Forex analysis review |

- Forecast for EUR/USD on August 3, 2020

- Forecast for GBP/USD on August 3, 2020

- Forecast for AUD/USD on August 3, 2020

- Forecast for USD/JPY on August 3, 2020

- Hot forecast and trading signals for the GBP/USD pair on August 3. COT report. Major players preparing for a strong downtrend.

- Hot forecast and trading signals for the EUR/USD pair on August 3. COT report. Bulls give bears a chance to make money in

- Overview of the GBP/USD pair. August 3. UK GDP may shrink by 20% in the second quarter. London and Washington have started

- Overview of the EUR/USD pair. August 3. "American circus" in action. Trump is trying to shift the electorate's attention

- Dollar expected to strengthen at the start of the week

- USDCAD tests weekly support

- Weekly EURUSD analysis

- Weekly analysis of Gold

| Forecast for EUR/USD on August 3, 2020 Posted: 02 Aug 2020 08:27 PM PDT EUR/USD The euro fell 67 points last Friday, which formed a divergence with the Marlin oscillator on the daily chart. Apparently, this is the reversal of the single currency, which we have been waiting for several days. The nearest target for the euro is 1.1620. The second target is 1.1490 (March high), the third target is 1.1420 (May high). A double divergence has already formed on the 4-hour Marlin chart. The signal line of the oscillator is fixed on the territory of the bears. If the price moves under the MACD line (1.1740), it opens the way to a decline to the first target of 1.1620. |

| Forecast for GBP/USD on August 3, 2020 Posted: 02 Aug 2020 08:25 PM PDT GBP/USD The pound sterling showed the first black candlestick in the last ten sessions on the daily chart last Friday. It is known from practice that this pattern - a black candlestick after the previous ten white ones (and vice versa) - is often a reversal signal - either to a deep correction or to a trend change. The Marlin oscillator showed a reversal from the overbought zone. This is probably the desire to reach the target level of 1.2912, which coincides not only with the Fibonacci level of 76.4%, but also with the low on December 23, 2019. It is noticeable that since the price reached the 1.2912 level on the 4-hour chart, this will result in the price moving under the MACD line, which will become an additional technical factor for a further decline, and the next target at 1.2725 is the 100.0% Fibonacci level, correlating with the February 28 low. We are waiting for confirmation of the British pound reversal. And although the trend is steady upward, it is dangerous to buy. |

| Forecast for AUD/USD on August 3, 2020 Posted: 02 Aug 2020 08:22 PM PDT AUD/USD The Australian dollar made the last rush to the upper border of the target range of 0.7190-0.7225 and, having turned down, closed the day by losing 50 points last Friday, July 31. The triple price divergence with the Marlin oscillator has fully formed on the daily chart. Now we are waiting for the price to fall to the MACD line, to the 0.6960 level. Pinning the price under the MACD line will launch a medium-term downward trend. There is a pronounced price divergence with an oscillator on the four-hour chart. The price consolidated below the balance (red) and MACD (blue) indicator lines - the trend is completely down. We are waiting for the price to break the nearest target level of 0.7070, then we observe the price behavior at the key level 0.6960. |

| Forecast for USD/JPY on August 3, 2020 Posted: 02 Aug 2020 08:20 PM PDT USD/JPY The dollar jumped 113 points against the yen last Friday. Trading volumes were high - the highest since June 10. The US stock index S&P 500 rose 0.77% on Friday. Visually, it is preparing to storm the pre-crisis high of 3393. It seems that there is not much time left to wait until the S&P 500 resolves the situation, both in the event of a real growth, and in case of a reversal from the area of current levels to a new four to eight-week fall. But the dollar-yen pair is growing, the price has already gone above the embedded line of the price channel, the Marlin oscillator has turned vertically upward. The growth target is the price channel line around the 106.80 mark. Here the price will fight the resistance of the MACD line. The price has consolidated above the balance and MACD indicator lines on the four-hour chart. The Marlin Oscillator is growing, and it has formed, albeit unexpressed, a triple convergence. We are waiting for further price growth. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Aug 2020 06:43 PM PDT GBP/USD 1H The GBP/USD pair also started to adjust on Friday. However, the correction was very weak, and the upward trend line continues to signal an upward trend. At the moment, the pair has not even managed to get close to the trend line or the Kijun-sen line. Thus, it is extremely early to talk about a change in the trend. By and large, everything remains the same as it was. Buyers continue to dominate the market, and bears continue to rest. Thus, it is still not recommended to consider selling the British currency, since all technical factors indicate that the upward trend is continuing at the moment. GBP/USD 15M Both linear regression channels are still directed upwards on the 15-minute timeframe, so there are no prerequisites for changing the trend direction at the moment. New Commitments of Traders (COT) report on the British currency. Recall that the last COT report for July 15-21 showed that non-commercial traders opened more Sell-contracts than Buy-contracts, however, the British pound continued to grow throughout the reporting period. Friday's COT report showed roughly the same pattern. The "non-commercial" category opened 2,700 Sell-contracts and closed 8,700 Buy-contracts. Thus, the net position for this category of traders has fallen even further, which means that the bearish mood has increased. And we are thinking about the prospects of the British currency for the second consecutive week, since the most professional group of traders have not been buying the pound all this time, and the British currency is growing. We are still inclined to the option that professional traders are preparing for a serious fall in the pound, but will the fundamental background allow it to do so? On the other hand, the fundamental background is not a secret, so we believe that non-commercial traders who enter the market for the purpose of making a profit from trading know what they are doing. The fundamental background for the GBP/USD pair also remains the same. No important messages have been received from the UK in the past week. The only positive event for the pound is the start of preliminary negotiations on free trade between Washington and London. However, it is already known that the discussion of the deal is just beginning and it is unlikely for the talks to last "a couple of months". Thus, we are still waiting for the moment when traders will remember that the situation in the UK is no less bad than in the United States. We believe that a group of non-commercial traders is already beginning to prepare for a new fall in the British pound. And we recommend that our readers also prepare for a new downward trend. But at the same time, as usual, fundamental hypotheses and assumptions need to be confirmed by technical signals, which are not yet available. The UK is set to publish the index of business activity in the manufacturing sector on Monday. However, this report, as well as a similar American one, is unlikely to cause a serious market reaction. Business activity recovered fairly quickly in all developed countries of the world, even in the United States, where the coronavirus continues to rage. At this time, these are not indicators of the state of the economy. On the other hand, business activity may start to deteriorate again in America, although this will most likely concern the service sector, not manufacturing. Thus, in the near future, we will be very interested in the meeting of the Bank of England and the report on UK GDP for the second quarter. There are two main scenarios as of August 3: 1) Buyers are still the dominant traders in the pound/dollar market, but at the moment there is a correction. The last target was almost reached, the pair did not have enough to hit it just a few points. Thus, in the event of a rebound from the trend line or the Kijun-sen line, we recommend buying the pound again with the goal of 1.3174. All target levels will be updated today. The potential Take Profit in this case will be about 150 points. 2) Sellers are advised to start considering the possibility of opening short positions with the goal of the Senkou Span B line (1,2707) after overcoming the Kijun-sen line (1,3000) and, accordingly, the upward trend line. Sellers will have a good chance of forming a downward trend below these two barriers. The potential Take Profit in this case is about 250 points. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Aug 2020 06:39 PM PDT EUR/USD 1H The euro/dollar pair finally started a more or less noticeable downward movement on the hourly timeframe of July 31. We have specially built a new ascending channel that shows that the pair's quotes have left it. At the same time, buyers released the pair below the critical Kijun-sen line, so we have two factors at once at this time, speaking in favor of a certain downward movement. However, it is premature to conclude that the bulls are completely sated with the pair's purchases. The pair can return to the area above the Kijun-sen line at any time, which will mean the resumption of the upward trend. Thus, traders will have to decide on their further actions and strategies in the coming days. EUR/USD 15M The lower channel of linear regression turned down on the 15-minute timeframe, the correction began, and there are also signs of a downward movement starting on the hourly timeframe. A new report from the Commitments of Traders (COT) report showed a very telling change in the mood of professional traders. The category of non-commercial traders opened 36,000 new Buy-contracts during the reporting week (July 22-28). This category has opened only 3,700 Sell contracts. Thus, the net position increased by 32,000 at once, which is a signal of a firm strengthening of the bullish mood. In principle, we made similar conclusions with you over the past week, as the euro currency continued to grow non-stop. As for other categories of traders, they do not matter now. For example, commercial traders opened 48,000 Sell-contracts, but the euro continued to sharply grow! In total, all major players opened more Sell-contracts, but, as we can see, this factor did not significantly affect the pair's movement during the week. Thus, the report data completely coincided with what is happening in the market. The fundamental background for the EUR/USD pair did not change at all on Friday. We believe that the euro started to fall solely due to the technical need to adjust and the desire of traders to take part of the profit on long positions. Although a large number of important statistics were published on Thursday and Friday in the United States and the EU. However, it was a failure in every sense of the word in America, and let's say, tolerant in the EU, as for the crisis. Therefore, the fundamental background has not changed in the long term, but we still believe that market participants could already take into account all the current factors and will also be satisfied with the pair's purchases. The European Union, Germany and the United States are set to publish business activity indices for July on Monday, August 3. All these indicators should reach more than 50, and we have no doubt that they will exceed the forecasts. However, in any case, these reports are not extremely important at this time, so it is unlikely to expect a serious market reaction. We believe that technical factors will still come first on the first trading day of the week. Therefore, the correction may continue. However, do not forget to keep track of news on the most important topics. These are the topics of the political, epidemiological, social and economic crisis in the United States. For example, a new increase in the number of daily coronavirus infections in the US could negatively affect the demand for the US currency. Based on all of the above, we have two trading ideas for August 3: 1) Buyers finally gave the bears a chance to take a breath. Buy orders remain relevant for the target resistance level of 1.1996, but now the bulls need to wait for the pair's quotes to return to the area above the Kijun-sen line (1.1797), which will mean the resumption of the upward trend. The potential Take Profit in this case is about 150 points. 2) Bears have a chance to form a more or less strong downward movement for the first time in a long time. Formally, even now it is possible to open short positions while aiming for the Senkou Span B line (1.1575), but we recommend doing this in small lots, as well as placing a short Stop Loss. The potential Take Profit in this case is about 190 points. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Aug 2020 05:08 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - upward. CCI: 98.7842 The British pound continues to react to what is happening in the world with much less eagerness than, for example, the euro/dollar pair. We have repeatedly said that if there is no openly failed and negative fundamental background in the European Union, then there is one in the UK. However, the pound has grown no weaker than the euro in recent weeks and has grown by 8 cents since July 1. Just as in the case of the euro, there were almost no corrections over the past month, and last Friday the pullback began, but so far it does not exceed the scale and size of the meager corrections that were in July. So, for now, we can't even say that the pair has started to adjust. Returning to the fundamental background, over the past week, no macroeconomic reports were published in Britain, there was not a single news item on the Brexit negotiations, there was not a single important message from Boris Johnson. Complete calm. However, the lack of news is not generally a positive thing. If the United States has so-called "4 crises", then the UK has its own "3 economic crises". At the very least, they were able to cope with the "coronavirus" in Foggy Albion, although new waves are expected with the arrival of autumn and winter. But while this is not the case, we can only focus on economic problems. And here the situation is not much different from the American one. If in the United States GDP decreased in the first quarter by 5%, and in the second by 33%, then in the UK GDP has been losing billions of pounds in the last 4 years, in the first quarter this figure decreased by 2.2%, and in the second it may lose 20.4%. You will agree that this is also a very large figure, although not as huge as in the United States. But at the same time, we should not forget that the fate of the American economy is in the hands of the White House. If the US government makes the right decisions, the epidemic can be stopped and the economy restored. But this judgment cannot be applied to the UK. Since there will be no "deal" with the European Union with almost 100% probability, and not because Boris Johnson or David Frost are bad diplomats, but because London simply does not want to sign a comprehensive agreement with Brussels. London does not want to make mutual concessions. London does not want to remain dependent on the European Union. Thus, Boris Johnson, who was initially ready to take the country out of the EU through a "hard" Brexit, has not changed his position at all now. Personally, the Prime Minister is not afraid of this option, but he is afraid of the Bank of England, Andrew Bailey and all the economists and businessmen of the Foggy Albion. Because everyone understands that if the UK suffers losses of 70-100 billion pounds annually since 2016 due to Brexit, then after December 31, 2020, when Brexit will be officially completed, and there will be no trade deal with either the European Union or the US, this will be another stronger blow to the British economy. Thus, from our point of view, the British economy will certainly begin to recover in the third and fourth quarters, but the recovery will be weak, and in 2021, there may be a slowdown in the growth rate of the economy. And this is all in a favorable epidemiological situation in the country. If there is a second "wave" of the pandemic, then a new quarantine, a new "lockdown" will be possible. And if the British government is as selfish as in the US, and does not introduce a new quarantine, then this will not save the economy much. An example is America at this time. At the same time, the situation across the ocean does not change at all. The pandemic in America is slowing down a little, but we can not yet say that the wave of the epidemic is coming to an end. Every day, at least 60,000 cases of diseases are recorded in the United States. Donald Trump, on whom much depends now, continues to conduct polemics and try to "whiten" his reputation. In particular, the US president announced this weekend that China is to blame for high unemployment. "Pelosi and Schumer blocked the necessary unemployment payments. This is so terrible, especially given that they know for sure that it's not the fault of the workers, it's the fault of China!"- Donald Trump wrote on Twitter, not forgetting to "take a ride" on the Democrats. At the same time, there were 14 cases of "coronavirus" among US congressmen and senators. Based on all the above, it follows that the British pound should stop rampant growth in the near future, because the fundamental background in the UK is now no better than in the United States. At the same time, technical factors also remain extremely important. and they do not yet indicate in favor of changing the trend to a downward one. Thus, we still recommend considering trading for an increase until the pair's quotes are fixed below the moving average. This week, an important event will finally happen in the UK - the meeting of the Bank of England. However, as with the Fed, no changes in monetary policy parameters are expected by traders, so it is unlikely that the reaction to this event will be strong. However, the speech by Bank of England Governor Andrew Bailey may have an impact on market sentiment. In any case, do not lose sight of this event. Also recently, we often talk about the publication of the report on GDP in the UK for the second quarter, but it is planned only for August 12, that is, not even for this week. As for the United States, the topic of "coronavirus" will continue to be in the first place, which will be supplemented by data on mass riots. Also on Monday and Tuesday, British Foreign Trade Minister Liz Truss plans to meet with US trade representative Robert Lighthizer and hold talks on a future free trade agreement, but, as Truss says, no one is going to rush the negotiations, and there is no clearly set schedule.

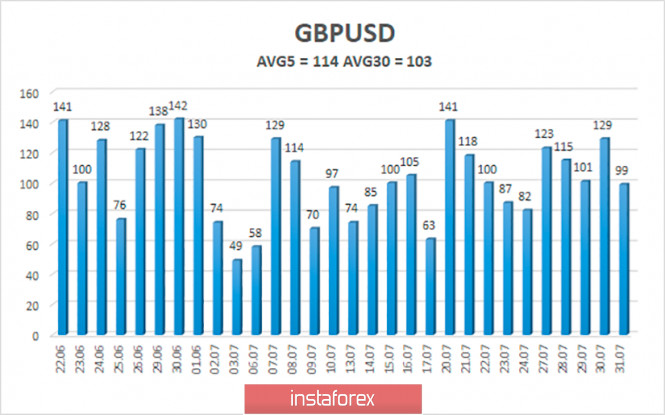

The average volatility of the GBP/USD pair continues to remain stable and is currently 114 points per day. For the pound/dollar pair, this value is "high". On Monday, August 3, thus, we expect movement within the channel, limited by the levels of 1.2967 and 1.3195. Turning the Heiken Ashi indicator upward will indicate the resumption of the upward movement of the pair. Nearest support levels: S1 – 1.3062 S2 – 1.2939 S3 – 1.2817 Nearest resistance levels: R1 – 1.3184 R2 – 1.3306 R3 – 1.3428 Trading recommendations: The GBP/USD pair started a correction cycle on the 4-hour timeframe. Thus, today it is recommended to wait for the completion of the correction and resume trading for an increase with the goals of 1.3184 and 1.3306. Short positions can be considered no earlier than fixing the price below the moving average with the first goal of the Murray level of "1/8" - 1.2817. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Aug 2020 05:06 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - upward. CCI: 31.4677 The US currency has fallen into the abyss in recent weeks at the rate of almost free fall. Such strong growth of the euro and the pound against the dollar has not happened for a long time. And given the fact that there has been no optimistic news in the European Union and the UK recently, then, as we have repeatedly said, the reason for the fall of the dollar is only the "4 crises" that are raging now in the United States. We have already written about them many times, as well as about the fact that the upward trend can be interrupted at any time. Last Friday, buyers took the first step towards completing the upward trend. A powerful pullback followed and now it is unknown whether traders will want to start buying euros and selling the dollar again? After all, despite the fact that it is now very difficult to find a sphere of life in America where everything would be in order, the euro currency has already risen quite significantly against the dollar. The American currency cannot fall forever! Therefore, we will not be surprised if the dollar rises this week, even though there are no fundamental reasons for this now. By and large, the past trading week ended as expected. The most interesting macroeconomic report on Friday was GDP in the Eurozone for the second quarter. It turned out that GDP declined by 12.1% in quarterly terms, which is approximately equal to the forecast of -12%. So we can't even say that the numbers were much worse than traders' expectations. The second most important report of the day – EU inflation for July – was even better than forecasts. Core inflation was 1.2% y/y with a forecast of +0.8%, and overall inflation was + 0.4% y/y with a forecast of +0.2%. Thus, we would even conclude that the euro currency had no fundamental or macroeconomic reasons to fall on this day. However, the euro/dollar pair absolutely needed to adjust. And this correction has been brewing for a long time. The chief newsmaker of recent months and years, Donald Trump, again came under massive criticism from the media. After it became known that the American economy shrank by 33% in the second quarter, which has never happened in the history of the United States, the American president immediately came under a barrage of criticism. In principle, this is logical when the head of state not only rests on his laurels when everything is good in the country, telling people left and right that it is his merit, but also takes responsibility for what is happening when the country is in crisis. Trump, of course, is unlikely to take responsibility for all the types of crises that now exist in the United States, however, the Americans have put the responsibility for what is happening on Trump and the government as a whole. And this is normal and logical. The government is to lead the country. If the results are bad, then the government needs to change. At least in democratic countries, this is true, and the US proclaims itself a democratic country. Thus, the conclusion is self-evident. Trump needs to go. And a chain of inferences, which now sits in the minds of Americans is as simple as ever: Trump has a fight with China - China "took revenge" on the United States with a "coronavirus" - even if there was no targeted revenge, the US government has "missed" all the preparations for the epidemic and are unable to respond effectively - in Europe, they managed to stop the first "wave" - in the United States, no - the EU GDP (for example) decreased by 12% in the second quarter - in America, by 33% - unemployment in the EU increased just a few percent - in the United States, at 7-8% by conservative estimates - the new "wave" of COVID-2019 may lead to new consequences for the economy, even more finishing it - who is responsible for all this? The answer is obvious. But even this is not the most interesting thing. The most interesting thing is how Trump is trying to "whitewash" himself, to prove to the American people that he is not to blame for everything that is happening, and most importantly – to be re-elected for a second term. Some respected media outlets with a global reputation have noticed interesting patterns in Trump's behavior. As soon as any significant event happens in the United States that "casts a shadow" on the president, the president himself immediately makes a loud statement to distract the attention of the people from negative news. For example, Trump got in touch with a proposal to postpone the presidential election 19 minutes after the Bureau of Statistical Information published -33% of GDP. Earlier, Trump began to inflate the baseless case of "Obamagate", accusing Joe Biden, Barack Obama and other Democrats of dishonest play in the 2016 election, saying they did not want his victory and put all their forces "sticks in the wheels", despite the fact that no evidence of their words. Then, the number of deaths from the "coronavirus" crossed the 80,000 mark. And even if this is a pure coincidence, and Trump's proposal to postpone the election is serious, it does not add points to the president's karma, because his proposal was immediately criticized by everyone, even Republicans, who said that never before in the history of the United States has a presidential election been postponed. In general, "American circus" continues and it is unclear how it can end. Thus, at the moment, we would say that the US currency has no prospects. Nevertheless, they are there. First, the technical ones. Almost non-stop growth continued on July 1, that is, exactly a month. During this time, the euro rose by 7 cents. For comparison, for the entire 2019 year, with a favorable fundamental background for the dollar, this currency has grown by 2 cents. Thus, traders can expect 200-300 points of correction. Then, secondly, all the current negative fundamental and macroeconomic background has already been played out. It is clear that the longer the epidemic persists in the US, the longer the mass riots continue, the more Trump will "bury" his chances of reelection thanks to absolutely opaque actions and statements, the more likely it is that the fall of the US currency will continue. However, we still believe that first there should be these very reasons for new sales of the US currency. Thus, as long as the price is above the moving average line, we continue to recommend trading on the trend no matter what. It is recommended to consider seriously selling the pair only after overcoming the moving average. But at the same time, we must understand that a correction of 200-300 points down is now very likely. So we must be ready for this option.

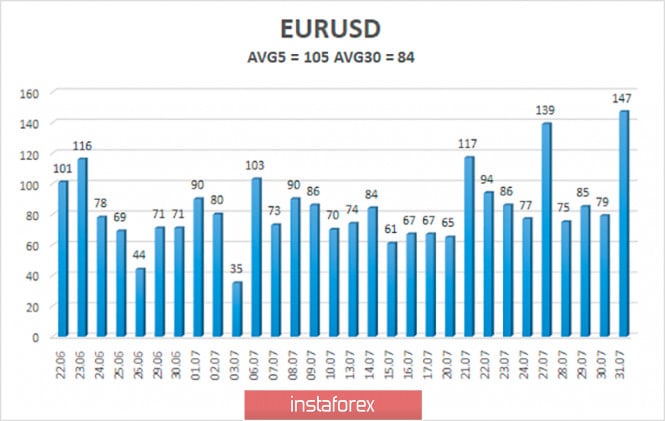

The volatility of the euro/dollar currency pair as of August 3 is 105 points and is now characterized as "high". Thus, we expect the pair to move today between the levels of 1.1673 and 1.1883. The upward reversal of the Heiken Ashi indicator signals the end of the downward correction within the ascending trend. Nearest support levels: S1 – 1.1719 S2 – 1.1597 S3 – 1.1475 Nearest resistance levels: R1 – 1.1841 R2 – 1.1963 Trading recommendations: The EUR/USD pair has started a long-awaited round of corrective movement. Thus, at this time, it is recommended to continue to consider the possibility of opening purchases with the goals of 1.1841 and 1.1883, but to do this, you need to wait for the Heiken Ashi indicator to turn upward. It is recommended to open sell orders no earlier than when the pair is fixed below the moving average line with the first target of 1.1597. The material has been provided by InstaForex Company - www.instaforex.com |

| Dollar expected to strengthen at the start of the week Posted: 02 Aug 2020 02:20 PM PDT Last week EURUSD ended on Friday after profit taking by bulls and some Dollar buying as price pulled back from 1.19 to 1.18. After the break out at 1.14 EURUSD has risen more than 400 pips. There are signs of a coming Dollar bounce EURUSD pull back.

EURUSD is expected to pull back. Our first pull back target is at the 38% Fibonacci retracement at 1.1620. A sign, that will increase the chances of reaching 1.1620, is if price breaks below 1.17-1.1740 short-term support area. Medium-term trend remains bullish as long as price is above the consolidation area. This gives us hopes of a longer-term upward move above 1.2510. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Aug 2020 02:14 PM PDT USDCAD ended last week around 1.34 finding some support buyers at the end of it moving off the lows at 1.3330. Looking at the weekly chart we observe similar price action the last times USDCAD was trading between 1.33-1.34.

USDCAD has reacted bullishly three times to far at 1.33-1.3350 area. The second time the upward move was smaller than the first time. Last week we saw another weekly long-tail candlestick at 1.33-1.34 area. Expecting this week to start on a positive note for the Dollar, it is important to see if price breaks above 1.35-1.36 area for a bigger bounce. Failure to hold above .13330 will open the way for a move towards 1.30-1.2950. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Aug 2020 02:05 PM PDT EURUSD ended last week right on top of the major long-term resistance trend line and at important Fibonacci retracement level. As we explained in previous analysis when we were giving 1.18-1.1850 as target for the bounce, we also explained that this would be the most probable area to see the rally pause.

EURUSD is at a major inflection point. An initial rejection and pull back towards 1.17 is justified. However recovering 1.19 price and staying above 1.18 would be a major win for bulls that could put 1.2130 into play. Trend is bullish. There is no sign of a trend reversal. There are some signs that point to a corrective pull back and another buying opportunity but not at a major top. For now we consider each pull back as a buying opportunity as we could next see 1.2130 before breaking above 1.2510. 1.12 remains key support for the bullish scenario. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 02 Aug 2020 01:59 PM PDT Gold price ended the week at new all time highs at $1,974. Trend is clearly bullish as price is rising in a parabolic shape. It is not wise to go against this trend, but also I would be wise not to get overconfident. A pull back will come, but the long-term weekly break out is real.

Green line - expected path Gold price is breaking every resistance level it tests and continues to make higher highs and higher lows. Our last bullish signal was given at $1,830 and both $1,925 and $1,964 targets have been achieved. Our next target is at $2,010. The RSI is at overbought levels. A pull back is justified but I would not expect to see a major top forming. The upside in Gold has lots of potential as price has just broken to new all time highs. Unless we see a violent reversal below $1,600, I expect this up trend to continue over the coming months. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment