I hope you had a great weekend. It's great to see people out and about, masked or not. I happen to live where things are opening up more quickly, and I have to tell you, it's a relief.

| You're receiving this email because you are subscribed to Trading Tips,

if you no longer wish to receive these emails you can unsubscribe here. |  |  |  | |

|  |  Good morning. I hope you had a great weekend. It's great to see people out and about, masked or not. Good morning. I hope you had a great weekend. It's great to see people out and about, masked or not.

I happen to live where things are opening up more quickly, and I have to tell you, it's a relief.

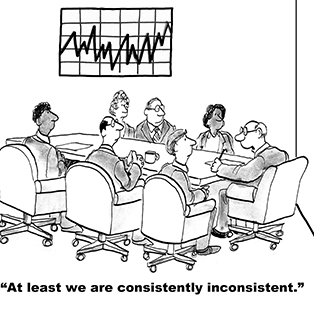

The only problem is that what is true for one, is not true for the whole. The fallacy of composition across states is leading to a lot of uncertainty. That uncertainty is what's holding the bulls at bay.There needs to be another bullish catalyst or the bears will want to come out of quarantine as well. | |  | |  |  |

|  |  |  | DOW 23,685.42 | +0.25% |  | |  | S&P 2,863.70 | +0.39% |  | |  | NASDAQ 9,014.56 | +0.79% |  | |  | | *As of market close |  | | • | Stocks rose yesterday, as it posted the third weekly decline in four weeks. |  | | • | Oil rallied 6.81%, as it breaks $25 and closes in on $30. |  | | • | Gold rose 0.76% , as it closed above recent highs near $1735. |  | | • | Cryptocurrencies traded lower, with Bitcoin finishing 4.42 % lower closing at $9295. | |  | | | |

|  | | 5 Retail Trade Companies Having a Breakout Week |  |  |  | The S&P 500 has finished lower in three of the last four weeks, with last week's performance being on the weakest since the week of MARCH 30 and the biggest intraweek losses since the week of March 16.

The weakness in the broader market isn't necessarily being felt in all industries and certainly not in every stock. For the week, Health Services posted the best weekly performance at 1.73%, followed by Health Technology at 0.98% and Retail Trade at 0.89%.

» FULL STORY |  | | |  |

|  | China Better Watch Out, the Option Market is Coming for You |  |  |  | The rhetoric is heating up between the U.S. and China over the virus, Huawei, renegotiating the Phase 1 trade deal, and the halting of U.S. pension investment in Chinese companies. As all the news is swirling around and the potential impact on Chinese companies could be big. The option market has been taking notice and has made large bearish bets in the past couple weeks. The big bearish trades reemerged again on Friday.

» FULL STORY |  | | |  |

|  | This Company Claims the Prize for Insider Selling for Last Week |  |  |  | YETI Holdings, Inc (YETI) announced a secondary offering of 15 million shares priced at $28.20 a share. The offering was expected to have closed last week as well. The desire to raise capital came after the company posted earnings that beat analyst estimates. The company has beaten estimates for four quarters in a row. Based on insider trading data available for last week, YETI led optionable companies with over $384.26 million in insider trading value on 13.7 million shares.

» FULL STORY |  | | |  |

|  |  | | TOP |  | | RCL | 6.543% |  |  | | GPS | 5.997%% |  |  | | NVDA | 5.471% |  |  | | OKE | 5.432% |  |  | | MAC | 12.898% |  |  | | BOTTOM |  | | LRCX | 6.379% |  |  | | VFC | 6.277%% |  |  | | QCOM | 5.133%% |  |  | | CMA | 4.816% |  |  | | KLAC | 4.815% |  |  | |  |

|  |  |  | | "There has been a very highly technical loophole through which Huawei has been in able, in effect, to use U.S. technology with foreign fab producers." |  | - Wilbur Ross, U.S. Commerce Secretary, Quoted by Reuters |  |

|  | No. 1 Commodity Stock to Buy in 2020 |  |  |  Hint: It's not silver, platinum or any other precious metal. It's not aluminum, nickel, iron ore or lithium, either. But without it, we couldn't make airplanes, automobiles, batteries, boats, cosmetics, computers, surgical tools or smartphones. Hint: It's not silver, platinum or any other precious metal. It's not aluminum, nickel, iron ore or lithium, either. But without it, we couldn't make airplanes, automobiles, batteries, boats, cosmetics, computers, surgical tools or smartphones.

Yet this metal could soon experience the greatest supply crunch in history … which could launch its price to levels never seen before. Read the full story here…

| |  |

|

No comments:

Post a Comment