Forex analysis review |

- Forecast for AUD/USD on October 30, 2020

- Hot forecast and trading signals for GBP/USD on October 30. COT report. Perfect rebound, perfect signal, perfect target level

- Hot forecast and trading signals for EUR/USD on October 30. COT report. Lagarde pulled down the euro. Will the downward momentum

- Overview of the GBP/USD pair. October 30. Brexit: no news. Markets continue to sit "on a powder keg" and wait for the results

- Overview of the EUR/USD pair. October 30. The highest turnout of Americans in the election indirectly indicates the nation's

- The Dollar and Trump widened the gap. How will it end?

- Why did the euro fall and what did Lagarde say?

- Analytics and trading signals for beginners. How to trade EUR/USD on October 30? Plan for opening and closing trades on Friday

- European indices rose on corporate news

- Ichimoku cloud indicator Daily analysis of EURUSD

- Gold price in bearish trend

- October 29, 2020 : EUR/USD daily technical review and trade recommendations.

- EUR/USD and GBP/USD: ECB stands pat on monetary policy, delaying crucial decisions until December. GBP weighed down by Brexit

- October 29, 2020 : EUR/USD Intraday technical analysis and trade recommendations.

- October 29, 2020 : GBP/USD Intraday technical analysis and trade recommendations.

- Evening review of EURUSD on October 29, 2020

- GBP/USD: plan for the American session on October 29 (analysis of morning deals)

- Stock market: APX suffers losses following US and Europe

- EUR/USD: plan for the American session on October 29 (analysis of morning deals)

- AUD/USD Accelerates Its Sell-Off

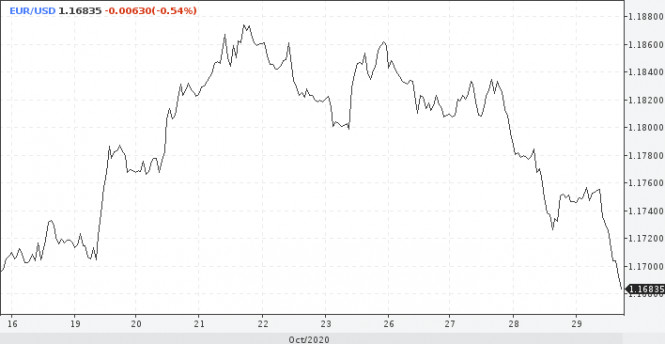

- EUR / USD: dollar gains 0.5% while euro suffers uncertainty amid COVID-19 crisis

- BTC analysis for October 29,.2020 - BTC reached downside target at $13.200 and i heading towards next at $12.720

- Lockdown again in Germany and France

- EUR/USD analysis for October 29 2020 - Downward target reached at 1.1715 and potential for next downward target at 1.1615

- Analysis of Gold for October 29,.2020 - First downward target at $1.871 has been reached. Potential for test of second target

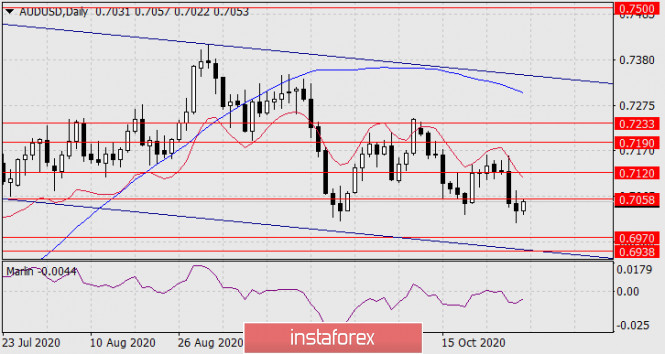

| Forecast for AUD/USD on October 30, 2020 Posted: 29 Oct 2020 07:46 PM PDT AUD/USD The Australian dollar consolidated below the broken level of 0.7058 yesterday. The Marlin oscillator's signal line is turning up, being in the territory of bearish players. In the Asian session today, the growth of the Australian dollar blocked yesterday's decline in the body of the candlestick. Consolidation is likely to occur after the previous two-day drop. Today and possibly on Monday, consolidation approximately in the range of extremes of yesterday is highly anticipated. With its completion, there is a possibility of a further decline to the targets of 0.6970 and 0.6938.

On the four-hour (H4) chart, the price is trying to return above the level of 0.7058, but the indicators are not helping it very much. Marlin is moving up with a slowdown, while the balance line is turning up, trying to move away from the price, which indicates that it remains in a stable downward trend. The completion of consolidation and then the decline to the designated goals of 0.6970 and 0.6938 are anticipated.

|

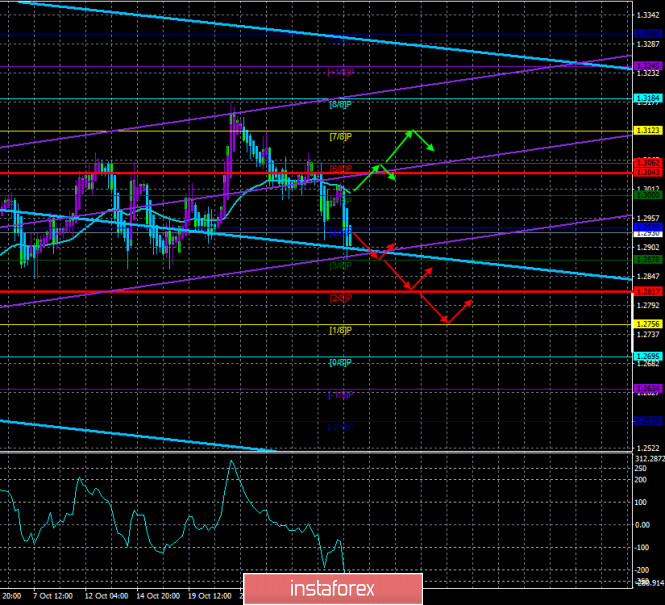

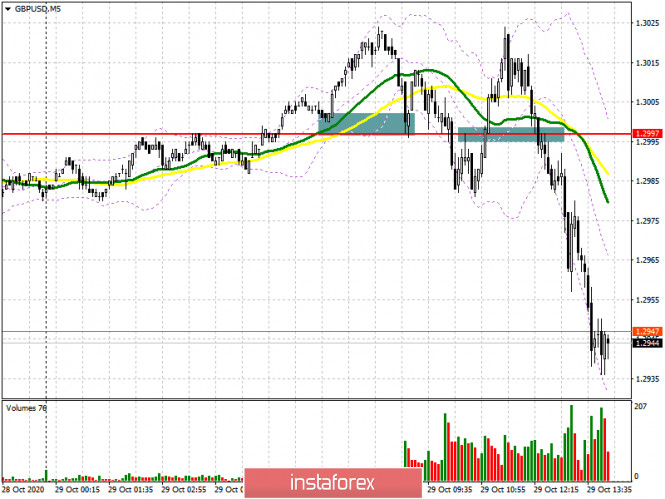

| Posted: 29 Oct 2020 07:27 PM PDT GBP/USD 1H The GBP/USD pair was also trading lower for most of the day on Thursday, October 29. The pair perfectly rebounded from the Senkou Span B line in the morning, thereby forming a sell signal. It fell to the support level of 1.2897 during the day. Therefore, the downward trend remains in effect despite the fact that the price left the descending trend channel earlier. Now bears need to overcome the support area of 1.2854-1.2874 to build on their own success. In this case, they will be able to pull down the pair by another 100 points. Buyers only have to wait until they return to the important Kijun-sen and Senkou Span B lines. We can only expect the pair to return to the upward channel above these lines. However, according to fundamental analysis, this option is unlikely in the near future. GBP/USD 15M Both linear regression channels are directed downward on the 15-minute timeframe, which reflects the trend of the last two days. There are no signs of starting an upward correction at the moment. COT report The new Commitments of Traders (COT) report for the pound showed that non-commercial traders were quite active during October 13 to 19. However, at the same time, the last few reports have completely made the situation complicated. The "non-commercial" group of traders opened 4,485 Buy-contracts (longs) and closed 4,072 Sell-contracts (shorts). Thus, the net position of professional traders immediately grew by 8,500 contracts, which is quite a lot for the pound. However, the problem is that non-commercial traders have been building up their net position (strengthening the bullish sentiment) over the past few weeks, and before that they have reduced their net position for several weeks (strengthening the bearish sentiment). Thus, over the past months, professional players have not even been able to decide in which direction to trade. The fundamental background continues to be very difficult and ambiguous for the pound/dollar pair, which is why the trades are so confusing. The pound sterling lost approximately 110 points during the reporting period. And the net positions of commercial and non-commercial traders are now practically zero. In other words, both the most important and largest groups of traders have approximately the same number of Buy and Sell contracts open. Naturally, such data from the COT report does not allow any conclusions, either short-term or long-term. Fundamental background for GBP/USD remained unchanged on Thursday. Traders were forced to pay attention to US reports, since London did not provide any data. Either Michelle Barnier and David Frost decided to extend the next round of negotiations even further, or there is no progress and there is simply nothing to announce. However, US reports were enough to pull down the pound. We already warned you that the GDP report is an important report, and if the forecast value is exceeded, then the reaction is almost inevitable. And so it happened. The forecast was exceeded by 2.1% and this report was enough for the pound to tumble by100 points. But if we receive information about the lack of progress in negotiations between London and Brussels, this could cause the pound to fall by another 100 points. Minor reports will be released in the United States on Friday, such as changes in the level of income and expenses or consumer confidence index. Not a single publication planned for the UK, therefore, the reports on inflation and GDP in the European Union will cause the greatest interest among traders. We have two trading ideas for October 30: 1) Buyers for the pound/dollar pair failed to gain a foothold above the Senkou Span B line. Therefore, the initiative remains in the hands of the bears, and long positions are irrelevant. You are advised to consider long deals in case the price settles above the Senkou Span B (1.3018) and Kijun-sen (1.3002) lines while aiming for the resistance area of 1.3160 -1.3184. Take Profit in this case will be up to 110 points. However, this is unlikely to happen today. 2) Sellers continue to pull down the pair and so they reached 1.2897, now a correction may take place for some time. If the correction is strong, that is, to the Kijun-sen line, then you are advised to resume trading down in case the price rebounds from this line, and you can aim for 1.2897 and the support area of 1.2854-1.2874. Otherwise, we recommend waiting for the price to settle below the 1.2854-1.2874 area and trade while aiming for the 1.2754 level. Take Profit in the first case will be 90-110 points, in the second - up to 80. Hot forecast and trading signals for EUR/USD Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the "non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Oct 2020 07:25 PM PDT EUR/USD 1H The EUR/USD pair has sharply resumed its downward movement on the hourly timeframe on Thursday, October 29, practically without any correction. The support area of 1.1693-1.1700 was overcome, which was the lower line of the horizontal channel at 1.17-1.19, in which the pair has been trading for three months. On the one hand, everything is clear: the lower boundary of the channel has been overcome, which means the downward movement will continue. However, on the other hand, if you look at the higher charts, you can see that the pair had already crossed this area once before, but the bears then managed to pull down the pair by only 80 points, after which the quotes quickly returned to the horizontal channel. So something like this could happen now. Take note that the fundamental background for both the euro and the dollar remains very diverse and complex, as well as ambiguous. Therefore, the pair could grow again at any moment. EUR/USD 15M Both linear regression channels are directed to the downside on the 15-minute timeframe, which eloquently indicates the current trend on the hourly chart and shows that there are no signs of completing the downward movement. COT report The EUR/USD pair fell by around 40 points during the last reporting week (October 13-19). But in general, no significant price changes have been observed for the pair in recent months. Therefore, data from any Commitment of Traders (COT) report can only be used for long-term forecasting. The new COT report showed even fewer changes in the mood of professional traders than the previous one. Non-commercial traders, who, we recall, are the most important group of traders in the foreign exchange market, opened 1,081 Buy-contracts (longs) and 673 Sell-contracts (shorts). Take note that the "non-commercial" group decreased its net position in the last two weeks, which may indicate the end of the upward trend. However, the data provided by the latest COT report does not tell us anything at all. There are no changes, since non-commercial traders have opened almost 300,000 euro contracts. Thus, opening or closing of 1,000-2.000 contracts does not indicate anything. The lines of net positions of the "non-commercial" and "commercial" groups (upper indicator, green and red lines) continue to barely narrow, while the pair itself continues to trade in a horizontal channel. Therefore, we stick to our opinion - the upward trend is completed or is about to be completed, and the high reached near the 1.2000 level may remain the peak of this trend. The US just released its third-quarter GDP report in its first estimate. Recall that the American economy contracted by 31% in the second quarter, but in the third quarter it grew by 33%. Traders received the news with a bang and actively bought the dollar. Also, the results of the European Central Bank meeting were summed up yesterday. As expected, the rates remained unchanged, but ECB President Christine Lagarde's rhetoric during the press conference, as they say, finished off the euro. Lagarde said: "The data signals that the economic recovery in the eurozone is losing momentum faster than expected, after a strong, albeit partial recovery in economic activity during the summer months." Lagarde believes that the increase in the number of cases of coronavirus represents a new serious threat to the European economy. Lagarde also noted that business activity in the service sector is declining, and significantly. Inflation, according to Lagarde, will also experience negative pressure for a long time to come. Such rhetoric caused a sell-off in the euro currency. We have two trading ideas for October 30: 1) The EUR/USD pair went down. Thus, buyers are advised to resume trading upward while aiming for the resistance area of 1.1887-1.1912 but not before the quotes have settled above the descending channel, below which the price has already gone very far. Take Profit in this case can be up to 70 points. Thus, we do not expect this scenario to come true in the near future. The price is too far away even from the Kijun-sen line. 2) Bears continue to actively pull down the pair. Thus, sellers are advised to continue trading down while aiming for the support levels of 1.1637 and 1.1570. A price rebound from any target can trigger a round of corrective movement. Take Profit in this case can be up to 70 points. Hot forecast and trading signals for GBP/USD Explanations for illustrations: Support and Resistance Levels are the levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Kijun-sen and Senkou Span B lines are lines of the Ichimoku indicator transferred to the hourly timeframe from the 4-hour one. Support and resistance areas are areas from which the price has repeatedly rebounded off. Yellow lines are trend lines, trend channels and any other technical patterns. Indicator 1 on the COT charts is the size of the net position of each category of traders. Indicator 2 on the COT charts is the size of the net position for the "non-commercial" group. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Oct 2020 06:15 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - downward. CCI: -203.3117 The British pound sterling was also trading lower against the US currency on Thursday. However, if in the case of the European currency, the decline may be within a sideways trend, then in the case of the pound sterling – the beginning of a new long downward trend. However, the situation for both major pairs is now so complex and confusing, and there are so many factors that can influence the mood of market participants, that it is extremely difficult to make any more or less accurate conclusion and forecast. Traders of the British pound continue to wait. They continue to wait for the US presidential election, as the future of the country, its domestic and foreign policy, as well as methods of fighting the "coronavirus", which the US authorities have simply "scored" on now, depends on it. This led to almost a record economic recovery in the third quarter (+33% of GDP), however, we are talking about human lives. Traders are also waiting for the results of the next round of negotiations between the groups of Michel Barnier and David Frost. Unfortunately, at the time of writing, no new information has been received. And when it will arrive is unknown. The talks were supposed to end yesterday, Thursday, but there were no speeches from top UK and EU officials in the press. Meanwhile, the pound is fed up with everything. During this week alone, there were reports in the press that the parties allegedly managed to reach a compromise in the negotiations and "the negotiations broke the deadlock". Such reports appeared in the press when Britain was just agreeing on a deal on "divorce" with the EU, when Theresa May went to Brussels almost every week, then came to London, where the Parliament successfully blocked each new version of her agreement. Such optimistic rumors were constantly appearing, and they are still appearing now. But they have nothing to do with reality in 90% of cases. Because Brexit will be "tough" unless London and Brussels somehow manage to reach an agreement. For the parties to reach a consensus, we believe that it is Brussels that should concede, which needs it much less than London. But it was Brussels that insisted in recent weeks on intensifying negotiations. His desire to negotiate with Boris Johnson is visible to the naked eye, but a similar desire in London is not observed. Maybe we don't know anything about the whole situation? Maybe Boris Johnson has a trump card up his sleeve, with which he manipulates the European Union and diligently pushes through his version of the agreement? In any case, sooner or later, we will know the answer to this question. In the meantime, the British currency has started to become cheaper and is likely to continue to do so in the coming days. We recommend that traders conduct extremely cautious trading since the factor of the US election has not been canceled either. In terms of the fundamental background, the entire market is now sitting "on a powder keg". Any news from the US or the UK can have the status of "extremely important" and the markets will significantly increase volatility. A separate topic for the British pound is the "coronavirus" epidemic. We all witnessed how Angela Merkel and Emmanuel Macron officially announced new "lockdowns" in Germany and France yesterday. This is approximately the same situation in the UK. According to Johns Hopkins University, the total number of cases of "coronavirus" in Britain is approaching one million. On October 28, about 25,000 new cases of infection were recorded, which is not much lower than in France or Germany. To be more precise, this is the same as in Germany or Italy. Only Spain and France are solidly ahead of other European countries in this terrible ranking. Thus, Boris Johnson may soon have to introduce a "lockdown" or again tighten quarantine measures, which, in principle, is the same thing. The US economy contracted by 31% during the first "wave", but grew by 33% in the third quarter. The British economy lost 20% in the second quarter and may grow by 15% in the third quarter. Thus, even preliminary forecasts suggest that the pace of recovery in the British economy is much weaker than in the US. This means that the British currency is even more inclined to a new prolonged fall. Its economy is not only recovering worse but may also be closed for a second "lockdown". The Bank of England may switch to negative rates in the near future. There may not be a deal with the European Union, and even if it is, the blow to the economy due to Brexit in 2021 will still be inflicted. Therefore, we continue to insist that the prospects for the British economy remain very negative, and the prospects for the British pound are vague. From a technical point of view, the pound/dollar pair has fixed below the moving average line, so the trend has changed to a downward one. Thus, in the short term, we expect the downward movement to continue. The downward movement is also supported by the senior linear regression channel and the downward-pointing Heiken Ashi indicator. The main problems now are still uncertainty. We hope that after November 3, it will become more or less known about the results of the US elections, as well as the results of the next round of negotiations in London. This information can relax the markets a bit and allow them to trade more freely. If you look at the chart carefully, you can see that in the last month, the pound/dollar pair very often changed the direction of its movement, fixed above the moving average, then below it, which only complicated the trading process. We also remind traders about the important level of 1.3170, which is 61.8% of the Fibonacci from the fall of quotes from September 1. The price bounced back from it, "like a textbook", and we believe that this is a very strong signal for further movement to the south in the long term.

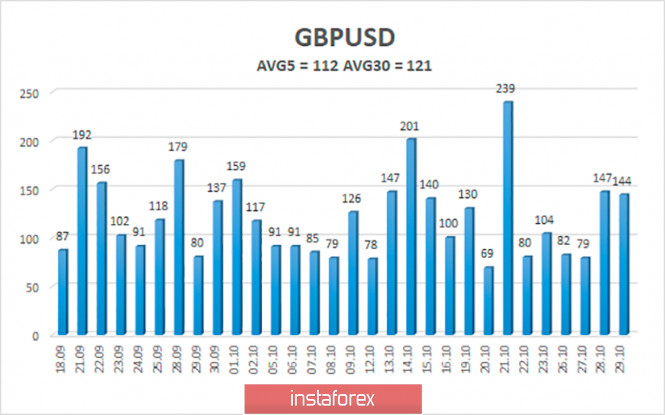

The average volatility of the GBP/USD pair is currently 112 points per day. For the pound/dollar pair, this value is "high". On Friday, October 30, therefore, we expect movement inside the channel, limited by the levels of 1.2818 and 1.3043. A reversal of the Heiken Ashi indicator-up signals a round of corrective movement within a likely new downward trend. Nearest support levels: S1 – 1.2878 S2 – 1.2817 S3 – 1.2756 Nearest resistance levels: R1 – 1.2939 R2 – 1.3000 R3 – 1.3062 Trading recommendations: The GBP/USD pair started a new round of downward movement on the 4-hour timeframe. Thus, today it is recommended to stay in short positions with targets of 1.2878 and 1.2817 as long as the Heiken Ashi indicator is directed down. It is recommended to trade the pair for an increase with targets of 1.3062 and 1.3123 if the price is fixed back above the moving average line. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Oct 2020 05:56 PM PDT 4-hour timeframe

Technical details: Higher linear regression channel: direction - downward. Lower linear regression channel: direction - upward. Moving average (20; smoothed) - downward. CCI: -189.8880 During the fourth trading day of the new week, the EUR/USD pair resumed its downward movement without any correction or upward pullback. It resumed and fell to 1.1700 during the day while remaining inside the same side channel of 1.17-1.19, in which it has been trading for about 3 months. So, by and large, nothing extraordinary happened again. The euro/dollar pair dropped to the lower line of the side channel. Now, it has an excellent chance of breaking this line, however, even now, when the pair has gone below 50 points, this does not mean an unambiguous end to the sideways trend. Earlier, the pair went below 1.1700, but then returned to the channel. Thus, it is possible that now the pair is waiting for something similar. The main reason for the fall in the pair's quotes on Thursday was the US GDP report, which showed that the economy recovered by 33.1% in the third quarter, which is more than the losses of the second quarter. In real terms, the results of the second and third quarters still have a "minus", however, the pace of economic recovery impressed traders. Thus, the US currency forgot about the elections and the uncertainty factor of the future. The second reason for the fall of the European currency on the penultimate trading day of the week was the statements of German Chancellor Angela Merkel and French President Emmanuel Macron about the introduction of new "lockdowns". Thus, the authorities of European countries did not wait for the health systems of their countries to collapse and introduced "strict" quarantines. However, as many experts note, "lockdowns" are still not as severe as in the spring. However, these are almost total quarantines, so the European economy may start experiencing problems in the near future. In general, according to the results of Thursday, we can say the following: the American economy showed a really serious recovery rate, although the country remains the first in the world in the number of cases of "coronavirus" and the number of deaths from it. However, the European economy, thanks to the new "lockdown", will decrease almost 100% in the third quarter. Therefore, in just one day, the euro currency turned from a currency with good prospects for the coming months into outsiders. Of course, we should not forget that the American presidential election is still ahead, which is only a few days away. This is the topic that has kept market participants on their toes in recent weeks and even months, so it can hardly be said that now the markets have lost interest in this topic and it is no longer important and significant. Therefore, in the coming days, everything may still change. Do not put an end to the European currency in advance. Meanwhile, Americans are showing how important the 2020 election is to them. At the moment, that is, four days before the official Election Day, 76 million people have already voted ahead of schedule, which is more than half of the total number of those who voted in 2016. As we have repeatedly said, there is a reason for this behavior of Americans. Judge for yourself, if it were "just another election", why such a sharp increase in voters? If Donald Trump had done a great job like Barack Obama did in his first four years, would there have been such a rush for re-election? We believe that Americans have become more active precisely because they understand that if they ignore the election, then Donald Trump may stay for a second term. We don't see any other explanation. That is why amid the second "wave" of the pandemic in the United States, when 70-80 thousand people fall ill every day, people are not afraid to leave their homes, go to the polls, stand in queues for several hours, and vote. Because unlike the Europeans, who began to introduce new "lockdowns" in their countries as soon as the "smell of fried", Trump is not interested in the health and lives of people. At least, all his actions and statements say exactly this. The US President is interested in the economy and business, his own business, which will begin to suffer serious losses if the country plunges into a second "lockdown". That is why the US President is doing everything he can to show that the "coronavirus" is not so terrible. What is the story with the "infection" of Trump himself and a miraculous cure in 10 days? We do not claim that the US President was not ill at all, however, we assume that this option is quite possible. Recall that, when Britain ended the first "wave" COVID-2019, the authorities even made timid attempts to motivate a healthy way of life of the British people. America is famous all over the world as "the nation with obesity". However, no steps were taken in this direction either. What is the output? The US President did not take into account the "coronavirus" from the very beginning. All the last 7 or 8 months, he shocked doctors and epidemiologists with his statements concerning COVID-2019, then offering to "enlighten the sick with a strong light source", then "pour a strong disinfectant inside", then simply stating that "the virus will magically disappear in April". Maybe in April 2021? And now Americans are going to the polls to "pay Trump in his coin". Of course, we are not saying that the outcome of the election is already a foregone conclusion, but from our point of view, the probability that Biden will become the new President is extremely high. For the US currency, this factor does not mean anything. For the US dollar, elections, as well as all the possible problems that are associated with them (for example, legal proceedings that can be initiated by one of the candidates in case of defeat), are just a factor of uncertainty. Market participants do not want to invest in the dollar until it becomes clear and clear what is waiting for America in the next four years.

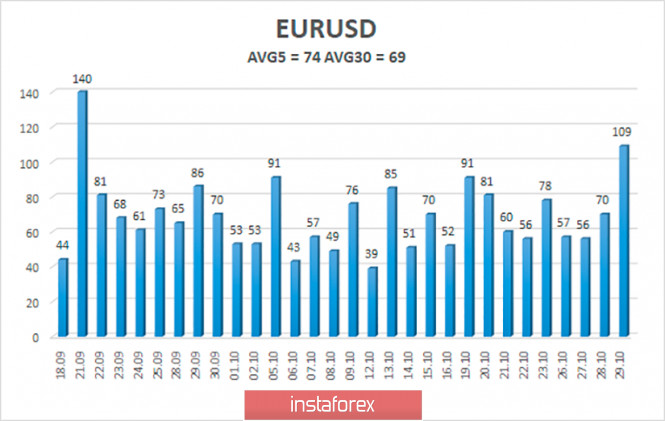

The volatility of the euro/dollar currency pair as of October 30 is 74 points and is characterized as "average". Thus, we expect the pair to move today between the levels of 1.1600 and 1.1748. A reversal of the Heiken Ashi indicator to the top may signal a round of upward correction. Nearest support levels: S1 – 1.1658 S2 – 1.1597 Nearest resistance levels: R1 – 1.1719 R2 – 1.1780 R3 – 1.1841 Trading recommendations: The EUR/USD pair continues its downward movement and seems to have even overcome the important level of 1.1700. Thus, today it is recommended to support open sell orders with targets of 1.1658 and 1.1600, while the Heiken Ashi indicator is directed down. It is recommended to consider buy orders if the pair is fixed above the moving average line with a target of 1.1841. The material has been provided by InstaForex Company - www.instaforex.com |

| The Dollar and Trump widened the gap. How will it end? Posted: 29 Oct 2020 04:58 PM PDT Statistics from American fields on Thursday added optimism to investors. Appetite for risks improved and the Dollar also remained among those who received the data positively. The US economy expanded at an annualized rate of 33.1% in the third quarter, according to the first estimate. The growth rate was a record. This was the fastest pace since record keeping began in 1947 and followed a historic 31.4% drop in the second quarter. It is unlikely that this report will soften the effects of COVID-19 due to the huge number of fatalities in America. Millions of people are also still out of work. However, Trump should not miss this positive moment for himself/ He will try to make the situation about him. The election is just days away and the current President is lagging behind in most national polls. The current rebound it will probably give out as a sign of recovery. Joe Biden should not stay silent. He must emphasize that the growth spurt will quickly dry up. On Thursday, the dollar was able to overcome the important mark of 94 points. If it manages to fix itself beyond its limits, then the upward dynamics may continue. Meanwhile, the Coronavirus situation continues to put pressure on markets. France introduced a self-isolation regime, while Germany has limited itself to a lighter lockdown. There is growing concern that restrictive measures in Europe are also being extended to the US. Although the chances that another major economy in the world will be stopped are extremely small. The Dollar's jump on Thursday may be short-lived. GDP data will be released and markets will switch to other more important topics. Ahead of the presidential election, and against this background, the Dollar may shake slightly. Volatility is sure to increase. It is possible that the US Dollar will start trading regardless of risk appetite and will largely depend on the history of the elections. Donald Trump still has a good chance of winning. According to the majority, Joe Biden should win but the forecast of those who are more often right speaks in favor of Trump. The Trafalgar Group released the results of a new survey conducted between October 24 and 25 in Minnesota, Wisconsin and Pennsylvania. In Minnesota, the Democrat remains the leader but he has already reduced the gap from the Republican by 1%. However, this does not change the situation, since Minnesota was already on Biden's side. A week ago in Wisconsin, Biden had 3% more votes, now he goes with a margin of just 0.7 percentage points. The states have not changed sides but now it is important that the gap between the candidates is shrinking, which, of course, plays on the side of Trump. Meanwhile, the election news agency said that Georgia and North Carolina still chose the side of the Democrats. The material has been provided by InstaForex Company - www.instaforex.com |

| Why did the euro fall and what did Lagarde say? Posted: 29 Oct 2020 04:58 PM PDT

Yesterday's highlight is the ECB's interest rates, which it expectedly left unchanged. The refinancing rate was kept at 0.00%, while the deposit rate was kept at 0.50%. The markets didn't expect any surprises or anything like that. But before the meeting itself, there was little hope for an immediate reaction from the Central Bank to the tightening restrictions on economic and social life in Germany and France. Nothing happened, and the financial authorities refrained from announcing new stimulus measures. At the same time, the accompanying statement sounded signals that the risks on rates are clearly aimed downward. There is a policy correction in the ECB's plans, which may happen in December as soon as more realistic economic estimates appear. The next meeting is scheduled for December 10. It is possible that the European regulator will announce at the next meeting new and quite serious incentives proportional to the fiscal stimulus in the eurozone countries later. But for now, everything remains unchanged. A hard stance on rates and inflation tends to strengthen the euro, while a soft stance tends to lower it. The European currency tried to correct upward after the meeting. There was a slight rebound from the area of multi-day lows reached. This trend, however, could not be maintained and the rate went down again, which was facilitated by the statements of Christine Lagarde. The result of the meeting and press conference of the head of the ECB, it seems, will be not just a weakening of the euro, but also a further depreciation. The strong support level at the moment is 1.1660.

According to Lagarde, the rapid increase in the number of COVID-19 cases is a new challenge for the health of the population and the growth prospects of the eurozone and other countries. Incoming macroeconomic data signals a slowdown in the economic recovery after a relatively "light" summer months. There is now a clear deterioration in the short-term economic outlook. Consumers are cautious against the backdrop of the pandemic, and activity in the service sector is slowing despite measures of support from fiscal policy. Growth of uncertainty concerning economic assessments are putting pressure on business investment, while the fall in energy prices has a negative impact on inflation. Lagarde also stated that the measures taken in March help maintain favorable financial conditions in the eurozone. But considering the current downside risks, the Central Bank's Board of Governors will carefully study the incoming information, including the situation with the pandemic, the prospects for the release of vaccines, and the dynamics of exchange rates. A new round of macroeconomic forecasts in December will allow the regulator to carefully calculate the balance of risks. Based on more accurate updated estimates, the ECB will take further steps to protect economic growth. Earlier, the downside risks included Brexit, escalating trade conflicts, and factors of political instability in the region. And now, the coronavirus and the threatening increase in the number of infected people in Europe have been added to the threats to the European economy. When the head of the European Commission Ursula von der Leyen made it clear that "the jump in morbidity is alarming, and you should not delay anti-crisis measures," she also called on European governments to be more active in responding to the pandemic. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Oct 2020 01:21 PM PDT Hourly chart of the EUR/USD pair After a very slight correction, the EUR/USD pair went back to moving down on Thursday, October 29. A sell signal from MACD was generated and novice traders could also work it out.The euro/dollar pair fell by almost 100 points during the day, and traders could earn around 70 points of profit at the moment. Given the strength of the current movement and its fundamental foundations, the euro may well continue to fall. However, here we leave the decision at the discretion of the traders themselves. You can close short positions right now and go to bed calmly, you can wait for the MACD indicator to turn up. The problem is that this indicator has already fallen quite significantly, so if the price continues to drop, then it is not a fact that the indicator itself is the one responsible for it, which may simply start to discharge (indicator movement in the direction opposite to the price movement). As for the pair's future prospects, it is quite difficult to talk about them right now. Quotes have left the horizontal channel, now it does not affect trading in any way. The price has left the descending channel, it also has no value now. There are no new trend lines, so now you can trade exclusively using the MACD indicator. In any case, we recommend considering opening new positions tomorrow morning. There were two fundamental events on Thursday that deserve attention. The report on US GDP for the third quarter showed an increase of 33.1%, which is higher than the forecasts of experts, and in general is a very high value. It means that the American economy is recovering at a very high rate, which provided support to the US dollar. On the contrary, European Central Bank President Christine Lagarde made very mild, dovish statements, noting that the growth in the number of infections with the coronavirus in the EU countries could again slow down economic recovery and put additional pressure on inflation. Therefore, Lagarde's words did not support the euro. As a result, the pair fell by100 points. The EU will publish the most important data on GDP in the third quarter on Friday, October 30, as well as on inflation for October. The EU's GDP is expected to grow 9.0% in the third quarter, after falling 11.8% in the second quarter. Therefore, compared with the US GDP, we can say that the recovery of the eurozone economy is proceeding more slowly. However, if the real value of the indicator is above 9.0%, then we can expect the euro to slightly strengthen. Moreover, after such a tangible fall, a correction is in any case necessary. But the report on inflation might be extremely weak, or rather negative. Forecasts speak in favor of -0.3% y/y, which still means deflation or falling prices instead of rising. Negative inflation, from the ECB's point of view, is a negative phenomenon for the economy, therefore, the demand for the euro is unlikely to grow after this report. Possible scenarios for October 30: 1) Buy positions on the EUR/USD pair are currently irrelevant. The price left the horizontal channel altogether, so now there are no preconditions for a new upward trend to form. For long deals on the pair, you need to wait, perhaps it could take several days. The most you can expect right now is an upward correction. 2) Trading for a fall at this time remains relevant, although the pair went down 180 points in two days. Thus, now we expect an upward correction, from which it will be necessary to "hop" further. A new downward channel might appear. As for the signals, you need to wait for the correction so that the MACD indicator is discharged and afterwards, wait for a new sell signal to appear. The pair is unlikely to begin and end a correction earlier tomorrow morning. On the chart: Support and Resistance Levels are the Levels that serve as targets when buying or selling the pair. You can place Take Profit near these levels. Red lines are the channels or trend lines that display the current trend and show in which direction it is better to trade now. Up/down arrows show where you should sell or buy after reaching or breaking through particular levels. The MACD indicator (14,22,3) consists of a histogram and a signal line. When they cross, this is a signal to enter the market. It is recommended to use this indicator in combination with trend lines (channels and trend lines). Important announcements and economic reports that you can always find in the news calendar can seriously influence the trajectory of a currency pair. Therefore, at the time of their release, we recommended trading as carefully as possible or exit the market in order to avoid a sharp price reversal. Beginners on Forex should remember that not every single trade has to be profitable. The development of a clear strategy and money management are the key to success in trading over a long period of time. The material has been provided by InstaForex Company - www.instaforex.com |

| European indices rose on corporate news Posted: 29 Oct 2020 07:56 AM PDT

At 03:35 am ET (08:35 GMT), Germany's DAX was trading 0.4% higher, France's CAC 40 was up 0.1%, and the UK's FTSE was up 0.1%. On Wednesday, it announced additional measures to combat the new surge in COVID-19. After that, France shut down all non-essential businesses, and Germany closed its hotel industry for a month. This hit European stocks hard on Wednesday, with the DAX closing 4.2% lower, for example. Positive corporate news helped stabilize the situation on Thursday. Oil producer Royal Dutch Shell posted higher-than-expected third-quarter earnings and increased dividends. Its shares were up 3.3%. British bank Lloyds reported its results in the third quarter. They were above analyst expectations for profit after the largest increase in mortgage applications since 2008. The company's shares were up 2%. Nokia shares were down more than 12%. The Finnish telecommunications equipment maker reported disappointing third-quarter basic profit in its first statement of income under new CEO Pekka Lundmark. On Thursday, oil prices fell. This was served by the prospects for global demand after the introduction of new restrictive measures in Europe due to COVID-19. In addition, data from the US Energy Information Administration (EIA) on Wednesday showed that the country's crude oil inventories rose 4.3 million barrels last week, fueling concerns about a potential oversupply. The material has been provided by InstaForex Company - www.instaforex.com |

| Ichimoku cloud indicator Daily analysis of EURUSD Posted: 29 Oct 2020 07:16 AM PDT EURUSD is in neutral trend according to the Ichimoku cloud indicator. However the Cloud indicator has warned us with several signals so far of the vulnerability of EURUSD. With price now just below 1.17, bulls are in a very difficult spot. Price is making lower lows and lower highs and price is about to break down below the lower cloud boundary.

The rise from 1.1612 to 1.1880 has most probably been complete and now we are at the early stages of a move lower that will eventually break below 1.16 and reach 1.15. Confirmation of the bearish signal will come first when price breaks out and below the Kumo (cloud). Secondly bears would want to see the tenkan-sen cross below the kijun-sen. Resistance is found at 1.18 and as long as price is below this level we remain pessimistic. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Oct 2020 07:11 AM PDT Gold price got another rejection at $1,920-30 area and is now breaking lower below short-term support of $1,900. Next key support is at $1,850 and next is at $1,805 where we find our first bearish target.

Green lines - expected size of downward move Gold price has been rejected several times at the downward sloping red trend line. As long as price is below the trend line we remain bearish looking for a move towards $1,810-$1,800. Price is expected to make an equal decline relative to the last downward move. Confirmation of the $1,810 target will come once price breaks below recent lows at $1,850. Until then any upward move is considered opportunity to sell as long as price is below the resistance trend line. The material has been provided by InstaForex Company - www.instaforex.com |

| October 29, 2020 : EUR/USD daily technical review and trade recommendations. Posted: 29 Oct 2020 06:53 AM PDT

Two weeks ago, temporary breakout above 1.1750 was demonstrated within the depicted ascending channel. This indicated high probability of bullish continuation towards 1.1880. However, downside pressure pushed the EUR/USD pair towards 1.1700 where significant BUYING Pressure Existed. This was followed by a quick upside movement towards 1.1880-1.1900. The price zone around 1.1880-1.1900 constituted a KEY Price-Zone as it corresponded to the backside of the depicted broken ascending channel. The Recent Upside breakout above 1.1780 allowed the price levels around 1.1880-1.1900 to be tested where significant bearish pressure and a reversal Head & Shoulders pattern were demonstrated. Recently, Two opportunities for SELL Entries were offered upon the recent upside movement towards 1.1880-1.1900. Both positions are already running in profits. Exit level should be lowered to 1.1750 to secure more profits. Trade Recommendations :- Currently, the price zone of 1.1740-1.1780 stands as a significant Resistance-Zone to be watched during any upcoming upside pullback for a valid SELL Position. Initial bearish target would be located around 1.1720 and 1.1690 The material has been provided by InstaForex Company - www.instaforex.com |

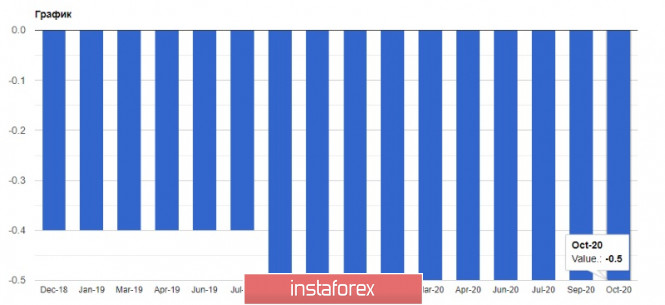

| Posted: 29 Oct 2020 06:50 AM PDT Today the ECB stood pat on all settings of its monetary policy. The regulator announced that the key policy rates remains at 0.0% and the deposit rate is left at -0.5%. The ECB has not changed the bond-buying program. It is running as a financial aid program to the ailing eurozone's economy which is not able to recover from the fallout of the first pandemic wave. The ECB policy update reads that the regulator is ready to ensure favorable financial conditions and adjust all of its fiscal tools when necessary. The Pandemic Emergency Purchase Program (PEPP) launched in March 2020 was left unchanged at €1.35 trillion. So, the ECB will carry on with its bond purchases until June 2021 when the coronavirus-driven crisis is likely to complete. As for the Asset Purchase Program (APP), it also remained unchanged with a monthly purchase volume of €20 billion. In the forward guidance, the regulator said that interest rates would be put on hold at the current or even lower levels until inflation firmly reaches the target level that is long-distant prospect. Such outcome is beneficial to speculative buyers of risky assets because they were braced for monetary easing today. Now investors are alert to a press conference of ECB President Christine Lagarde who could shed light on the central bank's approach to the COVID-19 resurgence when advanced European economies are tightening restrictions. Eventually, the ECB pledged its commitment to provide favorable financial conditions and to revise its outlook in December. When it comes to the economic calendar, a report on economic sentiment in the Eurozone for October did not tell anything new. The business sentiment index did not improve and consumers' sentiment turned sour in October. This comes from the pandemic resurgence which forced authorities to tighten restrictions on businesses and daily people's lives. According to a report by the European Commission, am economic sentiment index for the Eurozone remained flat at 90.9 in October. Yesterday, German Chancellor Angela Merkel announced a partial lockdown. Economists have already reckoned the costs entailed by such restrictive measures. The worse-case scenario says that a new nationwide lockdown could slash a GDP by nearly 1% provided that restrictions are lifted at the end of November. Previously, Angela Merkel announced that the authorities would shut restaurants and bars from November 4 due to soaring numbers of coronavirus cases. At the same time, stores, school, and kindergartens will remain open. Besides, theatres, sports clubs, and cinemas are also suspended for 1 month. Hotels are not allowed to accommodate foreign tourists. Angela Merkel believes that such measures are introduced to prevent the emergency situation in healthcare. The restrictions are not overcautious, but mandatory measures amid record high daily rates of new infections. Although today's report on the unemployment rate in Germany in October was better than the forecasts, it did not help the European currency much. According to the Federal Employment Office, in October 2020 the number of applications for unemployment benefits in Germany fell by 35,000, while economists had expected the number of applications to fall by 5,000. The unemployment rate edged down to 6.2% from 6.3% in September. It is not difficult to conclude that a new wave of coronavirus infections at the end of October will surely stall the decline in the unemployment rate and might lead to its rise again. As for France, yesterday President Macron also announced the introduction of the nationwide lockdown. Economists have already calculated the losses that would be inflicted by such restrictions. Experts estimated that due to strict lockdown measures, the country's GDP may lose from 1% to 2% in Q4 this year, depending on how long they are in effect. The technical picture of EUR/USD is complicated as the pair is set to trade under higher volatility during the press conference by ECB President Christine Lagarde. The crucial level for the buyers is still seen at near 1.1690. Its breakout will trigger a new sell-off of risky assets. Today's local high of 1.1760 is still acting as resistance. If broken, this will open the door towards 1.1800 and 1.1840. GBPUSD Meanwhile, the British pound is losing ground against the US dollar amid the lack of news on the Brexit trade agreement, which has been in talks all week. Lots of analysts do not believe in a compromise between the parties. So, there are rumors that at the policy meeting scheduled for November 5, the Bank of England is likely to downgrade its forecasts for the second half of 2020 and soften monetary policy. And this will hit the value of the British pound, which is already on the verge of a major fall due to uncertainty with Brexit and rising rates of COVID-19 cases in the UK. Another Brexit-related pain will clearly force the Bank of England to take more drastic measures, since the expansion of the asset purchase program alone will clearly not be enough. At the same time, the British regulator may follow the example of the ECB, taking a short pause for thoughts. The introduction of negative interest rates anticipated by investors for a long time will require a new approach from the central bank because such a decision will be made for the first time. So, it is necessary to carefully weigh everything. Earlier, the Bank of England projected that the UK GDP in Q4 2020 would be 5% down from a year ago. Nevertheless, the central bank expected economic expansion by the end of 2021. Nowadays, the regulator is more down to earth. The tough reality makes it downgrade the economic outlook for late 2020 and early 2021. This is bearish for the sterling. The technical picture of GBP/USD tells us that the bears are one step away from a retracement to the major psychological support of 1.2865 which has been tested at least 4 times this month. The 5th test of this level could be fatal, thus terminating stop orders of the sterling bulls and pushing the pair towards new lows of 1.2750 and 1.2640. The bullish trend could be resumed only after a breakout of 1.3060 that will open the door towards one-month highs of 1.3120 and 1.3175. The material has been provided by InstaForex Company - www.instaforex.com |

| October 29, 2020 : EUR/USD Intraday technical analysis and trade recommendations. Posted: 29 Oct 2020 06:40 AM PDT

In July, the EURUSD pair has failed to maintain bearish momentum strong enough to move below 1.1150 (consolidation range lower zone). Instead, bullish breakout above 1.1380-1.1400 has lead to a quick bullish spike directly towards 1.1750 which failed to offer sufficient bearish pressure as well. Bullish persistence above 1.1700 - 1.1760 favored further bullish advancement towards 1.1975 - 1.2000 ( the upper limit of the technical channel ) which constituted a Solid SUPPLY-Zone offering bearish pressure. Moreover, Intraday traders should have noticed the recent bearish closure below 1.1700. This indicates bearish domination on the short-term. On the other hand, the EURUSD pair has failed to maintain sufficient bearish momentum below 1.1750. Instead, another bullish breakout was being demonstrated towards 1.1870 which corresponds to 76% Fibonacci Level. As mentioned in previous articles, the price zone of 1.1870-1.1900 stood as a solid SUPPLY Zone corresponding to the backside of the broken channel. Intraday Trend-Traders could have considered the recent bearish H4 candlestick closure below 1.1770 as a valid short-term SELL Signal with a potential bearish target located around 1.1700 and 1.1630 if sufficient bearish momentum is maintained. Any bullish pullback towards the price zone of 1.1770 should be considered for signs of bearish rejection and a valid SELL Entry. The material has been provided by InstaForex Company - www.instaforex.com |

| October 29, 2020 : GBP/USD Intraday technical analysis and trade recommendations. Posted: 29 Oct 2020 06:37 AM PDT

Intermediate-term technical outlook for the GBP/USD pair has remained bullish since bullish persistence was achieved above 1.2780 (Depicted Key-Level) on the H4 Charts. However, On September 1, the GBPUSD pair looked overbought after such quick bullish movement while approaching the price level of 1.3475. That's why, short-term bearish reversal was expected especially after bearish persistence was achieved below the newly-established key-level of 1.3300. A quick bearish decline took place towards 1.2780 where considerable bullish rejection brought the pair back towards 1.3000 and 1.3100 during the past few weeks. The price zone of 1.3100-1.3150 (the depicted channel upper limit) remains an Intraday Key-Zone to determine the next destination of the GBPUSD Pair. Bullish Persistence above the mentioned price zone of 1.3100-1.3150 was supposed to allow bullish pullback to pursue towards 1.3400 as a final projection target for the suggested bullish pattern. However, the GBPUSD pair failed to do so, Instead, another bearish movement is probably targeting the price level of 1.2840 where bullish SUPPORT will probably exist. The material has been provided by InstaForex Company - www.instaforex.com |

| Evening review of EURUSD on October 29, 2020 Posted: 29 Oct 2020 06:19 AM PDT

Strong US data: The US GDP for the third quarter gains 33% after falling 30% in the second quarter. The GDP deflator also went up at 3.8%. The country's long-term unemployment fell by another 700,000. That is, from 8.4 million to 7.7 million. Meanwhile, as observed, the euro managed an upward reversal, thus, purchases can be considered from 1.1760 with a stop at 1.1715. The ECB meeting is scheduled today at 13:30 UTC, where we expect a speech from the head of the regulator, Christine Lagarde. The material has been provided by InstaForex Company - www.instaforex.com |

| GBP/USD: plan for the American session on October 29 (analysis of morning deals) Posted: 29 Oct 2020 05:57 AM PDT To open long positions on GBPUSD, you need: In the first half of the day, several signals were formed to enter the market, however, not all of them brought profit. Amid the lack of news on Brexit, many investors are losing their nerve, and the increase in the number of coronavirus infections is putting even more pressure. If you look at the 5-minute chart, you will see how the bulls managed to get to the level of 1.2997 in the first half of the day and tested it from top to bottom, forming a fairly good signal to buy the pound. The growth from this level was no more than 15 points, after which the bears tried to take control and formed a new entry point into short positions, which also turned out to be incorrect. It was only after the GBP/USD returned to the level of 1.2997 that the pressure on the pair returned.

At the moment, there is no point in reviewing the technical picture of the pair, since it has not changed much. The lack of news on Brexit seems to be weighing on both buyers and sellers. Buyers have a chance for a market reversal, and for this, they need to prevent a breakout of the support of 1.2919. The formation of a false breakout on it will be the first signal to open long positions. If there is no activity there, I recommend postponing purchases until the minimum of 1.2865 is updated, from where you can open long positions immediately for a rebound based on a correction of 20-30 points within the day. However, it will be possible to talk about a more likely recovery of the pound and a change in the trend only after the pair fixes above the resistance of 1.2991, the test of which on the reverse side forms a new entry point into purchases to update the highs of 1.3058 and 1.3120, where I recommend fixing the profits. To open short positions on GBPUSD, you need to: Bears are now aimed at reducing the GBP/USD to the support area of 1.2919, and while trading is conducted in the middle of the channel, there will be no reference points for entering short positions. Only an upward correction and the formation of a false breakout in the resistance area of 1.2991 will be a signal to sell the pound in the continuation of the current trend. Negative news on Brexit may increase pressure on the pair, which will lead to a breakout and consolidation below the support of 1.2919. In this case, the weekly target will be at least 1.2865. In the scenario of growth of GBP/USD above the resistance of 1.2997 in the second half of the day, I recommend postponing sales until the test of the maximum of 1.3072 in the expectation of a correction of 20-30 points.

Let me remind you that in the COT reports (Commitment of Traders) for October 20, there was a reduction in short and a sharp increase in long positions. Long non-commercial positions increased from 36,195 to 39,836. At the same time, short non-commercial positions fell from 45,997 to 41,836. As a result, the negative value of the non-commercial net position increased slightly to -2,000 against -9,802 a week earlier, which indicates that sellers of the British pound remain in control and have a minimal advantage in the current situation. Signals of indicators: Moving averages Trading is below 30 and 50 daily averages, which indicates a resumption of the bear market. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1. Bollinger Bands In the case of an upward correction, the average border of the indicator around 1.32991 will act as a resistance, from which you can sell the pound. Description of indicators

|

| Stock market: APX suffers losses following US and Europe Posted: 29 Oct 2020 05:51 AM PDT

The Asia-Pacific Stock Exchanges (APX) suffers losses as major stock indexes are reducing their positions following the fall in the US and Europe stock exchanges the previous day. Note that the trading indicators of the US and Europe plummeted Wednesday, but the APX did not lose enthusiasm. However, on Thursday, the situation has changed dramatically. And the main factor of pressure is still the deteriorating coronavirus situation across the globe. Some European countries are already reimplementing lockdowns and restrictive quarantine measures to combat the spread of coronavirus infection. The situation in individual countries has escalated to the limit against the background of a rapid increase in infections. In particular, France and Germany are ready to stop all possible economic processes on their territory by the end of November this year. Of course, Asian traders could not help but react to this. Japan's Nikkei 225 Index dropped 0.28%. The unsatisfactory statistics on the country's economy also added fuel to the fire. First, the Bank of Japan decided to leave the short-term interest rate on deposits at the same negative level of 0.1% per annum. Second, the forecast for the GDP level has been revised for the worse. For the current fiscal year, which should come to an end in March 2021, the decline should already be 5.5%, while previous data indicated a decrease of 4.7%. This turned out to be a fully justified decline, which was due to the slow recovery of demand in the country's services sector. Nevertheless, analysts note that the country's economy is still coping well with the consequences of the crisis caused by the coronavirus pandemic. The level of retail sales in Japan in the first month of autumn fell by 0.1%, while earlier this indicator showed a rapid growth of 4.6%. On an annualized basis, retail sales fell by 8.7%, which turned out to be much worse than the initial estimates which expected a fall of no less than 7.7%. China's Shanghai Composite Index rose 0.32%. The Hong Kong Hang Seng Index did not support the positive trend and sank 0.6%. South Korea's KOSPI parted from 0.91%. It should be noted that the index of confidence in business circles in the country became significantly higher in the second month of autumn: it moved to the level of 79 points, although earlier it occupied the mark of 68 points. The Australian S&P / ASX 200 index fell 1.61% at once. Meanwhile, a positive atmosphere reigns on European stock exchanges. Major stock indexes are growing on expectations of changes in ECB policy, which is expected to conduct a meeting on Thursday. The general index of large enterprises in the STOXX Europe 600 region jumped 0.41% in the morning, which moved it to 343.57 points. The UK FTSE 100 Index climbed 0.42%. The German DAX index rose 0.79%. France's CAC 40 index rose 0.34%. Italy's FTSE MIB Index also gained 0.45%. Spain's IBEX 35 Index is the only one that showed negative dynamics which decreased by 0.78%. In addition to the announcement lockdowns on several European countries, market participants are also looking forward to the release of the next portion of corporate statistics with the hope of finding at least some signals for a positive attitude. Investors are also waiting for the ECB's readiness to start ratifying new stimulus measures in the economy. So far, there are no grounds for emergency implementation, which is likely to be the reason for their postponement at least until December of this year. The material has been provided by InstaForex Company - www.instaforex.com |

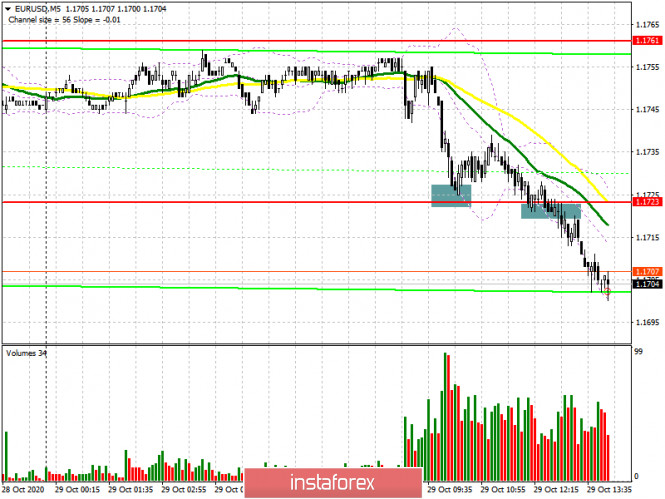

| EUR/USD: plan for the American session on October 29 (analysis of morning deals) Posted: 29 Oct 2020 05:22 AM PDT To open long positions on EURUSD, you need: In my morning forecast, I paid attention to the level of 1.1723 and recommended relying on it when making trading decisions. If you look at the 5-minute chart, you will see how the bulls protect this area during the first test. However, the active actions of sellers return the pair to the level of 1.1723, forming an entry point for short positions further down the trend. Wait for the formation of a false breakout in the area of the morning resistance of 1.1761, as the bulls could not even reach this level.

The further movement of EUR/USD will depend entirely on the decisions taken today by the European Central Bank, as well as on US GDP data. In the second half of the day, buyers will focus on protecting the support of 1.1688, as a lot depends on this level. Only the formation of a false breakout will be a signal to open long positions against the trend. In the case of a test of the area of 1.1688 and the lack of activity from buyers, I recommend that you postpone long positions in EUR/USD until the meeting with the minimum of 1.1644 and buy the euro immediately for a rebound based on the same correction of 15-20 points within the day. However, I repeat that we need to act very carefully against the trend since it is not known what measures the European Central Bank will take and how strong the market movement will be. For buyers to regain control of the market, it is necessary to make much more effort and climb above the resistance of 1.1723, which was missed today in the first half of the day. Only a test of this level from top to bottom forms a good entry point into purchases to restore EUR/USD to the resistance area of 1.1761, where I recommend fixing the profits. There are also moving averages that play on the side of euro sellers. To open short positions on EURUSD, you need: Sellers coped with the morning task and broke below the support of 1.1723, forming a fairly convenient entry point for short positions to continue the trend. As long as trading is conducted below the level of 1.1273, the pressure on the euro will remain, which may lead the pair to update the larger minimum of 1.1688, the breakthrough of which depends entirely on today's decisions of the European Central Bank. Fixing below this range will easily push EUR/USD to new lows in the area of 1.1644 and 1.1617, where I recommend fixing the profits. In the scenario of an upward correction of the pair in the second half of the day, it is best not to rush with sales, but to wait for the formation of a false breakdown at the level of 1.1723 after the ECB press conference. I recommend opening short positions in EUR/USD immediately for a rebound from the maximum of 1.1796, based on a correction of 15-20 points within the day.

Let me remind you that the COT report (Commitment of Traders) for October 20 recorded both the growth of long positions and the growth of short ones. However, the latter turned out to be more, which led to an even greater decrease in the positive delta. But despite this, buyers of risky assets believe in the continuation of the bull market, but prefer to proceed cautiously, as there is no good news on the Eurozone yet. Thus, long non-commercial positions rose from 228,295 to 229,878, while short non-commercial positions increased from 59,658 to 63,935. The total non-commercial net position fell to 165,943 from 168,637 a week earlier. However, bullish sentiment on the euro remains quite high in the medium term. The stronger the euro declines against the US dollar at the end of this year, the more attractive it will be for new investors. Signals of indicators: Moving averages Trading is below 30 and 50 daily moving averages, which indicates a further decline in the euro. Note: The period and prices of moving averages are considered by the author on the hourly chart H1 and differ from the general definition of classic daily moving averages on the daily chart D1. Bollinger Bands In the case of an upward correction, the average border of the indicator around 1.1745 will act as a resistance where you can sell the euro. Description of indicators

|

| AUD/USD Accelerates Its Sell-Off Posted: 29 Oct 2020 04:52 AM PDT AUD/USD is trading in the red after its failure to stay higher. Technically, it should drop deeper after the most recent rebound. The USD has taken full control as the USDX seems determined to develop a broader upside movement. The pair should drop significantly if the USDX prints an up reversal. Better than expected US data today could boost the greenback and it could confirm a sharp drop on AUD/USD. The US Advance GDP, Unemployment Claims, Pending Home Sales, and the ECB could shake the markets later. AUD/USD Strongly Bearish!

AUD/USD failed to retest the down channel's resistance signaling strong bears in the short-term. It has also failed to stabilize within the ascending pitchfork's body suggesting selling again. Now, is traded below the S1 (0.7050) level and is targeting 0.7016 former low. A valid breakdown under this static support will validate further drops. Technically, the outlook will remain bearish as long AUD/USD is located within the descending channel's body.

You can sell a valid breakdown through the 0.7016 level, the S2 (0.6966), and the S3 (0.6912) could be used as targets. The first warning line (WL1) could attract the price as well. Actually, the short-term major downside target remains at the channel's downside line. Dropping and stabilizing under 0.7016 activates the bearish scenario. The material has been provided by InstaForex Company - www.instaforex.com |

| EUR / USD: dollar gains 0.5% while euro suffers uncertainty amid COVID-19 crisis Posted: 29 Oct 2020 04:50 AM PDT

The greenback managed to gain about 0.5% for the current week. The slow progress in negotiations on the stimulus package to support the US economy, as well as the uncertainty of the US presidential election, boosted demand for the US dollar. According to the latest polls, Joe Biden continues to lead the race. However, even if he wins, no additional incentive measures may follow until the end of the year. On Thursday, the greenback holds on to recent gains, trying to move further upward from support at 93 points. The dynamics of the USD will soon be determined by the US GDP data for the third quarter and investors' appetite for risk. Analysts expect the US economy to recover from a sharp decline in the second quarter. The main questions are how much the indicator has improved and whether it will matter to investors, as this data already lags behind the events of the past few weeks. The US government has so far ignored the record rate of growth in the number of COVID-19 cases in the country. Several states have already introduced restrictive measures, however, if others do not follow this example, the recovery of the national economy could last in the fourth quarter.

If the US GDP growth in July-September exceeds experts' expectations, the greenback will continue to strengthen in relation to its main competitors, including the euro. The EUR / USD pair slipped to weekly lows around 1.1710 amid the strengthening of the second wave of coronavirus in the Eurozone, as well as rumors that the ECB may consider additional stimulus at the next meeting. On Wednesday, Germany imposed a partial quarantine for a month. France announced the introduction of a nationwide quarantine until December 1. Previously, economists expected the ECB to leave monetary policy unchanged following the October meeting. However, the rapid deterioration of the epidemiological situation in the EU may prompt the regulator to take action. The ECB is unlikely to reduce the rate on deposits (it is already -0.50%), but it may announce an acceleration in the pace of bond purchases. In any case, the regulator cannot say anything that would support the single currency. The European Central Bank is preparing to soften the policy, while its American counterpart is quite pleased with the current position. According to experts, this is the main reason why the main currency pair should trade closer to 1.16 than to 1.18. The almost simultaneous announcement of quarantines in Paris and Berlin, as well as expectations that the ECB might decide to act now, have led to a sell-off in the euro. "Strengthening bearish momentum indicates continued downside risks for EUR / USD. However, only the pair's close below 1.1685 will signal its readiness to continue its steady decline. At this stage, the likelihood of this scenario being realized is very high, unless EUR / USD rises above 1.1835 in the next two days," said UOB experts. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Oct 2020 04:30 AM PDT Further Development

Analyzing the current trading chart of BTC, I found that BTC tested the my downward target at $13,200 but that there is still space for more downside towards $12,720. My expectation is the BTCcan trade lower and the selling opportunities on the rallies is preferable strategy for this condition. Watch for selling opportunities... Downward target is set at the price of $12,790 Key Levels: Resistance: $13,300 and $13,190Support level: $12,190 The material has been provided by InstaForex Company - www.instaforex.com |

| Lockdown again in Germany and France Posted: 29 Oct 2020 04:28 AM PDT

Repeated lockdown is still introduced in France and Germany. The heads of these countries explain such drastic measures by the larger second wave of coronavirus that has swept Europe. Yesterday, it became clear that the tightening of measures is expected from day to day. By the way, such restrictions already apply in Italy and Spain. According to news reports, on Wednesday, German Chancellor Angela Merkel was going to meet with the heads of federal states to discuss the closure of all restaurants and bars in her country. As for schools and kindergartens, they were not mentioned. In her televised address, the Chancellor noted that all this is only for the benefit of the German population, among which the ill-fated virus is circulating at lightning speed. German authorities fear that the health system, which is still coping with such a challenge, may collapse in the coming weeks. Restrictive measures in Germany (closing bars, restaurants, and theaters) are still planned to be introduced from November 2 to 30. It was decided to keep the schools open. The stores will be organized with strict restrictions. Emmanuel Macron made a similar speech last night, announcing a return to the previous lockdown. Most of France has been under curfew for the past week. New French restrictions that allow people to leave their homes only to buy necessities, seeking medical care, and exercising for no more than one hour a day are due to take effect from Friday. You can only go to work if you can't work remotely. Schools, as in Germany, will remain open. The movement of citizens will be possible only with a special document explaining their stay on the street. At the same time, the police will monitor the movement of people and the availability of this document. It is worth recognizing that the economic consequences of such a decision will be quite severe in any case. Most likely, radical methods will suspend the economic recovery, which was still observed this summer. It is clear that after the spring lockdown, it is still extremely difficult for the global economy to reach pre-crisis levels, and with such restrictive measures, the risk of a double-dip recession increases many times. Needless to say, it will take years to eliminate the expected consequences. The announcement of the introduction of additional measures for combating coronavirus has severely hit European equity markets on Wednesday. European stocks hit their lowest level since mid-June on Wednesday. The euro fell against the dollar. The changes also affected oil: on Thursday, its cost has decreased. The dollar is only better off from the new restrictive measures in Europe: at the beginning of European trading on Thursday, it was almost unchanged, maintaining its recent growth. The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Oct 2020 04:23 AM PDT Eurozone October final consumer confidence -15.5 vs -15.5 prelim Economic confidence 90.9 vs 89.6 expected

While industrial confidence continued to improve, services confidence is seen slipping amid the resurgence in virus cases across the region. That is tempering with economic sentiment surrounding the outlook in Q4 and the announcements by Germany and France yesterday will only add to concerns in the coming months. Further Development

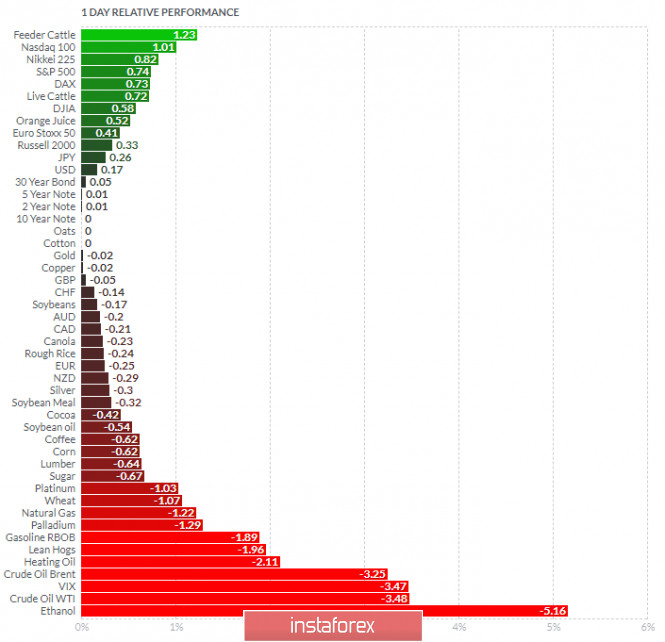

Analyzing the current trading chart of EUR/USD, I found that EUR tested the my second downward target at 1,1715 but that there is still space for more downside towards 1,1690 and 1,1615. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Feeder Cattle and NASDAQ and on the bottom Ethanol and Crude Oil. Key Levels: Resistance: 1,1750Support levels: 1,1690, 1,1615 The material has been provided by InstaForex Company - www.instaforex.com |

| Posted: 29 Oct 2020 04:17 AM PDT ECB's Jochnick: The possibility of a double-dip recession cannot be ruled out yet Comments by ECB banking supervision member, Kerstin af JochnickAdding that "the baseline scenario of our projections cannot be taken for granted". This could be a personal opinion but it also reflects the downside risks to the outlook, which I would expect to be brought up by Lagarde in her press conference later today. Looking at the ECB decision later, recent virus developments have arguably accelerated the pace for more action by the ECB and they may very well bring forward their PEPP expansion decision to today, should there be a need to act preemptively.

Further Development

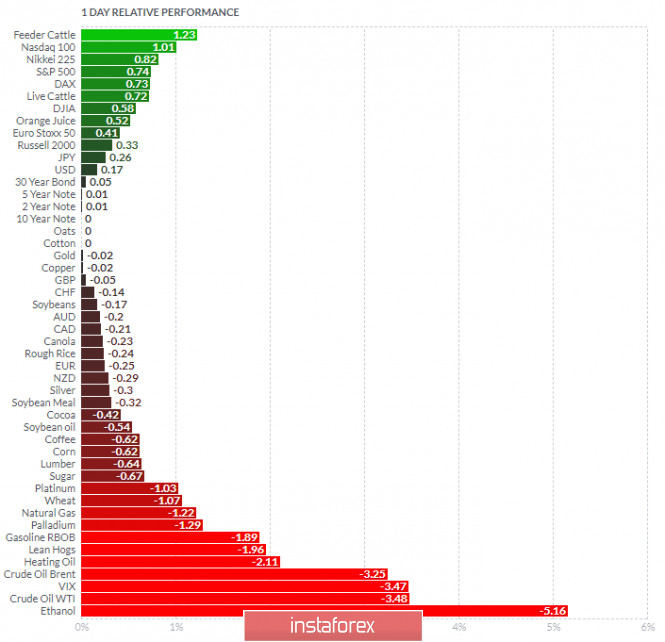

Analyzing the current trading chart of Gold, I found that there is the strong breakout of the consolidation and support at $1,891 as I expected. 1-Day relative strength performance Finviz

Based on the graph above I found that on the top of the list we got Feeder Cattle and Nsdaq and on the bottom Ethanol and Crude Oil. Key Levels: Resistance: 1,891Support levels: $1,848 The material has been provided by InstaForex Company - www.instaforex.com |

| You are subscribed to email updates from Forex analysis review. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google, 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment