Forex analysis review |

- CAD/JPY approaching resistance, potential reversal

- Forecast for EUR/USD on May 26, 2020

- Forecast for GBP/USD on May 26, 2020

- Forecast for AUD/USD on May 26, 2020

- Forecast for USD/JPY on May 26, 2020

- CADJPY holding above ascending trendline support! Further push up expected!

- Overview of the GBP/USD pair. May 26. Mike Pompeo demands compensation from China for the "coronavirus". China accuses Washington

- Overview of the EUR/USD pair. May 26. Donald Trump again insults the Democrats, Joe Biden, and China. A new batch of accusations

- Hot forecast and trading signals for the GBP/USD pair on May 26. COT report. Sellers have moderate advantage. Pound can lose

- Hot forecast and trading signals for the EUR/USD pair on May 26. COT report. Sellers urgently need to overcome 1.0871

- EUR/USD. Calm before the storm?

- Comprehensive analysis of movement options for #USDX vs AUD/USD, USD/CAD, and NZD/USD (Daily) in May-June 2020

- May 25, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- Evening review for May 25, 2020

- May 25, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- Analysis of EUR/USD and GBP/USD on May 25. Markets are waiting for a denouement or new data on the US-China conflict

- BTC analysis for May 25,.2020 - Downcycle in progress. Downward target set at $8.140

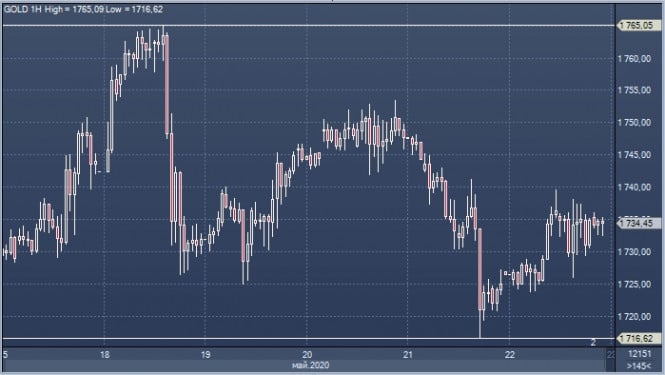

- Analysis of Gold for May 25,.2020 - Downside cycle in progress. Potetnial for the re-test of the swing low at $1.717

- Trading recommendations for EUR/USD on May 25, 2020

- EUR/USD analysis for May 25, 2020 - Rejection of the support at the price of 1.0890. Upside movement is expected towards

- Gold is set to become a leading currency in the near future.

- The yen forced the dollar to fight

- Trader's diary for May 25, 2020

- Eurozone conflict and US-China trade war poses threat on EUR/USD growth

- Oil

| CAD/JPY approaching resistance, potential reversal Posted: 25 May 2020 08:17 PM PDT

Trading Recommendation Entry: 77.528 Reason for Entry: horizontal swing high resistance and 78.6% fibonacci retracement Take Profit: 76.499 Reason for Take Profit: horizontal pullback support, 61.8% fibonacci retracement Stop Loss: 77.814 Reason for Stop loss: Horizontal swing high resistance, 61.8% fibonacci extension The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for EUR/USD on May 26, 2020 Posted: 25 May 2020 08:05 PM PDT EUR/USD As expected, the euro was trading in a small range on Monday due to holidays in the UK and the US. The single currency ended the day at the opening price. The price consolidated under the trend line of the price channel on the euro's daily chart, but remained above the MACD indicator line. The euro should overcome the MACD line and work out the lower limit of the range 1.0767-1.0995, and overcome it either immediately or with a slight delay. The target of the decline is 1.0575. A small convergence has formed on the four-hour chart on the Marlin oscillator, this may be a sign of continued price consolidation. The euro can be helped by today's data on consumer climate in Germany from GfK - the forecast for the June index is -19.1 against -23.4 in May. Data on sales of new homes in the US for April will come out in the evening - a forecast of 492,000 against 627,000 in March. US consumer confidence is expected to rise from 86.9 to 87.1 in May. The growth is insignificant and therefore a breakthrough down may not take place today. To form a condition for a decrease, the price should be consolidated at a signal level of 1.0885 The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for GBP/USD on May 26, 2020 Posted: 25 May 2020 08:04 PM PDT GBP/USD The British pound failed to gain a foothold under the MACD line on Monday (closing of the day was slightly higher than this line), and it opened above this line today. But the Marlin oscillator remains in the zone of negative values. The price may return below the MACD line, as it is still below the Fibonacci level of 161.8% and below the balance line (indicator red). The price is developing between the signal level of 1.2165 and the MACD line on the H4 chart. A reversal of the current candle occurred from this line, the Marlin oscillator in a neutral position - on its own zero line. The CBI retail sales balance for the current month will be published this afternoon, with a forecast of -65 versus -55 in April, which may support the pound in deciding to once again attack the support of the signal level to the downside. Consolidation under it opens the way to 1.1935 - Fibonacci level of 200.0%. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for AUD/USD on May 26, 2020 Posted: 25 May 2020 08:04 PM PDT AUD/USD The Australian dollar took advantage of the lull in the market and slightly grew on Monday and this morning. A double divergence on the Marlin oscillator exerts pressure on the price on the daily chart, so the 0.6677 level (the goal of a growing trend) is unlikely to be achieved. The price should work out and gain a foothold at the 0.6478 level, then the prospect of a medium-term decline will open up for the aussie. The price intensified growth after a reversal from supporting the MACD line on the four-hour chart, which was also helped by today's data on the New Zealand trade balance, which showed growth from $722 million to $1267 million in April while expectation was at $1250 million. Marlin in the growth zone. The price will take at least a day to return to starting positions before the assault on the MACD line support (0.6540). |

| Forecast for USD/JPY on May 26, 2020 Posted: 25 May 2020 08:04 PM PDT USD/JPY The dollar only grew by seven points against the yen on Monday, the balance indicator line kept the growth for several days, but this morning a breakthrough of this resistance took place and the price boldly moved to the first target level of 108.30 (February 3 low). Overcoming the level will open the second target of 109.50 - a November 2, 2019 high. The Marlin oscillator moved up, already in the zone of positive values. The price crossed the signal level of 107.78, a May 11 high, on the four-hour chart, while the Marlin oscillator turned up from the border with the decline territory. The situation is completely up. |

| CADJPY holding above ascending trendline support! Further push up expected! Posted: 25 May 2020 07:28 PM PDT

Trading Recommendation Entry: 76.946 Reason for Entry: Ascending trendline support, 50% Fibonacci retracement. Take Profit : 77.822 Reason for Take Profit: Horizontal swing high Stop Loss: 76.529 Reason for Stop loss: Graphical swing low, 61.8% Fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 May 2020 05:14 PM PDT 4-hour timeframe

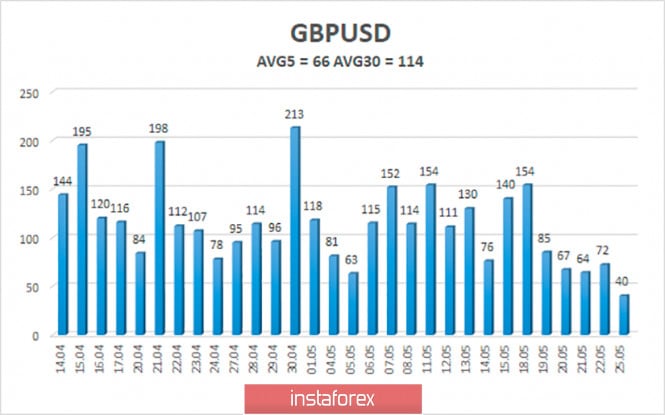

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - sideways. CCI: -57.1704 The British pound spent the first trading day of the new week in calm and quiet trading. After the bulls made an unsuccessful attempt to start a new upward trend, the pair's quotes returned to the area below the moving average line, so the trend has now changed back to a downward trend. On Monday, May 25, the pair began to adjust against the new trend, but this correction is very difficult to call a strong or weak correction or even a correction at all. The volatility of the day is less than 50 points, which is a kind of anti-record for the pound/dollar pair. Thus, we still assume that the formation of a downward trend will continue, since almost all technical indicators speak in favor of this. Both linear regression channels are directed downward, the pair is below the moving average, and the Ichimoku indicator has formed a "dead cross". The overall fundamental background for the British currency remains completely negative, and last Friday it was supported by the macroeconomic background. The UK retail sales report for April showed a 23% year-on-year decline. And yes, the situation in the United States is no better, just remember the unemployment reports overseas. However, it is the UK that is now facing a "double" crisis, as in addition to the crisis caused by the pandemic, its economy has been suffering from a "divorce" from the European Union for more than three years. There were no important publications in the UK or the United States on Monday. Exactly the same number of them will be today, on Tuesday, May 26. In such conditions, the volatility of the GBP/USD pair may remain low, but at the same time, we remind you that traders are now paying much more attention to technical factors and the overall fundamental background, rather than regular reports. Little news and important information have been received from the UK recently. We remember the time when every day the Parliament received news on Brexit, on the vote on the "deal" with the European Union, on the opposition of the Democrats and Conservatives, on the activities of Theresa May, and then Boris Johnson. Now - news calm. But from across the ocean, the news flows "like a bucket". Most of it has already been covered, most of it has a certain cyclical nature since Donald Trump has clearly formed a list of the most exciting topics in recent months and comments on them almost every day as if reading a mantra. However, yesterday, Trump also made a statement that has never been heard from his lips in recent months. The US leader said that Vladimir Putin probably does not want him to remain President for a second term. Trump said that "he is the worst thing that has happened to Russia", but he "got along with the Russian President". Thus, according to Trump, who has recently been complaining more and more often, China and Russia do not want his re-election, although, after the 2016 election, Trump was accused of having ties with Russia, which could have influenced the election. No evidence has been found, and just like in the case of the Chinese pandemic, we will never know the truth. By the way, not only Donald Trump in the White House believes that China is to blame for the "coronavirus" epidemic. To be fair, other politicians have the same opinion. However, among these politicians, it is difficult to find at least one member of the Democratic Party, which probably chose the path of cooperation with China and not the other way around. US Presidential National Security Advisor Robert O'Brien compared China's actions or inaction on the coronavirus issue with the actions of the Soviet government in the 1986 accident at the Chernobyl nuclear power plant. According to O'Brien, Beijing knew from the very beginning what was happening with the virus that appeared in Wuhan, but lied to WHO and did not allow experts from other countries to access the information. "They released a virus that destroyed trillions of dollars of American economic welfare that we have to spend to keep our economy going, to keep the American population afloat during this epidemic," O'Brien said. The head of the US State Department, Mike Pompeo, echoes him. "First we need to deal with the epidemic. The second stage is that we need to inform the whole world that the Chinese Communist Party still does not provide us with information," Pompeo said at a regular briefing. "The world should come together to make China pay its bills until it changes its behavior and behaves like a decent country," Pompeo added. "Then, when the first two stages are completed, the US President will decide how best to get China to admit its mistakes and realize the consequences of its actions and agree to pay compensation for those in the US affected by the virus." According to Pompeo, compensation should be given not only to those Americans who fell ill or lost a loved one but also to those who suffered financial damage. At the same time, Chinese Foreign Minister Wang Yi said that "some political forces in America are holding Sino-American relations hostage, trying to push them to a new cold war." "This is dangerous and will endanger world peace," Wang Yi said. The US currency does not react to all this news yet and continues to grow steadily in price in a pair with the British pound. We believe that in the future of several months, the quotes may fall to absolute lows over the past decades around $1.14. And a lot will depend on what happens just in the Foggy Albion. But the questions remain the same. Will Boris Johnson be able to negotiate with Brussels (unlikely) and, if not, how is he going to pull the British economy "from the other world", where it may end up at the end of the "coronavirus" crisis and after a complete break in ties with the European Union? The future of the British pound and the UK economy depends on the answers to these questions. According to some experts, London deliberately does not make contact with the group of Michel Barnier and is not going to concede, and therefore is not eager to sign a comprehensive agreement. Thus, the second issue is increasingly on the agenda.

The average volatility of the GBP/USD pair has been steadily decreasing in recent days and is currently only 66 points. On Tuesday, May 26, thus, we expect movement within the channel, limited by the levels of 1.2125 and 1.2257. A reversal of the Heiken Ashi indicator downwards will indicate a possible resumption of the downward trend. Fixing the price above the moving average will indicate the weakness of the bears. Nearest support levels: S1 – 1.2146 S2 – 1.2085 S3 – 1.2024 Nearest resistance levels: R1 – 1.2207 R2 – 1.2268 R3 – 1.2329 Trading recommendations: The GBP/USD pair was fixed below the moving average on the 4-hour timeframe, so the trend changed to a downward one. Thus, it is now recommended to trade the pound/dollar pair for a decrease with the goals of 1.2146 and 1.2085, but after the reversal of the Heiken Ashi indicator down. It is recommended to buy the pound/dollar pair if traders manage to return to the area above the moving average, with goals of 1.2257 and 1.2329. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 May 2020 05:14 PM PDT 4-hour timeframe

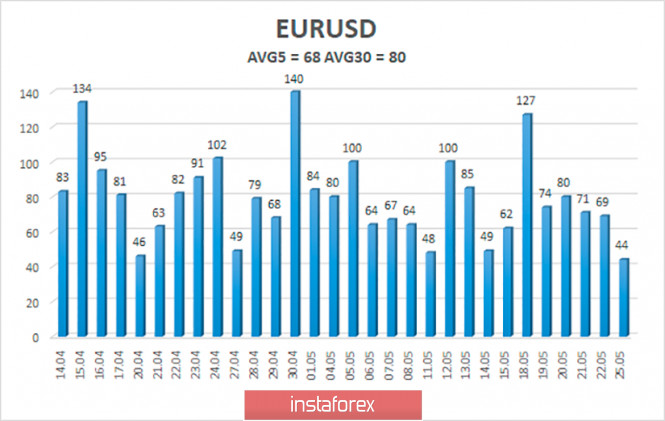

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - sideways. CCI: -90.7906 The EUR/USD currency pair spent the first trading day of the week in absolutely calm trading without major price changes. By and large, the market was flat all day. In principle, this behavior of traders is not surprising for Monday. It often happens that the first days of the week are spent in a frank flat. No important macroeconomic statistics were planned for this day, either in the United States or in the European Union. Moreover, most of the macroeconomic background continues to be simply ignored by market participants. We would call the fundamental background for the EUR/USD pair very strong, but it is important for the future, not at this time. The most important topics that can affect both the US economy and the economy of the whole world are now plentiful. They are developing, but do not yet have a proper effect on the movement of the pair. Hardly anyone can argue that the topic of the re-election of Donald Trump for a second term is not important. This will determine the entire future policy of the United States for the next 4 years. Will trade wars and conflicts continue around the world, or will there be a relatively quiet time when the global economy can recover from the coronavirus epidemic? It is safe to say that there will be little peace in the world under Donald Trump. With a calmer Joe Biden, the chances of establishing relations with China and Russia are much greater. Thus, it would seem that the presidential election is still about six months away, but many experts already consider the probability of a candidate's victory, regularly updating their political ratings and conducting various simulations, according to which Trump is unlikely to win. If this topic were not so important, it would not be given so much time. Also of great importance is the confrontation between China and the United States, which is again gaining momentum. We have already repeatedly discussed why the conflict between the two superpowers has re-emerged. In short, China's spread of the COVID-2019 virus has dealt a major blow to the US economy and personally to the positions of Donald Trump. We can't say whether Beijing did it on purpose, and no one can. This kind of information will never become public. Therefore, Washington can only continue to blame China, and China - to renounce accusations. However, both countries can award each other new sanctions, duties and other "amenities" in 2020, and not only the American and Chinese economies will suffer, which would be fair, but also the economies of other countries of the world, since everyone on the planet Earth is tied to each other. As we have already said, the entire fundamental background for the EUR/USD pair continues to revolve around US policy, the China-US confrontation, and future US elections. The head of the White House, Donald Trump, continues to criticize and insult everyone who comes under his hand. Of course, most of the attention goes to China, the Democrats, personally Joe Biden and Barack Obama. For example, just the other day, Donald Trump, who dubbed his main opponent "Sleepy Joe" said that he is not fit to serve as President of the United States. Asked about Biden's strong qualities, Trump said: "I could say that he has the experience, but in reality, this is not the case, because he does not even remember what he did yesterday. He has been in politics for a long time, and he has never been known as a smart person." When asked by the same journalist about Biden's weaknesses, Trump replied: "He has a lot of them. I can talk about them all day. First, he doesn't have a sharp enough mind to be President. Biden doesn't know if he's alive. I'm against anyone who can't answer simple questions. I've never seen anything like it." These two statements are all about Donald Trump, as well as a reflection of his policies inside and outside the country. The most important thing is the US President's lack of respect for really strong opponents. Biden was elected by the Democratic Party, which means he is one of the most powerful US politicians at this time. China is one of the strongest countries in the world and has one of the largest economies. However, Trump continues to treat these opponents from a position of strength, threats, and insults, believing that he is invincible. Moreover, Trump continues to make a huge number of unsubstantiated statements that are not supported by anything. For example, he called the entire Democratic Party "corrupt": "I am against a powerful and very corrupt party. The Democrats are very corrupt, and we caught them on it." Who and what caught the Democrats is unclear. However, Trump allows himself to continue making such statements, which further incites voters against him. Also, the odious leader of the United States said that the media, which he personally regularly insults, do not write enough about his services to the country and are generally unfair to him. "The media is also completely corrupt in this country. Whenever I do good things, they write something bad about me. I do something good again and again get a bad story or nothing at all. I solved the problem with the ventilator – nothing in response. Raised the economy – in response, nothing. Have you ever seen anything good written about me? I raised the market, but if Biden takes my place, it will collapse." Is there anything to comment on here? We are not biased against the US President, we only analyze his statements and come to the conclusion that this is a very strange leader who seems to have leadership qualities and can raise the country, however, his exceptional conflict levels all his advantages as a President. Well, technical factors remain the most important and significant for the euro/dollar pair. We have already said that after the price rebounds from the level of 1.1000 and we expect a move down to the lower border of the side channel of 1.0750. Thus, the pair remains inside the side channel and overcame the moving average line. The volatility of the first trading day of the week was low, no more than 50 points. Thus, there were no significant changes in the technical picture.

The average volatility of the euro/dollar currency pair as of May 26 is 68 points and has been steadily declining in recent days. Thus, the value of the indicator is characterized at this time as "average". Today, we expect quotes to move between the levels of 1.0828 and 1.0964. The reversal of the Heiken Ashi indicator downwards signals a possible resumption of the downward movement to the lower border of the side channel 1.0750-1.1000. Nearest support levels: S1 – 1.0864 S2 – 1.0803 S3 – 1.0742 Nearest resistance levels: R1 – 1.0925 R2 – 1.0986 R3 – 1.1047 Trading recommendations: The EUR/USD pair has started a round of upward correction. Since traders have fixed below the moving average line and rebounded from the level of 1.1000, it is now recommended to sell the pair with the goals of 1.0864 and 1.0803, but after the reversal of the Heiken Ashi indicator down. It is recommended to buy the euro currency in the case of a reverse price fixing above the moving average line with the goal of a volatility level of 1.0964. The material has been provided by InstaForex Company - www.instaforex.com |

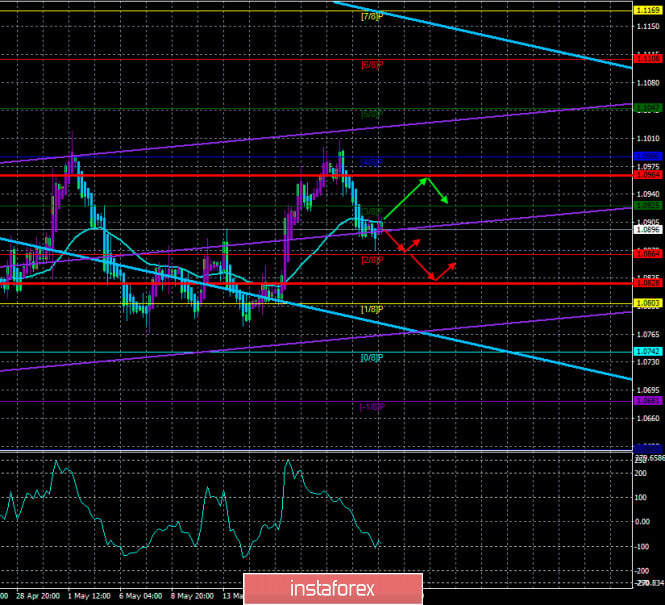

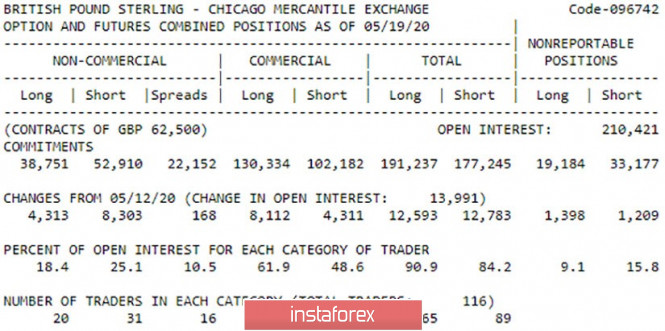

| Posted: 25 May 2020 05:11 PM PDT GBP/USD 1H An absolute flat was observed on the hourly chart for the pound/dollar pair on Monday. The activity of market participants was minimal, even lower than for the EUR/USD pair, which is traditionally considered less volatile. Quotes that have already overcome the support area of 1.2196-1.2216 returned to it and, at the time of writing, were trading slightly below it. Given the trend of recent days, a new downward channel has formed, which eloquently shows the current trend for the pair. It's down. Therefore, the pair can now rebound off the area 1.2196-1.2216 from below, as well as from the upper border of the descending channel and resume downward movement. Last week, the bulls did not manage to cross the Senkou Span B line, therefore, in aggregate, technical factors speak in favor of continuing the movement down to the May 18 low. GBP/USD 15M The lowest linear regression channel turned up on the 15-minute timeframe, however, we would not rush to conclude that the downward trend was coming to an end in the shortest term, since the bulls and bears were in almost complete balance on Monday. There is no upward movement as such now. The pair was trading between levels 1.2164 and 1.2204 on Friday and Monday, that is, in a very narrow side channel. COT Report The latest COT report for May 19 shows that the total number of buy and sell transactions among large traders per week increased by 29,000, and in equal proportions. Thus, large traders began to more actively trade the pound, which, however, is not particularly noticeable on the pair's movement chart, the volatility remains the same, not too high for the pound. Nevertheless, professional traders in the reporting week continued to actively sell British currency (+8303 sales contracts) and they were much less active in acquiring purchase contracts (total +4313). Thus, from our point of view, the mood for the GBP/USD pair remains more downward. The fundamental background for the British pound remains negative. No important macroeconomic publications are planned in the first days of the new trading week in the United Kingdom and the United States, and fno important information from Great Britain is being received at all. In recent weeks, traders have been interested in promoting negotiations on an agreement between Brussels and London, but the next round ended in nothing, the parties admitted that they were at an impasse and without further concessions it makes no sense to continue the discussion. Too many cornerstone questions exist between Britain and the EU. Thus, it is now very difficult for the British pound to fuel demand among market participants, but at the same time, it cannot fall constantly and continuously, especially during the crisis, which also covered the US tightly. Thus, we believe that the pair will continue to fall to 1.2073, but it may take some time. Nonetheless, the advantage of sellers is not so strong at the moment. We have two main options for the development of the event on May 26: 1) The initiative for the pair remains in the hands of bears. Thus, we recommend buying the British pound not before consolidating the price above the Senkou Span B line at 1.2270 and above the resistance level of 1.2280 with the first target resistance level of 1.2399. Take profit will be about 110 points in this case. The pairs are fraught with high risks below these levels of purchase, since the bulls don't have much strength now. 2) Sellers are currently more likely to implement their plans. Bears have already returned to the area below 1.2196-1.2216, which is enough to resume sales while aiming for the May 18 low at 1.2073. In this case, take profit will be about 100-110 points. The material has been provided by InstaForex Company - www.instaforex.com |

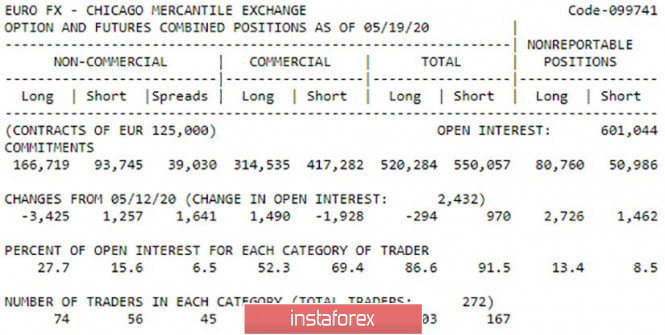

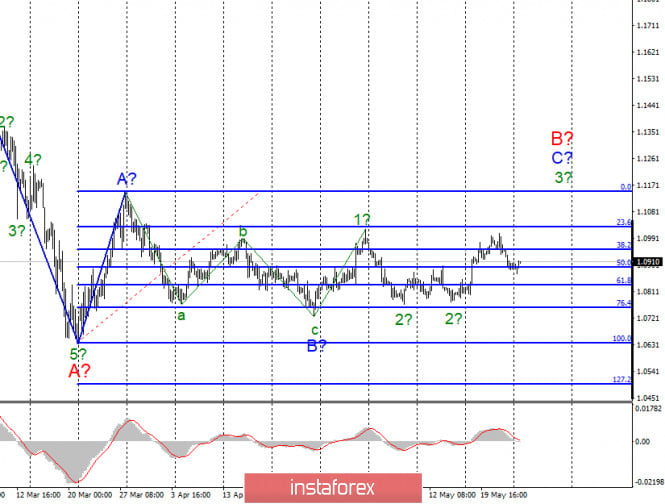

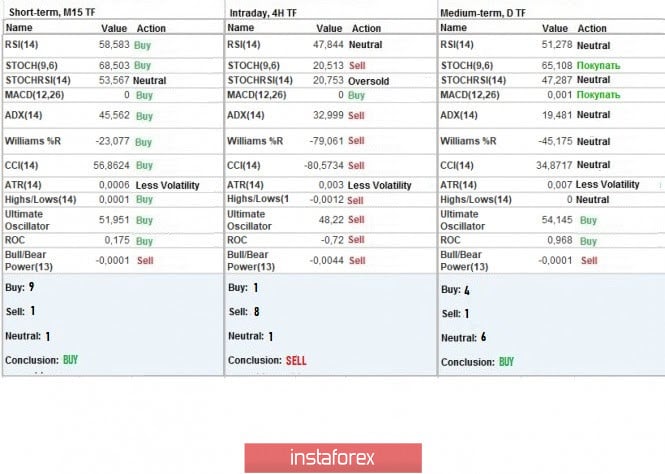

| Posted: 25 May 2020 05:09 PM PDT EUR/USD 1H The EUR/USD pair showed multidirectional movements in a narrow price range not exceeding 50 points on the hourly timeframe during the first trading day of the week. The bears did not manage to overcome the support area of 1.0881-1.0892 on Monday, as well as the Senkou Span B line of the Ichimoku indicator for the 4-hour timeframe. Thus, the downward movement has stalled so far, and no signals have been received to open new sales. Nevertheless, the euro's fate remains in the hands of sellers, as they can resume the pair's sales today. We believe that the pair should fall to an ascending trend line in the short term, which now lies near the 1.0810 level, and possibly to the lower border of the side channel of 1.0750-1.1000. The bulls' potential is limited so far to the 1.0990-1.1008 range. We can conclude that the bulls will try to form a new upward trend above this area. EUR/USD 15M We see that the downward trend is still preserved on the 15-minute timeframe, however, the lower linear regression channel turned sideways. Monday was an absolute flat, so such a channel reversal is not surprising. Everything will now depend on the Senkou Span B line. The pair can be sold when you overcome this. COT Report The latest COT report of May 19 showed that large traders who engage in professional activities with the aim of earning exchange rate profit continued to reduce purchases of the euro and increase sales in the reporting week. The growth of the latter was small, only 1257 contracts, but in aggregate with -3425 contracts for sale, we have a serious deterioration in the mood of traders regarding the euro. The total number of purchase contracts also decreased by 294 units, and the number of Short-deals increased by 970 units. Thus, we see that the mood of traders remains bearish and only intensifies. Therefore, we can even count on overcoming the ascending trend line on the hourly chart, but for now we are just waiting for quotes to fall to this line. The fundamental background for the pair remains neutral at this time. Nothing interesting happened in the world (meaning events that could affect the pair here and now) and no macroeconomic report was published on the first trading day of the week. The calendar of macroeconomic events also does not contain anything interesting on Tuesday. Thus, the pair's volatility and the activity of market participants may continue to remain low today. Perhaps the situation will change on Wednesday when ECB President Christine Lagarde and ECB Vice President Luis de Guindos make speeches. However, we believe that when a pair is trading in the side channel, it does not need special motives to continue moving between its borders. In general, we recommend that traders continue to monitor any messages on the subject of the US-Chinese confrontation, as they can be potentially very important. Based on the foregoing, we have two trading ideas for May 26: 1) It is possible for the pair to grow if the price rebounds from the area of 1.0881-1.0892, however, we would not recommend traders to process this signal, since it can be false. Buyers of the euro are advised to enter when the pair consolidates above the Kijun-sen line (1.0939). In this case, we recommend buying the pair with a target of 1.0990. Potential to take profit in this case will be about 50 points. 2) The second option - bearish - is more likely. You are advised to sell the euro after overcoming the area of 1.0881-1.0892 and the Senkou Span B line (1.0871) with the aim of an ascending trend line (approximately 1.0810), around which the future fate of the euro/dollar pair will be decided. Potential to take profit in executing this scenario will be 55 points. Given the pair's volatility in recent days, taking profit is quite high. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. Calm before the storm? Posted: 25 May 2020 01:31 PM PDT General sentiment in the foreign exchange market has not changed over the weekend: anti-risk sentiment is still prevailing, providing background support for the US currency. High-ranking officials from the United States and China continue to exchange high-profile accusations that only exacerbate the overall situation. The high-profile national security bill in Hong Kong added fuel to the fire: now Washington is threatening Beijing with sanctions, not only in connection with a possible refusal to jointly investigate the causes of COVID-19, but also in connection with the "capture" of Hong Kong. China fights back - they say it's impossible to capture what is rightfully yours. After all, Beijing considers Hong Kong to be its full territory, where the formula "one country - two political systems." Therefore, any comments of American politicians regarding the Hong Kong issue, the Chinese perceive with hostility, claiming interference in the internal affairs of the state. Nevertheless, Washington has been putting pressure on this "corn" for quite some time, provoking the anger of high-ranking Chinese politicians. First, the Americans openly supported anti-Chinese protests in Hong Kong. Back in November last year, Trump signed scandalous bills that supported Hong Kong protesters. Under the first law, the US Department of State must confirm to Congress at least once a year that Hong Kong maintains sufficient autonomy to maintain favorable trading conditions with the United States. Otherwise, the document provides for sanctions against the city authorities for violating human rights. The second law banned the supply of funds to the Hong Kong police that could be used to disperse demonstrations: tear and pepper gases, rubber bullets and stun guns. The coronavirus blocked the protest movements of anti-Chinese activists for several months, but so far the rallies have flared up with renewed vigor, especially since Beijing has provided yet another piece of information to"rock the boat". Initially, protests began against considering amendments to the law on extradition of suspects, which would allow Hong Kong to extradite suspects to jurisdictions with which it does not have an extradition agreement (including Taiwan, Macau and mainland China). According to the protesters, this rule of law posed a threat to those activists who disagree with the policies of official Beijing. Subsequently, the Hong Kong administration refused to consider these amendments, and then completely removed them from the agenda. But, as they say, "appetite came with eating" - protesters have already begun to demand liberalization of local legislation and a decrease in the influence of mainland influence. Beijing responded in a peculiar way: Chinese parliamentarians introduced a bill on national security in Hong Kong. According to this document, the special administrative region of the PRC should at the legislative level prevent "treason, schism, incitement and subversive activity" against the government in Beijing. Supporters of democracy in Hong Kong consider this step another attempt by the Chinese Communist leadership to level out local freedoms. Nevertheless, the bill is already on the agenda of the session of the National People's Congress, which began on May 22 and will last until May 28. This initiative was opposed not only by the United States, but also by the European Union, Canada, Great Britain, and also Australia. However, according to some analysts, Beijing is very likely to adopt the bill, provoking retaliatory sanctions from Washington. Thus, the growth of anti-risk sentiment in the foreign exchange market is justified. Moreover, the United States exerts pressure on the PRC not only on the "Hong Kong line", but also on the issue of COVID-19. In particular, yesterday, Trump's national security adviser Robert O'Brien compared the actions of China after the outbreak of coronavirus with concealing the disaster at the Chernobyl nuclear power plant by the Soviet Union in 1986. Such accusations were made against the backdrop of the Republican legislative initiative - Lindsay Graham's bill allows President Donald Trump to impose sanctions on China for refusing to cooperate in identifying the causes of the pandemic. Thus, US sanctions against China are only getting stronger. The Cold War between the United States and China will obviously slow down the global economic recovery after the coronavirus crisis, and this fact puts pressure on risky currencies. The dollar, in turn, can again "return to the game," since recently it has been playing the role of the main defensive asset. The foreign exchange market is passive today because the United States is celebrating Memorial Day - US trading floors are closed. Therefore, the main price fluctuations for the will begin on Tuesday. If Beijing does not refuse to adopt the above bill (which is unlikely), and the representatives of China and the United States do not sit at the negotiating table regarding the investigation of the causes of COVID-19 (which is almost unbelievable), then the pressure on the pair will continue. This will allow the pair bears to test the nearest support level of 1.0860 (the middle line of the Bollinger Bands indicator, which coincides with the Kijun-sen line on the daily chart). If the rhetoric of the parties is tightened, then sellers will be able to push the pair to the bottom of the eighth figure. If the PRC shows signs of compromise (at least in the Hong Kong issue), then the bulls will be able to return to the upper line of the Bollinger Bands indicator, that is, to the 1.0990 level. But this scenario is not basic, given the recent statements by senior politicians in both China and the United States. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 May 2020 09:44 AM PDT Minor operational scale (Daily) The last week of spring and the beginning of summer - how the dollar index #USDX and the "raw" currencies AUD/USD, USD/CAD, and NZD/USD will behave - options for the development of the movement from May 26, 2020. ____________________ US dollar index From May 26, 2020, the movement of the dollar index (#USDX) will be determined by the development and direction of the breakdown of the range:

When the LTL control line is broken, the minute fork - the resistance level of 100.10 - followed by the breakout of 1/2 Median Line Minor (110.20) will determine the continuation of the upward movement of the dollar index towards the goals:

The sequential breakdown ISL38.2 Minor support level of 99.45 and lower border of the channel 1/2 Median Line Minor 99.25 - it is confirmed that no further movement #USDX will flow in the zone of equilibrium (99.45-98.45-97.45) of the Minor operational scale fork prospect of achieving the ultimate Shiff Line Minor (96.30). The markup of #USDX motion options from May 26, 2020 is shown on the animated chart.

____________________ Australian dollar vs US dollar The development of the movement of the Australian dollar (AUD/USD) from May 26, 2020 will depend on the development and direction of the breakdown of the range:

The breakdown of the reaction line RL38.2 of the Minor operational scale fork - support level 0.6470 - will direct the movement of the Australian dollar to the borders of the 1/2 Median Line channel (0.6430-0.6305-0.6185) and the equilibrium zone (0.6140-0.5990-0.5820) of the Minor operational scale fork. In case of a joint breakdown of resistance levels:

The upward movement of AUD/USD can be continued towards the goals:

The markup of the AUD/USD movement options in May 2020 is shown on the animated chart.

____________________ US dollar vs Canadian dollar The development of the movement of the Canadian dollar (USD/CAD) from May 26, 2020 will also depend on the development and direction of the breakdown range:

A breakdown of the support level of 1.3930 on the Median Line Minor followed by an update of the local minimum 1.3849 will direct the development of the USD/CAD movement to the borders of the 1/2 Median Line channel (1.3780-1.3660-1.3530) of the Minor operational scale fork. A breakdown of the resistance level of 1.4030 on the control line LTL of the Minuette operational scale fork will determine the development of the movement of the Canadian dollar to the goals:

The markup of the USD/CAD movement options from May 26, 2020 is shown on the animated chart.

____________________ New Zealand dollar vs US dollar The development of the movement of the New Zealand dollar (NZD/USD) from May 26, 2020 as well as other tools, will depend on the practice and direction of a breakout of the range:

The breakdown ISL38.2 Minor - support level of 0.6070 - together with the breakdown of the control line UTL (0.6050) of the Minuette operational scale fork will determine the development of the movement in the NZ dollar in the zone of equilibrium (0.6070-0.5930-0.5800) of the Minor operational scale fork prospect of the achievement of the channel borders 1/2 Median Line (0.5690-0.5570-0.5450) of the Minuette operational scale fork. When the resistance level of 0.6140 breaks, the development of the NZD/USD movement will continue in the 1/2 Median Line channel (0.6140-0.6230-0.6320) of the Minor operational scale fork with the prospect of reaching the initial SSL Minor line (0.6480). We look at the markup of the NZD/USD movement options in May 2020 on the animated chart.

____________________ The review is compiled without taking into account the news background, the opening of trading sessions of the main financial centers, and is not a guide to action (placing "sell" or "buy" orders). Formula for calculating the dollar index: USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. Where the power coefficients correspond to the weights of currencies in the basket: Euro - 57.6 %; Yen - 13.6 %; Pound - 11.9 %; Canadian dollar - 9.1 %; Swedish Krona - 4.2 %; Swiss franc - 3.6 %. The first coefficient in the formula brings the index value to 100 on the starting date-March 1973 when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

| May 25, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 25 May 2020 08:55 AM PDT

Few weeks ago, the EURUSD pair has expressed remarkable bullish recovery around the newly-established bottom around 1.0650. Bullish engulfing H4 candlesticks as well as the recently-demonstrated ascending bottoms indicated a high probability bullish pullback at least towards 1.0980 and 1.1075 (Fibo Level 50%). Around the price zone between (1.1075-1.1150), a bearish Head & Shoulders pattern was demonstrated. That's why, Further bearish decline was demonstrated towards 1.0800 where the nearest demand level to be considered was located near the backside of the broken channel (1.0800-1.0750). Evident signs of Bullish rejection have been manifested around the price zone of (1.0800-1.0750) leading to the recent bullish spike up to 1.0990. The short-term technical bullish outlook remains valid as long as bullish persistence is maintained above the recently-established Demand Zone around 1.0770. On May 1, Lack of bullish momentum around 1.1000 lead to another bearish decline towards the depicted price zone around 1.0800. However, the price zone of (1.0815 - 1.0775) has been standing as a prominent Demand Zone providing quite good bullish support for the pair so far. Currently, bullish breakout above 1.1000 is needed to enhance further bullish advancement towards 1.1075 and 1.1175. On the other hand, any bearish breakdown below 1.0770 should be marked as an early Exit signal for all short-term BUY trades. Trade recommendations : Intraday traders are advised to wait for bullish breakout above 1.1000 as a valid BUY signal. T/P levels to be located around 1.1075 then 1.1175 if sufficient bullish momentum is maintained while S/L to be located below 1.0950. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review for May 25, 2020 Posted: 25 May 2020 08:27 AM PDT

EURUSD: You may consider purchases from 1.0915, stop at 1.0870. You may consider sales from 1.0869, stop at 1.0915 The direction of the big trend for the euro will be determined at present. The market comprehends economic prospects and the course is attractive for taking positions on the trend. Conservative: You may consider purchases from 1.1000. Sell from 1.0770. Keep purchases from 1.0855, stop at breakeven. The material has been provided by InstaForex Company - www.instaforex.com |

| May 25, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 25 May 2020 08:25 AM PDT

Recently, Bullish persistence above 1.2265 has enhanced another bullish movement up to the price levels of 1.2520-1.2590 where significant bearish rejection as well as a quick bearish decline were previously demonstrated (In the period between 14th - 21 April). Currently, Atypical Bearish Head & Shoulders reversal pattern is in progress. The GBP/USD pair was recently demonstrating the Right Shoulder of the pattern. Hence, Bearish persistence below 1.2265 (Reversal Pattern Neckline) was needed to confirm the pattern. Thus, enhance another bearish movement towards 1.2100, 1.2000 then 1.1920. Two Weeks ago, the price zone of 1.2300-1.2280 corresponded to a short-term uptrend as well as a recently established demand zone where a low-risk short-term BUY trade could be taken. However, the recently demonstrated Lower High around 1.2440 invalidated the suggested short-term bullish trade. Shortly After, the price zone of 1.2300-1.2280 failed to provide enough bullish support for the pair. The current bearish breakdown below 1.2265 should be taken into consideration as it confirms the previously-mentioned reversal-top pattern. Hence, further bearish decline would eventually be enabled towards 1.2020 as a projection target for the reversal pattern. Currently, the price zone of 1.2265-1.2300 (Backside of the broken Uptrend) stands as a recently-established SUPPLY-Zone to offer bearish rejection and a valid SELL Entry for the pair in the short-term. Trade recommendations : Intraday traders can consider any bullish pullback towards 1.2265-1.2300 as a valid SELL Entry. T/P level to be located around 1.2150, 1.2100 and 1.2000 while S/L should be placed above 1.2350. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 May 2020 06:44 AM PDT EUR/USD On May 22, the euro/dollar pair lost another 55 basis points. Thus, the instrument continues to move, which contradicts the current wave markup, which assumes the construction of an upward wave 3 or C or B. Either the expected wave 2 or C or B will become more complicated, or the increase in quotes should resume today or tomorrow. A successful attempt to break through low wave 2 or low wave B will indicate the complexity of the entire wave markup. Fundamental component: There were no important reports or events in the European Union or America on Friday. The US dollar was in demand in the foreign exchange market, but I can't conclude that it was caused by anything. Recently, the market is swarming with a huge amount of different information, arguments, opinions, guesses, forecasts. Moreover, it is quite difficult to make an unambiguous conclusion about what awaits the world economy as a whole or the European economy separately. In times of another crisis, there are a huge number of factors that affect or may affect a particular pair. However, as we can see, after almost a month of shock, the markets recovered and after that, the instrument is trading in a range of about 250 points wide. The movement of this nature began on April 6 and has been going on for more than a month and a half, respectively. Meanwhile, the American and European economies continue to suffer losses. According to various forecasts of economists, each will lose from 5% to 10% in the first half of the year. In addition, unemployment rates are rising, and central banks need more and more stimulus assistance. Also, US and UK banks may even resort to negative rates, but this is just speculation by economists. On Monday, the European Union and America again have no news. Donald Trump is silent, there is no news on the US-China standoff, no new data from the White House or the US Congress. General conclusions and recommendations: The euro/dollar pair presumably continues to build an upward wave C or B. Thus, I recommend buying a tool with targets located, as before, around the mark of 1.1148, which is equal to 0.0% of the Fibonacci level on the new "up" signal of the MACD. The low of wave B has not been updated, so the current wave markup still retains its integrity. GBP/USD The pound/dollar pair lost another 60 basis points on May 22, but the changes in recent days are too small to affect the current wave markup. Thus, at the moment, I conclude that the construction of the expected wave 3 or C, the upward section of the trend, which originates on March 19, continues. The price increase may resume with targets located near the peak of wave 1 or A and higher. At the same time, the alternative assumes a significant complication of wave 2 or B, which can take a 5-wave horizontal form. However, in this case, I also expect an increase in quotes with targets located around 26 figures within the internal wave of 2 or B. Fundamental component: In the UK, data on retail sales in April was released on Friday. This report showed how bad things are in the UK, as it lost almost 23% y/y and 18% m/m when fuel sales were taken into account. Excluding fuel sales, the cuts were -18.4% y/y and 15.2% m/m. On the one hand, the same amount of reduction is recorded in America, on the other hand - in any case, such figures can not cause the growth of the British currency. General conclusions and recommendations: The pound/dollar instrument has presumably completed the construction of the second wave of a new upward trend. So, now I recommend buying the pound with goals around 26 and 27 figures, in the expectation of building a wave 3 or C or d or 2 or B (if the wave becomes more complicated) for each new MACD signal "up". A successful attempt to break the mark of 1.2645 will allow you to buy the pound more confidently. The material has been provided by InstaForex Company - www.instaforex.com |

| BTC analysis for May 25,.2020 - Downcycle in progress. Downward target set at $8.140 Posted: 25 May 2020 06:38 AM PDT Corona virus summary:

The volume of Bitcoin (BTC) tweets is on the rise once again pointing to a strengthening of bullish expectations among traders. Tweeting on Monday, analyst Zack Voell highlighted the significant surge in Bitcoin Twitter mentions over the past few months. In the past, social media metrics such as tweet volume or comments on platforms like Reddit have indicated the emergence of bullish sentiments among traders. Anyway, I cant see technicly any sings of the upside and there is good condiiton for further downside. Technical analysis: BTC has been trading downwards as I expected. The price is heading towards our second target from Friday at the level of $8,137. I still see further downside movement. Trading recommendation: Watch for selling opportunities on the rallies targets at $8,137 and $7,785. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 May 2020 06:26 AM PDT Corona virus summary:

Trump had already banned certain travelers from ChinaEuropeUnited KingdomIrelandIranRussia Technical analysis: Gold has been trading downwards as I expected on Friday. I still see potential for the downside towards the levels at $1,717 and $1,711. Trading recommendation: Watch for selling opportunities on the rallies with the targets at the price of $1,717 and $1,711. Stochastic oscillator is showing flat condition The material has been provided by InstaForex Company - www.instaforex.com |

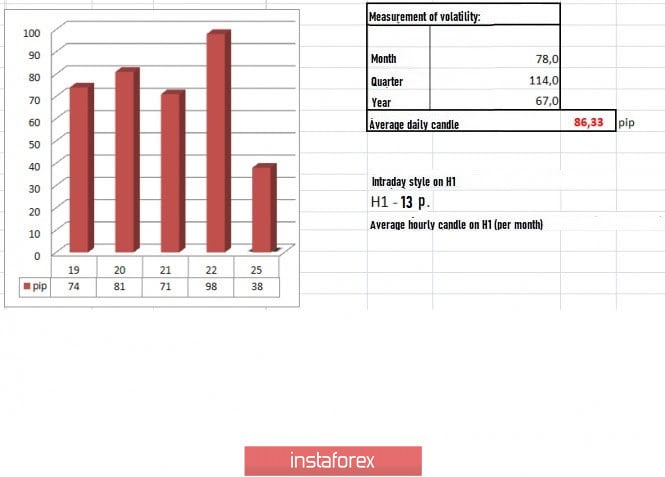

| Trading recommendations for EUR/USD on May 25, 2020 Posted: 25 May 2020 06:23 AM PDT From the point of view of complex analysis, we can see the downward movement that occurred from the upper limit. Last trading week surprised everyone with its dynamics. The quotes formed a channel from the lower border of the flat 1.0775 / 1.1000, after which it worked out the upper limit, forming a downward tact. The series of fluctuations that occurred after stretched the sideways channel to a seven-week scale, which made it unstable. The longer the flat lives, the higher is the chance of a breakout to occur. The sideways channel is part of the fluctuations, with which all movement in general refers to the global downward trend. Analyzing Friday's trading in detail, we can see that the bearish mood set by the market on Thursday remained, which pushed the quotes to consolidate below 1.0900. Shorting the pair remains to be the main goal of traders, but in order for the plan to succeed, the quote needs to overcome at least the sideways channel 1.0775 / 1.1000, after which the goal will be the value 1.0700, which may update the historic lows. As discussed in the previous review, traders worked on shorting the pair from the 1.1000 border. The movement occurred after the breakdown of May 20's low. In terms of volatility, last week recorded consistently high activity indicators, averaging about 90 points. The dynamics of the GBP / USD pair also measured to 93 points last week, which indicates that the pair is in the acceleration phase. Looking at the daily chart, we can see the regularity associated with the movements within the flat, with which fluctuations occurred regularly during the movement of the quotes from the border. The news published last Friday did not contain any important statistics for Europe and the United States. The ECB published its minutes, which could have put pressure on the euro, but it was not affected. According to the report, the Governing Council of the ECB does not count on a V-shaped economic recovery after the coronavirus crisis, and revealed a change in the bond repurchase program. "The Governing Council is fully prepared to increase the size and adjust the composition of the asset repurchase program, as well as other tools, if necessary," the document states. Meanwhile, the final data on Germany's 1st quarter GDP was published today, where the forecasts coincided with the -2.3% decrease recorded. However, the market did not react to such weak statistics, as it already expected the low figure. The reduced trading volumes because of the US and UK day-offs also contributed to the non-reaction. Further development Analyzing the current trading chart, we can see a sluggish fluctuation within 40 points, where an attempt to resume the downward movement has been made, overcoming last Friday's lows. The quote found a variable support level relative to the average deviation of the side channel, but this is just temporary, since the movement has already set, and the descent to the lower boundary will occur soon. A consolidation below 1.0870 will pretty much trigger a bearish mood, with which the variable level 1.0850 will no longer play any role in the market, and the quotes will continue to decline towards 1.0830-1.0775. Based on the above information, we derived these trading recommendations: - Traders have already placed sell positions from the value of 1.0950, towards 1.0775. If you do not have any deals, wait for the quotes to consolidate below 1.0870. - Consider buying positions higher than 1.0920, targeting the level 1.0950. Indicator analysis Analyzing the different sectors of time frames (TF), we can see that the indicators of the daily chart continue to work on an upward tact, but they are just tail ends, as indicated by neutral indicators. Meanwhile, the hourly charts have already taken a bearish mood, which is signaled by the rebound of quotes from the upper border of the flat. Volatility per week / Measurement of volatility: Month; Quarter Year The measurement of volatility reflects the average daily fluctuation calculated by Month / Quarter / Year. (May 25 was built, taking into account the time of publication of the article) Volatility is currently 38 points, which is still considered low, relative to the dynamics of the previous days. Because of scarce trading volumes, activity may be reduced. Key levels Resistance zones: 1,1000 ***; 1.1080 **; 1,1180; 1.1300; 1.1440; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1,2100 Support areas: 1.0850 **; 1.0775 *; 1.0650 (1.0636); 1,0500 ***; 1.0350 **; 1,0000 ***. * Periodic level ** Range Level *** Psychological level The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 May 2020 06:20 AM PDT Corona virus summary:

The Japanese prime minister, Shinzo Abe, is to lift the state of emergency imposed due to the coronavirus crisis. He said on Monday that the country had managed to get the spread of the virus under control in under two months. Physical distancing curbs were loosened for most of the country on 14 May as new infections fell, but the government has kept Tokyo and four other prefectures under watch. Technical analysis:Technical analysis: EUR/USD has been trading sideways at the price of 1,0895. My analysis from Friday is still active and I still expect upward rotation towards the level at 1,0940. Trading recommendation: Watch for buying opportunities near the support at 1,0890. I see potential for the test of the recent swing low on the 4H time-frame at 1,0940. Key support level is set at the price of 1,0870 The material has been provided by InstaForex Company - www.instaforex.com |

| Gold is set to become a leading currency in the near future. Posted: 25 May 2020 04:44 AM PDT

Many experts believe that in the near future, gold will become a leading asset or currency in the market, displacing the dollar. The prospects are not even diminished by the intense fluctuation of its quotes. Last Friday, May 22, market analysts recorded a rise in gold quotes by 0.4%, amounting to $ 1,734 per 1 troy ounce. The increase was due to the escalating geopolitical tensions in the US and China, caused by the issues surrounding Hong Kong. Investors were prompted to buy the yellow metal, so gold futures for June delivery increased by 0.79%, and won to $ 1,735.5 per ounce.

Afterwards, gold quotes slipped 0.6%. The fluctuation undermine its position, but it does not deprive the asset its attractiveness in the long run. A plus for the yellow metal was the active price increase since the beginning of 2020, which was not affected even by the coronavirus pandemic. On the contrary, the outbreak became a catalyst for growth, since the demand for the asset increased, as traders considered it as a safe currency. On Monday, May 25, gold dipped slightly, trading near $ 1,728 for 1 ounce. According to economist Peter Schiff, the US dollar will soon weaken, while gold will take over and increase against all other currencies. Schiff is confident that in the near future, gold will displace the dollar and become the new main global currency, due to its numerous advantages such as reliability and relevance regardless of political and economic situations in the world. According to Schiff, changes are awaiting the global economy after the pandemic. One of them will be a reversal in relation to precious metals, with gold becoming a reserve currency and used in international settlements more often than others. The material has been provided by InstaForex Company - www.instaforex.com |

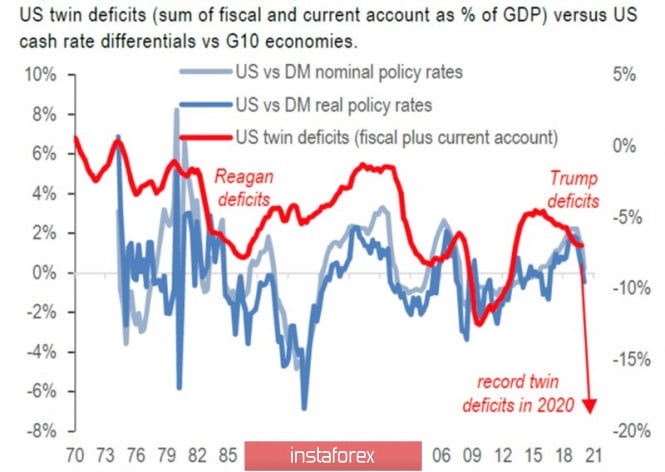

| The yen forced the dollar to fight Posted: 25 May 2020 04:24 AM PDT Stability – a sign of class. Although the strengthening of the Japanese yen against the US dollar since the beginning of the year looks modest, nevertheless, the USD/JPY pair closed in the red zone each of the past four months in 2020. This circumstance increases the confidence of speculators in the currency of the Land of the Rising Sun, because, unlike most other world monetary units, it finds the strength to resist the popular US dollar. Hedge funds have been building up net long positions on the yen for five consecutive weeks and by mid-May, it had reached 47,181 futures contracts, the highest since November 2012. "Japanese" as a safe haven asset draws strength from the turmoil in global financial markets, pandemics, factors of the long-term weakness of the US dollar, and trade wars. Reducing the federal funds rate to almost zero, rumors about its departure to the negative area, the unlimited scale of the Fed's asset purchase program, the bloating of the Federal Reserve's balance sheet to $9 trillion and $11 trillion by the end of 2020 and 2021, as well as a large-scale fiscal stimulus that leads to a rapid increase in the US national debt, will faithfully serve the "bears" for USD/JPY on the long-term investment horizon. Double deficits (budget and foreign trade), paired with a reduction in the differential of nominal and real rates, will still affect the "American" in the future. Dynamics of the US double deficit and rate differentials

However, the strengthening of the yen is an extremely undesirable thing for official Tokyo. Especially in the face of the first deflation in the Land of the Rising Sun in the past three years. The government and the Bank of Japan are constantly emphasizing the scale of fiscal (£117 trillion) and monetary (£75 trillion) incentives. They are afraid of repeating the history of 2009-2011 when after the crisis, the market considered that the country's leadership had done too little, and began to buy up the Japanese currency. By the way, at its meeting on May 22, the Board of Governors announced additional credit support in the amount of £30 trillion (about $279 billion). This is about providing resources to commercial banks at a zero rate to finance the government's lending program for companies affected by the pandemic. According to CIBC World Markets, the escalation of the conflict between the US and China will extend a helping hand to the "bears" in USD/JPY, because in 2018-2019, the yen was the main beneficiary of trade wars. In my opinion, after the Fed rate fell to 0-0, 25%, the US dollar took over its status as the main currency haven, so we can not say that the escalation of the conflict will definitely lead to a decrease in the quotes of the analyzed pair. On the contrary, it can drop US stock indices and contribute to the growth of USD/JPY. Rather, the factor of a new round of trade wars should be played out in such instruments as AUD/JPY, NZD/JPY, and EUR/JPY. Technically, if the "bulls" for USD/JPY managed to implement the "shark" pattern and achieve its target of 88.6% (it corresponds to the level of 109), traders will be able to sell the pair. In my opinion, it will remain inclined to consolidate in the range of 106-110. USD/JPY and S&P 500, the daily chart

|

| Trader's diary for May 25, 2020 Posted: 25 May 2020 04:10 AM PDT Oil:

It can be seen that oil is at its highs since mid-April. This is inadequate to the foundation, since oil reserves are very large and market supply is higher than the demand. We are waiting for the fall. EURUSD:

Euro returned to the range where it will either break above 1.0915, or fall to 1.0850 and below. You may keep purchases from 1.0855, stop at breakeven. A breakthrough of 1.1000 is possible down to 1.0770. The material has been provided by InstaForex Company - www.instaforex.com |

| Eurozone conflict and US-China trade war poses threat on EUR/USD growth Posted: 25 May 2020 03:59 AM PDT

It would seem that the joint initiative of Paris and Berlin to save the eurozone economy and the ECB's willingness to do everything possible to this end, contrary to the decision of the German Constitutional Court, will allow the main currency pair to throw off its shackles and rush up. However, the euro does not seem to be able to grow without the support of US stock indexes. The decline in the latter and the increased demand for safe haven assets have knocked the bulls out of EUR / USD. Earlier, the S&P 500 index was confidently soaring due to expectations of the opening of the US economy as well as the faith in a V-shaped recovery of US GDP, and news about the creation of a vaccine against COVID-19. Now, it's obvious that the first factor has almost been won back, hopes for the second, on the other hand, are gradually fading and the timing of the third is rather vague. Only 10% of global investors surveyed recently by Bank of America rely on a V-shaped recovery in the US economy. The rest believe that the weakness of the labor market, the reduction in investment, and the colossal fiscal stimulus, inflating the national debt, will restrain the country economic growth. According to OECD studies, rich countries can take on an additional $ 17 trillion of debt, some of which are associated with a reduction in tax revenues due to the coronavirus pandemic. As a result, the total debt of developed countries will increase from 109% to 137% of GDP. Obviously, without a vaccine against COVID-19, global GDP growth should not be expected. Coronavirus exacerbates pathologies that lead to a deterioration in the state of the global economy. Before the pandemic, the weakness of the latter manifested itself in China and the Eurozone, which were most affected by the Beijing and Washington trade war, as well as in monetary policy, which was super soft even without additional incentives. Meanwhile, the tension in relations between the United States and China is increasing, which supports the dollar as a defensive asset.

Beijing is trying to tighten legislative control over autonomous Hong Kong, which causes dissatisfaction with the White House. Meanwhile, China itself is also unhappy with the close ties between America and Taiwan. In addition, the United States announced the withdrawal from the open skies treaty, which returns fears of a new round of the arms race. Although this may be a prologue to Donald Trump's new "great deal", fears about the next round of geopolitical tensions and fragmentation in difficult times for the global economy have intensified in the markets. Recall that it was the combination of the economic downturn and the growth of protectionism that led to the Great Depression of the 1930s. And now, in politics, the direction of protectionism is intensifying, which further reduces global trade and undermines the potential for global GDP recovery. According to experts, further escalating geopolitical tensions could return markets to a steady decline. Although it is unlikely that it will be as pronounced as in February – March, it can turn out to be much longer by returning the shares to the territory of the "bear" market. The fact that the USA and China so far adhere to their obligations under the latest trade agreement remains a ray of light for investors, and this holds back the strengthening of the dollar. However, pressure on the euro is exerted by expectations regarding the expansion of QE at the ECB meeting on June 4. According to the protocol from the April meeting of the Governing Council of the ECB, the regulator intends to avoid previous mistakes related to the loss of confidence in financial markets and is ready to increase the volume of asset purchases. The situation of economic uncertainty in the Eurozone has been holding the EUR / USD pair in the 1.0750-1.1000 corridor for the second month. Last week, the pair first rose to the upper limit of this range, and then sank into its central zone, completing a five-day period near 1.0900. Further rollback under 1.0900 will indicate the resumption of a downward trend. In this case, the main currency pair may move to horizontal support at 1.0845. Further, the target of the bears will be the mark of 1.0800 and below - support formed by a multi-week range near 1.0775. Its breakdown may become a fresh trigger for sellers and pull EUR / USD under 1.0700. Meanwhile, a break of the 1.0900 mark will make the bulls target the resistance area of 1.0945–1.0950. Then they will take a course at 1.0975 and 1.1000. A confident breakthrough of the 200-day moving average, which is now located in the area of 1,1010–1,1015, will nullify the bearish mood in the short term and will contribute to further growth of the pair. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 May 2020 03:29 AM PDT

In the US, oil quotes rose more than 75% this month. However, drilling activity reached historic lows after demand for oil fell due to quarantine. Oil shale producers shut off drilling rigs at a record pace. In the future, they may even hesitate restoring the rigs, due to fears of another oil glut, which could provoke another collapse in oil prices. According to ShaleProfile, the US relies on oil drilling, which accounts for 55% of the country shale production from wells drilled in the past 14 months. "These are very large wells, much larger than the small ordinary onshore wells." described Tom Loughrey, President of Friezo Loughrey Oil Well Partners, LLC (FLOW). "We have these relatively large and numerous shale wells, but they are rapidly shrinking," he added. According to IHS Markit, less than 20% of the expected total drop in US oil production this year will be due to the closure of existing wells. The vast majority of supply cuts will be directly due to these canceled drilling projects. President of Dallas Fed, Robert Kaplan, said in an interview with Bloomberg, that most of the closed production will likely resume by the end of this year. In Russia, President Vladimir Putin is set to develop a plan to support the country oil industry by June 15, relative to the OPEC + agreement. Large oil field service companies are also ruled to be included in the government list of systemically important companies, thus, entitling them state support. According to Russia's Energy Minister Alexander Novak, the set production cuts may cause service companies to lose about 40% operating profit. Russia promises to seek strict compliance with the terms of agreement, until the next OPEC + meeting scheduled next month. According to the Kremlin, while the OPEC + agreement is in effect, oil companies should not be sanctioned for failing to meet the set production cuts. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment