Forex analysis review |

- Forecast for USD/JPY on September 7, 2020

- Hot forecast and trading signals for GBP/USD on September 7. COT report. Nonfarm Payrolls report could not spoil the mood

- Hot forecast and trading signals for EUR/USD on September 7. COT report. Major players started to close long trades in the

- Analytics and trading signals for beginners. How to trade EUR/USD on September 7? Getting ready for Monday session

- GBP/USD. Brexit-2. "ScExit". The collapse of the European Union can be supplemented by the collapse of the United Kingdom?

- EUR/USD. Brexit-2: "ItExit" and "NExit". Italy and the Netherlands can still follow the example of the UK.

| Forecast for USD/JPY on September 7, 2020 Posted: 06 Sep 2020 08:09 PM PDT USD/JPY Despite the upbeat US employment data on Friday, stock indices continued their inertial fall after Thursday's collapse of more than 3%. The Dow Jones lost 0.56%, while the S&P 500 fell 0.81%. As a result, the USD/JPY pair gained only 6 points amid the dollar's growth. The price channel line around 106.60 was not reached for the second time. Today, the price will make its third attempt to reach 106.60, but it's a holiday in the United States and therefore, the expected growth is again in doubt. The price is above the balance (red) and MACD (blue) indicator lines on the four-hour chart, while the Marlin oscillator is in the upper half of its area, and all these characteristics indicate that the price will increase in the short term. An alternative scenario may reverse when the price settles below the MACD line, below 106.15. In this case, the price could fall to the 195.60 level, the September 1 low. |

| Posted: 06 Sep 2020 06:35 PM PDT GBP/USD 1H The GBP/USD pair traded almost identical to the euro currency on September 4. The pair's quotes stood in one place in the morning and practically did not move from it in the afternoon, a pullback to the downside was made, followed by a similar upward pull. As a result, the pound/dollar pair ended both day and week between the Kijun-sen and Senkou span B lines, which only confuses the current technical picture, as it does not allow us to clearly assume which direction it will move. On the one hand, the downtrend is visible to the naked eye, but it is visible on the hourly chart. The current downward movement does not even pull a correction on higher timeframes. Thus, as in the case of the euro, we believe that the dollar's potential for growth is very limited at this time. GBP/USD 15M Both linear regression channels are directed downward on the 15-minute timeframe, thus, we can conclude that the downward trend is weak, but continues to persist. The latest Commitments of traders (COT) report for the British pound turned out to be even more unexpected than the one for the euro. If non-commercial traders were already shorting the euro, the same category of traders continued to buy the pound. In total, professional traders opened 5,500 new Buy-contracts and 3,000 new Sell-contracts during the reporting week (August 26 - September 1). Thus, their net position even increased by 2,500, according to the new COT report. In principle, such data perfectly describes what is happening in the foreign exchange market, since the British currency continued to grow during all five trading days included in the report. The pound has been depreciating in the period from September 1 to the present day, but the latest COT report shows that there are no hints that professional traders have stopped looking towards the pound (unlike the euro). Therefore, we can not find a correlation between the two main competitors of the US dollar at this time, although both major currency pairs have been moving almost identically in recent days based on the COT reports. The fundamentals of Friday, September 4, mainly came down to the Nonfarm Payrolls report. We already mentioned in the euro article that, in general, the package of macroeconomic data from across the ocean turned out to be quite optimistic. The unemployment rate fell while wages rose. The Nonfarm Payrolls report turned out to be worse than forecasted, but not much. 1.4 million new jobs outside the agricultural sector were predicted, but in reality, 1.371 million were created. There was only a 29,000 difference. Therefore, we can not conclude whether this report was weak or considered a failure. Therefore, it should not have spoiled the general picture of the state of affairs. Nevertheless, after the US dollar slightly strengthened, it began to fall in price anyway. It had an excellent chance of growth on this day. Consequently, the bears still see no good reason to sell the euro/dollar and pound/dollar pair. The general fundamental background in America remains rather complicated and, most likely, it does not allow the US dollar to show confident growth. We have two trading ideas for September 7: 1) Buyers continue to be in the shadows. The quotes of the pound/dollar pair have settled below the ascending channel, thus, it is not relevant to buy the pound at this time. So far, there are no prerequisites for reviving the upward trend, and the bears managed to overcome the Kijun-sen and Senkou Span B lines in half. Thus, the bulls are not going to return to the market, and it is recommended to only consider buying when the price has settled above the Kijun-sen line. (1.3328) with the target of the resistance level 1.3451. Take Profit in this case will be about 100 points. 2) Bears continue to push slowly, so short positions remain relevant with the target of the support area of 1.3157-1.3183, but you are advised to reject this target very carefully, as sellers show their weakness day after day. Take Profit in this case will be no more than 50 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

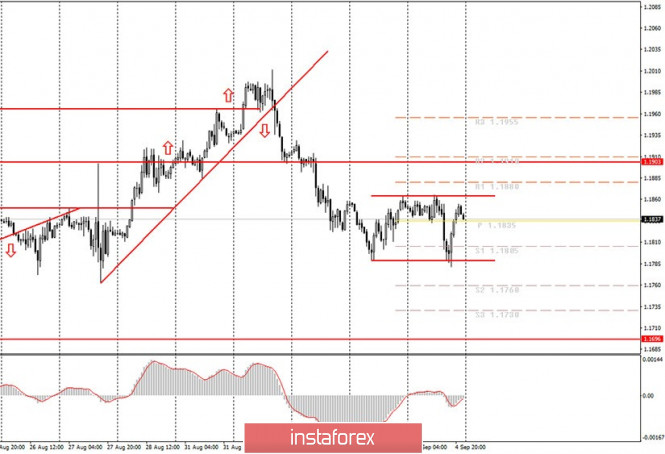

| Posted: 06 Sep 2020 06:33 PM PDT EUR/USD 1H The hourly timeframe on September 4 showed that the euro/dollar pair reached the support level of 1.1803 for the second time, unsuccessfully trying to overcome it as it did the first time, and then it began to retreat to the upside by the end of the trading day. Thus, last Friday's trading was already in a very narrow sideways range even without an intraday trend. The overall technical picture remains as vague and incomprehensible as it did in the last month and a half. On the one hand, we can say that the pair continues to be flat despite the fact that quotes have gone above the upper limit of the side channel twice at 1.17-1.19. At the same time, the pair spends most of its time within the specified range. And since this range is only 200 points, the pair is now moving flat. Therefore, we suggest that you continue to rely on the flat when making any trading decisions. EUR/USD 1H The 15-minute timeframe shows that the higher linear regression channel is the best way to show that even in the short term, the pair is moving inside the sideways channel. The latest Commitment of Traders (COT) report, which, let me remind you, comes out with a three-day delay and only covers the dates from August 26 to September 1, unexpectedly showed a decrease in the net position for the "non-commercial" category of traders. Let me remind you that non-commercial traders are the most important category of traders who enter the foreign exchange market in order to make a profit. So, non-commercial traders reduced Buy positions and opened Sell contracts during the reporting week. The number of Buy positions decreased by almost 11,000, while the number of Sell positions increased by 3,000. Thus, the net position immediately decreased by 14,000. Take note that the euro did not really get cheaper during the reporting week, which is covered by the latest COT report. The euro strengthened during all five trading days, and only started falling on September 1, which we can now describe as being provoked by professional traders and their sell positions. The euro was falling after September 1, so the new COT report may signal an even greater decrease in net positions. And in this case, it will confirm that the mood of non-commercial traders is really changing to a downward one. Three important reports were published in America on September 4, Friday, which could have an impact on the euro/dollar pair's movement. They could have, but in the end they practically did not. Looking ahead, the US dollar initially rose in price by 60 points when these data were released, and then it fell by the same amount. In fact, markets did not react. Or it could be called highly mediated or indirect. Nevertheless, there was enough positive news from America. The unemployment rate fell by the end of August to 8.4%, while a broader measure of unemployment known as the U6 suggests the "real" rate was 14.2%, and the average hourly wages rose by 0.4%, although analysts had predicted zero growth. Therefore, the US dollar had an excellent opportunity to continue growing, but failed to do so again. Even the Nonfarm Payrolls report could not prevent this. We have two trading ideas for September 4: 1) Bulls continue to keep their finger on the pulse of the market and feel ready to return at any time to start new buy positions for the euro. At least the current drop in quotes is very weak, and the price has not yet approached the important level of 1.1700, which we still consider as the lower border of the side channel. You can buy the pair in small volumes in case it settles above the Kijun-sen line with targets at 1.1961 and 1.2020. Take Profit in this case will be from 35 to 100 points. 2) Bears got the opportunity to start forming a new downward trend, as they managed to gain a foothold below the Senkou Span B line (1.1882), but so far they clearly do not want to use it. Thus, for now, we can recommend selling the pair while aiming for the support area of 1.1705-1.1729, if there is a consolidation below the 1.1803 level. In this case, the potential Take Profit is 50-60 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Sep 2020 02:20 PM PDT Hourly chart of the EUR/USD pair The EUR/USD currency pair spent the whole day inside a75-point corrective side channel on Friday, September 4. This is not small for an intraday channel, but then again it can also be considered as somewhat small. The main thing is that there was no trend movement on Friday. In general, the trend remained downward, so novice traders could open short positions, as the MACD indicator moved down twice during the day. Unfortunately, the first sell signal turned out to be false, as the indicator swiftly moved back up, and the second one was not false, but sharp, the price simply started falling too quickly and it turned out to be too short-lived. In the first case, traders could limit themselves to minimal losses, since the price could not continue to move up after a false signal. In the second case, traders had to open trades after the quotes fell by 50 points near the first target for the day – 1.1805. However, we warned in Friday's morning review that sharp price reversals are possible once important US macroeconomic data are released, and we recommended that you conduct the most cautious trading at this time, do not forget about Stop Loss orders or leave the market altogether. Therefore, in general, Friday should not have brought big losses to traders. As for fundamental events, all the most interesting things happened again in the United States. Economic factors are considered the most important in terms of the degree of influence on any currency's movement. However, they have clearly faded into the background in recent months (during the coronavirus pandemic). Thus, the macroeconomic reports from the US were very important, but at the same time they caused a rather weak and not entirely logical reaction from the market. For example, the US unemployment rate fell by almost 2% in August, which is a lot. The hidden unemployment rate fell by 2.3%, while the average wages rose by 0.4% m/m. All these are positive aspects for both the American economy and the dollar. However, we only saw a short-term rise in the dollar, and then it immediately fell. The Nonfarm Payrolls report turned out to be slightly worse than forecasted, but not at all critical. We would even say that it was in line with forecasts, therefore, it could not cause disappointment among market participants. Thus, the entire package of data was positive, but did not result in a significant rise from the dollar. Macroeconomic data from the EU or the US will not be published on Monday, September 7. Thus, the macroeconomic background does not have any influence on this day, so the pair can be traded in a very narrow range with low volatility. Friday's movement may extend until Monday. We recommend novice traders to wait for the price to leave the side channel and only then should you resume trading. Possible scenarios for September 7: 1) Novice traders are advised to not consider buy positions at this time, since the pair has settled below the upward trend line, so the trend has now changed to a downward trend. There are currently no signals or technical patterns that support the upward trend. Therefore, buyers need to wait for trend lines or channels that would show an upward trend. 2) Sell positions continue to look more relevant, but the pair spent the last two days in a side channel. Therefore, novice traders are advised to wait until this correction is completed and also wait for the price to leave the channel (shown in the illustration) through its lower line. This may not happen on Monday, since market movements are usually weak on this day. However, we recommend trading lower after the price settles below 1.1789. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Sep 2020 04:06 AM PDT The Scots are actively thinking about leaving the United Kingdom in the past few years. In 2014, an independence referendum was already held in Scotland with the permission of London, the results of which showed that the majority of Scots want to remain part of the United Kingdom. However, at that time, no one in the UK knew about Brexit (perhaps other than the highest political forces). Thus, two years later, when the UK decided to leave the EU with "as much as" 52% of the vote, Scotland immediately opposed this option, and then wanted to hold a new referendum, "because the conditions have changed". There is no doubt that if a new referendum were held now, its results would no longer be in favor of London and Scotland would start its Brexit. However, as Boris Johnson correctly pointed out, Edinburgh cannot hold referendums on independence every 5 years. Thus, London is not going to grant Edinburgh a new right to hold a referendum in the coming years for sure. In fact, for Edinburgh and Minister of Scotland, Nicola Sturgeon, there is only one option left – an unauthorized referendum. And will Sturgeon take this step of direct conflict with London? It should be noted immediately that the number of Scots who do not support the UK is about the same as the number of Britons who do not support the EU. In other words, the British did not have a clear general opinion in 2016, and the Scots do not have it now. Various opinion polls show that approximately 55-56% of Scots support leaving the European Union, which means that 44% of the country's population will oppose it. This means that even in this case, almost half of the citizens will end up with the option that they do not support. And if the "losers" do not lose much in the elections to Parliament or Prime Minister, since the country's policy cannot be changed dramatically in a few years, then in a situation with a possible "Brexit" almost half of the country will be forced to live differently from what it lived before for three centuries. Scotland will come out of Britain and immediately there will be borders with Wales, England, and Northern Ireland. And the countries that are part of the United Kingdom are about the same as the countries that are part of the former USSR. A huge number of Scots live in England and vice versa, a huge number of relatives of Scots live in the rest of the UK. In times between countries, there will be borders, customs, and checks. The same applies to businesses that have worked for 300 years within the framework of a single economic system with England, Wales, and Northern Ireland, and they will have to adapt to new realities, customs, duties, and restrictions, just as British businesses now need to adapt to the new realities of trade with European companies. 44% of the Scottish population does not support this option. Thus, if Scotland initiates an exit from the UK in any way, it may turn out to be the same long-standing "Brexit". Nicola Sturgeon, who has repeatedly asked Boris Johnson to allow Edinburgh to hold a referendum, however, is not going to rush things on this issue. The First Minister of Scotland wants to wait for the parliamentary elections, where the position of her party can be further strengthened. After that, the Scottish leader may start putting pressure on London again. In general, the UK may soon face not only new economic problems but also geopolitical problems that will lead to a lot of new economic and social problems. Unfortunately, the EU continues to fall apart. It's just that it's not fast. How many years has the European Union been created and acquired its present form? So far, the case has been limited to the UK alone, but in the future, other countries will want to leave the European Union and, as we can see, some countries also want to leave the jurisdiction of others. Thus, the very long-term prospects of the pound, from our point of view, remain quite unattractive. The United States of America is unlikely to break up into separate states. Thus, they only need to solve their internal problems, which were actively created by Donald Trump in the last few years. Economic power cannot be lost in a short period. So whatever it is now, the United States remains the country with the strongest economy in the world. Thus, if Trump does not become the next president of the country, then we can expect that the situation will improve in the coming years. In the case of the UK, everything is more complicated. We believe that the situation will only get worse, and the Kingdom may also face a political crisis in the coming years, as we still believe that Boris Johnson gave the UK nothing but the completion of the "divorce" process with the European Union. Recommendations for the GBP/USD pair: The pound/dollar pair continues its more pronounced upward movement on the 24-hour timeframe. Thus, unlike the euro, the British pound continues to get more expensive in pair with the dollar, which raises more and more questions every day. However, the technical picture is the same now, and there is nothing you can do about this discrepancy with the fundamental background. At the moment, the pair has corrected the critical Kijun-sen line. A price rebound from this line may trigger a resumption of the upward trend. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 06 Sep 2020 04:06 AM PDT In recent months, most of the news flow is coming from America, however, we cannot say that no important and significant messages are coming from the European Union. For example, until recently, the EU was at the center of a serious process in which all 27 member states of the alliance tried to agree on the economic recovery fund and the budget for 2021-2027. However, the amount of news that is available recently in the States crosses out the rest of the fundamental background. We have already talked about all the difficulties, problems, and crises that the United States faced in 2020 more than once. Today we propose to focus on a potentially serious problem of the European Union. A problem called ItExit (similar to BrExit). More recently, amid discussions by EU member states on the recovery fund and its distribution, there were rumors that Italy might initiate a "divorce" from the European Union. Back then, the Italians claimed that wealthier European countries that were less affected by the "coronavirus" pandemic refused to help them and other hard-hit countries on a gratuitous basis. Thus, some political leaders in Italy put the question as follows: "Why the need to stay in the EU at all, if the EU does not help at a difficult moment?" We can discuss this issue for a very long time. On the one hand, Germany, Austria, and the Scandinavian countries have repeatedly accused the Italians and French of excessive waste and uneconomical living. It is also unclear why more financially stable countries should simply give tens of billions of euros to Italy, Spain, Poland, and others. On the other hand, Italy is not obliged to remain in the EU. If its political forces believe that it is time to go in different directions, and in the next elections in 2021, these political forces will be supported by the Italians themselves, then the country has every right to follow the example of Great Britain. At the moment, this issue has subsided, since Italy still received free assistance. However, anti-European views have been maturing in Italy for a long time. For several years, some political parties are beginning to look towards separation from the EU, and only the 2021 elections will show how much the Italians themselves want the same. The main thing here is that it doesn't work out the same way as with the UK. We have nothing against the very exit of any country from the bloc, however, the absolute majority of the country's residents should vote for this option. The same applies to the Netherlands. It is noted that anti-European sentiments and views have been maturing in the country for quite a long time. Amsterdam is not happy with the migration and financial policy of the European Union. However, the advantages of European integration still outweigh the disadvantages, so the process of a new "divorce" is not yet launched. On the issue with the Netherlands, the last straw may just be the EU summit, which resolved the problems with the recovery fund and the budget for 2021-2027. It's simple. The Netherlands was "on the other side of the barricades" from Italy, Spain, and other "southerners" or "spenders". Amsterdam believes that the seven-year budget is too expensive (recall that the European Parliament believes that the budget is too meager), and the plan to save the EU economy supports countries that spend a lot and require a lot of help from the EU itself. Dutch Prime Minister Mark Rutte believes that countries such as the Czech Republic, Estonia, Hungary, Italy, Greece, Spain, Latvia, Lithuania, Romania, Slovakia, Cyprus, and Portugal are interested in remaining in the EU. According to many experts, the last EU summit showed how much opinions differ between its 27 participants, and that national interests almost always prevail over common ones. Simply put, none of the "prosperous countries" wanted to just give away tens of billions of euros from their treasury. However, this is the option that the European Council insisted on and this option was adopted in the end. However, the fact that the Netherlands, Scandinavians, Germany, and Austria supported this option does not mean that they were satisfied with everything. There is a political force that can implement NExit in the Netherlands. This is the "Freedom Party" with its leader Geert Wilders, who in 2014 called for leaving the European Union. That is two years before the UK referendum. "NExit is the best thing that can happen. We would be masters of our country again. We would be holding the key to all our doors again," Wilders said in an interview. The Prime Minister himself in 2014-2017 was not particularly zealous in supporting the exit from the EU. However, now that relations between many members of the alliance have been reduced to calculations of "who, to whom, how much", its eurosceptic mood has increased. The Netherlands, according to opinion polls, also support leaving the EU. A few years ago, this option was supported by about 56% of respondents. Now that the Netherlands has had to hand out grants to a whole list of countries, we can be sure that the number of eurosceptics has increased even more. It is also noted that Amsterdam is very dissatisfied with the quotas for refugees that the European Union has determined. The Netherlands has a fairly high population density and a small territory, so it is more difficult than others to accept refugees. Although two new "Brexits" are already brewing in Europe, European political analysts believe that in the next few years or a decade, all members of the "lean four" can follow the example of the UK. We are talking about Sweden, Denmark, and Austria, which also opposed "coronabonds" and the free distribution of money to the most affected EU countries. Later, these countries were joined by Finland, which also had to support the decision within the framework of the notorious summit, according to which the country will have to invest free of charge in restoring the economies of European spenders. In general, the European Union still looks more or less stable. In the last three months, the European currency has strengthened quite a lot compared to the US dollar, and we can not say that it is completely groundless. There hasn't been much negative news from Europe lately. But in the future, the EU may face serious geopolitical problems, which is hardly possible, for example, in the United States. Trading recommendations for the EUR/USD pair: The technical picture of the EUR/USD pair on the 24-hour timeframe shows that the semi-flat movement continues in recent months with a minimal upward slope. Thus, formally, purchase orders remain more relevant, since there are no technical grounds for selling the currency pair at all (on the current timeframe). At the same time, buyers are cautious when opening new longs. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment