Forex analysis review |

- Forecast for EUR/USD on July 7, 2020

- Forecast for AUD/USD on July 7, 2020

- Forecast for USD/JPY on July 7, 2020

- USDCAD bouncing from 1st support, more upside!

- AUDUSD reacting above supports! Further rise expected!

- Hot forecast and trading signals for the GBP/USD pair on July 7. COT report. London-Brussels talks hinder pound growth

- Hot forecast and trading signals for the EUR/USD pair for July 7. COT report. Bulls did not cope with the first critical

- Overview of the EUR/USD pair. July 7. President of the European Council Charles Michel: "The EU will need years to return

- GBP/USD. Attempt number: London tries to negotiate with Brussels

- July 6, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- EURUSD recaptures 1.13 key resistance

- Gold price continues higher

- July 6, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- Investors wake up risk appetite, which puts pressure on the dollar

- Comprehensive analysis of movement options for the commodity currencies AUD/USD, USD/CAD, and NZD/USD (H4) on July 7, 2020

- European and Asian stock markets jump

- Breaking News of following week

- Evening review on EURUSD for July 06, 2020

- EURUSD: The German Supreme Court is no longer a hindrance. Investors believe in the recovery of the European economy

- BTC analysis for July 06,.2020 - Descending triangle in creation, potential bigger drop incoming towards the $7.800

- UK opens borders

- GBP/USD: plan for the American session on July 6

- EUR/USD: plan for the American session on July 6

- EUR/USD analysis for July 06 2020 -Potential for the downside rotation casue of rising resistance on the test at 1.1315

- Analysis of Gold for July 06,.2020 - Potential for the new upside leg due to strong upside trend in the background and rising

| Forecast for EUR/USD on July 7, 2020 Posted: 06 Jul 2020 08:00 PM PDT EUR/USD The euro broke the resistance of the target level of 1.1265 on Monday, showing a growth of 61 points. The price peaked on June 23. After overcoming the intermediate level of 1.1353, we expect the growth to continue to 1.1420, the second goal is 1.1465. Reaching any of these levels with the Marlin oscillator will form a technical divergence, which will become a reversal signal. Perhaps a medium-term downward trend. The price is firmly held above both indicator lines on the four-hour chart – the balance line (red) and the MACD line (blue). The Marlin oscillator is in the growth zone. We are waiting for the euro to grow to the designated goal of 1.1420. |

| Forecast for AUD/USD on July 7, 2020 Posted: 06 Jul 2020 07:48 PM PDT AUD/USD The Australian dollar added 30 points on Monday thanks to the overall weakening of the US dollar (-0.37%) and the growth of commodities: iron ore 1.80%, copper 2.12%, oil 0.34%. Values may continue to increase for some time on growing risk appetites, but we do not expect any long-term trend – the second wave of coronavirus infection is developing in the world. The signal line of the Marlin oscillator has entered the growing trend zone on the daily chart, and it is very possible that a triple divergence of the oscillator will be formed with the price. This is a strong reversal pattern. To form such a divergence, the price needs to enter the target range of 0.7190-0.7225, this range is formed by the extremes of February, April and July 2019, August 2018. The aussie's first goal is the July 2019 high at the price of 0.7080. Overcoming this level will allow the price to reach the second target range. The price is rising above the balance and MACD lines on the four-hour chart, but it has already significantly broken away from them, so the price has slightly pulled back with a decreasing Marlin oscillator. After a few black candles, we are waiting for the recovery of the Australian dollar. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for USD/JPY on July 7, 2020 Posted: 06 Jul 2020 07:48 PM PDT USD/JPY The USD/JPY pair tested the resistance of 107.77 and retreated on the first day of the week, eventually closing the day by losing 17 points. The price never left the body of the candle above the balance indicator line on the daily chart, staying under it for four sessions. The Marlin is currently in the negative zone. It is difficult for the pair to grow. But the main trend remains bullish, the question is whether it will be able to remain so, the price should not go below 107.00 for it to do so, that is, under the MACD line on the daily chart, and the price will have to overcome the resistance of 107.77 in order to confidently continue growth to 108.38 and 108.95. The price is located between the balance and MACD lines on the four-hour chart. Here the price has two supports: the actual MACD line and just below the support of the trend line of the price channel of the daily timeframe (107.08). The nearest task is to go over the balance line (107.50), repeat the attack at 107.77 and gain a foothold over it. This is our main scenario, but it is no longer being implemented today. It is not advisable to trade in the current situation, you need to wait for the consolidation of a particular trend. The material has been provided by InstaForex Company - www.instaforex.com |

| USDCAD bouncing from 1st support, more upside! Posted: 06 Jul 2020 07:18 PM PDT

Trading Recommendation Entry: 1.3528 Reason for Entry: 61% fib extension Take Profit :1.3576 Reason for Take Profit: The horizontal swing high resistance Stop Loss:1.3486 Reason for Stop loss: Horizontal swing low support The material has been provided by InstaForex Company - www.instaforex.com |

| AUDUSD reacting above supports! Further rise expected! Posted: 06 Jul 2020 06:54 PM PDT

Trading Recommendation Entry: 0.69947 Reason for Entry: Market entry Take Profit: 0.70511 Reason for Take Profit: -61.8% Fibonacci retracement, ascending trendline support Stop Loss: 0.69677 Reason for Stop Loss: Ascending trendline support, 38.2% and 23.6% Fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

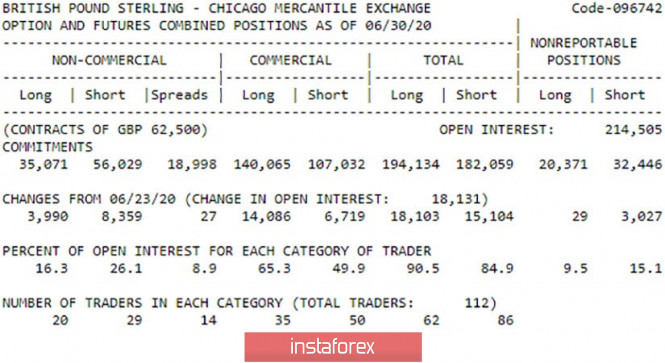

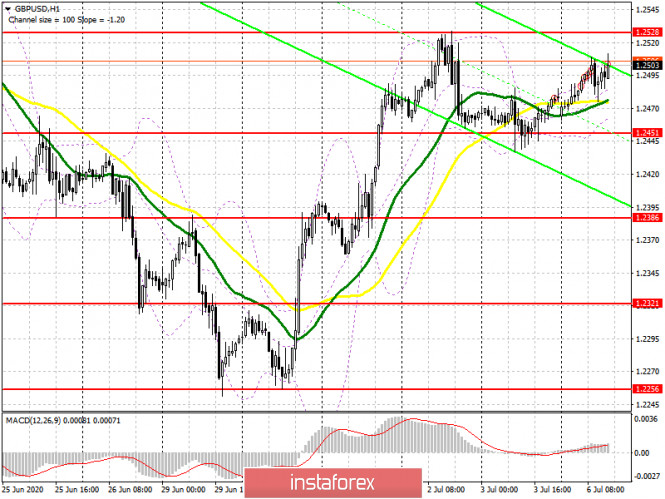

| Posted: 06 Jul 2020 05:31 PM PDT GBP/USD 1H The GBP/USD currency pair, in contrast to EUR/USD, was trading very reluctantly and frankly sluggish on Monday. After the pair left the downward channel and overcame the resistance area of 1.2404–1.2424, buyers got a certain carte blanche, but they can't take full advantage of it yet. Thus, in the current conditions, the upward trend continues as long as the pair's quotes continue to remain above the area of 1.2404–1.2424 and the Senkou span B and Kijun-sen lines. Bears will only be able to return to the market below these three supports. There is also a fairly strong resistance line around the 1.2530 level, from which the quotes have rebounded several times. GBP/USD 15M Both linear regression channels continue to be directed upwards on a 15-minute timeframe, so the overall trend remains upward in the short term. However, the lack of overcoming the 1.2530 level can push the pair down by 250 points. The COT report The latest COT report, which covers the dates of June 24-30, shows that the pound was traded by large traders very actively at this time. Major market participants basically reduced contracts in the euro currency, but then they increased it in the pound. Professional market participants increased the number of contracts for the purchase by 4,000 and by 8,400 for sale. Thus, the net position decreased by 4,400 contracts only in the non-commercial category. It is logical that the pound has become cheaper during this period. The Commercial group, which does not set itself the goal of making a profit from foreign exchange transactions, naturally bought the pound more. If someone sells the currency, then who buys it. In total, the total net position for the pound even increased during the reporting week (18,000-15,000 = +3,000). The pound only grew after the report expired, thus, it can be assumed that professional market participants are already looking in the direction of purchases of the British currency. The fundamental background for the GBP/USD pair on Monday did not change much compared to the previous week. The next stage of negotiations on the terms of the Brexit agreement has failed, so the UK does not have good news for the pound. The British pound continues to rely on negative news from overseas, which helps this currency grow from time to time. As for the UK itself, Great Britain's economy in 2020 will continue to sink in any case. Yes, there will be a recovery by the end of the year, but it will not be as rapid as, for example, in the EU. In 2021, new shocks are also possible for the British economy, since this year the country can start trading with the European Union under the rules of the World Trade Organization, that is, with quotas, duties and other charms of non-EU membership. From our point of view, British Prime Minister Boris Johnson has not achieved anything positive for his country in almost a year of his rule. The only thing that can be credited to him is the completion of Brexit. And even then, not to him, but to the British people, who for the second time expressed their will to leave the EU as soon as possible, when they gave the majority of votes to the Conservatives. Based on this, we believe that the pound can continue to grow, but for this, traders will need to constantly feed on the negative from overseas. In this case, market participants will have reasons to continue to get rid of the dollar. However, new portions of negativity from Britain may return the desire of traders to get rid of the pound. There are two main scenarios as of July 7: 1) Since the resistance area of 1.2404-1.2424 has been passed, the upward movement has more prospects now . However, at the same time, the pound/dollar pair stopped near the past local high (about 1.2530) and the bulls still can not overcome it. Therefore, we recommend buying the pair after overcoming this level with targets at resistance levels of 1.2589 and 1.2698. Potential Take Profit in this case will be from 40 to 150 points. 2) Sellers are advised to wait until the pair has been pinned below the support area of 1.2404-1.2424, and at the same time the Kijun-sen and Senkou Span B lines. In this case, the downward trend will take place, and the first targets for sell orders will be 1.2311 and the support area of 1.2196-1.2216. Potential Take Profit in this case will be from 70 to 170 points. The material has been provided by InstaForex Company - www.instaforex.com |

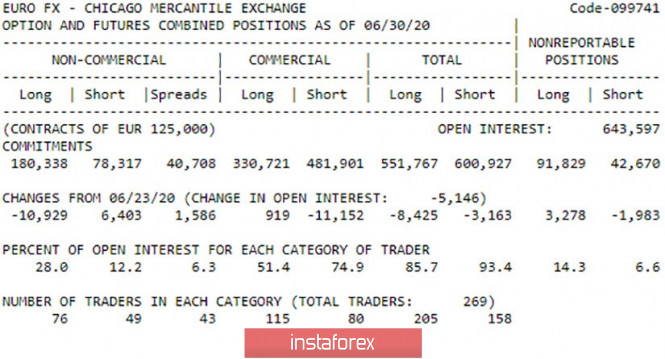

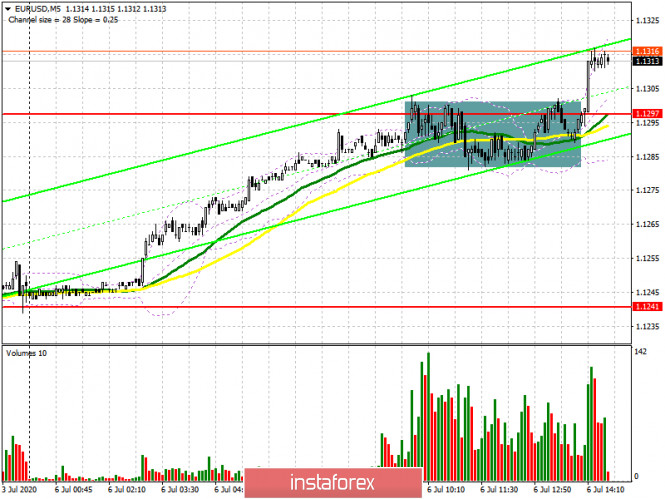

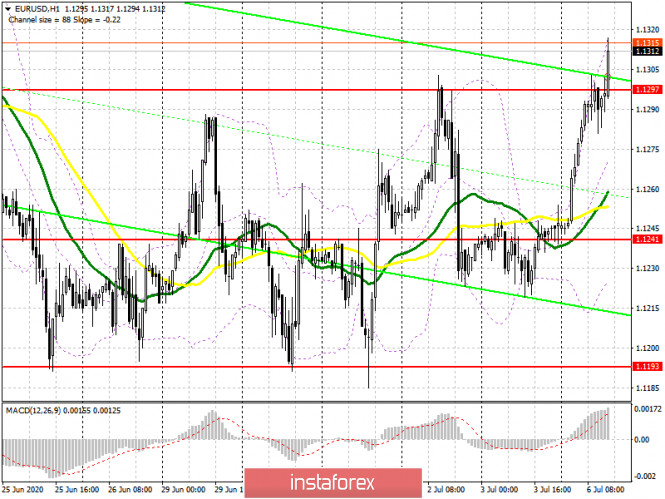

| Posted: 06 Jul 2020 05:31 PM PDT EUR/USD 1H The EUR/USD pair perfectly worked out the resistance area of 1.1326–1.1342 in the hourly timeframe on July 6, which we previously designated as quite strong and is also an approximate upper line of the side channel in which the pair has been trading in for the last month. Thus, buyers showed that they do not have the strength to leave the side channel at the moment. After the price rebounds from the upper line, you can only expect a fall to the lower border, which runs around the level of $.12. Thus, in the current conditions, buyers need to overcome the area of 1.1326–1.1342 in order for the euro to continue to grow in price. EUR/USD 15M Both linear regression channels are directed upwards on a 15-minute timeframe, signaling an upward trend in the most short-term plan. However, the side channel and the pair rebounded off its upper line – a downward movement can already begin. The COT report The new COT report, which was released on Monday, showed that during the reporting week (June 24–30), professional traders were busy closing buy contracts and opening sell contracts. It is interesting that the European currency fell in price during this period of time, but not too much, not by -17,000 contracts in the net position. At the same time, from a technical point of view, the euro/dollar pair is now in a flat, which is clearly visible on the 4-hour timeframe and even higher. Thus, we cannot conclude that major market participants have completely abandoned euro purchases. It should also be noted that market participants who hedge their risks have closed contracts for sale in the reporting week with the same zeal, thus slightly offsetting the actions of speculators. In total, 8,500 Buy-contracts and 3,000 Sell-contracts were closed. Therefore, almost in any case, the euro should have fallen in price during the reporting week. But the future prospects of the euro are difficult to track on the COT report. All recent changes have not been trending. The overall fundamental background for the EUR/USD pair was almost absent on Monday. Several business activity indices published in the US and retail sales in the European Union did not have a particularly strong impact on the pair's movement from our point of view. Moreover, since the side channel is clearly visible on the 4-hour timeframe, this means that such a trend is currently absent, although the European currency still has a certain advantage from a fundamental point of view. Thus, first of all, market participants need to overcome the level of 1.1353 (the Murray level "5/8" according to the linear regression channels system). Only then will it be possible to pay attention to fundamental events and macroeconomic reports again. In general, we believe that the foundation is now on the side of the euro, mainly due to the fact that the second wave of the coronavirus epidemic has begun in the United States, although we believe that this is an incomplete first wave. Thus, America may soon face new problems related to quarantine restrictions, which might affect the economy. In the European Union, in terms of coronavirus, everything is much calmer and there are few openly negative topics for the euro. Based on all of the above, we have two trading ideas for July 7: 1) Buyers reached the 1.1326-1.1342 area for the third time in the last month and rebounded from it for the third time. Thus, we advise you to buy the euro but not before this area has been overcome with the goals of resistance levels 1.1362 and 1.1422. Potential Take Profit is up to 80 points. 2) Sellers are unable to return to the market today. To begin with, we expect the pair's quotes to fall to the two strong lines of the Ichimoku indicator - Senkou span B (1.1258) and Kijun-sen (1.1266). However, we do not advise you to trade the first stage of a new fall. It is better to wait until the support area of 1.1227–1.1243 has been overcome. And only then should you open short positions with the goals of 1.1186 and 1.1126. The potential Take Profit in this case is from 35 to 95 points. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Jul 2020 05:21 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - upward. CCI: 177.4751 The currency pair was trading quite uneasily on the first trading day of the new week. It seems that at the end of the past week, American market participants left it in advance. On Thursday, and yesterday, they began to work out all the things that they missed in those days. And they missed quite a lot. For example, macroeconomic statistics from the United States, the publication of which was specifically moved from Friday to Thursday to make Friday a day off in honor of Independence Day, which was officially scheduled for Saturday, July 4. We described the package of macroeconomic statistics from overseas as contradictory, as some reports turned out to be optimistic, however, recalling the fall of the same indicators in April-May, the current growth seems very weak. First of all, this applies to NonFarm Payrolls, which increased by as much as 4.8 million. However, two months earlier, this figure lost 11 million. The unemployment rate has fallen, however, it has fallen to 11.1%, which is a very high figure. Wages decreased by 1.2% compared to the previous month. Thus, in general, this package of statistics can be considered negative for the dollar, although at first glance it does not seem so. There are no other explanations for the growth of the European currency on Monday. However, we would also like to note that at this time, traders may pay increased attention to the "coronavirus" epidemic in the United States. Yes, that's the exact wording. If earlier it was a worldwide epidemic, now only a few countries of the world continue to update their anti-records for disease incidence daily. And the United States is in a confident first place on this sad indicator. Moreover, the situation is aggravated by the fact that the country's quarantine did not bear much fruit. The epidemic was only contained for a while, but after Donald Trump began to "open" the economy, after rallies and protests raged in the country for about a month, after Donald Trump himself began to ride around the country with his election rallies, the situation with the "coronavirus" immediately escalated and every day is now recorded 40-50 thousand new cases of the disease. And this means that the pandemic in the United States persists and it is bad from which side not to look. Even if there is no new "lockdown", it is still bad for the economy. Sick and scared people will not go to work, especially as long as the United States pays increased unemployment benefits. Businesses will continue to suffer, which again threatens to lose jobs and increase unemployment. People will not be socially active, as they realize that the COVID-2019 virus is not dormant. It is in Europe that the population has calmed down, the authorities have lifted the quarantine, since in most countries the incidence rates have fallen almost to zero, and new local outbreaks are immediately tracked and localized. In America, everything is different. In the worst case, the country will face a new quarantine. Some states have already imposed some restrictions since the virus is spreading at a very high rate. From all this, we can draw a banal conclusion that the European economy is now not hindered by anything to begin to recover. Of course, it would be easier to do this if the European Parliament, the European Commission, and the European Council agreed on an additional package of assistance to the EU economy for 750 billion euros, however, this is not yet the case. But the European Union managed to defeat the "coronavirus" and stop its spread. Thus, it is the European economy that is now in a better position than the American one. And it is the euro currency that for the first time in many years has an advantage (albeit small) over the US dollar. We do not claim that the euro will now start a new long-term upward trend, however, the fundamental and macroeconomic advantage of the dollar has indeed been leveled in the past few months. However, even in this advantageous position, the top officials of the European Union see high risks for the economy. Christine Lagarde and others have repeatedly said that a new wave of the epidemic can "finish off" the economy. European Council President Charles Michel said at the weekend at an economic forum that the EU will need years to reach pre-crisis levels. The head of the European Council said that from the first days of the pandemic, all political decisions were made through the prism of the health and life of Europeans. The main goal was to stop the spread of the virus. The EU has loosened some levers and principles for all EU member states to make it easier for them to deal with the epidemic at the national level. However, over time, it turned out that not all EU countries were ready for a pandemic crisis and showed equal opportunities to overcome the consequences. "Economic growth does not have an automatic magic power. Inequality and injustice not only sow frustration but also create obstacles to prosperity. Reducing inequality increases the stability of the economy, " said the President of the European Council. Thus, said Charles Michel, the European Union has chosen the right path: by 2050, the EU plans to reorient itself to a "green" economy, switch to digital technologies, and reduce inequality between members of the alliance. On Monday, July 6, the European Union published a report on retail sales for May. It turned out that this indicator increased by 17.8% in monthly terms, and lost 5.1% in annual terms. These figures were significantly better than the forecast values and could also support buyers of the European currency a little. However, we believe that traders generally continue to ignore macroeconomic statistics, at least not as important as was published in the United States at the end of last week. Today, on July 7, in the European Union, Germany is scheduled to publish also not the most significant indicator of industrial production. It is expected that in the country - the locomotive of the European economy by the end of May, production will decrease by 11.1% in annual terms and add 10% monthly. On the other hand, according to Christine Lagarde, the speed of recovery of the European economy will depend on the recovery of production. Thus, this indicator is important, although it is unlikely to cause a momentary reaction. In general, the euro/dollar currency pair again reached the Murray level of "5/8"-1.1353 and continues to remain, thus, inside the side channel, in which it has been trading for almost a month. The level of 1.1353 is just its upper limit. If traders manage to overcome it, the upward movement may resume. Otherwise, the pair will try to return to around $ 1.12.

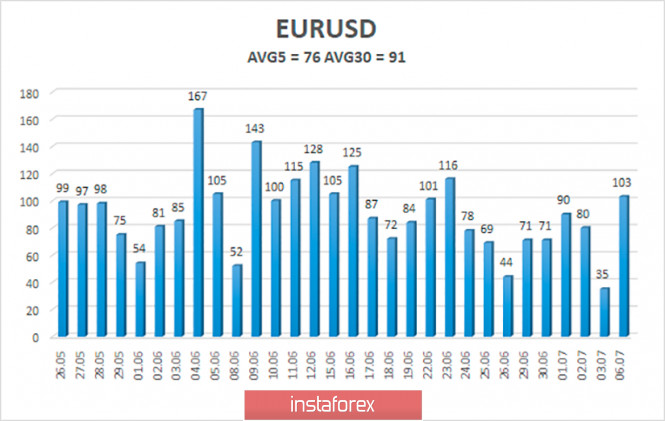

The volatility of the euro/dollar currency pair as of July 7 is 76 points and is characterized as "average". We expect the pair to move between the levels of 1.1235 and 1.1387 today. A new reversal of the Heiken Ashi indicator downwards will signal a new round of downward movement within the side channel. Nearest support levels: S1 – 1.1230 S2 – 1.1108 S3 – 1.0986 Nearest resistance levels: R1 – 1.1353 R2 – 1.1475 R3 – 1.1597 Trading recommendations: The euro/dollar pair continues to trade near the moving average line, inside the side channel. Thus, at this time, it is recommended to trade down if traders manage to overcome the level of 1.1175, which is the approximate lower limit of the channel, with the goals of 1.1108 and 1.0986. It is recommended to open buy orders no earlier than the Murray level of "5/8"-1.1353 with a target of 1.1475. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD. Attempt number: London tries to negotiate with Brussels Posted: 06 Jul 2020 02:07 PM PDT The pound-dollar pair tested the 25th figure today, reacting to the general weakening of the US dollar. The PMI index for the construction sector provided additional support for the British currency, which came out much better than forecast values. But in general, the fundamental background for GBP/USD has not changed: the pound is still under the background pressure of Brexit, so it is still advisable to use rare northern "arches" to open short positions. But longs look quite risky, given the results of the previous round of negotiations between representatives of London and Brussels. Let me remind you that at the end of last week, the parties parted early in the corners of the ring, refusing to hold the final meeting on Friday. The main (but not the only) differences between the negotiators arose in the field of fishing. Britain considers the EU's demand of providing European fisherman access to British fishing areas as unacceptable. According to London, such requirements are incompatible with the future status of the UK as an independent coastal state. The British want an annual review of the "admission" issue of European fishermen, but France strongly opposed such a proposal. In addition to this issue, the parties also failed to agree even on the outlines of common competition rules for business. As it turned out, negotiators interpret this term differently. According to the European Union, London's proposals put British businesses in a privileged position relative to the companies of the other members of the bloc; in turn, the British insist on their proposals, considering them fair. On the other positions, the same differences remained – according to the negotiators themselves, the parties were not able to come one iota closer to a common denominator on key issues. Actually, for this reason, the negotiations were interrupted. The dialogue between London and Brussels resumed today: the chief negotiator from the European Union, Michel Barnier, arrived in the British capital to take part in the next round of negotiations. They should last until the end of this week, but given the experience of the previous round, the negotiation process may be interrupted ahead of schedule. Although most experts and traders have no illusions about the current negotiations, the fact of another failure will put quite a lot of pressure on the British currency. According to the British press, in mid-or late July (that is, before or after the EU summit), British Prime Minister Boris Johnson will visit Brussels for face-to-face and personal talks with EU leaders and the EU leadership. This step can hypothetically move the situation from a dead point. Last year, it was the personal meetings of the head of the British Parliament that decided the fate of Brexit. In this context, we can say only one thing with confidence - before the face-to-face meeting of the leaders takes place, the parties will zealously defend their positions, expressing principles and demonstrating intransigence. It is obvious that if the negotiators are too flexible until then, they will weaken the negotiating positions of their patrons. Therefore, it is highly likely that the current negotiations will share the fate of the previous ones – that is, they will end in failure. The situation is being escalated partly artificially, as it was done last year. For the same reason, Johnson stated his categorical disagreement with the extension of the transition period. According to the laws of the genre, the overall situation around Brexit will heat up to its limit – Johnson is preparing a comfortable (for himself) ground for key negotiations. This can also include talk about the implementation of the Australian scenario (Canberra did not enter into a single trade agreement with Brussels, so the exchange of goods takes place mainly under the rules of the World Trade Organization). All these messages with which London fills the information space serve as preparation for the main battle on the negotiating front. At least, this scenario was implemented last year, and Johnson is undertaking similar political maneuvers this year. Thus, the current negotiations will probably end without result. Such news always puts downward pressure on the GBP/USD pair – regardless of the dollar's health. Therefore, in my opinion, sales are still relevant for the pair, despite the impulsive corrective growth at the beginning of the trading week. From the technical point of view, the price on the daily chart is located on the middle line of the Bollinger Bands indicator, and the trend indicators have not formed any clear and unambiguous signals. If the pair does not break the 1.2500 mark (and most importantly – does not gain a foothold over it), this will also indicate the priority of the downward direction. In this case, you can consider short positions with the first goal of 1.2360 (the upper limit of the Kumo cloud on D1) and the main goal of 1.2260 (a five-week price low that coincides with the lower line of the Bollinger Bands on the same timeframe). The material has been provided by InstaForex Company - www.instaforex.com |

| July 6, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 06 Jul 2020 10:27 AM PDT

On March 20, the EURUSD pair has expressed remarkable bullish recovery around the newly-established bottom around 1.0650. Shortly after, a sideway consolidation range was established in the price range extending between 1.0770 - 1.1000. On May 14, evident signs of Bullish rejection as well as a recent ascending bottom have been manifested around the price zone of (1.0815 - 1.0775), which enhances the bullish side of the market in the short-term. Bullish breakout above 1.1000 has enhanced further bullish advancement towards 1.1175 (61.8% Fibonacci Level) then 1.1315 (78.6% Fibonacci Level) where bearish rejection was anticipated. Although the EUR/USD pair has temporarily expressed a bullish breakout above 1.1315 (78.6% Fibonacci Level), bearish rejection was being demonstrated in the period between June 10th- June 12th. This suggested a probable bearish reversal around the Recent Price Zone of (1.1270-1.1315) to be watched by Intraday traders. Hence, Bearish persistence below 1.1250-1.1240 (Head & Shoulders Pattern neckline) was needed to confirm the pattern & to enhance further bearish decline towards 1.1150. Moreover, bearish breakdown below the depicted keyzone around 1.1150 is mandatory to ensure further bearish decline towards 1.1070 and 1.0990 if enough bearish pressure is maintained. Trade recommendations : The current bullish movement towards the price zone around 1.1300-1.1330 (recently-established supply zone) should be followed by Intraday Traders as a valid SELL Signal.T/P levels to be located around 1.1175 then 1.1100 while S/L to be placed above 1.1350 to offset the associated risk. The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD recaptures 1.13 key resistance Posted: 06 Jul 2020 10:24 AM PDT As we explained in previous analysis, it is very important for bulls to recapture the 1.13 level. Each time we saw price above 1.13 the previous weeks, sellers came in and pushed price back below 1.13. This week will be decisive. Will we see a break out or a rejection?

EURUSD is above the horizontal weekly resistance. Staying above it is key for the medium-term trend. Support is at 1.1225 for the medium-term. In our previous analysis I said that I saw a downward break down as the most probable scenario. However we also noted the importance of the triangle pattern in the short-term. The break above the upper triangle boundary changed our view.

Green line - support Short-term support is at 1.1285. Previous resistance is now support. Bulls do not want to see price get back inside the triangle and specially break below the green trend line support. This would be the worst scenario. This would lead price to 1.11-1.1050. For now bulls have the upper hand. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Jul 2020 10:18 AM PDT Gold price today is trading around $1,780 near the June highs. Price continues to respect the bullish channel boundaries and is heading to new highs. Trend remains bullish but bulls also need to be cautious.

Red lines - bullish channel Gold price has support at $1,772. Breaking below that level will be a bearish sign. If this support fails to hold I will be expecting Gold price to retest $1,750-45 support area. Resistance remains at recent highs at $1,789. The RSI is diverging in the 4 hour chart. This is just a warning and not a bearish sign. The material has been provided by InstaForex Company - www.instaforex.com |

| July 6, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 06 Jul 2020 10:15 AM PDT

Recently, Bullish breakout above 1.2265 has enhanced many bullish movements up to the price levels of 1.2520-1.2590 where temporary bearish rejection as well as a sideway consolidation range were established (In the period between March 27- May 12). Shortly after, transient bearish breakout below 1.2265 (Consolidation Range Lower Limit) was demonstrated in the period between May 13 - May 26. However, immediate bullish rebound has been expressed around the price level of 1.2080. This brought the GBPUSD back above the depicted price zone of 1.2520-1.2600 which failed to offer sufficient bearish rejection. Hence, short-term technical outlook has turned into bullish, further bullish advancement was expressed towards 1.2780 (Previous Key-Level) where signs of bearish rejection were expressed. Short-term bearish pullback was expressed, initial bearish destination was located around 1.2600 and 1.2520. Moreover, a bearish Head & Shoulders pattern (with potential bearish target around 12265) was recently demonstrated on the chart. That's why, bearish persistence below 1.2500 ( neckline of the reversal pattern ) was needed to pause the bullish outlook for sometime to enable further bearish decline. However, significant bullish rejection around 1.2265 brought the GBP/USD pair back towards 1.2490. Any bullish pullback towards 1.2520-1.2550 (recent supply zone) should be watched by Intraday traders for a valid SELL Entry. Trade recommendations : Intraday traders can wait for the current bullish pullback towards 1.2520-1.2550 (recent supply zone) for another valid SELL Entry. S/L should be placed above 1.2600 while T/P level to be located around 1.2450 & 1.2265. The material has been provided by InstaForex Company - www.instaforex.com |

| Investors wake up risk appetite, which puts pressure on the dollar Posted: 06 Jul 2020 09:14 AM PDT

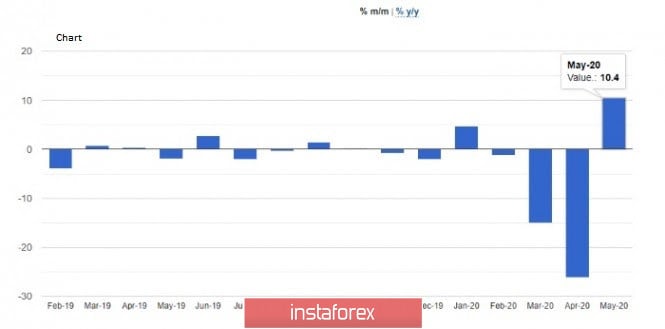

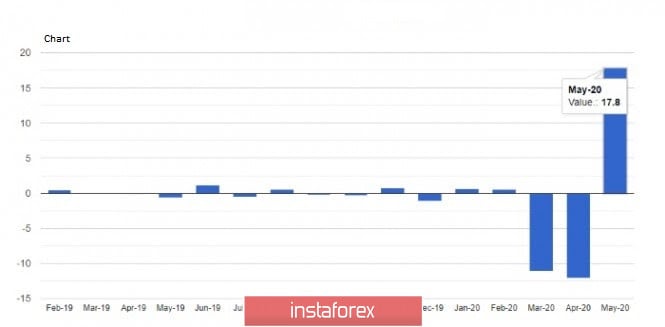

Today, the bulk of commodity currencies has strengthened against the US dollar. Interest in risky transactions in the market grew amid excellent statistics reflecting economic recovery at a faster pace than previously thought. The Chinese yuan rapidly went up after the publication of statistics, but the US dollar was under pressure from the news of an increase with the number of COVID-19 patients in the country over the weekend. In addition, China's securities have shown steady growth for the fifth week in a row, and so far the end to this trend is not yet foreseen since there are still more positive outlooks on the market than negative ones. The Chinese government also has hopes for a quick economic recovery after the crisis brought by the COVID-19 pandemic. So far, these hopes are not baseless since the yuan today was able to get to the maximum values against the dollar, which has not been fixed since mid-March of this year. The problem of China is that the economy remains too dependent on external factors, which, by the way, are now more favorable than before. In this regard, the government of the country begins a period of great and laborious work, which consists in the proper construction and regulation of all actions, which, in turn, can ensure further success and growth. A steady rise in the Chinese market can pull up not only the entire Asia-Pacific region, but also the rest of the world. A positive sign is the growing economic activity of China in various sectors. At least Australia's closest neighbor, as well as the European region, will be pleased because, for them, Chinese partners are one of the main ones. Today, the euro increased by 0.38% and reached the level of 1.1292 dollars per euro, closely approaching the maximum value of 1.1303 dollars per euro. The volume of orders in the German manufacturing sector over the last month of spring increased by 10.4% which served as a good indicator for this growth. In addition, the overall retail sales in the European region also jumped significantly by 17.8%. The aussie also strengthened by 0.3% and reached the level of 0.6954 dollars per aussie. The main attention of the foreign exchange market here is directed to the next meeting of the Reserve Bank of the country, from which certain decisions regarding further monetary policy are expected. The pound sterling also began to cost a little more, which allowed it to be at the level of 1.2492 dollars per pound sterling. The rise here began to be recorded after the country's finance minister declassified the government's plans to increase the minimum threshold for the real estate tax, as well as a short-term reduction in value-added tax in the services sector. Meanwhile, the value of the US dollar against a basket of six major currencies of the world fell by 0.3% today and reached 96.908 points, which is the lowest value since the beginning of this month. Taking risks is becoming fashionable among investors during this time of crisis, which, of course, is not at all in the hands of the US dollar, which is also under pressure due to the increasing number of COVID-19 patients in the United States. The pressure on the dollar is great enough, and so far there are no ways to overcome this situation. The preliminary forecasts of analysts, who have recently been revised for the worse, added fuel to the fire. So, the Goldman Sachs agency has adjusted down its data on the possible growth of the US economy. So, now GDP is expected to decrease by about 4.6%, whereas earlier it was announced that it would fall by no more than 4.2%. As some experts note, this is not the only reduction that the country will have to face in the near future. Consumer spending will also slow down significantly, due to new restrictive measures to counter the spread of COVID-19. The material has been provided by InstaForex Company - www.instaforex.com |

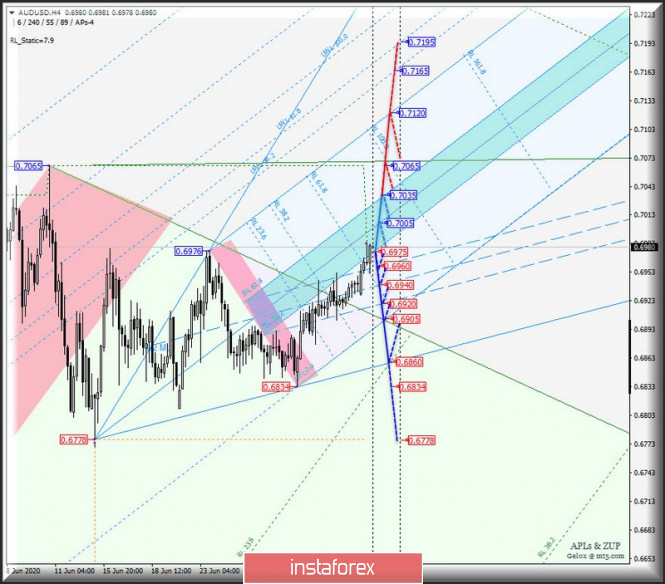

| Posted: 06 Jul 2020 08:25 AM PDT Minute operational scale (H4) The second week of July - continued growth of "commodity" currencies against the US dollar? Overview of options for the development of the movement for AUD/USD, USD/CAD, and NZD/USD (H4) on July 7, 2020. ____________________ Australian dollar vs US dollar From July 7, 2020, the development of the movement of the Australian dollar (AUD/USD) will be determined by the development and direction of the breakdown of the boundaries of the equilibrium zone (0.6975 - 0.7005 - 0.7035) of the Minuette operational scale fork - we look at the animated chart for details of the movement inside this zone. If the resistance level of 0.7035 on the top border ISL61.8 equilibrium zone of the Minuette operational scale fork will make the actual continuation of the upward movement of the Australian dollar to a local maximum 0.7065 and the ultimate line FSL Minuette (0.7120). In case of breaking the lower border ISL38.2 equilibrium zone of the Minuette operational scale fork - support level of 0.6975, the AUD/USD movement can continue to the boundaries of the 1/2 Median Line Minuette channel (0.6960 - 0.6940 - 0.6920), as well as to the initial one - SSL (0.6950) and control - LTL (0.6860) lines of the Minuette operational scale fork. The AUD/USD movement options from July 7, 2020 are shown on the animated chart.

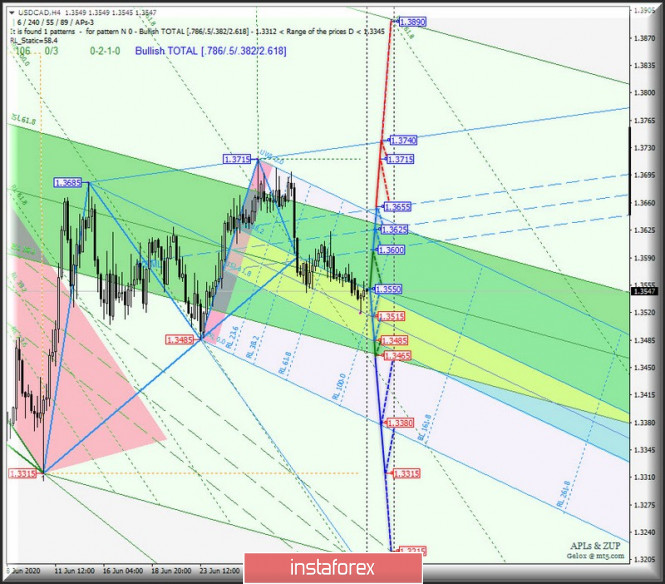

____________________ US dollar vs Canadian dollar The development of the movement of the Canadian dollar (USD/CAD) from July 7, 2020 will be determined by working out and the direction of the breakdown of the boundaries of the equilibrium zone (1.3485 - 1.3515 - 1.3550) of the Minuette operational scale forks - the movement markings inside the indicated equilibrium zone are shown on the animated chart. In the breakdown of the support level of 1.3485 on the lower border ISL38.2 zone equilibrium of the Minuette operational scale fork, the downward movement of the Canadian dollar may continue to the goals:

In case of a breakdown of the top border ISL61.8 equilibrium zone of the Minuette operational scale fork - the resistance level of 1.3550 - can take place to be the development of the upward movement the USD/CAD to the boundaries of the channel 1/2 Median Line Minuette (1.3600 - 1.3625 - 1.3655) with the prospect of updating local maximum of 1.3715 and the line of control UTL Minuette (1.3740). From July 7, 2020, we look at the USD/CAD movement options on the animated chart.

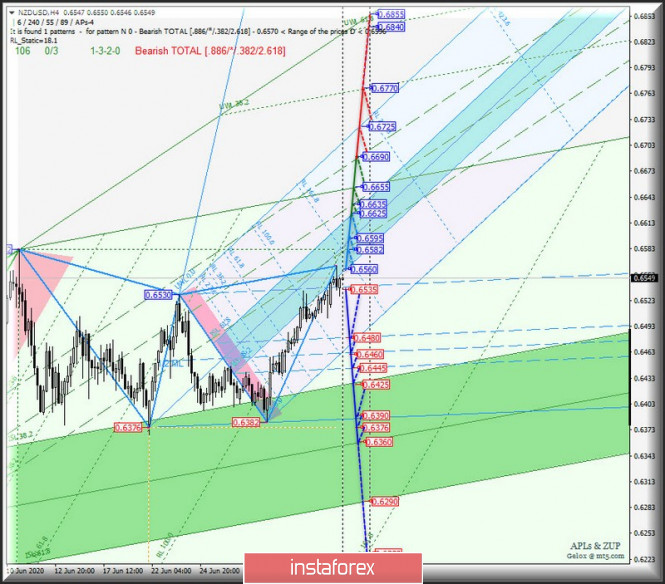

____________________ New Zealand dollar vs US dollar Further development of the movement of the New Zealand dollar (NZD/USD) from July 7, 2020 would depend on the practice and direction of a breakout of the range:

With the breakdown of ISL38.2 Minuette - resistance level of 0.6560 - the development of the movement of the New Zealand dollar will continue within the equilibrium zone (0.6560 - 0.6595 - 0.6625) of the Minuette operational scale forks and 1/2 channel of the Median Line (0.6582 - 0.6635 - 0.6690) of the Minute operational scale forks with the prospect of reaching the final line FSL Minuette (0.6725) and the warning line UWL38.2 Minute (0.6770). In the event of a breakdown of the final Shiff Line of the Minuette operational scale fork - support level 0.6535 - the downward movement of NZD/USD can continue to the borders of the 1/2 Median Line Minuette channel (0.6480 - 0.6460 - 0.6445) and the equilibrium zone (0.6425 - 0.6360 - 0.6290) of the Minute operational scale. The markup of the NZD/USD movement options from July 7, 2020 is shown on the animated chart.

____________________ The review is compiled without taking into account the news background, the opening of trading sessions of the main financial centers and is not a guide to action (placing "sell" or "buy" orders). The material has been provided by InstaForex Company - www.instaforex.com |

| European and Asian stock markets jump Posted: 06 Jul 2020 07:35 AM PDT Today, participants of the stock markets in the Asia-Pacific region are in a good mood. Most indices showed a rise and there is still hope for a more rapid economic recovery. At least, all governments of the world are doing their best to accelerate economic rise by means of the stimulus measures. The Nikkei 225 index jumped by 1.7%. Car producers are among the leaders. Thus, shares of Nissan Motor Co increased by 5.4% whereas shares of Suzuki Motor Corp gained 5.1%. At the same time, shares of Mitsubishi Motors Corp climbed by 4.2%. J. Front Retailing Co. Ltd showed the most significant growth. Its shares soared by 6.9%. SoftBank Group Corp. also demonstrated a confident rise of 2.5% to reach its highest levels. The Shanghai composite soared by 5.2% while the Hang Seng index shower weaker performance and grew by 3.11%. The leaders of the Chinese market are shares of China's insurance company Life Insurance Co. and car manufacturer Geely Automobile Holdings Ltd., which rose in value by 10.3% and 8.3%, respectively. Following them, the shares of the chip manufacturing Corporation AAC Technologies Holdings Inc. went up by 8%. South Korea's Kospi index was 1.68% higher in the morning. LG Electronics (5.2%) and carmaker Kia Motors Corp showed the most significant growth (2.6%). Australia's S&P/ASX 200 index went against the overall positive trend and declined by 0.42%. At the same time, the most significant drop was recorded in the mining sector: shares of BP Group fell by 1.5% and Rio Tinto shares declined by 1.1%. Two different factors continue to put pressure on the stock market. On the one hand, the number of new coronavirus cases is catastrophically increasing. On the other hand, strong and encouraging statistics on economic growth was published. Investors have to balance between these two poles. So far, there has been more positive news, but the situation is unstable and may change at any moment. Meanwhile, the current week is expected to be really important for market participants. They are waiting for decisions from the central banks of Australia and Malaysia on the key interest rate. According to preliminary forecasts, the Australian regulator will leave the key interest rate at the same low level of 0.25%. But, the main Malaysian regulator may lower the benchmark rate. The key aim is to maintain and increase the pace of economic recovery of the countries. At the same time, the stock market is responding well to the news about the continued gradual lifting of the quarantine measures on the territory of some states. All this should have a positive impact on the recovery of business activity. However, it is not necessary to wait for a serious jump in this indicator. It will hardly be a V-shaped rise. Stock markets in Europe were also exposed to positive emotions and showed quite significant growth in almost all areas. Market participants mainly focused on the prospects of a speedy recovery of the region's economy. At the same time, an increase in the number of new COVID-19 patients does fear investors who are focused on positive statistics. The STOXX Europe 600 index of businesses in the European region jumped by 1.54% to 371.07 points. The UK's FTSE 100 index was up by 2.08%. Germany's DAX index rose by 1.9%. France's CAC index jumped by 1.77%. Italy's FTSE MIB index gained 1.94%. The leader was Spain's IBEX 35 index which increased immediately by 2.61%. The positive market mood was caused, first of all, by the news that the drug against the coronavirus infection, created in the United States by Gilead Sciences Inc., passed all stages of testing and was approved for the treatment. Moreover, the UK is expected to provide the COVID-19 vaccine in the near future. The vaccine is being developed by two companies – Sanofi and GlaxoSmithKline. The number of people infected with the coronavirus continues to grow rapidly. So, over the last Saturday, their number increased by 200 thousand, as reported by the World Health Organization. Most of the new cases were recorded in the territory of North and South America. All this may be a sign of a second wave of the pandemic that threatens to impose restrictive measures again. Meanwhile, statistical data from the European region is quite positive. Thus, the overall level of orders from the German industrial enterprises in the last month of spring increased by 10.4%, which demonstrates a jump in business activity. In addition, this was the highest rate of recovery in the last 45 years. At the same time, preliminary forecasts slightly exceeded the final data. Today, attention of market participants will also be focused on the publication of the retail sales data in the eurozone. The material has been provided by InstaForex Company - www.instaforex.com |

| Breaking News of following week Posted: 06 Jul 2020 07:18 AM PDT

The second half of the year seems to be difficult too. The number of new infections is growing in some US states. EU leaders continue to discuss Brexit issues. Here is news in detail: 1. COVID-19 is gaining momentum again The US government has reported a new rise in the number of infected people with coronavirus. In one day, almost 20 thousand new cases were confirmed in the US. The epicenter of the disease is in Florida and Texas. In this regard, many US enterprises are shut down again. 2. Outlook for the beginning of the second half of the year The second half of the year begins with the hope for a vaccine against coronavirus. In this regard, market bulls begin the second half with signs of economic recovery. However, the market recovery will take a lot of time. The issue of increasing unemployment benefits in the United States after July 31 is being discussed. Also, the US presidential election will be held in November. The presidential race promises to be nervous, especially if Democrat Joe Biden remains the leader of the race. Besides, the EU should agree to approve a $750 billion eurozone economic recovery fund. At the same time, investors fear the weakening of stimulus measures, as problems may continue to arise. 3. Eurozone problems EU leaders discuss a plan to restore the economies of the worst-hit countries. More than €1 trillion ($ 1.1 trillion) will be spent on this issue. Leaders also negotiate on the EU-UK relations after Brexit. Moreover, a summit will be held on July 17-18. It is crucial for reaching an agreement on a restoration fund. Germany wants to use the EU presidency to improve the European economy. An agreement on a recovery fund will certainly help. Markets hope that solidarity will prevail: the euro has grown by 5% since March, but investors' optimism may fade away, if disputes begin. 4. Difficult negotiations on Brexit Last week, the Brexit negotiations did not end successfully. Serious disagreements arose between the parties. Michel Barnier believes that the British government is not interested in this process. Negotiations will be held again this week, but success is hardly possible. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review on EURUSD for July 06, 2020 Posted: 06 Jul 2020 07:04 AM PDT

EURUSD: The euro trades upward aiming for the level of 1.1500. Today, July 6, the euro made a serious bid for the upward trend. The highs of the last two weeks have been broken making a way out of consolidation with the first targets at 1.1420 and 1.1500. If this becomes successful, the upwards trend may continue with the next targets at 1.1700 and 1.1800. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Jul 2020 06:20 AM PDT The European currency continues to strengthen its position against the US dollar after information emerged that the German Constitutional Court and the European Central Bank will be able to agree on maintaining the Bundesbank's participation in the asset purchase program. Let me remind you that in May this year, the constitutional court in Germany declared that the central bank will withdraw from the program if the ECB does not provide a clear justification for the need for this program. Already today, the media reported that, despite all the differences between the constitutional court and the ECB, the Bundesbank will follow the instructions of the Finance Minister and the German Parliament, which is aimed at implementing the program of the European regulator. Against this background, the split within the Central Bank can be stopped, at least at such a difficult time for Europe, when the economy is beginning to gradually return to normal after the coronavirus pandemic. Some experts in this area believe the case has already been resolved, which will lead to further strengthening of the euro since the risks to the Eurozone and the single currency from the German court's decision were eliminated promptly. Data released today on the growth of production orders in Germany also encouraged traders betting on further strengthening of the euro. The report shows that orders in May increased significantly after a sharp collapse in April this year. However, growth was not enough after a record reduction in April. This confirms the fact that the German economy has not overcome the coronavirus as well as previously thought. Even after the lifting of quarantine measures, which led to a V-shaped surge in the activity, it will be very difficult to quickly return to pre-crisis levels. According to released official data, orders in the German manufacturing sector in May 2020 increased by 10.4% compared to the previous month. For April, orders were revised downward and decreased by 26.2% compared to March. Economists had forecast that orders increased by 15% in May compared to April. But compared to the same period in 2019, orders fell immediately by 29.3%. The report also shows that domestic orders in May increased by 12.3% compared to the previous month, and export orders – by 8.8%. Data on retail sales in the Eurozone once again convinced investors of the correct choice of an asset. The good pace of recovery in sales gives some confidence that the resumption of the economy has triggered an automatic jump in the activity. Of course, there will be no permanent rapid growth in the summer months, and by August the pace will slow significantly, as demand will become lower against the backdrop of rising unemployment in the Eurozone. A report from the European statistics agency indicated that retail sales in May 2020 jumped immediately by 17.8% compared to April. Economists had expected retail sales to grow by 14%. Surprised by the growth in clothing sales, which recorded an increase in the indicator immediately by 147% compared to April after a reduction of 54.7% and 55.5% in the previous two months. As for the technical picture of the EURUSD pair, the expected breakout of the resistance of 1.1300 led to the preservation of the bullish momentum of the trading instrument. The nearest target will be a fresh high in the area of 1.1350, and the further level remains the area of 1.1390. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Jul 2020 06:08 AM PDT Trading recommendation:

Watch for potential breakout of support at the price of $8,900, which will confirm further downside movement and test of $7,825, which is the projected target based on the triangle pattern. Resistance level is seen at the price of $8,900 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Jul 2020 05:52 AM PDT

The epidemiological situation in the UK has stabilized. In April, the number of new cases of COVID-19 reached almost 9 thousand people, but now the number of new cases hardly reaches 1,000 people per day. In this regard, Prime Minister Boris Johnson is ready to lift quarantine measures. Earlier, the Prime Minister eased requirements for social distancing. Restaurants and bars will resume their work soon. Besides, beauty salons and pools will open next week. However, Mr. Johnson said that if measures to prevent the second wave of coronavirus infection do not work, then the country's economy will be shut down again. Moreover, from July 10, the borders of the United Kingdom will be open to tourists from more than 50 countries. This list includes France, Germany, Italy, and Spain. However, citizens of other countries, especially of the US, will be forced to stay in 14-day quarantine. British Transport Minister Grant Shapps noted that the whole country was doing its best to lift the quarantine as soon as possible. However, safety comes first. All measures will be taken to prevent the further spread of COVID-19 if the level of infections in the country begins to rise again. According to the latest data, there have been 283,757 confirmed coronavirus cases and 43,995 deaths in the UK. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: plan for the American session on July 6 Posted: 06 Jul 2020 05:04 AM PDT To open long positions on GBPUSD, you need: From a technical point of view, nothing has changed at all, since volatility has remained at a fairly low level, which does not allow signals to be formed when entering the market. News on the PMI for the UK construction sector, where activity again began to show growth, did not significantly affect the pound's quotes. At the moment, while trading is conducted above the area of 1.2451, we can expect the pound to continue growing to the maximum of 1.2528, fixing above which will necessarily lead the pair to a new resistance area of 1.2607, where I recommend fixing the profits. In the scenario of a decline in GBP/USD in the second half of the day, only the formation of a false breakout at the level of 1.2451 will be a signal to open long positions. This may happen after the release of bad reports on activity in the US service sector. If there is no activity from the bulls in this range, it is best to postpone purchases until the update of the larger area of 1.2386, from which the bulls will try to build the lower border of the new ascending channel. To open short positions on GBPUSD, you need: Sellers of the pound will definitely show activity in the resistance area of 1.2528, which they managed to protect last Thursday, forming a fairly good sell signal from there. However, in the first half of the day, the pair could not reach this level. At the moment, the bears need to consolidate below the level of 1.2451, which will be a signal to open short positions in the expectation of resuming the downward correction to the area of the minimum of 1.2386, where I recommend fixing the profits. In the scenario of further growth of GBP/USD, it is best to postpone sales until the formation of a false breakout at the level of 1.2528. However, you can safely open short positions immediately for a rebound only after testing the maximum of 1.2607, counting on a correction of 30-40 points within the day.

Signals of indicators: Moving averages Trading is conducted just above the 30 and 50 daily averages, which leaves a chance of continuing the upward correction of the pound. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands A break in the lower border of the indicator in the area of 1.2451 should increase pressure on the British pound. Breaking the upper limit of the indicator around 1.2510 will lead to a new growth in GBP/USD. Description of indicators

|

| EUR/USD: plan for the American session on July 6 Posted: 06 Jul 2020 05:02 AM PDT To open long positions on EURUSD, you need: In the first half of the day, I paid special attention to the resistance level of 1.1297, since the entire trading strategy was based on it. If you look at the 5-minute chart, you will see how the bears formed a false breakout in the resistance area of 1.1297 several times. However, each time, the downward trend did not continue, which brought EUR/USD back to the level. The report on the growth of retail trade in the Eurozone was better than the forecasts of economists, which allowed the bulls to keep the pair in the area of 1.1297. The goal of buyers for the second half of the day remains a breakdown and consolidation above this range. However, I recommend opening long positions only after testing this area from top to bottom on the volume, after which the upward trend should immediately continue, which will lead to further growth of the euro in the maximum area of 1.1346. However, its update will also depend on what data will be released today on activity in the US services sector. If the pressure on the euro returns in the second half of the day, and the bulls do not show activity above the level of 1.1241, it is best to wait for another decline to the middle of the channel 1.1241 and open long positions in the expectation of correction of 25-30 points within the day. Larger bulls remain in the area of last week's lows of 1.1193, from where you can buy EUR/USD immediately on the rebound.

To open short positions on EURUSD, you need: Sellers of the euro are not very lucky yet, as all attempts to resume the downward trend in the first half of the day were unsuccessful. In the afternoon, bears will wait for weak data on activity in the US services sector, which may slightly subdue the demand of euro buyers. However, only the pair's return to the support area of 1.1297, which the bears gave in the first half of the day, and fixing under it will be a signal to open short positions. This scenario will lead to a repeated decline in EUR/USD to the area of the middle of the 1.1241 channel, where the pair spent the entire past week. The longer-term goal of sellers remains the minimum of 1.193, the next test of which will increase pressure on the euro and collapse the pair to the area of 1.155, where I recommend fixing the profits. If the bears fail to return the pair to the support of 1.1297 in the second half of the day, it is best to postpone short positions until the upper limit of the 1.1346 channel is updated, which is now gradually approaching the euro. You can sell from there immediately on the rebound in the expectation of correction by the end of the day of 25-30 points.

Signals of indicators: Moving averages Trading is conducted above the 30 and 50 daily moving averages, which indicates a gradual increase in the advantage of euro buyers. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Bollinger Bands In case of a decline in the euro, the average border of the indicator around 1.1270 will provide support, and you can only buy EUR/USD for a rebound from the minimum of 1.1225. Description of indicators

|

| Posted: 06 Jul 2020 04:51 AM PDT Trading recommendation:

EUR is trading at the rising resistance, which is sign that buying looks very risky around 1,1300. I see potential for the rotation downside towards the levels at 1,1257 and 1,1222. Stochastic oscillator is in overbought area, which is another indication for the downside rotation. Watch for selling opportunities with the downward targets at 1,1257 and 1,1222 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Jul 2020 04:39 AM PDT Trading recommendation:

Gold is trading in the well defined upward channel and I did found few rejections of the support, which is sign for the further bullish continuation. Stochastic oscillator did another bull cross, which is another confirmation of the strength. Watch for buying opportunities and potential targets at $1,790 and $1,3820 Support level is set at the price of $1,758 The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment