Forex analysis review |

- Forecast for EUR/USD on June 1, 2020

- Forecast for GBP/USD on June 1, 2020

- Forecast for AUD/USD on June 1, 2020

- Forecast for USD/JPY on June 1, 2020

- AUDUSD reacting above trendline support and looks for further upside!

- Hot forecast and trading signals for the GBP/USD pair on June 1. COT report. Negotiations on Brexit continue "for the sake

- Hot forecast and trading signals for the EUR/USD pair on June 1. COT report. Large traders actively bought the euro last

- The latest COT report (Commitments of Traders). Weekly prospects for GBP/USD

| Forecast for EUR/USD on June 1, 2020 Posted: 31 May 2020 07:55 PM PDT EUR/USD The euro worked out the embedded line of the price channel last Friday, and makes an attempt to overcome it this morning. Success paves the way for the price in the target range of 1.1250-1.1265. The indicators on the daily timeframe show no signs of a reversal. The price is above the balance and MACD lines on the four-hour chart, the Marlin oscillator is growing without signs of a reversal. Apparently, the transition of the price above the signal level of 1.1145, which triggers it to go higher, is only a matter of time. |

| Forecast for GBP/USD on June 1, 2020 Posted: 31 May 2020 07:51 PM PDT GBP/USD The pound could not gain a foothold over the signal level of 1.2362 last Friday, it only did so in the morning. The 1.2422 target for the Fibonacci level 138.2% on the daily chart, obviously, will be taken, consolidating above it on the lower timeframe will allow the price to continue rising to the second target of 1.2540 - to the Fibonacci level 123.6%. The Marlin oscillator is optimistically growing in the positive trend zone. The price consolidated above the signal level of 1.2362 on the H4 chart this morning, the signal line of the Marlin oscillator is growing after a Friday reversal from the boundary with the territory of the negative (decreasing) trend. |

| Forecast for AUD/USD on June 1, 2020 Posted: 31 May 2020 07:50 PM PDT AUD/USD The Australian dollar has successfully realized its bullish potential, which has been accumulating for three days. This morning, the price went above the signal-target level of 0.6677 and jumped to the target level of 0.6825 - the January 2016 low. Overcoming it will allow the price to grow to the price channel line in the region of 0.6935. Now the double reversal of the signal line of the Marlin oscillator from the boundary zero line is interpreted as an enhanced trend reversal. The price goes up on the four-hour chart, but is not in a hurry to not follow the Marlin oscillator. It even retains the ability to form double divergence. Taking into account the strong upward momentum of the daily scope, we expect the indicator to grow further on H4 without forming a divergence, but this is a signal to make purchases with a small trading volume. |

| Forecast for USD/JPY on June 1, 2020 Posted: 31 May 2020 07:50 PM PDT USD/JPY The yen traded in the range of more than 80 points on Friday, closing the day by 15 points with the release of US data on personal income and expenses for April. Revenues rose 10.5% from expectations of -7.0%, which will lead to increased consumption in the coming months. Stock indices reacted mixed: S&P 500 0.48%, Dow Jones -0.07%, Nasdaq 1.29%, Russell 2000 -0.72%. Today, in the Asian session, the Japanese Nikkei 225 index grows by 1.26% and even the Chinese Shanghai Composite, despite Trump's threats to reconsider its relations with Hong Kong (and, obviously, with China), grows by 1.40%. American investors still believe that Trump will not go to extreme aggravation with China before the presidential election. The price is confidently held by the red balance indicator line on the daily chart. The MACD line proved to be a reliable support. Since the price was released above the signal level of 107.78, we are waiting for its growth to 108.30. The price is above the MACD line on the four-hour chart, Marlin returned to the growth zone. The time for a decisive assault on the first target level has arrived. The material has been provided by InstaForex Company - www.instaforex.com |

| AUDUSD reacting above trendline support and looks for further upside! Posted: 31 May 2020 07:24 PM PDT

Trading Recommendation Entry: 0.66799 Reason for Entry: Ascending trendline support, 23.6% Fibonacci retracement Take Profit : 0.67560 Reason for Take Profit: -27.2% Fibonacci retracement Stop Loss: 0.66237 Reason for Stop loss: Graphical swing low, 61.8% Fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

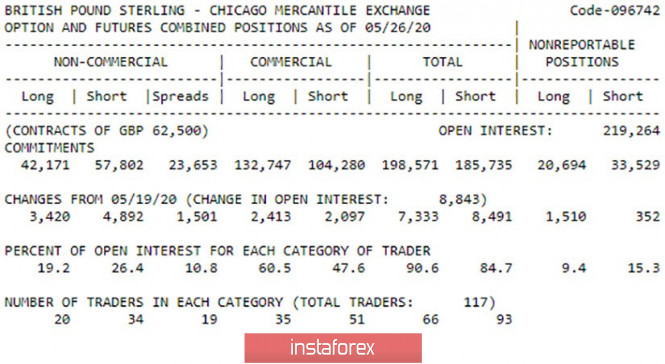

| Posted: 31 May 2020 05:27 PM PDT GBP/USD 1H The pound/dollar on Friday also tried to continue to move up, however, unlike EUR/USD, it failed to do so. In general, the entire movement of the GBP/USD pair remains weaker, although it still persists. An attempt was made to overcome the local May 26 high, but it failed. Moreover, a strong resistance area of 1.2402-1.2423 and a resistance level of 1.2399 are waiting for the pair above. Thus, there are immediately three obstacles that can stall upward movement. Buyers of the British pound continue to doubt the appropriateness of these trading operations. If the general fundamental background is approximately the same in the EU and the US, therefore, we can expect movement in different directions, then in the pound/dollar pair's case, the fundamental background remains weaker in the UK than in the US. Thus, the upward trend still remains, but in the near future, bears can begin to put pressure on the pair and try to overcome the upward trend line. GBP/USD 15M Both linear regression channels continue to be directed upward on the 15-minute timeframe, therefore, there are no signs of an upward trend ending here. However, as we said above, it will be difficult for buyers to overcome the resistance area, which is located higher. Therefore, both channels can begin to turn down at the beginning of a new trading week and month. COT Report The same picture as for the euro/dollar pair. Despite the fact that in total the demand for the pound did not change among all major traders during the reporting week (a total of 8600 contracts for buying and selling were opened), professional players mainly bought the pound - plus 5205 contracts, and from contracts for sale they, on the contrary, got rid of (-1,686 contracts). Thus, the mood of traders remained upward and at the end of last week the situation, in principle, did not change. But in order for the upward movement to continue, it is necessary that large traders continue to invest in the British currency, and for this we need reasons and reasons, which, in the pound's case, are now quite difficult to find. The fundamental background for the British pound remains negative. No macroeconomic report was published in the UK during the previous trading week. However, it is obvious that the British economy continues to experience serious problems. If US GDP could lose about 5% in the first quarter, then it might be more for Britain's GDP. In addition, exactly one month remains until July 1, when London and Brussels will have to announce the end of the "transition period" on December 31, 2020. Negotiations between the parties on a comprehensive deal are being conducted more "for the sake of now." The last three rounds did not bring the parties closer to signing the agreement and showed that no progress was made on the most complex issues. In the second half of June, British Prime Minister Boris Johnson will personally travel to Brussels to negotiate with Ursula von der Leyen and other EU top officials. However, hardly anyone expects the prime minister to be able to "smooth the corners" between the parties in a couple of days. Most likely, he also will not be able to agree, and he will return to London with nothing, but once again he will be able to declare to the public that he tried to negotiate with the EU, but the bloc does not want to concede. We have two main options for the development of the event as of June 1: 1) The initiative for the pound/dollar pair remains in the hands of the bulls, however, further upward movement will be possible only after breaking the resistance line of 1.2361. If this happens, it will be possible to open small purchases while aiming for the resistance area of 1.2402 - 1.2423. We recommend considering larger and longer-term purchase transactions only if this area is overcome with a view to the resistance level of 1.2502. Take Profit will amount to around 30 points in the first case and 70 in the second. 2) Sellers continue to remain in the shadow, but will be ready to join the game below the ascending trend line. If the pair is fixed below this line, we recommend resuming sales of the GBP/USD pair with the targets of the Senkou Span B line 1.2206 and the May 18 low at 1.2073. In this case, Take Profit will be about 55 to 180 points. The material has been provided by InstaForex Company - www.instaforex.com |

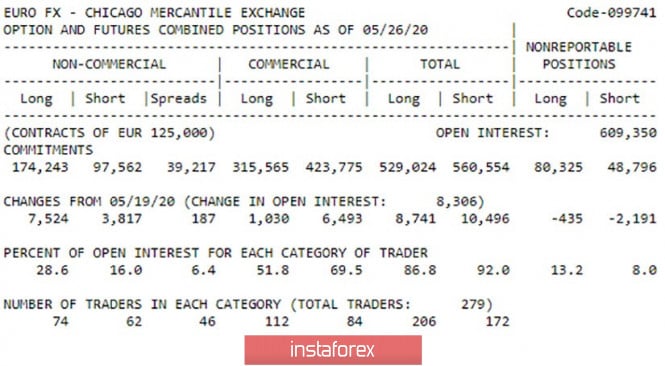

| Posted: 31 May 2020 05:27 PM PDT EUR/USD 1H The EUR/USD pair continued to move upward on the hourly timeframe during Friday, andthe resistance level of 1.1111 and the March 27 high at 1.1147 worked at the end of the day. More precisely, until the last two points were not reached, but it can also be considered a test. The euro/dollar started a downward correction after these events, which was very expected for the last trading day of the week and month. However, the bulls hold the pair tightly in their hands, even too tightly. The correction turned out to be very weak and upward movement may resume today. At least this is what the pair's presence inside the ascending channel with several points of support indicates. Thus, the upward trend is unambiguously maintained. By the way, two ascending trend lines also signal this. EUR/USD 15M We see the same picture on the 15-minute timeframe. Two ascending channels of linear regression, which clearly indicate the current upward trend and on the lowest chart. Thus, at the moment we do not have a single signal about the end of the trend. Even the correction happened inside both channels and can already be completed. COT Report The latest COT report showed that professional traders unexpectedly bought European currency during the reporting week. "Suddenly" - because, from our point of view, the fundamental background was not entirely in favor of the euro. It was not in anyone's favor. However, over the past week, we drew the attention of traders to the fact that sometimes the euro grows without having the necessary grounds for this. Large traders are present in the market and usually they are the ones who move one or another pair. And they do not always perform trade operations, based on a fundamental or macroeconomic background. Large traders found reasons to open new 7524 purchase contracts. There were only 3817 sales contracts for the reporting week. Actually, this is already enough to understand how the mood of large traders for the reporting week has changed. The end of the week ended on the side of the buyers, so the euro's demand may continue to grow among major players. The overall fundamental background for the pair remains neutral. Several not so significant macroeconomic reports were released in the current conditions in the eurozone and the US on Friday, which, as you might guess, failed. The European Union published inflation for May in a preliminary estimate and amounted to 0.1% in annual terms. Recall that the normal value for inflation is more than 1.5% y/y, and the target is 2.0% y/y. Reports on changes in personal income and expenses of the US population were issued. The first indicator unexpectedly increased by 10.5% in April, and the second - decreased by 13.6%. Michigan consumer confidence index turned out to be worse than forecasted and amounted to only 72.3 in May. Thus, these statistics were not supposed to support any currency, however, market participants found reasons for new purchases of the euro, and we believe that this is exactly the case when large players led the market. Based on the foregoing, we have two trading ideas for June 1: 1) It is possible for quotes to grow further with the goal of the resistance level for the 4-hour chart at 1.1214. However, since traders still could not overcome the March 27 high last Friday, there are still little chances of moving down and ending the upward trend. Therefore, we recommend that you wait until this level is overcome and only after that open new purchase orders. Potential Take Profit in this case will be about 60 points. 2) The second option - bearish - involves consolidating the EUR/USD pair under the upward channel, which will allow sellers to turn on and start trading lower with targets at 1,1016 (Kijun-sen) - 1,0960 (upward trend line) - 1.0891 (Senkou Span B) - 1.0835 (ascending trend line). Overcoming each of the obstacles will allow you to keep short positions open. Potential Take Profit range from 45 to 200 points. The material has been provided by InstaForex Company - www.instaforex.com |

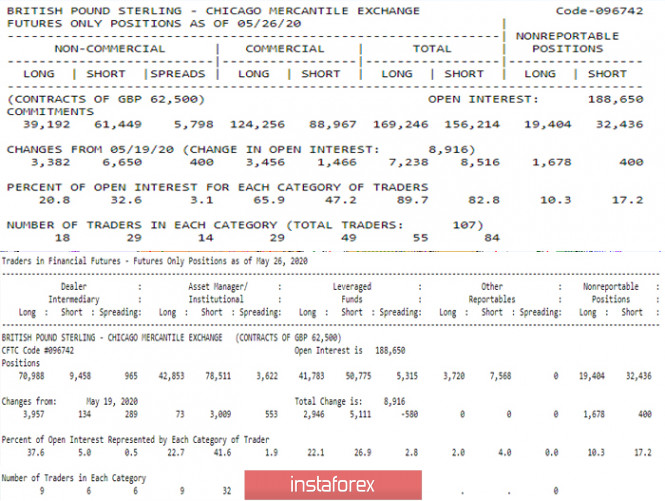

| The latest COT report (Commitments of Traders). Weekly prospects for GBP/USD Posted: 31 May 2020 04:41 PM PDT The latest COT report (Commitments of Traders). Weekly prospects for GBP/USD

Based on the latest report of the COT (Commitments of Traders), the British pound continues to maintain high open interest (188,650) and quantitative interest among major players (107 against 105). In the total monetary equivalent, the positions long (169,246) and short (156,214) are now approximately equal. The same conclusion can be reached with a more detailed analysis of the statistics of individual groups, although major players (Non-Commercial) retain a certain balance of power on the side of the bearish trend (61.449 against 39.192), while hedgers (Commercials) continue to actively strengthen long positions (3.456 against 1.466 - 124.256 against 88.967). The COT financial report, with more detailed statistics on major players, shows that the number of traders with short contracts significantly exceeds the number of those who keep long contracts. Main conclusion The confrontation will continue. At the same time, as before, tactics will most likely dominate among rivals on either side - a step forward and two steps back.

The technical picture shows that although the players to decline managed to keep the pair under the key resistance, indicated earlier in the area of 1.2357 (daily medium-term trend), they did not manage to achieve more and return their activity to the market. Perhaps, the support of big money will do the trick and we will see a recovery and a continuation of the bearish trend, but the greener line of the positions of the Commercials group of traders on the chart of the COT report, which is more abruptly increasing, does not inspire much optimism in the execution of this scenario. On the other hand, bullish prospects are now associated with the liquidation of the daily cross (1.2357 - 1.2425) and the formation of an upward target for the breakdown of the daily Ichimoku cloud. Bearish interests, in turn, will depend on the effectiveness of breaking through important supports 1.2214 (weekly Fibo Kijun + lower border of the daily cloud) - 1.2073 (minimum extreme) - 1.1970 (historical support). Ichimoku Kinko Hyo (9.26.52), Pivot Points (classic), Moving Average (120) The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment