Forex analysis review |

- Overview of the GBP/USD pair. May 15. The split is maturing not only in the European Union. In the UK, Wales, Scotland, and

- Overview of the EUR/USD pair. May 15. Donald Trump may end all relations with China. The Chinese economy is beginning to

- Hot forecast and intraday trading signals for the GBP/USD pair for May 15. COT report. Bears crossed the significant zone

- Hot forecast and intraday trading signals for the EUR/USD pair for May 15. COT report. US dollar may continue to grow, but

- EUR/USD. "Attempt Number. ...". Bears trying to gain a foothold in the seventh figure

- Comprehensive analysis of movement options for EUR/GBP, GBP/JPY, and EUR/JPY (H4) on May 15, 2020

- May 14, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- May 14, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- EURUSD: Relations between the US and China continue to deteriorate very quickly. The bottom of the decline in economic activity

- EUR / USD: dollar performs well, while euro continues to struggle

- EURUSD moves lower following yesterday's bearish price action

- GBP/USD: plan for the US session on May 14 (analysis of morning deals). Bears continue to sell the pound, but bulls are trying

- EUR/USD: plan for the US session on May 14 (analysis of morning deals). A chance for the euro's growth remains, as buyers

- Short-term technical analysis of Gold for May 14, 2020.

- Evening review for May 14, 2020

- BTC analysis for May 14, 2020 - Strong resistance at the price of $10.000 is on the test. Watch for potential downside rotation

- Analysis on EUR / USD and GBP / USD for May 14, 2020

- Analysis for Gold for May 14,.2020 - Breakout of the symmetrical tirangle is very possible. Watch for buying opportunities

- EUR/USD analysis for May 14, 2020 - Rejection of the strong support level at 1.0770, watch for buying opportunities...

- USD/RUB is more dependent on external background than on internal factors

- Technical Analysis of AUD/USD for May 14, 2020

- New Zealand dollar collapsed

- Trading recommendations for the EUR/USD pair on May 14, 2020

- Market review. Trading ideas. Q&A

- Powell warns of a long recession in the US

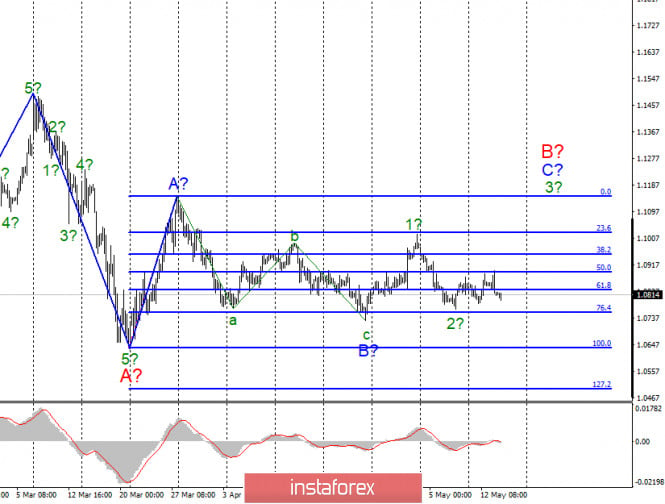

| Posted: 14 May 2020 05:17 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - downward. CCI: -120.8191 The British pound is trading lower for the fifth day in a row and has come close to the lowest possible border of the side channel. Thus, we still expect a rebound from the level of 1.2165 with the resumption of the upward movement to the Murray level of "7/8"-1.2634. At the same time, the downward movement in recent days is very confident, so it is possible to overcome the level of 1.2165, which will allow the pair to continue moving south in the medium term. The position of the British pound again raises serious concerns, as the UK economy is experiencing much more serious problems than the US or European. Entering the CCI indicator in the area below the "-200" mark will be a strong signal for the end of the downward movement. The macroeconomic background of yesterday was expressed only in one report on applications for unemployment benefits in the United States. We have already written about it in the article on the euro/dollar. Traders ignored this report or considered it optimistic, although it was complicated to do so. Thus, the US currency continued to appreciate, despite 36.5 million initial applications for unemployment benefits over the past 8 weeks. At the same time, experts began to pay attention to the looming constitutional crisis and the split in the UK itself (previously, we have repeatedly reported on the possible split of the European Union and the exit of Italy or Germany). For example, the UK officially started easing quarantine measures on May 13. This was stated personally by Boris Johnson. However, the governments of Northern Ireland, Scotland, and Wales did not listen to London and extended the quarantines until May 28. Also, the British Prime Minister allowed citizens to travel by car, but the borders inside the UK are closed, which means that only the British will move freely and only within England. This "disobedience" of Ireland, Scotland, and Wales is not disobedience to the will of London since these states were able to make independent decisions in the field of health 20 years ago. However, the very refusal to follow the recommendations of Boris Johnson eloquently expresses the position of defiant states. And it is expressed by the fact that everyone except England, for the most part, did not want to leave the European Union. Scotland is determined to hold a second independence referendum in the last 6 years just to leave the UK and return to the EU. Wales, Northern Ireland and Scotland do not support Boris Johnson and his "hard" Brexit initiatives in principle. And everything is going to him at the moment, since the probability of signing an agreement with the European Union is negligible, as is the extension of the "transition period". There is also no deal yet with the US, although a few months ago both Boris Johnson and Donald Trump were chanting about a "Grand trade agreement." It is clear that now is not the most favorable time for trade negotiations. But for Britain, these deals are vital, although Boris Johnson's government pretends they are not. Also yesterday, it was reported that the Ministry of Finance of the UK believes that the economy will face a severe recession shortly. In principle, this is not news. A similar statement was made a day earlier by the head of the Federal Reserve, Jerome Powell. The market also received information about a secret document for the British government about the economic consequences of the "coronavirus" epidemic. According to this document, under the mildest scenario of a pandemic, the crisis creates a budget deficit of 340 billion pounds. In the worst-case scenario (longer-term epidemics, a second wave, a new outbreak), losses will amount to more than 500 billion, which is almost half of the UK budget. Thus, the Kingdom has found a perfect time to leave the European Union. It is clear that in 2016, no one could have imagined that such a serious pandemic would happen in 2020. However, the British government, by all accounts, as well as the American government, failed to prepare for the epidemic. The number of infections and deaths is the highest in Europe. And the economic losses of the United Kingdom will complement the set of financial losses from the "divorce" with the European Union. And after 7 months, the British economy will begin to suffer from the lack of trade agreements with the EU and will start trading with the countries of the Alliance under the rules of the WTO. If Britain continued to stay in the EU, it could count on the help of other states, on the ECB's programs to stimulate the economy, but it pompously left the EU and now can only count on itself. This means that these 340 or 500 billion pounds will have to be taken out of their own pockets by taxpayers sooner or later. Boris Johnson and his Cabinet can borrow these funds, but in any case, ordinary British people will have to pay. Thus, the Conservative Party in December last year won a historic election victory, which allowed Boris Johnson to practically single-handedly run the country in the next election, could suffer the same crushing defeat if taxes increase and British living standards fall. No important macroeconomic statistics are scheduled in the UK for Friday, May 15. Therefore, traders will only pay attention to American statistics. However, we still believe that macroeconomic data have very little impact. Quietly and imperceptibly, the pound/dollar pair approached the minimum from April 7 and worked it out perfectly (1.2165-1.2165). Now it remains to be seen whether the bears will be able to overcome this level because if so, the pair can start forming a new downward trend. The side channel, as we have said more than once, has an extremely blurred lower border, but its minimum value, in any case, is not lower than the level of 1.2165. Therefore, this level is now the key to the prospects of the British currency. If the price rebounds from this level, the pair may again rush to the upper border of the side channel, where it has been since March 30.

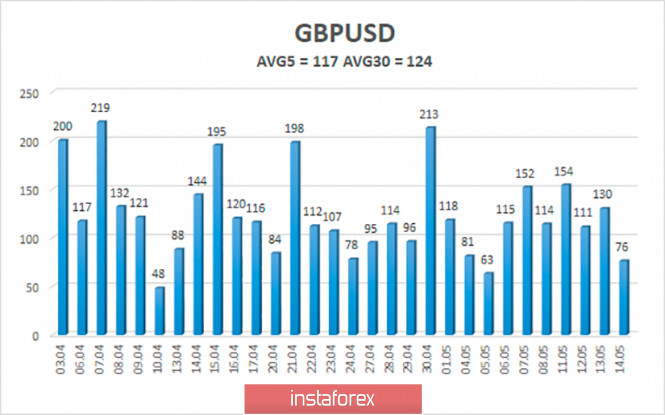

The average volatility of the GBP/USD pair remains stable and currently stands at 117 points. On Friday, May 15, we expect movement within the channel, limited by the levels of 1.2078 and 1.2312. A reversal of the Heiken Ashi indicator upward will indicate a new round of upward movement. Nearest support levels: S1 – 1.2146 S2 – 1.2085 Nearest resistance levels: R1 – 1.2207 R2 – 1.2268 R3 – 1.2329 Trading recommendations: The GBP/USD pair continues its downward movement on the 4-hour timeframe. Thus, formally, sell orders with the goals of 1.2146 and 1.2085 remain relevant now, but the downward momentum may dry up around the mark of 1.2165, so we recommend that you be careful with opening sell positions until this level is overcome. It is recommended to buy the pound/dollar not before fixing the price back above the moving average with the first goals of 1.2390 and 1.2451. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 14 May 2020 05:17 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - sideways. Moving average (20; smoothed) - sideways. CCI: -158.2454 On Friday, May 15, the EUR/USD currency pair starts with a continuation of the downward movement within the side channel. However, the pair's movements for several days in a row do not resemble movements between the borders of the channel with a width of 250 points, but "swings" in the range of 120 points. The pair's quotes are once again approaching the lower line of the channel near the Murray level of "0/8"-1.0742, however, there is also a minimum from April 6 – 1.0768, from which the pair has already bounced several times. Also, traders should take into account the possible flat channel of 1.0777-1.0897. Thus, there are several strong support levels located at the bottom, which must be overcome to continue the downward movement. Yesterday was interesting for traders only because of one macroeconomic report. In the United States, another report on applications for unemployment benefits was published, which showed another increase of several million (3 million). Thus, over the past 8 weeks, a total of 36.5 million Americans have filed initial applications for benefits. Many experts believe that the indicator of secondary applications for benefits more accurately reflects the current unemployment rate. According to this indicator, as of May 1, the total number of repeat applications is 22.833 million (the forecast was 25.1 million). Thus, if we look at the second indicator, it turned out to be even better than the forecasts, but when we are talking about 25-35 million people who lost their jobs in just two months, we can hardly say that the indicator is "optimistic" or "positive". Rather, the expression "not as bad as expected" is appropriate. Meanwhile, passions between China and the US continue to heat up. It is difficult to say who is to blame in this situation, however, it is from the United States that information continues to arrive daily that Washington may impose sanctions, may start a new trade war, may completely terminate business relations with Beijing. Yes, it was the last phrase that was uttered not later than yesterday, from the American President Donald Trump. "We could do a lot of things. We could have ended the relationship completely. If you did, what would happen? You would save $ 500 billion," Donald Trump said during another interview. Also, the American President again stressed that he is very disappointed in China because of the situation with the "coronavirus". "I made a great trade deal with China. But then (in January) no one understood anything. I am very disappointed in China. We have a lot of information and some of it is unfavorable. Whether the virus came from the lab or bats, it was still spreading from China, and they had to stop it. They had to stop it at the source of distribution," Trump summed up. The US President also commented on the bill, which was presented by Senator Lindsey Graham, which implies the introduction of sanctions and restrictions on China if within 60 days Beijing does not provide a full report on what happened in Wuhan. Trump said: "I will be ready to consider this bill." Also, the media got information that China is very dissatisfied with the United States and is preparing to respond with "painful countermeasures" if Washington still imposes sanctions. However, by "painful countermeasures", Beijing still understands only sanctions against several members of the US government and several American organizations. There is no talk of imposing proportionate sanctions yet. However, at the same time, we are all used to the fact that official Beijing is extremely taciturn and rarely "responds" to Washington. At the same time, there is no doubt that if the entire list of measures from the "Graham law" is applied, then China will respond with mirror measures. In general, the world is on the threshold of new trade and economic confrontation, which may cause an additional blow to the economy, which has not yet recovered but continues to decline due to the COVID-2019 epidemic. In general, the situation is heating up and now everything will depend on the American leader. If it believes that China is to blame and imposes sanctions/duties/restrictions against it, the world will see a new confrontation between the two giants. And since the coronavirus crisis is not over yet, a new Beijing-Washington conflict could further slow the global economic recovery. The question is, does this make sense for Donald Trump and the US? From our point of view, it makes sense for Trump, but not for the United States. The American President needs to win the presidential race this November and, as a true businessman, he will do everything possible to get ahead of Joe Biden. Trump needs to make China look guilty, cover up their own mistakes and miscalculations. And then everything will depend on American voters. If they believe that Trump is not to blame for the current crisis, for more than 80,000 deaths from the pandemic, and in principle want this conflicted and odious leader to rule the country, then he will be re-elected. If not, then Trump is still not risking anything. He needs to go all-in, and that's probably what he'll do. Several macroeconomic publications are planned for today. And we will not start with the EU or the US, but with China. Industrial production in China by the end of April may grow by 1.5% in annual terms, which will mean the beginning of the recovery of the Chinese economy. Thus, now the gap between the United States and China will begin to widen and not in favor of Washington. In China, the epidemic was localized very quickly and with relatively small losses. Now the Chinese economy is starting to recover. In Europe and the US, this is not even a dream yet. In Germany, GDP for the first quarter will be published today, which will decline by 2.2% compared to the fourth quarter of the previous year according to experts' forecasts. However, this is only a preliminary value. The EU will also release GDP for the first quarter in an inconclusive estimate, which may be -3.8% q/q and -3.3% y/y. From overseas, data will be received on retail sales for April (forecast -10% m/m), as well as on industrial production for April (-11.5% m/m). The Michigan Institute's consumer confidence index will continue to decline in May and reach 68. Thus, both European and American statistics are likely to disappoint traders equally, so neither the dollar nor the euro currency will have a fundamental advantage.

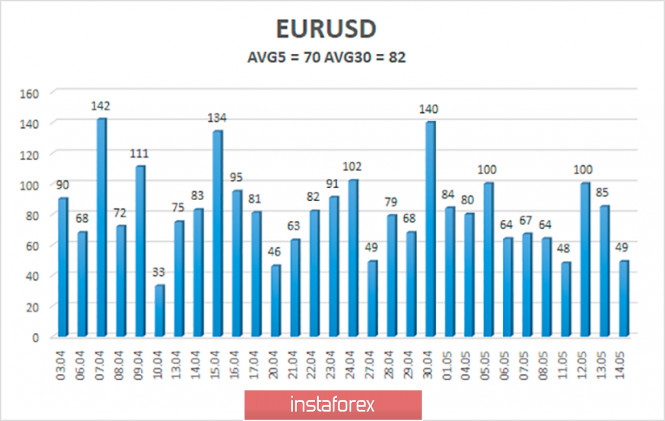

The average volatility of the euro/dollar currency pair as of May 15 is 70 points. Thus, the value of the indicator remains stable and is characterized as "average". Today, we expect quotes to move between the levels of 1.0711 and 1.0851. The upward turn of the Heiken Ashi indicator may signal a new round of upward movement within the 1.0750-1.1000 channel but within the 1.0777-1.0897 channel. Nearest support levels: S1 – 1.0742 S2 – 1.0681 S3 – 1.0620 Nearest resistance levels: R1 – 1.0803 R2 – 1.0864 R3 – 1.0925 Trading recommendations: The EUR/USD pair continues to be located below the moving average, so short positions are formally relevant at the moment. However, we are increasingly inclined to believe that the pair is flat. Thus, it is best to start trading down if the lower limits of both side channels (1.0777 and 1.0750) are overcome. The goals, in this case, are the levels of 1.0711 and 1.0681. It is also recommended to consider buying the euro/dollar pair after the quotes exit from the side channel, that is, above 1.0897 with the goal of the Murray level of "4/8"-1.0986. The material has been provided by InstaForex Company - www.instaforex.com |

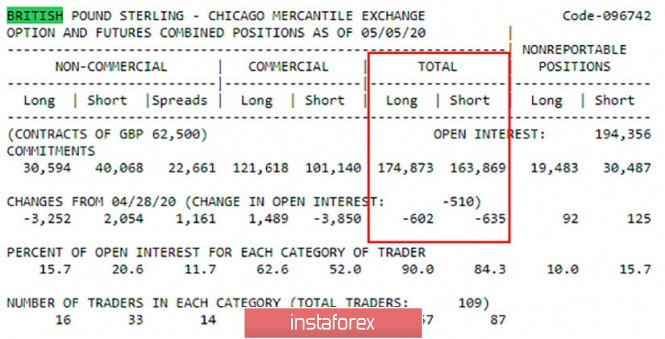

| Posted: 14 May 2020 05:11 PM PDT GBP/USD 1H The downward movement continued on the hourly chart for the pound/dollar pair on May 14. The day before yesterday, the price reached the support area of 1.2198 - 1.2216, which formed on April 3-7 and, thus, there was a question of overcoming this area. We managed to overcome it, but the bears did not succeed in continuing their downward movement below the support level of 1.2164. It is also worth recalling that 1.2165 is the April 7 low, so there is a chance of a rebound from this level with the start of the upward movement. Despite the certain probability of a reversal around the specified level, before overcoming the downward trend, we do not recommend considering the option with a change in trend as the main one. The downward trend is also supported by the downward channel. GBP/USD 15M. We have two linear regression channels on the 15-minute timeframe, which are also directed downwards and signal a downward trend. The CCI indicator entering the "-200" area was a signal to turn up. However, there was no rebound from the 1.2198-1.2216 area on the hourly timeframe, and the price low at which the CCI signal was formed was overcome with forming a divergence. Thus, the divergence indicated that the signal is false, and the downward movement is still ongoing. COT report. The latest COT report for May 5 shows that the total number of buy and sell transactions among large traders decreased by 1200 per week. Thus, the general mood has not changed and remains "moderately upward" despite the fact that the pound was cheaper in the last few days. However, the pound is getting cheaper in the short term, and COT reports published once a week are more relevant to the long term. The calendar of macroeconomic events in the UK on May 15 is empty. Thus, traders will only have to observe US statistics, which, admittedly, disappoints as well as in other countries, but does not force market participants to refuse new purchases of the US dollar. Thus, today's reports on industrial production and retail sales can be ignored. So far, the dollar feels absolutely carefree, especially against the pound sterling, since the British economy is experiencing much more serious problems than the US or the eurozone. And this is not just because of the coronavirus pandemic and the crisis it caused. We have two main options for the development of the event on May 15: 1) The initiative for the pound/dollar pair is still in the hands of the bears, as the price continues to be located inside three descending channels at once and with the support of the downward trend line. Thus, we recommend buying the British pound no earlier than overcoming the trend line on the hourly chart with the first goal of the Kijun-sen line - 1.2314. If the bulls manage to overcome this line (and at the same time exit the descending channel), it is recommended to leave the longs open for the Senkou Span B line - 1.2453. Take Profit will be around 60 points in the first case and 200 points in the second. 2) Sellers will be able to continue moving down if they manage to overcome 1.2165. Then we recommend opening new sales or maintaining existing ones while aiming for 1.2062. In this case, Take Profit will be about 90 points. The material has been provided by InstaForex Company - www.instaforex.com |

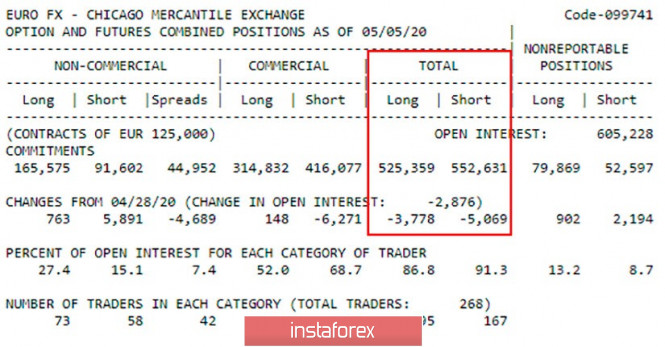

| Posted: 14 May 2020 05:03 PM PDT EUR/USD 1H The EUR/USD pair tried to gain a foothold below the long-term upward trend line on the hourly timeframe yesterday, however, the attempt again failed. After that, the bears slightly loosened their grip and the pair rolled up, however, it was also impossible to go above the downward trend line (less long-term, and besides, it was already overcome by traders). As a result, traders were caught in a very narrow price range. It seems that today one of the two trend lines will be overcome, which will show the trend for the pair in the coming days. Bears still need to overcome the area of 1.0763 - 1.0775 so that the US currency continues to rise in price. EUR/USD 15M. We see mixed trading on May 14th on the 15-minute timeframe. After forming a signal to complete the downward movement of the CCI indicator (entering the area below the "-200" mark), the pair began to grow, but by the end of the day it again returned to the lows of the day, failing to overcome them. Thus, chances for the euro's growth remain, and quite good, given the stubborn inability of the bears to overcome the trend line on the hourly timeframe. Both channels of linear regression are directed downward, which clearly indicates a downward trend in the context of several days. COT report. The latest COT report of May 5 showed a decrease in the number of transactions for purchase among large traders by 3,778 and a decrease in the number of transactions for sale by 5.069. Thus, the downward mood slightly weakened for the euro. But, since the total number of sales contracts exceeds the number of purchase contracts, the overall trend still remains downward. As we have repeatedly said in fundamental reviews, the entire macroeconomic background is now ignored by market participants. At least yesterday, the US dollar was not prevented from resuming growth by the failed report on applications for unemployment benefits. Today, we are waiting for failed reports on the GDP of the eurozone and Germany in the first quarter and no less failed reports on US retail sales and industrial production in April. Given the fact that macroeconomic data will be on both sides, we believe that they will not have a big impact on the pair's movement during the day. However, the overall technical picture, suggesting another rebound from the area of 1.0763 - 1.0775 and the trend line, can help the euro. Based on the foregoing, we have two trading ideas for May 15: 1) A further drop in the quotes of the pair will be possible only after overcoming the area of 1.0763 - 1.0775. In this case, the immediate goal will be the support level of 1.0745, however it is located very close. In any case, you can open shorts when overcoming a trend line. But the goal would be better if you consider the support level of 1.0651. The potential to take profit is about 100 points. 2) The second option - bullish - suggests another rebound from the long-term upward trend line. We recommend buying the pair only if the price consolidates above the Kijun-sen line (1.0835). In this case, you should trade for an increase with a goal of 1.0893 (Senkou Span B line). The potential to take profit in executing this scenario will be around 55 points. Bulls are hardly capable of anything more now. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. "Attempt Number. ...". Bears trying to gain a foothold in the seventh figure Posted: 14 May 2020 12:12 PM PDT So, the next blitzkrieg of the bulls of the EUR/USD pair failed: after several attempts, the buyers could not gain a foothold above the 1.0880 mark and, all the more, enter the ninth figure. Surrendering under the onslaught of various fundamental factors, the bulls lost control of the situation, after which the bears quickly seized the initiative. Their task is to gain a foothold in the area of the seventh figure, which in the current conditions is also very problematic. In other words, the pair is still within the wide-range flat - only now at the lower boundary of the price range 1.0750-1.0900. For the second week, traders have been trading in the 150-point range, testing the upper or lower border of the specified range. But the contradictory information flow does not allow either bulls or bears to escape from it in order to develop, respectively, the upward or downward trend. Let me remind you that at the beginning of this week the pair showed growth due to the general weakening of the dollar, which, in turn, responded to negative macroeconomic reports. April Nonfarms confirmed the catastrophic situation in the labor market, while inflation indicators (CPI and producer price index) reminded traders of a significant decline in US consumer activity. Key economic indicators have gone deep into the negative area, scaring investors with their dynamics. Against the backdrop of such statistics on the market, they started talking about the fact that the Federal Reserve may decide to introduce negative rates. The fact of a wide discussion of this scenario put significant pressure on the greenback. Even the Fed members who commented on these rumors indirectly weighed on the dollar - they say, if this topic was discussed at such a level, then the likelihood of this scenario still exists, because "there is no smoke without fire". Nevertheless, Fed Chairman Jerome Powell reassured traders yesterday, thereby supporting the dollar bulls. He categorically rejected the idea of introducing negative rates, saying that the Fed has other methods of influencing the economy in its arsenal. In addition, he urged congressmen not to put off the bill on an additional assistance package, the total amount of which exceeds the trillion mark. Although Powell actually announced further steps to ease monetary policy (excluding a rate cut below zero), traders received his speech positively, after which the dollar recovered throughout the market. The Fed chief offset fears about a negative rate, and secondly, publicly supported the idea of additional assistance from Congress. The fact is that we are talking about an initiative of the Democrats, which was perceived "with hostility" by the Republicans. And since the same party members of Trump (who is preparing to be re-elected in November for a second term) control the Senate, the chances of passing this bill, at least in its current form, are quite small. Therefore, traders reacted positively to Powell's "agitation" – although, in my opinion, he could not and will not change the political situation around this legislative initiative. Today, dollar bulls have strengthened their positions, but for a different reason. Anti-risk sentiment has increased in the market amid reports of a second wave of coronavirus. These assumptions are (so far) hypothetical, but the market has taken them seriously. The starting point here is a warning from the European center for disease prevention and control. According to the experts of this department, EU member states should prepare for the second wave of infections, using all possible means to improve their surveillance systems for the epidemiological situation. In this case, a relapse may occur even if the first wave was "correctly taken under control". A message appeared on the background of repeated disease outbreaks in South Korea, Saudi Arabia, Singapore and even China. It is worth noting that key European countries have just started to come out of quarantine, reviving economic processes, so such news provoked if not panic, then serious concern among traders. Thus, the bears received a reason to break the price range of 1.0750-1.0900 in order, firstly, to settle in the seventh figure, and secondly, to identify new price horizons (the next level of support is mark 1, 0636 is the low of this year as well as the previous three years). But so far, sellers have not even approached the lower limit of this range. Therefore, from current values, you can open short positions to around 1.0750. There is a more risky option for the medium term - a long position to the level of 1.0850 (the middle line of the Bollinger Bands indicator on the daily chart) with a mandatory stop loss of 1.0750. The material has been provided by InstaForex Company - www.instaforex.com |

| Comprehensive analysis of movement options for EUR/GBP, GBP/JPY, and EUR/JPY (H4) on May 15, 2020 Posted: 14 May 2020 10:59 AM PDT Minuette operational scale (H4) The second half of May in the development of the movement of the main cross-tools EUR/GBP, GBP/JPY, and EUR/JPY (H4). ____________________ Euro vs Great Britain pound The development of the movement of the "main" cross-instrument EUR/GBP from May 15, 2020 will be determined by the development and direction of the breakdown of the range:

In the event of the breakdown of the final Shiff Line Minuette - the support level of 0.8845 - the development of the downward movement of the "main" cross-instrument will be directed to the borders of the 1/2 Median Line (0.8777-0.8752-0.8730) of the Minuette operational scale forks. The breakout of ISL38.2 Minuette - the resistance level of 0.8875 - will determine the development of the EUR/GBP movement in the equilibrium zone (0.8875-0.8910-0.8940) of the Minuette operational scale forks. The options for the EUR/GBP movement from May 15, 2020, depending on the working out of the above range, are shown on the animated chart.

____________________ Great Britain pound vs Japanese yen The development of the movement of the GBP/JPY cross-instrument from May 15, 2020 will be due to the development and direction of the breakdown of the 1/2 Median Line channel boundaries (129.90-130.30-130.70) of the Minuette operational scale forks - see the animated chart for the details of the movement inside the channel. Breakdown of the upper border of the channel 1/2 Median Line in the operating scale minuette - resistance level 130.70 - a variant of the upward movement of GBP/JPY to the goals:

If the lower border of the 1/2 medium Line channel is broken, the Minuette operational scale forks - the support level of 129.90 - will continue to develop the downward movement of GBP/JPY towards the goals: lower border of the channel 1/2 Median Line (129.50) of the operating scale fork Minuette; equilibrium zone (129.10 - 128.55 - 128.00) of the operating scale fork Minuette; SSL Minute start line (126.95). From May 15, 2020, we look at the GBP/JPY movement options on the animated chart.

____________________ Euro vs Japanese yen Range development and breakdown direction:

And it will determine the development of the EUR/JPY cross-instrument movement from May 15, 2020. The breakdown of the initial line SSL of the operational scale fork Minuette - resistance 115.90 - variant development of the upward movement of EUR/JPY to the borders of the channel 1/2 Median Line (116.50 - 117.15 - 117.77) fork operational scale Minute. If the support level of 115.45 breaks down at the upper border of the 1/2 medium Line Minuette channel together with ISL38.2 Minuette (115.20), the development of the EUR/JPY movement will occur within the borders of the 1/2ML Minuette channel (115.45-115.05-114.70) and balance zones of the Minuette operational scale fork (115.20-114.40-113.65) and Minuette (114.05-113.40-112.75). The markup of the EUR/JPY movement options from May 15, 2020 is shown on the animate chart.

____________________ The review is compiled without taking into account the news background, the opening of trading sessions of the main financial centers and is not a guide to action (placing "sell" or "buy" orders). The material has been provided by InstaForex Company - www.instaforex.com |

| May 14, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 14 May 2020 09:23 AM PDT

Intermediate-term Technical outlook for the GBP/USD pair remains bullish as long as bullish persistence is maintained above 1.1890-1.1900 (Double-Bottom Neckline) on the H4 Charts. Recently, Bullish persistence above 1.2265 has enhanced another bullish movement up to the price levels of 1.2520-1.2590 where significant bearish rejection as well as a quick bearish decline were previously demonstrated (In the period between 14th - 21 April). Currently, Atypical Bearish Head & Shoulders reversal pattern may be in progress. The pair was recently demonstrating the right Shoulder of the pattern. Hence, Bearish persistence below 1.2265 (Reversal Pattern Neckline) was needed to confirm the pattern. Thus, enhance another bearish movement towards 1.2100, 1.2000 then 1.1920. By the end of Last Week, Intraday traders were advised to wait for bearish pullback towards the price levels of 1.2300-1.2280 where a low-risk short-term BUY trade could be taken. The recently demonstrated Lower High around 1.2440 endangered the previously-mentioned short-term bullish scenario. That's why, the price zone of 1.2300-1.2280 failed to provide enough bullish support for the pair. Thus, the suggested short-term BUY trade was invalidated shortly after. The current bearish breakdown below 1.2265 should be taken into consideration as it confirms the previously-mentioned reversal-top pattern. Hence, This would probably enable further bearish decline eventually towards 1.2020 as a projection target for the reversal pattern. Currently, the price zone of 1.2265-1.2300 stands as a recently-established SUPPLY-Zone to offer bearish rejection for the pair in the short-term. Trade recommendations : Intraday traders can wait for upcoming bullish pullback towards 1.2265-1.2300 for a valid low-risk SELL entry. T/P level to be located around 1.2150, 1.2100 and 1.2000 while S/L should be placed above 1.2330. The material has been provided by InstaForex Company - www.instaforex.com |

| May 14, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 14 May 2020 08:50 AM PDT

Few weeks ago, the EURUSD pair has expressed remarkable bullish recovery around the newly-established bottom around 1.0650. Bullish engulfing H4 candlesticks as well as the recently-demonstrated ascending bottoms indicated a high probability bullish pullback at least towards 1.0980 and 1.1075 (Fibo Level 50%). Around the price zone between (1.1075-1.1150), a bearish Head & Shoulders pattern was demonstrated. That's why, Further bearish decline was demonstrated towards 1.0800 where the nearest demand level to be considered was located near the backside of the broken channel (1.0800-1.0750). Evident signs of Bullish rejection have been manifested around the price zone of (1.0800-1.0750) leading to the recent bullish spike up to 1.0990. The short-term technical bullish outlook remains valid as long as bullish persistence is maintained above the recently-established ascending Bottom around 1.0770. Further bullish advancement was expected to pursue beyond 1.1000 towards 1.1175 where 61.8% Fibonacci Level is located. However, lack of bullish momentum brought another recent bearish decline towards the depicted price zone around 1.0800. On the other hand, the price zone of (1.0815 - 1.0775) still stands as a prominent Demand Zone which can provide quite good bullish support for the pair. However, Any bearish breakdown below 1.0770 should be marked as an early Exit signal for all short-term BUY trades. Trade recommendations : Intraday traders are advised to consider the current bearish pullback towards the price zone of 1.0815 - 1.0775 as another valid short-term BUY trade. S/L should be placed at 1.0750 while T/P levels to be located around 1.0930, 1.1000 then 1.1075 if sufficient bullish momentum is maintained. The material has been provided by InstaForex Company - www.instaforex.com |

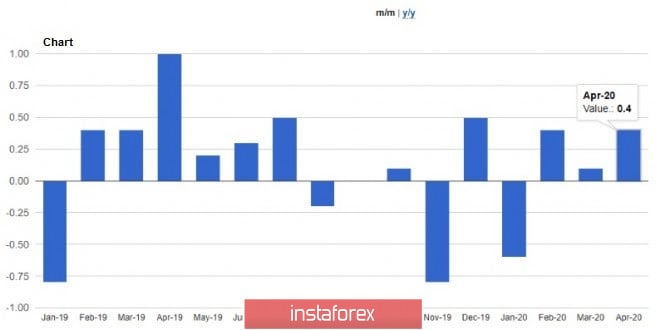

| Posted: 14 May 2020 07:41 AM PDT Relations between the US and China may worsen. Although it has not yet reached a real scandal, the United States continues to "inflate" the problems of COVID-19 distribution, placing full blame on China and blaming it for all the consequences that occurred after the outbreak of the pandemic. During today's interview, Donald Trump said that the United States could end relations with China because of the coronavirus situation. Trump also did not rule out a complete break in the relationship, which would save more than $ 500 billion. However, according to what estimates and how this could be achieved, Trump did not specify. When asked how the American leader represents further relations with Chinese leader Xi Jinping, Trump replied that he still treats Xi well, but now he does not want to call him. Let me remind you that at the beginning of the week, US Senator Lindsey Graham made proposals for a bill on sanctions. We are talking about the draft law "on responsibility for COVID-19", where it is proposed to introduce restrictive measures against the PRC if they do not provide a full report on the causes of the outbreak. The Senator said that the Chinese authorities are acting through deception to hide the real source of the outbreak, and are doing everything possible to prevent the international community from conducting an investigation in the laboratory in Wuhan. The bill sets a two-month deadline for the Communist party to provide a full report on the causes of the pandemic, as well as release all activists detained in Hong Kong after the outbreak of the pandemic, otherwise the sanctions may start with the denial of visas to Chinese students. So far, there has been no official response from Beijing, but there have already been opinions from Chinese analysts who focus on at least four members of the US Congress and two American legal entities, which may be very seriously affected, as they will be included in the retaliatory sanctions list of Beijing. First of all, we are talking about those politicians who are trying the hardest to hold the PRC responsible for the global COVID-19 pandemic. Legal entities include Missouri Attorney Eric Schmitt. Also, a number of Chinese experts believe that if the United States does not cease to exert pressure on China and impose a number of sanctions, the response by the PRC will also not be symbolic. In the meantime, the situation remains in limbo, and the market situation will depend on how the relationship will develop further. In the meantime, risk assets will continue to lose their positions against the US dollar, and this trend is likely to continue. This morning's reports on the state of the European economy did not strongly support the euro, although it was possible to cope with the pressure from major sellers. According to the statistics agency, the unemployment rate in France in the 1st quarter of this year fell to 7.8% against 8.1% in the 4th quarter, while the unemployment rate for the 1st quarter was forecast at 8.6%. However, it is hardly worth paying special attention to this report, since already in the 2nd quarter, the indicators will significantly change for the worse due to the isolation measures that are still in effect, which may lead to a reduction in French GDP in the 2nd quarter of 2020 by 20%-25%. Today's report on consumer price growth in Germany in April surprised markets a little, as it turned out to be better than economists' forecasts, even against the background of a sharp drop in oil prices. According to the Federal Bureau of Statistics Destatis, the final consumer price index of Germany in April 2020 increased by 0.4% compared to March but decreased by 0.9% compared to April last year. Economists had expected the index to grow by only 0.3% compared to the previous month and 0.8% compared to April last year. As for the EU-standardised CPI, it grew by 0.4% in April and by 0.8% compared to last year, which fully coincided with the forecasts of economists. However, such indicators are unlikely to be good news for the market, since judging by expectations, already in the 2nd quarter of this year, the German economy may lose more than 14% compared to the 1st quarter. A sharp decline in personal consumption is the main reason for such a sharp decline in the economy. In just a year, German GDP may decline by 9%, and in 2020, it will grow by 4%. Today, another quite interesting report from ING was published, which says that the bottom of the decline in economic activity in the Eurozone is behind us. But this is on the condition that there will not be a second outbreak of the pandemic, and governments will not be forced to return to quarantine measures. Even despite the fact that we are still waiting for terrible fundamental data for April and May, however, future indicators are likely to differ from the expectations of economists for the better, which will indicate that the worst is over. As for the technical picture of the EURUSD pair, it remained unchanged compared to the morning forecast. The bulls have already managed to assert themselves in the support area of 1.0780 and are still seriously aimed at returning to the resistance of 1.0845. Closing the week above this level will lead to the formation of a fairly good formation with a real potential for updating the maximum of 1.0890 and going beyond it, which will open a direct road to the levels of 1.0980 and 1.1040. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD: dollar performs well, while euro continues to struggle Posted: 14 May 2020 07:12 AM PDT

The dismal comments of Fed Chairman Jerome Powell and the growing pessimism about the V-shaped recovery of the US economy caused the S&P 500 to fall and supported the greenback, while the euro, weighed down by internal problems, sank again. The economic situation in Europe is far from being the best. In March, industrial production in the region decreased by 11.3%, demonstrating the maximum monthly decrease in the entire history of observations. The ECB warns that the eurozone expects an unprecedented in speed and strength in peacetime economic downturn. Scenarios prepared by the experts of the financial institute suggest that the GDP of the currency block this year may fall by 5% -12%, depending on the duration of the restrictive measures and the success of European politicians to mitigate the economic consequences of coronavirus for businesses and workers. Against the backdrop of a global pandemic and the inability of European countries to rally in the face of a common threat, the euro becomes the most vulnerable monetary unit G10, reports Bloomberg. If the EUR / USD bulls were supported by US stock indexes before the beginning of the second week of May, then their fall may allow the greenback to firmly take the initiative in its hands. The euphoria about large-scale monetary and fiscal stimulus from the Fed and the White House, as well as hopes for a quick recovery of the US economy, is gradually dying. According to a survey conducted recently by The Goldman Sachs, most executives of companies whose securities are included in the calculation base of the S&P 500 index doubt that the recovery of national GDP will be V-shaped. The consensus assessment of 64 experts from The Wall Street Journal suggests that in 2020, the US economy will shrink by 6.6% and will be able to reach levels that took place before the current crisis, not earlier than 2022.

According to the US Treasury head Steven Mnuchin, the second quarter will be very weak, but if the United States slowly restarts the economy, the performance of subsequent quarters will improve. A similar view is taken by Powell where he said, at a webinar organized by the Peterson Institute for International Economics, that the US GDP recovery would be slower than desired and Congress would need more incentives not to put an end to the efforts that had been undertaken earlier. "Although the economic response was both timely and adequately large-scale, this chapter may not be the last, given that the upcoming path is very uncertain and subject to significant downward risks," the head of the Fed said. At the same time, Powell did not want to give a gift to the head of the White House, Donald Trump, whom the latter had previously hinted at. The Fed chairman said that the regulator has good tools for monetary expansion, and negative rates are not the option that the Central Bank is currently considering. Awareness of the fact that the V-shaped recovery of the American economy is becoming a pipe dream and the euphoria brought the S&P 500 index too high, makes stock buyers take profits. The fall of US stock indices pushes the EUR / USD pair down. In the case of a breakthrough of support at 1.0770–1.0775, the likelihood of continued movement of the pair in the direction of the lower boundary of the medium-term consolidation range 1.0650–1.11150 will increase. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD moves lower following yesterday's bearish price action Posted: 14 May 2020 06:46 AM PDT Yesterday I noted how EURUSD got rejected once again and the inability to recapture 1.0880-1.09 could lead price lower. Support was at 1.0845-1.0830 and failure to hold this level, would price below 1.08 as I explained yesterday.

Green rectangle - support EURUSD is trading below 1.08 once again as expected. Price action showed vulnerability signs. Bulls were not strong enough to break resistance at 1.09. Now there is a big test ahead for bears. Will they be strong enough to break below the green support area? If yes then I expect to see EURUSD push towards 1.0650 and lower over the next few sessions. The material has been provided by InstaForex Company - www.instaforex.com |

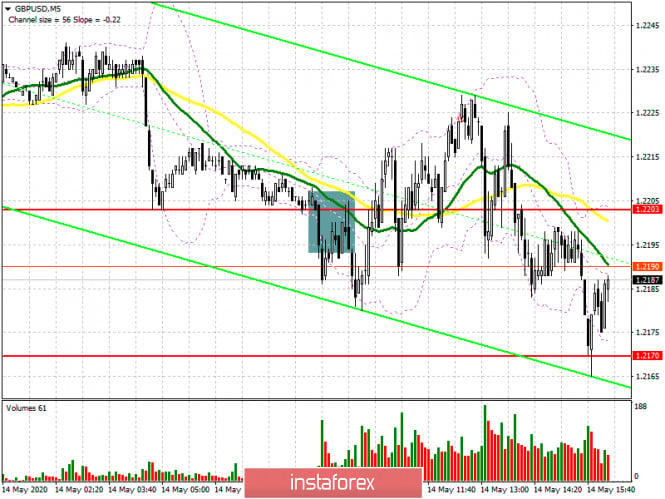

| Posted: 14 May 2020 06:43 AM PDT To open long positions on GBPUSD, you need: In my morning forecast, I paid attention to sales at the breakdown and consolidation below the level of 1.2203. If you look closely at the 5-minute chart, you can see how the bears managed to break below this range and even tested it from the bottom up, which formed a good sell signal further down the trend. Unfortunately, the downward movement did not amount to more than 30 points, which led to a market reversal and the removal of a short position to zero. However, if someone carefully read the morning review, I placed special emphasis on the support level of 1.2170 and recommended opening long positions from it. At the moment, this signal continues to work itself out and buyers can count on a return to the area of intermediate resistance of 1.2225, fixing above which will necessarily lead GBP/USD to a new wave of growth in the area of the highs of 1.2275 and 1.2323, where I recommend fixing the profits. If the market starts to gradually return to the support of 1.2170 by the middle of the North American session, then it is better to exit long positions and wait for the update of the larger lows of 1.2127 and 1.2030, from where you can buy immediately for a rebound in the expectation of correction of 30-40 points within the day. And it is important to remember that buying the pound even at current lows, you are going against the trend.

To open short positions on GBPUSD, you need: Bears did not act very actively and showed themselves only after the speech of the Governor of the Bank of England. Although the sellers managed to cope with the morning breakout of 1.2203, however, they failed to do anything with the larger support of 1.2170, which is now their main goal. Only a break in this range will return major players to the market that can collapse the pound to the area of lows of 1.2127 and 1.2030, where I recommend fixing the profits. A more optimal and safe scenario for opening short positions will be an upward correction of GBP/USD in the second half of the day to the resistance area of 1.2225, where I recommend opening short positions if a false breakout is formed. Selling the pound immediately on the rebound can only be after testing the highs of 1.2275 and 1.2323 in the expectation of a downward movement to the close of the day.

Signals of indicators: Moving averages Trading is below the 30 and 50 daily averages, which indicates a continuation of the bearish trend. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands A break in the lower border of the indicator at 1.2170 will increase the pressure on the pair, while a rise in the upper border at 1.2230 will strengthen the British pound. Description of indicators

|

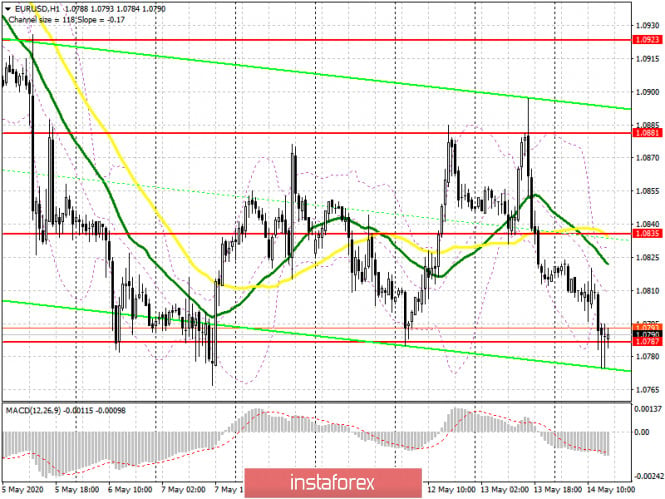

| Posted: 14 May 2020 06:40 AM PDT To open long positions on EURUSD, you need: From a technical point of view, nothing much has changed, and the data on inflation in Germany managed to keep the euro from falling further. In my morning forecast, I paid attention to the level of 1.0787 and recommended opening long positions from it when a false breakout is formed. On the hourly chart, you can see how the bears are trying to actively break below the level of 1.0787 several times, but each time the price closes above this range, which allows you to count on an upward correction in the second half of the day. While trading is above the level of 1.0787, the buy signal will be active, which may lead to an increase in EUR/USD and an update of the larger resistance of 1.0835, where the moving averages are located. If after the data on the US labor market, the pair still goes below the level of 1.0787, it is best to abandon long positions in the expectation of updating the larger lows of 1.0728 and 1.0636 and buy EUR/USD immediately on the rebound. To open short positions on EURUSD, you need: Sellers can only expect a breakout and consolidation below the support of 1.0787, which was not possible in the first half of the day, which will increase pressure on the euro and lead to an update of the lows in the area of 1.0728, and then to a test of large support of 1.0636, where I recommend fixing profits. If EUR/USD rises after the US labor market report, you can view short positions from the resistance of 1.0835, but only if a false breakout is formed. If there is no activity on the part of sellers, it is best to defer short positions in EUR/USD to test a larger maximum of 1.0881, which is the upper boundary of the sideways channel or to sell euros immediately on the rebound from the resistance of 1.0923 based on the correction of 25-30 points intraday.

Signals of indicators: Moving averages Trading is below the 30 and 50 day moving averages, which indicates a possible continuation of the euro's growth in the short term. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands A break in the upper limit of the indicator around 1.0835 may lead to a larger increase in the euro. Bears will return to the market only after breaking the lower border of the indicator in the area of 1.0785. Description of indicators

|

| Short-term technical analysis of Gold for May 14, 2020. Posted: 14 May 2020 06:37 AM PDT Gold price has not made any important movement today. Price action is quiet. Gold price remains above key support of $1,700 and below key short-term resistance of $1,720-25. Gold price has more chances of breaking upwards as long as we trade above $1,700.

Gold price remains above both the tenkan-sen and kijun-sen indicators. Support by those two indicators remains in the area of $1,700-$1,695. As long as we are above this support, we expect a move higher to new 2020. The confirmation of this scenario will come with the break of the black trend line. If support fails to hold I expect price to move towards the Kumo and the $1,630 area. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review for May 14, 2020 Posted: 14 May 2020 06:28 AM PDT

EURUSD: The euro is falling, the dollar is strengthening on the negative side of the economy. In a situation of a fast-growing economic crisis, the main indicators are very late, and the market begins to respond to news that no one has reacted to for many years which is the weekly report on US employment. This is now the most important indicator at present. It is important for the market when the sharp rise in unemployment in the USA will stop and at what level. The update and released report on May 14 indicated a 2.98 million new applications for unemployment benefits. This is above the forecast and almost at the level of the previous value (3.176 million). The long-term unemployment is already at 22.8 million. I will express this thought: perhaps the United States did not need to go along the path of distributing money to all people, rather just go along the path of Europe, where the state subsidized 70%-80% of salaries to businesses so that people would not lose touch with work and unemployment would not become stagnant. EURUSD: You may consider sales from 1.0825. Consider purchases from 1.0900. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 14 May 2020 06:00 AM PDT BTC News:

Major cryptoasset exchange Coinbase claims that although most of its users initially favor bitcoin (BTC), the vast majority also go on to trade altcoins and other digital assets. In ablog post, the platform claimed, "Among customers with at least five purchases, 60% start with bitcoin but just 24% stick exclusively to BTC." It means that 60% of BTC buyers on Coinbase are going into altcoins eventually. In total, it claims that "over three quarters" of its customers "eventually buy other assets" – namely altcoins. Furthermore, Coinbase says its customers "trade non-BTC assets at a roughly 3% higher rate than their relative market caps would suggest." Technical analysis: Trading recommendation: The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis on EUR / USD and GBP / USD for May 14, 2020 Posted: 14 May 2020 05:43 AM PDT EUR / USD On May 13, the EUR / USD pair lost about 40 basis points. Thus, the construction of the alleged wave 3 in C in B continues to drag out. The current wave marking is so far unambiguous and involves the construction of a rising wave. But in case of a successful attempt to break through the minimum of wave B, it will require corrections and additions. Roughly the same thing happens if the tool will update the low waves 2 to C in B. Fundamental component: The entire background of the information was reduced to a speech by the Fed Chairman Jerome Powell saying that the country is in a very difficult recession and that everything will depend on how the fight against coronavirus proceeds. Powell indicated that the US Congress should provide great financial support to the US economy, as additional to the 3 trillion dollars that he has already poured into it. Also reassured that the Fed does not plan to use negative interest rates. Thus, Powell's presentation can be interpreted in different ways. On the one hand, the Fed is not going to further mitigate monetary policy, on the other hand, hundreds of billions of dollars can continue to flow into the economy. One might say that the markets were not too upset because the US economy will be in a recession for a long time. Probably because the rest of the countries are also experiencing similar, and perhaps worse, problems. Thus, despite the fact that wave marking involves the construction of an upward wave, the US dollar is slowly but creeping down, strengthening in pair with the euro. Today, a report on applications for unemployment benefits will be released in the United States, which is most likely to be weak again. However, the mood of the markets is unlikely to deteriorate because of it. Everyone has become accustomed to the idea that unemployment in the United States will reach 20-25%. a report on applications for unemployment benefits will be released in the United States, which is most likely to be weak again. However, the mood of the markets is unlikely to deteriorate because of it. Everyone has become accustomed to the idea that unemployment in the United States will reach 20-25%. a report on applications for unemployment benefits will be released in the United States, which is most likely to be weak again. However, the mood of the markets is unlikely to deteriorate because of it. Everyone has become accustomed to the idea that unemployment in the United States will reach 20-25%. General conclusions and recommendations: The Euro-Dollar pair presumably continues to build the upward wave C in B. Thus, I recommend buying the instrument with targets located, as before, around 1.1148, which equates to Fibonacci 0.0%, or near the peak of wave A on a new MACD signal "up". A successful attempt to break through the minimum of wave B will require corrections and additions to the current wave marking. GBP / USD On May 13, the GBP / USD pair lost a few dozen basis points and thus resumed the construction of a prospective wave within 2 or B. A successful attempt to break through the 38.2% Fibonacci level will lead to even more complication of this wave. At the same time, the whole wave 2 or B can take a more elongated 5-wave horizontal form. An unsuccessful attempt to break the 1.2170 mark will indicate that the markets are not ready for further sales of the pound. Fundamental component: The news background for the GBP / USD pair on May 13 was quite interesting. An important data came out on the UK's GDP for the first quarter, which sparked a bit of optimism in the buyers of the pound. According to March results, the GDP fell not as much as the markets expected. Industrial production also turned out to be better than expected. However, in the case of the pound sterling, the US currency continues to be in higher demand, threatening to complicate the entire wave marking. General conclusions and recommendations: The Pound-Dollar instrument is nearing completion of the construction of the second wave of a new upward trend section. Thus, now I recommend buying the pound with targets around 26 of the figure, counting on building a wave of 3 or C or d in 2 or B on a new MACD signal "up" or in case of an unsuccessful attempt to break 1.2170. A successful attempt to break the 1.2645 mark will allow you to buy the pound more confidently. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 14 May 2020 05:42 AM PDT Corona virus summary:

Singapore Airlines has reported an annual loss of almost $150m, driven by the collapse in air travel caused by the coronavirus pandemic, and the latest sign of the outbreak's devastating impact on the aviation sector. The airline group - which includes subsidiaries SilkAir and Scoot - suffered a net loss of Sg$212m (US$148m) for the financial year that ended on 31 March, compared to a profit of Sg$683m last year. "Fears about the spread of the virus, as well as global travel restrictions and border controls, led to a collapse in the demand for air travel during the quarter," the airline said in its financial report. Technical analysis: Gold has been trading upwards. As I expected the Gold did breakout the pivot high at $1,711 and it confirmed the start of the upside cycle. My analysis from yesterday is still active and i do expect the breakout of the symmetrical tirangle pattern, which will be confirmation for the further upside movement. Trading recommendation: Watch for potential buying opportunities with the SL at $1,695 and potential upward targets at $1,746 and $1,790. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 14 May 2020 05:29 AM PDT Corona virus summary:

The Japanese prime minister, Shinzo Abe, has lifted the state of emergency for 39 of its 47 prefectures, but said it would remain in place in Tokyo, as well as the second-largest urban area of Osaka, until the novel coronavirus is contained. Abe also said he would begin work on a second extra budget as part of his government's economic stimulus measures.

Technical analysis: EUR/USD has been trading downwards. The price tested and rejected of the key support at the price of 1,0775. I expect further upside movement towards the resistance levels at 1,0820 and 1,0840. Trading recommendation: Watch for potential buying opportunities with the SL at 1,0770 and potential upward targets at 1,0820 and 1,0840. The material has been provided by InstaForex Company - www.instaforex.com |

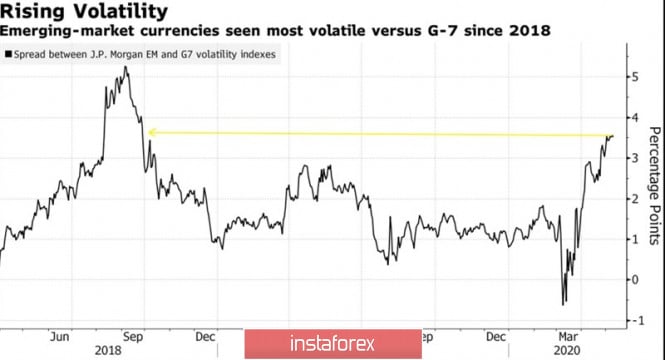

| USD/RUB is more dependent on external background than on internal factors Posted: 14 May 2020 04:43 AM PDT The fall of US stock indices and the ongoing concerns about the escalation of the US-China trade conflict are putting the Russian ruble under pressure. Moreover, Brent crude oil is in no hurry to continue the rally and is trading near the psychologically important mark of $30 per barrel amid fears of the possibility of a second wave of the pandemic. The tax period which starts in a few days and the increase in foreign currency sales by the Ministry of Finance to $154 million per day as part of the implementation of the budgetary rule are unlikely to support the Russian ruble. The USD/RUB pair is more dependent on the external background than on internal factors. Despite the stability of the ruble, it must be understood that the pandemic is a more serious challenge for developing countries than for developed ones. The latter have the ability to increase debt in national currencies. Iin addition, their rates are extremely low, and often negative, as in the eurozone and Japan. Emerging markets do not have such preferences. They cannot afford to launch the QE programme and rely only on lowering their interest rates and funds. At the same time, developing countries are highly dependent on China, the largest consumer of raw materials. In this regard, the possibility of another trade war between Washington and Beijing concerns sellers of the USD/RUB. According to the trade agreement signed in January in the framework of phase 1, China commits to increase purchases of American agricultural products by $80 billion over two years, including by $36.5 billion in 2020. In fact, the parties were talking about $3 billion in the January-March period. The main negotiators such as Chinese Deputy Prime Minister Liu He, US Trade Representative Robert Lightheiser, and US Treasury Secretary Steve Mnuchin are confident that the obligations will be fulfilled by the end of the year. However, if something goes wrong, the White House will increase tariffs, and the renminbi will fall. Apart from that, it will cause an increase in the spread of volatility in currencies of emerging markets. This is the last thing Russia and other countries need at the moment. Volatility of emerging market currencies

Bad news for the ruble comes from the US stock market. The S&P 500 bulls finally realized that they were too presumptuous about the V-shaped recovery of the US economy. The euphoria gradually passes, as does the desire to buy what is cheap. Profit-taking on long positions is fraught with a continued fall in stock indices, a deterioration in global risk appetite, and an increase in demand for safe haven assets, primarily the US dollar. Let us not forget that the beginnings of the constitutional crisis in the EU, the inability of finance ministers of the eurozone countries to agree on a fiscal stimulus, and unresolved issues on Brexit burden the economy of the key trading partner of Russia - the European Union. Its problems, continuing geopolitical risks, the weakness of the Russian economy and sells-off on the US stock market create the prerequisites for buying the USD/RUB pair on a breakthrough at the upper border of the triangle near 74.9 and the pivot level of 75.5. USD/RUB, daily chart

|

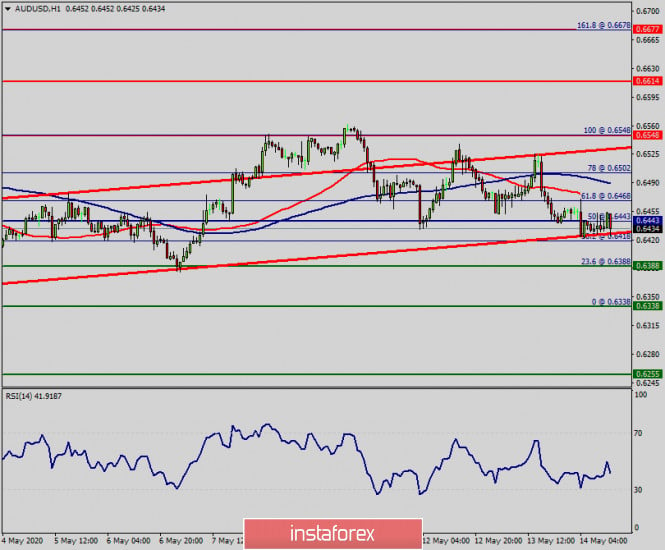

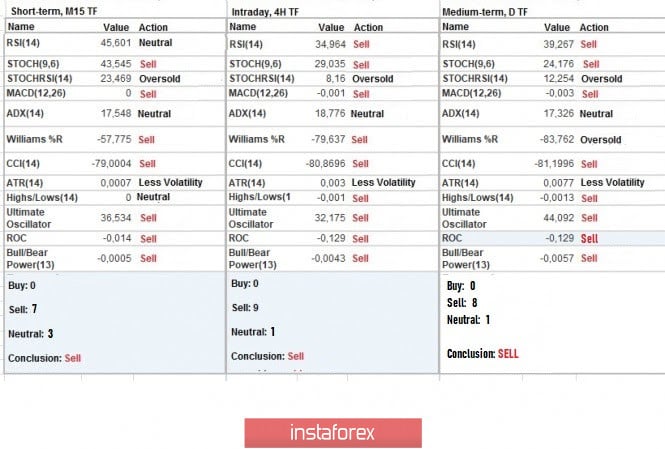

| Technical Analysis of AUD/USD for May 14, 2020 Posted: 14 May 2020 03:51 AM PDT Overview: The AUD/USD pair (Australian Dollar) pulls back from major level, for that the AUD/USD pair fell from the top of 0.6548 to close at the 0.6400 level. We are still looking for bullish market as long as the price is set above the area of 0.6350. The AUD/USD pair will continue to rise from the level of 0.6443. The support is found at the level of 0.6443, which represents the 50% Fibonacci retracement level in the H1 time frame. The price is likely to form a double bottom. Today, the major support is seen at 0.6443, while immediate resistance is seen at 0.6548. Accordingly, the AUD/USD pair is showing signs of strength following a breakout of a high at 0.6443. So, buy above the level of 0.6500 with the first target at 0.6548 in order to test the daily resistance 1 and move further to 0.6614. Also, the level of 0.6614 is a good place to take profit because it will form second resistance. Amid the previous events, the pair is still in an uptrend; for that we expect the AUD/USD pair to climb from 0.6443 to 0.6614 today. However, in case a reversal takes place and the AUD/USD pair breaks through the support level of 0.6443, a further decline to 0.6338 can occur, which would indicate a bearish market. But we are still looking for a bullish market as long as the price is set above the spot of 0.6388. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 14 May 2020 03:51 AM PDT

The relatively positive trend of the New Zealand dollar, which has been tracked for several weeks, ended in a huge failure. The currency of a cozy island nation collapsed after a meeting of the Reserve Bank of New Zealand (RBNZ). According to a statement by Adrian Orr, head of the RBNZ, the regulator decided to keep the interest rate at a near-zero level until March 2021. The catalyst for this decision was government measures taken to minimize the negative consequences of the COVID-19 pandemic. The actions of the New Zealand authorities aimed at fighting the coronavirus have led to a reduction in the national economy. In this regard, the RBNZ had to resort to "heavy artillery". The current situation has extremely negatively affected the dynamics of the New Zealand dollar. This was facilitated not only by the current aggressive steps of the Reserve Bank of the country, but also by the possible transition of the regulator to negative rates. According to ANZ Bank economists, negative rates could cause disaster in the New Zealand economy, and its further stabilization will be called into question. According to analysts, the authorities of the island state are making incredible efforts to lessen the effects of the lockdown, which turned out to be one of the toughest in the world. Current tensions reduce the chances of the NZD/USD pair not only for further growth, but also for moderate recovery. In the middle of the trading week, the pair came under a serious fundamental press, and because of which, the Kiwi had to retreat to the level of 0.6000. Moreover, the loss of the "New Zealander" reached 0.88% yesterday. By the end of yesterday, the New Zealand dollar underwent a total sale after a meeting of the RBNZ. As a result, on Thursday, May 14, the NZD/USD pair finally moved into the category of outsiders, ending up in the low range of 0.5988 - 0.5990. An additional factor in the decline of the New Zealand dollar was the increase in purchases of government bonds by the RBNZ. It is expected to increase from 30 billion to 60 billion New Zealand dollars. The revitalization of the quantitative easing program (QE) by the regulator triggered the current economic tsunami. According to experts, the upcoming doubling of purchases of state bonds was the final mishap that brought down NZD. Experts fear that under the burden of the negative consequences of the pandemic, the Kiwi will fall even more, captivating New Zealand's economy. According to analysts, the process of its restoration may take several years and require unprecedented measures of financial support. Experts believe that the introduction of negative rates will slow down economic growth in the country, although it can help restore it in the short-term. Meanwhile, in the medium-term, the currency of New Zealand is expected to fluctuate in volatility. According to analysts, periods of relative stability NZD will alternate with moments of moderate decline. The material has been provided by InstaForex Company - www.instaforex.com |

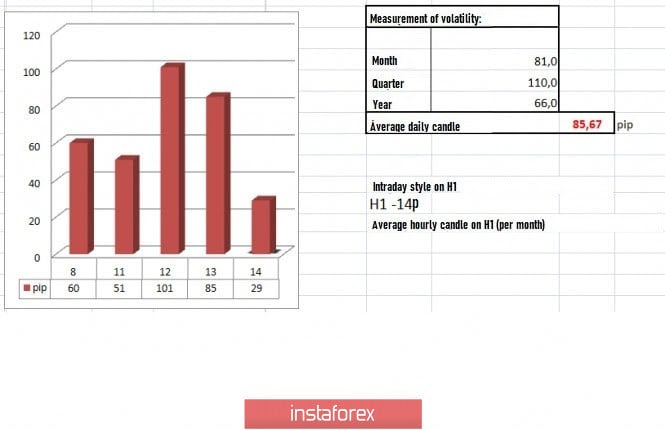

| Trading recommendations for the EUR/USD pair on May 14, 2020 Posted: 14 May 2020 03:47 AM PDT From the point of view of complex analysis, we can see a rapid downward move, which eventually worked out most of the previous impulse. A bearish mood persisted yesterday, during which the quote rebounded from the 1.0880 area and headed towards the level of 1.0800. The surge in activity on May 12, which was more than 80%, may be attributed to traders who are working on a downward movement, since the quote was held in the lower part of the conditional sideways corridor 1.0775 // 1.0850 // 1.1000. A decrease is still the priority of traders, but in order to gain a significant part, quotes must consolidate below 1.0775, and then go to the level of 1.0700. Such case may update March 20's high. Analyzing yesterday's trading by minutes, we can see a local surge of long positions at 11:00-13:00 (UTC+1), where the coordinates of 1.0880 were affected. At the US session, bearish mood arose, which managed to pull the quotes to the level of 1.0811. In terms of volatility, activity equal to the average daily value was recorded. High volatility is already typical for the entire market, as for example, the GBP/USD currency pair, has recorded a value over 100 points for six days in a row. As discussed in the previous review, traders worked on local operations from a standstill within the mirror level of 1.0850, where they could earn both long and short positions. Analyzing the daily chart, we can see that the variable range of 1.0775 // 1.0850 // 1.1000 continues to be on the market, but the concentration of short positions in its lower part may give a signal for a downward movement. Yesterday's news contained data on industrial production in Europe, where the pace of decline has accelerated significantly from -2.2% to -12.9% for already 17 months in a row. The picture is terrifying, but the market ignored the statistics, being in a kind of shock. In the afternoon, data on producer prices in the United States was published, where a -1.3% decline was recorded, which is considered a direct signal to deflation. However, the US dollar ignored this and continued to strengthen. The market reaction, or the lack thereof, is caused by the global risks and impact of the quarantine measures in the economy. Investors do not jump from asset to asset, but try to wait out the storm in one thing. Meanwhile, Fed Chairman Jerome Powell made a speech at the Peterson Institute of World Economy, and warned of a prolonged economic downturn, where the United States will need to spend more resources to localize the crisis caused by the coronavirus pandemic. "It will take some time to get back to where we were. There is a feeling that recovery may go slower than we would like. But it will come, and it may mean that we need to do more," Powell said. Powell also noted that the current recession is significantly worse than what happened after World War II. Thus, economic recovery will be gradual, and the provision of additional assistance to homeowners and businesses by the state is justified if it wants to avoid long-term damage to the economy. Powell also responded to the White House's demand to introduce negative rates in the country, to which he replied that he is not going to consider the issue and introduce negative rates. The weekly report on US unemployment will be published today, where a decrease in the number of unemployed, compared to last week, is expected. However, the figure may still reach 2,450,000, and repeated applications may continue to set anti-records, at about 25,650,000. Further development Analyzing the current trading chart, we can see that the quote is already in the region of 1.0800, and maintains a bearish mood. About 25 points remain before reaching the control mark, which means that the chance of reaching the level of 1.0775 and its breakdown is high. The convergence of prices with the control level can lead to the activation of not only the main positions, but also local ones. Movement to the level of 1.0775 will resume soon, but main transactions will occur after a consolidation below 1.0760, towards 1.0700. Consider local deals after a slowdown and rebound from the area of interaction of trade forces 1.0765 / 1.0785. Based on the information above, we formulated these trading recommendations: - Sell positions are already being held by traders in the direction of 1.0775. Subsequent transactions are expected, after a consolidation of prices below 1.0760, towards 1.0700. - Open buy positions when quotes rebound from the area of interaction of trade forces 1.0765 / 1.0785, towards 1.0850. Indicator analysis Analyzing the different sector of timeframes (TF), we see that the indicators of technical instruments on hourly and daily periods, prone to a further decrease, signal sales. Volatility per week / Measurement of volatility: Month; Quarter; Year The measurement of volatility reflects the average daily fluctuation calculated by Month / Quarter / Year. (May 14 was built taking into account the time of publication of the article) Volatility is currently 29 points, which is considered extremely low for this time period. If the area of interaction of trading forces remain stable, volatility will remain at the specified level, below the average daily value. Key levels Resistance zones: 1.0850 **; 1.0885 *; 1,1000 ***; 1.1080 **; 1,1180; 1.1300; 1.1440; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1,2100 Support Areas: 1.0775 *; 1.0650 (1.0636); 1,0500 ***; 1.0350 **; 1,0000 ***. * Periodic level ** Range Level *** Psychological level The material has been provided by InstaForex Company - www.instaforex.com |

| Market review. Trading ideas. Q&A Posted: 14 May 2020 03:43 AM PDT Trading recommendations: GOLD - buy up to 1723 The material has been provided by InstaForex Company - www.instaforex.com |

| Powell warns of a long recession in the US Posted: 14 May 2020 02:31 AM PDT

On Wednesday, Fed Chairman Jerome Powell warned of a long recession in the United States, and said that the long-term state of the US economy will depend on additional financial incentives to combat the economic impact of the coronavirus. Here are Powell's remarks for the Peterson Institute for International Economics: The coronavirus has led to devastating not only human, but also economic consequences, as it spread throughout the world. This is a global public health crisis, and healthcare professionals were the first to show courage and determination, thereby deserving our gratitude. The same can be said for the legions of other important professions that put themselves at risk every day. The scale and speed of this decline is much worse than any recession since World War II. We are witnessing a serious decline in economic activity and employment, and the results already achieved over the past decade have been erased. Since restrictions were imposed two months ago, more than 20 million people have lost their jobs. Previously, in the aftermath of World War II, economic downturns were sometimes associated with a high inflation cycle, followed by a tightening of the Fed. The current decline is unique in that it is associated with the virus and measures taken to limit its effects. To date, the Congress has provided approximately $ 2.9 trillion for financial support to households, enterprises, health care providers, as well as state and local governments — about 14% of the GDP. On the Fed side, we reduced the rate to zero and took a number of additional measures to facilitate the flow of loans in the economy, which can be grouped in four directions: First, direct purchases of Treasury bonds and mortgage-backed securities. Secondly, liquidity and financing measures to exchange with foreign central banks. Thirdly, with additional support from the Treasury, support for the flow of loans to households, enterprises, as well as state and local authorities. And fourthly, temporary regulatory adjustments designed to stimulate and allow banks to expand their balance sheets to support their home and business clients. The Fed only takes such actions in extreme circumstances similar to those that we are facing today. For example, our authority to provide loans directly to private non-financial enterprises, as well as to local and state governments, exists only in "unusual and urgent circumstances" and with the consent of the Secretary of Treasury. When this crisis is over, we will change our lending tactics. Economic forecasts and better times are uncertain There are also new questions that are being asked today: can new restrictions be avoided? How long will it take to restore confidence and resume normal income and expenses? The answers to these questions will be of great importance in determining the timing and pace of economic recovery. Since the answers are currently unknown, we must be prepared to solve a number of possible problems. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment