Business.com |

- How to Protect Your Startup With a Sustainable Mindset

- How to Decide on Your Company's Fiscal Year

- 17 Simple Improvements You Can Make to Your Hiring Process Right Now

- SPONSORED: A Comprehensive Overview of Vast Conference

- SPONSORED: A Guide to Accounting Basics for Freelancers

- What Is Cash Flow Management?

- Why Having a Diverse Board Is Good for Business

| How to Protect Your Startup With a Sustainable Mindset Posted: 02 Apr 2020 05:55 PM PDT

Companies misuse the word "scale" a lot, typically as shorthand for growing, expanding into new locations and gaining customers at lightning speed. In other words, it's wrongly used as a synonym for fast growth. In reality, scaling means bringing on new customers and, by virtue of that, measurably improving the company's margins. If a company's unit economics don't improve as it adds customers, it hasn't truly scaled – it has simply grown. If we head into an economic slowdown, as some analysts are predicting, this kind of reckless growth will shut down a slew of promising startups. Scaling correctly requires a sustainable growth mindset. A company guided by a sustainable growth mindset knows it needs more than just a desirable idea or product. It doesn't operate under the presumption that if it gets enough customers, it can figure out the cost side of the business and transform itself into Google. This mindset eschews the growth-at-all-costs drive that focuses on acquiring customer after customer. Among startups, there's a common sentiment that growth solves all problems, which might be why 70% of startups scale prematurely and why only one-third of the fastest-growing startups listed by Inc. magazine survive to their fifth year. This growth-as-panacea attitude is dangerous because it relies on growth as a constant and doesn't account for the whims of the economy, like the economic downturn on the horizon. The true issue is growth versus scale: Scaling companies might not grow as fast, but they'll develop the necessary infrastructure and ensure they can sustain themselves financially. On the other hand, growth without that groundwork opens a company up to risk in terms of operating expenses, miscommunications and more that threaten the organization's longer term viability. The hallmark of a sustainably growing company is its plan for profitability. This perspective shift – from the pursuit of rapid growth to the cultivation of sustainable maturation – is essential for burgeoning businesses to protect themselves over time. Startups that want to implement this sustainable mindset into their practices should start with these steps. Sit down and review the company's performance.Dedicate time to review your company's financial performance: all levels of profit and loss. Don't let yourself get so caught up in growth that you misattribute why your business is booming or forget what your operating expenses include. Determine whether you can quickly explain the major drivers in revenue, costs of goods sold and operating expenses. Dive in and understand the details of why operating expenses are so high, why they've changed and where they might be going. For growth-oriented companies, this review represents a shift in perspective. It's a crucial point: If you don't understand where the company's books are now, then you have no way of understanding where to go next. You might have a good product and be growing – when the economy is doing well. But once you get into a recession, your customers' reduced spending could easily cut 20% off your growth. With your runway suddenly much shorter and your losses getting bigger, you won't be able to hit the aggressive milestones you set to justify additional funding. But if you have built this comprehensive picture of your finances, you'll know what to attribute to the market and what is happening within your walls. Then you can readjust your funding milestones and revenue goals as necessary. The company I work for, Chewse, is in the food space. We've done well in the past year and have launched in many new cities, but to do that, we needed to build out our infrastructure, a cost-intensive undertaking. Because of changes in the investment environment, we've doubled down on our initiatives to improve margin and reduce operating expenses before expanding into additional cities. We're focusing on the technology that helps us gain margin and cutting back on what previously allowed us to grow fast rather than sustainably. These adjustments have come from carefully reviewing the company's performance. Develop a vision for sustainable growth.The definition of sustainable growth is consistent, but the implementation is different for each company. To determine yours, you need to clearly articulate – to yourself and to others – what sustainable growth means. For guardrails, adopt the principle that growth means a clear line of sight to profitability in a reasonable time frame and then define what "reasonable" means for your company. For some, that could mean six months; for others, it could mean three years. That lead time is a function of the company's funding cushion, and "reasonable" means giving yourself time to become profitable before you burn through your cash. If you get this wrong, you'll choose the wrong strategies. At our company, our vision for sustainable growth meant waiting for the existing markets to pay back a little more before we expanded into the next. We wanted to wait until our return was high enough to justify continued investment. Executing a vision for sustainable growth like this can be difficult: It can mean cutting off investments you've made in the past. Economics books remind you to think of past investments as sunk costs, but the heart reminds you of the energy and strategy you've put into them. That's why creating and executing on the vision is crucial. Shape a sustainable-growth culture by building up from small wins.If you perform a full financial assessment and decide you can grow properly only through massive changes, you've missed the point: You need to value all the smaller indicators of growth. Creating sustainable growth is about the culture you create, and that culture needs to mark and celebrate the smaller pieces that make up the larger whole. This starts with painting a clear picture of the future at the company level. At ours, we then give teams the authority to evaluate what they can accomplish in a short period, such as a two-week window, and drive managers to prioritize initiatives based on time and impact. Within a few cycles, people get good at spotting high-return, low-investment opportunities. Meanwhile, don't ignore the small wins that signal sustainable growth as you go along. For example, an operating expenses win has an outsize value on cash burn: If you cut $10 from expenses, that's the equivalent of gaining a $50 customer with a 20% gross margin. People often forget that gaining $10 in revenue is not equal to cutting $10 in expenses. Often, the smaller wins enable hidden gains and signal the organization to be thoughtful about not just costs, but also the strategies they need to execute for growth – and those reminders are genuinely valuable. This will protect you from making major changes based on external, temporary events like an economic slowdown. Startups bent on growth at all costs sometimes succeed, but too often they're just racing against time (and their burn rates). To avoid joining the 90% of startups that fail, companies need to protect themselves from the outset by developing a sustainable-growth vision that the entire company understands and shares. A company's growth initiatives require all the numbers to support them – and that's the bottom line. |

| How to Decide on Your Company's Fiscal Year Posted: 02 Apr 2020 03:42 PM PDT Choosing when to start your fiscal year is one of the first things you need to do when setting up a new business. It may sound like the easiest thing to do, but this one small step definitely has a big impact. Among other things, your fiscal year will dictate your business strategy and your income tax return filing timeframe. It will determine how you track your company's financial status and how you report it to your shareholders. A strategically planned fiscal period can also improve your operations, help you cut costs and make your company attractive to potential investors. How do you decide when to begin your fiscal year? First, let's review what a fiscal year is and take a look at the factors that affect it. What is a fiscal year?A fiscal year is a period of 12 months over which you track your company's financial situation. Its start marks the point at which you begin your company's annual financial records. At the end of this 12-month period, you have a year's worth of financial data that you can use to determine your taxes and your business's financial health. Unlike a regular year, a fiscal year doesn't have to start on January 1 and end on December 31. You can choose to start it at any point, as long as it spans 12 consecutive months. As a business owner, you get to adopt the fiscal year that makes the most sense for your company. This can either be

Following the calendar year is the straightforward option, but as you'll learn, this doesn't work for all businesses and all industries. When choosing a fiscal year, you'll have to consider several factors, including the nature of your business, tax purposes, and seasonal variations in your company's activities. While you can start it at any time, it's common practice for business owners to kick off their fiscal year at the beginning of certain quarters. However, fiscal years are usually expressed in terms of a year-end date, so you'll often hear people talk about "the fiscal year ending March 31" or "the fiscal year ending September 30." Now that we've gone over the fiscal year definition, let's look into the factors you need to consider when deciding when to start your company's fiscal year. Fiscal year and taxesIf you are the sole owner of your company, the Income Tax Act requires that you follow the standard tax year. The same is true if you are a shareholder in an S corporation or if your business is registered as a single-member limited liability company (LLC). If the business is a partnership, then its tax year must be the same as the tax year of the partners. Along with sole proprietorships, partnerships, S corporations and LLCs, the fiscal year-end of personal service corporations must also follow the calendar year. Regular C corporations may or may not follow the calendar year, depending on which is more advantageous. While the IRS would rather have small businesses following the calendar year, they will grant permission for you to follow any fiscal year if there is a compelling reason to do so. For instance, you may choose to follow an accounting period based on the natural sales cycle of businesses in your industry. Fiscal year and sales cyclesAlmost every industry has its own unique sales patterns. For example, retail businesses tend to be busiest during Thanksgiving, Christmas and New Year holidays. In contrast, most service-based businesses have peaks and valleys throughout the year, depending on the nature of the service they provide. If your business doesn't experience significant changes in sales volume over the course of the year, conforming to the standard calendar year should work well. However, if your business undergoes pronounced seasonal variations, you may opt for a fiscal year that follows the natural sales cycle of your industry. Is your business the type that is taxed according to the calendar year? If the answer is no, you may choose to base your fiscal year at the end of the busiest time for your business. For example, the natural end of the business year for retail merchants is in January, after the Christmas holiday rush and the preinventory selling period. This is why retailers usually begin their fiscal year in February. If you own home improvement or landscaping business, you probably don't have much activity during the winter months, with fewer clients minding their lawns or having the time to take on renovation projects. In this case, a fiscal year that starts in March or April is beneficial as it places your most profitable months in the first half of the year. Front-loading your accounting year lets you put your best foot forward financially and is a huge help when applying for loans or trying to attract investors. For the same reason, businesses that experience an uptick in sales during the summer might go with a September 30 fiscal year-end. Similarly, gyms and fitness clubs benefit from starting their accounting period during the holiday season, when health-related resolutions for the new year are top of mind. Fiscal year and accountingDoes an accountant manage your financial statements? If you answered yes, then you may save some money by following a fiscal year that doesn't conform to the calendar year. Accounting firms are also seasonal businesses. This type of business usually peaks during the end of the standard calendar year, when most companies traditionally close their books. This means that if you choose to wrap up your financial year at a different time, you may be able to avail of your accountant's off-season rate and save some cash. Accountants also typically have busy seasons near the end of each quarter, so you might want to avoid those periods too. Other factorsApart from the main ones mentioned above, business owners may also decide on a fiscal year based on these factors.

Changing your fiscal yearYou may change your current fiscal year for any number of reasons. But if you do, you must also change your tax year. And this is where it gets tricky. To change your tax year, you have to get permission from the IRS. This means filing IRS Form 1128 (Application to Adopt, Change, or Retain a Tax Year). Personal services corporations, S corporations, and partnerships may need to file IRS Form 8716 so that they can use a tax year other than the calendar year. If you're doing this for the first time, you might want to get a tax attorney's help. The questions are numerous and complicated and you'll want to make sure you're answering everything correctly. To get approval, make sure you follow the guidelines laid out by the IRS and have a legitimate business reason for requesting the change. Instead of having to change your fiscal year somewhere down the road, avoid the hassle by making a well-informed decision at the very start. This means doing the necessary research and consulting an accounting or tax expert before making a decision. Questions to askTo summarize, here are a few questions to ask when choosing a fiscal year for your company.

The way you set up your fiscal year affects every part of your business – from your financial strategy to your taxes, from your record-keeping to your business growth. But don't be daunted. Keep the questions above in mind as you figure out the best fiscal year for your business and you'll be well on your way. |

| 17 Simple Improvements You Can Make to Your Hiring Process Right Now Posted: 02 Apr 2020 02:14 PM PDT With so many factors involved in the hiring process, it's easy to miss important steps or neglect asking an illuminating question during an interview. The outcome of these seemingly simple mistakes can be costly however, especially if the hire turns out not to be a fit and you have to start the process over again. Fortunately, most hiring processes don't need a complete overhaul. To find out more, we asked members of the Young Entrepreneur Council to share some simple, straightforward ways to make the hiring process more effective. Here's what they recommend. These answers are provided by the Young Entrepreneur Council (YEC), an invite-only organization comprised of the world's most successful young entrepreneurs. YEC members represent nearly every industry, generate billions of dollars in revenue each year and have created tens of thousands of jobs. Learn more at yec.co. 1. Create a detailed job description."Before posting your job, it's important to understand your specific needs for the position and the kind of person who will fit in your company's culture. Based on that, develop a detailed job description. This ensures you will get applicants that are a better fit, and reduces wasted time for you and job candidates." – Vladimir Gendelman, Company Folders Inc. 2. Check references first."Prior to interviewing a candidate, phone the references first. Referrals can point directly to flaws or misrepresentation of skills. Additionally, they can offer insight into how a candidate works in certain situations from resolving conflict to giving compliments to team members. This helps you organize a hire within your teams and introduce them in a context that they are comfortable with." – Matthew Capala, Alphametic 3. Ask for work samples."To see how applicants apply their skills, ask for work samples (as long as their deliverables are not confidential). This can be done across all job functions. For customer service, ask them to share sample scripts. For developers, have them show previous code they've produced. This gives you insight into how they operate so you can see if their skill set will translate well with your job opening." – Firas Kittaneh, Zoma Mattress 4. Have the candidate 'role play.'"Candidates can seem perfect on paper or wow you in an interview, and then be real disasters once hired if you don't test them on the activities they will be expected to do on a daily basis when hired. Choosing a social media manager? Ask them to create a new campaign and explain the metrics used to track its success. Picking a salesperson? Ask them to call customers and show you their stuff." – Vanessa Nornberg, Metal Mafia 5. Seek out your next strategic addition before you need them."Hiring should be intentional and slow by design. Don't wait to hire until you have a gap that needs to be filled immediately. Strategically identify the next addition to the team that would make the most impact on your business. Build the ideal persona, start the recruitment process, and interview in different settings, depth and levels. Filter with said persona and be clear with expectations." – Devesh Dwivedi, Idea2Inception 6. Use premium job boards."Premium job boards are a great way to streamline your hiring process. Many companies use popular free job boards, and this leads to some problems when it comes time to sift through applicants. With premium boards, you can often be confident that the people applying for your job will be more professional and skilled when compared to free hiring platforms." – Chris Christoff, MonsterInsights 7. Include others in the interview process."Have existing team members ask questions during the interview process. Involving them provides you with more insights and perspectives to ensure that you are hiring the best candidates. This also helps determine team chemistry with your existing employees."– Solomon Thimothy, OneIMS 8. Create a private company website for onboarding."We have a private company website where we keep training material, resources and job information. I think that this site helped us streamline the process by making it easy for new employees to get oriented with our company values, goals, and expectations all in one place."– John Turner, SeedProd LLC 9. Conduct video interviews."I use a product called Ducknowl, which allows me to send preset questions to all the shortlisted candidates and has everyone submit a video response. I get to see recorded video responses from each candidate, which helps me to see their soft skills, personality and level of interest in the job. It saves me a lot of time and avoids a bad hire." – Piyush Jain, SIMpalm 10. Personalize your interactions."It's important to personalize your communication with potential candidates as much as possible. Doing so can build a positive image of your business and will make the best candidates more willing to work with you. It leads to better communication, which will help you uncover the candidate's needs and whether they're a good fit with your organization." – Blair Williams, MemberPress 11. Get feedback after the interview."It's really important to measure how well your hiring process is going, which is why you should ask for feedback after an interview. You could send a survey form and ask candidates about their experience. This feedback can help you improve your hiring process and see the whole process from the candidate's viewpoint." – Syed Balkhi, WPBeginner 12. Hire based on core values."Setting your company's core values is an extremely important exercise for any organization to do. Once completed, you'll have a framework to base your hires on, and you can gauge potential new hires on an even playing field. This helps alleviate the guessing of the new hire being the right fit for your organization and gives you a document to rely on to utilize across the board." – Joel Mathew, Fortress Consulting 13. Let prospects meet their team."Have potential hires meet the team they would be on before any commitments are made. It is possible that someone interviews well and has great experience, but if they don't collaborate and mesh well with their team, it will be a struggle. Host lunch during their interview or have a portion of the interview include members of their prospective team to gauge their level of compatibility." – Matthew Podolsky, Florida Law Advisers, P.A. 14. Give them a paid test project."Sometimes it's good to test potential hires, and a great way to go about doing that is to provide them with a paid test on the specific tasks you would need them to do. It's also a good thing to do when selecting a new freelancer. Just make sure you compensate them fairly for their time." – Nicole Munoz, Nicole Munoz Consulting Inc. 15. Include a question to weed out applicants who aren't detail-oriented."When hiring, I want someone that I know is going to pay attention to detail. To rid myself of people that likely won't meet that qualification, I put a test in my hiring post. Three-quarters of the way down I will ask a very simple question to be answered in their response. Those applicants who do not address this were clearly not paying attention to the details and get dismissed." – Rana Gujral, Behavioral Signals 16. Outline your value to the job candidate."Think through the process from a candidate's perspective, especially when seeking top-tier talent. What can this company offer me? Why do I want to work here? Rather than creating a list of requirements, outline your value as a company to potential applicants: flexible hours, career advancement, shared mission, etc. This will not only attract more applicants to your posts, but also better ones." – Jordan Conrad, Writing Explained 17. Manage your preconceptions."We all have biases around what makes a great employee. Our preconceptions can blind us to outstanding candidates that might not fit our mental model. There are several techniques for reducing bias. Blind resume selection is effective. It helps to ensure that bias doesn't knock people out at the early stages. Collaborative hiring can also help – get your team involved in hiring decisions." – Chris Madden, Matchnode |

| SPONSORED: A Comprehensive Overview of Vast Conference Posted: 02 Apr 2020 11:31 AM PDT Connecting and collaborating with colleagues, clients, and different departments are essential workplace requirements. And doing both well can significantly improve your office's efficiency and productivity. Whether it's streamlining daily operations, ensuring project deadlines are met promptly, delighting clients, or keeping the workplace culture exceptional, a masterful leader will tell you that the key to maintaining a successful and thriving work environment is communication. Conferencing – hosting virtual meetings via phone, desktop, VoIP or mobile device – is the proven communication method for bringing people together easily. By incorporating conferencing into your business as a best practice, teams can reap multiple benefits. Employees can stay apprised of company developments and keep up with training. Co-workers can track the progress of tasks and collaborate on projects in real time. A top-notch video conference platform also enables face-to-face communication with vendors and clients, helping your business maintain its most important relationships. If incorporating a video conferencing service seems like a daunting endeavor, especially for those businesses with established work routines, think again. Conferencing tools should be reliable, simple to use, and even easier to roll out, all while providing the features you need to meet, collaborate, and just simply get work done. One conferencing service offers all of the above. That service is Vast Conference. What is Vast Conference?Vast Conference is focused on providing businesses the highest-quality HD audio and video conferencing capabilities across the many meetings it takes to keep your workplace running effectively. This includes practical features and tools for hosting and presenting such as conference calling, video meetings with screen sharing and recording, and even a mobile app for conferencing on the go. In designing the software, Vast Conference prioritizes ease of use so that meetings start and end on time. With its one-click-to-join feature, there are no PINs and nothing that meeting attendees need to download before a conference. Participants join the meeting frustration-free. For those using video, Vast thoughtfully incorporated a preview pane where participants can test their settings and double-check that they look their best before joining the video meeting. Additionally, helpful tools like Vast Conference's screen-sharing capability with built-in chat and file transfer enable team members to present key documents without having to open other programs or leave the conference. And the recording and transcription features mean you'll never have to take hurried notes again. The entirety of the call or online presentation can be recorded, stored in the cloud and transcribed for later reference or reuse. These are just some of the features that make Vast Conference an intuitive, user-friendly platform. Here's a closer look at some of standout conferencing features. Vast Conference featuresVast Conference offers many valuable tools through their software that are key to enhancing your conferencing experience, all accessible through a web browser-based platform.

Vast Conference is the clear conferencing choice for a modern businessEase of use, accessibility, consistency and quality are the key criteria to consider when choosing a conferencing service. Taking advantage of a platform that offers key features – such as video conferencing, screen sharing, recording and a mobile app – will increase the communication, collaboration and productivity of any work environment. Investing in a service that offers dedicated tools and quality HD audio and video is worthwhile for any growing business or established industry to examine further. Vast Conference delivers this assurance along with all the tools a business needs to succeed. |

| SPONSORED: A Guide to Accounting Basics for Freelancers Posted: 02 Apr 2020 10:51 AM PDT For many people with full-time jobs, filing taxes requires little more than submitting W-2s, since full-time employers deduct taxes from paychecks. Freelancers, on the other hand, have no money withheld from their payments, and this lack of withholding is a huge reason why, when you're a freelancer, accounting involves so many moving pieces that can be tough to understand and track. For starters, as a freelancer, you'll need to properly organize personal and business expenses so you don't confuse one with the other. Additionally, you'll pay quarterly taxes to make up for the lack of money withheld from your payments. And if you're new to freelancing, or you experience a large shift in your annual freelance income, you'll also pay one large lump sum of taxes on or around Tax Day. If this all seems overwhelming, rest assured that many technologies exist to make accounting easier for you. If you master the basics of freelancer accounting before using these technologies, you should have minimal issues when it comes time to file your taxes. Freelancer accounting basicsAs a freelancer, chances are that none of your clients are withholding tax money from your paychecks. Therefore, you'll need to track all money your clients pay you so that, come tax time, you don't accidentally underpay your self-employment tax. This tax includes federal income tax and your contributions to Social Security and Medicare, all of which full-time employers automatically withhold from their employees. Although your clients won't withhold money from their payments to you, they're still legally required to report the amount they pay you to the IRS. To make sure they can properly do so, you'll need to file your Form W-9 with each of your clients. This form shares your Social Security number or Taxpayer Identification Number with your clients so they can successfully inform the IRS of their payments to you. Unlike a Form W-4 that you'd file with a full-time employer, a Form W-9 signifies that you're a freelancer working as a separate business, not a full-time employee. Any clients who pay you $600 or more during a calendar year will use your Form W-9 and income information to issue you a Form 1099-MISC or 1099-K. (You'll only receive the latter if you take payments by credit card.) Your clients will also file these forms with the IRS to show how much they've paid you, so it's crucial that you include all 1099 forms with your tax return. Perhaps more importantly, you'll still need to report all of your non-1099 income on your tax return. Your income comprises all the money that you earn, not just money that your clients report to the IRS. For example, if one of your clients pays you less than $600 during a calendar year, you still need to include this amount in your yearly revenue. You can ensure that you properly tally your revenue by tracking and monitoring all your income. What do freelancers and independent contractors need to track?Freelancers and independent contractors need to track each and every dollar they earn, whether this money is reported on a 1099 or not. You should log your client's name, the amount paid, the project title, the date paid and the invoice number (as well as a copy of the invoice). Since taxes, Social Security and Medicare are not withheld when your clients pay you as a freelancer, you may have to pay your taxes on these earnings in one large lump sum. Alternatively, freelancers who earn over $1,000 per year are encouraged to split this large one-time payment into four evenly sized, more affordable quarterly income tax payments. (Penalties may apply if quarterly taxes are not filed.) The amount of these estimated quarterly tax payments is determined using Form 1040-ES. Several software platforms can help you estimate your quarterly taxes and keep track of all your earnings. These platforms can also allow you to maximize your tax deductions. To achieve the largest possible tax deduction, you'll need to track all your business expenses and keep organized, detailed receipts for them. As a freelancer, you may be able to write off business expenses such as advertising costs, office supplies, travel and more. You will list all your business expenses and deductions on Schedule C (Form 1040) of your tax return. As a freelancer, you should also take extra care to properly organize personal and business expenses without accidentally categorizing one as the other. It will be vital to have an accurate tally of expenses when you calculate your net income, which is your revenue from all 1099 and non-1099 sales minus your expenses. If you accidentally include personal expenses in your business accounting, then you may report an inaccurate income to the IRS, potentially raising red flags on your tax return and leading to a dreaded IRS audit. Best practices for freelancersIt's one thing to know that you have to track all your income. It's another thing to do so in an organized manner. There are several best practices for freelancers that can help you do so. For starters, make a list of information categories that may be crucial to your tax return, and commit to filing this information in your logs immediately upon receiving it. This information may include client payment amounts and invoice numbers, travel expenses, transfers from business bank accounts to personal bank accounts, office rent (including home rent and utility bills if you work from home), receipts for office purchases, website hosting, and more. To aid your organizing efforts, be sure to keep your personal and business assets separate. Many freelancers find this part of bookkeeping challenging, but with the right financial tools and accounting software, it couldn't be easier. How to keep personal and business expenses separateTo keep your personal and business expenses separate, open a new checking account that's just for your business. Direct all your client payments to this account, and use the debit card associated with this account to pay for all your business expenses. If you own any business-specific credit cards, use your business checking account to pay off these credit card bills. Separating your two bank accounts not only helps you organize personal and business expenses and payments, but it usually makes saving enough money to pay your taxes much easier. It also ensures that your accounting software will more accurately track your earnings, expenses and estimated taxes. Why bookkeeping software is crucial for freelancersWith bookkeeping software, you can automatically link your business checking account to your software so that all your income and spending are automatically logged. You can use bookkeeping software to quickly, easily categorize all transactions as well. Most bookkeeping software also allows you to maximize your tax deductions and automatically calculate your estimated quarterly taxes. Other platforms go the extra mile in automating your bookkeeping. QuickBooks Self-Employed, for example, allows for automated invoice creation and sending. Instead of laboring over these forms and having to remember to send them, QuickBooks Self-Employed does all the work for you. It also helps you to enable online payments from clients and sends notifications to overdue clients. QuickBooks Self-Employed is especially useful for freelancers with extensive travel expenses. The QuickBooks Self-Employed app uses your smartphone's GPS to automatically track your miles when you travel, so whenever you're on the move for business purposes, you can log a business trip and use the mileage calculated to discover as much as 45% more deductions. If you want to maximize your tax deductions and minimize the time you spend bookkeeping, QuickBooks Self-Employed is currently offering new users half off on their first three months. Click here to sign up and discover thousands of dollars in tax savings you might not find otherwise. |

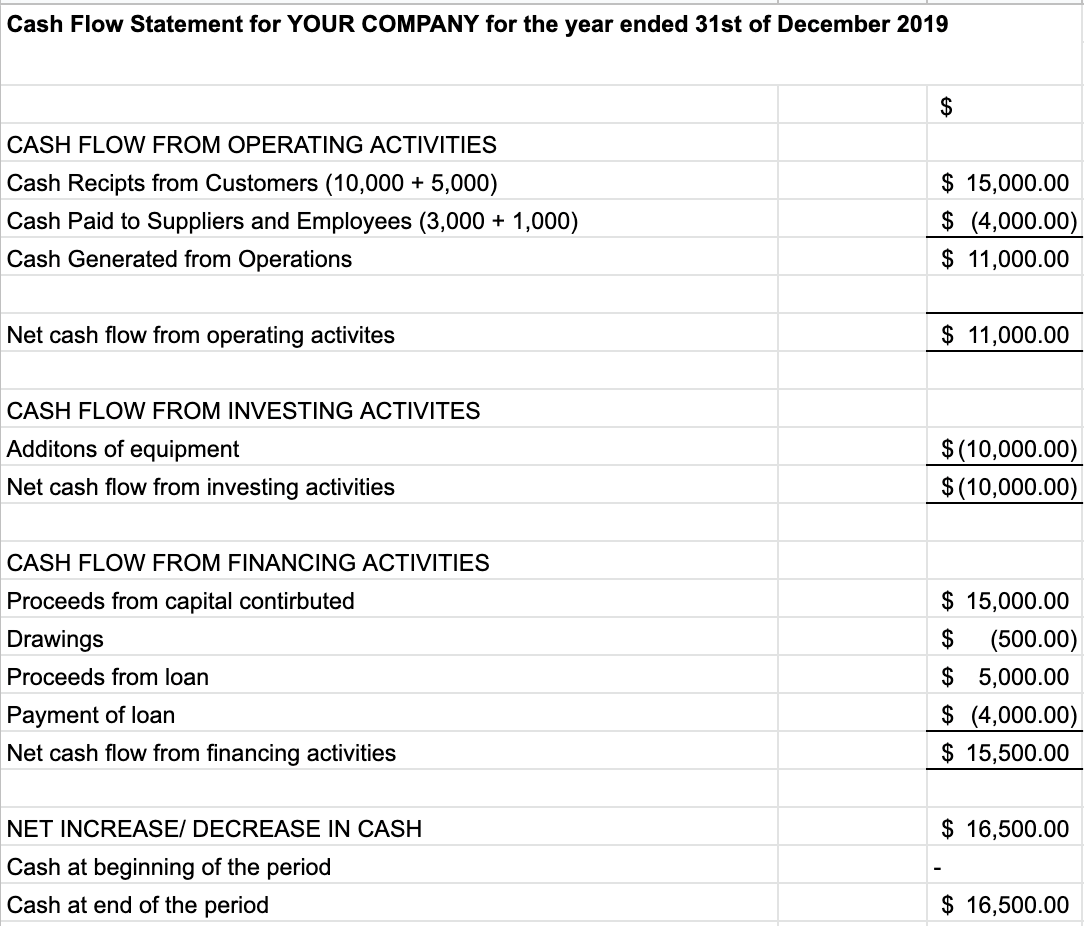

| Posted: 02 Apr 2020 07:09 AM PDT A business can't survive without money. But how much does cash flow really impact a business, and what happens when that business runs into a cash flow problem? In the simplest of terms, cash flow is the amount of money that a business has, whether that money is being transferred in or out of the business. Managing that money can be a bit more complicated, requiring some helpful tools and tricks of the trade. "Cash flow is the lifeblood of every business, and without a positive cash flow, the company can incur problems in operating the business," said Bob Castaneda, director for Walden University's MS in Accounting program. "Not paying some of the most important stakeholders in a company – such as employees, vendors or the IRS – can severely impact a company from doing business over the long term." Proper cash flow management is a key element of a healthy, growing business. This guide will explain the basics of cash flow management and offer advice on how to improve your business's cash flow. Why cash flow management is a crucial part of running a business"Cash flow management is simple – think of it as the process of analyzing and monitoring the amount of cash you receive minus the cash you spend," said Chris Terschluse, head of marketing and content at Chime. "A business's ability to optimize its net cash flow is usually an indicator that a business's overall financial health is strong." The opposite is also true. If cash flow becomes a problem, it can result in things such as late payroll and the inability to pay vendors or suppliers, which could lead to the deterioration of a business. Negative cash flow can impact other areas, "such as reinvesting profits into growth opportunities or being able to properly staff their already-existing operations," Terschluse said. "Studies show that most businesses fail due to poor cash flow management practices. Without keeping track of your cash flow, it's easy to spend money you don't have." Jenn Flynn, head of the Small Business Bank division at Capital One, said a recent Capital One study found that 42% of small business owners list cash flow management as a top concern. "To get ahead of this, small business owners should consider developing a cash flow management plan," she said. "This will help measure how much money is coming in and out every month. This process will also highlight any potential cash shortfalls and allow business owners to get ahead of issues that might arise in the future. Building a savings cushion can also help business owners prepare for unexpected expenses or future growth opportunities." Keeping your cash flow under controlFlynn emphasized that since effective cash flow management is essential to running a successful business, planning ahead can help you get there. Understanding your cash flow statements is also imperative. "A cash flow statement summarizes money entering and leaving a company, detailing cash receipts (from sales) and cash expenditures (from expenses)," Flynn said. "These expenses include operating expenses like payroll, utilities, insurance, as well as taxes and loan repayments. If you are entering a growth phase, take the time to understand what you are going to need to support your business now and down the road. It's important to realize that any cash flow challenges aren't going to be fixed overnight with a loan. A financial forecast will help flush out the timing of cash flow needs." Castaneda said that a good enterprise resource planning system used in budgeting can help you capture and track payment commitments in the future by identifying when goods or services are ordered. "Weekly and monthly cash flow budgets should be created and reviewed by management to understand the financial condition of the company," he said. "Cash flow strategies can then be put into place, such as financing long-term assets or developing working capital commitments from vendors." Flynn also said that "understanding how much money is coming in and out every month, ensuring prompt payment from customers and vendors, paying bills on time, planning for the financial future, watching inventory, and various other factors" are key to better cash flow management. "The best thing that a business owner can do is to understand the money coming and coming out, know their financials inside and out, and be diligent about saving extra funds for the unexpected. Additionally, we often recommend business owners consider opening a line of credit even when cash flow is positive, economic conditions are good, and interest rates are low," Flynn said, adding that this can help bring peace of mind in case of a market downturn, sudden expenditure or even an unexpected growth opportunity. Cash flow statement example Source: Courtesy of Chime

Factors that can lead to cash flow problemsCash flow issues are not reserved for seasonal or niche businesses. Even a business with the most "in" product or service can run into cash flow problems. "Cash flow problems can be caused by a fundamental issues, like not having enough customers or clients, not charging enough for your services, or simply having too many expenses," Flynn said. But those aren't the only things that can result in cash flow issues. Flynn added that they can also be the result of more nuanced or unexpected factors – "for example, a client who is chronically late in paying invoices, an unexpected tax bill or changes in minimum wage." Many of these problems present themselves in seasonal businesses, Terschluse added, because they tend to bring in most of their revenue during the summer or holiday season. But the leading cause of cash flow problems is low profits, losses, overspending and excessive customer credit. "To avoid these, make sure your profit margins support and sustain total business operations, your stock meets the demand, and limit your customers' credit or give them incentives to pay off their debts quickly," Terschluse said. Dewey Martin, professor emeritus at the Husson University School of Accounting, also noted that businesses that grow too fast often have cash flow problems. "As a small business grows, it will have more cash tied up in accounts receivable and inventory," he said. "Reducing the amount of accounts receivable or decreasing the amount of inventory a small business is holding can improve an organization's cash flow." Cash flow management is a process, Martin said, and as part of this process, a company decides when to pay bills and estimates when it is likely to receive income. "Good cash flow management requires companies to prepare a budget of projected receipts and disbursements," Martin added. "Cash flow management is essential to the sound financial health of an organization. It is quite possible to have a profitable organization go out of business due to poor cash flow management." |

| Why Having a Diverse Board Is Good for Business Posted: 02 Apr 2020 04:00 AM PDT

At the beginning of 2020, investment bank Goldman Sachs announced a new policy: They will no longer take a company public unless it has at least one "diverse" member of the board. In 2021, Goldman Sachs will require that companies have two diverse board members. Goldman Sachs joins other companies such as BlackRock and State Street that will vote against companies with an all-male board of directors. (California imposes a $100,000 fine against companies that have all-male boards.) Other countries, such as Norway, Spain, France, and Iceland, have had laws requiring that women make up at least 40% of boards at publicly listed companies for years. Studies have proven that diversity within a company is good for business. It increases a business's understanding of its customer base, supports creative thinking and promotes a global mindset. McKinsey's "Diversity Matters" report found that companies rated well for racial and ethnic diversity were 35% more likely to have greater financial returns than their industry peers. Although though Goldman Sachs is certainly on the right path, diversity is not something that is gained by having one person who is not white and male on the board. What does it mean to have board diversity?Board diversity can mean many things, but it ultimately comes down to diversifying the way members think and look at the business. "Diversity can be looked at from a number of viewpoints," said Heidi Pozzo, founder of Pozzo Consulting. "When discussed today, the focus is often on gender and race. But to have a truly diverse board, you need experience from inside and outside the industry; you also need people with different perspectives of business." It is important to keep in mind, however, that differences in thinking are informed by a person's experiences, which are influenced by things like their gender, race or ethnicity, which is why initiatives like Goldman Sachs' are effective. "Boards can too easily slip into groupthink, where ideas are rarely challenged and the board does not update its own thinking," said Robert C. Bird, a professor of business law at the University of Connecticut. When determining whether a board is diverse or not, consider where members differ according to these variables:

The more perspectives you have, the more likely your board is to have productive discussions that will better serve your business. Why is it important to have a diverse board of directors?A diverse board serves your company in many ways. The purpose of a board of directors is to guide the company – it is in the company's best interest to make sure that the board is capable of looking at issues and challenges from many perspectives. Here are four ways a diverse board can help your business. 1. A diverse board creates good corporate governance.While it is widely agreed that a board's first responsibility is to its shareholders, those shareholders are dependent on the support of customers and the company's employees. A diverse board more accurately reflects the real world and opens a company up to considering the needs of a broader group of people who may be involved with the company. "A business owner cannot know everything," said Timothy Seeley, a coach and speaker on leadership development. "It is helpful to have people that can bolster your weak areas." 2. A diverse board mitigates risk.By incorporating several different viewpoints and philosophies, a diverse board decreases a company's chances of making risky decisions. "If a board is made up of entirely like-minded people from the same backgrounds, it's essentially a sounding board that will agree with any decision and not have new ideas or perspectives to share," said Deborah Sweeney, CEO of MyCorporation. Corporate boards should be made up of members with a range of experiences who will help business owners approach a decision or problem from multiple angles, which can help them discover opportunities and identify potential roadblocks. 3. A diverse board keeps the company moving forward.A board must constantly be challenging itself and the company to keep pace with the ever-changing dynamic of modern business, and that cannot happen with stagnant ways of thinking. Boards should operate under the idea that there is no right answer, and make a commitment to hearing everyone's ideas out carefully and respectfully. 4. A diverse board provides an example for the rest of the company.Leadership starts at the top, and a diverse board sends a strong message to the rest of the company that diversity is valued and practiced within the entire organization. A diverse workforce can mean good things for your business, too – 83% of millennials report feeling more engaged in an inclusive workplace. How can you create a diverse board of directors?Creating an effective and diverse board is not as simple as hiring one woman or one person of color. It requires careful thought and deliberate recruiting, taking into consideration multiple types of diversity. Here are a few strategies to help you recruit a diverse board. Avoid tokenism.The most important thing to avoid when diversifying your board is tokenism, or making no more than a symbolic effort. Hiring one woman for gender diversity or one person of color to your all-male or all-white board would be tokenism, and it does not fulfill the purpose of true diversity. Try hiring or bringing on several new board members at once, ensuring they all bring with them unique perspectives and qualities. Make it policy.Having rules and regulations regarding diversity for your board seats may make it seem like you are checking a box for diversity, but having it as a company policy can show your shareholders, employees, and other organizations how seriously you are taking the issue of diversity in your board composition. It can also help hold the board accountable and encourage targeted hiring, but implement policies that make sense to your employees so they don't feel like the policies have been forced on them or are restrictive. Consider search firms."Search firms are a great resource," said Pozzo. "There are organizations such as the National Association of Corporate Directors that provide education and training for directors, as well as provide a network for directors and potential directors. To broaden diversity, candidates should not be limited to CEOs and CFOs. Leaders in marketing, technology and other areas should be considered." Embrace all kinds of diversity.Ensure that you are not only looking to add people of different genders or races to your board. It is important that you include age, experience, way of thinking or religion in your considerations. This helps create a truly diverse board that can provide nuanced and varied perspectives on the many issues and challenges your business will face. |

| You are subscribed to email updates from Business.com. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment