Forex analysis review |

- EURUSD holding above trendline support and looks for further upside!

- Forecast for USD/JPY on June 4, 2020

- USDCAD bouncing from 1st support, further upside!

- GBP/USD approaching support, potential bounce

- Hot forecast and trading signals for the GBP/USD pair for June 4. COT report. Bulls are full and can soon put bears on the

- Hot forecast and trading signals for the EUR/USD pair for June 4. COT report. ECB meeting results can moderate the ardor

- ECB June meeting: preview

- June 3, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- OPEC + countries plan to extend the oil reduction deal.

- June 3, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- Gold quotes continue to drop

- Oil caught a wave: prices are skyrocketing

- Stock markets in America, Europe and Asia on the same positive wave

- USDJPY breaks above key short-term resistance

- Gold challenges key short-term support

- Evening review on EURUSD for June 03, 2020

- EUR/USD and GBP/USD likely to plunge as bullish trend comes to a halt. Surprising eurozone unemployment rate to be reflected

- EUR/USD analysis for June 03, 2020 - Extended run to the upside on EUR but still more upward movement to come. Upward target

- BTC analysis for June 03,.2020 - Massive drop on the BTC as I expected. Watch for selling opportunities on the rallies with

- Trading recommendations for the EUR/USD pair on June 3, 2020

- Analysis of Gold for June 03,.2020 - Yesterday's target at the price of $1.720 has been reached. Next downward target set

- EUR / USD: Euro remains in positive position

- GBP/USD. All hopes are on Johnson: ambitious pound updated four-week high

- GBP/USD: plan for the American session on June 3 (analysis of morning deals). The pound took a pause before a new wave of

- EUR/USD: plan for the American session on June 3 (analysis of morning deals). The bulls failed to continue the euro's growth.

| EURUSD holding above trendline support and looks for further upside! Posted: 03 Jun 2020 08:19 PM PDT

Trading Recommendation Entry: 1.11670 Reason for Entry: Ascending trendline support, 23.6% Fibonacci retracement, moving average Take Profit : 1.13623 Reason for Take Profit: -27.2% Fibonacci retracement Stop Loss: 1.11154 Reason for Stop loss: 38.2% Fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for USD/JPY on June 4, 2020 Posted: 03 Jun 2020 07:42 PM PDT USD/JPY The USD/JPY pair continues its steady growth towards the nearest target of 109.50. Consolidation above the level will allow the price to continue rising to the second target of 110.83 (November 26, 2017 low). Stock indices so far favor this desire of the dollar: S&P 500 gained 1.36% yesterday, while the Nikkei 225 is adding 0.68% this morning. Nothing portends a decline on the four-hour chart; the price rises above the indicator lines, the Marlin oscillator decreases in a small frame of the indicator discharge before further growth. |

| USDCAD bouncing from 1st support, further upside! Posted: 03 Jun 2020 07:10 PM PDT

Trading Recommendation Entry: 1.3482 Reason for Entry: 100% fibonacci extension Take Profit :1.3733 Reason for Take Profit: Horizontal pullback resistance, 38.2% fibonacci retracement Stop Loss: 1.3300 Reason for Stop loss: 161% fibonacci extension The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD approaching support, potential bounce Posted: 03 Jun 2020 07:08 PM PDT

Trading Recommendation Entry: 1.24612 Reason for Entry: Horizontal pullback support, 100% fibonacci extension and 38.2% fibonacci retracement Take Profit: 1.26348 Reason for Take Profit: Horizontal swing high resistance Stop Loss: 1.23622 Reason for Take Profit: Horizontal pullback support, 61.8% fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

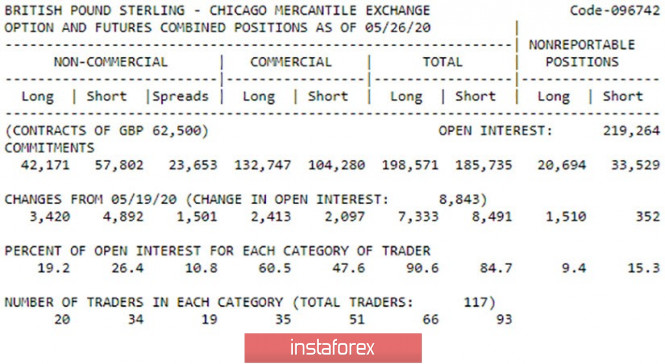

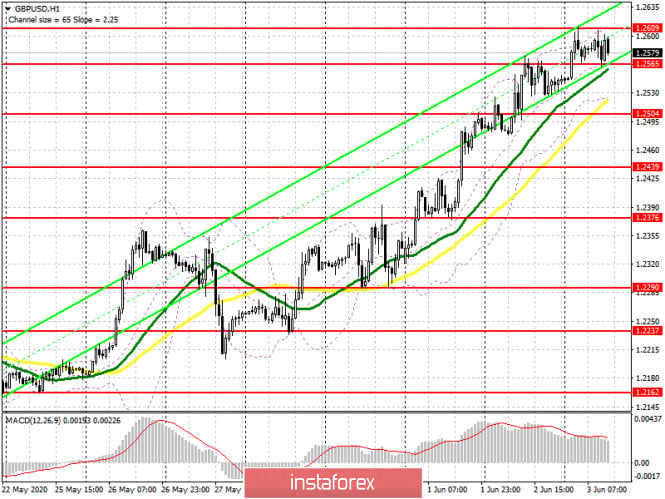

| Posted: 03 Jun 2020 05:34 PM PDT GBP/USD 1H The pound/dollar pair continued its upward movement on Wednesday, June 3, but the movement has already thoroughly weakened. On the way to the highs of April 14 and 30, buyers clearly became more cautious and stopped buying the British pound (and selling the dollar) with the same volumes and with the same zeal. Thus, we believe that in the near future the upward movement may be stopped. There is also a new upward channel on the current chart, however, it is more formal in nature, since it does not originate from the very beginning of the upward movement of the pair and has a too strong inclination angle, which does not imply any correction in principle. Thus, it shows well the strength of the movement of recent days, but is useless for determining the general trend. Based on the foregoing, the pair's new purchases are now considered quite risky. The only trend line is far from the current price, therefore, a downward correction can be very strong, and the upward trend will continue anyway. GBP/USD 15M Both linear regression channels continue to be directed upward on the 15-minute timeframe, therefore, there are no signs of an upward trend ending here, just as there are no signs of starting the correctional movement. Only the lower channel can begin to unfold in the coming hours, and even then not down, but sideways. COT Report Despite the fact that in total among all major market participants, the demand for the pound sterling did not change during the reporting week (a total of 8600 contracts for buying and selling were opened), professional traders mainly bought the pound sterling - +5205 contracts, and from contracts for on the contrary, they got rid of the sale at -1,686 transactions. Therefore, traders are upbeat and in principle, the situation has not changed at the end of last week. The GBP/USD pair continued to grow in the new week, which means that demand for the pound is not declining. The new COT report may show even greater strengthening of the position of large buyers. The fundamental background for the British pound remains negative despite the fact that this currency continues to go up in tandem with the dollar. There were practically no important macroeconomic statistics in the UK and the United States this week, and those reports that could have caused interest were again ignored. The most interesting publications came on Wednesday, when just the pair showed the least volatility and stood in one place all day. Thus, traders continue to ignore most of the reports, and in recent days, the British currency should thank the riots in the United States. However, if the euro can still continue to rise in price, then the pound seems to have exhausted its growth potential. All the blame is the fundamental background from the UK itself, which remains very sad and disappointing. We have repeatedly said that the absence of a deal with the European Union, the very fact of Brexit, the epidemic of the coronavirus have a strong negative impact on the British economy, which can continue to decline in 2020 and in 2021, when most countries of the world can already show growth. Thus, in the medium and long term, it will be very difficult for buyers to find the reasons and reasons necessary for opening new positions. There are two main scenarios as of June 4: 1) The initiative for the pound/dollar pair remains in the hands of buyers, who so far remain in purchases with goals of 1.2642 and 1.2664. However, opening new buy-positions is now associated with increased risks. There is still no correction, which means a high probability of its onset. A short Stop Loss can be set below 1.2529 and, if it works, it is recommended that new purchases be made only after the correction is completed and an upward trend is maintained. Possible Take Profit for current purposes is about 70-90 points. 2) Sellers continue to remain in the shadow and will be ready to return to the market only below the ascending trend line. Of course, short positions can be considered up to this point, but now there are no prerequisites for this at all. We consider the minimum necessary condition for sellers to overcome the area of 1.2403 - 1.2423. Then it will be possible to sell the pair with the goals of the trend line (1.2350) and Senkou Span B line (1.2260). In this case, Take Profit will be from 50 to 130 points. The material has been provided by InstaForex Company - www.instaforex.com |

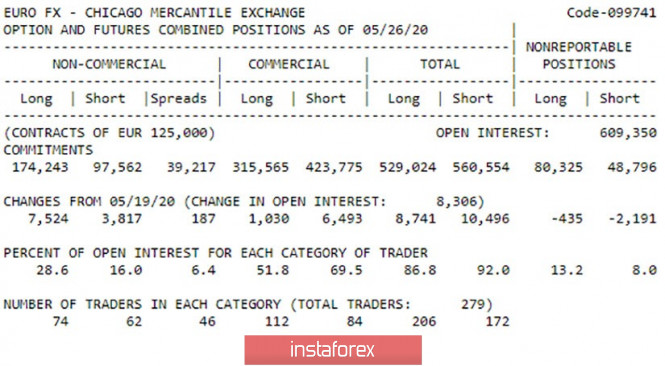

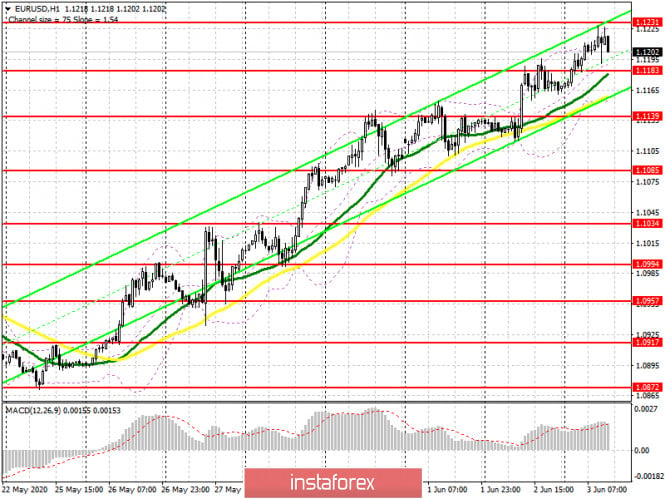

| Posted: 03 Jun 2020 05:34 PM PDT EUR/USD 1H The EUR/USD pair continued its upward movement on June 3. This time the pair managed to grow by another 70 points or so, and also overcome the resistance level of 1.1205. Thus, nothing has changed over the past trading day. Buyers continue to dominate the market. At the moment, there is no sign of the beginning of a downward correction. The pair continues to gently trade inside the rising channel, without going beyond it. Thus, the bears have no reason to open short positions. At least the market participants can count on a correction, but in the current conditions, for its identification, consolidating under the ascending channel will be required. We remind you that in addition to the channel, there are also two upward trend lines that also support traders to increase. EUR/USD 15M We see the same picture on the 15-minute timeframe. Two linear regression channels, both still pointing up and clearly signal an upward trend. Thus, at the moment, there is not a single signal that traders can use regarding the completion of the upward trend, even on the lowest timeframe. COT Report The latest COT report showed that professional traders unexpectedly started buying European currency during the reporting week. Suddenly- because, from our point of view, the fundamental background was not in favor of the euro. However, over the course of the current week, it became expectedly in favor of the euro due to mass rallies and protests in the US. Large traders found reason to open new 7524 purchase contracts last week. For the reporting week, only 3817 sales contracts were opened, if we take into account the most important group of traders - professional players who work in the market with the goal of making a profit due to exchange rate differences. This information is already enough to understand that the mood of large traders for the reporting week has changed to bullish. The beginning of the new week also remains with the buyers, so in the new COT report we can see an even greater increase in purchase contracts among professional traders. The overall fundamental background for the pair remains neutral, if only economic news is taken into account. However, today it may shift a little in the direction of the negative. On June 4, the results of the ECB meeting will be summed up and traders are waiting for changes in the parameters of the PEPP economic stimulus program, or rather its expansion. In addition, the ECB will hold a press conference and announce forecasts for 2020 on GDP and inflation. It is expected that forecasts will be adjusted for the worse, and ECB representatives will not be able to reassure and inspire optimism in the markets. However, market participants still want to work out all this information. It is no secret that in recent months most of the macroeconomic information has been ignored, and programs for quantitative easing and stimulating the economy are expanding in many countries. Thus, traders' reaction to the ECB's decision may simply be absent. But market participants continue to closely monitor what is happening in the United States and, as riots, rallies and protests continue there, they continue to sell the US currency. Thus, from our point of view, the topic of riots in the United States is now in first place in terms of importance. Based on the foregoing, we have two trading ideas for June 4: 1) It is possible for quotes to grow further with the goal of the resistance level for the 4-hour chart at 1.1312. However, for this, the bulls just need to continue to stay within the rising channel. Stop Loss levels can be placed below the channel and gradually transferred to the top. Potential Take Profit in this case will be 70 points. 2) The second option - bearish - involves consolidating the EUR/USD pair under the rising channel, which will allow sellers to join the game and start trading down. However, we also recommend waiting for consolidation below the Kijun-sen line, and then open short positions with targets at 1.1010 (upward trend line) - 1.0945 (Senkou Span B line). Overcoming each of the barriers will keep sales open. Potential Take Profit range from 130 to 180 points. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 03 Jun 2020 11:09 AM PDT The euro-dollar pair is growing, as they say, "not by the day, but by the hour": the price was able not only to stay within the 12th figure today, but also to update the three-month high along the way. Buyers, apparently, intend to test the resistance level 1.1270 (the upper line of the Bollinger Bands indicator on the weekly chart) in the near future, thereby confirming a trend reversal. And yet, despite the clear dominance of the bulls, buying now looks risky, especially in the context of the medium term. Tomorrow's meeting of the ECB may turn the attention of traders from American events, while the rhetoric of the head of the European regulator may put pressure on the euro. And if today the pair is growing mainly due to the weakness of the US currency (the dollar index continues to decline to 96 points), then tomorrow the euro will turn into a kind of "anchor", which will at least slow down the price increase. However, there is no consensus on the possible outcomes of the ECB June meeting. But at the same time, everyone agrees that the issue of expanding the Pandemic Emergency Purchase Program (PEPP) will become the central theme of tomorrow. So far, the European regulator has spent less than a third (namely 210 billion) of emergency funds, the total amount of which is 750 billion euros. Therefore, the central bank, by and large, can afford not to rush with further decisions on this issue, that is, not to consider the issue of expanding PEPP at the June meeting. But the main problem of the EUR/USD bulls is that most market participants expect Christine Lagarde to expand this program by 500 billion euros. And if the head of the ECB does not meet these expectations, the European currency will be under significant pressure, sharply weighing on EUR/USD. After all, it is already obvious that the 750 billionth volume is not enough to cover all the necessary "targeted" expenses - at the current pace the money will run out by October. Naturally, the regulator will hold several more meetings until October (July 16 and September 10), but if tomorrow Lagarde does not indicate the corresponding intentions, then the volatility in the pair will not be in favor of the euro. By the way, the head of the ECB can also make a "Solomonic decision", thereby reassuring the markets - for example, declare an expansion of the program by 250 billion, extending its validity by next year. The central bank may also inform us about expanding the list of redeemable assets by including, for example, issuers whose rating has recently been lowered to a speculative level from investment. All of these measures would provide additional support to the eurozone economy in the current crisis. In addition, according to most analysts, Lagarde will again call on eurozone countries to increase fiscal stimulus to support the economy. In this vein, she can comment on the recently presented anti-crisis plan of the European Commission. Most likely, she will support this initiative. It is also necessary to take into account the "German factor" in the context of tomorrow's meeting. Let me remind you that in early May, the German Constitutional Court stated that the ECB's quantitative easing program partially violates the German Basic Law. The judges did not "cut off the shoulder", allowing the European Central Bank to argue its decision within three months and prove that it did not exceed its authority - but otherwise the court would prohibit the Bundesbank from participating in this program. However, the court did not agree with the arguments of the European Court, which two years ago legalized QE. In other words, the judges questioned the legitimacy of the program, which the European regulator resumed last fall. And although Brussels has already stated that "a German court does not order the European Central Bank," general anxiety among traders has persisted. Here it must be emphasized that the above court decision does not apply to "coronavirus money" - the judges considered the legality of only the 2015 QE QE program. Nevertheless, some analysts have warned that the verdict of the German Themis may affect the expansion of PEPP. In their view, the ECB's ability to increase quantitative incentives may be limited in light of the above court decision. Although in my opinion, this is unlikely, given the previous rhetoric of Lagarde on this issue. In addition, not so long ago, Isabele Schnabel, who represents Germany on the ECB's executive board, said in an interview with the Financial Times that the European regulator "will ignore this court decision" and that the German Central Bank will deal with this problem. Thus, there are three main scenarios for the June meeting of the European Central Bank. According to the first scenario, Lagarde will declare a wait-and-see attitude by announcing the consideration of the expansion of the program at the July meeting. In this case, the European currency will collapse throughout the market. The second option is to increase the program by 250 billion euros. The regulator will thus support the eurozone economy, but at the same time make it clear that it is not in a hurry with actions, given the widespread weakening of quarantine in the EU countries. A restrained, and possibly short-term (but positive) reaction of the euro is expected here. Well, the third option is to increase the volume of the PEPP program by 500 billion euros. Thus, the repurchase volume for this year under all programs will be brought up to 1 trillion 600 billion euros. In this case, the pair will definitely break the resistance level of 1.1270, and, possibly, will test the 13th figure. All other related factors of tomorrow's meeting (even updating economic forecasts) will play a secondary role. Given such a high degree of uncertainty, it is advisable for the pair to take a wait-and-see attitude, at least until the end of the final press conference, Christine Lagarde. The material has been provided by InstaForex Company - www.instaforex.com |

| June 3, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 03 Jun 2020 09:43 AM PDT

On March 20, the EURUSD pair has expressed remarkable bullish recovery around the newly-established bottom around 1.0650. Bullish engulfing H4 candlesticks as well as the recently-demonstrated ascending bottoms indicated a high probability bullish pullback towards 1.0980 and 1.1075 (Fibo Level 50%). Shortly After, a bearish Head & Shoulders pattern was demonstrated around the price zone between (1.1075-1.1150). Shortly after, a sideway consolidation range was established in the price range extending between 1.0770 1.1000. The price zone of (1.0815 - 1.0775) has been standing as a prominent Demand Zone providing quite good bullish support for the pair so far. On May 14, Evident signs of Bullish rejection have been manifested around this price zone. Moreover, recent ascending bottom has been established around 1.0870 which enhances the bullish side of the market in the short-term. Short-term technical bullish outlook remains valid as long as bullish persistence is maintained above the recently-established ascending bottom around 1.0850-1.0870. Currently, the recent bullish breakout above 1.1000 has enhanced further bullish advancement towards 1.1175 (61.8% Fibonacci Level) where temporary bearish rejection was anticipated. Although the EUR/USD pair is expressing a bullish breakout above 1.1175 (61.8%Fibonacci Level), there's negative divergence being expressed on the H4 chart. This suggests a probable bearish reversal around the current price levels (1.1235) to be watched by Intraday traders. Trade recommendations : Conservative traders are advised to wait for bearish pullback towards 1.1000 as a valid BUY Entry. T/P levels to be located around 1.1075 then 1.1175 while S/L to be located below 1.0900. The material has been provided by InstaForex Company - www.instaforex.com |

| OPEC + countries plan to extend the oil reduction deal. Posted: 03 Jun 2020 09:42 AM PDT OPEC + countries plan to extend the oil reduction deal. Many countries, including Russia, are in favor of the extension. Saudi Arabia has not yet voiced its decision in this regard. At the same time, the Kingdom recently expressed interest in extending the deal. Mitigation of restrictive measures in some regions has led to an increase in energy demand. Also, finally, oil prices rose sharply thanks to the OPEC + deal. This also influenced the end of the price war between Saudi Arabia and Russia. Now the parties to the transaction need to decide how long to maintain the current conditions for reducing oil production. These days there is a discussion of the date of the next meeting on the OPEC deal. There was a proposal to hold it earlier than June 9, as previously planned, and to schedule a meeting for June 4. Recently, both Russia and Saudi Arabia are changing their positions regarding the OPEC deal. But at the same time, they always manage to find a convenient solution.

Not everyone supports the OPEC deal. US shale companies are gradually increasing oil production. Texas-based Parsley Energy, announced plans to restore daily oil production (26,000 barrels per day) in June. The volume of oil production in the Bakken formation has also grown from mid-March by 35,000 barrels per day. The initial OPEC + deal suggested that its participants cut oil production by 9.7 million barrels per day. This is about 10% of world production. Then, Saudi Arabia, Kuwait and the UAE decided to further reduce production by 1.2 million barrels per day in June. Thus, the total reduction in oil production by OPEC + participants in June should be about 11 million barrels per day. The material has been provided by InstaForex Company - www.instaforex.com |

| June 3, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 03 Jun 2020 09:32 AM PDT

Recently, Bullish persistence above 1.2265 has enhanced another bullish movement up to the price levels of 1.2520-1.2590 where significant bearish rejection as well as a quick bearish decline were previously demonstrated (In the period between 14th - 21 April). Moreover, Atypical Bearish Head & Shoulders reversal pattern was in progress. The GBP/USD pair was demonstrating the Right Shoulder of the pattern. Hence, Bearish persistence below 1.2265 (Reversal Pattern Neckline) was needed to confirm the pattern. Thus, enhance another bearish movement towards 1.2100, 1.2000 then 1.1920. Moreover, the price zone of 1.2300-1.2280 corresponding to a short-term uptrend was breached to the downside failing to provide enough bullish support for the pair. Thus, enhancing the bearish side of the market. Temporary bearish breakout below 1.2265 was demonstrated in the period between May 13 - May 26. However, immediate bullish rebound has been expressed on May 18. On the other hand, the price zone of 1.2520-1.2600 (Backside of the broken Uptrend) stands as a recently-established SUPPLY-Zone to offer bearish rejection and a valid SELL Entry for the pair in the short-term. Hence, bearish decline would be expected to be enabled towards 1.2020 as a projection target for the reversal pattern provided that no bullish breakout above 1.2600 is expressed. Trade recommendations : Intraday traders can still consider the current bullish pullback towards the price zone of 1.2520-1.2600 as a valid SELL Entry. T/P level to be located around 1.2345, 1.2265 and 1.2150 while S/L should be placed above 1.2650. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 03 Jun 2020 08:38 AM PDT

Gold quotes continue to drop, largely due to the rapid rise of the stock market. The US, Asian and European stock indices have been growing for several days in a row now, which allowed some to reach their highest values over the past three months. Market participants are encouraged by the ongoing recovery of the global economy, as evidenced by incoming statistics. The drop of gold has several factors. First is the weakening US dollar, which has recently been feeling extremely insecure, and the second is the ongoing riots and mass protests across the streets of America. The unrest though is no longer putting much pressure on the mood of investors now. Nevertheless, in the morning, gold fell by another 0.51% and reached the level of $ 1,718.29 per troy ounce. The support for the precious metal is at the value of $ 1,710 per troy ounce, while resistance came around $ 1,761 per troy ounce. Most market participants have now ceased to react sharply on negative external factors. Riots, conflicts and other incidents no longer shake investor confidence that economic recovery is proceeding at a good pace. Analysts also argue that global outlooks are now favorable, which, of course, seriously puts pressure on the demand for precious metals. But the economic situation is still far from ideal, so gold still has some support. Investors still strive to provide their assets with some security that can only be expected in the precious metals sector. Thus, Palladium rose by 1.57% today and went to the level of $ 1,979.84 per troy ounce, while Silver, on the contrary, decreased by 1.13%, dropping to a value of $ 17.89 per troy ounce. Now, palladium has started to move down, falling by about 0.54%, amounting to $ 834.39 per ounce. Copper futures for July delivery, meanwhile, indicate a downward trend, falling this morning by about 0.36%. Its cost at the moment is $ 2,486 per pound. The material has been provided by InstaForex Company - www.instaforex.com |

| Oil caught a wave: prices are skyrocketing Posted: 03 Jun 2020 08:10 AM PDT Crude oil is rapidly moving up. The cost of futures does not stop its growth, which has already allowed the Brent brand to step over the strategically and psychologically important mark of $40 per barrel. Analysts believe that the reason for such success, first of all, is possible success in agreements on extending the reduction of oil production between the OPEC member countries. Today it has become clear that most countries are ready to further reduce production on their territory for another two months. Even Russia, which had previously expressed sufficient skepticism about this, began openly calling for a continuation of the reduction course, since it had already worked well in order to adjust supply and demand, which allowed the oil market to begin its recovery. Some other OPEC members are also set to reduce production, which is what their colleagues are calling for. In addition, investor interest is also fueled by the fact that the remote meeting of OPEC ministers was decided to be postponed from June 10 to an earlier date. Thus, negotiations will be held at the end of this week, that is, June 4-5, and the further policy of oil-producing countries will be clear very soon. Market participants, in anticipation of a decline in production and with hope for a better outcome of the meeting, began active work on trading floors, which did not take long and was reflected in the price of oil. Experts believe that the market is adjusting to a new wave, which indicates a transition from excess supply to deficit, which will stimulate the growth of futures contracts and support the raw materials market as a whole. Demand for raw materials also continues to grow as the economies of the world open up and emerge from stagnation after the coronavirus pandemic. The main focus here is that the prospects for growth in demand from China, which is one of the world's largest consumers of crude oil, are very good. The country's economy is rapidly recovering, therefore, demand is also gaining momentum. In general, the world expects an increase in black gold consumption to 92 million barrels per day. Iraq also acts as a problem zone for OPEC, which reduced its oil exports by 7% last month compared to previous results. A total of 3.212 million barrels per day was produced. Thus, 99.585 million barrels of raw materials were exported, which cost on average about $21 per barrel, which is much higher than April prices. Meanwhile, serious financial problems have emerged in the country, the budget deficit is growing, and with it reflections begin on the further desire to participate in the contract to reduce production. Iraq so far remains committed to the agreement with OPEC and will continue to reduce its production, despite the difficulties. Another positive news that influenced the mood of investors was the release of preliminary statistics on oil reserves in the United States of America, which is traditionally represented by the Petroleum Institute - API. The published data reflect a decrease in black gold reserves by 483,000 barrels last week, the current level of reserves was at around 531 million barrels. This fall, of course, is not the most grandiose in history, but, in comparison with preliminary forecasts of analysts, it is much better. Recall that earlier experts said that reserves should grow by no less than three million barrels. At the same time, stocks of gasoline and distillates increased: gasoline increased by 1.7 million barrels, and distillates - by 5.9 million barrels. This, in turn, also did not coincide with preliminary forecasts of analysts who expected gasoline to grow by no more than one million barrels, and the increase in distillates should not be higher than 2.7. Commercial oil reserves at the Cushing distribution center decreased by 2.2 million barrels, according to API. However, all these are preliminary data, the official ones will arrive today in the afternoon, and if they justify the forecasts, the oil market will receive an additional incentive for growth. This morning, the price of Brent crude futures for delivery in August at a trading platform in London is growing rapidly by 1.62%, or $0.64 in cash. Its level has stepped over an important mark of $40: it is still worth $40.21 per barrel. Recall that yesterday's session also ended in a positive: growth was 3.26%, or 1.25 dollars, and trading closed at the level of 39.57 dollars per barrel. The price of futures for light crude oil brand WTI with delivery in July at auction in New York increased by 2.61%, or 0.96 dollars. Now they are in the range of 37.77 dollars per barrel. Tuesday's session also reflected a significant increase of 3.87%, or 1.37 dollars, and their final price at the close was 36.81 dollars per barrel. According to analysts, both contracts showed very steady growth, which allowed them to be at their highest values in the last two months. The material has been provided by InstaForex Company - www.instaforex.com |

| Stock markets in America, Europe and Asia on the same positive wave Posted: 03 Jun 2020 08:10 AM PDT The stock markets of the United States of America were able to find a foothold and, following the results of past trading, closed mostly in positive territory. Investors have ceased to win back the news about the unrest in the country, as well as about the possible repetition of the scenario with coronavirus. For them, mitigating measures that support the growth of the economy affected by the COVID-19 pandemic came to the fore. In addition, statistics also add to the positive, reflecting a more rapid than previously expected exit from the crisis. The main support for the three major stock indices was provided by the technical sector. However, the industrial and financial sectors were also on top. Securities of the technical sector are becoming more expensive, thereby pushing the index up, despite the fact that there are quite serious external factors for the negative, which include, for example, protest demonstrations in the United States. Recall that at the very beginning of the week, the US President DOnald Trump spoke out that unauthorized demonstrations that arose against the backdrop of the death of African American George Floyd will be severely dispersed by the authorities, up to the use of military forces. If the words of the head of state do not go wrong, investors will be forced to turn their attention to this fact, which in turn can lead to lower stock indices. To avoid looting, shops in the United States will be closed, and a possible curfew will result in people being unable to get to outlets. This will be a repetition of the situation that developed during the global pandemic. It is difficult to say about the scale of what is happening. The Dow Jones index was higher at the end of the trading session by 1.05% and reached the level of 25,742.65 points. The S&P 500 index increased by 0.82% and was at the level of 3,080.82 points. The Nasdaq index recorded a less positive dynamic, which rose by 0.59% and was at 9 608.375 points. Stock indices in the Asia-Pacific region began the day by increasing, which allowed them to maintain and slightly improve the results that were recorded following the results of the last session. Australia's ASX 200 Index gained 0.86%, despite the fact that statistics are poor. As it became known yesterday, the country's GDP showed a decline of 0.3% in the first quarter of this year. Japan's Nikkei 225 index climbed 1.11%. The South Korean KOSPI index is up 2.25%. Hong Kong's Hang Seng index is also up 1.18%. Although the tension between Beijing and Washington has not yet passed, it has ceased to exert such significant pressure on investors. China's Shanghai Composite index rose 0.35%, while the Shenzhen Component recorded a smaller, but still rising 0.29%. Positive here was supported by news about the resumption of the services sector and corresponding growth in it. In addition, the Caixin/Markit services purchasing managers index was at 55 points. In general, the situation is such that market participants are betting on a systematic and targeted restoration of all processes in the economy and its return to the previous (pre-crisis) level. Hopes are based on the fact that an increasing number of enterprises are starting their activities after long stagnation. Optimism regarding the acceleration of economic growth so far can not be offset, and besides, statistics provide it with proper support. Meanwhile, the number of patients with coronavirus in the world remains extremely high, and the vaccine from it has not yet passed all the required clinical trials, so it's impossible to say with full confidence that there will be only growth ahead. Experts also try to protect everyone from being overly optimistic, pointing out that there are a lot of problems and enthusiasm should be moderate, especially since the statistics on economic growth in the next quarter will most likely not be as impressive. According to analysts, negative values will prevail over positive statistics. European stock indexes reflected strong, if not powerful, growth today , the reason for which was the expectation of the introduction of the next portion of incentive measures to boost the eurozone economy. The German DAX index rose 1.7%, the French CAC 40 index jumped 1.6%, the UK FTSE index increased 1.1%. The main factors contributing to this significant result were clear signs of economic recovery. First of all, it is worth noting the service sector, which showed the best results compared to the previous period, but so far it has not moved far from its historical low marks. The unemployment rate in Germany has increased by 5.8%, but the previous rate was at around 6.3%, which indicates a gradual improvement in the situation. The greatest attention of investors is still focused on the pending decision of the ECB. The regulator can extend soft economic policies and make as a stimulus the purchase of a new portion of bonds. Recall, in total, the repurchase of securities under the previously adopted plan to maintain the economy should be about 750 billion euros, or 830 billion dollars. The material has been provided by InstaForex Company - www.instaforex.com |

| USDJPY breaks above key short-term resistance Posted: 03 Jun 2020 06:43 AM PDT USDJPY is breaking out. Price has finally broken above the horizontal resistance at 108 area and is moving towards our first target of 109. Price so far has made a high at 108.85 and we continue to be bullish as long as price is above 108.

Green rectangle - horizontal resistance Blue line -long-term resistance Black lines - wedge pattern USDJPY is approaching our target of 109. Price has broken above resistance at 108 and now this is key support. Bulls do not want to see price break below 108 again as this will imply more downside to come. Next target and resistance as we said earlier is at 109. Next target is 111.50 but we need to be patient. A pull back towards 108.30 is not out of the question, however bulls would want to see such a pull back followed by a strong bounce. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold challenges key short-term support Posted: 03 Jun 2020 06:39 AM PDT Gold price got another reversal from the $1,750 area and is pulling back towards key support of $1,720-$1,710. Gold price is challenging channel support and important support levels by the Ichimoku cloud indicators.

Gold price is trading below both the tenkan-sen and kijun-sen indicators. A daily close below them would be a sign of weakness. If the tenkan-sen (red line indicator) also crosses below the kijun-sen ( yellow line indicator) then we will have a weak sell signal. Price is also challenging the lower channel boundary of this short-term bullish channel. Breaking below and out of this channel will add to the bearishness of the Daily chart. First target area would be the Ichimoku cloud upper boundary at $1,680. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review on EURUSD for June 03, 2020 Posted: 03 Jun 2020 05:52 AM PDT

The ADP employment report for the month of May showed a number of 2.76 million unemployed. This is lower than what the forecasts expected which is around 9 -11 million. This means that there is a sharp stop in the unemployment growth which will support the market sentiment for a V-shaped economic growth. If this is retained the US market may grow further. EURUSD: We look forward to a strong pullback down for purchases from 1.1100 and below. The material has been provided by InstaForex Company - www.instaforex.com |

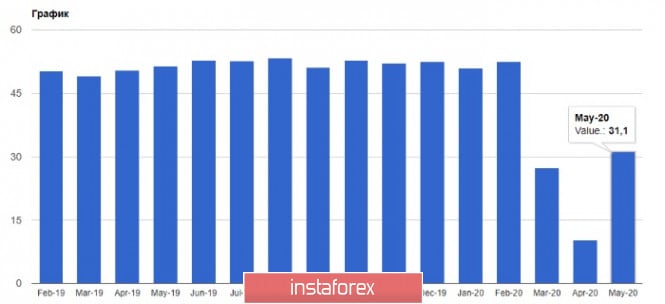

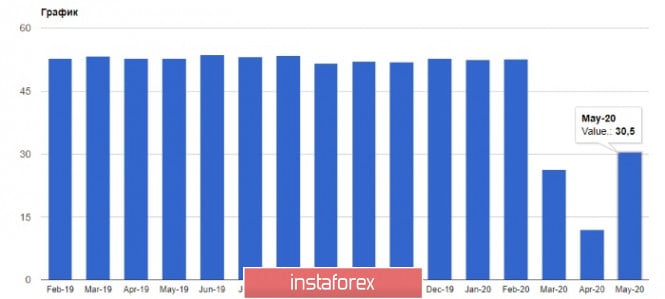

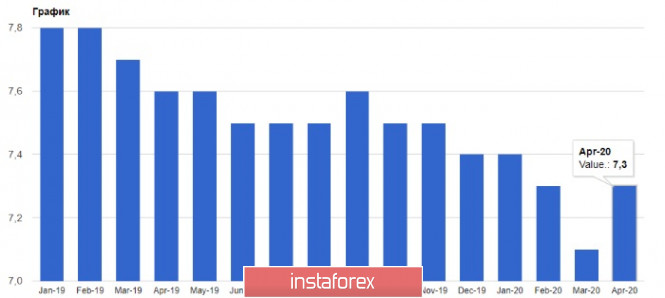

| Posted: 03 Jun 2020 05:42 AM PDT The expected recovery in business activity in the eurozone services sector did not provide any significant support for the euro. This may signal that the bullish momentum has come to a halt ahead of tomorrow's meeting of the European Central Bank. The final composite Purchasing Managers' Index of the eurozone was up on the surprising data indicating that the European economy hit by the coronavirus-related crisis has reached its low and may start to recover in the near future. According to Markit, Italy's Supply Managers' Index in services sector jumped to the level of 28.9 in May, while back in April it was just at 10.8 points. Analysts expected the PMI to reach 26.5 points. In France, the situation is even better. After the quarantine restrictions have been partially lifted, the Services PMI surged to 31.1 points in May following a drop to 10.2 points in April. Germany has also shown good results. The PMI in the German services sector in May increased to 32.6 points compared to 16.2 points in April, whereas economists had predicted a rise to 31.4 points. However, it's worth noting that the rising indices in the euro area may point at a slowdown in the business activity reduction rather than at its recovery. Unless the index goes above the mark of 50, the economy will still remain in the recession. The overall eurozone Services PMI rose to 30.5 in May compared to 12.0 in April. Experts predicted the PMI to reach 28.7 points. Markit also reported that the final composite eurozone PMI for May was revised upwards from the first estimates and amounted to 31.9 points versus 13.6 points in April. The data on the unemployment rate in Europe did not support risk assets, although the indicators were much better than expected. Against this backdrop, the European Central Bank may revise and upgrade its economic outlook for the euro area at its meeting on Thursday. According to the report, the unemployment rate in the eurozone went up in April from March amid the imposed quarantine measures. However, the unemployment grew much less than expected. Most likely, the decision of the European authorities to make payments to furloughed employees helped sustain the unemployment rate. It is reported that in April this year the number of unemployed in the European countries was up by only 211,000, and the unemployment rate rose to 7.3% from 7.1% in March. Economists predicted the unemployment rate would rise to 8% in April. Surprisingly, unemployment in Italy has even decreased in April because many employees did not look for a job during the lockdown. Italy's unemployment rate fell to 6.3% in April from 8.4% in March, while economists had expected the unemployment to rise to 9.5%. As traders continue to ignore the overall positive fundamental statistics, the euro is unlikely to show a rapid growth. In the morning review, I mentioned that the growth of risk assets can be capped in the short term, especially when German lawmakers still disagree about the final version of the stimulus plan which was recently proposed by the European Commission. It is better to be cautious when buying the euro ahead of the ECB meeting. Tomorrow, the European Central Bank will present economic outlook for the euro area which may be rather gloomy, although today's report on the eurozone labor market may partially outweigh negative factors. All the focus will be on ECB President Christine Lagarde's speech which may potentially interrupt the euro's rally if the projection for the eurozone recovery turns out to be too pessimistic. The euro moved notably higher last week after the European Commission had offered a stimulus package of 750 billion euros to support the European economies. Still, the rescue plan needs to be approved by all the members who failed to reach an agreement so far. In particular, the northern EU countries seem reluctant to support the plan. The report on retail prices in the eurozone showed a considerable drop in April. The producer price index signals a significant downward pressure on inflation. However, the drop was mainly due to the collapse in energy market which is already showing some signs of recovery. The PPI fell by 2.0% in April this year compared to March, and fell by 4.5% compared to the same period in 2019. Economists had forecast a decline of -1.7% and -4.0% respectively. As for the eurozone producer price index, excluding energy, or the base index, it dropped by only 0.3% in April and by 0.3% on the yearly basis. The technical picture for the EUR/USD pair remains almost unchanged from the morning forecast. A breakout of the resistance level at 1.1230 can fuel the demand for the euro and may send the pair to new highs at 1.1295 and 1.1350. If the euro stays under pressure after today's reports on the US services sector, which has suffered the most from the coronavirus, traders can start taking profit ahead of the tomorrow's ECB meeting. In this case, the first two strong levels of support will be seen at around 1.1140 and 1.1070. GBP/USD The British pound has largely shrugged off positive reports on services sector, although usually this data triggers a strong bullish momentum. Analysts think that the chances for a quick recovery in the UK services sector and its return to pre-crisis levels are very slim this year. Today's report showed that the restrictions introduced due to the coronavirus pandemic still have an effect on the services sector. And even if quarantine measures are lifted, the social distancing rules will continue to weigh on it. According to Markit, the final Services PMI for the UK in May 2020 increased slightly and amounted to 29.0 points against the preliminary estimates of 27.8 and the final reading of 13.4 in April. As long as the indicator is below 50 points, business activity will continue to decline. The technical picture for the GBP/USD pair remaines unchanged from the morning forecast. The breakthrough of the next resistance at 1.2610 will lead to an upward trend to the of highs 1.2650 and 1.2740. As for the downward correction, the key support levels can be found at around 1.2505 and 1.2430. AUD The Australian dollar stopped its rally after today's data showed that the Australian economy contracted in the 1st quarter of this year due to the quarantine. According to a report by the Australian Bureau of Statistics, Australia's GDP for the first quarter of this year fell by 0.3% compared to the previous quarter. It gained 1.4% compared to the same period last year. Most likely, in the 2nd quarter, the indicator will drop even lower as it will fully embrace the picture of the coronavirus aftermath. In his speech, the Australian Treasury Secretary said that the government estimates a potential decline of 20% in GDP in the 2nd quarter 2020. However, the Australian economy is giving some encouraging signals and showing unexpected resilience during the crisis. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 03 Jun 2020 05:36 AM PDT Corona virus summary:

Boris Johnson has opened the path to what he called one of the "biggest changes" to the British visa system, stating he was ready to offer a right to live and work in the UK to any of the nearly 3 million Hong Kong citizens eligible for a British National Overseas passport. Technical analysis: Trading recommendation: The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 03 Jun 2020 05:21 AM PDT Corona virus summary:

Quick Take

Technical analysis: Trading recommendation: Watch for selling opportunities on the rallies using the intraday frames 5/15 minutes for better entry location. The downside target is set at $8,685 The material has been provided by InstaForex Company - www.instaforex.com |

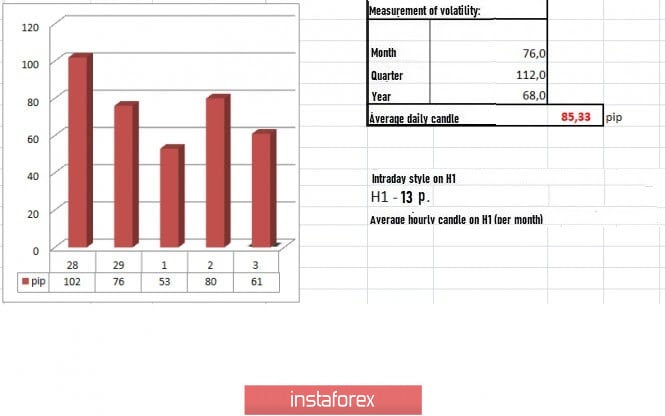

| Trading recommendations for the EUR/USD pair on June 3, 2020 Posted: 03 Jun 2020 04:53 AM PDT From the point of view of complex analysis, we can see that the quotes consolidated above the range level. The past trading day was as if decisive in terms of long positions, since the day before, the quote literally stood still with an oscillation amplitude of 1.1100 / 1.1150. The shift arose during the European session, in which market participants, in just one hourly candle, crossed the variable border of 1.1150 and drove the quotes to the range of1.1180 / 1.1200. The movement seemed to signal the continuation of the current mood, which has already transpired in about 2.5 weeks. Of course, not all of the outcomes were satisfactory, as a slowdown occurred at the range level, splitting the trading positions into smaller shares or closing them. If we analyze the recovery relative to the movement on March 9 to March 20, we can see that the output was 68%, which is quite impressive for being able to maintain the mood. Such jump formulated many theories, particularly on a possible upward trend, but we should remember to be careful in making any conclusions. Anyhow, the movement from March 9 to March 30 is actually part of the downward trend, which has been going on since August 2008. The economy of the European Union just simply can not pull this burden, so a change in tact into upwards is quite unlikely. The upward movement which is currently being observed is built on speculative mood, and the duration and scale of it is not clear. However, as soon as trading closes, an equally rapid downward move is possible, which will continue along the global downward trend. In terms of volatility, acceleration relative to Monday is 53 ---> 80 points, where the current dynamics reflects healthy market activity. In the general analysis of volatility since March of this year, one can distinguish steadily high activity on the part of speculators, which violated the general principles of dynamics for the EUR / USD pair. In another note, the news published yesterday did not contain important statistics for the US and the EU, so all attention was focused on external news. The most significant occasion was the mass protests and ongoing riots in the streets of the United States, which has wandered in the scale of "emergency." Curfews were imposed in many cities to restore order, but clashes between civilians and law enforcers continue, escalating The deterioration of the situation. Arrests have exceeded ten thousand, and the number of deaths of protesters has reached 11 (but the actual number may be higher). Donald Trump is doing all methods to suppress the protesters, but so far he is without success. Investors are now concerned with the scale of the protests, since there has not yet been so much unrest in the US this large. The dollar, in turn, weakened and lost its position against other currencies. Data on business activity in the European services sector was published today, revealing a huge increase in the index from 12.0 points to 30.5 points. Unemployment indicators in the EU also came out, the level of which rose from 7.1% to 7.3%, lower than the forecasted 8.1%. However, despite the positive statistics, the dynamics of the market remained unchanged. In the afternoon, the ADP will publish its report on US employment, where the figure could decline by another 9.6 million, which everyone already expects due to the weekly figures of applications for unemployment benefits. Data on business activity in the US services sector will also come out, which is expected to grow from 26.7 to 36.4. Further development Analyzing the current trading chart, we can see a consolidation above the range 1.1180 / 1.1200, where the quotes slightly decreased activity, even though it still hasn't passed the level 1.1240, which theoretically could give a chance to accelerate long positions. A lot depends now on external news, the state of unrest in the US in particular, as the said situation is the cause of speculative mood in the market. If the quotes disregard the current discourse in the US and proceed to consolidate above 1.1240, the upward trend will continue, in the direction of 1.1300. But if demand drops due to the negative news, a correction will occur, and the quotes will return within the range of 1.1150 / 1.1180. A more significant downward movement will depend on the perseverance of speculators to short positions. Thus, based on the above information, we present these trading recommendations: - Open sell positions lower than 1.1190, in the direction of 1.1150. - Open buy positions higher than 1.1240, towards 1.1300. Indicator analysis Analyzing the different sectors of time frames (TF), we can see that the indicators of technical instruments unanimously signal a bullish mood, due to the rapid upward movement and the breakdown of key levels. Volatility per week / Measurement of volatility: Month; Quarter Year The measurement of volatility reflects the average daily fluctuation calculated by Month / Quarter / Year. (June 3 was built, taking into account the time of publication of the article) The volatility of the current time is 61 points, which is already more than half the average value. Speculative mood and external news are expected to continue pumping activity into the market. Key levels Resistance zones: 1,1000 ***; 1.1080 **; 1,1180; 1.1300; 1.1440; 1.1550; 1.1650 *; 1.1720 **; 1.1850 **; 1,2100 Support areas: 1.0850 **; 1.0775 *; 1.0650 (1.0636); 1,0500 ***; 1.0350 **; 1,0000 ***. * Periodic level ** Range Level *** Psychological level The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 03 Jun 2020 04:46 AM PDT Corona virus summary:

The World Health Organization and a number of national governments have changed their Covid-19 policies and treatments on the basis of flawed data from a little-known US healthcare analytics company, also calling into question the integrity of key studies published in some of the world's most prestigious medical journals. Technical analysis: Gold has been trading towards as we expected after the breakout of the symmetrical triangle pattern in the background. The Gold reached yesterday's downside objective at $1,720. Anyway, I still see further downside towards the $1,696. Trading recommendation: Watch for selling opportunities on the rallies using the intraday frames 5/15 minutes for better entry location. The downside target is set at $1,696 and SL can be placed at $1,727 The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD: Euro remains in positive position Posted: 03 Jun 2020 04:28 AM PDT

Global stock indices continue to grow by leaps and bounds, ignoring the risks of the second wave of the coronavirus pandemic, mass protests in the United States, ongoing tensions between Washington and Beijing, as well as the White House's renewed of digital taxation in the EU against US companies, which could result in an introduction of new duties from the White House against Brussels. A confident rally of the S&P 500 index, apparently, indicates that investors consider the economic consequences of social unrest limited and short-lived. However, given that economic activity in the US has already been suppressed by the COVID-19 pandemic, these protests could slow down the recovery of the national economy, which could potentially cost billions of dollars in lost profits. In the meantime, it looks as if investors have decided to close their eyes to current events and find solace in the news that China may continue to import American soybeans, and the liquidity flow will not run out in the foreseeable future. It seems that the markets still believe in a V-shaped recovery of the US economy, contrary to statements by representatives of the Federal Reserve and the Budget Office of Congress on the long process of returning US GDP to the trend.

And here a completely logical question arises as to who is right: markets or politicians? The latter are anxiously looking to the future and are considering ever new measures to support the economy. One gets the impression that investors were carried away by buying stocks on the rebound and went too far, buying back the March collapse. A similar thing had already happened earlier this year, when the S&P 500 index vigorously conquered new heights in January with an increasing epidemiological threat. Now the same can be said about the foreign exchange market, where technical indicators indicate the oversoldness of the dollar to a wide range of currencies, including the euro. Due to the improvement in global risk appetite, the USD index slipped to a three-month low, and according to Wall Street, the upward trend of the greenback was probably coming to an end. According to Citigroup experts, in a situation where the Fed's interest rate is close to zero and the potential growth of US GDP is lower than in the rest of the world, one can observe how the greenback enters the bearish market, which will last from five to ten years. Strategists of Deutsche Bank, The Goldman Sachs, and JP Morgan take a similar position, which recommends investors to reduce the share of American currency in portfolios. Amid growing general market optimism and hopes that EU authorities will continue to stimulate the region's economy, the EUR / USD pair rose above 1.12, reaching its highest level since mid-March.

The focus of traders this week is the ECB meeting. Most experts expect ECB chairman Christine Lagarde to announce the expansion of the Pandemic Emergency Purchase Program (PEPP) by at least € 500 billion. Some of them even forecast an increase of € 750 billion - € 1 trillion. Others believe that the Central Bank should leave room for maneuver. There are three scenarios: 1. QE expansion of € 250 billion. This option assumes that the ECB will bring the PEPP program to € 1 trillion. Thus, the regulator will signal that it continues to support the EU economy, but is not in a hurry, since the restrictions associated with COVID-19 are already being lifted. In this scenario, the probability of which is estimated to be high, the EUR / USD pair may show growth, but it will be restrained. 2. Large-scale expansion of QE (by € 500 billion or more). Some market participants believe that Lagarde learned from her blunder in March when she recklessly stated that it wasn't the task of the financial institute to control the spreads of the European debt market and could announce an increase in the emergency fund by € 500 billion or even more. The likelihood of such a scenario is average. Although such measures would support the EU economy, Lagarde and the doves of the ECB Governing Council would have to be convinced of the need for hawks. In this case, the EUR / USD pair would rise. 3. No new measures. This option implies that the ECB will be satisfied with the pace of lifting restrictions amid improved statistics on COVID-19 and will not resort to urgent measures. Thus, the regulator will give markets a signal that it is worth waiting for new measures in July. In a similar scenario, which seems unlikely as the European economy continues to suffer due to the pandemic, the EUR / USD pair may fall. In addition, this will be considered a concession to the German Constitutional Court. Thus, the larger the expansion of the PEPP program, the better for the euro. The lack of action on the part of the ECB will put pressure on the single European currency. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. All hopes are on Johnson: ambitious pound updated four-week high Posted: 03 Jun 2020 04:22 AM PDT Dollar pairs continue to take advantage of the weakness of the US currency. The dollar index is slowly but still slipping to the 96th figure amid massive US protests and a slowdown in the US economy. The risk of a second outbreak of coronavirus in the United States and subsequent lockdown causes quite justifiable concern for investors, as a result of which the greenback has become a "persona non grata" in the foreign exchange market. The pound-dollar pair here was no exception: for the first time since the end of April, GBP/USD tested the area of the 26th figure as part of its upward trek. The pound has risen in price since Friday, and British events related to the exit from the lockdown and the negotiation process between London and Brussels also contribute to this. All of these fundamental factors have allowed buyers to upgrade the four-week high. At the same time, the pound maintains the potential for further growth - the closest resistance level is located at 1.2740 - this is the lower border of the Kumo cloud on the weekly chart. Of course, to achieve this target, the bulls must first gain a foothold in the 26th figure, and judging by the downward pullbacks, this is a rather difficult task. Nevertheless, if the news from the "negotiation front" is positive, the pound will be able to overcome the 150-point distance in a few hours. As you know, the British are very keenly reacting to any more or less significant news regarding the prospects of Brexit. Let me remind you that at the end of last week, the pound rose on the news that Boris Johnson will hold personal talks in June with the head of the European Commission and the leaders of key EU countries. General pessimism was again replaced by ghostly hopes: after all, last year it was Johnson who was able to move the long-suffering Brexit issue off the ground, having successfully negotiated with the prime minister of Ireland and further with the EU leadership. This year, the dialogue on a new agreement came to a standstill barely beginning: the parties could not find common ground on any key issue. Then the negotiators were forced to interrupt the negotiation process due to quarantine, resuming it only this week. However, a pause in the negotiations did not benefit: the parties are still upholding their positions, and London is categorically against prolonging the transition period, even despite the coronavirus crisis. That is why Boris Johnson has such great hopes. According to the Financial Times, the British politicum, including the prime minister's inner circle, convinces Johnson to give the negotiations a "political impetus" so that the parties can find a common denominator by the end of the summer. As noted by an unnamed British senior official, London should not delay the negotiation process even until October, given the consequences of the coronavirus crisis. At the same time, the European Union believes that reaching an agreement before the end of the year will be "very difficult, but possible." At the moment, it is not known exactly when Boris Johnson will meet with Ursula von der Leyen. According to general expectations, this will happen at the end of this month, probably after the summit of the European Commission (June 19), which will be entirely devoted to the approval of the anti-crisis plan of the European Commission. Most likely, after this summit, Brussels will deal closely with the British issue. As I said above, traders have hopes that a personal dialogue between Johnson and the EU leadership will help cut the knot in one form or another: either negotiations will move forward, or London will nevertheless agree to extend the transition period, since there is a suitable, "politically reliable" reason for this - the coronavirus crisis. By the way, the mayor of London has already appealed to the British government with a request, asking not to aggravate the already difficult economic situation in the country. An additional factor supporting GBP/USD is the weakening of quarantine in Britain. Markets and schools partially opened in the country, competitions in professional sports tournaments resumed, etc. In addition, according to the results of the last day, a little more than one and a half thousand new patients with coronavirus were found in Britain - this is the lowest figure since March 23. Also, do not forget that the pair is growing due to the weakening dollar, which is under pressure from recent events in the United States. Due to ongoing unrest in the United States, nearly two thousand troops were put on alert near Washington, while Trump is calling for troops to be sent to New York. In large cities across the country, protests continue, in many cases they are accompanied by looting. According to the American press, the death toll has increased to 11, and the number of detainees is estimated in the thousands (according to the latest data - more than 8 thousand). In the US, news about the protests dominates the news about coronavirus - on CNN, MSNBC and Fox News on Sunday May 31, 2.5% of the broadcast was devoted to coronavirus and 25% to protests. However, the market is concerned precisely with the coronavirus - and more precisely, the risk of a re-outbreak. The economic consequences will be disastrous if the United States quarantine again. Such a fundamental background exerts quite strong pressure on the dollar, which is weakening throughout the market. Thus, the pair retains the potential for its further growth. The nearest price barrier is 1.2600. If the bulls can gain a foothold above this target, we can consider long positions with the first target of 1.2700 and 1.2740 (the lower border of the Kumo cloud on the weekly chart). The material has been provided by InstaForex Company - www.instaforex.com |

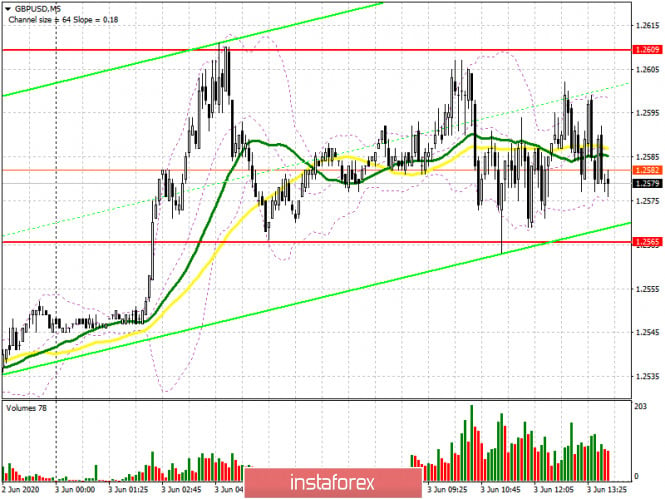

| Posted: 03 Jun 2020 04:19 AM PDT To open long positions on GBPUSD, you need: Good data on the recovery of the service sector was ignored, which is a bad signal for buyers, although nothing has changed from a technical point of view. If you look at the 5-minute chart, you will see how the bulls made an unsuccessful attempt to rise above the resistance of 1.2609, after which the pressure on the pound returned. However, the support test of 1.2565, which I drew attention to in my morning forecast and where I recommended buying under the condition of a false breakdown, returned demand for the pound, which leaves the market on the side of buyers. The bulls will continue to focus on breaking through the resistance of 1.2609, fixing on which can lead to the continued growth of the pair in the area of the highs of 1.2647 and 1.2686, where I recommend fixing the profits. In the case of a repeated decline in the pair to the support area of 1.2565, I recommend not to rush with purchases. It is best to wait for the update of the minimum of 1.2504, where the moving averages pass or buy GBP/USD immediately on the rebound from the larger level of 1.2439, where buyers will try to form a new lower border of the ascending channel.

To open short positions on GBPUSD, you need: Sellers are still acting quite cautiously and are not in a hurry to return to the market, although buyers ignoring good data on the service sector and the pair's inability to get above resistance 1.2609 in the morning is the first call for a possible downward correction. However, much will depend on the market's reaction to similar data for the United States. The task of the bears is to hold the resistance at 1.2609, and the formation of a false breakout there will be the first signal to sell the pound, which will be able to lead to a breakout and consolidation below the support of 1.2565, which is very important for the current short-term outlook. Only a move below the level of 1.2565 will force many speculative buyers to close long positions, which will lead to a sale of GBP/USD to the area of lows of 1.2504 and 1.2439, where I recommend fixing the profits. However, updating even these supports will only be considered a corrective movement within the upward trend of May 18. In the scenario of further growth of the pound in the second half of the day, it is best to return to short positions only after updating the resistance of 1.2647 or even higher – from the maximum of 1.2686 with the goal of a downward movement of 30-35 points to the close of the day.

Signals of indicators: Moving averages Trading is conducted above the 30 and 50 daily averages, which indicates a high probability of continuation of the bullish trend. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands Breaking the upper limit of the indicator around 1.2609 will lead to a new powerful wave of growth of the pound. In case of a decline, the lower border of the indicator around 1.2530 will provide support, from where you can open long positions immediately for a rebound. Description of indicators

|

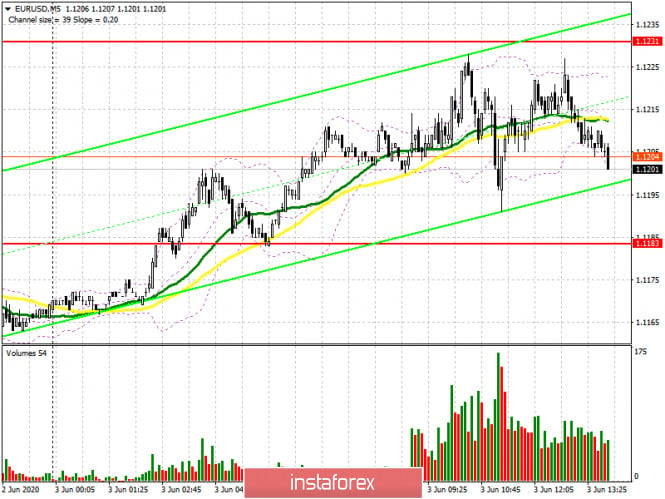

| Posted: 03 Jun 2020 04:17 AM PDT To open long positions on EURUSD, you need: In the first half of the day, I paid attention to the resistance level of 1.1231, which buyers could not reach, which is a very worrying signal for the bulls. Even good indicators in the service sector did not lead to a new wave of growth, as the data was offset by a weak report on the German labor market and a sharp decline in producer prices in the Eurozone. If you look at the 5-minute chart, you will see how buyers tried several times to get close to the level of 1.1231 but failed to break through this range, which left the technical picture in EUR/USD unchanged. Only fixing above the resistance of 1.1231 will lead to a new upward wave of EUR/USD with an exit to the highs of 1.1295 and 1.1344, where I recommend fixing the profits. The formation of a false breakout at the level of 1.1183 will also be a signal to open long positions. However, you need to understand that as soon as the pair returns to this level, the pressure on the euro will increase sharply, so it is best to postpone purchases until the support test of 1.1139, just above which the moving averages pass or buy EUR/USD immediately on the rebound from the minimum of 1.1085 with the goal of an upward correction of 30-35 points by the close of the day.

To open short positions on EURUSD, you need: After an unsuccessful move above the level of 1.1231, optimism in the ranks of sellers began to gradually strengthen, as well as the calculation for a downward correction of the pair in the second half of the day. However, it is best to wait for the resistance update of 1.1231 and watch sales from there only if a false breakout is formed there. Larger highs, from which you can open short positions immediately on the rebound, are in the area of 1.1295 and 1.1344. An equally important task for bears will be to return EUR/USD to the support level of 1.1183, as fixing below this range may lead to the demolition of stop orders of speculative players, which will cause a downward correction in the euro and lead to an update of the support of 1.139, where the market will again try to return to the bulls. The longer-term goal of sellers will be at least 1.1085, where I recommend fixing the profits.

Signals of indicators: Moving averages Trading is above the 30 and 50 daily moving averages, which indicates a continuation of the bull market in the short term. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands If the euro falls in the second half of the day, the lower border of the indicator around 1.1155 will provide support. Breaking the upper limit in the area of 1.1225 will lead to the new strong growth of the euro. Description of indicators

|

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment