Forex analysis review |

- GBP / USD: negative economic prospects threaten pound decline

- Comprehensive analysis of movement options for #USDX vs EUR USD & GBP/USD & USD/JPY (H4) on July 20, 2020

- Evening review on EURUSD for July 17, 2020

- July 17, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- July 17, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- USDCAD has no clear direction

- Gold bounces off support

- Short-term technical analysis of EURUSD

- European market opened in different directions

- Oil reserves to reach critical level

- Asia, US, and EU stocks traded in different directions

- Oil's negative correction not a change in trend

- Trading recommendations for EUR/USD

- GBP/USD analysis for July 17, 2020 - Watch for selling opporutnities on the rallies due to potential drop towards 1.1250

- The euro will face a gap

- BTC analysis for July 17,.2020 - Watch for the potential drop on BTC towards the 8.150. Bollinger bands in contraction mode,

- EUR / USD. Do not open deals until the announcement of the results of the EU summit

- Analysis of Gold for July 17,.2020 - First downside target at $1.795 has been reached. Gold still trading inside of TR, so

- EUR/USD: The direction of the euro will depend on the results of the upcoming EU summit.

- GOLD Uptrend Still Intact!

- EUR/USD Ready To Jump Higher!

- Trader's diary for 7/17/2020. EURUSD

- Analysis of EUR/USD and GBP/USD for July 17. ECB meeting has ended; the EU summit has begun. News from the leader's meeting

- Trading plan for EUR/USD on July 17, 2020. Coronavirus infections in the United States continue to rise. Meanwhile, the euro

- AUD/USD Oversold Condition is Evident!

| GBP / USD: negative economic prospects threaten pound decline Posted: 17 Jul 2020 08:10 AM PDT

The pound sterling is close to showing the weakest week of the month, as the economic outlook for Great Britain worsens. According to MUFG analysts, a report on British GDP published on Tuesday disappointed not only with weak growth in the main indicator but also with details. "The recovery of the services sector, in particular, whose main driver is consumer demand, was extremely sluggish. The activity index in the service sector in May increased only by 0.9% in monthly terms, which was significantly lower than the forecast of + 4.8%, " MUFG analysts said. As British GDP grew weaker than expected in May, investors doubt that the already announced fiscal stimulus measures would be enough to support the national economy. Although data released on Thursday showed that the country's unemployment fell in June, but economists expect a potential increase. The pound became the worst currency among colleagues this week, falling 0.6% against the US dollar. "There is concern about the UK economy. There are also concerns that the Monetary Policy Committee (MPC) may ultimately weaken it even further, "strategists at Societe Generale said. "Apparently, Britain is facing an extreme period of gloomy sentiment, as the national government plans to curtail its expensive job-saving program, and investors fear that the UK will only be able to close a bad trade deal with the European Union," MUFG experts said. "The current picture indicates that the Bank of England will be forced to do more for the national economy than it promised at the moment, and the pound may be another regulator tool to stimulate economic growth," they added. "The fact that the macroeconomic situation in the United Kingdom looks worse than in most other significant economies suggests that by the end of the current quarter the GBP / USD pair will return to the lower limit of the range in which it has been trading since April, around 1.21 ", - noted MUFG. Nomura experts revised their forecast for the GBP / USD pair at the end of 2020 downward - from 1.2700 to 1.2400. "It does not matter in what form the deal between Britain and the European Union will be concluded: in the form of a free trade agreement following the example of the EU-Canada or in the form of an association agreement that will resemble the EU-Ukraine agreement. In any case, for the United Kingdom it will be an economic blow, " Nomura experts. "In addition, measures to support the British economy after the COVID-19 pandemic are significant, but they are much smaller than the stimulus package in Germany or other countries. At the same time, the duration of financial incentive programs or employment incentive programs is a problem for the UK, "analysts at Nomura believe. The material has been provided by InstaForex Company - www.instaforex.com |

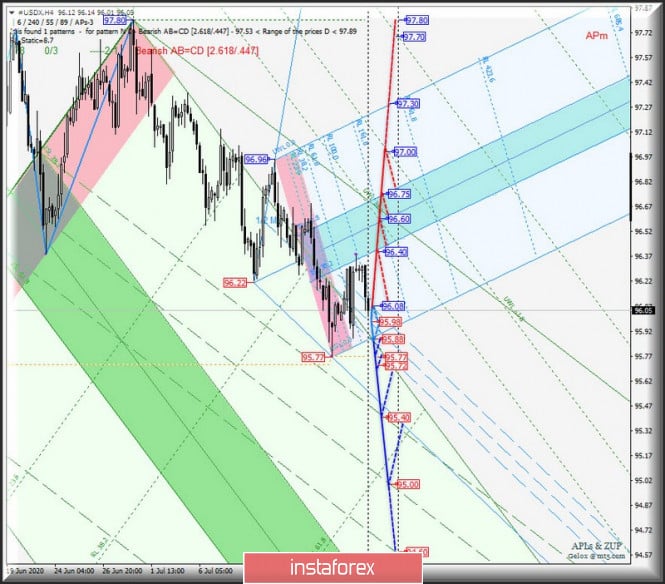

| Posted: 17 Jul 2020 08:01 AM PDT Minute operational scale (H4) The third week of July - growth of the US dollar? Options for the development of the movement #USDX vs EUR/USD & GBP/USD & USD/JPY (H4) on July 20, 2020. ____________________ US dollar index The development of the movement of the dollar index #USDX from July 20, 2020 will be due to the development and direction of the breakdown of the boundaries of the 1/2 Median Line channel (95.88 - 95.98 - 96.08) of the Minuette operational scale forks - see the animated chart for details of the movement inside this channel. When the resistance level of 96.08 breaks at the upper border of the channel 1/2 Median Line Minuette, it will become relevant to continue the development of the upward movement #USDX to the borders of the equilibrium zone (96.40 - 96.60 - 96.75) of the Minuette operational scale forks with the prospect of reaching the UWL61.8 warning line (97.00) of the Minute operational scale forks. When the support level of 95.88 breaks at the lower border of the 1/2 Medan Line channel, the Minuette operational scale forks, followed by the update of the local minimum 95.77- 95.72, will become relevant for the dollar index to reach the borders of the 1/2 Median Line channel (95.40 - 95.00 - 94.00) of the Minute operational scale forks. The layout of the #USDX movement options from July 20, 2020 is shown on the animated chart.

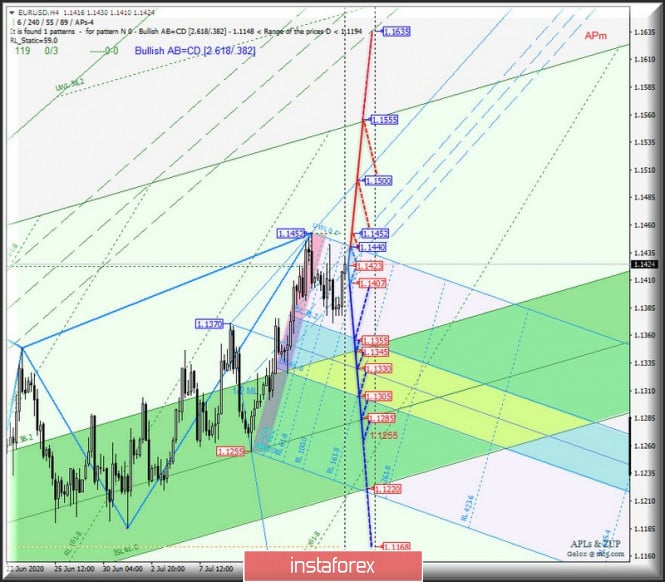

____________________ Euro vs US dollar The development of the single European currency EUR/USD since July 20, 2020 will also be determined by testing and the direction of the breakout of the channel borders 1/2 Median Line (1.1440 - 1.1423 - 1.1407) of the Minuette operational scale forks - see the animated chart for details. In case of breaking the support level of 1.1407 on the lower border of the channel 1/2 Median Line Minuette, the single European currency will continue its movement to the boundaries of the zones equilibrium of the Minuette operational scale forks (1.1355 - 1.1330 - 1.1305) and Minute (1.1345 - 1.1285 - 1.1220). The breakdown of the upper border of the channel 1/2 Median Line of the Minute operational scale forks - resistance level of 1.1440 - and then updating the local maximum 1.1452, the upward movement of the EUR/USD may be continued to the line of control UTL (1.1500) of the Minuette operational scale forks and the initial line SSL (1.1555) of the Minute operational scale forks. The EUR/USD movement options from July 20, 2020 are shown on the animated chart.

____________________ Great Britain pound vs US dollar The movement of Her Majesty's currency GBP/USD from July 20, 2020 will continue depending on the development and direction of the breakdown of the boundaries of the 1/2 Median Line channel (1.2610 - 1.2575 - 1.2530) of the Minuette operational scale forks - details of movement within this channel are shown on the animated graph. A breakdown of the support level of 1.2530 at the lower border of the channel 1/2 Median Line Minuette will determine the development of the downward movement of GBP/USD to the local minimum 1.2479 and the boundaries of the equilibrium zone (1.2405 - 1.2342 - 1.2280) of the Minute operational scale forks. If the resistance level 1.2610 on the upper border of the channel 1/2 Median Line fork operational scale Minuette confirm the continuation of the development of currency movements of Her Majesty inside the channel 1/2 Median Line (1.2575 - 1.2655 - 1.2730) of the Minute operational scale forks considering testing the local maximum 1.2669 and helpful line UWL38.2 Minute (1.2710). We look at the GBP/USD movement options from June 20, 2020 on the animated chart.

____________________ US dollar vs Japanese yen And the movement of the USD/JPY currency of the "Land of the Rising Sun" from July 20, 2020 will depend on the development and direction of the breakdown of the channel boundaries 1/2 Median Line (107.10 - 107.30 - 107.45) of the Minuette operational scale forks - the traffic markings inside this channel are shown on animated graphics. The breakdown of the resistance level of 107.05 on the upper border of the channel 1/2 Median Line Minuette upward movement of the USD/JPY will be allocated to the zone boundary equilibrium (108.00 - 108.30 - 108.60) of the Minuette operational scale forks. If the support level of 107.10 is broken at the lower border of the channel 1/2 Median Line of the Minute operational scale forks, the downward movement of the currency of the "Land of the Rising Sun" may continue to the goals:

The markup of the USD/JPY movement options from July 20, 2020 is shown on the animated chart.

____________________ The review is compiled without taking into account the news background, the opening of trading sessions of the main financial centers and is not a guide to action (placing "sell" or "buy"orders). Formula for calculating the dollar index: USDX = 50.14348112 * USDEUR0.576 * USDJPY0.136 * USDGBP0.119 * USDCAD0.091 * USDSEK0.042 * USDCHF0.036. where the power coefficients correspond to the weights of currencies in the basket: Euro - 57.6 %; Yen - 13.6 %; Pound sterling - 11.9 %; Canadian dollar - 9.1 %; Swedish Krona - 4.2 %; Swiss franc - 3.6 %. The first coefficient in the formula brings the index value to 100 on the starting date - March 1973, when the main currencies began to be freely quoted relative to each other. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review on EURUSD for July 17, 2020 Posted: 17 Jul 2020 07:55 AM PDT

EURUSD: Euro soars nearly approaching the highs of the week. You may keep purchases from 1.1345 with a stop at 1.1295, and 1.1370. The first target is at the level of 1.1520. The upward trend may continue towards 1.1800. The material has been provided by InstaForex Company - www.instaforex.com |

| July 17, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 17 Jul 2020 07:53 AM PDT

On March 20, the EURUSD pair has expressed remarkable bullish recovery around the newly-established bottom around 1.0650. Shortly after, a sideway consolidation range was established in the price range extending between 1.0770 - 1.1000. On May 14, evident signs of Bullish rejection as well as a recent ascending bottom have been manifested around the price zone of (1.0815 - 1.0775), which enhances the bullish side of the market in the short-term. Bullish breakout above 1.1000 has enhanced further bullish advancement towards 1.1175 (61.8% Fibonacci Level) then 1.1315 (78.6% Fibonacci Level) where bearish rejection was anticipated. Although the EUR/USD pair has temporarily expressed a bullish breakout above 1.1315 (78.6% Fibonacci Level), bearish rejection was being demonstrated in the period between June 10th- June 12th. This suggested a probable bearish reversal around the Recent Price Zone of (1.1270-1.1315) to be watched by Intraday traders. Hence, Bearish persistence below 1.1250-1.1240 (Head & Shoulders Pattern neckline) was needed to confirm the pattern & to enhance further bearish decline towards 1.1150. However, the EURUSD pair has failed to maintain enough bearish momentum to do so. Instead, a narrow-ranged bullish channel is being expressed while re-approaching the price levels of 1.1380-1.1400 where the upper limit of the channel is located. Please note that any bullish breakout above 1.1400 will probably lead to a quick bullish spike directly towards 1.1500. Trade recommendations : The current bullish movement towards the price zone around 1.1380-1.1400 should be watched cautiously by Intraday Traders for any signs of bearish rejection.T/P levels to be located around 1.1315, 1.1250 then probably 1.1175 while S/L to be placed above 1.1400 to minimize the associated risk. The material has been provided by InstaForex Company - www.instaforex.com |

| July 17, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 17 Jul 2020 07:39 AM PDT

Since April, the GBPUSD pair has been moving sideways within the depicted consolidation range extending between the price levels of 1.2265 and 1.2600. On May 15, transient bearish breakout below 1.2265 (Consolidation Range Lower Limit) was demonstrated in the period between May 13 - May 26 denoting some sort of weakness from the current bullish trend. However, immediate bullish rebound has been expressed around the price level of 1.2080 bringing the GBPUSD back above the depicted price zone of 1.2520-1.2600 which failed to offer sufficient bearish rejection. Further bullish advancement was expressed towards 1.2780 (Previous Key-Level) where signs of bearish rejection were expressed. Short-term bearish pullback was expressed, initial bearish targets were located around 1.2600 and 1.2520. Moreover, another bearish Head & Shoulders pattern (with potential bearish target around 1.2265) was recently demonstrated around the same price the pair is approaching Today. Recent bearish persistence below 1.2500 ( neckline of the reversal pattern ) paused the bullish outlook for sometime & enabled further bearish decline towards 1.2265. However, last week, significant bullish rejection was originated around 1.2265 bringing the GBP/USD pair back towards 1.2600 - 1.2650 where a cluster of resistance levels are located. Earlier this week, signs of bearish rejection were manifested around the price zone of 1.2620 - 1.2650 (Mid-channel zone). Thus, the GBPUSD is demonstrating an ascending-wedge around the current price levels.This indicates a high probability of bearish reversal provided that early bearish breakout is achieved below 1.2500. Trade recommendations : Intraday traders could consider Yesterday's bullish pullback towards the depicted Supply Zone (1.2600-1.2650) as a valid SELL Entry. Stop Loss should be tight, it can be placed above 1.2700 while initial T/P level to be located around 1.2450 & 1.2265. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 17 Jul 2020 07:12 AM PDT USDCAD has been moving sideways inside a trading range since early June. Price is moving between 1.37 and 1.35 and there is no clear direction for the last couple of months. This is not necessarily a bad thing because when price breaks out of the trading range we will have an important strong signal. To the downside or to the upside.

USDCAD as can be seen in the chart above is moving sideways inside the trading range. The best choice a trade can make now is to be patient and wait. Wait for price to break out of the trading range. Then the trader will have the most chances of success. Price has confirmed both the upper and lower boundary of the trading range several times. This strengthens the signal of any break out. So we are bullish above 1.37 and bearish below 1.35. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 17 Jul 2020 06:57 AM PDT Gold price has held above the key short-term support at $1,790-95 area. In our latest analysis we noted that it was favorable to open new long positions for short-term traders as price was very close to key support and stop loss levels.

Blue rectangles - triple top Black line - resistance trend line Gold price remains in a bullish trend. Price the last couple of days is moving sideways. So far we have a triple top formation. Resistance has been confirmed at $1,814 and a break above it will be an important short-term bullish signal. Support at $1,79-95 has also been confirmed as price has visited this area three times so far and each time price bounced. Breaking below this level will open the way for a deeper correction towards $1,750. As we explained yesterday, since price is above key short-term support we prefer to be bullish. Breaking above the black trend line resistance and the triple top will increase the chances for a move towards $1,830. The material has been provided by InstaForex Company - www.instaforex.com |

| Short-term technical analysis of EURUSD Posted: 17 Jul 2020 06:53 AM PDT EURUSD is bouncing off the support area of 1.1360-1.1380 as we expected from our latest analysis. Trend remains bullish. Price continues to make higher highs and higher lows and that is why we continue to expect a move closer to 1.15.

EURUSD is bouncing strongly off the blue support area. Our next target is at 1.1480 as we mentioned yesterday. Support has been confirmed at 1.1360-1.1380 and as long as we trade above this level new highs are expected. Longer-term trend remains bullish as long as price is above 1.12. Breaking below 1.1360 would open the way for a deeper pull back towards 1.1280. For now this scenario has the least chances. The bullish scenario and a price near and above 1.1480 is the most likely scenario as we explained yesterday. The material has been provided by InstaForex Company - www.instaforex.com |

| European market opened in different directions Posted: 17 Jul 2020 06:42 AM PDT

Hopes for new government support in the US and Europe and growth in the number of new cases of COVID-19 led to mixed trading in the European stock market. Germany's DAX rose by 0.1%, France's CAC 40 fell by 0.5%, and Britain's FTSE dropped by 0.2%. European Union leaders will meet again to discuss the amount of the aid package for countries hit hard by the coronavirus. Around €750 billion will be allocated for grants and loans. This is an important step towards the fiscal integration made by Europe. However, not all countries support this policy. For example, the Prime Minister of the Netherlands believes that the countries are unlikely to reach an agreement. At the same time, the French President is confident that the EU will be able to sign the document. Analysts at Danske Bank also doubt that EU leaders will agree on the weekend. The head of the European Central Bank, Christine Lagarde, in turn, believes that additional incentives are needed to counter the growing uncertainty in the fight against the virus and to mitigate the impact of the epidemic. The Daimler AG share price rose by 4%. The Telefonaktiebolaget LM Ericsson B ADR shares increased by 8.1%. Shares of automaker Saab AB advanced by 2.6%. However, oil prices fell amid rising incidence in the United States. This could lead to a drop in oil demand. Futures for WTI crude oil declined by 0.7% to trade at $40.45 per barrel, while the international contract for Brent crude dropped by 0.8% to $43.01 per barrel. Gold futures rose by 0.1% to $1,801.20 per ounce, while EUR/USD increased by 0.1% to 1.1387. The material has been provided by InstaForex Company - www.instaforex.com |

| Oil reserves to reach critical level Posted: 17 Jul 2020 06:19 AM PDT

The second wave of COVID-19 could destroy economic recovery. In this regard, OPEC countries doubt that their record cut of oil production will not be able to keep the balance in the market. That is why it would be difficult to get rid of the record-high surplus of raw materials. From August 1, OPEC and OPEC + countries will soften record restrictions on oil production, as demand for oil is advancing amid the loosening of quarantine. Oil-producing countries expect oil demand to grow by 7 million barrels per day in 2021. However, there is no point to forget about the threat of new lockdowns, because in this case goals may become unattainable. According to the OPEC analysis, in the case of the second quarantine, oil demand will drop by 11 million barrels per day in 2020. Stocks, in turn, will reach an unprecedented level of 1.218 billion barrels in 2020. In case of the second wave of coronavirus infection, oil reserves will remain at 149 million barrels level. This goes beyond the five-year average for the industrialized OECD countries. According to OPEC, countries want to keep stocks at or below the five-year average. Meanwhile, oil prices are moving up. August oil futures rose by 0.07% to trade at $40.78 per barrel. September Brent futures grew by 0.02% to $43.36 a barrel. The difference in price between the contracts for Brent crude and WTI oil is $2.58 per barrel. The US dollar index, which measures the US dollar against a basket of six major currencies, increased by 0.08% to trade at $96.245. The material has been provided by InstaForex Company - www.instaforex.com |

| Asia, US, and EU stocks traded in different directions Posted: 17 Jul 2020 05:57 AM PDT

There were no common dynamics on the Asia-Pacific stock exchanges that are the same for all. On Friday, market participants reacted differently to incoming news about the reduction in the value of the shares of American colleagues, as well as the very limited growth opportunities of the US economy. However, most analysts note that a slight decline in the stock markets is justified and will not last long. This is only a short respite before the next rapid transition to a higher level. All losses that occurred earlier this year have already been successfully returned and some even increased. The main engine on the market so far is hopes for an early release of a vaccine against coronavirus infection, which, however, cannot be considered too strong a support. Analysts point to the fact that growth is still extremely rapid and unjustified in the face of a relatively vague future economic expansion against the backdrop of the ongoing COVID-19 pandemic. The positive ended with the release of a new batch of statistics on unemployment in the United States of America. So, yesterday it became known that there were 10 thousand more applications for unemployment benefits. In total, they turned out to be at the level of 1,300 million units. Preliminary data were much more optimistic with an expectation to decrease to approximately 1,240 million units. Unjustified expectations again undermined the good mood of investors, but not enough to fall into deep gloom. Chinese statistics, also released on Thursday, showed an extremely uneven and restrained pace of economic recovery after the COVID-19 pandemic crisis. The country's GDP growth slowed down only rising at about 3.2% for the second quarter of this year. However, the good thing is that after the recession, growth has begun. The level of industrial production in the first month of summer grew by 4.8%, and only 4.4% in May. But retail sales in June recorded a decline that no one expected amounting to 1.8% in annual terms. Earlier, there was also a fall of 2.8%, which was explained by a deep crisis. In addition to statistics, market participants pay close attention to the conflict between the USA and China. The United States intends to ban the entry into the country of those officials and their families who are involved in the ratification of the Hong Kong National Security Act. At the same time, the list of persona non grata is constantly replenished, and now military men from the People's Liberation Army of the PRC get into it. Moreover, already issued American visas are likely to be annulled. In this situation, China, of course, will not be silent, and in the near future, we should expect retaliatory measures, which will be the next step in progressing the situation. However, information has already appeared that Beijing does not intend to completely break off relations with Washington and will continue to comply with the terms of the trade agreement concluded between the states earlier. The Shanghai Composite China index fell 0.5% against this mixed background. Hong Kong Hang Seng Index did not support the trend and showed an increase of 0.4%. Japan's Nikkei 225 Index dipped 0.5%. The South Korean Kospi Index, on the contrary, increased its position by 0.6%. The Australian index fell slightly by 0.1%. The American stock market, on the other hand, unanimously went down. Own statistics and data from China put pressure here too. It is especially sad that the Dow Jones index was forced to stop its rapid growth, which has been going on for four consecutive trading sessions. The Dow Jones Industrial Average index fell by 0.5% or 135.39 points, which forced it to go to the mark of 26 734.71 points. The Standard & Poor's 500 index fell from 0.34% or 10.99 points. Its current level is in the range of 3,215.57 points. The Nasdaq Composite Index declined the most with 0.73% or 76.66 points, which sent it to the area of 10,473.83 points. Europe stocks also underwent a negative trend falling in almost all directions. Market participants closely monitor the financial statements of companies and the course of the EU summit. Most of all, investors are worried about the adoption of the next budget of the region for a period of seven years, since it will determine the pace and level of economic recovery from the crisis. The overall index of the largest enterprises in the European region, Stoxx Europe 600, dipped slightly by 0.2% and is now at around 371.34 points. The UK FTSE 100 index fell 0.27%. The French CAC 40 index fell even further by 0.6%. The Italian FTSE MIB index went down by only 0.09%. The Spain index showed the deepest drop of 0.87%. The German index, on the contrary, went up by 0.07%. The material has been provided by InstaForex Company - www.instaforex.com |

| Oil's negative correction not a change in trend Posted: 17 Jul 2020 05:57 AM PDT

The price of crude oil on Friday turned to a negative correction. The mood of market participants is generally very restrained and not too confident, which makes growth seriously limited. The pandemic crisis continues to put pressure on the market. Investors still do not understand how the growth in the number of new patients can affect the oil products market. Initially, the level of fear was too high, nonetheless, the price of black gold immediately recovered. Today, you can hear more about the uncertainty, but it scares traders much less than the first months of the crisis. Analysts began to say that crude oil has already survived its worst times and the lowest point of decline is already behind. This means that now we are waiting for growth and during which there will be a correction similar to the one that the market faced this week. Meanwhile, supply and demand are also recovering and are gradually finding a balance. The fairly good pace of recovery last Wednesday was announced at OPEC at a ministerial meeting. The organization made a very positive conclusion that oil demand is steadily moving towards its recovery, which means that the contract to reduce oil production can be ratified further according to plan. In this regard, from August of this year it is planned to increase the production of raw materials by 2 million barrels per day. However, there are some problems associated with those parties to the contract who have not fully fulfilled their previous obligations under it. They were ordered to submit a production compensation plan in the shortest possible time and bring it to the proper level. At the same time, most experts consider the fears regarding new fluctuations in demand for raw materials unfounded, since demand has already strengthened sufficiently, and new volumes of raw materials in the market will not be able to shake it. Moreover, they will be quickly eliminated, since a certain shortage of oil products has arisen in certain regions. On the whole, the gradual removal of restrictions on oil production fits into the concept of restoring global demand for raw materials. The market is confidently returning to its previous performance, and the price of black gold is gradually growing. The price of futures contracts for Brent crude oil for delivery in September at a trading floor in London fell slightly to 0.39% or $0.17, which caused the brand to move to the mark of $43.20 per barrel. Recall that at the close of trading on Thursday, there was also a slight decrease in price by 1% or $ 0.42, and the price level stopped at $ 43.37 per barrel. The price of futures contracts for WTI light crude oil for delivery in August on an electronic trading platform in New York also slightly decreased by 0.22% or $0.09, which forced it to move to the area of $40.66 per barrel . Thursday's trading was also in the negative zone for the brand, and at the end of the session it became cheaper by 1.1% or $0.45, which moved it to the level of $40.75 per barrel. Today, it is becoming clear that crude oil is preparing to confidently take the next strategically and psychologically important mark of $ 43 per barrel. Nevertheless, so far this does not look so confident against the background of fears periodically arising from the second wave of coronavirus infection. One way or another, oil has already tried to break through this level earlier, which at that time was unsuccessful. Today, the market situation is more than favorable. There are at least three factors that indicate the formation of a new price peak in the raw materials market. The first is demand, which has shown good strength and, most importantly, was able to return to its pre-crisis positions. Of particular support is the fact that supply in the raw materials market is also rapidly declining, and the resulting deficit will only spur prices to growth. The second factor is a more restrained attitude towards the possibility of a repetition of the situation with the global coronavirus pandemic. Market participants stopped being scared of every rustle and began to soundly analyze the situation, which, however, turned out to be much more positive than previously thought. The main gain today is happening in the United States of America, and even due to the physical increase in the number of tests for COVID-19. And this may indicate not a new wave of the pandemic, but its unfinished first stage. The third factor is the still unchanged bullish trend, which directly indicates a continued increase in oil prices. Indirect evidence is that the correction goes smoothly, without sharp movements down and rapid drops in value. All this, most likely, becomes evidence of the consolidation of crude oil at around $ 43 per barrel. It is from this mark that black gold will build on its desire to occupy the next peak. Moreover, the next strategic point of $ 48 per barrel has already been outlined, which can be completed in the near future. The material has been provided by InstaForex Company - www.instaforex.com |

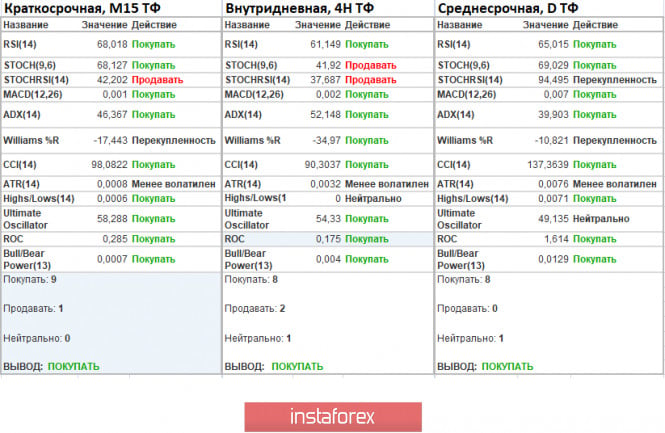

| Trading recommendations for EUR/USD Posted: 17 Jul 2020 05:29 AM PDT The trading week is coming to an end and it is time to sum up the preliminary results. An attempt to radically change the medium-term trend led to a discussion among technical analysis specialists after the local price fixed above the 1.1440 level. There were a lot of judgments and theories, but everyone agreed on the fact that the market is charged with emotions. This is a basis for movements that will hardly carry drastic changes. Let's analyze the past day, which would interest even the laziest trader. We can see high speculative activity. At the beginning of the European session, the quote was moving downwards. However, it unexpectedly changed its direction around the 1.1380 level. At this level, a lot of long positions were opened. This returned the euro/dollar pair to 1.1440. After touching this important level, the quote reversed. After that, a lot of short deals were opened. The reverse V-shaped formation appeared after such a rally. The most interesting thing is that the downward mood still prevails despite local price jumps. In terms of volatility, there is a discrepancy. Thus, on the one-minute and one-hour charts, we can see acceleration that confirms the fact that speculators are still in the market. The daily chart, on the contrary, has an indicator close to the daily average of 71 (76) pips, which points to stabilization. The discrepancies are probably related to the emotional component of the market, where short-term intervals are of great importance for traders. As discussed in the previous review, market participants are more likely to consider downward development, but they are always ready for local jumps. In general, it is necessary to mention that the single currency is extremely overbought. The price fluctuation near the high of the current year drums up traders' interest in a downward move. The ECB's meeting was the main event of the day. The regulator remained the key interest rate at the zero level and left the parameters of the special asset purchase program PEPP [Pandemic Emergency Purchase program] unchanged. During the press conference, ECB chief Christine Lagarde said that she expected economic activity in the eurozone to recover in the third quarter of this year. She also added that they still needed large-scale monetary stimulus measures to support the economic recovery and ensure medium-term price stability. "Incoming information since our last monetary policy meeting in early June signals a resumption of euro area economic activity, although the level of activity remains well below the levels prevailing before the coronavirus (COVID-19) pandemic and the outlook remains highly uncertain," Christine Lagarde said. Thus, monetary policy remains the same, and the ECB's head repeated the already known assumptions about the recovery. At the same, the US retail sales data was published. In June, the indicator advanced by 1.1% on a yearly basis. Economists had expected a drop of 3.0%. On a monthly basis, retail sales rose by 7.3%. After that, the US revealed the unemployment claims figures which were below the forecast. Thus, the number of the first-time claims dropped to 1,300,000 from 1,310,000. Economists had expected a decline to 1,250,000. The number of continuous claims decreased to 17,338,000 from 17,760,000 whereas analysts had forecast a drop to 17,600,000. Today, the eurozone inflation report was published. The data was in line with the forecast. Thus, the indicator advanced to 0.3% from 0.1%. Amid the news, the quote dropped to the area of 1.1400/1.1440. The US will report on its construction sector later today. Construction of new homes may increase by 12.9%, and the number of building permits may rise by 2.5%. The US dollar could gain in value after the publication. The overall news background has a positive effect on the US economy. However, speculators did not give an opportunity to take advantage of such optimistic figures. Next trading week is almost empty in macroeconomic events. Data on the US unemployment claims will be the only important report of the week. However, the market will still be under pressure of the news background. Below you can find the most important events of the next week: Wednesday, July 22nd US – Existing home sales (June) Thursday, July 23rd US – Unemployment claims Friday, July 24th EU – Manufacturing PMI (July) US – New Home Sales (June) Further development of the pair Analyzing the current trading chart, we can see another round of speculation, which drove the quote to the area of 1.1400/1.1440. However, for how long it will last is the main question. There is an assumption that speculators will feel pressure within the area of 1.1440, where long positions will be systematically fixed. This may lead to a new round of downward movement towards 1.1375. These are local operations amid a strong emotional background. To hit higher levels, the price should break the current year's high. If the price rebounds from the area of 1.1440, it may approach 1.1375. If the pair fixes below the mentioned level, deals can be held up to the level of 1.1350. Indicator analysis Analyzing different time frames, we can see that there are buy signals on the one-minute and one-hour charts. The daily chart reflects the general direction of the market. The volatility for the week / Measurement of volatility: Month; Quarter; Year The volatility measurement reflects the average daily fluctuation calculated for the Month / Quarter / Year. The current time volatility is 5 pips, which is 28% lower than the daily average. We can assume that in the wake of speculation, volatility may continue growing, exceeding the average dynamics indicator. Key levels: Resistance zones: 1.1440/1.1500; 1.1650*; 1.1720**; 1.1850**; 1.2100 Support zones: 1.1350; 1.1250*;1.1180**; 1.1080; 1.1000***; 1.0850**;1.0775*; 1.0650 (1.0636); 1.0500***; 1.0350**; 1.0000***. * Periodic level * * Range level ***Psychological level To be aware of all trends, read the burning forecast for the GBP/USD pair following the link You may also look through the following analysis: Brief trading recommendations for EUR/USD and GBP/USD and USD/CAD on 07/17/20 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 17 Jul 2020 04:53 AM PDT Technical analysis:

GBP has been trading downside. As I expected, the GBP is heading towards the swing low at 1,2480 and i see further downside continuation Trading recommendation: Watch for the selling opporutnities in the next period with the downward targets at 1,2480 and 1,2445 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 17 Jul 2020 04:47 AM PDT Despite local failures, the EUR/USD pair managed to close the week by July 17 in the green zone. The ECB's wait-and-see attitude, the Central Bank's reluctance to end its emergency asset purchase program ahead of time, and the more favorable epidemiological situation in the Old World compared to the New pushed the euro above $ 1.14. Investors are eagerly awaiting the EU's verdict on the Franco-German fiscal stimulus project, which will become known on Saturday. In this regard, the opening of a new five-day period on Forex is fraught with gaps. The US dollar, to the surprise of many investors, positively received strong statistics on industrial production, retail sales and the real estate market. The previous concept of selling it as a safe haven asset in case the data for the United States is disappointing is no longer working. Markets have calmed down after the shock, with roughly identical central bank rates allowing trading to thrive on the news. There is another factor that does not allow you to use the previous strategy: from the point of view of P/E, the S&P 500 looks pretty overbought. Investors are afraid that the inflated bubble will burst, and do not rush to buy shares. P/E dynamics for stocks included in the S&P 500 calculation base

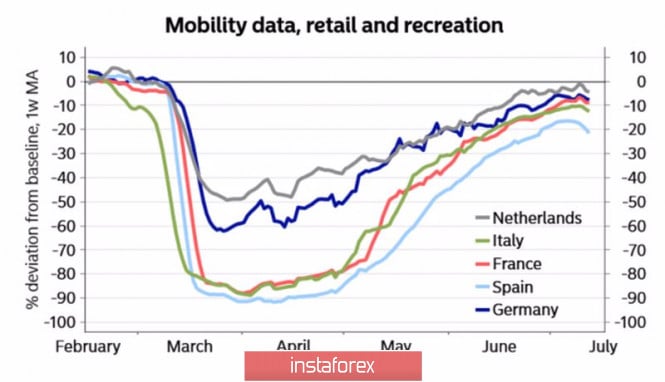

A $ 210 billion reduction in the Fed's balance sheet since July 10, an increase in the number of hospitalizations in the United States, and continuing tensions between Washington and Beijing are other obstacles to the stock index's path to the north. According to Donald Trump, no sooner had the ink dried after signing a trade agreement with China, as it sent a plague to the United States. According to Wall Street experts, the Fed's balance sheet will grow this year to $ 8.5 trillion, not by $9.5 trillion, as expected in the May forecast. As long as US stock indices are stable, internal factors come into play. While the latest state-by-state macro statistics may be pleasing to the eye, the sharp increase in the number of COVID-19 infections increases the risk that the situation will worsen in the future. The euro, on the contrary, is experiencing a surge of optimism due to the rapid recovery of the Eurozone economy. Perhaps the ECB could already improve its GDP forecast (-8.7% in 2020 and +5.2% in 2021), but this would provoke a sell-off in the bond market of the peripheral countries of the currency bloc, which is not part of the plans of Christine Lagarde and her colleagues. Dynamics of recovery of the Eurozone economies

On the contrary, the fact that a large-scale fiscal stimulus leads to an increase in public debt and emissions, and auctions - to an outflow of capital from the secondary market, may require the ECB to increase activity in the form of expanding the scope of QE. The key event of the week by July 24 will be the release of data on German and European business activity, which will allow you to make sure or be disappointed in the speed of the return of GDP to the trend. In the meantime, the market is waiting for the EU's verdict on the Franco-German fiscal stimulus project. A positive decision will increase the risks of opening EUR/USD at the top of the 14th figure; adjusted program volumes or an additional summit may cause the pair to sink to 1.1365–1.138. A further correction to 1.13 and 1.125 will create an opportunity for purchases with a target of 1.157-1.158. EUR/USD, the daily chart

|

| Posted: 17 Jul 2020 04:46 AM PDT Technical analysis:

Trading recommendation: The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD. Do not open deals until the announcement of the results of the EU summit Posted: 17 Jul 2020 04:40 AM PDT The EUR/USD pair has shown increased volatility in recent days. However, it still remains within the range of 1.1370-1.1450, in which on Wednesday, the bulls managed to update the four-month high, almost nearing the middle of the 14th figure. But the conflicting rumors on the possible outcome of the EU summit (which starts today) returned the pair to the lower border of the above range. The bulls are rapidly losing their positions, the reason for which is the news that the parties may not reach a consensus on the anti-crisis plan of the European Commission. Today, rumors arose once again, after which the quote returned to the 14th figure. But given the continuing intrigue around the summit, opening any orders (both for buying and selling) for the EUR / USD pair is risky.

Although there are preconditions for a compromise, there is currently no confidence on a positive outcome in the summit. Nevertheless, European Council president Charles Michel said that EU leaders "are most likely to be able" to agree on the creation of a fund for economic recovery, and Emmanuel Macron, President of France, also expressed cautious confidence in the possibility of a deal. A similar rhetoric was also voiced by the head of the Greek government, but he admitted that there were disagreements. The bulls used these phrases to push the EUR/USD price up, ignoring the skepticism of other EU representatives. In particular, the head of the Dutch government said that he did not believe in the success of today's meeting, saying that the chances of reaching an agreement at the July summit were "less than 50 percent." Even Angela Merkel, Chancellor of Germany, doubts that a consensus will be reached today, as she believes that the negotiations will be "very difficult" since the differences between the countries "remain significant." The main reason for the disagreements is the fact that richer countries of the eurozone are not eager to borrow capital in the markets for the entire European Union. They know that the debt will be given mainly to them, and not to those states that already have a large national debt. In addition, the long-running conflict between Northern and Southern Europe has been going on since spring, when Italy and Spain insisted on the introduction of the so-called "corona bonds", in which Germany and almost all countries of Northern Europe opposed this initiative. Now, Germany supports the anti-crisis plan of the European Commission, even though it includes both loans and grants. But the problem is that the implementation of this plan requires the consent of absolutely all EU member states, while at least four states (Austria, Sweden, Denmark, and the Netherlands) do not agree with the proposed conditions.

According to available information, the negotiations began with a discussion of the proposal put forward by the President of the European Council. On the one hand, he proposed to keep the volume of the economic recovery fund in its original form (750 billion), while maintaining the ratio of grants and loans. On the other hand, he proposed a compromise solution: a part of their contributions will be returned to those countries that pay more to the general budget of the European Union than receive from it. These are the aforementioned four countries plus Germany. Charles Michel also proposed covering losses by increasing the EU's own resources through future taxes on plastic waste, importing industrial products from countries that apply less stringent standards to reduce greenhouse gas emissions. It can also be through a digital tax that will affect companies such as Google, Facebook and Amazon. In turn, the Prime Minister of the Netherlands offered to demand reforms in exchange for assistance to the lagging countries. If the idea of Michel finds a response among the representatives of the "north" and "south", then the proposal of the head of the Dutch government will clearly be accepted "with hostility" by Italy and Spain. In other words, the parties will have a difficult dialogue. Negotiations began in the morning of Friday, and, given the importance of the issue at hand, they can last until late at night. For example, one of the previous rounds of negotiations (in spring) lasted more than 15 hours. Moreover, the summit itself will last 2 days. This means that the market reaction to the summit results will follow on Monday. If a decision is made (or not made) already on Saturday, then the start of trading on the EUR/USD pair will be marked by a gap. The only question that remains is where the price will go in the chart. Thus, due to such uncertainty, it is better to refrain from trading at the moment, and in any case, do not leave open transactions on weekends. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 17 Jul 2020 04:40 AM PDT Technical analysis:

Gold has been trading downwards. As I expected, the Gold reached our first downward target at $1,794 but then rejected into the middle of the trading range again. I see sideways movement but with potential for the breakout and bigger direction movement. Trading recommendation: The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD: The direction of the euro will depend on the results of the upcoming EU summit. Posted: 17 Jul 2020 03:48 AM PDT

The EUR / USD pair is trading in a narrow range ahead of the two-day meeting of EU leaders on July 17-18, during which the fate of the eurozone economic recovery fund will be decided. According to experts, EU leaders will have a hard time finding a common ground with regards to the 750-billion assistance plan to combat the coronavirus pandemic. Prime Minister Mark Rutte of the Netherlands even believes that the chances of reaching an agreement is less than 50%. Rutte is the unofficial leader of the so-called "Mean Four", or the countries that oppose the basic principles of forming the EU economic recovery fund. It includes the Netherlands, Austria, Denmark and Sweden. Representatives of these countries argue that the proposed amount of the recovery fund is too large, and the fund itself should be based on loans, not grants. Meanwhile, Giuseppe Conte, Prime Minister of Italy, one of the EU countries most affected by the coronavirus, is pushing for an early consensus on this issue. Chancellor of Germany Angela Merkel and ECB President Christine Lagarde are voicing the same call as well. As a result, investors do not have high hopes for the upcoming EU summit. Nevertheless, despite low expectations, the EUR / USD pair still has a chance of rising, especially if the meeting comes out with good news. It is assumed that market participants will buy positions in the euro if the leaders were able to find an agreement in the recovery fund. But the bulls still need to overcome the resistance of the dollar, which continues to attract investors as a safe asset. As for macroeconomic statistics published yesterday, the report showed that US retail sales in June exceeded forecasts by coming out at 7.5%, much higher than the expected 5%. However, unemployment in the country remains at a high level, which casts doubt on the confident V-shaped recovery of the US economy. In addition, coronavirus infections in the United States continue to establish antirecords, in which over the past day, more than 77 thousand new cases were registered in the country. Indeed, the euro has chances of growing, but the increasing demand for the dollar may reduce these. "The EUR/USD pair fell again below 1.1422, after briefly increasing to 1.1452 earlier this week. Nevertheless, we still expect a breakout from 1.1495 and a rise to 1.1570. The pair will maintain a "bullish" mood, while holding above the two-month support line at 1.1302," said strategists at the Commerzbank. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 17 Jul 2020 03:39 AM PDT

Gold is trading at $1,803 level and is fighting hard to stabilize above the broken $1,800 psychological level. You can notice that the uptrend is unharmed as the rate is traded above the red uptrend line, so the outlook is bullish. The yellow metal has confirmed further growth when it has ignored the former resistance line, the price has jumped and stabilized above the black resistance line confirming a further increase at least till the $1,800 level. The consolidation, accumulation above the $1,800 psychological level could give us a chance to buy gold as well if you are not long already. The global risk and the COVID-19 second wave fear makes gold very attractive, the traders and investors want to place their money into safe-haven assets/instruments like the yellow metal. The higher demand could push the price towards fresh new highs and maybe you want to catch the uptrend as well.

The outlook is bullish as long as the gold price is located above the $1,800 and above the uptrend line, another peak high, higher high, will bring another buying opportunity. We may have a good long opportunity if Gold reaches the $1,820 level, you can set your first upside target at the $1,850 psychological level. Further growth will be invalidated if the price drops and stabilizes below the uptrend line, this scenario will bring a potential selling opportunity because most likely the price will turn to the downside, will give birth to a corrective phase, downside movement. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 17 Jul 2020 02:52 AM PDT EUR/USD has rallied again signaling that the decrease is complete, the greenback has lost ground again as the Dollar Index has plunged in the last hours. The pair is traded at 1.1413 level and it could resume its upside movement even if the US data have come in better than expected in the last days. Technically, EUR/USD was expected to climb higher after taking out some important resistance levels, some poor US data later today could weaken the dollar.

EUR/USD has found support at 1.1383 level and right below the 50% Fibonacci line of the minor descending pitchfork and now has come back above the R1 (1.1403) level, a valid breakout above the upper median line (uml) of the minor pitchfork will suggest buying. The aggressive breakout above the 1.1348 and above the sliding line (SL) has signaled that EUR/USD will register a larger upside movement. Maybe the minor retreat was natural after the last rally and it could give us a great long opportunity.

The failure to reach the sliding line (SL), the 1.1348, and to approach the median line (ml) of the minor pitchfork it has confirmed that EUR/USD is strongly bullish as the USDX is under pressure. A valid breakout above the upper median line (uml) will confirm a further growth towards the 1.1495 and higher towards the R2 (1.1573) level. The 1.1383 - 1.1422 represents a very important resistance area, a valid breakout, and stabilization above this area will validate a further upside movement. EUR/USD will extend its short term decline only if the USDX rallies after the US data and if the pair drops and stabilizes below the 50% Fibonacci line (descending dotted line) of the minor pitchfork. The material has been provided by InstaForex Company - www.instaforex.com |

| Trader's diary for 7/17/2020. EURUSD Posted: 17 Jul 2020 02:25 AM PDT

EUR/USD: The euro/dollar pair is starting a new attempt to grow. We buy the dollar and the euro from pullbacks to the average. The ECB's decision and news from the US are mixed for the euro. The ECB is for growth while the US wanted to slow it down. We hold euro purchases from the level of 1.1345. The target is 1.1500 and above. In case of a reversal, stopping at the minimum of today or waiting for a rebound up from this level can be considered. We can also consider selling sharply from 1.1365. The material has been provided by InstaForex Company - www.instaforex.com |

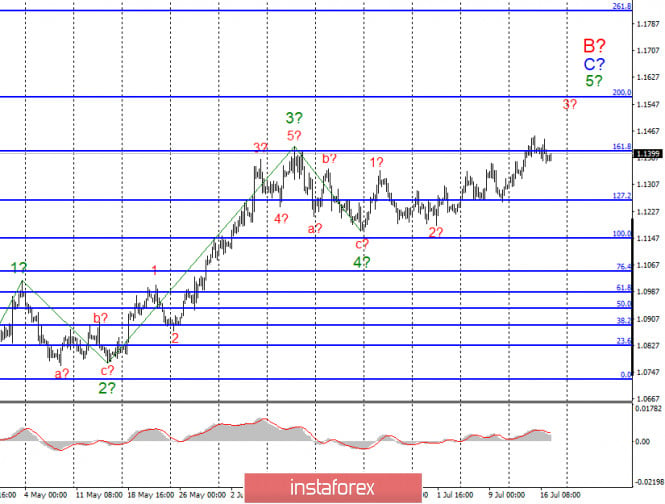

| Posted: 17 Jul 2020 01:54 AM PDT EUR / USD On July 15, the EUR/USD pair lost about 30 pips, but this decline did not particularly affect the current wave counting. Thus, the instrument presumably remains within the framework of a wave 3 in 5 in C in B. If this is true, then the increase in quotes will resume in the near future with targets located near the level of 200.0% Fibonacci level. In any case, wave 5 in C in B does not look fully equipped yet. Fundamental component: The end of the trading week belongs entirely to Europe and the Euro. The ECB meeting ended yesterday, and the EU summit begins today. There was a lot of news from the ECB meeting, but almost all of them meant the absence of any changes. So the deposit and lending rates remained unchanged. PEPP and APP have not been expanded. Thus, the expectations of the markets were fully justified. No one expected any changes. Moreover, ECB President Christine Lagarde was also quite stingy with comments. The only thing Lagarde drew attention to was the restoration of economic activity, which at the same time, remains at levels much lower than before the crisis and pandemic. The head of the ECB also announced that she expects the growth of key economic indicators in the third and fourth quarter. However, this event is already behind and, judging by the reaction of the markets, they were not particularly impressed. Now, all the attention to the EU summit. If the news is also neutral, for example, if no decision is made during the meeting, then there may be no market reaction. However, other options are possible. For example, EU leaders will not be able to agree on a fund and, therefore, new negotiations on this issue will be required. The demand for the euro in this case can seriously decline, since without this package of assistance the economy can recover much harder and longer. However, extremely "optimistic" news came from the US today. The number of new cases of coronavirus per day exceeded 70 thousand. Until the forecast of the country's chief epidemiologist Anthony Fauci (100 thousand a day) remains not so much. General conclusions and recommendations: The euro/dollar pair presumably continues to build the rising wave C to B. Thus, I recommend buying the instrument with targets located near the calculated level of 1.1570, which is equivalent to 200.0% Fibonacci, for each MACD up signal in the calculation to continue the construction of wave 5 in C in B. GBP / USD On July 16, the GBP/USD pair lost about 30 pips. The proposed wave of 2 to 5 is completed, thus, I believe that the tool has moved on to building wave 3 of 5 before a successful attempt to break through its minimum. If this is true, then upgrading the instrument will resume with targets located around 28 and 30 figures in the near future. A successful attempt to break through the low of wave 2 into 5 will indicate a possible complication of this wave and postpone the execution of the option with building wave 3 for some time . Fundamental component: The unemployment data was published in the UK on Thursday, which turned out to be much better than expected to see the markets. In particular, the unemployment rate did not increase in May, remaining at 3.9%. However, the demand for the British in recent days has still declined. During the day, markets can only pay attention to the statement of the Chairman of the Bank of England, Andrew Bailey. General conclusions and recommendations: The pound/dollar pair has greatly complicated the current wave marking, which now involves the construction of a new upward wave. Therefore, I recommend buying the instrument at this time with targets near the levels of 1.2816 and 1.2990, which equates to the peak of wave 3 or C and 100.0% Fibonacci level. The material has been provided by InstaForex Company - www.instaforex.com |

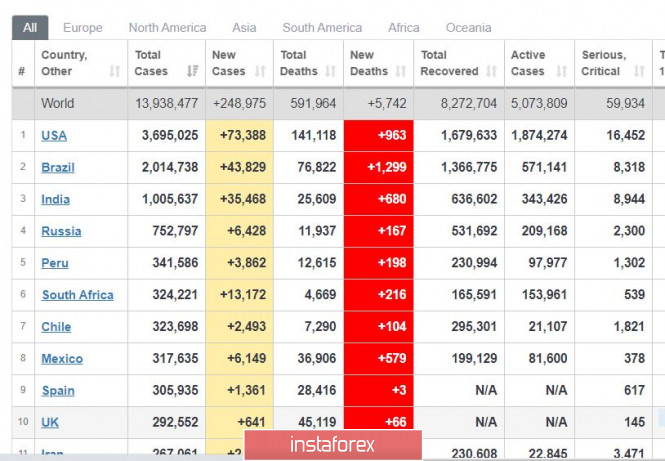

| Posted: 17 Jul 2020 01:51 AM PDT

It seems that the second wave of the pandemic is much stronger than the first. According to the latest data, the United States has recorded a new peak in daily incidence at 73 thousand. If added with the number of cases in the two other leaders, Brazil and India, the number of infections total to almost half of all the cases around the world. In addition, South Africa is quickly catching up in the number of coronavirus infections. Meanwhile, the government of Israel re-enforced strict quarantine measures in the country in attempt of de-escalating the situation.

The growth in the US market halted due to the weak US employment data that was published on Thursday. According to the report, unemployment fell by about 240 thousand, but is much better than the record last week.

EUR / USD - the euro arose amid the decision of the ECB to inject liquidity through its 1.35-trillion program that will be valid until at least June 2021. It is now in an upward trend so buy positions from the level of 1.1345, targeting the level of 1.1500. The material has been provided by InstaForex Company - www.instaforex.com |

| AUD/USD Oversold Condition is Evident! Posted: 17 Jul 2020 01:48 AM PDT AUD/USD is trading at 0.6985 level and maintains a bullish bias, but the false breakout above 0.7000 and the bearish engulfing has signaled that the pair is under pressure in the short term. The latest upbeat US data has pushed AUD/USD lower again in the short. It remains to see what will happen today after the US publishes the Prelim UoM Consumer Sentiment, the Housing Starts, and the Building Permits figures. Better than expected data will boost the USD, which could take full control against the Aussie.

AUD/USD has failed once again to come back towards the median line (ML) of the ascending pitchfork. It is trapped between the lower median line (lml) and the 50% Fibonacci line of the red ascending pitchfork, a valid breakdown from this pattern will suggest selling. I believe that only a false breakdown with huge separation, pin bar, below the 0.6976 and below the lower median line (lml) will bring a strong upside momentum, otherwise, continuous pressure on the lower median line (lml) could finally lead to a breakdown and to a bearish movement. RSI is signaling a bearish divergence, but this signal is not enough for us to open a bearish position.

A valid breakdown below the lower median line (lml) of the red ascending pitchfork will represent a short signal, the 0.6799 could be used as a downside target. The bias is still bullish now as the rate is traded within the ascending pitchfork's body. A drop below the 0.6963 low could activate the bearish movement. Buy a false breakdown with a huge separation below the lower median line (lml) or another higher high and a valid breakout above the 0.7064 level. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment