Forex analysis review |

- Control zones AUD/USD on 03/04/20

- Forecast for EUR/USD on March 4, 2020

- Forecast for GBP/USD on March 4, 2020

- Forecast for USD/JPY on March 4, 2020

- Fractal analysis of the main currency pairs for March 4

- Comprehensive analysis of movement options of #USDX vs EUR/USD vs GBP/USD vs USD/JPY (DAILY) on March 2020

- GBP/USD. Results of March 3. Paradoxical pound ignores Fed decision and the coronavirus

- EUR/USD. Results of March 3. EU inflation has failed again. Fed suddenly reduced the rate

- EUR/USD. Dollar falls throughout the market: Fed still succumbed to pressure

- Urgent! Fed lowered the rate by 0.5% to 1.0-1.25% due to coronavirus. EURUSD is growing

- GBP/USD: what prevents the pound from spreading its wings?

- EUR/USD: pendulum of forex market could swing towards dollar growth and increased pressure on the euro

- March 3, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- March 3, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

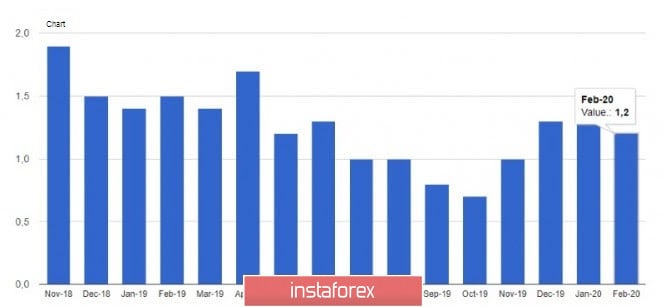

- EURUSD: the G-7 countries will join forces to fight the coronavirus in order to maintain global economic growth. Inflation

- Analysis and trading ideas for EUR/USD on March 3, 2020

- GBP/USD: plan for the US session on March 3. Buyers continue to fight for the resistance of 1.2796

- EUR/USD: plan for the US session on March 3. The bulls are in no hurry to return to the market and gave the level of 1.127

- Trading recommendations for EURUSD pair on March 3

- EUR/USD analysis for 03.03.2020 - Broken mini downward Pitchfork channel, upside continuation very possible. Main targets

- Analysis for Gold 03.03.2020 - Sell signal active due to breakout of mini upward Pitchfork channel, downside target set at

- BTC analysis for 03.03.2020 - Watch for the breakout of mini upward Pitchfork channel to confirm further downside continuation

- Oil gave hope

- Trading plan for EUR/USD for March 03, 2020

- Analysis of EUR/USD and GBP/USD on March 3. Euro began to decline without waiting for inflation to exit. Markets are waiting

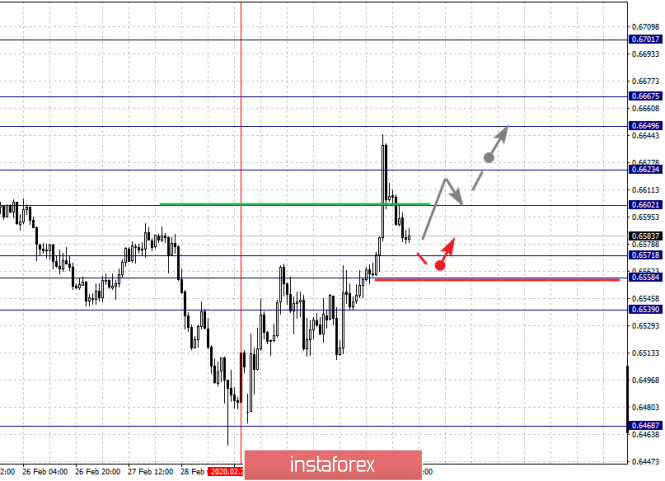

| Control zones AUD/USD on 03/04/20 Posted: 03 Mar 2020 08:08 PM PST Developing in the direction of the upward movement is now becoming less profitable, as the pair is trading above the zone of the average weekly move. At the same time, the probability of a return to the level of 0.6576 is 90%; thus, it is necessary to wait for the formation of a pattern of "false breakdown" and enter the direction of return to the middle stroke zone. This pattern becomes the main one in the second half of this week. This week, further development will be targeted at returning to the level of 0.6576. The probability of closing trades above this level is 30%. An alternative pattern will be developed if growth continues. This will allow you to get more favorable prices for the sale of the instrument in the future. In addition, buying from current levels is not profitable, since according to statistics, the probability of a return to the middle course zone is 90%. Any purchase should have a risk-to-profit ratio above 1 in 9, which is unlikely. Daily CZ - daily control zone. The zone formed by important data from the futures market that changes several times a year. Weekly CZ - weekly control zone. The zone formed by the important marks of the futures market, which change several times a year. Monthly CZ - monthly control zone. The zone that reflects the average volatility over the past year. The material has been provided by InstaForex Company - www.instaforex.com |

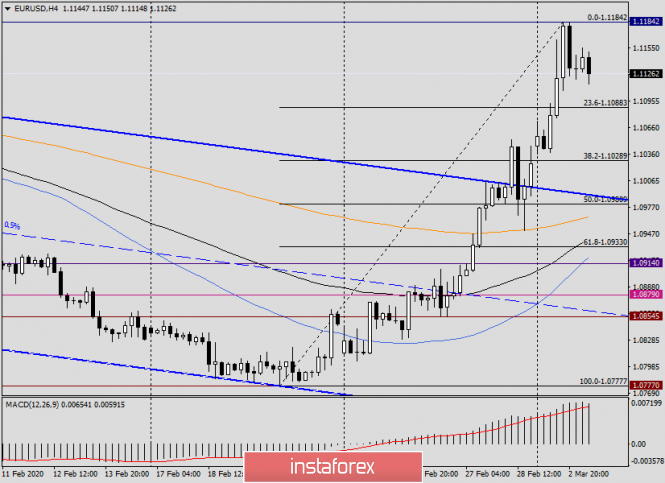

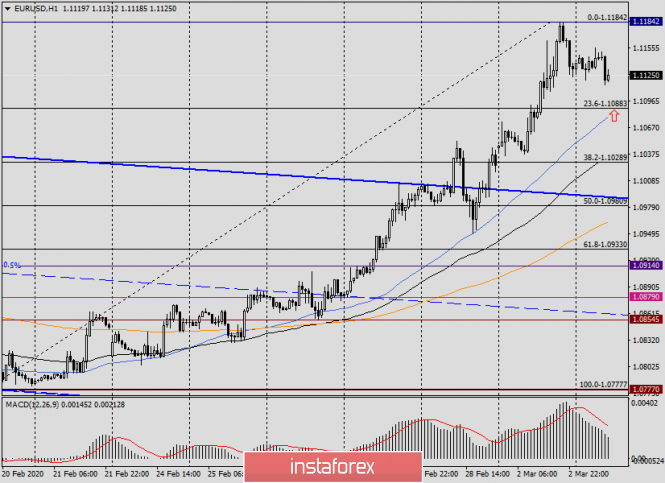

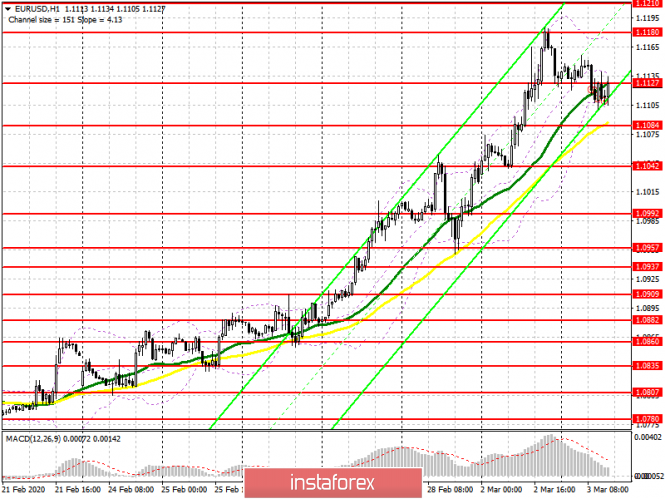

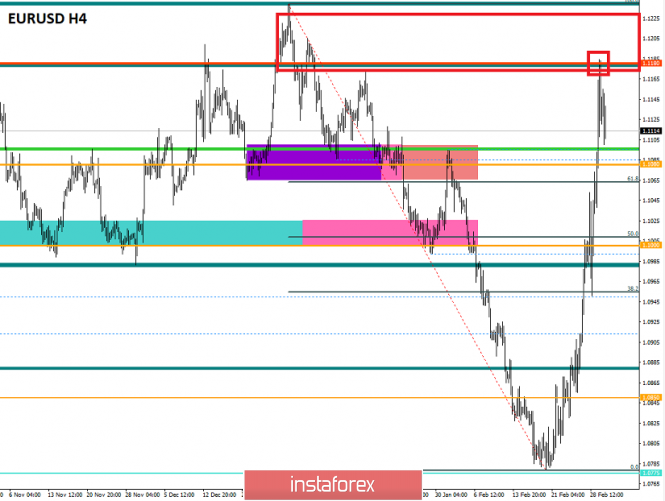

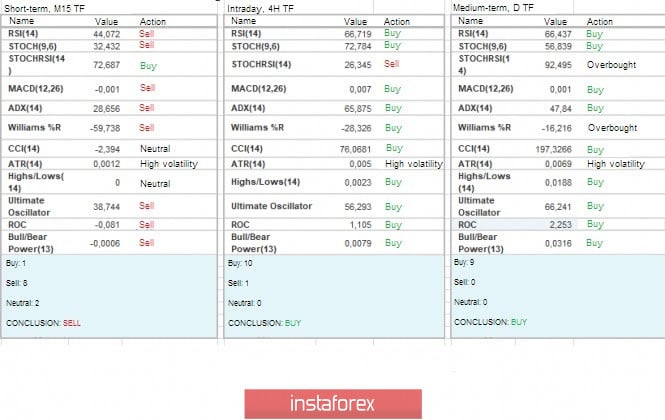

| Forecast for EUR/USD on March 4, 2020 Posted: 03 Mar 2020 08:02 PM PST EUR/USD An emergency meeting of the FOMC Fed was held last night in order to cut the base rate immediately by 0.50% - from 1.75% to 1.25%. The last time the Federal Reserve convened an extraordinary meeting on the rate was back in the crisis year of 2008. The Fed exceeded market expectations, as investors already doubted a double rate cut at a scheduled meeting on the 18th, assuming one decrease by a quarter point in March and April. But since the growth on expectations last week was very high, the euro responded moderately directly to the news. Daily growth amounted to 36 points at extremely high volumes, which indicates the closure of positions opened in the period from February 21. When the entire volume is closed, the euro will unfold in decline. We can only say that by such actions the Fed officially recognized the current situation in the US as a crisis, as it was in 2008. Obviously, the crisis is not so much in the danger of the coronavirus as in the ruptured problems of the United States itself. Now we have to wait for technical conditions to form for strengthening the dollar as a safe- haven currency. The signal line of the Marlin oscillator is moving down on the daily chart. So far this is the only sign of the upcoming cooling of the market. On the four-hour chart, yesterday's events only slightly affected the oscillator, the signal line continues to consolidate at the lower boundary of the range highlighted in gray. A price drop under yesterday's low (1.1095) will be the first signal for a reversal. In this case, we are waiting for the price at the Fibonacci level of 50.0%, towards which the MACD indicator line (blue) is aiming. The material has been provided by InstaForex Company - www.instaforex.com |

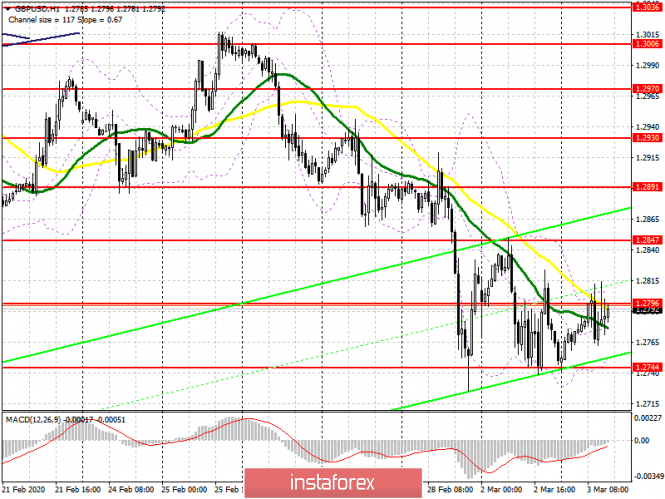

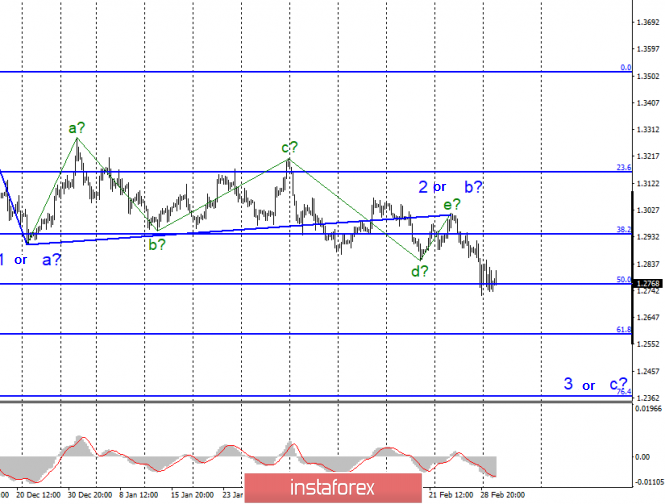

| Forecast for GBP/USD on March 4, 2020 Posted: 03 Mar 2020 08:01 PM PST GBP/USD Yesterday, the growth of the British pound was stopped at the Fibonacci level of 110.0% (1.2843). At the moment, technical indicators do not show any proactive signals of continued growth or a price reversal. The same situation of uncertainty in the political sphere, the results of trade talks between the UK and the EU should become known tomorrow. On the four-hour chart, the signal line of the Marlin oscillator touched the boundary with the growth territory. There may be a downward turn from this line, but there may be continued growth. In general, the situation is going down on both scales - the price is lower than the indicator lines, there are no warning reversal patterns. The pound may rise after the price overcomes the Fibonacci level of 110.0% (1.2904), a return to decline is likely after leaving the level of 123.6% at the price of 1.2760. We are waiting for news from Brussels where trade negotiations take place. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for USD/JPY on March 4, 2020 Posted: 03 Mar 2020 07:58 PM PST USD/JPY The US stock market lost 2.81% (S&P 500) on Tuesday. As a result, the yen strengthened against the dollar by 118 points on investors' desire to get out of risk, that is, according to the USD/JPY chart, there was a decrease. The price has stopped at the Fibonacci level of 223.6%, currently it is trying to overcome the red trend line of the price channel. It may be possible to do this to the price, but there is very strong resistance ahead of the two intersecting lines of the ascending and descending price channels in the region of 107.98. The price can turn down from this level again. Price taking under today's low opens the target range of 105.92-106.13, determined by Fibonacci levels of 271.0% and 261.8%. A convergence with price has formed on the four-hour chart on the Marlin oscillator. With a greater degree of probability, the price will choose a correction option. The 107.98 target level can be overcome, above it is the second target 108.45 in Fibonacci level on the daily chart 161.8%. |

| Fractal analysis of the main currency pairs for March 4 Posted: 03 Mar 2020 05:41 PM PST Forecast for March 4 : Analytical review of currency pairs on the scale of H1:

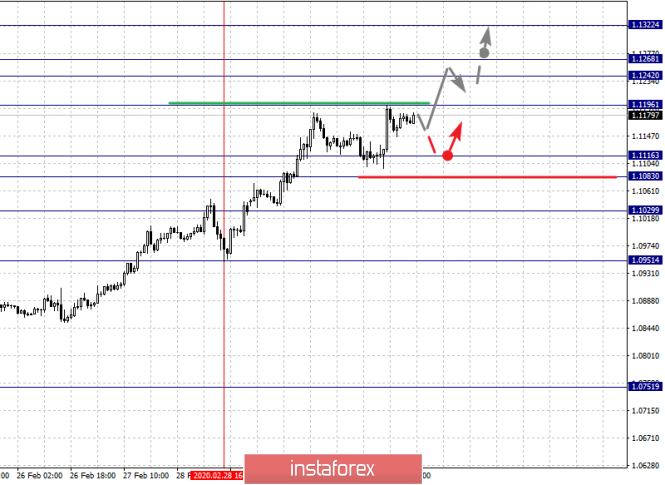

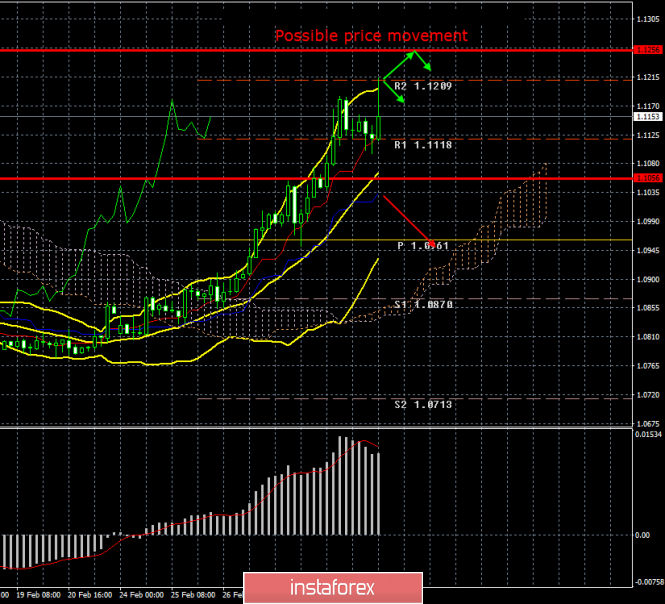

For the euro / dollar pair, the key levels on the H1 scale are: 1.1322, 1.1268, 1.1242, 1.1196, 1.1116, 1.1083 and 1.1029. Here, we are following the local upward cycle of February 28. The continuation of the movement to the top is expected after the breakdown of the level of 1.1196. In this case, the target is 1.1242. Price consolidation is in the range of 1.1242 - 1.1268. For the potential value for the top, we consider the level of 1.1322. Upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is expected in the range 1.1116 - 1.1083. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 1.1029. This level is a key support for the top, its passage at the price will lead to the formation of initial conditions for the downward cycle. The main trend is the local upward cycle of February 28 Trading recommendations: Buy: 1.1196 Take profit: 1.1242 Buy: 1.1268 Take profit: 1.1320 Sell: 1.1116 Take profit: 1.1084 Sell: 1.1081 Take profit: 1.1030

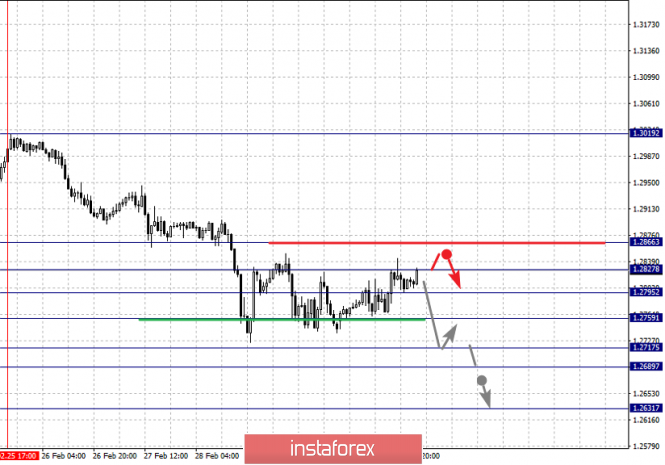

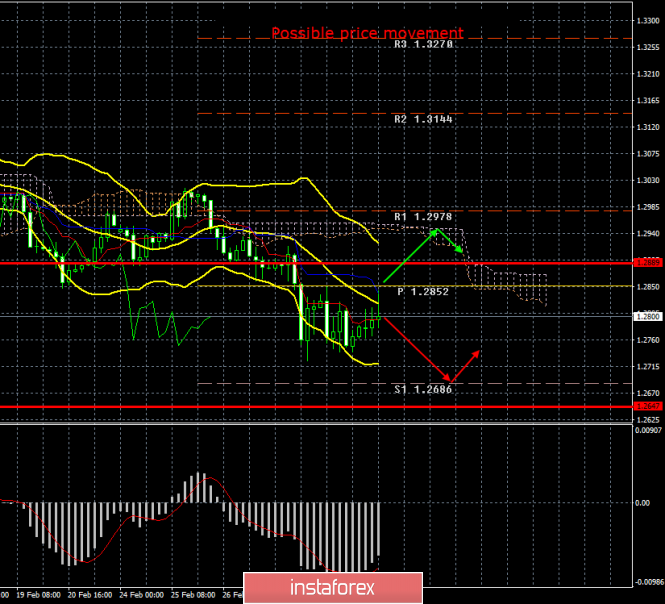

For the pound / dollar pair, the key levels on the H1 scale are: 1.2866, 1.2827, 1.2795, 1.2759, 1.2717, 1.2689 and 1.2631. Here, we are following the development of the downward cycle of February 25. The continuation of movement to the bottom is expected after the breakdown of the level of 1.2759. In this case, the first goal is 1.2717. Short-term downward movement is possibly in the range of 1.2717 - 1.2689. The breakdown of the last value will lead to a movement to a potential target - 1.2631. Upon reaching this level, we expect a pullback to the top. Consolidated movement is possibly in the range of 1.2795 - 1.2827. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 1.2866. This level is a key support for the downward movement. The main trend is the downward cycle of February 25. Trading recommendations: Buy: Take profit: Buy: 1.2828 Take profit: 1.2864 Sell: 1.2759 Take profit: 1.2718 Sell: 1.2717 Take profit: 1.2690

For the dollar / franc pair, the key levels on the H1 scale are: 0.9655, 0.9622, 0.9598, 0.9553 and 0.9518. Here, the price is near the limit values for the descending cycle of February 20. In connection with which, we expect a correction. Short-term upward movement is possibly in the range of 0.9598 - 0.9622. The breakdown of the latter value will lead to in-depth movement. Here, the target is 0.9655. This level is a key support for the downward structure. Short-term downward movement is possibly in the range of 0.9553 - 0.9518. From here, we expect a key reversal to the top. The main trend is a downward cycle of February 20, we expect a correction Trading recommendations: Buy : 0.9598 Take profit: 0.9621 Buy : 0.9624 Take profit: 0.9653 Sell: 0.9551 Take profit: 0.9520 Sell: Take profit:

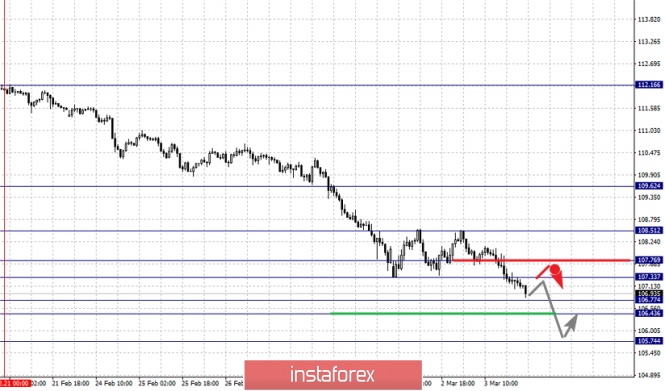

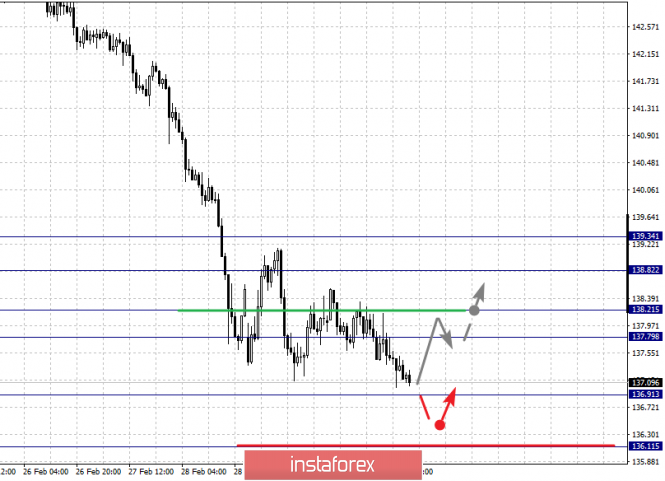

For the dollar / yen pair, the key levels on the scale are : 108.51, 107.76, 107.33, 106.77, 106.43 and 105.74. Here, we are following the development of the downward cycle of February 21. Short-term downward movement is expected in the range of 106.77 - 106.43. The breakdown of the last value will lead to movement to a potential target - 105.74, when this level is reached, we expect a pullback to the top. Short-term upward movement is possibly in the range of 107.33 - 107.76. The breakdown of the latter value will lead to an in-depth correction. In this case, the target is 108.50. This level is a key support for the downward structure. The main trend: the downward cycle of February 21 Trading recommendations: Buy: 107.33 Take profit: 107.74 Buy : 107.78 Take profit: 108.50 Sell: 106.77 Take profit: 106.45 Sell: 106.40 Take profit: 105.74

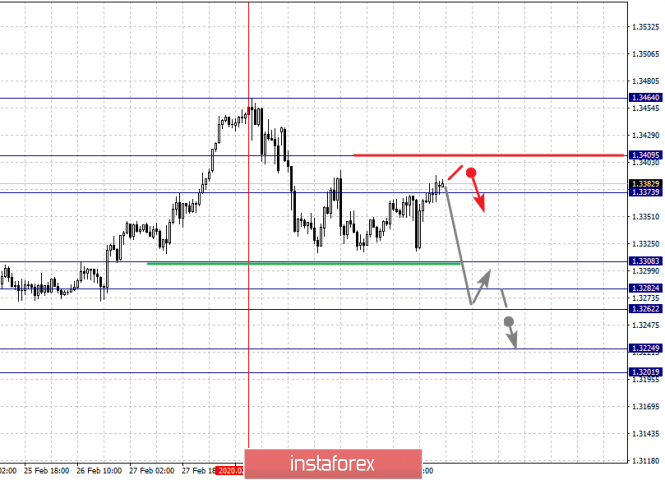

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.3409, 1.3373, 1.3350, 1.3308, 1.3282, 1.3262, 1.3224 and 1.3201. Here, we are following the formation of the descending structure of February 28. The continuation of the movement to the bottom is expected after the breakdown of the level of 1.3308. In this case, the target is 1.3282. Price consolidation is near this level. The passage at the price of the noise range 1.3282 - 1.3262 should be accompanied by a pronounced downward movement. Here, the target is 1.3224. For the potential value for the bottom, we consider the level of 1.3201. Upon reaching which, we expect consolidation, as well as a rollback to the top. Short-term upward movement is possibly in the range of 1.3373 - 1.3409. There is a high probability of a downward reversal from this range. At the same time, the breakdown of the level of 1.3410 will lead to the formation of initial conditions for the upward cycle. In this case, the target is 1.3464. The main trend is the formation of the downward structure of February 28 Trading recommendations: Buy: 1.3375 Take profit: 1.3409 Buy : 1.3412 Take profit: 1.3460 Sell: 1.3308 Take profit: 1.3282 Sell: 1.3260 Take profit: 1.3225

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6701, 0.6667, 0.6649, 0.6623, 0.6602, 0.6571, 0.6558 and 0.6539. Here, we are following the development of the upward cycle of February 28. Short-term upward movement is expected in the range of 0.6602 - 0.6623. The breakdown of the latter value will lead to a pronounced movement. Here, the target is 0.6649. Short-term upward movement, as well as consolidation is in the range of 0.6649 - 0.6667. For the potential value for the top, we consider the level of 0.6701. Upon reaching which, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 0.6571 - 0.6558. The breakdown of the latter value will lead to an in-depth correction. Here, the target is 0.6539. This level is a key support for the top. The main trend is the upward cycle of February 28 Trading recommendations: Buy: 0.6602 Take profit: 0.6620 Buy: 0.6625 Take profit: 0.6649 Sell : 0.6570 Take profit : 0.6558 Sell: 0.6556 Take profit: 0.6540

For the euro / yen pair, the key levels on the H1 scale are: 122.07, 121.61, 121.36, 120.92, 120.23, 119.95 and 119.54. Here, we are following the formation of the initial conditions for the top of February 28. The continuation of the movement to the top is expected after the breakdown of the level of 120.23. In this case, the first goal is 120.92. The breakdown of which, in turn, will allow you to count on the movement to 121.36. Price consolidation is in the range of 121.36 - 121.61. For the potential value for the top, we consider the level of 122.07. Upon reaching which, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 119.54 - 119.31. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 118.87. This level is a key support for the upward structure. The main trend is the formation of initial conditions for the top of February 28 Trading recommendations: Buy: 120.25 Take profit: 120.90 Buy: 120.92 Take profit: 121.36 Sell: 119.30 Take profit: 119.00 Sell: 118.85 Take profit: 118.44

For the pound / yen pair, the key levels on the H1 scale are : 139.34, 138.82, 138.21, 137.79, 136.91 and 136.11. Here, we are following the downward cycle of February 21. The continuation of movement to the bottom is expected after the breakdown of the level of 136.90. In this case, the goal is 136.11. Upon reaching this level, we expect a rollback to correction. Short-term upward movement is possibly in the range of 137.79 - 138.21. The breakdown of the last value will lead to the development of an in-depth correction. Here, the goal is 138.82. This level is a key support for the downward cycle. Its breakdown will lead to the formation of an upward structure. In this case, the goal is 139.34. The main trend is the downward cycle of February 21. Trading recommendations: Buy: 137.80 Take profit: 138.20 Buy: 138.25 Take profit: 138.80 Sell: 136.90 Take profit: 136.11 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 03 Mar 2020 03:36 PM PST The first month of spring. Here is a comprehensive analysis of the options for the movement of the main currency instruments #USDX, EUR / USD, GBP / USD and USD / JPY - DAILY in March 2020 Minor operational scale (daily time frame) ____________________ US dollar index The movement of the #USDX dollar index in March 2020 will be determined by developing the boundaries of the equilibrium zone (97.15 - 97.65 - 98.10) of the Minuette operational scale forks. The details for working out the boundaries are shown in the animated chart. In case of breakdown of the upper boundary of the ISL38.2 (resistance level of 98.10) equilibrium zone of the Minuette operational scale forks, together with 1/2 Median Line Minuette (98.20) upward movement of the dollar index can be continued to the upper boundary of 1/2 Median Line Minuette channel (98.60) and the control line UTL (99.00) of the Minor operational scale forks. On the contrary, in case of breakdown of the lower boundary of the ISL61.8 (support level of 97.15) equilibrium zone of the Minuette operational scale forks, it will lead to an option to continue the downward movement #USDX to the targets: - final Schiff Line Minuette (96.50); - local minimum 96.36 ; - final line FSL (95.40) of the Minuette operational scale forks. The marking up options for the #USDX movement in March 2020 is shown in the animated chart. ____________________ Euro vs US dollar The development of the movement of the single European currency EUR / USD in March 2020 will depend on the development and direction of the breakdown of the range :

A return below the support level of 1.1090 to ISL61.8 Minuette will determine the development of the EUR / USD movement in the equilibrium zone (1.1090 - 1.1030 - 1.0970) of the Minuette operational scale forks with the prospect of reaching the boundaries of 1/2 Median Line Minuette channel (1.0945 - 1.0900 - 1.0860). Meanwhile, in the event of a breakdown of the resistance level of 1.1175 on the initial SSL line of the Minor operational scale forks, it will be possible to update the local maximum 1.1240 and the European currency will reach the final line FSL (1.1275) of the Minuette operational scale forks. The details of the EUR / USD movement options in March 2020 are shown on the animated chart. ____________________ Great Britain pound vs US dollar In March 2020, the development of Her Majesty's GBP / USD currency movement will depend on the development and direction of the breakdown of the boundaries of 1/2 Median Line channel (1.2625 - 1.2800 - 1.2980) of the Minuette operational scale forks. The detail of movement inside the channel 1/2 Median Line Minuette is presented on the animated chart. The breakdown of the upper boundary (resistance level of 1.2980) of the 1/2 Median Line channel of the Minuette operational scale forks will lead to the development of the upward movement GBP / USD which may continue to 1/2 Median Line Minor (1.3160) with the prospect of reaching the upper boundary of the 1/2 Median Line channel (1.3435) of the Minor operational scale forks. Alternatively, in case of breakdown of the lower boundary (support level of 1.2625) of the 1/2 Median Line Minuette channel, then the downward movement of Her Majesty's currency will continue to the boundaries of the equilibrium zone (1.2580 - 1.2350 - 1.2120) of the Minuette operational scale forks. The details of the GBP / USD movement in March 2020 can be seen on the animated chart. ____________________ US dollar vs Japanese yen The development of the USD / JPY currency movement of the "country of the rising sun" in March 2020 will be determined by the development and the direction of the breakdown of the range :

The breakdown of the upper boundary of ISL38.2 (resistance level of 107.75) of the Minuette operational scale forks will direct the development of the currency of the country of the rising sun to the 1/2 Median Line Minuette channel (108.20 - 109.40 - 110.60) of the Minor operational scale forks. On the contrary, in case of breakdown of the lower boundary (support level of 107.35) of the 1/2 Median Line Minuette channel, the downward movement of USD / JPY can be continued to the goals : - initial SSL line (107.05) of the Minor operational scale forks; - 1/2 Median Line Minuette (106.35); - lower boundary of ISL61.8 (105.00) of the equilibrium zone of the Minuette operational scale forks. We look at the details of the USD / JPY movement in March 2020 on the animated chart. ____________________ The review was compiled without taking into account the news background. Thus, the opening trading sessions of major financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index : USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of the currencies in the basket: Euro - 57.6% ; Yen - 13.6% ; Pound sterling - 11.9% ; Canadian dollar - 9.1%; Swedish krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the starting date - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. Results of March 3. Paradoxical pound ignores Fed decision and the coronavirus Posted: 03 Mar 2020 03:11 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 104p - 108p - 87p - 194p - 111p. Average volatility over the past 5 days: 121p (high). The British pound was trading as if there were no news and events today, March 3. There were no planned macroeconomic publications in the United Kingdom and the United States. The pound/dollar pair quietly began to adjust in the morning. However, then trailers began to receive various kinds of messages and news that simply could not be ignored. The first thing that should be noted is the rumors that all the largest central banks of the world will lower key rates in the fight against the consequences of the coronavirus. The central bank of Australia and the US Federal Reserve have already done so. However, the pound almost did not react either to the rumors themselves, or to the negative expectations of most traders, or to the speech of Mark Carney, who almost openly declared his readiness to soften monetary policy, nor the Fed's decision to reduce the key rate by 50 basis points !!! And after all, if there were now more important topics for the British currency, such as negotiations between Britain and the EU on trade relations after 2020, one could understand this behavior of the pound/dollar pair. However, nothing of the kind happened. Traders of the pound simply missed the information about the sharp, unexpected rate cut by the US central bank. Even the GBP/USD volatility has not changed during the day. There was no surge of emotion, nothing. We talked in a neighboring review that the euro is paired with the US dollar is now devoid of logic in motion. It turns out that the pound sterling does not differ by this logic and validity either. In the morning, Bank of England Chairman Mark Carney said that the regulator was ready to take all necessary measures to help the British economy cope with the consequences of the coronavirus. Earlier, Carney said that despite the fact that there are still quite a few sick and dead in the world, the quarantines imposed on many countries still have a negative effect on the British economy. The head of the British regulator also said that the monetary committee is now considering the consequences of the Covid-2019 virus and possible measures that it can take. At the same time, most likely, Carney will not be able to solve the problems of the coronavirus and its impact on Great Britain's economy, since he is set to leave his post on March 15. Also today, the G7 countries have declared their readiness to use fiscal measures in case the situation with the epidemic worsens. Unfortunately, no specifics about the future actions of governments, ministries of finance and central banks were made available to traders. In fact, it was an emergency meeting of top officials of the G-7 countries, after which a statement was made in the style of: "the situation is under control, the governments of all countries of the world are in close cooperation to timely combat the spreading virus." The following message was posted on the US Treasury website: "Given the potential impact of Covid-19 on global economic growth, we consider it necessary to use all available tools to achieve strong, sustainable growth and protection against risks. Along with increasing medical efforts, G7 finance ministers are ready to take any action, including fiscal measures, to help counter the virus and support the economy at this stage." All other statements by officials from other countries were about the same. Thus, at the moment we can expect a softening of the monetary policies of the ECB and the BoE. In the current conditions, it's even hard to imagine what the market reaction to these events might be, how many key points key rates will be lowered, what consequences of the coronavirus all countries of the world will face in the near and more distant future. One thing is for sure, panic can take over markets. And if panic seizes the markets, then there is no need to talk about any reasonable trade. So far, we hope that the markets calm down a bit and trading returns to normal. But the situation in the world now is such that you cannot be sure of anything. From a technical point of view, the pound/dollar has corrected today to the Kijun-sen critical line. Thus, since the fundamental and macroeconomic backgrounds do not currently have a special effect on the pair, technical factors remain the most important and significant. Based on this, a rebound in the price from the Kijun-sen line could trigger a resumption of the downward movement. Bollinger Bands and other trend indicators are also pointing down. If the BoE lowers its key rate in the near future, then the British pound may begin to feel more serious pressure from market participants. Trading recommendations: The GBP/USD pair continues the upward correction. Thus, it will be possible to sell the British pound again with targets at 1.2686 and 1.2647, after the completion of the current correction (MACD indicator turns down or rebounds from the Kijun-sen line). We recommend that you buy the pair with targets at the level of 1.2889 and the Senkou Span B line in small lots if the bulls are able to gain a foothold above the Kijun-sen line. The fundamental background now has practically no effect on the movement of the pair. This is alarming. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicators window. Support / Resistance Classic Levels: Red and gray dashed lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. Results of March 3. EU inflation has failed again. Fed suddenly reduced the rate Posted: 03 Mar 2020 03:11 PM PST 4-hour timeframe Amplitude of the last 5 days (high-low): 60p - 54p - 127p - 102p - 157p. Average volatility over the past 5 days: 100p (average). The second trading day of the week ends with a new attempt by the euro to continue the upward movement, but it seems that the fuse in the bulls has completely dried up. We already drew the attention of market participants in previous reviews to the fact that there is very little logic and validity in the current upward movement of the euro currency. Initially, the upward movement was suggested for at least two weeks, as a necessary correction from a technical point of view. However, the correction turned out to be more than the downward trend itself. That is, in fact, it is very difficult to say why the European currency rushed up at a wild speed, and, for example, the British pound continues to fall in price paired with the dollar? Why did factors that seem to have an impact on the euro/dollar have no impact on the pound/dollar? Perhaps the problem is precisely in the pound, but on what, in principle, could the strengthening of the euro be based? On the fall of the US stock market? This is not the first time in history. On the fears of traders of the consequences of the coronavirus and its negative impact on the US economy? It will have no less impact on the economy of the European Union; this is clear to everyone. On a possible cut in the Fed key rate? So the European Central Bank announced its readiness to soften monetary policy. At the same time, the US economy continues to feel much better than the European one. In general, we stick with our original opinion: the market is now full of various kinds of news, data, rumors and speculation, all of them are very important, and traders simply panic, which leads to such unreasonable logical movements. The most vivid proof of this: today the Fed suddenly lowered its key rate by 0.5%, which did not happen a long time ago, and the euro managed to add no more than 40 points. Yesterday, when there were practically no important messages and fundamental events, the euro grew by more than 100 points. Thus, we still believe that markets need to calm down in the first place. The state of panic should pass. We do not know when this reassurance will come if the situation with the coronavirus does not improve. Now the Fed has lowered its key rate at an emergency meeting, completely unplanned. Tomorrow, the ECB or the Bank of England can do the same. Obviously, these news and events will not bring reassurance to either stock market investors or currency traders. It is difficult to say whether there is any sense at all to consider the macroeconomic background of Tuesday, March 3? At the very beginning of the day, the euro/dollar began to adjust, but this correction was extremely weak, despite the fact that the consumer price index in the European Union slowed down to 1.2% yoy in February. This is, of course, a negative moment for the eurozone and the single currency, but, as we see, the EU currency did not fall under any selloff. Accordingly, we can already conclude that the bears did not plan to join the trade today, even with weak statistics from the European Union. Furthermore, the bulls that have recently dominated the market could begin to reduce long positions against the background of the same weak inflation report, however, did not begin to do this, although once again one of the key indicators of the state of the EU economy failed. Just the other day, ECB Vice President Luis de Guindos said that the regulator will continue to do everything necessary and use all its available tools so that inflation continues to move to the target level of 2.0%. Many in this speech considered a hint to lower rates in the near future due to the same current situation in the world with the Chinese virus. However, the fact of weak inflation in the EU cannot be denied. Well, after the Fed announced in emergency mode that the key rate was reduced by 0.5%, the bulls were completely at a loss. It's hard not to respond with selling the US dollar and purchases of the euro when the Fed cuts the rate by 50 basis points at once. But if at the same time the pair has already risen in price by 400 points in recent days, having passed them completely without rollbacks, a stupor arises. From a technical point of view, a downward correction has begun, which the MACD indicator has signaled. However, at the same time the pair has just updated yesterday's highs and may continue to increase. And at the same time, the chances of resuming correction remain high after traders calm down after an unexpected decision by the Fed. Thus, now is not the most favorable situation for trading the EUR/USD pair. Trading recommendations: The EUR/USD pair retains the same chances for the beginning of the correction and for the continuation of the upward movement. Thus, now it is formally possible to stay in long positions with the target of the resistance level of 1.1209. However, from our point of view, this is rather dangerous, and this level has already been worked out today. It will be possible to sell the pair with the first goal of the Senkou Span B line, when traders will be able to gain a foothold back below the critical line. Explanation of the illustration: Ichimoku indicator: Tenkan-sen is the red line. Kijun-sen is the blue line. Senkou Span A - light brown dotted line. Senkou Span B - light purple dashed line. Chikou Span - green line. Bollinger Bands Indicator: 3 yellow lines. MACD indicator: Red line and bar graph with white bars in the indicators window. Support / Resistance Classic Levels: Red and gray dashed lines with price symbols. Pivot Level: Yellow solid line. Volatility Support / Resistance Levels: Gray dotted lines without price designations. Possible price movements: Red and green arrows. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. Dollar falls throughout the market: Fed still succumbed to pressure Posted: 03 Mar 2020 03:11 PM PST The European currency has suspended its triumphal procession for several hours today - conflicting data on inflation growth in the eurozone slightly cooled the bulls of the EUR/USD pair. Buyers stepped back, but did not capitulate, staying within the 11th figure. The fact is that the general consumer price index for February turned out to be lower than forecasted values (the indicator reached 1.2%, and the consensus forecast was 1.4%). While core inflation came out in accordance with the forecast, at around 1.2%. The producer price index also showed contradictory dynamics: on an annualized basis, the indicator remained in the negative area, dropping to the level of -0.5%, but on a monthly basis it rose to 0.4% (this is the best result since October 2018). The market, of course, focused on the negative aspects of today's release, and the EUR/USD bulls were forced to retreat from the daily high - but literally a few hours before the US session started. Looking ahead, it should be noted that short positions in the pair are now in any case extremely risky (even with price pullbacks), since the dollar remains vulnerable. Moreover, the rhetoric of the ECB representatives continues to amaze with their equanimity, while Fed members today unexpectedly and unscheduled reduced their interest rates by 50 basis points at once. This dissonance keeps the euro afloat, despite the slowdown in general inflation in the eurozone. Let me remind you that Vice President of the ECB Luis de Guindos yesterday unexpectedly announced that it was necessary to respond to the current situation not with the help of monetary policy, but with the help of financial policy. Today, a similar position was voiced by ECB member Robert Holtzman (head of the central bank of Austria). In his opinion, those actions taken by the regulator are secondary with respect to fiscal support. At the same time, he clarified that at the moment he would not vote for a rate cut. His colleague, the head of the central bank of Slovakia, Peter Kazimir, also said that in the near future there is no need for easing monetary policy. In turn, the head of the central bank, Christine Lagarde, has for several months been calling for tax incentives for Germany and the Netherlands, which could use their budget surpluses. In other words, the European Central Bank so far does not intend to soften the terms of monetary policy - instead, central bank officials are urging EU leaders to increase fiscal stimulus in their countries. It is likely that this position of the members of the European regulator is explained by the existing split in the ECB camp - after all, the resumption of QE and a decrease in the interest rate last year were not easy for Lagarde. After the September meeting, many central bank officials criticized the actions of the regulator. In particular, we are talking about Benoit Coeure, Jens Weidmann, Klaas Knot and Villeroy de Galhau. Given the positions voiced this week by Guindos, Holtzman and Kazimir, it can be assumed that the ECB will maintain a wait-and-see attitude in the near future. But on the other side of the ocean, a whole campaign was launched to campaign for lowering the interest rate. US President Donald Trump today cited the Reserve Bank of Australia as an example, which cut interest rates by 25 basis points. According to him, the Federal Reserve "forces Americans to pay more." He added that the Fed's policies put pressure on exporters and deprives the country of their competitive advantage. "We need to lower the rate more, and Jerome Powell's policy is wrong," the head of the White House concluded. According to reporters from Bloomberg, the head of the National Economic Council under the White House of the US, Larry Kudlow and Finance Minister Stephen Mnuchin, also insist on reducing the rate. Representatives of the dovish wing of the Fed also called for easing monetary policy, increasing pressure on the centrists and on the hawks. As a result, the Fed surrendered and trimmed the rate immediately by half a percent. Meanwhile, the coronavirus continues to march around the planet, including on the territory of the United States of America. There have already been 91 recorded cases of coronavirus and six deaths from diseases caused by COVID-19. Just the day before yesterday, the number of cases was significantly less - 60 people. Dynamics does not bode well - in particular, Trump has already stated that he is considering the possibility of introducing additional restrictions on entry into the country. The increase in the number of sick and dead from COVID-19 in the United States will put further pressure on Fed members. Thus, despite the fact that in Europe the number of infected is estimated at hundreds, the dollar looks like the "affected" currency in the EUR/USD pair - primarily due to the more restrained position of the ECB representatives. The Fed was under tremendous pressure, including from the top officials of the state, which is why it is not surprising that the US regulator made such a non-standard decision today. All this suggests that the EUR/USD pair retains the potential for its further growth - to the nearest resistance level of 1.1240, which corresponds to the upper boundary of the Kumo cloud on the weekly chart. The material has been provided by InstaForex Company - www.instaforex.com |

| Urgent! Fed lowered the rate by 0.5% to 1.0-1.25% due to coronavirus. EURUSD is growing Posted: 03 Mar 2020 03:11 PM PST The Fed urgently (outside the scheduled meeting!) Lowered the rate by 0.5% - to the range of 1.000-1.125%, In order to reduce the negative for the economy from the effects of coronavirus. The euro continued to grow and broke up to 1.1200. The next target for the euro is 1.1246. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: what prevents the pound from spreading its wings? Posted: 03 Mar 2020 03:11 PM PST GBP/USD continues to trade near 4.5-month lows. The continuing uncertainty surrounding the future relations between the UK and the European Union, as well as expectations regarding the interest rate cut by the Bank of England, are putting pressure on the pound. About 100 British officials went to Brussels to participate in the first round of negotiations with EU representatives, which should last until Thursday. They will discuss annual trade and close ties in the field of security. At stake is a half-trillion-euro relationship. The EU wants to give the United Kingdom favorable access to a single market in exchange for guarantees that London will prevent dumping. British Prime Minister Boris Johnson has already stated that the country does not want to be bound by EU rules or the jurisdiction of its highest court. The EU believes that this is necessary to ensure fair competition. Being near the lowest pound values over the past four and a half months, the pound is also held by increased fears about the spread of the coronavirus. Signs that the impact of the new virus at the global level is beginning to affect production recovery in the UK after the December MP elections came on Monday, as local manufacturers reported large delays in their supply chains. According to IHS Markit, the business activity index (PMI) in the country's manufacturing sector rose to 51.7 points in February compared to January 50.0. However, the indicator was below the forecast of 51.8 points and a preliminary estimate of 51.9. The BoE said it was working with the British Department of the Treasury and international partners to ensure that all necessary measures were taken to protect the banking system and the economy as a whole from the effects of coronavirus. The derivatives market lays in the quotes with a more than 80% probability of lowering the interest rate BoE by 25 basis points at the March meeting. "We believe that the Bank of England will reduce the interest rate by 0.25% at the next meeting, which will be held March 26. We also expect that the state budget, which will be presented on March 11, will be largely aimed at containing the coronavirus," analysts at ING said. As for the technical picture, it has changed little since last week. After Friday's bearish breakout of the GBP/USD two-month downward trend channel, the mood remains downward. The absorption of this year's lows in the region of 1.2750 will strengthen the bearish forecast and the pair can aim for the round 1.2700 mark. From here, sellers will head to the next important horizontal support at 1.2645. Only a breakout of the 1.2875–1.2880 area can neutralize the bearish forecast and throw the pair above 1.2900. This will clear the bulls' path to the important psychological mark of 1.30, where the 50-day moving average passes, which makes this area a key turning point. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 03 Mar 2020 03:10 PM PST Until recently, the single European currency was under pressure due to divergence in the monetary rates of the Federal Reserve and the European Central Bank. The euro also suffered from interruptions in the supply of components to the EU from China and weak macroeconomic indicators of almost all major European countries and the eurozone as a whole. However, in the past seven trading days, the fall of EUR/USD has given way to rapid growth. If the main currency pair was trading at 1.0780 on February 20, now it is above the 1.11 mark. It should be noted that something similar already took place during the 2008 global economic crisis. Amid a sharp decline in stock indices, at a certain moment gold that was growing earlier began to fall in price. This happened because some market participants began to sell precious metals in order to plug holes and maintain unprofitable positions formed on stocks. The question is, where should the investor go in conditions when the USD index is also falling, and high-yield and risky assets are falling by definition? All that remains is the euro, which temporarily acquires the status of a defensive asset that helps to survive the collapse in the stock market. However, if only the stock exchanges stabilize, they will start selling the euro from the top with terrible force. It is possible that this moment is already close. Shares receive investor support pending coordinated action by national governments and central banks. In particular, investors are actively playing out the idea of a deeper interest rate cut by the Fed compared to the ECB. Rumors about the weakening of the monetary policy of the Fed at an extraordinary meeting add fuel to the fire. Goldman Sachs and BofA Merrill Lynch experts expect that after the FOMC meeting in March, borrowing costs will fall not by 25, but by 50 basis points. It is possible that money markets have already laid very ambitious expectations in quotes. This revaluation last week became one of the main drivers of volatility. Apparently, the markets have gone too far in their fears, which again creates favorable conditions for the dollar to grow as part of a rebound in the near future. Against the backdrop of more than a weekly correction of the markets, the USD index slipped 2%, returning closer to the middle of the trading range over the past year after reaching three-year highs on February 20. The transition from the dollar to less profitable currencies occurred along with a sharp revision of expectations regarding the monetary policy of the Fed. Currently, federal funds rate futures indicate a 100% chance of a 50-point decline in March. As of February 20, the derivatives market gave almost equal chances of keeping rates at the current level (1.50% –1.75%) and one decrease (1.25% –1.50%). However, the full effect of lowering interest rates in the economy becomes noticeable only after six to nine months. In this regard, sharp cuts in rates are likely only with forecasts of a prolonged and sharp slowdown in economic activity. Now, however, most experts are inclined to believe that the effect will be short-term. Most likely, measures to support markets will now focus on a short-term infusion of liquidity, and lowering rates against this background will be less decisive. There is another point. The coronavirus epidemic is so far more affecting Europe than the United States. This is due to both the number of cases in the EU and its close ties with manufacturing companies in China. In this regard, the ECB's more stimulating actions look more logical than the Fed. This could be a turning point for the forex market. Last week, traders put too aggressively into the quotes expectations of lower interest rates by the US central bank. It is possible that in the coming days, such a reassessment of expectations will put pressure on the long-term interest rates on eurozone government bonds. One can hear assurances that the Fed is unlikely to meet recent expectations. This means that the pendulum of the foreign exchange market has high chances to swing again towards a stronger dollar and increased pressure on the euro. The material has been provided by InstaForex Company - www.instaforex.com |

| March 3, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 03 Mar 2020 07:01 AM PST

On December 30, a bearish ABC reversal pattern was initiated around 1.1235 (Previous Key-zone) just before another bearish movement could take place towards 1.1100 (In the meanwhile, the EURUSD pair was losing much of its bearish momentum). One more bullish pullback was executed towards 1.1175 where the depicted key-zone as well as the recently-broken uptrend were located. Since then, the pair has been down-trending within the depicted bearish channel until two weeks ago, when extensive bearish decline established a new low around 1.0790. This was where the EUR/USD pair looked oversold after such a long bearish decline. Hence, Intraday traders were advised to look for signs of bullish recovery around the price levels of (1.0790). By the end of Last week, recent signs of bullish recovery were manifested around 1.0790 leading to the current bullish movement towards 1.0910, 1.0950 and 1.1000. The price level of (1.1000) constituted a temporary SUPPLY level in confluence with the upper limit of the current movement channel. That's why, transient bearish pullback was executed towards 1.0950 (Backside of the broken channel) where another bullish swing was initiated. Yesterday, a quick bullish spike was expressed above 1.1100 (Previous Key-Level). Further bullish advancement was anticipated towards 1.1175 where the current bearish pullback was initiated earlier Today. Currently, the EURUSD pair is retesting the KeyLevel around 1.1100 where another bullish swing is expected to be initiated towards 1.1175 and probably 1.1235. On the other hand, bearish breakout below 1.1100 will probably bring further bearish decline towards 1.1040 and possibly 1.1000. The material has been provided by InstaForex Company - www.instaforex.com |

| March 3, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 03 Mar 2020 06:52 AM PST

In the period between December 18th - 23rd, bearish breakout below the depicted previous bullish channel followed by quick bearish decline below 1.3000 were demonstrated on the H4 chart. However, immediate bullish recovery (around 1.2900) brought the pair back above 1.3000. Bullish breakout above 1.3000 allowed the mentioned Intraday bullish pullback to pursue towards 1.3250 (the backside of the broken channel) where the current wide-ranged movement channel was established between (1.3200-1.2980). Since January 13, progressive bearish pressure has been built over the price zone of 1.2980-1.3000 until February 5. On February 6, recent bearish breakdown below 1.2980 enhanced further bearish decline towards 1.2890 (the lower limit of the movement channel) where two episodes of bullish rejection were manifested on February 10th and 20th. This was followed by the recent bullish pullback towards the price zone of 1.2980-1.3000 which has offered considerable bearish rejection. On the other hand, the lower limit of the channel around 1.2850 has failed to provide enough bullish Support for the pair. That's why, a quick bearish decline was expressed towards the nearest DEMAND level around 1.2780 where significant bullish rejection and an atypical double-bottom pattern is being demonstrated. Bullish recovery is expected to pursue towards 1.2980 provided that early bullish breakout is achieved above 1.2850 once again. On the other hand, bearish persistence below 1.2780 enhances the bearish side of the market probably towards lower bearish targets around 1.2650 (Daily Demand Level). The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 03 Mar 2020 06:14 AM PST The pound reacted with a small increase to statements made by Bank of England Governor Mark Carney. However, the pair did not receive long-term support and the euro fell slightly after a weak report on inflation, which slowed down amid lower oil prices. Attention should be paid to the G7 summit, as well as the statements of the head of the European Central Bank, which are related to the topic of the association to combat the economic consequences of the spread of coronavirus. As noted above, Mark Carney spoke about the economic shock that is now caused by the coronavirus, however, its impact will not last long. The head of the Bank of England also added that the monetary policy committee of the Bank of England is considering various options for action. In this regard, all necessary measures will be taken to support the economy and the financial system. The Governor also called for a joint set of fiscal and monetary measures from central banks around the world. The French government did not take long to say that it will give struggling companies a delay in paying taxes against the background of the coronavirus epidemic, and will also help struggling companies get bank loans. During the G7 meeting, Finance Ministers and heads of central banks of the G7 countries also expressed their readiness to take various measures, including fiscal stimulus. However, it was not indicated what specific measures were discussed. As for joining efforts to combat coronavirus in an economic context, the President of the European Central Bank, Christine Lagarde, said yesterday that she would like to hold a telephone conference with representatives of the G-7 countries on this topic. Thus, it is already clear that governments and central banks will not sit on the sidelines, which has a positive effect on stock indices, which are gradually adjusted after the major falls recorded last week. Meanwhile, a number of major economic agencies and leading analysts have expressed concerns about the likelihood of a recession in both the US economy and the eurozone economy. The global economy will definitely slow down because of the coronavirus outbreak, but much will depend on the speed of the measures taken. The likelihood of lower interest rates in the US is already putting pressure on the US dollar, however, the main issue for everyone is the duration of the downturn in the activity. If the global economic downturn is observed only during the first two quarters of this year, and the threat of worsening of the situation with the coronavirus is gradually smoothed out, we can expect a strong recovery in the second half of the year. The negative outlook includes a longer economic downturn, in which global central banks will be forced to resort to unconventional stimulus measures. As for today's data on inflation in the eurozone, the report had a negative impact on the European currency, as it was worse than economists' forecasts. As noted above, the slowdown in inflation in February this year is directly related to the decline in oil prices, which is directly intertwined with the spread of the coronavirus. According to the report, overall inflation in the eurozone slowed to 1.2% in February this year from 1.4% in January. Economists had expected it to remain unchanged. In this regard, expectations have also increased that the European Central Bank will take a number of more drastic measures to stimulate economic growth during its meeting in March. It is possible to expand the bond purchase program and lower deposit rates, which are already at a negative level. As for the technical picture of the EURUSD pair, there was no strong pressure on the euro, but the upward momentum slowed down. Now the bears are focused on the support of 1.1045, but buyers of risky assets need to return to the resistance of 1.1135, which can lead to a surge in purchases and update the highs around 1.1180 and 1.1240. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis and trading ideas for EUR/USD on March 3, 2020 Posted: 03 Mar 2020 05:25 AM PST Hello, colleagues! Yesterday, the EUR/USD currency pair continued its upward movement. At the same time, it turned out to be quite significant. Before proceeding to the technical picture, I will highlight the macroeconomic data that can influence the price dynamics of the main currency pair of the Forex market. The eurozone will provide data on the consumer price index today, and reports on retail sales will be released tomorrow. No more important and significant indicators will be published. In the US, the most important event will be the report on the labor market. As usual, the market participants will pay the most attention to the creation of new jobs in non-agricultural sectors of the economy (Nonfarm Payrolls), the unemployment rate and the growth of the average hourly wage. I believe that nonfarm will have the biggest impact on the course of weekly trading and the pair is irrepressibly eager to go up. Daily

As a result of yesterday's strong growth, the 200 exponential moving average was passed and the Ichimoku indicator cloud was literally stitched up from the bottom The maximum values of the Monday session were shown at 1.1184, after which the pair retreated and finished trading at 1.1132. The upper shadow of yesterday's candle was quite impressive. At the time of writing, the pair was rising to 1.1155 but turned around from this mark and is now trading near 1.1125. It is possible that the euro/dollar is adjusted to the previous growth, and in this case, we can expect a pullback to the 200 exponential broken the day before, which is at 1.1103. I assume that from here we can consider opening long positions on euro/dollar, and we will look for confirmation of this idea at lower time intervals. H4

On this chart, I stretched the grid of the Fibonacci instrument to the growth of 1.0777-1.1184. As I have repeatedly expressed my opinion, after such strong price movements, the correction is often limited to the first pullback level of 23.6. If this assumption is correct, then taking into account the daily 200 EMA, the price zone for potential purchases can be defined as 1.1103-1.1088. With a deeper corrective pullback, the euro/dollar will fall to the Fibo levels of 38.2 and 50.0. However, here we need to carefully monitor the situation on the market. This may be a turning point. In yesterday's review, I marked the price zone of 1.1178-1.1238 as very strong and difficult to pass. As you can see, having risen in this area, the pair turned to a decline, which at the moment is more likely to be corrective. H1

On the hourly chart, the correction rollback option is confirmed. After the appearance of the two Doji candles, it became clear that the growth can hardly be continued from the current values, and some adjustment of the exchange rate is necessary. It is worth noting that under the level of 23.6 Fibo, there is a 50 simple moving average, which can also provide good support for the quote. Thus, the area for possible purchases, taking into account the location of 50 MA, should be slightly changed and designated as 1.1103-1.1080. Once again, I note that the correction should not be deep and the pair can resume the rise from the current values. At the end of this article, such attempts are observed. Conclusion and trading recommendations. In my opinion, there is a high probability that the upward movement will continue, which means that the main trading idea for euro/dollar remains purchases. You can aggressively and risky try to buy from the current prices (1.128). It is less risky to buy the euro/dollar after a corrective pullback to the price zone of 1.1103-1.1080. Those who use a breakout strategy can try to buy on the breakout of yesterday's highs of 1.1184, but in this case, it is necessary to remember that the strong levels of 1.1200, 1.1223 and 1.1238 are above, where the pair may meet serious resistance and turn down. Regarding sales, you need to wait for the characteristic candle signals in the area of 1.1150-1.1180 or higher, near the listed levels. In any case, before opening short positions, you should see confirmation in the form of appropriate signals. Position against the current and fairly strong upward trend. Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: plan for the US session on March 3. Buyers continue to fight for the resistance of 1.2796 Posted: 03 Mar 2020 05:07 AM PST To open long positions on GBPUSD, you need: The parliamentary hearings on the issue of inflation were held absolutely without a trace for the pound. However, the bulls tried to get above the resistance of 1.2796 in the first half of the day. Unfortunately, nothing came of it. The task for the US session will be to consolidate above this range, which will open a direct road to the highs of 1.2847 and 1.2891, where I recommend fixing the profits. An equally important task is to protect the support of 1.2744, just above which the lower border of the current upward correction channel passes. Only the formation of a false breakdown at this level will signal the opening of new long positions. Otherwise, you can only buy the pound at the lows of 1.2707 and 1.2664, based on a rebound of 20-30 points inside the day. To open short positions on GBPUSD, you need: The sellers achieved their goal and returned the pound to the level of 1.2796. However, the key task will be to close the day below the support of 1.2744, which will keep the pair in a downward trend that can update the lows in the area of 1.2707 and 1.2664, where I recommend fixing the profits. In the scenario of an upward correction, only the formation of a false breakdown in the resistance area of 1.2847 will signal the opening of short positions. However, I recommend selling immediately for a rebound from a maximum of 1.2891. Given the absence of important fundamental statistics on the US economy in the afternoon, the direction of the pound will depend on any news on the negotiations between the EU and the UK. Signals of indicators: Moving averages Trading is conducted in the area of 30 and 50 daily averages, which indicates a possible change in the short-term trend to an upward one. Bollinger Bands A break of the lower border of the indicator in the region of 1.2744 will increase the pressure on the pair. A break of the upper border of the indicator at 1.2810 will lead to a new wave of pound growth.

Description of indicators

|

| Posted: 03 Mar 2020 05:07 AM PST To open long positions on EURUSD, you need: Activity on the part of euro buyers decreased after the report on eurozone inflation, which continues to slow down, causing the European Central Bank even more problems. In the second half of the day, the bulls need to return to the resistance level of 1.127 in order to count on a repeat attempt to update the maximum in the area of 1.1180, a breakthrough of which will lead EUR/USD to the new levels of 1.1210 and 1.139, where I recommend taking the profits. In the scenario of a further downward correction, and we only have a G7 meeting scheduled for the second half of the day, it is best to return to long positions after forming a false breakdown in the area of 1.1084 or buy the euro immediately for a rebound from the minimum of 1.1042, where the bulls will try to form the lower border of the current upward trend from February 21. To open short positions on EURUSD, you need: Sellers are gradually pushing the euro and have already managed to pick up the level of 1.127. While trading is below this range, you can expect a further decline to larger support of 1.1084, as well as an update to the minimum of 1.1042, where I recommend taking the profits. The absence of important fundamental statistics on the American economy will allow us to maintain the advantage of sellers. In a scenario of growth of EUR/USD above the resistance of 1.1127 during the second half of the day, it is best to return to short positions to rebound from a maximum of 1.1180 or sell the euro even higher from levels 1.1210 and 1.1239 with the aim of a slight correction of 20-30 points inside the day. Signals of indicators: Moving averages Trading is conducted in the area of 30 and 50 moving averages, which limit the downward correction in the pair. Bollinger Bands A break of the lower border of the indicator in the region of 1.1110 will increase pressure on the euro, and growth will be limited by the upper level in the region of 1.1175, where you can see sales.

Description of indicators

|

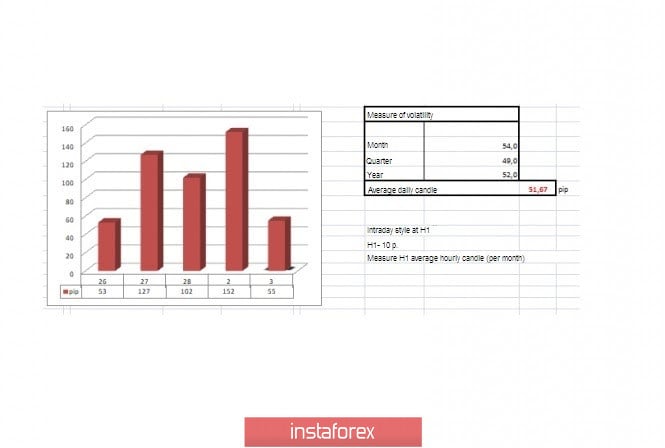

| Trading recommendations for EURUSD pair on March 3 Posted: 03 Mar 2020 04:40 AM PST From a comprehensive analysis, we see activity that many currency pairs could envy, however, the euro continues to surprise traders with its inertial course. Now, about the details. The given upward move last week acquired a scale of more than 400 points, where at first they could not think that a harmless correction would turn into a full recovery relative to the decline in February, and then return to the highs of the previously passed oblong correction. The lost profit syndrome (FOMO) overcame everyone at the moment of crossing the mark of 1.1000, where everyone instantly forgot about overbought, trend, and other circumstances that can not give the euro a different outcome than the decline. I don't think it is worth mentioning the topic of changing the trend or resuming the main trend because it is best to work on the situation together with the background. The corrective course is considered to be the main task at this stage. There is a characteristic shift at the beginning of the phase. But perhaps the maximum of the oblong correction (1.1180-1.1230) will serve as the starting point and if we refer to the existing behavior of the quote, then there is something in this. As for the acceleration, the topic was touched upon yesterday, the return of the price back occurred several times faster than the descent, and in terms of regularity, this is a signal of the strongest overheating, in this case, long positions. In terms of volatility, we see the same acceleration that we wrote about above: activity is again breaking records and the past day has surpassed the daily average by 198%. Such impressive indicators once again prove that FOMO was not enough. Volatility details: Thursday-127 points; Friday-102 points; Friday-152 points. The average daily indicator relative to the volatility dynamics is 51 points (see the volatility table at the end of the article). Analyzing the past day by the minute, we see that the upward movement set at 9:00 lasted until seven in the evening, where the quote touched the level of 1.1180, which displays the area of the conditional maximum of the oblong correction in history. The subsequent development was in terms of the rollback, which was put on the bet that this is the starting point of the future correction. As discussed in the previous review, traders expected a correction from the level of 1.1080, however, this did not happen. I do not exclude that there were traders who went back to long positions after passing the level of 1.1080 and fixing at 1.1100. Looking at the trading chart in general terms (the daily period), we see a huge gap in terms of interests, where the existing inertia is comparable to the dynamics of only the fall, which we often see in the market, but here the opposite situation turns out. Against this background, there were traders who began to make a reference to 2017, which may be a similarity, but under the circumstances, I would not make such extreme conclusions. The news background of the previous day included the final index of business activity in the manufacturing sector of the eurozone, which rose from 47.9 to 49.2 with a forecast of 49.1. In the second half of the day, we published a similar index of business activity in the manufacturing sector from ISM, but already in the US, we recorded a decrease from 50.9 to 50.1 with a forecast of 50.2. I doubt whether this set of statistics has affected the single currency in terms of growth, but in any case, the flow was in favor of the single currency. In terms of the general information background, there was the start of the negotiations of the March negotiations between England and Brussels, where no loud statements or criticism were made on the first day. The parties kindly exchanged plans and outlined the topics of the upcoming talks, indicating that the areas of trade, energy, and fishing will be discussed in the coming days. In fact, all major actions will begin only on Tuesday, which was later confirmed by a representative of the European Commission. In turn, ECB head Christine Lagarde was a little late, but still assessed the impact of the coronavirus on the economy. "The situation with the coronavirus outbreak is developing very quickly and creates risks for the economic prospects and the functioning of financial markets. The ECB is closely monitoring events and their consequences for the economy," said Christine Lagarde. Almost simultaneously with the head of the ECB, ECB Vice-President Luis de Guindos made comments about the regulator's readiness to adjust existing instruments from the coronavirus. "We remain vigilant and will closely monitor all incoming data. Our further guidance will determine our monetary policy. In any case, the governing council is prepared to adjust all its instruments accordingly to ensure that inflation moves steadily towards its goal," said the ECB Vice-President. Finally, a few words about the noise of the coronavirus and the Fed's interest rate. So, the administration of US President Donald Trump is considering measures that will reduce the impact of the coronavirus on the economy and markets. In particular, they intend to push the Fed to reduce the base interest rate. Let me remind you that the Federal Reserve System is not controlled by the administration and has the right to make a decision itself, but the noise, background pressure and the masses can theoretically put pressure on the opinion of the chairmen of the regulator. Today, in terms of the economic calendar, we have preliminary data on inflation in the eurozone, which confirmed a slowdown from 1.4% to 1.2%. The market reaction to such an important indicator, which directly affects the monetary policy of the European Central Bank, was extremely mixed. In fact, we should have seen a downward turn, but as a result, we got a sluggish oscillation, as if the same FOMO syndrome is weighing on the common sense of market participants. Further development Analyzing the current trading chart, we see a weak correction, which is not quite typical in such circumstances. In fact, everything is just beginning, the area of 1.1180/1.1230 can play the role of a reference point, and the current sketch is similar to the outline of a future correction, which will be directed towards at least 1.1000. In this judgment, there is one "but", this is the same syndrome of lost profits, which right now puts pressure on sellers who can not go into the corrective phase. So, market participants need to air out or at least look around, since they have a vertical move behind them, and it can't be permanent. The current pullback is not enough for a full-fledged regrouping of trading forces. Thus, the work on catching the correction continues. In terms of emotional mood, we see a solid FOMO, which puts a lot of pressure on the market. By detailing every minute the available period, we see a conditional stagnation, in which there are small hints of a decline. In fact, this weakness is frightening, since everything can turn to the fact that the quote will return back to 1.1180. In turn, some intraday traders have already climbed into short positions after working out the level of 1.1180. The first prospect is in the area of 1.1080. In turn, FOMO followers consider the breakdown of the mark of 1.1180 as another round of long positions, where the entry is made already at the mark of 1.1160. It is likely to assume that in the event of a decline in the FOMO syndrome, the correction will still occur, where a relatively inertial course is waiting for us to descend to the area of the level of 1.1000, possibly lower. If the FOMO does not fall, and the hype is not at the limit, then there is a variant of oscillation in the range of 1.1100/1.1155. Based on the above information, we will output trading recommendations: - Buy positions are considered in the plan based on the noise of the syndrome higher than 1.1160, in the direction of 1.1180-1.1230. - Sell positions in the form of correction are considered lower than 1.1095, in the direction of 1.1080-1.1060-1.1000. Indicator analysis Analyzing different sectors of timeframes (TF), we see that the indicators of technical instruments are under the pressure of inertia, giving a signal to buy. Minute intervals variably slide in the available rollback. Volatility for the week / Volatility Measurement: Month; Quarter; Year. The volatility measurement reflects the average daily fluctuation from the calculation for the Month / Quarter / Year. (March 3 was based on the time of publication of the article) The current time volatility is 55 points, which is already 7% higher than the daily average. It is likely to assume that the characteristic acceleration will still persist in the market due to the FOMO syndrome, as well as the information background. Key levels Resistance zones: 1.1180; 1.1300**; 1.1450; 1.1550; 1.1650*; 1.1720**; 1.1850**; 1.2100. Support zones: 1.1080**; 1.1000***; 1.0950**; 1.0850**; 1.0775*; 1.0700; 1.0500***; 1.0350**; 1.0000***. * Periodic level ** Range level *** Psychological level ***** The article is based on the principle of conducting a transaction, with daily adjustments. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 03 Mar 2020 04:28 AM PST Technical analysis:

EUR/USD has been trading sideways at the price of 1.1115. I do expect further upside continuation due to successful test of support at 1.1100 and the bull flag on the hourly time-frame. Eventual upward targets are set at the price of 1.1180 and 1.1238.Watch for buying opportunities The breakout of the mini downward Pitchfork channel was the key for the long bias. Stochastic oscillator is showing oversold condiiton, which is indication that selling looks risky and buying very attractive. Resitance levels are set at the price of 1.1153and 1.1180 Major support level is set at the price of 1.1095 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 03 Mar 2020 04:20 AM PST Technical analysis:

Gold has been trading sideways at the price of $1.603. My analysis from yesterday is still active, I still expect drop on the Gold and potential test of $1.560 and $1.541.I found the breakdown of the mini Pitchfork upward channel, which is early entry sell signal. Stochastic oscillator is showing overbought condiiton, which is indication that buying looks risky and selling very attractive. Resitance levels are set at the price of $1.610 and $1.626 Support levels and downward targets are set at the price of $1.561 and $1.541. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 03 Mar 2020 04:13 AM PST Industry news: The network's hash rate today reached an estimated all-time high of around 136 quintillion hashes per second, according to Blockchain.com, which monitors the metric. Other monitoring services like Bitcoin Info Charts put it at around 120 quintillion hashes, which would still indicate that it has almost tripled in the past year. Bitcoin's hash rate generally measures the estimated computational power dedicated to the Bitcoin network. This accounts for things such as mining, public and private key creation, and the validation of blocks on the network. Miners also protect the network: the higher the hash rate and the more miners, the less likely the network is susceptible to a hostile takeover through a 51-percent attack. Technical analysis: BTC has been trading sideways at the price of $8.900. My analysis from yesterday is still active, I still expect bigger downside and potential testing of $8.190 and $7.695. To confirm the strong downside continuation I would like to see the breakout of the mini upward Pitchfork channel ($8.726). Downward targets are set at the price of $8.190 and $7.695 Stochastic oscillator is showing overbought condiiton, which is indication that buying looks risky and selling very attractive. Resitance levels and potential sell levels are set at $8.950 and $9.270. Support levels and downside targets are set at the price of $8.190 and $7.657. The material has been provided by InstaForex Company - www.instaforex.com |

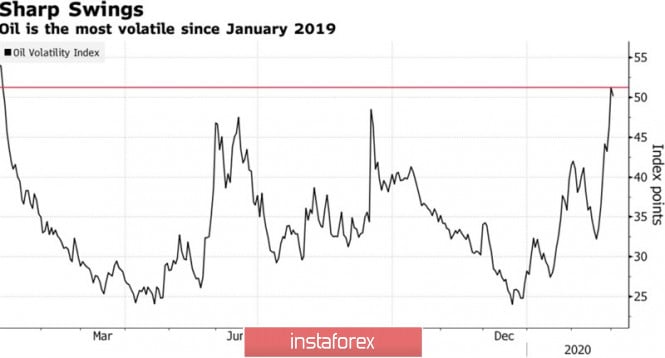

| Posted: 03 Mar 2020 03:51 AM PST After losing more than 30% of its value from January highs and sagging to the bottom since December 2018, black gold managed to mark the best daily rally since the attack on oil companies in Saudi Arabia last September. The most rapid collapse of US stock indices from record peaks in history and pessimistic forecasts of the OECD forced central banks, finance ministries and OPEC to get down to business. The coordinated efforts of the powerful suggest that the worst for Brent and WTI is behind us. According to the Organization for Economic Cooperation and Development, the global GDP in 2020 will expand by 2.4% instead of 2.9%, as previously expected. And that's assuming that the coronavirus is forgotten within the next few months. In the opposite case, the growth rate of the world economy risks being reduced by almost two times. Up to +1.5%. The lower the index, the worse the situation with global oil demand. The situation with China looks especially sad, as the gross domestic product will slow down from 6% to 4.9%. China is the largest consumer of black gold, so bad news from Asia is a "bearish" factor for Brent and WTI. Everyone is well aware that joint efforts are needed. The Fed and ECB are ready to act on the circumstances, hinting at easing monetary policy. The Bank of Japan and the Bank of England intend to do everything possible to stabilize financial markets, and the Reserve Bank of Australia even cut the rate by 25 bps to 0.5%. G20 Finance Ministers will discuss the possibility of fiscal stimulus, and OPEC+ will discuss the possibility of another reduction in production volumes. Inaction by the cartel and Russia is fraught with another sell-off in the oil market, which increases uncertainty and increases volatility. The dynamics of the volatility of oil

Despite the fact that Saudi Arabia intends to assume the main burden of responsibility, the market is concerned about the participation of the Russian Federation in the new volume of obligations. Moscow says it is ready to continue cooperation with OPEC but it is satisfied with the current oil prices of about $50 per barrel. Russia understands that further production cuts create additional preferences for competitors, in particular for American black gold producers. Taking into account the fact that since the beginning of February, short positions on WTI in the futures market have increased by the equivalent of 460 million barrels. Their scheme of working with price risk hedging by selling oil is working. It allows you to increase production and increase your market share regardless of the current value of black gold. According to 27 of the 29 Bloomberg experts, OPEC+ will report a reduction in production by another 750 thousand b/d. Technically, the "Wolf Wave" pattern is forming on the daily Brent chart. A rebound of quotes to the resistance at $57 per barrel with its subsequent successful assault will increase the risks of activating the "Shark" subsidiary model with a target of 88.6%, which corresponds to the level of $67. Brent, the daily chart

|

| Trading plan for EUR/USD for March 03, 2020 Posted: 03 Mar 2020 03:05 AM PST

Technical outlook: EUR/USD climbed to print a high at 1.1184 levels yesterday, before puling back lower. It has taken out 2 resistances at 1.1095 and 1.1172 as displayed on the 4H chart here. The most popular currency pair is seen to be trading around 1.1112 levels at this point in writing and could print yet another high at 1.1240 levels before producing a meaningful retracement. Please note that EUR/USD could drop until 1.0933 levels, which is the fibonacci 0.618 retracement of the rally between 1.0778 and 1.1184 respectively. Also note that the back side of the trend line resistance which could act as support going forward is also passing through 1.0930/50 zone. After nearly a 400-pips rally, the euro is expected to produce a meaningful retracement lower before resuming its rally towards 1.1500 and even higher levels, going forward. A retracement could provide yet another opportunity to initiate fresh long positions going forward. Trading plan: Remain long, one can take partial profits. Stop 1.0778, target is open. Buy on dips towards 1.0930. Good luck! The material has been provided by InstaForex Company - www.instaforex.com |