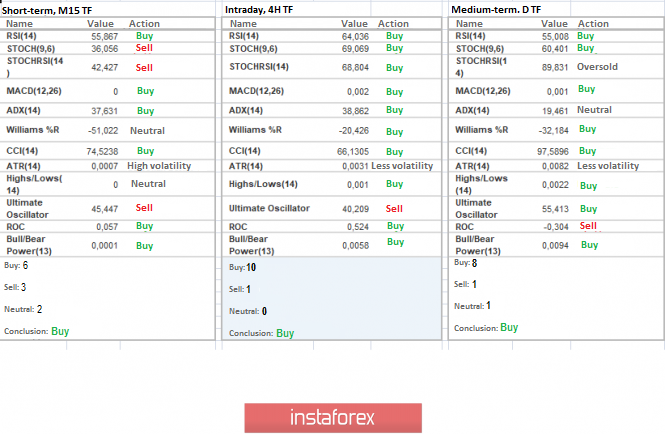

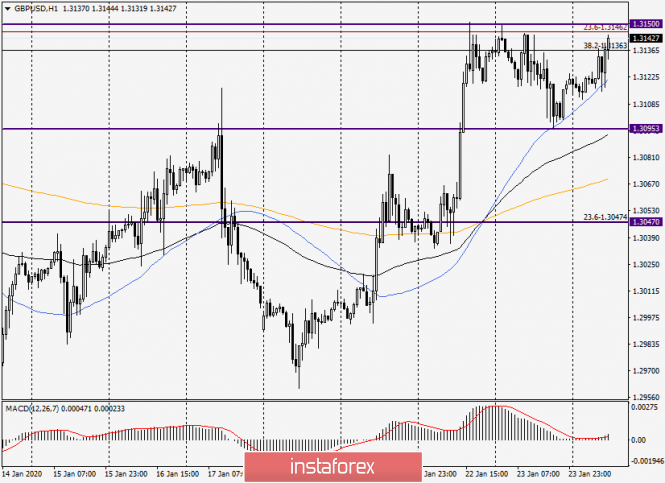

| January 24, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 24 Jan 2020 06:34 AM PST

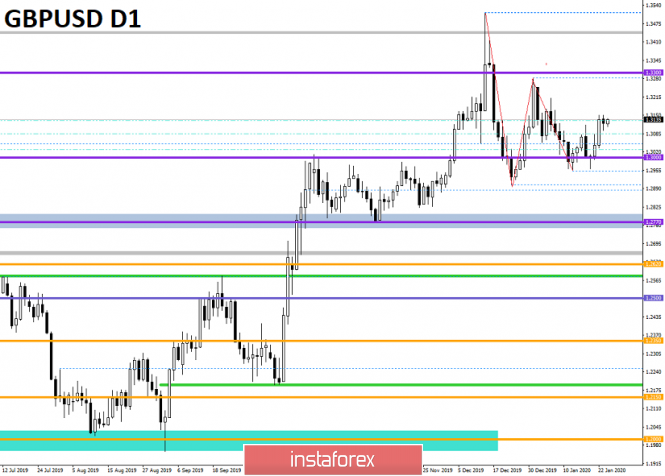

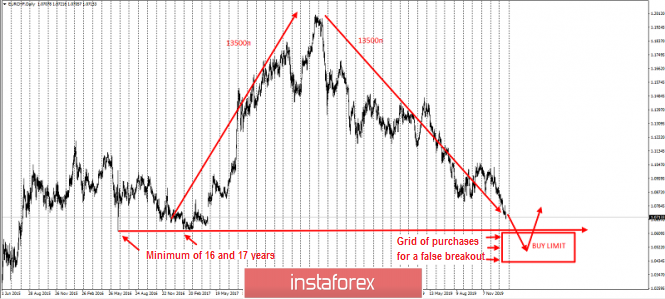

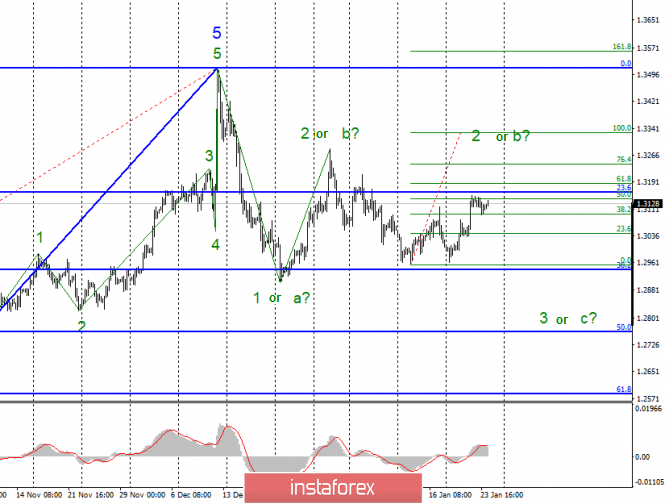

On December 13, the GBPUSD pair looked overpriced around the price levels of 1.3500 while exceeding the upper limit of the newly-established bullish channel. On the period between December 18 - 23, bearish breakout below the depicted channel followed by initial bearish closure below 1.3000 were demonstrated on the H4 chart. However, earlier signs of bullish recovery were manifested around 1.2900 denoting high probability of bullish pullback to be expected. Thus, Intraday technical outlook turned into bullish after the GBP/USD has failed to maintain bearish persistence below the newly-established downtrend line. That's why, bullish breakout above 1.3000 allowed the recent Intraday bullish pullback to pursue towards 1.3250 (the backside of the broken channel) where bearish rejection and another bearish swing were suggested for conservative traders in previous articles. Intraday technical outlook was supposed to remain bearish as long as the pair maintains its movement below 1.3120 (recently established descending high). However, recent bullish breakout above 1.3100-1.3120 is being demonstrated Today. This hindered the intraday bearish scenario. Thus, further bullish advancement was expected towards 1.3200. In the Meanwhile, Intraday traders can watch any bullish pullback towards the depicted price zone (1.3170 - 1.3200) for bearish rejection and another valid SELL entry with intraday bearish targets projected towards 1.3000 and 1.2980. On the other hand, conservative traders can wait for bearish breakdown below 1.2980. This would be needed first to enhance further bearish decline towards 1.2900, 1.2800 and 1.2780 where the backside of the previously-broken downtrend is located. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC analysis for 01.24.2020 - Important pivot-resistance level is set at the price of $8.470 Posted: 24 Jan 2020 05:07 AM PST Industry news: Countries continue to move forward in the cryptocurrency market with new intentions of issuing central bank digital currencies (CBDCs). Japan, one of the richest countries in the world is analysing the effects that a local digital currency would have on the economy. One of the lawmakers from the Liberal Democratic Party, Norihiro Nakayama, the first step would be to look into the idea of creating the so-called digital yen. Mr. Nakayama is also a parliamentary vice-minister for foreign affairs. Technical analysis:

BItcoin has been trading sideways at the price of $8.400. The price is near very important pivot-resistance at the $8.470. Watch for price action around this pivot to confirm further direction. The rejection of resistance may confirm further downside continuation and the downward targets at $8.090 and $7.683. The stronger breakout of the resistance at $8.470 cam confirms re-test of the $8.780. MACD oscillator is showing positive reading above the zero... Major resistance is set at the price of $8.470 Support levels and downward targets are set at the price of $8.090 and $7.683. The material has been provided by InstaForex Company - www.instaforex.com |

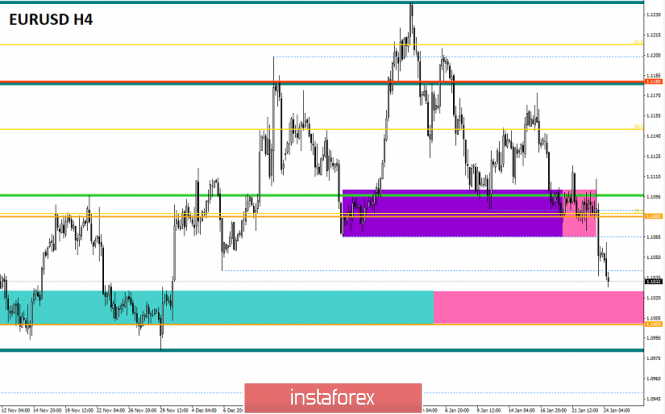

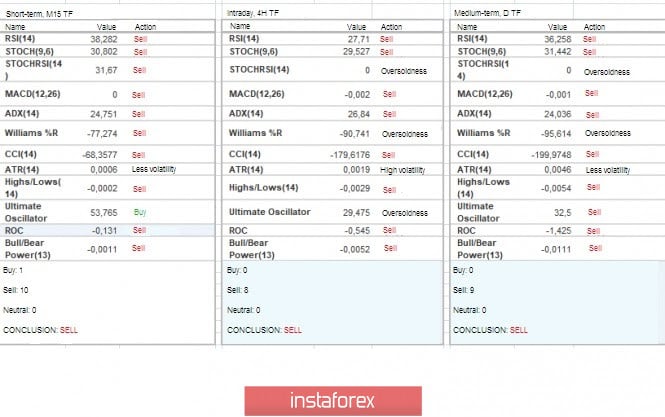

| Posted: 24 Jan 2020 04:55 AM PST EUR/USD - 4H.

As seen on the 4-hour chart, the EUR/USD pair continued the process of falling and performed a consolidation under the upward trend line. Thus, now traders can count on the continuation of the decline of the euro-dollar pair. To date, the quotes have already made a drop to the low level of 1.1040 and closed below it. Thus, there is still one more undeveloped target for the fall – 1.0989. The pair remains inside the downward trend corridor, which still clearly reflects the mood of most traders. Today, the divergence is not observed in any indicator. The information background yesterday was negative for the euro currency, but today traders are still in a bad mood. Despite more or less good indicators of business activity in the European Union and Germany (almost all values exceeded their forecasts), the fall of the euro currency continued. Thus, we are now seeing the reaction of European traders to the events of yesterday in the ECB. Today, the release of business activity indices in the US services and manufacturing sectors is also planned, as well as a speech by ECB President Christine Lagarde. Thus, in the second half of the day, the mood of traders may still change or, conversely, increase. EUR/USD - daily

As seen on the 24-hour chart, we still have a trading idea with a drop to the lower border of the downward trend corridor. At the moment, the pair has completed a consolidation under this trend line, which significantly increased the probability of a fall in the long term in the direction of the target level of 1.0850. Forecast for EUR/USD and trading recommendations: The long-term trading idea remains valid. Traders still have a long-term target for a fall near the level of 1.0850 confirmed by a close below the trend line. The short-term trading idea is to sell the pair with the goal of 1.0989 since the trend on the 4-hour chart remains "bearish". The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. January 24. Business activity in the UK has grown, and the British – fell Posted: 24 Jan 2020 04:55 AM PST GBP/USD - 4H.

As seen on the 4-hour chart, the GBP/USD pair performed two rebounds from the corrective level of 38.2% (1.3139) at once and a reversal in favor of the US currency with consolidation under the small correction line. Thus, another signal was received for sales of the British with the goal of a global correction line or the Fibo level of 76.4% (1.2995). There are no emerging divergences today. Closing the pair's rate below the global correction line will significantly increase the probability of a further fall in the pound. The information background was favorable to the pound today. The index of business activity in the service sector was better than traders' expectations at 52.9, while the index of business activity in the manufacturing sector was also better at 49.8. However, these economic data did not help the pound, which a few days earlier showed growth without positive statistics. Now I expect the pair's quotes to fall by 100 points down, where I expect the situation to clear up near the global correction line. This is what the graphical indicators are saying now. Forecast for GBP/USD and trading recommendations: The trading idea is still in the sales of the pound. Near the level of 1.3139, there was a reversal with a close under the correction line. I recommend traders to sell with the goal of 1.2995, Stop Loss should be taken out for 1.3139. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 24 Jan 2020 04:50 AM PST EUR has been trading downwards. As I expected, after the ECB Press Conference yesterday, the price tested our first downward target from yesterday at the level of 1.1040. I see further downside on the EUR and potential test of our second target at 1.1000.

The rejection of Head and Shoulders pattern in the background was key factor for the downside. My advice is still to watch for selling opportunities on the rallies using intraday-frames 5/15 minutes. MACD oscillator is showing new momentum down and the slow line is turned to the downside. Resistance levels are set at the price 1.1040 and 1.1060 Support level and our second target is set at the price of 1.1000. The material has been provided by InstaForex Company - www.instaforex.com |

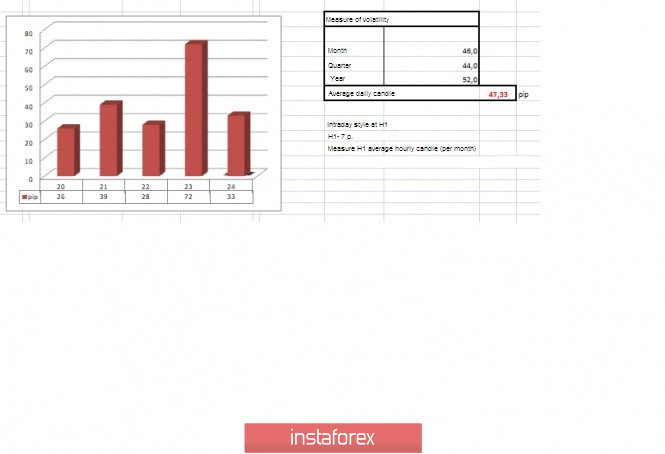

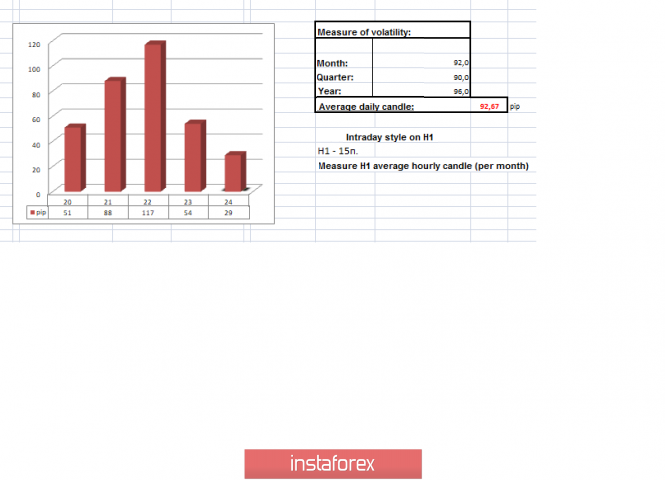

| Trading recommendations for EUR/USD on January 24 Posted: 24 Jan 2020 04:47 AM PST From a complex analysis, we see three events at once: the breakdown of the range level, the breakdown of accumulation, and the expected resumption of the recovery process. For three days in a row, the quote moved along the range level of 1.1080, having a rather narrow oscillation amplitude of 1.1070/1.1100. The process of peculiar accumulation was unwavering, which led many to think of the coming surge in the activity. Thursday was the starting point in our rally, where, against the backdrop of the ECB meeting, accumulation was no longer able to hold back borders and we saw a sharp surge in short positions. The existing activity immediately lowered the quote to the area of 1.1035, where a point of variable support was found against the background of local oversold and a pullback. Everything that happened above again led to a broad discussion of the recovery process, in connection with the breakdown of the first stage (1.1080), relative to the oblong correction. The recovery theory has been rumored by traders for a very long time, referring to the fact that the main downward trend did not suffer from the existing correction, and everything that happens is similar to the history of the fall of 2018. As you may have guessed, it is a pattern that underlies the theory, and it surprisingly works. In terms of volatility, we see a long-awaited acceleration, where 72 points were recorded last day, which is 53% higher than the daily average. Let me remind you that since the beginning of the trading week, the average volatility index was 31 points, and the minimum value was 26 points. Analyzing the past day by the minute, we see that the main increase in activity occurred in the period at 15:30-18:00 (time on the trading terminal). The subsequent oscillation was in terms of rollback/stagnation with a small amplitude. As discussed in the previous review, traders were at a low start due to significant accumulation, where the trading tactics were chosen using the method of breaking the set boundaries with the entrance to the impulse candle, which turned out to be an extremely profitable strategy. Looking at the trading chart in General terms (the daily period), we see signs of recovery relative to the oblong correction. Recovery steps: #1-1.1080; #2-1.1000; #3/1-1.0950; #3/2-1.0879. The news background of the previous day included data on applications for unemployment benefits in the United States, where the indicators were good, primary applications increased by 6 thousand, and repeated applications decreased by 37 thousand. The market reaction to the statistics was paired with a general decline. The main event of the day and week was the ECB meeting, where the regulator left the key interest rate unchanged without any surprise. "The Governing Council expects that the ECB's key interest rates will remain at their current or lower levels until it sees that the inflation forecast is steadily approaching a level close enough, but below 2% within its forecast horizon, and this convergence is consistently reflected in the dynamics of core inflation," the ECB said in a statement. The main reaction of the market to such an important event came after the press conference with Christine Lagarde. So, we expected a lot from her because the secrecy regime before the meeting was great. As a lever for the media, there were rumors that Lagarde would announce plans to revise the regulator's strategy, which will be revised for the first time since 2003. The "X" hour has arrived, and the ECB head confirms the launch of the monetary policy review, which will be completed by the end of this year. Today, in terms of the economic calendar, we had preliminary data on the Eurozone PMI, where we expected optimistic indicators, but were disappointed. So, the composite index of business activity in the manufacturing sector (Markit) remained unchanged at 50.9 with a forecast of growth to 51.2. At the same time, the index of business activity in the services sector (Markit) fell from 52.8 to 52.2. In the second half of the day, similar data will be released - for the United States, the manufacturing sector is expected to grow from 52.4 to 52.5, and in the services sector - from 52.8 to 52.9 (Markit). The upcoming trading week in terms of the economic calendar is expected to be saturated, which is worth only one meeting of the Federal Reserve System, which will certainly cause interest among speculators. The most interesting events displayed below: On Monday, January 27 USA 16:00 London time - Sales of new homes (m/m) (Dec): Prev 1.3% ---> Forecast 0.8% On Tuesday, January 28 USA 14:30 London time - Orders for durable goods On Wednesday, January 29 USA 20:00-20:30 London time - Fed meeting, followed by a press conference On Thursday, January 30 EU 11:00 London time - the unemployment rate USA 14:30 London time - GDP (preliminary) On Friday, January 31 EU 11:00 London time - GDP (preliminary) Further development Analyzing the current trading chart, we can see that the inertial downward trend was successfully set during yesterday's rally, and small stops in the course structure served as platforms for regrouping trading forces. The recovery theory now looks great in comparison with other arguments, and the point of the subsequent support of 1.1000 is not far away. In terms of the emotional component, we see an influx of not only local speculative positions but intraday ones, which can not but please in terms of market acceleration. Detailing the available trading day every minute, we see that after the stagnation/pullback that took place in the Pacific – the beginning of the European session, it turned into a resumption of the downward course, where the minimum of the previous day was broken and the price is trying to fix below it. In turn, traders continue to work on the downside, where there are partial fixing of trading operations, and the main prospect is the psychological level of 1.1000. It is likely to assume that such a rapid downward move will not be able to be constantly maintained by inertia and we will need a stop, which is currently considered within the psychological level of 1.1000. Thus, you should not be greedy, fix previously opened short positions, leaving optimal volumes in the market. Subsequent bays will occur after the price is fixed below the reference level of 1.1000. Based on the above information, we derive trading recommendations: - Buy positions will be considered in case of a rebound from the psychological level of 1.1000. - Positions for sale are already being held by traders, where fixes are made. Right now, opening a position is considered a risky idea, since the price is extremely close to the psychological level of 1.1000. Indicator analysis Analyzing different sectors of timeframes (TF), we see that the indicators of technical instruments unanimously signal a sale due to a sharp surge in the activity of short positions. Volatility for the week / Volatility measurement: Month; Quarter; Year. The volatility measurement reflects the average daily fluctuation, based on the calculation for the Month / Quarter / Year. (January 24 was based on the time of publication of the article) The current time volatility is 33 points, which is close to the average. It is likely to assume that there is still a chance of further volatility growth against the background of the growth of speculative positions. Key levels Resistance zones: 1.1080**; 1.1180; 1.1300**; 1.1450; 1.1550; 1.1650*; 1.1720**; 1.1850**; 1.2100. Support zones: 1.1000***; 1.0900/1.0950**;1.0850**; 1.0500***; 1.0350**; 1.0000***. * Periodic level ** Range level *** Psychological levels ***** The article is based on the principle of conducting a transaction, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold 01.24.2020 - Breakout of the upward Pitchfork channel, selling oppotuntiies preferable Posted: 24 Jan 2020 04:43 AM PST Gold has been trading downwards. As I expected, the price tested the level of $1,557. I see further downside on the Gold and potential re-test of $1.552 and $1.546. Additionally, there is the breakout of the Pitchfork upward channel.

The rejection of the strong pivot level at $1.567 in the background was key factor for the downside. My advice is to watch for selling opportunities on the rallies using intraday-frames 5/15 minutes. MACD oscillator is showing negative reading below the zero and slow line is turning to the downside. Resistance levels are set at the price of 1$1.562 and $1.567 Support levels and downward targets are set at the price of $1.552 and $1.546. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review for EURUSD on January 24, 2020. We are waiting for a correction Posted: 24 Jan 2020 04:30 AM PST

The euro has been in a state of the downward movement for a day. More precisely, the euro has been falling since the beginning of the year (the maximum of 1.1240 took place on December 31), however, this was a fall within the correction to the previous growth. But on Thursday, at the ECB's decisions, the euro fell, breaking through support, and moved into a state of downward movement. However, the movement is sluggish, and you need to enter it with a rollback. For example, up to 1.1070. EURUSD: We sell from 1.1070. Stop at 1.1110 and the target - 1.0970. We keep purchases from 1.1110. The material has been provided by InstaForex Company - www.instaforex.com |

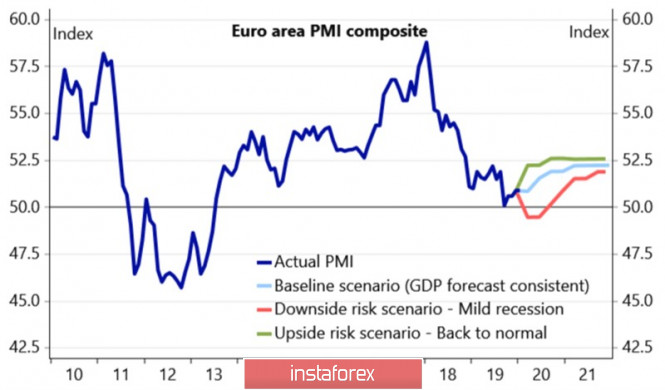

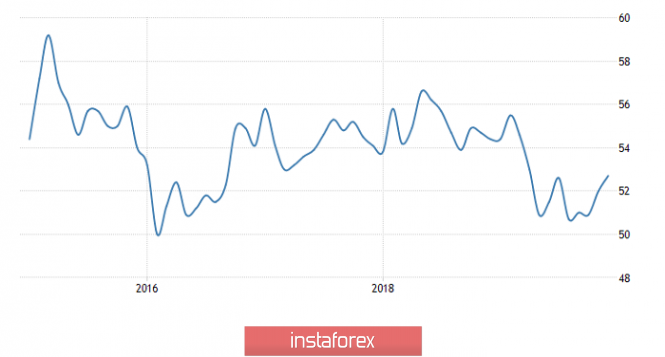

| Posted: 24 Jan 2020 03:10 AM PST The hopes of the "bulls" on the recovery of the upward trend of EUR/USD turned into lost illusions after Christine Lagarde refused to signal the imminent departure of negative interest rates from the ECB policy. Moreso, following the example of the Riksbank, statistics on European business activity during January was mixed, and the threat of a trade war between US and EU have become more explicit. Because of these, the "bears" attacked the euro, and led the quotes of the pair to the lowest level since the beginning of December. Prior to the World Economic Forum in Davos, investors were weighing the risks of the escalating trade conflict between Washington and Brussels. Some thought that Donald Trump, inspired by the success of his protectionist policy, would not want to postpone the case, while others hoped for a negative impact on the US economy and stock market. The President, however, managed to find a middle ground, threatening EU with tariffs on imports of European cars. Trump tried to reassure investors, arguing that a serious fall in stock indexes should not be expected, as Brussels still has no way out. He will sign the document proposed by Washington. Thanks to President Trump, the S&P 500 did not feel much fear, unlike the Eurozone and the euro. Euro's already weak economy is not set up for a trade war, as it has just barely began to recover, as evidenced by the growth of business activity in the manufacturing sector. The service industry, on the contrary, upset Bloomberg experts, making the composite purchasing managers' index for January disappointing as well. This prevented the EUR/USD bulls from launching a counterattack. The future dynamics of business activity will depend on the recovery of global and European GDP, as well as on whether the US will start a trade war with the EU or not. Dynamics of European business activity:

Christine Lagarde did not give anything good to euro fans either. In contrast to the December meeting of the Governing Council, when the ECB talked a lot about positive developments in the Eurozone economy, the central bank declared a long period of holding negative interest rates in January's meeting. They say that despite the signing of the US and China trade agreement, uncertainty still remains. I wonder how the Fed will answer colleagues from Frankfurt. The FOMC meeting, coupled with the release of data on European and American GDP for the fourth quarter, will be the main events of the week on January 31. The futures market is giving an 88% probability of keeping the Federal funds rate at 1.75%, while the chances of monetary expansion by the end of 2020 are growing by leaps and bounds. The US economy will likely to expand by 2.1% compared to October-December 2018, and the Eurozone economy by 0.2%, as compared to July-September 2019. Technically, the daily EUR/USD chart continues to implement a combination of the Three Indians and 1-2-3 patterns. After a confident assault on the diagonal support in the form of the lower border of the ascending trading channel, the pair is confidently moving towards the target of 88.6% on the "Shark" model, located near 1,1-1,101. EUR / USD, daily chart:

|

| Canadian dollar could not keep balance Posted: 24 Jan 2020 03:07 AM PST

The current week has been saturated for the Canadian currency. Looney was under pressure due to many factors, the center of which was the meeting of the Bank of Canada at a key rate. Which analysts emphasized to have provoked a negative wave of decline in the "loonie". Recall that on Wednesday, January 22, the regulator expectedly kept the key rate unchanged at 1.75%. According to analysts, after such a decision, the Canadian dollar staggered and moved down, losing about 0.5% of its value. In addition, the department allows further rate cuts in the event of a deterioration in the prospects for the Canadian economy. In addition to the decision on the rate, the Bank of Canada worsened forecasts for GDP growth. According to Stephen Poloz, the head of the regulator, much will depend on the state of the economy. He previously stated that the country's economy is stable enough to keep rates unchanged, but now much has changed. The Bank of Canada will focus on current circumstances, including the situation in the global economy, in order to timely respond and lower rates. Recall that the regulator keeps them unchanged since October 2018, but this cannot last forever. Currently, a number of prerequisites have appeared for a further reduction in rates. First of all, this is a very low level of inflation, not reaching the target mark of 2%. Another factor is the rather negative outlook for the country's economic growth. In the fourth quarter of 2019, the Bank of Canada worsened it to 0.3% compared to 1.3% expected in October. There was also new information on the consumer price index last Thursday where according to which the December inflation in Canada remained at the same level of 2.2%. The reason for this was the rise in energy prices, analysts say. They also added that the current state of affairs negatively affected the dynamics of the Canadian currency. The USD/CAD pair was trading near 1.3133 on Wednesday showing moderate growth. However, later on, the situation changed to not in favor of the "loonie". The currency of the Maple Leaf Country began to fall, becoming a downward trend for a long time. On Friday, the tandem glide continued where it started the day at 1.3125 and attempted to get out of the low range.

On the latter days, these attempts were crowned with success as the USD/CAD pair reached its goal of rising to 1.3140. And experts concluded that this result exceeded the level of the environment. Now the pair is trying to enter an upward trend, and analysts are confident that the Canadian dollar will succeed.

According to experts, pressure on the "loonie" also contributed to the decline in oil prices. Recall that black gold is one of the key export items of the country. At the end of the week, massive oil sales were recorded, triggered by comments by the International Energy Agency (IEA) about the oversupply of the global market. The IEA also expressed serious concerns about the demand for hydrocarbons due to the spread of coronavirus in China. Despite a number of current negative factors, the growth potential of the Canadian currency impresses experts and they reassure that in the near future the USD/CAD pair will again tune in to the rising wave. The main driving force of the Canadian dollar will be the dynamics of oil quotes, which currently demonstrate stability. This gives confidence to the "loonie" who intends to regain its lost ground. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading recommendations for GBP/USD Posted: 24 Jan 2020 02:19 AM PST Using complex analysis, we can see extremely low activity, where even the breakdown of the periodic flat of 1.3115/1.3150 did not give the desired result. In fact, the upward movement that was set days earlier is holding back sellers who cannot fully enter the market without proper trading volumes. This judgment is confirmed if you make a reference to the EUR/USD currency pair, which over the past days, showed active downward interest. The GBP/USD pair correlating with it also locally broke the lower limit of the range in the same period of time. The range of 1.3115/1.3150 was not broken, as there were not enough volumes, and the local surge is a partial reflection of the EUR/USD. Based on the above information, the theory of fracture of the Zigzag-shaped model has a basis for reflection. As discussed in previous reviews, the Z-model has been compressing the quote for a long time, which should have led to a significant surge in activity with a fracture of the existing fluctuation frameworks. A surge of activity has occurred, but there are no fundamental changes, hence the assumption arose that we have an increasing inertial course, which will lead to a more significant change. Thus, referring to the stability of the quotes in the past day, this assumption takes on a real basis, which was previously not the case. However, no matter how beautiful it sounds, I still have one thought: if the assumption is the same, then we see a growing inertial course, which hypothetically can lead to values such as 1,3300 and 1,3500. This signal indicates that the medium-term trend continues to make adjustments to the global trend, and in the light of possible economic problems in Britain, it is not entirely logical. Because of this, I would not rush to make final conclusions yet, but look at the price behavior instead. In terms of volatility, we see another slowdown relative to the previous day, where the daily candle is 41% lower than the average value. This signals the restraint of market participants. Analyzing the past day by the minute, we see a steady sideways movement of 1.3115/1.3150, where the lower border was broken locally during the period 14:00-16:30 London time [time on the trading terminal]. The subsequent fluctuation returned the quote back to the specified limits. As discussed in the previous review, speculators considered a temporary flat as a starting point for the future movement, however, expectations were not met. The price did not break the border of 1.3115, although positions were open. Looking at the trading chart in general terms [the daily period], we can see that the structure of the medium-term upward movement began to form a slowdown, expressed in the local sideways course. The news background of the previous day included data on applications for unemployment benefits in the United States. The indicators on the said data were good, as primary applications increased by 6 thousand. The repeated ones, on the contrary, decreased by 37 thousand. The statistical data did not garner market reaction. The strongest background on EUR/USD was caused by the ECB meeting, which we will discuss in this article. In terms of the general information background, we have the completion of Brexit. It was first approved by the UK Parliament, and afterwards was signed by Queen Elizabeth II. The European Union signed it today. "Today, I signed the agreement on UK's withdrawal from the European Union, together with Ursula von der Leyen. Things will inevitably change, but our friendship will continue. We are starting a new chapter as partners and allies, " said European Council President Charles Michel On January 29, the agreement is expected to be ratified in the European Parliament. On January 31, at 21:00 London time, Brexit will take place. The schedule of subsequent actions looks like this: February 25 - around this date, the 27 remaining heads of the European Union will sign a mandate to hold talks, which will allow official negotiations to begin. The final deadline for extending the transition period is at the end of June. A number of agreements should have already been reached by this date. December 31 - the transition period ends. If the parties do not agree on a deal, UK cannot trade with EU under the terms of the World Trade Organization. Today, in terms of the economic calendar, we have preliminary British PMI data, where the manufacturing sector is expected to grow from 47.5 to 48.9. Meanwhile, the services sector is expected to grow from 50 to 51 [Markit]. In the second half of the day, similar data will be released for the United States, where the manufacturing sector is expected to grow from 52.4 to 52.5, and the services sector from 52.8 to 52.9 [Markit]. The upcoming trading week is expected to be extremely busy due to the two meetings of the Fed and the Bank of England. These meetings will interest both investors and speculators, who try to make money on local bursts of activity. The most interesting events are displayed below - - - > Monday, January 27 US 16:00 London time - Sales of new homes (m/m) (Dec): PREV: 1.3% - - - > Forecast: 0.8 % Tuesday, January 28 US 14:30 London time - Orders for durable goods Wednesday, January 29 US 20:00-20:30 London time - Fed meeting, followed by a press conference Thursday, January 30 13:00 London time - Bank of England's meeting, followed by a press conference US 14:30 London time - GDP (preliminary) Further development Analyzing the current trading chart, we can see a continuous fluctuation within the same range of 1.3115/1.3150, where the amplitude is extremely small. In fact, the characteristic restraint is still there, which is alarming, since there's a chance and reasons of acceleration. Now, the question arises as to how much this restraint will be enough. I suppose that there is a certain setting of prospects now. In terms of the emotional mood of the market, we can see that the trading volumes have fallen, and market participants have taken a short pause, which may later result in an acceleration. By detailing the time interval every minute, we can see the price fluctuation from the lower border of the corridor, where the candle structures have local impulses. Because of this, speculators have insured their previously opened short positions, in the form of restrictive orders above the range. At the same time, they are working on the position of the shifter in case of continued movement All in all, it is possible to assume that the market activity will still surprise us. For now, we need to take a break and understand how the price will behave. The trading strategy is selected according to the method of local positions relative to the corridor, where trading volumes will flow into the positions gradually in order to minimize the risks of a false movement. Based on the above information, we have these trading recommendations: - Consider buying positions if the price fixes higher than 1.3180. Speculative positions can be as low as 1.3155. - Some market participants already have positions for sale, where they are advised to use a stop loss restrictive order. If you don't have any deals, wait for the price to fixed below 1.3095. Indicator analysis Analyzing the different sectors of the timeframes (TF), we can see that the performance of the technical instruments are keeping the quotes in a given range, protecting the upward interest. In case there's hovering in the accumulation, variable signals relative to smaller time sections will appear. Volatility for the week / Volatility Measurement: Month; Quarter; Year The volatility measurement reflects the average daily fluctuation, and is based on the calculation for the Month / Quarter / Year. (January 24 was based on the article's time of publication) The volatility at the moment is 29 points, which is an extremely low value for this section of time. Most likely, if the accumulation process is delayed, the volatility will still be at low levels. Acceleration will occur as soon as the main movement is selected relative to the range. Key level Resistance zones: 1,3180**; 1,3300**; 1,3600; 1,3850; 1,4000***; 1,4350**. Support areas: 1,3000; 1,2885*; 1,2770**; 1,2700*; 1,2620; 1,2580*; 1,2500**; 1,2350**; 1,2205(+/- 10p.)*; 1,2150**; 1,2000***; 1,1700; 1,1475**. * Periodic level ** Range level ***Psychological level **** This article is based on the principle of conducting a transaction, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis of EUR/USD for January 24, 2020 Posted: 24 Jan 2020 02:14 AM PST Overview: The EUR/USD pair continues to move downwards from the level of 1.1088, which represents the double top in the H1 chart. The pair dropped from the level of 1.1088 to the bottom around 1.3036. Today, the first resistance level is seen at 1.1082 followed by 1.1121, while daily support is seen at the levels of 1.0998 and 1.0963. The first resistance stands at 1.1088, for that if the EUR/USD pair fails to break through the resistance level of 1.1088, the market will decline further to 1.0998. The pair will probably go down because the downtrend is still strong. Consequently, the market is likely to show signs of a bearish trend. This would suggest a bearish market because the RSI indicator is still in a negative area and does not show any trend-reversal signs. The pair is expected to drop lower towards at least 1.0998 in order to test the second support (1.0963). In case of a successful breakout, the next target will be at the level of 1.0903. Even though, stop loss should always be taken into account, accordingly, it will be of beneficial to set the stop loss above the last bullish wave at the level of 1.1173. The material has been provided by InstaForex Company - www.instaforex.com |

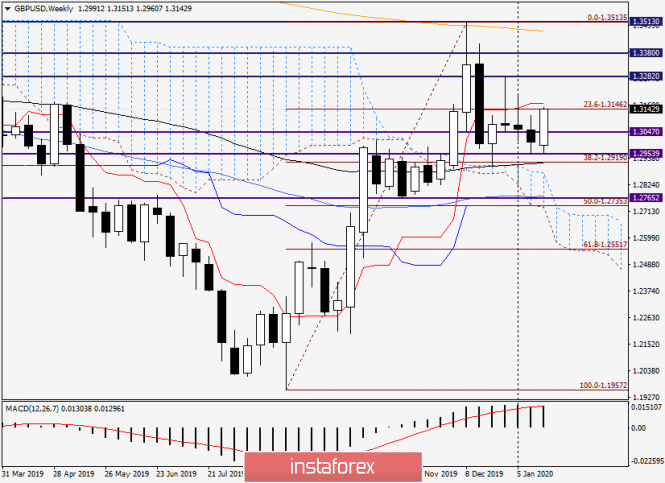

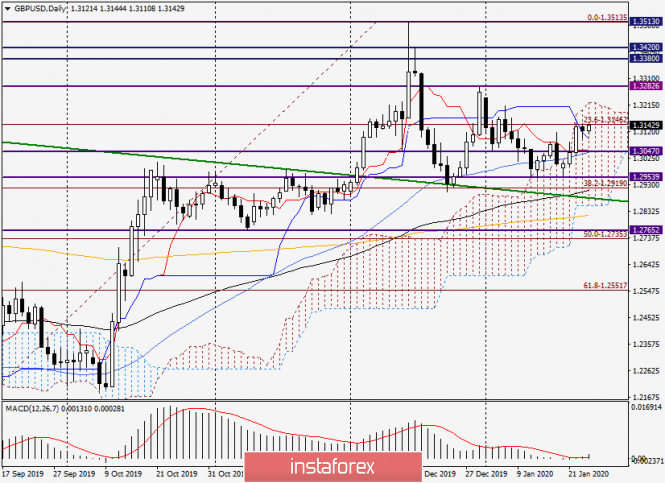

| Analysis and forecast for GBP/USD on January 24, 2020 Posted: 24 Jan 2020 01:58 AM PST Once again, welcome dear traders! In this article, as you have already understood, we will talk about the pound-dollar currency pair. As usual, the focus will be on the technical component. Nevertheless, let me remind you of the macroeconomic reports that may affect the price dynamics of this currency pair today or tomorrow. So, today at 14:30 (London time), data on initial applications for unemployment benefits will come from the US. Tomorrow, the States will report on the index of business activity in the manufacturing and services sector from Markit. No statistics are expected from the UK today, but tomorrow we will find out how things are with the PMI manufacturing activity index, as well as the PMI in the services sector. All additional information about these and other events can be easily found in the economic calendar. This is probably all, and we can move on to the technical part of the review. Weekly

Although today is not yet Monday, I consider it necessary to demonstrate the weekly timeframe and consider options for closing the current five-day period. As you can see, the stumbling block for further strengthening of the pair is the Tenkan line of the Ichimoku indicator, which is located at 1.3170. Closing the week above Tenkan will increase the chances of further movement of GBP/USD in the north direction. If the pound bulls manage to close the weekly session above the resistance of 1.3282, this will become an even stronger signal for further growth. The downward trend scenario is signaled by the closing of the current weekly candle below the previous minimum values at 1.2953. In this case, the pair is likely to be under the control of the bears in the future. Daily

On the daily chart, the situation is no less interesting and important. To confirm the seriousness of their intentions, players need to display the price up from the Ichimoku indicator cloud. But it's not just to withdraw, but to be fixed above the upper boundary of the cloud. This is extremely important! We see that the bulls are currently trying to make such attempts on the pair. We will find out what will happen in the end only after the closing of weekly trading. In the meantime, it is worth noting that the upper border of the cloud passes near 1.3223, and this mark can play the role of fairly strong resistance. At the moment, the nearest resistance is represented by yesterday's highs at 1.3150, and support is at the familiar technical level of 1.3047. It should be noted that in addition to the level itself, the 50 simple moving average and the Tenkan line are located here, which will certainly strengthen the already strong level of 1.3047. The further support level is located at the already mentioned mark of 1.2953. H1

On the hourly chart, the pound-dollar is trading in the range of 1.3150-1.3095. It can be assumed that the further direction of GBP/USD will be determined depending on which direction the price goes out of this range. At the moment, 50 MA provides good support for the pair. This moving average actively turns up behind the price. However, both 89 and 200 exponential moving averages are a little slower, but they also turn up behind the course. In my personal opinion, there is more chance of an upward trend scenario and a breakdown of the sellers' resistance at 1.3150. However, buying under resistance is not the best trading idea. In my opinion, it is less risky to wait for the breakout of 1.3150, fixing above this level, and open long positions on the pound on the rollback to it. For those who use the breakout strategy, you can try to buy directly on the breakout of the resistance at 1.3150. However, do not forget that often breakouts are false, so I consider this positioning riskier. However, you decide. Good luck and big profits! The material has been provided by InstaForex Company - www.instaforex.com |

| Mario Draghi still ECB's head? (Review of EUR/USD and GBP/USD on 01.24.2020) Posted: 24 Jan 2020 01:33 AM PST It seems to me that it's worth starting with the following words of Christine Lagarde: "The Governing Council expects that the ECB's key interest rates will remain at their current or lower levels until he sees that the inflation forecast will steadily approach a level close enough, but below 2.0% within its forecast horizon, and such convergence will be reflected in the core inflation dynamics ".

In general, this can diverge, and somehow it seems that these words were not spoken by Lagarde, but by Mario Draghi since there is simply no difference. The European Central Bank continues to pursue the same policy, which consists in a gradual and leisurely reduction in interest rates. This, in particular, is indicated by the words "or lower levels". The wording about the "inflation forecast will be steadily approaching" has also remained unchanged since the days of Mario Draghi. Because nothing has changed still. Anyway, what is this wording? What if the leadership of the European Central Bank at this very moment is occupied with more pressing problems and simply does not see this very approximation? And what about "fairly close, but below 2.0%"? Is the current inflation rate of 1.3% insufficient? Necessary, so that inflation rises to 1.8% or is 1.7% enough? Perhaps it is time to raise interest rates at 1.4%? As you can see, there are a lot of questions, but no answers to them. And this official wording, market participants have heard from the leadership of the European Central Bank for several years, when all the regulators just did is constantly cut interest rates. So it is not surprising that investors were disappointed and had expressed their attitude to what was happening with a further decline in the single European currency, which tirelessly lowered interest rates. Refinancing Rate (Europe):

However, due to the sadness into which the unfortunate market participants plunged, they did not seem to hear Christine Lagarde saying that the board of the European Central Bank was starting to review its entire monetary policy. Yes, it starts. She does not plan to consider such an opportunity in the near future but rolling up her sleeves, she already did yesterday and began this revision itself. The thing, however, is not simple and rather slow, so they should keep only within by the end of this year. The current policy of the European Central Bank can only be reviewed in one way, which is towards a gradual increase in the three times damned interest rates. After all, rumors have been circulating about this for a long time. It's not just that Christine Lagarde introduced a complete radio silence on the eve of yesterday's meeting of the European Central Bank, forbidding everyone to give at least some comments on the issue of monetary policy. Another thing is that there are no specifics, except for the terms regarding what exactly is meant by this very revision. Although it is easy to guess what is meant. But rumors and speculations are worthless in comparison with official statements and comments, so investors are forced to wait further. Another thing is that, at least now, it's clear when everything should happen. And I will make a bold assumption that yesterday's speech by Christine Lagarde will be the beginning of a gradual reversal, which has been dragging on for more than a decade of the slow weakening of the single European currency. Yes, for a while it will decline, but the speed of this process will noticeably decrease.

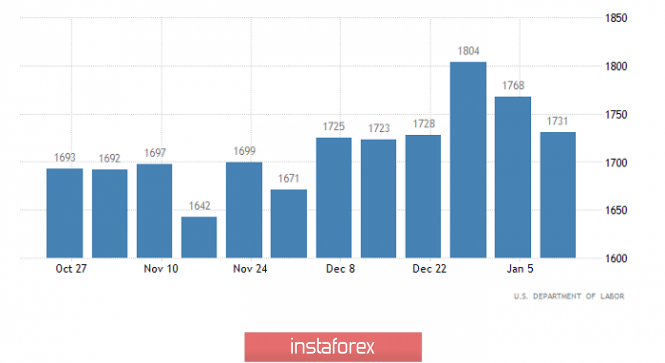

It is clear that against the backdrop of a meeting of the European Central Bank, the question of what happened yesterday with applications for unemployment benefits belongs to the category of the question of the cost of bananas in a neighboring bazaar. Nevertheless, it is worth taking a look at these data, as they will certainly have an impact on the general data on the labor market, which will be published in just two weeks. So, the number of initial applications for unemployment benefits is increased by 6 thousand rather than the expected 7 thousand, while the number of repeated applications for unemployment benefits fell to as much as 37 thousand instead of decreasing by 9 thousand. These scenarios would suggest that we should expect further improvement in the state of the labor market, which is already the best in the last fifty years. Repeated Unemployment Insurance Claims (United States):

Today, preliminary data on business activity indices will be published not only in Europe but also in the UK and the United States. So, the forecasts for Europe are quite optimistic since the composite index of business activity should grow from 50.9 to 51.1. If we look in the context, then the index of business activity in the manufacturing sector can grow from 46.3 to 46.9. The service sector, on the other hand, is expecting a growth of 52.9 from 52.8. But this will not lead to the explosive growth of the single European currency, as everyone will wait for US data. Composite Business Activity Index (Europe):

The pound will behave in the same way, although forecasts for business activity indices are even better than on the continent. The index of business activity in the manufacturing sector should increase from 47.5 to 48.4, while the service sector growth is projected from 50.0 to 50.7. Due to all this, the composite index of business activity can grow from 49.3 to 50.2, exceeding the psychological mark of 50.0 points and dividing the recession in the economy and its growth. Composite Business Activity Index (UK):

But as already mentioned, everyone will wait for American data, forecasts for which are diametrically opposed. Thus, the production index of business activity should decline from 52.4 to 52.2. In the service sector, they forecast a decline from 52.8 to 52.7, so it is not surprising that a composite index is expected to decline from 52.7 to 52.5. Against the backdrop of rising indices in the Old World, their decline in the New World will clearly lead to a decrease in the dollar. However, the wait-and-see attitude of investors will also be connected with the fact that there are forecasts that indices may show insignificant growth, although there are few of which. These are particularly the production index from 52.4 to 52.5 and in the service sector from 52.8 to 52.9. Which left us with some uncertainty and intrigue. That is what the fate of the dollar will become. Composite Business Activity Index (United States):

It all depends on preliminary data on business activity indices in the United States, and if they coincide with forecasts, then one should not be surprised at the growth of the single European currency to 1.1075. If they suddenly show an increase in the indices, then a reduction to 1.1025 is possible.

For the pound, the scenario is exactly the same as for the single European currency, and in the case of weak US data, the pound may properly rise to 1.3175. If optimistic forecasts are confirmed, then we should expect a gradual decline in the direction of 1.3075.

|

| Where is the best place to buy euro? Posted: 24 Jan 2020 01:12 AM PST Good day, dear traders! Usually, when people talk about the euro, they automatically imagine the EUR/USD pair and try to gush trading ideas within this popular tool among intraday traders. Today though, in my opinion, there is one very interesting pair that was completely undeservedly forgotten by analysts - the EUR/CHF pair, which is now developing a very interesting situation. Before moving on to the chart, I would like to remind you that almost all pairs involving the franc has limited volatility. Making them very popular with representatives of the grid world of traders. The most striking tool is, of course, CAD/CHF, whose range has fallen by several hundred points. Concurrently, the EUR/CHF also has its own patterns. Let's see. It is clear that the average rollback in recent years at EUR/CHF is 13500p for 5zn. This is not a lot, and not a little, which is normal for the tool. After the passage of such trends, you can expect a reversal or correction, where you can actually earn profit. Good news is, right now, it so happened that the pair is trading at the average historical lows in the immediate vicinity of the so-called "platform" at the level of 1.06200. I suggest setting a grid of limit purchases under this level in increments of 500P (5zn), with the calculation of the volume according to your deposit on the trader's calculator. Good luck in trading and have a good weekend! The material has been provided by InstaForex Company - www.instaforex.com |

| Euro accepted the fight and... lost? Posted: 24 Jan 2020 12:57 AM PST This weekend proved to be a testing time for the single currency. The most important of them was the speech of Christine Lagarde, head of the ECB. The results of the further decisions regarding the Euro zone's monetary policy turned out to be very deplorable for euro, and its fall was not long in coming. After the ECB meeting, it became known that the regulator kept the interest rate unchanged, and reduced the deposit rate for banks by 0.5%. Such a decision will remain in effect until inflation in the Eurozone reaches the target level of slightly below 2%. As a result, we should not expect any increase or reduction in rates in the near future. Asset buyback programs will also remain unchanged. According to Lagarde, if the economic background improves, the program of quantitative easing (QE) will be curtailed, and only then can we return to the issue of raising rates. One of the most important measures taken after the ECB meeting is to review the current monetary policy strategy, which has not been updated since 2003. Of course, over the past 17 years, a lot of questions have matured and there are a huge number of changes that need to be taken into account. According to the regulator's plans, the review will last throughout 2020 and will cover the most "pressing" issues, ranging from the inflation target to virtual currencies and the fight against climate change. The financial and economic storms that were raging in the Eurozone could not but affect the single currency. After the ECB meeting, the euro, which held steady near the level of 1.1090, slid sharply down. On the evening of Thursday, January 23, euro began to capitulate, dropping its points. The EUR/USD pair fell to 1.1042, losing its previous gains. Friday morning, January 24, did not bring positive results to the classic tandem. The EUR/USD pair moved slightly up, running in the range of 1.1049–1.1050. Now, the tandem is trying to leave this range, but the attempts remain unsuccessful. The gloomy picture that has developed around euro, however, does not add to the pessimism of the markets. Many experts believe that the decline will be followed by a rise, and the European currency will regain its position. Although euro fell by more than 1% on January 2020, experts note its huge growth potential. Of course, negative rates and high volatility have added a fly in the ointment to the Eurozone's financial honey, and turned the euro into a funding currency. However, experts believe that the final defeat of the currency is not worth talking about. According to their calculations, even minor signals indicating changes in deposit rates can give a second wind to the single currency. They consider them to be the spark that will ignite the flame of the new impulse needed to overcome the gravity of the current low range of the euro. Analysts conclude that the talks regarding the complete failure of euro is premature. They quote this situation as: "the currency may have lost the battle, but not the war." Experts are sure that the single currency will have an opportunity to show itself, demonstrate its potential, and win back its losses. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD buyers trap slammed at ECB Posted: 24 Jan 2020 12:47 AM PST Good afternoon, dear traders! Congratulations to those who took advantage of our trading recommendation for the sale of EUR/USD according to PLAN1 and PLAN2. It has long been noticed that breakdowns of strong levels occur precisely on the news. And it happened this time. Yesterday, after a disappointing performance by Christine Lagarde, the couple went on the storm of December lows, near which they traded for quite a long time. As I said yesterday in my VIDEO ARTICLE, the ECB press conference is always a "day of divorce" (false breakdowns). And this press conference was no exception. Let's take a closer look. Lagarde's speech began at 13:30, and after 5 minutes we have a sharp false breakdown of the extreme day: With short plans, this is a "gift of fate" for a short speculator! Well, for those who are going before the news, put a stop for the current extreme of the day - it's a fiasco. In fact, this scenario is from the classics of the "hunt for feet" method, where the so-called "provocation" is the capture of stops from the opposite border of a local auction or daily extreme. In such cases, jumping into a trend is very cheap in terms of risks and very profitable in profit. After capturing the upper border of the day, the EURUSD pair followed in the footsteps of more important levels of liquidity accumulation: Where worked scenarios for the breakdown of the lower stop levels. The pass was 600 p, but even if you took 500, you still get a good result! Good luck in trading and a good weekend! The material has been provided by InstaForex Company - www.instaforex.com |

| Technical analysis recommendations for EUR/USD and GBP/USD on January 24 Posted: 24 Jan 2020 12:45 AM PST Economic calendar (Universal time) The economic calendar is quite calm today, but you need to pay attention to a number of significant indicators for the UK and the eurozone in the morning. So now, indexes of business activity and a composite index for the UK will be published at 9:30 UTC+00, as well as the expected performance of the President of the ECB. EUR / USD Yesterday, the pair made an attempt to break through the supports holding back the development of the decline, after another test of resistance in the 1.1110 protected area (weekly levels + daily Tenkan + upper border of the daily cloud). As a result of the successful attack, we managed to go beyond the limits of the daily cloud and the weekly medium-term trend. Today, we are closing the week. A small lower shadow on the weekly candle and closing below important levels for this section of the movement (1.1065 weekly Kijun + lower border of the daily cloud) will provide players with a lower level of safety for their positions and prospects. The prospects and subsequent plans now primarily include the elimination of the weekly golden cross (final line 1.1021), as well as the preservation of pronounced bearish potential with the upcoming closing of the first month of the new year. You can see that the development of yesterday's upward correction was implemented again within the framework of the key resistance of the lower halves. These levels were able to limit and complete the correctional rise, after which the lower players restored the downward trend. Today, reference points for the continuation of decline within the day are the support of the classic Pivot levels (1.1024 - 1.0993 - 1.0951). On the other hand, key resistance will meet a pair at 1.1066 (central Pivot-level of the day) and 1.1086 (weekly long-term trend) in the case of the development of another upward correction. GBP / USD The week threatens to consolidate the predominance of forces on the side of the players to increase, but raises great doubt that this achievement will be significant and decisive. Today, important resistance continues to hang before the players (1.3171 weekly Tenkan + monthly Kijun - 1.3314 lower boundary of the monthly cloud - 1.3452 final boundary of the monthly dead cross), which they will have to overcome before they manage to get closer to the maximum extreme weekly correction (1.3514). Moreover, today's attraction is provided by the daily Kijun and Fibo Kijun (1.3094 - 1.3139), support is still located at 1.3053 (daily short-term trend) and in the region of 1.2920 - 1.2877 (accumulation of high levels). Developing a corrective decline, the players lowering to H1 have not been able to cope with the central Pivot level (1.3122) for a long time, remaining in the zone of its attraction. Now, breaking through the level will make the support of the weekly long-term trend (1.3062) the next important reference point for the downward correction. If the central Pivot cope with the task and is able to restrain the development of the correction, then the resistance within the day will be R2 (1.3176) and R3 (1.3202), after the restoration of the trend (1.3152). Ichimoku Kinko Hyo (9.26.52), Pivot Points ( classic ), Moving Average (120) The material has been provided by InstaForex Company - www.instaforex.com |

| Trader's Diary: EUR/USD on 01/24/2020, What's next, ECB? Posted: 24 Jan 2020 12:23 AM PST

The ECB meeting was held on Thursday, the main event for the EURUSD for this week and probably even for the month. What has the ECB decided? Rates remained at an extremely low level with the base rate of 0%, and - 0.5% for bank deposits. The QE program also remains unchanged at 20 billion euros per month. If there were any changes, that is the ECB's initiation of a "strategy review." There is only one way the ECB can revise its strategy, which is by tightening its monetary policy. Experts have been emphasizing for a long time that the super-soft policy of the ECB has long been spent and does not give an impact. At the same time, the risk for the ECB is that a new Big Crisis will come when ECB rates are already at lows which may result in it from losing tools to help the economy get out of the crisis. It would seem that the ECB's decision was to push the euro up, and somehow we saw some growth attempts, but in the end, the euro still fell. If you look at weekly or monthly long charts, you can see that there has been a reversal to the euro where the last minimum the EURUSD had was a long time ago which is last October 1, 2019, with 1.0880. Right now, we are probably inside the big reversal figure for the euro and the new "bottom" can be both at 1.0980 and at 1.0880. Another event to anticipate is the Fed meeting on January 29, where there is a small probability that the Fed will change the rate, however, surprises tend to happen. EURUSD: We sell from 1.1070. We buy from 1.1110. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: Pound believed in the economy. Will it live up to expectations? Posted: 24 Jan 2020 12:22 AM PST

The British currency was in disgrace, due to a series of disappointing statistics on the United Kingdom and the "pigeon" rhetoric of the Bank of England representatives. The market actively exaggerated talks that the December rally in the pound was excessive, that all the good news is already embedded in the quotes, and that the weakness of the British economy will force the BoE to reduce the interest rate. This caused the chances of monetary policy easing in the UK to increase to 70% at the end of January. However, as soon as this positivity appeared, the pound wiped the nose of the skeptics. Analysts at the Deutsche Bank predicted that the Bank of England would lower the interest rate not only in January, but also in March, and then reanimate the program of quantitative easing (QE). On the other hand, experts at the Bank of New York Mellon and Nomura argued that at the end of the month, the BoE will refrain from active actions, and the disappointment of the "bears" will result in the growth of the GBP/USD exchange rate. The strongest increase in the British employment since January 2019 (by 208 thousand) was the catalyst of GBP/USD's rise above 1.31. Based on fundamental analysis, it seems that the pound, which has missed the economic calendar, is once again becoming the most predictable currency. It flies like a rock in response to disappointing statistics, and takes off like a rocket in response to positive data. Meanwhile, the increase of speculative "bullish" pound positions in the futures market up to the maximum value since April 2018 indicates that hedge funds and asset managers are using negative to form "longs". It should be noted that the latest data on inflation, retail sales and the UK labor market reflect last year's picture. Business activity, on the other hand, is a leading indicator, and its growth will reduce the chances of the BoE cutting the interest rate, and allow the GBP/USD pair to continue its movement upwards. According to forecasts, in January, the British manufacturing PMI will accelerate to 48.8 points from 47.5 points recorded in December. At the same time, the composite index will rise above the critical mark of 50 for the first time in three months, and will reach 50.7 points. If these indicators turn out to be even better, then the "bulls" for GBP/USD will be able to reduce quotes to the resistance at 1.3220–1.3225. However, if statistics turn out to be disappointing, the quotes will be sent to the lower limit of the medium-term trading range of 1.3000-1.3350. Investors also need to keep in mind the potential conflict between the United Kingdom and the United States over the digital tax. Washington is threatening to impose duties on exports of goods and services from the UK, whose share in total deliveries reaches almost 20%. The material has been provided by InstaForex Company - www.instaforex.com |

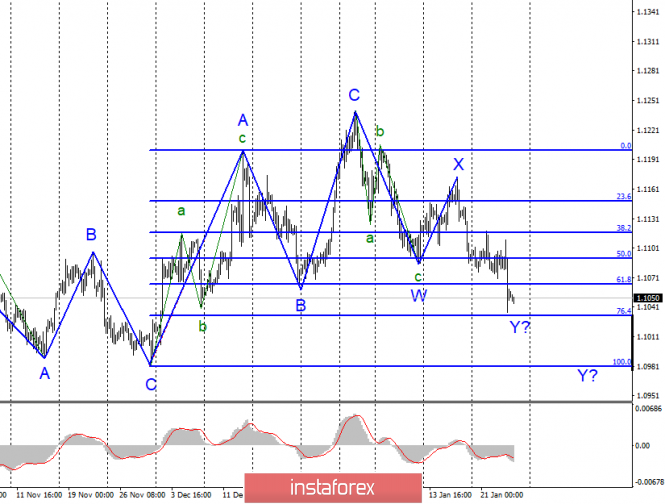

| Analysis of EUR/USD and GBP/USD for January 24. EU's economic statistics may help eurocurrency Posted: 24 Jan 2020 12:04 AM PST EUR / USD On January 23, the EUR / USD pair lost about 40 basis points. Thus, the construction of the alleged wave Y as part of the bearish trend section, continues with the targets located near the levels of 76.4% and 100.0% Fibonacci. If this assumption is true, then the decline in quotes of the instrument will continue after a successful attempt to break through the level of 76.4%. On the contrary, an unsuccessful attempt to break through this level will lead to quotes moving away from the lows reached, but, most likely, the construction of wave Y will continue. Fundamental component: The news background for the instrument was very interesting on Thursday. I already said yesterday that the speech of Christine Lagarde made the markets declined after the ECB meeting, if not into a state of shock, then thoroughly spoiled their mood. In short, Lagarde's argument was that inflation remains extremely weak, and until it reaches the ECB target levels (about 2.0% y / y), there will be no talk of tightening monetary policy. In addition, Lagarde noted the weakness of the industrial sector, "inhibiting the economy of the European Union." And to top it off, she acknowledged that the ECB is wary of geopolitical tensions, which are expressed by current and future trade wars. Thus, the demand for European currency seriously fell yesterday in the afternoon. Today, on Friday, a slight departure of quotes from the lows reached is possible, but everything will depend on the news background, as several quite important economic reports will be released today in the Euro zone and America. The most interesting are probably reports on business activity for January (not final values) in Germany and the eurozone. Market expectations are as follows: a slight increase in all business activity indices in both Germany and the EU. The biggest questions are caused by indices in the manufacturing sectors, which are deep below the 50.0 level, below which it is believed that the industry is in decline. However, in any case, an increase in indicators is positive news for the euro. Now, it remains only to wait for the reports themselves and to make sure that the indices have really grown, because otherwise, the demand for the euro may decline even more. General conclusions and recommendations: The euro-dollar pair is supposedly continuing to build a downward set of waves. Thus, I would recommend continuing to sell the instrument with targets located near the levels of 1.1034 and 1.0982, which corresponds to 76.4% and 100.0% Fibonacci. GBP / USD On January 23, the GBP / USD pair lost about 20 basis points, but at the same time, it continues to remain within the framework of the construction of the alleged wave 3 or c, which takes a very complex and extended form. An alternative wave marking has also appeared, which identifies the trend section since December 23 as complex wave 2 or b, which takes on a distinct three-wave structure. Thus, the goals of the internal wave c in 2 or b can be located up to the level of 1.3329, which corresponds to 100.0% Fibonacci of wave a in 2 or b. After the completion of the construction of this wave, it is still expected that the quotes of the instrument will decrease within the framework of building 3 or c. Fundamental component: There was no news background for the GBP / USD instrument on Thursday. The trading amplitude of the pound / dollar instrument was not high, but the situation may change today, since there will be quite important reports on business activity in the UK and, it will be released in the USA after lunch. Moreover, business activity in the manufacturing sector may increase to 48.9, and in the services sector - up to 51. As well as in the eurozone, this will be positive news for Britain. In the afternoon - business activity indices in all areas of the United States. Forecasts are less optimistic than on the British and European indices. Nevertheless, a slight improvement is also expected. Thus, today, the dynamics of the instrument will entirely depend on economic reports. General conclusions and recommendations: The pound / dollar instrument continues to build a new downward trend. I recommend selling the instrument with targets near the levels of 1.2941 and 1.2764 again, which corresponds to 38.2% and 50.0% Fibonacci, with the new MACD signal "down" if it is formed around the level of 23.6 % Fibonacci. The instrument can complicate wave 2 or b, therefore, the increase can continue to 1.3329 (in case of a successful attempt to break through the 23.6% Fibonacci level), and sales are then recommended to be considered much higher. The material has been provided by InstaForex Company - www.instaforex.com |

| The SELL Side Liquidity Pool will attract the EUR/USD For Jan 24, 2020 Posted: 23 Jan 2020 11:44 PM PST

Market participants mainly gave a negative response to the ECB meeting results and the regulator's decision on the interest rate in particular. That is why the EUR/USD pair lost ground. It may try to test the daily sell-side liquidity pool at 1.1040 and the 4 hour chart sell-side liquidity pool at 1.1036. There is a probability that fiber will retrace to test the fair value gap, especially the main threshold at 1.1070. However, unless the pair does not edge higher and close above 1.1118, the sell-side liquidity pool can be tested. (Disclaimer) The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment