Forex analysis review |

- Prospects for GBPUSD. The accumulation phase continues.

- EURUSD. Calm before growth

- Hot forecast and trading signals for GBP/USD on October 27. COT report. Sellers will try to form a new downward trend

- Hot forecast and trading signals for EUR/USD on October 27. COT report. Sellers need to take the 1.1784 level

- Overview of the GBP/USD pair. October 27. The second "wave" of COVID-2019 in the UK is already four times stronger than the

- Overview of the EUR/USD pair. October 27. Americans have formed a collective immunity against Trump's remarks. The European

- Analytics and trading signals for beginners. How to trade EUR/USD on October 27. Analysis of Monday trades. Getting ready

- Trade setup for Gold using Ichimoku cloud indicator

- USDCAD bullish divergence plays out

- Two scenarios for EURUSD

- EUR / USD: dollar takes on offense while euro declines

- ECB meeting could provoke a powerful correction on the euro

- What the current week promises for traders

- Gold losing ground but set to rebound soon

- October 26, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- GOLD Attracts New Buyers Around $1,900

- EURUSD: euro is under pressure amid Germany's weak economic data

- October 26, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- USD/JPY Temporary Recovery!

- BTC analysis for October 26,.2020 - Upside breakout of the symmetrical triangle pattern and potential for the rally towards

- GBP/USD: plan for the American session on October 26 (analysis of morning deals)

- Analysis of Gold for October 26,.2020 - Rejection of the support trendline and potential for the rally towards $1.913/31

- EUR/USD analysis for October 26 2020 - Watch for the breakout of the balance and potential upside continuation

- October 26, 2020 : EUR/USD daily technical review and trade recommendations.

- Trading plan for GBPUSD for October 26, 2020

| Prospects for GBPUSD. The accumulation phase continues. Posted: 26 Oct 2020 06:50 PM PDT Last week, another flat pattern was formed, which continued the medium-term phase. The implementation of the priority ascending pattern has been completed and the weekly CZ 1.3202 - 1.3154 has been tested. This allows us to view the decline as an opportunity to find favorable purchase prices. Today the pair continues to trade within the upward movement that took place on October 21. While the instrument is trading within the specified range, the probability of a retest of last week's high is 75%. This should be used when determining the priority direction of trade. The most favorable purchase prices are within the WCZ 1/2 1.2936-1.2912. A decline to this zone will allow entering purchases with a favorable risk-reward ratio. The first target of growth remains the high of the last week, which is also the monthly extreme. Working in a flat implies partial fixing of profits when the boundaries of the weekly movement are reached. Part of the position can be transferred to breakeven and left in case the upward movement continues. To break the bullish movement, today's trading will need to close below the WCZ 1/2. |

| Posted: 26 Oct 2020 06:49 PM PDT The upward movement of the previous week sets the direction for trading for the current week. The probability of a retest of the October maximum is at 75%. This allows you to use a decline for finding the best prices on the purchase. The main support is the Weekly Control Zone of 1/2 1.1765-1.1754. Testing this zone will allow you to enter a long position with a favorable risk-to-profit ratio. Updating the monthly maximum is only the first goal on the way to strengthening the Euro. The next target level will be the WCZ 1/2 1.1959-1.1948, which is located near the weekly average move. Growth may continue from the current levels. To enter the opposition, you will need to form the absorption pattern on a timeframe not lower than M30. The option of testing the support zone of the WCZ 1/2 will be more likely, as this will lead to the end of the correction phase that began in the second half of last week. Sales of the instrument are not profitable yet due to the formation of an upward cycle. To break the bullish momentum, you will need to close today's trading below the WCZ 1/2 in today's US session. If this model is implemented, you will have to give up attempts to buy the instrument. Sales will come to the forefront through the end of October. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Oct 2020 06:29 PM PDT GBP/USD 1H The GBP/USD pair also continued to correct on Monday, October 26. The pair reached the support area of 1.3004-1.3024 several times during the day, as well as the Kijun-sen line. Thus, the bears continued to put pressure on the pair, but they still have the Senkou Span B line on their way. In general, the Senkou Span B line is still the last obstacle for the bears on the way to forming a new downward trend under these conditions. Trading on Monday was rather sluggish, however, this is not surprising, given the lack of important news. Moreover, if sellers manage to overcome the Senkou Span B line, we will consider that this is absolutely logical, since the overall fundamental background for the pound remains extremely weak. A descending channel also appeared today, above which it will be possible to conclude that the bulls are taking over the initiative. GBP/USD 15M Both linear regression channels are directed downward on the 15-minute timeframe, which indicates a continuing downward correction on the hourly chart and there are no signs of its completion. COT report The new Commitments of Traders (COT) report for the pound showed that non-commercial traders were quite active during October 13 to 19. However, at the same time, the last few reports have completely made the situation complicated. The "non-commercial" group of traders opened 4,485 Buy-contracts (longs) and closed 4,072 Sell-contracts (shorts). Thus, the net position of professional traders immediately grew by 8,500 contracts, which is quite a lot for the pound. However, the problem is that non-commercial traders have been building up their net position (strengthening the bullish sentiment) over the past few weeks, and before that they have reduced their net position for several weeks (strengthening the bearish sentiment). Thus, over the past months, professional players have not even been able to decide in which direction to trade. The fundamental background continues to be very difficult and ambiguous for the pound/dollar pair, which is why the trades are so confusing. The pound sterling lost approximately 110 points during the reporting period. And the net positions of commercial and non-commercial traders are now practically zero. In other words, both the most important and largest groups of traders have approximately the same number of Buy and Sell contracts open. Naturally, such data from the COT report does not allow any conclusions, either short-term or long-term. No major publications in the UK on Monday. Moreover, traders did not receive any important information regarding the progress of Brexit negotiations. There was no confirmation that any progress was made in these very talks. There was only news about the coronavirus that continues to overwhelm the UK. Accordingly, traders continued a moderate sell-off of the pound, based on the technical overbought currency and the absence (so far) of the prospects for signing a free trade deal. We might receive positive news about the London-Brussels talks this week, and the pound could grow in this case. But there are none as of the moment. The UK will publish a secondary report on retail sales on Tuesday, which market participants have always ignored. They might also brush off the US report on durable goods orders. Accordingly, we do not expect strong movements in the pound/dollar pair on Tuesday. We have two trading ideas for October 27: 1) Buyers for the pound/dollar pair failed to stay above the Kijun-sen line. Thus, long positions have ceased to be relevant, as the entire upward trend is called into question. You are advised to re-consider the option of longs in case the price settles above the critical line (1.3043) and a descending channel appears with the target on the resistance area of 1.3160 -1.3184. Take Profit in this case will be up to 110 points. 2) Sellers have made several steps towards the new downward trend, but now they need to confidently overcome the Senkou Span B line (1.2971). You can consider options for opening sell orders, but only below this line while aiming for 1.2897 and the support area of 1.2857-1.2872. Take Profit in this case can range from 50 to 80 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the "non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

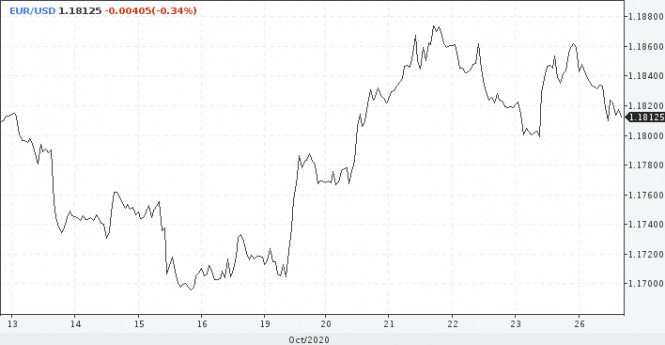

| Posted: 26 Oct 2020 06:28 PM PDT EUR/USD 1H The EUR/USD pair began to correct again on the hourly timeframe on Monday, October 26, but now everything looks as if a new stage of horizontal movement is starting. First, it is now impossible to build a more or less convincing trendline or trend channel. It is impossible to thoroughly determine the current trend (it is also not visible to the naked eye). Secondly, we continue to remind traders that the pair remains within the 1.17-1.19 horizontal channel (or its alternative 1.1640-1.1920), thus, in the long term, the flat remains. Thirdly, the fundamental background now is such that it is impossible to draw a conclusion about the advisability of buying or selling. Even the Kijun-sen and Senkou Span B lines, which are strong lines, now do not make much sense, since it is also impossible to trade against them. EUR/USD 15M The lower linear regression channel turned to the downside on the 15-minute timeframe, indicating a new round of corrective movement on the hourly chart. However, sellers need to break the 1.1784 level to have a chance of falling further. COT report The EUR/USD pair fell by around 40 points during the last reporting week (October 13-19). But in general, no significant price changes have been observed for the pair in recent months. Therefore, data from any Commitment of Traders (COT) report can only be used for long-term forecasting. The new COT report showed even fewer changes in the mood of professional traders than the previous one. Non-commercial traders, who, we recall, are the most important group of traders in the foreign exchange market, opened 1,081 Buy-contracts (longs) and 673 Sell-contracts (shorts). Take note that the "non-commercial" group decreased its net position in the last two weeks, which may indicate the end of the upward trend. However, the data provided by the latest COT report does not tell us anything at all. There are no changes, since non-commercial traders have opened almost 300,000 euro contracts. Thus, opening or closing of 1,000-2.000 contracts does not indicate anything. The lines of net positions of the "non-commercial" and "commercial" groups (upper indicator, green and red lines) continue to barely narrow, while the pair itself continues to trade in a horizontal channel. Therefore, we stick to our opinion - the upward trend is completed or is about to be completed, and the high reached near the 1.2000 level may remain the peak of this trend. No macroeconomic reports from the European Union or America on Monday. Therefore, it is easy to explain why trading was very calm during the day, and it is also logical. Several minor reports from Germany had no effect on the mood of traders. In general, the fundamental background has not changed at all lately, and so the fact that the euro/dollar pair has been standing in one place for three months is also quite logical. Market participants continue to wait for the US elections and their results. Coronavirus in the eurozone causes great concern, but one should not forget that the epidemic is also present in the United States, no weaker than in Europe. The EU is set to publish a report on orders for durable goods on Tuesday. In normal times, this is a fairly important report, since the category of durable goods is distinguished by its high cost. However, the latest report showed minimal changes in indicators, and forecasts for the upcoming data are equally neutral. Therefore, we believe that this report will not have any impact on the pair, unless the numbers turn out to be over-optimistic or overly disappointing. We have two trading ideas for October 27: 1) The pair still maintains an upward trend. Thus, traders are advised to continue to trade upward while aiming for the resistance area of 1.1887-1.1912 and the 1.1926 level as long as the price is above the strongest line of Senkou Span B (1.1784). Take Profit in this case can be up to 100 points. However, the 1.1887-1.1912 and 1.1900-1.1920 areas are extremely strong and the bulls are unlikely to be able to overcome them. 2) Bears remain in the shadows. Thus, sellers need to wait for the price to break through the Senkou Span B line (1.1784) in order to have reasons to open sell positions while aiming for the 1.1748 level and the support area of 1.1692-1.1699. The potential Take Profit in this case is from 30 to 70 points. Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the "non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Oct 2020 05:14 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - sideways. CCI: -26.8672 The British pound sterling paired with the US currency on Monday also traded quite calmly and fell to the moving average line in the first half of the day. There was no "supersonic" reaction to Sunday's information that the next round of talks in London was extended since the parties allegedly came to a certain compromise. The pound has not grown and continues to balance between North and South, between growth and decline. Thus, most likely, for once, traders did not work out unverified information that gave another hope for the successful completion of Brexit and the "divorce" between the EU and the Kingdom. From our point of view, technical factors are in the first place in the pound/dollar pair. We have already talked about the Fibonacci level of 61.8% (1.3170), which was worked out just perfectly. After that, a new round of downward movement began, which may develop into a new downward trend. This is supported by a huge number of factors, ranging from the most negative fundamental background from the UK to technical factors that suggest that after a six-month growth of the British currency, it is time for the dollar to move to growth. However, it is a difficult political situation and the upcoming elections across the ocean that are keeping sellers from active actions. However, we still believe that the downward trend will resume in the near future. Thus, the next round of negotiations continues, and so far there is no official information. If this information is received, then the pound may perk up for a while and try to continue forming an upward trend. However, we still believe that the downward trend will resume in any case. If not now, then in a week. The fact is that even if the negotiations are successful, it will not save the British economy from another contraction. A "deal" can only smooth out the negative impact of Brexit on the economy, but not completely neutralize it. And while the markets are waiting for information from the negotiations, they can only pay attention to the growing numbers of the epidemic in the Foggy Albion. Even in the first "wave", Great Britain was one of the first places in Europe in terms of the number of infected people and deaths. There it remains during the second "wave". In recent days, at least 20,000 cases a day have been reported in Britain. And, most likely, this figure will continue to grow, as the coldest time of the year is still ahead. Several coronavirus vaccines are still being tested in the UK, but even if the clinical trials are completed successfully, mass production of the vaccine should not be expected until next spring, and mass vaccination of the population should not be expected until the summer of 2021. Meanwhile, almost 60 million people have already voted in the US. It is reported that this is more than half of those who registered for early voting. At the moment, 43% of the total number of citizens who voted in 2016 have already voted in America, which once again confirms the judgment about the highest degree of importance of the 2020 elections, if not in the history of the United States, then in recent decades for sure. In principle, the same opinion is held by Donald Trump himself, who has already voted "for a guy named Donald". At the same time, the US President continues to ride with campaign speeches in the most "controversial" states, where he shines with radiant smiles and exudes tons of optimism and confidence in his victory. Experts believe that this is almost the last chance of Donald's re-election. The fact is that Trump has already lost all the stronger trumps. There is a strong economy, low unemployment, and a strong labor market. Now Trump is more remembered for the 200 thousand victims of the "coronavirus", the strongest fall in the economy, the highest unemployment, and the trade war with China, in which it is the United States that is losing so far. All recent polls continue to point to Biden's 11% lead. Thus, experts now call Trump's only chance almost "mysticism", similar to 2016, when opinion polls also indicated that Trump lost the election. However, the pound is now more interested in the factors of Brexit and the presence/absence of a trade agreement with the European Union. Since there was no news on Monday, we continue to recommend that traders pay attention to this technique. The main problem is that on the 4-hour chart, the technical picture now also looks not quite clear. Over the past few weeks, the price has repeatedly fixed below the moving average line and each time very quickly returned to the area above the moving average. Thus, these signals were simply false. Therefore, something similar may happen again at this time, so we recommend taking into account more global signals, such as a rebound from the Fibonacci level of 61.8% (1.3170) as part of the correction against the fall in quotes from September 1. This level can be considered as a "critical" level, above which the price is unlikely to leave. And if it does go above it, then you should review the entire trading strategy for the near future. The fundamental background can also influence the mood of traders at any time and it is impossible to predict in advance.

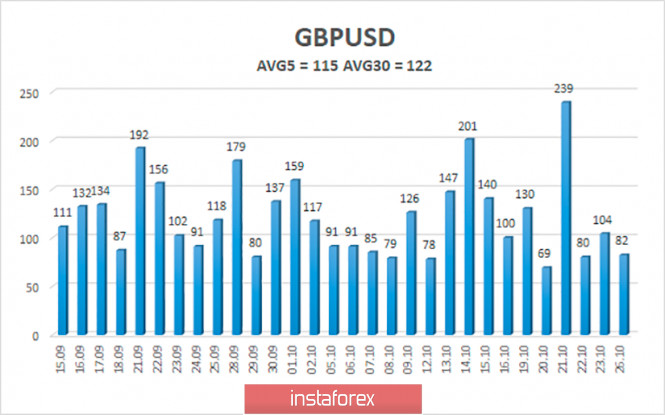

The average volatility of the GBP/USD pair is currently 115 points per day. For the pound/dollar pair, this value is "high". On Tuesday, October 27, therefore, we expect movement inside the channel, limited by the levels of 1.2908 and 1.3138. A reversal of the Heiken Ashi indicator-up signals a possible resumption of the upward movement. Please note that the last 4 out of 5 trading days ended with volatility lower than 104 points. So, the average volatility may be below 115 points per day. Nearest support levels: S1 – 1.3000 S2 – 1.2939 S3 – 1.2878 Nearest resistance levels: R1 – 1.3062 R2 – 1.3123 R3 – 1.3184 Trading recommendations: The GBP/USD pair has started a new round of corrective movement on the 4-hour timeframe. Thus, today it is recommended to trade for an increase with the targets of 1.3123 and 1.3138 if the Heiken Ashi indicator turns up or the price rebounds from the moving average. It is recommended to trade the pair down with targets of 1.2939 and 1.2908 if the price is fixed below the moving average line. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Oct 2020 05:14 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - upward. CCI: -31.6527 During the first trading day of the new week, the EUR/USD pair started correcting again and has been trading in different directions for the last few days. We have already repeatedly talked about the key technical factors (from our point of view). Naturally, the side channel $ 1.17-1.19 (alternative 1.1640-1.1920) continues to be in the first place. The pair's quotes have spent the lion's share of the last three months inside this channel, so if you approach one of its borders, you can immediately expect a reversal in the opposite direction. Secondly, in the area of $1.19-1.20, it is very difficult for buyers to find motivation and grounds for new purchases of the European currency. After all, there is a two-year high of the pair near the 1.2000 level, which was reached recently and after which the price could not form a normal correction. Thus, further growth is highly unlikely. Third, sellers are extremely wary of investing in the dollar, as it is completely unclear who will become the new President of the United States and what changes will follow in the country and its economy. Thus, the pair is not sold, simply fearing for the prospects of the American economy. And altogether, this gives us a "flat" when there is no reason for either serious purchases or serious sales. Therefore, the euro/dollar pair has been trading for three months in a range of plus or minus 250 points. Nothing changed for the EUR/USD pair on Monday. First of all, there was no important news that day. Second, there were no macroeconomic statistics. Thus, even if traders wanted to react to an event, they would not be able to do so. Third, markets continue to ignore almost all macroeconomic statistics in any case. Thus, the volatility during the day was quite moderate, and market participants were forced to focus on the secondary fundamental background. The US presidential election is just over a week away, and Donald Trump, who, according to everyone, could not defeat Biden in the last round of debates, continues to sing his favorite song that "the coronavirus will soon be defeated". The US President started singing this song in the spring, when the epidemic was just gaining momentum in America and when, according to doctors and epidemiologists, it was still possible to turn the situation around and prevent a huge number of victims from COVID-2019 in the United States. However, in recent months, Trump has changed his rhetoric. Instead of the phrase "the virus will disappear on its own", the phrase "a vaccine will be invented soon" is now used. Trump is not interested in the fact that doctors from all over the world continue to say that creating a vaccine usually takes up to 10 years (meaning a safe, fully tested vaccine, and not a hastily put together one). He continues to promise a vaccine "soon", "before the election", "before the end of October", and so on. However, Americans who have not yet received collective immunity from the "coronavirus" have already acquired it against Trump's false statements and promises. If at the beginning of the presidential term, Donald was believed, now any of his words are carefully analyzed by the media and sorted out simply into components. Even if Trump is telling the truth now, his words are still broken down into atoms and they contain inaccuracies, omissions, tricks, and so on. The same media and periodicals regularly update statistics on the number of misleading statements from Trump. Recent studies have shown that Trump lies at least 15 times a day, and the number one person in the world in terms of the number of statements about COVID-2019 that do not correspond to reality is the American President. Thus, a new batch of promises in the form of "a vaccine will be found soon" does not calm the Americans a bit and does not add rating points to Trump himself before the election. In any case, even if the vaccine is invented tomorrow, it will take months to produce it on an industrial scale, so that the entire population of the United States, which has more than 330 million, can get it. Meanwhile, the European Union is also full of "coronavirus" problems. The second "wave" of the pandemic began quite abruptly and quickly, and now many countries are covered by the epidemic and impose "strict" restrictions to somehow stop the spread of infection. The worst situation is in Italy (in recent days, there are 20 thousand infections daily), in Spain (20-30 thousand daily), in France (30-40 thousand daily), and in the UK (at least 20 thousand daily). Thus, curfews are being actively introduced in European countries and quarantine measures are being tightened as much as possible, which will inevitably lead to a new slowdown in the economy. So far, the consequences of the second "wave" are not yet visible, since it began no more than a month ago (only the indices of business activity in the services sectors of the EU countries fell below 50.0). However, there is no doubt that they will. And the worst thing is that the current levels of morbidity in the EU countries exceed the spring ones by 3-4 times. That is, theoretically, the health systems of European countries can no longer cope with the influx of patients (not only COVID), and then collapses will follow. Or total "lockdowns". In the spring, countries such as Italy, Spain, and the United Kingdom could no longer cope with the number of infected people, and then they had a maximum of 5-6 thousand diseases per day (up to a maximum of 10 thousand). Now the incidence rates are much higher. As you can see, there are a huge number of factors that can and will affect the US and EU economies in the near future. If, for example, Biden wins the election, then there is no doubt that he will immediately begin to fight the "coronavirus" in his way. And the results of this struggle are unknown to the American economy. In the European Union, in the winter months, the incidence rates may be twice as high as the current ones, and what will happen then again is extremely difficult to predict now. So, theoretically, in a couple of months, we can see the euro/dollar pair anywhere. So far, the markets are responding very calmly to the epidemiological situation in the EU and are just waiting for the elections, showing that they do not intend to trade actively until the results of the vote are announced. But sooner or later, this period of inertia will be completed. And the pair will have to move in one direction. As long as the pair holds above the moving average line, weak upward prospects remain.

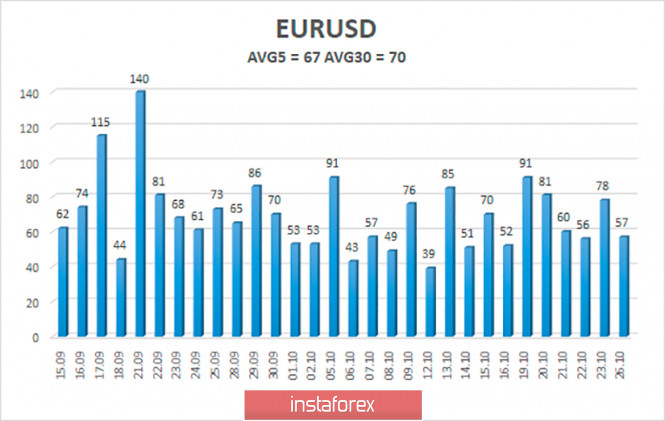

The volatility of the euro/dollar currency pair as of October 27 is 67 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1753 and 1.1887. A reversal of the Heiken Ashi indicator to the top can signal a new round of upward movement if the price remains above the moving average. Nearest support levels: S1 – 1.1780 S2 – 1.1719 S3 – 1.1658 Nearest resistance levels: R1 – 1.1841 R2 – 1.1902 R3 – 1.1963 Trading recommendations: The EUR/USD pair again corrected to the moving average line. Thus, today it is recommended to open new buy orders with the target level of 1.1887 if the price bounces off the moving average. It is recommended to consider sell orders if the pair is fixed below the moving average line with targets of 1.1753 and 1.1719. The material has been provided by InstaForex Company - www.instaforex.com |

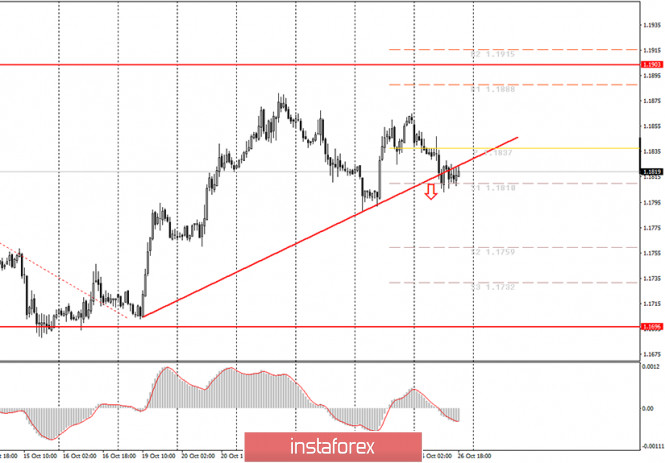

| Posted: 26 Oct 2020 12:02 PM PDT EUR/USD hourly chart

On Monday, October 26, the EUR/USD pair started a new round of the downtrend that was just enough to pass the new ascending trendline. It was the second time that the price failed to rebound from the trendline. This means that at the moment the uptrend has finally come to an end. During the day, there were no clear buy signals, so novice traders should not have opened long positions if they followed our recommendations. Since the price has now crossed the trendline, sell orders have become relevant. However, we do not recommend entering the market in the evening. It is worth noting that the pair has made a reversal in favor of the US currency to the upper boundary of the $1.17-1.19 sideways channel. Therefore, the downward movement should now continue with the target set at the lower boundary of this channel. At the same time, beginners should remember that the pair continues to trade in the flat channel, which means there is no clear trend at the moment. Unexpected movements of the price are also possible within the channel. For example, after today's downtrend, it would be good to wait for a pullback to the upside. Then, you can trace sell signals from the MACD indicator. Today, no important macroeconomic reports or events were observed in the EU or the US. So, the decline of the euro was mainly determined by technical factors. Several topics remain extremely important for the euro/dollar pair, but they did not have an immediate impact on the pair's trajectory. On Tuesday, October 27, no economic releases are expected in Europe, while a report on durable goods orders will be published in the US. Last time, the pair moved by no more than 30 pips when this report was released. In general, this data is considered quite important. However, in the past six months, market participants tend to ignore the key macroeconomic data. So, it is quite possible that tomorrow there will be a weak or no reaction at all. Traders should focus on the two main topics instead: the coronavirus in the EU and the US presidential election. With the rising infection cases in Europe, there are more chances that the euro will depreciate. On the other hand, negative news on the US election front will most likely trigger a new round of decline in the US dollar. Negative news may appear in the near future as the elections will take place next Tuesday. This may be followed by long vote counts as well as legal proceedings if one of the candidates refuses to admit his defeat. Possible scenarios for October 27 1) Buying the EUR/USD is not relevant at the moment, as the bears have managed to break the ascending trendline. Thus, in the near future, the pair should continue the downtrend. You can consider opening buy deals only when a new ascending trend is formed or when a downtrend is completely canceled. 2) Selling the pair has become relevant now, since the price failed to hold above the trendline. Thus, we recommend that novice traders wait for an upward pullback. Then, it will be possible to track sell signals from the MACD indicator which can be tested with the targets at 1.1759 and 1.1732. On the chart Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trendlines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator (14, 22, and 3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend patterns (channels and trendlines). Important announcements and economic reports that you can always find on the economic calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommend trading as carefully as possible or exit the market in order to avoid sharp price fluctuations. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| Trade setup for Gold using Ichimoku cloud indicator Posted: 26 Oct 2020 09:35 AM PDT Gold price fell below support at $1,900 today and reached $1,892. However bulls stepped in and price is again above $1,900. Gold price is challenging the tenkan-sen at $1,906 and we keep a close eye on today's lows.

Price is still below the Ichimoku cloud resistance. If price breaks below $1,892 (4 hour candlestick close) then we get a sell signal and a target of $1,850 with stops at $1,913. Gold price is vulnerable to a move lower as long as price is below Kumo (cloud). Our trade is triggered if price breaks the blue support horizontal line and today's low. The material has been provided by InstaForex Company - www.instaforex.com |

| USDCAD bullish divergence plays out Posted: 26 Oct 2020 09:26 AM PDT In our last USDCAD analysis we warned bears that a bullish divergence was being noted when price was between 1.3150-1.3170. With price now at 1.3215 and the RSI making higher highs and higher lows, we see that it is more probable for USDCAD to reach 1.33-1.3350 than fall.

Blue lines -bullish divergence Red line - resistance USDCAD is moving higher today and we expect price to move closer to the red downward sloping resistance trend line. This trend line is now at 1.3356. However we expect USDCAD to continue its move higher at least towards 1.33. Key short-term support is at 1.3130. Breaking below this support level will increase chances of a move towards 1.3060-1.30. I do not believe it is worth it now to be bearish. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Oct 2020 09:22 AM PDT EURUSD is trading around 1.1850-1.18 area. Depending on what we see the rest of the week can be decisive for the next few weeks. EURUSD bulls need to defend 1.18-1.1780 and stay above it, while on the other hand bears need to push price lower and break below this level.

|

| EUR / USD: dollar takes on offense while euro declines Posted: 26 Oct 2020 08:38 AM PDT

The US dollar fell against most major currencies on Friday. However, it launched a counteroffensive against its main competitors on Monday amid a record increase in COVID-19 cases in the Eurozone, as well as a lack of progress in negotiations on new measures to support the American economy. Corrective dynamics also contributes to the strengthening of the dollar. The USD index rose 0.2%, rising above 93 points, after a decline of almost 1% last week. Europe continues to signal an acceleration in the rate of increase in the incidence of coronavirus, which threatens to slow down economic activity in the region and puts pressure on the euro. According to the daily record in France, the number of new cases of COVID-19 in the country has exceeded 50,000 on Sunday. Meanwhile, Italy introduced a partial lockdown until November 24. And Spain has declared an emergency regime and a nationwide curfew. Similar news from the US increases the demand for a safe greenback. The daily number of cases in the country jumped to more than 80,000. At the same time, state authorities are trying to avoid full-scale quarantine, limiting themselves to local restrictions.

Lingering doubts about a new stimulus package in the US are also forcing traders to ditch risky assets in favor of the USD as a safe haven. Last weekend, House Speaker Nancy Pelosi said the House could pass a new stimulus package of around $2 trillion this week, but it's unclear if the Senate is ready to approve it. Meanwhile, White House Chief of Staff Mike Meadows accused Pelosi of constantly changing the rules of the game. "We continue to make one proposal after another, and Nancy Pelosi continues to change the rules of the game," Meadows said. The persistence of significant disagreements between the parties suggests that the adoption of the next stimulus package before the US presidential election is unlikely. There is less time before the November 3 elections. While Democratic candidate Joe Biden continues to lead, investors have been slowly ditching the dollar. Unexpectedly for many, Donald Trump deserves the victory in the 2016 elections, and this story may well repeat itself.

Investors' attention will be on the ECB this week after hints from its representatives that they see a growing need for further action. In addition, data on the US and Eurozone GDP for the third quarter will be released. The US economy is estimated to expand by 31.9% in July-September. The European economy is also expected to show recovery after falling 11.8% in the second quarter. "As for the ECB, we expect a strong message from its head Christine Lagarde and many hints about further quantitative easing in December," strategists at ING said. They predict that in the third quarter, the eurozone's GDP will increase by 9.5% compared to the previous quarter, but this could be the peak, as quarantine restrictions in the EU expand every day. "All this means that the EUR / USD pair will continue to trade in the 1.1700-1.1900 range instead of rising above 1.20," said ING. "Probably, the main currency pair will remain in the range for now ahead of such important events like the October meeting of the ECB and the US presidential elections. The pullback from the 1.1880 level has strengthened us in this opinion. Support at 1.1750-1.1760 could be a potential magnet for bears," TD Securities said. In the conditions of the second wave of COVID-19, Europe risks facing pressure on the economy and prices. Deflation in the region has already reared its head in September, and this may force the ECB to increase the volume of the stimulus. In this regard, the downside seems to be the path of least resistance for EUR / USD, as the Fed does not feel the same pressure to immediately introduce new stimulus measures. The material has been provided by InstaForex Company - www.instaforex.com |

| ECB meeting could provoke a powerful correction on the euro Posted: 26 Oct 2020 08:15 AM PDT

The viral component and the lack of progress in the negotiations on stimulus measures in the United States are forcing market players to move away from risk and pay attention to defensive assets, including the dollar, which has gone on the offensive against major currencies and the EM sector. US stocks retreat on Monday, losing more than 1% on key indices. Ahead of the presidential elections and related uncertainty. It looks like the situation is heating up, and the last week before the elections will be marked by risk-off. It slowly becomes clear that if Joe Biden wins, current President Donald Trump will resist the outcome of the election. The current market concern is largely due to record increases in the number of cases in the US and European countries. Nothing new has yet appeared in the arsenal of the American authorities that could soften the blow to the economy. The vaccine is still far away, which means that restrictive measures cannot be avoided. Even if they are gentle, the consequences will not be long in coming. This can be observed in Europe. The markets have assessed the September index of activity in the service sector of the Eurozone. Judging by the numbers, the sector is in trouble again. If everything goes on like this, the fiscal or monetary authorities will begin to intervene. In this regard, the medium-term prospects for the euro are becoming increasingly negative. The ECB meeting will take place this week and investors are waiting for the regulator's reaction to the drop in activity in the service sector and a downgrade of growth forecasts for the Euroblock by the market. Given the deteriorating coronavirus situation, the rate will not be adjusted. However, this does not negate the typical increase in volatility before and after the meeting. In addition, it is worth paying attention to the increasing demand for the greenback. The euro will most likely not be able to avoid another downward correction wave. As observed, the euro began a new week in the red zone due to the worsening epidemiological situation in the region. There is a risk that the governments of European countries will begin to introduce new quarantine restrictions. From a technical point of view, it makes sense to revise the boundaries of the range 1.17-1.19. In the meantime, the main Forex pair manages to maintain this balance.

There are growing opinions among investors that if the European Central Bank does not soften the monetary policy at the upcoming meeting, it will certainly do so at the December meeting. The financial authorities are likely to increase the volume of the emergency asset purchase program, which currently provides for the purchase of securities for 1.35 trillion euros, for example, for 600 billion euros, and will extend it until the end of next year. If the regulator also cuts rates, the euro will be in trouble. The material has been provided by InstaForex Company - www.instaforex.com |

| What the current week promises for traders Posted: 26 Oct 2020 06:54 AM PDT

US stocks exhibited volatility on Friday. The Dow Jones index fell slightly by 0.1%. The S&P 500, on the other hand, rose 0.3%. the NASDAQ also showed positive dynamics and closed with a growth of 0.4%. The publication of macroeconomic data last week was a stimulating factor for currency flows in the market. The dollar showed a drop against most of the leading currencies, ignoring only the pound. Market players focused on business activity reports, which are extremely important for assessing the market as a whole, as they reflect the state of the economy and mainly the degree of damage that the second wave of coronavirus caused to the above-mentioned countries. According to the data, in most countries, there was not the strongest slowdown that traders feared in October. Thus, Germany registered an increase in business activity in the manufacturing segment. This contributed to partially equalizing the weakness of the indicator in the service sector. Activity in both sectors is also picking up in the US. In Australia, an improvement in the indicator for services offset the regression in production. As a result, market players noticed a rise in the composite index. However, a number of countries also reflect negative dynamics. For example, in Japan despite the fact that the index of the manufacturing sector surpassed the figure for the previous month, activity in the services sector is still slowing. And the UK, according to the data provided, showed a decline in both indicators. The current week promises a lot of reports on the earnings of leading companies, including the high-tech segment. 170 companies, including Beyond Meat, Boeing, Caterpillar, Honeywell, Merck, and Pinterest, will provide earnings reports to investors. Microsoft is expected to report on Tuesday, and Apple, Facebook, Alphabet, Amazon, and Twitter on Thursday. Central Bank meetings on monetary policy are also scheduled for this week. Attention will be drawn to the European Central Bank, which, according to traders ' expectations, should ease the DCP by the end of this year. It is worth noting that the composite index of business activity in Europe shows a negative trend. But despite this, the sudden rise in flash and manufacturing sector data is intended to help single currency traders recoup Thursday's losses. It is noteworthy that the EUR / USD pair last Friday showed the best indicator for the first time in a month and even led the results of Friday's trading. And this is despite the obvious decline in business activity and the unfortunate pandemic. Undoubtedly, the Euro's progressive dynamics is largely due to the fall in demand for the US dollar, but the main driver is still the indecision of the heads of most countries to impose a full quarantine. The data on GDP growth in Europe for the third quarter is expected to be published by the end of this week. It is worth noting that the PMI data last Friday reflected a recession in economic activity at the beginning of the fourth quarter. The US presidential election is just over a week away. According to official data, Donald Trump is still lagging behind Biden in the election race. If Joe Biden wins, the stimulus package that the Democrats are proposing will be accepted unequivocally. Moreover, the victory of Biden should support clean energy, cyclical stocks, and stocks of companies involved in the production of cannabis. If Trump wins the election, it will trigger a rise in shares of traditional energy and technology companies. These same companies, if Biden wins, are likely to be subject to high corporate taxes. If we talk about currency flows, then the victory of the current President can cause an unbreakable blow to the Mexican peso and the Russian ruble, but provoke the rise of the weakened US dollar. The key factor in the market is still on the negotiations on the stimulus package to support the US economy in its fight against the coronavirus crisis. Despite the recent statement by House Speaker Nancy Pelosi that the chances of a stimulus package before the presidential election are high, Treasury Secretary Steven Mnuchin still speaks of significant differences between the parties. Moreover, the top Republican in Congress, Mitch McConnell, clearly does not want to introduce such a large bill in the Senate on the eve of the election. This is primarily due to the level of public debt. In light of these statements, the stock market responded with a sell-off the day before. The epidemiological situation in the US is as depressing as in Europe. However, the head of state is limited only to the introduction of local restrictions, not deciding on a complete, all-consuming quarantine. This approach increases the percentage of confidence, as well as supports spending and economic growth in the US. On Thursday, investors also expect coverage of the preliminary estimate of US GDP for the third quarter. Analysts estimated a record growth of 31.9%. This expected figure is higher than the record of the historical fall in the second quarter which is at 31.4% when the coronavirus led the global economy into decline. It is worth noting that the prospects for economic recovery are still vague, because existing stimulus measures do not have the proper effect, and cases of coronavirus infection continue to multiply. The weekly report on initial applications for unemployment benefits in the US is also expected on Thursday. This report will help you understand whether the labor market recovery is really gaining momentum. The coming week promises to be hot, given the uncertainty about the fate of negotiations on the stimulus package for the US economy, political events in the run-up to the presidential election, the release of many income reports, as well as key economic data. The market is clearly expecting increased volatility in the coming days, as investors may well adjust positions before such a risky event as the November 3 elections. The material has been provided by InstaForex Company - www.instaforex.com |

| Gold losing ground but set to rebound soon Posted: 26 Oct 2020 06:51 AM PDT This morning, gold was trading in negative territory mainly due to the strengthening of the US dollar against its major rivals. In the morning trade, gold futures for December delivery declined by 0.34%, or 6.4 US dollars. Currently, the price has consolidated at around $1,898.8 per troy ounce. Silver futures contracts for December also fell by 1.26%, approaching the level of $24.3 per troy ounce. The main reason for today's depreciation in gold is the rapid change in the US dollar rate. The greenback has sharply changed its direction and began to move upwards. Thus, gold is getting too expensive for holders of the US currency, and they choose not to buy gold and wait for better times. Meanwhile, the US dollar asserts its strength amid a surge in the number of new coronavirus cases not only in the United States but also all around the world. Besides, the protracted negotiations over a new fiscal stimulus package in the US and the lack of clarity on when the package will be adopted also push the US dollar higher. Earlier, markets expected the stimulus bill to be passed before the US presidential election. Now, this hope is gradually fading, thus boosting the rise of the US national currency. The precious metal market began to fluctuate sharply last week. In the middle of the week, gold skyrocketed above the level of $1,930 per troy ounce. Later, the rise was followed by a rapid decline at the end of the weekly session. As a result, the precious metal settled near the level of $1,900 per troy ounce. Such high market volatility indicates instability caused by several factors. The gold's future trajectory will largely depend on the outcome of the US presidential election. Analysts believe that if Joe Biden wins, the quotes of precious metals will surge, while the US dollar will again extend its losses. In the meantime, upbeat economic data from the US has sparked investors' interest in risk assets. Thus, the number of initial jobless claims in the country fell to a record low of 787 thousand last week. Moreover, the business activity index has significantly increased. All this has led to an inevitable decline in gold prices. Nevertheless, mid-term and long-term forecasts for the gold market still remain bullish. Analysts think that commodities will regain their popularity among traders at the very beginning of 2021. The depreciation of the American currency, the increase of inflation risks, as well as the possibility of a larger financial stimulus in the US will contribute to the risk appeal. According to estimates, the value of gold may well jump to $2,300 per troy ounce next year, and this is not the limit. This year, the average price of gold is holding near $1,836 per troy ounce. Gold is likely to get its main driver right after the US presidential election, which will become the starting point for a new gold rally. The material has been provided by InstaForex Company - www.instaforex.com |

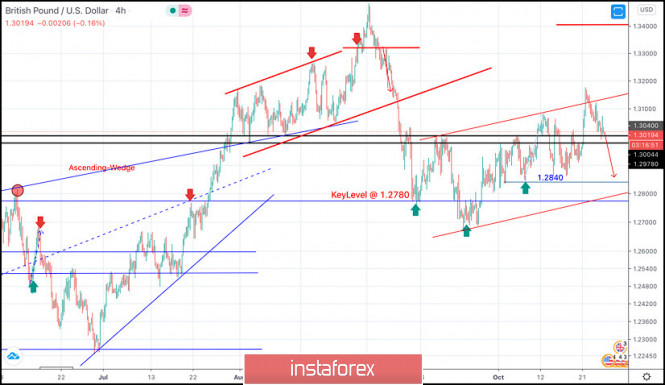

| October 26, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 26 Oct 2020 06:51 AM PDT

Intermediate-term technical outlook for the GBP/USD pair has remained bullish since bullish persistence was achieved above 1.2780 (Depicted Key-Level) on the H4 Charts. However, On September 1, the GBPUSD pair looked overbought after such quick bullish movement while approaching the price level of 1.3475. That's why, short-term bearish reversal was expected especially after bearish persistence was achieved below the newly-established key-level of 1.3300. A quick bearish decline took place towards 1.2780 where considerable bullish rejection brought the pair back towards 1.3000 and 1.3100 during the past few weeks. The price zone of 1.3130-1.3150 (the depicted trend line) remains an Intraday Key-Zone to determine the next destination of the GBPUSD Pair. Bullish Persistence above the mentioned price zone of 1.3100-1.3150 will probably allow bullish pullback to pursue towards 1.3400 as a final projection target for the suggested bullish pattern. However, the GBPUSD pair failed to do so, Instead, another bearish movement will probably be expressed towards the price level of 1.2840 where bullish SUPPORT will probably exist. The material has been provided by InstaForex Company - www.instaforex.com |

| GOLD Attracts New Buyers Around $1,900 Posted: 26 Oct 2020 06:40 AM PDT

Gold seems undecided in the short term after escaping from the down channel. It hovers around the $1,900 psychological level, so we have to wait for a fresh trading opportunity, signals before deciding to go long or short. The bias remains bullish, gold could increase, as long it stays above the $1,900 level. Dropping and stabilizing under this psychological level could indicate a deeper drop towards $1,850 static support. From the technical viewpoint, an increase, jump above the former near-term highs validates further growth. This scenario could bring us a great buying opportunity.

We could buy gold again from above the $1,935 level with a short term target at the $2,000 level. Passing and stabilizing above this upside obstacle validates a potential increase towards the $2,075 all-time high. The material has been provided by InstaForex Company - www.instaforex.com |

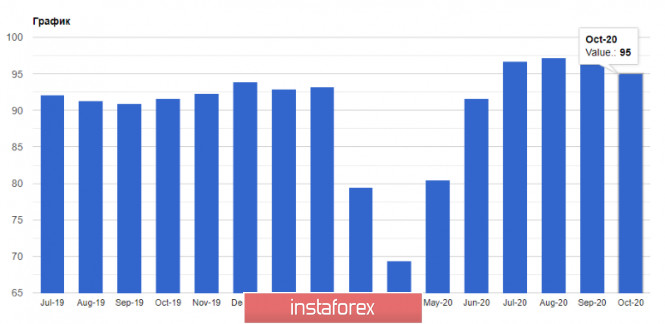

| EURUSD: euro is under pressure amid Germany's weak economic data Posted: 26 Oct 2020 06:30 AM PDT In the first half of the day, investors' attention was devoted to the German business sentiment report. Market players expected a decline in the business climate index. However, the final data turned out to be much worse than economists forecast, leading to a depreciation of the euro in the short term.

The second wave of the coronavirus became the reason for such weak results. The situation is not that bad as to impose quarantine restrictions similar to those that were introduced in the spring of 2020. Nevertheless, it can deteriorate Germany's economic outlook. Apart from that, the coronavirus has an adverse impact on the country's recovery in the fourth quarter. The German authority will, of course, try to prevent the service industry from collapsing and will not close all shops and companies because it can come as a severe blow to the industrial sector. Notably, the industrial sector is the only one that helps Germany to stay aloft. Closures in the service sector are likely to lead to another decrease in retail sales, aggravating the situation in the long term.

Survey data from Ifo Institute showed that German business sentiment weakened in October. The business climate index fell to 92.7 in October from revised 93.2 in September. The current conditions indicator rose more-than-expected to 90.3 from 89.2 a month ago. The expectations indicator came in at 95.0, down from revised 97.4 in September. Notably, Friday's data indicated an increase in business activity in the manufacturing sector to 1.6 points from -0.5 in September. As a result, the business climate index improved for the first time since June 2019, returning to positive territory. Meanwhile, business activity in the service sector worsened significantly in October due to the second wave of the coronavirus. The index fell to 3.9 points from 6.9 points in September.

Now let's get to the upcoming meeting of the Executive Board of the European Central Bank, which is going to take place during the week, and the issue of monetary policy. Thus, experts believe that the current pandemic emergency purchase programme (PEPP) is suitable only for low interest rates and is not enough to boost inflation. In autumn, the inflation rate in the euro area slowed down. Moreover, it is expected to continue falling. Therefore, market participants expect more than just an expansion of the PEPP from the ECB. However, the regulator is unlikely to take any actions during the upcoming meeting. Still, ECB President Christine Lagarde will definitely talk about the possibility of negative interest interest rates. This will put the euro under additional pressure or will limit its upward potential at least. As for the technical analysis of EUR/USD, pressure on risky assets returned immediately after the release of Germany's weak economic data. Currently, buyers need to return to the resistance level of 1.1830 and the price may rise to the upper border of the sideways channel, the level of 1.1865. The pressure on the euro will increase if there is a breakout at 1.1790, the lower border of the sideways channel. In such a case, the price may go down to the lows of 1.1760 and 1.1705. The material has been provided by InstaForex Company - www.instaforex.com |

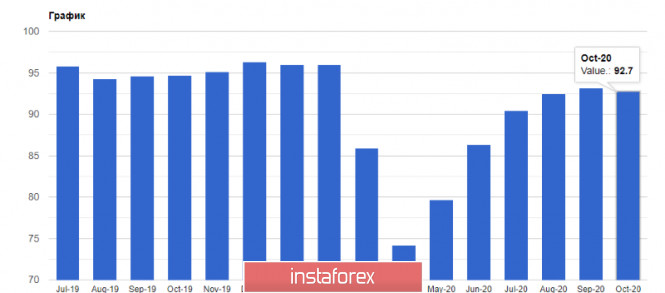

| October 26, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 26 Oct 2020 06:26 AM PDT

In July, the EURUSD pair has failed to maintain bearish momentum strong enough to move below 1.1150 (consolidation range lower zone). Instead, bullish breakout above 1.1380-1.1400 has lead to a quick bullish spike directly towards 1.1750 which failed to offer sufficient bearish pressure as well. Bullish persistence above 1.1700 - 1.1760 favored further bullish advancement towards 1.1975 - 1.2000 ( the upper limit of the technical channel ) which constituted a Solid SUPPLY-Zone offering bearish pressure. Moreover, Intraday traders should have noticed the recent bearish closure below 1.1700. This indicates bearish domination on the short-term. On the other hand, the EURUSD pair has failed to maintain sufficient bearish momentum below 1.1750. Instead, another bullish breakout was being demonstrated towards 1.1870 which corresponds to 76% Fibonacci Level. As mentioned in previous articles, the price zone of 1.1870-1.1900 stands as a solid SUPPLY Zone corresponding to the backside of the broken channel if bullish pullback occurs again soon. Intraday Trend-Traders can wait for a bearish H4 candlestick closure below 1.1770 as a valid short-term SELL Signal with a potential bearish target located around 1.1700 and 1.1630 if sufficient bearish momentum is maintained The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Oct 2020 05:49 AM PDT USD/JPY should drop deeper if the USDX and Nikkei decline in the upcoming period. The pair has rebounded but this could be only a temporary increase before the currency pair resumes its sell-off. The pair has increased only because the US dollar index has managed to recover after its most recent drop. Technically, the pair has printed a Head and Shoulders pattern which signals a potential further decline after the actual rebound.

USD/JPY has found temporary support at 104.34 level and now is trying to recover after the most recent aggressive drop. A rejection from the PP (104.92) or from the neckline could attract more sellers again. The pair is trapped within an extended range, between 104.18 and 107.03 levels. The failure to approach the upside line signals a bearish pressure. Also, the breakdown from the ascending pitchfork has announced a deeper drop.

Sell a false breakout with great separation, bearish engulfing above the PP (104.92), or above the neckline. Also, a new lower low followed by a valid breakdown below 104.18 suggests selling as well. On the other hand, a larger growth could be signaled by another higher high, jump above 106.10 level. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Oct 2020 05:48 AM PDT Further Development

Analyzing the current trading chart of BTC, I found that there is breakout of the symmetrical triangle pattern to the upside, which is good indication for the further upside continuation. My advice is to watch for buying opportunities on the dips with the target at $13,830, which is also the projected target of the symmetrical triangle pattern. Key Levels: Resistances: $13,830 Support level: $12,700 The material has been provided by InstaForex Company - www.instaforex.com |

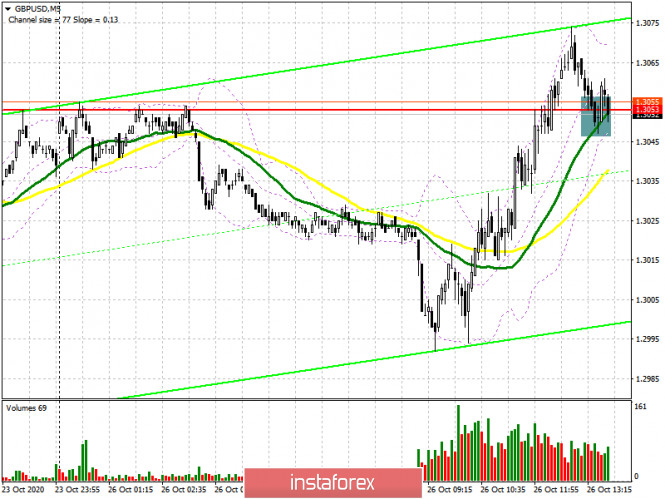

| GBP/USD: plan for the American session on October 26 (analysis of morning deals) Posted: 26 Oct 2020 05:47 AM PDT To open long positions on GBPUSD, you need: In the first half of the day, it was possible to observe the bulls' attempt to return to the resistance area of 1.3053, however, it was not possible to wait for the formation of a signal to enter long positions there. Let's figure out why. We can see that on the 5-minute chart, immediately after the price fell to the level of 1.3053 to test its strength, the bulls failed to keep the pair above this range. All that remains now is a price return and a trade above 1.3053. Only in this case, you can count on the continuation of the upward trend of the pair to the area of a new local maximum of 1.3120, where I recommend fixing the profits. A longer-term target will be the area of 1.3174, however, it will only be available if there is good news on Brexit. If the bears are stronger in the second half of the day and return the pressure on the pound, then I recommend opening new long positions only for a rebound from the new local minimum of 1.2977, based on a correction of 20-30 points within the day.

To open short positions on GBPUSD, you need: The bears are still defending the resistance of 1.3053. All they need to do in the second half of the day is to form a false breakout and return the pair to the level of 1.3053, which will be a signal to open short positions. In the meantime, on the 5-minute chart, we can see an active struggle for this range. If a sell signal is formed for the pound, we can expect the pair to return to the support area of 1.2977, where I recommend fixing the profits. The area of 1.2919 will be a more distant target. If the bulls turn out to be stronger and the growth of GBP/USD continues in the second half of the day, then you can open short positions for a rebound from the new local maximum in the area of 1.3120 in the expectation of a downward correction of 20-30 points within the day.

Let me remind you that in the COT reports (Commitment of Traders) for October 20, there was a reduction in short and a sharp increase in long positions. Long non-commercial positions increased from the level of 36,195 up to level 39 836. At the same time, short non-commercial positions fell from the level of 45,997 to the level of 41,836. As a result, the negative value of the non-commercial net position increased slightly to -2,000, against -9,802 a week earlier, which indicates that sellers of the British pound remain in control and have a minimal advantage in the current situation. Signals of indicators: Moving averages Trading is conducted around 30 and 50 daily averages, which limit the upward correction of the pound. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of the classic daily moving averages on the daily chart D1. Only a breakdown of the lower border of the indicator around 1.3005 will increase the pressure on the pound. Description of indicators

|

| Posted: 26 Oct 2020 05:44 AM PDT Japan's largest private insurer says to reduce investment into foreign bonds without currency hedge Nippon Life announces to cut FX exposure and shift back to domestic debtThe insurer just announced plans to increase its holding of yen fixed income products - JGBs and corporate bonds - while reducing investments into foreign bonds without currency hedge in the six months from October to March next year. Adding that they already sold some of such bonds in the past six months, mainly in the euro after the currency rose following the announcement of the EU recovery fund. But the firm says it plans to keep its currency-hedged foreign bond holdings more steady. Elsewhere, the firm says it plans to increase foreign stock holdings - for diversification - and will likely trim its domestic stock holdings as such.

Further Development

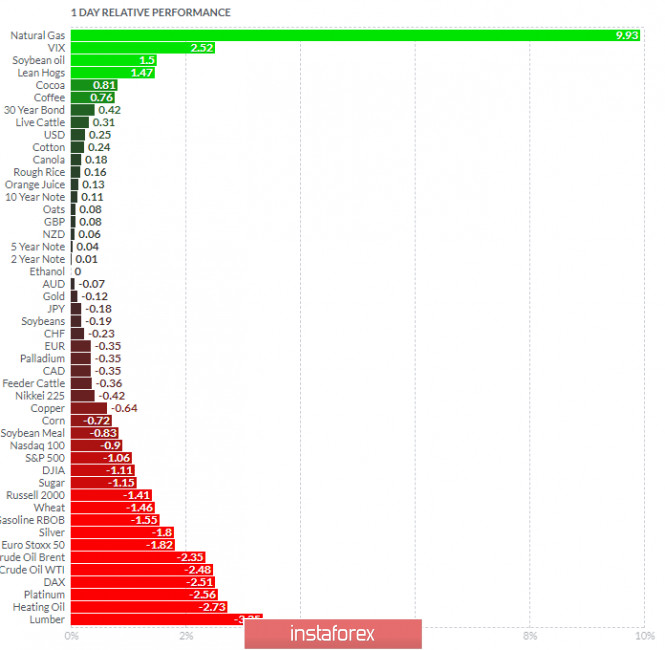

Analyzing the current trading chart of Gold, I found that there is another rejection of the main support rising trendline, which is indication that buyers are in control and that trend is bullish. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Natural Gas and VIX today and on the bottom Heating Oil and Lumber. Gold slightly positive today on the relative strength list... Key Levels: Resistances: $1,913 and $1,931 Support level: $1,894 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 26 Oct 2020 05:32 AM PDT Germany October Ifo business climate index 92.7 vs 93.0 expected Prior 93.4; revised to 93.2

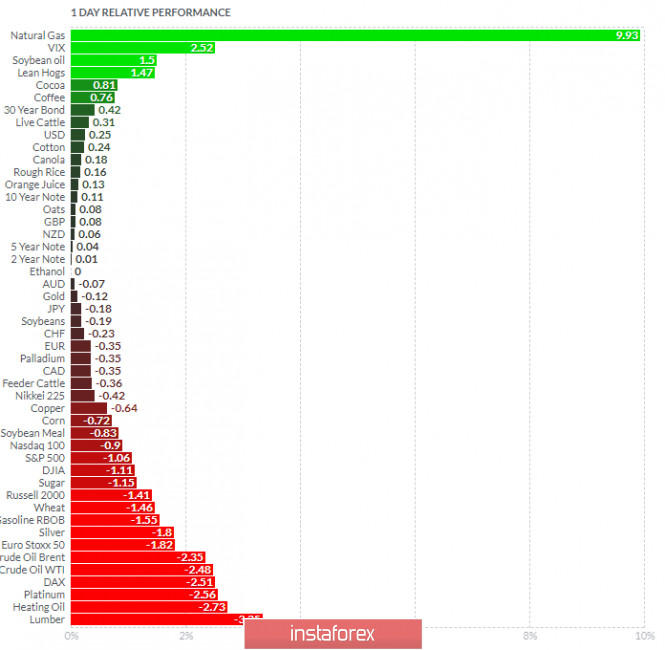

Slight delay in the release by the source. The headline marks the first drop in German business morale in six months, with the expectations component also falling amid the resurgence in virus cases dampening economic prospects in the region. Further Development

Analyzing the current trading chart of EUR/USD, I found that tthere is consolidation and the balance regime, which is sign of netural market. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Natural Gas and VIX today and on the bottom Heating Oil and Lumber. EUR slightly negative on the relative performance list but with the decrease on the momentum. Key Lvels: Resistance: 1,1865, 1,1915 and 1,2000 Support level: 1,1785 The material has been provided by InstaForex Company - www.instaforex.com |

| October 26, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 26 Oct 2020 05:25 AM PDT

On September 25, The EURUSD pair has failed to maintain enough bearish momentum to enhance further bearish decline. Instead, recent ascending movement has been demonstrates within the depicted movement channel leading to bullish advancement towards 1.1750-1.1780 which failed to offer sufficient bearish pressure in the first attempt. Two weeks ago, temporary breakout above 1.1750 was demonstrated as an indicator for a possible bullish continuation towards 1.1880. However, temporary downside pressure pushed the EUR/USD pair towards 1.1700. This is where the previous bullish spike was initiated. Currently, the price zone around 1.1880-1.1900 constitutes a KEY Price-Zone as it corresponds to the backside of the depicted broken ascending channel. Recent Upside breakout above 1.1780 enabled further advancement towards the price levels around 1.1880-1.1900 where significant bearish pressure and a reversal Head & Shoulders pattern were demonstrated. Trade Recommendations :- Recently, Two opportunities for valid SELL Entries were offered upon the recent upside movement towards 1.1880-1.1900. Initial Bearish target remains projected towards 1.1780 while Exit level should be placed around 1.1870 to offset the associated risk The material has been provided by InstaForex Company - www.instaforex.com |

| Trading plan for GBPUSD for October 26, 2020 Posted: 26 Oct 2020 05:23 AM PDT

Technical outlook: The GBPUSD had rallied through 1.3175 levels last week, before pulling back. The Cable currency pair is seen to be trading around 1.3040 levels at this point in writing and is expected to continue dropping lower towards 1.2200. Immediate resistance is seen at 1.3488, while intermediary support is around 1.2675 levels respectively. The larger boundary which is being worked upon is between 1.1414 and 1.3488 levels respectively. The currency pair might drop to fibonacci 0.618 retracement of the above rally, which is seen towards 1.2200 as depicted on the daily chart here. The counter trend drop looks to have completed two legs already from 1.3488 highs. Ideally, GBPUSD should resume lower from here until prices remain below 1.3500 highs. Trading plan: Remain short, Stop @ 1.3500, target is 1.2200 Good luck! The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment