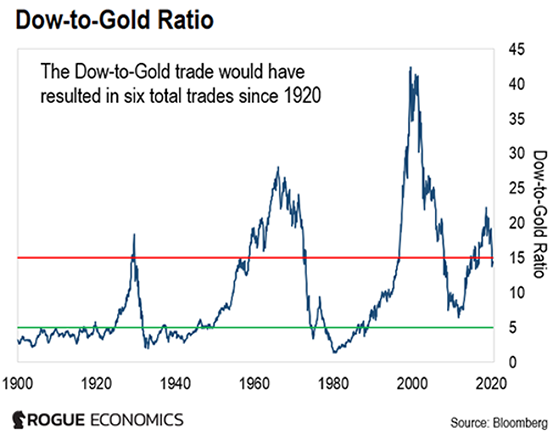

| The financial world is either risk-on or risk-off… It’s a world that is either expanding with win-win deals or contracting… civilizing… or decivilizing. It is either making progress… or it has gotten too far ahead of itself and is backtracking. – Bill Bonner The most important trend in finance is the decline in the Dow-to-Gold ratio. The Dow-to-Gold ratio tracks the Dow Jones stocks as priced in gold. It tells us the best time to buy gold, and the best time to buy stocks. It peaked in 1999 at 42. Then, it began what I call its “long walk down the mountain” to where it always ends up. That is, below 5. Let’s call this the “primary trend.” But along this primary trend, it got waylaid. And it spent eight years backtracking. Eight long years… of fake money and rising stocks. Now, finally, this most important trend in finance is “back on.” To my mind – and for my money – it’s presenting the biggest opportunity to profit since, well… I found bitcoin in 2011. It’s go time. This is it. | Recommended Link | | All this Hype about 5G is Pointless. Here's Why… By now, you've heard big promises about 5G. 5G will make you rich… 5G will change your life… 5G will usher in the new Industrial Revolution. You've seen the Super Bowl commercials. And every one touting the next big 5G stock. But here's the hard truth the pundits will never say… All the hype about 5G is useless. Without the technology of this one tiny company, there will be no 5G rollout across America. That's why Facebook, Lockheed Martin, L3, Sprint, T-Mobile, China Satcom, and dozens of networks are banging on this company's door. And for the first time, this tiny $8 company is about to roll out this long-awaited technology. To be one of the first to get in on this big stock market opportunity… | | | -- | My Gold Story: Why I Went “All In” I left my job nearly two years ago. We sold all our things. Kate and I (we’re divorced) hit the road with our three kids. We don’t have anywhere to live. And we homeschool the kids. We left “the matrix” in another important way, too. When we left America, we drained our bank and retirement accounts of cash, and we converted all our savings into gold and silver. Why did we do this? We don’t want to be in the system anymore. It’s unbalanced and unstable. So we’re going to sit on the sidelines, in precious metals, until it’s safe to return to the financial system. When it’s finally safe, we’ll sell all our gold and invest in the top dividend-raising stocks. Our money will stay there – I hope – generating bigger and bigger dividends for the rest of our lives. (More on this in a moment.) How will we know when it’s safe? That’s where the Dow-to-Gold ratio comes in. It’s the ultimate barometer of systemic “health”… | Recommended Link | | COVID-19: The Pin That Burst the Bubble It's no surprise that coronavirus has created a worldwide pandemic, as we see markets around the world hitting record-breaking lows. But what you might not know is that Bill Bonner and Dan Denning have been tracking the debt bubble for more than 20 years and were prepared for it to burst. (Actually, Bill has been warning his readers about it for many years.) The coronavirus was just the nail in the coffin… If you were following our advice, you would have been prepared for this situation... but the good news is it's not too late to prepare yourself now. (You might even be able to profit.) | | | -- | Recent Reversal Our Dow-to-Gold trade is based on a simple premise… You buy stocks when they are cheap relative to gold. That is, when the Dow-to-Gold ratio is below 5. Then you sell stocks when they become expensive – when the Dow-to-Gold ratio rises above 15. At that point, you return to gold. Over the course of the last 100 years, you would have made only six trades. But you would have also handily beaten a “buy-and-hold” approach. The chart below shows it all. The towering peak in 1999. The countertrend rally from 2011 to 2018. And if you look carefully, the recent reversal…

I interpret this recent reversal as the Dow-to-Gold’s primary trend reasserting itself, getting back on track, and once again marching back down towards single digits. This next chart shows the zoom-in of the last two decades or so…

The ratio topped out at 22.36 in September 2018. It’s been falling since… and I speculate it’s about to head much lower. Of course, if I’m wrong and the Dow-to-Gold ratio isn’t ready to resume its primary trend lower, the market will let us know. How? By making a new high, rising above 22.36, and invalidating the downtrend. (It’s why I set our “stop loss” at 22.36.) But I’m willing to bet that’s not going to happen… Trend in Motion The ratio likes to move in big, clear trends. And once it’s in motion, it tends to stay in motion. Its drop in 2018 implied to me that gold would start outperforming the stock market… possibly for as much as the next five or 10 years. I immediately drained my bank and retirement accounts and put everything into gold and silver. Then, I started nagging my friends and family to do the same. Remember, the ratio peaked in September 2018 at 22.36. My hypothesis is that the Dow-to-Gold ratio is now back on its way down… to a level somewhere below 5. Bill calls this its “rendezvous with destiny.” I will hold on to my gold until then, at which point I’ll sell it all and invest the proceeds into the stock market. Until then, I’m keeping an eye on the Dow-to-Gold ratio. It’s at about 14 as I write. Regards, Tom Dyson

Editor, Postcards From the Fringe P.S. If you’re following my strategy, don’t just buy gold bullion. I’ve created an entire trade to take advantage of this opportunity. I’ve invested nearly $1 million of my own money into it. And on Wednesday night, I shared all the details during a special online briefing. Bill even joined me from his ranch in Argentina. If you missed it, there’s still time to watch the replay right here.

Like what you’re reading? Send us your thoughts by clicking here. IN CASE YOU MISSED IT… EXCLUSIVE: U.S. Military Quietly Pours Millions Into Tiny Boston Biotech The U.S. military is not in the business of making bets on the stock market. But during his research trip to the Pentagon, one of America's top biotech investors stumbled across a shocking discovery… Away from the public eye, the military made a big bet on a tiny biotech firm. With a major announcement due in a few weeks, this tiny stock could spike 12x in just hours. What does the U.S. military know that you don't? Click here to find out.

Get Instant Access Click to read these free reports and automatically sign up for daily research. |

No comments:

Post a Comment