Forex analysis review |

- Forecast for AUD/USD pair on July 6, 2020

- Forecast for USD/JPY on July 6, 2020

- CADJPY approaching swing high! Pullback towards trendline expected!

- Overview of the GBP/USD pair. July 6. The UK is relaxing its quarantine measures. Doctors are preparing for a new outbreak

- Overview of the EUR/USD pair. July 6. Donald Trump will not leave the White House voluntarily. American experts talk about

- GBP/USD. Brexit talks failed again. Pound afloat against the dollar solely due to US events

- EUR/USD. Beijing and Washington put on pause the verbal sparring, new aid packages for the American and European economies

- Weekly Bitcoin analysis

- Weekly EURUSD analysis

| Forecast for AUD/USD pair on July 6, 2020 Posted: 05 Jul 2020 07:40 PM PDT AUD/USD The Australian dollar is pinned above the level of 0.6900 oon the daily chart. The pair grew by 18 points last Friday. The growth continues today in the Asian session. The Marlin oscillator entered the growing trend zone today. Now the aussie's actual goal is 0.7080. There is a high probability that the first goal will be overcome in order to form a divergence with the Marlin oscillator. The price accelerates growth over the balance indicator lines (red) and the MACD indicator lines (blue) on the four-hour chart. The signal line of the Marlin oscillator came out of the local consolidation (gray rectangle) up. We are waiting for the growth to continue towards the goal of 0.7080. |

| Forecast for USD/JPY on July 6, 2020 Posted: 05 Jul 2020 07:34 PM PDT USD/JPY The USD/JPY pair gave a clear signal for growth today in the Asian session. After the price consolidated under the balance on the daily scale chart for two days, the price surged when other indicators confirmed the growth. This is the exit of the Marlin oscillator into the growing trend zone - above the zero line, and the transition of the horizontal MACD line, which it has been in for the last two days, into a growing trend. The nearest growth target is 108.38. Then to 108.95. A decrease in the price below 107.08 (this is an alternative option) will turn the price into a medium-term decline. The price is rising above the red balance indicator line on the four-hour chart – the balance has shifted to a preferential growth, the Marlin oscillator has invaded the territory of the bulls. We are waiting for the USD/JPY pair to grow further. Indexes are showing healthy growth on the stock market: Nikkei 225 1.45%, China A50 2.42%, Kospi SEU 1.20%, which convey optimism to the USD/JPY pair. The material has been provided by InstaForex Company - www.instaforex.com |

| CADJPY approaching swing high! Pullback towards trendline expected! Posted: 05 Jul 2020 07:23 PM PDT

Trading Recommendation Entry: 79.703 Reason for Entry: Recent swing high, -27% Fibonacci retracement, 161.8% Fibonacci extension Take Profit: 79.332 Reason for Take Profit: 61.8% Fibonacci retracement, ascending trendline support Stop Loss: 79.914 Reason for Stop Loss: 161.8% Fibonacci extension The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Jul 2020 05:17 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - upward. CCI: 74.2307 The British pound starts a new trading week with an attempt to resume the upward movement. Since the pair is currently anchored above the moving average line, the blue bars of the Heiken Ashi indicator signaled a downward correction, which could already be completed. Thus, on the first trading day of the new week, the pound/dollar pair may try to resume an upward movement, according to the new trend. However, it is noteworthy that the pair failed to update the previous local maximum, which is also the Murray level of "5/8"-1.2512. Thus, it is not excluded that the downward movement will be resumed with a departure below the moving average. For the British pound, the fundamental background still comes down to negotiations on an agreement that will be in effect between the UK and the European Union after December 31, 2020. Recall that not so long ago, both sides of the negotiation process confirmed that the "transition period" will not be extended, which means that after 2020, all current agreements will be canceled. The old ones will be canceled, however, the new ones still can't be signed. Last week, a new round of talks was launched between the groups of Michel Barnier and David Frost, however, the parties did not even wait for its completion, saying that there was no progress in the negotiations and there was no reason to continue them. In addition to this negative information, last week it became known that GDP in the first quarter decreased by 1.7% y/y, although forecasts were slightly more optimistic. And despite all this information, the British pound still rose in price. We believe that in the current conditions, this strengthening of the British currency should not be given too much attention. We believe that there is no pronounced trend at the moment, and the United States and the UK are competing with each other, whose fundamental background will be worse. About the problems that America has faced recently, everyone has long been familiar with and aware of. Thus, we believe that neither the pound nor the dollar can have a clear advantage at this time. Based on these considerations, the pair may try to return to the area below the moving average line at the beginning of the new week. We also remind you that the macroeconomic background is still ignored in most cases and is ambiguous in almost all cases. For example, is almost 5 million Nonfarm Payrolls good or bad? Good! And if we take into account -21 million jobs a month earlier? However, there is a small positive for the British pound. From July 10, restrictions on the entry of foreign citizens from more than 50 countries will be lifted in the UK. A little earlier, many quarantine measures were canceled or replaced with more lenient ones. This means that the British economy may begin to recover in the near future. It was decided to reopen restaurants and bars, and this week it is expected that a plan will be presented to open several other businesses, such as beauty salons or fitness centers. Also, the requirements for social distance have already been lowered, from two meters to one, but Boris Johnson said that if measures to prevent the second wave of the epidemic do not work, the authorities will be forced to re-introduce a full "lockdown". Many medical experts are already expecting a second wave of the epidemic, believing that the British will consider the quarantine completed and will not observe any security measures at all. In principle, many British media and periodicals have already called the opening day of pubs "super Saturday". According to forecasts, the Sun newspaper on this day, pubs could sell about 8.5 million liters of beer. Given the mentality of the British, for whom the pub is a second home, we can assume that the second wave of "coronavirus" may happen in the near future. After all, the British did not particularly zealously observe the quarantine and during its full operation, now the situation can only get worse. Thus, the "coronavirus" continues to keep in fear, and at the slightest suspicion of a new outbreak of the epidemic, the UK authorities can begin to re-strengthen quarantine measures. On the first trading day of the week, the UK is scheduled to publish only the index of business activity in the construction sector, and in the US – the index of business activity in the service sector. We believe that both of these indicators are unlikely to have a serious impact on the mood of market participants. Thus, first of all, we still pay attention to technical factors. Overcoming the Murray level of "5/8" will allow traders to reconsider long positions, and the return of quotes below the moving average will change the current trend to a downward one.

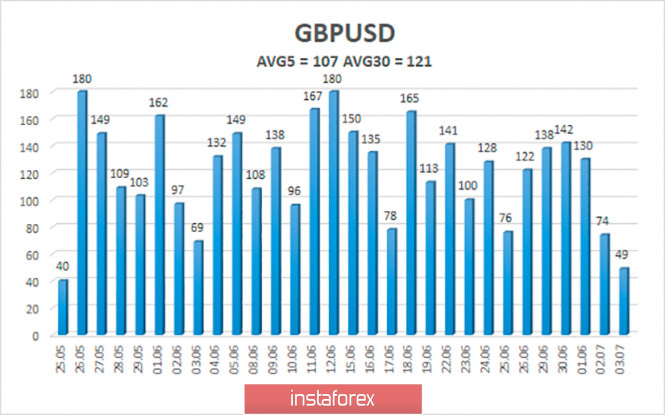

The average volatility of the GBP/USD pair continues to remain stable and is currently 107 points per day. For the pound/dollar pair, this indicator is "high". On Monday, July 6, thus, we expect movement within the channel, limited by the levels of 1.2373 and 1.2587. Turning the Heiken Ashi indicator down will indicate a new round of downward correction. Nearest support levels: S1 – 1.2451 S2 – 1.2390 S3 – 1.2329 Nearest resistance levels: R1 – 1.2512 R2 – 1.2573 R3 – 1.2634 Trading recommendations: The GBP/USD pair is fixed above the moving average on the 4-hour timeframe. Thus, today it is recommended to buy the pound/dollar pair with the goals of 1.2512 and 1.2573 and keep them open until the Heiken Ashi indicator turns down. It is recommended to sell the pair after the reverse consolidation of quotes below the moving average with the first goals of 1.2390 and 1.2329. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Jul 2020 05:17 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - sideways. CCI: 23.8095 As we have already mentioned in articles over the weekend, the euro/dollar currency pair has been trading in a relatively narrow trading range in recent weeks, which can be called flat. At the moment, the pair is trading just below the moving average line, however, in flat conditions, this location does not have any special significance. Traders continue to ignore the macroeconomic background, and there have been few fundamental events in recent days or even weeks. We are even a little surprised by this fact since most of the interesting topics seem to be put on pause now. China and the United States have stopped verbal sparring, and Washington has stopped daily accusing Beijing and making unsubstantiated statements about the alleged evidence of its guilt in the spread of the COVID-2019 virus. Dr. Anthony Fauci, after a long pause, finally went on the air, only to say that the current incidence of coronavirus was "terrible". Meanwhile, there were 55,000 new cases recorded in the United States yesterday, which Donald Trump immediately explained with an already proven argument. "The number of coronavirus cases is growing because our testing is so massive and so good, much bigger and better than in any other country. This is great news, but the even better news is that deaths and death rates are declining," Trump wrote on Twitter. However, it does not matter to the economy why the number of cases of "coronavirus" is growing. Earlier, we wrote that in several states, public institutions and some places of potential congestion of large numbers of people have been closed again. The latest information related to the state of Florida, where a curfew was imposed. The state of Arkansas has made it mandatory to wear masks in all public places. Seven states reported a record number of new cases over the weekend. Thus, the economy may start to slow down again. After all, the economy is not only about industrial production and trade with other countries. The economy is also about ordinary people, ordinary citizens who go (or don't go) to work, visit (or don't visit) public institutions, cinemas, restaurants, sports clubs, and more. If the country's anti-disease records are updated daily, how many Americans will want to lead an active social life? Thus, even if the new lockdown is not introduced, even if the White House does not tighten the quarantine measures, it will not have a particularly positive impact on the economy, because most Americans will continue to avoid public places. However, many periodicals and experts note that the November elections are now on the agenda for the American President. It seems that the original plan of Donald Trump has already failed. We believe that the American President wanted to restore the country's economy as quickly and fully as possible before November, to once again have excellent arguments in his favor before the voters. However, realizing the utopian nature of this idea, he seems to have abandoned it. It is unlikely that the US economy will recover to pre-crisis values in a few months. But Trump may try to use the "coronavirus" precisely to prevent his main rival, Joe Biden, from winning the election. In general, it seems that future elections will be the most absurd in the history of the United States. After all, the Governor of each state can impose or cancel quarantine restrictions. Thus, "foul play" may occur in many states. It may look something like this. There are so-called "contested states" - states that fluctuate between Biden and Trump. In such disputed states with Democratic governors, there may be restrictions on access to polling stations in those cities where Trump is most likely to win. And vice versa. That is, Biden and Trump may try to influence the election results by restricting voter access to those precincts where it is obvious that a competitor will win. Thus, "coronavirus" can now be used for political purposes. Easier scenarios are also possible. For example, there will be no direct restriction on access to polling stations, but in some places, there may be a new quarantine or a warning that there is a new outbreak, which will greatly reduce the desire of many Americans to leave their homes. It has also long been rumored that Donald Trump opposes voting by mail, believing that this way he will lose part of his electorate. Biden, however, seems to support this method of voting. But why? Because he doesn't want a mass gathering of Americans across the country or because he believes that Donald Trump is right? Also, there are fantastic options. Fantastic for any President other than Trump. For example, it is possible that "election fraud" may be declared after the vote has been counted. The President of the United States has the right to make such a statement and initiate an investigation. The investigation, which will be dragged out by the Republicans with all their might, can drag on for several months, as in the time of impeachment. Thus, until December 14 (the date when all states must appoint their representatives to the board), electors from "swing states" currently controlled by Republicans will not be approved. Accordingly, the Democrats may lose a certain part of the vote, and they will try to challenge this in the Supreme Court. But the Court can also redirect the case to the US Congress, where its Upper House is controlled by Republicans, who will block any attempts by Democrats to win the case. One thing is certain - Donald Trump will not leave the White House voluntarily, even if he loses the election. On Monday, July 6, the European Union will publish the retail sales figure for May. This indicator is expected to decrease again, by 15% monthly and by 7.5% on an annual basis. In the United States, the service sector business activity indices for June according to Markit and ISM versions are scheduled for today, with forecasts of 46.7 and 49.5. However, given the fact that market participants continue to ignore most of the macroeconomic information, we believe that this data will have a very indirect impact on the course of trading. Plus, Monday trading can be boring and inactive in itself. Thus, we do not expect the flat to end tomorrow.

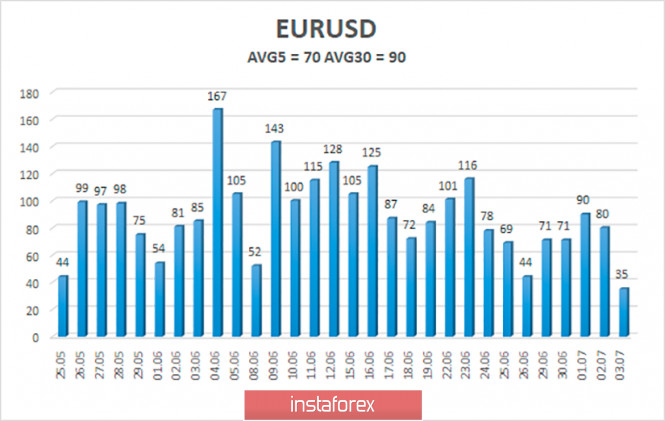

The average volatility of the euro/dollar currency pair as of July 5 is 70 points and is characterized as "average", but in general, it continues to decline. We expect the pair to move between the levels of 1.1175 and 1.1315 today. A new turn of the Heiken Ashi indicator upward will signal a new round of upward movement so far within the side channel. Nearest support levels: S1 – 1.1230 S2 – 1.1108 S3 – 1.0986 Nearest resistance levels: R1 – 1.1353 R2 – 1.1475 R3 – 1.1597 Trading recommendations: The EUR/USD pair continues to trade near the moving average line, inside the side channel. Thus, at this time, it is recommended to trade down if traders manage to overcome the level of 1.1175, which is the approximate lower limit of the channel, with the goals of 1.1108 and 1.0986. It is recommended to open buy orders not earlier than the Murray level "5/8"-1.1353 with a target of 1.1475. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. Brexit talks failed again. Pound afloat against the dollar solely due to US events Posted: 05 Jul 2020 12:11 PM PDT 4-hour timeframe In contrast to the EUR/USD pair, the British pound fell in price at the beginning and end of the trading week, and the rest of the time it grew quite strongly. A flat was not observed during the week. However, it is also impossible to say that there is a pronounced trend movement at the moment. If the downward trend persists at this time, it means that the correction in its composition is quite strong. For example, we are now witnessing one of these corrections, in which the pair has reached the upper line of the Ichimoku cloud and may even overcome it, which could become the starting point for a new upward trend. Meanwhile, in fundamental terms, the UK is completely calm. From time to time, market participants get confirmation that the negotiation process between Brussels and London is firmly in place, the parties are not going to make concessions and will only exchange mutual accusations, and that's all. This information clearly does not help the British currency, however, since everything is far from smooth over the ocean, the pound sterling still continues to stay afloat. Last Tuesday, you could only pay attention to UK GDP for the first quarter, which declined more than expected by 1.7% in annual terms. And on Friday, the business activity index for the services sector was published, which only exceeded the forecast value by 0.1. The speech of the head of the Bank of England, Andrew Bailey, at the beginning of the week did not contain anything interesting. Prime Minister Boris Johnson also gave a speech, calling the coronavirus a disaster for the British community and economy. At the same time, Johnson believes that it is absolutely necessary to conduct a check and find out what went wrong in the confrontation with the COVID-2019 virus. The prime minister is appalled by the scale of the epidemic and the large number of victims of the virus. However, Johnson believes that the current situation is a chance to change the country for the better. In general, nothing is changing in the UK, and the country is confidently moving towards economic collapse. Perhaps this is too loud a statement, but who could have guessed six months ago (when the coronavirus was already known) that this virus would lead to such economic consequences and have such a high death rate? But COVID-2019 has not disappeared. In fact, it was possible to stop the spread of this virus in European countries, including the UK. However, this does not mean that the virus is gone forever. A striking example of this is the United States, where even the first wave has not yet finished. Moreover, in many other countries around the world, where governments have relaxed or lifted quarantines, there are new outbreaks of infection. Thus, no one knows how many more lives the coronavirus will take, what measures governments around the world will have to take to stop future waves, and when a vaccine will be invented against this infection. It is a vaccine, not a cure. Because even though drugs exist, they can not cure everyone, and they can not stop the spread of infection at all. In addition to the serious consequences of the epidemic, the UK still has to deal with Brexit, and its negotiations fail from time to time. In fact, the negotiations with Brussels is still the number one topic for the British pound. Just last year, Johnson triumphantly won the election, first in the election of prime minister, and then in the parliamentary elections, which made it possible for London to finally end the parliamentary wars over the divorce with the European Union. However, as the next six months showed, Johnson and his government could not achieve anything positive for the country. What is the point of the current version of Brexit, if it was exactly the same one that was proposed by Theresa May? That is, the current option is, in fact, a hard Brexit, which could have been implemented in 2016-2017, that is, without a three-year delay. It turns out that the main point in Johnson's victory and the Conservative party is that the policy of these diplomats do not suit the majority of the British people. The point is simply that the majority of British people wanted to finish the epic of leaving the EU as soon as possible. Which the Johnson government is now implementing. The UK will be facing the most serious financial losses on the horizon. By the end of 2020, Britain will lose at least 70 billion pounds due to the divorce itself in the EU, and from 2021 will begin to lose money due to quotas and duties that have begun to operate, according to the rules of the World Trade Organization. Well, the financial losses due to the epidemic and the coronavirus crisis are not even worth talking about now. In general, as we have said in recent years, rescuing the sinking British pound is the work of the US dollar. The situation developed in the United States in 2020, which made it possible for both the euro and the pound to grow. The political crisis in America, the absurd policy of US President Donald Trump, his contradictory statements, failed to fight the epidemic, being the first in the world in the number of infections and deaths from the coronavirus, the constant wars with the Democrats, impeachment proceedings, a trade war with China, the book of the former national security adviser John Bolton, who reveals many aspects of Trump, and the racist scandal, which has led to several weeks of rallies and protests across the country, and in which Trump once again showed himself not at its best, all this could be the reasons why the US currency has ceased to become more expensive in the long term. Therefore, this entire year could turn out to be quite balanced for both the British pound and the US dollar. From our point of view, the future will solely depend on whether Trump is re-elected for a second term or not. Trading recommendations: The pound/dollar pair started an upward movement on the 4-hour timeframe. Thus, you are advised to consider long positions with targets of 1.2587 and 1.2624. You are also advised to return to sell orders, but not before you pin the pair below the critical line with the first targets of 1.2250 and 1.2168. All goals will be reviewed on Monday. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Jul 2020 03:45 AM PDT 4-hour timeframe Another trading week on the Forex market has ended, and the euro/dollar currency pair has gone into a dead flat. During the past trading week, the pair's quotes were traded in a narrow side channel despite a large number of macroeconomic statistics, important news, and messages. Thus, we can only once again focus the attention of traders on the fact that the markets remain rather alarming due to all the events of 2020. And we are talking primarily about the "coronavirus crisis", which continues to harm the world economy and confronts investors and traders with absolute uncertainty. Thus, at the very beginning of the coronavirus epidemic, the markets were in an absolute storm, and now – in absolute calm. As we have already noted, there were a lot of events in the past week. Even if you didn't take into account the secondary reports, there was a lot of information. For example, on Wednesday, data on unemployment in Germany were released, which showed that at the end of June, this figure increased to just 6.4%. The number of newly unemployed in the country increased by only 69 thousand, and the index of business activity in the most important sector of the economy – manufacturing – rose to 45.2. Thus, the data from Germany were very optimistic, better than the forecast values. Business activity in the European Union increased in production to 47.4, meaning that we are seeing a rapid recovery in this indicator. On the same day in America, data on the change in the number of employees from ADP in the private sector, which showed an increase of only 2.4 million instead of the projected 3 million. However, business activity indices were even more optimistic than in Europe. The ISM manufacturing index was 52.6, and the Markit manufacturing index was 49.8. Thus, we can say that both indices signal growth in the US manufacturing sector, and not a slowdown in the fall. Unfortunately, all these figures are relative. They are usually relative to the previous month. And if the economy of any country has been seriously shrinking for several months in a row, now these "optimistic figures" are just a small improvement after an absolute collapse. Also on Wednesday, July 1, the head of the European Central Bank, Christine Lagarde, spoke via videoconference at a forum in France. The topic of her speech concerned changes in the world economy as a result of the coronavirus pandemic. According to Lagarde, the changes in the economic system will be extremely profound. They particularly affect the sphere of production, as well as labor and trade. The head of the ECB believes that the crisis and the pandemic will lead to the expansion of the use of digital technologies, to an increase in the scale of automation and robotics in the manufacturing sectors. Also, according to Lagarde, the volume of trade via the Internet should significantly increase. Well, the minutes of the last meeting of the Federal Reserve reflected information about the need for long-term support of the American economy. Thus, in general, we can say that despite the macroeconomic data, both economies of interest to traders continue to remain in a weak position and recover very hard, as noted by the top officials of the Fed and ECB. On Thursday, July 2, there was again plenty of macroeconomic information. In the European Union, the unemployment rate was published, which, like in Germany, rose slightly, but not too much, to just 7.4%, which in the context of the global crisis can not be considered a failure value. In America, unemployment has fallen to 11.1%. The Nonfarm Payrolls report was also quite strong. Although this indicator of the state of the labor market for several months showed negative values for millions of jobs, at the end of June, the number of people employed in the non-agricultural sector increased by 4.8 million. However, the number of applications for unemployment benefits increased again, this time by almost 1.5 million. The total number of secondary applications for benefits increased to 19.3 million. In general, all these statistics can be interpreted in absolutely different ways. On the one hand, it can be called strong, because it showed high absolute increases and values exceeding forecasts, on the other – contradictory. We believe that after the severe collapse of the American and European economies, these figures do not matter much now. We must wait for the time when the crisis will be completely behind us, and the "coronavirus" will be defeated and will no longer have a destructive impact on the economy. Only after this, any growth in any macroeconomic indicator can be considered seriously and not be afraid that a new quarantine will be introduced in a month or the COVID-2019 virus will break free again. It seems that the majority of large investors and traders now believe approximately the same since most of the macroeconomic reports continue to be ignored. Well, in such conditions, ordinary traders are still not very comfortable to trade. We believe that increased attention should still be paid to technical factors. And technical factors are now also disappointing and do not contribute to active trading. We can say that the trend movement ended on June 10. Since then, in the first days, the pair still corrected, and then completely went into absolute flat. At the moment, it is limited to approximately the levels of 1.1200-1.1320. It is difficult to say when and under what conditions traders will be able to withdraw the pair from this channel. The key themes for the euro/dollar currency pair remain unchanged. And the lack of news on these topics may be the real reason for the flat in recent weeks. After all, traders may now be interested in the prospects of the American and European economies. After a strong downturn, everyone is interested in recovery. Therefore, the topics of the "US-China" conflict, as well as the provision of new stimulus packages to the EU and US economies, can greatly concern market participants. However, Washington and Beijing decided to put their bickering on pause, and the adoption of new financial aid packages is still stuck in Congress and the European Council. Thus, traders are deprived of new information on these important topics, and do not force events, preferring to wait for the necessary information. Trading recommendations: On a 4-hour timeframe, the euro/dollar pair trades inside a side channel, without even trying to work out its upper and lower lines. Thus, we now recommend that traders wait for the pair's quotes to exit this channel, and only then resume trading, according to the new trend. Purchases are recommended to be considered above the level of 1.1320, sales – below the level of 1.1200. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Jul 2020 02:16 AM PDT Bitcoin has been trying since May to break above the key resistance area near the February highs. Price is mostly moving sideways. Resistance is key here at $9,500-$10,000 area. A rejection could push price back towards $7,500.

BTCUSD is trading below our red resistance trend line. As we explained above there we find key long-term resistance. Bulls need a break above the $9,500-$10,000 area in order to move higher towards $12,000-$13,000 area. The longer it takes to break the resistance, the higher the chances of a rejection at current levels. A pull back towards $7,500 is justified. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 05 Jul 2020 02:09 AM PDT EURUSD has tried several times the past few weeks to recapture the 1.13 level. Each time price managed to push through it but sellers were stronger and price never managed to make a weekly close above it. This price action signals the importance of the resistance in that level.

EURUSD has major horizontal resistance in the area around 1.13-1.1350. A major reversal and top in the first quarter of the year and four attempts since May to recapture 1.13 has been unsuccessful. I prefer to be bearish below key resistance like this. In case of a new rejection combined with a break below 1.12, this would lead to more downside towards 1.11-1.1075 area and possibly even lower. A weekly close above 1.13 will change my view to bullish. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment