Forex analysis review |

- Hot forecast and trading signals for the GBP/USD pair for July 15. COT report. California reintroduces hard quarantine. Bears

- Hot forecast and trading signals for the EUR/USD pair for July 15. COT report. Buyers dominate, aiming for 1.1422-1.1432.

- Overview of the GBP/USD pair. July 15. A "winter wave" of "coronavirus" in the UK could claim the lives of another 120,000

- Overview of the EUR/USD pair. July 15. The "coronavirus" mutates and becomes more contagious. The United States is waiting

- EURUSD breaks important long-term trend line

- July 14, 2020 : EUR/USD daily technical review and trade recommendations.

- Comprehensive analysis of movement options for gold, palladium, platinum, and silver (H4) on July 15, 2020

- How to trade ahead of the ECB and the Bank of England meetings?

- Gold slightly stalled down

- EUR/USD: rumors flying around market. EUR gaining ground ahead of EU summit, but long deals still risky

- Expect no economic growth: stock markets moved to a negative correction

- Evening review on EURUSD for July 14, 2020

- AUDJPY holding above trendline support! Further rise expected!

- USDCAD reversing off 1st resistance, possible drop!

- XAUUSD approaching support, potential bounce!

- Instaforex Daily Analysis - 14th July 2020

- Outlook for EUR/USD and GBP/USD. Pound sterling continues dropping against US dollar after GDP report

- July 14, 2020 : GBP/USD demonstrating consolidations within a wide-ranged channel respecting the mid-channel level at 1.2650.

- July 14, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- Chainlink breaks into top 10

- EUR/USD analysis for July 14 2020 - Strong ressitance at the price of 1.1380 is on the test. Watch for potential downside

- Oil: time to collect stones

- Oil continues to sag with rapid decline in raw materials price

- How long indices may rise?

- BTC analysis for Jully 14,.2020 - Breakout of the 3-day balance and symmetrical triangle in the background. Potential for

| Posted: 14 Jul 2020 05:33 PM PDT GBP/USD 1H The GBP/USD pair, unlike the EUR/USD pair, started a downward movement and continues it. The support level of 1.2497 was reached yesterday, from which the price successfully rebounded and at the moment adjusted to the critical Kijun-sen line, which is very convenient, since now we will find out in the next few hours whether there will be a rebound from this line or a closure over it. In the first case, the initiative in the market will remain in the hands of sellers and the downward movement will continue with new goals indicated by the red arrows in the illustration. In the second case, the bulls will have a chance to resume moving up, at least to the resistance area of 1.2668-1.2688, which the pair has reached three times in recent days. GBP/USD 15M The lower linear regression channel turned up on the 15-minute timeframe, signaling a correction. Thus, it is now extremely important for sellers to stay below the Kijun-sen line, so that the correction does not go into an upward trend. The latest COT report was absolutely logical and reflects the essence of what is happening at this time in the currency market for the pound/dollar pair. Professional traders opened 6,743 Buy-contracts and as many as 12 Sell-contracts during the reporting week. Thus, the total net position in the commercial category immediately increased by 6,700. Despite the fact that the total number of contracts in the commercial category is approximately 115,000, and the preponderance of Buy over Sell was -21 thousand, which is +6,700 in the net position - this is a serious strengthening of the bullish mood. However, the pound is mostly cheaper at the beginning of the new week. It is still difficult to say whether this movement will continue, but the COT report may show changes in favor of sellers at the end of the new reporting week. The fundamental background for the GBP/USD pair does not change much. Latest report showed that the UK GDP began to recover in May, but at a much slower pace than market participants expected. In addition, UK doctors predict a second wave of the pandemic, which will be much stronger than the first and will take 2.5 times more lives. On this news, the British pound began a new round of decline. However, if the UK is only predicting new epidemiological problems, then the United States is sitting in them up to their ears. Yesterday it became known that one of the largest and most economically active states of America – California - is again closed for quarantine. This was reported by its governor, Gavin Newsom. The reason, of course, is the coronavirus, the increase in cases of which is growing at an alarming rate, as stated by Newsom. Restaurants, bars, concert venues, zoos and museums should prohibit visitors from entering their premises, but they will be allowed to carry out their activities outdoors. At the same time, World Health Organization head Tedros Adhanom Ghebreyesus said that "the actions of many governments do not correspond to the status of the number one COVID virus problem in the world at this time." Ghebreyesus said that the epidemic will spread further and deeper if governments around the world do not take serious and decisive measures to counteract it. "There will be no return to the old normal for the foreseeable future", Ghebreyesus said. There are two main scenarios as of July 15: 1) The bullish outlook dramatically worsened at the start of the new trading week. At this time, the pair's purchases are no longer relevant, as quotes have gone below the critical line and below the rising channel. Thus, we recommend that you return to buying the British pound, but not before crossing the Kijun-sen line of the Ichimoku indicator, which lies at 1.2573. The goal is the resistance area of 1.2668-1.2688. Potential Take Profit in this case will be about 90 points. 2) Sellers are advised to resume trading on a lower level with targets at support level 1.2497, Senkou Span B line (1.2458) and support level 1.2375 if a rebound follows from the Kijun-sen line. Today's reports on UK inflation and US industrial production are unlikely to fundamentally change the mood of traders. Potential Take Profit range from 60 to 180 points. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 14 Jul 2020 05:33 PM PDT EUR/USD 1H The euro/dollar pair corrected to the critical Kijun-sen line and rebounded off it on the hourly timeframe on July 14. Thus, buyers dominated the market again despite the fact that they released quotes from the ascending channel a few days earlier. As a result, the ascending channel had to be rebuilt and now it signals an upward trend again. At the same time, we note that the bulls do not completely dominate the pair right now. Very frequent corrections, each of which can potentially result in a change of the trend to a downward one. In general, as we mentioned in the fundamental reviews, now is not the most convenient time to work with the EUR/USD pair. However, everything does not look as bad as on the higher ones on the hourly chart. The pair managed to break out of the 1.1200–1.1350 side channel, so certain prospects are opening up for the euro. EUR/USD 15M Both linear regression channels are still directed upwards on the 15-minute timeframe, signaling an upward trend in the most short-term plan. There are no signs of starting a new round of corrective movement at the moment. The latest COT report from July 7 was quite boring. The most interesting category of large traders commercial, which is a set of professional traders who trade for commercial profit, opened almost 6,000 Buy-contracts and only 1,700 Sell-contracts. Thus, the net position for this category has increased by almost 4,000, which, simply put, means that the bullish mood of major players has increased. In principle, the beginning of a new trading week confirms this attitude of professional traders, as the euro continues to rise in price against the dollar. Slowly but surely. The total number of Buy-contracts for professional traders is also much higher than the number of Sell-contracts – 186,000 against 80,000. The fundamental background for the EUR/USD pair did not change at all on Tuesday, as did the mood of the market participants themselves. Several relatively important macroeconomic reports did not particularly change the picture of things, as markets continue to pay more attention to the coronavirus epidemic in the United States, the statements of the country's chief epidemiologist Anthony Fauci, which are completely opposite to the optimistic statements of the head of state Donald Trump, as well as the very gloomy prospects for the American economy if the second wave of coronavirus is not stopped in the near future. The European Union is more calm. The EU summit will be held this week, during which the most important issue for the bloc will be resolved – the issue of forming an economic recovery fund and the issue of approving the budget for 2021-2027. All 27 EU member states need to agree that 750 billion euros should be raised and distributed among the most affected sectors of the economy, as proposed by the European Commission. Thus, we can expect the euro to fall after the end of the summit, if there are no positive results. Otherwise, the euro's fate will depend on traders, who will sooner or later take a time-out and the pair will begin to adjust at least. It is difficult to expect more than a correction for the US currency in the current conditions. Based on the foregoing, we have two trading ideas for July 15: 1) Buyers pushed back from the critical Kijun-sen line and resumed purchases after a slight correction. Thus, the trend remains unambiguously upward, but do not forget about the frequent pullbacks and corrections that are now inherent in the euro/dollar pair. Judging by the last few bars, traders are preparing for a correction, however, the goals for long positions remain the same - resistance levels of 1.1432 and 1.1494. Potential Take Profit in this case is from 40 to 100 points. 2) The bears have failed to cross the Senkou Span B line or the Kijun-sen line over the past few days. Therefore, we state the fact: sellers do not have enough strength to start a new downward trend at this time. Thus, we advise you to sell the euro, but not before overcoming the Kijun-sen line, and ideally after closing below a new rising channel, while aiming for supporting levels of 1.1238 and 1.1176. Potential Take Profit in this case is from 50 to 110 points. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 14 Jul 2020 05:07 PM PDT 4-hour timeframe

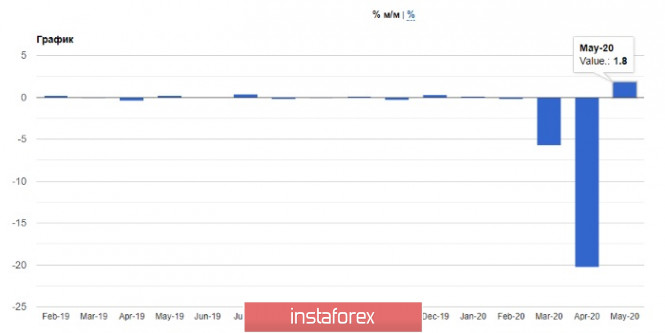

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - sideways. CCI: -121.2859 The British pound, unlike the European currency, was trading lower on Tuesday, July 14. On the one hand, the reason for the uncorrelation of the two main currency pairs could be the macroeconomic statistics from the UK, which turned out to be quite weak. On the other hand, no less weak statistics from the Eurozone were ignored by market participants, so such a conclusion can not be considered unambiguous. It should also be noted that the nature of the movement of both pairs in recent months has been completely different. The euro currency has spent the last month in an absolutely indistinct sideways or weak upward movement. While the pound was trading very actively and did not standstill. At the same time, it is the position of the British pound in the foreign exchange market that now looks weakest due to the uncertainty associated with the future relationship between the European Union and Britain, as well as an extremely strong fall in the British economy as a result of the pandemic and Brexit. However, the British currency regularly shows growth, which we correlate with the epidemiological emergency in the United States, as well as the political and economic crisis in this country. As we wrote earlier, the Fed lowered key rates "almost to zero", so the strength of the monetary policies of these two states equalized. The US dollar no longer has the unquestionable advantage that it previously had. Macroeconomic statistics from the UK disappointed traders. GDP in May was recorded at +1.8%, although traders expected to see at least +5% after the failed -20.4% a month earlier. Industrial production, as in the European Union, decreased by 20% in annual terms, which was more or less ready for market participants. Such a package of statistics could not cause the British pound to strengthen. Therefore, the GDP report may have created additional pressure on the British pound. Also, negative news continues to come from the fields of Brexit. According to the survey, only a quarter of all UK companies are fully prepared to complete the transition period and switch to the EU trade regime under WTO rules. Meanwhile, no less negative forecasts are given by representatives of the UK health sector. According to them, in 2020-2021, the country will face the so-called "winter wave" of the epidemic, which will be much worse than the first "wave", which claimed the lives of about 45,000 people, which is the highest figure in all of Europe. A report from the British Academy of Medical Sciences says that people spend much more time indoors in winter, which contributes to the faster and easier spread of infection. Thus, between September and June, about 120,000 Britons may die from COVID. The author of the report, Professor Stephen Holgate, believes that if the necessary measures are taken now, it will be possible to avoid such a scenario. "This is not a prediction, but it is a possibility. The model suggests that there may be more fatalities with a new wave of COVID-19 this winter, but the risk of this can be reduced if immediate action is taken," said Professor Holgate. The Academy of Medical Sciences believes that under the current circumstances, it is necessary to more actively vaccinate the population against influenza, more widely test the population for "coronavirus", constantly remind the population of the importance of observing safety measures, improve the definition of epidemic foci and more effectively localize them. At the same time, the US recorded a record budget deficit. In June, it amounted to $ 864 billion, which is much higher than the average annual value. The deficit came from the fact that the White House and Congress allocated trillions of dollars to support the economy. But tax revenues during the pandemic were greatly reduced, as at least 25 million workers were laid off, which significantly reduced tax revenues to the Treasury. Meanwhile, the total public debt in the United States has already exceeded $ 26 trillion. The Budget Office forecasts that the budget deficit will be at least $ 3.7 billion in 2020. Meanwhile, the American president Donald Trump does not allow you to forget about yourself for a day. A few months ago, we reported that YouGov conducted quite an interesting study, which resulted in the figure of 14,000. That's how many times, according to YouGov calculations, Donald Trump was misled in his speeches, comments, and social media posts. A similar study was conducted by the Washington Post, which estimated that the US President has already made more than 20 thousand erroneous or deceptive statements. That is, on average, Donald Trump makes thirteen false statements a day. However, the Washington Post's research is much more in-depth. For example, the publication reports that most often Trump made false statements on the topics of his impeachment, the "coronavirus" pandemic, as well as the racist scandal caused by the death of George Floyd. The publication also reports that most often the President made statements that do not correspond to reality when he spoke about the US economy, that it achieved the best state in the history of the country. Also, Trump lied when he said that he had the largest tax cut in the history of the country. Such statistics again do not paint Trump in the run-up to the presidential election. In the UK, the consumer price index for June is scheduled to be published on the third trading day of the week. According to experts' forecasts, inflation will slow even more and amounted to 0.4% in June. In monthly terms, the price increase will be 0%. It is possible that in reality, we will see even weaker figures, but the main question now is how market participants look at the topics of the deep economic crisis in the UK, complete uncertainty in the future, and the topic of the epidemiological crisis in the US. Judging by the fact that the quotes of the pound/dollar pair were fixed below the moving average line, the trend changed to a downward one, and traders began to pay more attention to the problems of the Foggy Albion. Thus, in the near future, we still expect a further decline in the pound. However, the reverse fixing of the price above the moving average can bring buyers back into the game. Both linear regression channels are directed upwards.

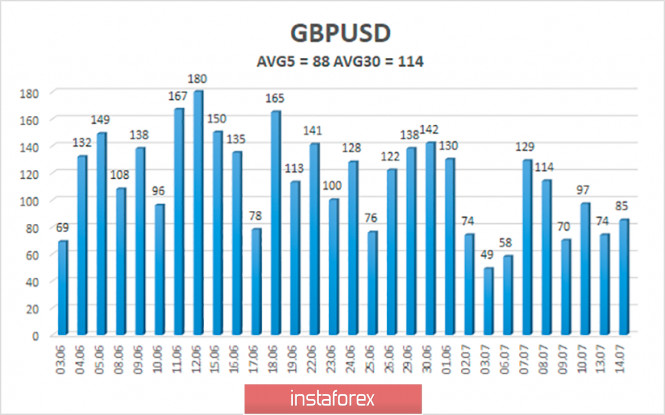

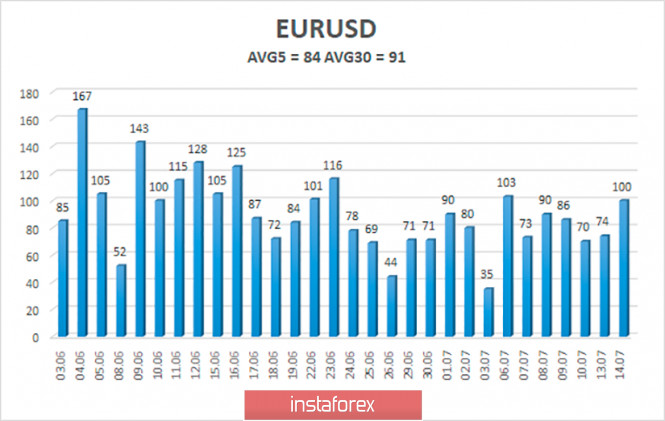

The average volatility of the GBP/USD pair continues to remain stable and is currently 88 points per day. For the pound/dollar pair, this value is "average". On Wednesday, July 15, thus, we expect movement within the channel, limited by the levels of 1.2458 and 1.2634. Turning the Heiken Ashi indicator upward will indicate a possible resumption of the upward movement. Nearest support levels: S1 – 1.2512 S2 – 1.2451 S3 – 1.2390 Nearest resistance levels: R1 – 1.2573 R2 – 1.2634 R3 – 1.2695 Trading recommendations: The GBP/USD pair has started a new round of downward correction on the 4-hour timeframe, which may turn into a downward trend. Thus, today it is recommended to open sell orders with the goals of 1.2451 and 1.2390 if the Heiken Ashi indicator does not turn up in the next few hours. It is recommended to resume buying the pair after fixing quotes above the moving average with the first goals of 1.2634 and 1.2695. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 14 Jul 2020 05:07 PM PDT 4-hour timeframe

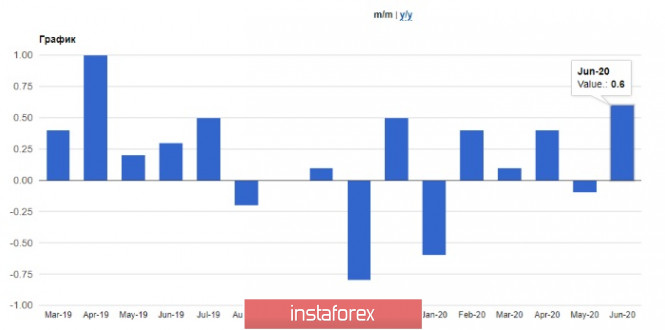

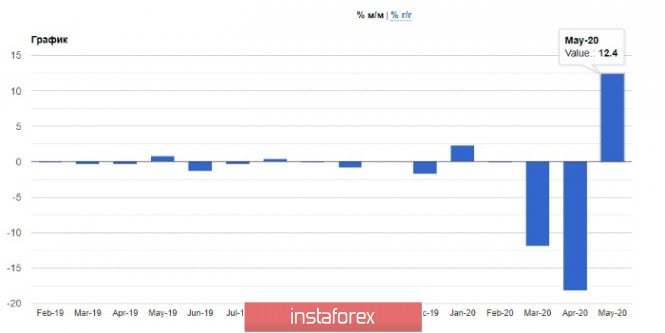

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - upward. CCI: 180.3218 The second trading day of the week again remained behind the European currency, which slowly but surely continues to creep up. The upward movement has not stopped since June 26, that is, for 13 working days. During this period, the pair managed to cover a distance of approximately 150 points. Judge for yourself whether this can be called an "upward trend". Moreover, during the past day, the pair again traded near the Murray level of "5/8"-1.1353, which is also the upper limit of the side channel 1.1200-1.1350, in which the pair has been trading for more than a month. Thus, the current technical picture is quite ambiguous. On the one hand, there is a side channel, above which buyers have not managed to gain a foothold, on the other - a weak upward trend. One thing is for sure - now is not the most favorable time to conduct trading. The movements of the euro/dollar pair are multidirectional alternating segments. As we expected, the macroeconomic statistics of the last day did not have any impact on the mood of market participants. Yesterday, the consumer price index in Germany for June was published first. This indicator fully coincided with the forecast values, amounting to 0.9% in annual terms and 0.6% in monthly terms. A little later, data from the ZEW Institute was published, which reflects the mood in the business environment of Germany and the European Union. Without going into the figures, we can say that all three indicators were worse than the forecast values. Absolute values of indicators indicate that investors are very skeptical about the current state of the German and EU economies, but still optimistic about the future. But industrial production in the European Union turned out to be much worse than experts' forecasts. In annual terms, the reduction was 20.9% with a forecast of -20.0%, and in monthly terms - an increase of 12.4% with a forecast of 15.0%. Thus, the conclusions on European statistics are unambiguous – it failed. However, the euro currency was trading higher in the European session. In the afternoon, the United States published a report on inflation for June, which showed 0.6% in annual and monthly terms for the main indicator and +1.2% y/y and +0.2% m/m for the indicator excluding food and energy. In general, these values almost completely coincided with the forecast. They are neither optimistic nor pessimistic. So the general conclusion is this. In the European session, traders had reason to sell the euro but did not do so. There was no reason to change the mood in the American session. In general, the entire package of macroeconomic information was ignored. Meanwhile, more and more media are paying attention to the raging "coronavirus" epidemic in the United States. According to the American doctor Chad Krilich, the second "wave" is currently taking place in the United States, but after it, there will be a third. The doctor also said that in the near future we should not expect a vaccine against "coronavirus", as "this is a very long and time-consuming process". Meanwhile, Hong Kong scientists have concluded that the "coronavirus" has mutated and is now even more contagious than before. Previously, a person with the COVID-2019 virus could potentially infect three other people, but now this figure has increased to four. This was stated by the Dean of the medical school of the University of Hong Kong, Professor Gabriel Leung. Earlier, the same was reported by the chief epidemiologist of the United States Anthony Fauci. Dr. Fauci, who remains at this time almost the main actor in America, continues to conflict with President Donald Trump based on the epidemic. The conflict is very simple. The doctor makes statements based on his knowledge, experience, and research, which Donald Trump does not like, who makes his statements based on nothing. The leader of the American nation does not like that Fauci's attitude is too pessimistic and he constantly predicts deterioration of the situation. Fauci's latest statement, made on July 14, states that "the US authorities have not been able to impose a total quarantine, which is why we are currently seeing a huge increase in new cases". According to the epidemiologist, the United States managed to achieve a significant reduction in the number of diseases, to about 20,000 per day, which is not so terrible for a multi-million country. But at this point, it was necessary to maintain the "lockdown", instead, the government began to remove restrictive measures and received a second "wave" of the pandemic, according to Fauci. Also, Fauci said that now the country does not need to introduce a full range of restrictions, it is enough to "roll back a little" and then prudently take steps towards lifting the restrictions. Donald Trump himself continues to bend his line on the issue of the gigantic scale of the epidemic in the United States. The President still believes that the high incidence of diseases in his country is due to the large number of tests carried out, and the death rate from the "coronavirus" is falling. "We check more than anyone in the world. We have one of the lowest death rates in the world. We are doing a great job. We have the best and most extensive testing program in the world. If you were testing China, Russia, or any of the major countries like we are testing, you would see numbers that would surprise you," Trump said during a speech at the White House. On the third trading day of the week in the US, only a more or less important report is planned – on industrial production for June. We believe that in the current conditions, it is the production indicator that is one of the most important, but yesterday's report on European production shows that most traders do not think so. Therefore, we do not expect a serious reaction from market participants to this report. There are no more planned events in the EU or the US today unless you count the evening economic review of the Federal Reserve "Beige Book", which rarely causes any reaction from the market. Thus, from our point of view, technical factors continue to be in the first place, which, unfortunately, can not lead the pair out of an inarticulate upward movement, which is extremely difficult to reject. However, the upward movement continues, and cautious and small purchases of the euro currency are allowed as long as the EUR/USD pair is located above the moving average line. Moreover, both linear regression channels are also directed upwards.

The volatility of the euro/dollar currency pair as of July 15 is 84 points and is characterized as "average". We expect the pair to move today between the levels of 1.1336 and 1.1504. A reversal of the Heiken Ashi indicator downwards will signal a turn of the downward correction to the moving average. Nearest support levels: S1 – 1.1353 S2 – 1.1230 S3 – 1.1108 Nearest resistance levels: R1 – 1.1475 R2 – 1.1597 R3 – 1.1719 Trading recommendations: The EUR/USD pair seems to have resumed the formation of an upward trend. Thus, it is now recommended to trade for an increase with the goals of 1.1475 and 1.1504 before the Heiken Ashi indicator turns down. Sell orders are recommended to be considered no earlier than fixing the pair below the moving average line with the first goal of 1.1230. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD breaks important long-term trend line Posted: 14 Jul 2020 02:17 PM PDT EURUSD is trading above 1.14. Price is now breaking above a long-term downward sloping trend line resistance that connects the 2018 highs and the recent 2020 highs at 1.1450 area. EURUSD has been mostly moving sideways the last few months but now the chances are in favor of the bulls.

EURUSD by breaking above the black trend line has provided us with a bullish signal. This break out has medium-term bullish implications on the trend. This means that we should expect more upside over the coming weeks. For this break out to be confirmed we should continue to see price make higher highs and higher lows.

Traders should be focused on the bullish side of EURUSD. Price will remain in a bullish trend as long as we do not see it break below the blue rectangles. 1.12 area is now key support. We are bullish above this level looking for a move towards 1.16-1.17. A break below 1.12 will cancel our bullish view. The material has been provided by InstaForex Company - www.instaforex.com |

| July 14, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 14 Jul 2020 12:31 PM PDT

The EURUSD pair has been trending-up since the pair has initiated the depicted uptrend line on May 14. On June 11, a major resistance level was formed around 1.1400 which prevented further upside movement and forced the pair to have a downside pause towards the uptrend line. This week, the uptrend seems to be showing signs of weakness while approaching the mentioned resistance level (1.1400). A couple of Fundamental News from the U.S. and the EURO zone are supporting the downside direction in the short-term. We should be expecting a probable breakdown for the depicted uptrend line to occur to the downside in the near future. Short-term traders can have a valid SELL order/position anywhere around the mentioned resistance level of 1.1400. Another SELL order can be placed after a breakdown below the uptrend line occurs. Estimated target levels are located around 1.1300, 1.1225 and 1.1170. The material has been provided by InstaForex Company - www.instaforex.com |

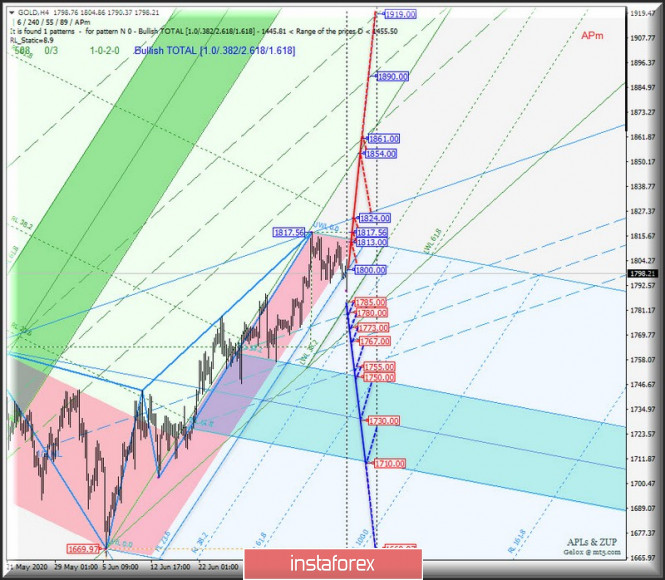

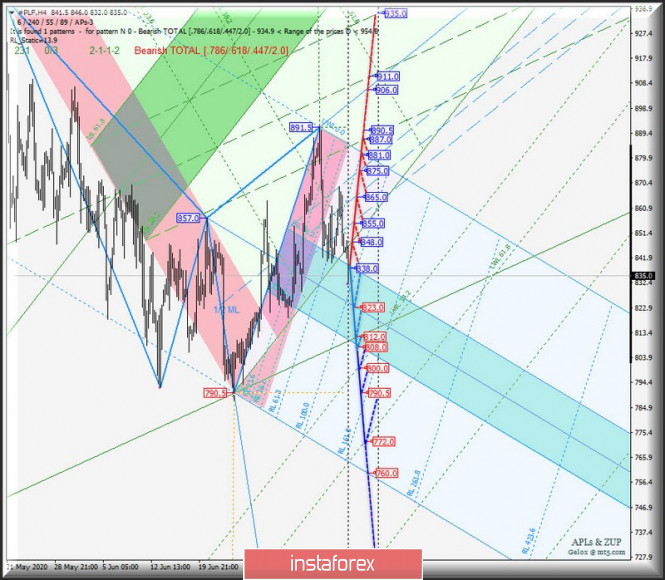

| Posted: 14 Jul 2020 09:32 AM PDT Minute operational scale (H4) Second half of July - overview of the movement options for the main precious metals gold, palladium, platinum, and silver on July 15, 2020. ____________________ Spot Gold The development of the Spot Gold movement from July 15, 2020 will be determined by the development and direction of the breakdown of the range:

If the warning line UWL38.2 of the Minute operational scale forks is broken, the support level of 1785.00 will determine the Spot Gold movement to the borders of the 1/2 Median Line channel (1780.00 - 1767.00 - 1755.00) and the equilibrium zone (1750.00 - 1730.00 - 1710.00) of the Minuette operational scale. In case of breakdown of the reaction line RL23.6 of the Minuette operational scale forks - resistance level of 1800.00 - the development of the movement of this instrument will continue towards:

Details of the Spot Gold movement from July 15, 2020 can be seen on the animated chart.

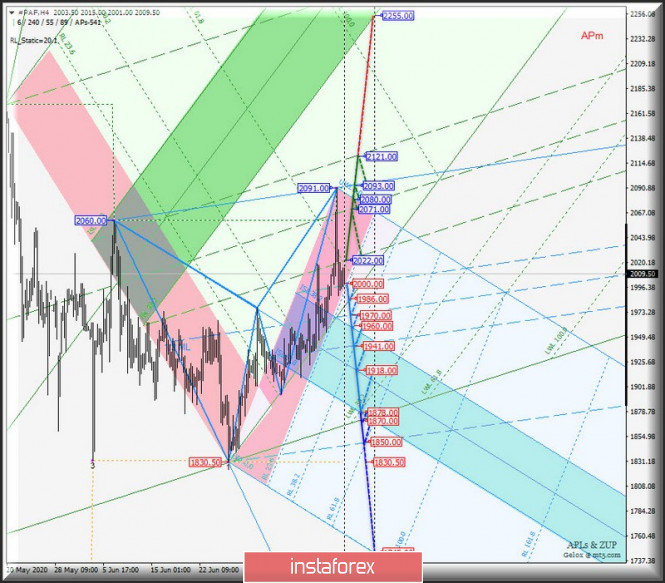

____________________ #PAF (Palladium) Current Month From July 15, 2020, the movement of #PAF (Palladium) will be determined by the development and direction of the breakdown of the range:

With the breakdown of the support level of 2000.00, the development of the Palladium movement can continue within the boundaries of the 1/2 Median Line channel (2000.00 - 1970.00 - 1941.00) and the equilibrium zone (1960.00 - 1918.00 - 1878.00) of the Minuette operational scale forks. In case of breakdown of the resistance level at 2022.00, #PAF movement will begin to flow within the 1/2 Median Line channel (2022.00 - 2071.00 - 2121.00) of the Minute operational scale forks, taking into account the development of the initial - SSL (2080.00) and control - UTL (2093.00) lines of the Minuette operational scale forks. The markup of #PAF (Palladium) motion options from July 15, 2020 is shown on the animated chart.

____________________ #PLF (Platinum) Current Month The development of the #PLF (Platinum) movement from July 15, 2020 will be determined by the development and direction of the breakdown of the boundaries of the equilibrium zone (838.0 - 823.0 - 808.0) of the Minuette operational scale forks - details of the motion marking in this zone are shown in the animated graph. In case of breakdown of the lower border of ISL61.8 of the Minuette operational scale forks - support level of 808.0 - the downward movement #PLF can be continued to the goals:

If the upper limit of the ISL38.2 zone of equilibrium of the Minuette operational scale forks is broken - resistance level of 838.0 - the Platinum movement will be directed to the initial SSL line (848.0) of the Minute operational scale forks scale and the channel boundaries 1/2 Median Line Minuette (855.0 - 865.0 - 875.0), with the prospect of reaching the SSL Minuette start line (881.0) and the 1/2 Median Line (887.0 - 911.0 - 935.0) of the Minute operational scale forks. Details of #PLF (Platinum) motion options from June 15, 2020 are shown on the animated chart.

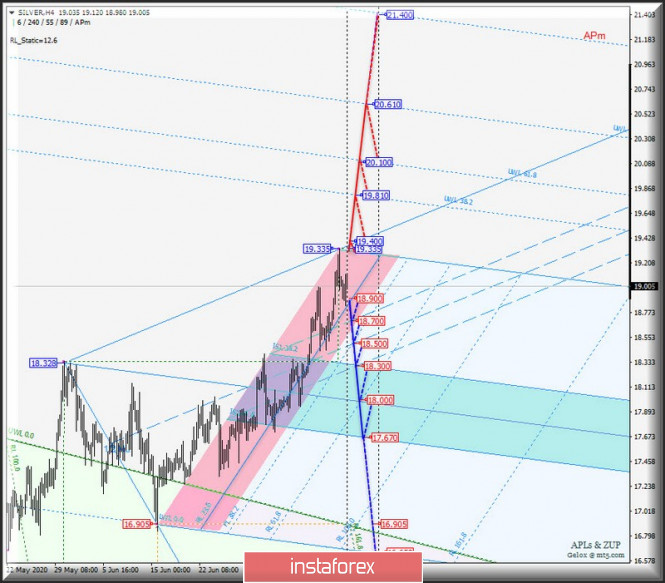

____________________ Spot Silver The development of the Spot Silver movement from July 15, 2020 will also be determined by the development and direction of the breakdown of the range:

Breakdown of the reaction line RL23. 6 forks operating scale Minuette-support level 18.900-a variant of the development of the movement of Spot Silver to the borders of the channel 1/2 Median Line (18.700 - 18.500 - 18.300) and equilibrium zones (18.300 - 18.000 - 17.670) a minuette operating scale fork. Breakdown of the reaction line RL23.6 forks of the operational scale Minuette - support level 18.900 - option for the development of Spot Silver movement to the borders of the 1/2 Median Line channel (18.700 - 18.500 - 18.300) and the equilibrium zone (18.300 - 18.000 - 17.670) of the Minuette operational scale forks. Details of the Spot Silver movement options from July 15, 2020 are shown in the animated chart.

____________________ The review is compiled without taking into account the news background, the opening of trading sessions of the main financial centers and is not a guide to action (placing "sell" or "buy" orders). The material has been provided by InstaForex Company - www.instaforex.com |

| How to trade ahead of the ECB and the Bank of England meetings? Posted: 14 Jul 2020 09:26 AM PDT The dollar index still tends to decline, trading in a narrow range. The US dollar accelerated the pace of its decline against a basket of competitors on Tuesday in the US session. The indicator went below the level of 96.30. Thus, it broke down the border of the medium-term upward trend. The US dollar may still benefit from the spread of the coronavirus in the short term. It is the fears of a pandemic that keep it from falling even further now. The long-term forecast remains bearish if we consider that COVID-19 will still be defeated. However, opportunities for growth in the short and medium term cannot be excluded. A jump can happen on a major correction of the US stock market. In general, the greenback has a lot of negative factors. These include a drop in demand for dollar liquidity and weak interest in protective assets. Additional difficulties for it include increasing the rating of the US presidential candidate Joe Biden. The policy of the Democrats is just a bearish factor for the dollar. USDX At the same time, the dollar was growing against the British pound on Tuesday, continuing the trend that had begun the day before. However, it is more likely that the dollar is not growing, but the pound is falling, as the bearish dynamics of the GBP/USD pair is connected with the news in Britain. Bank of England Governor Andrew Bailey made it clear that the central bank will have to resort to more aggressive quantitative easing to overcome the crisis in the country. Earlier, Bailey said that the central bank is considering a scenario of negative rates. Now the rate is 0.1%, but "we are extremely close to zero interest rates," Bailey said. The pound received an additional negative from the publication of UK GDP data for May. The economy grew by only 1.8%, while markets were counting on 5% growth. The indicators in the construction and manufacturing sectors turned out to be very weak. The GBP/USD pair was trading in the positive during the US session, which is mainly due to increased pressure on the greenback. Trading volatility increased after the publication of consumer price indices in the United States. Despite the rise in sterling earlier this month, it remains under pressure from fundamental factors. These are the risks of a hard Brexit and an expected slowdown in the country's economy, undermined by the coronavirus pandemic. The pound once again went to the zone below the key resistance level of 1.2580. If the pound continues to trade around this level without a hint of a higher exit, then short positions on the GBP/USD pair will be preferred. A breakout of the 1.2490 support will confirm the scenario for a subsequent decline in sterling. GBP/USD As for the alternative scenario, the pound's growth, it is worth looking at the breakout of 1.2580 and the local resistance level of 1.2670. If this happens, the GBP/USD pair will resume the upward trend. The euro's position looks pretty good now. The EUR/USD pair continues to develop growth waves to around 1,1400. Given the upward trend, it can be assumed that after a small correction, the quote will continue to grow to the resistance level of 1.1420. In this case, do not exclude the possibility of returning to the price of 1.1300. EUR/USD The next meeting of the European Central Bank will be held on Thursday. The regulator can now afford to relax a little. Two important tasks have been completed – financial markets have been stabilized and economic activity has been rebooted together with the EU government. Signs of recovery can be seen in macroeconomic publications. It is unlikely that the ECB will be able to surprise the euro at this meeting after three rounds of powerful stimulus. According to the latest data, the ECB has no reason to expect sharp changes in inflation, despite the fact that inflationary pressures have appeared in some parts of the economy. In general, conditions for slowing inflation prevail. So far, officials of the European regulator do not have a good reason to correct the policy. The status quo will probably be maintained. The euro will lose an important driver of growth if the gloomy forecasts of Wall Street experts come to life. Now the rally of US stock indexes does not allow the dollar to take a full breath. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 14 Jul 2020 08:38 AM PDT

The price of gold on Tuesday went down to some correction. The main reason for the emerging recession is, on the one hand, though not quite solid, is the strengthening of the greenback, and on the other, the uncertainty regarding the epidemiological situation. As well observed over the previous trading days, the increase in the number of COVID-19 patients in the world is forcing the precious metal to move up, as well as the fact that the United States of America has again begun to provoke China into a conflict that will never stop and periodically escalates. If not for these facts, gold would not have been able to continue to be kept within $ 1,800 per troy ounce, which is now strategically significant for it. At the auction, the price of precious metal futures for delivery in August fell by about 0.77%, which led to a decrease to $ 1,800.15 per troy ounce. The reduction will not end there, and even greater losses are expected during the day, which is likely to cause the metal to fall below the defense level of $ 1,800, which is extremely important for it. The level of support for gold settled at around $ 1,796.50 per troy ounce, and the resistance, in turn, went to the area of 1,825, $ 50 per troy ounce. According to the established tradition, investors begin to turn to gold at the moment when they feel the danger. Gold, to them, became a safe haven asset amid strong the storms. However, now the situation has developed on the market where it is preferable to use precisely the greenback in order to preserve assets. Nevertheless, it should be noted that from a global point of view, the trend for gold will not lose its relevance for a long time, only occasionally being noted by a slight weakening of interest. Over the past few weeks, gold has continued to consolidate near the level of $ 1,800 per troy ounce, which indicates stabilization in the precious metal market, which is a fulcrum for further growth. However, for the time being, amid external factors, the precious metal is driven into a narrow corridor, most likely it will take a long time to get out of it. Nevertheless, the support that can make the price of gold much higher has not disappeared and is only waiting in the wings. Some experts believe that growth will resume very soon. The coronavirus pandemic has not receded anywhere, and in the near future, the situation will only worsen, which will inevitably affect the dollar exchange rate in the direction of its fall. This is the first support factor for precious metals. The US Federal Reserve will face the need to make the base interest rate higher, which will also make gold rise. This is the second support factor. In a difficult situation of uncertainty, risks seriously increase, and as you know, not all market participants want to endanger their assets. In this regard, investors will be forced to go into the protective zone, which is the precious metals market. This is the third support factor. All this can cause gold to jump up to the level of $ 1,900 per troy ounce this year. And in the next, it will be able to storm the level of $ 2,000 per troy ounce. However, it is also possible to prepare for a correction within $ 1,790 per troy ounce. Silver futures for September delivery rose well on Tuesday gaining 1.67%. Its current level is still kept at around $19.457 per troy ounce. Copper futures for September delivery also slightly went up by 0.11%, and the price was in the region of $2.9133 per pound. Palladium, on the contrary, began to cost 0.73% less, which sent it to the level of $ 1,965.44 per ounce. Platinum supported the negative trend and fell 0.33%, which made it move to the mark of $825.59 per ounce. The material has been provided by InstaForex Company - www.instaforex.com |

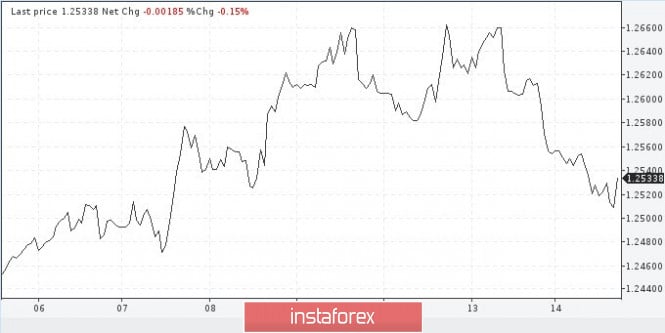

| Posted: 14 Jul 2020 08:35 AM PDT Traders speculating on EUR/USD gave an unexpected response to the US inflation data released today. Despite upbeat data, EUR/USD did not hit a new intraday high. On the contrary, the currency pair hit a new one-month low, having tested 1.14. The driving force for the pair today is EUR which is advancing not only versus USD but also in all forex crosses. The thing is that EU leaders are trying to come to the common denominator ahead of the EU summit slated for this Friday. The key policymakers of the EU are holding talks with the view of reaching the compromise decision which will determine the fate of the €750-billion anti-crisis plan suggested by the European Commission. It was presented in May. Since then, the leaders of the 27 EU countries have been engaged in the painstaking talks to settle the blueprint. To implement this scenario into practice, the Commission needs consent from all member counties. At the same time, some countries teamed up in the so-called Frugal Four alliance. They raise serious objections to some terms of delivering financial aid. Apparently, rumors on the recovery package are pushing EUR/USD upwards. Yesterday, Angela Merkel voiced doubts about whether the parties would be able to come to a compromise at the summit in July. From her viewpoint, stance of some countries differs from the majority in the EU. So, there is a long way until the package is eventually settled. Those four countries are the Netherlands, Austria, Denmark, and Sweden. They still oppose the EU authorities and the most influential European players like Germany and France. The Frugal Four offered their own plan. As an alternative to gratis bailouts, they suggest single-time loans with a payback period of no longer than two years and on condition of clearly defined fields of spending. For your reference, the recovery package includes €500 billion as grants to ailing economies and the remaining €250 billion as credits on the terms suggested by the European Commission. The EU lawmakers invite ailing countries to borrow in financial markets. Loans will have to be repaid, but grants are a different matter. They will be also repaid but at the expense of the EU. For this purpose, the EU members will be required to increase alliance fees and trim some expenses. The EU will provide its own funds, including customs charges and the VAT as well as though raising some taxes. Brussels offers repaying interest on the borrowed funds as the first step starting from 2021 until 2027. Later, loans themselves will have to be paid pack for the period of 30 years. In a nutshell, the agenda of the summit consists of two points only: 1) on what terms the financial will be delivered, 2) the scheme of paybacks. As I said earlier, the Frugal Four countries advocate only for loans but not grants, whereas the European Commission stands for joining these two options in the proportion of 250/500. The second obstacle is the question of how the budget will be backed. The recovery package will require the member countries to increase their EU fees to the common purse. Such prospects aroused disagreement among EU leaders. The proposal of the European Commission to impose new taxes across the EU sparked controversy. In particular, Eastern European countries headed by Poland oppose the introduction of the common European tax on CO2 emissions. Such revenues are expected to replenish the EU budget. At present, the revenues from the quotas of CO2 emissions are allocated to the national budgets of the EU members. In 2019, their overall amount equaled €14.600 billion. Besides, Brussels proposed to impose other taxes, including plastic and incomes of digital corporations. Meanwhile, experts do not dare to predict the outcome of the EU summit in July. Indeed, the participants have sent too controversial signals. Moreover the skeptic tone of Angela Merkel raised doubts. Today, the fundamental background improved notably amid some rumors which haven't been confirmed. The European media reported that Angela Merkel managed to assure opponents to come to some compromise. Importantly, this information is unofficial, so opening long deals on EUR/USD is highly risky. Ahead of such crucial events, the market is usually flooded with rumors which are not confirmed in the wake of the events. As of now, the anti-crisis package worth €750 billion is at stake. Therefore, if the optimistic rumors do not come true, EUR/USD will tumble in response. Thus, it would be a good idea to play the waiting game at least until the first comments from the policymakers. I mean Angela Merkel and Emmanuel Macron. If they confirm the progress in the talks, EUR/USD will extend its climb. Only under such conditions, long positions towards 1.1460 will make sense. The material has been provided by InstaForex Company - www.instaforex.com |

| Expect no economic growth: stock markets moved to a negative correction Posted: 14 Jul 2020 08:22 AM PDT

A collapse occurred on the Asia-Pacific stock market on Tuesday, which was caused primarily by fears of market participants about the rapid increase in the number of people infected with coronavirus infection in the world. In addition, the escalating conflict situation between the United States of America and China has also had its share of pressure. On Monday, the US State Department made a statement that it was ready to provide significant support to its partners in Southeast Asia, who took the stand of protecting their rights to use and preserve the natural resources of the South China Sea. At the same time, it is indicated that the PRC is trying in every possible way to interfere with activities aimed at this, and affirms the sole use of resources. A response from the Chinese authorities followed immediately. The Chinese Embassy in the United States hastened to make a statement that the US authorities did not take into account the efforts of China that are being made to maintain peace and stability in the region. The message was also followed by an official protest against the words of Washington. All this becomes evidence of the next phase of the conflict between the countries, which destabilizes the situation on stock exchanges. In addition, there are other factors that only exacerbate the situation. So, the World Health Organization presented yesterday a report saying that most world states have chosen not quite the right tactics to combat coronavirus infection. In view of this, one can not expect that the world will return to its former life in the near future. Among other things, the report notes the fact that some countries demonstrated a very successful struggle, which nevertheless did not affect the global rapid increase in the incidence rate, breaking records almost every day. The global trend is still extremely negative: the number of infected by the virus continues to increase. And if this problem is not taken seriously in the near future, then one can face even more serious consequences, and the economic crisis alone will not work. Meanwhile, a large-scale economic crisis, which, according to some experts, is only gaining momentum, has not been canceled. Singapore statistics are a vivid example of this. In the second quarter of this year, the country's GDP fell by an alarming 12.6% per annum. No one expected such a fall and according to preliminary data, it should have been no more than 10%. This is taking into account the fact that Singapore was a region that did not suffer too much from coronavirus infection. However, what happened was evidence of a growing crisis, the consequences of which are still difficult to imagine and evaluate. Japan's Nikkei 225 Index Down 0.9% China's Shanghai Composite Index lost 2.1%. Hong Kong's Hang Seng Index also continued this trend and lost 1.8%. However, it should be noted that the level of exports and imports in the country for the first month of summer showed growth, despite the fact that experts predicted its inevitable decline. The volume of exports rose by 0.5%, while imports rushed up immediately by 2.7% on a yearly basis. The South Korean Kospi Index fell 0.5%. Australia's S & P / ASX 200 Index went down by 0.6% A widespread fall in stock markets in Asia is likely to continue this week, as adequate support factors do not yet exist. The stock markets of the United States of America also underwent a negative correction, however, it was not noted everywhere. The S&P 500 and Nasdaq indices were down, while the Dow Jones still remains in the positive zone. The Dow Jones Industrial Average Index showed a slight increase of 0.04% or 10.50 points, which sent it to the mark of 26 085.80 points. The Standard & Poor's 500 Index sank stronger at 0.94% or 29.82 points. Its current level at the close of yesterday's trading was in the region of 3,155.22 points. The Nasdaq Composite Index led the decline. It immediately fell from 2.13%, which corresponds to 226.60 points. Currently, it is located at 10,390.84 points. However, it is worth noting that at the very beginning of the trading session, it still continued to grow rapidly and set new records, which by the end of the day came to naught. The reason for the reduction in the US market was the fall in the securities of technology companies, which until that moment provided the most significant support to the main indicators. In addition, the introduction of quarantine measures on the territory of individual states also seriously frightened market participants who can no longer ignore the difficult epidemiological situation in the state. The United States of America remains the country with the largest number of cases. The next batch of statistics, which is actively preparing for release this week, can add fuel to the fire. The season of reports has begun, and with it, a new fall may occur if the experts' forecasts come true or turn out to be too positive. Analysts advise not to expect anything good, because, most likely, the second quarter of this year will be one of the worst, which has not happened for more than ten years. Nevertheless, investors in the markets hope that by the third quarter, companies will be able to move to growth and restore everything that they immediately lost. This may mitigate the impact that will hit the market this week. European stock markets also began to decline rapidly. Market participants were greatly disappointed with extremely weak economic data. The German DAX Index is down by 1.8%. The UK FTSE Index dipped 1%. French stock exchanges today rest on the occasion of the national holiday - Bastille Day. Meanwhile, the data on the growth of the UK economy over the last month of spring were not as impressive as investors had expected. The country's economy was able to rise by only 1.8%, while the decline was much more serious. Preliminary forecasts were also better expecting a growth of at least 5.5%. Of course, such changes did not please the stock exchanges at all, which immediately affected them. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review on EURUSD for July 14, 2020 Posted: 14 Jul 2020 08:17 AM PDT

EURUSD: The euro continues to trade upward and already managed to broke through 1.1370 and is trying to gain a foothold higher. This what the ECB has expected. Investors turn to euro as insurance against the too aggressive Fed policy. You may keep purchases from 1.1345, the minimum target is 1.1500. The material has been provided by InstaForex Company - www.instaforex.com |

| AUDJPY holding above trendline support! Further rise expected! Posted: 14 Jul 2020 07:38 AM PDT

Trading Recommendation Entry: 74.240 Reason for Entry: 78.6% Fibonacci retracement, ascending trendline support, moving average support Take Profit: 75.160 Reason for Take Profit: Horizontal swing high Stop Loss: 73.917 Reason for Stop Loss:100% Fibonacci extension, Horizontal swing low The material has been provided by InstaForex Company - www.instaforex.com |

| USDCAD reversing off 1st resistance, possible drop! Posted: 14 Jul 2020 07:37 AM PDT

Trading Recommendation Entry: 1.3626 Reason for Entry: Horizontal swing high resistance Take Profit :1.3578 Reason for Take Profit: Horizontal pullback support Stop Loss:1.3650 Reason for Stop loss: Horizontal pullback resistance The material has been provided by InstaForex Company - www.instaforex.com |

| XAUUSD approaching support, potential bounce! Posted: 14 Jul 2020 07:36 AM PDT

Trading Recommendation Entry: 1789.21 Reason for Entry: Ascending trend line, 38.2% fibonacci retracement and horizontal pullback support Take Profit: 1832.17 Reason for Take Profit: Horizontal swing high resistance, 61.8% fibonacci extension Stop Loss: 1769.45 Reason for Take Profit: Horizontal swing low support, 78.6% fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

| Instaforex Daily Analysis - 14th July 2020 Posted: 14 Jul 2020 07:34 AM PDT Today we take a look at AUDUSD and how we can use Fibonacci retracements, Fibonacci extensions, market momentum, trend lines and support/resistance to play this move.The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 14 Jul 2020 07:02 AM PDT The euro continues its confident rise against the US dollar due to the optimism of market participants concerning the EU summit. The fact is that, during the meeting, the EU leaders may approve the aid plan proposed by the European Commission worth of 750 billion euros. However, the data released today for the eurozone countries is not as optimistic as it seemed earlier. Germany's inflation figures, which met the forecast, were not very strong. The fact is that the recovery of consumer prices amid zero interest rates is supposed to be quite weak. Moreover, the consumer price data reflects low consumer activity and other economic problems. According to Destatis, in June 2020, consumer prices in Germany increased due to an advance in the price of food and beverages. The data was in line with preliminary estimates. Thus, the consumer price index climbed by 0.6% compared to the previous month, and the EU-harmonized index rose by 0.7%. The figures also met the economists' expectations. Compared with the same period of the previous year, the national index in June increased by 0.9%. Tobacco prices rose the most by 6.2%, but food prices jumped by 4.4% compared to the same period of the previous year. However, the German economic expectations fell in July. This indicator reflects economic problems and smoother GDP growth in the second half of the year. The expected V-shaped jump will hardly occur and the economy will return to its pre-crisis levels only in 2021. According to the data published by ZEW research center, in July, the index of economic expectations in Germany fell to 59.3 points from 63.4 points in June. Economists had expected the index to reach the level of 60.0 points in July. However, an increase in the assessment of the current situation looks encouraging for market participants. In July, the corresponding index advanced to -80.9 points from -83.1 points in June. Such dynamic indicates positive changes after a sharp decline during the spread of the coronavirus. This suggests that the German economic recovery will continue, although it will be weaker than initially expected. Another indicator that should be mentioned today is the eurozone industrial production. Thus, recovery in the industrial sector was not as rapid as many economists had expected. According to the report, in May, industrial production in the eurozone jumped by 12.4% compared to April. However, in one month it was impossible to recoup losses that occurred in April and March of this year. Industrial production grew the most in Italy, where the index jumped by 42.1%. Judging by the current dynamic of the euro, many analysts believe that it will gain in value, especially after yesterday's statements made by German Chancellor Angela Merkel. She said that she hopes to reach an agreement, but they need to resolve sharp differences. Let's take a look at the technical analysis of the euro/dollar pair. The bullish momentum is obvious. The second test of the 1.1375 resistance level has already occurred. However, the euro sellers are not very active. The entire focus was shifted to the 14th pattern. If the pair breaks it, it may lead to a larger bullish impulse of risky assets towards the highs of 1.1460 and 1.1520. The single currency may lose ground during the US trading session, if buyers fail to consolidate above 1.1375. In this case, the level of 1.1300 may act as support. However, larger buyers of risky assets will be concentrated around the low of 1.1255. GBP/USD The British pound continues to update weekly lows. The pound sterling may again be under pressure. According to the report, the May GDP data was extremely disappointing as the services sector remained almost unchanged and only a small increase was recorded in industry and construction. The UK's economy is consumer-oriented and largely depends on the services sector, whose recovery leads to more rapid GDP growth. It is already clear that hopes for a rapid recovery have not been fulfilled, and the full recovery of the economy will take much more time than expected According to the National Bureau of Statistics, in May, the UK economy grew by 1.8% while in April, the indicator slid by 20.3%. Compared to May last year, the UK's GDP fell by 24%. The services sector showed the smallest rise. Thus, the indicator increased by only 0.9%. Let's take a look at the technical analysis of the pound/dollar pair. At the moment, bears are aimed at breaking the support of 1.2511, which will only strengthen the downtrend and push the pair to fresh lows of 1.2450 and 1.2380. Buyers may return to the market only after a confident break of the 1.2565 level. However, such a scenario is unlikely in the near future without good news on Brexit. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 14 Jul 2020 06:54 AM PDT

The previous bullish breakout above 1.2265 has enhanced bullish movement up to the price levels of 1.2520-1.2590 where temporary bearish rejection as well as a sideway consolidation range were established (In the period between March 27- May 12). Shortly after, transient bearish breakout below 1.2265 (Consolidation Range Lower Limit) was demonstrated in the period between May 13 - May 26 denoting some sort of weakness from the current bullish trend. However, immediate bullish rebound has been expressed around the price level of 1.2080 bringing the GBPUSD back above the depicted price zone of 1.2520-1.2600 which failed to offer sufficient bearish rejection, and the broken uptrend line as well. Further bullish advancement was expressed towards 1.2780 (Previous Key-Level) where signs of bearish rejection were expressed. Short-term bearish pullback was expressed, initial bearish d located around 1.2600 and 1.2520. Moreover, another bearish Head & Shoulders pattern (with potential bearish target around 1.2265) was recently demonstrated around the same price the pair is approaching Today. Recent bearish persistence below 1.2500 ( neckline of the reversal pattern ) paused the bullish outlook for sometime & enabled further bearish decline towards 1.2265. However, last week, significant bullish rejection was originated around 1.2265 bringing the GBP/USD pair back towards 1.2600 - 1.2650 where a cluster of resistance levels were located. Earlier Today, signs of bearish rejection were manifested around the price zone of 1.2620 - 1.2650 (Mid-channel zone). This indicates a high probability of bearish reversal provided that early bearish breakout is achieved below 1.2500. Trade recommendations : Intraday traders could consider Yesterday's bullish pullback towards the depicted Supply Zone (1.2600-1.2650) for a valid SELL Entry. Stop Loss should be tight, it can be placed above 1.2700 while initial T/P level to be located around 1.2450 & 1.2265. The material has been provided by InstaForex Company - www.instaforex.com |

| July 14, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 14 Jul 2020 05:56 AM PDT

On March 20, the EURUSD pair has expressed remarkable bullish recovery around the newly-established bottom around 1.0650. Shortly after, a sideway consolidation range was established in the price range extending between 1.0770 - 1.1000. On May 14, evident signs of Bullish rejection as well as a recent ascending bottom have been manifested around the price zone of (1.0815 - 1.0775), which enhances the bullish side of the market in the short-term. Bullish breakout above 1.1000 has enhanced further bullish advancement towards 1.1175 (61.8% Fibonacci Level) then 1.1315 (78.6% Fibonacci Level) where bearish rejection was anticipated. Although the EUR/USD pair has temporarily expressed a bullish breakout above 1.1315 (78.6% Fibonacci Level), bearish rejection was being demonstrated in the period between June 10th- June 12th. This suggested a probable bearish reversal around the Recent Price Zone of (1.1270-1.1315) to be watched by Intraday traders. Hence, Bearish persistence below 1.1250-1.1240 (Head & Shoulders Pattern neckline) was needed to confirm the pattern & to enhance further bearish decline towards 1.1150. However, the EURUSD pair has failed to maintain enough bearish momentum to do so. Instead, a narrow-ranged bullish channel is being expressed while re-approaching the price levels of 1.1380-1.1400 where the upper limit of the channel is located. Initially, bearish rejection should be anticipated. However, Please note that any bullish breakout above 1.1400 will probably lead to a quick bullish spike directly towards 1.1500. Trade recommendations : The current bullish movement towards the price zone around 1.1380-1.1400 should be watched cautiously by Intraday Traders for any signs of bearish rejection.T/P levels to be located around 1.1315, 1.1250 then probably 1.1175 while S/L to be placed above 1.1400 to minimize the associated risk. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 14 Jul 2020 05:32 AM PDT

The Chainlink cryptocurrency surged to $8.5 for the first time. According to CoinMarketCap, one of the largest cryptocurrencies rose in price by 24% per day. Moreover, in general, Chainlink has increased by 375%. Last week, Santiment noted that LINK continued to hit new records in the number of daily active addresses. As analyst Josh Rager noted, LINK is a great example of why it is better to trade altcoins, even by being a bitcoin maximalist. During the past weeks, Bitcoin was trading around $1,000. At the same time, LINK rose from $3.65 to $ 8.5. Expert Michael van de Popp is sure that in the near future, Chainlink will rise to $10, but it is necessary to wait for some time. He anticipates a jump by the end of 2020. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 14 Jul 2020 05:08 AM PDT Technical analysis:

Trading recommendation: The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 14 Jul 2020 05:07 AM PDT It is difficult to overestimate the role of OPEC+ in saving the oil market. Thanks to a large-scale reduction in production by 9.7 million b/d, 23 countries, including Saudi Arabia and Russia, managed to double the price of black gold in April-July. It's time to collect the stones. The transition to the second stage of the agreement, which provides for a reduction in the volume of obligations to 7.7 million b/d in August-December, is expected by investors with apprehension. Previously, it was assumed that global demand will continue to grow and absorb the missing 2 million b/d, however, the difficult epidemiological situation in the United States and the reluctance of California, the state-largest consumer of gasoline, to leave the lockdown, cast doubt on this. Bad news from Hong Kong, which has re-introduced strict measures on social distancing, as well as from Japan, which does not exclude the re-closure of the economy, does not add to the optimism of the "bulls" for Brent and WTI. According to the International Energy Agency, oil production in April-June decreased by 14 million b/d. The indicator will gradually recover, including due to a decrease in the volume of OPEC+ obligations. In June, the cartel's production of black gold fell to 22.7 million b/d, the lowest level in three decades. Global supply is expected to fall by 7.1 million b/d by 2020, and then by 1.7 million b/d. Dynamics of OPEC oil production

The IEA forecasts that global demand in the second quarter fell less than initially expected – by 16.4 million b/d. As it recovers in Asia, in particular in China, the indicator will fall short of 7.4 million b/d by the end of 2020. Indeed, China's oil imports reached daily and monthly highs in June. However, the International Energy Agency warns that due to the deterioration of the epidemiological situation, forecasts may be revised for the worse. In such circumstances, the OPEC+ meeting is obligated to suggest in which direction Brent and WTI should move further. Optimists, including Rapidan Energy Group, believe that the market will easily absorb 2 million b/d. The consulting company estimates that global demand will grow by 18% in the third quarter to 95.7 million b/d and continue in the same vein in the fourth. As a result, world reserves of 5.6 million b/d will disappear, and prices will rise. Pessimists led by Morgan Stanley argue that due to uncertainty in the demand area, the growth in OPEC+ production will trigger a correction in the black gold market. In my opinion, the increase in the number of COVID-19 infections and the growing risks of repeated lockdowns are bad news for both the global economy and black gold. Nevertheless, the world is on the threshold of the discovery of vaccines and effective drugs, so it is unlikely that the situation will take a threatening turn, and the US GDP will go on the path of a W-shaped recovery. If OPEC+ gives the market more than it expects, we buy Brent on the breakout of resistance at $ 44 and $ 44.7 with a target of $ 50-51 per barrel. The rollback will allow you to form longs from more profitable levels: $ 40.15 and $ 37.8. Technically, while the quotes of the North sea variety have not fallen below the moving averages, the situation continues to be controlled by the "bulls". Brent, the daily chart

|

| Oil continues to sag with rapid decline in raw materials price Posted: 14 Jul 2020 05:07 AM PDT

The price of crude oil continues to decline on Tuesday. The unyielding COVID-19 situation remains the leading factor for the recession. This provoked immediate reimposition of restrictive quarantine measures on the territory of individual states. The number of newly detected cases of COVID-19 infection in the world is growing rapidly, and these statistics can no longer be ignored by market participants, causing them extreme concern about the further development of events. In the US, authorities in the state of California decided new quarantine measures for business, since the number of cases has grown significantly and there is an urgent need to restrain this process in the future. In Los Angeles and San Diego, it is prescribed to cancel all children's activities, it is planned to introduce home quarantine before the end of August. In addition, an order was released issuing, again, force closures of bars, restaurants, cinemas, museums, parks, and other public places of recreation. And by the end of the month, hairdressers, gyms, churches, and so on should temporarily suspend their activities as well. So far, such measures are only applicable to areas with a record-breaking number of cases. However, no one can guarantee that the restrictions will not soon apply to the rest of the states. Investors began to take the news on coronavirus infection more seriously, which immediately affected the price of crude oil. So far, quarantine imposed in some US states is still moderate, but even it can seriously undermine the economy and affect the level of demand for crude oil and fuel. At least most analysts believe that the second summer month will be rather difficult for the oil market, and most of the problems are related to the uncertainty surrounding the coronavirus pandemic. Meanwhile, investors' attention are presently divided into the coronavirus situation and the meeting tomorrow of the ministers of the OPEC monitoring committee. The main issue that will be raised at the said meeting is the transition to the next stage of the contract to reduce oil production. Since August, the extraction of raw materials, according to the agreement between the countries, should grow slightly and be at the level of 7.7 million barrels per day. This fact is already starting to put pressure on market participants, who are moving to more restrained work. On top of that, there are a number of states that are likely to oppose easing in production and will stand on the idea of leaving everything at the same level until a more stable market position is achieved. The reasons for this position are also sufficient: a sharp lifting of restrictions may return to the raw materials market the excess supply that states tried to leave when they accepted the current conditions. This, in turn, can lead to a rapid collapse in the price of black gold, which will also be supported by the spread of COVID-19. Nevertheless, there is practically no assurance that everything will remain the same. The ministers are determined to begin to reduce restrictions since so far the prices on the oil market are at a rather high level. A new period begins for market participants, in which the bearish trend may take the main place, which means that the negative correction will continue. The short position can be considered as the most promising in the present movement. This is confirmed by statistics from the International Energy Agency: in the first month of summer, the demand for oil raw materials went down by 2.4 million barrels per day, which forced it to switch to the lowest level of 86.9 million barrels per day over the past nine years. The price of futures contracts for Brent crude oil for delivery in September at a trading floor in London fell by 1.78% or $0.76. Its level so far has stopped at the level of $41.96 per barrel, closely approaching the strategically important mark of $40 per barrel. According to the results of yesterday's session, the brand also found itself in the red by 1.2% or $ 0.52, which stopped its movement in the region of $ 42.72 per barrel. The price of futures contracts for WTI light crude oil with delivery in August on an electronic trading platform in New York also rapidly crept down. By morning, it decreased by 2.09% or $0.84, which sent it to the mark of $39.26 per barrel. Yesterday's trading ended with a decline of 1.1% or $0.45 and ended within $40.1 per barrel. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 14 Jul 2020 04:32 AM PDT

According to French Finance Minister Bruno Le Maire, the government has prepared a youth employment support plan and an incentive plan that outlines tax cuts for companies in August. This week, the EU leaders will meet to discuss the seven-year budget of the eurozone, as well as the creation of an incentive fund worth €750 billion. Thanks to increasing sales of coronavirus tests, Novacyt shares rose by 2.4%. Also, Credit Suisse can boast of a 1.1% climb in its shares. Moreover, the British military company reported an increase in shares of 8.5%. However, not everyone is doing well. So, Ubisoft Entertainment SA shares fell by 8.1% due to allegations of misconduct. At the same time, the retail chain boohoo.com lost 13% of its shares. Despite the fact that green light is visible in Europe, Covid-19 continues to spread around the world and take lives of people. A record 230,370 new cases were reported on Sunday. Florida broke the record high in the number of new infections per day. More than 15 thousand people were tested positive for the coronavirus in one day. Meanwhile, oil prices are falling again. Soon, a meeting of OPEC technical specialists will be held. They are expected to recommend cartel members to adhere to the recovery schedule as demand grows. WTI oil futures fell by1.2% to trade at $40.05 per barrel, as well as Brent oil dropped by 1.1% to $42.77 per barrel. Gold futures rose by 0.4% to $1,808.65 per ounce, while EUR/USD advanced by 0.2% to trade at 1.1322. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 14 Jul 2020 04:27 AM PDT Technical analysis:

Trading recommendation: I found the breakout of the symmetrical triangle on the daily time-frame, which is very good sign for further downside movment. Watch for selling opportunities with the targets at $8,150 and $7,450. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment