It was just a tweet, a harmless tweet from President Trump that sent oil prices skyrocketing nearly $7 off the low of the day.

| You're receiving this email because you are subscribed to Trading Tips,

if you no longer wish to receive these emails you can unsubscribe here. |  |  |  | |

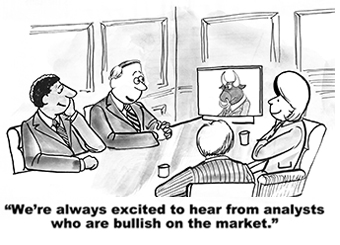

|  |  Good morning. It was just a tweet, a harmless tweet from President Trump that sent oil prices skyrocketing nearly $7 off the low of the day. It's just representative of the powder keg we currently live on when news can cause amazingly bullish or bearish swings in a moment. Good morning. It was just a tweet, a harmless tweet from President Trump that sent oil prices skyrocketing nearly $7 off the low of the day. It's just representative of the powder keg we currently live on when news can cause amazingly bullish or bearish swings in a moment.

While the "joyous" news became more muted when more details came out about Saudi Arabia's need to see all nations cut production. While it's unlikely to get done, it did provide a little support under the market when it looked like we were slipping again. | |  | |  |  |  |  | Look who's going bankrupt next in America |  |  |  No one believed Porter Stansberry years ago when he said the world's largest mortgage bankers (Fannie Mae and Freddie Mac) would soon go bankrupt. No one believed Porter Stansberry years ago when he said the world's largest mortgage bankers (Fannie Mae and Freddie Mac) would soon go bankrupt.

And no one believed him when he said GM would fall apart… or that the same would happen to General Growth Properties (America's biggest mall owner)… or that oil would fall from over $100 per barrel to less than $40 a barrel.

But in each case, that's exactly what happened.

And now, Stansberry says something new and even bigger is quietly unfolding in America (watch his video clip here)

Don't get left behind. Get the facts for yourself here. | |  |

|  |  |  | DOW 21.413.441 | +2.24% |  | |  | S&P 2,526.90 | +2.28% |  | |  | NASDAQ 7,487.31 | +1.72% |  | |  | | *As of market close |  | | • | Stocks rose 2.28% yesterday, as stocks rallied along with oil. |  | | • | Oil prices rose 21.81%, on Trump's Tweet about Saudi and Russia production cuts. |  | | • | Gold prices rose 2%, on news that Russia will stop it's gold purchases to help supply. |  | | • | Cryptocurrencies traded higher, with Bitcoin finished 9.18% higher closing at $6780. | |  | | | |

|  | | 3 High Yielding Dividend Aristocrats to Buy Now but With Protection |  |  |  | This isn't an easy time to buy stocks for the long haul. There is significant risk of formerly consistent dividend payers of cutting the dividend.

Dividend Aristocrats are S&P 500 companies that have paid and increased their dividend for 25 consecutive years. That would seem to be a strong track record to count on, but we are in uncharted territory. This is how to use options to cap your risk and collect the dividend.

» FULL STORY |  | | |  |

|  | Option Traders Eyeing Inflation Risk from COVID-19 Stimulus |  |  |  | When discussion of multiple trillion-dollar stimulus efforts are either being implemented of being discussed, it makes you wonder how long it will be until the inflationary effects start to be felt.

One way to reflect inflation expectations is looking at the spread between normal U.S. Treasuries and Treasury Inflation Protected Securities (TIPS). Option traders are making their move in order to capitalize on generally rising U.S. Treasury prices and a widening spread between TIPS and standard Treasuries.

» FULL STORY |  | | |  |

|  | Bill Ackman's Pershing Square Made this Stock Top the List with Most Shares Bought in Last Two Weeks |  |  |  | The Howard Hughes Corporation (HHC) announced a 10 million share private placement with Pershing Square International Ltd that increased its holdings from 2 million to 12 million shares.

That investment was followed by a call from Bill Ackman to President Trump to work on the passage of the biggest-ever infrastructure spending bill. Of course, that places HHC in a great place as one of the nation's largest real estate development companies in the U.S.

» FULL STORY |  | | |  |

|  |  | | TOP |  | | OXY | 18.901% |  |  | | APA | 16.667% |  |  | | FANG | 15.876% |  |  | | HP | 14.817% |  |  | | DVN | 14.728% |  |  | | BOTTOM |  | | LVV | 12.68% |  |  | | SCLH | 12.042% |  |  | | MAC | 9.874% |  |  | | KSS | 9.505% |  |  | | CCL | 9.432% |  |  | |  |

|  |  |  | | The question is not will markets come into balance, the question is will it be done in a strategic and thoughtful way, or done in a reactive way once all the storage fills up |  | - Ryan Sitton, Texas Oil Regulator, quoted by Bloomberg.  |  |

|  | Are you about to get left behind? |  |  |  All across America, people are losing hope… All across America, people are losing hope…

You've noticed all the angry political rhetoric, which is getting even more heated than usual these days.

But here's the thing…

There's a reason so many Americans are losing hope – and also losing their sense of independence and their dignity.

There's a reason so many people are turning to the failed plans of socialism.

It's because most Americans are being left behind… in a way we've never, ever seen before.

And now… Porter Stansberry has come forward to explain what is REALLY going on… and what you can do about it.

Fair warning: Some of what Porter has to say is not even close to "politically correct."

But if you care about your financial future get the facts for yourself and heed Porter's urgent recommendations. | |  |

|

No comments:

Post a Comment