Forex analysis review |

- Forecast for EUR/USD on October 26, 2020

- Forecast for GBP/USD on October 26, 2020

- Forecast for AUD/USD on October 26, 2020

- Hot forecast and trading signals for EUR/USD on October 26. COT report. EU service sector starts to face problems due to

- Forecast for USD/JPY on October 26, 2020

- Overview of the GBP/USD pair. October 26. Progress has been made in negotiations between Brussels and London. A deal is still

- Overview of the EUR/USD pair. October 26. Americans don't vote for Joe Biden. They vote either for Trump or against Trump.

- Analytics and trading signals for beginners. How to trade the GBP/USD currency pair on October 26? Analysis of Friday's deals.

- Analytics and trading signals for beginners. How to trade the EUR/USD currency pair on October 26? Analysis of Friday's deals.

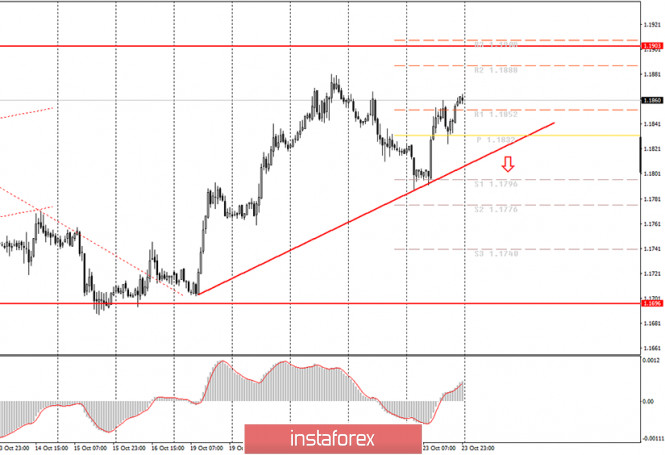

| Forecast for EUR/USD on October 26, 2020 Posted: 25 Oct 2020 08:09 PM PDT EUR/USD The euro fully recovered on Friday after falling on Thursday, now the price intends to reach the target level of 1.1917 - the highs of September 10 and August 6. Perhaps growth will be slightly higher in order to reach the MACD line. The highest peak is seen at the upper border of the price channel at 1.1960. The Marlin oscillator is growing, the bullish trend of the corrective plan continues. The price rises after a false departure under the MACD line on the four-hour chart, which is its own sign of continuing the movement after a false price maneuver. The same maneuver was made by the Marlin oscillator, now the price is in a growing position for all indicators on this timeframe. We are waiting for the price to rise to the designated target of1.1917. |

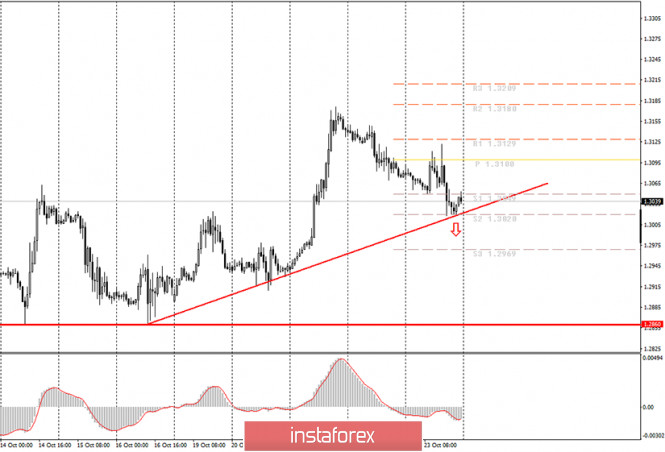

| Forecast for GBP/USD on October 26, 2020 Posted: 25 Oct 2020 08:06 PM PDT GBP/USD After a strong growth on October 21st and a subsequent two-day decline, the pound settled in the range of uncertainty between the balance and MACD indicator lines. The price could continue rising within the range after it goes beyond the target level of 1.3082 - the goal is 1.3185, possibly 1.3255, which according to the main downward scenario will be nothing more than a false exit above the MACD line, then the price will find itself below the 1.3185 level. the Marlin oscillator is in the growth zone, this allows the price to make another growth branch. It is possible for the price to continue falling towards the target of 1.2860 after it settles below 1.3000 (resistance on September 16-18). The price settled below the MACD line on the four-hour chart, but it is above the balance line, that is, in the zone of uncertainty. The signal line of the Marlin oscillator in the territory where bears dominate is a sign of the price's intent to overcome the signal level of 1.3000. We will find out soon whether the price can do it. |

| Forecast for AUD/USD on October 26, 2020 Posted: 25 Oct 2020 08:06 PM PDT AUD/USD The Australian dollar rallied alongside other counter-dollar currencies last Friday. The movement started from the target level of 0.7120, but it is very difficult to determine where it will end, there are many strong levels on the way, the closest of which is 0.7190. Without the price breaking above the balance indicator line (red), the price can reach the target range of 0.7233/55, and this growth will still be considered corrective. The price must go beyond the balance line for a solid upward movement. The Marlin oscillator has moved into growth territory, which also gives the price some upside potential with overcoming the first target level. The four-hour chart shows that the price went above the MACD line for the second time in the last 24 hours, and the price never fell below the balance line. Marlin is developing in a range, but it is in a positive trend zone and still has the potential to move up. We expect the Australian dollar to continue growing in the short term. |

| Posted: 25 Oct 2020 07:54 PM PDT EUR/USD 1H The euro/dollar pair abruptly moved up on the hourly timeframe on Friday, October 23, settling above the critical Kijun-sen line and then it rushed to the resistance level of 1.1882, which was already reached last week. Thus, the upward trend continues in spite of the fact that the pair previously left the ascending channel and the price was settling below the Kijun-sen line. It will be extremely difficult for traders to overcome the 1.1882 level, as well as the resistance area of 1.1887-1.1912. Take note that the euro/dollar continues to trade within a horizontal channel, even two, and the 1.1900-1.1920 level is the area of the upper boundaries of both channels. Therefore, a rebound from it is very likely. On the other hand, going beyond it will show the bulls' intentions to move up further. EUR/USD 15M The lower linear regression channel turned to the upside on the 15-minute timeframe, displaying the resumption of the upward movement on Friday. But further growth prospects will entirely depend on the 1.1900-1.1920 area. COT report The EUR/USD pair fell by around 40 points during the last reporting week (October 13-19). But in general, no significant price changes have been observed for the pair in recent months. Therefore, data from any Commitment of Traders (COT) report can only be used for long-term forecasting. The new COT report showed even fewer changes in the mood of professional traders than the previous one. Non-commercial traders, who, we recall, are the most important group of traders in the foreign exchange market, opened 1,081 Buy-contracts (longs) and 673 Sell-contracts (shorts). Take note that the "non-commercial" group decreased its net position in the last two weeks, which may indicate the end of the upward trend. However, the data provided by the latest COT report does not tell us anything at all. There are no changes, since non-commercial traders have opened almost 300,000 euro contracts. Thus, opening or closing of 1,000-2.000 contracts does not indicate anything. The lines of net positions of the "non-commercial" and "commercial" groups (upper indicator, green and red lines) continue to barely narrow, while the pair itself continues to trade in a horizontal channel. Therefore, we stick to our opinion - the upward trend is completed or is about to be completed, and the high reached near the 1.2000 level may remain the peak of this trend. The European Union and Germany published indexes of business activity in the services and manufacturing sectors last Friday. Traders have not been reacting to macroeconomic statistics for quite some time now. However, they react to the general fundamental background. For example, the loss of 32% of GDP by the US economy in the second quarter cost the dollar approximately 13 cents paired with the euro. Thus, the deterioration in business activity may indicate serious consequences for the economy as a result of the second wave of coronavirus. In principle, this is exactly what we can say by looking at the indices. In Germany, the service sector continued to decline and reached 48.9, while it continued to decline and hit 46.2 in the European Union as a whole. The service sector, the industry that suffers the most from quarantines, epidemics and various kinds of restrictions, just began to suffer, as soon as high levels of COVID-2019 morbidity began to be recorded in Europe, compared to that of summer. Similar indices were published overseas, but they showed the exact opposite picture. The service sector is doing well and rose to 56, while the manufacturing PMI fell to 53.3. We have two trading ideas for October 26: 1) The pair still maintains the prospects for an upward trend. And so traders are advised to continue trading up while aiming for the resistance levels of 1.1882 and 1.1939 as long as the price is above the Kijun-sen line. Take Profit in this case will be up to 70 points. However, one should take the 1.187-1.1912 area into account, which the bulls may not be able to overcome, as well as the 1.1900-1.1920 level. 2) Bears remain in the shadows. Thus, sellers need to wait for the price to break the Kijun-sen line (1.1820) in order to have reasons to open sell positions with the targets of the Senkou Span B line (1.1759) and the support area of 1.1692-1.1699. The potential Take Profit in this case is from 50 to 110 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the "non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| Forecast for USD/JPY on October 26, 2020 Posted: 25 Oct 2020 07:54 PM PDT USD/JPY The yen is in no hurry to strengthen (decline on the chart), since the situation on the stock markets has been mixed since Friday. The price is still developing below the line of the descending price channel on the daily chart, while the Marlin oscillator is growing weakly, the probability of a succeeding price fall remain, the target is 103.75. Getting the price to settle above Friday's high of 104.95 and automatically going beyond the price channel line will become a condition for further growth towards the MACD line at 105.55. The price is also under pressure from all indicators on the four-hour chart. There is a possibility that Marlin would enter the zone of positive values, but if this happens without the price settling above 104.95, then the signal will be weak and false. Also, the price needs to overcome the resistance of the MACD line in the 105.22 area. It will be difficult for the pair to rise. The first sign that the price would succeedingly fall is if the price moves below Friday's low of 104.56. |

| Posted: 25 Oct 2020 05:14 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - upward. CCI: 9.9393 The British pound sterling, paired with the US currency, corrected to the moving average line on Friday. However, in general, there is still an upward trend, which raises a lot of questions. The fundamental situation for the pound/dollar pair remains extremely difficult. On the one hand, the US dollar is under pressure from the election situation and general instability and uncertainty in the US. On the other hand, the British pound is under no less pressure from Brexit, the prospects for the British economy, and the extremely low probability of signing a trade agreement with the European Union. However, both currencies cannot be under pressure at the same time. Therefore, one has to become more expensive, the second - cheaper. However, in general, we believe that the British pound will continue to fall in the long term. It is the prospects for the British economy that cause the greatest concern. Moreover, the pound has grown quite strongly in recent months, so it's time for it to start forming a downward trend even for technical reasons. This process may have already started on September 1. After the first round of the downward movement, a long correction followed, which may be completed in the near future. Recall that within this correction, the pair worked out the level of 61.8% Fibonacci. Thus, if there is no consolidation above this level, we would say that the probability of a new fall is extremely high. However, first, the pair needs to be fixed below the moving average line. Meanwhile, today the British pound may rise again as the well-known British newspaper Telegraph said on Sunday that the UK and the European Union still began to give in to each other in the negotiations and a deal can still be concluded in the near future. The EU's chief negotiator, Michel Barnier, is going to stay in London until October 28 and continue working on the agreement, despite the progress made in the negotiations. However, the publication also reports that excessive optimism is still not appropriate now, since the shifts in the negotiations are not very large yet. London and Brussels have until October 31 to decide whether there is any point in negotiating further. According to unconfirmed reports and sources close to the UK government, it has become known that there is indeed progress, however, we would recommend waiting for official statements from the parties. However, most traders may not wait for these statements. For the pound in the last four years, rumors and expectations of traders are almost the only opportunities to get more expensive at least from time to time. That is why we assume that this currency may grow on Monday. At the same time, we remind you that the differences between the EU and the Kingdom in their views on the trade agreement are significant. Therefore, it is far from a fact that the parties will still be able to agree. We also remind you that the following questions remain key. First, of course, the "fish" question. The UK does not want to provide access to its waters to European fishermen, which is why the fishing industry in many countries of the Eurozone may suffer significantly. Second, there is the issue of dispute settlement at the international level. The European Union wants the European Court of Justice to always have the last word, which, of course, London wants to avoid. Third, it is a question of fair competition between British and European companies, which is what the European Union wants to achieve. Fourthly, these are European standards and norms that the EU wants to force Britain to adhere to. Besides, the future of the "Johnson bill" remains completely unclear, as well as the situation and regime on the Northern Ireland border after December 31, 2020. Thus, we would not recommend that traders open the champagne and prepare large purchases of the pound. Unfortunately for the British economy, signing a free trade agreement will only smooth out the negative impact of Brexit. So even if a deal is struck, it is far from certain that the British economy will be doing well in 2021. Most likely, the Bank of England will still be forced to reduce the key rate, which will move to the negative area. Market participants are also waiting for the expansion of the quantitative stimulus program in 2020. And most importantly, an epidemic against which there is still no vaccine (100% safe and proven) and which, according to WHO and many governments around the world, will continue to terrorize people until at least the spring and summer of 2021. And no one can say what will be the levels of morbidity in a month. The UK is already breaking all the anti-records of the first "wave". In the last three days, at least 20,000 cases were recorded daily, which is four times higher than the maximum levels in the spring, when the health system was already experiencing certain problems. If the number of cases continues to grow, then a "hard" quarantine is inevitable. From a technical point of view, the upward trend is still maintained since the pair still manages to stay above the moving average line. We also once again point out that in general, trading on the pound/dollar has been extremely "ragged" in recent weeks. Quotes can go one way 200 points, and the next day the same amount in the opposite direction. Thus, now is not the most favorable time for trading, and fixing the price below the moving average does not guarantee that the pair will not resume its upward movement the next day.

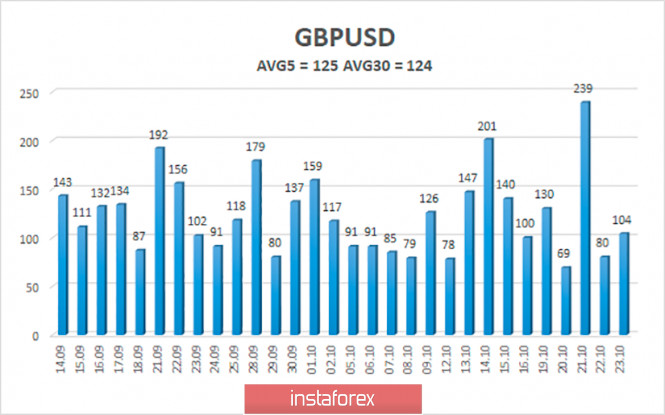

The average volatility of the GBP/USD pair is currently 125 points per day. For the pound/dollar pair, this value is "high". On Monday, October 26, thus, we expect movement inside the channel, limited by the levels of 1.2914 and 1.3164. A reversal of the Heiken Ashi indicator upward signals a possible resumption of the upward movement. Nearest support levels: S1 – 1.3000 S2 – 1.2939 S3 – 1.2878 Nearest resistance levels: R1 – 1.3062 R2 – 1.3123 R3 – 1.3184 Trading recommendations: The GBP/USD pair started a round of corrective movement on the 4-hour timeframe. Thus, today it is recommended to trade for an increase with the targets of 1.3123 and 1.3164 if the Heiken Ashi indicator turns up or the price rebounds from the moving average. It is recommended to trade the pair down with targets of 1.2939 and 1.2914 if the price is fixed below the moving average line. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 Oct 2020 05:14 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - upward. CCI: 81.2937 During the last trading day of the past week, the EUR/USD pair completed a correction near the moving average line, bounced off it, and resumed its upward movement. Thus, at the moment, we can say that the upward trend for the pair remains, but at the same time, we once again note that the price continues to move in the most long-term plan inside the side channel of $1.17-$1.19 (or 1.1640-1.1920). Thus, in the next few days, there may be a downward reversal and a resumption of the downward movement to the lower line of channel 1.1700. Accordingly, it is still impossible to talk about a full-scale trend now. Rather, these are micro-trends inside the side channel. Of course, the flat won't last forever. It will be completed sooner or later. If the pair's quotes manage to overcome the upper line of the channel, then a new full-fledged upward trend may begin to form. However, we still doubt that market participants will rush to buy the euro for no apparent fundamental reasons near its two-year highs. As for the US currency, we still do not consider its growth possible and probable before the elections on November 3. There was very little news on Friday. By and large, the markets are already fully focused on the upcoming elections, as well as the candidates themselves and the entire country. At least, all other topics that worried traders and forced them to trade are put on pause. All three rounds of the debate between Donald Trump and Joe Biden have passed (except for the canceled second), so a week before the election, none of the candidates will be able to influence their political ratings. Although, by and large, none of the candidates has done anything in recent weeks to change these very ratings. We believe that if both presidential candidates had gone on vacation a couple of months ago, the balance of power a week before the election would have been the same as it is now. The fact is that Trump has already said everything he could say and do everything he could do. The "coronavirus" pandemic, which the US president treated from the very first day as a cold, constant statement about COVID-2019, which was criticized, refuted by all doctors, epidemiologists, and virologists. Yes, even ordinary Americans who do not have a medical education understand that more than 200,000 people do not die from cold in six months. Every American understands that the whole world is dealing with an epidemic. Only Donald Trump, who continues to make absurd statements with enviable regularity, does not understand this. For example, this weekend, he said at a campaign rally in Florida that "they (the government) are going to put a quick end to this pandemic". Earlier, Trump promised a vaccine. He also said that the virus will evaporate and disappear on its own, will not survive the summer, and so on. All of Trump's other "merits" stem from the pandemic. Record-breaking economic decline, record-high unemployment, total inability to work as a team with the Democrats. And also, a trade war with China, in which it is the United States that is losing. Thus, in four years, Trump has shown himself as president from all sides and most Americans do not even need new promises about the "Golden Age". They saw firsthand all of Trump's work and its consequences. As for Joe Biden, he didn't have to do anything at all. All he had to do was not make mistakes, not make unsubstantiated statements, and criticize Trump for a whole lot of mistakes he made. That's the whole recipe for winning the election. Of course, Biden hasn't won anything yet. However, all opinion polls continue to show record ratings for the Democratic presidential candidate. Well, Trump can only continue to do what he did for four years. Criticize the media, try to blame others, or pretend that nothing terrible has happened, and a bright future awaits everyone, of course, with him at the head of the country. A week before the election, Trump recalled the activities of Hunter Biden and Joe Biden in Ukraine and China. Earlier, he failed to play the same card. No evidence of the Bidens' illegal activities was found, and there was not even a specific reason to launch an investigation. However, Trump continues to "trash" this card, trying to squeeze at least some dividends out of it. At first, he called on the FBI to launch an investigation against the presidential candidate and his son and to put both in prison. After that, he began to criticize the media for not covering the topic of Biden's corruption schemes enough and trying to hide them. At the same time, according to Trump, the media pays a lot of attention to the COVID pandemic, only scaring citizens. Meanwhile, more and more foreign media support the view that the US election is not the election of Trump or Biden. This is the election of Trump or not Trump. In other words, the American people will decide whether they want Trump as the head of state, and if they don't, it doesn't matter who the other president is. We have repeatedly encountered this idea in one form or another. We have previously drawn parallels with the UK parliamentary elections that took place in December last year. Then the conservatives won by a large margin. We were and still believe that the British did not vote for the conservatives or labor. They voted for or against Brexit. Since it was the conservatives who proposed an early end to Brexit, that's why Boris Johnson's party won. It may be the same in America now. Biden can win, not because the Americans support him, but because they don't want new problems with Trump. Well, for the US currency in terms of prospects, nothing has changed yet. Before the election, that is, at least a week, it is unlikely that the US dollar will become more expensive. It is possible, but only within the side channels that we discussed above. No one knows what will happen after the elections and when they will end at all. Therefore, any further plans and strategies should be made after the election is over and the results are announced.

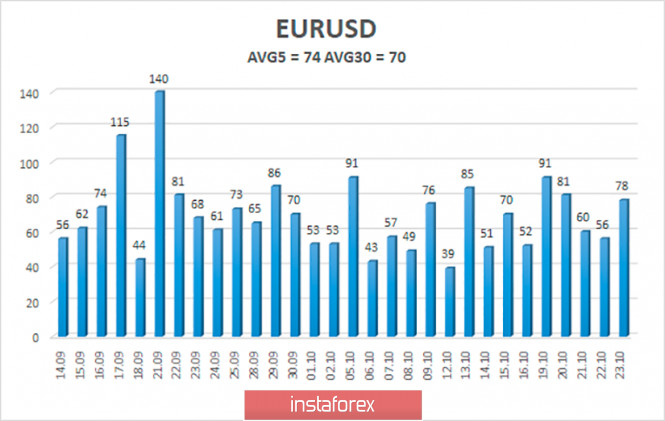

The volatility of the euro/dollar currency pair as of October 26 is 74 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1786 and 1.1934. A downward reversal of the Heiken Ashi indicator may signal a new round of downward correction. Nearest support levels: S1 – 1.1841 S2 – 1.1780 S3 – 1.1719 Nearest resistance levels: R1 – 1.1902 R2 – 1.1963 R3 – 1.2024 Trading recommendations: The EUR/USD pair resumed its upward movement. Thus, today it is recommended to stay in buy orders with targets of 1.1902 and 1.1934 as long as the Heiken Ashi indicator is directed upwards. It is recommended to consider sell orders if the pair returns to the area below the moving average line with a target of 1.1719. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 Oct 2020 06:11 AM PDT The hourly chart of the GBP/USD pair.

For the GBP/USD currency pair, trading during the last trading day of the week was quite difficult. However, by the end of Friday, the price still worked out an upward trend line, which is not strong and clear. However, a rebound from it can provoke a new upward movement. Moreover, the formal upward trend continues. But if this trend line is overcome, then the trend will change to a downward one and short positions will become relevant. Thus, on Monday, novice traders are advised to be very careful. We have repeatedly said that we are leaning towards the option with a downward movement of the pair since the pound sterling looks much weaker than the US dollar. However, until specific technical signals appear, this is just a hypothesis. The fundamental background for the British currency remains an extremely important factor. Just today, it became known about some "progress" that seems to have been made in the negotiations on a trade agreement between Brussels and London. It is not known what specific progress or issues are being discussed. Sources are insider, so the information itself is rather unconfirmed. However, on Monday, this information may help the British currency resume its upward movement. Novice traders should know that in recent years, the pound is very fond of reacting to various kinds of rumors related to the positive and imminent outcome of Brexit, as well as the positive result of negotiations between the UK and the European Union regarding a trade deal. Thus, this time, with the opening of the foreign exchange market, traders can again rush to buy the pound, especially since this is justified from a technical point of view. Therefore, you need to be prepared for this scenario on Monday. As for the usual macroeconomic statistics, nothing is planned for Monday either in America or the UK. Throughout the trading week in America, there will be several important reports that can cause a market reaction, however, we also encourage you to remember the US presidential election, which will be held next Tuesday. Voting has already begun and is continuing. We also do not forget that in the next week or two, negotiations on the deal may end, so there may be a large amount of various and important information regarding the pound sterling. On October 26, the following scenarios are possible: 1) We still recommend buying the pound/dollar pair, since the upward trend is still maintained. However, we do not recommend that novice traders do this with large lots, since the upward trend may well be canceled in the near future. However, an eloquent price rebound from the trend line will allow you to open buy orders with targets at the levels of 1.3100 and 1.3129. 2) Sales, from our point of view, are now much more appropriate, however, you should not rush to open them until the price is fixed below the ascending trend line. in this case, the targets will be the support level of 1.2969 and 1.2860. The dollar is now extremely difficult to get more expensive, however, the fundamental background for the British pound is "no sugar". If the information about the progress in negotiations with the EU is confirmed, then you can count on the growth of the pound. What's on the chart: Price support and resistance levels – target levels when opening purchases or sales. You can place Take Profit levels near them. Red lines – channels or trend lines that display the current trend and indicate which direction is preferable to trade now. Up/down arrows – show when you reach or overcome any obstacles to trade for a rise or fall. MACD indicator – a histogram and a signal line, the intersection of which is a signal to enter the market. It is recommended to use it in combination with trend lines (channels, trend lines). Important speeches and reports (always included in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market to avoid a sharp reversal of the price against the previous movement. Beginners in the Forex market should remember that every trade cannot be profitable. Developing a clear strategy and money management is the key to success in trading over a long period. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 25 Oct 2020 06:11 AM PDT The hourly chart of the EUR/USD pair.

On Friday, October 23, the EUR/USD currency pair quite unexpectedly did not resume its downward movement, although everything was going exactly to this. However, at the very last moment, the pair's quotes turned up and resumed their upward movement. Thus, what we were worried about a couple of days ago happened. The upward trend line had to be rebuilt, as at the moment everything is going to ensure that the upward trend will continue. At the same time, we remind novice traders that the price continues to be inside the side channel, limited to the level of 1.1700 and 1.1900. Thus, in the upper area of this side-channel (where the price is currently located), there is a high probability of ending the upward trend. At the moment, we do not see how the pair can overcome this level and go significantly higher than it. Thus, it is likely that the downward movement back to the trend line will resume on Monday. As before, overcoming this line signals a change in the trend to a downward one. On Friday, we recommended that novice traders open short positions if the MACD indicator turns down. However, this did not happen, so there was no need to open transactions. On Monday, the European Union and America will not have any important macroeconomic reports or speeches. Thus, traders will again have to consider only technical factors, which are also not very clear at the moment. However, we can not say that the fundamental background is now absent in principle. Recall that in a week, on Tuesday, November 3, elections will be held in America that will determine the name of the next president. The election has already begun, as early voting is practiced in the United States. The media notes queues at polling stations, which indicates a high level of civic responsibility among Americans. It is reported that about 50 million citizens have already voted. Why is this so important? In the fundamental articles, we have already said that the name of the president is not just the name of the person who will lead the country. It will determine the domestic and foreign policy of the state with the strongest economy in the world. Donald Trump, for example, showed the world that a lot can depend on the president's name. And the consequences of the rule of one or another president can be "felt" by the country for many years to come. Thus, although the election theme does not have a daily impact on the US dollar, however, novice traders should remember that it is there and be prepared for different options for the movement of each pair in which the US dollar is present. On October 26, the following scenarios are possible: 1) Purchases of the EUR/USD pair have become relevant again at the moment, as the upward trend line has been rebuilt and now again supports traders who are trading for an increase. However, on Friday, the pair made a significant jump up, so now the price should correct before presumably continuing to move up. Therefore, we recommend waiting for the downward correction and its completion before opening new purchases with targets of 1.1888 and 1.1903. 2) It is not recommended to trade lower at this time, as the upward trend line is in action again. Thus, to be able to sell the pair, novice traders need to wait again for the price to consolidate below the trend line. In this case, sales will become relevant with targets of 1.1776 and 1.1740. What's on the chart: Price support and resistance levels – target levels when opening purchases or sales. You can place Take Profit levels near them. Red lines – channels or trend lines that display the current trend and indicate which direction is preferable to trade now. Up/down arrows – show when you reach or overcome any obstacles to trade for a rise or fall. MACD indicator(14,22,3) – a histogram and a signal line, the intersection of which is a signal to enter the market. It is recommended to use it in combination with trend lines (channels, trend lines). Important speeches and reports (always included in the news calendar) can greatly influence the movement of the currency pair. Therefore, during their exit, it is recommended to trade as carefully as possible or exit the market to avoid a sharp reversal of the price against the previous movement. Beginners in the Forex market should remember that every trade cannot be profitable. The development of a clear strategy and money management is the key to success in trading over a long period. The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment