Forex analysis review |

- Hot forecast and trading signals for GBP/USD on October 1. COT report. Traders are confused, waiting for new information

- Hot forecast and trading signals for EUR/USD on October 1. COT report. Traders remain calm, ready to resume selling the pair

- Overview of the GBP/USD pair. October 1. London and Brussels simultaneously declared that they would not concede and started

- Overview of the EUR/USD pair. October 1. The most pointless, angry, and chaotic debate in US history.

- Analytics and trading signals for beginners. How to trade EUR/USD on October 1. Analysis of Wednesday's trade. Getting ready

- EUR/USD. Weak euro, weak dollar: conflicting signals keep the pair in the grip of a flat

- September 30, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- September 30, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- September 30, 2020 : EUR/USD daily technical review and trade recommendations.

- JPMorgan to pay $920 million for manipulating bond and precious metals market

- Technical analysis of EURUSD

- Technical analysis of Gold for September 30, 2020

- Daily Video Analysis: USDCNH High Probability Setup

- GBPJPY holding above ascending trendline support. Further push up expected!

- AUDJPY pulling back to the trendline, potential for a bounce !

- EURUSD is facing bearish pressure, potential for drop!

- Expecting a pull back in USDCAD

- Opposite forces at work all the time in the Forex Market

- Jim Rogers' Secret to Success. Why you shouldn't invest in Apple, Amazon, and Google

- The market is expecting a shake-up on Wednesday

- Evening review on September 30, 2020

- Pre-election passions in the US heats up, USD rate rises

- Trading recommendations for the GBP/USD pair on September 30

- US stocks fell while Asia went multidirectional

- Trading plan for US Dollar Index for September 30, 2020

| Posted: 30 Sep 2020 06:06 PM PDT GBP/USD 1H The GBP/USD pair continued to trade in a narrow price range between the Kijun-sen line and the resistance level of 1.2915 on September 30. Therefore, the technical picture has not changed compared to the previous day. Sellers made an attempt to resume the downward movement, crossed the Senkou Span B line, but could not go below the Kijun-sen. Buyers remain in a more advantageous position, but now they need to overcome the 1.2915 level in order to count on maintaining growth. Bears still need to pull the pair back below the Senkou Span B and Kijun-sen lines in order to expect the downward trend to resume. The general trend remains uncertain, as there is no clear upward trend now. GBP/USD 15M Both linear regression channels turned to the downside on the 15-minute timeframe, but only formally. In fact, they are directed more sideways than down. The latest Commitment of Traders (COT) report for the British pound showed that non-commercial traders got rid of buying the pound and opened Sell-contracts (shorts). A group of commercial traders got rid of huge amounts of both longs and shorts of the pound. We then concluded that the pound sterling is now, in principle, not the most attractive currency for large traders. The new COT report showed absolutely minor changes for the "non-commercial" group. Buy-contracts (longs) fell by 2,000 while Sell-contracts decreased by 1,500. Thus, the net position for non-commercial traders remained practically unchanged for the reporting week (September 16-22). The British pound continued to fall, which can be considered a consequence of the previous reporting week, when the net position of non-commercial traders greatly decreased, by 11,500 contracts. No changes in the rate of the pound/dollar pair on the 23rd, 24th, 25th, which will be included in the next report. Thus, a long term decline in the pound's quotes is quite questionable, although the pound is still the most unattractive currency in the foreign exchange market. The UK GDP for the second quarter in the third estimate was released on Wednesday, September 30. The report showed that GDP contracted by 19.8%, which is slightly less than what previous estimates showed. However, this improvement did not particularly support the British pound, which continued to trade in a very narrow range yesterday. A report on business activity in the manufacturing sector is scheduled for Thursday in the UK, the significance of which is not yet alarming. However, given the beginning of the second waves of the epidemic in both the European Union and Britain, we can expect that business and economic activity will begin to decline again. The manufacturing PMIs Ism and Markit will also be published in America, which do not cause any concerns yet. The number of new applications for unemployment benefits and the total number of secondary applications will also be released today, which many consider as the absolute value of unemployment. These are the most important reports of the day, but even they may not generate any reaction from market participants. The overall fundamental background remains more important. And any news regarding Brexit and negotiations between Brussels and London is especially important for the British pound. We have two trading ideas for October 1: 1) Buyers continue to push the pair upward and have broken through the Kijun-sen and Senkou Span B lines, and have also reached the first resistance level of 1.2915 twice. Thus, you are recommended to stay in long positions while aiming for the resistance area of 1.3004-1.3024 and the 1.3086 level, as long as the pair remains above the Senkou Span B line. Take Profit in this case will be from 70 to 150 points. The current fundamental background is simultaneously bad for both the pound and the dollar. 2) Sellers failed to keep the pair below the critical line, and then failed to return below this line. Thus, now they need to wait for a new price consolidation below the Kijun-sen line (1.2814), and only after that it is recommended to resume trading downward with the target of the support area of 1.2636-1.2660. Take Profit in this case can be up to 110 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

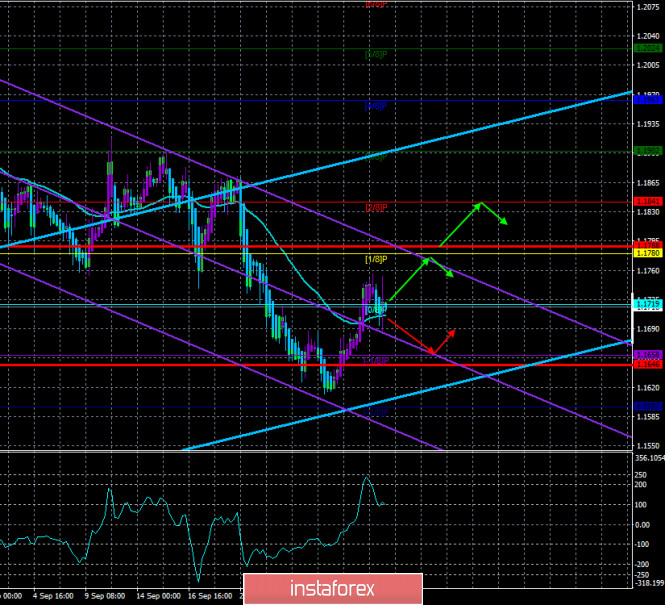

| Posted: 30 Sep 2020 06:05 PM PDT EUR/USD 1H The euro/dollar pair perfectly reached the upper line of the descending channel, despite failing to overcome it the first time on the hourly timeframe on September 30. Therefore, it is likely that the pair might fall. Of course, buyers can make another attempt to overcome it. However, the downward trend remains as long as the price remains within the descending channel. Moreover, the bulls still need to overcome the equally strong Senkou Span B line in order to expect the upward movement to continue. If the pair settles below the critical line, then it may go back to moving downwards. EUR/USD 15M Both linear regression channels began to reverse to the downside on the 15-minute timeframe, as the price failed to overcome the descending channel on the hourly chart. The euro/dollar fell by about one and a half cents last reporting week (September 16-22). Recall that the previous Commitment of Traders (COT) report showed that the "non-commercial" group of traders, which we have repeatedly called the most important, sharply reduced their net positions. Thus, in general, the downward movement that began later on was sufficiently substantiated. The only problem is that it started late. The new COT report, which only covers the dates when the euro began its long-awaited fall, showed completely opposite data. Non-commercial traders opened 15,500 new Buy-contracts (longs) and almost 6,000 Sell-contracts (shorts) during the reporting week. Thus, the net position for this group of traders has increased by around 9,000, which shows that traders are becoming bullish. Accordingly, the behavior of the EUR/USD pair and the COT report data simply do not match. For the second week in a row. However, if you try to look at the overall picture, you can still take note of a very weak strengthening of the bearish sentiment, so the COT report allows a slight fall in the euro. The question is, will it continue to decline or is it already over? The pair even managed to rise by 40 points from September 23-29. Therefore, there are no such changes again. Germany published the unemployment rate on Wednesday, which is only interesting because it helps to predict the pan-European unemployment rate. It turns out that unemployment actually decreased by the end of September, amounting to only 6.3%. This is not much for the crisis. Retail sales in Germany rose 3.1% month-on-month. Thus, the statistics for Europe were quite encouraging. The US data also turned out to be stronger than what market participants expected. The ADP's Private Sector Employment Change report showed more gains than traders had expected, and the third quarter GDP estimate showed an improvement to -31.4%. However, neither the one nor the other news caused a strong reaction from market participants. The European Union will publish the PMI for the manufacturing sector on Thursday, October 1. Similar figures will be released in Germany and the United States We have two trading ideas for October 1: 1) Buyers continue to put pressure on the pair, but it is still not enough to break the current trend and for us to go beyond the descending channel. Therefore, we recommend opening long positions if the pair settles above the descending channel and the Senkou Span B line (1.1763) with targets at 1.1798 and the resistance area of 1.1886-1.1910, not earlier. Take Profit in this case will be from 20 to 110 points. 2) Bears keep it under control despite the fact that the euro has been growing for several days. As long as the price is within the channel, there are chances for the downward movement to resume. Below the Kijun-sen line, you are advised to resume trading bearish while aiming for the support level of 1.1538. In this case, the potential Take Profit is up to 110 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 30 Sep 2020 05:07 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - upward. CCI: 119.7727 On Wednesday, September 30, the British pound paired with the US dollar also traded absolutely calmly. Throughout the trading day, there was also plenty of interesting information for the GBP/USD pair, starting from the same Trump-Biden debate, ending with the publication of GDP in the UK and the US for the second quarter of 2020. However, traders did not consider all the information at their disposal important. As a result, the quotes first corrected to the moving average line, after which they attempted to resume the upward movement they had started. The pound is now in an even more difficult fundamental situation than the euro. The growth of the European currency is stopped by the fears of traders associated with purchases of this currency near two-year highs. In addition, the ECB optically hinted that it considers the current euro exchange rate to be too high, so further appreciation may lead to currency interventions, which is also feared by traders. With the GBP/USD pair, the situation remains such that there is no reason to buy either the dollar or the pound itself. The fundamental background in the US and the UK is equally bad and weak. What important news came from Albion yesterday? First, the British Parliament passed the "Johnson bill" in the second reading. Now it will be sent to the House of Lords for revision and amendment, after which the final vote will take place. Most experts still believe that this bill is nothing more than a way to put pressure on the European Union and force it to make concessions. After all, the final round of negotiations between Brussels and London on an agreement on future relations also began on Tuesday. However, Vice-President of the European Commission Maros Sefcovic said that the European Union is not going to make concessions to the UK, which is going to adopt the controversial bill "on the internal market" and thus violate the agreement on the Northern Irish border with the EU. A little later, a similar statement was made by the chief negotiator from Britain, David Frost, who said that London wants to get full independence from the European Union, and not remain tied to it in many areas. Thus, it is not clear why this final stage of negotiations is needed at all. The parties can basically just have tea and talk about football. No one believes in the conclusion of an agreement anyway. Meanwhile, a member of the British government, Michael Gove, repeated the words of British Prime Minister Johnson that the approved law is insurance in case there is no deal with the European Union. Gove did not comment on the fact that the adoption and implementation of this law would lead to a gross violation of international law. Thus, it is difficult for the pound to count on a "bright future" with Boris Johnson. And the US dollar – with Donald Trump. If the situation for the US currency can be resolved in a little over a month, then the British Prime Minister can still lead the Kingdom for a very long time. Meanwhile, the situation with the "coronavirus" around the world continues to worsen. In the States, approximately 40,000 new diseases are still recorded every day. In Britain, the anti-record of three days ago was updated yesterday – plus 7,156 cases of COVID-2019. Thus, in both countries that are interesting in the GBP/USD pair, there is no improvement in the epidemiological situation. Britain, in addition to all the problems that it has already faced, may run into new, unscheduled, and unaccounted for economic problems. The fact is that if the second "wave" of the pandemic is stronger than the first (and the number of daily recorded cases of infection is already higher than in the spring), this will potentially be another strong blow to the economy. In addition to the first wave of the pandemic and the crisis, in addition to Brexit, in addition to the lack of trade deals with the US and the European Union. But London signed a $ 15 billion agreement with Japan. Naturally, this is sarcasm. As for macroeconomic statistics, the British Gross Domestic Product, although revised upwards, still amounted to a record minus 19.8% in quarterly terms, and minus 21.5% in annual terms. Thus, it was extremely difficult for the British currency to count on support with such figures. In the States, however, the numbers were not much better. GDP for the second quarter in America was -31.4% q/q. Only the ADP report on changes in the number of employees in the private sector showed a larger increase than market participants expected (749 thousand against 650 thousand). However, the US dollar did not gain 10 points on this report, once again proving that macroeconomic statistics now have almost no meaning for traders. What can we say about the index of personal consumption expenditures for the second quarter and the price index of personal consumption expenditures? They didn't matter at all. From a technical point of view, the pair has bounced off from the moving average line, so the upward movement may resume. At the same time, as long as the price does not overcome the previous local maximum (1.3000), it is pointless to think about the high prospects of the pound. Buyers need to prove their strength and desire to push the pound up again. And, as we have already said, there are very few fundamental reasons for this. And below the moving average line, bears will return to the market.

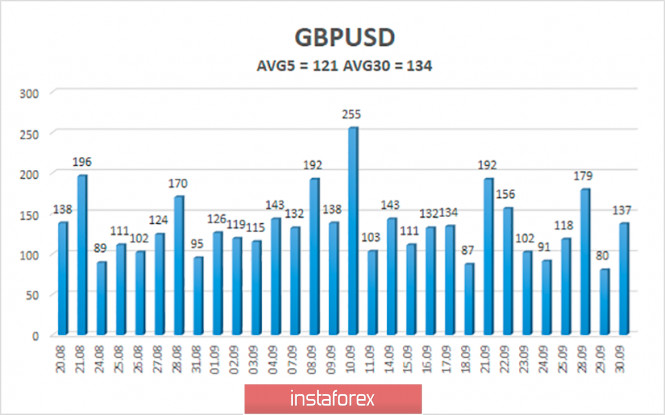

The average volatility of the GBP/USD pair is currently 121 points per day. For the pound/dollar pair, this value is "high". On Thursday, October 1, therefore, we expect movement inside the channel, limited by the levels of 1.2783 and 1.3025. A new reversal of the Heiken Ashi indicator down may signal about a possible resumption of the downward movement. Nearest support levels: S1 – 1.2878 S2 – 1.2817 S3 – 1.2756 Nearest resistance levels: R1 – 1.2939 R2 – 1.3000 R3 – 1.3062 Trading recommendations: The GBP/USD pair resumed its upward movement on the 4-hour timeframe, rebounding from the moving average line. Thus, today it is recommended to stay in the longs with the goals of 1.2939 and 1.3000 as long as the Heiken Ashi indicator is directed upwards. It is recommended to trade the pair down with targets of 1.2783 and 1.2695 if the price returns to the area below the moving average line. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 30 Sep 2020 05:06 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - upward. Lower linear regression channel: direction - downward. Moving average (20; smoothed) - sideways. CCI: 102.8927 The US currency paired with the euro traded very calmly on the third trading day of the week, although a huge number of potentially important events were planned for this day. However, market participants reacted to them rather sluggishly, thus, there is no need to talk about serious exchange rate changes. We have repeatedly stated that the long-term fundamental background plays an important role for the pair now, not macroeconomic statistics or "one-time" news. By and large, traders continue to ignore most of the economic data, because they are now completely predictable. First, there was a collapse in macroeconomic indicators, which did not cause anyone any surprise, since the epidemic and crisis covered the whole world. Now, after the removal of "lockdowns", the recovery of all countries' economies has begun, which is also absolutely logical. Important and interesting news began to arrive on Wednesday night. It was on this day in the American city of Cleveland that the first debate between Donald Trump and Joe Biden took place. The debate was set aside for 1.5 hours, divided into 15-minute segments devoted to each of the six topics (the political "background"; the situation in the Supreme Court due to the death of Ruth Ginsburg; the COVID-2019 epidemic; the economy and its recovery from the pandemic; racial conflicts and problems; protection of electoral processes). According to media reports, about 100 million Americans watched the live broadcast. Naturally, most of them wanted specific answers to specific questions. According to statistics, one in ten Americans has not yet decided who they will vote for in the election. The debate could also change (at least slightly) the balance of power between Biden and Trump. In recent weeks, data on political ratings have varied. Some opinion polls show that the gap of 8-10% has not decreased, some indicate that Trump has managed to reduce the gap to 2-3%. We are inclined to believe that the gap has remained the same. All in all, the debate was potentially a very interesting event that disappointed everyone. Almost all American media called the event the worst in the history of the United States. Both candidates spent most of the allotted hour and a half insulting and accusing each other of all mortal sins. Bickering, interrupting, inciting, provoking – these are the terms that best reflect what happened last night in America. Most Americans wanted to get a clear answer to the question: what will a candidate do if he gets the post of President of the United States? Instead, they received an online showdown between Trump and Biden, which had previously only taken place in absentia. It should be noted at once that most media outlets still record the results of the debate as Biden's asset. Six out of ten observers believe Biden performed better than Trump. Both presidential candidates, however, used their own tools, to which everyone has long been accustomed. Trump – rude, accused, interrupted, did not allow to speak, put pressure on Biden and host Chris Wallace. Biden also "rode" all of Trump's "achievements" as President in his first term, from the "coronavirus" to racial scandals. In general, it seemed that Trump continues to post messages on the social network Twitter. Many experts noted that the US President constantly made ridiculous statements that were not relevant, told gossip, and shared absolutely unsubstantiated information about Biden. The results of this "boorish domination" of Trump were as follows: only 29% of respondents believe that Trump was truthful and sincere in his statements, and only 28% believe that the current President performed better than his opponent. Biden was supported by 69% of respondents, and another 65% said that the attacks on Trump were fair. Thus, the winner of the first round of the confrontation can be considered a Democrat. However, you should not make an "innocent lamb" out of it. Biden used "sharp words" as well as Trump, openly called on Trump to "shut up" and called him a "clown." Thus, according to the common opinion of Western media and experts, yesterday's elections will have almost no effect on the balance of power before the elections, which are only 34 days away. At the end of the debate, Donald Trump could only strengthen the faith of his supporters in himself, and Joe Biden – to show that his solid age is not a hindrance and he quite cheerfully opposed his opponent. Fast forward from America to the European Union. Christine Lagarde gave another speech earlier this week. During it, the head of the ECB said that the regulator will do everything necessary to stimulate the economy in the future and help it recover from the coronavirus pandemic. She said the current level of economic recovery is "incomplete" and the prospects for further recovery are "uncertain." According to Lagarde, consumers are very cautious about spending money, and companies are very reluctant to invest. In principle, this is not surprising, given the scale of the crisis and the beginning of the second "wave" of the epidemic in Europe. "The health crisis will continue to put pressure on economic activity and pose downside risks to the economic outlook," said Christine Lagarde. She also noted negative inflation and said that the CPI will remain negative for some time due to high pressure on it due to the growth of the European currency. In general, a neutral performance. As for the euro/dollar pair and the impact of all events on it, it was quietly trading for most of the day near the moving average line. It is clear that traders are again confused. On the one hand, it seems that buying the euro currency looks more attractive due to the complete uncertainty in the future of the United States. On the other hand, the European currency has already risen quite seriously in the last few months. Thus, we can only wait and analyze the technical picture. We are still inclined to the option that the euro currency will continue to grow. It may not be strong, however, it will continue. To be honest, it is absolutely normal practice when the national currency becomes cheaper before the elections. Something similar may happen to the dollar in the next six weeks. The last thing I would like to note is that in the coming weeks, there will be two more rounds of debates between the current President and the former Vice President of the United States. Despite the fact that there was almost no reaction to the first round, this does not mean that it will be the same for the next two rounds.

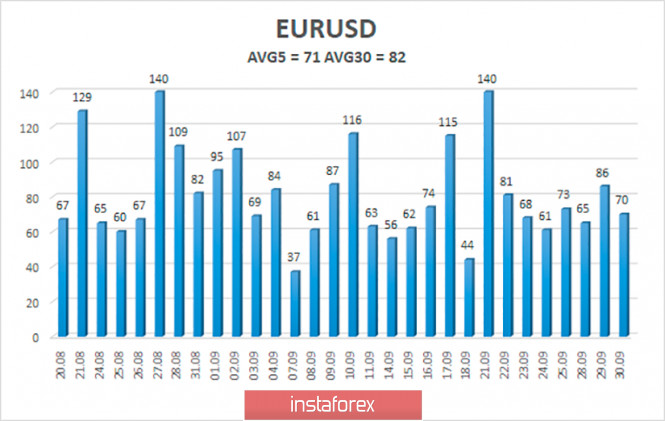

The volatility of the euro/dollar currency pair as of October 1 is 71 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1646 and 1.1788. A reversal of the Heiken Ashi indicator back down may signal the end of an upward correction. Nearest support levels: S1 – 1.1719 S2 – 1.1658 S3 – 1.1597 Nearest resistance levels: R1 – 1.1780 R2 – 1.1841 R3 – 1.1902 Trading recommendations: The EUR/USD pair is fixed above the moving average line. Thus, it is now recommended to consider long positions with targets of 1.1780 and 1.1808 before the Heiken Ashi indicator turns down or the price fixes below the moving average. It is recommended to consider sell orders again if the pair is fixed back below the moving average with the first targets of 1.1658 and 1.1597. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 30 Sep 2020 11:41 AM PDT 1-hour chart of EUR/USD On Wednesday, September 30, EUR/USD was trading again in a complicated way, especially for beginners. After the price had fixed above the downward channel, the trajectory changed into the upward one. On Wednesday morning, I warned that the pair was about to begin a downward correction because the price climbed 120 pips. Besides, the pair needed a downward retracement in any case so that the MACD indicator could lose steam and traders could use it again to open long positions. That's exactly what has happened today. The pair has started a moderate correction. As a result, the price declined to 1.1687. However, this correction finished rapidly and sharply. The price regained all losses with literally one bar. At the same time, the currency pair managed to hit a higher high following the previous one (1.1755). Well, the situation is rather difficult for understanding. The correction is underway and it is not over yet. Moreover, it is getting more complicated. It would have been wrong to open long positions with the MACD signaling upwards. Why? First, it is getting too late at night. Second, the move upwards began abruptly that always looks suspicious. To sum it up, I would recommend wait for a new round of correction. On Wednesday, there has been a series of interesting events. Nevertheless, most of them have made no impact on EUR/USD. I'm not going to expand on the televised debate between Donald trump and Joe Biden. This political event was of no importance for the US dollar. The same is true about a report on Q2 US GDP that came in better than expected. ADP employment report also revealed stronger employment in the US private sector in September than the market had projected. Both reports are upbeat. However, the US dollar has not found much support from them. In fact, none of the fundamental events of the day influenced the EUR/USD pair. On Thursday, October 1, the economic calendar contains a batch of manufacturing PMIs for the EU and the US. Another report to take notice is the unemployment rate in the Eurozone for August. As usual, traders monitor weekly updates on initial unemployment claims for the US. Basically, none of these reports will impact on the EUR/USD trajectory. The exception is the composite PMI for the Eurozone or the US provided that it turns out to be lower than the flash estimate, especially if it sinks below 50.0 points. Thus, I reckon that macroeconomic data which is due tomorrow will be of little importance for EUR/USD. On October 1, the following scenarios are possible 1)At present, it would be a good idea to plan buying the pair because traders managed to overcome the upper border of the downward channel. Nevertheless, it is common knowledge that the pair always needs correction. So, I believe that a correctional stage will continue. Thus, it is recommended to open buy orders not until the correction is over. Once it is complete, it would be possible to plot the upward trend line. The upward targets are 1.1771 and 1.1801. 2)Traders reject the selling idea because the downward channel has been breached. So, there is a chance for the pair to resume even the downtrend, but the technical picture is in favor of the uptrend. In other words, the development of a new downtrend or cancellation of the uptrend will support the idea of selling. But this scenario has not been confirmed yet. What's on the chart: Support and Resistance levels are the levels that are targets when opening buy or sell orders. Take Profit levels can be placed near them. Red lines are channels or trend lines that display the current trend and show which direction it is preferable to trade now. Up / down arrows show whether the pair should be traded up or down when reaching or overcoming particular obstacles. MACD indicator (10,20,3) - a histogram and a signal line. When they are crossed, this signals a market entry. It is recommended for use in combination with trend lines (channels, trend lines). Important speeches and reports in the economic calendar can greatly influence the movement of the currency pair. Therefore, during their release, it is recommended to trade as carefully as possible or exit the market in order to avoid a sharp price reversal against the previous movement. Beginners in the forex market should remember that every trade cannot be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR/USD. Weak euro, weak dollar: conflicting signals keep the pair in the grip of a flat Posted: 30 Sep 2020 09:47 AM PDT The euro/dollar pair continues to show contradictory dynamics. The US dollar index, which initially ignored the debate between Trump and Biden, began to gain momentum at the start of the US session on Wednesday. According to a CNN poll, the head of the White House lost the first round of a verbal duel. This fact provided small support to the greenback, which showed itself in almost all dollar pairs. The European currency, in turn, continued its downward movement throughout the market, amid a decline in German inflation and unexpected statements from the ECB representative. Also, today, the lower house of the British Parliament still adopted the scandalous bill "on the internal market of the UK", crossing out some points of the Brexit agreement and jeopardizing the conclusion of a trade deal. News from London also undermined the euro's position, adding to the negative fundamental picture.

However, let's start with American events. As mentioned above, traders initially ignored the debate of candidates for the post of President of the United States, although this event is the most important stage of the election race. Such a phlegmatic reaction was because it was impossible to determine a clear winner based on the results of the "battle". Trump showed his assertiveness, however, Biden did not look like a "whipping boy". If you believe the results of a CNN poll, the speech of the democratic leader was liked by 60% of viewers, while Trump scored only 28% of likes. If we look at the structure of the survey, we will see that 65% of respondents believe that Biden's answers were "more truthful", and his claims to the current President are "fairer". Trump has these indicators at 29% and 32%, respectively. Similar surveys of local TV channels show similar results. Therefore, with a certain degree of probability, we can assume that the first round of the debate remained for Biden. Against this background, the dollar gained at price, although it remained paired with the euro in a wide-range flat. The US economy growth data for the second quarter published today did not help the American either. The final figures were revised to improve, but given the "depth of the fall", they remained in negative territory. So, the volume of US GDP decreased in the second quarter by -31.4% (initial estimate – 31.7%), the price index of GDP fell by 1.8% (instead of a two-percent decline). As you can see, the indicators "improved" very slightly, so the market ignored this release. Dollar bulls also ignored the ADP report, which came out better than expected. According to experts of this agency, the number of people employed in the US private sector in September increased by 749 thousand (with a forecast of growth of 650 thousand). However, traders ignored this release due to its low correlation with Non-Farm (for several months, indicators were released randomly, although previously a high level of correlation with the official report was recorded). On the other hand, the greenback is still under background pressure due to political differences between Republicans and Democrats. Today, US Treasury Secretary Steven Mnuchin said that approximately by Friday, it will be clear whether representatives of both parties and representatives of the White House will be able to find a common denominator in the adoption of the financial assistance program. Given the fact that the Democrats introduced their bill for $ 2.2 trillion on Monday, we can assume that the parties will not sit down at the negotiating table. The European currency, in turn, also can not show character against the background of recent events. In particular, data on the growth of German inflation for September were published yesterday. The indicators disappointed traders: both in monthly and annual terms, they went further into the negative area. It is worth noting that on Friday, pan-European inflation indicators will be published, so negative signals from Germany alerted investors. Also, the European currency was under pressure for another reason. The fact is that today the ECB member Francois Villeroy de Galo (the head of the Central Bank of France) made an unexpected statement, saying that the European regulator will take a course on the average inflation target. In other words, the official admitted that the ECB could go the Fed's way. Let me remind you that at the end of August, the Federal Reserve revised its monetary policy strategy, becoming more "tolerant" of rising inflation. The new strategy of the US Central Bank allows the regulator to keep base rates at the current record low level for a longer time. Figuratively speaking, the Federal Reserve agreed to "tolerate" inflation at a level above two percent, without tightening the parameters of monetary policy. This fact put a lot of pressure on the dollar.

And so, the ECB members want to adopt a similar strategy. It is noteworthy that the European currency reacted rather weakly to Villeroy's words. This can be explained by two factors. First, the head of the Bank of France only allowed such a scenario. Whether his colleagues will support him in this matter is an open question. Secondly, the target level of the European Central Bank is currently too far from the current values to make any calculations in the context of time benchmarks. Therefore, market participants, after some fluctuations (after Villeroy's speech, there was increased volatility), decided not to panic ahead of time. Thus, an ambiguous fundamental picture emerges in the "dry balance". Both the dollar and the euro are showing weakness and uncertainty. This is the reason for today's flat: traders can't "catch on" to one or another fundamental factor to get the pair out of the price range of 1.1805-1.1630. The "ceiling" of this corridor corresponds to the upper boundary of the Kumo cloud on D1, and the lower level corresponds to the lower line of the Bollinger Bands indicator on the same timeframe. When approaching the upper limit of the range, it is advisable to consider short positions. The material has been provided by InstaForex Company - www.instaforex.com |

| September 30, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 30 Sep 2020 09:41 AM PDT

Intermediate-term technical outlook for the GBP/USD pair has remained bullish since bullish persistence was achieved above 1.2780 (Depicted Key-Level) on the H4 Charts. On the other hand, the GBPUSD pair looked overbought after such a quick bullish movement while approaching the price level of 1.3475. That's why, short-term bearish reversal was expected especially after bearish persistence was achieved below the key-level level of 1.3300. A quick bearish decline took place towards 1.2900 then 1.2825 where some bullish recovery was recently expressed. The price zone of 1.3130-1.3150 (the backside of the broken trend) remains an Intraday Key-Zone to offer bearish pressure if retested again. However, the GBPUSD pair has shown lack of sufficient bullish momentum to pursue above the price level of 1.3000. This enabled further bearish decline towards 1.2700 where another episode of bullish recovery may be executed. Bullish Persistence above the depicted price zone of1.2975 is currently needed to allow bullish pullback to pursue towards 1.3100. Otherwise, further bearish decline would be expected towards the price level of 1.2600. Trade recommendations : Conservative traders are advised to wait for the current bullish pullback to pursue towards 1.3130-1.3150 (the backside of the broken trend) as a valid SELL Entry. Initial T/p level is to be located around 1.3050 and 1.2900 if sufficient bearish pressure is maintained. The material has been provided by InstaForex Company - www.instaforex.com |

| September 30, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 30 Sep 2020 09:21 AM PDT

The EURUSD pair has failed to maintain enough bearish momentum below 1.1150 (consolidation range lower zone) to enhance further bearish decline. Instead, bullish breakout above 1.1380-1.1400 has lead to a quick bullish spike directly towards 1.1750 which failed to offer sufficient bearish pressure. Bullish persistence above 1.1700-1.1760 favored further bullish advancement towards 1.1975 where some considerable bearish rejection has been demonstrated. The price zone around 1.1975-1.2000 ( upper limit of the technical channel ) stood as a strong SUPPLY-Zone to offer bearish reversal. Intraday traders should have considered the recent bearish closure below 1.1700 - 1.1750 as an indicator for a possible bearish reversal. The price zone of 1.1775-1.1850 remains a solid SUPPLY Zone to be considered for signs of bearish reversal by Intermediate-term traders. Trade recommendations : Conservative traders should wait for the current bullish pullback to pursue towards the recently-broken DEMAND Zone around 1.1770 as a valid SELL Entry. T/P levels to be located around 1.1645 and 1.1600 while S/L to be placed above 1.1800 to minimize the associated risk. The material has been provided by InstaForex Company - www.instaforex.com |

| September 30, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 30 Sep 2020 08:14 AM PDT

By the end of August, the EURUSD pair has achieved a temporary breakout above the previously mentioned resistance zone located around 1.1900. However, Significant SELLING pressure was applied around 1.2000 where the upper limit of the movement pattern came to meet the pair. That's why, the EUR/USD pair has demonstrated a quick bearish decline towards 1.1800 then 1.1770-1.1750 which failed to offer sufficient Support for the EUR/USD. Earlier Last week, a breakout to the downside was executed below the price level of 1.1750 (Lower limit of the depicted movement pattern). Hence intraday technical outlook has turned into bearish. Intraday traders should be waiting for any pullback to the upside towards the recently-broken key-zone (1.1750-1.1770) for a valid SELL Entry. On the other hand, a breakout above 1.1820 (Exit Level) will probably enable further upside movement towards 1.1860-1.1900. The material has been provided by InstaForex Company - www.instaforex.com |

| JPMorgan to pay $920 million for manipulating bond and precious metals market Posted: 30 Sep 2020 07:55 AM PDT

The American financial holding JPMorgan Chase & Co will pay more than $920 million in order to cover all losses incurred as a result of delinquencies in the manipulation of transactions with futures and precious metals. This decision is aimed at settling the claims of the US federal authorities.Claims against JPMorgan Chase are held by the US Department of Justice, the US Federal Securities and Exchange Commission, and the Commodity Futures Trading Commission.JPMorgan will pay $ 436.4 million in fines, $ 311.7 million in damages and more than $ 172 million in seizure of all amounts received from all illegal transactions to the state. As a result, the bank will pay the largest fine in the history of the Futures Trading Commission for this kind of manipulation.In the period from 2008 to 2016, the number of bank employees were accomplices in a fraudulent scheme, which involves flooding a market with orders that are not actually binding. This practice was banned after the 2008 US financial crisis.Also there was an agreement to defer prosecution of charges of electronic fraud between JPMorgan, the US Department of Justice, and the Connecticut County Attorney's Office. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 30 Sep 2020 07:44 AM PDT EURUSD has bounced off the 1.16 level and has so far reached 1.1760. However this bounce could very well be just a relief bounce before the next sell off. Today we identify the key support and resistance levels that will give us more information of the coming trend.

EURUSD is in bearish short-term trend as long as price is below the red downward sloping trend line resistance. This resistance is now at 1.18. Support is found at today's low at 1.1685. If support is broken on a daily basis then we should expect 1.16 to be challenged once again with high chances to be broken. If price follows our plan and gets rejected at the resistance, then our next downside target is 1.15 and it is confirmed with a break below 1.16. The material has been provided by InstaForex Company - www.instaforex.com |

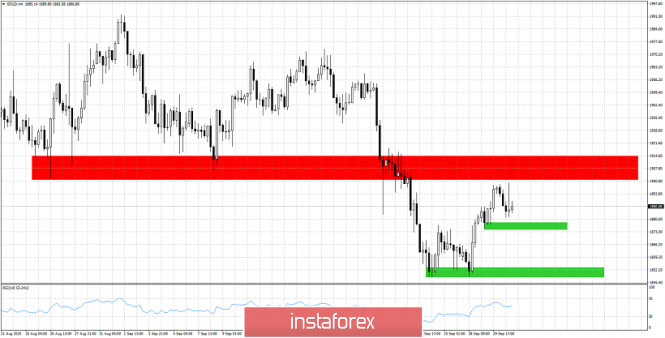

| Technical analysis of Gold for September 30, 2020 Posted: 30 Sep 2020 07:39 AM PDT Gold price has bounced towards the key resistance of $1,900 that was once support. Price has stopped the advance higher at $1,899 and is now trading at $1,884. The chances for a rejection and move lower are higher than a move above $1,900.

Red rectangle - major resistance Green rectangles - short-term support levels Gold price has support at $1,874-77 and next at $1,848-52. Bear want to see price get rejected at the red rectangle and push below the green rectangles. Bulls want price to start making higher highs and higher lows and eventually to recapture $1,900. I expect Gold price to get rejected and move lower. As long as price is below $1,900 I remain bearish. The material has been provided by InstaForex Company - www.instaforex.com |

| Daily Video Analysis: USDCNH High Probability Setup Posted: 30 Sep 2020 07:39 AM PDT Today we take a look at USDCNH. Combining advanced technical analysis methods such as Fibonacci confluence, correlation, market structure, oscillators and demand/supply zones, we identify high probability trading setups. The material has been provided by InstaForex Company - www.instaforex.com |

| GBPJPY holding above ascending trendline support. Further push up expected! Posted: 30 Sep 2020 07:37 AM PDT

GBPJPY holding above ascending trendline support and moving average. A further push up above 1st support at 135.852 towards 1st resistance at 136.363 can be possible. Trading Recommendation Entry: 135.825 Reason for Entry: 38.2% fib retracement, moving average, Ascending trendline support Take Profit : 136.363 Reason for Take Profit: -61.8% fib retracement, 127.2% Fib extension Stop Loss: 135.673 Reason for Stop loss: 61.8% Fib extension ,Recent swing low The material has been provided by InstaForex Company - www.instaforex.com |

| AUDJPY pulling back to the trendline, potential for a bounce ! Posted: 30 Sep 2020 07:37 AM PDT

AUDJPY is pulling back to the ascending trendline and 1st support where the 61.8% fib retracement is. Price could bounce there towards our 1st resistance. Ichimoku also indicates that further upside could be seen from here. Trading Recommendation Entry: 74.64 Reason for Entry: 61.8% fib retracement , ascending trendline Take Profit: 75.46 50% fib retracement , horizontal swing high Stop Loss: 73.99 Reason for Stop Loss: Horizontal swing low The material has been provided by InstaForex Company - www.instaforex.com |

| EURUSD is facing bearish pressure, potential for drop! Posted: 30 Sep 2020 07:36 AM PDT

Price is facing bearish pressure from our first resistance, in line with our 100% fibonacci extension, 50%, 78.6% fibonacci retracement, and horizontal graphical resistance where we could see a potential reversal under this level to our support level. The Stochastics is also showing signs of bearish pressure from the resistance level of 84.31. Trading Recommendation Entry: 1.17378 Reason for Entry: 100% fibonacci extension resistance, 50%, 78.6% fibonacci retracement and horizontal graphical resistance level. Take Profit: 1.16449 Reason for Take Profit: 38.6%, 76.4% fibonacci retracement. Stop Loss: 1.17848 Reason for Stop Loss: 127% fibonacci Extension, 61.8% fibonacci retracement The material has been provided by InstaForex Company - www.instaforex.com |

| Expecting a pull back in USDCAD Posted: 30 Sep 2020 07:35 AM PDT USDCAD is trading the last couple of days between 1.3350 and 1.3420. Price is consolidating near recent highs. If resistance at 1.3420 is broken we should expect price to continue higher towards 1.35, but our most probable scenario is a pull back towards 1.33-1.3275.

Green rectangle - target USDCAD has made a triple short-term top at 1.3420 confirming the resistance at that price level. Breaking it will be a bullish sign for more upside to come. However I expect price to move lower towards the support trend line. When and if price reaches this trend line, we will re-evaluate the possible scenarios. The material has been provided by InstaForex Company - www.instaforex.com |

| Opposite forces at work all the time in the Forex Market Posted: 30 Sep 2020 07:30 AM PDT

In the currency market opposite forces are at work all the time. Some companies need to buy USD and sell EUR to pay for goods or services and some companies needs to sell USD to buy EUR to pay for goods or services. At the same time you have investors buying USD and selling EUR to buy US assets and you have investors selling USD to buy EUR to buy assets within the EU and the list of opposite forces working in the currency market goes on. If the group of companies, investors and speculators selling USD and buying EUR is larger/stronger, than the opposite group EUR/USD will go up in price, which means you will have to pay more USD for the one EUR. In that case, we speak of EUR/USD being in an uptrend. The above chart shows EUR/USD being in an uptrend, but within that uptrend, there will be times when the opposite forces will be equal or almost equal and the price of EUR against USD for a time will move sideways until one of the forces gains or regains the upper hand and the trend continues or it changes direction. Currency pairs tend to move in a channel up or down and in the above chart of EUR/USD we can see that EUR/USD moved higher within the channel from mid-March to September, where EUR/USD top, at lest for now, and started a smaller channel lower. The question of course becomes has the uptrend from mid-March completed or will it continue higher? This is still an open question. The uptrend from mid-March remains intact and only a break below key-support at 1.1605 will indicate a change in the trend from up to down, but as long as key-support at 1.1605 remains intact, we will need consider the decline from the 1.2014 peak as a temporary pause in the uptrend and more upside likely to come, once this temporary pause is complete. Remember, that the primary trend – in this case the uptrend - is the most likely to continue rather than being reversed. The material has been provided by InstaForex Company - www.instaforex.com |

| Jim Rogers' Secret to Success. Why you shouldn't invest in Apple, Amazon, and Google Posted: 30 Sep 2020 07:00 AM PDT

Everyone knows that shares of Apple, Amazon, and Google, as well as many other major corporations, are trading at very high prices and are growing every day. Shares of such companies are not able to fall, so investors expect them to grow steadily. This is the position held by most investors, but not by Jim Rogers. He believes that nothing can grow forever and only once a serious fracture occurs. The owner of Rogers Holdings said that it is not going to buy shares of the named giants, as it predicts their inevitable fall. And he was referring not only to the companies mentioned above but also to the entire US technology sector. Jim Rogers is one of the world's most famous investors. His name is inextricably linked to another famous investor – George Soros. In the 1970s, they co-founded the Quantum Fund, which provided its owners with an income of 4,200%. Rogers was not satisfied with what he achieved on wall street: in 1980, he became interested in traveling and got into the Guinness Book of records, making two trips around the world on a motorcycle and a car. It is difficult to disagree with the opinion of such an experienced player in the investment market, although there are many doubts because, over the past year, the shares of technology giants have significantly increased in price. For example, Apple's growth for the year exceeded 110%, Amazon shares rose by 83.95%, and Tesla – by 769%. As for the NASDAQ index, which reflects the situation in the high-tech market in the US, it was able to grow by almost 48% over the year. Moreover, at the auction on September 2, this index reached a historical high. Rogers sees these figures and nevertheless plans to invest in opposite unpopular and even depressing industries, including the sphere of Russian assets. Among the attractive industries, he named travel, tourism, and entertainment. And this is a very reasonable move: the collapse of these areas into a pandemic created favorable conditions for buying. The investor is convinced that as soon as the alarm about the pandemic recedes, people will start living their usual lives again. Such previously ordinary, but under restrictive measures, little-used public places, such as bars, restaurants, cinemas, and even flights by plane, will gain unprecedented popularity. As a result, investment in these areas, according to Rogers, should bring investors an unprecedented profit. Previously, the investor was dissatisfied with the fact that it is limited to the countries in which it can invest. For example, he sees Venezuela and North Korea as very promising in terms of financing, even despite their low standard of living and obvious economic problems. Under US law, investments by US citizens cannot be extended to States where US sanctions apply. As Rogers says, countries experiencing a disaster are the most profitable for investors. This is because it is a cheap investment that should pay off in full in five or six years. It is worth noting that Jim Rogers embodies his beliefs: since 2014, he has been actively investing in Russian assets – in the Moscow exchange, PhosAgro, and Aeroflot. In 2020, the investor's fortune is estimated at $320 million. Jim Rogers ' formula for success is clear: invest in cheap assets with the prospect of further growth. The material has been provided by InstaForex Company - www.instaforex.com |

| The market is expecting a shake-up on Wednesday Posted: 30 Sep 2020 06:59 AM PDT

The energy and financial sectors determined the mood of market players. All this was compounded by the official statistics on coronavirus – about 1 million deaths. The statement of New York Mayor Bill de Blasio that the number of positive test results for coronavirus is more than 3% for the first time in several months did not bring relief to the market. This week, financial companies, in particular banks, which lost a significant part of the profit achieved just a day earlier, are also suffering a defeat. In recent months, investors have been concerned about how much the growth of coronavirus infection can affect the revival of the economy. Moreover, this problem is still open. The market is looking forward to the adoption of a bill to stimulate economic growth, however, this long-awaited event remains unfulfilled. The following events may affect market sentiment on Wednesday: the next IPO of the technology company Palantir, the confrontation between two contenders for the US presidency (Trump and Biden), and the publication of economic data on home sales in the US. Let's start with the IPO or the first public sale of shares of a joint-stock company to an unlimited number of people. This time, Palantir Technologies is a public company. Founded in 2003, Palantir is a privately held American company that develops software for data analysis. It focuses on the intelligence agency of the US government, intelligence agencies, investment banks, and hedge funds. Palantir launches through a direct listing on the New York stock exchange. It is worth noting that investors expect the latest technologies to enter the market with great interest. It is noteworthy that the company's founder, Peter Thiel, is also a co-founder of PayPal Holdings Inc. and one of the first investors in Facebook and Microsoft. The declarative battle of US presidential candidates can also affect the market. On Tuesday night in Cleveland, Trump and Biden met for their first debate, and according to polls, the winner of the verbal battle was Joe Biden. During an hour and a half of the argument, he gave Donald Trump a large number of offensive characteristics. Two more meetings are expected ahead, during which the audience will form a certain opinion about the problem and largely determine the outcome of the upcoming elections in November. The second meeting of candidates for the post of head of the White House is scheduled for October 15 and will be held in Miami, and the third – on October 22 in Nashville. According to the Financial Times newspaper, which refers to a study by financial consultant deVere Group, the US presidential election concerns investors many times more than the second wave of coronavirus. However, we will not underestimate the role of other equally important factors that can affect the market on Wednesday. Investors are waiting for the publication of economic data on home sales and expect that in the third reading, the US GDP for the 2nd quarter will remain unchanged, namely at the level of 31.7%. It is worth noting that the press release will present GDP statistics for the first time concerning industries. Investors also expect that the number of pending home sales in the US in August will be able to rise by 3.2% compared to July (then the number of transactions increased by 5.9%). Analysts also forecast that the number of people employed in the US non-agricultural sector will rise from 428 thousand in August up to 650 thousand. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review on September 30, 2020 Posted: 30 Sep 2020 05:53 AM PDT

The EURUSD pair will undergo correction after rising slightly. In order for the growth to continue, it is necessary that the euro does not consolidate below the level of 1.1685. According to the September jobs report from the ADP, companies in the US added 749,000 new jobs. This turned out to be much better than the initial estimates. The said result did not affect the euro in any way. You may keep buying from 1.1685, with a stop at 1.1640. The material has been provided by InstaForex Company - www.instaforex.com |

| Pre-election passions in the US heats up, USD rate rises Posted: 30 Sep 2020 05:33 AM PDT

The US presidential election is about five weeks away, and the tension is growing every day. According to polls, Democratic candidate Joe Biden's leadership has eased slightly, while the popularity of his Republican rival, Donald Trump, has recently slowed. Biden retains a small advantage in many swing States, and this may well be enough to win. However, most swing States do not show preferences in either direction, which makes the election results less predictable. "The stakes are high and the results of the November US election are far from clear," said strategists at Nordea Bank. According to them, a decisive victory for the Democrats is likely to hit the dollar, as Biden promises to cancel tariffs with China and increase the volume of incentive programs. Specialists at Deutsche Bank share a similar opinion saying, "The victory of the democratic candidate in November will make the greenback the most vulnerable, as it can lead to increased fiscal stimulus and an increase in the budget deficit in the US. In addition, a Democratic victory could encourage greater global cooperation and tariff waivers, which could also have very negative consequences for the dollar." However, experts warn that another term of office for Trump will be full of uncertainties. On Wednesday, the greenback is growing in relation to most of its main competitors, including the euro, regaining the decline of the last two days, as well as the results of the first TV debates between Trump and Biden, which only increased political risks in the United States. The greenback is growing against most of its main competitors on Wednesday. This played down the decline of the last two days, as well as the results of the first televised US presidential debates which only increased political risks in the US itself. The EUR/USD pair declined from a local high of 1.1755 to 1.1700 after the current US President Donald Trump said that the election results may be known only in a few months. Adding that it is unlikely to end well. These comments heightened fears of a delay in election results and lent support to the dollar. The USD index rose above 94.2 points after two-day losses that followed a two-month high last week. "Investors have again begun to worry about the controversy surrounding the election results, the delay in publishing the results, and whether Trump will behave peacefully in the event of defeat," AMP Capital said. The pressure on the euro was also exerted by comments from ECB chief Christine Lagarde, who said that low inflation in the EU creates fundamental problems. This is one of the main reasons why the ECB may consider further policy easing. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading recommendations for the GBP/USD pair on September 30 Posted: 30 Sep 2020 05:04 AM PDT The GBP / USD pair is currently in the stage of a correction, but yesterday, there was a stagnation at price levels 1.2822 / 1.2900, which could well serve as a signal of the end of the process. In addition, the bearish sentiment is prevailing all throughout the market, and it could result in a strong downward move, perhaps even below the current local lows. Thus, if we analyze the M15 chart and look closely at the trades set yesterday, we will see that speculative positions surged in the market at 15: 15-17: 00, particularly at price levels 1.2822 / 1.2900. The lowest activity was also recorded in terms of daily dynamics, so as a result, volatility was only 78 points, which is 37% below the average level. This very phenomenon indicates an upcoming surge in activity, as well as the completion of the current correction. This is because as discussed in the previous review , market participants used the levels 1.2825 / 1.2885 / 1.2910 as a temporary platform for a slowdown, setting off such a result. Meanwhile, if we look at the daily chart, we will see the consistent downward price movement with a scale of more than 800 points. Two corrections from this movement were recorded this September. With regards to news, a better-than-expected statistics were published for the UK lending market yesterday, one of which was the strong improvement on approved mortgage loans. According to the latest report, it number to 84.7 thousand, while the volume of mortgage lending increased from £ 2.90 billion to £ 3.10 billion. At the same time, the House of Commons have passed the third reading of the controversial internal market bill, which, if approved, would allow UK to violate the terms of the Brexit agreement. The next step is a formal consideration of the House of Lords, however, if this really happens, negotiations as well as relationship between the UK and the EU could break down. Any update in this direction would lead to more speculative positions in the GBP / USD pair. Back to statistics, the final data for the UK 2nd quarter GDP was released today, but it revealed that economic decline accelerated from -1.7% to -21.5%. The same data will be published in the afternoon for the US GDP, but this time, it is expected to show an economic decline of -9.1% in annual terms, which coincides with the preliminary estimate. However, what investors will pay particular attention to is the upcoming ADP report on the level of employment in the US private sector, where there is an expected increase of employment by 610,000. If this happens, the US dollar will rise in the markets. US 13:15 - ADP Employment change report (September) US 13:30 - GDP (Q2) Further development As we can see in the trading chart, the quote has broken out of the earlier price range (1.2822 / 1.2900) during the start of the European session, as a result of which the pound traded at a price of 1.2820. If the quote continues to consolidate below this level, short positions will rise again, which will then lead to a further decline towards 1.2770-1.2720. But if the quote returns to the previous levels, the pound will move towards 1.2900, where activity will be high again in the market. Indicator analysis Looking at the different time frames (TF), we can see that the indicators on minute period signal SELL due to a local breakout from the earlier price range. Meanwhile, the hourly period signals BUY due to the current bullish correction in the GBP / USD pair. The daily period, which as before signals SELL, is still under the depth of the September decline. Weekly volatility / Volatility measurement: Month; Quarter; Year Volatility is measured relative to the average daily fluctuations, which are calculated every Month / Quarter / Year. (The dynamics for today is calculated, all while taking into account the time this article is published) Volatility is at 67 points, which is 45% below the average value. The current accumulation has already managed to concentrate a sufficient amount of trading volumes, so as a result, an acceleration is to follow soon. Key levels Resistance zones: 1.2885 *; 1.3000 ***; 1.3200; 1.3300 **; 1.3600; 1.3850; 1.4000 ***; 1.4350 **. Support Zones: 1.2770 **; 1.2620; 1.2500; 1.2350 **; 1.2250; 1.2150 **; 1.2000 *** (1.1957); 1.1850; 1.1660; 1.1450 (1.1411). * Periodic level ** Range level *** Psychological level Also check trading recommendations for the EUR/USD pair here, or brief trading recommendations for the EUR/USD and GBP/USD pairs here. The material has been provided by InstaForex Company - www.instaforex.com |

| US stocks fell while Asia went multidirectional Posted: 30 Sep 2020 05:01 AM PDT

The US stock exchanges crashed on Tuesday. Major stock indexes reduced their positions amid unfavorable news in the surge of COVID-19 infection in New York. According to the official statement released by the city authorities, the number of cases that tested positive increased by 3%. This means that the next introduction of restrictive quarantine measures is not far off. The Dow Jones Industrial Average dropped 0.48% or 131.4 points on Tuesday, pushing it to 27,452.66 points. The S&P 500 index also sank 0.48% or 16.13 points. Its current level was 3,335.47 points. The NASDAQ Composite Index fell 0.29% or 32.28 points, pushing it down to 11,085.25 points. Before the first televised debate of the election campaign in the US, market participants were in a rather agitated position. Some analysts believe that it is the first debate that determines the future winner with almost one hundred percent accuracy. That's why investors were looking forward to them. Moreover, the markets are almost certain about what to expect from the current President Donald Trump, but Biden's position is not too clear to them yet. This is what investors tried to clarify during the debate. Another important point for markets was the proposal of a new stimulus package in the US. The negotiation process seems to have moved forward, and there are hopes that the government may reach a consensus in the near future and adopt this long-awaited program. Democrats have put forward a modified package of measures to support the economy, which comes in a total budget of $2.2 trillion. It includes payments for unemployed citizens by the end of this summer. Its size is estimated to be about $600 per week. According to the latest information, the voting on the new proposed package will be held this week, and then the prospects for the entire incentive program will be seen more clearly. In the meantime, the press receives rather ambiguous statistics on the growth of the US economy. These statistics showed that the trade deficit in goods over the last month of summer increased by 3.5% and reached a record high of $82.94 billion. At the same time, imports in the country also rose by 3.1%, following exports, which increased by 2.8%. Meanwhile, the consumer confidence index in the US for the first month of this fall increased to 101.8 points, although earlier it was 86.3 points. This is the maximum value of the indicator since the outbreak of the coronavirus pandemic. Stocks in Asia moved multidirectional on Wednesday. Major stock indexes did not show any significant dynamics. The main points for market participants were statistics from China and Japan. Investors are also closely following the US presidential debate. Experts have stressed that the first televised debates did not help market participants figure out which of the candidates looks stronger in the current fight. The very atmosphere was quite hostile, which already made investors wary. Japan's Nikkei 225 Index dropped 1.43%. According to the data, its retail sales over the last month of summer fell by 1.9%. The previous decline in the indicator was stronger with 2.9%, thus we can talk about some recovery in this sector, although not so significant. In addition, the level of industrial production in the state increased by 1.7% compared to the previous record. Nevertheless, on an annualized basis, this indicator remains in the negative zone. China's Shanghai Composite Index sank 0.12%. Hong Kong Hang Seng Index, on the contrary, showed positive dynamics, adding 0.98%. The index of purchasing managers in the processing industry sector for the first month of autumn has already increased to 51.5 points, which was its maximum value since the beginning of this spring. The services and construction sectors have achieved even greater success. Its PMI index reached a record high of 55.9 points, which has not happened in almost seven years. South Korea's trading floors are closed on Wednesday due to a national holiday. Australia's S & P / ASX 200 Index fell 1.88%. Such a significant drop could eventually lead to a global decline for the second consecutive month. The negativity is due to the concerns about the second wave of the coronavirus pandemic. The material has been provided by InstaForex Company - www.instaforex.com |

| Trading plan for US Dollar Index for September 30, 2020 Posted: 30 Sep 2020 04:55 AM PDT

Technical outlook: GBPUSD had managed to push through 1 2930 levels early this week, after dropping through 1.2675 lows last week. The Cable currency pair is seen to be trading around 1.2833 levels at this point in writing and could continue to rally towards 1.3000 or 1.3200 mark to complete the counter trend rally. Please note that 1.3000 is the fibonacci 0.382 retracement of the recent drop between 1.3485 and 1.2675 respectively while 1.3200 is fibonacci 0.618 retracement. GBPUSD might reverse lower from either levels and push below 1.2675 in the near term. Immediate resistance is seen around 1.3485, while interim support comes in at 1.2675 levels respectively. Overall, GBPUSD remains bearish until prices stay below 1.3500 levels. Trading plan: Remain short, stop above 1.3500, target is open. Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment