Forex analysis review |

- Fractal analysis of the main currency pairs for April 3

- Volatile trading is expected amid the publication of data from the United States on employment (continuation of the decline

- USDCAD testing ascending trendline support!

- USD/CAD approaching 1st resistance, potential drop expected!

- Dollar is vulnerable to the publication of employment reports and ISM in the services sector; Overview of EUR/USD and GBP/USD

- Technical Analysis of ETH/USD for 03/04/2020:

- Technical Analysis of BTC/USD for 03/04/2020:

- AUD/USD. Bulls held a strategically important position, despite the hype around China

- Technical Analysis of EUR/USD for 03/04/2020:

- Technical Analysis of GBP/USD for 03/04/2020:

- Trading plan for EUR/USD on April 3, 2020

- USD/CHF approaching resistance, potential drop!

- Overview of the GBP/USD pair. April 3. Nonfarm Payrolls and the US unemployment rate are a second chance for traders to get

- Overview of the EUR/USD pair. April 3. The European Commission is being activated after the United States. The second package

- Elliott wave analysis of EUR/GBP for April 3, 2020

- Elliott wave analysis of GBP/JPY for April 3, 2020

- GBP/USD: plan for the European session on April 3. Sluggish attempt by the bulls to correct the situation and exit the weekly

- EUR/USD: plan for the European session on April 3. Bears made their way below 1.0880, but further movement depends on Non

- Forecast for EUR/USD on April 3, 2020

- Forecast for GBP/USD on April 3, 2020

- Forecast for AUD/USD on April 3, 2020

- Forecast for USD/JPY on April 3, 2020

- Comprehensive analysis of movement options of #USDX vs EUR / GBP & GBP / JPY & EUR / JPY (DAILY) on April 03, 2020

- EUR/USD. Panic returns: China statistics scandal and new Covid-19 outbreak

- April 2, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

| Fractal analysis of the main currency pairs for April 3 Posted: 03 Apr 2020 12:17 AM PDT Forecast for April 3 : Analytical review of currency pairs on the scale of H1:

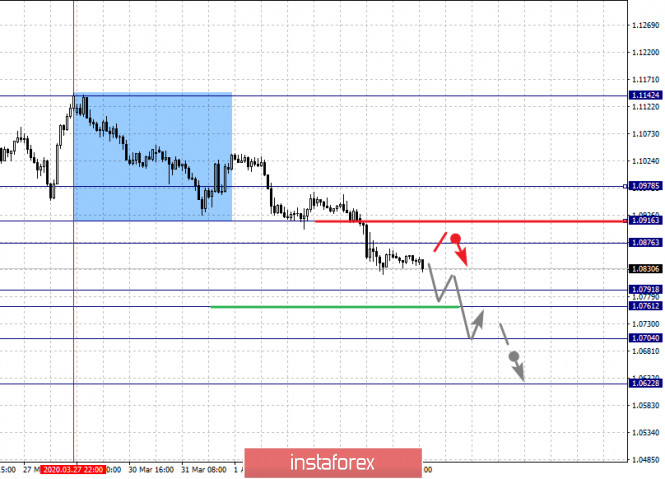

For the euro / dollar pair, the key levels on the H1 scale are: 1.0978, 1.0916, 1.0876, 1.0791, 1.0761, 1.0704 and 1.0622. Here, we are following the development of the descending structure of March 27. The continuation of movement to the bottom is expected after the price passes the noise range 1.0791 - 1.0761. In this case, the target is 1.0704. Price consolidation is near this level. For the potential value for the bottom, we consider the level of 1.0622, upon reaching which, we expect a pullback to the top. Short-term upward movement is possibly in the range 1.0876 - 1.0916. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.0978. This level is a key support for the downward structure. The main trend is the descending structure of March 27 Trading recommendations: Buy: 1.0876 Take profit: 1.0914 Buy: 1.0918 Take profit: 1.0978 Sell: 1.0760 Take profit: 1.0705 Sell: 1.0702 Take profit: 1.0622

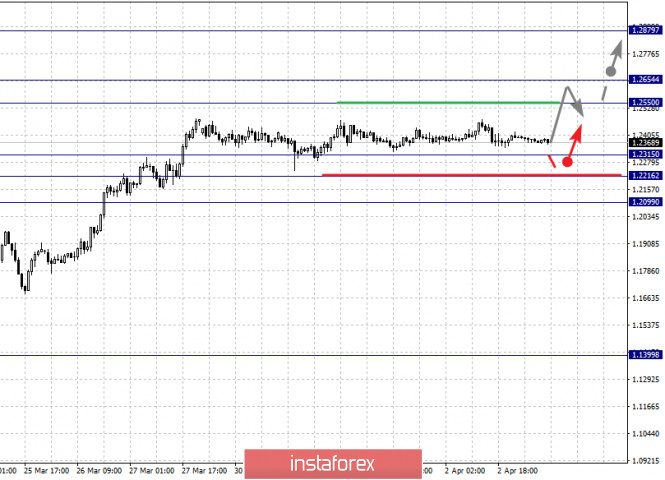

For the pound / dollar pair, the key levels on the H1 scale are: 1.2879, 1.2654, 1.2550, 1.2315, 1.2216 and 1.2099. Here, we are following the development of the upward cycle of March 19. Short-term upward movement is expected in the range of 1.2550 - 1.2654. The breakdown of the latter value will lead to a pronounced movement. Here, the potential target is 1.2550. Upon reaching which, we expect consolidation, as well as a pullback to the bottom. Short-term downward movement is expected in the range of 1.2315 - 1.2216. The breakdown of the last value will lead to an in-depth correction. Here, the target is 1.2099. This level is a key support for the top. The main trend is the upward cycle of March 19 Trading recommendations: Buy: 1.2550 Take profit: 1.2652 Buy: 1.2655 Take profit: 1.2876 Sell: 1.2315 Take profit: 1.2218 Sell: 1.2214 Take profit: 1.2100

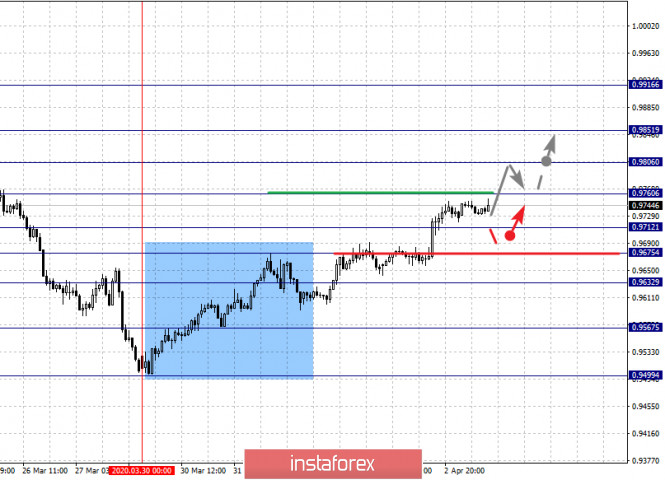

For the dollar / franc pair, the key levels on the H1 scale are: 0.9916, 0.9851, 0.9806, 0.9760, 0.9712, 0.9675 and 0.9632. Here, we are following the ascending structure of March 30. The continuation of the movement to the top is expected after the breakdown of the level of 0.9760. In this case, the target is 0.9806. The breakdown of which, in turn, will allow us to expect movement to the level of 0.9851. We expect consolidation near this value. For the potential value for the top, we consider the level of 0.9916, from which we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 0.9712 - 0.9675. The breakdown of the last value will lead to an in-depth correction. Here, the target is 0.9632. This level is a key support for the top. The main trend is the upward structure of March 30 Trading recommendations: Buy : 0.9760 Take profit: 0.9804 Buy : 0.9808 Take profit: 0.9806 Sell: 0.9712 Take profit: 0.9677 Sell: 0.9673 Take profit: 0.9635

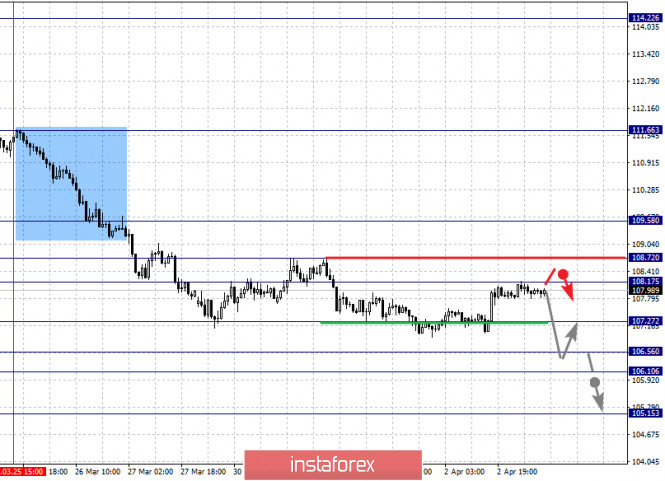

For the dollar / yen pair, the key levels on the scale are : 109.58, 108.72, 108.17, 107.27, 106.56, 106.10 and 105.15. Here, we are following the development of the downward structure of March 25. At the moment, the price is in correction. The continuation of movement to the bottom is expected after the breakdown of the level of 107.27. In this case, the target is 106.56. Price consolidation is in the range of 106.56 - 106.10. For the potential value for the bottom, we consider the level of 105.15. Upon reaching this level, we expect a rollback to the top. Consolidated movement is possibly in the range of 108.17 - 108.72. The breakdown of the last value will lead to an in-depth correction. Here, the goal is 109.58. This level is a key support for the downward structure. Main trend: the downward trend of March 25 Trading recommendations: Buy: 108.17 Take profit: 108.70 Buy : 108.74 Take profit: 109.56 Sell: 107.25 Take profit: 106.56 Sell: 106.10 Take profit: 105.15

For the Canadian dollar / US dollar pair, the key levels on the H1 scale are: 1.4653, 1.4498, 1.4369, 1.4246, 1.4085, 1.4017 and 1.3933. Here, the price forms the potential for the top of March 27. The continuation of the movement to the top is expected after the breakdown of the level of 1.4246. In this case, the target is 1.4369. Price consolidation is near this level. The breakdown of the level of 1.4369 will lead to the development of an upward cycle. Here, the first goal is 1.4498. For the potential value for the top, we consider the level of 1.4653. Upon reaching which, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 1.4085 - 1.4017. The breakdown of the latter value will lead to the development of a downward structure. In this case, the first target is 1.3933. The main trend is the formation of the rising structure of March 27. Trading recommendations: Buy: 1.4248 Take profit: 1.4367 Buy : 1.4371 Take profit: 1.4498 Sell: 1.4085 Take profit: 1.4018 Sell: 1.4015 Take profit: 1.3935

For the Australian dollar / US dollar pair, the key levels on the H1 scale are : 0.6596, 0.6511, 0.6352, 0.6241, 0.6031, 0.5935 and 0.5779. Here, we are following the development of the upward cycle of March 19. At the moment, we expect a movement to the level of 0.6241. Short-term downward movement, as well as consolidation is in the range of 0.6241 - 0.6352. The breakdown of the level of 0.6352 will lead to a pronounced upward movement. Here, the potential target is 0.6595. Price consolidation is in the range of 0.6595 - 0.6511. Short-term downward movement is possibly in the range of 0.6031 - 0.5935. The breakdown of the last value will lead to an in-depth correction. Here, the target is 0.5779. This level is a key support for the top. The main trend is the upward structure of March 19 Trading recommendations: Buy: 0.6241 Take profit: 0.6350 Buy: 0.6354 Take profit: 0.6511 Sell : 0.6030 Take profit : 0.5935 Sell: 0.5933 Take profit: 0.5780

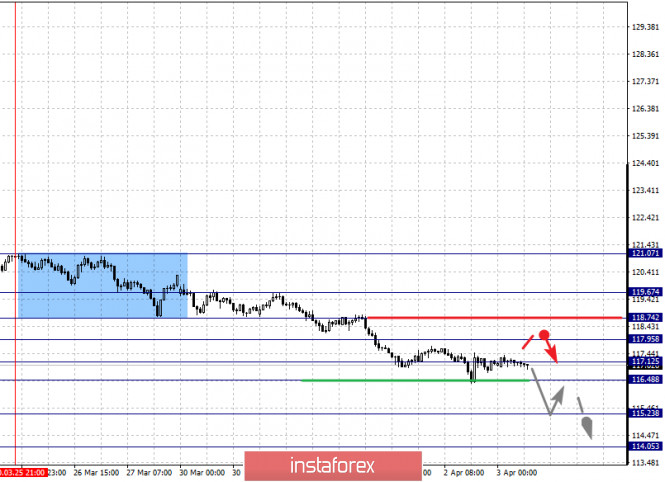

For the euro / yen pair, the key levels on the H1 scale are: 121.07, 119.67, 118.74, 117.95, 117.12, 116.48, 115.23 and 114.05. Here, we are following the development of the descending structure of March 25. The continuation of the movement to the bottom is expected after the price passes the noise range 117.12 - 116.48. In this case, the target is 115.23. Price consolidation is near this level. For the potential value for the bottom, we consider the level of 114.05. Upon reaching which, we expect a pullback to the top. Short-term upward movement is possibly in the range of 117.95 - 118.74. The breakdown of the last value will lead to an in-depth correction. Here, the target is 119.67. This level is a key support for the downward structure. The main trend is the descending structure of March 25 Trading recommendations: Buy: 117.95 Take profit: 118.72 Buy: 118.76 Take profit: 119.65 Sell: 116.45 Take profit: 115.25 Sell: 115.20 Take profit: 114.05

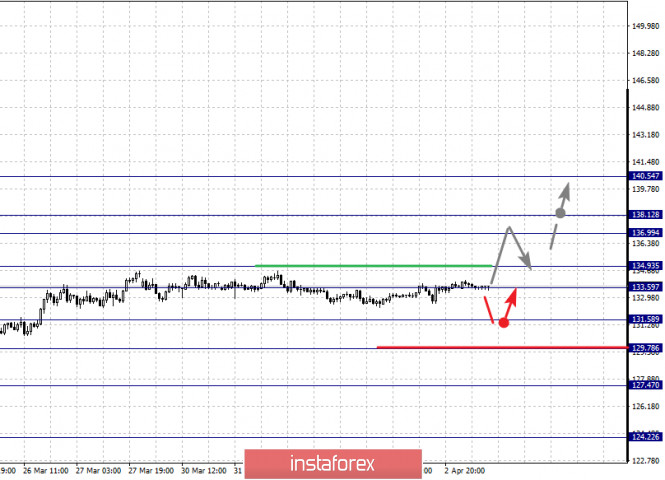

For the pound / yen pair, the key levels on the H1 scale are : 140.54, 138.12, 136.99, 134.93, 133.59, 131.58, 129.78 and 127.47. Here, we are following the development of the upward cycle of March 18. Short-term upward movement is expected in the range of 133.59 - 134.93. The breakdown of the last value should be accompanied by a pronounced upward movement. Here, the target is 136.99. Price consolidation is in the range of 136.99 - 138.12. For the potential value for the top, we consider the level of 140.54. Upon reaching this level, we expect a pullback to the bottom. Short-term downward movement is possibly in the range of 131.58 - 129.78. The breakdown of the latter value will lead to in-depth movement. Here, the target is 127.47. This level is a key support for the upward structure. The main trend is the upward cycle of March 18 Trading recommendations: Buy: 133.60 Take profit: 134.90 Buy: 134.95 Take profit: 136.99 Sell: 131.58 Take profit: 129.80 Sell: 129.70 Take profit: 127.50 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 03 Apr 2020 12:15 AM PDT The currency market almost froze in the face of massive incentive measures taken by the world's leading central banks led by the Federal Reserve. We have previously commented on these reasons, and today, we only recall them to understand the situation and consider possible options for the development of events. The dynamics of major currencies is still under the influence of large-scale incentive measures taken by the Fed, the ECB, the Bank of England, the Central Bank of Japan, Switzerland and so on, which actually flood local financial systems with money, while exerting downward pressure on national currencies. But ahead of the rest is the American regulator, which has actually opened an unlimited credit line to support liquidity. And here the question arises, why is the dollar not falling against other major currencies? Its growth against the currencies of developing countries is clear. The reason for this is the repatriation of investor funds against the backdrop of the coronavirus pandemic from these countries to the dollar. But why is the dollar supported against major currencies? Of course, the Central Banks of the countries to which they belong carry out measures to support national economies, but they are incomparable with those unprecedented measures taken by the Federal Reserve, which means the dollar should fall, as it did at the beginning of the last decade. But this does not happen due to the fact that there is a high degree of uncertainty about the prospects for the global economy as a whole and its leaders in the USA, China and large Europe. This picture is clearly visible in the dynamics of stock markets, which are moving along the strip - rising and falling again. The dollar is perceived as the most reliable safe haven currency, being the world's reserve currency. And that means We, as before, believe that this state of affairs will last until the situation is stabilized by the pandemic of the coronavirus in Europe, and most importantly in the United States. As for the publication of economic statistics, they now play almost no role, since they simply confirm the forecasts of the consequences of strict quarantines in China, Europe and North America. Therefore, we do not consider the data on employment in America published today as extremely important and crucial. They can be worse or better than forecasts, the market will react locally to them, and nothing more. We believe that in general, the dynamics of the currency exchange market will remain sideways for now. Forecast of the day: EUR/USD is trading above the level of 1.0820. The pressure on the pair has a wide demand for the dollar as a reserve currency. We believe that the data on US employment published today will lead to an increase in limited volatility in the currency markets. At this wave, the pair may rise to the level of 1.0950, and then fall again to the level of 1.0820 with the prospect of continued decline to 1.0740 if it does not hold above this level. Spot gold quotes are consolidating below the trend line at the level of 1620.50. If it holds and the pair falls below the level of 1606.00, it will have the opportunity to fall to 1575.25.

|

| USDCAD testing ascending trendline support! Posted: 03 Apr 2020 12:03 AM PDT

Trading Recommendation Entry: 1.40841 Reason for Entry: 61.8% Fibonacci retracement, Ascending trendline resistance. Take Profit : 1.43489 Reason for Take Profit: 61.8% Fibonacci retracement, graphical swing high Stop Loss: 1.39225 Reason for Stop loss: 61.8% Fibonacci extension The material has been provided by InstaForex Company - www.instaforex.com |

| USD/CAD approaching 1st resistance, potential drop expected! Posted: 03 Apr 2020 12:01 AM PDT

Trading Recommendation Entry: 1.42677 Reason for Entry: Horizontal swing high resistance, 76.4% Fibonacci retracement Take Profit : 1.40165 Reason for Take Profit: Graphical swing low, 78.6% Fibonacci extension Stop Loss: 1.45321 Reason for Stop loss: Horizontal swing high resistance The material has been provided by InstaForex Company - www.instaforex.com |

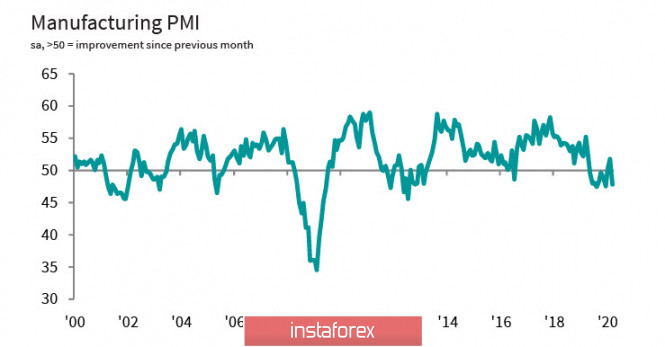

| Posted: 02 Apr 2020 11:53 PM PDT The Congressional Budget Committee said that the US economy will shrink in the 2nd quarter by 7% according to preliminary estimates. The unemployment rate will exceed 10% during the 2nd quarter, which reflects the huge growth rate of applications for unemployment benefits – 6.65 million new applications on April 2, 3.3 million applications a week earlier, in total, the US economy lost about 10 million jobs in just two weeks. These rates are more than 10 times higher than the lowest rates of 2007/2009, which indicates an unprecedentedly high level of threat in recent history. Thus, before the publication of the employment report in March today, expectations are more than gloomy. The manufacturing sector began to decline, which is unlikely to be stopped in the foreseeable future - the ISM new orders index in March declined from 49.8g to 42.2p, while the inflation acceleration index, reflecting business sentiment regarding inflation, declined from 45.9p to 27.4p. Today, the ISM index for the services sector will also be released along with the employment report. Here, forecasts are extremely negative, and in general, Friday can go down in history as the day with the maximum deterioration in statistics compared to the previous period. The measures taken by the US financial authorities are a time bomb. The dollar looks strong during the crisis, but only because most of the debt is denominated in USD, so it is in demand when liquidity is reduced worldwide. As soon as the first signs of a decrease in panic appear, for which two conditions must be met - the recession of the coronavirus epidemic and the stabilization of the oil market, as the dollar goes down sharply. The second condition can be fulfilled earlier than the first - the 3 largest players in the oil market, namely the USA, Saudi Arabia and Russia, have begun to search for a mutually beneficial solution. Now, it's up to the virus. EUR/USD Most macroeconomic parameters are gradually declining in the eurozone, and despite the strong increase in panic due to the explosive increase in the spread of coronavirus, the situation does not look threatening. Moreover, most of the indicators from the European Commission fell within the forecast, inflation in March slowed a little more than expected, but it is still far from deflation. On the agenda is a discussion of measures that can accelerate economic recovery - France initiated the release of "corona bond", with the aim of creating a fund for economic recovery in the EU, which is essentially the same well-known method of monetary stimulation in a new wrapper. EUR/USD pair retreated 38% from the recent high of 1.1146, but this decline does not indicate a reversal, but only a correctional pullback before a new growth wave. The current level is favorable for purchases, the nearest target is 1.0960 / 70, then 1.1080, in the future 3-5 days we should expect a return to the local maximum and an attempt to go higher to 1.14. GBP/USD The pound can not overcome the resistance zone 1.2400 / 80, but the chances are growing every day. Unlike the dollar, the pound has not yet received any sensitive statistical hits - the consumer confidence index from Gfk fell slightly in March from -7p. up to -9p., business activity in the manufacturing sector in March also changed slightly from 48p to 47.8p, which looks amazing against the backdrop of the collapse of PMI in other countries. In addition, even a drop in output at the fastest pace since July 2012 doesn't look as bad as the ISM drop in the United States. Today, a report on the PMI in the services sector will be published, but it risks staying in the background amid the expected failure in the US employment market. Negotiations on a trade agreement between the UK and the EU are blocked indefinitely. Both sides are trying to pretend that they are not up to it now, in any case, there is no driver for the pound here. The bottom line is, the likely growth of oil and a strong hit to the dollar against the background of the exponential growth of the epidemic in the US give the pound a chance to move up from the consolidation zone. Support is at 1.2370 / 80, the goal is to test the psychological resistance of 1.2500 for strength. On Friday, this is the most likely scenario for the pound. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical Analysis of ETH/USD for 03/04/2020: Posted: 02 Apr 2020 11:44 PM PDT Crypto Industry News: Vitalik Buterin - co-creator of Ethereum - got involved in a Twitter discussion with the Bitcoin developer yesterday. "Digital gold was, is and will be a bitcoin narrative," one user wrote on Twitter, which caused a stormy discussion. Buterin emphasized that the oldest cryptocurrency was originally to act as digital cash, not gold. He also added that he joined the BTC community in 2011, and yet he remembers that even then the atmosphere around this cryptocurrency was completely different. Bitcoin was originally an electronic peer-to-peer cash, only later it became gold. As proof of this statement, Buterin attached the BTC White Paper, because even in its title it was clearly emphasized. It is no surprise, therefore, that he supports this original version. Although fees in the Bitcoin network may seem relatively high to some, others accept this state of affairs. Vitalik Buterin himself wrote that this is a controversial matter. He added, however, that users do not have to use BTC, if they do not like it, they can always use a different block chain. The nickname of digital gold, which was given to Bitcoin, deviates from the original concept. In this case, this cryptocurrency begins to be perceived more as a speculative object, not money, but no matter what role BTC currently plays, its initial assumptions were undoubtedly associated with P2P transactions, not value storage. This is difficult to deny. Technical Market Outlook: The ETH/USD pair has made a new local high after a breakout through the level of $142.77 has been made. The new high was made at the level of $149.52, but the candlestick pattern of a Pin Bas has been made during this move, so the price wend back down below the level of $142.77 again. The Ethereum is still trading below this level and the bulls are still trying to make use of the momentum behind this move up and move higher towards the level of $153.44 which is a technical resistance for the price. On the other hand, if the bulls fail here, then the next technical support is seen at the level of $132.21 - $130.87. Weekly Pivot Points: WR3 - $161.35 WR2 - $151.83 WR1 - $136.71 Weekly Pivot - $127.64 WS1 - $112.54 WS2 - $102.86 WS3 - $88.46 Trading Recommendations: The fear of the coronavirus consequences is very strong among the global investors and it rules on the financial markets. So far the global investors are not so keen to invest in cryptocurrency, because they are being perceived as risky assets. The larger time frame trend on Ethereum remains down and as long as the level of $214.67 is not violated, all rallies will be treated as a counter-trend corrective moves. This is why the short positions are now more preferred.

|

| Technical Analysis of BTC/USD for 03/04/2020: Posted: 02 Apr 2020 11:28 PM PDT Crypto Industry News: With the rise of panic and uncertainty caused by the coronavirus, Egypt has become the latest country to limit withdrawals from banks. Individuals can now charge a maximum of $ 635 per day from their bank and only $ 317 from ATMs. According to press reports, on Sunday the Egyptian central bank instructed banks around the country to apply temporary daily withdrawal and deposit limits. This movement aims to control inflation in the country and prevent citizens from accumulating cash during a pandemic. The daily limit for individuals has been reduced to 10,000 Egyptian pounds in bank branches and 50,000 pounds for companies. Only companies that need to withdraw money to pay their employees will be exempted from the limits. Restrictions appear after a wave of mass payments from banks in the country. Central bank governor Tarek Amer said on Sunday that 30 billion Egyptian pounds (1.91 billion dollars) had been removed from the banks over the past three weeks. "It turned out that individuals withdraw money from banks, although they did not need them ... in the last three weeks they have paid 30 billion pounds. We want discipline. We live in society and we must think about others" - said the governor. Registered coronavirus cases in Egypt are currently slightly less than 800. However, the national health service is not prepared for a mass epidemic. In addition, Egypt is prone to high inflation, which can further aggravate the crisis. This can reduce inventory and panic and keep prices down. Technical Market Outlook: The BTC/USD pair has rallied through the technical resistance zone located between the levels of $6,759 - $6,908 and made a new local high at the level of $7,212. Nevertheless, the overall rally has failed to continue and market has made a red Pin Bar candlestick pattern after the breakout. The rally was short-lived and currently the Bitcoin price has returned to the main channel area and is again trading below the red zone. If the bearish pressure will intensify, then the price might move even lower towards the technical support located at $6,568 or even towards the level of $6,271. Weekly Pivot Points: WR3 - $7,805 WR2 - $7,343 WR1 - $6,514 Weekly Pivot - $6,022 WS1 - $5,217 WS2 - $4,764 WS3 - $3,965 Trading Recommendations: The fear of the coronavirus consequences is very strong among the global investors and it rules on the financial markets. So far the global investors are not so keen to invest in Bitcoin and treat BTC as a digital gold. The larger time frame trend remains down and as long as the level of $10,791 is not violated, all rallies will be treated as a counter-trend corrective moves. This is why the short positions are now more preferred.

|

| AUD/USD. Bulls held a strategically important position, despite the hype around China Posted: 02 Apr 2020 11:20 PM PDT The Australian dollar reached a local high at 0.6215 against the US currency, but failed to gain a foothold within the 62nd figure. However, the aussie continues to stay above the key 0.6000 mark, despite the overall strengthening of the greenback. It is worth noting that the Australian dollar now reacts mainly to the external fundamental background – internal statistics play a secondary role. Therefore, the further dynamics of the AUD/USD pair will depend on the news flow from China and the behavior of the US currency. It took two weeks for the aussie to go from an 18-year low of 0.5510 to a local high of 0.6215. A fairly strong 700-point growth was primarily due to the decline in the excitement around the dollar (after the corresponding actions of the Federal Reserve) and positive news from China. Representatives of Beijing at the end of March said that they had coped with the coronavirus and were returning to normal life – including in the industrial sphere. Almost 99% of China's main industrial enterprises have restored their normal production cycle, about 80% of the industry's employees have returned to their jobs, and work has resumed on major investment projects, from airport expansion to gas pipelines. At least, that's what Chinese officials say. Against this background, the Australian dollar regained its position, since it's economy is largely dependent on China. Therefore, despite the increase in the number of Covid-19 cases both in Australia and around the world, the AUD/USD pair was steadily going up, reaching the 62nd figure on the last day of March. But the further growth of the aussie has stalled – again because of China. This week, the world community doubted that everything in China is as good as their official representatives say. For example, the Chinese publication Caixin (whose employees conduct their own investigative journalism) reported that the real situation is different from the picture shown in the state media. According to their data, a number of lower-and middle-level officials "strongly recommend" that companies embellish their recovery indicators. Some firms and factories were allegedly told to consume more energy and turn on non-working equipment so that central authorities could not expose the trickery of grassroots officials by comparing data on electricity consumption. In addition, measures aimed at preventing another surge of coronavirus have been introduced at actual operating enterprises. These restrictive measures have added to the inherent difficulties in China's manufacturing sector. As if in addition to the publication of Caixin, Bloomberg recently published information that official Chinese data on the number of infected and died as a result of the coronavirus pandemic are falsified. According to Bloomberg journalists, this conclusion is contained in a secret report of US intelligence, which was submitted to the White House. However, the journalists' sources did not provide any additional information about this report. But they also clarified that China significantly underestimated the statistics on infected and dead people. At the same time, according to experts, the real picture of the epidemic in China is very important for modeling the spread of Covid-19 worldwide, as well as for evaluating the effectiveness of measures to combat it. That is, if the Bloomberg information is true, then all the forecast constructions that were modeled earlier will be useless. In the wake of such publications, anti-risk sentiment increased in the market, and the dollar index was able to return above the 100-point mark. The AUD/USD pair retreated to the bottom of the 60th figure. But it should be emphasized here that the bears could not overcome the 0.6000 mark and did not even try to test the 59th figure. The excitement around the dollar decreased during the Asian session on Friday, allowing the AUDUSD bulls to move away from the strategically important price boundary. By the way, the US currency was lucky yesterday - thanks to the hype around China, the failed statistics from the US remained in the shadows. However, the fact remains that the number of applications for unemployment benefits in the United States increased by six million, with a forecast growth of up to three million. Such dynamics have not been observed in the entire history of observations. Actually, this is why it is difficult for the dollar to develop a full-scale rally, especially against the background of the dollar liquidity provided by the Federal Reserve. In addition, today China has responded quite sharply to the US reproaches about hiding the true consequences of the new coronavirus. Beijing has denied the charges, calling them "a blatant attempt to put political interests above human life." Chinese officials also denied information that appeared yesterday about a new outbreak of coronavirus in the country. According to official data, only 35 new cases were registered in China on the first day of April. In other words, the hype around China will probably come to naught in the near future, unless some new data is published that indicates that the PRC is hiding the real figures for the epidemic. Otherwise (and this is most likely) today, the market's attention will again switch to macroeconomic indicators, and to be more precise – to US Non-Farms. On the one hand, traders are prepared for the fact that almost all components of today's release will come out in negative territory. But if they turn out to be worse than expected, the dollar could come under pressure across the entire spectrum of the market. Thus, traders of the AUD/USD pair should consider long positions to the nearest resistance level of 0.6101 (the average line of the Bollinger Bands indicator on the daily chart). The next goal of the upward movement corresponds to the local high, that is, the 0.6215 level. The material has been provided by InstaForex Company - www.instaforex.com |

| Technical Analysis of EUR/USD for 03/04/2020: Posted: 02 Apr 2020 11:18 PM PDT Technical Market Outlook: The EUR/USD has retraced 61% of the last short-lived corrective wave up and is trading around the level of 1.0830. The bears are still trying to push the rate even lower, so another wave down towards the next technical support at the level of 1.0778 is possible.The USD dollar keeps appreciate across the board as the global coronavirus pandemic continues, so the EUR down move is favored. The market conditions are starting to become oversold, but it is not a time for a serious bounce yet. Please notice, that the larger time frame trend remains down and all the moves up will be treated as a local counter-trend corrections during the down trend. Weekly Pivot Points: WR3 - 1.1885 WR2 - 1.1507 WR1 - 1.1380 Weekly Pivot - 1.1006 WS1 - 1.0876 WS2 - 1.0484 WS3 - 1.0325 Trading Recommendations: The fear of the coronavirus consequences is very strong among the global investors and it rules on the financial markets. ON the EUR/USD pair the main trend is down, but the reversal is possible when the coronavirus pandemic will be tamed. The key long-term technical support is seen at the level of 1.0336 and the key long-term technical resistance is seen at the level of 1.1540. Only if one of this levels is clearly violated, the main trend might reverse (1.1540) or accelerate (1.0336).

|

| Technical Analysis of GBP/USD for 03/04/2020: Posted: 02 Apr 2020 11:08 PM PDT Technical Market Outlook: Not much has changed since yesterday as GBP/USD pair is still hovering just below the 61% Fibonacci retracement located at the level of 1.2516 despite the overbought market conditions. The bulls were rejected from that level and the price went down towards the nearest technical support located at the level of 1.2308. Since then, the market is trading slowly in a narrow horizontal range. There is still no indication of a local up trend reversal and the momentum is still strong and positive. The next technical support is seen at the level of 1.2199, so there is a room for bears. Please notice, that the larger time frame trend remains down and all the moves up will be treated as a local counter-trend corrections during the down trend. Weekly Pivot Points: WR3 - 1.3952 WR2 - 1.3223 WR1 - 1.2933 Weekly Pivot - 1.2180 WS1 - 1.1877 WS2 - 1.1101 WS3 - 1.0804 Trading Recommendations: The fear of the coronavirus consequences is very strong among the global investors and it rules on the financial markets. On the GBP/USD pair the main trend is down, but the reversal is possible when the coronavirus pandemic will be tamed. The key long-term technical support has been recently violated (1.1983) and the new one is seen at the level of 1.1404. The key long-term technical resistance is seen at the level of 1.3518. Only if one of this levels is clearly violated, the main trend might reverse (1.3518) or accelerate (1.1404).

|

| Trading plan for EUR/USD on April 3, 2020 Posted: 02 Apr 2020 10:59 PM PDT

Yesterday, the report on the applications for unemployment benefits in the US came out, which showed a huge increase of 6.6 million. This is a huge anti-record after the crisis in 2008-09. To aid the citizens and businesses in the country, the US government has already implemented a huge package of assistance worth $ 2 trillion, and is ready to accept new assistance packages. Today, at 13:30 London time, the US employment report for the month of March will come out. However, by the time of its release, the report will probably be very outdated already and will not show the real picture. In addition, at 15:00 London time, ISM's report on the service sector will be released, where a strong decline on the index is expected. News on oil: Trump mediated between Russia and OPEC, saying that it is necessary to reduce oil production to 10 million barrels per day to stabilize the oil market. As a result, oil rebounded sharply from the lows on Thursday, with rising sharply to +40%.

OPEC is preparing an emergency meeting after Trump's statements and his talks with Saudi Arabia and Russia. Update on the coronavirus: Once again, there's a huge increase in the number of infected people in the US. The increase is more than +30 thousand people per day, so the country now has 245,000 confirmed COVID-19 cases. Deaths increase by +968 per day, so the total number of deaths at the moment is 6,000. In Spain, the number of infected people increases by +8000 per day, while deaths increase by +960. The total number of deaths now is 10,000. Spain is catching up with Italy in the number of deaths. The death rate in France and Britain is 550. Using my method (method M) though, I think that there's an underestimation of at least 2 times in the number of deaths in both countries. Nevertheless, the situation in other European countries is better In Russia: New data on the number of infected will be released after 10:00 London time. A sharp increase of +30% in both Moscow and Russia is expected (in Moscow, there's an increase of +600 infected per day). Putin also declared the days until April 20 as non-working. However, unlike in developed countries, the government in Russia will not provide financial assistance to citizens and small businesses (the most affected by the quarantine) directly. The burden of paying salaries during non-working days is completely put on the business. Only state employees (including security officers), pensioners, and employees of vital industries are protected because they are allowed to work. EUR/USD: Despite the negative news on the US, we do not see any movement dynamics. We are ready to buy euros from 1.1040 We are ready to sell euros from 1.0635 The material has been provided by InstaForex Company - www.instaforex.com |

| USD/CHF approaching resistance, potential drop! Posted: 02 Apr 2020 10:25 PM PDT

Trading Recommendation Entry: 0.97458 Reason for Entry: Horizontal pullback resistance, 61.8% Fibonacci retracement Take Profit : 0.94878 Reason for Take Profit: 61.8% Fibonacci retracement, horizontal swing low support, 61.8% fibonacci extension Stop Loss: 0.98661 Reason for Stop loss: Horizontal swing high resistance, 88.6% fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Apr 2020 10:05 PM PDT 4-hour timeframe

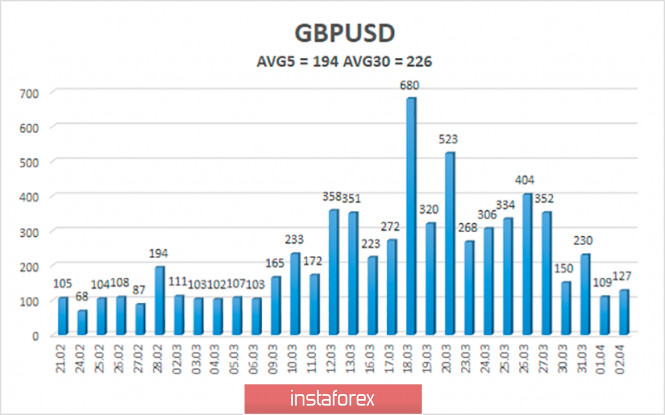

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - upward. CCI: 1.0981 The GBP/USD currency pair is trading this week as simply and clearly as possible. Despite the fact that volatility remains quite high (more than 100 points per day), its current size is not in any way comparable to what it was just two or three weeks ago, when the pair regularly passed more than three hundred points. However, this week, the pair worked out the Murray level of "3/8"-1.2451 as part of the correction after a one-and-a-half thousandth fall and stopped. The level of 1.2451 was worked out at least three times, and each time the pound/dollar pair bounced off it, while not starting a logical downward correction in this case, at least to the moving average. Thus, in fact, we now have an absolute flat, within which you can only trade on small timeframes between the upper and lower border of the side channel. On a 4-hour timeframe, we recommend waiting for the end of the flat and the resumption of the upward movement or the beginning of the downward movement. Macroeconomic statistics, as we have already found out in the article on EUR/USD and in yesterday's final article, do not play any role for market participants. However, we still can not pass by the macroeconomic reports scheduled for Friday, as this is, in any case, important data that market participants will take into account when opening their positions in the future. Today, on April 3, the UK will publish the index of business activity in the service sector for March, which is likely to fall in comparison with February to a value of 34.8. As in the case of Germany and the European Union, the British index has never fallen to such low value in the past 12 years. But in 2008, there was a time when it also fell down, though then "only" to the value of 40. In the United States, macroeconomic statistics will be much more interesting and expected. First, we will know the unemployment rate for March, which, according to various forecasts, will grow from 3.5% to 3.8%-4.0%. The report on changes in average wages in March is the least attractive of the entire package of statistics and has the most neutral forecast – 3% in annual terms and 0.2% in monthly terms. But the Nonfarm Payrolls indicator for March is preparing to become the second most important indicator after applications for unemployment benefits. No matter what Steven Mnuchin says, when the number of applications for benefits increases by 6.5 million in two weeks, the report from ADP on the number of people employed in the private sector falls below zero (for only the second time since the 2008 crisis), it is impossible to turn a blind eye to what is happening. And we can't expect any positive report on NonFarm Payments either. According to experts\' forecasts, the number of new jobs created outside the US agricultural sector may fall from -100 to -150 thousand. The last time such Nonfarm cuts were made was during the mortgage crisis. As the "cherry on the cake" in the States, business activity indices in the service sector will be published according to the Markit and ISM versions. The first may decrease to 39.1 from the current 49.4, and the second – from 57.3 to 43.0-44.0. Thus, the entire package of macroeconomic statistics from overseas is projected to significantly deteriorate compared to February. The key question is: will this information be ignored by market participants? The EUR/USD currency pair has a better chance to "react". The pair is in motion. The pound stands still. But unfortunately, the "coronavirus" epidemic is not standing still, which continues to spread around the world and, in particular, in Britain, taking with it more and more victims. In the UK, the highest daily death rate was recorded yesterday – 393 people. In total, almost 3,000 people died from the epidemic in the Foggy Albion. Meanwhile, even in the economically developed UK, there is a banal lack of artificial ventilation devices. According to the new recommendations of the British Medical Association, doctors can decide which patient to give preference to and provide treatment with deficient devices. Fortunately, such situations have not yet occurred, but given the doctor's expectations for a further increase in the number of infected, these problems may arise. "Medical professionals may be forced to refuse treatment to some patients in order to provide treatment to others with a higher chance of survival." It is also reported that Britain is going to increase the number of daily tests for "coronavirus" to 25,000 in the next two weeks. And the last thing I would like to tell you. At the end of April 2, the price of all oil brands, including WTI and Brent, jumped. At the moment, WTI rose to almost $27.5 per barrel with a daily low of $20.75. Brent from a low of $25.49 rose to $36.16 per barrel, but then again fell below $30. Nevertheless, there are chances for a recovery in oil prices, which is good news for all markets. From a technical point of view, to resume the upward trend, you still need to wait for the overcoming of the Murray level of "3/8"-1.2451 or a distinct correction. Both linear regression channels are directed downward, so a downward trend is preferable. However, given the fact that these channels turned down during the panic in the currency market, their values can not be considered completely reliable. Well, the moving average line may soon reach the price itself and turn sideways, which will also indicate a sideways movement of the pair.

The average volatility of the GBP/USD pair continues to decline. At the moment, the average value for the last five days is 194 points. However, the activity of traders on the pound/dollar pair still remains quite high, which should be taken into account when opening any positions. On Friday, April 3, we expect movement within the channel, limited by the levels of 1.2170 and 1.2558. Although now there is a frank flat with much narrower borders of the channel. Nearest support levels: S1 - 1.2207 S2 - 1.1963 S3 - 1.1719 Nearest resistance levels: R1 - 1.2451 R2 - 1.2695 R3 - 1.2939 Trading recommendations: The GBP/USD pair on a 4-hour timeframe retains the prospects of an upward movement. Thus, buy orders for the pound with targets of 1.2558 and 1.2695 remain relevant now. It is recommended to open new buy positions if the bulls overcome the level of 1.2451, which now stops further northward movement. It is recommended to sell the British currency with the goal of 1.1963 if the bears manage to gain a foothold below the moving average. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Apr 2020 10:04 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - downward. CCI: -197.5158 For the EUR/USD pair, the last trading day of the week begins with a continuing downward movement, which may very soon end. We believe that the euro currency is now simply correcting against the correction against the strongest fall between March 9 and 20. Thus, the entire current downward movement can end near the level of 1.0830, which is equal to 61.8% of the previous upward movement. Following the example of the pound, the euro can also go flat, since there are no new reasons for active trading among market participants at the moment. The volatility of the EUR/USD pair has decreased to about 120-130 points per day,which is still quite high. However, this is less than it was a couple of weeks ago. Thus, we still believe that when trading, we should first take into account technical factors that are still in favor of continuing the downward movement. Around the level of 1.0830, we recommend considering the option of turning the price up. However, if the Heiken Ashi indicator does not turn up or there is no eloquent rebound from any Murray level, then we do not recommend shorting short positions ahead of time. Yesterday showed that market participants do not pay any attention to macroeconomic statistics. It is clear that this will not always be the case. The time will come when trading on the currency market will be fully adjusted and will return to its usual course. But now we do not expect this until the markets have completely calmed down, volatility will fall to normal values of about 60 points per day, and the pair may spend some time in a narrow side channel. Only after that, when the situation on the currency market stabilizes, we can expect that macroeconomic reports will again play at least some significance for traders. However, this scenario also implies that there will be no new shocks to the US stock market in the near future, that the "coronavirus" epidemic will be overcome, if not overcome, then at least stop the growth rate of its spread, and oil prices will begin to rise. The situation with the pandemic is now a key negative factor for the global economy. The more cases there are around the world, the longer the quarantine lasts, the more the economy of each state will suffer, and the longer each economy will recover... Meanwhile, today, Ursula von der Leyen, the President of the European Commission, announced a proposal to attract 100 billion euros in the second package of stimulus measures for the EU economy. It is expected that 100 billion euros will be used to help businesses and save jobs. This money will be issued as loans to EU member states, which, in turn, will send it to pay employees for the hours they could not work due to the "coronavirus" pandemic. There will also be support for both freelancers and private entrepreneurs. "During the "coronavirus" crisis, only strong measures can help. We must use all available means. Every euro available in the EU budget will be used to solve the crisis, and every rule will be simplified to ensure quick and efficient financing. We are mobilizing 100 billion euros to save people their jobs. We join forces with the alliance's member states to save lives and protect livelihoods. This is European solidarity," von der Leyen said on Thursday, April 2. In addition to helping businesses and employees, the European Commission is going to raise an additional 3 billion euros from the current EU budget and use this money to purchase personal protective equipment and finance mobile field hospitals. At the same time, members of the European Parliament agreed to hold an extraordinary plenary session to discuss actions aimed at combating the spread of the "coronavirus". The meeting will be attended by representatives of the European Council and the European Commission, and a vote will be held on all proposed measures to counter the epidemic. US Treasury Secretary Steven Mnuchin commented on the latest reports on applications for unemployment benefits in the US, one of which was published yesterday. According to Mnuchin, these reports are not indicative, since they reflect the state of things in the US economy, which was before the 2-trillion stimulus package was agreed. Mnuchin said that the package of assistance to the American economy will "work" only for three weeks and then, companies that were previously forced to reduce their staff due to the epidemic will re-hire employees. A large number of macroeconomic publications are planned for the last trading day of the week. In the European Union, as well as separately in Germany, Spain, Italy, France and Britain, data on business activity, services and composite indices will be published. Forecasts for this area look terrifying. If the manufacturing sector of all EU countries remained afloat with the arrival of the epidemic, the service sector has almost completely stopped due to quarantine measures. Business activity in the EU services sector is expected to be at 28.4, while Germany's is expected to be at 34.3. Over the past 12 years, neither in the European Union nor in Germany, business activity indicators for the service sector have decreased so low. The European Union will also publish data on retail sales in February. The forecast is +1.7% in annual terms and +0.1% in monthly terms. However, we consider these data to be absolutely insignificant for the market. Most likely, both this report and reports on business activity, despite their "anti-record", will be completely ignored by traders. Also today, many interesting reports will be published in the US, which will be analyzed in detail in the article on GBP/USD. From a technical point of view, while the downward movement continues. And there are no signals for its completion. The fact that the panic has subsided slightly in recent days should not mislead market participants. It is quite possible that there will be not only a "second wave" of the epidemic, but also a "second wave" of panic in the markets. In the European Union, a total of more than 400 thousand citizens are infected. Quarantine measures are being extended and tightened. The total number of cases worldwide is approaching one million. And this is only official data. In one way or another, the government of every country in the world admits that the real number of cases is much higher, and the peak of the epidemic has not yet passed.

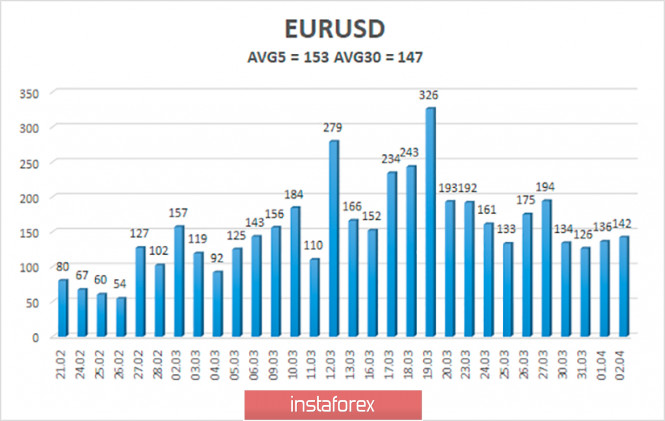

The volatility of the euro/dollar currency pair remains at fairly high values. As of April 3, the value of the indicator is 153 points and in the last ten days, the volatility does not exceed 200 points per day. We believe that the markets continue to return to normal and this is a very good sign for traders. Today, we expect a further decrease in volatility and price movement between the levels of 1.0673 and 1.0979. Turning the Heiken Ashi indicator upward will signal a round of upward correction. Nearest support levels: S1 - 1.0742 S2 - 1.0620 S3 - 1.0498 Nearest resistance levels: R1 - 1.0864 R2 - 1.0986 R3 - 1.1108 Trading recommendations: The EUR/USD pair continues its downward movement. Thus, traders are now recommended to stay in the sales of the euro with the targets of 1.0742 and 1.0673, until the Heiken Ashi turns up. It is recommended to buy the euro only after the reverse consolidation of traders above the moving average line with the first target of the Murray level of "3/8"-1.1108. Increased caution is still recommended when opening any positions, as volatility is still high. The material has been provided by InstaForex Company - www.instaforex.com |

| Elliott wave analysis of EUR/GBP for April 3, 2020 Posted: 02 Apr 2020 10:03 PM PDT

The corrective decline in wave iv continued lower to the 61.8% corrective target at 0.8747 as expected. This likely marks the completion of wave iv, but we need a break above minor resistance at 0.8818 and more importantly a break above resistance at 0.8867 to confirm that wave iv has completed and wave v towards our ideal target at 0.9742 is developing. As long as minor resistance at 0.8818 is able to cap the upside, we still could see a final spike to just below 0.8747, but the downside should be very limited from here. R3: 0.8867 R2: 0.8818 R1: 0.8784 Pivot: 0.8773 S1: 0.8747 S2: 0.8715 S3: 0.8682 Trading recommendation: We bought EUR at 0.8760 and we have placed our stop at 0.8700. The material has been provided by InstaForex Company - www.instaforex.com |

| Elliott wave analysis of GBP/JPY for April 3, 2020 Posted: 02 Apr 2020 09:56 PM PDT

Short-term support at 132.72 continues to act as a barrier keeping the corrective rally in wave iv alive for a possible final spike to just above 134.72. However, a clear break below the 132.72 support will indicate wave iv has completed and a break below support at 132.10 will confirm wave has completed and wave v to below 123.99 is unfolding. So we remain in a wait and see situation, whether a final spike is needed in wave iv or wave v is ready to unfold. R3: 135.50 R2: 135.05 R1: 134.72 Pivot: 134.40 S1: 133.45 S2: 132.70 S3: 132.10 Trading recommendation: WE are short GBP from 134.45 with our stop placed at 135.45 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Apr 2020 09:35 PM PDT To open long positions on GBP/USD, you need: Nothing has changed from a technical point of view. Bulls attempted to grow above the upper limit of the side channel, but failed to break it, which only led to moving this level to the 1.2475 area. Now trading is conducted in the middle of the channel, and I do not recommend taking any actions from there. While the pair is above the 1.2315 area, we can expect continued growth of GBP/USD in the resistance area of 1.2475, the breakout of which will provide a direct path to the highs of 1.2605 and 1.2686, where I recommend taking profits. However, given that the report on the index of activity in the UK services sector is coming out today, which is likely to significantly slow down, we can expect a second correction of the pound to the support of 1.2315. However, I recommend opening long positions from it only after forming a false breakout. It is best to wait for the test of the low of 1.2150, or buy immediately for a rebound from the level of 1.1985. To open short positions on GBP/USD, you need: Sellers of the pound have already approached the support of 1.2315 four times, but they have not managed to break below this range. Bears need to try to return the market under their control, and to do this, it is necessary to consolidate below the 1.2315 level, which will lead to a larger sell-off of GBP/USD to the area of the lows of 1.2150 and 1.1985, where I recommend taking profits. This can be helped by today's data on the index for the UK service sector, which will be sharply reduced due to the spread of the coronavirus pandemic. The 1.1985 support test will also indicate the resumption of the bear market. If the bulls try to regain the upward trend, the formation of a false breakout in the resistance area of 1.2475 will be the first signal to open short positions. Otherwise, it is best to sell the pound on a rebound from the highs of 1.2605 and 1.2686. Signals of indicators: Moving averages Trade is conducted in the region of 30 and 50 moving average, which indicates the lateral nature of the market. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differs from the general definition of the classic daily moving averages on the daily chart D1. Bollinger bands A break of the upper boundary of the indicator at 1.2460 will lead to a larger growth of the pound. Breakout of the lower boundary in the region of 1.2330 will raise the pressure on the pair. Description of indicators

|

| Posted: 02 Apr 2020 09:31 PM PDT To open long positions on EURUSD, you need: If you look at the 5-minute chart, you can clearly see a breakout with a consolidation below the support level of 1.0880, which I have repeatedly drawn attention to in my reviews. Consolidating below this area yesterday in the afternoon caused the euro to fall after disappointing weekly data on the US labor market. Today we expect a more important report from the Non Farm Employment Change, as well as an indicator on the unemployment rate, which is likely to grow. This situation can maintain the demand for the US dollar. As for buying euros, I do not recommend rushing them. The initial task of the bulls will be to regain the resistance of 1.0880, just above which the moving averages pass. Consolidating on this range will allow you to think about continuing the upward correction against the background of profit taking by bears, with a likely test of the high of 1.0955, where I recommend consolidating profits. If the pressure on EUR/USD persists in the first half of the day after the reports on the services sector index of the eurozone, it is best to return to long positions only after updating the low of 1.0790, provided that a false breakout is formed, or immediately on the rebound from the larger support of 1.0718. To open short positions on EURUSD you need: Bears yesterday coped with the task and settled below 1.0880, which led to another sell-off of the euro. Today, sellers will actively protect this range, and the next formation of a false breakout on it will be a signal to sell EUR/USD in the hope of further pulling down the pair to the lower boundary of the descending channel and updating the weekly lows with a support test of 1.0790. However, more persistent sellers will expect a test of the 1.0718 level, where I recommend taking profits at the end of the week. In case the pair grows above the resistance of 1.0880 in the first half of the day after the data on the composite PMI index of the eurozone, which, of course, is unlikely, sellers should not be upset. You can safely look at short positions for a rebound from the major resistance of 1.0955, as reports on the state of the US labor market will once again return negative sentiment to the market. Signals of indicators: Moving averages Trade is conducted below 30 and 50 moving averages, which indicates a further decline in the euro in the short term. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differs from the general definition of the classic daily moving averages on the daily chart D1. Bollinger bands A break of the lower boundary of the indicator in the region of 1.0800 will raise pressure on the euro. Growth will be limited by the upper level of the indicator at 1.0920. Description of indicators

|

| Forecast for EUR/USD on April 3, 2020 Posted: 02 Apr 2020 08:24 PM PDT EUR/USD Weekly data on applications for unemployment benefits in the United States was published on Thursday. The data from the Ministry of Labor was a failure: 6,648 million against the forecast of 3,600 million and 3,307 million a week earlier, revised up from 3,283 million. Markets, however, calmly accepted such indicators – on the one hand, investors have already acquired immunity and understanding of employment data, on the other hand, the US trade balance for February showed an improvement from -45.5 billion dollars to -39.9 billion – the best indicator since October 2015. On the third hand, any bad data only spurs investors' flight from risk and increases demand for dollars. In this light, the dollar will continue to strengthen today, no matter how the unemployment data comes out; conditionally good indicators will show the best state of the US economy during the G7 pandemic, bad data will also support the demand for a better currency. The forecast for Non-Farm Employment Change is -100,000, unemployment is projected to grow from 3.5% to 3.8%. The euro's fall from yesterday reached the Fibonacci level of 23.6% (daily chart). The next goal at 0.0625 opens – support for the embedded price channel line. The price struggles with the support of the MACD line on the four-hour chart. Success, that is, when the price leaves the area below yesterday's low of 1.0821, then becomes a signal to open short positions. S/L above 1.0870. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for GBP/USD on April 3, 2020 Posted: 02 Apr 2020 08:22 PM PDT GBP/USD The British pound has been moving sideways for five sessions along the 138.2% Fibonacci line. The short-term price drop on March 31 does not break the overall picture. If the price goes out of the range, it will trigger a further increase in the price to the Fibonacci levels of 123.6% and 110.0% - to the prices of 1.2540 and 1.2645, respectively. The resistance of the second target is boosted by the approaching MACD line. The targets of the downward movement are the Fibonacci levels of 161.8% and 200.0% at the price levels of 1.2235 and 1.1935. We will highlight the signal levels on a smaller scale chart. These are: 1.2484 - March 27 peak and 1.2329 - April 1 low. Accordingly, at the moment of overcoming the price of 1.2484, purchases with goals up to 1.2645 are possible, with overcoming the price of 1.2329, it is advised to open sales with the goal of 1.1935. The intermediate target is 1.2030, which the MACD line is aiming for. If the price reverses from this level, it is advisable to close a short position. |

| Forecast for AUD/USD on April 3, 2020 Posted: 02 Apr 2020 08:22 PM PDT AUD/USD The price consolidated under the Fibonacci level on the daily chart on Thursday, by the end of the day the aussie fell by 11 points. The indicators have not changed, the 0.5834 target along the price channel is preserved. On the four-hour chart, the price with the last eight candles shows steady development under the red indicator line of balance, which indicates the stability of the market sentiment to continue to decline. The intermediate goal of the Australian dollar on the way to the goal of 0.5834 is the MACD line at around 0.5950. Either there will be some rebound in the price upwards from this line, or the price will overcome it with force and continue to decline. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for USD/JPY on April 3, 2020 Posted: 02 Apr 2020 08:21 PM PDT USD/JPY The quote of the USD/JPY currency pair crossed the upper limit of the range of two lines of the price channel of 107.00-107.83 yesterday . This opens the immediate growth target of 108.75 - the resistance of the MACD line on the daily chart. The signal line of the Marlin oscillator is on the zero line (actually a little higher, but in the current context it does not matter), the price is still held by the resistance of the balance indicator line. And now, after the price left the uncertain range of 107.00-107.83, the price entered another uncertain range of 107.83-108.75. In general, as long as the price is in the 107.00-108.75 range, uncertainty will remain and directly from a practical point of view, the non-trading situation may persist for several more days. The price exit under the lower limit of the range (107.00) opens the prospect of a decline to 102.60. The price exit above 108.75 still does not open the prospect of growth, since there are resistance on the lower-level chart. This resistance is the MACD line at 109.70 on the four-hour chart. At the moment, the price is under the red indicator line of the balance, the Marlin oscillator is in the growth zone, which only confirms uncertainty in the indicated price ranges. The material has been provided by InstaForex Company - www.instaforex.com |

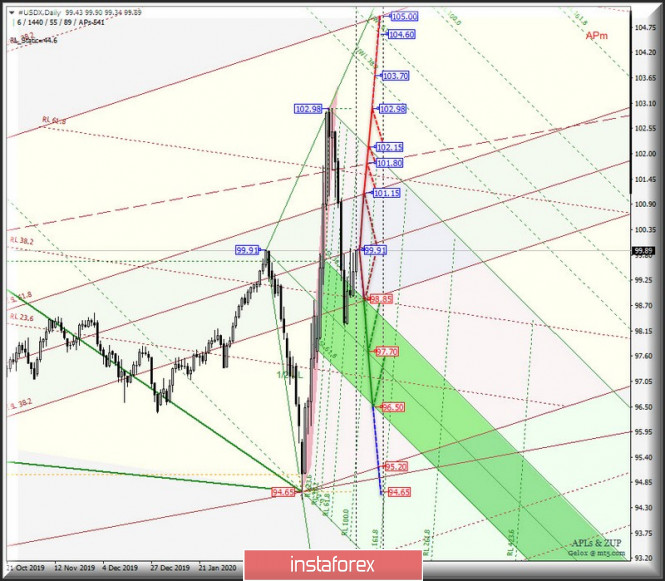

| Posted: 02 Apr 2020 04:39 PM PDT Let's pay attention to the situation with the dollar index and the options for the development of the movement of the main cross-instruments #USDX vs EUR/GBP & GBP/JPY & EUR/JPY (DAILY) on April 03, 2020. Minor operational scale (daily time frame) ____________________ US dollar index Starting April 3, 2020, the movement of the USD index index #USDX will continue to develop within the equilibrium zone (98.85 - 99.91 - 101.15) of the Minor operational scale. The details of working out the above levels are presented in the animated chart. In case of breakdown of the upper boundary ISL61.8 (resistance level of 101.15) of the equilibrium zone of the Minor operational scale forks, the upward movement of the dollar index will become possible to goals: - ultimate Schiff Line Minor (101.80); - Starting line SSL Minuette (102.15); - maximum 102.98. On the contrary, in case of breakdown of the lower boundary of the ISL38.2 (support level of 98.85) equilibrium zone of the Minor operational scale forks, it will be confirmed that further development of the #USDX movement will proceed in the equilibrium zone (98.85 - 97.770 - 96.50) of the Minuette operational scale forks with the prospect of reaching the SSL initial line (95.20) of the Minor operational scale forks. The details of #USDX movement options from April 03, 2020 is shown on the animated chart.

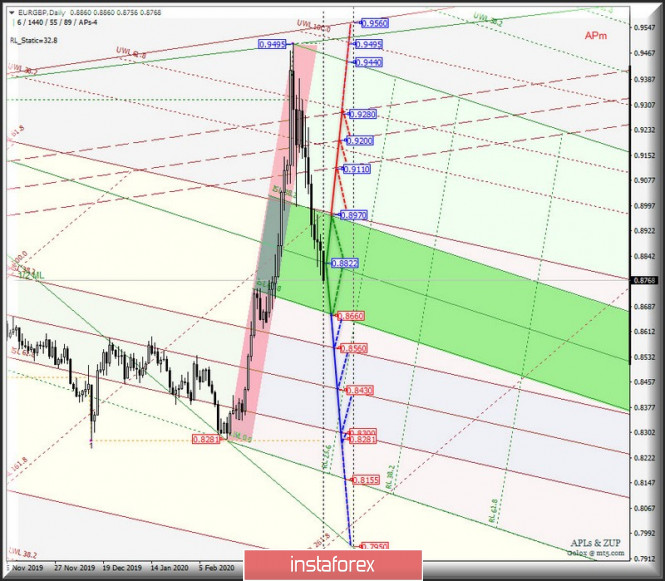

____________________ Euro vs Great Britain pound The development of the movement of the "main" cross-instrument EUR / GBP on April 3, 2020 will be determined by the development and direction of the breakdown of the boundaries of the equilibrium zone (0.8660 - 0.8822 - 0.8970) of the Minuette operational scale forks. The details are shown in the animated chart. In case of breakdown of the lower boundary of the ISL61.8 (support level of 0.8660) equilibrium zone of the Minuette operational scale forks, the downward movement of this cross-instrument can be continued to the boundaries of the equilibrium zone (0.8560 - 0.8430 - 0.8300) of the Minor operational scale forks. Meanwhile, the breakdown of the resistance level of 0.8970 at the upper boundary of ISL61.8 of the equilibrium zone of the Minuette operational scale forks will lead to the resumption of the upward movement of EUR / GBP to the boundaries of the 1/2 Median Line channel (0.9110 - 0.9200 - 0.9280) of the Minuette operational scale forks. The movement options of EUR / GBP from April 03, 2020, depending on the development of the 1/2 Median Line Minuette channel, are shown on the animated chart.

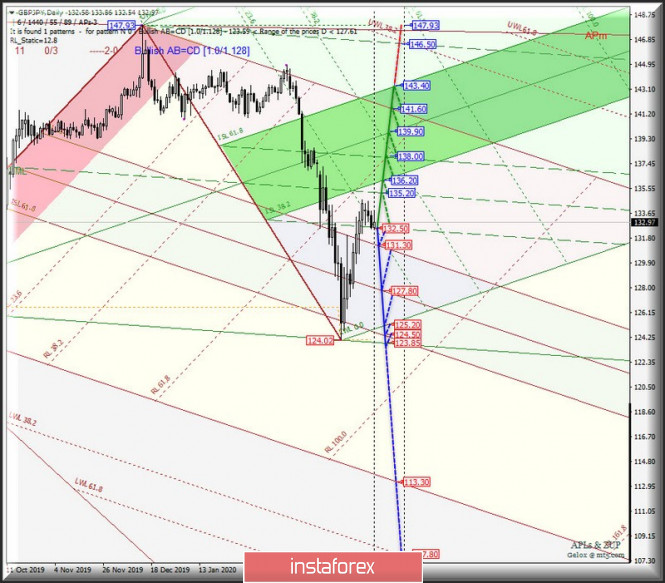

____________________ Great Britain Pound vs Japanese Yen The development of the GBP / JPY cross-instrument movement from April 3, 2020 will be determined by the development and direction of the breakdown of the boundaries of 1/2 Median Line channel (132.50 - 135.20 - 138.00) of the Minuette operational scale forks. The details of the movement marking in this channel is shown on the animated chart. In case of a breakdown of the lower boundary (support level of 132.50) of the 1/2 Median Line channel of the Minuette operational scale forks, then the movement of the cross-instrument will be directed to the boundaries of the equilibrium zone (131.30 - 127.80 - 124.50) of the Minor operational scale forks. Alternatively, the breakdown of the upper boundary (resistance level of 138.00) of the 1/2 Median Line Minuette channel will confirm the further development of the GBP / JPY movement in the equilibrium zone (136.20 - 139.90 - 143.40) of the Minuette operational scale forks. The markup of the GBP / JPY movement options from April 03, 2020 is shown on the animated chart.

____________________ Euro vs Japanese Yen The direction of breakdown and testing the range:

will determine the development of the movement of the cross-instrument EUR / JPY from April 03, 2020. Updating the local minimum (support level of 116.10) followed by the breakdown of the lower boundary of the 1/2 Median Line channel (115.84) of the Minor operational scale forks will send the downward movement EUR / JPY to warning line LWL38.2 Minor (112.50). At the same time, with the joint breakdown of the resistance level of 116.70 and 1/2 Median Line Minor (117.10), the upward movement of this cross-instrument will become possible to be directed to the upper boundary of the 1/2 Median Line channel (118.40) of the Minor operational scale forks, as well as to the boundaries of the 1/2 Median Line channel (118.80 - 119.60 - 120.40) of the Minuette operational scale forks. The markup of the EUR / JPY movement options from April 03, 2020 is shown on the animated chart.

____________________ The review was compiled without taking into account the news background. Thus, the opening trading sessions of major financial centers does not serve as a guide to action (placing orders "sell" or "buy"). The formula for calculating the dollar index : USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of the currencies in the basket: Euro - 57.6% ; Yen - 13.6% ; Pound Sterling - 11.9% ; Canadian dollar - 9.1%; Swedish krona - 4.2%; Swiss franc - 3.6%. The first coefficient in the formula leads the index to 100 at the starting date - March 1973, when the main currencies began to be freely quoted relative to e The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. Panic returns: China statistics scandal and new Covid-19 outbreak Posted: 02 Apr 2020 02:04 PM PDT The dollar is strengthening throughout the market despite the unthinkable increase in the number of applications for unemployment benefits in the US. The dollar index again exceeded the 100-point mark, reflecting increased demand. The focus of traders' attention is still on the news flow regarding the spread of the coronavirus. However, today market participants looked at this problem from a slightly different angle, taking into account the resonant publication of Bloomberg. Although the information released is not official (in fact, it is just unconfirmed rumors), the panic in the financial markets has increased again. The key beneficiary of this situation was the US dollar - concerned investors returned to the greenback, creating a stir around this currency. US press recently released information that the official Chinese data on the number of infected and died as a result of the coronavirus pandemic are falsified. According to reporters from Bloomberg, this conclusion is contained in a secret report by US intelligence, which was presented to the White House. However, the sources of journalists did not provide any additional information about this report. But at the same time, they clarified that China significantly underestimated the statistics on infected and dead. It is also worth noting here that a few days before the above publication, the Chinese economic journal Caixin, which is engaged in investigative journalism, also doubted the official statistics. According to their information, funeral homes in Wuhan recently received an unusually large number of funeral urns. Trucks delivered 5,000 ballot boxes to just one of seven funeral homes last week, and there are queues to receive the ashes of loved ones. According to journalists, this may indicate a significantly higher mortality rate as a result of the pandemic. According to some estimates, the actual number of deaths may exceed 40,000, while the official figure is 3.3 thousand deaths. At first glance, there is no reason to panic, since the alleged statistics concern only China. But, according to experts, the real picture of the development of the epidemic in China is very important for modeling the spread of Covid-19 around the world, as well as for assessing the effectiveness of measures to combat it. If the published information is confirmed, all predictive designs that were modeled earlier will collapse. Let me remind you that the Chinese authorities officially reported 82,000 cases of infection and 3,300 deaths (with a population of 1.3 billion people), while the United States currently identified more than 200,000 infected, of which more than 4,000 died (with a population in 320 million people). Official Beijing has not yet commented on Bloomberg news. But the situation was answered by a Mosal of China in France: in an interview with BFMTV, he denied the manipulation of statistics. According to him, we are talking about "normal mortality", not related to the coronavirus - he said that the urns with ashes ceased to be issued on January 23, so now that the restrictive measures in this regard have been lifted, queues have appeared in funeral homes. However, panic in the foreign exchange market began to intensify not only due to the resonant publication of Bloomberg. Today it also became known that an outbreak of Covid-19 was recorded in China again: 1,600 new cases of infection were registered there per day. So far, China has managed to contain the disease, but today the Chinese have officially reported a worsening situation. Meanwhile, the total number of people infected in the world is approaching the millionth mark. If this morning this indicator was at the level of 930,000, then at the moment it has exceeded the 980,000 mark. Obviously, tomorrow this sad indicator will cross the millionth threshold. This fact may provide additional support to the dollar, which again performs the duties of the main defensive instrument. Speaking directly about the EUR/USD pair, in the wake of the anti-risk sentiment, the bears were able to overcome the support level of 1.0890 (the lower boundary of the Kumo cloud, which coincides with the Tenkan-sen line on the daily chart), opening the way for an intermediate, psychologically important price barrier of 1,0800. The main support level is the price of 1.0750 (the lower line of the Bollinger Bands indicator on the weekly chart), but for now it is advisable to open short positions to the base of the eighth figure. In the area of the price target of 1.0800, the downward impulse may lose its strength, so you need to be careful with sales. It is also worth noting that if the bears do not enter the eighth figure, the pair is unlikely to remain at such price bottoms - with a high degree of probability correction will follow at least to the boundary of the ninth figure (with a stronger correctional impulse - to today's high, that is, to around 1.0963). It is also worth noting that the dollar today completely ignored the crushing data on the growth in the number of applications for unemployment benefits. Last week, this release shocked the markets, as it was at a three-million mark. Today it surprised even more: with a forecast of growth of up to 3,500,000, the indicator jumped to six million, again updating the historical record. But a surge of anti-risk sentiment offset a negative reaction regarding this release. If panic does not subside by tomorrow, the US currency will ignore Nonfarms, no matter how bad it will be. In this case, the EUR/USD pair can really end the week on a minor note, that is, in the middle of the seventh figure. The material has been provided by InstaForex Company - www.instaforex.com |

| April 2, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 02 Apr 2020 10:33 AM PDT

Since December 30, the EURUSD pair has trended-down within the depicted bearish channel until few weeks ago, when a new low around 1.0790 was recently established where the EUR/USD pair looked OVERSOLD after such extensive bearish decline. On February 20, recent signs of bullish recovery were demonstrated around 1.0790 leading to the recent steep bullish movement towards 1.1000, 1.1175, 1.1360 and finally 1.1480 where a (123) bearish reversal pattern was initiated around. This turned the short-term technical outlook for the EURUSD pair into bearish when bearish persistence below the Keyzone of 1.1235 was maintained on a daily basis. Moreover, the mentioned intermediate-term bearish Head & Shoulders pattern has achieved all of its projection target levels. Earlier last week, the EURUSD pair has expressed significant bullish recovery around 1.1065 The recent bullish engulfing H4 candlesticks as well as the recently-demonstrated ascending bottoms indicated a high probability bullish pullback at least towards 1.0980 and 1.1075 (Fibonacci Level 50%). Key Supply-Levels in confluence with significant Fibonacci levels are located around 1.1075 (50% Fibonacci) and 1.1175 (61.8% Fibonacci) where bearish rejection was highly-expected. Moreover, a Head & Shoulders reversal pattern was being demonstrated around the price levels of 1.1075. The pattern neckline existed near the key-level around 1.1000. Further bearish movement is being demonstrated towards 1.0850 shortly after the neckline of the reversal pattern was breached to the downside. The nearest demand level to be considered is located near the backside of the broken channel around 1.0850-1.0820 where bullish rejection may exist soon. Trade recommendations : Intraday traders can wait for more bearish pullback towards the mentioned demand-zone around 1.0820-1.0850 and look for any bullish rejection signs as a valid BUY signal for a short-term trade. S/L to be placed below 1.0780 while Initial T/P level to be located around 1.0920 and 1.1000. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment