Forex analysis review |

- Forecast for AUD/USD on June 3, 2020

- Forecast for USD/JPY on June 3, 2020

- Comprehensive analysis of movement options for Gold, Palladium, Platinum, and Silver (H4) on June 3, 2020

- Hot forecast and trading signals for the GBP/USD pair for June 3. COT report. Buyers are in a rage, but must protect 1.2529

- Hot forecast and trading signals for the EUR/USD pair for June 3. COT report. Buyers continue to enjoy the favorable situation.

- EURUSD remains in a bullish short-term trend,

- Short-term Ichimoku cloud indicator analysis of Gold

- EUR/USD and GBP/USD. Most Americans consider Trump a racist (opinion poll), which further affects his political ratings.

- Between two lights: gold hung in a narrow range

- EUR/USD. American riot, coronavirus and European confrontation

- Evening review on EURUSD for June 2, 2020

- June 2, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- June 2, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- Accumulation of trading volumes may lead to an increase in Bitcoin

- Trader's diary. June 2, 2020. Covid-19 in Russia. Russian rouble

- Analysis of Gold for June 02,.2020 - Watch for the breakout of the symmetrical triangle contraction pattern to confirm further

- GBP/USD: plan for the American session on June 2 (analysis of morning deals). The pound continues to update monthly highs.

- Oil continues to rally

- EUR/USD: plan for the American session on June 2 (analysis of morning deals). Bulls break through the resistance of 1.1139

- EUR/USD analysis for June 02, 2020 - Upward extension and the old trading channel became active again. Watch for downside

- Oil needs a compromise

- US and Asian stock markets continue to rise

- BTC analysis for June 02,.2020 - Massive buying climax at the $10.000 level. Watch for potential selling opportunities...

- EUR / USD growth impede by previous snags

- Trading plan for EUR/USD on June 2, 2020. Coronavirus updates from around the world. The US market keeps on rising despite

| Forecast for AUD/USD on June 3, 2020 Posted: 02 Jun 2020 07:49 PM PDT AUD/USD Optimistic data on the Australian economy came out this morning, on Wednesday. As we expected, GDP for the first quarter turned out to be better than forecast: -0.3% against the expected -0.4%. In addition, issued permits for new construction in April showed a decline of only 1.8% compared to expectations of -10.8%. As a result, the Australian dollar grew by 90 points in the Asian session today, breaking the upper border of the price channel (0.6937), which is why the channel disappears from our reviews until a new unambiguously readable reversal appears. The target levels are record extremes. The nearest at 0.6975 was reached this morning, the next target is the level of 0.7080. Behind it is 0.7185. The price rises very quickly with a moderate growth of the Marlin oscillator in its own narrow channel on the four-hour chart. The output of the indicator signal line from its own channel down will become a signal for a correction of the price. This can happen when the price drops below 0.6900. It is hardly possible to calculate the depth of the correction since there are many local levels in front of it, therefore, it is not advised to open sales, respectively. You can possibly retain purchases while aiming for 0.7080. It is acceptable to open short-term purchases with a price transition above 0.6975. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for USD/JPY on June 3, 2020 Posted: 02 Jun 2020 07:49 PM PDT USD/JPY Following a two-week sideways movement, the USD/JPY pair finally pulled up yesterday due to the continuing rise in risk appetites: the S&P 500 added 0.82% yesterday, gold fell 0.69%, and 5-year US government bond yields were up from 0.31% to 0.32%. The growth of the USD/JPY pair reached 110 points, the first bullish target of 108.30 was overcome. The second target of 109.50 is open, where now we are waiting for the price. With its overcoming, growth is possible to 110.83 (November 2017 low). The Marlin oscillator is in the zone of positive values. The price slightly retreated after strong growth on the four-hour chart. Target level of 108.30 now acts as support. After completing the local correction, we expect the currency pair to continue growing. |

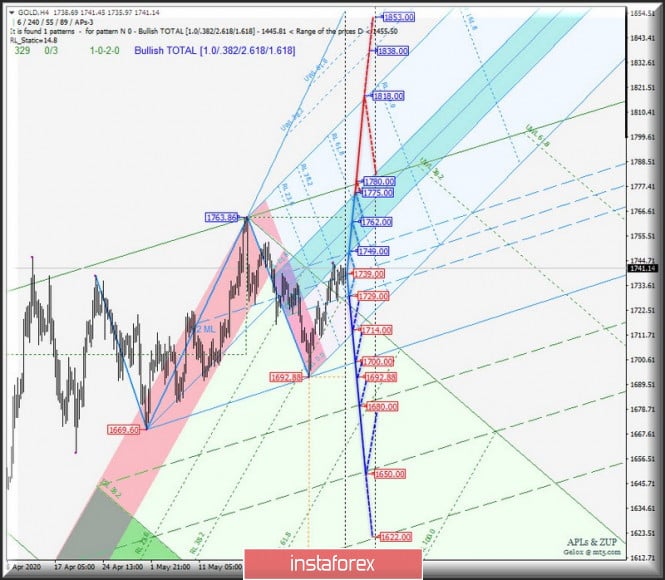

| Posted: 02 Jun 2020 05:14 PM PDT Minuette operational scale (H4) The main precious metals Gold, Palladium, Platinum, and Silver - overview of movement options from June 3, 2020. ____________________ Spot Gold The development of the Spot Gold movement from June 3, 2020 will be determined by the development and direction of the breakdown of the boundaries of the 1/2 Median Line channel (1729.00-1739.00-1749.00) of the Minuette operational scale fork - details of working out these levels are shown on the animated chart. A breakout of the lower border of the channel 1/2 Median Line of the Minuette operational scale fork - support level 1729.00 - development option for the Spot Gold downward movement towards the goals:

In case of breaking the upper border of the channel 1/2 Median Line Minuette - resistance level of 1749.00 - the development of this tool will continue in the zone of equilibrium (1749.00-1762.00-1775.00) of the Minuette operational scale fork of the achievement of the line of control UTL (1780.00) of the Minuette operational scale fork and end line FSL Minuette (1818.00). Details of the Spot Gold movement from June 3, 2020 can be seen on the animated chart.

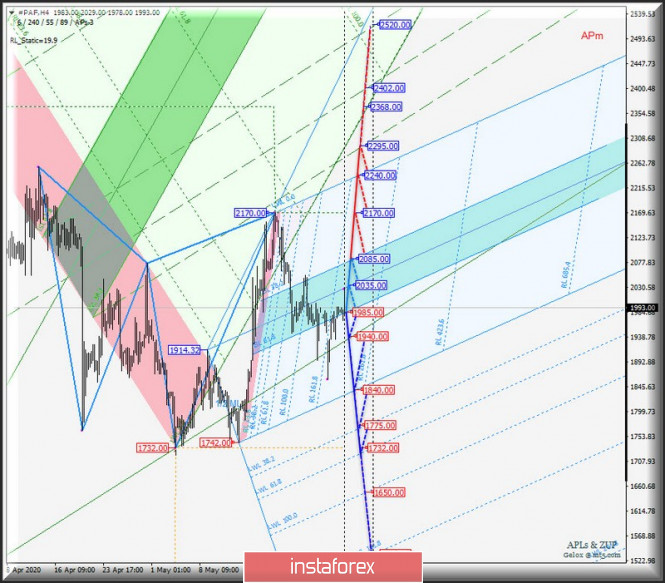

____________________ #PAF (Palladium) Current Month From June 03, 2020, the #PAF (Palladium) movement will be determined by working out and the direction of the breakdown of the boundaries of the equilibrium zone (1985.00-2035.00-1085.00) of the Minuette operational scale fork - see the animated chart for details of the movement in this equilibrium zone. The breakdown of the top border ILS38.2 equilibrium zone of the Minuette operational scale fork- resistance level 2085.00 - the upward movement of #PAF can be continued to the goals:

If the support level of 1985.00 breaks at the lower border of ISL61.8 of the balance zone of the Minuette operational scale forks, the downward movement of the Palladium Current Month can be continued towards the goals:

The markup of #PAF (Palladium) motion options from June 3, 2020 is shown on the animated chart.

____________________ #PLF (Platinum) Current Month The development of the #PLF (Platinum) movement from June 3, 2020 will be determined by the development and direction of the breakdown of the range:

In the event of a breakdown of the initial SSL line of the Minuette operational scale fork - support level 875.0 - there may be a development of a downward movement #PLF to the LTL Minuette control line (862.0) and the boundaries of the equilibrium zone (850.0-822.0-792.0) balance zones of the Minuette operational scale fork with the possibility of updating the local minimum 757.5. With the breakdown of the resistance level of 895.0, the development of the Platinum Current Month movement will continue in the channel 1/2 Median Line (895.0-911.0-929.0) of the Minuette operational scale fork with the prospect of reaching the borders of the equilibrium zone (942.5-966.0-988.0) of the Minuette operational scale fork. Details of the #PLF (Platinum) movement options from June 3, 2020 are shown in the animated chart.

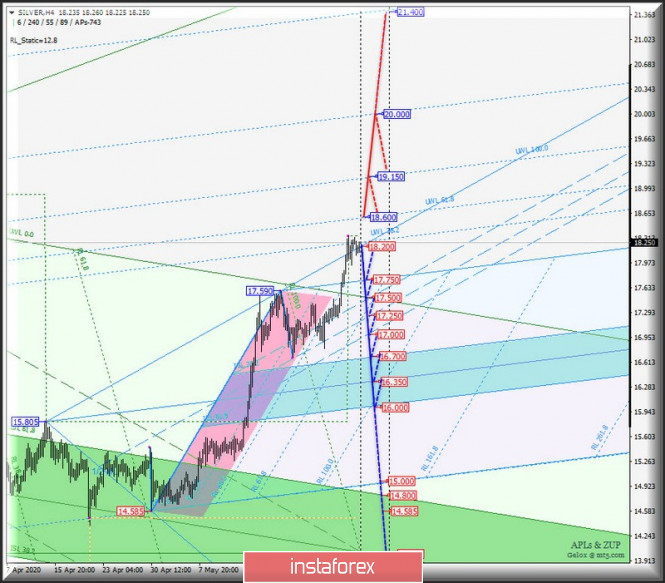

____________________ Spot Silver The development of the Spot Silver movement from May 27, 2020 will also be determined by the development and direction of the breakdown of the range:

The breakdown of the UTL control line of the Minuette operational scale fork - support level of 18.200 - will determine the development of the downward movement Silver Spot can be directed to the goals:

If the resistance level 18.600 is broken on the warning line UWL61.8 of the Minuette operational scale fork, the upward movement of Spot Silver will be directed to the warning lines UWL100.0 Minuette (19.150) and UWL161.8 Minuette (20.000). Details of the Spot Silver movement options from June 3, 2020 are shown in the animated chart.

____________________ The review is compiled without taking into account the news background, the opening of trading sessions of the main financial centers, and is not a guide to action (placing "sell" or "buy" orders). The material has been provided by InstaForex Company - www.instaforex.com |

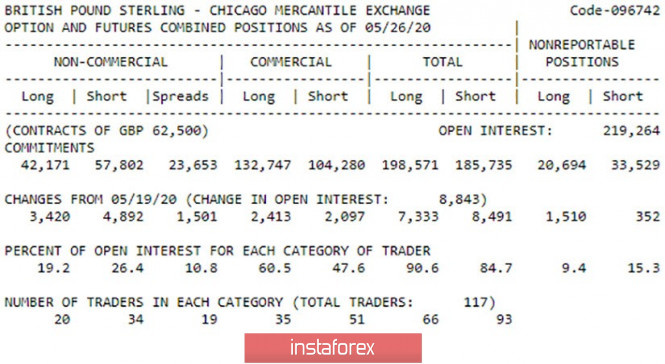

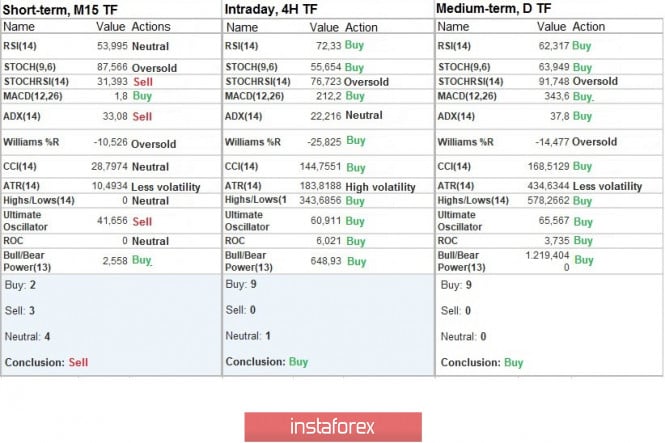

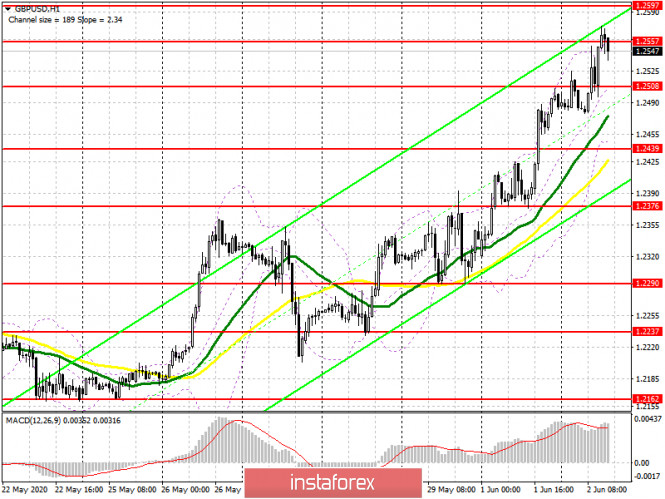

| Posted: 02 Jun 2020 05:12 PM PDT GBP/USD 1H The pound/dollar pair continued its upward movement on Tuesday, June 2, and also overcame the resistance level of 1.2529. Now this resistance level may be a kind of reference level for further purchases of the British currency. The fact is that, unlike the euro currency, which has a very narrow upward channel, the GBP/USD pair has only an upward trend line, which now lies at a distance of about 230 points. Thus, even if the instrument falls by 230 points tomorrow, formally the upward trend will continue. This combination of circumstances is very inconvenient for opening new positions for the purchase. Especially in conditions when the British pound can return to a fall at any moment. Thus, we recommend using the 1.2529 level to set the Stop Loss under it. If the pair goes below it, then the new buy-position can be considered after the reverse consolidation above it. GBP/USD 15M Both linear regression channels continue to be directed upward on the 15-minute timeframe, therefore, there are no signs of completing the upward trend here, just as there are no signs of starting a correctional movement. COT Report Despite the fact that in total among all major market participants, the demand for the pound sterling did not change during the reporting week (a total of 8600 contracts for buying and selling were opened), professional traders mainly bought the pound sterling - +5205 contracts, and from contracts for on the contrary, they got rid of the sale at -686 transactions. Thus, the mood of traders remains upward, and in principle, the situation has not changed at the end of last week. The GBP/USD pair continues to grow at the beginning of the new week, which means that the demand for the pound does not decrease. The new COT report may show even greater strengthening of the position of large buyers. The fundamental background for the British pound remains negative despite the fact that this currency continues to go up in tandem with the dollar. Macroeconomic reports in the first two trading days of the week were not published either in the US or in the UK. And at the same time in both countries there are already serious financial problems, as well as new ones are brewing. However, the US dollar is now cheaper because of mass protests, the wave of which swept the United States, and not because of economic reports or the possible start of a new trade war with China. Recall that during the previous trade conflict with Beijing, most of the time the US currency continued to rise in price against the euro and against the pound. At least, fears for an escalation of the conflict did not push traders to sell the dollar. Thus, even now, this reason seems insufficient to independently cause the US currency to fall. All macroeconomic publications of today are already listed in the forecast for EUR/USD. In the UK, only the index of business activity in the services sector is planned on June 3, which is likely to be ignored by traders with a 99% probability. However, market participants are now interested in completely different things. For example, the outcome of the fourth round of negotiations between the groups of Michel Barnier and David Frost, as well as the results of Boris Johnson's trip to Brussels. There are two main scenarios as of June 3: 1) The initiative for the pound/dollar pair remains in the hands of buyers and, since the next resistance level of 1.2529 was overcome yesterday, traders are advised to stay in purchases with the target of 1.2664. A short Stop Loss can be set below the 1.2529 level and, if it works, it is recommended that new purchases be made only after re-consolidation above the 1.2529 level. Take Profit will be about 100 points. 2) Sellers continue to remain in the shadow and will be ready to return to the market only below the ascending trend line. Of course, short positions can be considered up to this point, but at the moment there are no prerequisites for this. We consider the minimum necessary condition for sellers to overcome the area of 1.2403-1.2423. Then it will be possible to sell the pair while aiming for the trend line (1.2310). In this case, Take Profit will be about 90 points. The material has been provided by InstaForex Company - www.instaforex.com |

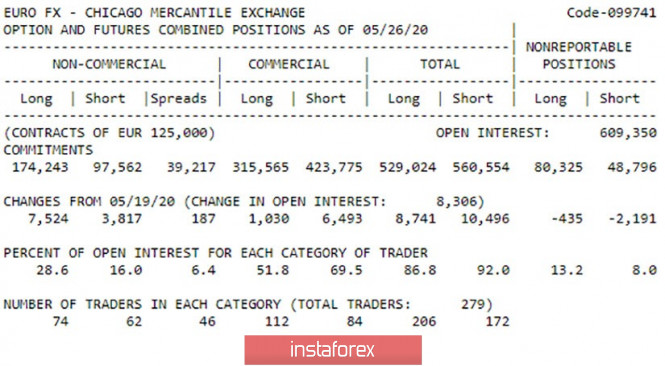

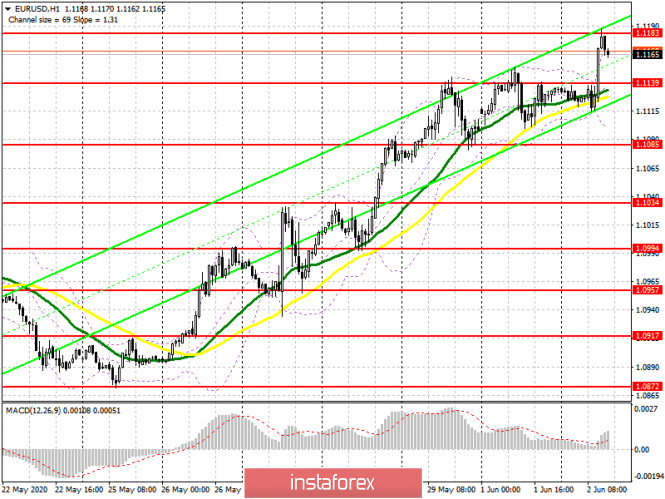

| Posted: 02 Jun 2020 05:09 PM PDT EUR/USD 1H The EUR/USD pair calmed down on Monday, but already on Tuesday resumed a strong upward movement on the hourly timeframe, while remaining inside the upward channel, which is very narrow, which indicates an almost recoilless upward movement. In recent days, buyers did not completely take the initiative out of their hands, sellers did not have a single chance to consolidate under the ascending channel. Thus, today, buyers can continue to trade with the objectives of the two nearest resistance levels of 1.1205 and 1.1312. We also recall that the upward trend is supported by two upward trend lines, which previously repeatedly supported the traders to increase and did not let the bears down. Bears can enter the battle not before closing the quotes of the euro/dollar pair below the rising channel. EUR/USD 15M We see the same picture on the 15-minute timeframe. Two linear regression channels, both still directed upward and clearly signal an upward trend. Thus, at the moment, there is no signal at the disposal of traders regarding the end of the upward trend. COT Report The latest COT report showed that professional traders unexpectedly started buying the European currency during the reporting week. Suddenly - because, from our point of view, the fundamental background was not in favor of the euro. However, during the current week it became expectedly in favor of the euro due to mass rallies and protests in the US. Large traders found reason to open new 7524 purchase contracts last week. Only 3817 sales contracts were opened for the reporting week, if we take into account the most important group of traders - professional players who work in the market with the goal of making profit due to exchange rate differences. This information is already enough to understand that the mood of large traders for the reporting week has changed to bullish. The beginning of the new week also remains with the buyers, so in the new COT report we can see an even greater increase in purchase contracts among professional traders. The overall fundamental background for the pair remains neutral, given news of an economic nature only. However, market participants are now very worried about the future of the US economy, which is on the verge of a new trade war with China, which will have a negative impact on it, and the whole country is covered by rallies, protests and outright riots that do not allow us to expect economic recovery in the near future. But they allow us to expect the second wave of the epidemic of the coronavirus. Doctors warned before the riots and rebellions that Donald Trump prematurely weakened the quarantine and a new outbreak could happen in the country. Now the likelihood of a new outbreak has increased many times over. No macroeconomic statistics were published yesterday, but today there are several reports that deserve attention. Firstly, it is data on unemployment and on the number of applications for unemployment benefits in Germany for May and June. These reports will make it possible to conclude whether the worst is left behind. It is expected that the unemployment rate will rise to 6.2%, which is not so much, and the number of new unemployed will be 200,000. Secondly, the unemployment rate will also be released in the European Union, which threatens to jump to 8.2% in April. Thirdly, the ADP report on the level of employment in the private sector for May will become known (forecast -9 million workers). Fifth, business activity indices for Markit and ISM services in the United States will be published. We believe that absolutely all of these reports will have practically no effect on the course of trading. Just because traders are absolutely ready for the numbers that appear in the forecasts. Based on the foregoing, we have two trading ideas for June 3: 1) It is possible for quotes to grow further with the goals of resistance levels for the 4-hour chart of 1.1205 and 1.1312. However, the bulls simply need to stay within the rising channel for this. Stop Loss levels can be placed below the channel and gradually transferred to the top. Potential Take Profit in this case will be from 30 to 130 points. 2) The second option - bearish - involves consolidating the EUR/USD pair under the upward channel, which will allow sellers to join the game and start trading lower with targets at 1.1074 (Kijun-sen) - 1.0990 (upward trend ) - 1,0931 (support level). Overcoming each of the barriers will keep sales open. Potential Take Profit range from 50 to 200 points. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD remains in a bullish short-term trend, Posted: 02 Jun 2020 02:21 PM PDT EURUSD remains in a bullish trend. Price has broken out and above the resistance of the Kumo. Both the tenkan-sen and kijun-sen are positively sloped. As long as price is above them trend will remain bullish.

|

| Short-term Ichimoku cloud indicator analysis of Gold Posted: 02 Jun 2020 02:16 PM PDT Gold reached $1,745 but price got rejected once again at recent highs and is now pulling back. Trend remains bullish as long as price is above $1,720-$1,710. This is very important support both horizontally and by using the tenkan-sen and kijun-sen indicators.

The tenkan-sen (red line indicator) has a negative slope. If this indicator crosses below the kijun-sen (yellow line indicator) we will have a weak sell signal. Key support to be tested afterwards. This support would be at the Cloud (Kumo) at $1,675. Inability to produce higher high is a sign of weakness.As we said many times before, trend might be bullish, but the weekly RSI provides us a with a bearish warning. This makes us be bearish Gold around $1,750 and higher. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Jun 2020 10:35 AM PDT 4-hour timeframe Average volatility over the past five days: 85p (average). The EUR/USD currency pair continued to trade with an increase on Tuesday, June 2 as if nothing had happened. Traders have been waiting for a downward correction for several days in a row, but it still does not start. Just a few days ago, the euro/dollar was firmly "sitting" inside the side channel, and there was no fundamental reason for a new upward trend to begin. Market participants cheerfully ignored all macroeconomic reports. Now, even a macroeconomic background is not required. In principle, we cannot even say that the US dollar is falling in value in pairs with the euro and the pound solely due to riots and riots in the United States. Most likely, traders are getting rid of the US currency now for a combination of reasons. And among this aggregate, one can distinguish the impending threat of a new trade war with China, the threat of a cold war with China, the strongest collapse of the US economy, the high threat of the second wave of the epidemic (the likelihood of which has also increased over the past week thanks to all the same rallies and protests of the American people, during which, of course, no rules of social distance are respected), and, frankly, the political crisis. We talked about Donald Trump, his activities, his manner of conducting international and internal affairs a thousand times. In short, we believe that Donald Trump is an excellent businessman who managed to apply his business qualities in the first three years, which benefited America and its GDP, but a bad leader and a bad politician, because he managed to lose everything due to the lack of necessary qualities his merits for the next few months of his reign. Trump constantly underestimated China, underestimated the Democrats, believing that it is the smartest and most powerful. In practice, it turned out that it was intentionally or accidentally, but it was Beijing that dealt such a blow to America that it is now unknown when the "great country" will recover from it. And Trump himself with a high degree of probability will not be the next president of the country. The events of recent weeks have affected Trump's political ratings not only because the country's president is always responsible for what is happening in this country. According to opinion polls, most Americans think Trump is a racist (52% according to YouGov). 45% of respondents said that, in their opinion, interracial relations in America have worsened in recent years. Agree, it is very disadvantageous when the majority of the population considers the president a racist in the midst of a racist scandal. As for the liking of potential voters, Trump lost 4% in popularity over the past week, and Joe Biden scored 4% and, thus, now the Democrat is leading by a margin of between 8% and 10%. Meanwhile, Hong Kong Prime Minister Carrie Lam accused the US government of "double standards." At the end of last year, when riots took place in Hong Kong due to the adoption of several laws that contradict the autonomy of the district and the principle of "one state - two systems of government," Washington publicly condemned the actions of the Chinese police, which too harshly pacified the rebels. The White House even made a decision at the legislative level to restrict sales of certain categories of goods that were used by the Chinese police to suppress the riots. Now, when mass protests are taking place in the United States themselves, the American police do not limit themselves at all in the means of suppressing rebellions. "America is very concerned about its own national security, but they look at our national security through tinted glasses," said Lam. "We see how the authorities in the US" cope "with the riots and compare it with their position that they took when almost the same riots occurred in Hong Kong last year." Lam also recalled Trump's words about the "powerful blow", clearly hinting that America had run into what it was fighting for. 4-hour timeframe Average volatility over the past five days: 141p (high). The GBP/USD currency pair also continued its upward movement on June 2, which has clearly intensified in recent days. Thus, during the day the pound/dollar pair overcame the second resistance level for this week at 1.2529 and did not show a single sign of starting a correctional movement. The pair's volatility has significantly grown in recent days, and the reasons for strengthening the British currency are now similar to the reasons for the euro's growth. And they obviously do not lie in the European Union or Great Britain. From the UK, we have already forgotten when the last time came positive news or macroeconomic data. Which, in principle, is not surprising in times of global crisis and epidemic. However, even when the economies of all countries of the world are contracting, and the epidemic is affecting the inhabitants of these countries, for some reason, Britain is in first place in the number of COVID-19 related deaths in Europe, as well as the one with the most number of cases of diseases. A second wave of a pandemic is possible in Britain. Thus, even in a situation where all countries of the world are experiencing serious problems, Britain is even more serious. And if it were not for the unexpected and completely discouraging story in the United States, the pound would now fall back to the March 23 lows. However, instead, the British currency is growing and already approaching the highs of April 14 and April 30, which almost coincide at a price level of 1.2647. Actually, only about 100 points remain until this level is reached. We believe that it is around this level that the fate of the pound will be decided in the coming weeks. If traders show their strength and overcome this level, then the upward movement may continue with renewed vigor, but its duration will depend on the current circumstances on how quickly it will be possible to suppress rebellions and riots in America. In case the pair's quotes rebound from the 1.2647 level, bears can return to the market and recall that the economic situation in Britain (the most important and significant for traders) is no better than in the US, which means there are no particularly good reasons for long-term purchases of the British no pound. Well, if a new chunk of information about the failure of the next round of Brussels-London negotiations arrives in June, it can also significantly reduce the attractiveness of the pound in the eyes of traders. Recommendations for EUR/USD: For long positions: The EUR/USD pair continues its upward movement on the 4-hour timeframe. Thus, the current targets for open buy orders are now levels 1.1205 and 1.1312. You are advised to manually close longs when the price rebounds from any target. The MACD indicator may now give false signals about the beginning of a correction, since the upward movement is practically recoilless. For short positions: Orders for sale can be opened no earlier than consolidating the price below the critical line with the first target support level of 1.0931. However, in this case, trading for a fall is recommended in small lots. Recommendations for GBP/USD: For long positions: The pound/dollar is also continuing its upward movement. Thus, it is also advised to stay in purchases with targets of 1.2620 and 1.2664 until a rebound from any target occurs or the MACD indicator turns down when the price drops in parallel. For short positions: It is recommended that sales of the GBP/USD pair be considered with a target of 1.2299 and Senkou Span B line not before consolidating quotes under the Kijun-sen line, which is not expected in the near future. The material has been provided by InstaForex Company - www.instaforex.com |

| Between two lights: gold hung in a narrow range Posted: 02 Jun 2020 08:28 AM PDT

The price of gold began to decline today against the background of gradually fulfilling hopes for a faster recovery in global economies after the lifting of quarantine measures related to the COVID-19 pandemic. At the same time, the growing tension between the United States and China, as well as riots in America, are pushing the precious metals market in the opposite direction, which does not allow the fall to worsen. Thus, gold began to decline, which so far has its limits. The price of gold fell by 0.15% this morning and reached the level of $ 1,737.46 per troy ounce. Support for gold is at the level of $ 1,720 per troy ounce, and the resistance was at around 1,761 dollars per troy ounce. Today it has become clear that multidirectional forces press on gold, which does not allow it to choose a specific vector for movement. There are factors that support and make us move up, and there are pressures that pull down. On the one hand, this allows you to stay within the same range, almost eliminating a sharp and rapid drop. On the other hand, growth is also severely limited. Until the forces outweigh in one direction or another, we will observe movement in an extremely narrow corridor. Of the news that market participants pay special attention to, it is worth noting the continuation of the conflict between Beijing and Washington, which could lead to the abolition of Hong Kong privileges and its status as a global financial center. The situation is aggravated by retaliatory measures by the Chinese authorities, which have already canceled the purchase of agricultural products produced in the United States of America. This may result in complete trade isolation of the largest economies in the world, which in turn will negatively affect the general economic climate of the world. The rupture of US-Chinese trade relations is a support factor for gold, which means that it will grow in value. However, the positive attitude is offset by negative news, which should include the protest movements in the United States of America that erupted due to another act of racial discrimination that resulted in death. The situation on the stock exchanges of the world is now more than favorable, and this is a counterargument for the purchase of precious metals. Investors still have the courage, and they do not need gold as a safe-haven asset. According to experts, the short-term movement of gold will be in the range of 1,700 to 1,750 dollars per troy ounce. Trade within these limits will continue until there is serious pressure from the outside world. The cost of palladium decreased by 0.12% and stopped at around 1,958.99 dollars per troy ounce. Silver slowed down by 0.18% and reached the level of 18.24 dollars per ounce. The price of platinum fell 0.81%, pushing the metal one line at $ 840.75 an ounce. Copper futures for July delivery fell by 0.24% which makes it $ 2.642 per pound. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. American riot, coronavirus and European confrontation Posted: 02 Jun 2020 07:50 AM PDT The euro-dollar pair came close to the 12th figure today, updating almost three-month price highs. The last time the pair was in this price area was in mid-March, on the way to the annual low of 1.0653. Today, buyers are clearly dominant - with slight downward pullbacks, the pair has been growing for a week, rising from the support level of 1.0880 to the current local high of 1.1195. And if the price strengthened last week mainly due to the euro's growth and the vulnerability of the dollar, now the upward price dynamics is only a result of the devaluation of the US currency. On the contrary, European events act as a kind of anchor, not allowing the bulls to momentarily break through the resistance level of 1.1200. However, first things first. The riots in the U.S. at first did not bother investors, as they did not bode anything extraordinary- unfortunately, incidents like Minneapolis occur in the country with a certain regularity, and, as a rule, retaliatory protests are local and short-lived. However, current events have gone beyond the expected scenario, gaining completely different perspectives - especially in the light of the coronavirus pandemic. At the moment, curfews have been imposed in nearly 80 cities in the United States, while protests in one form or another are taking place in all major cities. In 15 states, National Guard forces came to the rescue of local authorities, and the number of detainees is in the thousands (totaling about 4,400 people across the country). To many, the current situation resembles the year 1968, when Martin Luther King was killed. According to journalists, then there was also an epidemic and there were also mass protests. Indeed, the scale is incomparable (especially with regard to the epidemiological situation), so some experts predict the worst summer for the United States since the Great Depression. Donald Trump added fuel to the fire, who in his usual manner declared that he could use the army to suppress riots. This initiative was criticized by many governors (mainly from the pool of Democrats) and, of course, by Joe Biden. Trump's future rival in the presidential election warned that the head of the White House cannot, by his sole decision, direct the army against his own people. The fact is that according to the law "Posse Comitatus Act", which was adopted in 1878, the armed forces cannot operate inside the country without the permission of Congress. Trump, in turn, threatens to use the law "Insurrection Act" (it was adopted even earlier, in 1807), which has never been applied in the United States. However, traders are worried not so much about the riots amidst the political crisis, as the risk of a second wave of the epidemic. There can be no talk of any social distance at such rallies, while thousands and tens of thousands of Americans are involved in these events. Possible prospects emerge by themselves: a re-outbreak, a new lockdown, rising unemployment, a further slowdown in the economy, and a protracted recession. Such a scenario looks very realistic and quite frightening against the background of recently published macroeconomic reports. That is why the dollar is now so responsive to the news flow regarding the dynamics of the protest movement. After all, do not forget that the United States is still leading in the number of infected and dead from coronavirus. According to the latest data, COVID-19 was confirmed in 1,837,170 people over there. Nevertheless, after the country reached the so-called "plateau", almost all regions decided to weaken the quarantine, thereby launching the country's economy. If protests are followed by an outbreak of disease, Americans will have to return to the "zero point". The euro also has its own problems. The political conflict in Europe, although less noticeable in the information space, nevertheless carries a potential risk for the growth prospects of EUR/USD. We are talking about the notorious anti-crisis plan of the European Commission. The proposed plan provides that the affected EU countries will receive 500 billion euros in subsidies, and 250 billion in loans. However, Austria officially opposed the initiative yesterday. According to the Minister of Finance Gernot Blumel, Vienna will not approve the proposed plan, as it is "a heavy burden for Austrian taxpayers." Earlier, a similar position was voiced by the representatives of the Netherlands, Sweden and Denmark. They reacted somewhat more softly to the Ursula plan, calling Brussels' initiative "the starting point for negotiations." As you know, according to the procedure, this plan should be considered by all member states of the European Union and express their opinion at the corresponding summit (according to some forecasts, such a summit may take place at the end of July). But even if the program is approved in principle, another procedural step is needed for its implementation: it is necessary to increase the "ceiling" (that is, the upper limit) of the EU's own resources. And for this, ratification of the national legislative bodies of the EU countries is needed. In other words, the proposed program should go through the millstone of the parliaments of all 27 member states of the EU. In other words, if Austria continues to show integrity in this matter, then the European currency will become an anchor for the EUR/USD pair, at least slowing down the price increase. However, this threat is still potential in nature: such heavyweights like Germany and France are allies of Brussels, so Austria's position does not bother EUR/USD traders. At least at the moment there is general confidence in the market that Vienna will be able to convince - perhaps with the help of some compromises regarding the amount of mandatory payments. Thus, the rebellion in America is still the number one topic for the pair's traders. Mass riots could potentially have widespread and extremely negative economic consequences for the country. Therefore, if the situation on this front is aggravated, the dollar will continue to plunge. And vice versa - if the authorities manage to repay the wave of protests, a correction will follow for the pair, especially considering the proximity of the June meeting of the European Central Bank (Thursday, June 4). From a technical point of view, the pair maintains its growth potential - on the daily chart, the pair is located on the upper line of the Bollinger Bands indicator and above all the lines of the Ichimoku indicator. On the weekly chart, the price is located in the Kumo cloud, and the closest growth target is the upper border of this cloud - the 1.1225 mark. The next resistance level is the upper Bollinger Bands line at W1 and the price is 1.1260. The material has been provided by InstaForex Company - www.instaforex.com |

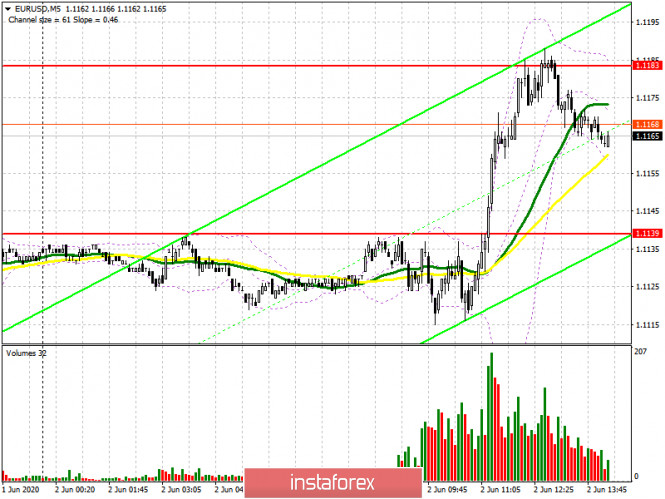

| Evening review on EURUSD for June 2, 2020 Posted: 02 Jun 2020 07:10 AM PDT Comparison of the two graphs:

This is the USDJPY in D1 chart which shows a clear signal for the growth of the dollar.

This is the euro in H4 chart which clearly shows growth against the dollar. With the given data above, we, therefore, conclude that one of these instruments is deceiving us. But it could also mean that either the euro or the dollar will rise. You may consider purchases from 1.1155 euros. Stop at 1.1110 and target at 1.1500. Note that the employment report is set for tomorrow. The material has been provided by InstaForex Company - www.instaforex.com |

| June 2, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 02 Jun 2020 06:54 AM PDT

Recently, Bullish persistence above 1.2265 has enhanced another bullish movement up to the price levels of 1.2520-1.2590 where significant bearish rejection as well as a quick bearish decline were previously demonstrated (In the period between 14th - 21 April). Moreover, Atypical Bearish Head & Shoulders reversal pattern was in progress. The GBP/USD pair was demonstrating the Right Shoulder of the pattern. Hence, Bearish persistence below 1.2265 (Reversal Pattern Neckline) was needed to confirm the pattern. Thus, enhance another bearish movement towards 1.2100, 1.2000 then 1.1920. Moreover, the price zone of 1.2300-1.2280 corresponding to a short-term uptrend was breached to the downside failing to provide enough bullish support for the pair. Thus, enhancing the bearish side of the market. Temporary bearish breakout below 1.2265 was demonstrated in the period between May 13 - May 26. However, immediate bullish rebound has been expressed on May 18. On the other hand, the price zone of 1.2520-1.2600 (Backside of the broken Uptrend) stands as a recently-established SUPPLY-Zone to offer bearish rejection and a valid SELL Entry for the pair in the short-term. Hence, further bearish decline would be expected to be enabled towards 1.2020 as a projection target for the reversal pattern provided that no bullish breakout above 1.2600 is expressed. Trade recommendations : Intraday traders can still consider the current bullish pullback towards the price zone of 1.2520-1.2600 as a valid SELL Entry. T/P level to be located around 1.2345, 1.2265 and 1.2150 while S/L should be placed above 1.2650. The material has been provided by InstaForex Company - www.instaforex.com |

| June 2, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 02 Jun 2020 06:49 AM PDT

On March 20, the EURUSD pair has expressed remarkable bullish recovery around the newly-established bottom around 1.0650. Bullish engulfing H4 candlesticks as well as the recently-demonstrated ascending bottoms indicated a high probability bullish pullback towards 1.0980 and 1.1075 (Fibo Level 50%). Shortly After, a bearish Head & Shoulders pattern was demonstrated around the price zone between (1.1075-1.1150). Shortly after, a sideway consolidation range was established in the price range extending between 1.0770 1.1000. The price zone of (1.0815 - 1.0775) has been standing as a prominent Demand Zone providing quite good bullish support for the pair so far. On May 14, Evident signs of Bullish rejection have been manifested around this price zone. Moreover, recent ascending bottom has been established around 1.0870 which enhances the bullish side of the market in the short-term. Short-term technical bullish outlook remains valid as long as bullish persistence is maintained above the recently-established ascending bottom around 1.0850-1.0870. Currently, the recent bullish breakout above 1.1000 has enhanced further bullish advancement towards 1.1175 (61.8% Fibonacci Level) where temporary bearish rejection is anticipated. On the other hand, the price level of 1.0930 (Latest ascending bottom) stands as an Intradaily key-level to be watched by the EUR/USD intraday traders. Trade recommendations : Conservative traders are advised to wait for bearish pullback towards 1.1000 as a valid BUY Entry. T/P levels to be located around 1.1075 then 1.1175 while S/L to be located below 1.0900. The material has been provided by InstaForex Company - www.instaforex.com |

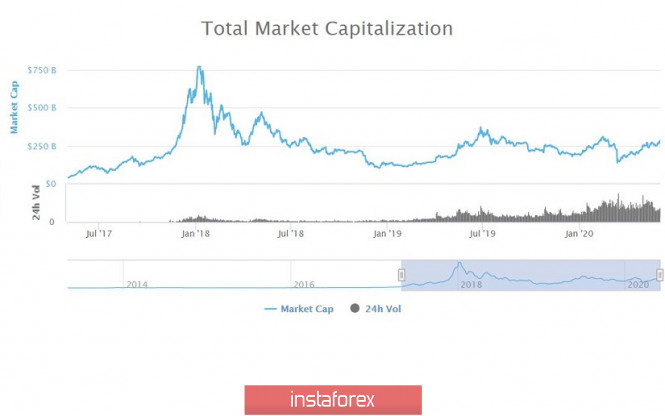

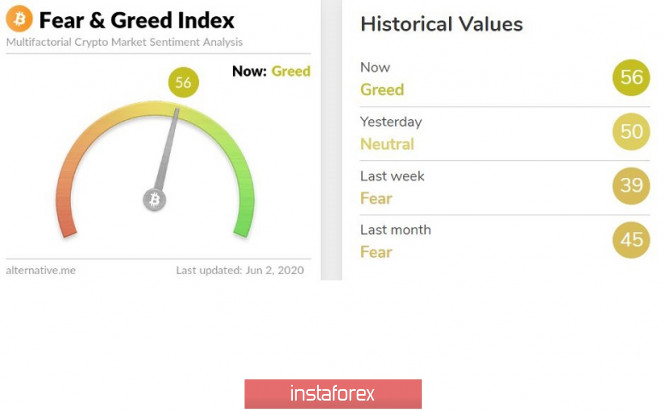

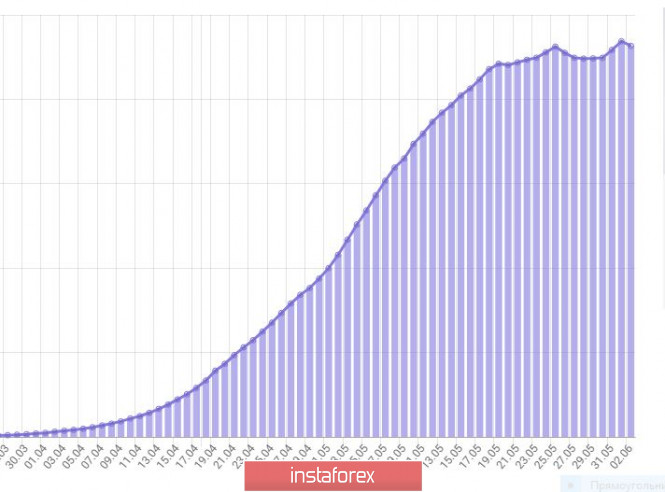

| Accumulation of trading volumes may lead to an increase in Bitcoin Posted: 02 Jun 2020 06:35 AM PDT Greetings crypto enthusiasts! Its been three weeks since the Bitcoin halving, and thus, it is only necessary that we clear and sort out what has changed and what is worth paying attention to. On May 11, 2020, a new stage in the complication of digital gold mining took place, where market participants were able to prepare for a significant event and that is buying out BTC a few weeks before the halving. As a result, the quotes once again met a well-known level of interaction between the trading forces of $ 10,000, where there was a systematic slowdown, thereby even before the halving, traders recorded profits from long positions. The subsequent process had a peculiar accumulation of trading volumes, where the quotes worked out a new range within the range of $ 8500 / $ 10,000. Should the existing slowdown be considered as a platform for future BTC growth? Why not, if there are reasons for this. Market participants, as well as major players, consider the new round of Bitcoin's life as a full-fledged exchange tool, and if we refer to JP Morgan's research, the intrinsic value of bitcoin coincides with its market price. That is, the fundamentally justified value of BTC has recently begun to correspond to the market price of the cryptocurrency, this can be considered a good signal for investors. Returning back to the price range of $ 8500 / $ 10,000, you can see that the hype has subsided, but there is no accumulation, and stop orders [StopLoss] $ 8300 / $ 10 500 are concentrated outside the borders. Thus, a breakdown of one or another border will lead to a cascading model, where the activity of market participants will increase significantly. It is worth considering that the location of stop orders is available on both sides of the range, but still the specified movement has an upward slope, and the combination of external factors indicates the prevailing interest from buyers. Of the recent insider rumors, Goldman Sachs tried to manipulate the opinions of market participants in order to weaken the BTC rate for its subsequent acquisition, but the crypto community in the face of large and influential participants, such as the Winklevoss twins, rebuffed the double standards of the imposing party. Current development and prospects For the first time since February of this year, the quotes managed to reach $ 10,428, thereby bringing it closer to the $ 10,500 stop loss area, where shorts are sitting in shock, walking along the knife's edge in the current situation. It can be assumed that updating local highs is one of the signals indicating the intention of market participants in a further upward move. Do not rush into action if, of course, you didn't enter the market on our recommendation for another breakdown of the stagnation of $ 6500 / $ 7500, but even if you are sitting in profit and thinking about topping up, then wait until the price has passed the mark of $ 10,500. If our theories are correct, then we can see the real crypto spring, where a phased ascent will bring the BTC quotes to the local maximum of 2019 - $ 13,868, which, perhaps, will not become the limit. The general background of the cryptocurrency market Analyzing the total market capitalization, we can see a good upward trend in trading volumes, where the Total market is currently $ 284 billion, which is $ 40 billion more than three weeks earlier. If we consider the volume chart in general terms, then it is clear that the breakdown of February of this year at $ 304 billion will lead to further growth towards the 2019 high of $ 362 billion. The emotion index (aka fear and euphoria) of the cryptocurrency market has recently grown substantially to level 56, which is considered a signal of growth in the activity of market participants. Let me remind you that three weeks earlier , the index indicator was 41. Indicator analysis Analyzing a different sector of timeframes (TF), it can be seen that there is a buy signal relative to the main time periods, but it is worth taking into account that factor until the level of $ 10,500 is broken, the indicators will be affected by the sideways movement. |

| Trader's diary. June 2, 2020. Covid-19 in Russia. Russian rouble Posted: 02 Jun 2020 05:59 AM PDT

This is the chart of the coronavirus cases in Russia as of morning of June 2. The good news is that the number of new cases (+8,000) is less than the number of recovered (+11,000) per day. However, this happened only thanks to Moscow region, where +2,000 people were infected and +6,000 patients recovered per day. Consequently, the number of COVID-19 cases in Russia, excluding Moscow, continues growing and the epidemiological situation is not getting any better. Apparently, Russia, excluding Moscow, has not yet passed the peak. Accordingly, the epidemiological situation in the country is likely to improve no earlier than July 2 - that is, in a month.

The Russian rouble continues strengthening. I believe that this is a false movement caused by the attack of central bank on currency buyers. The upward trend is likely to last until the vote on constitutional changes - that is, July 1. It is better to refrain from buying currency for roubles until there is a signal for the movement to stop. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Jun 2020 05:06 AM PDT News :

(Bloomberg) -- German Chancellor Angela Merkel will seek to broker a compromise Tuesday on a second stimulus package to help Europe's biggest economy recover from the deep recession caused by the coronavirus. Merkel's government launched an initial shot of stimulus and guarantees in March to cushion consumers and businesses from the impact of the outbreak. Officials are now focusing on trying to bring the economy back from a contraction expected to exceed 6% this year, the deepest since the aftermath of World War II. Merkel will host officials from the ruling coalition of her Christian Democratic-led bloc and the Social Democrats in Berlin from 2 p.m. local time. They'll attempt to thrash out a deal on a plan worth between 50 billion euros ($56 billion) and 100 billion euros, a person with knowledge of the matter told Bloomberg last week. Technical analysis: Gold has been trading sideways at the price of $1,741. I found that market is in contraction and waiting for the next breakout of consolidation to confirm further direction. Trading recommendation: Watch for the breakout of the symmetrical triangle to confirm further direction. The upside breakout of the $1,744 may lead us for test of $1,753 and $1,765 The down break of support at $1,734 may lead us for test of $1,717 The material has been provided by InstaForex Company - www.instaforex.com |

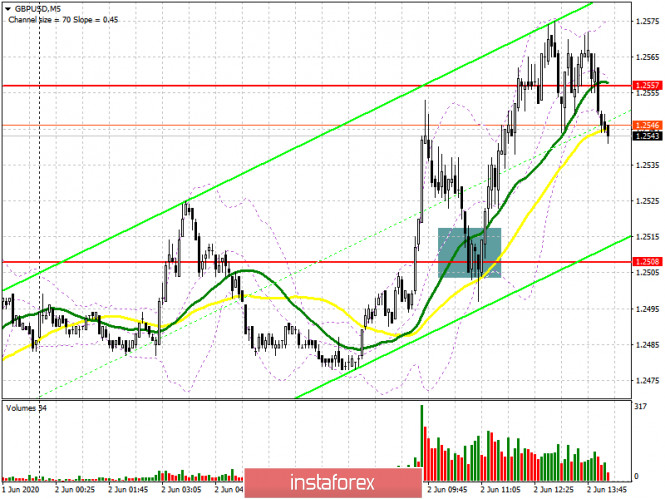

| Posted: 02 Jun 2020 05:05 AM PDT To open long positions on GBPUSD, you need: The break in the resistance of 1.2508, which I drew attention to in my morning forecast, led to the continuation of the upward trend in the British pound, even despite the high risk of failure of the next round of trade negotiations between the EU and the UK. If you look at the 5-minute chart, you will see how the entry point, after the breakout of the resistance of 1.2508, was exactly the return of the price to this level from the opposite side, which was a signal to open long positions in the expectation of continuing to strengthen the British pound, which happened. So far, the bulls have retreated from the level of 1.2557, and their main task for the second half of the day is to return this range, which can lead to a new powerful bullish impulse, capable of updating the highs of 1.2597 and 1.2638, where I recommend fixing the profits. If buyers fail to get above 1.2557, and the outcome of negotiations will not produce the desired result, it is best to postpone long positions to update major lows around 1.2439 and 1.2376, where you can buy the pound from the rebound in the calculation of correction of 30-40 points intraday.

To open short positions on GBPUSD, you need: Sellers are not letting the pair go above the resistance of 1.2557 yet, and are trying to form a strong resistance there. Another false breakout formation at this level in the second half of the day will signal the opening of short positions, and the failure in the UK's negotiations with the EU will serve as a good bearish impulse that can return the GBP/USD to the support area of 1.2508. Fixing below this level in the American session will lead to the demolition of stop orders of bulls and update the lows of 1.2439 and 1.2376, where I recommend fixing the profits. If the demand for the pound continues and the bulls regain the resistance of 1.2557, it is best not to rush to sell but to see how the pair will behave after updating the maximum of 1.2597. Or sell immediately on a rebound from the area of 1.2638 in the expectation of correction of 30-40 points at the end of the day.

Signals of indicators: Moving averages Trading is conducted above the 30 and 50 daily averages, which indicates a high probability of continuing the bullish trend. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands Breaking the upper limit of the indicator around 1.2560 will lead to a new powerful wave of growth of the pound. In case of a decline, the lower border of the indicator around 1.2439 will provide support, from where you can open long positions immediately for a rebound. Description of indicators

|

| Posted: 02 Jun 2020 05:04 AM PDT

Crude oil recorded a steady recovery yesterday, rising by 2.8% and amounting to $ 38.51 per barrel. The main reasons for the increase were the slow but steady recovery of demand in fuel and raw materials, and the production cuts promoted by OPEC + members. At the end of this week, the OPEC + members are scheduled to discuss further decisions on the production cuts earlier agreed on to reduce oil supply. However, investors are concerned about rumors that Russia, which is one of the largest members of OPEC, is not inclined to extend the contract, as it considers its participation in it impractical. Saudi Arabia, meanwhile, advocates the continuation of the policy until August. Other members of the organization are also having weighty arguments about the cancellation of the contract, as according to them, the oil is already increasing steadily, even without the news of further production cuts. In addition, the retreat of the coronavirus pandemic has returned the demand for raw materials. These facts are of particular concern to Russia, which is already saying that it is not ready to reduce production further, increasing the chances of its withdrawal from the agreement. Russia may refuse further cooperation in this direction. OPEC + members will try to reach consensus on the issue of reducing production, but most experts are skeptical that they will succeed. The main issue is the uneven production cuts of member countries, since at the current policy, Saudi Arabia reduced production more than what was agreed on, while Iran and Nigeria took a long time before implementing the agreement. The production cuts also should have been 6.084 million barrels per day, but the actual reduction was not even higher than 4.48 million barrels per day. The completion of the agreement was only about 74%. Another important event that could significantly affect the oil industry is the escalation of conflict between the US and China, which investors are currently disregarding. Although it has not pulled the market yet, a serious negative in the geopolitical equilibrium will cause catastrophe in crude oil. China has already responded to the attacks of the US by suspending imports of agricultural products from the country, which could further aggravate the conflict. If the US retaliates and continues the war, trade relations between the two countries may break completely, which would heavily affect both sides, including the oil market. Meanwhile, Brent futures for August delivery was up 0.97%, or $ 0.37 in London, which rose the quotes to $ 38.69 per barrel. Yesterday, raw materials closed up to 1.3%, or 0.48 dollars, and stood at $ 38.32 per barrel. WTI oil for July delivery also traded positively in New York, rising to 0.73%, or $ 0.26 at the morning. Its current level is now $ 35.70 dollars per barrel, up from Monday's price of $ 35.44 per barrel. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Jun 2020 05:01 AM PDT To open long positions on EURUSD, you need: Given that important fundamental statistics are not released today, the entire focus in the first half of the day was at the resistance level of 1.139, the break of which led to a new powerful wave of euro growth. Unfortunately, it was not possible to wait for a signal to buy the euro, and a breakthrough of the upper border of the triangle led to a sharp strengthening of the euro. If you look at the 5-minute chart, the breakdown was very fast without any fixing at the level. But even if you missed this growth, you should not be upset. There is an American session where you can wait for the downward movement of the euro already in the support area of 1.1139, and the formation of a false breakout there will be a good signal to open long positions in the hope of continuing the growth of the euro in the short term. An equally important task for buyers will be to break through and consolidate above the resistance of 1.1183, which they rested against today in the first half of the day, which I drew attention to in my review. Only fixing above this range will open a direct road to the area of highs of 1.1231 and 1.1295, where I recommend fixing the profits. If there is no demand for the euro in the support area of 1.1139 and the pair is growing rapidly from this level, it is best to postpone long positions until the minimum of 1.1085 is updated or buy EUR/USD immediately for a rebound from the support of 1.1034 calculated for correction of 25-30 points at the end of the day.

To open short positions on EURUSD, you need: Riots in the US may be one of the reasons for the weakening dollar in recent days, and given the morning forecast and COT reports, where the number of people wishing to buy the euro clearly prevails over those wishing to sell, it is not surprising that the pair will continue to strengthen today in the morning. The bears have so far focused on the resistance of 1.1183, from which it was possible to open short positions, as I mentioned in the morning forecast. As long as trading is below this range, there is a probability of a test of the 1.139 level, which will now serve as a support. However, it is possible to talk about a return to the market of larger sellers only after fixing below this range, which will necessarily lead to an update of the lows of 1.1085 and 1.1034, where I recommend fixing the profits. If the demand for the euro persists in the second half of the day, and the bears miss the resistance of 1.1183, then it is best to sell EUR/USD only after updating the maximum of 1.1231 or even higher – from a large resistance of 1.1295 in the calculation of correction of 30-35 points within the day.

Signals of indicators: Moving averages Trading is above the 30 and 50 day moving averages, which indicates a continuation of the bull market in the short term. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands If the euro falls in the second half of the day, the lower border of the indicator around 1.1095 will provide support. Breaking the upper limit in the area of 1.1183 will lead to the new strong growth of the euro. Description of indicators

|

| Posted: 02 Jun 2020 04:58 AM PDT News :

Technical analysis: EUR/USD has been trading upwards but I found that EUR is way extend to the upside and the downside rotation is possible. The resistance is found at the price of 1,1180. Trading recommendation: Downward targets are set at the price of 1,1140 and 1,1120 Main resistance is set at 1,1180 The material has been provided by InstaForex Company - www.instaforex.com |

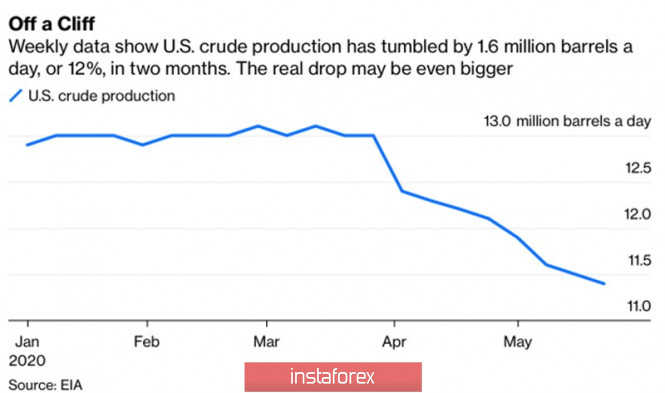

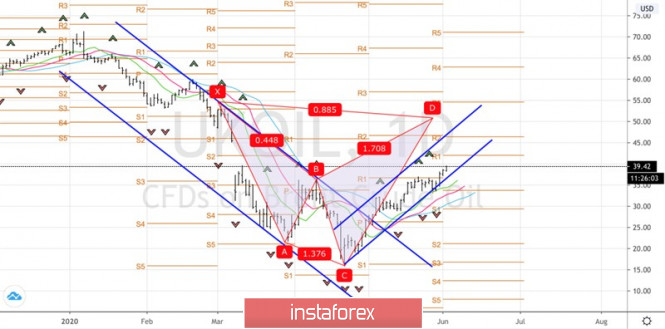

| Posted: 02 Jun 2020 04:56 AM PDT May has become a real holiday for oil. The Texas grade added about 88% to its value, which was the best result in the history of WTI futures contracts since 1983. Things were no worse for Brent, whose quotes doubled in 6 weeks and reached the highest level since the beginning of March. The post-lockdown opening and recovery of the world's major economies, growth in global demand, and reduced production were the catalyst for the black gold rally. "Bears" are forced to adjust forecasts. Thus, Deutsche Bank raised its estimates for the end of 2020 for WTI from $ 32 to $ 37, for Brent - from $ 35 to $ 40 per barrel. According to Bloomberg, there is a fleet of tankers off the coast of China with about 4 million tons of oil from Russia, Colombia, Brazil, Angola, and other countries. The rapid economic recovery of the Middle Kingdom requires energy, and the refineries are working at full capacity. Similar processes began to occur in the United States, which, according to the US Energy Information Administration, increased imports of black gold from Saudi Arabia from 0.6 million b/d to 1.6 million b/d, from all countries of the world – by 40% to 7.2 million b/d in the week to May 22. At the same time, production in the United States is falling. Over the same period, it was reported to have decreased by 1.6 million b/d to 11.4 million b/d, although the data may be subject to adjustment. BofA Merrill estimates that the overall size of the decline in production in the US and Canada in May was 2.5 million b/d. Dynamics of American oil production

Of course, the increase in prices may lead to the resumption of American production in the previous volumes, however, due to the reduction in the scale of drilling, shale producers face serious problems, which allows us to forecast a further reduction in the surplus and oil reserves in the US. OPEC+ contributes to the improvement of market conditions. And what else! By the end of May, the volume of commitments to reduce production was fulfilled by 77%. Only Iraq and Nigeria failed. Black gold production by the cartel fell by 5.84 million b/d to 24.6 million b/d, the lowest level since 2002. For Saudi Arabia, the figures look like 2.89 million b/d and 8.7 million b/d. Russia produced 9.39 million b/d, and exports of Urals oil by sea fell to the bottom over the past 5 years. At the OPEC+ summit scheduled for June 4, Riyadh intends to push the idea of maintaining the current volume of production cuts of 9.7 million b/d until the end of 2020. Let me remind you that at the previous meeting, the countries decided to reduce the figure to 7.7 million b/d from June to December. Moscow is likely to defend this option, and the market hopes for a compromise: for example, the figure will remain until September at 9.7 million b/d, in October-December, it will decrease to 7.7 million b/d. In any case, no one expects a repeat of the history of the oil war between Saudi Arabia and Russia. Both sides are aware of their consequences for the entire market and their own budgets. This circumstance allows us to continue to increase the Brent longs formed from the levels of $ 25.75 and $ 28 per barrel with targets of $ 45.5 and $ 50.5. Technically, the "shark" pattern remains relevant on the daily chart of the North Sea variety. Its target of 88.6% corresponds to the level of $ 50.5 per barrel. Brent, the daily chart

|

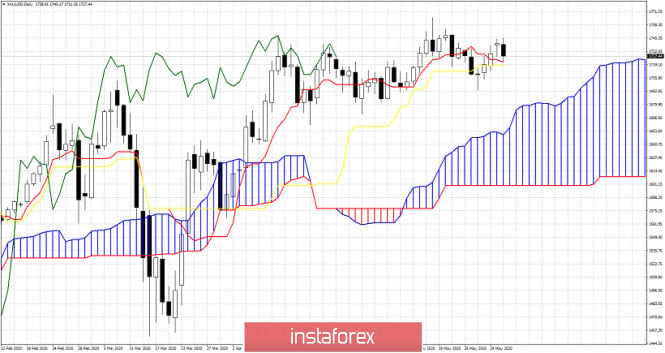

| US and Asian stock markets continue to rise Posted: 02 Jun 2020 04:50 AM PDT

Following the results of Monday's trading sesion, the US stock indices rose, the main reason of which is the steady continuation of economic recovery. Even the protests that forced the US authorities to take tough measures, as well as the crisis caused by the coronavirus pandemic and the conflict with China, could not add negativity and pull the market down. Today, the S&P 500 and Nasdaq increased, mainly due to the securities of Facebook Inc., Apple Inc. (NASDAQ: AAPL) and Amazon.com. The Dow Jones Index also moved up due to the shares of Boeing Co. The recovery of the stock market is quite rapid, which surprised most experts, since they assumed that the crisis in the market would last much longer than other sectors. Current stock market affairs are more than good already. Even the unrest that has been going on for six nights in the US, which provoked the authorities to take tough measures against large-scale unauthorized demonstrations, could not shake investor confidence. The mass protests began after the death African American George Floyd under the hands of police officers. Market participants are fully confident that the protests will not adversely affect the country economy, thus continuing to work actively. According to analysts, the riots, of course, are some deterrent, but they are not able to destroy the economy as did the COVID-19 pandemic. Recent statistics on the economy also convinced investors that there is more optimism than negativity. The PMI in the US, which is a reflection of activity in the manufacturing sector, came out as 43.1 points in May, up from its previous value of 41.5 points. A value above 50 points means steady and stable growth in this sector. To date, the US has not reached this level yet, but the monthly increase suggests that it is quite possible in the near future. The Dow Jones Index rose by 0.36% and reached 25,475.02 points, while the S&P 500 index increased by 0.38% and was at the level of 3,055.73 points. The Nasdaq index, meanwhile, recorded the highest increase of about 0.66%, which sent it to the level of 9,552.049 points. In general, almost all sectors of the S&P 500 index were able to complete the trading session on a positive note, with the exception of the healthcare industry. Most Asian stock indices also rose today, although moderate, but was still supported by the ongoing lifting of quarantine measures in the Asia-Pacific countries. The Japanese Nikkei 225 index rose 1.2%, as the securities of SoftBank Group, Nissan Motor Co. and Mitsubishi Motors Corp increased in value. The securities rose by 3.9%, 0.6% and 1.7%, respectively. Meanwhile, China's Shanghai Composite Index corrected mainly down, recording a slight 0.13% drop. Hong Kong's Hang Seng Index, on the other hand, rose slightly by 0.4%. The decline in the Chinese index was mainly due to the news that the People's Bank of China will start repurchasing loans from some regional banks in the near future. The bank is also planning to take other measures that will allow expanding the volume of lending to small and medium-sized businesses, as part of the plan to maintain the latter, since it was most seriously affected by the COVID-19 pandemic. Thus, the regulator is going to spend about 400 billion yuan, which corresponds to 56.1 billion dollars, to buy loans. The Hong Kong index, on the other hand, rose due to the shares of Link Real Estate Investment Trust, Geely Automobile Holdings and AAC Technologies Holdings Inc., which increased by 6%, 1.3% and 1% respectively. The South Korean Kospi Index also rose by 0.8%, due to the 1.4% increase in the country's economy in annual terms for the first quarter of this year. The securities of Samsung Electronics Co. and LG Electronics also moved up, increasing by 0.2% and by 1.4%, respectively. Australia's S&P / ASX 200 Index also increased by 0.3% today, the reason for which is the decision of the RBA to keep interest rates at a critically low level of 0.25% per annum. According to managers, the Australian economy has not experienced such a crisis since the 1930s, so it is necessary to introduce measures that contribute to its faster and better recovery. The overall scale of the drop is expected to be smaller than previously expected. Meanwhile, the stock prices of mining companies BHP and Rio Tinto are moving in different directions, as the former rose by 0.6%, while the latter declined by 0.1%. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Jun 2020 04:45 AM PDT News :

Key Takeaways

Technical analysis: BTC has been trading aggressively to the upside. The price tested the level of $10,400 but it did that on the ultra high volume and very wide spread of the candle, which represents climatic action and potential for the downside rotation. Trading recommendation: The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD growth impede by previous snags Posted: 02 Jun 2020 04:22 AM PDT

The EUR / USD pair opened the week with a small bullish gap and reached maximum levels since March 17 amid growing traders' positive sentiment associated with the restoration of economic activity around the world amid the gradual removal of restrictions due to COVID-19. When there is too much optimism in the market, good news is received with a bang, and bad news is ignored, you involuntarily start to think about whether it is time to curtail positions. US stock indices continue to grow, despite the most severe subsidence of the national economy since the Great Depression, rising unemployment in the direction of 20%, as well as pessimistic forecasts by the Congressional Budget Office. The CBO believes that in 2020 the US economy will shrink by 5.6% and it will take years to recover. However, the S&P 500 rally is only part of the solitaire played by the EUR / USD bulls. Against the backdrop of financial market turmoil, investors were forced to turn to defensive assets, primarily treasuries and greenbacks, however, as leading economies open, money begins to flow in the opposite direction. The USD index has been declining over several consecutive trading sessions, and the yield on thirty-year US government bonds has reached its highest level since March 20. At the same time, tensions between Washington and Beijing persists. According to Bloomberg, China ordered state-owned companies to stop purchasing US agricultural products. This raises concerns that a trade deal between the two largest economies in the world could be in jeopardy.

The euro is strengthening thanks to the Franco-German plan to save the EU economy, a statement by the European Commission on the issuance of bonds worth € 750 billion, as well as expectations that the ECB will expand the emergency program for the purchase of assets by € 500-750 billion. It is assumed that in this situation the yield on Italian government bonds will be reduced, as well as their spread with German counterparts, which will save Eurosceptics from unnecessary illusions. Along with the expansion of QE, the European regulator may announce the purchase of so-called fallen angel bonds, as well as the process of reinvesting income from acquired assets for many years. Although fiscal and monetary incentives are pushing the EUR / USD pair to trade in an upward direction, the factors that have pushed the euro down over the past two years are still valid. Namely, trade disputes, cautious markets, and weak hopes that economic growth in the eurozone will be more dynamic than in the USA. In addition, the Franco-German plan has not yet been approved, and the ECB's caution may play a trick on the EUR / USD bulls. This circumstance, along with the escalation of the trade conflict between Washington and Beijing, may trigger a profit-taking process. In the meantime, the main currency pair does not abandon attempts to continue growth. The key reversal level for short-term traders is now at 1.1165. A pure breakdown of this barrier will allow the bulls to aim at 1.1200 and further at 1.1235–1.1240. The nearest strong support is at 1.1100 and further at 1.1075. Breakdown of the last level can cause long compression and accelerate the decline in the direction of the 200-day moving average in the area of 1.1010. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Jun 2020 02:59 AM PDT

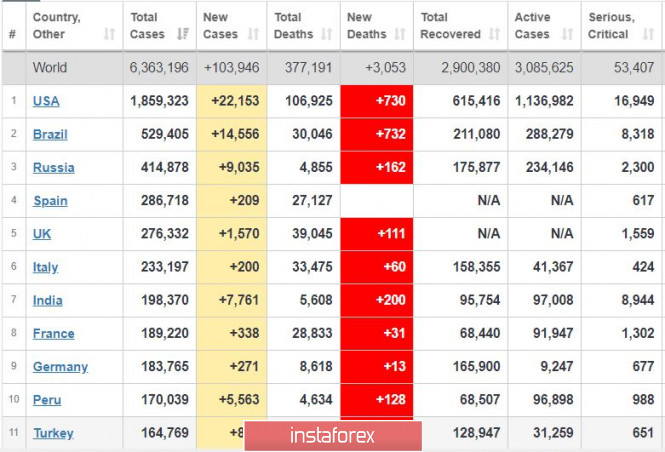

Coronavirus updates as of the morning of June 2: The situation in the US is a little bit brightening, as the number of deaths in the country have dropped below 1,000 per day for two days in a row. However, the number of new cases is still above 20 thousand per day, with the worst situation in Brazil, in which 15 thousand new cases are added per day. Meanwhile, a new wave of the pandemic may be declared in India and Peru, if the number of infections in both countries continue to accelerate. In Russia, the number of new cases is about 9,000 per day, but the number of people who recovered as of June 2 has already exceeded 3,000.

The US market keeps on growing despite the negative news surrounding the US. To date, there are already 20 million unemployed in the US, and another 8 million per month is expected. In addition, 40 cities in the country are under curfew due to racial unrest, and the pandemic problems still remain. Nevertheless, the US market will soon fall, so open sell positions from the current prices.

EUR/USD: The market is in an upward trend. Open buy positions at a breakout from 1.1155, or at a rebound from 1.1060 and below. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment