Forex analysis review |

- Hot forecast and trading signals for GBP/USD on September 2. COT report. Members of the Bank of England Monetary Committee

- Hot forecast and trading signals for EUR/USD on September 2. COT report. Euro reached the $1.20 level. This has not happened

- Overview of the GBP/USD pair. September 2. Negotiations on the relationship between Britain and the European Union can begin

- Overview of the EUR/USD pair. September 2. New factors of pressure on the dollar.

- EUR/USD. Assault on the 20th figure

- Analytics and trading signals for beginners. How to trade EUR/USD on September 2. Analysis of Tuesday trades. Getting ready

- Euro rapidly rises reaching highest level after two years

- Analysis of the GBP/USD pair on September 1. Pound continues to rise amid sharp decline on dollar demand in the market

- Analysis of the EUR/USD pair on September 1. Falling US Treasury yields decreases demand for dollar

- Evening review on September 1, 2020

- September 1, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- September 1, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- Global stock exchanges traded in multidirectional dynamics

- Bulls in the EURUSD pair are preparing for a breakdown of the 20th figure even against the background of deflationary risks

- AUDJPY bounced from (Intermediate) support, potential for a further rise!

- USDCAD testing downside confirmation , further drop expected !

- EURGBP is facing bearish pressure, potential reversal!

- EURGBP is facing bearish pressure, potential reversal!

- Daily Video Analysis: EURUSD High Probability Setup

- GBP/USD: plan for the American session on September 1

- EUR/USD: plan for the American session on September 1

- EUR/USD: plan for the American session on September 1

- USDCAD bears need to be very cautious as a bounce higher is highly probable

- USD suffers sharp losses

- Gold price recaptures key resistance showing signs of more upside to come

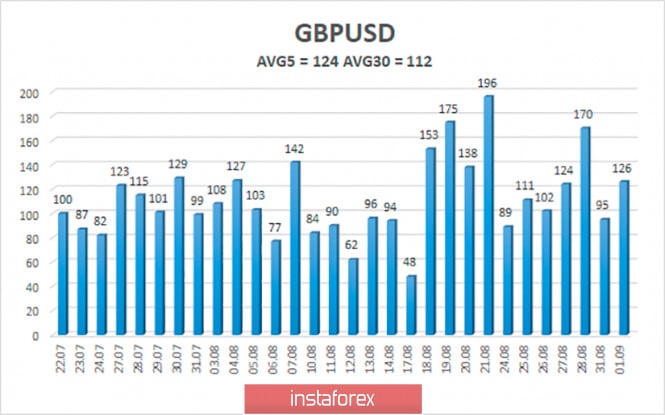

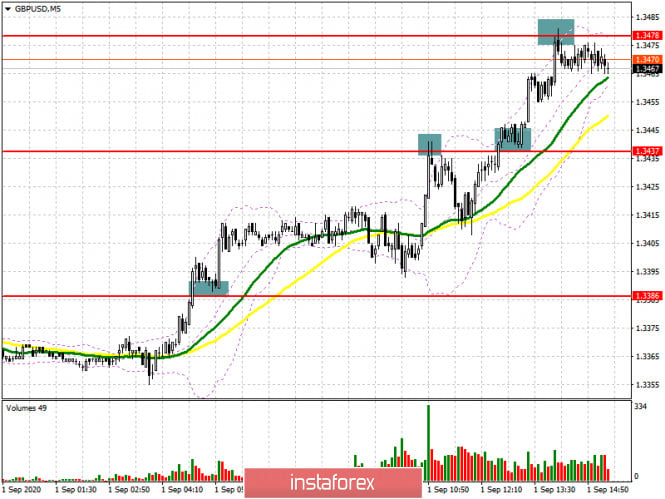

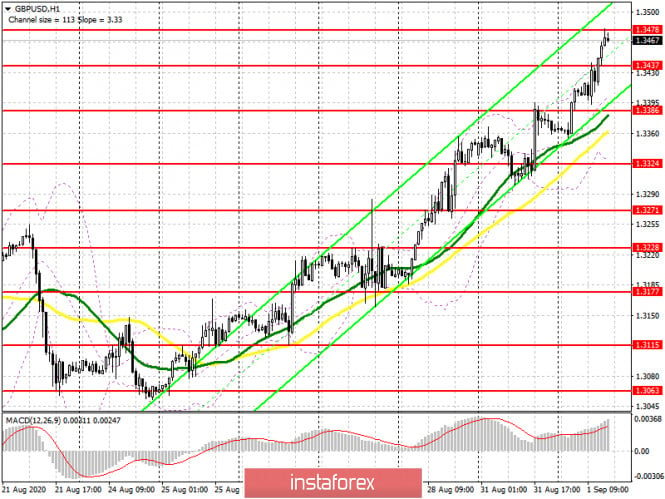

| Posted: 01 Sep 2020 07:09 PM PDT GBP/USD 1H The GBP/USD pair reached this week's first resistance level at 1.3451 on September 1 and then it began a new round of downward correction. Although this round may turn out to be the same as all the previous ones, which is very small. However, now traders have an ascending channel at their disposal, near the lower line of which they can expect to turn up and resume the path to growth. One way or another, there is still an upward trend within this channel. After a whole month of opportunities, the bears have gone back to rest and are not making any attempts to seize the initiative. It seems that the US dollar does not have much to count on as long as the bulls do not start taking profits on long positions again. GBP/USD 15M Both linear regression channels are directed upwards on the 15-minute timeframe. The latest Commitments of Traders (COT) report for the British pound, which was released last Friday, was completely neutral. Despite the fact that the UK currency resumed its growth against the dollar and continues to do so at the beginning of the new week, professional traders did not open new Buy-contracts during the reporting week of August 19-25. On the contrary, 9,700 Buy-contracts and 9,100 Sell-contracts were reduced. Thus, the net position for the non-commercial category of traders has slightly fallen. However, this change is so insignificant that it makes no sense to draw conclusions from it. Thus, the general mood of large traders remains the same. The last four trading days were not included in the latest COT report, and the British currency actually became more expensive again on such days. Thus, we can see a serious increase in the net position of non-commercial traders in the new COT report, which, in turn, will confirm the intention of large bulls to continue investing in the pound, while getting rid of the US dollar. The fundamentals of Tuesday, September 1, boiled down to a few reports from the UK and the US. We have already figured out that the ISM report for the US manufacturing sector supported the dollar in the afternoon. Prior to that, the UK published the PMI for the manufacturing sector, which showed the lowest decrease compared to July - 55.2, so traders did not react to it. This is where the important economic news concerning the pound or dollar ran out. The first place was taken by political, social, epidemiological problems, as well as general economic ones (such as falling yields on US government bonds or the absence of an agreement between Democrats and Republicans on a new package of financial assistance to the US economy). Members of the Bank of England Monetary Committee, Andrew Haldane and Ben Broadbent, are set to speak on Wednesday, September 2. The comments of the BoE board members may give us a peek on future changes in the monetary policy of the British central bank. In particular, everyone is interested in the answer to the question whether negative rates will be introduced in 2020 and whether the quantitative incentive program will be expanded even more. However, just like before, the general background from America will take precedence. We have already found out more than once that traders are not interested in the problems of Britain and the pound. Based on the above, we have two trading ideas for September 2: 1) Buyers have been active in recent days and are pushing the pair up again. At the moment, the price is still trading within the ascending channel, but the correction has begun. Thus, new long deals can be considered near the lower border of the channel or near the Kijun-sen line, with targets at the resistance levels of 1.3451 and 1.1355. Take Profit in this case will be from 65 to 165 points. 2) Bears have released the initiative from their hands again, thus, it is now recommended to consider short positions again after the price settles below the rising channel and the Kijun-sen line (1.3303) with the target of the support area 1.3156-1.3182. Take Profit in this case will be about 110 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

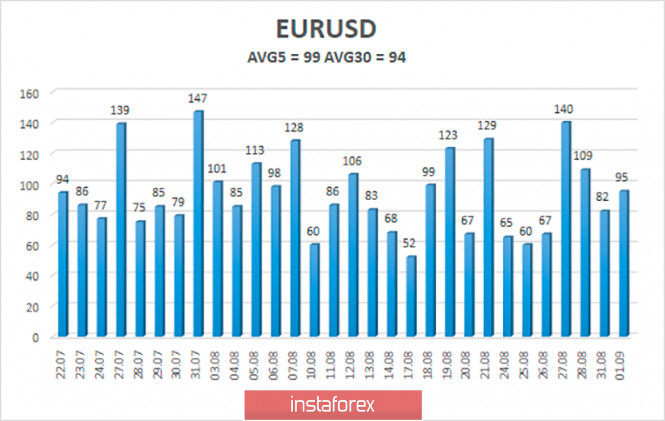

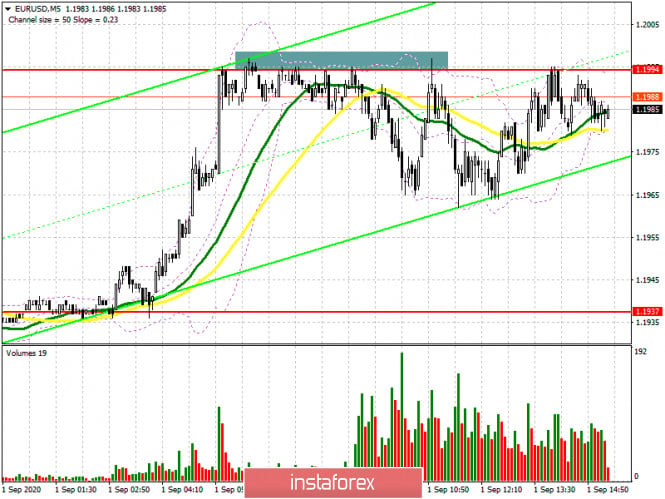

| Posted: 01 Sep 2020 07:08 PM PDT EUR/USD 1H The euro/dollar pair hit the psychological level of $1.20 on the hourly timeframe on September 1 and, rebounding off it, began to correct. However, given the general mood of market participants, the downward correction may not be too strong again. For example, there may be a rebound from the support area of 1.1885-1.1909, after which the upward movement will resume again. Thus, we recommend opening new long positions after rebounding from important supports or after overcoming important resistances. Unfortunately, there is still no upward trend line available to traders. More precisely, it can be built, but its angle would be too sharp of an inclination and will be broken literally by the first more or less significant correction. Thus, we believe that such a trend line does not make any sense. EUR/USD 15M Both channels of linear regression are still directed upwards on the 15-minute timeframe, signaling that there is no correction even in the most short-term plan. A new Commitments of traders (COT) report was released last Friday. Take note that its character has not changed at all compared to previous COT reports. Despite the fact that the euro/dollar has been trading within the side channel for more than a month, professional traders continue to increase their net position. In other words, the number of Buy-contracts for non-commercial traders (the most important group of traders) has been growing, while the number of Sell-contracts is decreasing. The non-commercial category of traders opened 1,302 Buy-contracts and closed 11,310 Sell-contracts during the reporting week of August 19-25. Thus, the net position (the difference between the number of Buy and Sell contracts) increased by 12,000. Therefore, we can draw the same conclusions as we did both a week ago and two weeks ago: professional traders continue to view the euro as a more attractive currency to invest in than the US dollar. The situation did not change during the last three trading days of last week, which were not included in the latest COT report, since the euro was still getting more expensive. The euro continues to grow at the beginning of the new trading week. Yesterday was the final day to be included in the new COT report, which will be released this Friday. Several rather important and interesting reports were published in the eurozone on September 1, Tuesday. However, as we assumed a day earlier, traders did not particularly react to any of them. Business activity indices in the manufacturing sectors of Germany and the EU remained practically unchanged in August compared to the previous month. The same can be said for the unemployment rate in Germany. In the European Union, unemployment rose to only 7.9% in July (forecast 8%), while European inflation slowed down to -0.2% y/y. In fact, deflation began in the eurozone - a fall in prices. The core consumer price index fell to 0.4% y/y. In general, you can consider the EU data as weak, but traders did not react to it in any way. A restrained reaction was only followed by the US ISM Manufacturing PMI, which rose from 54.2 to 56.0. The US dollar has risen in price by literally 60-70 points after this data was released. Today we recommend traders to pay attention to the ADP report on the level of employment in the US private sector for August. The strong value of the report may trigger new growth in the US currency. Based on the above, we have two trading ideas for September 2: 1) The bulls, having reached the 1.2000 level, began to take profits on long positions, which led to a correction. Nevertheless, buy orders remain relevant at this time (as long as the price is above the Kijun-sen line). Thus, we recommend looking for new buy signals. One of the possible options could be a rebound from the support area of 1.1885-1.1909 or the Kijun-sen line (1.1886), which will allow opening new longs with targets at 1.1961 and 1.2020. Take Profit in this case will be from 30 to 90 points. 2) Bears will have a new opportunity to start a new downward trend if they manage to gain a foothold below the Senkou Span B line (1.1860). In this case, we recommend opening short positions with targets at 1.1803 and the support area at 1.1705-1.1728. In this case, the potential Take Profit is from 40 to 110 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Sep 2020 05:58 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - upward. CCI: 79.5130 The British pound resumed the upward trend and continues to break all growth records. At the moment, this currency is close to two-year highs against the dollar and does not stop there for a second. There was no normal correction within the trend that started on June 29. We have repeatedly said that the British currency is too overvalued at this time (from our point of view), and the American currency is undervalued. Despite the huge number of problems in America, both economic and non-economic, we should not forget that the UK economy also contracted quite seriously in the second quarter. In addition, everything is heading towards "hard Brexit". This was the original idea of Boris Johnson, and he continues to stick to his plan now. The most interesting thing is that the European Union seems to have initially expected to conclude an agreement with London. However, seven rounds of negotiations, which ended in nothing, dispelled all myths and hopes about this issue. The latest comments from all those involved reflect utter demoralization. Michel Barnier has repeatedly accused London of not wanting to give in, and in his last comment, he said that "the negotiations are moving in the opposite direction". The French Foreign Ministry officially accused London of delaying the talks. Germany refused to hold new talks at the highest diplomatic level. Thus, it seems that the Kingdom and the Alliance will not just complete the "divorce" on December 31, 2020, but will also remain in a very difficult relationship. It is no secret that it is the UK that is less profitable to "divorce" without an agreement. The EU has a stronger economy and will more easily take the blow of diverging from Britain in different directions. Boris Johnson seems to have understood this from the very beginning. The British Prime Minister seemed to think that if you negotiate from a weak position, you will not be able to get any favorable agreement. So Johnson went the way of the bluff. He pretended that Britain is ready to terminate all agreements existing between the country and the bloc. And let the British economy suffer the most. On the one hand, his bluff was played, since now everyone believes that the UK will leave the EU without any agreement. On the other hand, the EU is also not making concessions, probably understanding what London is trying to achieve. Thus, in this situation, we believe that the parties will start new negotiations next year, when the "divorce" will be officially completed and everything can be started from scratch. Meanwhile, the States are preparing to approve the first American vaccine against the "coronavirus", without waiting for the completion of all the necessary tests. The head of the FDA in the United States, Stephen Hahn, said that the request for approval of a particular drug should come from the developer. "If the developer makes a similar request to us before the third stage of testing (large-scale human testing) is completed, we can approve the drug," Khan said. And in the same interview, Stephen Khan said that the approval of the new vaccine can not get under pressure from US President Donald Trump, who previously promised the vaccine to Americans until November 3. "This will not be a political decision," Khan said. However, we believe that this will be a "political decision". Trump, who just criticized the Russian vaccine a few weeks ago, which also did not pass all the necessary tests, can now praise and promote the American vaccine, similar to the Russian one. One of the main challenges in developing any vaccine is time. For example, large-scale human testing involves not only testing itself, but also identifying side effects and finding an answer to the question: is the vaccine suitable for all categories of people? It can take up to a year to collect this type of information, as many side effects can occur in a few months. Thus, a truly safe and effective vaccine should not be expected before 2021. Trump's haste is clear even to a child. The American President feels that he is losing the election, so he decided to focus on an issue that could turn the attitude of American voters on its head. We have little doubt that the coronavirus vaccine in America will be approved before November 3. As for the political ratings of Donald Trump, they remain very low, as for a candidate for a second term of the presidency. For example, a little more than two months before the election, the American magazine The Economist gives an 87% chance of winning Joe Biden and a 98% chance of winning the general vote. According to the magazine's analysts, Biden can get 340 votes, while 270 will be enough to win. Other forecasts of American publications also predict Biden's victory, although not so devastating. On average, Biden continues to outperform Trump in the ratings by 10-12%. From all of the above, it follows that the situation in the United States remains tense and does not improve, and does not change. However, things are not getting any more optimistic in Britain either. So we are very surprised to see how much the British pound is growing. However, the case is the euro currency. In the European Union, everything is relatively calm, GDP losses in the second quarter are relatively small (relative to American losses), and the "coronavirus" was still suppressed. But the British economy leaves many more questions unanswered. However, it is the US currency that continues to fall in price, and very much so. Thus, in the current situation, we continue to recommend traders to trade on the trend. The fundamental background does not speak clearly in favor of the pound, however, market participants continue to buy this currency. This is especially true for large market participants and non-commercial traders. Most likely, the new COT report will show a strong increase in the net position of the "Non-commercial" category. From a technical point of view, both linear regression channels continue to be directed upwards.

The average volatility of the GBP/USD pair is currently 124 points per day. For the pound/dollar pair, this value is "high". On Wednesday, September 2, therefore, we expect movement within the channel, limited by the levels of 1.3257 and 1.3508. A reversal of the Heiken Ashi indicator to the top will indicate a possible resumption of the upward trend. Nearest support levels: S1 – 1.3367 S2 – 1.3306 S3 – 1.3245 Nearest resistance levels: R1 – 1,.3428 R2 – 1.3489 R3 – 1.3550 Trading recommendations: The GBP/USD pair started a round of correction movement on the 4-hour timeframe. Thus, today it is recommended to wait for the completion of this correction and open new long positions with the goals of 1.3367 and 1.3428 after the reversal of the Heiken Ashi indicator upward. It is recommended to trade the pair down with the targets of 1.3184 and 1.3123 if the price returns to the area below the moving average line. The material has been provided by InstaForex Company - www.instaforex.com |

| Overview of the EUR/USD pair. September 2. New factors of pressure on the dollar. Posted: 01 Sep 2020 05:58 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - sideways. CCI: 46.4197 For almost a whole month, the EUR/USD currency pair was trading in a fairly narrow price range, which could not be clearly called either a flat or an upward trend. However, it seems that now this period and segment is over, and the price has again rushed up. Most analysts have long agreed that the US currency, despite all the types of crises that have engulfed the United States at this time, is highly undervalued. Yes, there are enough problems in America right now, however, we should not forget that the rest of the world also suffered from the pandemic and the "coronavirus crisis". The growth of the European currency by 12 cents in three months shows everything as if a revolution has already taken place in the United States, and the economy has collapsed. Thus, we continue to believe that the US dollar has lost enough in recent months and a strong correction is still brewing. However, the problem is that everything will depend on large traders, who may have their own decision-making logic. For example, one of the big problems for the US currency at this time is the fall in the yield of US government bonds. What does this mean in practice? Many countries (for example, China), many large investors, companies and banks prefer to keep their capital in the securities of stable states and strong economies. Thus, the fall in the yield of these very securities causes a drop in their attractiveness as an investment tool for international investors. Demand is falling, securities are sold, new ones are not placed, and accordingly, the demand for the US dollar is falling on the international market, since it is no longer needed in such quantities to buy new securities. Thus, in addition to the "four types of crisis" and the impending fifth, the United States now faces another new problem that may negatively affect the exchange rate of its national currency. The most interesting thing is that what is happening at this time is absolutely in the hands of Donald Trump. We are referring to the fall in the dollar. Recall that from the very beginning of his reign, Trump dreamed of a "cheap" dollar in order to more easily service the national debt and help national exporters. And now, at the end of his presidential term, when the national debt has grown to an unimaginable $ 30 trillion, inflated by several trillion dollars in just a year and may well continue to grow further, Trump's dream has come true. Will it help him in his desire and intention to be re-elected for a second term? In addition to the fall in US Treasury yields, the Fed has made various speeches over the past few days. It all started last Thursday with Jerome Powell, who did not say anything optimistic. He only said that now inflation in America will be allowed to grow above 2%. Everything would be fine, however, this level of inflation in the United States has not been seen for a long time. Thus, the decision to abandon targeting inflation at 2% is about the same as the statement: "We will tighten monetary policy as soon as GDP returns to pre-crisis levels and we can completely defeat the pandemic." It is obvious that in solving these two problems, it will be possible to tighten monetary policy, but when will this happen? At least in a few years. So it is with inflation. The fact that the Fed will now allow it to grow to 3% does not mean anything concrete. All the same, as before, the FOMC will decide whether to tighten monetary policy at this time or not. The performances at the beginning of the week by Raphael Bostic and Richard Clarida were overrated. In fact, the heads of the Atlanta-Fed and Deputy Jerome Powell also did not tell the markets anything super interesting. Clarida said that the Fed is not going to raise the key rate just because the unemployment rate has started to fall, but also does not intend to introduce negative interest rates, and also doubts the effectiveness of controlling the yield curve of government bonds. On the contrary, Raphael Bostic touched upon the topic of coronavirus in his speech, noting that high levels of morbidity in the United States slow down the economic recovery and create additional risks. Which of this information was not previously known to the markets? Thus, we believe that the fall in the US currency in the last few days is not directly related to the speeches of the Fed representatives. Most likely, their rhetoric only added to the overall unattractive picture of the current state of the US economy and its prospects for the coming months and years. Naturally, the factor of hopelessness of the American economy has further lowered the demand for the dollar and American government securities. It should also be recalled that mass rallies and protests continue in the States related to a new incident between the police and a black man, which ended with the shooting and serious injury of the latter. At least this time the whole country was not engulfed in mass riots. Meanwhile, the total number of recorded cases of "coronavirus" in the United States has exceeded 6 million. However, don't let this figure be misleading. It does not reflect the number of people who are currently being treated, but the total number of cases since the beginning of the pandemic for 6 months. Second, there has been a reduction in the number of new infections in recent weeks (according to data from Johns Hopkins University). For example, on August 30 and 31, 35 and 33 thousand people were infected in the country, which is twice lower than the values that were observed a month ago. Unfortunately, this factor does not yet provide any support to the US currency. Meanwhile, Donald Trump continues his election campaign, which is reduced to calling on his supporters to chant "Trump for another 12 years" and criticizing his main opponent, Joe Biden. This time, Trump said that "Biden is a very weak person and is controlled like a puppet." "If the radical left forces win, they will take control of your cities, it will be a real revolution," the current US President believes. Trump was also asked what kind of people controlling Biden is he talking about? "People you've never heard of. People who are in the shadows. People who control the protests in the streets," the American President responded, who never provides proof of his words.

The volatility of the euro/dollar currency pair as of September 2 is 99 points and is characterized as "high". Thus, we expect the pair to move today between the levels of 1.1824 and 1.2022. A reversal of the Heiken Ashi indicator to the top signals a possible resumption of the upward movement, as well as a rebound of the price from the moving average line. Nearest support levels: S1 – 1.1841 S2 – 1.1719 S3 – 1.1597 Nearest resistance levels: R1 – 1.1963 R2 – 1.2085 R3 – 1.2207 Trading recommendations: The EUR/USD pair started a downward correction. Thus, today you can continue to trade for an increase with the goals of 1.1963 and 1.2022, if the Heiken Ashi indicator turns upward or a rebound from the moving is performed. If the price is fixed below the moving average, it is recommended to trade lower with the goals of the Murray levels "5/8" and "4/8"-1.1841 and 1.1719. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. Assault on the 20th figure Posted: 01 Sep 2020 01:12 PM PDT The euro-dollar pair last traded in the area of 20 figures more than two years ago – in the early spring of 2018. Therefore, it is not surprising that EUR/USD buyers failed to overcome the psychologically important resistance level of 1.2000 the first time. As soon as the pair entered this price area, it immediately attracted sellers. At the same time, buyers began to take profits en masse, putting additional pressure on the pair. As a result, the EUR/USD bulls were forced to retreat to the bottom of the 19th figure. European inflation also did a disservice to traders (literally and figuratively), which significantly disappointed investors, turning out to be much worse than expected. Nevertheless, the pair still retains the potential for its growth – both from a technical point of view and from the point of view of the foundation, primarily due to the weak positions of the US currency. The transition of the US Federal Reserve to targeting average inflation is called a historical event - and it is difficult to disagree with this statement. The resounding speech of Fed Chairman Jerome Powell at the economic symposium is still following the greenback. After all, the new strategy of the US central bank allows the regulator to keep base rates at the current record low level for a longer period of time. Figuratively speaking, the Fed agreed to tolerate inflation at a level above two percent, while not tightening the parameters of monetary policy. Moreover, the 2% level still needs to be reached - with a weak growth in the level of wages, low consumer activity and a high level of unemployment. There is no consensus among experts, but many of them agree that the rate will remain at the current level at least until the end of next year. Such prospects disappointed investors, after which the US currency's appeal noticeably dropped. The dollar index serves as an eloquent illustration of the current situation: the indicator collapsed to 91.81 points, that is, to a two-year low. Against the background of such a fundamental picture, buyers of EUR/USD were able to emerge within the 20th figure today, reaching a price high of 1.2011. But they retreated almost immediately: firstly, traders did not dare to keep longs at such high positions, and secondly, European inflation, which turned out to be in the red zone was disappointing. Thus, the overall consumer price index in the eurozone unexpectedly collapsed into negative territory, reaching the level of -0.2%. At the same time, the overall forecast of inflationary growth was at +0.2%. Deflation in the eurozone was recorded for the first time since the spring of 2016. Core consumer price index (core inflation), which more clearly reflects consumer trends (therefore does not take into account volatile goods and basic necessities, such as food, tobacco, and fuel) also sharply slowed from a July reading of 1.2% to 0.4% in August. Analysts expected a slowdown in this component, but to this strong (namely to 0.8%). In other words, European inflation turned out to be even worse than the weak forecasts. This is a negative signal, but it can be associated with local outbreaks of coronavirus in some European countries (primarily in Spain, France and Germany). The increased risk of repeated lockdown forced Europeans to spend less and save more for a rainy day. These trends were reflected in the August CPI figures. Considering today's release, we can assume that the downward correction of EUR/USD will continue: buyers, as they say, have room to fall. The nearest support level is not located at the round mark of 1.1900, but at 1.1840 - this is the middle line of the BB indicator on the daily chart, which coincides with the Kijun-sen line. And yet, in my opinion, the pair will not go below the aforementioned target in the medium term. Traders are rightly concerned about the dynamics of European inflation, so today's correction looks quite logical. But at the same time, take note that the European Central Bank, unlike the Fed, did not change the inflation guidelines - this fact gives the euro an advantage over the dollar due to the long-term guidelines of the central bank. In addition, the dollar is still under an array of its own problems, including political ones. For example, US Treasury Secretary Stephen Mnuchin just accused Democratic lawmakers of unwillingness to "negotiate in good faith." Let me remind you that the representatives of the White House and representatives of the Democratic Party in Congress have not reached a compromise on the new stimulus package. Democrats in the House of Representatives approved more than $3 trillion for this purpose back in May, while the Republicans controlling the Senate presented a $1 trillion stimulus package. Democrats are blocking the adoption of the bill in the Lower House of Congress, while Republicans are blocking it in the Upper House. And here it is worth noting that Mnuchin has expressed optimism about the prospects for the negotiation process over the past months. Therefore, his recent pessimism surprised many - this means that the dialogue between political opponents has finally reached a dead end. Thus, at the moment, the EUR/USD bears can only afford a correction, since the fundamental problems of the dollar have not gone anywhere. Traders today simply did not take the risk of maintaining long positions amid slowing European inflation. The current price downturn can be used as a reason to open longs towards the main growth target in the medium term - the 1.2000 level. Moreover, we must not forget that August Nonfarm Payrolls data will be published on Friday, which may be in the red zone, given the increase in the number of initial applications for unemployment benefits. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Sep 2020 10:02 AM PDT EUR/USD hourly chart On Tuesday, September 1, the EUR/USD pair has finally reversed to the downside and settled below the upward trend line. However, as we have mentioned earlier, the uptrend line had a very strong decline. Therefore, almost any correction would lead to consolidation of the quotes below this line. This is exactly what happened today. First, the MACD indicator turned downward, giving a signal to all buyers to close long positions. Then, the price passed the trend line, so it was possible to open short positions. Even though the pair is going through a correction, it can still move down by a certain number of pips. The price passed the ascending trend line just as the downward movement started, and not when it ended. In this case it would be too late to open sell positions. Thus, we think that beginners had the right moment to open sell positions today, since the signal was quite obvious. In the morning, we set the downward target at the level of 1.1891. We believe that the price can reach this target today or tomorrow. Thus, if you opened the trades at the cross point with the trend line, you can leave them open until the morning by placing Stop Loss. There were a lot of macroeconomic events on Tuesday. However, as we warned yesterday evening and this morning, only the US ISM Manufacturing PMI influenced the pair's trajectory. The data exceeded the forecasts and amounted to 56 points. Apart from this index, it is worth mentioning the drop in the EU inflation rate in August. According to preliminary estimates, it is seen to decline to -0.2% year-on-year. This actually indicates deflation - a fall in prices - rather than inflation. It is believed that controlled inflation within 2-3% spurs the economic growth. Therefore, deflation is a very dangerous phenomenon for countries with developed economies. This is definitely bad news for the EU and the euro. That could be the reason of the weakening euro on Tuesday, as the estimated and the released readings differ sharply. On Wednesday, September 2, no key economic statistics are expected. We can advise novice traders to focus their attention on the ADP report on the change in total private employment data. This report and the NonFarm Payrolls, the number of new jobs created outside the agricultural sector, are believed to represent the real state of the labor market. And a stable labor market is one of the most important conditions for economic growth. In case with the US, it will reveal the pace of economic recovery from the pandemic. Thus, a reading higher than 950,000 could trigger more buy positions on the US currency. Other economic reports are unlikely to cause any serious fluctuations in the market. Possible scenarios for September 2 1) We do not recommend that beginners place buy positions on the pair at this time, since the pair has already consolidated below the uptrend line. So, the trend has now reversed to the downside. In the near future, the pair may still resume its uptrend, and the ascending line will change its position to a less steep decline. Thus, those who want to open buy deals should closely monitor the price movements. 2) Sell position look more relevant now. But as we mentioned above, the overall weak demand for the US currency and the possible resumption of the uptrend with a change in the trend line may cancel the downtrend movement. In any case, novice traders can leave their short positions open for now with the target at 1.1891. Once the MACD indicator turns upwards, you can close short deals. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid sharp price fluctuations. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| Euro rapidly rises reaching highest level after two years Posted: 01 Sep 2020 08:22 AM PDT

The euro rapidly went up on Tuesday morning which allowed it to quickly reach the highest levels over the past two years. The reason for this enthusiasm was mainly due to the rise in the stock markets of the region, which in turn occurred against the background of positive statistics on the growth of the European economy. Market participants were caught between two fires. On the one hand, they were cheered by clear signs of a gradual recovery in the economic development of the European region after the crisis associated with the impact of coronavirus infection. On the other hand, they were pressed by fears that the governments of European states intend to curtail the main package of aid provided in order to support the economy, which found itself in a difficult situation. Initially, the euro managed to reach a record high of $ 1.1999. Note that the pair ended at $ 1.1936 during the previous trading. This makes Tuesday's leap the highest in more than two years. However, it did not manage to go beyond the $ 1.20 mark, which may indicate an option barrier. Nonetheless, there are also positive aspects in this: after some correction, this barrier will be overcome, which means that the growth of the euro will continue in the near future. In general, the euro is facing rather favorable times at present. This is primarily due to the rather aggressive new policy of the US Federal Reserve System. After the regulator announced the move to targeting average inflation in order to improve the country's employment sector, it had more leeway to act to keep interest rates at record lows for an extended period. Of course, this played a cruel joke with the US dollar, which is already experiencing difficulties and is now under enormous pressure. The bearish trend in relation to the dollar is now more relevant than ever, which means that the euro has good support. Meanwhile, Democrats and Republicans cannot agree on a new portion of incentives for citizens of the country who have lost their jobs. The disputes in this matter erupted with renewed vigor leaving the Democrats to start accusing their opponents of deliberately delaying the entire process. There is nothing left but to close the federal government on October 1 due to the impossibility of making a single decision on the issue. Foreign exchange market participants are already tense in anticipation of the ratification of this aid program, and now they are completely confused. Most analysts are confident that the euro has no choice but to continue its rapid rise further. This means that the foreign exchange market may witness another rally of the euro, which may lead to new record levels. The material has been provided by InstaForex Company - www.instaforex.com |

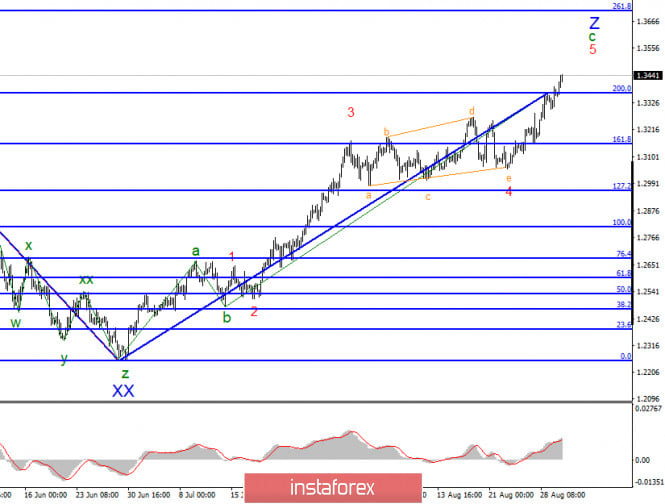

| Posted: 01 Sep 2020 08:18 AM PDT

The wave pattern of the upward trend is actually completed already, but the recent situation in the market, that is, high demand for pound and weak demand for dollar, has led to a more complicated wave structure in the chart. Thus, Wave Z can become even more complex, and it will adjust depending on dollar demand in the market. If demand for the dollar continues to decrease in the near future, price will continue to rise up to the 40th figure.

However, if we take a closer look at the current wave pattern, we will see that wave Z has already significantly lengthened in terms of structure, as was wave 4, which has taken the form of a triangle. In addition, the GBP/USD pair has successfully broken through the 200.0% Fibonacci level, which indicates that the market is ready for long positions with targets near the 261.8% and 323.6% Fibonacci levels. In another note, the latest news in the United Kingdom centered on the failed negotiations between London and Brussels, during which EU officials have accused London of not wanting to compromise with regards to Brexit. Nonetheless, the pound remains trading upwards in the market, and this is largely due to weaker demand for the US dollar caused by much bigger problems in the United States. General conclusions and recommendations: Wave Z continues to form in the GBP/USD pair, thus, long positions to 1.3709 and 1.4055, which corresponds to 261.8% and 323.6% Fibonacci, are suggested. The material has been provided by InstaForex Company - www.instaforex.com |

| Analysis of the EUR/USD pair on September 1. Falling US Treasury yields decreases demand for dollar Posted: 01 Sep 2020 07:35 AM PDT The wave pattern in the EUR / USD pair remains unchanged, but if we look closely at the upper part of the structure, we will see that movement continues to build up, thereby making the pattern more complicated, especially amid decreasing dollar demand in the market. The previous wave also assumes a decline to the 15th figure, while the new wave suggests an increase to about 21 pips above. Meanwhile, the pattern on the lower time frames indicates that wave 3 or C has resumed its construction, and this is clearly depicted by the successful breakout of the quotes from the highs reached the day before. Thus, wave 4 that is inside the pattern has taken an "a-b-c-d-e" structure, and wave 5 is starting to form in the chart as well. Keep in mind though that the current wave pattern is not final at all, as its structure could become more complex as time passes by. Everything will depend on the demand for the US dollar, as it is now the main reason why the euro and the pound is rising in the market. In particular, the recent statements made by the Federal Reserve have greatly impacted currency tradings in the market. Not only did the revisions on monetary policy decrease demand for the US dollar, but the sharp drop in US Treasury yields have contributed as well. In addition, Fed officials remain concerned about the situation with the coronavirus, since the pandemic continues to negatively affect the pace of economic recovery. In fact, the Fed's capabilities are not limitless, and if the virus is not defeated yet in the coming year, the US central bank may be deprived of the ability to support the country's economy and its liquidity. General conclusions and recommendations: Wave 3 or C continues to form in the EUR/USD pair, thus, long positions to 1.2089, or 323.6% Fibonacci are suggested. An unsuccessful breakout from this mark may suggest the completion of the entire wave 3 or C, but, as mentioned above, this wave can become infinitely more complicated, depending on the demand for the US dollar in the market. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review on September 1, 2020 Posted: 01 Sep 2020 07:19 AM PDT

EURUSD: The US ISM manufacturing index came today at 56% which was slightly better than the 54% preliminary forecasts. The euro is slowly put under pressure due to the recent improvements in the current situation of the dollar. You may consider buying euros from 1.1905, with the target at 1.2360. The material has been provided by InstaForex Company - www.instaforex.com |

| September 1, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 01 Sep 2020 07:16 AM PDT

Transient bearish breakout below 1.2265 (consolidation range lower limit) was demonstrated in the period between May 13 - May 26. However, immediate bullish rebound has been expressed around the price level of 1.2080 bringing the GBP/USD back towards 1.2780 (Previous Key-Level) where another episode of bearish pullback was initiated. Short-term bearish movement was expressed towards 1.2265 where Significant bullish rejection was originated bringing the GBP/USD pair back towards 1.2780 where this key-level failed to offer enough bearish rejection. Intermediate-term Technical outlook for the GBP/USD pair remains bullish as long as bullish persistence is maintained above 1.2780 (Depicted KeyLevel) on the H4 Charts. On the other hand, the pair looks overbought after such a quick bullish movement while approaching the current price levels.Hence, upcoming bearish reversal shouldn't be excluded provided that sufficient bearish reversal signs are expressed around the current depicted pattern upper limit. Trade recommendations : Intraday traders are advised to look for signs of bearish rejection around the current price levels (1.3440) as a valid SELL Entry. Initial T/p level is to be located around 1.3300, 1.3200 and 1.3100. On the other hand, bullish persistence above 1.3450 invalidates this trading scenario. The material has been provided by InstaForex Company - www.instaforex.com |

| September 1, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 01 Sep 2020 07:15 AM PDT

On May 14, the EUR/USD has expressed evident signs of Bullish rejection as well as a recent ascending bottom around the price zone of (1.0815 - 1.0775).Thus, enhancing the bullish side of the market in the short-term. Bullish breakout above 1.1000 has enhanced further bullish advancement towards 1.1150 then 1.1380 where another sideway consolidation range was established. The EURUSD pair has failed to maintain enough bearish momentum below 1.1150 (consolidation range lower zone) to enhance further bearish decline. Instead, the current bullish breakout above 1.1380-1.1400 has lead to a quick bullish spike directly towards 1.1700 (Fibonacci Expansion 150% level) which failed to offer sufficient bearish pressure. Bullish persistence above 1.1700-1.1760 favored further bullish advancement towards 1.1975 (200% Fibo Expansion Level) where some considerable bearish rejection has been demonstrated. The price zone around 1.1975-1.2000 ( upper limit of the technical channel ) remains a strong SUPPLY-Zone to be watched for bearish reversal. However, Conservative traders should be waiting for bearish re-closure below 1.1700. As this indicates lack of bullish momentum and enhances further bearish decline initially towards 1.1600 and 1.1500. Trade recommendations : Conservative traders should wait for the current bullish movement to pause and get back below 1.1700 as an indicator for lack of bearish momentum for a valid SELL Entry.T/P levels to be located around 1.1600 and 1.1500 while S/L to be placed above 1.1760 to minimize the associated risk. The material has been provided by InstaForex Company - www.instaforex.com |

| Global stock exchanges traded in multidirectional dynamics Posted: 01 Sep 2020 07:02 AM PDT

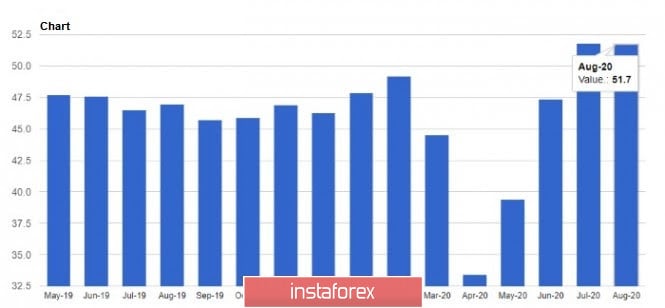

US stock exchanges ended Monday's trading with multidirectional dynamics. The Dow Jones Industrial Average and Standard & Poor's 500 indicators showed negative dynamics, while the Nasdaq Composite, on the contrary, showed good growth which allowed it to reach its record value and update it for the forty-first time this year. The Dow Jones index fell 0.78% or 223.82 points, which moved it to around 28,430.05 points. The Standard & Poor's 500 index decreased by 0.22% or 7.7 points. Its current level is at around 3,500.31 points. The Nasdaq Composite Index, on the contrary, became the only one that was in positive territory at the end of Monday's trading after gaining 0.68% or 79.82 points, which moved it to 11,775.46 points. The dynamics of the Dow Jones for the month of August came out quite good adding 7.6%. The S&P 500 also rose 7% which is its best monthly gain in thirty-five years. Nasdaq became took the lead in growth with a 9.6% gain over the last month of the summer, which also became its record increase over the past twenty years. If we evaluate the dynamics of the growth of indicators over the last five months, then great results were also recorded here. The Dow Jones gained 29.7% from March to August. Such growth has not been observed in eleven years. The S&P 500 jumped 35.4%, breaking a record for over eighty years. The Nasdaq index showed the most outstanding results gaining 52.9% in five months. The main wave of positive emotions in the stock market is associated with the expectations of the release of a vaccine against coronavirus infection, which gives participants hope that the pandemic may end soon. This news was supported by the speech of the head of the US Federal Reserve System. The new flexible inflation targeting policy is favored by the investors since it maintains stimulus measures for an extended period, and also makes the fight against unemployment the main task of the entire monetary policy of the country. Asian stock exchanges, on the other hand, traded in a green zone on Tuesday which was mostly swayed by the positive statistics from China. The PMI index in China's industrial production sector in the last month of summer reached its highest values in the previous nine years. This happened due to the rapidly growing demand for goods in this sector, both within the country and abroad. The indicator rose to 53.1 points, while earlier it stopped at around 52.8 points, which was already good, since the value is above the 50 point level, which indicates an increase in business activity. Experts' preliminary forecasts were more modest with an expected increase of 52.6 points. Note that the indicator has been above 50 points for four consecutive months. The sub-indices, reflecting production and the number of new orders for the last month of summer, also showed growth. In addition, for the first time in the current year, an increase in the number of export orders was recorded in the sector. However, problems were also not avoided. The index showing employment is still consolidating below the strategically important mark of 50 points, which indicates a decline in this section, which has been happening for eight consecutive months. Nevertheless, most analysts perceived the new statistics from China as a signal for an active recovery not only of a single sector but of the country's economy as a whole. Especially that the growth in supply followed an increase in foreign demand for Chinese-made goods. Japan's Nikkei 225 index remained in almost the same condition as it was on the previous day. However, the country's statistics is not so positive. Unemployment in the second month of the summer increased by 2.9%, which was not a significant rise since the previous figure was at around 2.8%. One way or another, these numbers are the highest over the past three years. Analysts, however, expected an increase of 3%. China's Shanghai Composite index slightly went down by 0.06%. The Hang Seng index of Hong Kong did not support this trend and increased by 0.04%. South Korea's Kospi Index rose decently at 1.06%. The Australian S & P / ASX 200, on the contrary, has significantly lost ground which fell 1.77%. As initially expected, the country's main regulator decided not to change the interest rate upward and left it at the same, record low level of 0.25% per annum. However, the Reserve Bank has made the mechanism for financing small and medium-sized businesses for a period of three years even larger with an increase of $ 200 billion. So far, Australian authorities are happy with the way the state's economic recovery is going against the backdrop of the coronavirus crisis. In their opinion, the recession was not as serious as previously assumed, which means that the recovery process will be easier too. Meanwhile, there are no uniform dynamics on the European stock exchanges on Tuesday as the main stock indicators have diverged on different sides. The reason for this should be sought in the publication of a new portion of statistics. Consumer prices in the European region decreased by 0.2% on an annualized basis, which came as a complete surprise to experts. This result was recorded for the first time in the last four years. Preliminary data reflected an increase of 0.2%, which ultimately never happened. The unemployment rate in the nineteen states of the region in the second month of summer was around 7.9%, which is the highest value for the last two years. The growth is still due to the impact of the COVID-19 pandemic. Meanwhile, analysts are expecting the worst result with an unemployment rate of 8%. The general index of large enterprises in the European region Stoxx Europe 600 increased by 0.23% and moved to the level of 367.34 points. The UK FTSE 100 index fell quite significantly by 1.01%. Spain's IBEX 35 index sank slightly by 0.06%. On the other hand, the German DAX index strengthened its position and increased by 0.69%. France's CAC 40 followed suit and gained 0.15%. Italy's FTSE MIB Index is up 0.38%. In general, according to the results of the last month of summer, the main indicators of the EU showed positive dynamics. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Sep 2020 06:57 AM PDT Buyers of risky assets in the EURUSD pair continue to knock on the 20th figure, and it seems that they are about to be able to form a breakout. This scenario is only a matter of time, so just be patient. From a technical point of view, the picture has not changed in any way, and the morning tasks have not been implemented. The bulls are clearly aimed at breaking the 20th figure. Another question is whether buyers of risky assets will be able to hold this level. If this happens and the bulls occupy the area of 1.2020, we can expect the upward trend to continue in the area of the highs of 1.2080 and 1.2140. It will be possible to talk about a break in the current upward pattern only if the bears regain the support area of 1.1935. This scenario will lead to a larger downward correction to the area of the 1.1885 minimum, and then to the test of the level of 1.1810. Today's data on inflation did not scare off buyers of risky assets, although it turned out to be worse than economists' forecasts, signaling its reduction. It is already clear that the August data on inflation in the Eurozone fell significantly short of expectations. This indicates the likelihood of an increase in deflationary factors that are echoes of the coronavirus pandemic. This fact will not be ignored by the European Central Bank, which will avoid tightening financial conditions for a long time. If inflationary pressures continue to ease in the autumn, the European regulator will probably resort to expanding and extending the emergency asset purchase program in the context of a pandemic (PEPP). However, we should not forget that many countries affected by the coronavirus will soon be able to use the newly created EU economic recovery fund. Therefore, in the short term, the ECB will not feel much pressure due to the decline in prices, which was clearly inevitable after a sharp increase in the early summer of this year, when the quarantine measures were lifted. According to the data, the consumer price index (CPI) of the Eurozone in August 2020 decreased by 0.2% compared to the same period of the previous year, after an increase of 0.4% in July. Economists had expected the index to grow by 0.2%. Even though global oil and food prices have recovered, this has not led to the deflationary pressures caused by the pandemic. The question is whether core inflation will also slow significantly. If so, this will lead to more decisive steps on the part of the European Central Bank in terms of easing monetary policy. It is not far from another reduction in negative deposit rates. Today, a number of reports on activity in the manufacturing sector of the Eurozone countries were also published. In general, there is order, and there is no significant slowdown in the growth of activity. For example, in Italy, the purchasing managers' index (PMI) for the manufacturing sector in August was 53.1 points against 51.9 points in July, while it was forecast at 52.0 points. In France, the same index for the manufacturing sector in August fell below 50 points, to 49.8 points, indicating a reduction in the activity. Back in July, it was 52.4 points. In Germany, things are quite calm - the index rose to 52.2 points in August. This spread of indicators across other Eurozone countries also led to a slight decline in the overall purchasing managers' index (PMI) for the Eurozone manufacturing sector in August to the level of 51.7 points against 51.8 points in July. The material has been provided by InstaForex Company - www.instaforex.com |

| AUDJPY bounced from (Intermediate) support, potential for a further rise! Posted: 01 Sep 2020 06:05 AM PDT

Price holding above moving average and ascending trendline support. A further push up above intermediate support at 78.091 towards 1st resistance at 78.462 can be expected. As long as price holds above 1st support, bullish idea remains intact. Trading Recommendation Entry: 78.091 Reason for Entry: 38.2% Fibonacci retracement, ascending trendline support Take Profit: 78.462 Reason for Take Profit: Graphical swing high Stop Loss: 77.865 Reason for Stop Loss: 61.8% Fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

| USDCAD testing downside confirmation , further drop expected ! Posted: 01 Sep 2020 06:04 AM PDT

Price is facing bearish pressure from our downside confirmation, where we could see a further drop towards 1st support at 1.2930 if price breaks below downside confirmation at 1.3005. Ichimoku is also indicating more bearishness to come. Trading Recommendation Entry: 1.3005 Reason for Entry: 100% fib extension Take Profit :1.2930 Reason for Take Profit: 161.8% fib extension Stop Loss: 1.3051 Reason for Stop loss: Horizontal overlap resistance The material has been provided by InstaForex Company - www.instaforex.com |

| EURGBP is facing bearish pressure, potential reversal! Posted: 01 Sep 2020 06:04 AM PDT

Price is facing bearish pressure from our first resistance, in line with our descending trend line, horizontal swing high resistance, 61.8% fibonacci extension and 78.6% fibonacci retracement where we could see a reversal below this level. The Ichimoku cloud is showing signs of bearish pressure in line with our bearish bias. A break below our downside confirmation level could provide the bearish acceleration to our take profit target. Trading Recommendation Entry: 0.89572 Reason for Entry: descending trend line, horizontal swing high resistance, 61.8% fibonacci extension and 78.6% fibonacci retracement Take Profit: 0.89090 Reason for Take Profit: Horizontal swing low support Stop Loss: 0.89770 Reason for Stop Loss: Horizontal swing high resistance The material has been provided by InstaForex Company - www.instaforex.com |

| EURGBP is facing bearish pressure, potential reversal! Posted: 01 Sep 2020 06:03 AM PDT

Price is facing bearish pressure from our first resistance, in line with our descending trend line, horizontal swing high resistance, 61.8% fibonacci extension and 78.6% fibonacci retracement where we could see a reversal below this level. The Ichimoku cloud is showing signs of bearish pressure in line with our bearish bias. A break below our downside confirmation level could provide the bearish acceleration to our take profit target. Trading Recommendation Entry: 0.89572 Reason for Entry: descending trend line, horizontal swing high resistance, 61.8% fibonacci extension and 78.6% fibonacci retracement Take Profit: 0.89090 Reason for Take Profit: Horizontal swing low support Stop Loss: 0.89770 Reason for Stop Loss: Horizontal swing high resistance The material has been provided by InstaForex Company - www.instaforex.com |

| Daily Video Analysis: EURUSD High Probability Setup Posted: 01 Sep 2020 06:02 AM PDT Today we take a look at EURUSD. Combining advanced technical analysis methods such as Fibonacci confluence, correlation, market structure, oscillators and demand/supply zones, we identify high probability trading setups. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: plan for the American session on September 1 Posted: 01 Sep 2020 06:01 AM PDT To open long positions on GBPUSD, you need to: It is very rare to see so many transactions in the pound as it was this morning. Both buyers and sellers could earn money on the market today. Everything was clear on the levels and on the trading system. Let's figure it out. If you look at the 5-minute chart and remember my morning forecast, you will see how I recommended buying the pound after the breakout and consolidation above the resistance of 1.3386, which happened. This was followed by a rise in the pound to the maximum of 1.3437, which brought about 50 points of profit. From the level of 1.3437, I recommended selling, which also allowed us to pick up about 20 points against the trend. A break and consolidation above 1.3437 is another buy signal and the pound will rise to the maximum of 1.3478, which is still about 40 points. So far, this deal is working itself out, however, you need to be extremely careful against such a strong upward trend with sales. At the moment, the bulls only need to form a breakout and consolidate above the resistance of 1.3478, after which we can expect the pound to continue growing to the highs of 1.3523 and 1.3563, where I recommend fixing the profits. If the pair declines in the second half of the day, only a false breakout in the support area of 1.3437 will be a signal to open long positions. This signal can be implemented after the release of ISM data for the US manufacturing sector. I recommend buying GBP/USD immediately on a rebound only from the minimum of 1.3386, to which the moving averages are now also reaching.

To open short positions on GBPUSD, you need to: Sellers are still not doing well. So far, the bears have protected the resistance of 1.3478, and we can expect a second downward movement of about 30-40 points after the release of US data. However, if the GBP/USD approaches the level of 1.3478 again, it is better to exit the sales and wait for the next high of 1.3523 to be updated, since a very strong upward trend is a serious problem for sellers. You can also look at the rebound from the resistance of 1.3563 based on a correction of 30-40 points within the day. An equally important task for the bears will be to regain control of the level of 1.3437, which will lead to a larger sale of GBP/USD to the area of the 1.3386 minimum, where I recommend fixing the profits.

Signals of indicators: Moving averages Trading is conducted above the 30 and 50 daily averages, which indicates that the pound continues to grow on the trend. Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differ from the general definition of the classic daily moving averages on the D1 daily chart. Bollinger Bands If the pair declines in the second half of the day, it is best to open long positions immediately on the rebound from the lower border of the indicator in the area of 1.3335. Description of indicators

|

| EUR/USD: plan for the American session on September 1 Posted: 01 Sep 2020 06:00 AM PDT To open long positions on EURUSD, you need to: During the European session, traders did not react strongly to the slowdown in business activity in the German manufacturing sector and the fall in Eurozone inflation. However, it was not possible to get beyond the level of 1.1994, which left everything in its place. The only thing you need to pay attention to on the 5-minute chart is the formation of a false breakout in the resistance area of 1.1994 and the formation of a signal to sell the euro, which has so far brought no more than 30 points of profit. Everything clearly indicates that an attempt to break the 20th figure will still be made during the American session. To do this, the bulls need a break of the resistance of 1.1994, which will lead to the demolition of a number of bears' stop orders above this level and to the continuation of the bull market with the renewal of the highs at 1.2022 and 1.2057, where I recommend taking profits. You can buy the euro immediately on the breakdown of this range and there is no need to wait for a consolidation on it. However, a more rational solution in this situation is to buy on the decline of the euro in the support area of 1.1937. There are also moving averages that play on the side of euro buyers. The formation of a false breakout at this level will be a signal to open long positions in the expectation of continuing the upward trend. If there is no activity of buyers at this level, you can safely open long positions for a rebound from the support of 1.1887 in the expectation of a correction of 20-30 points within the day.

To open short positions on EURUSD, you need to: Sellers of the euro have so far managed to restrain active attempts to break above the resistance of 1.1994, and this was partly due to weak fundamental statistics for the Eurozone. The formation of a false breakout at this level has already led to the formation of a signal to sell the euro and while trading will be conducted below this range, you can expect to strengthen the downward correction to the area of the minimum of 1.1937, where I recommend fixing the profits. However, only after consolidation below this range, it will be possible to speak about the formation of pressure on the pair and its further decline to the area of the minimum of 1.1887. If sellers will not rush to return to the market during the second return of EUR/USD to the resistance of 1.1994 in the afternoon, it is best to postpone short positions until the maximum of 1.2022 is updated or sell EUR/USD immediately to rebound from the resistance of 1.2057 in the expectation of a downward correction of 20-30 points within the day. During the US session, we are waiting for the release of a report on the US ISM manufacturing index, which may return pressure on the European currency. But so far, everything is in favor of the bulls and the market is developing according to their scenario. Therefore, be very careful with sales.

Signals of indicators: Moving averages Trading is conducted above the 30 and 50 daily moving averages, which indicates the formation of a bull market. Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differ from the general definition of the classic daily moving averages on the D1 daily chart. Bollinger Bands If the pair declines, you can open long positions immediately on a rebound from the lower border of the indicator in the area of 1.1925. Description of indicators

|

| EUR/USD: plan for the American session on September 1 Posted: 01 Sep 2020 06:00 AM PDT To open long positions on EURUSD, you need to: During the European session, traders did not react strongly to the slowdown in business activity in the German manufacturing sector and the fall in Eurozone inflation. However, it was not possible to get beyond the level of 1.1994, which left everything in its place. The only thing you need to pay attention to on the 5-minute chart is the formation of a false breakout in the resistance area of 1.1994 and the formation of a signal to sell the euro, which has so far brought no more than 30 points of profit. Everything clearly indicates that an attempt to break the 20th figure will still be made during the American session. To do this, the bulls need a break of the resistance of 1.1994, which will lead to the demolition of a number of bears' stop orders above this level and to the continuation of the bull market with the renewal of the highs at 1.2022 and 1.2057, where I recommend taking profits. You can buy the euro immediately on the breakdown of this range and there is no need to wait for a consolidation on it. However, a more rational solution in this situation is to buy on the decline of the euro in the support area of 1.1937. There are also moving averages that play on the side of euro buyers. The formation of a false breakout at this level will be a signal to open long positions in the expectation of continuing the upward trend. If there is no activity of buyers at this level, you can safely open long positions for a rebound from the support of 1.1887 in the expectation of a correction of 20-30 points within the day.

To open short positions on EURUSD, you need to: Sellers of the euro have so far managed to restrain active attempts to break above the resistance of 1.1994, and this was partly due to weak fundamental statistics for the Eurozone. The formation of a false breakout at this level has already led to the formation of a signal to sell the euro and while trading will be conducted below this range, you can expect to strengthen the downward correction to the area of the minimum of 1.1937, where I recommend fixing the profits. However, only after consolidation below this range, it will be possible to speak about the formation of pressure on the pair and its further decline to the area of the minimum of 1.1887. If sellers will not rush to return to the market during the second return of EUR/USD to the resistance of 1.1994 in the afternoon, it is best to postpone short positions until the maximum of 1.2022 is updated or sell EUR/USD immediately to rebound from the resistance of 1.2057 in the expectation of a downward correction of 20-30 points within the day. During the US session, we are waiting for the release of a report on the US ISM manufacturing index, which may return pressure on the European currency. But so far, everything is in favor of the bulls and the market is developing according to their scenario. Therefore, be very careful with sales.

Signals of indicators: Moving averages Trading is conducted above the 30 and 50 daily moving averages, which indicates the formation of a bull market. Note: The period and prices of moving averages are considered by the author on the H1 hourly chart and differ from the general definition of the classic daily moving averages on the D1 daily chart. Bollinger Bands If the pair declines, you can open long positions immediately on a rebound from the lower border of the indicator in the area of 1.1925. Description of indicators

|

| USDCAD bears need to be very cautious as a bounce higher is highly probable Posted: 01 Sep 2020 05:48 AM PDT USDCAD has reached our 1.30 target area since our bearish signal at 1.35. Price is now challenging the lower channel boundary. The RSI is at oversold levels and price remains bearish. USDCAD could now start a bounce higher so bears need to be cautious and not too greedy.

Blue lines -short-term bearish channel USDCAD bearish signal at 1.35 has now fulfilled both of our downside targets. Initially 1.32 and then 1.30. Our stop has been lowered to 1.3230 and now that price has reached 1.30 we prefer to take profits and wait for a bounce. The possibility of a counter trend bounce from current levels makes us believe that we should take our profits. We wait for a bounce towards resistance at 1.31-1.3150. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 01 Sep 2020 05:41 AM PDT

In the Asian trade on Tuesday, the US dollar lost ground once again. The ICE US dollar index, which measures the US dollar against a basket of six major currencies, fell by 0.4%. Generally, it lost 1.3% in August. At the same time, the WSJ Dollar Index also fell against the basket of sixteen currencies by 0.4%. In March, the US dollar reached its highest level amid growing demand for safe-haven assets. It was the first reaction of financial markets to the coronavirus pandemic. Then, the American currency started to dive. Today, bleak prospects of the US economic recovery prevent the US dollar from gains, the Financial Times noted. EUR/USD rose by 0.39% to trade at $1.1983. During the session, the euro came close to the psychologically important level of $1.2. Despite the depreciation of the US dollar, data on spending and income of consumers in the US exceeded all expectations. Analysts from Wells Fargo believe that rising spending would accelerate the pace of the economic recovery. On Friday, this figure rose by 0.4%, although it was expected to grow by only 0.2%. This suggests that there will be a big GDP growth in the third quarter. At current rates, the GDP could reach 35% in annual terms. However, amid the new wave of the coronavirus, some cost cuts may happen in the markets, especially in the services sector. Against the Japanese yen, the euro rose to 126.72. However, the dollar showed the opposite. It fell by 0.15% to 105.75 yen. GBP/USD rose by 0.26% to trade at $1.3405. The US dollar remains weak after statements from the Federal Reserve. This is the key driver of the pair. By the way, the beginning of the school year will help to boost UK GDP. Quarantine in the United Kingdom has been lifted, so students can freely go to school and parents return to their jobs. This will certainly have a positive effect on the economic recovery. Experts suggest a rise in business activity in key sectors of the country's economy. Therefore, the pound may receive additional support. That is why experts predicted further growth of the currency. The Australian dollar does not lag behind. It grew by 0.3% to $0.7398. The Reserve Bank of Australia cut its benchmark interest rate to a record low of 0.25%. And the target yield on three-year government bonds remains at 0.25%. RBA chief Philip Lowe expects rates to remain "exceptionally low" for some time. The US dollar dropped against the yuan by 0.4% to 6.8210 yuan. In China, both external and internal demand is growing. As a result, the Purchasing Managers Index in China's Industrial Sector, calculated by Caixin Media Co. and Markit, has risen to the highest level for the first time since January 2011. In August, this figure reached 53.1 points. However, according to Trading Economics, analysts expected it to drop to 52.6. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold price recaptures key resistance showing signs of more upside to come Posted: 01 Sep 2020 05:40 AM PDT Gold price has broken above the resistance levels of $1,950-70 we were talking about in previous posts. Staying above this level will open the way for a new higher high towards $2,100 as long as price also remains inside the bullish channel.

|

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

previous analysis we noted that breaking above the green trend line resistance and bouncing off the lower channel boundary were bullish signs and that this week Gold would try to recapture the $2,000 level. Gold price is $12 from reaching $2,000 and trend remains bullish. Support is now at $1,950. Bulls do not want to see price fail to hold this level.

previous analysis we noted that breaking above the green trend line resistance and bouncing off the lower channel boundary were bullish signs and that this week Gold would try to recapture the $2,000 level. Gold price is $12 from reaching $2,000 and trend remains bullish. Support is now at $1,950. Bulls do not want to see price fail to hold this level.

No comments:

Post a Comment